Attached files

| file | filename |

|---|---|

| EX-32.1 - DIGILITI MONEY GROUP, INC. | ex32-1.htm |

| EX-31.2 - DIGILITI MONEY GROUP, INC. | ex31-2.htm |

| EX-32.2 - DIGILITI MONEY GROUP, INC. | ex32-2.htm |

| EX-10.7 - DIGILITI MONEY GROUP, INC. | ex10-7.htm |

| EX-10.21 - DIGILITI MONEY GROUP, INC. | ex10-21.htm |

| EX-10.17 - DIGILITI MONEY GROUP, INC. | ex10-17.htm |

| EX-10.19 - DIGILITI MONEY GROUP, INC. | ex10-19.htm |

| EX-10.10 - DIGILITI MONEY GROUP, INC. | ex10-10.htm |

| EX-10.18 - DIGILITI MONEY GROUP, INC. | ex10-18.htm |

| EX-10.16 - DIGILITI MONEY GROUP, INC. | ex10-16.htm |

| EX-10.20 - DIGILITI MONEY GROUP, INC. | ex10-20.htm |

| EX-23 - DIGILITI MONEY GROUP, INC. | ex23.htm |

| EX-31.1 - DIGILITI MONEY GROUP, INC. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 000-53925

CACHET FINANCIAL SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 27-2205650 | |

| (State of incorporation) | (I.R.S. Employer Identification No.) | |

18671 Lake Drive East Southwest Tech Center A Minneapolis, MN |

55317 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (952) 698-6980

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common stock, $.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X] No

The aggregate market value of the voting stock held by persons other than officers, directors and more than 10% stockholders of the registrant, calculated with reference to conversion of our Series C Convertible Preferred Stock, as of June 30, 2015 was approximately $9.3 million. As of April 12, 2016, there were 41,626,842 shares of our common stock outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE: None.

Cachet Financial Solutions, Inc.

Form 10-K

Table of Contents

NOTE REGARDING INDUSTRY AND MARKET DATA

Industry data and other statistical information used in this report are based on independent publications, government publications, reports by market research firms and other published independent sources. Some data are also based on our good faith estimates, derived from our review of internal surveys and the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information.

| 2 |

Throughout this report, we refer to Cachet Financial Solutions, Inc., a Delaware corporation and the public reporting company filing this Annual Report on Form 10-K, as “we,” “us,” “Cachet” and the “Company.” Unless otherwise indicated or unless the context otherwise requires, references to “we,” “us,” “Cachet” and the “Company” include our consolidated subsidiary.

OVERVIEW

We are a technology solutions and services provider to the financial services industry. Our solutions and services enable our clients—banks, credit unions and alternative financial services providers (AFS)—to offer their customers remote deposit capture (RDC) and prepaid mobile money technologies and related services. Our clients typically seek these technologies in order to increase customer satisfaction and improve customer retention, attract new customers, develop market leadership, grow deposits in a low-cost manner, reduce their transaction costs and reduce traffic at bricks-and-mortar branches. We describe our current solutions and services below under the “Solutions” caption.

As of December 31, 2015, we had entered into more than 500 contracts with customers for our cloud-based SaaS products and services, and as of December 31, 2014 we had entered into 348 such contracts. Approximately 397 of those agreements were “active” as of December 31, 2015 meaning that the customer has implemented the RDC or prepaid mobile money technology enabling the processing of customer transactions. Our business operations are conducted through our wholly owned subsidiary, Cachet Financial Solutions Inc., a Minnesota corporation.

We became a public company through a reverse merger transaction described in more detail under the caption “Other — Reverse Merger Transaction” below. In considering whether to engage in the transaction, our Board of Directors and management was attracted to the ability to raise proceeds for the growth of the business and offer investors some measure of liquidity in their investment. Our board and management also considered the increased ability, as a public company, to grow the business through the use of stock to acquire other businesses and assets and attract and retain highly talented employees. The reverse merger transaction was the fastest means of becoming a public reporting company. The drawbacks of the reverse merger transaction include increased operating and compliance costs as a public reporting company, and the possibility that the public reporting entity we acquired in the reverse merger transaction could have unknown liabilities. Additional costs could be significant, and management estimates that the increased annual professional and consulting fees alone could be as high as $250,000. Other costs, such as the costs of engaging a transfer agent and working with financial printing intermediaries, could add up to another $50,000 on an annual basis. See also, “RISK FACTORS” on page 26 (“Being a public company results in additional expenses and diverts management’s attention . . . .”).

INDUSTRY

In its most simple terms, RDC is a service that allows a business or consumer to scan checks and transmit the scanned images to a financial institution for posting and clearing or, in the case of Alternative Financial Services (“AFS”) providers, cashing and loading remotely to a prepaid debit card. Checks received by the business or consumer can be scanned to create a digital deposit. The digital deposit is then transmitted to the RDC institution or service provider, who accepts the deposit and posts the deposit to their customer’s account. The product eliminates a trip to a financial institution or ATM to deposit the check(s). The basic requirements for an RDC service currently include a PC Windows or Mac computer and a check scanner for business applications, a “smartphone” for consumer applications, an Internet connection, and a service provider such as a bank.

RDC has been called an important development in the banking industry by the Federal Reserve and others. At this time, we believe that most major financial institutions in the United States have either launched the service, or are well on their way to doing so. The commonly viewed benefits of this new service include convenience, better deposit availability, reduced non-sufficient funds (NSFs) and reduced transportation costs and risk. Federal legislation commonly referred to as “Check 21” makes the entire RDC process possible. Passed in 2003 and implemented in October 2004, this legislation allows financial institutions to clear checks based upon images of the original items instead of having to transport the original check all the way back to the paying bank for clearing.

| 3 |

We also market our cloud-based SaaS solutions to the providers of non-traditional banking services to the unbanked or the underbanked market. This AFS market includes institutions providing prepaid debit cards, check cashing services and payday lending to consumers. The AFS market represents more than 350 million transactions per year, involving approximately $106 billion in various products and services. These AFS products and services, on an industry wide basis, generally consist of:

| ● | $58.3 billion in check cashing transactions; | |

| ● | $17.6 billion in money orders sold; | |

| ● | $8.3 billion in wire remittances; | |

| ● | $13.2 billion in payday advances; and | |

| ● | $5.4 billion in sales of prepaid stored-value cards. |

SOLUTIONS

We are a technology solutions and services provider to the financial services industry. The following products and services comprise the main technology solutions we currently offer to our customers:

| ● | remote deposit capture (RDC) products for businesses and consumers; | |

| ● | mobile money management products for consumers; and | |

| ● | training and support services for our financial services industry customers. |

Our RDC products are composed of various software applications that permit a business or consumer to (i) scan or take a picture of a check by using a smart phone, tablet or other device (e.g., a desktop computer that is connected to a scanner), and then (ii) transmit the resulting image to a bank for posting and clearing. These various software applications are developed to be compatible with both Windows and Mac operating systems, and are marketed with various features and levels of functionality. Our main RDC products are marketed under the name Select Business™ Merchant Capture, which provides a financial institution’s business customers with the ability to scan and deposit checks from their PC, Mac computer or mobile device, and Select Mobile™ Deposit, which allows a financial organization to offer their consumer customers the ability to scan and deposit checks via a mobile device by taking a picture of the front and back of the endorsed check. In all cases, our RDC software is made available to our customers through a license granting them Internet (“cloud-based”) access. Because we develop, host and maintain the software products that perform the RDC processes and services, our kind of business model is often referred to as a “software-as-a-service” business, or a “SaaS” model.

