Attached files

| file | filename |

|---|---|

| EX-10.2.8 - EXHIBIT 10.2.8 - PSYCHEMEDICS CORP | v432062_ex102-8.htm |

| EX-31.1 - EXHIBIT 31.1 - PSYCHEMEDICS CORP | v432062_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - PSYCHEMEDICS CORP | v432062_ex31-2.htm |

| EX-23.1 - EXHIBIT 23.1 - PSYCHEMEDICS CORP | v432062_ex23-1.htm |

| EX-32.1 - EXHIBIT 32.1 - PSYCHEMEDICS CORP | v432062_ex32-1.htm |

| EX-24 - EXHIBIT 24 - PSYCHEMEDICS CORP | v432062_ex24.htm |

| EX-32.2 - EXHIBIT 32.2 - PSYCHEMEDICS CORP | v432062_ex32-2.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2015

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-13738

PSYCHEMEDICS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 58-1701987 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| 125 Nagog Park Acton, Massachusetts |

01720 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number Including Area Code: (978) 206-8220

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class | Name of each exchange on which registered: |

| Common Stock, $0.005 par value | The Nasdaq Stock Market L.L.C. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Exchange Act of 1934). Yes ¨ No x

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934). Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer o | Smaller Reporting Company x |

(Do not check if a smaller reporting company)

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities and Exchange Act of 1934). Yes o No x

As of June 30, 2015, there were 5,422,541 shares of Common Stock of the Registrant outstanding. The aggregate market value of the Common Stock of the Registrant held by non-affiliates (assuming for these purposes, but not conceding, that all executive officers, directors and 5% shareholders are “affiliates” of the Registrant) as of June 30, 2015 was approximately $58.5 million, computed based upon the closing price of $14.83 per share on June 30, 2015.

As of February 26, 2016, there were 5,422,541 shares of Common Stock of the Registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference portions of the Registrant’s definitive proxy statement, to be filed with the Securities and Exchange Commission no later than 120 days after the close of its fiscal year; provided that if such proxy statement is not filed with the Commission in such 120-day period, an amendment to this Form 10-K shall be filed no later than the end of the 120-day period.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Business,” “Risk Factors,” “Legal Proceedings,” “Market for Registrant’s Common Stock and Related Stockholder Matters” and “Management Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on Form 10-K (this “Form 10-K”) constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements made with respect to future earnings per share, future revenues, future operating income, future cash flows, competitive and strategic initiatives, potential stock repurchases and future liquidity needs. These statements involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, growth, performance, earnings per share or achievements to be materially different from any future results, levels of activity, growth, performance, earnings per share or achievements expressed or implied by such forward-looking statements.

The forward-looking statements included in this Form 10-K and referred to elsewhere are related to future events or our strategies or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “believe,” “anticipate,” “future,” “potential,” “estimate,” “encourage,” “opportunity,” “growth,” “leader,” “could”, “expect,” “intend,” “plan,” “expand,” “focus,” “through,” “strategy,” “provide,” “offer,” “allow,” “commitment,” “implement,” “result,” “increase,” “establish,” “perform,” “make,” “continue,” “can,” “ongoing,” “include” or the negative of such terms or comparable terminology. All forward-looking statements included in this Form 10-K are based on information available to us as of the filing date of this report, and the Company assumes no obligation to update any such forward-looking statements. Our actual results could differ materially from the forward-looking statements.

Factors that may cause such differences include but are not limited to: (1) intense competition in the drug testing industry, particularly among companies that test utilizing hair samples; (2) risks associated with the development of markets for new products and services offered; (3) risks associated with capacity expansion; (4) risks associated with U.S. government regulations, including, but not limited to, FDA regulations, (5) risks associated with our international operations, including, but not limited to, Brazilian laws, proposed laws and regulations, and currency risks; (6) Psychemedics' ability to maintain its reputation and brand image; (7) the ability of Psychemedics to achieve its business plans, productivity improvements, cost controls, leveraging of its global operating platform, and acceleration of the rate of innovation; (8) information technology system failures and data security breaches; (9) the uncertain global economy; (10) our ability to attract, develop and retain executives and other qualified employees; (11) Psychemedics' ability to obtain and protect intellectual property rights; and (12) changes in economic conditions which affect demand for our products and services.

Additional important factors that could cause actual results to differ materially from expectations reflected in our forward-looking statements include those described in Item 1A, “Risk Factors.”

| i |

FORM 10-K

ANNUAL REPORT

For the Year Ended December 31, 2015

TABLE OF CONTENTS

| ii |

Available Information; Background

Psychemedics Corporation (“the Company” or “Psychemedics”) maintains executive offices located at 125 Nagog Park, Acton, MA 01720. Our telephone number is (978) 206-8220. Our stock is traded on the NASDAQ Stock Market under the symbol “PMD”. Our Internet address is www.psychemedics.com. The Company makes available, free of charge, on the Investor Information section of its website, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). Copies are also available, without charge, from Psychemedics Corporation, Attn: Investor Relations, 125 Nagog Park, Acton, MA 01720. Alternatively, reports filed with the SEC may be viewed or obtained at the SEC Public Reference Room in Washington, D.C., or the SEC’s Internet site at www.sec.gov. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

General

Psychemedics Corporation is a Delaware corporation organized on September 24, 1986 to provide testing services for the detection of drugs of abuse through the analysis of hair samples. The Company’s testing methods utilize a patented technology that digests the hair and releases drugs trapped in the hair without destroying the drugs. This is fundamental to the entire process because the patented method gets virtually 100% of the drug out of the hair, and if you cannot get the drug out of the hair, you cannot measure it. The Company then performs a proprietary custom-designed enzyme immunoassay (EIA) on the liquid supernatant, with confirmation testing by mass spectrometry.

The Company’s primary application of its patented technology is as a testing service that analyzes hair samples for the presence of certain drugs of abuse. The Company’s customized proprietary EIA procedures to drug test hair samples differ from the more commonly used immunoassay procedures employed to test urine samples. The Company’s tests provide quantitative information that can indicate the approximate amount of drug ingested as well as historical data, which can show a pattern of individual drug use over a longer period of time, thereby providing superior detection compared to other types of drug testing. This information is useful to employers for both applicant and employee testing, as well as treatment professionals, law enforcement agencies, school administrators, and parents concerned about their children’s drug use. The Company provides screening and confirmation by mass spectrometry using industry-accepted practices for cocaine, marijuana, PCP, amphetamines (including ecstasy, eve and Adderall) and opiates (including heroin, hydrocodone, hydromorphone, oxycodone, oxymorphone and codeine). In addition, in 2013, the Company launched a hair test for alcohol which also looks back on use over a 90 day period, as our hair drug tests do.

Testing services are currently performed at the Company’s Culver City, California campus located at 5832 Uplander Way and 6100 Bristol Parkway.

Background on Drug Testing with Hair

When certain chemical substances enter the bloodstream, the blood carries these substances to the hair where they become “entrapped” in the protein matrix in amounts approximately proportional to the amount ingested. The Company utilizes a patented drug extraction method followed by a unique enzyme immunoassay (EIA) procedure to identify drugs in the hair. The patented drug extraction method effectively releases drugs from the hair without destroying the drugs, getting virtually 100% of the drug out of the hair. The patented method can be used with a broad range of immunoassay screen techniques and mass spectrometry methods.

