Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - SPEEDEMISSIONS INC | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - SPEEDEMISSIONS INC | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - SPEEDEMISSIONS INC | ex32_2.htm |

| EX-23.1 - EXHBIT 23.1 - SPEEDEMISSIONS INC | ex23_1.htm |

| EX-10.30 - EXHIBIT 10.30 - SPEEDEMISSIONS INC | ex10_30.htm |

| EX-10.28 - EXHIBIT 10.28 - SPEEDEMISSIONS INC | ex10_28.htm |

| EX-10.29 - EXHIBIT 10.29 - SPEEDEMISSIONS INC | ex10_29.htm |

| EX-10.32 - EXHIBIT 10.32 - SPEEDEMISSIONS INC | ex10_32.htm |

| EX-10.31 - EXHIBIT 10.31 - SPEEDEMISSIONS INC | ex10_31.htm |

| EX-31.1 - EXHIBIT 31.1 - SPEEDEMISSIONS INC | ex31_1.htm |

| 10-K - FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015 - SPEEDEMISSIONS INC | s32516010k.htm |

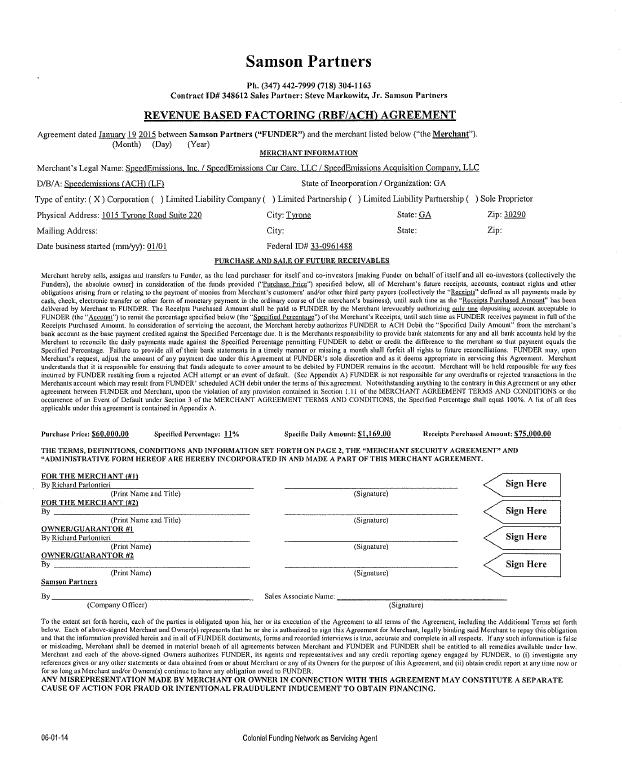

Exhibit 10.27

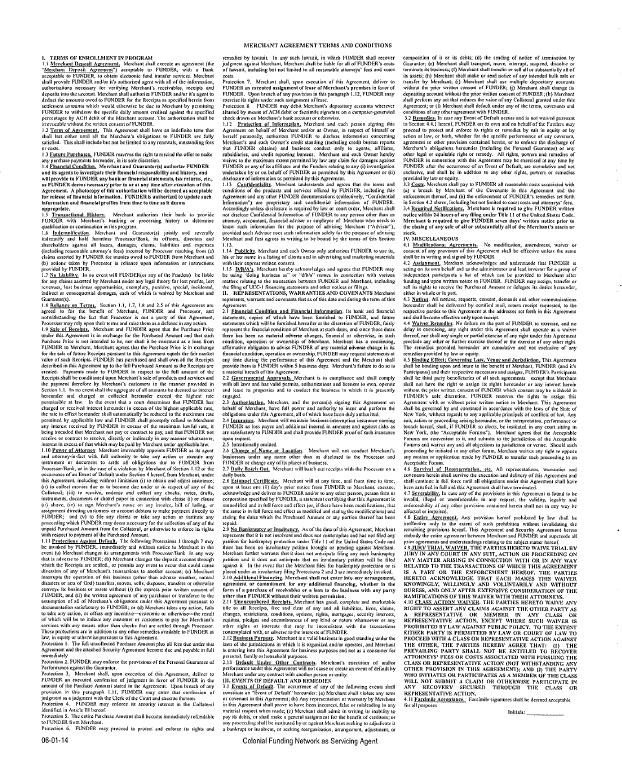

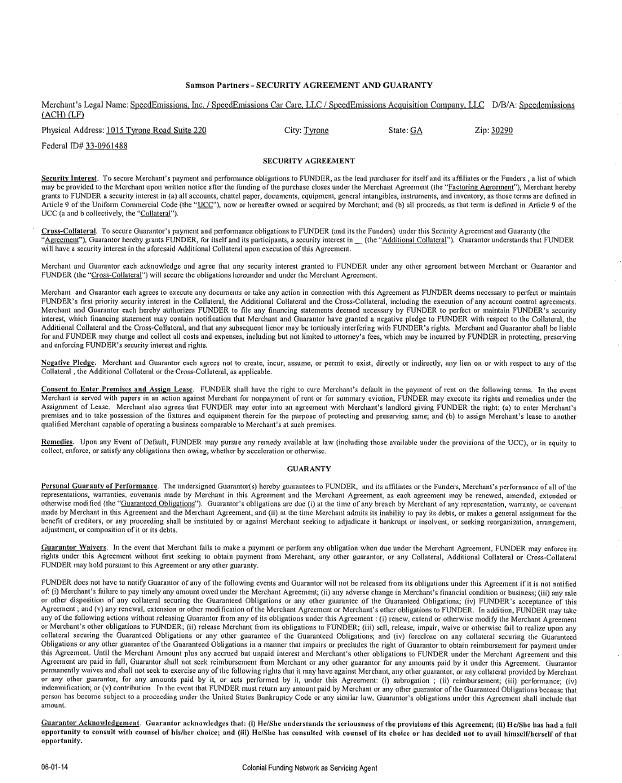

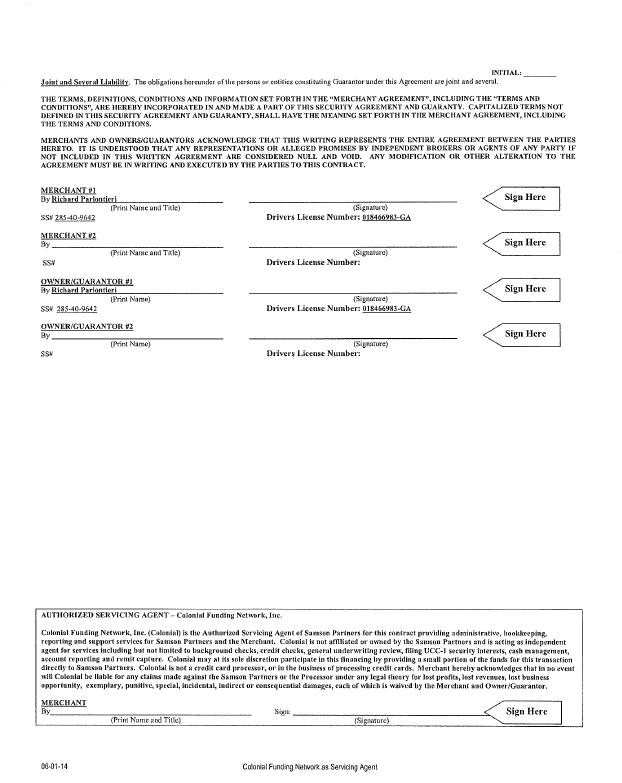

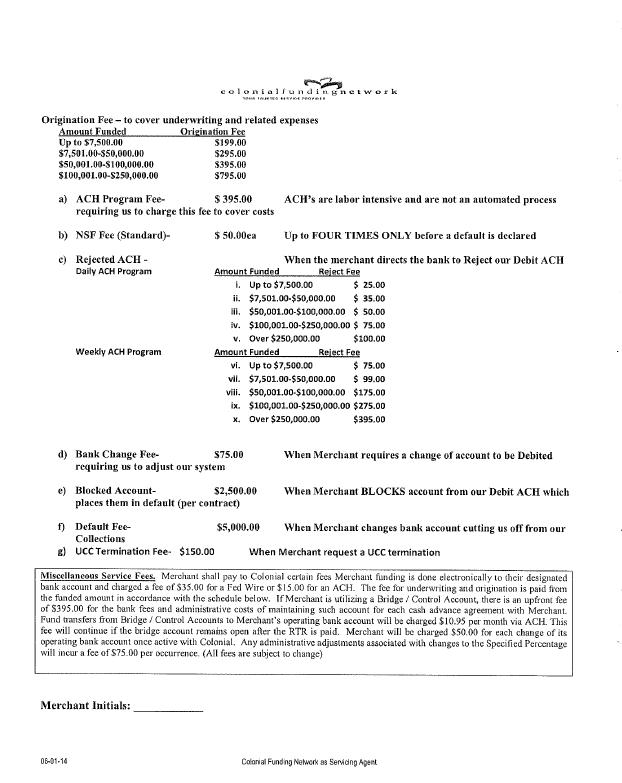

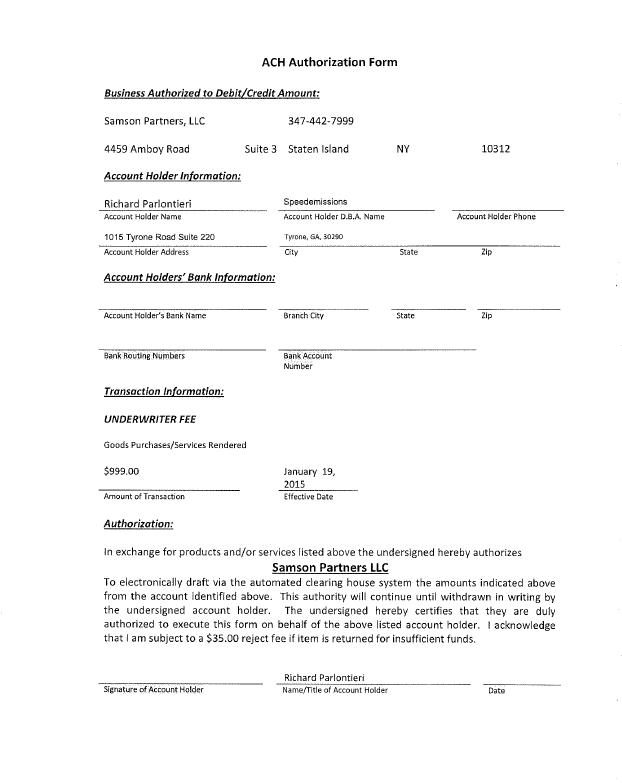

Samson Partners Ph. (347) 442-7999 (718) 304-1163 Contract ID# 348612 Sales Partner: Steve Markowitz, Jr. Samson Partners REVENUE BASED FACTORING (RBF/ACH) AGREEMENT Agreement dated Janumy 1.2. 2015 between Samson Partners ("FUNDER") and the merchant listed below ("the Merchant"}. (Month) (Day) (Year) MERCHANT INFORMATION Merchant's Legal Name: SpeedEmissions Inc. I SpeedEmissions Car Care LLC I SpeedEmissions Acquisition Company. LLC D/B/A: Speedemissions (ACH) CLF) State oflncorporation I Organization: GA Type of entity: ( X) Corporation ( ) Limited Liability Company ( ) Limited Partnership ( ) Limited Liability Partnership ( ) Sole Proprietor Physical Address: 1015 Tvrone Road Suite 220 Mailing Address: Date business stmtcd (mm/yy): 01/01 City: Tyrone City: Federal ID# 33-0961488 PUHCHASE ANI> SALE OF FUTUU.E RECEIVABLES State: GA State: Zip: 30290 Zip: Merchant hereby sdls, assigns and transfers to Fumier, as the lead purchaser for itself and co-investors [making Fundcr on behalf of itself and all co-investors (collectively the Funders), the absolute owner] in consideration of the funds provided ("Purchase Price") specified below, all of Merchant's future receipts, accounts, contract rights and other obligations arising from or relating to the payment of monies from Merchant's customers' and/or other third party payors (collectively the "Reccints" defined as all payments made by cash, check, electronic transfer or other form ofmonetmy payment in the ordimuy course of the merchant's business), until such time as the "Receipts Purchased Amount" has been del!vercd by Merchant ro FUNDE.R. The Rcce!prs Purchased Amoum shall be paid to FUNDER by the Merchant irrevocably authorizing only om: lkpositing accuulll acceptable to FUNDER (the"Account") to remit the percentage specified below (the "Snecificd Percentage") oft he Merchant's Receipts, until such time as FUNDER receives payment in full of the Receipts Purchased Amount. In consideration of servicing the account, the Merchant hereby authorizes FUNDER to ACH Debit the "Specified Daily Amount" from the merchant's bank account as the base payment credited against the Specified Percentage due. It is the Merchants responsibility to provide bank statements for any and all bank accounts held by the Merchant to reconcile the daily payments made against the Specified Percentage permitting FUNDER to debit or credit the difference to the merchant so that payment equals the Specified Percentage. Failure to provide all of their bank statements in a timely manner or missing a month shall forfeit all rights to future reconciliations. FUNDER may, upon Merchant's request, adjust the amount of any payment due under this Agreement at FlJNDER's sole discretion and as it deems appropriate in servicing this Agreement. Merchant understands that it is responsible for ensuring that funds adequate to cover amount to be debited by FUNDER remains in the account. Merchant will be held responsible for any fees incurred by FUNDER resulting from a rejected ACH attempt or an event of default. (Sec Appendix A) FVNDER is not responsible for any overdrafts or rejected transactions in the Merchants account which may result from FUNDER' scheduled ACH debit under the terms of this agreement. Notwithstanding anything to the contrary in this Agreement or any other agreement between FlJNDER and Merchant, upon the \'iolation of any provision contained i11 Section 1.11 of the MERCHANT AGREEMENT TERMS AND CONDITIONS or the occurrence of an Event of Default under Section 3 of the MERCHANT AGREEMENT TERMS AND CONDITIONS, the Specified Percentage shall equal !00%. A list of all fees applicable \mder this agreement is contained in Appendix A. Purchase Price: $60.000.00 Specified Percentage: !!