Our mobile money management product is a software application that permits a consumer with a prepaid debit card to (i) have a paper check directly deposited into the consumer’s prepaid card account using RDC technology similar to that used in our RDC Select Mobile product discussed above, (ii) cash checks by depositing a check into a prepaid card account and then accessing the related cash through an ATM machine, (iii) check account balance and transaction history (iv) access a national coupon network for local deals , and (v) transfer funds available in the prepaid card account to other participants in the same financial institution or AFS provider’s prepaid card program. Back-end analytics capabilities enable the financial institution to monitor user behavior and send relevant marketing messages. We market our mobile money management product under the name “Select Mobile™ Money.” Like our RDC products, we make our Select Mobile Money product available to our customers through an Internet/cloud-based SaaS business model.

| 4 |

The training and support services we offer and provide to our customers include: one-on-one and on-line product training; educational webinars to inform staff of product benefits and how to sell; customized marketing collateral and product videos to help our clients promote the product to their customers; risk mitigation consulting and documentation; reporting and analytics on customer transactions; post launch contests and promotions to increase customer adoption and transactions.

As indicated, our products and services (our “solutions”) are marketed and licensed or sold primarily to participants in the financial services industry. In this regard, our RDC products are offered to banks and credit unions in the United States, Canada and Latin America. Our mobile money management products are offered to traditional financial institutions (FIs), as well alternative financial services providers (AFS) in the United States, Canada and Latin America. These FIs and AFS providers include banks, credit unions, prepaid card issuers, check cashers and payday lenders. The banks, credit unions and AFS providers purchasing our RDC products or mobile money management solutions generally desire to offer remote and mobile technology-based services to their own retail consumers for competitive reasons such as increasing customer satisfaction and improving customer retention, attracting new customers, developing market leadership, growing deposits in a low-cost manner, reducing their transaction costs and reducing traffic at bricks-and-mortar branches. We do not offer, sell or license our solutions directly to retail consumers.

In our experience, the FIs and AFS providers that desire mobile money management solutions typically wish to serve retail consumers who are “unbanked” (meaning that they have no formal relationship with a traditional banking institution or credit union) or “underbanked” (meaning that they have only a minimal relationship with one or more traditional banking institutions or credit unions, and generally prefer not to grow that relationship due to fee concerns and/or minimum-balance requirements imposed on them by those institutions). In this regard, our Select Mobile Money product provides the unbanked and underbanked end-user customer with a convenient and secure “anywhere and anytime” access to self-service banking services through an easy-to-use mobile application downloaded onto their smart phone or tablet and linked to a prepaid card.

We believe that easy and immediate access to money is especially important to the unbanked and underbanked consumer because this demographic often lives “paycheck to paycheck” and requires quicker access to their funds to pay for their everyday living essentials such as food, rent, and the payment of other bills. We believe that the inconvenience and cost of accessing multiple service providers, which are common barriers among underbanked and unbanked consumers, serves as a strong incentive for these consumers to use an aggregated service like Select Mobile Money. We believe that our Select Mobile Money product can address the needs most unbanked or underbanked consumers who have a need or desire for services more complex than simple debit cards and check cashing.

Our typical client implementation process includes integrating our software into the infrastructure of the financial institution, initiating customer training and providing sales and marketing development to support our client’s success when their RDC or mobile money product is launched. We may offer technical support thereafter. As of December 31, 2015, we had entered into more than 500 contracts with customers for our products and services, and as of December 31, 2014, we had entered into 348 such contracts. Approximately 397 of those agreements were “active” as of December 31, 2015, meaning that they have implemented the RDC software enabling the processing of customer transactions.

DEVELOPMENT

In August 2010, we launched our cloud-based SaaS RDC Select platform, followed by the offering of our smartphone applications and our Apple OS X operating platform in September and October. In 2011, we launched CheckReview, a cloud-based SaaS proprietary technology that helps financial institutions better identify potential check fraud with the ability to view and validate the digital image of the check in real time. In 2011, we also introduced the industry’s first cloud-based SaaS mobile check capture solution tailored specifically to the AFS market, allowing a user to scan a check and transmit a high quality image using our Patent Pending Check Review for approval. The solution also provides real-time communication with the user to secure their acceptance of fees and terms (using our patent-pending check and load feature) via their smartphone to ultimately have the funds from a cashed check remotely loaded onto their prepaid debit card. In 2012, we introduced advanced business rules and support for home-based printer-scanner devices. In 2013, we introduced our cloud-based enterprise risk SaaS platform, CheckRiskPro.

| 5 |

In March 2014, we purchased from DeviceFidelity, Inc., a Texas corporation, certain tangible and intangible assets of a business engaged in the development and provision of technology platforms supporting mobile wallet applications. We believe our mobile wallet platform, marketed under the name “Select Mobile Money,” and sold through our existing sales force, provides all of the functionality of a mobile banking platform to the approximately 100 million unbanked and underbanked consumers. The acquisition provided us with an opportunity to obtain and enlarge strategic relationships with Visa, MasterCard, MoneyGram and Navy Federal Credit Union—the providers of those services to their consumers. This capability complements and supports our RDC and mobile deposit business by adding new features and services for consumers, creating an expanded consumer base and target market, and also expanded scope of potential partners in the AFS market. In the acquisition, we received rights under a contract with Visa to provide the customers of these institutions with services under the Visa-endorsed mobile platform. We also received rights under a contract with MoneyGram to implement that company’s first mobile solution for their customers. We paid an initial purchase price of $1.125 million for these assets, with an additional $1.0 million payable upon the satisfaction of certain performance-related contingencies, of which all has since been paid.

