Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from___________ to __________

Commission file number 001-36646

Asterias Biotherapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

46-1047971

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

6300 Dumbarton Circle

Fremont, California 94555

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code

(510) 456-3800

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of exchange on which registered

|

|

|

Series A Common Stock, $0.0001 par value

|

NYSE MKT

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒ (Do not check if a smaller reporting company)

|

Smaller reporting company☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes o No x

The aggregate market value of shares of voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2015 (based on the closing price for shares of the registrant’s common stock as reported on the NYSE MKT under the symbol AST on that date) was approximately $70,005,592.

As of March 23, 2016, there were outstanding 38,352,150 shares of Series A Common Stock, par value $0.0001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

2

Asterias Biotherapeutics, Inc.

|

Page

Number

|

|||

|

Part I.

|

Financial Information

|

||

|

Item 1 -

|

5

|

||

|

Item 1A

|

21

|

||

|

Item 1B

|

38

|

||

|

Item 2 -

|

38

|

||

|

Item 3 -

|

39

|

||

|

Item 4 -

|

39

|

||

|

Part II.

|

Other Information

|

||

|

Item 5 -

|

40

|

||

|

Item 6 -

|

42

|

||

|

Item 7 -

|

43

|

||

|

Item 7A

|

50

|

||

|

Item 8 -

|

55

|

||

|

Item 9 -

|

80

|

||

|

Item 9A-

|

80

|

||

|

Item 9B

|

81

|

||

|

Part III.

|

Item 10 -

|

82

|

|

|

Item 11 -

|

86

|

||

|

Item 12 -

|

92

|

||

|

Item 13 -

|

95

|

||

|

Item 14 -

|

98

|

||

|

Part IV

|

Item 15 -

|

101

|

|

|

105

|

|||

PART I

Certain statements contained herein are forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements pertaining to future financial and/or operating results, future growth in research, technology, clinical development, and potential opportunities for Asterias, along with other statements about the future expectations, beliefs, goals, plans, or prospects expressed by management constitute forward-looking statements. Any statements that are not historical fact (including, but not limited to statements that contain words such as “will,” “believes,” “plans,” “anticipates,” “expects,” “estimates”) should also be considered to be forward-looking statements. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization of potential products, uncertainty in the results of clinical trials or regulatory approvals, need and ability to obtain future capital, and maintenance of intellectual property rights. Actual results may differ materially from the results anticipated in these forward-looking statements and as such should be evaluated together with the many uncertainties that affect the businesses of Asterias, particularly those mentioned in the cautionary statements found in Asterias’ filings with the Securities and Exchange Commission. Asterias disclaims any intent or obligation to update these forward-looking statements

References to “Asterias,” “our” or “us” means Asterias Biotherapeutics, Inc.

The description or discussion, in this Form 10-K, of any contract or agreement is a summary only and is qualified in all respects by reference to the full text of the applicable contract or agreement.

Preliminary Note Regarding Ownership of Our Common Stock

As of March 23, 2016, we had 530 shareholders of record and there were 38,352,150 shares of our Series A Common Stock (“Series A Shares”) outstanding, of which 21,747,569 Series A Shares were held by our parent BioTime, Inc. ("BioTime"). These Series A Shares held by BioTime account for 56.7% of our Series A Shares outstanding as a whole. Accordingly, we are a consolidated subsidiary of BioTime.

Overview

Asterias is a clinical-stage biotechnology company focused on developing and commercializing novel therapies in the emerging fields of cell therapy and regenerative medicine. We have two core technology platforms. The first is an immunotherapy platform to teach cancer patients’ immune systems to attack their tumors. The second is pluripotent stem cell platform. Pluripotent cells are a type of stem cell capable of becoming all of the cell types in the human body. We are focused on developing therapies to treat conditions with high unmet medical needs and inadequate available therapies, with an initial focus on the therapeutic areas of oncology and neurology.

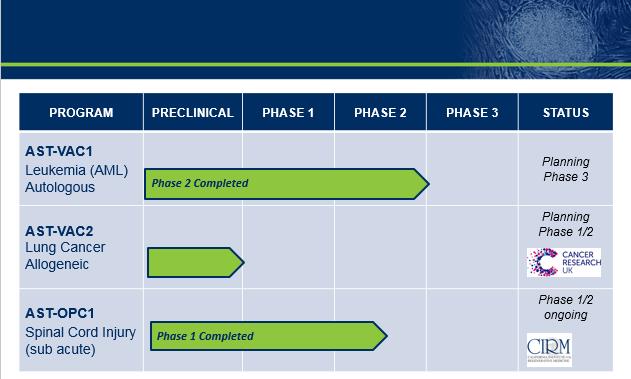

In October of 2013, we acquired intellectual property, cell lines, preclinical and clinical data, and other assets from Geron Corporation ("Geron") and also acquired rights to use certain human embryonic stem ("hES") cell lines and to practice certain patents from our parent company, BioTime, Inc. ("BioTime"). From the assets acquired in these transactions, we have prioritized the development of our two core technology platforms. From our immunotherapy platform, we are developing two programs. AST-VAC1 (telomerase loaded, autologous dendritic cells) which could teach a patient's own cells to recognize and fight cancer cells in acute myelogenous leukemia(AML). Together with our collaboration partner, Cancer Research United Kingdom (“CRUK”) we are also developing AST-VAC2 (telomerase loaded, -allogeneic dendritic cells), -derived from pluripotent stem cells which could provide 'off the shelf' cells that will teach a patient's immune system to recognize and fight cancer cells, in non-small cell lung cancer. We believe that our immunotherapy programs have potential for application in additional cancer indications. From our pluripotent stem cell platform we are developing AST-OPC1, oligodendrocyte progenitor cells, in an initial clinical indication of spinal cord injury, with potential for later expansion into other neurodegenerative diseases such as stroke and multiple sclerosis.

Products Under Development

Product Candidates

AST-VAC1 and AST-VAC2, Cancer Vaccine Candidates Targeting Telomerase

We are developing two experimental immunotherapeutic programs, AST-VAC1 and AST-VAC2, each designed to attack cancer cells by targeting the cancer cell’s expression of telomerase. Both product candidates use an immune cell type known as dendritic cells to stimulate immune responses to telomerase. Dendritic cells are antigen processing and presenting cells which are potent initiators of a cellular and antibody-mediated immune response Telomerase is a ubiquitous cancer antigen, expressed at high levels in nearly all human cancers, but at very low levels or not at all in normal human cells. The premise underlying these vaccines is to “teach” the patient’s own immune system to attack cancer cells while sparing other normal healthy cells.

AST-VAC1: Autologous Telomerase-loaded, Dendritic Cells

AST-VAC1 is an autologous product candidate, or a product that is derived from cells that come from the treated patient. AST-VAC1 consists of mature antigen-presenting dendritic cells pulsed with RNA for the protein component of human telomerase (“hTERT”) and a portion of a lysosomal targeting signal ("LAMP"). LAMP directs the telomerase RNA to the lysosome, the subcellular organelle that directs the RNA to a particular part of the cell membrane. AST-VAC1 is injected into the patient’s skin, with the objective of the dendritic cells to travel to the lymph nodes and instruct cytotoxic T-cells to kill tumor cells that express telomerase on their surface.