% Specific Daily Amount: $1.169.00 Receipts Purchased Amount: $75.000.00 THE TERMS, DEFINITIONS, CONDITIONS AND INFORMATION SET FORTH ON PAGE 2, THE "MERCHANT SECURITY AGREEMENT" AND "ADMINISTRATIVE FORM HEREOF AHE HEHEBY INCOHPOHATED IN AND MADE A PAHT OF THIS MERCHANT AGREEMENT. FOR THE MERCHANT (#I) By Richard Parlontieri (Print Name and Title) FOR THE MERCHANT (#2) By -----;-;:-c--:-;-;----;-;;;=----- (Print Name and Title) OWNER/GUAH.ANTOH. #1 By Richard Parlonticri (Print Name) OWNEH./GlJARANTOR #2 By (Signature) (Signature) (Signature) <Sign Here <Sign Here <Sign Here <Sign Here Samson Jlartncrs (Print Name) (Signature) By -- ,-,---------------- Sales Associate Name: -------,,--,--,--------- (Company Onlcer) (Signature) To the extent set forth herein, each of the parties is obligated upon his, her or its execution of the Agreement to all terms of the Agreement, including the Additional Terms set forth below. Each of above-signed Merchant and Owner(s) represents that he or she is authorized to sign this Agreement for Merchant, legally binding said Merchant to repay this obligation and that the information provided herein and in all ofFUNDER documents, forms and recorded interviews is 11uc, accurate and complete in all respects. If any such information is false or misleading, Merchant shall be deemed in material breach of a!! agreements between Merchant and FUNDER and FUNDER shaH be entitled to all remedies available under law. Merchant and each of the above-signed Owners authotizes FUNDER, its agents and representatives and any credit reporting agency engaged by FUNDER. to (i) investigate any references given or any other statements or data obtained from or about Merchant or any of its Owners for the purpose of this Agreement, and (ii) obtain credit report at any time now or for so long as Merchant and/or Owners(s) continue to have any obligation owed to FUNDER. ANY MISREPRESENTATION MADE BY MERCHANT OR OWNEH. IN CONNECTION WITH THIS AGREEMENT MAY CONSTITUTE A SEPARATE CAUSE OF ACTION FOR FRAUD OR INTENTIONAL FRAUDULENT INDUCEMENT TO OBTAIN FINANCING. MERCIIANT AGREEMENT TERMS A:-.ll CQNl)fTJONS I. T£HMS OF ENROLLMENT I)IIJ'IWGitA!'II 1.1 Mcrc!o nt Dcuo•lt Ayr<cm"nt Merchant <hall execute an •srecment (the ..Merchant )}cnosit Avrccmenl'') acccptublc U> FONDER, wi1h n !lank acceplable w FUNDER, w olnain electronic lUnd lnmofor se"•ices. Meodmnt shall provide f\JNDER and lor it's authorized ag>:nl with all of the information, nuthori><ltions necessary lOr verifying Merchanfo rccci••ablcs, receipts ond deposits imo the accolll\t. Merdu.nt ohall authori<'C flll'>'DER nndlor it's agent to dcduclth>: umo1mts owed to FUNDER for the Receipts"' specified herein from settlement wnounts whid> woulll olhe•wise be due to Merchant b)-' rennitting FUNI)ER to withdraw the IJiecific daily amount crcdit<d ogainst tho spccifi«< percentages by ACH debit of the Merchant account. "I'he aurl>ori..,tion shall be im:vocablwithout the written conomt ofFUNDER. 1.2 Term of Agrccm nt, This Asreemcnt shall have an inder.nitc lcnn llmt shall I»St eidltr umil ull the M«(hant's ubligatiom to FUNDER are fully satisfied. T!us shall include but not be limited to any renewal>, nutstanding fcc.\ or coots. I .3 Future l'urchuscs. FUNI)ER rC'lcrves the right to rescind the onOr to make ""Y pnrchoscpaymcnts hereunder, in its sole discretion 1.4 Financial Condl!lon. Merchant and Guoranl\u s) uuthorl:zFUNDER ,.nd lts agcntJ to b\\•cs!lgatc their flnondlll re1pon1lbiUty and hluury, and will pro\'ldc to t'UNDER any hank t•r flnancO.l dutem nh, tax rdurm, ole., •• flJNOEH deems n..:euny l>l"lor to or At any Ume Qft.rn..:uti-on of thl• Agreement, A photocopy ofthl;- authorization wiU be dccu1ed acceptable for rcleuc t>f flltwncllll btform tlon. FUND :n lS outhorl1.11d to update such lnformatlon und tlnot•d•l protlle• from time to time oslt deem• •l>proprlatc. LS Tronsaet!on l !Iiston•. Merchant •uthori""' their hank to prcwi<le !'UNDER with Mnch m's hanking or pmce sing his!ory 10 determine quahl"tcation or continu,Hion in tlnsptogram 1.6 h>dcmn!fip•tkm. Mcr hunt unJ Gu:otant<'l{S) jointly and s wrally i11demnit'y and hold harmless l'mceswr!Bank, its ot)lceiS, directors and shareholders against all lo;scs, damages, cla>ms. liabilities and c•penscs (including rca>onoble aUomcy'o fees) inoorred by l'ro.:cssor resulting from (o) claim> asserted by FUNDER for monies owod to FUNDER Jlom Mctchantand (b) actions taken b)-' l'wccs.>or in reliance upon infmmation or instntctions pw\'idod by FUNDEI\. 1.7 No Liability. In 110 c\"cnt will HJNDEI\(or •my of the Fundas) he lioblc for a11y claim.> asscncd by Merchant Ut1dcr any legal theory for lost prolits, lost rc>•cnucs, los1 busit>cs< op('ortunilies, cxcml'lary, punitive, ;pcci.il, ind<knlal, indirect or comCO[Umtia! domogc,;, each of which io w.1i1'ed by MeJchanl and Guammor(s). 1.Rrlillnu on Ttrm! Section 1.1, !.7, 1.and 2.5 of this Agreement arc asrccd to for the benefit of Merchant, FUNDER and l'rocc>Sor, and notwithstanding the fuel thai Pmco55or i• not a party of this Agr emont, Pwccsr.or may rely UfHln their terms ""'I mise them as" dcfrnsc in any action. 1.9 Sale of R••ce!nts. Mcnohanl and FUNDER agree that the Purchase Price under this Agreement is iu exchange fm the l'urchascd Amount and lh•t sud1 Purchase Price is 1101 intended to be, nor shall it be ronsuucd as a loan from FUNDER to Merchant Mcrcllal\t agrees that the l'urchasc Price is in exchange for >he sale of fit lure Receip1s pursuant to this Agreemcm equals the fair market value of such Receipt.<. FlJNDER lws I>Urchased and shall 0\\1! all the Receipts dcscnbcd in this Agrccmcnl up to Ihe full i'urehastd Amount"" the Receipts arc created. l'a)-'mcnls made lo FUNDER in respect 10 tlte full amount of tl1c Rc-.:ei11IS shall be <"<>nditioncd upo11 Mcrcham's sale ofpmduct.< and .