The immunoassays produced by the Psychemedics R&D team were uniquely designed specifically to meet and even exceed the standards of radioimmunoassay (“RIAH”), the original testing method created and utilized by the Company prior to 2013. Because Psychemedics is the only hair testing laboratory that manufactures its own screening assays, it has full control over all aspects of its technology, and that powerful advantage facilitated the Company's creation of its EIA assays with equivalence to its own previously FDA-cleared radioimmunoassays.

The EIA screened positive results are then confirmed by mass spectrometry. Depending upon the length of hair, the Company is able to provide historical information on drug use by the person from whom the sample was obtained. Because head hair grows approximately 1.3 centimeters per month, a 3.9 centimeter head hair sample can reflect drug ingestion over the approximate three months prior to the collection of the sample. Another option is sectional analysis of the head hair sample, in which the hair is sectioned lengthwise to approximately correspond to certain time periods, thereby providing information on patterns of drug use.

Validation of the Company’s Proprietary Testing Methods

The process of analyzing human hair for the presence of drugs has been the subject of numerous peer-reviewed, scientific field studies. Some of these studies were performed with the following organizations: Boston University School of Public Health; Citizens for a Better Community Court, Columbia University; Connecticut Department of Mental Health and Addictive Services; Koba Associates-DC Initiative, Harvard Cocaine Recovery Project; Hutzel Hospital, ISA Associates (Interscience America)-NIDA Workplace Study; University of California-Sleep State Organization; Maternal/Child Substance Abuse Project, Matrix Center, National Public Services Research Institute, Narcotic and Drug Research Institute, San Diego State University-Chemical Dependency Center, Spectrum Inc.; Stapleford Centre (London); Task Force on Violent Crime (Cleveland, Ohio); University of Miami-Department of Psychiatry, University of Miami-Division of Neonatology; University of South Florida-Operation Par Inc.; University of Washington, VA Medical Center-Georgia; U.S. Probation Parole-Santa Ana; and Wayne State University. The above studies included research in the following areas: effects of prenatal drug use, treatment evaluation, workplace drug use, the criminal justice system and epidemiology. Many of the studies have been funded by the National Institute of Justice or the National Institute on Drug Abuse (“NIDA”). Several hundred research articles written by independent researchers have been published supporting the general validity and usefulness of hair analysis.

1

Some of the Company’s customers have also completed their own testing to validate the Company’s hair test results compared to other companies’ urine test results. These studies consistently confirmed the Company’s superior detection rate compared to urinalysis testing. When results from the Company’s hair testing methods were compared to urine results in side-by-side evaluations, 5 to 10 times as many drug abusers were accurately identified by the Company’s proprietary methods.

In 1998, the National Institute of Justice, utilizing Psychemedics’ previously utilized RIAH hair testing assay, completed a Pennsylvania Prison study where hair analysis revealed an average prison drug use level of approximately 7.9% in 1996. Comparatively, urinalysis revealed virtually no positives. After measures to curtail drug use were instituted (drug-sniffing dogs, searches and scanners), the use level fell to approximately 2% according to the results of hair analysis in 1998. Again, the urine tests showed virtually no positives. The study illustrates the usefulness of hair analysis to monitor populations and the weakness of urinalysis.

The Company has received 510k clearance from the Food and Drug Administration (FDA) on seven EIA assays used to test head and body hair for drugs of abuse. As of the date of this document, Psychemedics is the only company to receive FDA clearance for testing of drugs of abuse using both head and body hair for seven drugs of abuse.

The Company’s decontamination wash protocol and the effects in eliminating surface contamination were analyzed in a study conducted by scientists at the Laboratory of the Federal Bureau of Investigation and published in August 2014 in the Journal of Analytical Toxicology. The FBI concluded that the use of an extended wash protocol of the type used by the Company will exclude false positive results from environmental contact with cocaine. In the study, the FBI cited Psychemedics’ studies published in 1993, 2002, 2004, and 2005, and named our lab director Dr. Michael Schaffer and our lab in its acknowledgments. The FBI study also supported the use of metabolites known as hydroxycocaines as evidence of ingestion. These metabolites were first identified in hair by Psychemedics.

Advantages of Using the Company’s Patented Method

The Company asserts that hair testing using its patented method confers substantive advantages over detection through urinalysis. Although urinalysis testing can provide accurate drug use information, the scope of the information is short-term and is generally limited to the type of drug ingested within a few days of the test. Studies published in many scientific publications have indicated that most drugs disappear from urine within a few days.

In contrast to urinalysis testing, hair testing using the Company’s patented method can provide long-term historical drug use information resulting in a significantly wider window of detection. This window may be several months or longer depending on the length of the hair sample. The Company’s standard test offering, however, uses a 3.9 centimeter length head hair sample cut close to the scalp, which measures use for approximately three months prior to collection of the sample.

This wider window enhances the detection efficiency of hair analysis, making it particularly useful in pre-employment and random testing. Hair testing not only identifies more drug users, but it may also uncover patterns and severity of drug use (information most helpful in determining the scope of an individual’s involvement with drugs), while serving as a deterrent against drug use. Hair testing employing the Company’s patented method greatly reduces the incidence of “false negatives” associated with evasive measures typically encountered with urinalysis testing. For example, urinalysis test results are adversely impacted by excessive fluid intake prior to testing and by adulteration or substitution of the urine sample. Moreover, a drug user who abstains from use for a few days prior to urinalysis testing can usually escape detection. Hair testing is effectively free of these problems, as it cannot be thwarted by evasive measures typically encountered with urinalysis testing. Hair testing is also attractive to customers since sample collection is typically performed under close supervision yet is less intrusive and less embarrassing for test subjects.

Hair testing using the Company’s patented method (with mass spectrometry confirmation) further reduces the prospects of error in conducting drug detection tests. Urinalysis testing is more susceptible to problems such as “evidentiary false positives” resulting from passive drug exposure or poppy seeds. To combat this problem, in federally mandated testing, the opiate cutoff levels for urine testing were raised 667% (from 300 to 2,000 ng/ml) on December 1, 1998, and testing for the presence of a heroin metabolite, 6-MAM, was required. These requirements, however, effectively reduced the detection time frame for confirmed heroin use, such that 6-MAM in urine can typically only be detected for several hours post drug use. In contrast, the metabolite 6-MAM is stable in hair and can be detected for months.

In the event a positive urinalysis test result is challenged, a test on a newly collected urine sample is not a viable remedy. Unless the forewarned individual continues to use drugs prior to the date of the newly collected sample, a re-test may yield a negative result when using urinalysis testing because of temporary abstinence. In contrast, when the Company’s hair testing method is offered on a repeat hair sample, the individual suspected of drug use cannot as easily affect the results because historical drug use data remains locked in the hair fiber.

2

When compared to other hair testing methods, not only are the Company’s assays cleared by the FDA for head and body hair, they also employ a unique patented method of digesting hair that the Company believes allows for the most efficient release of drugs from the hair without destroying the drugs. The Company’s method of releasing drugs from hair is a key advantage and results in superior detection rates.

Disadvantages of Hair Testing

There are some disadvantages of hair testing as compared to drug detection through urinalysis. Because hair starts growing below the skin surface, drug ingestion evidence does not appear in hair above the scalp until approximately five to seven days after use.