A Phase 2 clinical trial of AST-VAC1 was conducted at six U.S. medical centers in patients with acute myeloid leukemia (“AML”) in complete clinical remission. The trial examined the safety and feasibility of a prime-boost vaccination regimen (an initial injection ("prime") followed by multiple additional injections ("boost") to generate and extend the duration of telomerase immunity. This trial completed patient enrollment in December 2009. Thirty three patients with AML entered the study in their first or second complete remission. Prior to or shortly after completing consolidation chemotherapy, patients underwent leukapheresis, a process of collecting of white blood cells directly from the patient. AST-VAC1 was produced at a centralized manufacturing facility from the patient-specific white blood cells. Patient blood cells were differentiated to dendritic cells in culture, modified to express telomerase linked to the LAMP targeting signal, aliquoted and cryopreserved. AST-VAC1 was released for patient dosing contingent on several product specifications that included identity of mature dendritic cells, confirmation of telomerase expression, number of viable cells per dose after thawing, and product sterility.

AST-VAC1 was successfully manufactured and released in 24 out of the 33 patients enrolled in the study. Three patients progressed prior to vaccination, therefore only 21 of the 24 patients for whom AST-VAC1 was successfully manufactured and released received vaccine. The 21 patients were vaccinated weekly for six weeks, with AST-VAC1 administered intra-dermally (injection into the skin), followed by a non-treatment period of four weeks, and then subsequent boost injections every other week for 12 weeks. Monthly extended boost injections were then administered until the vaccine product supply was depleted or the patient relapsed.

Twenty-one patients received AST-VAC1 in the study, including 19 in clinical remission and two in early relapse. AST-VAC1 was found to have a favorable safety and tolerability profile in this study over multiple vaccinations, with up to 32 serial vaccinations administered (median = 17). Idiopathic thrombocytopenic purpura (bleeding into the skin caused by low platelets in blood) (grade 3-4) was reported in one patient. Other toxicities (grade 1-2) included rash or headache. These data from the trial were presented at the December 2010 American Society of Hematology annual meeting.

Patient immune response to telomerase after vaccination with AST-VAC1 was evaluated using a test called the enzyme-linked immunosorbent spot (“ELISPOT”) assay to measure the presence of activated T-cells specific to hTERT. Positive immune responses were detected in 55% of patients.

We have performed follow-up data collection on the 19 patients treated in complete remission to determine the long term effects of the AST-VAC1 administration on remission duration and disease-free survival. The results of this data collection were reported in an oral presentation at the American Society of Clinical Oncology annual meeting in May 2015. Eleven of 19 patients (58%) remained in complete remission at a median follow-up of 52 months. These results compare to historical data suggesting that between 20-40% of patients would be expected to be relapse free at 3-4 years. Additionally, of the 7 patients in the higher risk over 60 year old group, 4 (57%) remained relapse free at a median follow up of 54 months. Historically, relapse free survival rates in this population have been 10-20% at 3-4 years. We are in the process of preparing a manuscript describing our findings, and performing certain process development, clinical and regulatory activities.

We have conducted an End of Phase 2 meeting with the FDA with the goal of reviewing the proposed clinical development plan for AST-VAC1. In February 2016, we announced that the FDA indicated general agreement with Asterias' proposed development plan for registration of AST-VAC1 through a single Phase 3 trial to support an accelerated development pathway and BLA filing. In this study, Asterias will assess the impact of AST-VAC1 compared to placebo on the duration of relapse-free-survival as the primary endpoint, and on overall survival as the secondary endpoint in patients who have achieved complete remission using standard therapies. The proposed trial will include AML patients 60 years and older, along with younger individuals who are at high risk for relapse and are not candidates for allogeneic bone marrow transplantation. Pending positive results, this trial could be the basis for accelerated approval of AST-VAC1. We currently plan to submit a request for a Special Protocol Assessment (SPA) to the FDA to confirm the primary endpoint and other design elements of this pivotal Phase 3 trial.

AST-VAC2: hES Cell-Derived Allogeneic Dendritic Cells

AST-VAC2 is an allogeneic, or non-patient specific, cancer vaccine candidate designed to stimulate patient immune responses to telomerase. AST-VAC2 is produced from hES cells and can be modified with any antigen. We believe that the use of hES, as opposed to collecting and using the patient’s own blood, as the starting material for AST-VAC2 provides a scalable system for the production of a large number of vaccine doses in a single lot. Allogeneic vaccine production has the potential to have lower manufacturing costs, “off-the-shelf” availability and broader patient availability, and ensure product consistency. In addition, we believe that this approach has the potential to stimulate a more robust immune response through an adjuvant effect of the immune mismatch between the genetic makeup of AST-VAC2 and patients. Further, we believe AST-VAC2 may be synergistic with immune checkpoint inhibitors currently in development for many cancer indications. This is because immune checkpoint inhibitors function by relieving suppressive mechanisms exerted on T-cells by the tumor, whereas AST-VAC2 is designed to specifically target the T-cells to attack the telomerase expressing tumor cells.

Product Development Strategy for AST-VAC2

During September 2014, we entered into a Clinical Trial and Option Agreement with Cancer Research UK (“CRUK”) with CRUK and Cancer Research Technology Limited, (“CRT”), a wholly-owned subsidiary of CRUK the “CRUK Agreement”. Under the CRUK Agreement, CRUK has agreed to fund Phase 1/2 clinical development of our AST-VAC2 product candidate loaded with the same LAMP-telomerase construct we have used in AST-VAC1. Under the terms of the CRUK Agreement, we are responsible, at our own cost, for completing process development and manufacturing scale-up of the AST-VAC2 manufacturing process and transferring the resulting cGMP-compatible process to CRUK. CRUK is responsible, at its own cost, for manufacturing clinical grade AST-VAC2 and for carrying out the Phase 1/2 clinical trial of AST-VAC2.

In January 2016 we announced that we had completed the technology transfer of the AST-VAC2 manufacturing process to CRUK. CRUK is now verifying and scaling up the production of AST-VAC2 in their facility in preparation for pilot and full cGMP campaigns. Upon successful completion of AST-VAC2 production campaigns, Cancer Research UK’s Centre for Drug Development (“CDD”) will submit a Clinical Trial Authorization application to the UK regulatory authorities for the Phase 1/2 clinical trial in non-small cell lung cancer, which will be sponsored, managed and funded by CDD. The clinical trial will examine the safety, immunogenicity and activity of AST-VAC2 and position the immunotherapy to be tested for numerous clinical indications. We will continue to serve in a collaborative and advisory role with CRUK throughout this process.

Upon completion of the Phase 1/2 study, we will have an exclusive first option to acquire the data generated in the trial. If we exercise that option we will be obligated to make payments upon the execution of the license agreement, upon the achievement of various milestones, and then royalties on sales of products. In connection with the CRUK Agreement, we sublicensed to CRUK for use in the clinical trials and product manufacturing process certain patents that have been licensed or sublicensed to us by third parties. We would also be obligated to make payments to those licensors and sublicensors upon the achievement of various milestones, and then royalties on sales of products if AST-VAC2 is successfully developed and commercialized.

AST-OPC1 Glial Progenitor Cells

Our AST-OPC1 product candidate is comprised of oligodendrocyte progenitor cells, which are cells that become oligodendrocytes after injection, derived from a cGMP master cell bank of undifferentiated hES cells that has been fully qualified for human use. These cells, which are stored frozen until ready for use, are produced under cGMP conditions and screened for adventitious agents.

Oligodendrocytes are nature’s neuronal insulating cells. Like the insulation covering an electrical wire, oligodendrocytes enable the conduction of electrical impulses along nerve fibers throughout the central and peripheral nervous system. They are also known to promote neural growth, as well as induce blood vessel formation around nerve axons. AST-OPC1 cells reproduce all of the natural functions of oligodendrocytes in animal models, including: producing myelin that wraps around nerve fibers; producing neurotrophic factors which encourage neuro-regeneration and sprouting of new nerve endings, and inducing new blood vessels which provide nutrients and remove waste matter from neural tissue as it functions in the body.