«>vices and the paymcnl thorcforc by Merchant's cmlomcr< in the manner pm\'>dod in Section 1.1. In 110 c\'ent hall the agsrcgalc of all anwums be dccm<><i a> it tcrc>t h •ew1dcr '"'d ••hmgo:d or collected here1mdor ex>eed the highe11 ralc pen!l>S.SLbk al law. ln the event that a court de!em1inc• tho! HJ:-IDER has charged or rccci\'col in teres! hea•under in exec» of the highest ap('licoble rate, the rate in effect hereunder 1hall automatically be rccltlL:ed to the maximum rate pcrmiucd h;• applicable law and !'UNDER shall promptly refund to McJchanl any interest >cccivcd by FlJNDEI\ in cxcc>s of the m••imum luwful •ate, it b>ing intended >at Merchant no!pay or conlracllo pay, and thati'UNDER not receive nr e<>nu-act to rcccil'c, directly or indirectly in uny maJmer whatsoever, intcrc>l in excess of that which moy be p id by Me> chant under applicable law. l. 10 I' ower of AUorncy Merchant inevo>ably appoints FONDER as liS agem and unomey-in•facl with full uudoooity to luke any a<•tiun or execute any in>tnoment nr dnrumetll to c!llc all obligations due to FUNDER from l'>occ>o:ortHank, or in tiLe caoc or a \'iolation by Me> chant of Section I. 12 01 Ihe occu rcnocfcan Evel\1 of Dduul! uudtr Section 4 lwrcof, fmm Merchant, under this ,\grecmclll. inclu<ling without limitation (i) to obtain and adj11st in,< 1rance; (11) to collect monies due m to become due umkr or in >c.<pccl of any of the Cullatcra\; (iii) tu receive, endorse :md collo<:l ""Y che<:h, notes, drnfls, imtrum<nts, docnments or chattel paper in connection with c! use (i) or clause (11) almvc: (i\') to sig11 Mcrchanl'o ""'"" on any inl'oicc, bill of l,>dit>g, <)r as.<igmncm olirccting cmtume<• or acc-oun\ dcbtoro \('make pU)1\\enl directly 10 FUNDER; and (v) to lile any daims or t"ke any action or inslitute any proceeding which FUNDER may deem necessary for the co\lcction or any of the unpaid l'urdLascd Amoum from '" Collateral, or u1hcrwioc to enfOrce it> •ighls with respecl 10 p:oymem of the l'urd•ascd Amowu. I. II l'r<Ltccllll!>S ,\guinst )) fault. The following Protections l 1l1mngh 7 may be U\\"okcd by FUNDER. immcdialcly al!d without notice to McrciLant in the c>•cnt (a) Merchant ch•ngc:: its U>Tatlgemct!L< wilh l'«>cc<;.:.>rmank in any way that is ad>•crsc to FONDER; (b) Mcrchruu changos lhe deposit ac.•ountth>ough which the Receipts arc sculcd., or pcnnil> any cYcnt hl occur !hat cnu\d cmtoe divcroion of uny <lf Merchant's tmn<actions to anoU1cr account; (c) Mcr hanl interrupt;; the operation of this bu5iness (other thun ad\'<15weather, namml di a<ler> ur acts o>f God) !lJnsfclS, mo1•cs, >ells, d>si>O<e<, transfer< <>r othcrwi<> conveyits busine» or u>ScL< withou( (i) the cxpre» prior W> iltCll co"'em of FUNDER, and (>i) the wrinen asrecmcnt of uny purchu>er or trJn•fcrce to the o%mnption of all of Mc>ehmH'> uhligat1ons under thi!Ar,«cmmt pursuam to documentation oati.<lOctory 10 FONDER; or (d) Merchant takes anoction, fJil< liJ luke any aclion, or uffcr< uny incetuiv<>------<:e<>twmic OJ " 'cm•iscr-thc rc ult nr whid1 will he In i11ducc ancu.-tomer »r customers 10 poy Jilr Mcrdtam"s set\'lccs with at>y means Ollhcr than chech thaarc sculcd through J>mce.•sor •n,c;e protcctim!S arc in addition 10 uny <>lhcr remedies available lo FONDER at law, in equ11)-' or uliL<twioe pllr<Uanlto thi• Agreemen1. l'rolc lion I. The full uncllllecled l'urcha5c Ammon\ plu.< all fees due under tlus Agrcemcn1 and the uuachcd Sccudty Agreement become due and puyohlc m full immediatdy l'rol<etil>n 1. FUNIJER may enforce !he prol\'isions of the Personal Guaranlec of l'eofonnancc again;! Ouu>untor. l'r01cction 3, Merchant shall, upon execution of this Ag>ccmem, deliver II> FUNDER an ex c•uted confcssio!l uf judgmem in fa\'or of FUNDER in !he •IITIU\11\1 Olf the l'llrchasc Amount <late<! in tc Agrccmcm.Upc\n Iucado of O!l)' I"U''i>ion in thi> p•rag'"ph 1.11, FlJNDER may enter that conl"-<>i<>n of )Udgm ut us ajudgmont W1d1 the Clerk oftlw Co1u1 oul exeCII!< !hor<nn l'rotcction 4. FUNDER may enforce its ccurity intc>cst m the Collateral idcnlifocd in Aotide 111 hereof. l'wtcction S. '11oc cntirI'm chose Am(>Unl shall become immcdialcl)• >efundablc w F\iNDER f>om Mo>dtoou. Protection 6. FONDER may proceed to IH<'lccl ot>d <1ofmcc il< right< anol 1emcdies by lawsuit. In any such !aw uiin which FIJNDER shall rce<l\'tr judgment agam;( Mcrchat>l, Mereham <hall he liable for all ofFUNDER '< co.<l< of lawoui1, including but not !imi!cd to all reasonable allomcys' fees and ""Uti costs l'rolleclion 7. Mer(hant shall, upon execution of this Agreement, deliver In FUNDER an exNu!t•d nulgnm nl ofka•ofMcn:hnnl'> pnmiscJ in favor of FUNDEI\. l%>nn breach ofony provision in this paragoph 1.12, FUNDER may exercise ils rights under such assignmrnt oflc sc. l'tolccuon FUNDER may debit M rchant'> dcpo> lOI)' accounl.< wller •cr silllatcd by meum of ACH dd•it or facsimile ignaturc on "comput<r-gaoeratod check drawn on Merchant's ba11k accoum or otherwise. 1.12 l't•otrctlon of Jnform"!!un Mcrch LI! and cad\ pcr.<on signing this Asrcemcnt on behalf of Mcrchan! nndi<>r as Owner, in respect of himself or heHe!f persouollr, authorizes FUNDER to disclose it!!Om>atiolt cot\c ming Morchant's and each Owner'• credit standing (mcluding credit burcm> reports 1ha1 FUNDER obtains) and business conduct only to agents, aniliales, subsidiaries, Wid cr dit reponing bur aus. Merchant u11d ach Owner hereby wail'eS to tho maximum extent permincd by law any claim fo1r damages against FUNDER or any of its aniliatcs and the Fundcrs rclu(ing (o any (i) in\'csligntim> undcnakcn by or"" behalf of FUN)}ER as pcrmitlc>d by this Agrccnwnt or (ii) disdo.<ure ofinfomtminns pcrmilled l>y this Agreement. 1.13 Comtldrntlolity. Mcrchat>l undcr.