Thus, hair testing is not suitable for determining drug presence in “for cause” testing as is done in connection with an accident investigation. It does, however, provide a drug history which can complement urinalysis information in “for cause” testing.

The Company’s prices for its tests are generally somewhat higher than prices for tests using urinalysis, but the Company believes that its superior detection rates provide more value to the customer. This pricing policy could, however, adversely impact the growth of the Company’s sales volume.

Hair Alcohol Testing

In 2013, the Company launched a test for alcohol using hair. This test measures average alcohol consumption over a period of approximately three months, indicates the approximate level of alcohol use during that time period, and can provide a behavioral indication of excessive use. The test measures the amount of ethyl glucuronide (EtG) in the hair – a trace metabolite of ethanol and a direct alcohol biomarker. The test follows the guidelines determined by the World Health Organization in association with the Society of Hair Testing for measuring consumption.

Intellectual Property

Certain aspects of the hair analysis method currently used by the Company are covered by US and foreign patents owned by the Company. The Company has been granted a total of ten US patents, including a patent issued to the Company in 2011 that focuses on digesting hair and releasing drugs trapped in the hair without destroying the drugs. This patent can be used with a broad range of immunoassay screen techniques, mass spectrometry methods, and chromatographic procedures. In 2012, the Company received an additional patent that extended the range of the patent received in 2011. Additional patent applications are currently pending in the U.S. and internationally.

The Company also relies on trade secrets to protect certain aspects of its proprietary technology. The Company’s ability to protect the confidentiality of its trade secrets is dependent upon the Company’s internal safeguards and upon the laws protecting trade secrets and unfair competition.

In the event that patent protection or protection under the laws of trade secrets is not sufficient and the Company’s competitors succeed in duplicating the Company’s products, the Company’s business could be materially adversely affected.

Target Markets

Workplace

The Company focuses its primary marketing efforts on the private sector, with particular emphasis on job applicant and employee testing.

Most businesses use drug testing to screen job applicants and employees. The Hazeldon Foundation survey from 2007 indicated that 85 percent of human resource (“HR”) professionals believe that drug testing is an effective way to identify substance abuse. The prevalence of drug screening programs reflects a concern that drug use contributes to employee health problems and costs (as the same study found that 62 percent of HR professionals believe that absenteeism is the most significant problem caused by substance abuse and addiction, followed at 49 percent by reduced productivity, a lack of trustworthiness at 39 percent, a negative impact on the company’s external image at 32 percent, missed deadlines at 31 percent, and in certain industries, safety hazards.) It has been estimated that the cost to American businesses is more than $100 billion annually.

The principal criticism of employee drug testing programs centers on the effectiveness of the testing program. Most private sector testing programs use urinalysis. Such programs are susceptible to evasive maneuvers and the inability to obtain confirmation through repeat samples in the event of a challenged result. An industry has developed over the Internet, and through direct mail, marketing a wide variety of adulterants, dilutants, clean urine and devices to assist drug users in falsifying urine test results.

Moreover, scheduled tests such as pre-employment testing and some random testing programs provide an opportunity for many drug users to simply abstain for a few days in order to escape detection by urinalysis.

The Company presents its patented hair analysis method to potential clients as a better technology well suited to employer needs. Field studies and actual client results support the accuracy and superior effectiveness of the Company’s patented technology and its ability to detect varying levels of drug use.

The Company performs a confirmation test of all screened positive results through mass spectrometry. The use of mass spectrometry is an industry accepted practice used to confirm a positive test result from the screening process. The Company offers its clients an expanded drug screen with mass spectrometry confirmation of cocaine, PCP, marijuana, amphetamines (including Ecstasy and Eve), and opiates (including heroin, codeine, hydrocodone, hydromorphone, and oxycodone). In addition, the Company offers a hair test for alcohol which also looks back on use over a 90 day period, as our hair drug tests do.

3

Schools

The Company currently serves hundreds of schools throughout the United States and in several foreign countries. The Company offers its school clients the same five-drug screen with mass spectrometry confirmation that is used with the Company’s workplace testing service. In addition, the Company offers a hair test for alcohol which also looks back on use over a 90 day period, as our hair drug tests do.

Parents

The Company also offers a personal drug testing service, known as “PDT-90”®, for parents concerned about drug use by their children. It allows parents to collect a small sample of hair from their child in the privacy of the home, send it to the Company’s laboratory and have it tested for drugs of abuse by the Company. The PDT-90 testing service uses the same patented method that is used with the Company’s workplace testing service.

Research

The Company is involved in the following ongoing studies involving use of drugs of abuse in various populations: Mclean Hospital and Wayne State University.

Sales and Marketing

The Company markets its corporate drug testing services primarily through its own sales force and through distributors. Sales offices are located in several major cities in the United States in order to facilitate communications with corporate employers. The Company markets its home drug testing service, PDT-90, through the Internet.

Competition

The Company competes directly with numerous commercial laboratories that test for drugs primarily through urinalysis testing. Most of these laboratories, such as Quest Diagnostics, have substantially greater financial resources, market identity, marketing organizations, facilities, and more personnel than the Company. The Company has been steadily increasing its base of corporate customers and believes that future success with new customers is dependent on the Company’s ability to communicate the advantages of implementing a drug program utilizing the Company’s patented hair analysis method.

The Company’s ability to compete is also a function of pricing. The Company’s prices for its tests are generally somewhat higher than prices for tests using urinalysis. However, the Company believes that its superior detection rates, coupled with the customer’s ability to test less frequently due to hair testing’s wider window of detection (several months versus approximately three days with urinalysis), provide more value to the customer. This pricing policy could, however, lead to slower sales growth for the Company.

The Company also competes with other hair testing laboratories. The Company distinguishes itself from hair testing competitors by emphasizing the superior results the Company obtains through use of its unique patented extraction method (getting drug out of the hair), in combination with the Company’s FDA cleared immunoassay screen.

Government Regulation

The Company is licensed as a clinical laboratory by the State of California as well as certain other states. All tests are performed according to the laboratory standards established by the Department of Health and Human Services, through the Clinical Laboratories Improvement Amendments (“CLIA”), and various state licensing statutes.

A substantial number of states regulate drug testing. The scope and nature of such regulations varies greatly from state to state and is subject to change from time to time. The Company addresses state law issues on an ongoing basis.

The Federal Food, Drug and Cosmetic Act, as amended (the “FDC Act”) requires companies engaged in the business of testing for drugs of abuse using a test (screening assay) not previously recognized by the FDA to submit their assay to the FDA for recognition prior to marketing. In addition, the laboratory performing the tests is required to be certified by a recognized agency. In 2002, the Company received 510k clearance to market all five of its assays utilizing RIAH technology.

In 2008, the Company received the first CAP (College of American Pathologists) certification specifically including hair testing.

In 2011, the Company received ISO/IEC 17025 International Accreditation for a broad spectrum of laboratory testing including drugs of abuse and forensics in hair and urine specimens. ISO/IEC 17025 accreditation provides formal recognition to laboratories that demonstrate technical competency, and maintains this recognition through periodic evaluations to ensure continued compliance.

In 2012, the Company received 510k clearance from the FDA to market five of its assays utilizing the Company’s custom developed EIA technology.

In 2013, the Company received 510k clearance from the FDA to market two additional assays utilizing the Company’s custom developed EIA technology.

