Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - SPEEDEMISSIONS INC | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - SPEEDEMISSIONS INC | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - SPEEDEMISSIONS INC | ex32_2.htm |

| EX-23.1 - EXHBIT 23.1 - SPEEDEMISSIONS INC | ex23_1.htm |

| EX-10.28 - EXHIBIT 10.28 - SPEEDEMISSIONS INC | ex10_28.htm |

| EX-10.29 - EXHIBIT 10.29 - SPEEDEMISSIONS INC | ex10_29.htm |

| EX-10.27 - EXHIBIT 10.27 - SPEEDEMISSIONS INC | ex10_27.htm |

| EX-10.32 - EXHIBIT 10.32 - SPEEDEMISSIONS INC | ex10_32.htm |

| EX-10.31 - EXHIBIT 10.31 - SPEEDEMISSIONS INC | ex10_31.htm |

| EX-31.1 - EXHIBIT 31.1 - SPEEDEMISSIONS INC | ex31_1.htm |

| 10-K - FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015 - SPEEDEMISSIONS INC | s32516010k.htm |

Exhibit 10.30

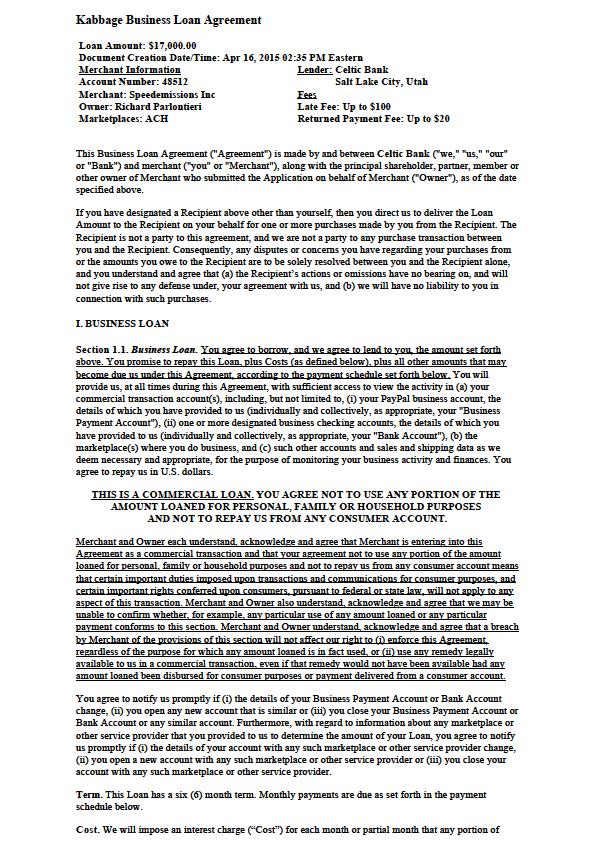

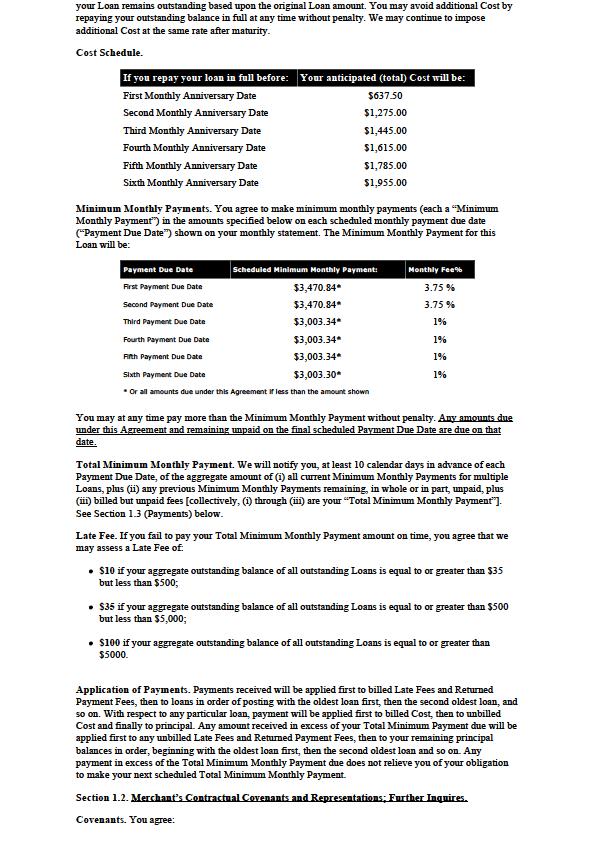

Kabbage Business Loan Agreement Loan Amount: $17,000.00 Document Creation Date/Time: Apr 16, 2015 02:35 PM Eastern Merchant Information Account Number: 48512 Merchant: Speedemissions Inc Owner: Richard Parlontieri Marketplaces: ACH Lender: Celtic Bank Salt Lake City, Utah Fees Late Fee: Up to $100 Returned Payment Fee: Up to $20 This Business Loan Agreement ("Agreement") is made by and between Celtic Bank ("we," "us," "our" or "Bank") and merchant ("you" or "Merchant"), along with the principal shareholder, partner, member or other owner of Merchant who submitted the Application on behalf of Merchant ("Owner"), as of the date specified above. If you have designated a Recipient above other than yourself, then you direct us to deliver the Loan Amount to the Recipient on your behalf for one or more purchases made by you from the Recipient. The Recipient is not a party to this agreement, and we are not a party to any purchase transaction between you and the Recipient. Consequently, any disputes or concerns you have regarding your purchases from or the amounts you owe to the Recipient are to be solely resolved between you and the Recipient alone, and you understand and agree that (a) the Recipient’s actions or omissions have no bearing on, and will not give rise to any defense under, your agreement with us, and (b) we will have no liability to you in connection with such purchases. I. BUSINESS LOAN Section 1.1. Business Loan. You agree to borrow, and we agree to lend to you, the amount set forth above. You promise to repay this Loan, plus Costs (as defined below), plus all other amounts that may become due us under this Agreement, according to the payment schedule set forth below. You will provide us, at all times during this Agreement, with sufficient access to view the activity in (a) your commercial transaction account(s), including, but not limited to, (i) your PayPal business account, the details of which you have provided to us (individually and collectively, as appropriate, your "Business Payment Account"), (ii) one or more designated business checking accounts, the details of which you have provided to us (individually and collectively, as appropriate, your "Bank Account"), (b) the marketplace(s) where you do business, and (c) such other accounts and sales and shipping data as we deem necessary and appropriate, for the purpose of monitoring your business activity and finances. You agree to repay us in U.S. dollars. THIS IS A COMMERCIAL LOAN. YOU AGREE NOT TO USE ANY PORTION OF THE AMOUNT LOANED FOR PERSONAL, FAMILY OR HOUSEHOLD PURPOSES AND NOT TO REPAY US FROM ANY CONSUMER ACCOUNT. Merchant and Owner each understand, acknowledge and agree that Merchant is entering into this Agreement as a commercial transaction and that your agreement not to use any portion of the amount loaned for personal, family or household purposes and not to repay us from any consumer account means that certain important duties imposed upon transactions and communications for consumer purposes, and certain important rights conferred upon consumers, pursuant to federal or state law, will not apply to any aspect of this transaction. Merchant and Owner also understand, acknowledge and agree that we may be unable to confirm whether, for example, any particular use of any amount loaned or any particular payment conforms to this section. Merchant and Owner understand, acknowledge and agree that a breach by Merchant of the provisions of this section will not affect our right to (i) enforce this Agreement, regardless of the purpose for which any amount loaned is in fact used, or (ii) use any remedy legally available to us in a commercial transaction, even if that remedy would not have been available had any amount loaned been disbursed for consumer purposes or payment delivered from a consumer account. You agree to notify us promptly if (i) the details of your Business Payment Account or Bank Account change, (ii) you open any new account that is similar or (iii) you close your Business Payment Account or Bank Account or any similar account. Furthermore, with regard to information about any marketplace or other service provider that you provided to us to determine the amount of your Loan, you agree to notify us promptly if (i) the details of your account with any such marketplace or other service provider change, (ii) you open a new account with any such marketplace or other service provider or (iii) you close your account with any such marketplace or other service provider. Term. This Loan has a six (6) month term. Monthly payments are due as set forth in the payment schedule below. Cost. We will impose an interest charge (“Cost”) for each month or partial month that any portion of your Loan remains outstanding based upon the original Loan amount. You may avoid additional Cost by repaying your outstanding balance in full at any time without penalty. We may continue to impose additional Cost at the same rate after maturity. Cost Schedule. If you repay your loan in full before: Your anticipated (total) Cost will be: First Monthly Anniversary Date $637.50 Second Monthly Anniversary Date $1,275.00 Third Monthly Anniversary Date $1,445.00 Fourth Monthly Anniversary Date $1,615.00 Fifth Monthly Anniversary Date $1,785.00 Sixth Monthly Anniversary Date $1,955.00 Minimum Monthly Payments. You agree to make minimum monthly payments (each a “Minimum Monthly Payment”) in the amounts specified below on each scheduled monthly payment due date (“Payment Due Date”) shown on your monthly statement. The Minimum Monthly Payment for this Loan will be: Payment Due Date Scheduled Minimum Monthly Payment: Monthly Fee% First Payment Due Date $3,470.84* 3.75 % Second Payment Due Date $3,470.84* 3.75 % Third Payment Due Date $3,003.34* 1% Fourth Payment Due Date $3,003.34* 1% Fifth Payment Due Date $3,003.34* 1% Sixth Payment Due Date $3,003.30* 1% * Or all amounts due under this Agreement if less than the amount shown You may at any time pay more than the Minimum Monthly Payment without penalty. Any amounts due under this Agreement and remaining unpaid on the final scheduled Payment Due Date are due on that date. Total Minimum Monthly Payment. We will notify you, at least 10 calendar days in advance of each Payment Due Date, of the aggregate amount of (i) all current Minimum Monthly Payments for multiple Loans, plus (ii) any previous Minimum Monthly Payments remaining, in whole or in part, unpaid, plus (iii) billed but unpaid fees [collectively, (i) through (iii) are your “Total Minimum Monthly Payment”]. See Section 1.3 (Payments) below. Late Fee. If you fail to pay your Total Minimum Monthly Payment amount on time, you agree that we may assess a Late Fee of: $10 if your aggregate outstanding balance of all outstanding Loans is equal to or greater than $35 but less than $500; $35 if your aggregate outstanding balance of all outstanding Loans is equal to or greater than $500 but less than $5,000; $100 if your aggregate outstanding balance of all outstanding Loans is equal to or greater than $5000. Application of Payments. Payments received will be applied first to billed Late Fees and Returned Payment Fees, then to loans in order of posting with the oldest loan first, then the second oldest loan, and so on. With respect to any particular loan, payment will be applied first to billed Cost, then to unbilled Cost and finally to principal. Any amount received in excess of your Total Minimum Payment due will be applied first to any unbilled Late Fees and Returned Payment Fees, then to your remaining principal balances in order, beginning with the oldest loan first, then the second oldest loan and so on. Any payment in excess of the Total Minimum Monthly Payment due does not relieve you of your obligation to make your next scheduled Total Minimum Monthly Payment. Section 1.2. Merchant’s Contractual Covenants and Representations; Further Inquires. Covenants. You agree: (i) (ii) (iii) (iv) (v) (vi) (vii) Not to use any amount loaned for personal, family or household purposes and not to repay us from any consumer account; Not to materially change the nature of the business that you conduct from the type of business originally disclosed to us in connection with this Agreement and, unless we are adequately notified in advance, to conduct your business substantially in accordance with past practices; To take all steps necessary to provide us with access to view the activity in your Business Payment Account, Bank Account and marketplaces where you do business and to such other accounts and sales and shipping data as we deem necessary and appropriate, for the purpose of monitoring your business activity and finances; Not to reduce or remove, or cause anyone to reduce or remove, our access, once granted, to your Business Payment Account, Bank Account, marketplaces where you do business and such other accounts and sales and shipping data as we have deemed necessary and appropriate; With regard to information about any marketplace or other service provider that you provided to us to determine the amount of your Loan, to notify us promptly if the details of your account with such marketplace or other service provider changes, you open a new account or you close your account To use your Business Payment Account in a volume consistent with the level of transactions you processed through such account(s) when you received your Loan, or otherwise ensure that funds sufficient to satisfy your obligations under this Agreement are deposited into your Bank Account; To maintain a minimum balance in your Business Payment Account or Bank Account, as appropriate (as required by Section 1.3 below); (viii) To collect on your sales promptly, in compliance with all applicable federal, state and local laws, rules and regulations and consistent with your past collection practices; (ix) (x) (xi) (xii) To make payments to us (in U.S. dollars) on the applicable Payment Due Date" Not to take any action to discourage the use of your Business Payment Account and not to permit any event to occur that could have an adverse effect on the use, acceptance or authorization of your Business Payment Account for the purchase of services and/or products by your customers; Not to open a new account other than the Business Payment Account or Bank Account (collectively, the "Accounts") into which your sales will be deposited and not to take any action to cause future sales to be settled or paid to any account other than the Accounts; Not to sell, dispose, convey or otherwise payment your business or assets without our express prior written consent and the prior payment or assumption of all of your obligations under this Agreement pursuant to documentation reasonably satisfactory to us; (xiii) Not to take any intentional action that would substantially impair or reduce your generation or collection of accounts receivable adequate to satisfy your obligations under this Agreement without our prior written permission; (xiv) Not to terminate your authorization of scheduled debits in Section 1.3, stop payment on any debit authorized pursuant to Section 1.3, claim that a debit transaction pursuant to Section 1.3 is unauthorized, or seek a refund, return, chargeback or dispute of a credit card transaction related to a payment under Section 1.3; and (xv) To notify us promptly if, with regard to any Business Payment Account or Bank Account, the details of your account change, you open a new account or you close your account. Collectively, the preceding items (i) through (xv) are your "Merchant Contractual Covenants". Representations. You represent that as of the date of this Agreement (i) you have no present intention to close or cease operating your business, in whole or in part, temporarily or permanently, (ii) you are solvent and not contemplating any insolvency or bankruptcy proceeding, (iii) during the four (4) months preceding the date hereof, neither Merchant nor any Owner has discussed with or among Merchant’s management, counsel, or any other advisor or creditor, any potential insolvency, bankruptcy, receivership, or assignment for the benefit of creditors with respect to Merchant and no such action or proceeding has been filed or is pending, and (iv) no eviction or foreclosure is pending or threatened against Merchant. Further Inquiries. Merchant and Owner authorize Bank, its agents and representatives, and any credit reporting agency