<tands and agree< that the terms and condition> of doc products and sm•iccs <>ffcrcd by FlJNilER, including this Agrccmet!t nnd "")' othc,- FUNIJER documentations (collectively, '"Conlidential lnfonnation'") arc pwpnc ll)' and cunftdenti.ll ittfnnnalion of FUNDER. Accmdingly unk<> disclom>c i> required by law or court mdor, Mc>dmm slmll nol diSclose Confidential Information of FUNDER to >my 11erson other than "" allomcy, accountant, finand•l ad\'isor '" employee of Merchotu who needs (o know such infomMiou lOr the 1>01-pose of advising Merchont (""Ad\'isor"), provided udt Advisor uses such mform"tion solely foo the puq>osc of ad\'ising Mc1cham and first awccs in w>iting to he hound hy the tcnns of this Section 1.13. I. 14 Puhilclly. Merchant and each Owner unly amhori"'s FUNDER to usc its, his or her nome in B liMing of clients uud in ud>'•tlising aud mwhling mute rial> with their express written ennscm. 1.15 - Merchant hc>ehy acknowledge> and agrees that FUNDER may be uoing '"doing lm•incss as" '" '"<llbla'' nan>co in connccti"" with va1ious malletS relating to tho uunsoction between FUNDER and Merchant, mcllldtng the fihng of\JCC-1 fina11cong <!a!cment' and other notic<S or filing< II. II.EPRESENTATIONS, WARRANTIESANil COVENANTS Merchant represents, wmrm!ls nnd covenant• that as of this date and duri11g d1c tCITll of this Agreement 2.1 l'lnonrlol Condltlon and Finandallnfo mallon. Its bank and financial statcmo!llS, COili<S of wh>ch have b•en fumishtd to !'UNDER, and liuuoe statements which will be furnished horca(kr at '" discrctin ofFUNIJER, fairlr •-.:present the r.nandal eondii!On ofMc>clMt!at uch dates, and Since those dute> there hu• boon no m"h:rial ...w-., changes, financial or otherwise, in sud! condition, operation or ownership of Merchot\1. Merc!Lalll hal a continuing, affmnatiw obligation to aoh•isc FUNDER of any nwcrial ad.,..,.,... change in its financial condition, opera lion or owne>ship. FUNDER >nay request ;;tatemcnts m any time dming !lie perli,.mancc of this Agreement und tho Morchnm •hoi\ provide them to HNDER within 5 businc;s days. Merchant's failure to do so is a material hreach ofthis Asrecmcnt. 2.2 Go\'ornmemal Appronls. Merd'"m ;, in mmpliance utod hull comply with all laws and has valid pennit,, authori7.;1tions and licenses to own. OJlctale und lea.'c il< propc>tie> and to conduc-t tl1e husine>S in which i1 i> l"e>cntl cngag . 2.3 Aulhorlgllon Me>chant, and the pcrson(s) oigning this Asreemcnl 011 behulf of Mcrcl1ant, have full ('OWer nnd amhodty to in(ttr and perform lhe obligations under Ihis Ag cemont, all ofwhido hove been dul;•authoti"ll'd 2.4 lmunn•c. Mc1chant will maintuin busines.•-intemtption insurance r1aming FlJNDER a> loS5 payee and mlditioma! insured i11 amounts and ogainsl rish as ure sMisfuctory 10 FUNDER and sllall provide FUNilER pruofof,'Uoh in>unmcc ttl"'" requc-'1. 2.5 lntcnlim>ally omitted 2.6 Cl••n1'• uf Namo or l.ccnt!un. Merchant will not conduct Merchant'> businc'"es Ut1dor nny momc other thton as dioclostd to the l'rocos or and FIJNDER oJ change any of itplocoofhu inoss. 2.7 Dail)'liMch Out. McTchanl will hatch Olll >cccipl> with the l'rocc.,,m on" daily basis 2.Fstonp£1 C£r!l!lc tc Mo1chant will ol nny limo, at\d from limo to time, "1"111 at lcd.<l ot>c 11) day'> p1iur nn11cc from FUN DE!\ m ?1-lcJChant. cxccll(c, acknowledge and deliver l<> FUNllER •wdlor tu any mher peroon, per<at> l"um or corpowl!on speciH<d by FUNDER, a statement cc>1ifying thar this Agreement is lllliMdiftcd illld 111 full for"and dfccl (.,r, if ocrc ha,•c hcon modLiications, tbat the some i> in lUll fmcc and en-eel"' modified and Sl:<ting tlw nu•dir.calioms) and otating the date< which tho l'tnch«scd Amount or '"'Y portion thereof hos bce11 repaid. Vi No Rpnkl"umey or lmoh•e ocy, As of the dulc ofll>is Agreement, Mcrdoanl represents th"t it i• not inwlvcnl w1d docs not rontemplatc nnd has not liled any potition for h•mkmptcy 11101ectinu unJcr Title 11 of tho United St"l"' Code and there hao been nn invnlnnlal)' pctiliom bJOnght or pcoding against M<rclLOnl Merchant funhor warrmm !hat il doc> not anli<•ipatc nling an)' such b.>nkruptcy p<liti<>n und it dnc• not anticipate 1h.11 an involuntar)' petition will be lil<cl again<\ it. In the t\'cnt th.11 the Mrrchant flit.' fol hankntptcy pn>tcction or i,; placed uttclor an ittvolumary nling l'rotc<:lil)n,; 2 and 3 urc immcdi ..tcly inn>ktd. 1.10 Addl!lo11l Ftnandni'• Mcr hunlsh•ll not enter into any arnwgcl!!Cnt, agncmcnt or commitme!ll for any additional Onanetng, whcth•r In the form of • purchase of t•e clvnhleJ or Q loan to tho buslncu with any l>&rly othrr than FU DER w houlthclr written pcrmis•lon. l.i I Unencumbered RccdnU. Me1dmm has gond, complete and markctJhk title hl all Re eipts, free and clear of any ru1d all liah!litic;, li m. claim>, dmnges, rcmictions, rondilion>, »plion>, rights, mnng.;ge<, sccmitinterest,, <>lUitiC'l, pledges and encumbrw>cC'l of any kind or nolum what,oe\•er oJ •ny other rights or interests that may be inc.msi>lcnl with the lHu>sactions con\emplatcd with, or udvcr>e 10 ll>e inte•ests ofFUNDER 1.12 llu•lncn l'uruo!c. Merchant is a \'alid busi11c;;s in good ;;tw>ding und..- the laws ofe junsdiction.• 111 which it is <>rgunizcd and/or operates, and Mereham i' entering into thi> Agreement for bu,inc>$ purpose.' and no! as a con>1.H\lcr fo> pc>wn:<l, family or household purposco 2.13 P£!Ju!! Umln Ollwr Contrueb. Metchont" execution uf and/or 1•crfonnancc under tll!S Agrccmenl will no\ cause or create an event of defaull hy Merchant under any contr.<CI with unothct pcn.nn or entity. ll!.lt.Vt:NTS OF D£ 'AULT AND REMEDI :s 3.1 Events or ll•fau. Tho occurrence nf any of the follnwmg C\'Cnts shall constitule an "hem of Dclduh" hcreut>doo: (.1) Merchant shall violate any term m covenant in thi1 Agrcrmrnt; (h) i\ny rcp e•ctuati\\n ur warr•n>)' h)• Mcr,•hant ill this Agre>mctu .