4

Research and Development

The Company is continuously engaged in research and development activities. During the years ended December 31, 2015, 2014 and 2013, $1.6 million, $1.3 million and $825 thousand, respectively, were expended for research and development. The Company continues to perform research activities to develop new products and services and to improve existing products and services utilizing the Company’s proprietary technology. The Company also continues to evaluate methodologies to enhance its drug screening capabilities. Additional research using the Company’s proprietary technology is being conducted by outside research organizations through government-funded studies.

Employees

As of December 31, 2015, the Company had 154 full-time equivalent employees, 7 of whom are in R&D. None of the Company’s employees are subject to a collective bargaining agreement.

5

In addition to other information contained in this Form 10-K, the following risk factors should be carefully considered in evaluating Psychemedics Corporation and its business because such factors could have a significant impact on our business, operating results and financial condition. These risk factors could cause actual results to materially differ from those projected in any forward-looking statements.

Companies may develop products that compete with our products and some of these companies may be larger and better capitalized than we are.

Many of our competitors and potential competitors are larger and have greater financial resources than we do and offer a range of products broader than our products. Some of the companies with which we now compete or may compete in the future may develop more extensive research and marketing capabilities and greater technical and personnel resources than we do, and may become better positioned to compete in an evolving industry. Failure to compete successfully could harm our business and prospects.

Increased competition, including price competition, could have a material impact on the Company’s net revenues and profitability.

Our business is intensely competitive, both in terms of price and service. Pricing of drug testing services is a significant factor often considered by customers in selecting a drug testing laboratory. As a result of the clinical laboratory industry undergoing significant consolidation, larger clinical laboratory providers are able to increase cost efficiencies afforded by large-scale automated testing. This consolidation results in greater price competition. The Company may be unable to increase cost efficiencies sufficiently, if at all, and as a result, its net earnings and cash flows could be negatively impacted by such price competition. The Company may also face increased competition from companies that do not comply with existing laws or regulations or otherwise disregard compliance standards in the industry. Additionally, the Company may also face changes in fee schedules, competitive bidding for laboratory services or other actions or pressures reducing payment schedules as a result of increased or additional competition. Additional competition, including price competition, could have a material adverse impact on the Company’s net revenues and profitability.

Our results of operations are subject in part to variation in our customers’ hiring practices and other factors beyond our control.

Our results of operations have been and may continue to be subject to variation in our customers’ hiring practices, which in turn is dependent, to a large extent, on the general condition of the economy. Results for a particular quarter may vary due to a number of factors, including:

| • | economic conditions in our markets in general; |

| • | economic conditions affecting our customers and their particular industries; |

| • | the introduction of new products and product enhancements by us or our competitors; and |

| • | pricing and other competitive conditions. |

A failure to obtain and retain new customers, or a loss of existing customers, or a reduction in tests ordered, could impact the Company’s ability to successfully grow its business.

The Company needs to obtain and retain new customers. In addition, a reduction in tests ordered, without offsetting growth in its customer base, could impact the Company’s ability to successfully grow its business and could have a material adverse impact on the Company’s net revenues and profitability. We compete primarily on the basis of the quality of testing, reputation in the industry, the pricing of services and ability to employ qualified personnel. The Company’s failure to successfully compete on any of these factors could result in the loss of customers and a reduction in the Company’s ability to expand its customer base.

Our business could be harmed if we are unable to protect our technology.

We rely primarily on a combination of trade secrets, patents and trademark laws and confidentiality procedures to protect our technology. Despite these precautions, unauthorized third parties may infringe or copy portions of our technology. In addition, because patent applications in the United States are not publicly disclosed until either (1) 18 months after the application filing date or (2) the publication date of an issued patent wherein applicant(s) seek only US patent protection, applications not yet disclosed may have been filed which relate to our technology. Moreover, there is a risk that foreign intellectual property laws will not protect our intellectual property rights to the same extent as United States intellectual property laws. In the absence of the foregoing protections, we may be vulnerable to competitors who attempt to copy our products, processes or technology.

Our business could be affected by a computer or other IT system failure.

A computer or IT system failure could affect our ability to perform tests, report test results or properly bill customers. Failures could occur as a result of the standardization of our IT systems and other system conversions, telecommunications failures, malicious human acts (such as electronic break-ins or computer viruses) or natural disasters. Sustained system failures or interruption of the Company’s systems in one or more of its operations could disrupt the Company’s ability to process and provide test results in a timely manner and/or bill the appropriate party. Failure of the Company’s information systems could adversely affect the Company’s business, profitability and financial condition.

6

Failure to maintain confidential information could result in a significant financial impact.

The Company maintains confidential information regarding the results of drug tests and other information including credit card and payment information from our customers. The failure to protect this information could result in lawsuits, fines or penalties. Any loss of data or breach of confidentiality, such as through a computer security breach, could expose the Company to a financial liability.

Our future success will depend on the continued services of our key personnel.

The loss of any of our key personnel could harm our business and prospects. We may not be able to attract and retain personnel necessary for the development of our business. We do not have key personnel under contract other than 3 officers who have agreements providing for severance and non-compete covenants in the event of termination of employment following a change of control. Further, we do not have any key man life insurance for any of our officers or other key personnel.

There is a risk that our insurance will not be sufficient to protect us from errors and omissions liability or other claims, or that in the future errors and omissions insurance will not be available to us at a reasonable cost, if at all.

Our business involves the risk of claims of errors and omissions and other claims inherent to our business. We maintain errors and omissions and general liability insurance subject to deductibles and exclusions. There is a risk that our insurance will not be sufficient to protect us from all such possible claims. An under-insured or uninsured claim could harm our operating results or financial condition.

Our research and development capabilities may not produce viable new services or products.

In order to remain competitive, we need to continually improve our products, develop new technologies to replace older technologies that have either become obsolete or for which patent protection is no longer available. It is uncertain whether we will continually be able to develop services that are more efficient, effective or that are suitable for our customers. Our ability to create viable products or services depends on many factors, including the implementation of appropriate technologies, the development of effective new research tools, the complexity of the chemistry and biology, the lack of predictability in the scientific process and the performance and decision-making capabilities of our scientists. There is no guarantee that our research and development teams will be successful in developing improvements to our technology.

Improved testing technologies, or the Company’s customers using new technologies to perform their own tests, could adversely affect the Company’s business.

Advances in technology may lead to the development of more cost-effective technologies that can be operated by third parties or customers themselves in their own offices, without requiring the services of a freestanding laboratory. Development of such technology and its use by the Company’s customers could reduce the demand for its testing services and negatively impact our revenues.

We may not be able to recruit and retain the experienced scientists and management we need to compete in our industry.

Our future success depends upon our ability to attract, retain and motivate highly skilled scientists and management. Our ability to achieve our business strategies depends on our ability to hire and retain high caliber scientists and other qualified experts. We compete with other testing companies, research companies and academic and research institutions to recruit personnel and face significant competition for qualified personnel. We may incur greater costs than anticipated, or may not be successful, in attracting new scientists or management or in retaining or motivating our existing personnel.

Our future success also depends on the personal efforts and abilities of the principal members of our senior management and scientific staff to provide strategic direction, to manage our operations and maintain a cohesive and stable environment.

Our facilities and practices may fail to comply with government regulations.