engaged by Bank, to (i) request information about and investigate Merchant and Owner and any references given or any other statements or data obtained from or about Merchant or Owner for the purpose of this Agreement and (ii) pull credit reports, whether in connection with Merchant’s application for a loan or at any time thereafter for so long as Merchant and/or Owner continue to have any obligation owed to Bank. Owner's Personal Guarantee of Merchant's Performance of Merchant Contractual Covenants. Owner personally guarantees the performance of all of the covenants of Merchant in this Agreement, specifically including the Merchant Contractual Covenants above. (Owner does not absolutely guarantee that sufficient future receivables will be generated or Proceeds collected to equal the Specified Amount sold to Company.) Section 1.3. Payments. Automatic Payment Authorization. You authorize us to initiate, on each Payment Due Date, an automatic electronic debit from your Business Payment Account or Bank Account, as appropriate, in the amount of the Total Minimum Monthly Payment; provided, however, that if a Payment Due Date falls on a Saturday, Sunday or holiday, then the debit may be initiated on the next business day. Any separate payments that you make on or before a Payment Due Date will not affect this authorization. You understand that your Total Minimum Monthly Payment may vary from time to time but will in no event exceed the total outstanding Loans. We will not be liable for any fees or Costs that you may incur if we are unable to debit your Total Minimum Monthly Payment under this authorization. We also are not responsible for any fees imposed on you by the provider of any Business Payment Account or Bank Account as the result of any authorized debit or any payments made directly by you under this Agreement. Automated Clearing House transactions must comply with the provisions of U.S. law. Payment Failure. If a debit is rejected or if you otherwise fail to pay your Total Minimum Monthly Payment when due, you agree that we may (i) terminate further automatic debits, in which case you will be responsible for making all further payments directly and in a timely manner, (ii) debit your Business Payment Account and Bank Account, at any time and from time to time, for any amounts due us until paid in full, (iii) subject to any right to notice of default and right to cure required by state law (which you agree to waive to the greatest extent possible), declare all outstanding Loans immediately due and payable and (iv) pursue any and all other remedies available to us. Account Maintenance. You agree to maintain in your Business Payment Account or Bank Account, as appropriate, sufficient funds to meet each Total Minimum Monthly Payment obligation. We may initiate a debit at any time on a Payment Due Date, including prior to the time that we open for business on any business day. Consequently, you understand that funds must be available by the end of the business day prior to the applicable Payment Due Date and maintained in your Business Payment Account or Bank Account until the debit is processed. Terminating or Disputing Authorization; Stopping Payment. You may terminate your automatic electronic debit authorization by notifying us in writing at least three (3) or more business days before a scheduled Payment Due Date, and your termination will be effective three (3) business days after the date your notice is received by us. If you call us, we may ask you to send your request in writing to us within 14 calendar days of your call. Terminating this automatic debit authorization, stopping payment on a scheduled debit or claiming that a debit transaction pursuant to this Section 1.3 is unauthorized is an event of default under this Agreement; as a result, we may initiate manually one or more debits to your Business Payment Account or Bank Account, at any time and from time to time, for all amounts due us. We may modify or terminate automatic debiting for any reason by notifying you in writing at your last known address in our records. Following the date of any termination of automatic debits by you or by us, you will be responsible for making all further payments directly and in a timely manner. Alternative Payment. If for any reason we are unable to initiate an electronic debit, you agree that we may prepare and deposit a remotely created check in the same amount. Credit Card Transactions. We do not accept payments from consumer accounts. If you choose to provide a credit card number as back-up funding for your Business Payment Account, you agree to waive any right of chargeback or dispute as to any commercial transaction involving us and your Business Payment Account. You agree that your obligation to pay under this Agreement is not related to any consumer transaction. There can be no ground for any refund or return. All payments to us are final. You agree that we may apply any credit balance to any outstanding Loan or other obligation you have with us or issue a check to you. Other Payments. You may make additional or alternative payments at any time. Payments by postal mail should be sent, postage paid, to the following address: Kabbage Business Loan Payments, P.O. Box 77073, Atlanta, GA 30357. You may also call Customer Service to arrange payments by overnight delivery, telephone or other acceptable method. Payments made to any other address than as specified by us may result in a delay in processing and/or crediting for which we will not be responsible. All payments must be made in good funds by check, money order, automatic payment from an account at an U.S. institution offering such service, or other instrument, in U.S. dollars. You are solely responsible for any costs associated with a payment. Payments received after 5:00 p.m. (ET) on any day will be credited on the next day. Credit to your account may be delayed up to five (5) calendar days if a payment (a) is not received at the above address, (b) is not made in U.S. dollars drawn on a U.S. financial institution located in the U.S., (c) contains more than one payment, or (d) includes staples, paper clips, tape, a folded check, or correspondence of any type. Acceptance of Late and Partial Payments; Disputed Amounts. We may accept late or partial payments without losing any of our rights under this Agreement. You agree not to send us partial payments marked “paid in full,” “without recourse” or similar language. If you send such a payment, we may accept it without losing any of our rights under this Agreement. All written communications concerning disputed amounts, including any check or other