<hallpmvc to ha>•e been incorrect, faloc or misleading in any nmcrial >espccl when made; (c) Merchant shall admit in wo it>ng itinabtlil)-' to poy its dohto, "r >hall make a general ussigntiiCI\1 for the bcnclit of crcd!lo><; 01 any proceeding .<h ll ho instituteol by or aj\ainst Me,chant .«eking t<> adjmli<•atc it a bankmpl or insolvent, or seeking rrorgani;- tion, arrangcmclll, adJusUncnl, 01 compo>!tion of it or it.< dclm; (d) the sending of notice of termination hy Ciua>anlor; (c) Me chant ;hall transport, n111vc, inteuupt, su;l'cnd, dossol\'c or lmninatc its business; (f) Mcrchunt shalltronsfet or ell all or subotanlialty all of its .<.,et'; {h) Merchall!shall mne or $Q'ld nutice of uny intended hulk sole "' tran>fcr by Merchant; (i) Merchant ohall usc multiple de('ository acwunts withoul the pri<>r wrillcn c•onM>H of FUNDf:R; (j) Merchant shall cbangc its depositing ucc >Unt without the prior written "'"'sent ol' FUNDER: (k) Merchant shall perform any act that reduce< the ,•a]uc of any Collateral granted under this Agreement; or (I) Merchant shall default under any of the letms, CO\'etlal\1.< anJ cm>ditions of nnyo!her agreement with FONDER. 3.2 n medl s.ln case MY Event of Default occurs and is not wa1ved pursuant to Section 4.4.! hereof, FONDER on its own and on bchalfofdLC !'u!ldero may proceed to protect and enforce io. rights or remedies by suit in equity or by action at law, or both, whother for the specilic performance of any 0\'e!Hult, asrcemcnl OJ o 1cr pruvi>ion comai11ed herein, or to enforce llte di> hargc of Merchant's ohligatiuns hereunder (including tho Pcr<onal Guarantee) or an)' other legal or equilllble right or remedy. i\11 rights, powers und remo:dies of FUNDER in connection wid> this Asrcemcnt may be exercised al any time by FUNDER allcr the occurrence or"" Even! of i}cfault, ure cumulative and not exclusive, and shall be in addition to a>>>' other tights, power; or rcmedic,; provid«< by law or equity. 3.3 Co•l•. Mc>elmnl shall pay to FUNI)Ell :!II reasonable costs associated with ( ) " breach by Merchant of Uoe Co>•enants in this Agreement und oc enforcement thereof, and (b) le enforccmrnt of UNDER '• remedies set tOrth in Scolion 4.2 alxwc, including hut nol)imitcd lo court !:()SIand anomcys' fcc . 3.4 ltouuirs:d Notllkat!rms l\lerdoantls requlrs:d to gh•e FUNDF.R wri((s:n ttolkc wllb!n 24 hours of n)" tlllng under Tklc II ofthe United St•lc• Code. Merchant Is required to h•e FU!'<DER senn days' written notice prior !u the c!u lnc uf nyul" of ll or ubuantMiy all of tiLe Mcn:llanl's osss:t< or stock. IV. HSCELU..NEOL'S 4.1 Mudlll>•oUon•• Al•recluenl•. No modilic tiot>, amendment, wai\'cr or onscnt or any provision r•f this Agrcemcnl shall he effective unlc." the same shall be in writing and •igned by FUNDER 4.2 Assi nmen!. Merchant acknowledges and understands that I'UNDER » acting on its own behalf 11nd a.> the aclmini>t>ator und lead investor for" gn!Up of indcpc11de!ll pa>1icipulll5 a liot of whi<;h c•n bprovided lo Men•hant "li"r funding and upon wriuen noucc to F\JNDEit. !'UNDER may u<Sign. uamfer or sell it, right.< to 1cceivc the Purchased Amount or delegate its dutic.< hereunder, either in whole or in purt. 4.3 Notices. All notices, requests, consent, dcmLI!lds and other communi<:Mion" hcrew>der hall he delivered by certified mail, rc!urn receipt requested, to \he r"'pectivc parti"' to !his Agrcemcn! at tho r.:ldre<scs set forth in this Agreement and >hall b.come efl"ective only UIMlll rocoipl. 4.4 W•h•n nemcdi<S. No failure on the part of FIJ.';'DER to exetctsc, and no delay in cxe>dsing, any 1ight under this Ag ecmenl shu!l ope1u1c us a waiver thereof, nor sht<\1 any single or P"rliol exercise of any right under this Agreement preclude at\)' other or funher exertise l11ercof or tltc exercise of any other 1igh1 'l11e rcmedic;; provided hereunder arc cumulati\'e and not e•clusivc of any remedies provided by law or equity. 4.511h>dbw Effttt• GovcrnJnr Lw \'cnuMnd Jurisdlcllnn This Agrwnen> shall be binding upon and inure to Ihe bct cfn of Merchanl, FUNI)F.R (and it's l'artidpums} and their rc pcctivc successors and as.,igns, FUNDF.R•l'articipanls shall be third plill)' benetlc>ad« of all such agreements. except thnt Merchant shall not ha\'C the righl 10 a.<Sign it' rights hereunder or any interest herein withoul oc p>io> wri1tet1 cotl>ct\1 of FUNDER which c"n>ctll moybc will oeld in UND!iR's solo discretion. FUNDER rescrv•o the rights to aSSi)ln this Agreement with or without IHior wriltcr> nnticc 10 Mcrchanl. This Aweemcnt .<hal\ be govemcd by and cons lted in aocordancc with Jl>e laws of !he SMc of New York, without ro urds to any app\ic:oblc principals or conllicts ol' luw. Any .<niaction or pro>eccding arisinu hereunder, or the intc netation,perfunuancc or bocach hereof, shall, if FUNDER so elects, be instilutcd in any court siUit>g "' New York, (the ""Acceptable Forums"). Me1chan1 asrces thill the Acceptable Fomms arc convcnicmto it, nud suhmit< to the jurisdiction of the AccCjliBhlc l'n>llll\and wa01•cs any a11d all ohjec!ions to jurisdiction or venue. Should >llch proccoding be i11itiated in "'I)' olhcr forum, Merchant waives ny >ight h> >•ppusc any m\lli\ln or application moUe by FUNDER to 1ransfor such proceeding to an Accoplablc Fomm. 4.6 Sun•ival of lhpn:sen!allon etc. All representation<, wllrtantic.