Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10q1215ex31i_chinamodern.htm |

| EX-32.1 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10q1215ex32i_chinamodern.htm |

| EX-32.2 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10q1215ex32ii_chinamodern.htm |

| EX-31.2 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10q1215ex31ii_chinamodern.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2015

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to______.

Commission File Number: 000-54510

CHINA MODERN AGRICULTURAL INFORMATION, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 27-2776002 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employee Identification No.) |

No. A09, Wuzhou Sun Town

Limin Avenue, Limin Development District

Harbin, Heilongjiang, China

(Address of principal executive offices, Zip Code)

(86) 0451-84800733

(Registrant’s telephone number, including area code)

Not Applicable.

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |

| (Do not check if a smaller reporting company) | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The registrant had 53,100,000 shares of its common stock, par value $0.001 per share, outstanding at February 22, 2016.

CHINA MODERN AGRICULTURAL INFORMATION, INC.

QUARTERLY REPORT ON FORM 10-Q

December 31, 2015

TABLE OF CONTENTS

| PAGE | ||

| PART 1 - FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements (Unaudited) | 4 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 47 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 57 |

| Item 4. | Controls and Procedures | 57 |

| PART II - OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 58 |

| Item 1A. | Risk Factors | 58 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 58 |

| Item 3. | Defaults Upon Senior Securities | 58 |

| Item 4. | Mine Safety Disclosures | 58 |

| Item 5. | Other Information | 58 |

| Item 6. | Exhibits | 58 |

| 58 | ||

| SIGNATURES | 59 | |

2

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q contains “forward-looking statements”. Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Quarterly Report on Form 10-Q and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Quarterly Report on Form 10-Q. All subsequent written and oral forward-looking statements concerning other matters addressed in this Quarterly Report on Form 10-Q and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Quarterly Report on Form 10-Q.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS QUARTERLY REPORT ON FORM 10-Q

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to China Modern Agricultural Information, Inc. and its consolidated subsidiaries Hope Diary, China Dairy, Value Development Holding, Value Development Group and Jiasheng Consulting, its variable interest entity Zhongxian Information, Xinhua Cattle and Yulong Cattle, the subsidiaries of Zhongxian Information.

In addition, unless the context otherwise requires and for the purposes of this report only:

| ● | “China Dairy” refers to China Dairy Corporation Ltd., a Hong Kong company; | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; | |

| ● | “Hope Diary” refers to Hope Diary Holdings Ltd., a British Virgin Islands company; | |

| ● | “Jiasheng Consulting” refers to Jiasheng Consulting Managerial Co., Ltd., a PRC company; | |

| ● | “Operating Company or Operating Companies” refers to Value Development Holding, Value Development Group, Jiasheng Consulting, Zhongxian Information, Xinhua Cattle, and Yulong Cattle; | |

| ● | “PRC,” “China,” and “Chinese,” refer to the People’s Republic of China; | |

| ● | “Renminbi” and “RMB” refer to the legal currency of China; | |

| ● | “SEC” refers to the United States Securities and Exchange Commission; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; | |

| ● | “Yulong Cattle” refers to Shangzhi Yulong Cattle Co., Ltd., a PRC company; | |

| ● | “U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States; | |

| ● | “Value Development Holding” refers to Value Development Holding Limited., a British Virgin Islands company; | |

| ● | “Value Development Group” refers to Value Development Group Limited, a Hong Kong company; | |

| ● | “Xinhua Cattle” refers to Heilongjiang Xinhua Cattle Industry Co., Ltd., a PRC company; | |

| ● | “Yulong Cattle” refers to Shangzhi Yulong Cattle Co., Ltd., a PRC company; and | |

| ● | “Zhongxian Information” refers to Heilongjiang Zhongxian Information Co., Ltd., a PRC company. |

3

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED

BALANCE SHEETS

DECEMBER 31, 2015 (UNAUDITED) and june 30, 2015 (IN U.S. $)

| December 31, 2015 | June 30, 2015 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | 29,185,601 | $ | 54,145,781 | ||||

| Accounts receivable | 18,744,391 | 7,490,501 | ||||||

| Inventories | 1,857,148 | 759,628 | ||||||

| Prepaid expenses | 809,607 | 898,905 | ||||||

| Deferred registration fee | 468,000 | - | ||||||

| Interest receivable | 336,271 | 182,422 | ||||||

| Notes receivable, current portion | 2,387,015 | 2,739,302 | ||||||

| Total current assets | 53,788,033 | 66,216,539 | ||||||

| Property, plant and equipment, net | 28,850,760 | 6,950,302 | ||||||

| Other assets | ||||||||

| Notes receivable | 5,841,279 | 7,092,206 | ||||||

| Prepaid leases and construction | 47,544,395 | 54,257,040 | ||||||

| Biological assets, net | 48,571,464 | 38,603,586 | ||||||

| Total other assets | 101,957,138 | 99,952,832 | ||||||

| TOTAL ASSETS | $ | 184,595,931 | $ | 173,119,673 | ||||

See accompanying notes to the consolidated financial statements.

4

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED

BALANCE SHEETS (CONTINUED)

DECEMBER 31, 2015 (UNAUDITED) AND JUNE 30, 2015 (IN U.S. $)

| December 31, 2015 | June 30, 2015 | |||||||

| (Unaudited) | ||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 523,215 | $ | - | ||||

| Accrued expenses and other payables | 688,143 | 593,766 | ||||||

| Stockholder loans | 1,607,104 | 937,524 | ||||||

| Total current liabilities | 2,818,462 | 1,531,290 | ||||||

| Deferred income taxes | 41,832,532 | 41,806,633 | ||||||

| Total liabilities | 44,650,994 | 43,337,923 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Common stock, $0.001 par value; 75,000,000 shares authorized; 53,100,000 shares issued and outstanding | 53,100 | 53,100 | ||||||

| Additional paid-in capital | 43,130,851 | 5,851,170 | ||||||

| Retained earnings | 42,209,419 | 117,035,653 | ||||||

| Statutory reserve fund | 475,304 | 792,174 | ||||||

| Other comprehensive (loss) income | (2,813,012 | ) | 4,772,880 | |||||

| Sub-total | 83,055,662 | 128,504,977 | ||||||

| Noncontrolling interests | 56,889,275 | 1,276,773 | ||||||

| Total stockholders’ equity | 139,944,937 | 129,781,750 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 184,595,931 | $ | 173,119,673 | ||||

See accompanying notes to the consolidated financial statements.

5

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

AND OTHER COMPREHENSIVE INCOME

FOR

THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2015 and 2014

(UNAUDITED) (IN U.S. $)

| Three

Months Ended December 31, | Six

Months Ended December 31, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Revenues | ||||||||||||||||

| Milk sales | $ | 19,006,425 | $ | 11,983,115 | $ | 34,992,610 | $ | 25,708,106 | ||||||||

| Sales commission | 5,018,969 | 4,138,755 | 10,211,095 | 7,181,862 | ||||||||||||

| Total revenues | 24,025,394 | 16,121,870 | 45,203,705 | 32,889,968 | ||||||||||||

| Cost of goods sold | (14,381,212 | ) | (4,744,024 | ) | (23,197,122 | ) | (10,584,200 | ) | ||||||||

| Gross profit | 9,644,182 | 11,377,846 | 22,006,583 | 22,305,768 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling and marketing | 528,976 | 224,792 | 958,046 | 416,180 | ||||||||||||

| General and administrative | 708,614 | 136,539 | 38,961,348 | 258,273 | ||||||||||||

| Total operating expenses | 1,237,590 | 361,331 | 39,919,394 | 674,453 | ||||||||||||

| Operating income (loss) | $ | 8,406,592 | $ | 11,016,515 | $ | (17,912,811 | ) | $ | 21,631,315 | |||||||

See accompanying notes to the consolidated financial statements.

6

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

AND OTHER COMPREHENSIVE INCOME (CONTINUED)

FOR

THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2015 and 2014

(UNAUDITED) (IN

U.S. $)

| Three Months Ended December 31, | Six

Months Ended December 31, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Other income (expense) | ||||||||||||||||

| Interest income on notes receivable | $ | 147,101 | $ | 154,208 | $ | 346,544 | $ | 262,628 | ||||||||

| Loss on sale of cows | (69,855 | ) | (1,099,748 | ) | (105,015 | ) | (1,099,748 | ) | ||||||||

| Other non-operating income | 43,991 | 61,557 | 99,399 | 114,787 | ||||||||||||

| Total other income (expenses) | 121,237 | (883,983) | 340,928 | (722,333) | ||||||||||||

| Income (loss) before income taxes | 8,527,829 | 10,132,532 | (17,571,883 | ) | 20,908,982 | |||||||||||

| Provision for income taxes | - | 2,481,504 | 2,441,438 | 5,259,559 | ||||||||||||

| Net income before noncontrolling interests | 8,527,829 | 7,651,028 | (20,013,321 | ) | 15,649,423 | |||||||||||

| Noncontrolling interests | (3,460,714) | (88,458) | (6,664,624) | (178,924) | ||||||||||||

| Net income attributable to common stockholders | $ | 5,067,115 | $ | 7,562,570 | $ | (26,677,945 | ) | $ | 15,470,499 | |||||||

See accompanying notes to the consolidated financial statements.

7

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

AND OTHER COMPREHENSIVE INCOME (CONTINUED)

FOR

THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2015 and 2014

(Unaudited)

(IN U.S. $)

| Three Months Ended December 31, | Six

Months Ended December 31, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Other comprehensive income: | ||||||||||||||||

| Foreign currency translation adjustment | $ | (2,545,664 | ) | 52,470 | $ | (7,585,892 | ) | $ | 57,399 | |||||||

| Total comprehensive income (loss) | 2,521,451 | 7,615,040 | (34,263,837 | ) | 15,527,898 | |||||||||||

| Earnings (loss) per common share, basic and diluted | $ | 0.10 | $ | 0.14 | $ | (0.50 | ) | $ | 0.29 | |||||||

| Weighted average shares outstanding, basic and diluted | 53,100,000 | 53,100,000 | 53,100,000 | 53,100,000 | ||||||||||||

See accompanying notes to the consolidated financial statements.

8

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED STATEMENTS OF changes in Stockholders’ EQUITY

FOR THE SIX MONTHS ENDED DECEMBER 31, 2015

(Unaudited) (IN U.S. $)

| Common Stock | Additional Paid-in Capital | Retained Earnings | Statutory Reserve Fund | Noncontrolling Interests | Other Comprehensive Income | Total | ||||||||||||||||||||||

Balance June 30, 2015 | $ | 53,100 | $ | 5,851,170 | $ | 117,035,653 | $ | 792,174 | $ | 1,276,773 | $ | 4,772,880 | $ | 129,781,750 | ||||||||||||||

| Stock compensation | - | 37,762,400 | - | - | - | - | 37,762,400 | |||||||||||||||||||||

| Net (loss) income | - | - | (26,677,945 | ) | - | 6,664,624 | - | (20,013,321 | ) | |||||||||||||||||||

| Reclassification of 40% noncontrolling interest | - | (482,719 | ) | (48,148,289 | ) | (316,870 | ) | 48,947,878 | - | - | ||||||||||||||||||

| Other comprehensive income | - | - | - | - | - | (7,585,892 | ) | (7,585,892 | ) | |||||||||||||||||||

| Balance, December 31, 2015 (unaudited) | $ | 53,100 | $ | 43,130,851 | $ | 42,209,419 | $ | 475,304 | $ | 56,889,275 | $ | (2,813,012 | ) | $ | 139,944,937 | |||||||||||||

See accompanying notes to the consolidated financial statements.

9

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR

THE SIX MONTHS ENDED DECEMBER

31, 2015 AND 2014

(UNAUDITED IN U.S. $)

| 2015 | 2014 | |||||||

| Cash flows from operating activities | ||||||||

| Net (loss) income | $ | (20,013,321 | ) | $ | 15,649,423 | |||

| Adjustment to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 1,975,979 | 1,240,483 | ||||||

| Amortization for prepaid land lease | 908,557 | 416,542 | ||||||

| Deferred income taxes | 2,441,438 | 5,259,559 | ||||||

| Loss from disposal from biological assets | 105,896 | 1,100,392 | ||||||

| Stock compensation for shareholder and consultants | 37,762,400 | - | ||||||

| Change in operating assets and liabilities | ||||||||

| (Increase) in accounts receivable | (11,964,262 | ) | (279,337 | ) | ||||

| (Increase) decrease in inventories | (1,168,481 | ) | 85,227 | |||||

| Decrease (increase) in prepayment | 263,816 | (1,289,445 | ) | |||||

| (Increase) decrease in interest receivable | (153,849 | ) | 2,903 | |||||

| Increase (decrease) in accrued expenses and other payables | 265,377 | (8,499 | ) | |||||

| Net cash provided by operating activities | 10,423,550 | 22,177,249 | ||||||

| Cash flows from investing activities | ||||||||

| Collection of notes receivable | 1,074,870 | 950,304 | ||||||

| Proceeds from sales of biological assets | 180,397 | 10,400 | ||||||

| Purchase of property, plant and equipment | (20,469,991 | ) | (926 | ) | ||||

| Biological assets | (8,165,115 | ) | (4,741,913 | ) | ||||

| Purchase of biological assets | (5,767,590 | ) | (4,550,000 | ) | ||||

| Net cash (used in) investing activities | (33,147,429 | ) | (8,332,135 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from stockholder loans | 77,517 | 248,450 | ||||||

| Repayment of stockholder loans | - | (65,556 | ) | |||||

| Net cash provided by financing activities | 77,517 | 182,894 | ||||||

See accompanying notes to the consolidated financial statements.

10

China Modern Agricultural Information, Inc.

and subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

FOR

THE three AND SIX MOTNHS ENDED december

31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2015 | 2014 | |||||||

| Effect of exchange rate changes on cash | (2,313,818 | ) | 50,968 | |||||

| Net (decrease) increase in cash | (24,960,180 | ) | 14,078,975 | |||||

| Cash, beginning of year | 54,145,781 | 58,032,554 | ||||||

| Cash, end of year | $ | 29,185,601 | $ | 72,111,529 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for income taxes | $ | - | $ | - | ||||

| Cash paid for interest | $ | - | $ | - | ||||

| Supplemental disclosure of non-cash activities: | ||||||||

| Payment of accrued expenses and other payables by shareholder | $ | 639,000 | $ | 80,000 | ||||

| Sale of cows through notes receivable | $ | - | $ | 6,068,725 | ||||

| Property, plant and equipment transferred from prepaid | $ | 2,725,023 | $ | - | ||||

| Property, plant and equipment accrued | $ | 405,230 | $ | - | ||||

See accompanying notes to the consolidated financial statements.

11

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 1. | ORGANIZATION |

China Modern Agricultural Information, Inc. (the “Company”), formerly known as Trade Link Wholesalers, Inc. (“Trade Link”), was incorporated on December 22, 2008 under the laws of the State of Nevada. On April 4, 2011, the Board of Directors of Trade Link filed an amendment to the Certificate of Incorporation with the State of Nevada to effect the name change from Trade Link to China Modern Agricultural Information, Inc.

On January 28, 2011, Trade Link entered into a Share Exchange Agreement (the “Exchange Agreement”) by and among (i) Value Development Holdings, Ltd. (“Value Development”), a British Virgin Islands company, (“BVI”) (ii) Value Development’s stockholders, (iii) Trade Link, and (iv) Trade Link’s principal stockholders. Pursuant to the terms of the Exchange Agreement, Value Development and the Value Development stockholders transferred to Trade Link all of the shares of Value Development in exchange for the issuance of 35,998,000 shares of Trade Link’s common stock as set forth in the Exchange Agreement, so that the Value Development stockholders owned 87.80% of Trade Link’s outstanding shares (the “Share Exchange”).

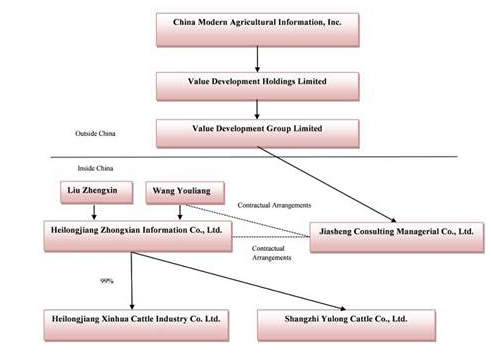

On January 28, 2011, Value Development through its wholly subsidiaries, Value Development Group Limited completed the acquisition of Harbin Jiasheng Consulting Managerial Co. Ltd. (“Jiasheng Consulting” or “WFOE”), a holding company. Jiasheng Consulting has Variable Interest Entity (“VIE”) agreements with Mr. Liu Zhengxin, the Company’s Chief HR Officer, and Mr. Wang Youliang, the Company’s Chief Executive Officer, as well as with Heilongjiang Zhongxian Information Co., Ltd. (“Zhongxian Information”). Mr. Zhengxin holds a 62% equity interest in Zhongxian Information and Mr. Youliang holds a 38% equity interest in Zhongxian Information. Pursuant to the VIE agreement signed by Mr. Zhengxin and Mr. Youliang, Jiasheng Consulting now controls and performs all management responsibilities for Zhongxian Information. The contractual arrangements are comprised of a series of agreements, including a shareholder voting rights proxy agreement, exclusive consulting and service agreement, exclusive call option agreement and equity pledge agreement, through which Jiasheng Consulting has the right to provide exclusive and complete business support and technical and consulting services to Zhongxian Information for an annual fee in the amount of Zhongxian Information’s yearly net profits after tax. Additionally, Zhongxian Information’s stockholders have pledged their rights, title and equity interests in Zhongxian Information as security for the collection of consulting and service fees provided through an Equity Pledge Agreement.

12

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 1. | ORGANIZATION (CONTINUED) |

In order to further reinforce Jiasheng Consulting’s rights to control and operate Zhongxian Information, the stockholders of Zhongxian Information have granted Jiasheng Consulting the exclusive right and option to acquire all of their equity interests in Zhongxian Information through an Exclusive Option Agreement.

The exchange agreement transaction constituted a reverse takeover transaction. Accordingly, reverse takeover accounting was adopted for the preparation of the consolidated financial statements. As a result, the consolidated financial statements are issued under the name of China Modern Agricultural Information, Inc. (the legal acquirer), but are a continuation of the consolidated financial statements of Value Development (the accounting acquirer) and the VIE its subsidiaries. Before and after the Share Exchange, Value Development, Value Development Group Limited (a wholly-owned subsidiary of Value Development), Jiasheng Consulting, and Zhongxian Information and their 99% owned subsidiary, Heilongjiang Xinhua Cattle Industry Co., Ltd. (“Xinhua Cattle”) were under common control. Therefore, the reorganization was effectively a legal recapitalization accounted for as transactions between entities under common control at the carry over basis, in a manner similar to pooling-of-interests accounting.

Zhongxian Information and Xinhua Cattle are engaged in the acquisition, breeding and rearing of dairy cows, and production and sale of fresh milk to manufacturing and distribution companies. Zhongxian Information was established in China in January 2005 with registered capital of 10 million Renminbi (“RMB”). In February 2006, it acquired 99% of the registered capital of Xinhua Cattle, which was established in China in December 2005 with registered capital of three million RMB. Xinhua Cattle had no significant activities and its cost approximated the fair value at the date of acquisition.

On November 23, 2011, Zhongxian Information acquired 100% of the equity interest of Shangzhi Yulong Co., Ltd. (“Yulong”) from Yulong’s original stockholders for consideration of 9,000,000 shares of the Company’s common stock and cash consideration of $4,396,000.

Yulong was a privately held company in China engaged in the acquisition, breeding and rearing of dairy cows, and production and sale of fresh milk to manufacturing and distribution companies.

13

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 1. | ORGANIZATION (CONTINUED) |

Our corporate structure pre-restructure is set forth below:

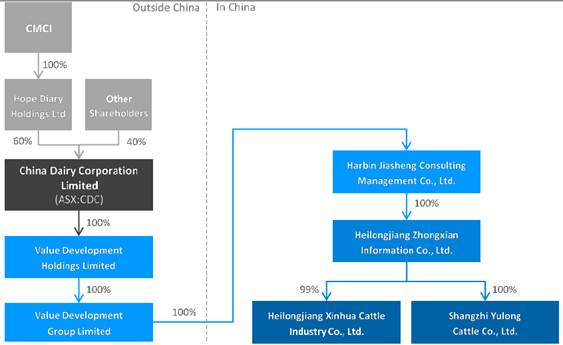

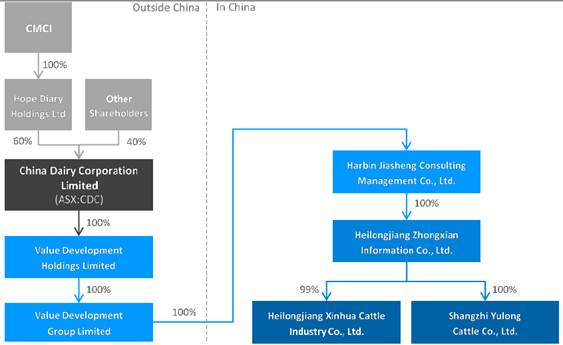

On July 16, 2015, the Company, transferred 100% of the issued and outstanding shares of Value Development Holdings, Ltd. (“Value Development”) to China Dairy Corporation Ltd. (“China Dairy,” a Hong Kong company), which is 60% owned indirectly by the Company through the Company’s wholly owned subsidiary, Hope Diary Holdings Ltd. (“Hope Diary,” a British Virgin Islands company). China Dairy was newly incorporated in January 2015 and did not have any significant assets or liabilities, or business operations, which was 100% owned by Company’s PRC corporate advisor, who formed China Dairy on behalf of the Company. Further, the sole shareholder transferred 60% of the total outstanding shares of China Dairy to Hope Diary and 40% to various shareholders and consultants of the Company (as described below) for nominal consideration.

These transactions involves no consideration received or paid as Value Development and China Dairy are under common control by the Company and this transaction is a restriction to the Company’s interests in Value Development.

14

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 1. | ORGANIZATION (CONTINUED) |

The 40% of the 10,000 shares of China Dairy were transferred from the sole shareholder of China Diary to the following entities for nominal consideration, which has direct or indirect relationship with the shareholder and consultants of the Company: 3% to Beijing Ruihua Future, 4% to Donghe Group, 3% to Integral Capital, 20% to Dingxi Shanghai Fund and 10% to Zhiyuan International. Immediately after the transfer, 65,000 bonus shares were issued at no consideration for every existing share held by the following entities:

| Original Shares | After bonus shares issued | ||||||||

| Hope Diary Holdings Ltd. | 6,000 | 390,000,000 | |||||||

| Beijing Ruihua Future Investment Management Co. Ltd. | 300 | 19,500,000 | |||||||

| Donghe Group Limited | 400 | 26,000,000 | |||||||

| Integral Capital Group Pty Ltd. | 300 | 19,500,000 | |||||||

| Dingxi (Shanghai ) Equity Investment Fund | 2,000 | 130,000,000 | |||||||

| Zhiyuan International Holding Co. Limited | 1,000 | 65,000,000 | |||||||

| Total | 10,000 | 650,000,000 | |||||||

Value Development is the sole owner of Value Development Group Limited, which is the sole owner of Harbin Jiasheng Consulting Managerial Co. Ltd., which is the Company’s subsidiary in China, with respect to which the operating company, Heilongjiang Zhongxian Information Co. Ltd., is a variable interest entity. The effect of this transaction was to reduce the interest of the Company in its operating company by 40%. The Company use the China Diary’s offering price for the proposed public offering in Australian (the “Proposed Offering”) to approximate the fair value of the 40% stock granted to the shareholder and consultants. The Company recognized a stock compensation to the shareholder and consultants of approximately $32,098,000 and $5,664,000, respectively, during the three months ended September 30, 2015 in general and administrative expense.

On September 16, 2015 the Company’s 60%-owned subsidiary, Harbin Jiasheng Consulting Management Co., Ltd. ("Jiasheng Consulting"), exercised its option to purchase all of the registered equity of the Company’s operating subsidiary, Heilongjiang Zhongxian Information Co., Ltd. ("Zhongxian Information") from its stockholders Zhenxin Liu and Youliang Wang, who are also the members of the Company’s Board of Directors, for RMB10,000 (approximately $1,634).

15

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 1. | ORGANIZATION (CONTINUED) |

Prior to the acquisition, Jiasheng Consulting controlled Zhongxian Information through a series of contractual agreements, which made Zhongxian Information a variable interest entity, the effect of which was to cause the balance sheet and operating results of Zhongxian Information to be consolidated with those of Jiasheng Consulting in the Company’s financial statements. As a result of the acquisition by Jiasheng Consulting of the registered ownership of Zhongxian Information, the balance sheet and operating results of Zhongxian Information will hereafter continue to be consolidated with those of Jiasheng Consulting as its 100% owned subsidiary.

As a result of the entry into the foregoing agreements, the Company has a corporate structure as set forth below:

16

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Accounting and Presentation

The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and include the financial statements of China Modern Agricultural Information, Inc. and its subsidiaries, Hope Diary, China Diary (Hope Diary’s 60% owned subsidiary), Value Development, Value Development Group Limited, Jiasheng Consulting, and, Zhongxian Information and Zhongxian Information’s 99% owned subsidiary, Xinhua Cattle and its 100% owned subsidiary, Yulong. All significant intercompany accounts and transactions have been eliminated in consolidation.

The unaudited consolidated financial statements of the Company as of December 31, 2015 and for the three and six months ended December 31, 2015 and 2014, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the SEC which apply to interim financial statements.

Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. The interim consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company’s Form 10-K for the year ended June 30, 2015, previously filed with the SEC. In the opinion of management, the interim information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The results of operations for the three and six months ended December 31, 2015 are not necessarily indicative of the results to be expected for future quarters or for the year ending June 30, 2016.

17

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Basis of Accounting and Presentation (continued)

Variable Interest Entity

Pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810, “Consolidation” (“ASC 810”), the Company is required to include in its consolidated financial statements the financial statements of its VIE’s. ASC 810 requires a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns. VIEs are those entities in which a company, through contractual arrangements, bears the risk of, and enjoys the rewards normally associated with ownership of the entity, and therefore the company is the primary beneficiary of the entity.

Zhongxian Information and its subsidiaries (collectively, the “Chinese VIE”) have no assets that are collateral for or restricted solely to settle their obligations. The creditors of the Chinese VIE and its subsidiaries do not have recourse to the Company’s general credit. Because Value Development, Value Development Group Limited and Jiasheng Consulting are established for the sole purpose of holding ownership interest and do not have any operations, the financial statement amounts and balances are principally those of the Chinese VIE and its subsidiaries.

Under ASC 810, an enterprise has a controlling financial interest in a VIE, and must consolidate that VIE, if the enterprise has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE’s economic performance; and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE. The Company’s determination of whether it has this power is not affected by the existence of kick-out rights or participating rights, unless a single enterprise, including its related parties and de facto agents, has the unilateral ability to exercise those rights. The Chinese VIE’s actual stockholders do not hold any kick-out rights that will affect the consolidation determination.

On September 16, 2015 the VIE structure was terminated upon the Jiasheng Consulting exercised its option to purchase all of the registered equity of Zhongxian Information. Jiasheng Consulting became the sole owner of Zhongxian Information.

18

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Foreign Currency Translations

All Company assets are located in People’s Republic of China (“PRC”). The functional currency for the majority of the Company’s operations is the Renminbi (“RMB”). The Company uses the United States dollar (“US Dollar” or “US$” or “$”) for financial reporting purposes. The consolidated financial statements of the Company have been translated into US dollars in accordance with FASB ASC 830, “Foreign Currency Matters.” All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. Statements of income and other comprehensive income amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company’s consolidated financial statements are recorded as other comprehensive income (“OCI”).

The exchange rates used to translate amounts in RMB and Australian dollars (the “A$”) into US dollars for preparing the consolidated financial statements are as follows:

December 31, 2015 | June 30, 2015 | December 31, 2014 | |||||||||||||||||||||||

| RMB | A$ | RMB | A$ | RMB | A$ | ||||||||||||||||||||

| Balance sheet items, except for stockholders’ equity, as of period end | 0.1540 | 0.7298 | 0.1632 | 0.7687 |

N/A | N/A | |||||||||||||||||||

| Amounts included in the statements of income, statement of changes in stockholders’ equity and statements of cash flows for the period | 0.1578 | 0.7228 | N/A |

N/A | 0.1625 | 0.8899 | |||||||||||||||||||

19

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Foreign Currency Translations (continued)

Foreign currency translation adjustments of $(2,545,664) and $52,470, respectively, $(7,585,892) and $57,399, respectively, for the three and six months ended December 31, 2015 and 2014, have been reported as other comprehensive income in the consolidated statements of income and other comprehensive income. Other comprehensive income of the Company consists entirely of foreign currency translation adjustments. Pursuant to ASC 740-30-25-17, “Exceptions to Comprehensive Recognition of Deferred Income Taxes,” the Company does not recognize deferred U.S. taxes related to the undistributed earnings of its foreign subsidiaries and, accordingly, recognizes no income tax expense or benefit from foreign currency translation adjustments.

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US dollars at that rate or any other rate.

The value of the RMB against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions. Any significant revaluation of the RMB could materially affect the Company’s consolidated financial condition in terms of US dollar reporting.

Revenue Recognition

The Company’s primary sources of revenues are derived from (a) sale of fresh milk to Chinese manufacturing and distribution companies of dairy products and (b) commissions from local farmers on their monthly milk sales. The Company’s revenue recognition policies comply with FASB ASC 605, “Revenue Recognition.” Revenues from the sale of goods are recognized when the goods are delivered and the title is transferred, the risks and rewards of ownership have been transferred to the customer, the price is fixed and determinable and collection of the related receivable is reasonably assured.

20

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Revenue Recognition (continued)

Milk sales revenue is recognized when the title has been passed to the customers, which is the date when the milk is delivered to designated locations and accepted by the customers and the previously discussed requirements are met. Fresh milk is delivered to its customers on a daily basis. The customers’ acceptance occurs upon inspection of the quality and measurement of quantity at the time of delivery. The Company does not provide the customer with the right of return. Sales commission revenue is recognized on a monthly basis based on monthly sales reports received.

Vulnerability Due to Operations in PRC

The Company’s operations may be adversely affected by significant political, economic and social uncertainties in the PRC. Although the PRC government has been pursuing economic reform policies for more than twenty years, no assurance can be given that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption or unforeseen circumstances affecting the PRC’s political, economic and social conditions. There is also no guarantee that the PRC government’s pursuit of economic reforms will be consistent or effective.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

21

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Fair Value of Financial Instruments

FASB ASC 820, “Fair Value Measurement” specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

| Level 1 Inputs – | Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access. | |

| Level 2 Inputs – | Inputs other than the quoted prices in active markets that are observable either directly or indirectly. | |

| Level 3 Inputs – | Inputs based on valuation techniques that are both unobservable and significant to the overall fair value measurements. |

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurements. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The Company did not identify any assets or liabilities that are required to be presented at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash, accounts receivable, interest receivable, accrued expenses, and other payables, and stockholder loans, approximated their fair values due to the short maturity of these financial instruments. The carrying value of notes receivable is valued at their net realizable value which approximates the fair value. There were no changes in methods or assumptions during the periods presented.

22

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Advertising Costs

Advertising costs are charged to operations when incurred. Advertising costs are $10,257 and $0, respectively, for the three and six months ended December 31, 2015 and 2014.

Cash and Cash Equivalents

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Accounts Receivable

Accounts receivable is stated at cost, net of an allowance for doubtful accounts, if required. Receivables outstanding longer than the payment terms are considered past due. The Company maintains an allowance for doubtful accounts for estimated losses when necessary resulting from the failure of customers to make required payments. The Company reviews the accounts receivable on a periodic basis and makes allowances where there is doubt as to the collectability of individual balances.

In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balance, the customer’s payment history, its current credit-worthiness and current economic trends. The Company has 30 days credit term for its milk sales, and usually receives the payment in the following month. The Company considers all accounts receivable at December 31, 2015 and June 30, 2015, to be fully collectible and, therefore, did not provide an allowance for doubtful accounts. For the periods presented, the Company did not write off any accounts receivable as bad debts.

Inventories

Inventories, comprised principally of livestock feed, are valued at the lower of cost or market value. The value of inventories is determined using the weighted average cost method.

The Company estimates an inventory allowance for excessive or unusable inventories. Inventory amounts are reported net of such allowances, if any. There was no allowance for excessive or unusable inventories as of December 31, 2015 and June 30, 2015.

23

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Prepaid Expenses

Prepaid expenses as of December 31, 2015 and June 30 2015 mainly represent the prepayments of approximately $809,607 and $898,900, respectively for prepaid cow insurances expenses and for heating expenses.

Prepaid Land Leases

Prepaid land leases represent the prepayment for grassland rental (see Note 7).

Property, Plant and Equipment

Property, plant and equipment are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire or construct the asset, including capitalized interest during the construction period, and any expenditures that substantially increase the assets value or extends the useful life of an existing asset. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred.

The estimated useful lives for property, plant and equipment categories are as follows:

| Machinery and equipment | 3 to 10 years | |

| Automobiles | 4 to 10 years | |

| Building and building improvements | 10 to 20 years | |

| Leasehold improvements | Lesser of the remaining term or useful life |

Deferred registration fee

Deferred registration fee consist of legal fees, consulting fees, and accounting fees incurred through the balance sheet date that relate to Proposed Offering on the Australian Securities Exchange (“ASX”) and that will be charged to stockholders’ equity upon completion of the Proposed Offering or charged to expense if the Proposed Offering is not completed.

24

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Impairment of Long-lived Assets

The Company utilizes FASB ASC 360, “Property, Plant and Equipment” (“ASC 360”), which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize an impairment of a long-lived asset in the event the net book value of such asset exceeds the estimated future undiscounted cash flows attributable to the asset. No impairment of long-lived assets was recognized for the three and six months ended December 31, 2015 and 2014.

Biological Assets

Biological assets consist of dairy cows for milking purposes and breeding.

Immature Biological Assets

Immature biological assets are recorded at cost, including acquisition costs, transportation costs, insurance expenses, and feeding costs, incurred in raising the cows. Once the cow is able to produce milk, the cost of the immature biological asset is transferred to mature biological assets using the weighted average cost method.

Mature Biological Assets

Mature biological assets are recorded at their original purchase price or the weighted average immature biological asset transfer cost. Depreciation is provided over the estimated useful life of eight years using the straight-line method. The estimated residual value is 10%. Feeding and management costs incurred on mature biological assets are included as cost of goods sold. When biological assets, including male cows, are retired or otherwise disposed of in the normal course of business, the cost and accumulated depreciation will be removed from the accounts and any resulting gain or loss will be included in the results of operations for the respective period. For the three and six months ended December 31, 2015 and 2014, a loss of $69,855 and $1,099,748, respectively, $105,015 and $1,099,748, respectively, on the sale of the adult cows is included in non-operating expenses in the accompanying consolidated statements of income and other comprehensive income. (See Note 5)

25

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Biological Assets (continued)

The Company reviews the carrying value of its biological assets for impairment at least annually or whenever events and circumstances indicate that their carrying value may not be recoverable from the estimated future cash flows expected from their use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss will be recognized equal to an amount by which the carrying value exceeds the fair value of the asset. The factors considered by management in performing this assessment include current health status and production capacity. There were no impairment losses recorded during the three and six months ended December 31, 2015 and 2014.

Income Taxes

The Company accounts for income taxes in accordance with FASB ASC 740, “Income Taxes” (“ASC 740”), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. The differences relate principally to the undistributed earnings of the Company’s subsidiary under PRC law. Deferred tax assets and liabilities represent the future tax consequences for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. At December 31, 2015 and June 30, 2015, undistributed earnings allocated to Zhongxian Information were approximately $177,607,000 and $160,600,000, respectively.

26

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Income Taxes (Continued)

ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for

interest and penalties associated with uncertain tax positions. As of December 31, 2015 and June 30, 2015, the Company does not have a liability for any uncertain tax positions.

The income tax laws of various jurisdictions in which the Company and its subsidiaries operate are summarized as follows:

United States

The Company is subject to United States tax at graduated rates from 15% to 35%. No provision for income tax in the United States has been made as the Company had no U.S. taxable income for the three and six months ended December 31, 2015 and 2014.

BVI

Value Development and Hope Diary are incorporated in the BVI and is governed by the income tax laws of the BVI. According to current BVI income tax law, the applicable income tax rate for the Company is 0%.

Hong Kong

Value Development Group Limited and China Dairy are incorporated in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non-Hong Kong source income.

27

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Income Taxes (Continued)

PRC

Xinhua Cattle and Yulong are entitled to a tax exemption for the full Enterprise Income Tax in China due to a government tax preferential policy for the dairy farming industry. In January 2015, Zhongxian obtained an income tax exemption notice from tax authority to exempt the income tax on its investment income from its subsidiaries Xinhua Cattle and Yulong.

Net Income (Loss) Per Share

The Company computes net income (loss) per common share in accordance with FASB ASC 260, “Earnings Per Share” (“ASC 260”). Under the provisions of ASC 260, basic net income (loss) per common share is computed by dividing the amount available to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted income per common share is computed by dividing the amount available to common stockholders by the weighted average number of shares of common stock outstanding plus the effect of any dilutive shares outstanding during the period. Accordingly, the number of weighted average shares outstanding as well as the amount of net income per share are presented for basic and diluted per share calculations for all periods reflected in the accompanying consolidated statements of income and other comprehensive income. There were no dilutive shares outstanding during the three and six months ended December 31, 2015 and 2014.

Statutory Reserve Fund

Pursuant to corporate law of the PRC, Jiasheng Consulting and the Company’s Chinese VIE and its subsidiaries are required to transfer 10% of their net income, as determined under PRC accounting rules and regulations, to a statutory reserve fund until such reserve balance reaches 50% of its registered capital. The statutory reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any, and may be utilized for business expansion or used to increase registered capital, provided that the remaining reserve balance after such use is not less than 25% of the registered capital. As of December 31, 2015 and June 30, 2015, the required statutory reserve funds have been fully funded.

28

China Modern Agricultural Information, Inc.

AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 3. | Recently Issued Accounting Standards |

In September 2015, the FASB issued Accounting Standards Update (“ASU”) 2015-16: Simplifying the Accounting for Measurement-Period Adjustments (“ASU 2015-16”), which eliminates the requirement to restate prior period financial statements for measurement period adjustments. The new guidance requires that the cumulative impact of a measurement period adjustment (including the impact on prior periods) be recognized in the reporting period in which the adjustment is identified. ASU 2015-16 is effective for interim and annual periods beginning after December 15, 2015. Early adoption is permitted. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

In May 2015, the FASB issued ASU No. 2015-09, “Financial Services-Insurance (Topic 944): Disclosures about Short-Duration Contracts.” This guidance requires insurance entities to disclose for annual reporting periods incurred and paid claims development information by accident year, after reinsurance, for the number of years for which claims typically remain open. Disclosures should also include quantitative information about claim frequency and a qualitative description of methodologies used for determining claim frequency information. This guidance is effective for annual reporting periods, including interim periods, beginning after December 15, 2015, and is applicable to the Company's fiscal year beginning June 1, 2016. Early and retrospective application is permitted. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

In May 2015, the FASB issued ASU No. 2015-07, “Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) (a consensus of the FASB Emerging Issues Task Force).” This guidance removes the requirement to categorize within the fair value hierarchy investments for which fair value is measured using the net asset value per share practical expedient and removes certain related disclosure requirements. This guidance is effective for annual reporting periods, including interim periods, beginning after December 15, 2015, and is applicable to the Company's fiscal year beginning June 1, 2016. Early adoption is permitted. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

29

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 3. | Recently Issued Accounting Standards (CONTINUED) |

In April 2015, the FASB issued ASU No. 2015-05, “Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement.” This guidance clarifies the accounting treatment for fees paid in cloud computing arrangements, including the determination of whether a cloud computing arrangement includes a software license. This guidance is effective for annual reporting periods, including interim periods, beginning after December 15, 2015, and is applicable to the Company's fiscal year beginning June 1, 2016. Early adoption is permitted. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

In April 2015, the FASB issued ASU No. 2015-03, “Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs.” This Guidance requires debt issuance costs to be presented in the balance sheet as a reduction of the related debt liability rather than an asset. This guidance is effective for annual reporting periods, including interim periods, beginning after December 15, 2015, and is applicable to the Company's fiscal year beginning June 1, 2016. Early adoption is permitted for financial statements not previously issued. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

In January 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") ASU 2015-01 – Income Statement – Extraordinary and Unusual Items (Subtopic 225-20). This ASU addressed the simplification of income statement presentation by eliminating the concept of extraordinary items. The objective of the Simplification Initiative is to identify, evaluate, and improve areas of generally accepted accounting principles (GAAP) for which cost and complexity can be reduced while maintaining or improving the usefulness of the information provided to the users of financial statements. The amendments in this update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. A reporting entity may apply the amendments prospectively. A reporting entity also may apply the amendments retrospectively to all prior periods presented in the financial statements. Early adoption is permitted provided that the guidance is applied from the beginning of the fiscal year of adoption. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

30

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 3. | Recently Issued Accounting Standards (CONTINUED) |

In August 2014, the FASB issued authoritative guidance that requires an entity’s management to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern and requires additional disclosures if certain criteria are met. This guidance is effective for fiscal periods ending after December 15, 2016, with early adoption permitted. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

In June 2014, the FASB issued Accounting Standards Update No. 2014-12, Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period (ASU 2014-12). ASU 2014-12 requires that a performance target that affects vesting and could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in Accounting Standards Codification (ASC) 718, Compensation—Stock Compensation, as it relates to such awards. ASU 2014-12 is effective for us in our first quarter of fiscal 2017 with early adoption permitted using either of two methods: (i) prospective to all awards granted or modified after the effective date; or (ii) retrospective to all awards with performance targets that are outstanding as of the beginning of the earliest annual period presented in the financial statements and to all new or modified awards thereafter, with the cumulative effect of applying ASU 2014-12 as an adjustment to the opening retained earnings balance as of the beginning of the earliest annual period presented in the financial statements. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

31

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 3. | Recently Issued Accounting Standards (CONTINUED) |

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers”, which supersedes the revenue recognition requirements in ASC 605, “Revenue Recognition”. The core principle of this updated guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The new rule also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. This guidance is effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. The FASB has recently extended the effective date for one year. Companies are permitted to adopt this new rule following either a full or modified retrospective approach. Early adoption is not permitted. The Company has not yet determined the potential impact of this updated authoritative guidance on its consolidated financial statements.

| 4. | Property, plant and equipment |

Property, plant and equipment are summarized as follows:

December 31, 2015 | June 30, 2015 | ||||||||

| (Unaudited) | |||||||||

| Machinery and equipment | $ | 3,059,348 | $ | 222,147 | |||||

| Automobiles | 2,251,699 | 2,071,656 | |||||||

| Building and building improvements | 23,892,012 | 6,246,502 | |||||||

| 29,203,059 | 8,540,306 | ||||||||

| Less: accumulated depreciation | (2,240,031 | ) | (1,590,004 | ) | |||||

| Construction in progress | 1,887,732 | - | |||||||

| Property, plant and equipment, net | $ | 28,850,760 | $ | 6,950,302 | |||||

32

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 4. | Property, plant and equipment (continued) |

The increase was the office buildings, cow houses, and forage storage built and refurbished on the new land, which are completed and in service before December 31, 2015. Construction in Progress(the “CIP”) contains amount paid and accrued on completed new construction but has not been placed into service as of December 31, 2015. No depreciation on those CIP as of December 31, 2015. In addition, a significant amount of production facilities and automobiles were purchased. Depreciation expense charged to operations for the three and six months ended December 31, 2015 and 2014 were $482,206 and $71,405, respectively, $757,911 and $143,742, respectively.

| 5. | Biological assets |

Biological assets consist of the following:

December 31, 2015 | June 30, 2015 | ||||||||

| (Unaudited) | |||||||||

| Immature biological assets | $ | 27,598,967 | $ | 24,555,303 | |||||

| Mature biological assets | 25,388,897 | 18,271,485 | |||||||

| 52,987,864 | 42,826,788 | ||||||||

| Less: accumulated depreciation | (4,416,399 | ) | (4,223,202 | ) | |||||

| Biological assets, net | $ | 48,571,465 | $ | 38,603,586 | |||||

In July 2015, Xinhua Cattle and Yulong purchase 2,000 and 2,300 adult cow, respectively at a price RMB 8,500 (US $1,354) per cow from an outside party.

In August 2015, Xinhua Cattle sold 200 cows to an outside party at a total price of RMB 160,000(US $25,488) including insurance of RMB 100,000 (US $ 15,930). The cows had a net book value approximately $44,000 as of the disposal date, which include cost basis approximately $573,000 and accumulated depreciation approximately $529,000.

33

CHINA MODERN AGRICULTURAL INFORMATION, INC.

AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 5. | Biological assets (continued) |

In November 2015, Yulong Cattle Sold 347 cows to an outside party at a total price of RMB 1,144,800 (US $176,299) including insurance of RMB 104,100 (US $ 16,031). The cows had a net book value approximately $235,000 as of the disposal date, which include cost basis approximately $574,000 and accumulated depreciation approximately $339,000.

In December 2015, Xinhua Cattle entered into agreements with 179 local farmers to pay them additional feeding cost of RMB 600 (US$94) for each young cow and adult cow, which were transferred to the farmers for raise at the beginning of October 2015, for improving the feeding environment. The company paid 50% of the total amount RMB 6,795,000 (US$1,072,000) in December 2015 and the remaining 50% was paid in January 2016. 82% of the additional cost for mature cows was included as cost of goods sold as incurred and the remaining are capitalized for immature cows.

Depreciation expense for the three and six months ended December 31, 2015 and 2014 was $595,133 and $508,534, respectively, and $1,218,068 and $1,096,741, respectively, all of which was included in cost of goods sold in the consolidated statements of income and other comprehensive income.

| 6. | Notes Receivable |

Notes receivable are related to the sales of cows (mature biological assets) to local farmers.

In September 2011, August 2011, and June 2011, Xinhua Cattle sold 3,787, 5,635, and 2,000 of its cows to local farmers, respectively.

In November and December 2014, Yulong sold 3,714 and 2,955 cows to local farmers respectively. 3,500 of the cows sold were purchased from outside parties for $4,550,000. The remaining cows sold were raised by Yulong.

34

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 6. | Notes Receivable (continued) |

According to the agreements signed with the local farmers in June 2011, the sales price will be collected over five years, with a minimum payment of 20% of the sales price to be paid each year. The related receivable is recorded at its present value at a discount rate of 12%, which is commensurate with interest rates for notes with similar risk. The Company also entered into agreements with these local farmers for a 30% commission of their monthly milk sales generated by the cows sold in exchange for the Company’s assistance in arranging for the sale of the milk.

Pursuant to the agreements signed in August 2011, September 2011, November 2014, and December 2014, the sales price will be collected in monthly installments plus interest at 7% on the outstanding balance, over the remaining useful lives of the cows, which range from one to eight years. Local farmers are required to pay a 30% of monthly milk sales generated from the cows purchased by the farmers. The 30% monthly payments are to be applied first to the monthly installment of principal for the cows sold and the balance as commission income for the Company’s assistance in arranging for the sale of the milk. The 30% monthly payments will continue over the entire remaining life of the cows sold. While the 30% rate and the amount applied to monthly installments for the purchase price of the cows remain the same, the amount of sales commission income will vary depending on total monthly milk sales and the progress of repayments towards the purchase price.

During the three and six months ended December 31, 2015 and 2014, the Company received principal and interest payments of $357,189 and $721,171, respectively, and $1,218,855 and $1,216,096, respectively. Commission income for the three and six months ended December 31, 2015 and 2014, was $5,018,969 and $4,138,755, respectively, $10,211,095 and $7,181,862, respectively, under these agreements.

The receivable related to the sales of cows is included in notes receivable in the consolidated balance sheets as of December 31, 2015 and June 30, 2015. The related commission receivable of $5,665,731 and $3,408,759 at December 31, 2015 and June 30, 2015, respectively, is included in accounts receivable in the consolidated balance sheets.

35

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 6. | Notes Receivable (continued) |

Notes receivable at December 31, 2015 and June 30, 2015 consists of the following:

December 31, 2015 | June 30, 2015 | ||||||||

| (Unaudited) | |||||||||

| Notes receivable | $ | 8,254,694 | $ | 9,873,474 | |||||

| Less: discount for interest | (26,400 | ) | (41,966 | ) | |||||

| 8,228,294 | 9,831,508 | ||||||||

| Less: current portion | (2,387,015 | ) | (2,739,302 | ) | |||||

| Non-current portion | $ | 5,841,279 | $ | 7,092,206 | |||||

Future maturities of notes receivable as of December 31, 2015 are as follows:

| Year Ending December 31, | ||||||

| 2016 | $ | 2,387,000 | ||||

| 2017 | 1,827,000 | |||||

| 2018 | 1,485,000 | |||||

| 2019 | 841,000 | |||||

| 2020 | 539,000 | |||||

| Thereafter | 1,149,000 | |||||

| $ | 8,228,000 | |||||

The Company considers these notes to be fully collectible and, therefore, did not provide an allowance for doubtful accounts. The Company will continue to review the notes receivable on a periodic basis and where there is doubt as to the collectability of individual balances, it will provide an allowance, if necessary.

36

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 7. | LeaseS |

The Company leases an office at no cost from an unrelated third party. On September 1, 2010, the Company entered into an operating lease agreement expiring on August 31, 2015. The lease agreement does not provide for payment of rent and it was not subsequently renewed.

All land in China is government owned and cannot be sold to any individual or company. The Company obtained a “land use right” to use a track of land of 250,000 square meters at no cost through December 1, 2015. On May 10, 2013, the Company, however, entered into an agreement with the municipality of Qiqihaer to obtain the “land use right” to use this land from May 1, 2013 to April 30, 2063. The Company recorded the prepayment of RMB 37,500,000 (US$6,060,000) as prepaid land lease. The prepaid lease is being amortized over the land use term of 50 years using the straight-line method. The remaining prepayment of $5,467,000 and $5,854,800 is included in prepaid land lease in the consolidated balance sheets as of December 31, 2015 and June 30, 2015, respectively. The lease provides for renewal options.

On October 9, 2011, the Company entered into an operating lease, from October 9, 2011 to October 8, 2021, with the municipality of Heilongjiang to lease 16,666,750 square meters of land. The lease required the Company to prepay the ten year rental of RMB 30,000,000 (US$4,686,000). The related prepayment of $2,656,500 and $3,060,000 is included in prepaid land lease in the consolidated balance sheets as of December 31, 2015 and June 30, 2015, respectively. The lease provides for renewal options.

On February 25, 2013, the Company obtained another “land use right” to use 427,572 square meters of land, from March 1, 2013 to February 28, 2063. The Company recorded the prepayment of RMB 77,040,000 (US$12,450,000) as prepaid land lease. The prepaid lease is being amortized over the land use term of 50 years using the straight-line method. The remaining prepayment of $11,191,858 and $11,986,191 is included in prepaid land lease in the consolidated balance sheets as of December 31, 2015 and June 30, 2015, respectively. The lease provides for renewal options.

37

China Modern Agricultural Information, Inc.

and subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ended dECEMBER 31, 2015 AND 2014

(UNAUDITED) (IN U.S. $)

| 7. | LeaseS (CONTINUED) |