Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - Clearday, Inc. | d20528dex21.htm |

| EX-32.2 - EX-32.2 - Clearday, Inc. | d20528dex322.htm |

| EX-31.2 - EX-31.2 - Clearday, Inc. | d20528dex312.htm |

| EX-32.1 - EX-32.1 - Clearday, Inc. | d20528dex321.htm |

| EX-23.1 - EX-23.1 - Clearday, Inc. | d20528dex231.htm |

| EX-31.1 - EX-31.1 - Clearday, Inc. | d20528dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission File Number 0-21074

SUPERCONDUCTOR TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| Delaware | 77-0158076 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

9101 Wall Street, Suite 1300, Austin, Texas 78754

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (512) 334-8900

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common stock, $0.001 par value | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ or No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ or No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x or No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x or No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

| Non-accelerated Filer | ¨ (Do not check if smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ or No x

The aggregate market value of the common stock held by non-affiliates was $15.4 million as of June 27, 2015 (the last business day of our most recently completed second fiscal quarter). The closing price of the common stock on that date was $1.05 as reported by the NASDAQ Capital Market. For purposes of this determination, we excluded the shares of common stock held by each officer and director and by each person who was known to us to own 10% or more of the outstanding common stock as of June 27, 2015. The exclusion of shares owned by the aforementioned individuals and entities from this calculation does not constitute an admission by any of such individuals or entities that he or it was or is an affiliate of ours.

We had 40,748,218 shares of common stock outstanding as of the close of business on March 15, 2016.

Table of Contents

SUPERCONDUCTOR TECHNOLOGIES INC.

FORM 10-K ANNUAL REPORT

Year Ended December 31, 2015

Unless otherwise noted, the terms “we,” “us,” “our” refer to the combined and ongoing business operations of Superconductor Technologies Inc. and its subsidiaries

i

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995 for these forward looking statements. Our forward-looking statements relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. Other statements contained in this Report that are not historical facts are also forward-looking statements. We have tried, wherever possible, to identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and other comparable terminology.

We caution investors that any forward-looking statements presented in this Report, or that we may make orally or in writing from time to time, are based on the beliefs of, assumptions made by, and information currently available to, us. Such statements are based on assumptions and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on past forward-looking statements, which are based on known results and trends at the time they are made, to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| • | our limited cash and a history of losses; |

| • | our need to materially grow our revenues from commercial operations and/or to raise additional capital (which financing may not be available on acceptable terms or at all) over the next 12-months to implement our current business plan and maintain our viability; |

| • | the performance and use of our equipment to produce wire in accordance with our timetable; |

| • | overcoming technical challenges in attaining milestones to develop and manufacture commercial lengths of our HTS wire; |

| • | the possibility of delays in customer evaluation and acceptance of our HTS wire; |

| • | the limited number of potential customers and customer pressures on the selling prices of our products; |

| • | the limited number of suppliers for some of our components and our HTS wire; |

| • | there being no significant backlog from quarter to quarter; |

| • | our market being characterized by rapidly advancing technology; |

| • | the impact of competitive products, technologies and pricing; |

| • | manufacturing capacity constraints and difficulties; |

| • | the impact of any financing activity on the level of our stock price; |

| • | the dilutive impact of any issuances of securities to raise capital; |

| • | cost and uncertainty from compliance with environmental regulations; |

| • | local, regional, and national and international economic conditions and events, and the impact they may have on us and our customers, and; |

| • | if we fail to maintain the listing of our common stock with a U.S. national securities exchange, the liquidity of our common stock could be adversely affected. |

1

Table of Contents

For further discussion of these and other factors see, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in this Report.

This Report and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date of this Report.

2

Table of Contents

General

We are a leading company in developing and commercializing high temperature superconductor (“HTS”) materials and related technologies. Superconductivity is the unique ability to conduct electricity with little or no resistance when cooled to “critical” temperatures. HTS materials are a family of elements that demonstrate superconducting properties at temperatures significantly warmer than previous superconducting materials. Electric currents that flow through conventional conductors encounter resistance that requires power to overcome and generates heat. HTS materials can substantially improve the performance characteristics of electrical systems, reduce power loss, and lowering heat generation providing extremely high current carrying density and zero resistance to direct current.

We were established in 1987 shortly after the discovery of HTS materials. Our stated objective was to develop products based on these materials for the commercial marketplace.

After analyzing the market opportunities available, we decided to develop products for the utility and telecommunications industries.

Our initial product was completed in 1998 and we began delivery to a number of wireless network providers. In the following 13 years, we continued to refine and improve the platform, with the primary focus on improving reliability, increasing performance and runtime, and most importantly, removing cost from the manufacturing process of the required subsystems. Our cost reducing efforts led to the invention of our proprietary, high-yield and high throughput HTS material deposition manufacturing process.

In late 2010, we transitioned our research and development efforts to adapting our proprietary HTS material deposition techniques to the production of our HTS Conductus® wire for next generation power applications, which is our primary opportunity to grow our future revenues. We continue to generate revenue from our legacy wireless communications products. This revenue has been declining and we expect this trend to continue until we completely abandon these products.

Our Proprietary Technology

Our development efforts over the last 28 years have yielded an extensive patent portfolio as well as critical trade secrets, unpatented technology and proprietary knowledge. We have an extensive patent portfolio in addition to critical trade secrets, unpatented technology and proprietary knowledge. Our current patents expire at various dates from 2016 to 2031. We enter into confidentiality and non-disclosure agreements with our employees, suppliers and consultants to protect our proprietary information.

Our strategic plan is to utilize our core proprietary technology in superconductivity and leverage our proprietary manufacturing processes to build Conductus wire for use in electrical power devices. As discussed above, we are adapting our unique HTS material deposition techniques to produce our energy efficient, cost-effective and high performance Conductus wire technology for next generation power applications. We have identified several large initial target markets for superconducting wire including energy (wind turbines, cables, fault current limiters), medical (NMR (nuclear magnetic resonance and MRI (magnetic resonance imaging)), science (high performance magnets) and industrial (motors, generators) applications. We are working with leading industry device manufactures to complete qualification and acceptance testing of Conductus wire. We expect significant commercial production of Conductus wire in the last half of 2016.

Our development efforts (including those described under “Our Future Business” below) can take a significant number of years to commercialize, and we must overcome significant technical barriers and deal with other significant risks, some of which are set out in our public filings, including in particular the “Risk Factors” included in Item 1A of this Report.

3

Table of Contents

Our Future Business

We have created several unique capabilities and HTS manufacturing systems related to our Conductus wire platform that we are seeking to produce by leveraging our leadership in superconducting technologies, extensive intellectual property and HTS manufacturing expertise.