< and cuvcnants herein shall sm\•ivc the exocutiotl and delivery of this Agreement and shnll continue ill full li>rcc tlnlil all ohligatim>s under this Agreement shall have been sal!slicd in full and this ,\greemcnt <hall have terminated. 4.7 Sr>•ernblllty. In ca.<o any of the provisioons in this Agreement is f<>Und I<> be invalid, illegal m uncnl\•rceablc in ony respect, the validity, logalily '"'d eLLforcc holit<>(an;• nthct l*"'isinn •>tl!:unod herein ;,hall no! m an)-' way be affcc•tcd or impaired. 4_8 F:n!lre Agrretncnt. Any pro\'ision hcrrof prohib!led by law 'halt be moffcctivc nnly to the extent of such prolubili,>ll without invalidating the remaining provisions heroof. ThiAgrccmonl and Seeul"l!y Agncn>enl hereto ctnb(>dy the entire ngceemcnt between Mc ehant and FUNllER and supersede all l"iur agreements and nnde11aandings relating to lllc suhject mancr hcrwf. 4.9JUR\' TlUAL WAIVEII. THE l'ARTIE-.'> IIERETOWMVK TRIAL B\' Jilin' IN ANY COURT IN ANY SUIT, ACJ"ION OR l'ROCEF.DII'\G ON ANY !Kn'ER ARISING !)II CONN :CTION WITH OR IN ANY WAY UELATE!> TO THE TJ{ANSACTIONS OF WHICH THIS AGREEMENT IS A PART OR THE E)IIFORCK\IF.NT HEREOF. TilE I'AR'fU:s HERETO ACKNOWLEIJGE THAT EACH ?>lAKES TillS WAIVER KNOV.'INGLY, WILLINGLY AND VOLUNTARILY AND \\'ITIIOUT llURESS, AN"ll DNLV AFTF.R EATF.NSJVF. CONSIIlERATION OF THE RAMIFIC,\TJONS OF TillS WAIVER WITH THEIR ATTORNEYS. 4.10 CLASS ACrlO)II WAJ\'ER. THE I'ARTJES II :RETO WAIVE ANY !tiGHT TO ASSF.In AN\' CLAI!IIS AGAINST THE OTHER PARTY AS A REPRESENTATlVE OR F.MBER II'\ ANY CLASS OR REl'lt£SEN"fATIVE ACTION, EXCEPT WHERE SUCH WAIVER IS l'lWIITIIIn:D BYLAW AGAJ:-.ST l'UBI.lC l'OUC\'. TO THE EXH:NT EITHER PARTY IS I'ER?I-!ITIED IIV LAW Olt COURT OF L,\W TO I'ROCEED \\'ITU A CL,\SS OR Rltl'RESI::NTATIVE ACTION AGAINST TilE OTHER, THE I'AUTIES HEREBY AGREE THAT; (I) THE I'REVAIUNG l'ARTY SHAU, NOT BE ENTITLED TO HF.CO\'ER ATTORNEYS' FKF.S OR COSTS ASSOCIATF.IJ WITH l't:RSlJlNG THE CI.ASS OU REPUESENTATI\'E ACTION (NOT WITilSTANiliNG ANY OTHEU !'IIOVISJON IN nus AGIIH:t\H:NT); AND (l) TilE I'ARn' WHO INITIATES OR I'ARTICII'ATF.S AS A l\IE:.\IIIER OF THE CLASS WILL NOT SUIIIIIIT A CLAn! Olt OTIIEltWJSE l'AitTICil'AH: IN ANY RF.COVF.!n' SECL'IlED TllllOlJG!l TilE CLASS OH REPRESENTATIVE ACTION. 4. II Fatdmllo Ae< h!O!ItO. Fuc.\imilo 'ignol\lre< 'hoi\ he de< mod rcq>tahlc li>rollpmp».'<'., Initials:------ Samson Partners -SECURITY AGREEMENT AND GUARANTY Merchant's Legal Name: SpccdEmissions. Inc. I SpeedEmissions Car Care LLC I SpeedEmissions Acquisition Company. LLC D/B/A: Speedemissions fACHl (LFl Physical Address: 1015 Tvrone Road Suite 220 Federal ID# 33-0961488 City: Tvrone State: GA Zip: 30290 SECURITY AGREEMENT Security Interest. To secure Merchant's payment and performance obligations to FUNDER, as the lead purchaser for itself and its affiliates or the Fundcrs , a list of which may be provided to the Merchant upon written notice after the funding of the purchase closes under the Merchant Agreement (the "Factoring Agreement"), Merchant hereby grants to FUNDER a security interest in (a) all accounts, chattel paper, documents, equipment, general intangibles, instruments, and inventory, as those terms arc defined in Article 9 of the Uniform Commercial Code (the ..UCC"), now or hereafter owned or acquired by Merchant; and (b) all proceeds, as that term is defined in Article 9 of the UCC {a and b collectively, the "Collateral"). Cross-Collateral. To secure Guarantor's payment and performance obligations to FUNDER (and its the Fundcrs) under this Security Agreement and Guaranty (the "Agreement"), Guarantor hereby grants FUNDER, fOr itself and its participants, a security interest in_ (the "Additional Collateral"). Guarantor understands that FUNDER will have a security interest in the aforesaid Additional Collateral upon execution of this Agreement. Merchant and Guarantor each acknowledge and agree that any security interest granted to FUNDER under any other agreement between Merchant or Guarantor and FUNDER (the "Cross-Collateral") wlll secure the obligations hereunder and under the Merchant Agreement. Merchant and Guarantor each agrees to execute any documents or take any action in connection with this Agreement as FUNDER deems necessmy to perfect or maintain FUNDER's first priority security interest in the Collateral, the Additional Collateral and the Cross-Collateral, including the execution of any account control agreements. Merchant and Guarantor each hereby authorizes FUNDER to file any financing statements deemed necessary by FUNDER to perfect or maintain FUNDER's security interest, which financing statement may contain notification that Merchant and Guarantor have granted a negative pledge to FUNDER with respect to the Co!lateral, the Additional Collateral and the Cross-Collateral, and that any subsequent lienor may be tortiously interfering with FUNDER's rights. Merchant and Guarantor shall be liable for and FUNDER may charge and collect all costs and expenses, including but not limited to uttorney's fees, which may be incuned by FUNDER in protecting, preserving and enforcing FONDER's security interest and rights. Negative Pledge, Merchant and Guarantor each agrees not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect to any of the Collateral , the Additional Collateral or the Cross-Collateral, as applicable. Consent to Enter Premises and Assign Lease. FUNDER shall have the right to cure Merchant's default in the payment of rent on the following terms. In the event Merchant is served with papers in an action against Merchant for nonpayment of rent