Our testing facilities and processes must be operated in conformity with current government regulations. These requirements include, among other things, quality control, quality assurance and the maintenance of records and documentation. If we fail to comply with these requirements, we may not be able to continue our services to certain customers, or we could be subject to fines and penalties, suspension of production, or withdrawal of our certifications. We operate a facility that we believe conforms to all applicable requirements. This facility and our testing practices are subject to periodic regulatory inspections to ensure compliance.

Our business could be harmed from the loss or suspension of any licenses.

The forensic laboratory testing industry is subject to significant regulation and many of these statutes and regulations are subject to change. The Company cannot assure that applicable statutes and regulations will not be interpreted or applied by a regulatory authority in a manner that would adversely affect its business. Potential sanctions for violation of these regulations could include the suspension or loss of various licenses, certificates and authorizations, which could have a material adverse effect on the Company’s business.

If our use of chemical and hazardous materials violates applicable laws or regulations or causes personal injury we may be liable for damages.

Our drug testing activities, including the analysis and synthesis of chemicals, involve the controlled use of chemicals, including flammable, combustible, and toxic materials that are potentially hazardous. Our use, storage, handling and disposal of these materials is subject to federal, state and local laws and regulations, including the Resource Conservation and Recovery Act, the Occupational Safety and Health Act and local fire codes, and regulations promulgated by the Department of Transportation, the Drug Enforcement Agency, the Department of Energy, and the California Department of Public Health and Environment. We may incur significant costs to comply with these laws and regulations in the future. In addition, we cannot completely eliminate the risk of accidental contamination or injury from these materials, which could result in material unanticipated expenses, such as substantial fines or penalties, remediation costs or damages, or the loss of a permit or other authorization to operate or engage in our business. Those expenses could exceed our net worth and limit our ability to raise additional capital.

7

Our operations could be interrupted by damage to our laboratory facilities.

Our operations are dependent upon the continued use of our laboratories and equipment in Culver City, California. Catastrophic events, including earthquakes, fires or explosions, could damage our laboratories, equipment, scientific data, work in progress or inventories of chemicals and may materially interrupt our business. We employ safety precautions in our laboratory activities in order to reduce the likelihood of the occurrence of certain catastrophic events; however, we cannot eliminate the chance that such events will occur. Rebuilding our facilities could be time consuming and result in substantial delays in fulfilling our agreements with our customers. We maintain business interruption insurance to cover continuing expenses and lost revenue caused by such occurrences. However, this insurance does not compensate us for the loss of opportunity and potential harm to customer relations that our inability to meet our customers’ needs in a timely manner could create.

Agreements we have with our employees, consultants and customers may not afford adequate protection for our trade secrets, confidential information and other proprietary information.

In addition to patent protection, we also rely on copyright and trademark protection, trade secrets, know-how, continuing technological innovation and licensing opportunities. In an effort to maintain the confidentiality and ownership of our trade secrets and proprietary information, we require our employees, consultants and advisors to execute confidentiality and proprietary information agreements. However, these agreements may not provide us with adequate protection against improper use or disclosure of confidential information and there may not be adequate remedies in the event of unauthorized use or disclosure. Furthermore, we may from time to time hire scientific personnel formerly employed by other companies involved in one or more areas similar to the activities we conduct. In some situations, our confidentiality and proprietary information agreements may conflict with, or be subject to, the rights of third parties with whom our employees, consultants or advisors have prior employment or consulting relationships. Although we require our employees and consultants to maintain the confidentiality of all proprietary information of their previous employers, these individuals, or we, may be subject to allegations of trade secret misappropriation or other similar claims as a result of their prior affiliations. Finally, others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets. Our failure or inability to protect our proprietary information and techniques may inhibit or limit our ability to compete effectively, or exclude certain competitors from the market.

Risks Related to Our Stock

Our quarterly operating results could fluctuate significantly, which could cause our stock price to decline.

Our quarterly operating results have fluctuated in the past and are likely to fluctuate in the future. Our results are impacted by the extent to which we are able to gain new customers, both domestically and internationally, and on the hiring practices of our existing customers, which are, in turn, impacted by changes in government requirements regarding testing for drugs of abuse, delays in implementation of such requirements, as well as general economic conditions. Entering into new customer contracts can involve a long lead time. Accordingly, negotiation can be lengthy and is subject to a number of significant risks, including customers’ budgetary constraints and internal reviews. Due to these and other market factors, our operating results could fluctuate significantly from quarter to quarter. In addition, we may experience significant fluctuations in quarterly operating results due to factors such as general and industry-specific economic conditions that may affect the budgets and the hiring practices of our customers.

Due to the possibility of fluctuations in our revenue and expenses, we believe that quarter-to-quarter comparisons of our operating results are not necessarily a good indication of our future performance. Our operating results in some quarters may not meet the expectations of stock market analysts and investors. If we do not meet analysts’ and/or investors’ expectations, our stock price could decline.

Our stock price could experience substantial volatility.

The market price of our common stock has historically experienced and may continue to experience extensive volatility. Our quarterly operating results, the success or failure of future development efforts, changes in general conditions in the economy or the financial markets and other developments affecting our customers, our competitors or us could cause the market price of our common stock to fluctuate substantially. This volatility may adversely affect the price of our common stock. In the past, securities class action litigation has often been instituted following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in potential liabilities, substantial costs and the diversion of management’s attention and resources, regardless of whether we win or lose.

8

Payment of a dividend could decline or cease.

Because we have historically paid dividends, any cessation of our program or reduction in our quarterly dividend could affect our stock price. We have paid dividends on our common stock for 77 consecutive quarters. It is our intent to continue this practice as long as we are able. However, if we are forced to cease this practice or reduce the amount of the regular dividend, due to operating or economic conditions, our stock price could suffer. Further, if the Company ceases its future dividends, a return on investment in our common stock would depend entirely upon future appreciation. There is no guarantee that our common stock will appreciate in value or even maintain the price at which stockholders have purchased their shares.

The general economic condition could deteriorate.

Our business is dependent upon new hiring and the supply of new jobs created by overall economic conditions. If the economy deteriorates, leading to a downturn in new job creation, our business and stock price could be adversely affected.

Item 1B. Unresolved Staff Comments

Not applicable.

The Company maintains its corporate office and northeast sales office at 125 Nagog Park, Acton, Massachusetts; the office consists of 3,971 square feet and is leased through February 2018.

The Company leases two facilities for laboratory purposes in Culver City, California. The first is 13,900 square feet of space with an additional 9,600 feet of storage space. This facility is leased through December 31, 2020 with an option to renew for an additional two years. In 2014, the Company added a second facility of 16,000 square feet of space. This facility is leased through March 14, 2017 with an option to renew for an additional two years.

The Company is involved in various suits and claims in the ordinary course of business. The Company does not believe that the disposition of any such suits or claims will have a material adverse effect on the continuing operations or financial condition of the Company.

Item 4. Mine Safety Disclosures

Not applicable.

9

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

The Company’s common stock is traded on the NASDAQ Stock Market under the symbol “PMD”. As of February 26, 2016, there were 180 record holders of the Company’s common stock. The number of record owners was determined from the Company’s stockholder records maintained by the Company’s transfer agent and does not include beneficial owners of the Company’s common stock whose shares are held in the names of various security holders, dealers and clearing agencies. The Company believes that the number of beneficial owners of the Company’s common stock held by others as or in nominee names exceeds 3,000.