HTS Wire Platform

Our Conductus wire product development is focused on large markets where the advantages of HTS wire are recognized by the industry. Our initial product roadmap targets three important applications: superconducting high power transmission cable, superconducting fault current limiters (SFCL) and high field magnets.

Superconducting High Power Transmission Cable:

Superconducting high power transmission and distribution cable transmit 5 to 10 times the electrical current of traditional copper or aluminum cables with significantly improved efficiency. HTS power cable systems consist of the cable, which is comprised of 100’s of strands of HTS wire wrapped around a copper core, and the cryogenic cooling system to maintain proper operating conditions. HTS power cables are particularly suited to high load areas such as the dense urban business districts of large cities, where purchases of easements and construction costs for traditional low capacity cables may be cost prohibitive. The primary application for HTS cables is medium voltage feeds to load pockets in dense urban areas. In these high demand zones the grid is often saturated with aging infrastructure. HTS technology brings a considerable amount of power to new locations where the construction of additional transmission to distribution substations, with major transformer assets, is not feasible. Another potential use of HTS power cable is to improve grid power transmission by connecting two existing substations. In dense urban environments many substations often reach capacity limits and require redundant transformer capacity to improve reliability HTS cables can tie these existing stations together, avoiding very costly transformer upgrades and construction costs.

Superconducting Fault Current Limiter (SFCL):

With power demand on the rise and new power generation sources being added, the grid has become overcrowded and vulnerable to catastrophic faults. Faults are abnormal flows of electrical current like a short circuit. As the grid is stressed, faults and power blackouts increase in frequency and severity. SFCLs act like powerful surge protectors, preventing harmful faults from taking down substation equipment by reducing the fault current to a safer level (20 – 50% reduction) so that the existing switchgear can still protect the grid. Currently, electrical-utilities use massive 80kA circuit breakers, oversized transformers and fuses to prevent faults from damaging their equipment and protecting against surges. However, once a fault has occurred, standard circuit breakers suffer destructive failure and need to be replaced before service can be restored. In addition, Smart Grid and embedded alternative energy generation enhancements will increase the need for SCFLs. Grid operators face a major challenge in moving power safely and efficiently, from generators to consumers, through several stages of voltage transformation step downs and step ups. At each stage, valuable energy is lost in the form of waste heat. Moreover, while demands are continually rising, space for transformers and substations—especially in dense urban areas—is severely limited. Conventional oil-cooled transformers pose a fire and environmental hazard. Compact, efficient superconducting transformers, by contrast, are cooled by safe, abundant and environmentally benign liquid nitrogen. As an additional benefit, these actively-cooled devices will offer the capability of operating in overload, to twice the nameplate rating, without any loss of life to meet occasional utility peak load demands.

Superconducting High Field magnets:

There are a variety of applications that utilize superconducting magnets in order to capitalize on their unique ability to create extremely high magnetic fields. The NMR and MRI machines of today utilize such superconducting magnets for this very reason. Currently, high-field superconducting magnets are manufactured using commercially available superconducting wire such as niobium-titanium (NbTi) or niobium-tin (Nb3Sn).

4

Table of Contents

NMR and MRI device manufacturers look towards advances in superconducting technologies to improve the overall performance of their systems by dramatically increasing the magnetic fields while reducing size. High demand for a robust, high performance and low cost superconducting wire has spurred rapid development of a next generation alternative. In the last 10 years, new second generation (2G) Rare Earth, Barium, Copper Oxide (ReBCO) superconducting materials have been proven to drastically increase magnetic field strengths, especially at low temperatures. These advanced ReBCO based superconductors now provide an excellent alternative to NbTi and Nb3Sn based materials.

Other Assets and Investments

In September 2014, STI and Robinson Research Institute entered a strategic agreement to jointly engage end customers and partners in the building of superconductor products utilizing our Conductus® superconducting wire and Robinson Research Institute’s superconducting device technology. The Robinson Research Institute, based at Victoria University of Wellington in New Zealand, has unique capabilities in the production of HTS Roebel cable used in superconducting machines and magnets, and in the development of HTS MRI and HTS transformers. The Robinson Research Institute has been a valuable ally as we prepare for the commercial launch of Conductus wire; Robinson’s performance characterization expertise and applications knowledge are truly impressive. As we move to full production, we are implementing a comprehensive plan to supply Conductus wire and support global leaders in the commercialization of superconducting devices. Robinson is an expert in the development of innovative superconducting products. Jointly, we have identified initial projects including applications such as rotating machines, transformers, scientific magnets and MRI systems. Additionally, Robinson and its partners have a strong focus on Asia and we believe our agreement will help us expand our reach into that fast-growing market. Working alongside many industry leaders, the Robinson Research Institute and its partners have built superconducting devices for the energy industry, recently completing a transformer for use in the electrical grid. In the healthcare market, Robinson has focused on applications of MRI systems where HTS wire gives a competitive advantage.

In July 2012, we contributed 14 issued and pending patents regarding our innovative Reconfigurable Resonance™ (RcR) technology in exchange for a minority investment in Resonant LLC. As of December 31, 2013 our interest in Resonant and the net value of the assets contributed, estimated to approximate fair value, was $185,000. In late September 2014 we entered into a private transaction to sell this minority interest to various buyers for gross proceeds to us of $3.6 million, and net proceeds to us of $3.3 million after offering expenses.

In 2007, we formed a joint venture with Hunchun BaoLi Communication Co. Ltd. (“BAOLI”) to manufacture and sell our SuperLink interference elimination solution in China. We use the equity method of accounting for our 45 percent joint venture interest. The joint venture agreement specified our joint venture partner to supply the capital and local expertise, and for us to provide a license of certain technology and supply key parts for manufacturing. Since 2007, there has been no significant progress to manufacture and sell our SuperLink interference elimination solution in China and the parties have not completed their contributions to the joint venture within the two year period specified by the agreement and Chinese law. We see our primary opportunity to grow future revenues with the production of our HTS Conductus® wire, and do not expect this joint venture to be a significant part of future revenues.

Licenses

We grant licenses for our technology to other companies. We have granted licenses to, among others, (1) Bruker for Nuclear Magnetic Resonance application, (2) General Dynamics for government applications, (3) Star Cryoelectronics for Superconducting Quantum Interference Device applications and (4) Theva for network infrastructure wireless electronic devices.

Government Contracts

We did not generate revenues from government contracts in the last three years.