In November, 2014, we also introduced an enhanced version of our Select Business solution, allowing our client’s commercial customers to electronically deposit checks using their smartphones or tablets, in addition to their office desktop scanners. This omni-channel solution enables commercial customers to better manage their businesses on the road. Remote users can access all the same functionality of an advanced merchant RDC system via their tablets or smartphones, including capturing multiple checks in a single mobile deposit.

In January of 2015, we expanded our feature set of Select Mobile Money to include integration with Apple Pay™ for point-of-sale transactions. This means iPhone 6 or iPhone 6 Plus users can simply click the Apple Pay icon from within their white label Select Mobile Money app, bringing their prepaid card as top-of-wallet to securely complete the transaction with Apple Pay. The Select Mobile Money app then automatically presents the details of the transaction along with an updated account balance. During that same month, we also launched a new, co-branded express option for deploying Select Mobile Money. The Select Mobile Money-Express option means the prepaid card program, mobile app and cloud services come pre-configured, and we handle all card issuance, processing and program management for our clients. This makes the co-branded option easier, faster and more affordable to implement, and thereby more accessible to a broader range of financial institutions. Select Mobile Money-Express is available for payroll, travel, student and unlimited use prepaid card programs.

We introduced Select Mobile NowPay, a mobile check payment solution in March of 2015. NowPay enables loan providers to offer their customers convenient and secure mobile check payments for reoccurring loan payments such as auto loans, leases, memberships, etc. With NowPay, mobile users can make their loan payments by check anywhere and anytime, at the last minute, if necessary, avoiding special trips to the post office, bank or loan office, and eliminating the worry of late payments. Users make a NowPay payment by first taking a photo of their signed check with the NowPay app or their existing financial institution’s mobile banking app that has been enabled with NowPay. Then, rather than having to electronically deposit the funds to a bank account and wait for the funds to clear, the user can immediately send the payment.

In August of 2015, we introduced an express version of our Select Mobile Deposit, solution to provide smaller banks and credit unions with an affordable, market-ready mobile deposit solution to offer their customers and members. Select Mobile Deposit-Express removes the barriers to entry typical of mobile deposit solutions, enabling smaller financial institutions to compete more effectively for mobile-centric consumers and businesses. The market-ready, standalone mobile application minimizes start-up costs and simplifies deployment, accelerating speed to market and ROI for smaller financial institutions. The Express version comes with the same full-service support as our custom mobile deposit solution, including dedicated client services, strategic marketing, 24/7 helpdesk and advanced risk mitigation with duplicate detection.

| 6 |

COMPETITIVE STRENGTHS

We believe that the following represent our competitive strengths:

| ● | Premier Technology. Our RDC and mobile money products represent premier IT solutions that alleviate large capital investments in hardware and software by financial institutions and AFS providers, using a dynamic SaaS and cloud-based platform that ensures the most up-to-date IT offerings for retail and commercial clients. Additionally, our Select Mobile Money prepaid platform has won multiple Paybefore Awards, including the 2015 Best-in-Category, Judge’s Choice Award for the Navy Federal Credit Union and Visa Buxx mobile app. | |

| ● | Robust Ecosystem. Cachet has built an ecosystem of channel partners and resellers who provide solutions to their client base. These important relationships are built by supplying premier technology and excellent client support. Cachet can provide a prospect a wide range of mobile banking platforms that are utilizing Cachet technologies versus our competitors’ single mobile banking platform offering. | |

| ● | Large Market Potential. We focus our sales efforts in three areas: (i) there are 13,000 financial institutions in our target market, (ii) AFS providers that serve the approximately 100 million unbanked and underbanked consumers in the United States and (iii) there are approximately 76 million Millennials who are mobile first consumers requesting prepaid products to manage their finances. | |

| ● | Innovation. We occupy what we believe to be a leadership position in innovation for the commercial banking market, evidenced by the fact that we have introduced (i) the industry’s first Apple compatible, patent-pending RDC technology platform, (ii) our CheckReview™ product, which is a patent-pending fraud-prevention solution allowing financial institutions to review a high quality image of a personal check prior to processing that check, (iii) a patent-pending interface for our cloud-based SaaS mobile check capture application (Select Mobile), targeting the growing prepaid card industry, (iv) a patent-pending method for applying fees and business rules to RDC transactions, (v) a patent-pending method for paying back loans through RDC, and (vi) a patent-pending process for accepting RDC transactions that includes the remote destruction of checks. | |

| ● | Customer Support. Our offer of marketing support and training to ensure that our customers understand the benefits of their RDC and mobile money solutions from Cachet and are able to effectively market to their customers and realize their full revenue opportunity. |

Our business faces some significant challenges. These include:

| ● | Relatively Short Operating History. Our business is subject to all the risks inherent in the establishment of a new enterprise and the uncertainties arising from the absence of a significant operating history. Due in part to our relatively short operating history, we cannot project whether or when we will become profitable. | |

| ● | Significant Debt Burden. We have a substantial amount of indebtedness. As of December 31, 2015, we had approximately $5.0 million of principal debt outstanding. In addition, the total amount of accrued but unpaid interest totaled approximately $0.6 million on that date. The holder of our series subordinated note referred to in note 6 of our consolidated financial statements has commenced an action against us to collect alleged amounts due and owing under the note. The holder of the note alleges we are in default. We dispute the allegations of the note holder and intend to vigorously defend the claim. However, the alleged default could subject the Company to claims of default or cross default by our other lenders. At this time no other lender has asserted such a claim. |

| 7 |

| ● | Need for Additional Financing. We require additional financing to continue our operations. Management expects that additional capital will be required to support our cash operating expenses after December 12, 2016 and repay debt that is maturing. | |

| ● | Going Concern. In its report dated April 14, 2016, our independent registered public accounting firm, Lurie, LLP, stated that our consolidated financial statements for the fiscal year ended December 31, 2015 were prepared assuming that we would continue as a going concern, and noted that our limited revenues, recurring losses from operations and shareholder deficit raise substantial doubt about our ability to continue as a going concern. We continue to experience limited revenues, operating losses and a shareholder deficit. As a result, it may be more difficult for us to attract investors, secure debt financing or bank loans, or a combination of the foregoing, on favorable terms, if at all. Our future depends upon our ability to obtain financing, extend our current debt obligation of $2,300,000 due December 12, 2016 and upon future profitable operations. In addition, concerns about our financial viability may have an adverse effect on current and potential customers’ willingness to enter into long-term relationships with us. | |

| ● | Competitive Market. The market for RDC is highly competitive and we expect the intensity of competition to increase. Most of our actual potential competitors have significantly greater financial, technical and marketing resources than us. These competitors may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. | |

| ● | Obsolescence. The market for our products is characterized by rapidly changing technology, evolving industry standards, changes in customer needs and heavy competition. To effectively compete, we must respond to changing technology and industry standards in a timely and cost-effective manner. Failure to so respond could mean that our current product offerings will have little practical appeal in the marketplace. | |

| ● | In-House Technology. On occasion, potential AFS clients have developed their RDC and mobile money products and services internally. In the future, as RDC, mobile money and related products gain more and more acceptance, it is possible that AFS providers may determine to develop these capabilities in-house. If this were to occur on a widespread basis, we expect that it will be significantly more difficult to sell our products due to territoriality, bias toward capabilities developed in-house, or concerns about our support availability in comparison to in-house support. |

Our business also faces those other risks discussed in the “RISK FACTORS” section of this report, beginning on page 16.

