Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NovoCure Ltd | nvcr-8k_20160329.htm |

Novocure (NVCR) Overview updated March 1, 2016 Actor Portrayal

Notice This presentation contains certain forward-looking statements with respect to the business of Novocure and certain of its plans and objectives, including with respect to the development and commercialization of its lead product candidate, Optune, for a number of oncology indications. These forward-looking statements can be identified in this presentation by the fact that they do not relate only to historical or current facts. Forward-looking statements often use words “expect”, “intend”, “anticipate”, “plan”, “may”, “should”, “would”, “could” or other words of similar meaning. These statements are based on assumptions and assessments made by Novocure in light of industry experience and perception of historical trends, current conditions, expected future developments and other appropriate factors. By their nature, forward-looking statements involve risk and uncertainty, and the factors described in the context of such forward-looking statements in this presentation could cause actual results and developments to differ materially from those expressed in or implied by such forward-looking statements. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in this presentation. Novocure assumes no obligation to update or correct the information contained in this presentation, whether as a result of new information, future events or otherwise, except to the extent legally required. The statements contained in this presentation are made as at the date of this presentation, unless some other time is specified in relation to them, and service of this presentation shall not give rise to any implication that there has been no change in the facts set out in this presentation since such date. Nothing contained in this presentation shall be deemed to be a forecast, projection or estimate of the future financial performance of Novocure, except where expressly stated. As of the date of this presentation, Optune is only FDA-approved for glioblastoma, or GBM, and its approval for other indications is not certain. Novocure can provide no assurances regarding market acceptance of Optune or its successful commercialization, and can provide no assurances regarding the company’s results of operations or financial condition in the future. This presentation is for informational purposes only and may not be relied upon in connection with the purchase or sale of any security. © Novocure 2016

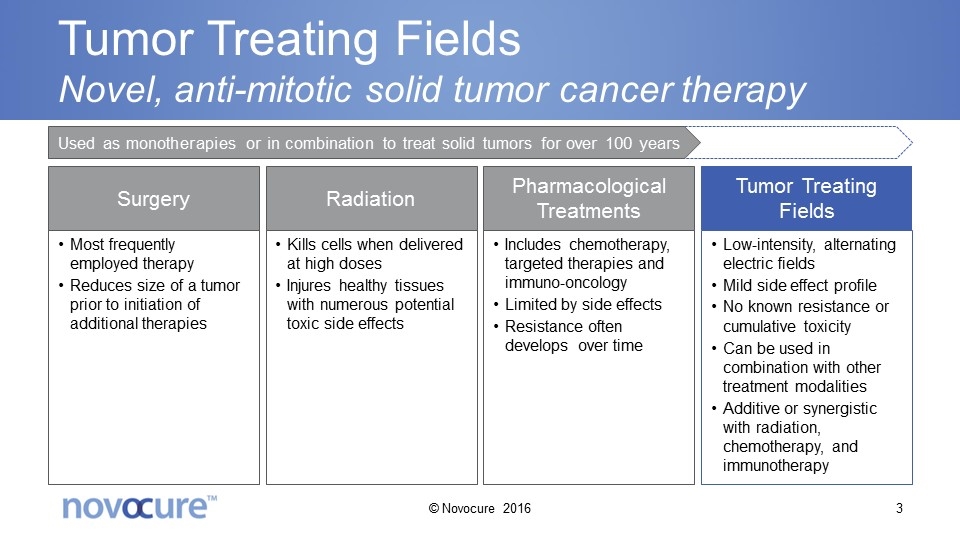

Tumor Treating Fields Novel, anti-mitotic solid tumor cancer therapy Surgery Radiation Pharmacological Treatments Tumor Treating Fields Most frequently employed therapy Reduces size of a tumor prior to initiation of additional therapies Kills cells when delivered at high doses Injures healthy tissues with numerous potential toxic side effects Includes chemotherapy, targeted therapies and immuno-oncology Limited by side effects Resistance often develops over time Low-intensity, alternating electric fields Mild side effect profile No known resistance or cumulative toxicity Can be used in combination with other treatment modalities Additive or synergistic with radiation, chemotherapy, and immunotherapy Used as monotherapies or in combination to treat solid tumors for over 100 years © Novocure 2016

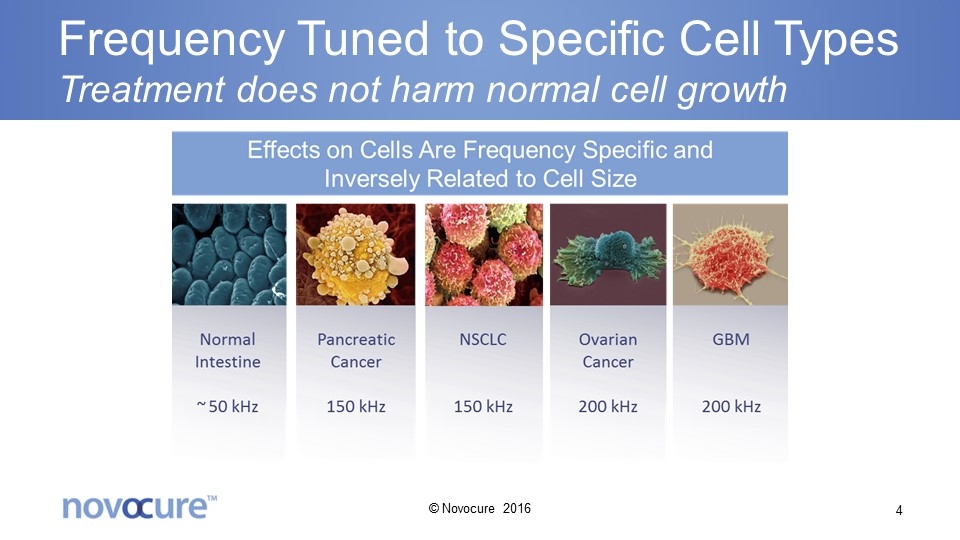

Frequency Tuned to Specific Cell Types Treatment does not harm normal cell growth © Novocure 2016

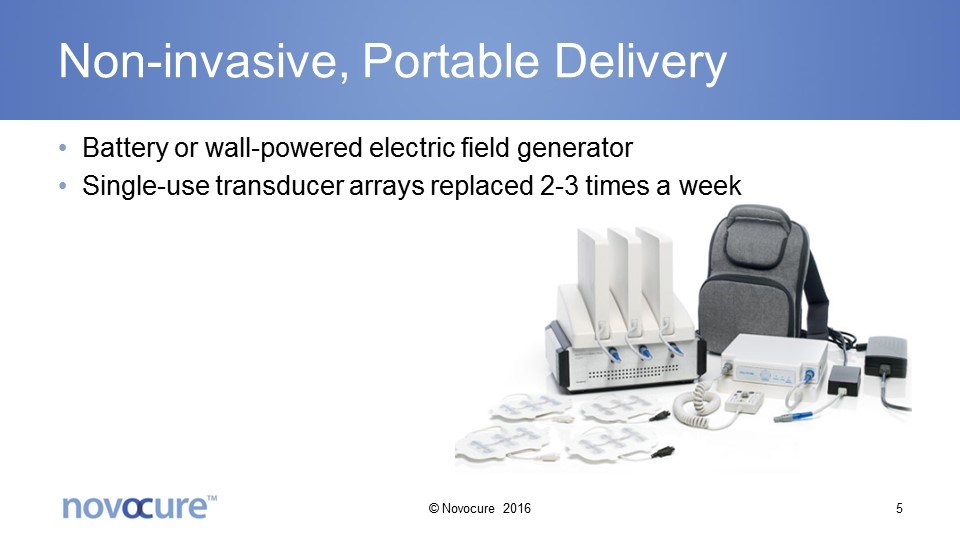

Non-invasive, Portable Delivery Battery or wall-powered electric field generator Single-use transducer arrays replaced 2-3 times a week © Novocure 2016

Home Use, Quality of Life Maintained Should be used at least 18 hours a day Mild side-effect profile with no known systemic toxicity Actor Portrayal © Novocure 2016

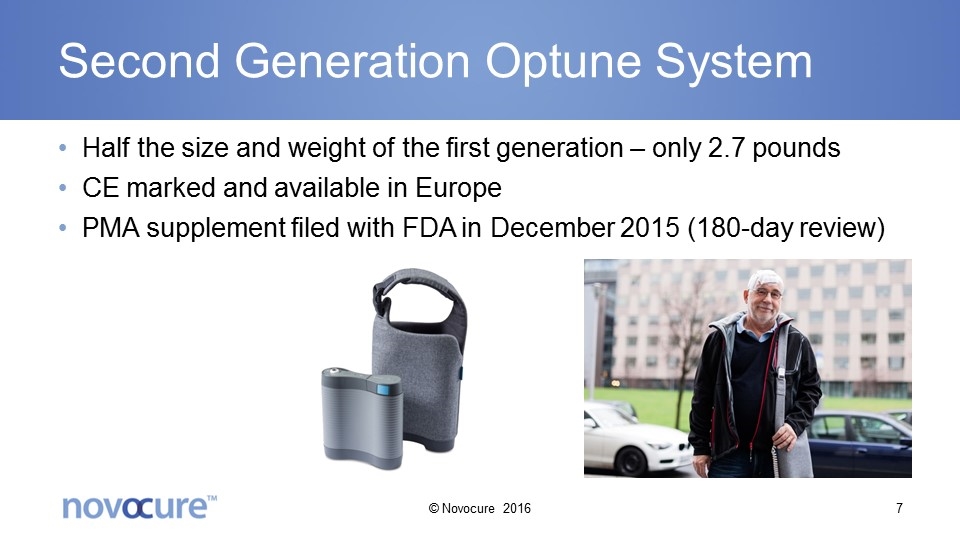

Second Generation Optune System Half the size and weight of the first generation – only 2.7 pounds CE marked and available in Europe PMA supplement filed with FDA in December 2015 (180-day review) © Novocure 2016

Extensive Preclinical Research 15+ years of research and multiple peer-reviewed publications Deep understanding of the underlying mechanism © Novocure 2016

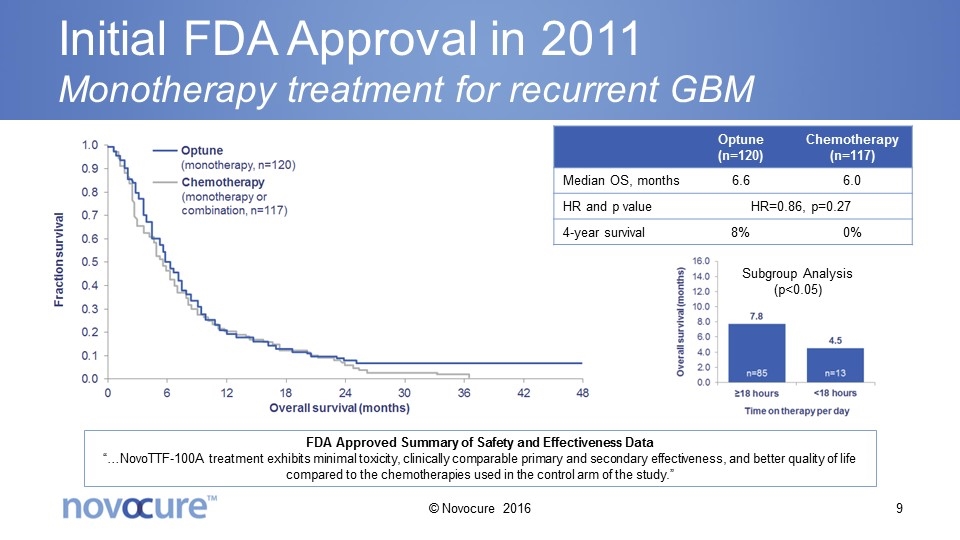

Initial FDA Approval in 2011 Monotherapy treatment for recurrent GBM Optune (n=120) Chemotherapy (n=117) Median OS, months 6.6 6.0 HR and p value HR=0.86, p=0.27 4-year survival 8% 0% FDA Approved Summary of Safety and Effectiveness Data “…NovoTTF-100A treatment exhibits minimal toxicity, clinically comparable primary and secondary effectiveness, and better quality of life compared to the chemotherapies used in the control arm of the study.” Subgroup Analysis (p<0.05) © Novocure 2016

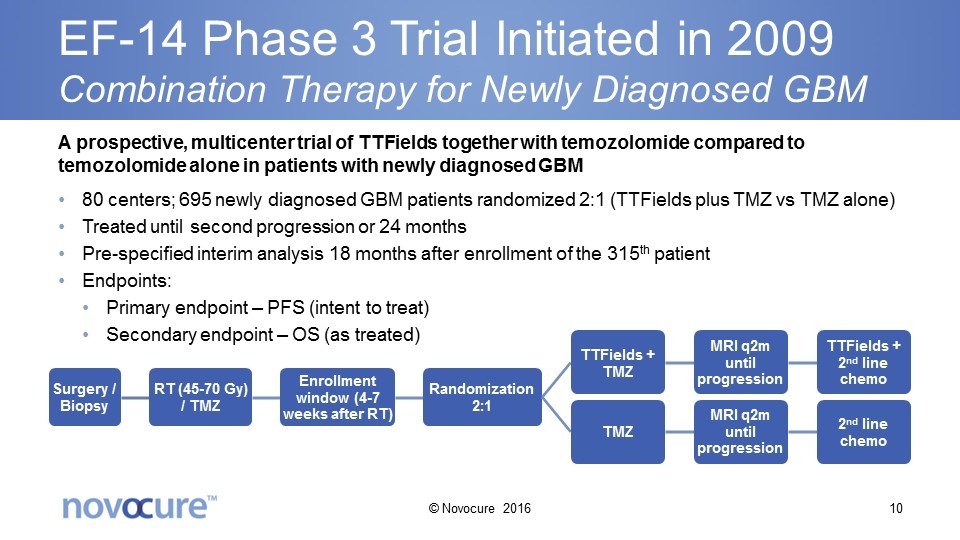

EF-14 Phase 3 Trial Initiated in 2009 Combination Therapy for Newly Diagnosed GBM A prospective, multicenter trial of TTFields together with temozolomide compared to temozolomide alone in patients with newly diagnosed GBM 80 centers; 695 newly diagnosed GBM patients randomized 2:1 (TTFields plus TMZ vs TMZ alone) Treated until second progression or 24 months Pre-specified interim analysis 18 months after enrollment of the 315th patient Endpoints: Primary endpoint – PFS (intent to treat) Secondary endpoint – OS (as treated) © Novocure 2016 Surgery / Biopsy RT (45-70 Gy ) / TMZ Enrollment window (4-7 weeks after RT) Randomization 2:1 TTFields + TMZ TMZ MRI q2m until progression MRI q2m until progression TTFields + 2 nd line chemo 2 nd line chemo

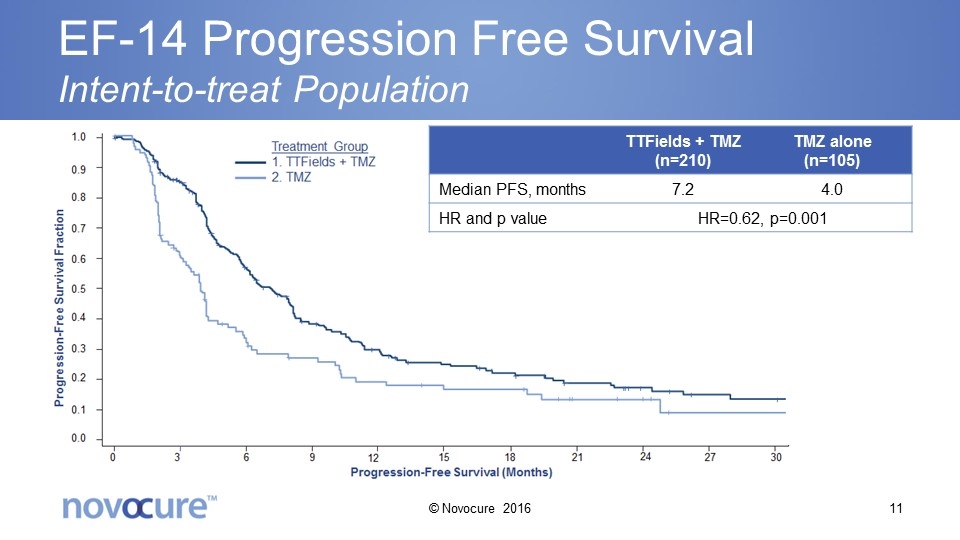

EF-14 Progression Free Survival Intent-to-treat Population TTFields + TMZ (n=210) TMZ alone (n=105) Median PFS, months 7.2 4.0 HR and p value HR=0.62, p=0.001 © Novocure 2016