5

Table of Contents

Manufacturing

Our manufacturing process involves the operation of sophisticated production equipment and material handling by production technicians. We purchase inventory components and manufacture inventory based on existing customer purchase requests, and to a lesser extent, on sales forecasts. Our primary facility is our advanced manufacturing center in Austin, Texas. This Texas facility addresses our growth expectations for our superconducting wire initiative. The opening of this facility coincided with the delivery of our first superconducting wire production equipment in early 2012. Sales of our Conductus wire are expected to increase as we reach production scale in the second half of 2016 and beyond. We currently assemble and test our wireless communications products at our facilities in Santa Barbara, California.

A number of components used in our products are available from only a limited number of outside suppliers due to unique designs, as well as certain quality and performance requirements. We do not have guaranteed supply arrangements with any of these suppliers, do not maintain an extensive inventory of parts or components and customarily purchase sole or limited source parts and components pursuant to purchase orders. Our reliance on sole or limited source suppliers involves certain risks and uncertainties, many of which are beyond our control, and some of which are set out in our public filings, including in particular the “Risk Factors” included in Item 1A of this Report.

Marketing and Sales

We utilize a direct selling model due to the concentrated customer base for superconducting wire.

Competition

We face competition in various aspects of our technology and product development. Our products compete on the basis of performance, functionality, reliability, pricing, quality and compliance with industry standards. Our primary competitors are American Superconductor (AMSC), SuperPower (Furukawa), SuNam, Fujikura, Sumitomo and THEVA, among others.

Research and Development

Our 2013 through 2015 research and development activities were focused entirely on developing our Conductus wire product. We spent a total of $4.1 million for 2015, and $6.0 million and $6.1 million for 2014 and 2013, respectively, on research and development.

Our Proprietary Technology

We have an extensive patent portfolio, in addition to critical trade secrets, unpatented technology and proprietary knowledge. Our current patents expire at various dates from 2016 to 2031. We enter into confidentiality and non-disclosure agreements with our employees, suppliers and consultants to protect our proprietary information.

Environmental Issues

We use certain hazardous materials in our research, development and manufacturing operations. As a result, we are subject to stringent federal, state and local regulations governing the storage, use and disposal of such materials. Current or future laws and regulations could require substantial expenditures for preventative or remedial action, reduction of chemical exposure, waste treatment or disposal. Although we believe that our safety procedures for the handling and disposing of hazardous materials comply with the standards prescribed by state and federal regulations, there is always the risk of accidental contamination or injury from these materials. To date, we have not incurred substantial expenditures for preventive action with respect to hazardous materials or for remedial action with respect to any hazardous materials accident. However, the use and disposal of hazardous

6

Table of Contents

materials involves the risk that we could incur substantial expenditures for such preventive or remedial actions. If such an accident were to occur, we could be held liable for resulting damages. The liability in the event of an accident or the costs of such remedial actions could exceed our resources or otherwise have a material adverse effect on our financial condition, results of operations or cash flows.

Corporate Information

Our facilities and principal executive offices are located at 9101 Wall Street, Suite 1300, Austin, Texas 78754. Our telephone number is (512) 334-8900. We were incorporated in Delaware on May 11, 1987. Additional information about us is available on our website at www.suptech.com. The information on our web site is not incorporated herein by reference.

Employees

As of December 31, 2015, we had a total of 25 full time employees. None of our employees are represented by a labor union, and we believe that our employee relations are good.

Backlog

Our commercial backlog consists of accepted product purchase orders with scheduled delivery dates during the next twelve months. We had commercial backlog of $58,000 at December 31, 2015, compared to $63,000 at December 31, 2014.

7

Table of Contents

| ITEM 1A. | RISK FACTORS |

The following section includes some of the material factors that may adversely affect our business and operations. This is not an exhaustive list, and additional factors could adversely affect our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. This discussion of risk factors includes many forward-looking statements. For cautions about relying on such forward looking statements, please refer to the section entitled “Forward Looking Statements” at the beginning of this Report immediately prior to Item 1.

Risks Related to Our Business

We have a history of losses and may never become profitable.

In each of our last five years, we have experienced significant net losses and negative cash flows from operations. In 2015, we incurred a net loss of $8.6 million and had negative cash flows from operations of $8.5 million. In 2014, we incurred a net loss of $8.3 million and had negative cash flows from operations of $10 million. Our independent registered public accounting firm has included in its audit reports an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. If we fail to increase our revenues, we may not achieve and may not maintain profitability, we may not realize our investment in infrastructure, and may not meet our expectations or the expectations of financial analysts who report on our stock.

We need to raise additional capital. If we are unable to raise capital our ability to implement our current business plan and ultimately our viability as a company could be adversely affected

At December 31, 2015, we had $7.5 million in cash and cash equivalents. Our current forecast is that our cash resources will be sufficient to fund our planned operations into the fourth quarter of 2016. Our cash resources will not be sufficient to fund our business for the next twelve months. Therefore, unless we can materially grow our revenues from commercial operations during such period, we will need to raise additional capital during the next 12-months to implement our current business plan and maintain the viability of the Company.

We believe the key factors to our future liquidity will be our ability to successfully use our expertise and our technology to generate revenues in various ways, including commercial operations, joint ventures and licenses. Because of the expected timing and uncertainty of these factors, we will need to raise funds to meet our working capital needs.

Additional financing may not be available on acceptable terms or at all. If we issue additional equity securities to raise funds, the ownership percentage of our existing stockholders would be reduced. New investors may demand rights, preferences or privileges senior to those of existing holders of common stock and could also require that we issue warrants in connection with sales of our stock. If we cannot raise any needed funds to grow our commercial resources, we might be forced to make changes to, or delay aspects of, our business plan which could adversely affect our ability to implement our current business plan and ultimately our viability as a company.

Our strategic initiative to develop a new wire platform may not prove to be successful.

We have spent a considerable amount of resources in developing a new wire platform for power applications. Substantial technical and business challenges remain before we can have a commercially successful product introduction. We may not be able to overcome these challenges in a timely or cost effective manner, if at all. Such a failure could adversely impact our prospects, liquidity, stock price and carrying value of our fixed assets.

8

Table of Contents

There are numerous technological challenges that must be overcome in order for our Conductus wire to become commercially successful and our ability to address such technological challenges may adversely affect our ability to gain customers.

We expect to begin commercial Conductus wire production in 2016. Conductus® wire is uniquely positioned to address three key technical challenges in the market: high performance, improved economics and commercial-scale capacity. To date, we, along with existing HTS wire manufacturers, have not overcome these challenges to allow for broad commercialization of HTS wire. Customers cannot purchase long-length wire with any reasonable confidence or guaranteed volume; and electric utilities lack confidence in product availability which leads to delays in their deployment roadmap. HTS wire performance is currently below what many customers require. Many power applications require high performance wire with high current carrying capacity, mechanical durability, electrical integrity with low AC losses and minimal splices. Producing high performance HTS wire has proven difficult, especially at volumes required for large scale deployment. The high demand for high performance wire available in very low volume results in a high wire price that narrows the market and limits commercial viability. Delays in our Conductus wire development, as a result of technological challenges or other factors, may result in the introduction or commercial acceptance of our Conductus wire products later than expected.

