Attached files

| file | filename |

|---|---|

| EX-10.3 - EX-10.3 - Kite Pharma, Inc. | kite-ex103_749.htm |

| EX-10.13 - EX-10.13 - Kite Pharma, Inc. | kite-ex1013_300.htm |

| EX-10.5 - EX-10.5 - Kite Pharma, Inc. | kite-ex105_299.htm |

| EX-10.23 - EX-10.23 - Kite Pharma, Inc. | kite-ex1023_302.htm |

| EX-32.2 - EX-32.2 - Kite Pharma, Inc. | kite-ex322_310.htm |

| EX-23.1 - EX-23.1 - Kite Pharma, Inc. | kite-ex231_305.htm |

| EX-32.1 - EX-32.1 - Kite Pharma, Inc. | kite-ex321_309.htm |

| EX-31.2 - EX-31.2 - Kite Pharma, Inc. | kite-ex312_308.htm |

| EX-23.2 - EX-23.2 - Kite Pharma, Inc. | kite-ex232_306.htm |

| EX-10.30 - EX-10.30 - Kite Pharma, Inc. | kite-ex1030_304.htm |

| EX-10.21 - EX-10.21 - Kite Pharma, Inc. | kite-ex1021_301.htm |

| EX-31.1 - EX-31.1 - Kite Pharma, Inc. | kite-ex311_307.htm |

| EX-10.29 - EX-10.29 - Kite Pharma, Inc. | kite-ex1029_303.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36508

KITE PHARMA, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

27-1524986 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

2225 Colorado Avenue Santa Monica, California |

|

90404 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(310) 824-9999

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.001 per share |

|

The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based on the closing price of the registrant’s common stock as reported on The NASDAQ Global Select Market on June 30, 2015, the last business day of the registrant’s most recently completed second quarter, was $1,863 million.

As of February 23, 2016, there were 48,839,557 shares of the registrant’s common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to its 2016 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

|

|

|

|

|

Page |

|

|

4 |

|||

|

Item 1. |

|

|

4 |

|

|

Item 1A. |

|

|

28 |

|

|

Item 1B. |

|

|

57 |

|

|

Item 2. |

|

|

57 |

|

|

Item 3. |

|

|

57 |

|

|

Item 4. |

|

|

57 |

|

|

|

|

|

|

|

|

|

58 |

|||

|

Item 5. |

|

|

58 |

|

|

Item 6. |

|

|

60 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

61 |

|

Item 7A. |

|

|

70 |

|

|

Item 8. |

|

|

71 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

103 |

|

Item 9A. |

|

|

103 |

|

|

Item 9B. |

|

|

104 |

|

|

|

|

|

|

|

|

|

105 |

|||

|

Item 10. |

|

|

105 |

|

|

Item 11. |

|

|

105 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

105 |

|

Item 13. |

|

Certain Relationships and Related Transactions and Director Independence |

|

105 |

|

Item 14. |

|

|

105 |

|

|

|

|

|

||

|

|

106 |

|||

|

Item 15. |

|

|

106 |

|

|

|

|

|

||

|

|

107 |

|||

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or this Annual Report, may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are subject to the “safe harbor” created by those sections. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below under Part I, Item 1A, “Risk Factors” in this Annual Report.

We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements and are based upon our current expectations, beliefs, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond our control. Forward-looking statements in this Annual Report include, but are not limited to, statements about:

|

|

● |

the success, cost and timing of our product development activities and clinical trials; |

|

|

● |

the ability and willingness of the National Cancer Institute, or the NCI, to continue research and development activities relating to our engineered autologous cell therapy, or eACT, pursuant to the Cooperative Research and Development Agreements, or CRADAs, with the U.S. Department of Health and Human Services, as represented by the NCI; |

|

|

● |

our ability to obtain and maintain regulatory approval of KTE-C19 and any other product candidates, and any related restrictions, limitations and/or warnings in the label of an approved product candidate; |

|

|

● |

the ability to license additional intellectual property relating to a product candidate targeting the EGFRvIII antigen from a third party and relating to additional product candidates from the National Institutes of Health and to comply with our existing license agreements; |

|

|

● |

our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates; |

|

|

● |

the commercialization of our product candidates, if approved; |

|

|

● |

our plans and ability to research, develop and commercialize our product candidates, including under our research collaboration with Amgen Inc.; |

|

|

● |

our ability to attract collaborators with development, regulatory and commercialization expertise; |

|

|

● |

our ability to integrate T-Cell Factory B.V., or TCF, a Dutch company we acquired in March 2015, and our ability to potentially significantly expand our pipeline of TCR-based product candidates using TCF’s proprietary TCR-GENErator technology platform; |

|

|

● |

future agreements with third parties in connection with the commercialization of our product candidates and any other approved product; |

|

|

● |

the size and growth potential of the markets for our product candidates, and our ability to serve those markets; |

|

|

● |

the rate and degree of market acceptance of our product candidates; |

|

|

● |

regulatory developments in the United States and foreign countries; |

|

|

● |

our ability to develop, validate and utilize our own clinical manufacturing facility and commercial manufacturing facility; |

|

|

● |

our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately; |

|

|

● |

the success of competing therapies that are or may become available; |

|

|

● |

our ability to attract and retain key scientific or management personnel; |

|

|

● |

the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

|

|

● |

our ability to in-license, acquire, or invest in complementary businesses, technologies, products or assets to further expand our portfolio of eACT-based product candidates or to complement our eACT-based product candidates; |

|

|

● |

our use of cash and other resources; and |

|

|

● |

our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates. |

2

We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot guarantee future results, level of activity, performance or achievements. Any forward-looking statement made by us in this Annual Report speaks only as of the date of this Annual Report or as of the date on which it is made. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Annual Report.

Trademarks and Trade names

We have common law, unregistered trademarks for Kite Pharma and eACT based on use of the trademarks in the United States. This Annual Report contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

3

Overview

We are a clinical-stage biopharmaceutical company focused on the development and commercialization of novel cancer immunotherapy products designed to harness the power of a patient’s own immune system to target and kill cancer cells. We do this using our engineered autologous cell therapy, or eACT, which we believe is a transformational approach to the treatment of cancer. eACT involves the genetic engineering of T cells to express either chimeric antigen receptors, or CARs, or T cell receptors, or TCRs. These modified T cells are designed to recognize and destroy cancer cells.

Immuno-oncology, which utilizes a patient’s own immune system to combat cancer, is one of the most actively pursued areas of research by biotechnology and pharmaceutical companies today. Interest and excitement for immuno-oncology is driven by recent, compelling efficacy data in cancers with historically bleak outcomes and the potential to achieve a cure, or functional cure, for some patients. We believe eACT presents a promising innovation in immunotherapy. eACT has been developed through our collaboration with the National Cancer Institute, or the NCI, where the program is led by Steven A. Rosenberg, M.D., Ph.D., a recognized pioneer in immuno-oncology. Our Founder, Chairman and Chief Executive Officer, Arie Belldegrun, M.D., FACS, in addition to his prior roles at Agensys, Inc. and Cougar Biotechnology, Inc., also has significant experience in this field dating back to his time at the NCI as a research fellow in surgical oncology and immunotherapy with Dr. Rosenberg.

A patient’s immune system, particularly T cells, is thought to play an important role in identifying and killing cancer cells. eACT involves modifying a patient’s T cells outside the patient’s body, or ex vivo, causing the T cells to express CARs or TCRs, and then reinfusing the engineered T cells back into the patient. CARs can recognize native cancer antigens that are part of an intact protein presented on the cancer cell surface. TCRs broaden the therapeutic approach by recognizing fragments on the cancer cell surface derived from intracellular proteins. By combining both CAR and TCR approaches, we have generated a broad portfolio of product candidates to target both solid and hematological tumors.

Our Pipeline

We are currently conducting four company-sponsored pivotal studies of our lead product candidate, KTE-C19, a CAR-based therapy. We are conducting a Phase 2 clinical trial (ZUMA-1) of KTE-C19 in patients with refractory diffuse large B cell lymphoma, or DLBCL, including primary mediastinal B cell lymphoma, or PMBCL, and transformed follicular lymphoma, or TFL. DLBCL, PMBCL and TFL are types of aggressive non-Hodgkin lymphoma, or NHL. We are also conducting a Phase 2 clinical trial (ZUMA-2) of KTE-C19 in patients with relapsed/refractory mantle cell lymphoma, or MCL, a Phase 1-2 clinical trial (ZUMA-3) of KTE-C19 in adult patients with relapsed/refractory acute lymphoblastic leukemia, or ALL, and a Phase 1-2 clinical trial (ZUMA-4) of KTE-C19 in pediatric patients with relapsed/refractory ALL.

In December 2015, the U.S. Food and Drug Administration, or FDA, granted breakthrough therapy designation status to our lead product candidate, KTE-C19, for the treatment of patients with refractory DLBCL, PMBCL and TFL. Breakthrough therapy designation is granted by the FDA to expedite the development and review of new therapies to treat serious or life-threatening conditions. The criteria for breakthrough therapy designation require preliminary clinical evidence that demonstrates the therapy may have substantial improvement on at least one clinically significant endpoint over available therapy. This designation conveys all fast track program features, as well as more intensive FDA guidance on an efficient drug development program and eligibility for rolling review and priority review.

KTE-C19 has also been granted orphan drug designation by the FDA to treat DLBCL and by the European Commission to treat DLBCL, PMBCL, ALL, MCL, chronic lymphocytic leukemia, or CLL, small lymphocytic lymphoma, and follicular lymphoma, or FL. The FDA designation may provide seven years of market exclusivity in the United States and the European Commission designation may provide 10 years of market exclusivity in Europe, each subject to certain limited exceptions. However, the U.S. and European orphan drug designations do not convey any advantages in, or shorten the duration of, the regulatory review or approval process.

We also have two Cooperative Research and Development Agreements, or CRADAs, with the U.S. Department of Health and Human Services, as represented by the NCI, through which we are funding the research and development of eACT-based product candidates utilizing CARs and TCRs for the treatment of advanced solid and hematological malignancies. Under the CRADAs, we have an exclusive option to negotiate commercial licenses from the National Institutes of Health, or the NIH, to intellectual property relating to CAR-and TCR-based product candidates developed in the course of the CRADA research plans. Since entering into the first CRADA in August 2012, or 2012 CRADA, we have secured multiple commercial license agreements with the NIH for intellectual property relating

4

to TCR-based product candidates targeting certain SSX2, NY-ESO-1, HPV and MAGE antigens and for a CAR-based product candidate targeting EGFRvIII.

In addition, we have a Research Collaboration and License Agreement with Amgen Inc., or Amgen, pursuant to which we expect to develop and commercialize additional CAR-based product candidates directed against various targets contributed to the collaboration by Amgen.

Our clinical trials of KTE-C19, and those being conducted in collaboration with the NCI and Amgen, are summarized below. The NCI filed the investigational new drug applications, or INDs, with the FDA in order to conduct the ongoing clinical trials of the CAR- and TCR-based product candidates other than KTE-C19. We will have to submit separate INDs to conduct our own clinical trials relating to these product candidates.

Recent Developments

2016 CRADA

On January 4, 2016, we entered into our second CRADA, or 2016 CRADA, for the research and clinical development of a fully human anti-CD19 CAR-based product candidate for the treatment of B cell lymphomas and leukemias. Under the 2016 CRADA, we are collaborating with James N. Kochenderfer, M.D., an investigator in the Experimental Transplantation and Immunology Branch of the NCI, to evaluate this product candidate in a Phase 1 clinical study. In addition, the 2016 CRADA will focus on the development of next-generation CAR programs directed against other novel antigens for the treatment of B cell lymphomas and leukemias. We will also continue to advance multiple CAR and TCR programs under the 2012 CRADA entered into with the Surgery Branch of the NCI, led by Dr. Rosenberg.

5

Our goal is to be the leader in immuno-oncology across multiple therapeutic indications. To achieve this, we are developing a pipeline of eACT-based product candidates for the treatment of advanced solid and hematological malignancies. Key elements of our strategy are to:

Rapidly advance KTE-C19 through clinical development.

We have four ongoing company-sponsored pivotal studies of KTE-C19. We plan to report interim Phase 2 data from ZUMA-1 in the second half of 2016. If the interim results are sufficiently compelling, we intend to discuss with the FDA submitting a Biologics License Application, or BLA, for accelerated approval of KTE-C19 for the treatment of refractory DLBCL, PMBCL and TFL. Subject to the interim results and discussions with the FDA, we plan to submit the BLA at the end of 2016. If approved, we plan to commercially launch KTE-C19 in 2017. We plan to report data from ZUMA-2 and the Phase 2 portions of ZUMA-3 and ZUMA-4 in 2017. If we believe the data are compelling, we plan to pursue FDA approval for these additional indications. Assuming positive data from the current ZUMA program, we expect to conduct additional ZUMA studies of KTE-C19 in 2017 for the treatment of FL, CLL and in earlier lines of DLBCL.

The FDA may grant accelerated approval for product candidates for serious conditions that fill an unmet medical need based on a surrogate or intermediate clinical endpoint, including tumor shrinkage, because such shrinkage could provide a real clinical benefit to patients. Assuming compelling data, we believe our accelerated approval strategy of submitting a BLA at the end of 2016 on interim data is warranted, given the limited alternatives for patients with refractory, aggressive NHL. Even if accelerated approval is granted, confirmatory trials are commonly required and we expect to discuss our plans to fulfill our requirements to convert any accelerated approval to regular approval with the FDA.

We also expect to expand the ZUMA clinical program to Europe in 2016.

Advance multiple TCR-based product candidates to target solid tumors.

We believe the advancement of TCR-based product candidates that target solid tumors will increase the cancer population coverage and allow us to leverage the expected manufacturing and development capabilities relating to KTE-C19. We plan to file an IND relating to a TCR-based product candidate targeting a MAGE antigen by the end of 2016.

We also plan to continue to exclusively license and develop a portfolio of TCR-based product candidates targeting various cancers based on data from the NCI clinical trials that we are funding under the CRADAs. In addition, we believe that our European subsidiary, Kite Pharma EU B.V., or Kite Pharma EU, has the potential to significantly expand our pipeline of TCR-based product candidates. Using its proprietary TCR-GENErator technology platform, we believe Kite Pharma EU can rapidly and systematically discover tumor-specific TCRs. We believe this platform could generate a TCR-based product candidate that could enter the clinic as early as 2017.

We plan to develop a TCR-based product portfolio that targets specific antigens expressed by cancer cells irrespective of where the cancer originates. As a result, we believe this approach may allow for regulatory approvals of our personalized TCR-based product candidates without respect to cancer cell origin.

Continue to leverage our collaborations to selectively identify and advance additional product candidates.

We plan to advance multiple additional eACT-based product candidates under our collaborations, including with Amgen, bluebird bio, Inc., Alpine Immune Sciences, Inc., or AIS, the Netherlands Cancer Institute, or NKI, and Leiden University Medical Center. We expect an IND to be filed for a CAR-based product candidate researched under the Amgen Agreement by the end of 2016.

In addition, our collaborations with the NCI provide us the opportunity to license products for oncology development based on human proof-of-concept data rather than preclinical animal data alone. We believe this approach significantly reduces the risk in our development programs. We plan to select products for development based on a favorable benefit-to-risk ratio and clinical proof-of-concept established by the NCI. Each CRADA has a five-year term, and may be terminated earlier by the NCI.

In addition, we may in-license, acquire, or invest in complementary businesses, technologies, products or assets to further expand our portfolio of eACT-based product candidates or to complement our eACT-based product candidates.

6

Establish commercialization and marketing capabilities of current and future pipeline products.

We anticipate that our commercial manufacturing facility in El Segundo, which is adjacent to Los Angeles International Airport, will be operational to support the planned commercial launch of KTE-C19 in 2017. We intend to build a fully operational commercial organization to commercialize KTE-C19. We expect to partner with the transplant and lymphoma referral centers in the United States. We may also selectively partner with third parties to commercialize and market any approved product candidates outside the United States.

Engineered Autologous Cell Therapy (eACT)

White blood cells are a component of the immune system and are responsible for defending the body against infectious pathogens and other foreign material. There are several types of white blood cells, including T cells, natural killer cells, and B cells. T cells can be distinguished from other white blood cells by T cell receptors present on their cell surface. These receptors contribute to tumor surveillance by helping T cells recognize cancerous cells. The T cell has the ability to kill the cancerous cell once it is identified. When the T cells with cancer-specific receptors are absent, present in low numbers, of poor quality or rendered inactive by suppressive mechanisms employed by tumor tissue, cancer may grow and spread to various organs. In addition, standard of care treatments can be deleterious to T cells’ ability to kill cancer. We believe eACT has the potential to treat cancer by overcoming the limits of a person’s immunosurveillance by increasing the effectiveness and number of a patient’s cancer-specific T cells.

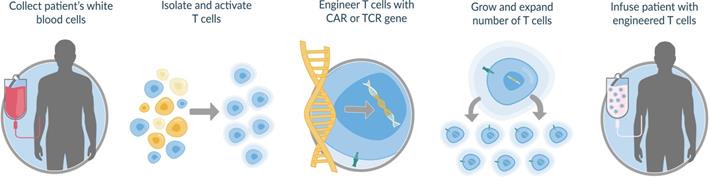

eACT involves genetically engineering T cells to express cancer-specific receptors as illustrated below.

The T cell engineering process that we have developed takes approximately two weeks from collection of the patient’s white blood cells to site delivery for infusion of the engineered T cells back to the patient. We provide eACT to patients in our clinical trials after they receive a short chemotherapy conditioning regimen, which is intended to improve the survival and proliferative capacity of the newly infused T cells.

Using eACT technology, T cells can be genetically modified to express one of two classes of cancer-specific receptors: CARs or TCRs. CARs recognize native cancer antigens that are part of an intact protein on the cancer cell surface. TCRs broaden the therapeutic approach by targeting cancer proteins that reside inside the cancer cells. In ordinary cell metabolism, intracellular proteins are broken down into fragments called peptides. These peptides are then “displayed” on the cell membrane by a “presenting” molecule called major histocompatibility complex, or MHC. While T cells may not be able to recognize cancer-specific proteins inside a cancer cell, T cells that are engineered with TCRs are able to recognize a specific peptide from an intracellular protein when it is displayed on the cancer cell surface.

T cells engineered with CARs or TCRs can proliferate inside a patient and have the potential to infiltrate the microenvironment of a solid cancer mass, killing large numbers of cancer cells. Furthermore, we believe T cells engineered with CARs or TCRs can potentially overcome several mechanisms of tumor escape to which endogenous T cells may be susceptible. Upon binding with a target cell and activation, the T cells release cytokines, which contribute to the killing of cancer cells. However, excessive cytokine release can result in a systemic inflammatory reaction consisting of fever and low blood pressure.

7

CARs and TCRs are discussed in more detail below.

CARs

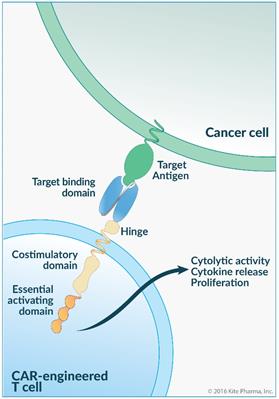

Engineering T cells with a CAR involves using a viral vector (a delivery vehicle) containing the CAR gene to transduce, or integrate, that gene into the T cell’s chromosomal make-up. The CAR gene encodes the single-chain CAR protein. Our KTE-C19 CAR is comprised of the following elements:

|

|

● |

Target Binding Domain: At one end of the CAR is a target binding domain of an antibody that is specific to the target antigen CD19 on the cancer cell surface. This domain extends out of the engineered T cell into the extracellular space, where it can recognize target antigens. The target binding domain consists of a single-chain variable fragment, or scFv, of an antibody comprising variable domains of heavy and light chains joined by a short linker. This allows the expression of the CAR as a single-chain protein. |

|

|

● |

Transmembrane Domain and Hinge: This middle portion of the CAR links the scFv target binding domain to the activating elements inside the cell. This transmembrane domain “anchors” the CAR in the cell’s membrane. In addition, the transmembrane domain may also interact with other transmembrane proteins that enhance CAR function. In the extracellular region of the CAR, directly adjacent to the transmembrane domain, lies a “hinge” domain. This region of the CAR provides structural flexibility to facilitate optimal binding of the CAR’s scFv target binding domain with the target antigen on the cancer cell’s surface. |

|

|

● |

Activating Domains: Located within the T cell’s interior are two regions of the CAR responsible for activating the T cell upon binding to the target cell. The CD3z element delivers an essential primary signal within the T cell, and the CD28 element delivers an additional, co-stimulatory signal. Together, these signals trigger T cell activation, resulting in proliferation of the CAR T cells and direct killing of the cancer cell. In addition, T cell activation stimulates the local secretion of cytokines and other molecules that can recruit and activate additional anti-tumor immune cells. |

TCRs

Engineering T cells with a TCR involves using a viral vector containing TCR genes to transduce those genes into the T cell’s chromosomal makeup. The TCR genes encode two protein chains, which are designed to bind with specific peptides presented by MHC on the surface of certain cancer cells. The TCR protein chains are expressed on the T cell surface where they associate with CD3 proteins, which are natural components of the T cell. Upon binding of the TCR to the peptide-MHC complex on the cancer cell

8

surface, the CD3 proteins deliver signals that trigger T cell activation, resulting in proliferation of the TCR T cells, direct killing of the cancer cell and stimulation of cytokines and other molecules that can recruit and activate additional anti-tumor immune cells.