or for summary eviction, FUNDER may execute its rights and remedies under the Assignment of Lease. Merchant also agrees that FUNDER may enter into an agreement with Merchant's landlord giving FUNDER the right: (a) to enter Merchant's premises and to take possession of the fixtures and equipment therein for the purpose of protecting and preserving same; and (b) to assign Merchant's lease to another qualified Merchant capable of operating a business comparable to Merchant's at such premises. Remedies. Upon any Event of Default, FUNDER may pursue any remedy available at law (including those available under the provisions of the UCC), or in equity to collect, enforce, or satisfy any obligations then owing, whether by acceleration or otherwise. GUARANTY Personal Guaranty of Performance. The undersigned Guarantor(s) hereby guarantees to FUNDER, and its affiliates or the Funders, Merchant's performance of all of the representations, wammties, covenants made by Merchant in this Agreement and the Merchant Agreement, as each agreement may be renewed, amended, extended or otherwise modified (the "Guaranteed Obligations"). Guarantor's obligations arc due (i) at the time of any breach by Merchant of any representation, warranty, or covenant made by Merchant in this Agreement and the Merchant Agreement, and (ii) at the time Merchant admits its inability to pay its debts, or makes a general assignment for the benefit of creditors, or :my pmcecding shall be instituted by or against Merchant seeking to adjudicate it bankntpt or insolvent, or seeking reorganization, arrangement, adjustment, or composition of it or its debts. Guaranto1• Waivers. In the event that Merchant f:tils to make a payment or perfOrm any obligation when due under the Merchant Agreement, FUNDER may enforce its rights under this Agreement without first seeking to obtain payment fimn Merchant, any other guarantor, or any Collateral, Additional Collateral or Cross-Collateral FUNDER may hold pursuant to this Agreement or any other guaranty. FUNDER docs not have to notifY Guarantor of any of the following events and Guarantor will not be released from its obligations under this Agreement if it is not notified of: (i) Merchant's f.'l.ilme to pay timely any amount owed under the Merchant Agreement; (ii) any adverse change in Merchant's financial condition or business; (iii) any sale or other disposition of any collateral securing the Guaranteed Obligations or any other guarantee of the Guaranteed Obligations; (iv) FONDER's acceptance of this Agreement; and {v) any renewal, extension or other modification of the Merchant Agreement or Merchant's other obligations to FUNDER. In addition, FUNDER may take any of the following actions without releasing Guarantor from any of its obligations under this Agreement : (i) renew, extend or otherwise modify the Merchant Agreement or Merchant's other obligations to FONDER; (ii) release Merchant fi•om its obligations to FONDER; {iii) sell, release, impair, waive or otherwise thil to realize upon any collateral securing the Guaranteed Obligations or any other guarantee of the Guaranteed Obligations; and (iv) foreclose on any collateral securing the Guaranteed Obligations or any other guarantee of the Guaranteed Obligations in a manner that impairs or precludes the right of Guarantor to obtainreimburst:rnent for payment under this Agreement. Until the Merchant Amount plus any accmed but unpaid interest and Merchant's other obligations to FONDER under the Merchant Agreement and this Agreement arc paid in full, Guarantor shall not seek reimbursement from Merchant or any other guarantor for any amounts paid by it under this Agreement. Guarantor permanently waives and shall not seck to exercise any oft he following rights that it may have against Merchant, any other guarantor, or any collateral provided by Merchant or any other guarantor, for any amounts paid by it, or acts performed by it, under this Agreement: (i) subrogation ; (ii) reimbursement; (iii) performance; (iv) indemnification; or (v) contribution In the ("vent that FUNDER must return any amount paid by Merchant or any other gu> rantor of the Guaranteed Obligations because that person has become subject to a proceeding under the United States Bankruptcy Code or any similar law, Guarantor's obligations under this Agreement shall include that amount. Guarantor Aclmowlcdgement. Guaranto1• acknowledges that: (i) He/She understands the seriousness of the provisions of this Agreement; (ii) He/She has had a full opportunity to consult with counsel of his/her choice; and (iii) He/She has consulted with counsel of its choice or has decided not to avail himself/herself of that opportunity. INITIAL:--- Joint and Several Liability. The obligations hereunder of the persons or entities constituting Guarantor under this Agreement are joint and several. THE TERMS, DEFINITIONS, CONDITIONS AND INFORMATION SET FORTH IN THE "MERCHANT AGREEMENT", INCLUDING THE "TERMS AND CONDITIONS", ARE HEREBY INCORPORATED IN AND MADE A PART OF THlS SECURITY AGREEMENT AND GUARANTY. CAPITALIZED TERMS NOT DEFINED IN TI-llS SECURITY AGREEMENT AND GUARANTY, SHALL HAVE THE !