The commercial uses of superconducting wire and superconducting wire related products are limited today, and a broad commercial market may not develop.

Even if the technological hurdles are overcome, there is no certainty that a robust commercial market for unproven HTS wire products will come to fruition. To date, commercial use of HTS wire has been limited to small feasibility demonstrations, and these projects are largely subsidized by government authorities. While customer demand is high and market forecasts project large revenue opportunity for superconducting wire in power applications, the market may not develop and superconducting wire might never achieve long term, broad commercialization. In such an event, we would not be able to commercialize our Conductus wire initiative and our business could be adversely impacted.

We have limited experience marketing and selling superconducting wire products, and our failure to effectively market and sell our superconducting wire solutions would lower our revenue and cash flow.

We have limited experience marketing and selling our Conductus wire. Once our Conductus wire is ready for commercial use, we will have to hire and develop a marketing and sales team to effectively demonstrate the advantages of our product over both more traditional products and competing superconducting products or other adjacent technologies. We may not be successful in our efforts to market this new technology.

We expect continued customer pressures to reduce our product pricing which may adversely affect our ability to operate on a commercially viable basis.

We expect to face pressure to reduce prices and accordingly, the average selling price of our Conductus wire. We anticipate customer pressure on our product pricing will continue for the foreseeable future. HTS wire is currently being sold at $250/kiloampere-meter (kA-m). At this price, HTS wire represents more than half the cost of the end device. A price reduction is required for long term commercialization. Cryogenic systems, including cryocoolers and cryostats, have been developed but will also need to be cost optimized as HTS wire becomes available in volume. We have plans to further reduce the manufacturing cost of our products, but there is no assurance that our future cost reduction efforts will keep pace with price erosion. We will need to further reduce our manufacturing costs through engineering improvements and economies of scale in production and purchasing in order to achieve adequate gross margins. We may not be able to achieve the required product cost savings at a rate needed to keep pace with competitive pricing pressure. Additionally, we may be forced to discount future orders or may never reach commercial viability. If we fail to reach our cost saving objectives or we are required to offer future discounts, our business may be harmed.

9

Table of Contents

We face competition with respect to various aspects of our technology and product development.

Our current wireless products compete on the basis of performance, functionality, reliability, pricing, quality, and compliance with industry standards. With respect to our Conductus wire materials, we compete with American Superconductor (AMSC), SuperPower (Furukawa), SuNam, Fujikura, Sumitomo and THEVA, among others. In addition, we currently supply components and license technology to several companies that may eventually decide to manufacture or design their own HTS components, rather than purchasing or licensing our technology. If we are unable to compete successfully against our current or future competitors, then our business and results of operations will be adversely affected.

We may not be able to compete effectively against alternative technologies.

Our products also compete with a number of alternative approaches and technologies. Some of these alternatives may be more cost effective or offer better performance than our products and we may not succeed in competing against these alternatives.

We currently rely on specific technologies and may not successfully adapt to rapidly changing market environments.

We must overcome technical challenges to commercialize our Conductus wire. If we are able to do so, we will need to attain customer acceptance of our Conductus wire, and we cannot ensure that such acceptance will occur. We will have to continue to develop and integrate advances to our core technologies. We will also need to continue to develop and integrate advances in complementary technologies. We cannot guarantee that our development efforts will not be rendered obsolete by research efforts and technological advances made by others. Our business success depends upon our ability to keep pace with advancing technology, including materials, processes and industry standards.

We may experience significant fluctuations in sales and operating results from quarter to quarter.

Our quarterly results may fluctuate due to a number of factors, including:

| • | the lack of any contractual obligation by our customers to purchase their forecasted demand for our products; |

| • | variations in the timing, cancellation, or rescheduling of customer orders and shipments; and |

| • | high fixed expenses that may disproportionately impact operating expenses, especially during a quarter with a sales shortfall. |

Order deferrals and cancellations by our customers, declining average sales prices, changes in the mix of products sold, increases in inventory and finished goods, delays in the introduction of new products and longer than anticipated sales cycles for our products have, in the past, adversely affected our results of operations. If our customers desire to purchase products in excess of the forecasted amounts or in a different product mix, there may not be enough inventory or manufacturing capacity to fill their orders.

Due to these and other factors, our past results have limited predictive value as to our Conductus wire initiative. Future revenues and operating results may not meet the expectations of stock analysts and investors. In either case, the price of our common stock could be materially adversely affected.

Worldwide economic uncertainty may adversely affect our business, operating results and financial condition.

The United States and global economies continue to experience a period of economic and financial uncertainty, which could result in economic volatility having direct and indirect adverse effects on our business, operating results and financial condition in a number of ways. For example, current or potential customers may

10

Table of Contents

delay or decrease spending with us may delay paying us for previously purchased products, or may not pay us at all. In addition, this recent downturn has had, and may continue to have, an unprecedented negative impact on the global credit markets. If we are required to obtain financing in the near term to meet our working capital or other business needs, we may not be able to obtain that financing. Further, even if we are able to obtain the financing we need, it may be on terms that are not favorable to us, with increased financing costs and restrictive covenants.

Our reliance on a limited number of suppliers and the long lead time of components for our products could impair our ability to manufacture and deliver our systems on a timely basis.

A number of components used in our products are available from a limited number of outside suppliers due to unique designs as well as certain quality and performance requirements. Our reliance on sole or limited source suppliers involves certain risks and uncertainties, many of which are beyond our control. These include the possibility of a shortage or the discontinuation of certain key components. Any reduced availability of these parts or components when required could impair our ability to manufacture and deliver our systems on a timely basis and result in the delay or cancellation of orders, which could harm our business.

In addition, the purchase of some of our key components involves long lead times and, in the event of unanticipated increases in demand for our solutions, we may be unable to obtain these components in sufficient quantities to meet our customers’ requirements. We do not have guaranteed supply arrangements with any of these suppliers, do not maintain an extensive inventory of parts or components and customarily purchase sole or limited source parts and components pursuant to purchase orders. Business disruptions, quality issues, production shortfalls or financial difficulties of a sole or limited source supplier could materially and adversely affect us by increasing product costs, or eliminating or delaying the availability of such parts or components. In such events, our inability to develop alternative sources of supply quickly and on a cost-effective basis could impair our ability to manufacture and deliver our systems on a timely basis and could harm our business.