The pathology of spinal cord injury involves extensive loss of the myelin sheath produced by oligodendrocytes at the site of injury.

There are currently no drugs approved by the United States Food and Drug Administration (“FDA”) specifically for the treatment of spinal cord injury, although methylprednisolone, a corticosteroid generally used as an anti-inflammatory drug, is sometimes prescribed on an off-label basis to reduce acute inflammation in the injured spinal cord immediately after injury. It is believed that in order to effect substantial benefit in treating this complex injury, multiple mechanisms of action are required, such as re-myelination of the demyelinated axons, generation of new blood vessels to repair the ischemic damage from injury, and the presence of biologics that cause neuro-sprouting or new nerve growth to enable the severed axons to repair. In studies to date, AS-OPC1 cells have been shown to exhibit all three effects.

Multiple studies in a validated rat model of spinal cord injury have been performed using AST-OPC1. These studies have shown that a single injection of AST-OPC1 cells at the site of injury produces durable re-myelination, new blood vessel formation, and new neuronal sprouting, all of which result in sustained and significant improvement in the animal’s locomotion within several months after injection. These data provided the rationale to initiate testing of AST-OPC1 to treat acute spinal cord injury in humans.

Phase I Safety Trial

After FDA authorization, AST-OPC1 was tested in patients with acute spinal cord injury beginning in October 2010. The trial was an open label design conducted at seven U.S. neuro-trauma sites. Five subjects were treated in the trial, each of whom had a sub-acute functional complete thoracic (chest) spinal cord lesion. Patients enrolled in the study received a single dose of 2 x 10 6 cells at the injury site between seven and 14 days after injury. All subjects received temporary low dose immune suppression treatment for 60 days. The primary endpoint of the study was safety, with secondary endpoints of neurologic function assessed by five different validated measures of sensory and motor function. Each subject received a screening MRI, and if treated and entered into the treatment protocol, received eight follow-up MRIs in the first year and multiple physical exams and laboratory testing. The patients then entered a separate protocol after the first year which will follow them intermittently over a period of 15 years.

As of March 23, 2016, the first patient has completed all five years of their follow-up data set and the remaining 4 patients have completed their four year follow-up data set. No surgical complications during or post-surgery have been observed, and there have been no significant adverse events to date in any patient attributable to the AST-OPC1 product, the surgery to deliver the cells, or the immunosuppressive regimen. There have been five minor adverse events possibly related to AST-OPC1 such as transient fever and nerve pain. There have been no unexpected neurological changes to date, nor has there been evidence of adverse changes or cavitation on multiple MRIs. MRI results in four of the five subjects are consistent with prevention of lesion cavity formation. Immune monitoring, conducted in some of the patients, has not detected any evidence of immune responses to AST-OPC1 at time periods of up to one year post-transplant.

Phase I/IIa Dose Escalation Study: Subjects with Neurologically Complete Cervical Spinal Cord Injuries

Based on the results of the completed Phase I trial of AST-OPC1 in thoracic Spinal Cord Injury (“SCI”), we obtained permission from the FDA in August 2014 to initiate a Phase I/IIa dose escalation trial in patients with neurologically complete cervical spinal cord injuries. Individuals with neurologically complete cervical SCI have an enormous unmet medical need due to the loss of function in all four limbs as well as multiple additional impairments such as impaired bowel and bladder function, reduced sensation, spasticity, sudden changes in blood pressure, deep vein thrombosis, sexual dysfunction, increased infections, skin pressure sores, and chronic pain. These individuals frequently require significant assistance for their care and activities of daily living. One recent published study estimated the lifetime costs of care for a person who suffers a cervical SCI at age 25 to be $4.2 million (Y. C. Cao and M. J. DeVivo (2009)).

Scientifically, the injured cervical spinal cord is a much better location than the upper or middle thoracic spinal cord to test the safety and potential activity of AST-OPC1. This is partly due to the fact that damaged and demyelinated nerve axons in thoracic injuries need to regrow over several spinal segments in order to restore neural function. In contrast, damaged and demyelinated nerve axons in cervical injuries only need to regrow a short distance to restore neural function.

We initiated enrollment of the Phase I/IIa dose escalation trial of AST-OPC1 in patients with complete cervical injuries in March 2015. The trial is designed to assess safety and activity of three escalating doses of AST-OPC1 in complete cervical SCI, the first targeted indication for AST-OPC1. The trial is an open-label, single-arm study in patients with sub-acute, C-5 to C-7, neurologically complete cervical SCI. These individuals have lost all sensation and movement below their injury site with severe paralysis of the upper and lower limbs. AST-OPC1 will be administered 14 to 30 days post-injury. Patients will be followed by neurological exams and imaging methods to assess the safety and activity of the product. We completed enrollment in the first (2 million cells) dose cohort in August 2015. No serious adverse events related to AST-OPC1, the administration procedure, or the immunosuppressive regimen have been observed to date. We are currently open for enrollment in the second (10 million cells) cohort. Following collection of initial safety data from this second dose cohort, we plan to seek FDA concurrence to increase the robustness of the proof of concept in the Phase I/IIa clinical trial by expanding enrollment. Asterias has received a Strategic Partnerships Award grant from the California Institute for Regenerative Medicine, which provides for up to $14.3 million of non-dilutive funding for the Phase I/IIa clinical trial and other product development activities for AST-OPC1, subject to achieving certain milestones.

Additionally, in February 2016, we announced that the FDA had granted our application for Orphan Drug Designation of AST-OPC1 for the treatment of acute spinal cord injury.

AST-OPC1 CIRM Grant

The California Institute for Regenerative Medicine, or CIRM, provided us a Strategic Partnerships Award grant that provides for up to $14.3 million of non-dilutive funding for the Phase I/IIa clinical trial and other product development activities for AST-OPC1, subject to achieving certain milestones. The grant will provide partial funding for the SCIStar study and for product development efforts to refine and scale manufacturing methods to support commercialization. Under our amended agreement effective March 2, 2016, CIRM will disburse the grant funds to us contingent on our achievement of certain specific progress milestones. As the distributions of the CIRM grant are subject to meeting certain milestones, there can be no assurance that we will receive the entire amount granted. In addition, pursuant to the Award, we agreed to notify and report to CIRM information relating to serious adverse events, studies, press releases clinical trial information and routine communications in accordance with an agreed schedule.

As of March 28, 2016, we have received $7.8 million of payments from CIRM, and recent progress on the Phase l/2a dose escalation trial for OPC-1 is expected to result in a further $2.5 million payment under the terms of the existing CIRM award grant.

Failure to timely achieve milestones or otherwise satisfy CIRM regarding any delay could lead CIRM to suspend payments. The foregoing description of our arrangement with CIRM is a summary only and is qualified by reference to the Notice of Grant Award, dated as of October 16, 2014, the Amendment to Notice of Grant Award, dated as of November 26, 2014, and Amendment No. 2 to the Notice of Grant Award, dated as of March 2, 2016 between us and CIRM.

We will need to raise additional capital in order to conduct the Phase I/IIa clinical trial and any subsequent clinical trial and product development work. We intend to apply for a supplementary CIRM grant to provide funding for the clinical trial expansion.