REVENUE SOURCES

Our sources of revenue include:

| ● | up-front payments associated with our initial implementation of RDC Select (or other product offerings) for our customers, which may include payments for the sale of scanning and related equipment and payments for additional marketing support from our Company; | |

| ● | professional services, including implementation services, development of interfaces requested by customers, assistance with integration of the Company’s services with the customers’ applications, dedicated support, and advisory services to customers who choose to develop their own interfaces and applications; and | |

| ● | recurring revenue associated with the following: |

| ● | deposit fees, monthly active-user fees, and bill-pay fees; and | |

| ● | transaction-processing fees and fees for the ongoing support and maintenance of our software. |

| 8 |

Recurring revenue is expected to include fixed monthly service charges to customers for our service, transactional fees for the number items processed, or a combination of both. We believe that this model of recurring revenue will have a positive impact on our cash flow and valuation. Reliance on recurring revenues will mean, however, that transactional volume will likely be a key metric for our ability to scale and generate sufficient revenues to ultimately become profitable.

GROWTH STRATEGY

Key elements of our growth strategy include:

| ● | Build our Direct Salesforce and Distribution Partners. We believe there is significant opportunity to accelerate our sales and transaction growth to further penetrate the customer base of small- and mid-sized banks, credit unions and prepaid card programs. | |

| ● | Continue to Innovate. We intend to continue to invest in development efforts to introduce new mobile related features and functionality to our customers. | |

| ● | Grow Revenue from Existing Customers. We intend to grow our revenues from our existing customers as they add new users and as we provide them with new features and functionality. | |

| ● | Pursue Acquisitions. We intend to selectively pursue acquisitions to accelerate the growth in our business through additional product offerings or acquisition of customers. While we intend to generate most of our growth organically, we believe there will be opportunities for us to acquire companies that will bring synergies to our business. | |

| ● | Offer our Products Internationally. To date, we have derived most of our revenues from the North American market. We believe that there is an additional growth opportunity for our cloud-based SaaS RDC and mobile wallet solutions in international markets. |

BUSINESS STRATEGY

Our objective is to be the premier provider of RDC and mobile money solutions designed to meet the specific requirements for our targeted customers in the financial institution and AFS marketplace. We expect that the majority of revenue will be recurring in nature, which will provide us with predictable cash flows in what we believe and are predicted to be a high growth market. To achieve this objective, we are pursuing the following strategies:

| ● | focus on targeted markets | |

| ● | market and brand our products and services effectively | |

| ● | where economically feasible, outsource certain functions, and | |

| ● | develop new products and enhancements to existing products. |

| 9 |

Focus on Targeted Markets

Using a direct sales force, we focus on banks and credit unions of $500 million to $30 billion in asset size and AFS providers that primarily serve the unbanked, underbanked and underserved consumer markets. We believe these institutions represent the best opportunity for acceptance and growth of RDC because they generally have multiple branches and a significant commercial and consumer customer base that would be typical users of RDC technologies. Many of these institutions often do not have internal marketing capabilities to effectively take advantage of the opportunity that RDC presents, as do the larger money-center financial institutions. We offer a retail RDC solution for financial institutions to offer to their customers. Our solution is currently also available for iPhone and Android smartphone operating systems. We believe the consumer market will have particular appeal to credit unions, which have historically had a much larger consumer customer base than a commercial base. As with the commercial markets, we believe the consumer market is a significant opportunity with high growth potential.

We provide technology, sales, training and marketing support to financial institutions and AFS clients to promote the RDC and mobile money initiatives we develop for them. We believe that this element of our business model is a key competitive differentiator for our company. We believe that with this support, financial institutions and AFS providers will understand the benefits for their institutions and, even more importantly, the benefits for their customers, providing for a successful RDC or mobile money initiative within their institution.

Market and Brand our Products and Services Effectively

Our branding and positioning strategy is based on our understanding of our target market needs and the desire to create value for our clients while differentiating Cachet in the marketplace. For example, we have determined that many small to mid-sized financial institutions do not have internal IT or marketing capabilities to manage new business initiatives outside of their core competencies. Our technology offering is a hosted solution that is fully managed by our company, thereby eliminating any significant internal changes to the financial institutions’ IT infrastructure, minimizing our clients’ cost and time to develop and deploy an RDC solution.

In addition, we provide technology, sales, training and marketing support to our clients. We believe that with this support, our clients will better understand the benefits that RDC and mobile money provides their organization as well as their customers, thereby facilitating a successful initiative within their institution. We believe this element of our business model to be a key differentiator for us.

Our market and brand strategy illuminates these differences while building awareness for Cachet through a strong presence at national banking, credit union and AFS tradeshows, securing speaking opportunities, conducting webinars, and executing other social media and target marketing activities.

Outsourced Functions

We are party to license agreements with various third-party vendors such as Mitek Systems Inc., Parascript, LLC, AQ2 Technologies, LLC and Nitro Mobile Solutions, LLC. These license agreements provide us with mobile application and server software for our RDC and mobile money software platforms. The software includes back-end image verification server and mobile applications for iPhone and Android smartphones. Server software for these applications also resides in our data centers, is integrated with our RDC and mobile money software platforms and is managed by us.

New Products & Product Enhancements

It is our plan to develop new products to enhance our core suite of RDC and related tools. We intend to continue to listen to our customers, analyze the competitive landscape, and improve our products and service offering. Future planned enhancements include:

| ● | single sign-on application for our mobile, home and business applications; | |

| ● | alternate platforms for home and business (such as tablets); | |

| ● | risk mitigation tools that include system-wide duplicate detection; | |

| ● | core integration with our back-end processes; | |

| ● | partner integration with our back-end processes; | |

| ● | expansion of supported mobile technology; and | |

| ● | integration into external accounting packages. |

| 10 |

COMPETITION

Since RDC incorporates both software and hardware solutions, companies involved with these platforms may be considered competitors if they offer a complete solution to their customers. Non-hardware or software companies also offer RDC solutions. These companies typically sell directly to their commercial customers. Pitney Bowes and NCR are two companies we are aware of which offer an RDC solution directly to their customers. Software companies offering RDC solutions include, but are not limited to, Bluepoint Solutions, Fiserv, Goldleaf ProfitStars, Net Deposit, VSoft, Deluxe Corporation (acquired Wausau), and Fidelity Information Services. Our primary competitor for our prepaid mobile money solution is Monitise.