Our reliance on a limited number of suppliers exposes us to quality control issues.

Our reliance on certain single-source and limited-source components exposes us to quality control issues if these suppliers experience a failure in their production process or otherwise fail to meet our quality requirements. A failure in single-source or limited-source components or products could force us to repair or replace a product utilizing replacement components. If we cannot obtain comparable replacements or effectively return or redesign our products, we could lose customer orders or incur additional costs, which could have a material adverse effect on our gross margins and results of operations.

Our ability to protect our patents and other proprietary rights is uncertain, exposing us to possible losses of competitive advantage.

Our efforts to protect our proprietary rights may not succeed in preventing infringement by others or ensure that these rights will provide us with a competitive advantage. Pending patent applications may not result in issued patents and the validity of issued patents may be subject to challenge. Third parties may also be able to design around the patented aspects of the products. Additionally, certain of the issued patents and patent applications are owned jointly with third parties. Because any owner or co-owner of a patent can license its rights under jointly-owned patents or applications, inventions made by us jointly with others are not subject to our exclusive control. Any of these possible events could result in losses of competitive advantage.

We depend on specific patents and licenses to technologies, and we will likely need additional technologies in the future that we may not be able to obtain.

We utilize technologies under licenses of patents from others for our products. These patents may be subject to challenge, which may result in significant litigation expense (which may or may not be recoverable against future royalty obligations). Additionally, we continually try to develop new products, and, in the course of doing

11

Table of Contents

so, we may be required to utilize intellectual property rights owned by others and may seek licenses to do so. Such licenses may not be obtainable on commercially reasonable terms, or at all. It is also possible that we may inadvertently utilize intellectual property rights held by others, which could result in substantial claims.

Intellectual property infringement claims against us could materially harm results of operations.

Our products incorporate a number of technologies, including high-temperature superconductor technology, technology related to other materials, and electronics technologies. Our patent positions, and that of other companies using high-temperature superconductor technology, is uncertain and there is significant risk that others, including our competitors or potential competitors, have obtained or will obtain patents relating to our products or technologies or products or technologies planned to be introduced by us.

We believe that patents may be or have been issued, or applications may be pending, claiming various compositions of matter used in our products. We may need to secure one or more licenses of these patents. There can be no assurances that such licenses could be obtained on commercially reasonable terms, or at all. We may be required to expend significant resources to develop alternatives that would not infringe such patents or to obtain licenses to the related technology. We may not be able to successfully design around these patents or obtain licenses to them and may have to defend ourselves at substantial cost against allegations of infringement of third party patents or other rights to intellectual property. In those circumstances, we could face significant liabilities and also be forced to cease the use of key technology.

Other parties may have the right to utilize technology important to our business.

We utilize certain intellectual property rights under non-exclusive licenses or have granted to others the right to utilize certain intellectual property rights licensed from a third party. Because we may not have the exclusive rights to utilize such intellectual property, other parties may be able to compete with us, which may harm our business.

Because competition for target employees is intense, we may be subject to claims of unfair hiring practices, trade secret misappropriation or other related claims.

Companies in HTS wire industries whose employees accept positions with competitors frequently claim that competitors have engaged in unfair hiring practices, trade secret misappropriation or other related claims. We may be subject to such claims in the future as we seek to hire qualified personnel, and such claims may result in material litigation. If this should occur, we could incur substantial costs in defending against these claims, regardless of their merits.

Our success depends on the attraction and retention of senior management and technical personnel with relevant expertise.

As a competitor in a highly technical market, we depend heavily upon the efforts of our existing senior management and technical teams. The loss of the services of one or more members of these teams could slow product development and commercialization objectives. Due to the specialized nature of our products, we also depend upon our ability to attract and retain qualified technical personnel with substantial industry knowledge and expertise. Competition for qualified personnel is intense, and we may not be able to continue to attract and retain qualified personnel necessary for the development of our business.

Regulatory changes could substantially harm our business.

Certain regulatory agencies in the United States and other countries set standards for operations within their territories. HTS wire is subject to a regulatory regime, which may become more strictly regulated if the market grows. Any failure or delay in obtaining necessary approvals could harm our business.

12

Table of Contents

We may acquire or make investments in companies or technologies that could cause loss of value to stockholders and disruption of business.

We may explore opportunities to acquire companies or technologies in the future. Other than the acquisition of Conductus, Inc. in 2002, we have not made any such acquisitions or investments to date and, therefore, our ability as an organization to make acquisitions or investments is unproven. An acquisition entails many risks, any of which could adversely affect our business, including:

| • | failure to integrate operations, services and personnel; |

| • | the price paid may exceed the value eventually realized; |

| • | loss of share value to existing stockholders as a result of issuing equity securities to finance an acquisition; |

| • | potential loss of key employees from either our then current business or any acquired business; |

| • | entering into markets in which we have little or no prior experience; |

| • | diversion of financial resources and management’s attention from other business concerns; |

| • | assumption of unanticipated liabilities related to the acquired assets; and |

| • | the business or technologies acquired or invested in may have limited operating histories and may be subjected to many of the same risks to which we are exposed. |

In addition, future acquisitions may result in potentially dilutive issuances of equity securities, or the incurrence of debt, contingent liabilities or amortization expenses or charges related to goodwill or other intangible assets, any of which could harm our business. As a result, if we fail to properly evaluate and execute acquisitions or investments, our business and prospects may be seriously harmed.

If we are unable to implement appropriate controls and procedures to manage our potential growth, we may not be able to successfully offer our products and implement our business plan.

Our ability to successfully offer our products and implement our business plan in a rapidly evolving market requires an effective planning and management process. Growth in future operations would place a significant strain on management systems and resources. We expect that we would need to improve our financial and managerial controls, reporting systems and procedures, and would need to expand, train and manage our work force worldwide. Furthermore, we expect that we would be required to manage multiple relationships with various customers and other third parties.

Compliance with environmental regulations could be especially costly due to the hazardous materials used in the manufacturing process. In addition, we could incur expenditures related to hazardous material accidents.

We are subject to a number of federal, state and local governmental regulations related to the use, storage, discharge and disposal of toxic, volatile or otherwise hazardous chemicals used in our business. Current or future laws and regulations could require substantial expenditures for preventative or remedial action, reduction of chemical exposure, waste treatment or disposal. Any failure to comply with present or future regulations could result in the imposition of fines, suspension of production or interruption of operations. In addition, these regulations could restrict our ability to expand or could require us to acquire costly equipment or incur other significant expense to comply with environmental regulations or to clean up prior discharges.