instrument that indicates that the payment constitutes “payment in full” of your payment or fee obligations or that is tendered with other conditions or limitations or as full satisfaction of a disputed amount, must be mailed or delivered to Kabbage Business Loan Dispute Resolution, P.O. Box 77081, Atlanta, GA 30357. Section 1.4. Returned Payment Fee. If a payment is rejected, returned or dishonored, for any reason, we may assess a Returned Payment Fee in the amount of $20, which fee will be in addition to any Late Fee that may be due. Section 1.5. Default. You will be in default if any of the following happen: (i) you fail to make any payment under this Agreement when due; (ii) you break any promise you have made to us, or you fail to comply with or to perform any term, obligation, covenant, or condition under this Agreement; (iii) you terminate your automatic scheduled debit authorization, stop payment on any authorized debit pursuant to Section 1.3 or claim that a debit transaction pursuant to Section 1.3 is unauthorized; (iv) you are in default under any loan, security agreement, or any other agreement, in favor of any other party to whom you owe debt that may affect any of your property or your ability to perform your obligations under this Agreement; (v) any representation or statement made or furnished to us by you or on your behalf is false or misleading either now or at the time made or furnished; (vi) a material change occurs in your ownership or organizational structure (acknowledging that any change in ownership will be deemed material when ownership is closely held); (vii) you liquidate or dissolve, or enter into any consolidation merger, partnership, joint venture or other combination without our prior written consent; (viii) you sell any assets except in the ordinary course of your business as now conducted, or sell, lease, assign or transfer any substantial part of your business or fixed assets or any property or other assets necessary for the continuance of your business as now conducted, including, without limitation, the selling of any property or other assets accompanied by the leasing back of the same; (ix) any guaranty of performance given to us ceases to be in full force and effect or is declared to be null and void; or the validity or enforceability thereof is contested in a judicial proceeding; or Owner denies that Owner has any further liability under such guaranty; or Owner defaults in any provision of any guaranty, or any financial information provided by Owner is false or misleading; (x) if you are a sole proprietorship, the Owner dies; if you are a trust, a trustor dies; if you are a partnership, any general or managing partner dies; if you are a corporation, any principal officer or 10.00% or greater shareholder dies; if you are a limited liability company, any managing member dies; if you are any other form of business entity, any person(s) directly or indirectly controlling ten percent (10.00%) or more of the ownership interests of such entity dies; (xi) any creditor tries to take any of your property on or in which we have a lien or security interest; (xii) a judgment is entered against you or Owner in the aggregate amount of $250 or more that is not satisfied within thirty (30) days or stayed pending appeal; (xiii) an involuntary lien is attached to any of your or Owner’s assets or property and not satisfied within thirty (30) days or stayed pending appeal; or (xiv) any of the events described in this default section occurs with respect to Owner. Our Rights Upon Default. Upon default, we may demand the immediate payment of all amounts owed us We may hire or pay someone else to help collect any amount that you may owe us. You agree to pay any collection, arbitration, court costs incurred by us or other sums provided or allowed by law. This includes, subject to any limits under applicable law, attorneys’ fees and legal expenses for bankruptcy proceedings, civil actions, arbitration proceedings, declaratory actions or other filings or proceedings, and efforts to modify or vacate any automatic stay or injunction, appeals, and any anticipated post- judgment collection services. Notice of Merchant or Owner Default. You agree to furnish to us, immediately upon becoming aware of the existence of any condition or event which with the lapse of time or failure to give notice would constitute an event of default under this Agreement, written notice specifying the nature and period of the existence of such condition or event and any action which you are taking or propose to take with respect thereto. Section 1.6. Arbitration (Agreement to Arbitrate Claims). Except as otherwise stated below, any Claim (as defined below) will be resolved by binding arbitration pursuant to (a) this Arbitration Provision and (b) the code of procedure of the national arbitration organization to which the Claim is referred (as in effect when the Claim is filed). Claims will be referred to either Judicial Arbitration and Mediation Services (“JAMS”) or the American Arbitration Association (“AAA”), as selected by the party electing to use arbitration. Streamlined arbitration procedures will be used if available. If a selection by us of one of these organizations is unacceptable to you, you have the right, within 30 days after you receive notice of our election, to select the other organization listed to serve as arbitration administrator. For purposes of this Arbitration Provision, “Claim” means any claim, dispute or controversy (whether in contract, tort, or otherwise) past, present or future, (collectively, "Claims") as further described below. (If for any reason a selected organization cannot, will not or ceases to serve as an arbitration administrator, you or we may substitute another arbitrator or arbitration organization that uses a similar code of procedure and is mutually acceptable to both parties, in accordance with Section 5 of the Federal Arbitration Act. If both parties cannot agree on an arbitration organization, then either party may ask a court of competent jurisdiction to appoint a qualified arbitration organization.) An arbitration proceeding can decide only your or our Claims. You cannot join other parties (or consolidate Claims). Neither you nor we will be permitted to arbitrate claims on a class-wide (that is, on other than an individual) basis. Small Claims Court Option. All parties, including related third parties, shall retain the right to seek adjudication of an individual (and not class or representative) Claim in a small claims tribunal in the county of your residence for disputes within the scope of such tribunal’s jurisdiction. Any