\lEANING SET FORTH IN THE MERCHANT AGREEMENT, INCLUDING THE TERMS AND CONDITIONS. MERCHANTS AND OWNERS/GUARANTORS ACKNOWLEDGE THAT THIS WRITING REPRESENTS THE ENTIRE AGREEMENT BETWEEN THE PARTIES HERETO. IT IS UNDERSTOOD THAT ANY REPRESENTATIONS OR ALLEGED PROMISES BY INDEPENDENT BROKERS OR AGENTS OF ANY PARTY IF NOT INCLUDED IN THIS WIUTTEN AGREEMENT ARE CONSIDERED NULL AND VOID. ANY MODIFICATION OR OTHER ALTERATION TO THE AGREEMENT MUST BE IN WRITING AND EXECUTED BY THE PARTIES TO THIS CONTRACT. MERCHANT#! By Richard Parlontieri (Print Name and Title) (Signature) < SignHere SSII 2R5-40-9642 Drivers License Number: 018466983 GA MERCHANT#2 By (Print Name and Title) (Signature) <Sign Here SS# Drivers License Number: OWNER/GUARANTOR #I By Richard Parlontieri {Print Name) (Signature) <Sign Here SS# 285-40-9642 Drivers License Number: 018466983-GA OWNER/GUARANTOR #2 By ------------ <Sign Here SS# (Print Name) (Signature) Drivers License Number: AUTHORIZED SERVICING AGENT- Colonial Funding Networl•, Inc. Colonial Funding Network, Inc.{Colonial) is the Authorized Senicing Agent of Samson Partners for this contract providing administrative, bookkeeping, reporting and support services for Samson Partners and the Merchant. Colonial is not affiliated or owned by the Samson Pa1•tners and is acting as independent agent for services including but not limited to background checks, credit checks, general unden\1"iting review, tiling UCC-1 security interests, cash management, account reporting and remit capture. Colonial may at its sole discretion participate in this financing by providing a small portion of the funds for this transaction directly to Samson Partners. Colonial is nut a credit card processor, or in the business of processing credit cards. Merchant hereby acknowledges that in no event will Colonial be liable for any claims made against the Samson Partners or the Processor under any legal theory for lost profits, lost revenues, lost business opportunity, exemplary, punitive, special, incidental, indirect or consequential damages, each of which is waived by the Merchant and Owner/Guarantor. MERCHANT By---------- 77-.--- ---------- (Print Name and Title) Sign: ------------=-----:--------------------<"'-. Sign Here tr-('.,J"'J c o l o n ia 1 f u n d '1 n g n c t v.r or k Origination Fee- to cover underwriting and related expenses Amount Funded Origination Fee Up to $7,500.00 $199.00 $7,501.00-$50,000.00 $295.00 $50,001.00-$100,000.00 $395.00 $100,001.00-$250,000.00 $795.00 a) ACH Program Fee- $ 395.00 ACH's are labor intensive and are not an automated process requiring us to charge this fee to cover costs b) NSF Fee (Standard)- $ SO.OOea Up to FOUR TIMES ONLY before a default is declared c) Rejected ACH Daily ACH Program When the merchant directs the bank to Reject our Debit ACH Amount Funded Reject Fee i. Up to $7,500.00 $ 25.00 ii. $7,501.00-$50,000.00 $ 35.00 iii. $50,001.00-$100,000.00 $ 50.00 iv. $100,001.00-$250,000.00 $ 75.00 v. Over $250,000.00 $100.00 Weekly ACH Program Amount Funded Reject Fee vi. Up to $7,500.00 $ 75.00 vii. $7,501.00-$50,000.00 $ 99.00 viii. $50,001.00-$100,000.00 $175.00 ix. $100,001.00-$250,000.00 $275.00 x. Over $250,000.00 $395.00 d) Bank Change Fee- $75.00 requiring us to adjust our system When Merchant requires a change of account to be Debited e) Blocked Account- $2,500.00 When Merchant BLOCKS account from our Debit ACH which places them in default (per contract) t) Default Fee Collections $5,000.00 When Merchant changes bank account cutting us off from our g) UCC Termination Fee- $150.00 When Merchant request a UCC termination Miscellaneous Service Fees. Merchant shall pay to Colonial certain fees Merchant funding is done electronically to their designated bank account and charged a fee of $35.00 tOr a Fed Vlire or $15.00 for an ACH. The fee for underwriting and origination is paid fi•om the funded amount in accordance with the schedule below. If Merchant is utilizing a Bridge I Control Account, there is an upfront fee of $395.00 for the bank fees and administrative costs of maintaining such account for each cash advance agreement with Merchant. Fund transfers fi_-om Bridge I Control Accounts to Merchant's operating bank account will be charged $10.95 per month via ACH. This fee will continue if the bridge account remains open after the RTR is paid. Merchant will be charged $50.00 for each change of its operating bank account once active with Colonial. Any administrative adjustments associated with changes to the Specified Percentage will incur a fee of$75.00 per occurrence. (All fees are subject to change) Merchant Initials: _ ACH Authorization Form Business Authorized to Debit/Credit Amount: Samson Partners, LLC 347-442-7999 4459 Amboy Road Suite 3 Staten Island NY 10312 Account Holder Information: Richard Parlontieri Speedemissions Account Holder Name Account Holder D.B.A. Name Account Holder Phone 1015 Tyrone Road Suite 220 Tyrone, GA, 30290 Account Holder Address City State Zip Account Holders' Bank lntormation: Account Holder's Bank Name Branch City State Zip Bank Routing-Numbers Bank Account Number Transaction lntormation: UNDERWRITER FEE Goods Purchases/Services Rendered $999.00 Amount of Transaction January 19, 2015 Effective Date Authorization: In exchange for products and/or services listed above the undersigned hereby authorizes Samson Partners LLC To electronically draft via the automated clearing house system the amounts indicated above from the account identified above. This authority will continue until withdrawn in writing by the undersigned account holder. The undersigned hereby certifies that they are duly authorized to execute this form on behalf of the above listed account holder. I acknowledge that I am subject to a $35.00 reject fee if item is returned for insufficient funds. Signature of Account Holder Richard Parlontieri Name/Title of Account Holder Date