In addition, although we believe that our safety procedures for the handling and disposing of hazardous materials comply with the standards prescribed by state and federal regulations, there is always the risk of accidental contamination or injury from these materials. To date, we have not incurred substantial expenditures for preventive action with respect to hazardous materials or for remedial action with respect to any hazardous materials accident, but the use and disposal of hazardous materials involves risk that we could incur substantial

13

Table of Contents

expenditures for such preventive or remedial actions. If such an accident were to occur, we could be held liable for resulting damages. The liability in the event of an accident or the costs of such remedial actions could exceed our resources or otherwise have a material adverse effect on our financial condition, results of operations or cash flows.

The reliability of market data included in our public filings is uncertain.

Since we operate in a rapidly changing market, we have in the past, and may from time to time in the future, include market data from industry publications and our own internal estimates in some of the documents we file with the Securities and Exchange Commission. The reliability of this data cannot be assured. Industry publications generally state that the information contained in these publications has been obtained from sources believed to be reliable, but that its accuracy and completeness is not guaranteed. Although we believe that the market data used in our filings with the Securities and Exchange Commission is and will be reliable, it has not been independently verified. Similarly, internal company estimates, while believed by us to be reliable, have not been verified by any independent sources.

Our international operations expose us to certain risks.

In 2007, we formed a joint venture with BAOLI to manufacture and sell our SuperLink interference elimination solution in China. In addition to facing many of the risks faced by our domestic business, if that joint venture or any other international operation we may have is to be successful, we (together with any joint venture partner) must recruit the necessary personnel and develop the facilities needed to manufacture and sell the products involved, learn about the local market (which may be significantly different from our domestic market), build brand awareness among potential customers and compete successfully with local organizations with greater market knowledge and potentially greater resources than we have. We must also obtain a number of critical governmental approvals from both the United States and the local country governments on a timely basis, including those related to any transfers of our technology. We must establish sufficient controls on any foreign operations to ensure that those operations are operated in accordance with our interests, that our intellectual property is protected and that our involvement does not inadvertently create potential competitors. There can be no assurance that these conditions will be met. Even if they are met, the process of building our international operations could divert financial resources and management attention from other business concerns. Finally, our international operations will also be subject to the general risks of international operations, such as:

| • | changes in exchange rates; |

| • | international political and economic conditions; |

| • | changes in government regulation in various countries; |

| • | trade barriers; |

| • | adverse tax consequences; and |

Risks Related to Our Common Stock

Our stock price is volatile.

The market price of our common stock has been, and is expected to be, subject to significant volatility. The value of our common stock may decline regardless of our operating performance or prospects. Factors affecting our market price include:

| • | our perceived prospects and liquidity; |

| • | progress or any lack of progress (or perceptions related to progress) in timely overcoming the remaining substantial technical and commercial challenges related to our Conductus wire initiative; |

| • | variations in our operating results and whether we have achieved key business targets; |

14

Table of Contents

| • | changes in, or our failure to meet, earnings estimates; |

| • | changes in securities analysts’ buy/sell recommendations; |

| • | differences between our reported results and those expected by investors and securities analysts; |

| • | announcements of new contracts by us or our competitors; |

| • | market reaction to any acquisitions, joint ventures or strategic investments announced by us or our competitors; and |

| • | general economic, political or stock market conditions. |

Recent events have caused stock prices for many companies, including ours, to fluctuate in ways unrelated or disproportionate to their operating performance. The general economic, political and stock market conditions that may affect the market price of our common stock are beyond our control. The market price of our common stock at any particular time may not remain the market price in the future.

If we fail to maintain the listing of our common stock with a U.S. national securities exchange, the liquidity of our common stock could be adversely affected.

On October 30, 2015, we received a letter from the Listing Qualifications Department of The Nasdaq Stock Market notifying us that the minimum bid price per share for our common stock fell below $1.00 for a period of 30 consecutive business days and that therefore we did not meet the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2).

We have been provided 180 calendar days, or until April 27, 2016, to regain compliance with the minimum bid price requirement. In accordance with Rule 5810(c)(3)(A), we can regain compliance if at any time during the 180-day period the closing bid price of our common stock is at least $1.00 for a minimum of 10 consecutive business days. If by April 27, 2016, we cannot demonstrate compliance with the Rule 5550(a)(2), we may be eligible for additional time. To qualify for additional time, we will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice of our intention to cure the deficiency during the second compliance period. If we are not eligible for the second compliance period, then the Nasdaq Staff will provide notice that our securities will be subject to delisting. At such time, we may appeal the delisting determination to a Hearings Panel.

We continue to monitor the closing bid price of our common stock and may, if appropriate, consider implementing available options to regain compliance with the minimum bid price requirement. If our common stock is delisted by The Nasdaq Stock Market, our common stock may be eligible to trade in an over-the-counter market. Any such alternative would likely result in it being more difficult for us to raise additional capital through the public or private sale of equity securities and for investors to dispose of, or obtain accurate quotations as to the market value of, our common stock. In addition, there can be no assurance that our common stock would be eligible for trading on any such alternative exchange or markets.

We have a significant number of outstanding warrants and options, and future sales of the shares obtained upon exercise of these options or warrants could adversely affect the market price of our common stock.

As of December 31, 2015, we had outstanding options exercisable for an aggregate of 1,973,606 shares of common stock at a weighted average exercise price of $2.54 per share and warrants to purchase up to 57,451,915 shares of our common stock at a weighted average exercise price of $0.55 per share. We have registered the issuance of all the shares issuable upon exercise of the options and warrants, and they will be freely tradable by the exercising party upon issuance. The holders may sell these shares in the public markets from time to time, without limitations on the timing, amount or method of sale. As our stock price rises, the holders may exercise their warrants and options and sell a large number of shares. This could cause the market price of our common stock to decline.

15

Table of Contents

Our corporate governance structure may prevent our acquisition by another company at a premium over the public trading price of our shares.

It is possible that the acquisition of a majority of our outstanding voting stock by another company could result in our stockholders receiving a premium over the public trading price for our shares. Provisions of our restated certificate of incorporation, as amended our bylaws and of Delaware corporate law could delay or make more difficult an acquisition of our company by merger, tender offer or proxy contest, even if it would create an immediate benefit to our stockholders. For example, our restated certificate of incorporation does not permit stockholders to act by written consent, and our bylaws generally require ninety days advance notice of any matters to be brought before the stockholders at an annual or special meeting.