TCR technology primarily targets cancer antigens that fall into the following main categories: self-antigens, viral antigens and neo-antigens, also known as cancer-specific antigens. Self-antigens are generally shared across patients and include differentiation markers and cancer testis antigens, or CTAs. CTAs are expressed on a wide variety of common tumor types of various histological origins. We believe a subset of CTAs, which include SSX2, NY-ESO-1 and MAGE, are appropriate eACT targets because their expression on normal tissue is generally restricted to tissues that do not express MHC in adults. Viral antigens, such as those expressed by oncogenes, such as HPV-E6 and HPV-E7, are also shared across patients and are not expressed on normal tissue. As a result, T cells engineered to target cells with such CTAs or viral antigens would primarily target cancer cells rather than non-cancerous cells. We are initially focused on developing CTA-specific and virus oncoprotein-specific TCR-based product candidates. Our 2012 CRADA was amended in 2015 to further the research and development of the next generation of TCR-based product candidates to target neo-antigens, which are those derived from mutations arising in the tumor.

CAR and TCR Differences

There are three main differences between CARs and TCRs:

|

|

● |

MHC Restriction: Since TCRs recognize peptides only in the context of MHC molecules expressed on the surface of the target cell, their peptide specificity is termed MHC-restricted. In contrast, CAR target recognition is MHC-unrestricted. In humans, MHC molecules are known as human leukocyte antigen, or HLA, proteins. There are several HLA protein types which display genetic variation across the human population. As a result, a TCR-based product candidate would have to be matched to the HLA type of the patient. |

|

|

● |

Cancer Target Frequency: CARs recognize native cancer antigens that are part of an intact protein on the cancer cell surface. Bioinformatic studies predict that 20% to 30% of all encoded proteins may be extracellular or membrane-associated. TCRs broaden the therapeutic approach by recognizing specific peptides of intracellular proteins that are displayed on the cancer cell surface in combination with MHC. |

|

|

● |

Antigen-Presenting Cell Recognition: As opposed to CARs, TCRs have the potential to recognize cancer antigens not only presented directly on the surface of cancer cells but also presented by antigen-presenting cells in the tumor microenvironment and in secondary lymphoid organs. Antigen-presenting cells are native immune-system cells responsible for the amplification of the immune response. |

9

Immuno-oncology is one of the most actively pursued areas of research by biotechnology and pharmaceutical companies today. Over the past few decades, several novel treatment methodologies have emerged that modulate the immune system including vaccines and monoclonal antibodies. Therapeutic vaccines have historically been associated with modest efficacy in the treatment of cancer. They commonly utilize dendritic cells, a form of immune cell that presents tumor antigens to T cells, which can result in T cell activation. Similarly, monoclonal antibodies, after binding a cancer antigen, classically utilize an effector arm in order to stimulate an immunological response.

More recently, interest and excitement has centered around the use of bi-specific antibodies and checkpoint inhibitors. Bi-specific antibodies commonly target both the cancer antigen and T cell receptor, thus bringing both cancer cells and T cells in close proximity to maximize the likelihood of an immune response to the cancer cells. Checkpoint inhibitors, or CPIs, work by releasing the body’s natural “brakes” on the immune system. Tumors can evade immune surveillance by triggering co-inhibitory receptors that can blunt T cell effectiveness and proliferation. By targeting these receptors, CPIs release these brakes, thereby reactivating T cells. Both bispecific antibodies and CPIs require functioning T cell populations in order to exert their effect.

We believe our eACT presents a promising innovation in immunotherapy by focusing directly on the key immune mediator, the T cell. Our genetically engineered T cells bind to cancer cells directly, and as such, have the potential to kill a substantial number of tumor cells. In addition, we note that eACT may be synergistic with other forms of immunotherapy. As an example, eACT may potentially be used in combination with CPIs to enhance efficacy.

KTE-C19

Overview

We are initially advancing KTE-C19 for the treatment of refractory, aggressive NHL. NHL is a cancer of white blood cells, including B cells. CD19 is expressed on the surface of B cells, including malignant B cells, and it is not thought to be expressed on any other tissue. B cells are considered non-essential tissue, as they are not required for patient survival. We believe CD19 is an appropriate target for the treatment of all types of B cell leukemias and lymphomas.

Diffuse Large B Cell Lymphoma, Primary Mediastinal B cell Lymphoma and Transformed Follicular Lymphoma

Initially, we expect initially to seek approval of KTE-C19 for the treatment of patients with refractory DLBCL, PMBCL and TFL. According to the American Cancer Society, DLBCL is the most common subtype of NHL, accounting for approximately 30% of the total 70,000 NHL patients diagnosed each year in the United States. It is classified as an aggressive lymphoma, in which survival is measured in months rather than years.

First line therapy for patients with DLBCL usually consists of chemotherapy regimen known as R-CHOP (rituximab, cytoxan, adriamycin, vincristine and prednisone), which includes the use of a monoclonal antibody known as rituximab. Approximately 50% to 60% of DLBCL patients are cured with first line therapy.

For patients who relapse or are refractory to first line therapy, the current standard of care for second line therapy consists of a platinum-based chemotherapy regimen with rituximab. These second line chemotherapy regimens include R-ICE (rituximab, ifosfamide, carboplatin and etoposide) or R-DHAP (rituximab, dexamethasone, cytarabine and cisplatin).

Patients who respond to second line therapy may go on to receive hematopoietic stem cell transplantation, or HSCT. Patients who do not respond to second line therapy or relapse after HSCT are treated with a third line salvage chemotherapy. These patients have a poor prognosis and treatment is generally palliative with no curative treatment options.

FL is the second most common subtype of NHL and the most common type of indolent NHL, or iNHL. There are approximately 15,300 new diagnoses of FL in the United States each year. Conventional therapy for FL is not curative, and most patients develop progressive disease and chemo-resistance. A pivotal event in the history of some patients with FL is histological transformation to more aggressive malignancies, most commonly DLBCL.

Due to differences in clinicopathologic features and treatment regimens, PMBCL can be considered a different patient population to DLBCL. There are approximately 1,650 new cases of PMBCL in the United States each year. Patients can be generally classified as having either limited stage or advanced stage disease. Limited stage disease can be contained within one irradiation field. In contrast, advanced stage disease refers to disease that cannot be contained within one irradiation field, bulky disease (greater than 10 centimeter wide tumors), and tumors that have an associated pericardial or pleural effusion. Patients of advanced stage disease are typically treated with induction chemoimmunotherapy. Primary refractory disease occurs when initial therapy fails to achieve a complete response and the general approach is to administer systemic chemotherapy with or without rituximab with plans to proceed to high-

10

dose chemotherapy and HSCT in those with chemotherapy-sensitive disease. The treatment of patients who are not candidates for HSCT, who fail to respond to second line chemotherapy regimens, or who relapse after HSCT is generally palliative. Salvage therapy is rarely curative.

Other Lymphomas and Leukemias

We also expect to seek regulatory approval of KTE-C19 for the treatment of other lymphomas and leukemias, including MCL, ALL and CLL.

There are approximately 4,200 new cases of MCL in the United States each year. Therapy for MCL is not curative, and virtually all patients will have refractory or recurrent disease. Treatment of MCL is difficult due to the rapid development of resistance to therapy.

ALL is an aggressive form of leukemia with approximately 6,500 patients diagnosed with ALL in the United States each year. Approximately 90% of patients with ALL will demonstrate a complete remission with intensive induction chemotherapy. However, after consolidation and maintenance therapy, the majority of patients will relapse in the bone marrow. Although approximately half of patients with relapsed ALL will obtain a second complete remission, most will eventually die from leukemia. The prognosis of patients with relapsed or refractory ALL is poor, with median survival less than one year.

CLL is the most common leukemia, with approximately 14,600 new cases in the United States per year. It is characterized by a progressive accumulation of functionally incompetent lymphocytes which are monoclonal in origin. Most patients with CLL will have an initial complete or partial response to chemotherapy, but relapse invariably occurs after treatment discontinuation unless the patient undergoes allogeneic HSCT, which is the only known curative therapy. Almost all patients with CLL will develop progressive disease.

Clinical Experience

In December 2015, at the annual meeting of the American Society of Hematology, or ASH, we announced data from the Phase 1 portion of ZUMA-1. Seven patients were treated with KTE-C19, of which four achieved complete remissions and one achieved a partial remission, representing an overall objective response rate of 71%. All complete remissions were first observed at one month. Three patients had ongoing complete remissions at three months. The patient who achieved a complete remission but relapsed was retreated and achieved a partial remission. The one patient who initially achieved a partial remission relapsed and died due to disease progression.

Overall, KTE-C19 related adverse events included severe and life threatening toxicities, consisting predominantly of cytokine release syndrome and neurotoxicity, which were reversible except in one patient with dose-limiting toxicities. This patient experienced dose-limiting toxicities of cytokine release syndrome and neurotoxicity that were life-threatening toxicities and died within 30 days of KTE-C19 infusion due to intracranial hemorrhage deemed unrelated to KTE-C19 per the investigator. Supportive care, tocilizumab, and corticosteroids were used to manage adverse events.

The ZUMA-1 results were generally consistent with the results from the NCI Phase 1-2a clinical trial of anti-CD19 CAR T cell therapy in patients with relapsed/refractory lymphomas and leukemias. For KTE-C19, we use the identical anti-CD19 CAR construct and viral vector that was used in the NCI clinical trial of anti-CD19 CAR T cell therapy. We believe we have streamlined and optimized the NCI’s original process, including by removing human serum from the process to minimize risk of viral contamination, moving process steps from an open system to a closed system to minimize the risk of other contamination and standardizing the viral transduction process to help eliminate processing inconsistencies. In July 2014, the NCI submitted an IND amendment to use our streamlined and optimized process, and has since treated multiple patients with T cells prepared by the new process.

11

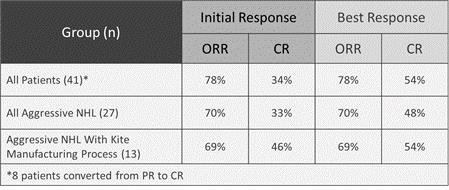

As of November 30, 2015, the objective response rate and complete response rate from the NCI trial are described in the table below.

In addition, as of November 30, 2015, 25 patients treated by the NCI were still in response and 21 of 22 patients with complete responses remained in remission. The duration of the responses from the NCI trial are summarized in the table below.

Severe and life threatening toxicities attributed to anti-CD19 CAR T cells related to cytokine release syndrome and neurotoxicity, which began mostly in the first two weeks after cell infusion, were generally reversible. Most prominent acute toxicities included symptoms thought to be associated with the cytokine release syndrome, such as fever, low blood pressure, hypoxia, heart dysfunction and kidney dysfunction. The symptoms of neurotoxicity included, among others, ataxia, confusion, somnolence and speech impairment. Approximately 30% of all patients and 31% of patients with aggressive NHL that received the anti-CD19 CAR T cells processed under the new manufacturing process experienced Grade 3 or higher cytokine release syndrome, in each case attributed to the anti-CD19 CAR T cells. Approximately 44% of all patients and 69% of patients with aggressive NHL that received the anti-CD19 CAR T cells processed under the new manufacturing process experienced Grade 3 or higher neurotoxicity, in each case attributed to the anti-CD19 CAR T cells. Grade 2 represents moderate toxicity, Grade 3 represents severe toxicity, Grade 4 represents life threatening toxicity, and Grade 5 represents toxicity resulting in death. There have been Grade 4 events related to cytokine release syndrome and neurotoxicity. Several patients have also died, but the deaths were not attributed to the CAR T cells.

The NCI clinical trial completed enrollment in January 2016, and we expect to report on the ongoing follow-up of the treated patients.

As reported at ASH in December 2015 by the NCI, in a separate Phase 1 dose escalation study conducted by the Pediatric Oncology Branch of the NCI, administration of anti-CD19 CAR T cells resulted in a 60% complete response rate in 45 pediatric or young adult patients with relapsed/refractory ALL. Fifty-one percent of the 45 patients achieved a minimal residual disease, or MRD, negative complete response. As seen in the NCI Phase 1-2a clinical trial described above, infusion of anti-CD19 CAR T cells was associated with significant, acute toxicities, including febrile neutropenia, cytokine release syndrome, chemical laboratory abnormalities, low blood counts and transient neurological deficits.

Development Strategy

ZUMA-1

We expect to enroll approximately 120 patients with refractory DLBCL, PMBCL and TFL in ZUMA-1. We expect ZUMA-1 to be conducted at approximately 25 sites, with objective response rate as the primary endpoint in Phase 2. In the Phase 2 portion of ZUMA-1, we expect to treat approximately 72 patients with DLBCL in cohort one and approximately 40 patients with PMBCL and TFL in cohort two. We plan to conduct an interim analysis in 2016 of cohort one after 50 patients are treated and followed for three months. If we believe the data are compelling and show a convincing benefit-to-risk ratio compared to historical data, we plan to discuss with the FDA submitting a BLA for accelerated approval of KTE-C19 as a treatment for patients with refractory DLBCL, PMBCL and TFL.

12

Even if we receive FDA approval, we may be required to initiate a randomized confirmatory study in NHL in order to fulfill likely post-marketing clinical study requirements to convert any accelerated approval to regular approval. The design of this randomized confirmatory study would be confirmed pending regulatory discussion and emerging clinical data.

ZUMA-2

We expect to enroll approximately 70 patients with relapsed/refractory MCL in ZUMA-2. We expect ZUMA-2 to be conducted at approximately 25 sites, with objective response rate as the primary endpoint. We plan to report data from ZUMA-2 in 2017. If we believe the data are compelling, we plan to pursue FDA approval for the MCL indication.

ZUMA-3 and ZUMA-4

We expect to enroll approximately 75 adult patients with relapsed/refractory ALL in ZUMA-3 and approximately 75 pediatric patients with relapsed/refractory ALL in ZUMA-4. We plan to transition to the Phase 2 portions of both trials in 2016 and report data from the Phase 2 portions of each trial in 2017. If we believe the data are compelling, we plan to pursue FDA approval for the adult ALL and pediatric ALL indications.

We expect to expand the ZUMA clinical program to Europe in 2016. Assuming positive data from the current ZUMA program, we also expect to conduct additional ZUMA studies of KTE-C19 in 2017 for the treatment of FL, CLL and in earlier lines of DLBCL.

Additional eACT-Based Product Candidates

Pursuant to the CRADAs, we are funding multiple NCI clinical trials involving CAR- and TCR-based T cell therapies. We expect to select CAR- and TCR-based product candidates for development based on data from these clinical trials. Our collaboration with the NCI provides us the opportunity to license products for oncology development based on human proof-of-concept data rather than preclinical animal data alone. We believe this approach will significantly reduce the risk in our development programs. We plan to select product candidates for further development based on a favorable benefit-to-risk ratio and proof-of-concept established in the NCI clinical trials.

We also expect that the Amgen Agreement will expand our CAR-based product candidate pipeline and that Kite Pharma EU has the potential to significantly expand our TCR-based product candidate pipeline.

CAR-Based Product Candidates

We may seek to develop additional CAR-based product candidates. Currently, we are funding an NCI Phase 1-2a clinical trial of a CAR-based T cell therapy targeting the EGFRvIII antigen in patients with glioblastoma, a highly malignant brain cancer. The NCI is conducting this trial at the NIH. The trial’s primary objectives are to (1) evaluate the safety of the administration of anti-EGFRvIII CAR T cell therapy in patients receiving the nonmyeloablative conditioning regimen, and Interleukin-2 and (2) determine the six month progression free survival of patients receiving anti-EGFRvIII CAR T cell therapy and Interleukin-2 following a nonmyeloablative but lymphoid depleting preparative regimen. The trial’s secondary objectives are to (1) determine the in vivo survival of the gene-engineered cells and (2) evaluate radiographic changes after treatment to measure objective tumor response. Patients are currently being enrolled into the Phase 1 dose escalation part of the trial and no results from this trial have been published.

We are also funding an NCI Phase 1 clinical trial of a fully human anti-CD19 CAR. The trial’s primary objective is to assess the safety of giving T cells expressing a fully-human anti-CD19 CAR to patients with advanced B-cell cancer. Patients are currently being enrolled into the Phase 1 dose escalation part of the trial and no results from this trial have been published.

TCR-Based Product Candidates

Pursuant to the 2012 CRADA, we are funding or expect to fund clinical trials at the NCI involving TCR-based T cell therapies targeting SSX2, NY-ESO-1, MAGE, HPV and KRAS antigens and neo-antigens. The Phase 2 clinical trial of a TCR-based therapy targeting the NY-ESO-1 antigen is being conducted by the NCI at the NIH. The trial’s primary objective is to determine whether the administration of anti-NY-ESO-1 plus high-dose Interleukin-2 following a nonmyeloablative lymphoid depleting preparative regimen may result in objective tumor regression in patients with metastatic cancers that express the NY-ESO-1 antigen. The trial’s secondary objectives are to (1) determine the in vivo survival of the gene engineered cells and (2) determine the toxicity profile of this treatment regimen. Patients are currently being enrolled into the dose escalation part of the trial and no results from this trial have been published.

13

Two Phase 1-2a clinical trials of TCR-based therapies targeting the MAGE antigen are being conducted by the NCI at the NIH. One trial’s primary objectives are to determine (1) a safe dose of the administration of autologous T cells transduced with an anti-MAGE-A3/A6, which is HLA-DP0401/0402 restricted, or MAGE-A3-DP4, TCR and Interleukin-2 to patients following a nonmyeloablative but lymphoid depleting preparative regimen, (2) if this approach will result in objective tumor regression in patients with metastatic cancer expressing MAGE-A3-DP4 and (3) the toxicity profile of this treatment regimen. This trial’s secondary objective is to determine the in vivo survival of gene-engineered cells. The second trial’s purpose is to see if the anti-MAGE-A3, which is HLA-A1 restricted, cells cause tumors to shrink and to assess safety. Patients are currently being enrolled into the Phase 1 dose escalation part of each of the trials. In November 2015, the NCI reported Phase 1 data from the clinical trial of anti-MAGE-A3-DP4 T cell therapy. Fourteen patients were enrolled in the Phase 1 portion of the study. One patient with cervical cancer, one with esophageal cancer, and one with urothelial cancer each experienced partial responses without dose limiting toxicities. No results from the anti-MAGE-A3-A1 trial have been published.

The Phase 1-2 clinical trial of a TCR-based therapy targeting the HPV-16 E6 antigen relating to certain cancers associated with the human papillomavirus is being conducted by the NCI at the NIH. The trial’s primary objectives are to determine (1) a safe dose of administration of autologous T cells transduced with an anti-HPV-16 E6 TCR and aldesleukin to patients following a nonmyeloablative but lymphodepleting preparative regimen and (2) the objective tumor response rate and duration in patients with metastatic or recurrent or refractory HPV-16+ cancers treated with this regimen. The trial’s secondary objective is to determine the toxicity of the treatment regimen and to study immunologic correlates associated with E6 TCR gene therapy for HPV-16+ cancers. Patients are currently being enrolled into the dose escalation part of the trial and no results from this trial have been published. Christian Hinrichs is the principal investigator of this trial.

NCI planned clinical trials of TCR-based product candidates targeting certain SSX2, KRAS and HPV-16 E7 antigens, and neo-antigens have not yet begun.

With respect to developing a TCR-based product portfolio, we plan to use a novel Phase 2 design wherein patients with various cancers will be screened for tumor antigen expression as well as the patient specific HLA proteins that present the tumor antigen on the cancer cell surface. Patients will then be assigned a TCR-based therapy that matches both the tumor antigen expression and their presenting HLA protein. We believe this approach may allow for regulatory approvals of our personalized TCR-based product candidates without respect to cancer cell origin. As a result, we may be able to select the appropriate treatment from a portfolio of TCR-based product candidates on a patient-by-patient basis.

Preclinical Experience

While we are currently funding clinical trials at the NCI involving TCR-based T cell therapies, we have strong preclinical data supporting the potential efficacy of multiple TCR-based T cell therapies. For example, several different SSX2-specific TCR genes were screened for their expression and ability to specifically recognize SSX2-expressing cancer cells of a variety of histologies. Based on superior expression, potency and selective activity, an SSX2 TCR was identified as an attractive candidate for subsequent clinical evaluation. In addition to enabling us to select among different human TCR genes that target the same antigen, such preclinical studies allow us to make critical decisions regarding utilization of TCR genes derived from humans or mice, or otherwise engineered to optimize function. For instance, preclinical studies have demonstrated that a mouse-derived, or murine, TCR targeting the antigen NY-ESO-1 was equivalent to or better than the comparable human-based NY-ESO-1 TCR with respect to stable expression, cytokine production and target cell killing. Compared to certain human TCR protein chains, those that are fully or partially murine, may be less likely to become entwined with endogenous human TCR protein chains.

Manufacturing, Processing and Delivering to Patients

Because it is important to rapidly treat patients with highly aggressive cancers, we have developed a T cell engineering process for KTE-C19 that takes approximately two weeks from collection of the patient’s white blood cells to site delivery for infusion of the engineered T cells back to the patient. The processing of our lead product candidate, KTE-C19, begins with the collection of the patient’s white blood cells using a standard blood bank procedure. The collected cells are then sent to a central processing facility, where the peripheral blood mononuclear cells, including T cells, are isolated from the other sample components. These cells are stimulated to proliferate, then transduced with a retroviral vector to introduce the CAR gene into the patient’s T cells. These engineered cells are then propagated in cell culture bags until a sufficient number of cells are available for infusion back into the patient. The engineered T cells are then washed and frozen at the cell processing site, and shipped back to the clinical center where they can be administered to the patient. In preparation for administration of the engineered T cells, the patient undergoes a short chemotherapy conditioning regimen, which is intended to improve the survival and proliferative capacity of the newly infused T cells.

Using our clinical manufacturing facility and also our contract manufacturer, PCT, a subsidiary of Caladrius Biosciences, Inc., we are processing KTE-C19 for our ZUMA clinical trials. Cell processing activities are conducted at our facility and at PCT under current good manufacturing practices, or cGMP, using qualified equipment and materials. We have engaged a third-party contractor to

14

manufacture the retroviral vector that delivers the applicable CAR gene into the T cells under cGMP. We believe all materials and components utilized in the production of the retroviral vector and final T cell product are readily available from qualified suppliers.

We expect to continue to rely on PCT to supply some of our anticipated clinical trial demands. To meet projected needs for commercial demand, we plan to commission our commercial manufacturing facility to supply and process products on a patient-by-patient basis. Our commercial manufacturing facility is in El Segundo, adjacent to Los Angeles International Airport. We anticipate the El Segundo facility will be operational to support the planned commercial launch of KTE-C19 in 2017. Developing our own manufacturing capabilities may require more costs than we anticipate or result in significant delays. If we are unable to develop our own manufacturing capabilities, we will rely on contract manufacturers, including both current and alternate suppliers, to ensure sufficient capacity is available for commercial purposes prior to the submission of a BLA.

In November 2015, we entered into a strategic research collaboration with GE Global Research to develop a next generation, functionally integrated and automated manufacturing system for engineered T cell therapy. We believe this collaboration will accelerate the development of automation technologies for engineered T cell therapy that have the potential to reduce cost, improve speed and minimize variability. Under the terms of the agreement, we and GE Global Research will each contribute resources and relevant expertise to the partnership.

Intellectual Property

Intellectual property is of vital importance in our field and in biotechnology generally. We seek to protect and enhance proprietary technology, inventions, and improvements that are commercially important to the development of our business by seeking, maintaining, and defending patent rights, whether developed internally or licensed from third parties. We will also seek to rely on regulatory protection afforded through orphan drug designations, data exclusivity, market exclusivity and patent term extensions where available.

To achieve this objective, a strategic focus for us has been to identify and license key patents that provide protection and serve as an optimal platform to enhance our intellectual property and technology base. Well before the field of adoptive T cell immunotherapy raised commercial interest and started its transition to an industrial environment, we initiated a process of identifying patents with broad coverage in the area of CARs. Between 2009 and 2013, we identified, and ultimately licensed, issued patents with broad claims directed to the CAR concept. These patents were originally filed by investigators at the Weizmann Institute of Science, the NIH, University of California San Francisco, or UCSF, and Cell Genesys. This process was finalized in December 2013.

This effort was paralleled by the creation and execution in August 2012 of our first CRADA. As discussed below under “—Our Research and Development and License Agreements,” this agreement provides the framework under which we may license product-related intellectual property to support our pipeline development and commercialization activities, as well as enhance and extend the life-time of our patent portfolio.

Our intellectual property estate strategy is designed to provide multiple layers of protection, including: (1) patent rights with broad claims directed to core CAR constructs used in our products; (2) patent rights covering methods of treatment for therapeutic indications; (3) patent rights covering specific products; and (4) patent rights covering innovative manufacturing processes and methods for generating new constructs for genetically engineering T cells.

We believe our current layered patent estate, together with our efforts to develop and patent next generation technologies, provides us with substantial intellectual property protection. We have conducted extensive freedom to operate, or FTO, analyses of the current patent landscape with respect to our lead product candidate, and based on these analyses we believe that there are no valid claims in any third party patents, which would prevent our ability to commercialize KTE-C19. However, the area of patent and other intellectual property rights in biotechnology is an evolving one with many risks and uncertainties. See “Risk Factors—Risks Related to Our Intellectual Property” for additional information.

Our current patent estate includes an exclusive license to a patent portfolio owned by Cabaret Biotech Ltd., or Cabaret, and directed to CAR constructs developed by Dr. Zelig Eshhar, Yeda-Weizmann, NIH, UCSF and Cell Genesys. Our CAR construct-directed patent portfolio includes 10 issued U.S. patents, seven of which are directed to core construct composition of matter and two of which are directed to methods of treatment for therapeutic indications. These patents first began to expire in April 2015, with the last of these patents, which broadly claims scFv-based CAR constructs and is also our most significant CAR-related patent, expiring in 2027. These patents represent all of the material patents underlying KTE-C19. We are working to develop the next generation of CAR and TCR technologies for use in this field, which we intend to patent on our own or to license from our collaborators, to expand this layer of our intellectual property estate.

Our current patent estate also includes an exclusive license from the NIH to patent applications related to CAR-based product candidates that target the EGFRvIII antigen for the treatment of brain cancer, head and neck cancer, and melanoma and TCR-based

15

product candidates that target the CTA SSX2 for treatment of head and neck cancer, hepatocellular carcinoma, melanoma, prostate cancer, and sarcoma. Our patent estate further includes a co-exclusive license to these same product candidates for the treatment of certain other cancer types. We also have exclusive licenses from the NIH to patent applications related to TCR-based product candidates that target certain HPV, NY-ESO-1, and MAGE antigens.

The identification of new technologies and initiation of the exclusive licensing process occur under the framework of the CRADAs between us and the NIH. Our product-specific intellectual property licensed to date includes six Patent Cooperation Treaty applications with priority dates in 2010, 2011, 2012, and 2013, corresponding U.S. non-provisional patent applications, and corresponding foreign patent applications in Canada, Australia, Europe, China, Israel and Japan, as well as additional pending U.S. provisional patent applications. The Patent Cooperation Treaty application with the 2010 priority date relates to our TCR-based product candidates targeting the SSX2 antigen, the Patent Cooperation Treaty application with the 2011 priority date relates to our CAR-based product candidate targeting the EGFRvIII antigen, the Patent Cooperation Treaty application with the 2012 priority date relates to our TCR-based product candidates targeting the NY-ESO-1 antigen, the Patent Cooperation Treaty application with the 2013 priority date relates to our TCR-based product candidates targeting HPV antigens, and the Patent Cooperation Treaty applications with the 2012 and 2013 priority dates relate to our TCR-based product candidates targeting the MAGE antigen. We may require an additional license relating to the EGFRvIII scFv target binding site in order to commercialize a CAR-based product candidate that targets the EGFRvIII antigen. We have no rights to any issued patents covering TCR-based product candidates.

Under the Amgen Agreement, we have a license to intellectual property rights to certain Amgen cancer targets. In addition, we have certain intellectual property rights related to the TCR GENErator platform. See “—T Cell Factory Acquisition” for additional information.

Our strategy is also to develop and obtain additional intellectual property covering innovative manufacturing processes and methods for genetically engineering T cells expressing new constructs. To support this effort, we have established expertise and development capabilities focused in the areas of preclinical research and development, manufacturing and manufacturing process scale-up, quality control, quality assurance, regulatory affairs and clinical trial design and implementation. We have filed a Patent Cooperation Treaty application, jointly with the NCI, relating to eACT closed manufacturing process, and expect to continue to file patent applications to expand this layer of our intellectual property estate.

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the date of filing of the first non-provisional application to which priority is claimed. In the United States, a patent’s term may be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the U.S. Patent and Trademark Office in granting a patent, or may be shortened if a patent is terminally disclaimed over an earlier-filed patent. The term of a patent that covers an FDA-approved drug may also be eligible for a patent term restoration of up to five years under the Hatch-Waxman Act, which is designed to compensate for the patent term lost during the FDA regulatory review process. The length of the patent term restoration is calculated based on the length of time the drug is under regulatory review. A patent term restoration under the Hatch-Waxman Act cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval and only one patent applicable to an approved drug may be restored. Moreover, a patent can only be restored once, and thus, if a single patent is applicable to multiple products, it can only be extended based on one product. Similar provisions are available in Europe and certain other foreign jurisdictions to extend the term of a patent that covers an approved drug. When possible, depending upon the length of clinical trials and other factors involved in the submission of a BLA, we expect to apply for patent term extensions for patents covering our product candidates and their methods of use.

Our commercial success may depend in part on our ability to obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to our business; defend and enforce our patents; preserve the confidentiality of our trade secrets; and operate without infringing the valid enforceable patents and proprietary rights of third parties. Our ability to stop third parties from making, using, selling, offering to sell or importing our products may depend on the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities. With respect to both licensed and company-owned intellectual property, we cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our commercial products and methods of manufacturing the same.

We may rely, in some circumstances, on trade secrets to protect our technology. However, trade secrets can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by entering into confidentiality agreements with our employees, consultants, scientific advisors and contractors. We also seek to preserve the integrity and confidentiality of our data and trade secrets by maintaining physical security of our premises and physical and electronic security of our information technology systems. While we have confidence in these individuals, organizations and systems, agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently

16

discovered by competitors. To the extent that our consultants, contractors or collaborators use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

Our Research and Development and License Agreements

Pursuant to the CRADAs, we have an exclusive option to negotiate commercial licenses from the NIH, to intellectual property relating to CAR- and TCR-based product candidates developed in the course of a CRADA research plan. We currently have four patent license agreements with the NIH for intellectual property relating to various TCR-based product candidates and a CAR-based product candidate. We also have a license agreement with Cabaret and its founder relating to intellectual property and know-how owned or licensed by Cabaret and relating to CAR constructs that encompass KTE-C19. We have also entered into the Amgen Agreement, a collaboration agreement with bluebird bio, Inc. and a license and research agreement with AIS.

For additional information regarding the CRADAs and our license agreements, see Note 6 to our financial statements appearing elsewhere in this Annual Report.

T-Cell Factory Acquisition

On March 17, 2015, we entered into a stock purchase agreement, or Purchase Agreement, with TCF and the shareholders of TCF, or the Sellers, to acquire all of the outstanding capital stock of TCF. The signing and closing of the transaction happened concurrently whereupon TCF became our wholly-owned subsidiary and was renamed Kite Pharma EU. The Purchase Agreement contains certain representations, warranties, covenants and indemnities by the parties thereto, in each case customary for a transaction of this nature and scope.

Pursuant to the Purchase Agreement, we paid €11.4 million (or approximately US$12.0 million based on a reference conversion rate of €0.95 to US$1), and issued €3.8 million in shares of our common stock, which equated to 66,120 shares of our common stock, to the Sellers. The cash paid to the Sellers is subject to customary adjustments for net working capital. €2.0 million was withheld from the Sellers at closing to satisfy any potential indemnity claims arising under the Purchase Agreement, the balance of which will be paid to the Sellers upon the termination of an indemnity holdback period of 18 months. In addition, we paid €2.7 million (or approximately $2.9 million based on a reference conversion rate of €0.95 to $1) to TCF directly, which TCF paid, and will pay to its licensors and certain of its employees.

We are obligated to pay up to €242.5 million upon the achievement of certain clinical, regulatory and sales milestones relating to TCR-based product candidates that may be developed by Kite Pharma EU. A portion of these milestone payments will be made to Kite Pharma EU directly to pay its licensors and employees. At our option, a portion of the clinical and regulatory milestones may be paid in shares of our common stock to the Sellers. In connection with the acquisition, each of the Sellers entered into non-competition and non-solicitation agreements with us, and certain of the Sellers and other key scientists entered into employment agreements with Kite Pharma EU.

We acquired Kite Pharma EU for the opportunity to significantly expand our pipeline of TCR-based product candidates. Using its proprietary TCR-GENErator technology platform, we believe Kite Pharma EU can rapidly and systematically discover tumor-specific TCRs.

Kite Pharma EU has an exclusive license agreement with IBA GmbH, or IBA, for intellectual property rights relating to certain methods of selecting TCRs. In addition, Kite Pharma EU has a non-exclusive license agreement with Sanquin Blood Supply Foundation, relating to certain methods of detecting and selecting TCRs. Kite Pharma EU also has a license agreement with the NKI for know-how, materials and protocols, and the right of first negotiation for certain intellectual property rights with relevance to TCRs that may be developed in Dr. Schumacher’s lab at the NKI over the next five years. NKI, IBA and Sanquin Blood Supply Foundation have a right to a certain portion of the milestone payments that may be paid under the Purchase Agreement. The intellectual property rights obtained from the NKI, IBA and Sanquin Blood Supply Foundation together form the basis of Kite Pharma EU’s proprietary TCR-GENErator technology platform.

The Kite Pharma EU acquisition also brings us expertise from Europe’s leading scientists in the field of immuno-oncology as well as a strong partnership with the NKI, which is the only dedicated cancer center in the Netherlands and maintains an important role as a national and international center of scientific and clinical expertise, development and training. Dr. Schumacher, a preeminent scientist in the field of immuno-oncology and Deputy Director and Principal Investigator of NKI, serves as Chief Scientific Officer of Kite Pharma EU.

17

Presently, the biotechnology and pharmaceutical industries put significant resources in developing novel and proprietary therapies for the treatment of cancer. We compete with companies in the space of immunotherapy, as well as companies developing novel targeted therapies for cancer. We anticipate that we will face intense and increasing competition as new drugs and therapies enter the market and advanced technologies become available.

Due to their promising clinical therapeutic effect in clinical exploratory trials, we anticipate substantial direct competition from other organizations developing advanced T cell therapies. In particular, we expect to compete with (1) therapies with tumor infiltrating lymphocytes, or TILs, that are naturally occurring tumor-reactive T cells harvested, propagated ex vivo and re-infused into patients; and (2) therapies with genetically engineered T cells, similar to eACT, rendered reactive against tumor-associated antigens prior to their administration to patients. TIL therapy and genetically engineering T cells are being pursued by multiple companies, including Adaptimmune LLC, Celgene Corporation, bluebird bio, Inc., Lion Biotechnologies, Juno Therapeutics, Novartis and Mustang Bio, Inc. In particular, Novartis and Juno Therapeutics, with the support of Celgene Corporation, are in the process of research and development of their own version of an anti-CD19 CAR T cell therapy and we expect Adaptimmune to compete with any TCR-based product candidates that we develop. In addition, some companies, such as Cellectis, are pursuing allogeneic T cell products that could compete with eACT.

While we believe that other known types of immunotherapies, including those described under “—Other Immunotherapies” above, may potentially be used in conjunction with eACT, such as CPIs, to enhance efficacy, we do not expect substantial direct competition from these other types of immunotherapies. However, we cannot predict whether other types of immunotherapies may be enhanced and show greater efficacy, and we may have direct and substantial competition from such immunotherapies in the future.

Many of our competitors, either alone or with their strategic partners, have substantially greater financial, technical and human resources. Accordingly, our competitors may be more successful than us in obtaining approval for treatments and achieving widespread market acceptance and may render our treatments obsolete or non-competitive. Mergers and acquisitions in the biotechnology and pharmaceutical industries may result in even more resources being concentrated among a smaller number of our competitors. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical study sites and patient registration for clinical studies, as well as in acquiring technologies complementary to, or necessary for, our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

Government Regulation and Product Approval