Manufacturing and Process Development Technologies

We have sufficient existing clinical grade lots of AST-OPC1 for the ongoing Phase 1/2 trial, and cGMP master and working cell banks of undifferentiated human embryonic stem (hES) cells of the H1 and H7 cell lines. Both the H1 and H7 hES cell lines have been routinely expanded under either cGMP (H1) or pilot (H7) conditions. No limit to the expandability of hES cell lines has been observed. The cGMP cell banks of undifferentiated hES cells have been qualified for human biologics production per FDA guidelines. They exhibit normal chromosomal structure and are considered suitable for the production of biologics for human clinical use.

Additionally we have completed construction of and are currently validating a cGMP manufacturing facility at our Fremont, California headquarters. This facility is intended for use to produce additional cGMP cell banks and AST-OPC1 to supply Phase 3 clinical development and early commercial drug supply.

Intellectual Property

Our policy is to seek to protect our proprietary position by, among other methods, filing United States and foreign patent applications related to our proprietary technologies and any improvements that we consider important to the development and implementation of our business and strategy. In addition to relying on patents, we rely on trade secrets, know-how, and continuing technological advancement to maintain our competitive position. We will enter into intellectual property, invention, and non-disclosure agreements with our employees, and it will be our practice to enter into confidentiality agreements with our consultants. There can be no assurance, however, that these measures will prevent the unauthorized disclosure or use of our trade secrets and know-how, or that others may not independently develop similar trade secrets and know-how or obtain access to our trade secrets, know-how, or proprietary technology.

Our success depends, in part, upon our ability to obtain and maintain patent and other intellectual property protection for our product candidates including compositions-of-matter, dosages, and formulations, manufacturing methods, and novel applications, uses and technological innovations related to our product candidates and core technologies. We also rely on trade secrets, know-how and continuing technological innovation to further develop and maintain our competitive position. Our business would be negatively impacted if we are not successful in developing additional proprietary technologies that are patentable.

We cannot ensure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications that may be filed by us in the future, nor can we ensure that any of our existing or subsequently granted patents will be useful in protecting our drug candidates, technological innovations, and processes. The claims of any patents that are issued may not provide meaningful protection, may not provide a basis for commercially viable products or may not provide us with any competitive advantages. Because of the extensive time required for clinical development and regulatory review of a product candidate, it is possible that any patent related to our product candidates may expire before any of our product candidates can be commercialized, or may remain in force for only a short period of time following commercialization, thereby reducing the advantage afforded by any such patent. In addition, others may independently develop similar or alternative technologies, duplicate any of our technologies and, if patents are licensed or issued to us, design around the patented technologies licensed to or developed by us. Therefore, our competitors may be able to commercialize similar products, or may be able to duplicate our business strategy, without infringing our patents or otherwise using our intellectual property.

The protection afforded by any particular patent depends upon many factors, including the type of patent, scope of coverage encompassed by the granted claims, availability of extensions of patent term, availability of legal interpretation of patent laws in the United States and other countries that could diminish our ability to protect our inventions and to enforce our intellectual property rights. Furthermore, others may have patents that relate to our technology or business that may prevent us from marketing our product candidates unless we are able to obtain a license to those patents. Accordingly, while our ability to maintain and solidify our proprietary position for our products and core technologies will depend, in part, on our success in obtaining and enforcing valid patent claims, we cannot predict with certainty the enforceability of any granted patent claims or of any claims that may be granted from our patent applications.

The biotechnology and pharmaceutical industries are characterized by extensive litigation and other challenges regarding patents and other intellectual property rights that involve complex legal and factual questions making our patent position generally uncertain. Any existing or subsequently granted patents may be challenged, invalidated, found unenforceable, circumvented or infringed. We have been in the past and are currently involved in administrative proceedings with respect to our patents and patent applications and may, as a result of our extensive portfolio, be involved in such proceedings in the future. Additionally, in the future, we may claim that a third party infringes our intellectual property or a third party may claim that we infringe its intellectual property. In any of the administrative proceedings or in litigation, we may incur significant expenses, damages, attorneys’ fees, costs of proceedings and experts’ fees, and management and employees may be required to spend significant time in connection with these actions.

A patent interference proceeding may be instituted with the United States Patent and Trademark Office (“USPTO”) when more than one person files a patent application covering the same technology, or if someone wishes to challenge the validity of an issued patent on patents and applications filed before March 16, 2013. At the completion of the interference proceeding, the USPTO will determine which competing applicant is entitled to the patent, or whether an issued patent is valid. Patent interference proceedings are complex, highly contested legal proceedings, and the USPTO’s decision is subject to appeal. This means that if an interference proceeding arises with respect to any of our patent applications, we may experience significant expenses and delay in obtaining a patent, and if the outcome of the proceeding is unfavorable to us, the patent could be issued to a competitor rather than to us. For patents and applications filed after March 16, 2013 a derivation proceeding may be initiated where the USPTO may determine if one patent was derived from the work of an inventor on another patent. Inventorship may also be challenged in litigation.

In addition to interference proceedings, the USPTO can reevaluate issued patents at the request of a third party seeking to have the patent invalidated. There are proceedings at the USPTO (ex parte reexamination, post grant review, or inter partes review proceeding), which allow third parties to challenge the validity of an issued patent where there is a reasonable likelihood of invalidity. As with the USPTO interference proceedings, these USPTO proceedings will be very expensive to contest and can result in the cancelation of a patent. This means that patents owned or licensed by us may be subject to further administrative challenges and may be lost if the outcome of the challenge is unfavorable to us.

There are also challenges to obtaining patents in countries outside of the United States. In particular, under European patent law and the patent laws of certain other countries, oppositions to the issuance of patents may be filed. These foreign proceedings can be very expensive to contest and can result in significant delays in obtaining a patent or can result in a denial of a patent application. Also in Europe, there is uncertainty about the eligibility of hES cell subject matter for a patent. The European Patent Convention prohibits the granting of European patents for inventions that concern "uses of human embryos for industrial or commercial purposes". A recent decision at the Court of Justice of the European Union interpreted parthenogeneticly produced hES cells as patentable subject matter. Consequently, the European Patent Office now recognizes that human pluripotent stem cells (including human ES cells) can be created without a destructive use of human embryos as of June 5, 2003, and patent applications relating to hES cell subject matter with a filing and priority date after this date are no longer automatically excluded from patentability under Article 53 (a) EPC and Rule 28(c) EPC.

We may benefit from a variety of regulatory frameworks in the United States, Europe, China and other territories that provide periods of non-patent-based exclusivity for qualifying drug products. See “FDA and Foreign Regulation.”

The patent portfolio that we acquired pursuant to the Asset Contribution Agreement with Geron, dated January 4, 2013 (the "Asset Contribution Agreement"), includes over 400 patents and patent applications previously owned or licensed to Geron that are directed to pluripotent stem cell-, human hES cell-, and dendritic cell-based product opportunities. The portfolio encompasses a number of cell types that can be made from hES cells, including hepatocytes (liver cells), cardiomyocytes (heart muscle cells), neural cells (nerve cells, including dopaminergic neurons and oligodendrocytes), chondrocytes (cartilage cells), pancreatic islet β cells, osteoblasts (bone cells), hematopoietic cells (blood-forming cells) and dendritic cells. Also included in the patent portfolio are technologies for growing hES cells without the need for cell feeder layers or conditioned media, and novel synthetic growth surfaces.

In addition, in February 2016, we executed a broad, non-exclusive cross-license with BioTime and its subsidiary ES Cell International Pte Ltd. Under this license, we have received: (i) non-exclusive worldwide rights in a range of therapeutic fields of use to a further 35 patents and applications relating to hES cells, and (ii) non-exclusive worldwide rights for therapeutic applications of pluripotent stem cell-derived neural and cardiac cells to 22 patents and applications relating to hydrogel formulations.

The patent positions for our two most advanced programs are summarized below.

Dendritic cells: The patent rights relevant to dendritic cells include rights licensed from third parties and various patent families directed to the growth of hES cells and their differentiation into dendritic cells. This portfolio is related to our AST-VAC1 and AST-VAC2 products. There are issued patents in the United States, Australia, Europe, Canada, China, Hong Kong, and Japan. The expiration dates of these patents range from 2019 to 2025. The commercial success of our AST-VAC1 and AST-VAC2 products depends, in part, upon our ability to exclude competition in these products with this patent portfolio, regulatory exclusivity, or a combination of both.

Neural cells: The patent rights relevant to neural cells, such as oligodendrocyte progenitor cells, include various patent families directed to the growth of hES cells and their differentiation into neural cells. These patent rights also include rights licensed from the University of California. There are issued patents in the United States, Australia, Canada, United Kingdom, Japan, China, Hong Kong, India, Korea, Singapore and Israel. The expiration dates of these patents will be within 2020 to 2030. The commercial success of our AST-OPC1 product depends, in part, upon our ability to exclude competition in this product with this patent portfolio, regulatory exclusivity, or a combination of both.

In addition, Asterias has patent protection in the Unites States and various other jurisdictions for producing cardiomyocytes, pancreatic islet cells, hepatocytes, chondrocytes, hematopoietic cells, and osteoblasts. The expiration dates of these patents range from 2020 to 2032. Should a competitor not be able to market a product covered by these patents or if Asterias cannot license these patents before their expiration, the benefits for procurement and maintenance of these rights would not be fully realized and the associated costs would not be fully reimbursed.

Licensed Stem Cell Technology and Stem Cell Product Development Agreements

Telomerase Sublicense

We received the Telomerase Sublicense from Geron in connection with our acquisition of Geron’s stem cell assets. The Telomerase Sublicense grants us an exclusive sublicense under certain patents owned by the University of Colorado’s University License Equity Holdings, Inc. relating to telomerase and entitles us to use the technology covered by the patents in the development of AST-VAC1 and AST-VAC2 as immunological treatments for cancer. Under the Telomerase Sublicense, we paid Geron a one-time upfront license fee of $65,000, and we will pay Geron an annual license maintenance fee of $10,000 due on each anniversary of the effective date of the agreement, and a 1% royalty on sales of any products that we may develop and commercialize that are covered by the sublicensed patents. The Telomerase Sublicense will expire concurrently with the expiration of Geron’s license. That license will terminate during April 2017 when the licensed patents expire. The Telomerase Sublicense may also be terminated by us by giving Geron 90 days written notice, by us or by Geron if the other party breaches its obligations under the sublicense agreement and fails to cure their breach within the prescribed time period, or by us or by Geron upon the filing or institution of bankruptcy, reorganization, liquidation or receivership proceedings, or upon an assignment of a substantial portion of the assets for the benefit of creditors by the other party.

We are obligated to indemnify Geron, Geron’s licensor, and certain other parties for certain liabilities, including those for personal injury, product liability, or property damage relating to or arising from the manufacture, use, promotion or sale of a product, or the use by any person of a product made, created, sold or otherwise transferred by us or our sublicensees that is covered by the patents sublicensed under this agreement.

License Agreement with University of California

Geron assigned to us its Exclusive License Agreement with The Regents of the University of California for patents covering a method for directing the differentiation of multipotential hES cells to glial-restricted progenitor cells that generate pure populations of oligodendrocytes for remyelination and treatment of spinal cord injury. Pursuant to this agreement, we have an exclusive worldwide license under such patents, including the right to grant sublicenses, to create products for biological research, drug screening, and human therapy using the licensed patents.

Under the license agreement, we will be obligated to pay the university a royalty of 1% from sales of products that are covered by the licensed patent rights, and a minimum annual royalty of $5,000 starting in the year in which the first sale of a product covered by any licensed patent rights occurs, and continuing for the life of the applicable patent right under the agreement. The royalty payments due are subject to reduction, but not by more than 50%, to the extent of any payments that we may be obligated to pay to a third party for the use of patents or other intellectual property licensed from the third party in order to make, have made, use, sell, or import products or otherwise exercise our rights under the Exclusive License Agreement. We will be obligated to pay the university 7.5% of any proceeds, excluding debt financing and equity investments, and certain reimbursements, that we receive from sublicensees, other than our affiliates and joint ventures relating to the development, manufacture, purchase, and sale of products, processes, and services covered by the licensed patent.

The license agreement will terminate on the expiration of the last-to-expire of the university's issued licensed patents. If no further patents covered by the license agreement are issued, the license agreement would terminate in 2024. The university may terminate the agreement in the event of our breach of the agreement. We can terminate the agreement upon 60 days' notice.

World-Wide Non Exclusive WARF License

On October 7, 2013, we entered into a Non-Exclusive License Agreement with the Wisconsin Alumni Research Foundation (“WARF”) under which we were granted a worldwide non-exclusive license under certain WARF patents and WARF-owned embryonic stem cell lines to develop and commercialize therapeutic, diagnostic and research products. The licensed patents include patents covering methods for growth and differentiation of primate embryonic stem cells. The licensed stem cell lines include the H1, H7, H9, H13 and H14 hES cell lines.

In consideration of the rights licensed to us, we have agreed to pay WARF an upfront license fee and have agreed to pay, payments upon the attainment of specified clinical development milestones, royalties on sales of commercialized products, and, subject to certain exclusions, a percentage of any payments that we may receive from any sublicenses that we may grant to use the licensed patents or stem cell lines.

The license agreement will terminate with respect to licensed patents upon the expiration of the last licensed patent to expire. We may terminate the license agreement at any time by giving WARF prior written notice. WARF may terminate the license agreement if payments of earned royalties, once begun, cease for a specified period of time or if we and any third parties collaborating or cooperating with us in the development of products using the licensed patents or stem cell lines fail to spend a specified minimum amount on research and development of products relating to the licensed patents or stem cell lines for a specified period of time.

WARF also has the right to terminate the license agreement if we breach the license agreement or become bankrupt or insolvent or if any of the licensed patents or stem cell lines are offered to creditors.

We will indemnify WARF and certain other designated affiliated entities from liability arising out of or relating to the death or injury of any person or damage to property due to the sale, marketing, use, or manufacture of products that are covered by the licensed patents, or licensed stem cells, or inventions or materials developed or derived from the licensed patents or stem cell lines.

ViaCyte Cross-License

As part of a settlement agreement in May 2014 related to litigation in the United States District Court for the Northern District of California (Civil Action No. C12-04813), ViaCyte, Inc. (“ViaCyte”) and Asterias granted to each other a royalty free, fully paid license to each other’s technology relating to endoderm lineage cells including definitive endoderm and gut endoderm cells, only to the extent necessary to allow the licensee to make, use, sell, offer for sale, or import endodermal lineage cells. The Asterias patents that were licensed to ViaCyte in the settlement include those based on U.S. Patent Application No. 11/262,633. The ViaCyte patents that were licensed to us in the settlement included those based on U.S. Patent Application Nos. 11/021,618, 12/093,590, 10/584,338, 11/165,305, 11/317,387, and 11/860,494.

Royalty Agreement with Geron

In connection with our acquisition of Geron’s stem cell assets, we entered into a Royalty Agreement with Geron pursuant to which we agreed to pay Geron a 4% royalty on net sales (as defined in the Royalty Agreement), by us or any of our affiliates or sales agents, of any products that we develop and commercialize that are covered by the patents Geron contributed to us. In the case of sales of such products by a person other than us or one of our affiliates or sales agents, we will be required to pay Geron 50% of all royalties and cash payments received by us or by our affiliate in respect of a product sale. Royalty payments will be subject to proration in the event that a product covered by a patent acquired from Geron is sold in combination with another product that is not covered by a patent acquired from Geron. The Royalty Agreement will terminate at the expiration or termination date of the last issued patent contributed by Geron under the Royalty Agreement. We estimate that the latest patent expiration date will be 2032.

Clinical Trial and Option Agreement with Cancer Research United Kingdom

During September 2014, we entered into a Clinical Trial and Option Agreement (the “CRUK Agreement”) with Cancer Research UK (“CRUK”) and Cancer Research Technology Limited, (“CRT”), a wholly-owned subsidiary of CRUK, pursuant to which CRUK has agreed to fund Phase I/IIa clinical development of our AST-VAC2 product candidate. We will, at our own cost, complete process development and manufacturing scale-up of the AST-VAC2 manufacturing process and will transfer the resulting cGMP-compatible process to CRUK. CRUK will, at its own cost, manufacture clinical grade AST-VAC2 and will carry out the Phase I/IIa clinical trial of AST-VAC2 in cancer patients in both resected early-stage and advanced forms of lung cancer. We will have an exclusive first option to obtain a license to use the data from the clinical trial. If we exercise that option we will be obligated to make payments upon the execution of the License Agreement, upon the achievement of various milestones, and then royalties on sales of products, and, if we sublicense product development or commercialization rights to a third party, we would pay CRT a share of any sublicense revenues we receive from the third party, with CRT’s share varying from a high of 40% in the case of a sublicense entered into prior to commencement of a Phase II clinical trial, to substantially lower rates in the case of a sublicense entered into at various later stages of clinical development but prior to completion of a Phase III clinical trial, and as low as 7.5% in the case of a sublicense entered into after completion of a Phase III clinical trial. In connection with the CRUK Agreement, we sublicensed to CRUK for use in the clinical trials and product manufacturing process certain patents that have been licensed or sublicensed to us by third parties. We would also be obligated to make payments to those licensors and sublicensors upon the achievement of various milestones, and then royalties on sales of products if AST-VAC2 is successfully developed and commercialized.

If we decline to exercise our option, CRT will then have an option to obtain a license to use our intellectual property relating to AST-VAC2 to continue the development and commercialization of AST-VAC2 and related products for which we will be entitled to receive a share of the revenue relating to development and partnering proceeds. The CRT’s option will be exercisable by CRT for four months from when our option expires.

The CRUK Agreement will expire upon the earliest of (i) the date we obtain a license to use the clinical data pursuant to an exercise of our option, (ii) the date CRT obtains a license to continue the development and commercialization of AST-VAC2 pursuant to an exercise of our option and (iii) the expiration of both our option and the CRT’s option. Notwithstanding the foregoing, any party may terminate the CRUK Agreement prior to its expiration for events including (i) a party materially breaches the agreement and such breach is not cured within 60 days after the non-breaching party delivers written notice, (ii) any party is insolvent or liquidated or (iii) if regulatory approval of the clinical trial is not obtained within two years after the parties complete the technology transfer phase of the agreement, or if regulatory approval is revoked, withdrawn or otherwise terminated, or if a regulatory authority orders a halt or hold on the clinical trial for more than 18 months. In addition, CRUK will have the right to terminate the CRUK Agreement under certain other circumstances.

The CRUK Agreement contains customary representations, warranties and covenants from us and CRUK, as well as customary provisions relating to indemnity, confidentiality and other matters.

Services Agreement with Cell Therapy Catapult Services Limited

We entered into a Services Agreement (the “Services Agreement”) with Cell Therapy Catapult Services Limited (“Catapult”), a research organization specializing in the development of technologies which speed the growth of the cell and gene therapy industry. Under the Services Agreement, Catapult will license to us, certain background intellectual property and will develop a scalable manufacturing and differentiation process for our human embryonic stem cell derived AST-VAC2 allogeneic (non-patient specific) dendritic cancer vaccine development program. In consideration for the license and Catapult’s performance of services, we agreed to make aggregate payments of up to GBP £4,350,000 over the next five years. At our option of, up to GBP £3,600,000 of such payments may be settled in shares of our Series A Common Stock.

The Services Agreement may be terminated by we for any reason upon 60 days prior written notice. Catapult may terminate the Services Agreement on 60 days prior written notice if it encounters a technical issue that would prevent it from completing the services at all or without obtaining additional resources, or if the estimated time and cost of completing the services will be exceeded and both parties do not reach agreement on revised time and cost terms. Catapult may terminate the Services Agreement in the event we fail to pay any amount due under the Services Agreement 30 days after Catapult makes a written demand for payment. In addition, a non-breaching party may terminate the Services Agreement upon the occurrence a material breach that is not remedied within 30 days. Either party may terminate the Services Agreement in the event the other party becomes subject to insolvency, receivership, liquidation, or a similar event.

Manufacturing

We entered into a new lease for a 44,000 square foot facility in Fremont, California at which we constructed a cGMP compliant facility for the production of our product candidates that cost approximately $4.9 million of which we used $4.4 million in a tenant improvement allowance from the landlord. Construction began at the Fremont facility during the first quarter of 2015 and all facilities were moved in during the fourth quarter of 2015. The lease on our Menlo Park facility expired in January 2016.

Marketing

Because our planned products are still in the research and development stage, we will not initially need to have our own marketing personnel. If we are successful in developing marketable products, we will need to build our own marketing and distribution capability for our products, which would require the investment of significant financial and management resources, or we will need to find collaborative marketing partners, independent sales representatives, or wholesale distributors for the commercial sale of those products.

If we market products through arrangements with third parties, we may pay sales commissions to sales representatives or we may sell or consign products to distributors at wholesale prices. This means that our gross profit from product sales may be less than would be the case if we were to sell our products directly to end users at retail prices through our own sales force. On the other hand, selling to distributors or through independent sales representatives would allow us to avoid the cost of hiring and training our own sales employees. There can be no assurance we will be able to negotiate distribution or sales agreements with third parties on favorable terms to justify our investment in our products or achieve sufficient revenues to support our operations.

Competition

We face substantial competition in our business, and that competition is likely to intensify further as new products and technologies reach the market. Superior new products are likely to sell for higher prices and generate higher profit margins once acceptance by the medical community is achieved. Those companies that are successful in introducing new products and technologies to the market first may gain significant economic advantages over their competitors in the establishment of a customer base and track record for the performance of their products and technologies. Such companies will also benefit from revenues from sales that could be used to strengthen their research and development, production, and marketing resources. All companies engaged in the medical products industry face the risk of obsolescence of their products and technologies as more advanced or cost effective products and technologies are developed by their competitors. As the industry matures, companies will compete based upon the performance and cost effectiveness of their products.

The stem cell industry is characterized by rapidly evolving technology and intense competition. Our competitors include major multinational pharmaceutical companies, specialty biotechnology companies, and chemical and medical products companies operating in the fields of regenerative medicine, cell therapy, tissue engineering, and tissue regeneration. Many of these companies are well-established and possess technical, research and development, financial, and sales and marketing resources significantly greater than ours. In addition, certain smaller biotech companies have formed strategic collaborations, partnerships, and other types of joint ventures with larger, well established industry competitors that afford these companies’ potential research and development and commercialization advantages. Academic institutions, governmental agencies, and other public and private research organizations are also conducting and financing research activities which may produce products directly competitive to those we are developing.

We believe that some of our competitors are trying to develop hES cell, iPS cell, and mesenchymal stem cell-based technologies and products that may compete with our potential stem cell products based on efficacy, safety, cost, and intellectual property positions.

We may also face competition from companies that have filed patent applications relating to the cloning or differentiation of stem cells. We may be required to seek licenses from these competitors in order to commercialize certain of our proposed products, and such licenses may not be granted.

Government Regulation

Government authorities at the federal, state and local level, and in other countries, extensively regulate among other things, the development, testing, manufacture, quality, approval, distribution, labeling, packaging, storage, record keeping, marketing, import/export and promotion of drugs, biologics, and medical devices. Authorities also heavily regulate many of these activities for human cells, tissues and cellular and tissue-based products or HCT/Ps.

FDA and Foreign Regulation

We believe that the FDA will regulate most of our proposed products as biologicals. In the United States, the FDA regulates drugs and biologicals under the Federal Food, Drug and Cosmetic Act or FDCA, the Public Health Service Act, or PHSA, and implementing regulations. In addition, establishments that manufacture human cells, tissues, and cellular and tissue-based products are subject to additional registration and listing requirements, including current good tissue practice regulations. Many of our proposed products will be reviewed by the FDA staff in its Center for Biologics Evaluation and Research (“CBER”) Office of Cellular, Tissue and Gene Therapies.

Clinical Development

Our domestic biological products will be subject to rigorous FDA review and approval procedures. After testing in animals to evaluate the potential efficacy and safety of the product candidate, an IND must be submitted to the FDA to obtain authorization for human testing. Extensive clinical testing, which is generally done in three phases, must then be undertaken at one or more hospitals or medical centers to demonstrate optimal use, safety, and efficacy of each product in humans. Each clinical trial will also be subject to review by an independent Institutional Review Board (“IRB”) at each institution at which the trial will occur. The IRB will consider, among other things, ethical factors, the safety of human subjects, and the possible liability of the institution.

Clinical trials are generally conducted in three “phases.” Phase 1 clinical trials are conducted in a small number of healthy volunteers or volunteers with the target disease or condition to assess safety. Phase 2 clinical trials are conducted with groups of patients afflicted with the target disease or condition in order to determine preliminary efficacy, optimal dosages and expanded evidence of safety. In some cases, an initial trial is conducted in diseased patients to assess both preliminary efficacy and preliminary safety, in which case it is referred to as a Phase 1/2 trial. Phase 3 trials are large-scale, multi-center, comparative trials and are conducted with patients afflicted with the target disease or condition in order to provide enough data to demonstrate the efficacy and safety required by the FDA. The FDA closely monitors the progress of each of the three phases of clinical testing and may, at its discretion, re-evaluate, alter, suspend, or terminate the clinical trial based upon the data which have been accumulated to that point and its assessment of the risk/benefit ratio to the intended patient population. All adverse events must be reported to the FDA. Monitoring of all aspects of the study to minimize risks is a continuing process. The time and expense required to perform this clinical testing can far exceed the time and expense of the research and development initially required to create the product.

Applications for Marketing Approval

No action can be taken to market any therapeutic product in the United States until an appropriate application, which in the case of a cell therapy or vaccine product will be a Biologics License Application (“BLA”), has been approved by the FDA. Submission of the application is no guarantee that the FDA will find it complete and accept it for filing. If an application is accepted for filing, following the FDA’s review, the FDA may grant marketing approval, request additional information or deny the application if it determines that the application does not provide an adequate basis for approval. FDA regulations also restrict the export of therapeutic products for clinical use prior to BLA approval. To date, the FDA has not granted marketing approval to any hES-based therapeutic products and it is possible that the FDA or foreign regulatory agencies may subject our product candidates to additional or more stringent review than drugs or biologicals derived from other technologies.

The FDA offers several programs to expedite development of products that treat serious or life-threatening illnesses and that provide meaningful therapeutic benefits to patients over existing treatments. A product may be eligible for breakthrough therapy designation if it treats a serious or life-threatening disease or condition and preliminary clinical evidence indicates it may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints. Features of breakthrough therapy designation include intensive guidance from FDA on an efficient development program, intensive involvement of FDA staff in a proactive, collaborative review process, and rolling review of marketing applications. Under its accelerated approval regulations, the FDA may approve a product based on a surrogate endpoint that is reasonably likely to predict clinical benefits or based on an effect on a clinical endpoint other than survival or irreversible morbidity. The applicant will then be required to conduct additional, post-approval confirmatory trials to verify and describe clinical benefit, and the product may have certain post-marketing restrictions as necessary to assure safe use. The FDA may withdraw approval granted under the traditional route or under an accelerated approval, if it is warranted. The FDA may also consider ways to use the accelerated approval pathway for rare or very rare diseases, and a new review designation has been created to help foster the innovation of promising new therapies with the potential to shorten the timeframe for conducting pivotal trials and speed up patient access to the approved product. There is no assurance that the FDA will grant breakthrough therapy or accelerated approval status to any of our product candidates.

Combination Products

If we develop any products that are used with medical devices, they may be considered combination products, which are defined by the FDA to include products comprised of two or more regulated components or parts such as a biologic and a device. When regulated independently, biologics and devices each have their own regulatory requirements. However, the regulatory requirements for a combination product comprised of a biologic administered with a delivery device can be more complex, because in addition to the individual regulatory requirements for each component, additional combination product regulatory requirements may apply. There is an Office of Combination Products at the FDA that coordinates the review of such products and determines the primary mode of action of a combination product. The definition and regulatory requirements for combination products may differ significantly among other countries in which we may seek approval of our product candidates.

Post-Approval Matters

Even after initial FDA approval has been obtained, further studies may be required to provide additional data on safety or to gain approval for the use of a product as a treatment for clinical indications other than those initially targeted. Use of a product during testing and after marketing could reveal side effects that could delay, impede, or prevent FDA marketing approval, result in an FDA-ordered product recall, or in FDA-imposed limitations on permissible uses or in withdrawal of approval. For example, if the FDA becomes aware of new safety information after approval of a product, it may require us to conduct further clinical trials to assess a known or potential serious risk and to assure that the benefit of the product outweigh the risks. If we are required to conduct such a post-approval study, periodic status reports must be submitted to the FDA. Failure to conduct such post-approval studies in a timely manner may result in substantial civil or criminal penalties. Data resulting from these clinical trials may result in expansions or restrictions to the labeled indications for which a product has already been approved.

FDA Regulation of Manufacturing

The FDA regulates the manufacturing process of pharmaceutical products, and human tissue and cell products, requiring that they be produced in compliance with cGMP. See “Manufacturing.” The FDA regulates and inspects equipment, facilities, laboratories and processes used in the manufacturing and testing of products prior to providing approval to market products. If after receiving approval from the FDA, a material change is made to manufacturing equipment or to the location or manufacturing process, additional regulatory review may be required. The FDA also conducts regular, periodic visits to re-inspect the equipment, facilities, laboratories and processes of manufacturers following an initial approval. If, as a result of those inspections, the FDA determines that that equipment, facilities, laboratories or processes do not comply with applicable FDA regulations and conditions of product approval, the FDA may seek civil, criminal or administrative sanctions and/or remedies against the manufacturer, including suspension of manufacturing operations. Issues pertaining to manufacturing equipment, facilities or processes may also delay the approval of new products undergoing FDA review.

FDA Regulation of Advertising and Product Promotion

The FDA also regulates the content of advertisements used to market pharmaceutical and biological products. Claims made in advertisements concerning the safety and efficacy of a product, or any advantages of a product over another product, must be supported by clinical data filed as part of a BLA or an amendment to a BLA, and must be consistent with the FDA approved labeling and dosage information for that product.

Foreign Regulation

Sales of pharmaceutical and biological products outside the United States are subject to foreign regulatory requirements that vary widely from country to country. Even if FDA approval has been obtained, approval of a product by comparable regulatory authorities of foreign countries must be obtained prior to the commencement of marketing the product in those countries. The time required to obtain such approval may be longer or shorter than that required for FDA approval.

California State Regulations

The state of California has adopted legislation and regulations that require institutions that conduct stem cell research to notify, and in certain cases obtain approval from, a Stem Cell Research Oversight Committee (“SCRO Committee”) before conducting the research. Advance notice, but not approval by the SCRO Committee, is required in the case of in vitro research that does not derive new stem cell lines. Research that derives new stem cell lines, or that involves fertilized human oocytes or blastocysts, or that involves clinical trials or the introduction of stem cells into humans, or that involves introducing stem cells into animals, requires advanced approval by the SCRO Committee. Clinical trials may also entail approvals from an IRB at the medical center at which the study is conducted, and animal studies may require approval by an Institutional Animal Care and Use Committee.

All hES cell lines that will be used in our research must be acceptably derived. To be acceptably derived, the pluripotent stem cell line must have either:

| · | Been listed on the National Institutes of Health Human Embryonic Stem Cell Registry, or |

| · | Been deposited in the United Kingdom Stem Cell Bank, or |

| · | Been derived by, or approved for use by, a licensee of the United Kingdom Human Fertilisation and Embryology Authority, or |

| · | Been derived in accordance with the Canadian Institutes of Health Research Guidelines for Human Stem Cell Research under an application approved by the National Stem Cell Oversight Committee, or |

| · | Been derived in accordance with the Japanese Guidelines for Derivation; or |

| · | Been approved by CIRM in accordance with California Code of Regulations Title 17, Section 100081; or |

| · | Been derived under the following conditions: |

| (a) | Donors of gametes, embryos, somatic cells, or human tissue gave voluntary and informed consent; |

| (b) | Donors of gametes, embryos, somatic cells, or human tissue did not receive valuable consideration. This provision does not prohibit reimbursement for permissible expenses as determined by an IRB; |

| (c) | Donation of gametes, embryos, somatic cells, or human tissue was overseen by an IRB (or, in the case of foreign sources, an IRB-equivalent); and |

| (d) | Individuals who consented to donate stored gametes, embryos, somatic cells, or human tissue were not reimbursed for the cost of storage prior to the decision to donate. |

Other hES lines may be deemed acceptably derived if they were derived in accordance with (a), (b), and (d) above and the hES line was derived prior to the publication of the National Academy of Sciences guidelines on April 26, 2005 and a SCRO Committee has determined that the investigator has provided sufficient scientific rationale for the need for use of the line, which should include establishing that the proposed research cannot reasonably be carried out with covered lines that did have IRB approval.

California regulations also require that certain records be maintained with respect to stem cell research and the materials used, including:

| · | A registry of all human stem cell research conducted, and the source(s) of funding for this research. |

| · | A registry of human pluripotent stem cell lines derived or imported, to include, but not necessarily limited to: |

| (a) | The methods utilized to characterize and screen the materials for safety; |

| (b) | The conditions under which the materials have been maintained and stored; |

| (c) | A record of every gamete donation, somatic cell donation, embryo donation, or product of somatic cell nuclear transfer that has been donated, created, or used; |

| (d) | A record of each review and approval conducted by the SCRO Committee. |

California Proposition 71

During November 2004, California State Proposition 71 (“Prop. 71”), the California Stem Cell Research and Cures Initiative, was adopted by state-wide referendum. Prop. 71 provides for a state-sponsored program designed to encourage stem cell research in the State of California, and to finance such research with State funds totaling approximately $295,000,000 annually for 10 years beginning in 2005. This initiative created CIRM, which will provide grants, primarily but not exclusively, to academic institutions to advance both hES cell research and adult stem cell research.

Medicare, Medicaid, and Similar Reimbursement Programs

Sales of our products will depend, in part, on the extent to which the costs of our products will be covered by third-party payors, such as government health programs, commercial insurance and managed healthcare organizations. These third-party payors are increasingly challenging the prices charged for medical products and services. Additionally, the containment of healthcare costs has become a priority of federal and state governments and the prices of drugs have been a focus in this effort. The U.S. government, state legislatures and foreign governments have shown significant interest in implementing cost-containment programs, including price controls, restrictions on reimbursement and requirements for substitution of generic products. Adoption of price controls and cost-containment measures, and adoption of more restrictive policies in jurisdictions with existing controls and measures, could further limit our net revenue and results. If these third-party payors do not consider our products to be cost-effective compared to other therapies, they may not cover our products after approved as a benefit under their plans or, if they do, the level of payment may not be sufficient to allow us to sell our products on a profitable basis.

The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act of 2010, collectively referred to as the ACA, enacted in March 2010, is expected to have a significant impact on the health care industry. ACA is expected to expand coverage for the uninsured while at the same time containing overall healthcare costs. With regard to pharmaceutical products, among other things, ACA is expected to expand and increase industry rebates for drugs covered under Medicaid programs and make changes to the coverage requirements under the Medicare Part D program. We cannot predict the impact of ACA on pharmaceutical companies, as many of the ACA reforms require the promulgation of detailed regulations implementing the statutory provisions which has not yet occurred. In addition, although the United States Supreme Court upheld the constitutionality of most of the ACA, some states have indicated that they intend to not implement certain sections of the ACA, and some members of the U.S. Congress are still working to repeal parts of the ACA. These challenges add to the uncertainty of the legislative changes enacted as part of ACA.

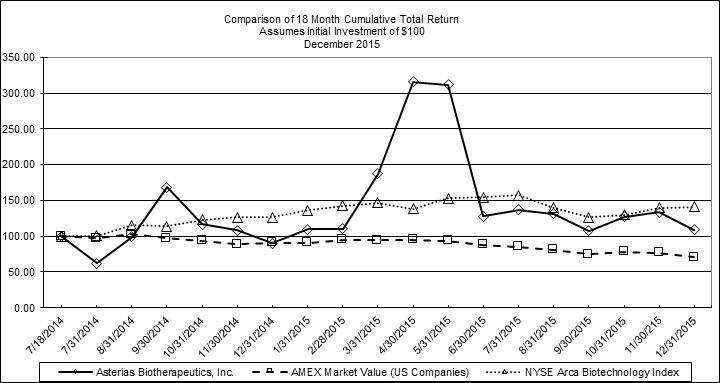

In addition, in some non-U.S. jurisdictions, the proposed pricing for a drug must be approved before it may be lawfully marketed. The requirements governing drug pricing vary widely from country to country. For example, the European Union provides options for its member states to restrict the range of medicinal products for which their national health insurance systems provide reimbursement and to control the prices of medicinal products for human use. A member state may approve a specific price for the medicinal product or it may instead adopt a system of direct or indirect controls on the profitability of us placing the medicinal product on the market. There can be no assurance that any country that has price controls or reimbursement limitations for pharmaceutical products will allow favorable reimbursement and pricing arrangements for any of our products. Historically, products launched in the European Union do not follow price structures of the United States and generally tend to be significantly lower.