In addition, our board of directors has the authority to issue up to 2,000,000 shares of preferred stock and to determine the terms, rights and preferences of this preferred stock, including voting rights of those shares, without any further vote or action by the stockholders. At March 15, 2016, 1,383,727 shares of preferred stock remained unissued. The rights of the holders of common stock may be subordinate to, and adversely affected by, the rights of holders of preferred stock that may be issued in the future. The issuance of preferred stock could also make it more difficult for a third party to acquire a majority of our outstanding voting stock, even at a premium over our public trading price.

Furthermore, our certificate of incorporation also provides for a classified board of directors with directors divided into three classes serving staggered terms. These provisions may have the effect of delaying or preventing a change in control of us without action by our stockholders and, therefore, could adversely affect the price of our stock or the possibility of sale of shares to an acquiring person.

We do not anticipate declaring any cash dividends on our common stock.

We have never declared or paid cash dividends on our common stock and do not plan to pay any cash dividends in the near future. Our current policy is to retain all funds and earnings for use in the operation and expansion of our business.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

| ITEM 2. | PROPERTIES |

We lease all of our properties. All of our operations, including our manufacturing facilities, are located in industrial complexes in Santa Barbara, California and Austin, Texas. We occupy approximately 14,000 square feet in Santa Barbara, California and 94,000 square feet in Austin, Texas under long-term leases that expire in November 2016 and April 2017, respectively. Although we currently have excess capacity, we believe these facilities can be managed in a flexible and cost effective manner and are adequate to meet current and reasonably anticipated needs for approximately the next two years. Both leases contain renewal options.

| ITEM 3. | LEGAL PROCEEDINGS |

From time to time, we are party to various lawsuits, claims and other legal proceedings that arise in the ordinary course of our business. Excluding ordinary, routine litigation incidental to our business, we are not currently a party to any legal proceedings that we believe would reasonably be expected to have a material adverse effect on our business, financial condition or results of operation or cash flow.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

16

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market for Common Stock

Our common stock is traded on the NASDAQ Capital Market under the symbol “SCON.” The following table shows the high and low sales prices for our common stock as reported by NASDAQ for each calendar quarter in the last two fiscal years:

| High | Low | |||||||

| 2015 | ||||||||

| Quarter ended December 31, 2015 |

$ | 0.78 | $ | 0.15 | ||||

| Quarter ended September 26, 2015 |

$ | 1.43 | $ | 0.76 | ||||

| Quarter ended June 27, 2015 |

$ | 1.44 | $ | 0.82 | ||||

| Quarter ended March 28, 2015 |

$ | 2.90 | $ | 1.31 | ||||

| 2014 | ||||||||

| Quarter ended December 31, 2014 |

$ | 3.10 | $ | 2.54 | ||||

| Quarter ended September 27, 2014 |

$ | 3.23 | $ | 2.42 | ||||

| Quarter ended June 28, 2014 |

$ | 3.23 | $ | 2.16 | ||||

| Quarter ended March 29, 2014 |

$ | 3.82 | $ | 2.15 | ||||

Holders of Record

We had 34 holders of record of our common stock on March 15, 2016. This number does not include stockholders for whom shares were held in a “nominee” or “street” name. We estimate that there are more than 5,000 beneficial owners of our common stock.

Dividends

We have never paid cash dividends and intend to employ all available funds in the development of our business. We have no plans to pay cash dividends in the near future.

Our ability to declare or pay dividends on shares of our common stock is subject to the requirement that we pay an equivalent dividend on each outstanding share of our Series A and Series B Preferred Stock (on an as-converted basis).

Sales of Unregistered Securities

We did not conduct any offerings of equity securities during the fourth quarter of 2015 that were not registered under the Securities Act of 1933.

Repurchases of Equity Securities

The following table summarizes repurchases of our common stock in the quarter ended December 31, 2015:

| Period |

Total Number of Shares Purchased(1) |

Average Price Paid Per Share |

||||||

| September 27, 2015—October 24, 2015 |

— | $ | — | |||||

| October 25, 2015—November 21, 2015 |

133,894 | 0.22 | ||||||

| November 22, 2015—December 31, 2015 |

— | — | ||||||

|

|

|

|

|

|||||

| Total |

133,894 | $ | 0.22 | |||||

|

|

|

|

|

|||||

17

Table of Contents

| (1) | Shares surrendered to us by employees to satisfy tax withholding obligations that arose upon the vesting of restricted stock awards. These repurchases were not made pursuant to publicly announced plans or programs. |

Securities Authorized for Issuance Under Equity Compensation Plans

Equity Compensation Plan Information

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||||

| Equity compensation plans approved by security holders |

1,973,606 | $ | 2.54 | 1,442,880 | ||||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

1,973,606 | $ | 2.54 | 1,442,880 | ||||||||

|

|

|

|

|

|

|

|||||||

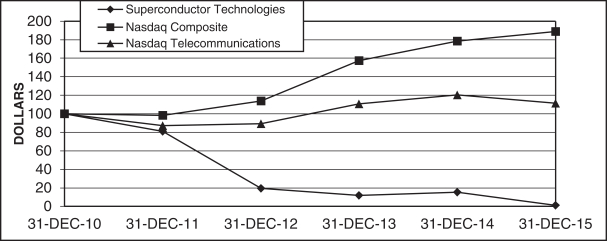

Stock Performance Graph

The stock performance graph and related information presented below shall not be deemed “soliciting material” or “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent that we specifically request that such information be treated as soliciting material or specifically incorporate it by reference into such a filing.

18

Table of Contents

The graph and table below compare the cumulative total stockholders’ return on our common stock since December 31, 2010 with the Nasdaq Composite Index, and the Nasdaq Telecommunications Index over the same period (assuming the investment of $100 in our common stock and in the two other indices, and reinvestment of all dividends).

| 31-Dec-10 | 31-Dec-11 | 31-Dec-12 | 31-Dec-13 | 31-Dec-14 | 31-Dec-15 | |||||||||||||||||||

| Superconductor Technologies |

$ | 100.00 | $ | 80.92 | $ | 19.52 | $ | 11.79 | $ | 15.19 | $ | 1.15 | ||||||||||||

| Nasdaq Composite |

100.00 | 98.20 | 113.82 | 157.44 | 178.53 | 188.75 | ||||||||||||||||||

| Nasdaq-Telecommunications |

100.00 | 87.38 | 89.13 | 110.55 | 120.38 | 111.36 | ||||||||||||||||||

19

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The information set forth below is not necessarily indicative of results of future operations and should be read in conjunction with our Financial Statements and Notes thereto appearing in Item 15 of Part IV of this Report and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

| Years Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||

| Net commercial product revenues |

$ | 244 | $ | 632 | $ | 1,710 | $ | 3,237 | $ | 3,416 | ||||||||||

| Government and other contract revenues |

— | — | — | 222 | 83 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net revenues |