The following table sets forth for the periods indicated the range of prices for the Company’s common stock as reported by the NASDAQ Stock Market and dividends declared by the Company.

| High | Low | Dividends | ||||||||||

| Fiscal 2015: | ||||||||||||

| First Quarter | $ | 16.85 | $ | 14.25 | $ | 0.15 | ||||||

| Second Quarter | 17.83 | 14.10 | 0.15 | |||||||||

| Third Quarter | 15.10 | 9.82 | 0.15 | |||||||||

| Fourth Quarter | 11.80 | 9.50 | 0.15 | |||||||||

| Fiscal 2014: | ||||||||||||

| First Quarter | $ | 18.76 | $ | 14.41 | $ | 0.15 | ||||||

| Second Quarter | 17.47 | 14.06 | 0.15 | |||||||||

| Third Quarter | 15.39 | 12.42 | 0.15 | |||||||||

| Fourth Quarter | 15.46 | 13.06 | 0.15 | |||||||||

The Company has paid dividends over the past nineteen years. It most recently declared a dividend on February 9, 2016, which will be paid on March 4, 2016. The Company’s current intention is to continue to declare dividends to the extent funds are available and not required for operating purposes or capital requirements, and only then, upon approval by the Board of Directors.

Issuer Purchases of Equity Securities

During 2015, the Company did not repurchase any common shares for treasury.

Unregistered Sales of Equity Securities and Use of Proceeds

There were no unregistered sales of common stock of the Company during 2015.

10

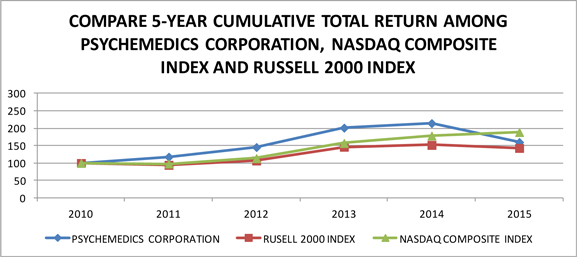

Performance Graph

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||||||

| Psychemedics Corp. | 100.00 | 117.96 | 145.63 | 201.35 | 214.39 | 160.15 | ||||||||||||||||||

| Russell 2000 Index | 100.00 | 94.60 | 107.03 | 146.64 | 151.81 | 143.14 | ||||||||||||||||||

| NASDAQ Composite Index | 100.00 | 98.20 | 113.82 | 157.44 | 178.53 | 188.75 | ||||||||||||||||||

Calculated by the Company using www.yahoo.com/finance historical prices

| (1) | The above graph assumes a $100 investment on December 31, 2010, through the end of the 5-year period ended December 31, 2015 in the Company’s Common Stock, the Russell 2000 Index and the NASDAQ Composite Index. The prices all assume the reinvestment of dividends. |

| (2) | The Russell 2000 Index is composed of the smallest 2,000 companies in the Russell 3,000 Index. The Company has been unable to identify a peer group of companies that engage in testing of drugs of abuse, except for large pharmaceutical companies where such business is insignificant to such companies’ other lines of businesses. The Company therefore uses in its proxy statements a peer index based on market capitalization. |

| (3) | The NASDAQ Composite Index includes companies whose shares are traded on the NASDAQ Stock Market. |

Item 6. Selected Financial Data

The selected financial data presented below is derived from our financial statements and should be read in connection with those statements.

| As of and for the Years Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (In Thousands, Except for per Share Data) | ||||||||||||||||||||

| Revenue | $ | 26,975 | $ | 29,205 | $ | 26,870 | $ | 25,224 | $ | 24,090 | ||||||||||

| Gross profit | 12,717 | 15,138 | 15,394 | 14,252 | 14,473 | |||||||||||||||

| Income from operations | 1,471 | 4,690 | 5,706 | 4,936 | 5,800 | |||||||||||||||

| Net income | 1,511 | 3,206 | 3,805 | 2,980 | 3,489 | |||||||||||||||

| Total assets | 22,363 | 24,078 | 16,550 | 14,121 | 13,801 | |||||||||||||||

| Working capital | 4,892 | 6,980 | 6,998 | 7,491 | 9,217 | |||||||||||||||

| Shareholders’ equity | 11,674 | 12,837 | 12,277 | 11,223 | 11,035 | |||||||||||||||

| Basic net income per share | 0.28 | 0.60 | 0.72 | 0.57 | 0.67 | |||||||||||||||

| Diluted net income per share | 0.28 | 0.60 | 0.72 | 0.57 | 0.67 | |||||||||||||||

| Cash dividends declared per common share | 0.60 | 0.60 | 0.60 | 0.60 | 0.48 | |||||||||||||||

11

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read together with the more detailed business information and financial statements and related notes that appear elsewhere in this annual report on Form 10-K. This annual report may contain certain “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. This information involves risks and uncertainties. Actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in “Item 1A — Risk Factors.”

Overview

Psychemedics Corporation is the world’s largest provider of hair testing for drugs of abuse, utilizing a patented hair analysis method involving digestion of hair, enzyme immunoassay technology and confirmation by mass spectrometry to analyze human hair to detect abused substances. The Company’s customers include Fortune 500 companies, as well as small to mid-size corporations, schools and governmental entities located in the United States and internationally. During the year ended December 31, 2015, the Company generated $27.0 million in revenue, while maintaining a gross margin of 47% and pre-tax margins of 5%. The Company received $710 thousand of R&D tax credits in 2015, of which $479 thousand related to prior years. At December 31, 2015, the Company had $2.7 million of cash. During 2015, the Company had operating cash flow of $4.6 million and it distributed approximately $3.2 million or $0.60 per share of cash dividends to its shareholders. In addition, the Company spent approximately $1.8 million on equipment, leasehold improvements and software development which was partially financed with a loan of $1.0 million. To date, the Company has paid seventy-seven consecutive quarterly cash dividends.

The following table sets forth, for the periods indicated, the selected statements of operations data as a percentage of total revenue:

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Revenue | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of revenue | 52.9 | % | 48.2 | % | 42.7 | % | ||||||

| Gross profit | 47.1 | % | 51.8 | % | 57.3 | % | ||||||

| Operating expenses: | ||||||||||||

| General and administrative | 16.9 | % | 15.3 | % | 15.5 | % | ||||||

| Marketing and selling | 18.7 | % | 15.8 | % | 17.5 | % | ||||||

| Research and development | 6.0 | % | 4.6 | % | 3.1 | % | ||||||

| Total operating expenses | 41.6 | % | 35.7 | % | 36.1 | % | ||||||

| Operating income | 5.5 | % | 16.1 | % | 21.2 | % | ||||||

| Other income (expense) | -0.5 | % | -0.2 | % | 0.4 | % | ||||||

| Income before taxes | 5.0 | % | 15.9 | % | 21.6 | % | ||||||

| Provision for income taxes | -0.6 | % | 4.9 | % | 7.4 | % | ||||||

| Net income | 5.6 | % | 11.0 | % | 14.2 | % | ||||||

Results for the Year Ended December 31, 2015 Compared to Results for the Year Ended December 31, 2014

Revenue decreased $2.2 million or 8% to $27.0 million in 2015 compared to $29.2 million in 2014. This decrease was due to a decrease in volume from both existing customers and from new customers. Volume was negatively impacted by the price of oil and other economic factors which reduced hiring, and consequently testing, with our customer base. Average revenue per sample was unchanged from 2014 to 2015.