Nearly all of these competitors are larger, have more resources, including marketing and sales resources, and have proven viability in the RDC and many other related businesses. Competing against these firms presents us with significant challenges and highlights our need to provide excellent products and service that remain innovative.

MARKETING STRATEGY

As noted previously, our market focus is banks and credit unions, as well as AFS providers that serve the unbanked and underserved segment of the population. Within these industries our marketing strategy has revolved around strengthening brand awareness, building thought leadership, and developing and executing targeted lead generation programs promoting Cachet’s key differentiators and innovative products and services.

| ● | Brand Awareness: Since Cachet’s inception, we have focused on building and maintaining a strong presence at national banking, credit union and AFS trade shows where we believe there is opportunity for significant exposure through exhibitions, conference sponsorships, speaking opportunities and pre-show, onsite and post-show communications. | |

| ● | Thought Leadership: We focus on establishing relationships with key industry media publications and industry associations, which has led to important conference speaking opportunities, as well as interviews and mentions in key print and online publications. We further distinguish Cachet as a trusted partner and industry leader by leveraging Cachet blog posts, social media, press releases, white papers, webinars and case studies. | |

| ● | Lead Generation: We employ a targeted, integrated and content-driven approach to lead generation. We segment our markets based on specific criteria that represent the best opportunity and fit with our capabilities for specific product offerings, and then target these groups with strategic campaigns that include content offers designed to nurture relationships, generate interest and produce leads. | |

| ● | Positioning Statement: Cachet helps our financial industry clients achieve their business objectives and increase competitive advantage through our industry-leading suite of remote deposit capture and prepaid mobile money solutions. With our premier technology, customer-centric focus and unprecedented client marketing support, we simplify development and minimize cost, helping clients to accelerate speed-to-market and return on investment. |

INTELLECTUAL PROPERTY

Like most of our competitors, we generally rely on a combination of patent, copyright, trademark and trade secret laws, internal security practices and employee and third-party confidentiality agreements to protect our various intellectual properties. We believe that we possess all proprietary rights necessary to conduct our business.

| 11 |

Our ability to enforce our intellectual-property rights is subject to general litigation risks and costs (See “LEGAL PROCEEDINGS” and “RISK FACTORS” – Companies may claim that we infringe their intellectual property or proprietary rights, which could cause us to incur significant expense or prevent us from selling our products.) Typically, when a party seeks to enforce its intellectual-property rights, it is often subjected to claims that the intellectual-property right is invalid, or is licensed to the party against whom the claim is being asserted. We cannot be certain that our intellectual-property rights will not be infringed upon, that others will not develop products in violation of our intellectual-property rights, or that others may assert, rightly or wrongly, that our intellectual-property rights are invalid or unenforceable. In instances where we may rely on trade secrets for the protection of our confidential and proprietary business information, we cannot be certain that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become discovered or, for that matter, independently developed by our competitors. In general, defending intellectual-property rights is expensive and consumes considerable time and attention of management. Our involvement in intellectual-property litigation would likely have a materially and adverse effect on our business and may threaten our viability. Even if we were ultimately successful in defending our intellectual-property rights, the cost of such defense may be crippling to our business and materially and adversely affect our prospects and viability.

We have applied for patents with regard to how our software is used on the Apple OS X platform and various tablet devices. We have also applied for patents with regard to certain aspects of the functionality of our software, including check deposit review, approval and fraud-prevention processes, fees and billing processes used by AFS providers and banks, as well as other capabilities. While these functions are important features of our RDC product offering, we presently believe that none of them are critical to our overall ability to provide RDC services. Nevertheless, our management does believe that these patents, if ultimately obtained, provide us with a competitive advantage in the marketplace for RDC services.

GOVERNMENTAL REGULATION

We are subject to regulation by federal, state and local governments that affect the products and services we provide. Generally, these regulations are designed to protect consumers who deal with us and not to protect our stockholders. As a provider of services to financial institutions, our operations are examined on a regular basis by state regulatory authorities and representatives of the federal Financial Institutions Examination Council, which is a formal inter-agency body empowered to prescribe uniform principles, standards and report forms for the federal examination of financial institutions and to make recommendations to promote uniformity in the supervision of financial institutions. In addition, independent auditors may periodically review many of our operations to provide internal control evaluations for our clients, auditors and regulators.

In 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted. The Dodd-Frank Act introduced substantial reforms to the supervision and operation of the financial services industry, including introducing changes that:

| ● | affected the oversight and supervision of financial institutions; | |

| ● | provided for a new resolution procedure for large financial companies; | |

| ● | introduced more stringent regulatory capital requirements; | |

| ● | implemented changes to corporate governance and executive compensation practices; and | |

| ● | required significant rule-making. |

The Dodd-Frank Act also established a new federal inter-agency council called the Financial Stability Oversight Council (“FSOC”) and a new federal bureau called the Consumer Financial Protection Bureau (“CFPB”). The FSOC monitors and assesses “systemic risk” to the safety of the United States financial system and coordinates the actions of the various regulatory agencies on those issues. The CFPB is empowered to conduct rulemaking and supervision related to, and enforcement of, federal consumer financial protection laws. The Dodd-Frank Act has generated, and is expected to continue to generate, numerous new regulations that will impact the financial industry. It is not possible to predict with any specificity the extent to which the Dodd-Frank Act, the FSOC, the CFPB, or the resulting regulations will impact our business or the businesses of our current and potential clients over the long term.

As a result of the banking capabilities we expect to offer our customers as a result of our acquisition of the Select Mobile Money assets, we will be required to comply with certain regulations under Gramm-Leach-Bliley Act, as well as certain state regulations relating to financial institutions. Those regulations are designed to establish, implement and maintain such physical, electronic and procedural safeguards to maintain the security and confidentiality to protect consumer data privacy. We continue to invest the resources required to maintain compliance with these regulations.

EMPLOYEES

We refer to our employees as our associates. At April 12, 2016, we had approximately 57 full-time and 2 part-time associates and 5 full-time contractors, including those added in connection with our acquisition of the Select Mobile Money assets. Our associates are involved in administration, sales/marketing, technology development, engineering and support.

| 12 |

CORPORATE INFORMATION

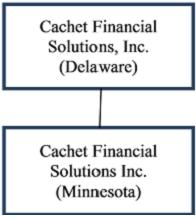

We were incorporated in Delaware in February 2010. As described below under the caption “Other — Reverse Merger Transaction,” in February 2014, we engaged in a reverse triangular merger through which we acquired the business of Cachet Financial Solutions Inc., a Minnesota corporation, and changed our corporate name to “Cachet Financial Solutions, Inc.” Prior to the merger, our corporate name was “DE Acquisition 2, Inc.” We were formed as “blank check” company with the sole purpose of acquiring a business seeking to become a public reporting company through a merger transaction. Our current corporate organization is depicted below:

Our corporate headquarters and principal executive offices are located at 18671 Lake Drive East, Southwest Tech Center A, Minneapolis, MN 55317 and our telephone number is (952) 698-6980. Our website address is www.cachetfinancial.com. The information on or accessible through our website is not part of this report.

OTHER

Reverse Merger Transaction

Pursuant to an Agreement and Plan of Merger and Reorganization dated January 14, 2014, as amended on February 11, 2014 (referred to simply as the “Merger Agreement”), we acquired by merger the business of Cachet Financial Solutions Inc., a Minnesota corporation, described in this report. The merger was completed and effective as of the close of business on February 12, 2014, upon the filing of Articles of Merger with the Minnesota Secretary of State.

At the time of the merger and pursuant to the Merger Agreement:

| ● | each share of common stock of Cachet Financial Solutions (Minnesota) issued and outstanding immediately prior to the merger was converted into the right to receive 10.9532 validly issued, fully paid and non-assessable shares of our common stock, with fractional shares rounded down to the nearest whole number (the “Exchange Ratio”); and | |

| ● | all securities convertible into or exercisable for shares of common stock of Cachet Financial Solutions (Minnesota) (including shares of common stock issuable upon exercise of issued and outstanding options and warrants) that were outstanding immediately prior to the merger were converted into securities convertible into or exercisable for that number of shares of our common stock as the holders thereof would have been entitled to receive if such securities of Cachet Financial Solutions (Minnesota) had been converted into or exercised for shares of common stock of Cachet Financial Solutions (Minnesota) immediately prior to the merger, based on the Exchange Ratio. As part of this conversion, the price at which the holders securities convertible into and exercisable for our common stock will be required to pay in connection with their later conversion or exercise is equal to the quotient obtained by dividing (i) the per-share price at which their related options and warrants for the purchase of common stock of Cachet Financial Solutions (Minnesota) were exercisable prior to the merger by (ii) the Exchange Ratio. |

| 13 |

In connection with the merger, we changed our corporate name to “Cachet Financial Solutions, Inc.” to reflect our ownership of the business of Cachet Financial Solutions (Minnesota). Prior to the merger, our corporate name was “DE Acquisition 2, Inc.” As a result of the merger, we came to own Cachet Financial Solutions Inc. (Minnesota) and its entire business.

The foregoing description of the Merger Agreement and the transactions contemplated and effected thereby is not complete and is qualified in its entirety by the contents of the actual Merger Agreement.

All share figures and share prices contained in this report are presented after giving effect to the capital stock transactions effected as part of the merger. In addition, all share figures and share prices contained in this report are presented after giving effect to a 1-for-10.9532 stock combination (reverse stock split) effected as of March 19, 2014.

Debt Issuance and Private Placements

See Notes 6 and 12 to our consolidated financial statements for information about our debt issuances and private placements that we have recently conducted.

Research and Development Expenses

The Company had research and development expenses of approximately $2.6 million and $2.7 million in the years ending 2015 and 2014, respectively. See PART II – ITEM 7 MANAGEMENT’S DISCUSSION AND ANLYSIS OF FINANCIAL CONDITION AND RESULTS OPERATIONS – RESULTS OF OPERATIONS: YEARS ENDED DECEMBER 31, 2015 AND 2014 for further discussion of the Company’s research and development expenses.

Implications of Being an “Emerging Growth Company”

As a public reporting company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); | |

| ● | are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); | |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; | |

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations, or MD&A; | |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and | |

| ● | are exempt from any PCAOB rules relating to mandatory audit firm rotation and any requirement to include an auditor discussion and analysis narrative in our audit report. |

| 14 |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act. See “RISK FACTORS,” below (“We are an ‘emerging growth company’ . . . .” ).

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding management’s assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, or such earlier time that we no longer meet the definition of an emerging growth company. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion in principal amount of non-convertible debt over a three-year period. Furthermore, under current SEC rules we will continue to qualify as a “smaller reporting company” for so long as we have a public float (i.e. the market value of common equity held by non-affiliates) of less than $75 million as of the last business day of our most recently completed second fiscal quarter.

| 15 |

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and any investment you have or may make in our Company. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us, or that we currently deem immaterial, may also affect our business.

Our operations and business are subject to the risks of an early stage company and we may not become profitable.

Our business will be subject to all the risks inherent in the establishment of a new enterprise and the uncertainties arising from the absence of a significant operating history. We cannot project whether or when we will become profitable because of the significant uncertainties regarding our ability to generate revenues. One of the principal challenges that we face is gaining customer acceptance. We face substantial competition from well-established companies with far greater resources, and our potential customers may be more familiar with our competitors and their capabilities.

Our future success will depend upon many factors and variables facing a new business, including factors which may be beyond our control or which cannot be predicted at this time. We have formulated our business plans and strategies based on certain assumptions regarding the acceptance of our business model and the marketing of our products and services. Nevertheless, our assessments regarding market size, market share, or market acceptance of our products and services or a variety of other factors may prove incorrect. We are a new enterprise and have not previously engaged in the market in which our products and services will be offered. Although certain members of our management have consulted with an existing company offering our products and services, none of them has managed or operated a business in this field prior to joining us. In sum, we may be unable to successfully implement our business plan and become a profitable business. Any such failure will have a materially adverse effect on our prospects and, likely, the value of any investment you may make in our Company.

We will require additional financing to sustain our operations and without it we may not be able to continue operations.

At December 31, 2015, we had a working capital deficit of $6.8 million. The independent auditor’s report for the year ended December 31, 2015, includes an explanatory paragraph to their audit opinion stating that our recurring losses from operations and working capital deficiency raise substantial doubt about our ability to continue as a going concern. We have an operating cash flow deficit of $7.5 million for the year ended December 31, 2015, an operating cash flow deficit of $10.1 million in fiscal year 2014, an operating cash flow deficit of $6.4 million in fiscal 2013 and an operating cash flow deficit of $7.5 million for the year ended December 31, 2012. We do not currently have sufficient financial resources to fund our operations or those of our subsidiary. Therefore, we need additional funds to continue these operations. We cannot provide assurance that the proceeds from the sale of equity securities, the exercise of warrants and conversion of debt will be sufficient to sustain the operations of the Company on a long-term basis or through the end of the year.

We may direct Lincoln Park Capital Fund, LLC to purchase up to $10,000,000 worth of shares of our common stock under a Purchase Agreement dated October 12, 2015 over a 36-month period generally in amounts up to 50,000 shares of our common stock on any such business day (a “Regular Purchase”), provided that at least one business day has passed since the most recent Regular Purchase, increasing to up to 200,000 shares, depending upon the closing sale price of the common stock. We may also direct Lincoln Park to purchase up to $100,000 worth of shares of common stock on any business day (an “Additional Purchase”), provided that at least six business days have passed since the most recent Additional Purchase was completed. As of April 12, 2016, we had utilized $272,755 of the $10,000,000 limit. However, Lincoln Park may not make further purchases of common stock under the Purchase Agreement if such purchases would result in it beneficially owning greater than 9.99% of our shares outstanding or if we are not in compliance with the terms of the Purchase Agreement. Further, in the future, maximum proceeds to the Company under the Purchase Agreement will be impacted by, among other things, the following factors: (i) the prevailing market price of our common stock at the time various purchases are made under the Purchase Agreement; (ii) whether or not our shares outstanding increases through, for example, the issuance of additional shares of our common stock outside the Purchase Agreement; and (iii) increases or decreases in Lincoln Park’s holdings of our common stock during the term of the Purchase Agreement. If we elect to issue and sell more than the 7,600,000 purchase shares under our agreement with Lincoln Park, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders. The number of shares ultimately offered for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement.

| 16 |

The extent we rely on Lincoln Park as a source of funding will depend on a number of factors including, the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources. If obtaining sufficient funding from Lincoln Park were to prove unavailable or prohibitively dilutive, we will need to secure another source of funding in order to satisfy our working capital needs. Even if we sell all $10,000,000 under the Purchase Agreement to Lincoln Park, we may still need additional capital to fully implement our business, operating and development plans. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could be a material adverse effect on our business, operating results, financial condition and prospects.

We will need additional financing in the future and any such financing may dilute our existing stockholders.

We require additional financing to continue our operations. Additional financing could be sought from a number of sources, including but not limited to additional sales of equity or debt securities (including equity-linked or convertible debt securities), loans from banks, loans from affiliates of the Company or other financial institutions. We may not, however, be able to sell any securities or obtain any such additional financing when needed, or do so on terms and conditions acceptable or favorable to us, if at all. If financing is not available, we may be forced to abandon our business plans or our entire business, or discontinue our preparation and filing of public disclosure reports with the SEC. If, on the other hand, we do successfully enter into a financing transaction, then any additional equity or equity-linked financing would be dilutive to our stockholders, and additional debt financing, if available, may involve restrictive covenants.

Our registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

In its report dated April 14, 2016, our independent registered public accounting firm, Lurie, LLP, stated that our consolidated financial statements for the fiscal year ended December 31, 2015 were prepared assuming that we would continue as a going concern and noted that our limited revenues, recurring losses from operations and stockholder deficit raise substantial doubt about our ability to continue as a going concern. We continue to experience limited revenues, operating losses and a stockholder deficit. Because we have received an opinion from our auditor that substantial doubt exists as to whether we can continue as a going concern, it may be more difficult for us to attract investors, secure debt financing or bank loans, or a combination of the foregoing, on favorable terms, if at all. If we are unable to generate sufficient revenue, find financing, or adjust our operating expenses so as to maintain positive working capital, then we likely will be forced to cease operations and investors will likely lose their entire investment. We can give no assurance as to our ability to generate adequate revenue, raise sufficient capital, sufficiently reduce operating expenses, or continue as a going concern. In addition, concerns about our financial viability may have an adverse effect on current and potential customers’ willingness to enter into long-term relationships with us.

We have a significant number of shares of our common stock issuable upon conversion of convertible preferred stock, the exercise of options and warrants and certain outstanding debt obligation, the issuance of such shares upon conversion and/or exercise will have a dilutive impact on our stockholders.

There are 14.4 million shares of common stock issuable upon conversion of our Series C Convertible Preferred Stock as of April 12, 2016. We also have outstanding as of such date stock options and warrants to purchase a total of 34.2 million shares of common stock. The issuance of such shares will have a dilutive impact on our stockholders.

| 17 |

Substantial future sales of shares of our common stock in the public market could cause our stock price to fall.

Shares of our common stock that we have issued directly or that have been or may be acquired upon exercise of warrants or conversion of convertible securities are or may be covered by registration statements which permit the public sale of stock. Other holders of shares of common stock that we have issued including shares issuable upon exchange or conversion as described above may be entitled to dispose of their shares pursuant to (i) the applicable holding period, volume and other restrictions of Rule 144 or (ii) another exemption from registration under the Securities Act of 1933. Additional sales of a substantial number of our shares of our common stock in the public market, or the perception that sales could occur, could have a material adverse effect on the price of our common stock.

We have a significant amount of secured and unsecured debt, which could limit or eliminate recovery of your investment if we fail to reach profitability.

We have a substantial amount of indebtedness. As of March 31, 2016, our total indebtedness aggregated to $5.3 million, of which $3.6 million was senior secured indebtedness owed to three lenders, and $1.7 million was unsecured indebtedness. In addition, the amount of accrued but unpaid interest as of March 31, 2016 totaled approximately $0.7 million. The holder of our series subordinated note referred to in note 6 of our consolidated financial statements has commenced an action against us to collect alleged amounts due and owing under the note. The holder of the note alleges we are in default. We dispute the allegations of the note holder and intend to vigorously defend the claim. However, the alleged default could subject the Company to claims of default or cross default by our other lenders. At this time no other lender has asserted such a claim. For more information, please see the risk factor immediately above (“We have a significant number of shares of our common stock issuable upon conversion. . . . ”) and Note 6 of our consolidated financial statements. We may be unable to satisfy the entirety of our debt owed to our lenders. Any such failure could have a material and adverse effect on our financial condition, business prospects, and our viability.

If we are unable to pay or refinance our senior secured indebtedness when due, or if we are declared bankrupt or insolvent, these junior creditors may not recover the value of their notes. As a matter of state and creditor law, common stock and preferred stock rank junior to all of our existing and future indebtedness, both secured and unsecured, and to other non-equity claims against our assets available to satisfy claims against us, including claims in bankruptcy, liquidation or similar proceedings. Due to the substantial indebtedness of our Company, holders of our common stock and preferred stock face the risk that they may not recover any portion of their investment unless all of the claims of our creditors are satisfied first or unless they are able to sell their stock prior to any such claims are asserted.

Our success critically depends on the continued popularity of our product and service technologies in general, and our products and services solution in particular, achieving and maintaining widespread acceptance in our targeted markets. If our products and services fall out of favor, or if our products and services fails to win consumer acceptance, the viability of our business may be threatened.

We expect that our success will depend to a large extent on the continuing broad market acceptance of our product and services technologies in general, and on market acceptance of our products and services among banks and credit unions. Our target customers may not currently use our products and services solutions for a number of other reasons, including unfamiliarity with the technology or perceived lack of reliability. We believe that the acceptance of our products and services by our prospective customers will depend on the following factors:

| ● | the continued importance of our product technologies and capabilities among end-user consumers; | |

| ● | our ability to demonstrate our products and services economic and other benefits; | |

| ● | our customers’ acceptance of us as a service provider; and | |

| ● | the reliability of the software and hardware comprising our products and services solution. |

| 18 |

Even if we are successful in refining, selling and servicing our products and related solutions, the market may slow or not grow fast enough for us to attain profitability in the near future, if ever.

Under our current business model, we rely upon third parties to provide software integration, hardware, fulfillment and support and maintenance services in connection with our products and services.

We do not own outright all of the rights and technologies, including software, that is used in our products. We may develop proprietary software for our solutions by using imaging, mobile solutions or other technologies from various partners. For instance, our product platform utilizes software and hardware from multiple third-party vendors such as Mitek Systems Inc., Parascript, LLC, AQ2 Technologies, LLC and Nitro Mobile Solutions, LLC, and we expect that we will continue to rely on multiple third-party vendors to create competitive software offerings for our customers and to provide them with state-of-the-art products.

We also rely on cooperation among our third-party vendors, and if they are unwilling to work with us or one another to perform needed integration services, our ability to provide competitive software offerings may be adversely impacted. The performance of our products and solutions depends upon the performance and quality of third party products and services, including hardware fulfillment, support and maintenance. If the systems provided by third parties develop technical or operations problems, or cannot be scaled to meet the needs of our customers, or the third parties do not perform required services in a timely manner, our business may be materially and adversely affected. Any such outcome could adversely affect the value or price of our common stock.

If our products have product defects or we fail to provide agreed upon services to our clients and end users, it could materially damage our reputation, sales and profitability and result in other costs.

The products we provide to our clients and industry partners, including those licensed from third parties and those we develop, are extremely complex and are constantly being modified and improved, and as such, they may contain undetected defects or errors when first introduced or as new versions are released. As a result, we could in the future face loss or delay in recognition of revenues as a result of software errors or defects. Our contracts with users and partners contain provisions that may require us to remedy malfunctions in our products or the services we provide and to pay damages if we breach our contractual obligations.

Despite our reliance on established software vendors and our testing, errors may still be found in our products, resulting in loss of revenues or delay in market acceptance, diversion of development resources, damage to our reputation, adverse litigation, or service and warranty costs, any of which would have a material adverse effect upon our business, operating results and financial condition. Ultimately, any of these outcomes could adversely affect the value or price of our common stock.

We face risks related to the storage of our customers’ and their end users’ confidential and proprietary information.

Our products are designed to maintain the confidentiality and security of our customers’ and their end users’ confidential and proprietary information that is stored on our systems, which may include sensitive financial data. However, any accidental or willful security breaches or other unauthorized access to this data could expose us to liability for the loss of such information, time-consuming and expensive litigation and other possible liabilities as well as negative publicity. Techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are difficult to recognize and react to. We may be unable to anticipate these techniques or implement adequate preventative or reactionary measures.

| 19 |

Our industry is characterized by rapid technological change. If we are unable to adapt our products and develop or acquire new technology to keep with these rapid changes, we will not be able to obtain or maintain market share.

The market for our product is characterized by rapidly changing technology, evolving industry standards, changes in customer needs and heavy competition. Furthermore, many of our competitors have greater capabilities and resources to develop and test new technology more rapidly than we do. We must respond to changing technology and industry standards in a timely and cost-effective manner. We may not be successful in acquiring new technologies, developing or acquiring new products or enhancing existing products in a timely and cost-effective manner. These new technologies or enhancements may not achieve market acceptance. Our pursuit of necessary technology may require substantial time and expense. We may need to license new technologies to respond to technological change. These licenses may not be available to us on financially favorable terms or at all. Finally, we may not succeed in adapting our products to new technologies as they emerge.

Our image in the marketplace could be damaged if our products and services become unavailable due to human error, power or Internet connectivity issues, or if there are security breaches.

It is important that our product and service solutions servers are available for processing to our customers on a 24/7/365 basis. We rely on our ISP to provide consistent service and administration, keep up with technical requirements and innovations, and maintain industry standards of redundancy and recovery. If our ISP does not meet these requirements, our image may suffer in the marketplace and we could lose customers.

Our business may be adversely affected by malicious applications that interfere with, or exploit security flaws in, our products and services. The financial services industry, and in particular banks and those involved in the check-cashing segment, are concerned about the maintenance of customer privacy and compliance with consumer privacy requirements under laws such as the Gramm-Leach-Bliley Act. While we strive to comply with all applicable data protection laws and regulations, as well as our own privacy policies, any failure or perceived failure on our part to comply, and even the failure of a competitor of ours in our industry, may result in proceedings or actions against us by government entities or others, or could cause us to lose users and customers, which could potentially have a material and adverse effect on our business.

In addition, as nearly all of our products and services are Internet based, the amount of data we store for our users on our servers (including personal information) has been increasing. Any systems failure or compromise of our security, or lapses by competitors in our industry, that results in the release of users’ data could seriously limit the adoption of our products and services, as well as harm our reputation and brand and, therefore, our business. We may also need to expend significant resources to protect against security breaches. The risk that these types of events could seriously harm our business is likely to increase as we expand the number of Internet-based products and services we offer.

Regulatory authorities around the world are considering a number of legislative and regulatory proposals concerning data protection. In addition, the interpretation and application of consumer and data protection laws in the United States, Europe and elsewhere are often uncertain and in flux. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data practices. If so, in addition to the possibility of fines, this could result in an order requiring that we change our data practices, which could have an adverse effect on our business. Complying with these various laws could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business.