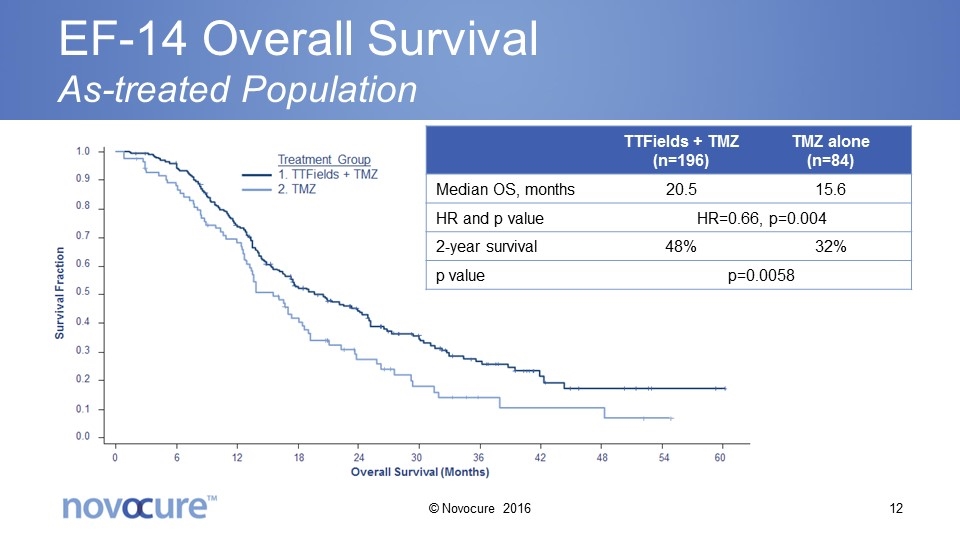

EF-14 Overall Survival As-treated Population TTFields + TMZ (n=196) TMZ alone (n=84) Median OS, months 20.5 15.6 HR and p value HR=0.66, p=0.004 2-year survival 48% 32% p value p=0.0058 © Novocure 2016

FDA Approval on October 5, 2015 Combination treatment for newly diagnosed GBM © Novocure 2016

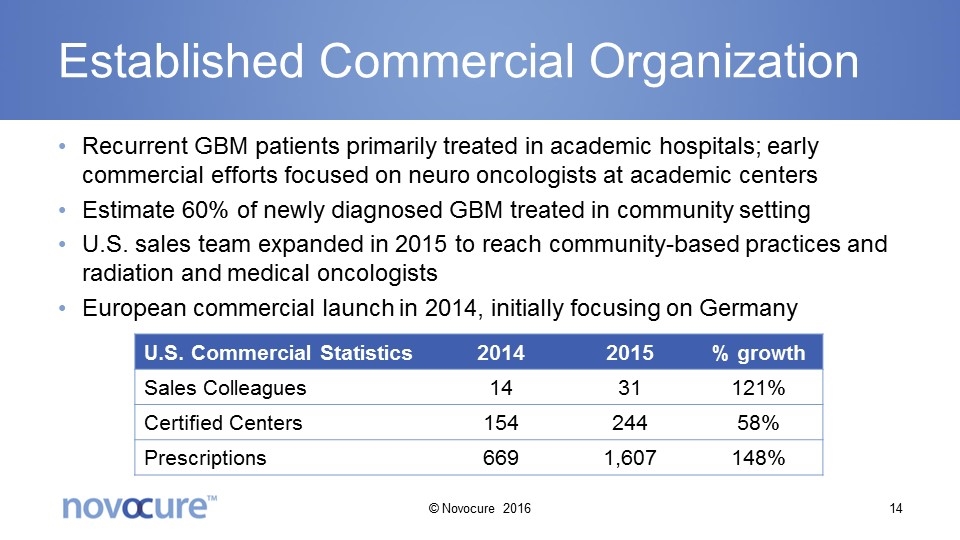

Established Commercial Organization Recurrent GBM patients primarily treated in academic hospitals; early commercial efforts focused on neuro oncologists at academic centers Estimate 60% of newly diagnosed GBM treated in community setting U.S. sales team expanded in 2015 to reach community-based practices and radiation and medical oncologists European commercial launch in 2014, initially focusing on Germany U.S. Commercial Statistics 2014 2015 % growth Sales Colleagues 14 31 121% Certified Centers 154 244 58% Prescriptions 669 1,607 148% © Novocure 2016

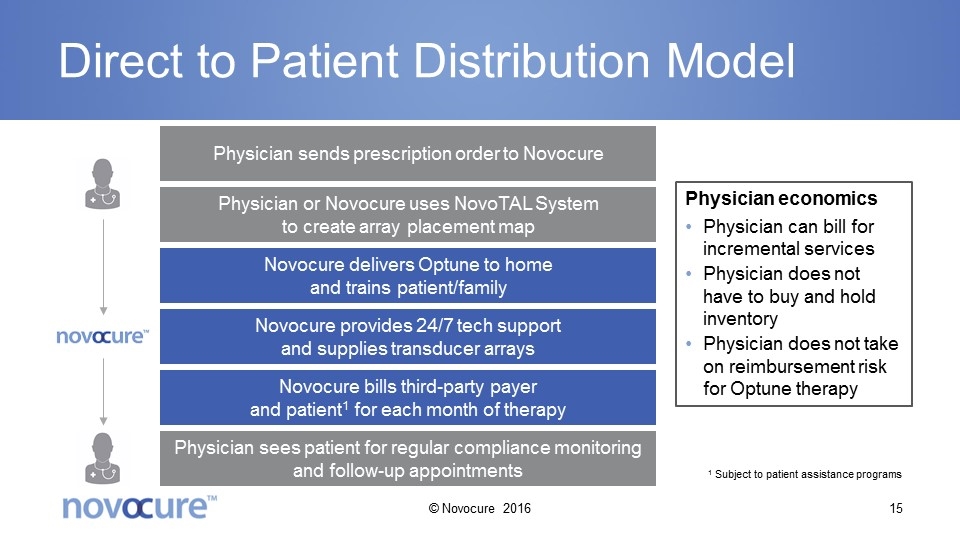

Direct to Patient Distribution Model Physician sends prescription order to Novocure Physician or Novocure uses NovoTAL System to create array placement map Novocure delivers Optune to home and trains patient/family Novocure provides 24/7 tech support and supplies transducer arrays Novocure bills third-party payer and patient1 for each month of therapy Physician sees patient for regular compliance monitoring and follow-up appointments Physician economics Physician can bill for incremental services Physician does not have to buy and hold inventory Physician does not take on reimbursement risk for Optune therapy 1 Subject to patient assistance programs © Novocure 2016

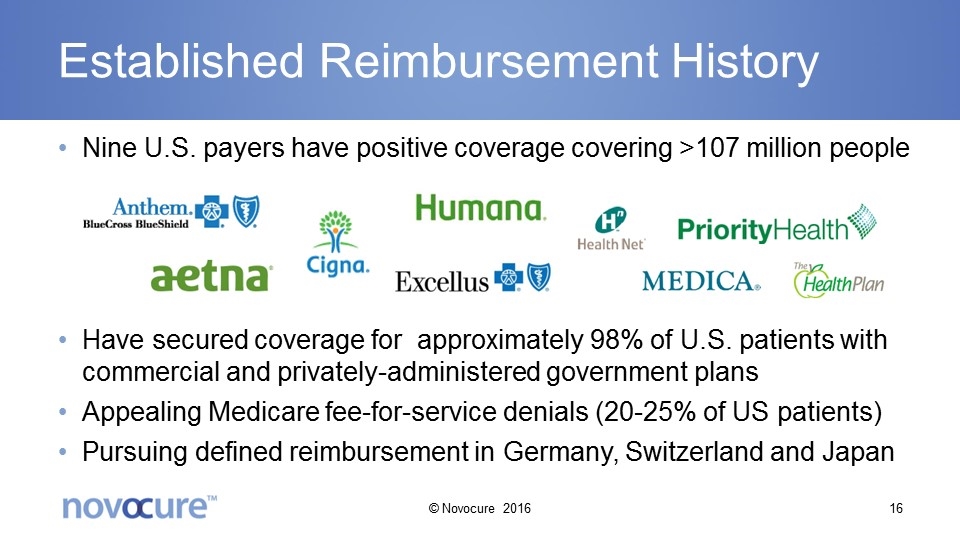

Established Reimbursement History Nine U.S. payers have positive coverage covering >107 million people Have secured coverage for approximately 98% of U.S. patients with commercial and privately-administered government plans Appealing Medicare fee-for-service denials (20-25% of US patients) Pursuing defined reimbursement in Germany, Switzerland and Japan © Novocure 2016

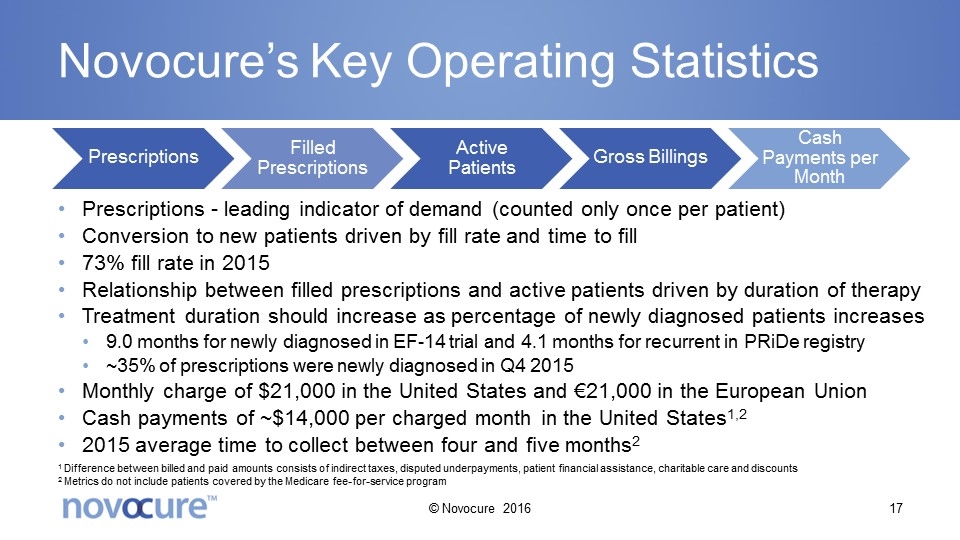

Novocure’s Key Operating Statistics Prescriptions - leading indicator of demand (counted only once per patient) Conversion to new patients driven by fill rate and time to fill 73% fill rate in 2015 Relationship between filled prescriptions and active patients driven by duration of therapy Treatment duration should increase as percentage of newly diagnosed patients increases 9.0 months for newly diagnosed in EF-14 trial and 4.1 months for recurrent in PRiDe registry ~35% of prescriptions were newly diagnosed in Q4 2015 Monthly charge of $21,000 in the United States and €21,000 in the European Union Cash payments of ~$14,000 per charged month in the United States1,2 2015 average time to collect between four and five months2 1 Difference between billed and paid amounts consists of indirect taxes, disputed underpayments, patient financial assistance, charitable care and discounts 2 Metrics do not include patients covered by the Medicare fee-for-service program © Novocure 2016 Prescriptions Filled Prescriptions Active Patients Gross Billings Cash Payments per Month

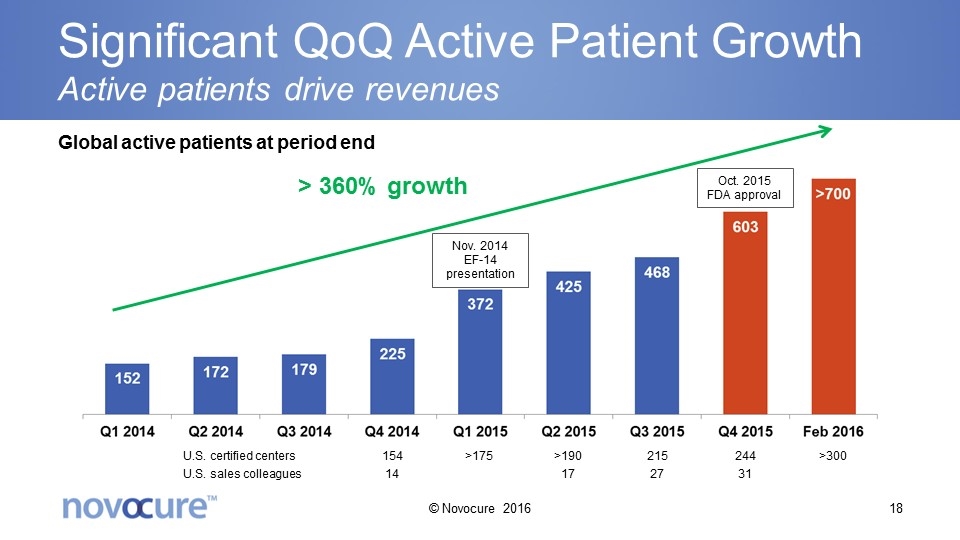

Significant QoQ Active Patient Growth Active patients drive revenues > 360% growth Nov. 2014 EF-14 presentation Global active patients at period end Oct. 2015 FDA approval U.S. certified centers U.S. sales colleagues 154 14 244 31 215 27 >190 17 >175 >300 © Novocure 2016

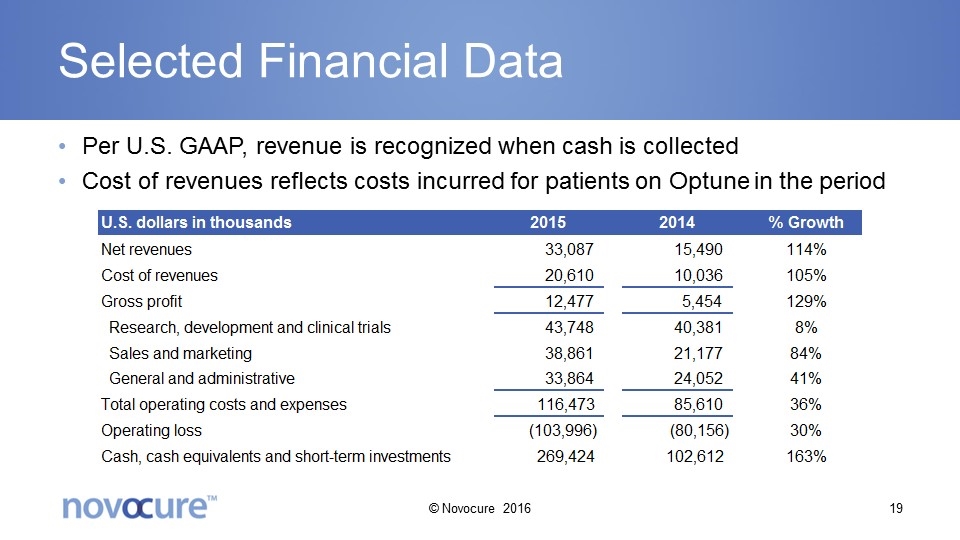

Selected Financial Data Per U.S. GAAP, revenue is recognized when cash is collected Cost of revenues reflects costs incurred for patients on Optune in the period © Novocure 2016

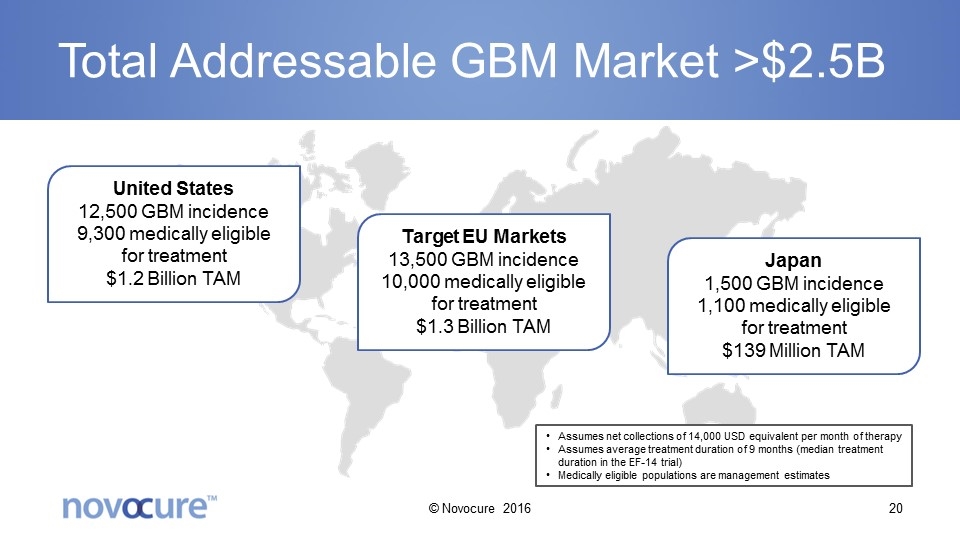

Total Addressable GBM Market >$2.5B United States 12,500 GBM incidence 9,300 medically eligible for treatment $1.2 Billion TAM Target EU Markets 13,500 GBM incidence 10,000 medically eligible for treatment $1.3 Billion TAM Japan 1,500 GBM incidence 1,100 medically eligible for treatment $139 Million TAM Assumes net collections of 14,000 USD equivalent per month of therapy Assumes average treatment duration of 9 months (median treatment duration in the EF-14 trial) Medically eligible populations are management estimates © Novocure 2016

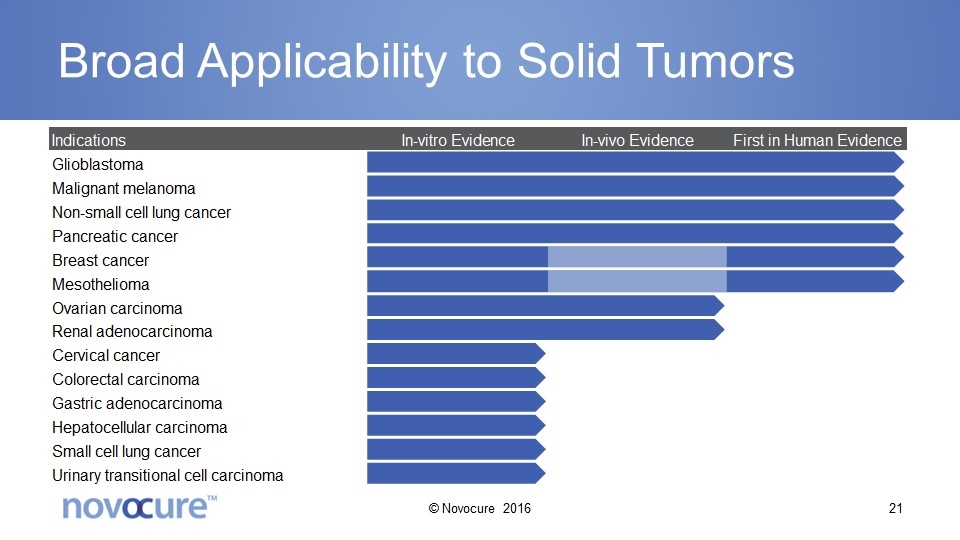

Broad Applicability to Solid Tumors © Novocure 2016

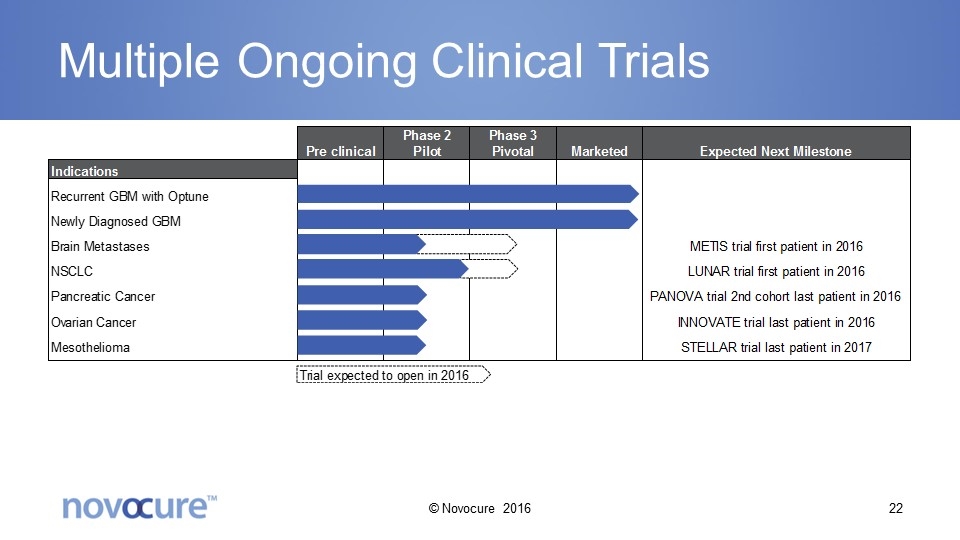

Multiple Ongoing Clinical Trials © Novocure 2016

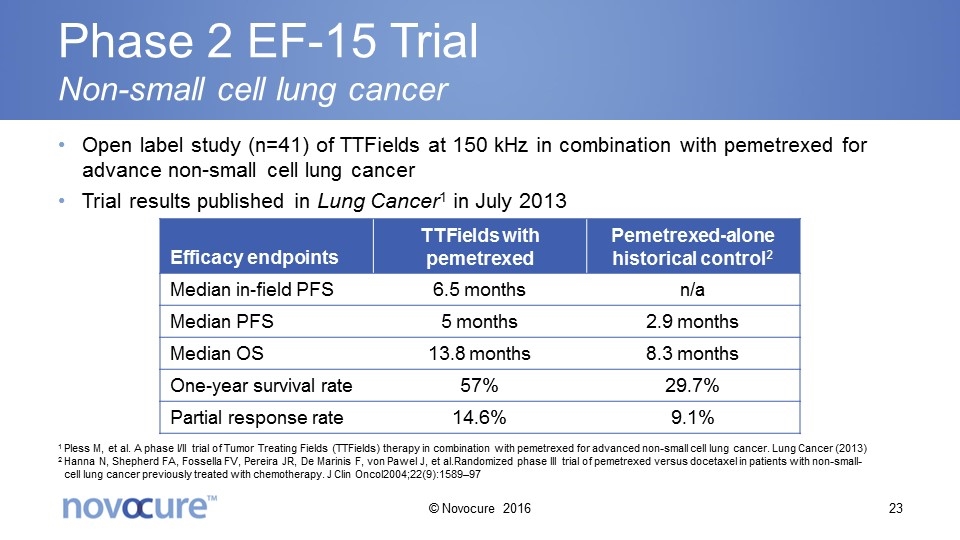

Phase 2 EF-15 Trial Non-small cell lung cancer Open label study (n=41) of TTFields at 150 kHz in combination with pemetrexed for advance non-small cell lung cancer Trial results published in Lung Cancer1 in July 2013 Efficacy endpoints TTFields with pemetrexed Pemetrexed-alone historical control2 Median in-field PFS 6.5 months n/a Median PFS 5 months 2.9 months Median OS 13.8 months 8.3 months One-year survival rate 57% 29.7% Partial response rate 14.6% 9.1% 1 Pless M, et al. A phase I/II trial of Tumor Treating Fields (TTFields) therapy in combination with pemetrexed for advanced non-small cell lung cancer. Lung Cancer (2013) 2 Hanna N, Shepherd FA, Fossella FV, Pereira JR, De Marinis F, von Pawel J, et al.Randomized phase III trial of pemetrexed versus docetaxel in patients with non-small-cell lung cancer previously treated with chemotherapy. J Clin Oncol2004;22(9):1589–97 © Novocure 2016

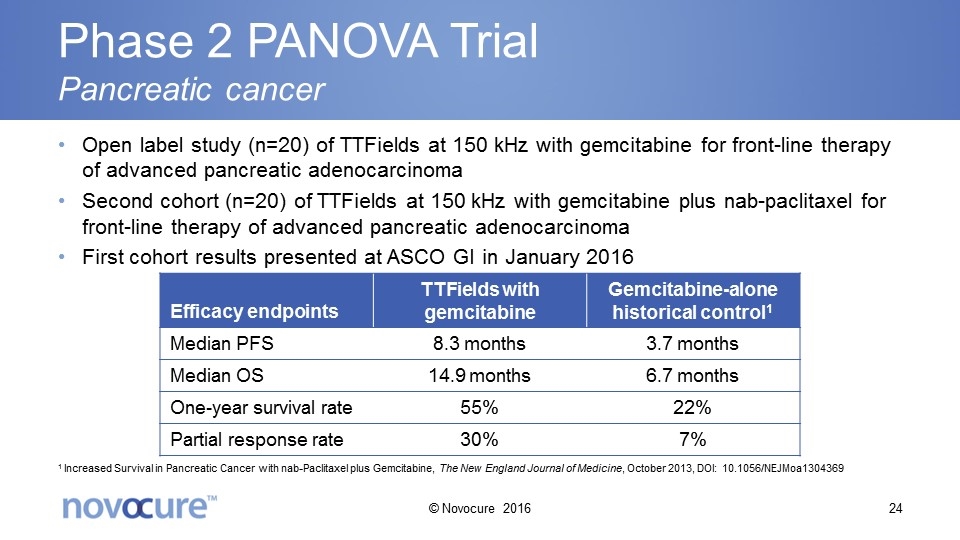

Phase 2 PANOVA Trial Pancreatic cancer Open label study (n=20) of TTFields at 150 kHz with gemcitabine for front-line therapy of advanced pancreatic adenocarcinoma Second cohort (n=20) of TTFields at 150 kHz with gemcitabine plus nab-paclitaxel for front-line therapy of advanced pancreatic adenocarcinoma First cohort results presented at ASCO GI in January 2016 Efficacy endpoints TTFields with gemcitabine Gemcitabine-alone historical control1 Median PFS 8.3 months 3.7 months Median OS 14.9 months 6.7 months One-year survival rate 55% 22% Partial response rate 30% 7% 1 Increased Survival in Pancreatic Cancer with nab-Paclitaxel plus Gemcitabine, The New England Journal of Medicine, October 2013, DOI: 10.1056/NEJMoa1304369 © Novocure 2016

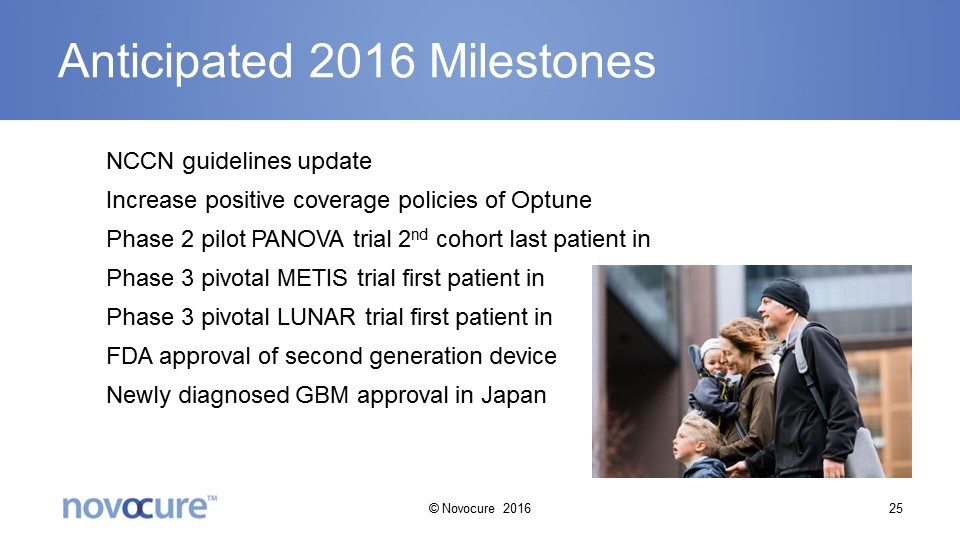

Anticipated 2016 Milestones NCCN guidelines update Increase positive coverage policies of Optune Phase 2 pilot PANOVA trial 2nd cohort last patient in Phase 3 pivotal METIS trial first patient in Phase 3 pivotal LUNAR trial first patient in FDA approval of second generation device Newly diagnosed GBM approval in Japan © Novocure 2016