dispute, which cannot be adjudicated within the jurisdiction of a small claims tribunal (including claims transferred by the small claims tribunal to another court) shall be resolved by binding arbitration. Any appeal of a judgment from a small claims tribunal shall be resolved by binding arbitration. SIGNIFICANCE OF ARBITRATION; LIMITATIONS AND RESTRICTIONS. IN ARBITRATION, NEITHER YOU NOR WE WILL HAVE THE RIGHT TO (i) HAVE A COURT OR JURY DECIDE THE CLAIM BEING ARBITRATED, (ii) ENGAGE IN PRE-ARBITRATION DISCOVERY (THAT IS, THE RIGHT TO OBTAIN INFORMATION FROM THE OTHER PARTY) TO THE SAME EXTENT THAT YOU OR WE COULD IN COURT, (iii) PARTICIPATE AS A REPRESENTATIVE OR MEMBER OF ANY CLASS OF CLAIMANTS IN A CLASS ACTION, IN COURT OR IN ARBITRATION, RELATING TO ANY CLAIM SUBJECT TO ARBITRATION OR (iv) JOIN OR CONSOLIDATE CLAIMS OTHER THAN YOUR OWN OR OUR OWN. OTHER RIGHTS AVAILABLE IN COURT MAY NOT BE AVAILABLE IN ARBITRATION. Except as set forth below, the arbitrator’s decision will be final and binding. Only a court may decide the validity of items (iii) and (iv) above. If a court holds that items (iii) or (iv) are limited, invalid or unenforceable, then this entire Arbitration Provision will be null and void. You or we can appeal any such holding. If a court holds that any other part(s) of this Arbitration Provision (other than items (iii) and (iv)) are invalid, then the remaining parts of this Arbitration Provision will remain in force. An arbitrator will decide all other issues pertaining to arbitrability, validity, interpretation and enforceability of this Arbitration Provision. The decision of an arbitrator is as enforceable as any court order and may be subject to very limited review by a court. An arbitrator may decide any Claim upon the submission of documents alone. A party may request a telephonic hearing if permitted by applicable rules. The exchange of non-privileged information relevant to any Claim, between the parties, is permitted and encouraged. Either party may submit relevant information, documents or exhibits to the arbitrator for consideration in deciding any Claim. Right to Opt-Out of Arbitration. You may opt-out of this Arbitration Provision. If you do so, neither you nor we will have the right to engage in arbitration. Opting out of this Arbitration Provision will have no effect on any of the other provisions in this Agreement. To opt out of this Arbitration Provision, we must receive your written notice of opt-out, within 60 calendar days after we approve your Loan, at Account Services Dispute Resolution, P.O. Box 77081, Atlanta, GA 30357; ATTN: Arbitration. In your letter, you must give us the following information: Name, Address and Loan number. The right to opt-out granted here applies solely to this Arbitration Provision and this Agreement, and not to any other provision of this Agreement or to any other Loan or other agreement with us. In the event of a dispute over whether you have provided a timely opt-out notice, you must provide proof of delivery. Broad Meaning of "Claims." The term "Claims" in this Arbitration Provision is to be given the broadest possible meaning and includes (by way of example and without limitation) Claims arising from or relating to (i) this Agreement, (ii) any transactions effected pursuant to this Agreement, (iii) terms of or change or addition of terms to this Agreement, (iv) collection of your obligations arising from this Agreement, (v) advertisements, promotions or oral or written statements relating to this Agreement or any transactions between us pursuant to this Agreement, including any Claims regarding information obtained by us from, or reported by us to, credit reporting agencies or others, (vi) Claims between you and us or our parent corporations, wholly or majority owned subsidiaries, affiliates, predecessors, successors, assigns, agents, independent contractors, employees, officers, directors or representatives arising from any transaction between us pursuant to this Agreement and (vii) Claims regarding the validity, enforceability or scope of this Arbitration Provision or this Agreement including but not limited to whether a given claim or dispute is subject to arbitration. Arbitration Procedure and Costs. For a copy of relevant codes of procedure, to file a Claim or for other information about JAMS and AAA, write them, visit their web site or call them at: (i) for JAMS, 1920 Main Street, Suite 300, Irvine, CA 92614, info@jamsadr.com, http://www.jamsadr.com, or 1-800- 352-5267; or (ii) for AAA, 1633 Broadway, 10th Floor, New York, NY 10019, websitemail@adr.org, http://www.adr.org, or 1-800-778-7879. If either party fails to submit to arbitration following a proper demand to do so, that party will bear the costs and expenses, including reasonable attorneys’ fees, incurred by the party compelling arbitration. Any physical arbitration hearing will be held in the federal judicial district selected by Merchant. No matter which party initiates the arbitration, we will advance or reimburse filing fees and other costs or fees of arbitration. Each party will initially be responsible for its own attorneys’, experts’ and witness fees and related costs and expenses. Unless prohibited by law, the arbitrator may, applying applicable law, award fees, costs and reasonable attorneys’ fees and expenses to the party who substantially prevails in the arbitration. The allocation of fees and costs relating to an appeal in arbitration will be handled in the same manner. For an explanation and schedule of the fees that may apply to an arbitration proceeding, please contact the organizations at the addresses above. The appropriate fee schedule in effect from time to time is hereby incorporated by reference into this Arbitration Provision. The cost of arbitration may be higher or lower than the cost of bringing a Claim in court, depending upon the nature of the Claim and how the arbitration proceeds. Having more than one Claim and holding a physical arbitration hearing can increase the cost of arbitration. Governing Law for Arbitration. This Arbitration Provision is made pursuant to a transaction involving interstate commerce, and will be governed by the Federal Arbitration Act ("FAA"), 9 U.S.C. §§ 1 et seq., as amended, notwithstanding any other governing law provision in this Agreement. The arbitrator will apply applicable substantive law consistent with the FAA and applicable statutes of limitations and will honor claims of privilege recognized at law. Judgment upon any arbitration award may be entered and enforced in any court having jurisdiction. The arbitrator’s decision will be final and binding, except for any right of appeal provided by the FAA, in which case any party can appeal the award to a three- arbitrator panel administered by the selected arbitration administrator. The panel will reconsider de novo (that is, without deference to the ruling of the original arbitration) any aspect of the initial award requested by the appealing party. Continued Effect of Arbitration Provision. This Arbitration Provision will continue to govern any Claims that may arise without regard to any termination or cancellation of this Agreement. If any portion of this Arbitration Provision (other than the provisions prohibiting class-wide arbitration, joinder or consolidation) is deemed invalid or unenforceable under the FAA, it will not invalidate the remaining portions of this Arbitration Provision. If a conflict or inconsistency arises between the code of procedures of the selected arbitration administrator and this Arbitration Provision, this Arbitration Provision will control. II. REPRESENTATIONS, WARRANTIES AND COVENANTS Each of Merchant and Owner represents, warrants and covenants the following as of the date hereof and at all times during the term of this Agreement: Section 2.1. Covenant Representation. Merchant shall comply with each of the Merchant Contractual Covenants as set forth herein. Section 2.2. Business Information. All information (financial and other) provided by or on behalf of Merchant to Bank in connection with the execution of or pursuant to this Agreement and during the term of this Agreement is and will be true, accurate and complete in all respects. Merchant shall furnish Bank such information as Bank may request from time to time. Section 2.3. Reliance on Information. Merchant and Owner acknowledge and agree that all information (financial and other) provided by or on behalf of Merchant and Owner either as of the date hereof or hereafter has been and may continue to be relied upon by Bank in connection with any decision that Bank makes to extend additional time to repay or to loan you future funds. Section 2.4. Compliance. Merchant is in compliance with any and all federal, state and local laws and regulations and rules and regulations relating to (i) the operation of Merchant’s business, including the collection of accounts receivable, and (ii) the provider of the Business Payment Account and Bank Account and any online sales channels (e.g., eBay) applicable to Merchant’s business. Merchant possesses and is in compliance with all permits, licenses, approvals, consents, registrations and other authorizations necessary to own, operate and lease its properties and to conduct the business in which it is presently engaged. Section 2.5. Authorization. Merchant and Owner have full power and authority to enter into and perform the obligations under this Agreement, all of which have been duly authorized by all necessary and proper actions. Section 2.6. Insurance. Merchant shall maintain insurance in such amounts and against such risks as are consistent with past practice and shall show proof of such insurance upon the request of Bank. Section 2.7. Change in Name or Location. Merchant does not and shall not conduct Merchant’s business under any name other than as disclosed to Bank and shall not change its place of business. Section 2.8. Merchant Not Indebted to Bank. Neither Merchant nor Owner is a debtor of Bank as of the date of this Agreement. Section 2.9. Owner. Owner shall cause Merchant to fulfill each of Merchant’s covenants hereunder. Section 2.10. Working Capital Funding. Merchant shall not enter into any arrangement, agreement or commitment that relates to or involves Merchant’s accounts receivable, whether in the form of a purchase of, a loan against, or the sale or purchase of credits against, Merchant’s accounts receivable or future credit card or online sales with any party other than Bank. Section 2.11. Unencumbered Accounts Receivable. Merchant has good, complete and marketable title to all of its accounts receivable, free and clear of any and all liabilities, liens, claims, charges, restrictions, conditions, options, rights, mortgages, security interests, equities, pledges and encumbrances of any kind or nature whatsoever or any other rights or interests that may be inconsistent with the transactions contemplated with, or adverse to the interests of, Bank. Section 2.12. Business Purpose. Merchant is a valid business in good standing under the laws of the jurisdictions in which it is organized and/or operates, and Merchant is entering into this Agreement solely for business purposes and not as a consumer for personal, family or household purposes. Merchant’s Business Payment Account and Bank Account are each specifically designated as business purpose accounts and are each used solely for sales of goods and or services sold or rendered by Merchant and not used for personal, family or household purposes. III. ADDITIONAL TERMS Section 3.1. Security Interest. Merchant grants to Bank, to secure Merchant’s performance under this Agreement, a continuing first lien security interest, unless otherwise agreed in writing by Bank, in the following property of Merchant, wherever found, that Merchant now owns or shall acquire: (a) all tangible and intangible personal property of Merchant, including, all accounts, deposit accounts, chattel paper, documents, equipment, general intangibles, instruments, inventory, investment property (including certificated and uncertificated securities, securities accounts, securities entitlements, commodity contracts and commodity accounts), letter of credit rights, commercial tort claims and as-extracted collateral (as those terms are defined in Article 9 of the Uniform Commercial Code (“UCC”) in effect from timeto time in the State of Georgia); (b) all patents, patent applications, trademarks, trade names, service marks, logos, copyrights, and other sources of business identifiers, and all registrations, recordings and applications with the U.S. Patent and Trademark Office (“USPTO”) and U.S. Copyright Office and all renewals, reissues and extensions thereof (collectively “IP”), together with any written agreement granting any right to use any IP; and (c) all accessions, attachments, accessories, parts, supplies and replacements, products, proceeds and collections with respect to the items described in (a) and (b) above, as those terms are defined in Article 9 of the UCC and all records and data relating thereto. Section 3.2. Financing Statements. Merchant understands and agrees that Bank may at anytime file one or more (i) UCC-1 financing statements, lien entry form or other document to perfect, amend or continue any interest granted in Section 3.1 above and (ii) assignments with USPTO and/or U.S. Copyright Office to perfect any security interest in IP described above. Merchant agrees to cooperate with Bank as may be necessary to accomplish said filing and authorizes Bank to sign Merchant’s name to effect the filing or continuation of any such filings. Section 3.3. Remedies. In the event that any representation or warranty of Merchant or Owner contained in this Agreement is not true, accurate and complete, or in the event of a breach of any of the covenants contained in this Agreement, including the Merchant Contractual Covenants, Bank shall be entitled to all remedies available under law. The obligation of Owner in Section 2.9 of this Agreement is primary and unconditional and Owner waives any right to require Bank to proceed first against Merchant before recovering damages from Owner. Section 3.4. [Reserved] Section 3.5. Protection of Information. Except for Confidential Information (as defined below), Merchant and Owner each authorize Bank to disclose to any third party information concerning Merchant’s and Owner’s business conduct. Merchant and Owner hereby waive to the maximum extent permitted by law any claim for damages against Bank or any of its affiliates relating to any (i) investigation undertaken by or on behalf of Bank as permitted by this Agreement or (ii) disclosure of information as permitted by this Agreement. Section 3.6. Confidentiality. Merchant understands and agrees that the terms and conditions of the products and services offered by Bank, including this Agreement and any other Bank documentation (collectively, “Confidential Information”) are proprietary and confidential information of Bank. Accordingly, unless disclosure is required by law or court order, Merchant shall not disclose Confidential Information to any person other than an attorney, accountant, financial advisor or employee of Merchant who needs to know such information for the purpose of advising Merchant (“Advisor”), provided such Advisor uses such information solely for the purpose of advising Merchant and first agrees in writing to be bound by the terms of this Section 3.6. The foregoing covenants of Merchant shall exist for the duration of the relationship of the parties and, with respect to all Confidential Information, that comprises a Trade Secret (under Georgia law) for so long as such information continues to constitute a Trade Secret and, otherwise, for three (3) years after termination of the relationship between the parties. Section 3.7. Transfer and Assignment. Without prior notice or approval by you, we reserve the right to sell or transfer all or any portion of our interest in this Agreement to another entity or person. Your rights and obligations under this Agreement belong solely to you and may not be transferred or assigned by you. Your obligations, however, are nonetheless binding upon you and your heirs, legal representatives, successors, and assigns. Section 3.8. Publicity. Merchant and Owner authorize Bank to use Merchant’s or Owner’s name in a listing of clients and in advertising and marketing materials. IV. MISCELLANEOUS Section 4.1. Modifications; Amendments; Construction. No modification, amendment or waiver of any provision of this Agreement shall be effective unless the same shall be in writing and signed by the parties affected. The headings of the sections and subsections herein are inserted for convenience only and under no circumstances shall they affect in any way the meaning or interpretation of this Agreement. For purposes of this Agreement, "including" shall mean "including, without limitation." Section 4.2. Notices. Except as otherwise provided in this Agreement, any notice provided under this Agreement must be in writing but may be provided electronically. Notices will be deemed given when properly addressed and deposited in the U.S. mail, postage prepaid, First Class mail; delivered in person; or sent by registered mail; by certified mail; by nationally recognized overnight courier; or by electronic mail. Notice to you will be sent to your last known address in our records. Notice to any of you will be deemed notice to all of you. Notice to us may be sent to Kabbage, P.O. Box 77081, Atlanta, GA 30357. You agree to notify us immediately if you change your name, your postal or electronic mail address or other contact information, if there are any errors in the information regarding transactions on your account or information that you provide to us, or if any of you dies, is declared incompetent or is subject of a bankruptcy or insolvency proceeding. You agree that a notice of incompetence is not effective unless issued by a court having jurisdiction and we receive notice and instruction from the court. Notwithstanding the above, we may, at our option, accept other evidence of incompetence acceptable to us. You agree to indemnify and hold us harmless from and against any and all claims relating to acceptance or non-acceptance of proof of incompetence in any transaction. This indemnity will survive termination of this Agreement. Section 4.3. Waiver; Remedies. No delay on the part of Bank to exercise, and no delay in exercising, any right under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right under this Agreement preclude any other or further exercise of any other right. The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity. Section 4.4. D/B/A’s. Merchant hereby acknowledges and agrees that Bank may be using “doing business as” or “d/b/a” names in connection with various matters relating to the transaction between Bank and Merchant, including the filing of UCC-1 financing statements and other notices or filings. Section 4.5. Binding Effect. This Agreement shall be binding upon and inure to the benefit of Merchant, Owner, Bank and their respective successors and permitted assigns. Section 4.6. Governing Law. With the exception of Section 1.17 above (which is to be governed exclusively by the FAA), this Agreement shall be governed by, and construed in accordance with, the internal laws of the State of Utah without regard to internal principles of conflict of laws. Merchant hereby submits to the jurisdiction of any Utah state or federal court sitting in Salt Lake County, Utah, at Bank’s choice. Merchant hereby waives any claim that an action is brought in an inconvenient forum, that the venue of the action is improper, or that this Agreement or the transactions of which this Agreement is a part may not be enforced in or by any of the above-named courts. Section 4.7. Term and Survival. This Agreement shall continue in full force and effect until all obligations hereunder have been satisfied in full; provided, however, that any Section that, by its terms suggests survival beyond termination hereof, shall so survive until the natural expiration thereof. Section 4.8. Severability. In case any one or more of the provisions contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein and therein shall not in any way be affected or impaired thereby. Section 4.9. Entire Agreement. This Agreement contains the entire agreement and understanding among Merchant, Owner and Bank and supersedes all prior agreements and understandings, whether oral or in writing, relating to the subject matter hereof unless otherwise specifically reaffirmed or restated herein. Section 4.10. Jury Trial Waiver. THE PARTIES HERETO WAIVE TRIAL BY JURY IN ANY COURT IN ANY SUIT, ACTION OR PROCEEDING ON ANY MATTER ARISING IN CONNECTION WITH OR IN ANY WAY RELATED TO THE TRANSACTIONS OF WHICH THIS AGREEMENT IS A PART OR THE ENFORCEMENT HEREOF, EXCEPT WHERE SUCH WAIVER IS PROHIBITED BY LAW OR DEEMED BY A COURT OF LAW TO BE AGAINST PUBLIC POLICY. THE PARTIES HERETO ACKNOWLEDGE THAT EACH MAKES THIS WAIVER KNOWINGLY, WILLINGLY AND VOLUNTARILY AND WITHOUT DURESS, AND ONLY AFTER EXTENSIVE CONSIDERATION OF THE RAMIFICATIONS OF THIS WAIVER WITH THEIR ATTORNEYS. Section 4.11. Class Action Waiver. THE PARTIES HERETO WAIVE ANY RIGHT TO ASSERT ANY CLAIMS AGAINST THE OTHER PARTY AS A REPRESENTATIVE OR MEMBER IN ANY CLASS OR REPRESENTATIVE ACTION, EXCEPT WHERE SUCH WAIVER IS PROHIBITED BY LAW AGAINST PUBLIC POLICY. TO THE EXTENT EITHER PARTY IS PERMITTED BY LAW OR COURT OF LAW TO PROCEED WITH A CLASS OR REPRESENTATIVE ACTION AGAINST THE OTHER, THE PARTIES HEREBY AGREE THAT: (1) THE PREVAILING PARTY SHALL NOT BE ENTITLED TO RECOVER ATTORNEYS’ FEES OR COSTS ASSOCIATED WITH PURSUING THE CLASS OR REPRESENTATIVE ACTION (NOT WITHSTANDING ANY OTHER PROVISION IN THIS AGREEMENT); AND (2) THE PARTY WHO INITIATES OR PARTICIPATES AS A MEMBER OF THE CLASS WILL NOT SUBMIT A CLAIM OR OTHERWISE PARTICIPATE IN ANY RECOVERY SECURED THROUGH THE CLASS OR REPRESENTATIVE ACTION. Section 4.12. Telephone Monitoring and Recording. To ensure that you receive quality service and for training purposes, you agree that we may select phone calls for monitoring and/or recording. Section 4.13. Communicating With You and Owner; Consent to Contact by Electronic and Other Means. For purposes of this Section 4.13, "you" means Merchant, Owner and any agent or representative of Merchant or Owner, collectively and individually, for purposes of communications between you and Bank regarding this Agreement and related commercial transactions. You agree that we may contact you as provided in this paragraph. We may contact you for any lawful reason, including for the collection of amounts owed to us and for the offering of products or services to Merchant in compliance with our Bank Privacy Policy in effect from time to time. No such contact will be deemed unsolicited. You specifically agree that we may (i) contact you at any address (including email) or telephone number (including wireless cellular telephone or ported landline telephone number) as you may provide to us from time to time, even if you asked to have your number added to any state or federal do- not-call registry; (ii) use any means of communication, including, but not limited to, postal mail, electronic mail, telephone or other technology, to reach you; (iii) use automatic dialing and announcing devices which may play recorded messages; and (iv) send text messages to your telephone. You may withdraw this express written consent at any time by contacting us at Kabbage Business Loan—Withdrawal of Express Consent, P.O. Box 77081, Atlanta, GA 30357 and telling us specifically what address or telephone number not to use. Section 4.14. In case of Errors or Questions About Your Account Summary If you think your Account Summary is wrong, or if you need more information about an item on your Account Summary, write as soon as possible to: Kabbage Business Loan Account Inquiries, P.O. Box 77081, Atlanta, GA 30357. We must hear from you no later than 60 days after we sent you the first Account Summary on which the error or problem appeared. In your letter, please give us the following information: Your name and email address, The dollar amount of the suspected error, A description of the error, and An explanation of why you believe there is an error. If you need more information, describe the item you are unsure about. You remain obligated to make any remaining Total Minimum Monthly Payment while we investigate. Consent to Electronic Disclosure. You can access transaction information by visiting www.kabbage.com and logging in. By checking the “Submit” box on your application, you agree to receive this Agreement and subsequent disclosures and notices (collectively, “Subsequent Disclosures”) electronically. We will provide electronic copies of periodic statements and Subsequent Disclosures on our web site. To access, view and retain electronic disclosures on our web site, you must have a computer with Internet access and either a printer connected to your computer to print disclosures/notices or sufficient hard drive space available to save the information. The minimum software requirements include browser software that supports 128bit security encryption and Adobe Reader® version 9.0. By clicking the “Submit” button on your application, you acknowledge that you are able to access our website (www.kabbage.com) and print, or otherwise retain, electronic disclosures. You may request a paper copy of any legally required disclosure by contacting us at Kabbage Business Loan—Paper Disclosure Request, P.O. Box 77081, Atlanta, GA 30357. You may also withdraw your consent to electronic disclosures by contacting us in the same manner. If you withdraw your consent to electronic disclosures, we may elect to terminate our relationship with you. You agree to provide us with your current e-mail address for notices. If your e-mail address changes, you must send us a notice of the new address by writing to us at least five days before the effective date of the change. By checking the “Submit” box in your application, you acknowledge receipt of this Agreement, state that you have read and agreed to its terms and conditions, and agree to receive disclosures electronically. Electronic Signature of Merchant/Owner: You each acknowledge and agree that any electronic or digital signature provided by telephone, on any application or other document signed in connection with your account represents your signature on this Agreement. Rev.7/23/2014