244 | 632 | 1,710 | 3,459 | 3,499 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Cost of commercial product revenues |

3,004 | 1,558 | 1,051 | 3,850 | 5,434 | |||||||||||||||

| Cost of government and other contract revenues |

— | — | — | 165 | 79 | |||||||||||||||

| Other research and development |

4,125 | 5,992 | 6,073 | 5,030 | 5,325 | |||||||||||||||

| Selling, general and administrative |

5,838 | 5,389 | 5,068 | 5,440 | 6,322 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total costs and expenses |

12,967 | 12,939 | 12,192 | 14,485 | 17,160 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(12,723 | ) | (12,307 | ) | (10,482 | ) | (11,026 | ) | (13,661 | ) | ||||||||||

| Other income (expense), net |

4,121 | 4,056 | (1,691 | ) | 98 | 278 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (8,602 | ) | $ | (8,251 | ) | $ | (12,173 | ) | $ | (10,928 | ) | $ | (13,383 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic and diluted net loss per common share |

$ | (0.44 | ) | $ | (0.64 | ) | $ | (1.71 | ) | $ | (3.34 | ) | $ | (5.05 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average number of shares |

||||||||||||||||||||

| Outstanding |

19,706 | 12,794 | 7,124 | 3,269 | 2,652 | |||||||||||||||

| Years Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 7,469 | $ | 1,238 | $ | 7,459 | $ | 3,634 | $ | 6,165 | ||||||||||

| Working capital |

6,900 | (407 | ) | 6,638 | 3,059 | 7,161 | ||||||||||||||

| Total assets |

14,365 | 10,799 | 14,840 | 12,029 | 12,949 | |||||||||||||||

| Long-term debt, including current portion |

400 | 5,624 | 6,263 | 674 | 628 | |||||||||||||||

| Total stockholders’ equity |

13,122 | 4,002 | 7,306 | 10,292 | 11,175 | |||||||||||||||

20

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Management’s Discussion and Analysis of Financial Condition and Results of Operations includes many forward-looking statements. For cautions about relying on such forward looking statements, please refer to the section entitled “Forward Looking Statements” at the beginning of this Report immediately prior to Item 1.

General

We are a leading company in developing and commercializing high temperature superconductor (“HTS”) materials and related technologies. HTS materials can substantially improve the performance characteristics of electrical systems, reducing power loss, lowering heat generation, and decreasing electrical noise.

Results of Operations

2015 Compared to 2014

Net revenues consist primarily of commercial product revenues. Net revenues decreased by $388,000 or 61%, to $244,000 in 2015 from $632,000 in 2014. Sales of our new Conductus wire were equal to $47,000, or 19%, of our total revenue in 2015. Sales of our Conductus wire are expected to increase as we reach production scale in the second half of 2016 and beyond.

The decrease is the result of lower sales volume for our wireless communications products as we grow sales of our Conductus wire. We sell this legacy product to large North American wireless operators whose spending on 3G data networks, where our products are deployed, has become a secondary priority. Sales prices for wireless products were essentially unchanged in 2015 from 2014. Our two largest customers accounted for 80% of our net commercial revenues in 2015 and 83% of our net commercial revenues in 2014. These customers generally purchase products through non-binding commitments with minimal lead-times. Consequently, our commercial product revenues can fluctuate dramatically from quarter to quarter based on changes in our customers’ capital spending patterns. We do not anticipate that the revenues for our legacy products will be significant in the future.

Cost of commercial product revenues includes all direct costs, manufacturing overhead and provision for excess and obsolete inventories. The cost of commercial product revenues totaled $3.0 million for 2015 compared to $1.6 million for 2014, an increase of $1.4 million, or 88%. The higher costs resulted principally from increased manufacturing operating expenses and early low capacity operation and efforts to improve yields from our new large Conductus wire production equipment.

Our cost of revenues includes both variable and fixed cost components. The variable component consists primarily of materials, assembly and test labor, overhead, which includes equipment and facility depreciation, transportation costs and warranty costs. The fixed component includes test equipment and facility depreciation, purchasing and procurement expenses and quality assurance costs. Given the fixed nature of such costs, the absorption of our production overhead costs into inventory decreases and the amount of production overhead variances charged to cost of sales increases as production volumes decline since we have fewer units to absorb our overhead costs against. Conversely, the absorption of our production overhead costs into inventory increases and the amount of production overhead variances expensed to cost of sales decreases as production volumes increase since we have more units to absorb our overhead costs against. As a result, our gross profit margins generally decrease as revenue and production volumes decline due to lower sales volume and higher amounts of production overhead variances expensed to cost of sales; and our gross profit margins generally increase as our revenue and production volumes increase due to higher sales volume and lower amounts of production overhead variances expensed to cost of sales.

21

Table of Contents

The following is an analysis of our commercial product gross profit margins for 2015 and 2014:

| Years Ended December 31, | ||||||||||||||||

| Dollars in Thousands | 2015 | 2014 | ||||||||||||||

| Net commercial product sales |

$ | 244 | 100 | % | $ | 632 | 100 | % | ||||||||

| Cost of commercial product sales |

3,004 | 1,231 | % | 1,558 | 246 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross loss |

$ | (2,760 | ) | 1,131 | % | $ | (926 | ) | 146 | % | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

We had a gross loss of $2.8 million in 2015 from the sale of our commercial products compared to a gross loss of $0.9 million in 2014. We experienced a gross loss in 2015 due to: increases in equipment depreciation, as we bring new Conductus wire equipment into service; our increased manufacturing efforts to bring our Conductus wire production to market and; our sales being insufficient to cover our overhead. To reduce our costs, in February 2015, we reduced our workforce and implemented certain other cost cutting measures. We also increased our legacy wireless inventory reserve by $58,000 during 2015, thus reducing this legacy inventory value to zero. As we emphasize improving manufacturing processes and increasing our yields at lower than optimal capacity, we expect gross losses to continue in the first half of 2016.

Research and development expenses relate to development of new wire products and new wire product manufacturing processes. In 2015, there were no new research and development efforts for our wireless commercial products. Research and development expenses totaled $4.1 million in 2015 compared to $6.0 million in 2014, a decrease of $1.9 million, or 32%. Our 2015 expenses were lower compared to 2014 as a result of our efforts moving from research and development to manufacturing of our new Conductus wire products.

Selling, general and administrative expenses totaled $5.8 million in 2015 compared to $5.4 million in 2014, an increase of $0.4 million or 7%. The higher expenses in 2015 were primarily the result of higher non-cash stock award expenses and were only partially offset by other cost saving efforts.