Gross profit decreased $2.4 million to $12.7 million in 2015 compared to $15.1 million in 2014. Direct costs increased by $192 thousand from 2014 to 2015. The capacity expansion costs within cost of sales was approximately $1.4 million and included; $0.4 million for hiring and training of additional personnel and $1.0 million for building related costs. The gross profit margin decreased from 52% in 2014 to 47% in 2015.

General and administrative (“G&A”) expenses were $4.6 million in 2015 compared to $4.5 million in 2014, an increase of 2%. As a percentage of revenue, G&A expenses were 16.9% and 15.3% for 2015 and 2014, respectively.

Marketing and selling expenses were $5.1 million in 2015 compared to $4.6 million in 2014, an increase of 9%. The increase was driven by spending on information technology projects supporting the sales function. Total marketing and selling expenses represented 18.7% and 15.8% of revenue for 2015 and 2014, respectively.

12

Research and development (“R&D”) expenses were $1.6 million in 2015 compared to $1.3 million in 2014, an increase of 21%. R&D expenses increased from additional personnel and supplies used to develop new tests for drugs of abuse as well as process improvements. R&D expenses represented 6.0% and 4.6% of revenue for 2015 and 2014, respectively.

Other income (expense) represented $125 thousand of other expenses for 2015 compared to $57 thousand of other income for 2014. The other expense primarily consists of interest expense related to long term debt.

During the year ended December 31, 2015, the Company recorded a tax benefit of $164 thousand, representing an effective tax rate of (12.2%). The tax rate for 2015 was affected by additional R&D tax credits related to information technology development projects. The Company recognized $479 thousand of R&D tax credits related to these projects for prior years. Without the prior year credits, the 2015 tax rate would have been 23.3%. During the year ended December 31, 2014, the Company recorded a tax provision of $1.4 million, representing an effective tax rate of 30.8%. We expect the tax rate to range from 32% to 34% for the foreseeable future.

Results for the Year Ended December 31, 2014 Compared to Results for the Year Ended December 31, 2013

Revenue increased $2.3 million or 9% to $29.2 million in 2014 compared to $26.9 million in 2013. This increase was due to an increase in volume from new and existing clients. The increase in volume was primarily driven by new customers which is a result of our recently expanded sales force and several sales initiatives. Average revenue per sample remained the same between 2014 and 2013.

Gross profit decreased $256 thousand to $15.1 million in 2014 compared to $15.4 million in 2013. Direct costs increased by 23% from 2013 to 2014, driven by the Company’s capacity expansion project and higher volume. The capacity expansion costs within cost of sales was approximately $1.3 million and included; $0.5 million for hiring and training of additional personnel, $0.5 million for building related costs, and $0.3 million for information technology and other one-time project costs. The gross profit margin decreased from 57% in 2013 to 52% in 2014.

General and administrative (“G&A”) expenses were $4.5 million in 2014 compared to $4.2 million in 2013, an increase of 8%. In 2014, G&A costs included approximately $0.2 million related to the Company’s capacity expansion project. As a percentage of revenue, G&A expenses were 15.3% and 15.5% for 2014 and 2013, respectively.

Marketing and selling expenses were $4.6 million in 2014, compared to $4.7 million in 2013, a decrease of 2%. Total marketing and selling expenses represented 15.8% and 17.5% of revenue for 2014 and 2013, respectively.

Research and development (“R&D”) expenses were $1.3 million in 2014 compared to $0.8 million in 2013. R&D expenses increased from additional personnel and supplies used to develop new tests for drugs of abuse as well as process improvements. R&D expenses represented 4.6% and 3.1% of revenue for 2014 and 2013, respectively.

Other income (expense) represented $57 thousand of other expenses for 2014 compared to $92 thousand of other income for 2013. The expense in 2014 was driven by interest expense related to long term debt incurred in 2014, while the income in 2013 represented a one- time insurance reimbursement of legal expenses.

During the year ended December 31, 2014, the Company recorded a tax provision of $1.4 million, representing an effective tax rate of 30.8%. During the year ended December 31, 2013, the Company recorded a tax provision of $2.0 million, representing an effective tax rate of 34.4%. The change in tax rate was driven by R&D tax credits from higher R&D spending and from a California R&D tax credit which was not previously taken.

Liquidity and Capital Resources

At December 31, 2015, the Company had $2.7 million of cash, compared to $3.6 million at December 31, 2014. The Company’s operating activities generated net cash of $4.6 million in 2015, $4.5 million in 2014 and $6.0 million in 2013. Investing activities used $1.8 million in 2015, $7.8 million in 2014 and $1.8 million in 2013. Financing activities used $3.7 million in 2015, generated $3.0 million in 2014 and used $3.3 million in 2013.

Operating cash flow of $4.6 million in 2015 primarily reflected net income of $1.5 million adjusted for depreciation and amortization of $1.7 million, stock compensation expense of $0.7 million, and an increase in net deferred tax liabilities of $0.1 million. This was affected by the following changes in assets and liabilities: a decrease in accounts receivable of $0.5 million, a decrease in accounts payable of $0.1 million, a decrease in accrued expenses of $0.5 million, and a decrease in prepaid expenses (and other current assets) of $0.6 million. While the operating cash flow was $0.1 million greater than in 2014, the net income was down $1.7 million. This was offset by a decrease in income tax receivable of $1.0 million which reduced the current tax due and an increase in depreciation and amortization of $0.7 million due to new equipment and leasehold improvements.

Operating cash flow of $4.5 million in 2014 primarily reflected net income of $3.2 million adjusted for depreciation and amortization of $1.1 million, stock compensation expense of $0.6 million, and an increase in net deferred tax liabilities of $1.4 million. This was affected by the following changes in assets and liabilities: a decrease in accounts receivable of $0.3 million, an increase in accounts payable of $0.3 million, a decrease in accrued expenses of $1.2 million, and an increase in prepaid expenses (and other current assets) of $1.2 million. The decrease in accrued expenses was driven by a $1.2 million reduction in the liability for equipment purchases which were paid for in 2014. The change in deferred tax liabilities and other current assets was driven by bonus depreciation on new assets purchased as part of the tax extender bill passed in December 2014.

13

Operating cash flow of $6.0 million in 2013 primarily reflected net income of $3.8 million adjusted for depreciation and amortization of $0.9 million, stock compensation expense of $0.5 million, and an increase in net deferred tax liabilities of $0.4 million. This was affected by the following changes in assets and liabilities: a decrease in accounts receivable of $0.3 million, a decrease in accounts payable of $0.2 million, a decrease in accrued expenses of $0.1 million, and a decrease in prepaid expenses (and other current assets) of $0.4 million.

Investing cash flow principally reflected the purchase of capital expenditures. Capital expenditures were $1.8 million, $7.6 million, and $1.5 million in 2015, 2014 and 2013, respectively. In 2015, the expenditures related principally to laboratory equipment, computer equipment, new software, and leasehold improvements for the Company’s new facility. Capitalized patent costs were $46 thousand, $244 thousand, and $226 thousand in 2015, 2014, and 2013, respectively.

During 2015, 2014 and 2013, the Company did not repurchase any shares of common stock for treasury. The Company has authorized 750,000 shares for repurchase since June of 1998, of which 250,000 shares of common stock were authorized in March of 2008 for repurchase. Since 1998, a total of 550,684 shares have been repurchased. The Company also distributed $3.2 million of cash dividends to its shareholders in 2015, 2014 and 2013.

At December 31, 2015, the Company’s principal sources of liquidity included approximately $2.7 million of cash and $700 thousand of available credit under its equipment financing arrangement. See Note 10 – Debt and Other Financing to the Financial Statements for further detail on the equipment financing arrangement. Management currently believes that such funds, together with future operating profits, should be adequate to fund anticipated working capital requirements, including debt obligations, and capital expenditures in the near term. Depending upon the Company’s results of operations, its future capital needs and available marketing opportunities, the Company may use various financing sources to raise additional funds. Such sources could include, issuance of common stock or debt financing, lines of credit, or equipment leasing, although there is no assurance that such financings will be available to the Company on terms it deems acceptable, if at all.

The Company has paid dividends over the past seventy-seven quarters. It most recently declared a dividend in February 2016 which will be paid in March 2016 in the amount of $813 thousand. The Company’s current intention is to continue to declare dividends to the extent funds are available and not required for operating purposes or capital requirements, and only then, upon approval by the Board of Directors. There can be no assurance that in the future the Company will declare dividends.

Contractual obligations as of December 31, 2015 were as follows:

| Payments Due by Period | ||||||||||||||||||||

| Contractual Obligation | Less Than 1 Year | 1 – 3 Years | 4 – 5 Years | Greater Than 5 Years | Total | |||||||||||||||

| (Amounts in Thousands) | ||||||||||||||||||||

| Operating leases | $ | 889 | $ | 993 | $ | 763 | $ | — | $ | 2,645 | ||||||||||

| Loan Obligations | $ | 1,620 | $ | 3,239 | $ | 1,033 | $ | — | $ | 5,892 | ||||||||||

| Total | $ | 2,509 | $ | 4,232 | $ | 1,795 | $ | — | $ | 8,537 | ||||||||||

Purchase Commitment

Operating leases consist of rent obligations for the company’s facilities. The Company has no significant contractual obligation for supply agreements as of December 31, 2015.

Significant Customers

The Company did not have any individual customers that exceeded 10% of revenue for the years ended December 31, 2015, 2014 and 2013. The Company had one customer that accounted for 11% of the total accounts receivable balance as of December 31, 2015. There were no customers who exceeded 10% of the accounts receivable balance as of December 31, 2014 or 2013.

Critical Accounting Policies

The Company’s significant accounting policies are described in Note 2 to the financial statements included in Item 8 of this Form 10-K. Management believes the most critical accounting policies are as follows:

Revenue Recognition

The Company is in the business of performing drug testing and reporting the results thereof. The Company’s drug testing services include training for collection of samples and storage of positive samples for its customers for an agreed-upon fee per unit tested of samples. The revenues are recognized when the predominant deliverable, drug testing, is provided and reported to the customer.

The Company recognizes revenue in accordance with Accounting Standards Codification “ASC” 605, “ Revenue Recognition.” In accordance with ASC 605, the Company considers testing, training and storage elements as one unit of accounting for revenue recognition purposes, as the training and storage costs are de minimis and do not have stand-alone value to the customer. The Company recognizes revenue as the service is performed and reported to the customer, since the predominant deliverable in each arrangement is the testing of the units.

The Company also provides expert testimony, when and if necessary, to support the results of the tests, which is generally billed separately and recognized as the services are provided.

14

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates, including bad debts, long-lived asset lives, income tax valuation and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Capitalized Development Costs

We capitalize costs related to significant software projects developed or obtained for internal use in accordance with U.S. generally accepted accounting standards. Costs incurred during the preliminary project work stage or conceptual stage, such as determining the performance requirements, system requirements and data conversion, are expensed as incurred. Costs incurred in the application development phase, such as coding, testing for new software and upgrades that result in additional functionality, are capitalized and are amortized using the straight-line method over the useful life of the software for 5 years. Costs incurred during the post-implementation/operation stage, including training costs and maintenance costs, are expensed as incurred. We capitalized internally developed software costs of approximately $364 thousand, $403 thousand and $715 thousand during the years ended December 31, 2015, 2014 and 2013, respectively. The software development is for primarily for three projects. Determining whether particular costs incurred are more properly attributable to the preliminary or conceptual stage, and thus expensed, or to the application development phase, and thus capitalized and amortized, depends on subjective judgments about the nature of the development work, and our judgments in this regard may differ from those made by other companies. General and administrative costs related to developing or obtaining such software are expensed as incurred.

Allowance for Doubtful Accounts

The allowance for doubtful accounts is based on management’s assessment of the ability to collect amounts owed to it by its customers. Management reviews its accounts receivable aging for doubtful accounts and uses a methodology based on calculating the allowance using a combination of factors including the age of the receivable along with management’s judgment to identify accounts that may not be collectible. The Company routinely assesses the financial strength of its customers and, as a consequence, believes that its accounts receivable credit risk exposure is limited. The Company maintains an allowance for potential credit losses but historically has not experienced any significant losses related to individual customers or groups of customers in any particular industry or geographic area. Bad debt expense has been within management’s expectations.

Income Taxes

The Company accounts for income taxes using the liability method, which requires the Company to recognize a current tax liability or asset for current taxes payable or refundable and a deferred tax liability or asset for the estimated future tax effects of temporary differences between the financial statement and tax reporting bases of assets and liabilities to the extent that they are realizable. Deferred tax expense (benefit) results from the net change in deferred tax assets and liabilities during the year. A deferred tax valuation allowance is required if it is more likely than not that all or a portion of the recorded deferred tax assets will not be realized.

The Company had net deferred tax liabilities in the amount of $2.5 million at December 31, 2015, which primarily related to depreciation and amortization, an increase of $0.1 million from 2014.

In 2015, the Company had a net tax benefit as a result of R&D tax credits related to information technology projects. This is the first year this benefit was recognized. The benefit from prior years related to these tax credits was $479 thousand. Without the prior year impact, the current year tax rate would have been 23.3%. In 2015, there was $108 thousand of tax credits related to information technology projects. The Company operates within multiple taxing jurisdictions and could be subject to audit in these jurisdictions. These audits may involve complex issues, which may require an extended period of time to resolve. The Company has provided for its estimated taxes payable in the accompanying financial statements. The Company did not have any unrecognized tax benefits and did not have any interest or penalties accrued as of December 31, 2015 or 2014. The Company does not expect the unrecognized tax benefits to change significantly over the next twelve months.

The above listing is not intended to be a comprehensive list of all of the Company’s accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by accounting principles generally accepted in the United States, with no need for management’s judgment in their application. There are also areas in which management’s judgment in selecting any available alternative would not produce a materially different result.

Recent Accounting Pronouncements

There were no new accounting pronouncements issued or effective during the fiscal year which have had or are expected to have a material impact on the Financial Statements. See Note 2 – Accounting Policies, to the Financial Statements for further detail on applicable accounting pronouncements that were adopted in 2015.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Not Required.

15

Item 8. Financial Statements and Supplementary Data

(a) Financial Statements:

16

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Shareholders

Psychemedics Corporation

Acton, Massachusetts: