Attached files

| file | filename |

|---|---|

| EX-2.6 - SHARE TRANSFER AGREEMENT - China Modern Agricultural Information, Inc. | f10k2015ex2vi_chinamodern.htm |

| EX-31.2 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10k2015ex31ii_chinamodern.htm |

| EX-2.5 - SHARE TRANSFER - China Modern Agricultural Information, Inc. | f10k2015ex2v_chinamodern.htm |

| EX-32.1 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10k2015ex32i_chinamodern.htm |

| EX-31.1 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10k2015ex31i_chinamodern.htm |

| EX-32.2 - CERTIFICATION - China Modern Agricultural Information, Inc. | f10k2015ex32ii_chinamodern.htm |

| EX-10.8 - THE TRANSFER AGREEMENT FOR LAND USE RIGHT - China Modern Agricultural Information, Inc. | f10k2015ex10viii_chinamodern.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2015

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________________ to ___________________________

Commission file number 000-54510

China Modern Agricultural Information, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 27-2776002 | |

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) | |

No.A09, Wuzhou Sun Town Limin Avenue, Limin Development District Harbin, Heilongjiang, China |

150000 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (86) 0451-84800733

Securities registered pursuant to Section 12(b) of the Exchange Act: None.

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer (Do not check if a smaller reporting company) |

☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Company’s common stock held by non-affiliates computed by reference to the closing bid price of the Company’s common stock, as of the last business day of the registrant’s most recently completed second fiscal quarter: $19,691,422.24

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: 53,100,000 shares of common stock, par value $0.001 per share, issued and outstanding as of October 12, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| 2 |

Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K constitute “forward-looking statements” made under the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 that are based on current expectations, estimates, forecasts and assumptions and are subject to risks and uncertainties. Words such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “goal,” “intend,” “plan,” “project,” “seek,” “target,” and variations of such words and similar expressions are intended to identify such forward-looking statements. All forward-looking statements speak only as of the date on which they are made. Such forward-looking statements are subject to certain risks, uncertainties and assumptions relating to certain factors that could cause actual results to differ materially from those anticipated in such statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

Use of Certain Defined Terms

In this Annual Report on Form 10-K, references to “we,” “our,” “us,” “the Company,” refer to China Modern Agricultural Information, Inc. and its subsidiaries and variable interest entities on a consolidated basis.

In addition, unless the context otherwise requires and for the purposes of this report only

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| ● | “Jiasheng Consulting” refers to Jiasheng Consulting Managerial Co., Ltd., a PRC company; |

| ● | “Operating Company or Operating Companies” refers to Value Development Holding, Value Development Group, Jiasheng Consulting, Zhongxian Information, Xinhua Cattle, and Yulong Cattle. |

| ● | “PRC,” “China,” and “Chinese,” refer to the People’s Republic of China; |

| ● | “Renminbi” and “RMB” refer to the legal currency of China; |

| ● | “SEC” refers to the United States Securities and Exchange Commission; |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; |

| ● | “Yulong Cattle” refers to Shangzhi Yulong Cattle Co., Ltd., a PRC company; |

| ● | “U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States; |

| ● | “Value Development Holding” refers to Value Development Holding Limited., a British Virgin Islands company; |

| ● | “Value Development Group” refers to Value Development Group Limited, a Hong Kong company; |

| ● | “Xinhua Cattle” refers to Heilongjiang Xinhua Cattle Industry Co., Ltd., a PRC company; |

| ● | “Zhongxian Information” refers to Heilongjiang Zhongxian Information Co., Ltd., a PRC company; |

| ● | “Hope Diary” refers to Hope Diary Holdings Ltd., a British Virgin Islands company; |

| ● | “China Dairy” refers to China Dairy Corporation Ltd., a Hong Kong company; |

| 3 |

PART I

Overview

We are a leading producer and distributor of natural fresh milk in China. We have two operating entities with an aggregate natural fresh milk production capacity of approximately 234 tons (approximately 7,431gallons) per day. We also have 76 exclusive individual partners with an aggregate natural fresh milk production capacity of approximately 405 tons per day. We have five major customers, one of which is the leading dairy company in China.

Corporate History

We were incorporated on December 22, 2008 under the laws of the State of Nevada. We were formerly known as Trade Link. On April 4, 2011, the Board of Directors of Trade Link filed an amendment to the Certificate of Incorporation with the State of Nevada and changed our name from Trade Link to China Modern Agricultural Information, Inc.

On January 28, 2011, we entered into the Exchange Agreement by and among (i) Value Development Holding, a British Virgin Islands company, (ii) Value Development Holding’s shareholders, (iii) us, and (iv) our former principal stockholders. Pursuant to the terms of the Exchange Agreement, Value Development Holding’s shareholders transferred to us all of the shares of Value Development Holding in exchange for the issuance of 35,998,000 shares of our common stock (the “Securities Exchange”). The shares issued to Value Development Holding’s shareholders in the Securities Exchange constituted approximately 87.80% of our issued and outstanding shares of common stock as of and immediately after the consummation of the Securities Exchange. As a result of the Securities Exchange, Value Development became our wholly owned subsidiary and Value Development’s former principal stockholder became our principal stockholder.

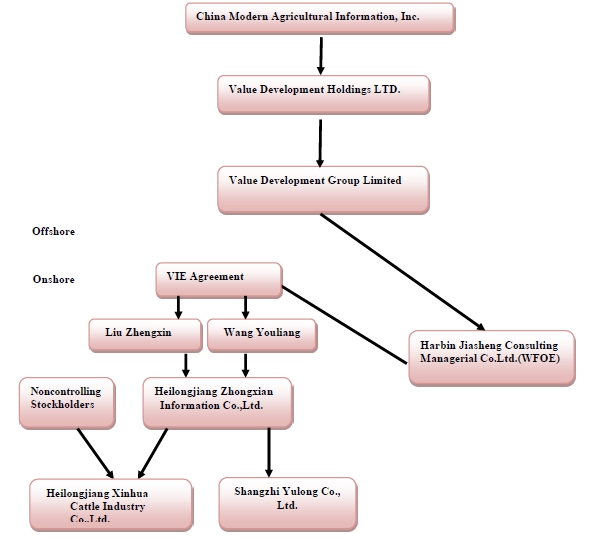

Value Development Holdings was incorporated under the laws of British Virgin Islands on June 24, 2010 to serve as an investment holding company. Value Development Holdings owns 100% of the equity interest of Value Development Group, a company incorporated under the laws of Hong Kong on September 17, 2010. Value Development Group owns 100% of the equity interest of Jiasheng Consulting, a company incorporated under the laws of the PRC on September 15, 2010.

On January 28, 2011, Value Development Group completed the acquisition of Jiasheng Consulting. Jiasheng Consulting entered into a series of agreements (the “Contractual Arrangements”) with Zhongxian Information, its shareholders, in which Jiasheng Consulting effectively assumed management of the business activities of Zhongxian Information and its 99% owned subsidiary Heilongjiang Xinhua Cattle, and acquired the right to appoint all executives and senior management and the members of the Board of Directors of Zhongxian Information. Zhongxian Information was founded on January 21 2005, and is headquartered in the Limin Development Zone, Harbin, Heilongjiang Province, with registered capital of 10 million RMB or $1,206,800. The Contractual Arrangements are comprised of a series of agreements, including an Exclusive Business Cooperation Agreement, Exclusive Option Agreement, and an Equity Interest Pledge Agreement, through which Jiasheng Consulting has the right to provide exclusive complete business support and technical and consulting service to Zhongxian Information. Additionally, Zhongxian Information’s shareholders have pledged their rights, titles and equity interest in Zhongxian Information as security for Jiasheng Consulting to collect consulting and services fees provided to Zhongxian Information through an Equity Pledge Agreement. In order to further reinforce Jiasheng Consulting’s rights to control and operate Zhongxian Information, the shareholders of Zhongxian Information have granted Jiasheng Consulting the exclusive right and option to acquire all of their equity interests in Zhongxian Information through an Exclusive Option Agreement.

Zhongxian Information was incorporated in China in January 2005 with registered capital of 10 million RMB or $1,206,800 US Dollars. In February 2006, it acquired 99% of the registered capital of Xinhua Cattle, which was incorporated in China in December 2005 with registered capital of three million RMB or $371,580 US Dollars. Xinhua Cattle is located in Qiqihar, Heilongjiang Province, in northeast China and is a livestock company that engages in cow breading and fresh milk production.

On November 23, 2011, Zhongxian Information acquired 100% of the equity interest of Yulong Cattle in exchange for (i) issuance of 9,000,000 shares of our common stock, and (ii) a cash payment of $4,396,000, to Yulong Cattle’s former shareholders. Yulong Cattle was incorporated on December 4, 2007 under the laws of the PRC. Yulong Cattle, located in Harbin, Heilongjiang, in northeast China, is a livestock company that engages in cow breeding and fresh milk production, and primarily generates its revenue from the sale of fresh milk.

4

Recent Company Restructure

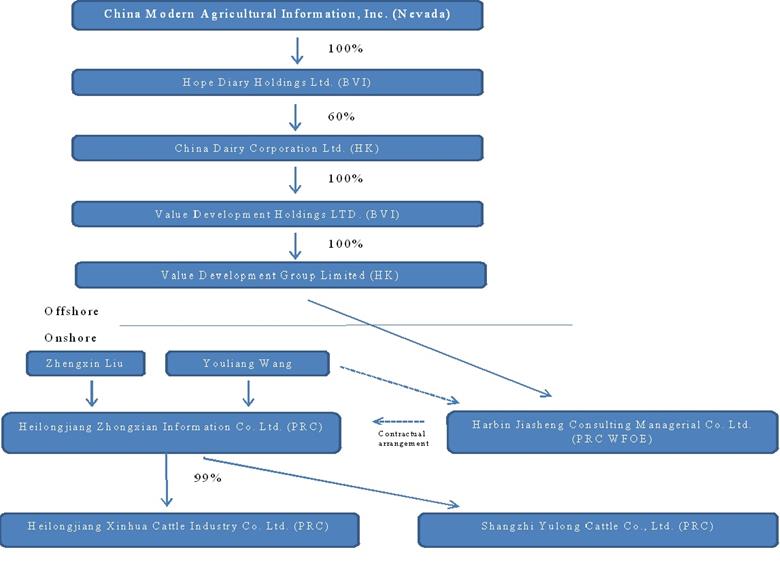

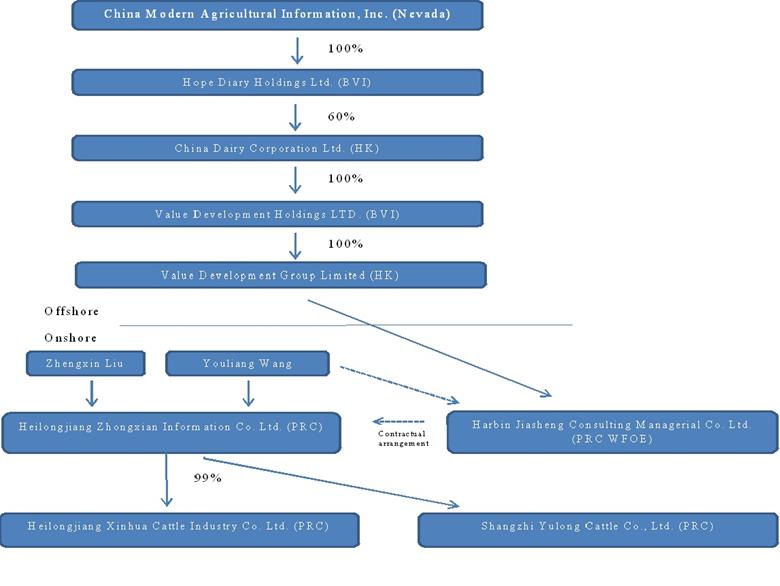

Early in July 2015, Hope Diary acquired 60% of China Dairy and became a wholly-owned subsidiary of the Company after Mr. Youliang Wang, Company’s Chief Executive Officer, transferred 100% of his interest in Hope Diary to the Company for $50,000 (the “Hope Diary Transfer”). On July 16, 2015, the Company transferred 100% of the issued and outstanding shares of Value Development to China Dairy, which is 60% owned indirectly by the Company through the Company’s wholly owned subsidiary, Hope Diary as a result of the Hope Diary Transfer (the “Restructure”).

The Restructure involves nominal consideration received or paid as Value Development and China Dairy are under common control by the Company and this transaction affects the Company’s interests in Value Development.

As a result of the Restructure, the Company indirectly owns 60% of China Dairy through its wholly-owned subsidiary, Hope Diary, which holds 60% of the issued and outstanding shares of China Dairy, which in turn holds 100% of the issued and outstanding shares of Value Development.

The effect of this transaction was the decrease in interest of the Company in its operating company by 40%. This will result in the Company recognizing a transaction loss of approximately $50,300,000 during the three months ended September 30, 2015.

The purpose of the transfer of Value Development to China Dairy is to facilitate a public offering of the capital stock of China Dairy in Australia. The completion of an offering in Australia is anticipated to further dilute the Company’s ownership of China Dairy.

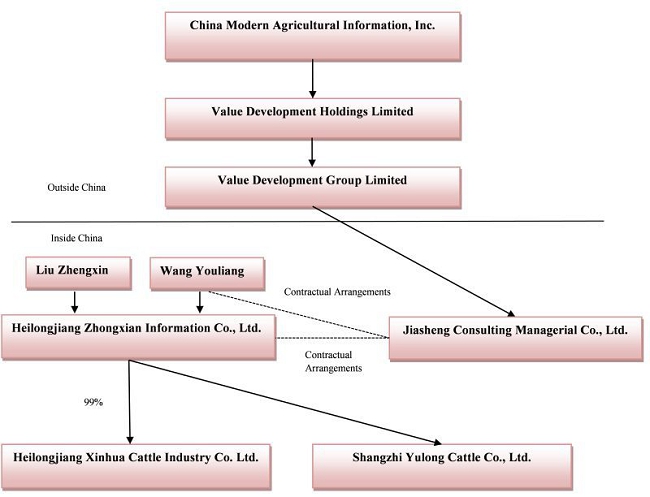

Our corporate structure pre-restructure is set forth below:

5

Our corporate structure post-restructure is set forth below:

Our Business Model

We generate revenues from three sources: sale of fresh milk, processing and sales of organic fertilizer, and assisting local farmers with their fresh milk sale efforts.

Fresh Milk

We exclusively use Holstein cows for our milk production. Holstein cows are well-regarded for their abundant milk production and high quality milk. Our cows currently have an average milking period of 305 days, and produce milk that contains approximately 3.5% fat. Each adult cow produces approximate 8,700 kilogram annually.

Our farmland is located in the Heilongjiang province which has a humid continental climate. This climate is ideal for the growth of grass, which in turn is essential in the grazing and feeding of our cattle that aids in our breeding of cows and calves, fresh milk production and organic fertilizer production. We maintain strict quality control and testing procedures to ensure our milk products are of high quality. The milk production and quality controls ensure that the milk produced is high in nutrients and active biological substances.

6

Cow Feeders

Xinhua Cattle outsources over 90% of the cow feeding to local farmers pursuant to a series of entrust feeding agreements with the local farmers. Pursuant to these agreements, we pay for the fostering fees and feed costs. In return, the local farmers provide us with the fresh milk produced by the cows.

Pursuant to these entrust feeding agreements, we entrust our cattle to local farmers to assist in a more efficient means to produce fresh milk, as well as manure, used in our production of organic fertilizer. In that regard, we pay a monthly fee to local farmers that correlate to the number of calves, cattle and cows that are placed in their care. Pursuant to the agreements, local farmers are responsible for the feeding and raising of the cattle as well as the fresh milk production. Additionally, these local farmers ensure that each cow produces a minimum of 20 kilogram of milk daily.

From July 2014 to February 2015, monthly feeding fee to the local farmers is $8.13 per baby cow, $11.39 per pre-adult cow, $16.27 per young cow and $32.54 per adult cow, respectively; food costs every month to the local farmers is $46 per baby cow, $57 per pre-adult cow, $62 per young cow, and $88 per adult cow, respectively. Since March 2015, the monthly feeding fee remains the same while the foods costs increased to $54 per baby cow, $68 per pre-adult cow, $75 per young cow, and $111 per adult cow, respectively.

Local farmers are responsible for milk production and are required to timely deliver the milk production daily. All of the raw milk produced by the cattle is owned by us. Additionally, the local farmers are contractually obligated to conduct periodic breeding for the young cattle and cows, at our expense. The breeding is overseen by veterinarians of our choosing. All calves produced by our entrusted cows are our property, and all calve births are overseen by veterinarians of our choosing. All cow waste produced by our entrusted cattle is owned by us. The local farmers are obligated to collect the waste and provide it to us for further processing, and eventual sale as organic fertilizer.

Fresh Milk Customers

Mengniu Dairy Co. Ltd.

Mengniu Dairy Co. Ltd. (“Mengniu”) has been a purchaser of our raw milk products since 2006. Our current and previous contractual arrangement provides for the purchase of our milk at the base price of RMB 3.45 or $0.55/kilogram. However, the base price is based on the quality of our raw milk, namely, fat percentage of 3.1%, protein percentage of 2.95%, and the Level One microorganism quality (less than 0.5 million / ml). Mengniu has renewed a two-year contractual commitment to continue to purchase raw milk products from us until February 21, 2016.

Mengniu accounted for 22.8% of all milk sales for the fiscal year ended June 30, 2015 and 43.4% of all milk sales for the fiscal year ended June 30, 2014.

Qiqihaer Heshan Dairy Co., Ltd.

Qiqihaer Heshan Dairy Co., Ltd. (“Heshan Dairy”) has been a purchaser of our fresh milk products since 2011. Our current and previous contractual arrangement provides for the purchase of our milk at the base price of RMB 3.50 or $0.56/kilogram. However, the base price is based on the quality of our fresh milk, namely, fat percentage of 3.1%, protein percentage of 2.95%, and the Level One microorganism quality (less than 0.5 million / ml). Heshan Dairy has renewed a one year contractual commitment to continue to purchase fresh milk products from us until December 31, 2014.

Heshan Dairy accounted for 20.3% of all our milk sales for the fiscal year ended June 30, 2015 and 13.9% of all our milk sales for the fiscal year ended June 30, 2014.

7

Heilongjiang Longxing Dairy Co., Ltd.

Heilongjiang Longxing Dairy Co., Ltd. (“Longxing Dairy”) has been a purchaser of our fresh milk products since 2011. Our current and previous contractual arrangement provides for the purchase of our milk at the base price of RMB 3.50 or $0.56/kilogram. However, the base price is based on the quality of our fresh milk, namely, fat percentage of 3.1%, protein percentage of 2.95%, and the Level One microorganism quality (less than 0.5 million / ml). Longxing Dairy has renewed a one-year contractual commitment to continue to purchase fresh milk products from us until December 31, 2014.

Longxing Dairy accounted for 19.4% of all our milk sales for the fiscal year ended June 30, 2015 and 14.3% of all our milk sales for the fiscal year ended June 30, 2014.

Heilongjiang Nongken Delong Dairy Co., Ltd.

Heilongjiang Nongken Delong Dairy Co., Ltd. (“Nongken Delong Dairy”) has been a purchaser of our fresh milk products since 2011. Our current and previous contractual arrangement provides for the purchase of our milk at the base price of RMB 3.50 or $0.56/kilogram. However, the base price is based on the quality of our fresh milk, namely, fat percentage of 3.1%, protein percentage of 2.95%, and the Level One microorganism quality (less than 0.5 million / ml). Nongken Delong Dairy has renewed a one-year contractual commitment to continue to purchase fresh milk products from us until December 31, 2014.

Nongken Delong Dairy accounted for 18.6% of all our milk sales for the fiscal year ended June 30, 2015 and 14.4% of all our milk sales for the fiscal year ended June 30, 2014.

SuihuaDongxing Dairy Co., Ltd.

SuihuaDongxing Dairy Co., Ltd. (“Dongxing Dairy”) has been a purchaser of our fresh milk products since 2011. Our current and previous contractual arrangement provides for the purchase of our milk at the base price of RMB 3.50 or $0.56/kilogram. However, the base price is based on the quality of our fresh milk, namely, fat percentage of 3.1%, protein percentage of 2.95%, and the Level One microorganism quality (less than 0.5 million / ml). Dongxing Dairy has renewed a one-year contractual commitment to continue to purchase fresh milk products from us until December 31, 2014.

Dongxing Dairy accounted for 18.9% of all our milk sales for the fiscal year ended June 30, 2015 and 14.0% of all our milk sales for the fiscal year ended June 30, 2014.

Organic Fertilizer

As a by-product of the fresh milk production, we use the resulting manure as a source of additional revenue. We combine the raw material, the manure, with inoculating complex microbial agents, and then ferment the product using biological and chemical processes and microbial fermentation technology, which produces the organic fertilizer.

Our fertilizer product is unique, in that it decomposes slowly, maintains long fertilizing effect and slow nutrient loss. It can effectively promote the proliferation of useful microorganisms and enhance soil fertility, resulting in more abundant crop growth.

Zhongxian Information has formed a livestock business system which integrates fresh milk production and organic fertilizer production for direct sale to suppliers.

The sale of organic fertilizer only makes up a very small amount of our total revenue. We generated USD $20,401 in revenue from our organic fertilizer sales in the fiscal year ended June 30, 2015 and USD 20,199 in revenue from our organic fertilizer sales in the fiscal year ended on June 30, 2014. Jianfa Bio-Organic Fertilizer Plant was the sole customer for our organic fertilizer products from 2006 to June 2011. Since July 2011, we have been selling our organic fertilizer products to Heilongjiang Soyang Bio Energy Development Ltd.

8

Sales Commissions

In addition to selling fresh milk to Chinese manufacturing and distribution companies of dairy products, we started to sell our milk cows to local farmer in exchange for monthly payments from the local farmers on their monthly milk sales since June 2011. The monthly payments represent the monthly installments, including interest, for the purchase price of milk cows sold, or a mix of the purchase price and commissions for our assistance in arranging for their milk sales.

In June 2011, Xinhua sold 2,000 milk cows to six local farmers with the purchase price being paid in installments over a five-year period with a minimum payment of 20% of the sales price annually. No down payment was made by the farmers for these sales in June 2011. In August 2011, through initial negotiation and subsequent modification of sales terms, Xinhua sold 5,635 milk cows to 20 local farmers with a 10% down payment plus monthly installments with interest at 7% on any remaining principal payment over a period of the remaining useful life of the cows sold. In September 2011, Xinhua also sold 3,787 milk cows to 13 local farmers with monthly installments over a period of the remaining useful life of the cows sold with no down payment. The receivables related to the sales of these all cows is included in notes receivable in the accompanying consolidated balance sheets as of June 30, 2015 and 2014. In addition to monthly installments for the purchase price of the cows sold, these local farmers who bought our cows in August and September 2011 also pay commissions to us each month for our assistance in arranging for the sale of their milk. In November and December 2014, Yulong sold 3,714 and 2,995 cows, respectively to 37 local farmers.

Pursuant to the agreements signed in August 2011, September 2011, November 2014, and December 2014, the sales price will be collected in monthly installments plus interest at 7% on the outstanding balance, over the remaining useful lives of the cows, which range from one to eight years. Local farmers are required to pay 30% of monthly milk sales generated from the cows purchased by the farmers. The 30% monthly payments are to be applied first to the monthly installment of principal for the cows sold and the balance as commission income for the Company’s assistance in arranging for the sale of the milk. The 30% monthly payments will continue over the entire remaining life of the cows sold. While the 30% rate and the amount applied to monthly installments for the purchase price of the cows remain the same, the amount of sales commission income will vary depending on total monthly milk sales and the progress of repayments towards the purchase price.

By the end of June 30, 2015, we had 22,206 cows, among which, 19,555 cows continue to be fed by local farmers, 400 cows are maintained by Xinhua Cattle, and 2,251 cows are maintained by Yulong Cattle.

From July 2014 to Feb 2015, monthly feeding fee to the local farmers of $8.13 per baby cow, $11.39 per pre-adult cow, $16.27 per young cow and $32.54 per adult cow, respectively; food costs every month to the local farmers of $46 per baby cow, $57 per pre-adult cow, $62 per young cow, and $88 per adult cow, respectively. Since March 2015, the monthly feeding fee remains the same while the foods costs increased to $54 per baby cow, $68 per pre-adult cow, $75 per young cow, and $111 per adult cow, respectively.

The increase in feeding costs was the main reason that we disposed of a large number of our cows. The bulk sales of milk cows provides us with a new revenue stream with relatively low direct costs as the local farmers assumed the milk production function.

Research and Development

We had no expenses on research and development activities during the fiscal years ended June 30, 2015 and 2014.

Intellectual Property

We regard the protection of our copyrights, service marks, trademarks, trade secrets and other intellectual property rights as critical to our future success. We rely on contractual restrictions to protect our proprietary rights in products and services. We cannot assure you that these contractual arrangements or the other steps taken by us to protect our intellectual property will prove sufficient to prevent misappropriation of our technology or to deter independent third-party development of similar technologies.

9

Trademarks

Through Zhongxian Information, we have registered the following trademark with the Trademark Office, State Administration for Industry and Commerce in the PRC:

| No. | Registration No. | Trademark | Registrant | Item Category | Expiration Date | |||||

| 1 | 5980762 | MANCUNXIANG | Zhongxian Information | Category No. 30 (Staple food): Coffee, tea, cocoa, sugar, rice, tapioca, sago, artificial coffee; flour and preparations made from cereals, bread, pastry and confectionery, ices; honey, treacle; yeast, baking-powder, salt, mustard; vinegar, sauces (condiments); spices; ice. | December 13, 2019 | |||||

| 2 | 4705072 | ZHONGXIAN PROPERTY |

Zhongxian Information | Category No. 31 (Natural agricultural products): Agricultural, horticultural and forestry products and grains not included in other classes; live animals; fresh fruits and vegetables; seeds, natural plants and flowers; foodstuffs for animals, malt. | March 6, 2018 | |||||

| 3 | 4705070 | ZHONGXIAN INFORMATION |

Zhongxian Information | Category No. 38 (Communication services): Telecommunications. | January 6, 2019 | |||||

| 4 | 4705071 | ZHONGXIAN TECHNOLOGY |

Zhongxian Information | Category No. 42 (Scientific and technological services): Scientific and technological services and research and design relating thereto; industrial analysis and research services; design and development of computer hardware and software. | January 6, 2019 |

We plan to file for extension with the Trademark Office of the above trademark prior to the expiration date.

Copyright

The Company currently does not own any copyrights. The copyright of Zhongxian Agricultural Economy Network Services System V1.0 and Zhongxian Agricultural Capital Information Services System V1.0 were previously contributed to the Company by its shareholders and have now been reverted back to such shareholders.

Domain Names

Zhongxian Information owns the domain name of www.hljzhongxian.com (Registration No.: Hei ICP Bei 10200342).

Government Regulation

We are subject to inspection of the Livestock and Veterinary Bureau each quarter for our breeder farms. We have never been penalized by the bureau.

10

China Regulations

This section sets forth a summary of the most significant Chinese regulations or requirements that may affect our business activities operated in China or our shareholders’ right to receive dividends and other distributions of profits from the PRC subsidiaries.

Foreign Investment in PRC Operating Companies

The Foreign Investment Industrial Catalogue jointly issued by the MOFCOM and the National Development and Reform Commission or the NDRC in 2007 classified various industries/business into three different categories: (i) encouraged for foreign investment; (ii) restricted to foreign investment; and (iii) prohibited from foreign investment. For any industry/business not covered by any of these three categories, they will be deemed industries/business permitted to have foreign investment. Except for those expressly provided restrictions, encouraged and permitted industries/business are usually 100% open to foreign investment and ownership. With regard to those industries/business restricted to or prohibited from foreign investment, there is always a limitation on foreign investment and ownership. The PRC Subsidiary’s business does not fall under the industry categories that are restricted to, or prohibited from foreign investment and is not subject to limitation on foreign investment and ownership.

Regulation of Foreign Currency Exchange

Foreign currency exchange in the PRC is governed by a series of regulations, including the Foreign Currency Administrative Rules (1996), as amended, and the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), as amended. Under these regulations, the Renminbi is freely convertible for trade and service-related foreign exchange transactions, but not for direct investment, loans or investments in securities outside the PRC without the prior approval of SAFE. Pursuant to the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), Foreign Invested Enterprises (“FIEs”) may purchase foreign exchange without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange, subject to a cap approved by SAFE, to satisfy foreign exchange liabilities or to pay dividends. However, the relevant Chinese government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside the PRC are still subject to limitations and require approvals from SAFE.

Regulation of FIEs’ Dividend Distribution

The principal laws and regulations in the PRC governing distribution of dividends by FIEs include:

| (i) | The Sino-foreign Equity Joint Venture Law (1979), as amended, and the Regulations for the Implementation of the Sino-foreign Equity Joint Venture Law (1983), as amended; |

| (ii) | The Sino-foreign Cooperative Enterprise Law (1988), as amended, and the Detailed Rules for the Implementation of the Sino-foreign Cooperative Enterprise Law (1995), as amended; |

| (iii) | The Foreign Investment Enterprise Law (1986), as amended, and the Regulations of Implementation of the Foreign Investment Enterprise Law (1990), as amended. |

Under these regulations, FIEs in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, foreign-invested enterprises in the PRC are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds unless such reserve funds have reached 50% of their respective registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

11

Regulation of a Foreign Currency’s Conversion into RMB and Investment by FIEs

On August 29, 2008, SAFE issued a Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises or Notice 142, to further regulate the foreign exchange of FIEs. According to the Notice 142, FIEs shall obtain verification report from a local accounting firm before converting its registered capital of foreign currency into Renminbi, and the converted Renminbi shall be used for the business within its permitted business scope. The Notice 142 explicitly prohibits FIEs from using RMB converted from foreign capital to make equity investments in the PRC, unless the domestic equity investment is within the approved business scope of the FIE and has been approved by SAFE in advance.

Regulation of Foreign Exchange in Certain Onshore and Offshore Transactions

In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Return Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies , or SAFE Notice 75, which became effective as of November 1, 2005, and was further supplemented by two implementation notices issued by SAFE on November 24, 2005 and May 29, 2007, respectively. SAFE Notice 75 states that PRC residents, whether natural or legal persons, must register with the relevant local SAFE branch prior to establishing or taking control of an offshore entity established for the purpose of overseas equity financing involving onshore assets or equity interests held by them. The term “PRC legal person residents” as used in SAFE Notice 75 refers to those entities with legal person status or other economic organizations established within the territory of the PRC. The term “PRC natural person residents” as used in SAFE Notice 75 includes all PRC citizens and all other natural persons, including foreigners, who habitually reside in the PRC for economic benefit. SAFE implementation notice of November 24, 2005 further clarifies that the term “PRC natural person residents” as used under SAFE Notice 75 refers to those “PRC natural person residents” defined under the relevant PRC tax laws and those natural persons who hold any interests in domestic entities that are classified as “domestic-funding” interests.

PRC residents are required to complete amended registrations with the local SAFE branch upon: (i) injection of equity interests or assets of an onshore enterprise to the offshore entity, or (ii) subsequent overseas equity financing by such offshore entity. PRC residents are also required to complete amended registrations or filing with the local SAFE branch within 30 days of any material change in the shareholding or capital of the offshore entity, such as changes in share capital, share transfers and long-term equity or debt investments and these changes do not relate to return investment activities. PRC residents who have already organized or gained control of offshore entities that have made onshore investments in the PRC before SAFE Notice 75 was promulgated must register their shareholdings in the offshore entities with the local SAFE branch on or before March 31, 2006.

Under SAFE Notice 75, PRC residents are further required to repatriate into the PRC all of their dividends, profits or capital gains obtained from their shareholdings in the offshore entity within 180 days of their receipt of such dividends, profits or capital gains. The registration and filing procedures under SAFE Notice 75 are prerequisites for other approval and registration procedures necessary for capital inflow from the offshore entity, such as inbound investments or shareholders loans, or capital outflow to the offshore entity, such as the payment of profits or dividends, liquidating distributions, equity sale proceeds, or the return of funds upon a capital reduction.

Government Regulations Relating to Taxation

On March 16, 2007, the National People’s Congress or NPC, approved and promulgated the PRC Enterprise Income Tax Law , which we refer to as the New EIT Law. The New EIT Law took effect on January 1, 2008. Under the New EIT Law, FIEs and domestic companies are subject to a uniform tax rate of 25%. The New EIT Law provides a five-year transition period starting from its effective date for those enterprises which were established before the promulgation date of the New EIT Law and which were entitled to a preferential lower tax rate under the then-effective tax laws or regulations.

12

On December 26, 2007, the State Council issued a Notice on Implementing Transitional Measures for Enterprise Income Tax, or the Notice, providing that the enterprises that have been approved to enjoy a low tax rate prior to the promulgation of the New EIT Law will be eligible for a five-year transition period since 1 January, 2008, during which time the tax rate will be increased step by step to the 25% unified tax rate set out in the New EIT Law. From 1 January, 2008, for the enterprises whose applicable tax rate was 15% before the promulgation of the New EIT Law, the tax rate will be increased to 18% for year 2008, 20% for year 2009, 22% for year 2010, 24% for year 2011, 25% for year 2012. For the enterprises whose applicable tax rate was 24%, the tax rate will be changed to 25% from January 1, 2008.

The New EIT Law provides that an income tax rate of 20% may be applicable to dividends payable to non-PRC investors that are “non-resident enterprises”. Non-resident enterprises refer to enterprises which do not have an establishment or place of business in the PRC, or which have such establishment or place of business in the PRC but the relevant income is not effectively connected with the establishment or place of business, to the extent such dividends are derived from sources within the PRC. The income tax for non-resident enterprises shall be subject to withholding at the income source, with the payor acting as the obligatory withholder under the New EIT Law, and therefore such income taxes generally called withholding tax in practice. The State Council of the PRC has reduced the withholding tax rate from 20% to 10% through the Implementation Rules of the New EIT Law. It is currently unclear in what circumstances a source will be considered as located within the PRC. We are a U.S. holding company and substantially all of our income is derived from dividends we receive from our subsidiaries located in the PRC. Thus, if we are considered as a “non-resident enterprise” under the New EIT Law and the dividends paid to us by our subsidiary in the PRC are considered income sourced within the PRC, such dividends may be subject to a 10% withholding tax.

Such income tax may be exempted or reduced by the State Council of the PRC or pursuant to a tax treaty between the PRC and the jurisdictions in which our non-PRC shareholders reside. For example, the 10% withholding tax is reduced to 5% pursuant to the Double Tax Avoidance Agreement Between Hong Kong and Mainland China if the beneficial owner in Hong Kong owns more than 25% of the registered capital in a company in the PRC.

The new tax law provides only a framework of the enterprise tax provisions, leaving many details on the definitions of numerous terms as well as the interpretation and specific applications of various provisions unclear and unspecified. Any increase in the combined company’s tax rate in the future could have a material adverse effect on its financial conditions and results of operations.

Regulations of Overseas Investments and Listings

On August 8, 2006, six PRC regulatory agencies, including MOFCOM, CSRC, SASAC, SAT, SAIC and SAFE, jointly amended and released the M&A Rules, which became effective on September 8, 2006. This regulation, among other things, includes provisions that purport to require that an offshore SPV formed for purposes of overseas listing of equity interest in PRC companies and controlled directly or indirectly by PRC companies or individuals obtain the approval of CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, CSRC published on its official website procedures regarding its approval of overseas listings by SPVs. CSRC approval procedures require the filing of a number of documents with CSRC and it would take several months to complete the approval process. The application of the M&A Rules with respect to overseas listings of SPVs remains unclear with no consensus currently existing among the leading PRC law firms regarding the scope of the applicability of CSRC approval requirement.

Regulations on Work Safety

On June 29, 2002, the Work Safety Law (“WSL”) of the PRC was adopted by the Standing Committee of the 9th National People’s Congress and came into effect on November 1, 2002, as amended on August 27, 2009. The WSL provides general work safety requirements for entities engaging in manufacturing and business activities within the PRC. Additionally, Regulation on Work Safety Licenses (“RWSL”), as adopted by the State Council on January 7, 2004 effective on January 13, 2004, requires enterprises engaging in the manufacture of dangerous chemicals to obtain a work safety license with a term of three years. If a work safety license needs to be extended, the enterprise must go through extension procedures with authorities three months prior to its expiration. In addition, on May 17, 2004, the Measures for Implementation of Work Safety Licenses of Dangerous Chemicals Production was promulgated as implementing measures to the Regulation on Work Safety Licenses which provides that entities producing dangerous chemicals are required to obtain work safety licenses pursuant to specific requirements. Without work safety licenses, no entity may engage in the formal manufacture of dangerous chemicals.

13

The Regulations on the Safety Administration of Dangerous Chemicals (“RSADC”) was promulgated by the State Council on January 26, 2002, effective as of March 15, 2002. It sets forth general requirements for manufacturing and the storage of dangerous chemicals in China. The RSADC requires that companies manufacturing dangerous chemicals establish and strengthen their internal regulations and rules on safety control and fulfill the national standards and other relevant provisions of the State. In addition, according to the RSADC, companies that manufacture, store, transport or use dangerous chemicals shall be required to obtain corresponding approvals or licenses with the State Administration of Work Safety and its local branches and other proper authorities. Companies that manufacture or store dangerous chemicals without approval or registration with the proper authorities can be shut down, ordered to stop manufacturing or ordered to destroy the dangerous chemicals. Such companies can also be subject to fines. If criminal law is violated, the persons chiefly liable, along with other personnel directly responsible for such impropriety, shall be subject to relevant criminal liability.

Regulations on Environmental Protection

According to the Prevention and Control of Water Pollution Law, as adopted by the Standing Committee of the 10th National People’s Congress on February 28, 2008 and effective on June 1, 2008, China adopted a licensing system for pollutant discharge. Companies directly or indirectly responsible for discharge of industrial waste water or medical sewage to waters shall be required to obtain a pollutant discharge license. All companies are prohibited from discharging wastewater and sewage to waters without or in violation of the terms of the pollutant discharge license.

The Regulations on the Administration of Construction Projects Environmental Protection (“RACPEP”), as adopted by the State Council on November 18, 1998 and effective on November 29, 1998, governs construction projects and the impact such projects will have on the environment. Pursuant to the RACPEP, the governing body is responsible for supervising the implementation of a three tiered system that includes (i) reviewing and approving a construction project, (ii) overseeing the construction project and (iii) to inspect the finished construction project and ensure that all harmful pollutants are disposed of correctly. Manufacturing companies are required to apply for inspection with environment protection authorities upon completion of a construction project.

Food Safety Law of the People’s Republic of China

The Food Safety Law of the People’s Republic of China (the “Food Safety Law”) as adopted at the 7th Session of the Standing Committee of the 11th National People’s Congress of the People’s Republic of China and effective on June 1, 2009, governs the food safety in food production and business operation activities. Pursuant to the Food Safety Law, food producers must establish an internal inspection and record system for raw materials and predelivery products, and food distributors must also establish internal systems to record and inspect food products procured from suppliers. In addition, any food addictives that are not in the approved government catalog must not be used and no food products can be sold inspection-free.

Regulations on the Implementation of the Food Safety Law of the People’s Republic of China

The Regulations on the Implementation of the Food Safety Law of the People’s Republic of China (the “Regulations”) as adopted at the 73rd Standing Committee Meeting of the State Council on July 8, 2009 and effective on July 20, 2009, are promulgated in accordance with the Food Safety Law. The Regulations require that the local People’s Government at or above the country level shall perform the responsibility specified in the Food Safety Law, improve the ability for supervision and administration of food safety, ensure supervision and administration of food safety; establish and improve the coordination mechanism between food safety regulatory authorities, integrate and improve the food safety information network, and realize the sharing of food safety and food inspection information and other technical resources.

14

Law of the People’s Republic of China on Quality and Safety of Agricultural Products

The Law of the People’s Republic of China on Quality and Safety of Agricultural Products was adopted at the 21st Meeting of the Standing Committee of the Tenth National People’s Congress on April 29, 2006. This Law was enacted in order to ensure the quality and safety of agricultural products, maintain the health of the general public, and promote the development agriculture and rural economy. Pursuant to this Law, agricultural products distribution enterprises shall establish a sound system of inspection and acceptance for their purchases. In addition, agricultural products that fail to pass the inspection based on the quality and safety standards of agricultural products cannot be marketed.

Compliance with Environmental Laws

We strive to meet the requirements provided in environmental protection regulations, and regulations related to facility safety and quality control, throughout the design, maintenance and growth of our operation facilities and manufacturing process.

Employees

We currently have approximately 168 employees of which Zhongxian Information has 6 employees, Xinhua Cattle has 78 employees and Yulong Cattle has 84 employees and all of our employees are full-time employees.

Smaller reporting companies are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments

Smaller reporting companies are not required to provide the information required by this item.

Farmland

All land in China is government owned and cannot be sold to any individual or company. The Company obtained a “land use right” to use a track of land of 250,000 square meters at no cost through December 1, 2015. On May 10, 2013, the Company, entered into an agreement with the municipality of Qiqihaer to obtain the “land use right” to use this land from May 1, 2013 to Apr 30, 2063. The Company recorded the prepayment of RMB 37,500,000 ($6,060,000) as prepaid land lease. The prepaid lease is being amortized over the land use term of 50 years using the straight-line method. The remaining prepayment of $5,854,800 and $5,947,900 is included in prepaid land lease in the consolidated balance sheets as of June 30, 2015 and 2014, respectively. The lease provides for renewal options.

On October 9, 2011, the Company entered into an operating lease, from October 9, 2011 to October 8, 2021, with the municipality of Heilongjiang to lease 16,666,750 square meters of land. The lease required the Company to prepay the ten year rental of RMB 30,000,000 (US$4,686,000). The related prepayment of $3,060,000 and $3,532,200 is included in prepaid land lease in the consolidated balance sheets as of June 30, 2015 and 2014, respectively. The lease provides for renewal options.

On February 25, 2013, the Company obtained another “land use right” to use 427,572 square meters of land, from March 1, 2013 to February 28, 2063. The Company recorded the prepayment of RMB 77,040,000 (US$12,450,000) as prepaid land lease. The prepaid lease is being amortized over the land use term of 50 years using the straight-line method. The remaining prepayment of $11,986,191 and $12,177,662 is included in prepaid land lease in the consolidated balance sheets as of June 30, 2015 and 2014, respectively. The lease provides for renewal options.

On May 7, 2015, the Company obtained another “land use right” to use 238,001 square meters of land, from May 7, 2015 to May 6, 2045. In addition, the Company also leased all the constructions on the land which includes cowsheds at 35,808 square meters on top of the land leased, an office building at 3,500 square meters and a flat building at 3,500 square meters. The lease period of all these constructions is the same as the land. The Company recorded the prepayment of RMB 74,847,600 (US$12,215,000) as prepaid lease. The prepaid lease is being amortized over the lease term of 30 years using the straight-line method. The remaining prepayment of $12,147,266 is included in prepaid lease in the consolidated balance sheets as of June 30, 2015.

On May 14, 2015, the Company obtained another “land use right” to use 283,335 square meters of land, from May 14, 2015 to May 13, 2045. In addition, the Company also leased all the constructions on the land which includes cowsheds at 42,100 square meters, an office building at 3,000 square meters and a flat building at 3,000 square meters. The lease period of all these constructions is the same as the land. The Company recorded the prepayment of RMB 111,887,500 (US$18,260,000) as prepaid lease. The prepaid lease is being amortized over the lease term of 30 years using the straight-line method. The remaining prepayment of $18,158,595 is included in prepaid lease in the consolidated balance sheets as of June 30, 2015.

Rent expense charged to operations for the fiscal years ended June 30, 2015 and 2014 was $1,029,601 and $860,813, respectively.

15

Office Space

We are under arrangements with an unrelated third party to use an office space at no cost from September 1, 2010, to August 31, 2015.

From time to time, we may be involved in litigation in the ordinary course of business. We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. To our knowledge, there is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of our executive officers or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or any of our companies or our companies’ subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not Applicable.

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases Of Equity Securities.

Market Information

Our common stock began to be quoted on the OTC Bulletin Board on July 8, 2010 and is currently quoted on OTCQB under the symbol “CMCI”. There has been a very limited public market for our common stock. There can be no assurance that a liquid market for our securities will ever develop.

The following table sets forth the high and low bid quotations for our common stock as reported on the OTCQB for the periods indicated.

High Bid* ($) | Low Bid* ($) | |||||||

| 2014 | ||||||||

| Fourth quarter | $ | 0.64 | 0.45 | |||||

| Third quarter | $ | 0.58 | 0.37 | |||||

| Second quarter | $ | 0.41 | 0.21 | |||||

| First quarter | $ | 0.24 | 0.10 | |||||

| 2015 | ||||||||

| Fourth quarter | $ | 0.65 | .51 | |||||

| Third quarter | $ | 0.54 | 0.33 | |||||

| Second quarter | $ | 0.89 | 0.46 | |||||

| First quarter | $ | 1.10 | 0.58 | |||||

* The quotations of the closing prices reflect inter-dealer prices, without retail mark-up, markdown or commission.

Holders

As of September 30, 2015, there are 787 holders of record of the Company’s common stock.

Dividends

The Company has not paid any cash dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize all available funds for the development of the Company's business.

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth securities authorized for issuance under any equity compensation plans approved by our stockholders as well as any equity compensation plans not approved by our stockholders as of June 30, 2015.

| Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | ||||||||||

| Plan category | ||||||||||||

| Plans approved by our stockholders: | ||||||||||||

| 2012 Stock Incentive Plan (1) | 0 | 0 | 0 | |||||||||

| (1) | On April 16, 2012, the Company granted 3,000,000 shares of restricted stock under the Plan to its employees and the shares were issued on April 26, 2012. The shares, with a fair value of $1,200,000 at the grant date, were fully vested on May 20, 2012 and the fair value of the shares was charged to operations for the fiscal year ended June 30, 2012. As of September 30, 2015, there are currently no shares available to be issued. |

17

Item 6. Selected Financial Data.

Smaller reporting companies are not required to provide the information required by this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of the results of operations and financial condition of the Company for the fiscal years ended June 30, 2015 and 2014. Such discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto and other financial information contained elsewhere in this Annual Report.

Overview

We are a leading producer and distributor of raw fresh milk in China. We have two operating entities with an aggregate fresh milk production capacity of approximately 234 tons per day. We also have 76 exclusive individual partners with an aggregate fresh milk production capacity of approximately 405 tons per day. We have five major customers, one of which is the leading dairy company in China.

We were incorporated on December 22, 2008 under the laws of the State of Nevada. We were formerly known as Trade Link. On April 4, 2011, the Board of Directors of Trade Link filed an amendment to the Certificate of Incorporation with the State of Nevada and changed our name from Trade Link to China Modern Agricultural Information, Inc.

On January 28, 2011, we entered into the Exchange Agreement by and among (i) Value Development, a British Virgin Islands company, (ii) Value Development’s shareholders, (iii) us, and (iv) our former principal stockholders. Pursuant to the terms of the Exchange Agreement, Value Development’s shareholders transferred to us all of the shares of Value Development in exchange for the issuance of 35,998,000 shares of our common stock. The shares issued to Value Development’s shareholders in the Securities Exchange constituted approximately 87.80% of our issued and outstanding shares of common stock as of and immediately after the consummation of the Securities Exchange. As a result of the Securities Exchange, Value Development became our wholly owned subsidiary and Value Development’s former principal shareholders became our principal shareholders.

On January 28, 2011, Value Development completed the acquisition of Jiasheng Consulting. Jiasheng Consulting entered into a series of agreements with Zhongxian Information, Mr. Zhengxin Liu, our Chief Human Resource Officer and holder of 62% the of equity interest in Zhongxian Information, and Mr. Youliang Wang, our Chief Executive Officer and holder of 38% of the equity interest of Zhongxian Information. Pursuant to the Contractual Arrangements, Jiasheng Consulting controls all managerial power of Zhongxian Information. The contractual arrangements include a shareholder voting rights proxy agreement, exclusive consulting and services agreement, exclusive call option agreement and equity pledge agreement, pursuant to which, Jiasheng Consulting shall provide exclusive and complete business support and technical and consulting service to Zhongxian Information in exchange for an annual fee in the amount of Zhongxian Information’s yearly net profits after tax, and Zhongxian Information’s stockholders pledged their rights, title and equity interest in Zhongxian Information as security for the collection of such consulting and service fees provided in the equity pledge agreement.

Zhongxian Information was incorporated in China in January 2005 with registered capital of 10 million Renminbi or $1,206,800 US Dollars. In February 2006, it acquired 99% of the registered capital of Xinhua Cattle, which was incorporated in China in December 2005 with registered capital of three million RMB or $371,580 US Dollars. Xinhua Cattle is located in Qiqihar, Heilongjiang Province, in northeast China and is a livestock company that engages in cow breading and fresh milk production and distribution.

On November 23, 2011, Zhongxian Information acquired 100% of the equity interest of Yulong Cattle in exchange for (i) issuance of 9,000,000 shares of our common stock, and (ii) a cash payment of $4,396,000, to Yulong Cattle’s former shareholders. Yulong Cattle was incorporated on December 4, 2007 under the laws of the PRC. Yulong Cattle, located in Harbin, Heilongjiang, in northeast China, is a livestock company that engages in cow breeding and fresh milk distribution, and primarily generates its revenue from the sale of fresh milk.

Recent Company Restructure

Early in July 2015, Hope Diary acquired 60% of China Dairy and became a wholly-owned subsidiary of the Company after Mr. Youliang Wang, Company’s Chief Executive Officer, transferred 100% of his interest in Hope Diary to the Company for $50,000 (the “Hope Diary Transfer”). On July 16, 2015, the Company transferred 100% of the issued and outstanding shares of Value Development to China Dairy, which is 60% owned indirectly by the Company through the Company’s wholly owned subsidiary, Hope Diary as a result of the Hope Diary Transfer (the “Restructure”).

The Restructure involves nominal consideration received or paid as Value Development and China Dairy are under common control by the Company and this transaction affects the Company’s interests in Value Development.

As a result of the Restructure, the Company indirectly owns 60% of China Dairy through its wholly-owned subsidiary, Hope Diary, which holds 60% of the issued and outstanding shares of China Dairy, which in turn holds 100% of the issued and outstanding shares of Value Development.

18

The effect of this transaction was the decrease in interest of the Company in its operating company by 40%. This will result in the Company recognizing a transaction loss of approximately $50,300,000 during the three months ended September 30, 2015.

The purpose of the transfer of Value Development to China Dairy is to facilitate a public offering of the capital stock of China Dairy in Australia. The completion of an offering in Australia is anticipated to further dilute the Company’s ownership of China Dairy.

Company’s current structure are set forth as follows:

| 19 |

Factors Affecting our Results of Operations

Our operating results are primarily affected by the following present factors:

| · | Dairy Industry Growth. We believe the market for dairy products in China for the long term will grow rapidly, driven by China’s economic growth, improved living quality and increased penetration of infant formula. Accordingly, we believe that the demand of fresh milk will increase rapidly. |

| · | Production Capacity. Our revenue largely depends on our production capacity. The production capacity in this industry is determined by the variety, aging and number of adult cows. Accordingly, we acquired Yulong Cattle in November 2011 which increased our number of cows by 3,800 and improved our production capacity by approximately 90 tons per day when acquired. |

| · | Raw Material Supplies and Prices. The per unit cost of fresh milk is affected by price volatility of our raw materials and feeding expenses in the China markets. In response to the increased cost, we leased 16,666,750 square meters of grassland in October 2011 and 427,572 square meters grassland in February 2013. We believe that the hay production of this grassland can satisfy our raw material demand and lower our feeding cost. |

| · | Change of operation method. We disposed a large number of adult cows to local farmers, introduced distribution channel to them and receive up to 30% of the farmers’ milk sales as a commission. It makes our performance is stably increased and we have enough production resources to feed more cows by ourselves. |

Sale of Cows

In September 2011, August 2011, and June 2011, Xinhua Cattle sold 3,787, 5,635, and 2,000 of its cows to local farmers, respectively. In November and December 2014, Yulong sold 3,714 and 2,995 cows to local farmers respectively. 3,500 of the cows sold in 2014 were purchased from outside unrelated parties for $4,550,000. The remaining cows sold were raised by Yulong.

According to the agreements signed with the local farmers in June 2011, the sales price will be collected over five years, with a minimum payment of 20% of the sales price to be paid each year. The related receivable is recorded at its present value at a discount rate of 12%, which is commensurate with interest rates for notes with similar risk. The Company also entered into agreements with these local farmers for a 30% commission of their monthly milk sales generated by the cows sold in exchange for the Company’s assistance in arranging for the sale of the milk.

Pursuant to the agreements signed in August 2011, September 2011, November 2014, and December 2014, the sales price will be collected in monthly installments plus interest at 7% on the outstanding balance, over the remaining useful lives of the cows, which range from one to eight years. Local farmers are required to pay 30% of monthly milk sales generated from the cows purchased by the farmers. The 30% monthly payments are to be applied first to the monthly installment of principal for the cows sold and the balance as commission income for the Company’s assistance in arranging for the sale of the milk. The 30% monthly payments will continue over the entire remaining life of the cows sold. While the 30% rate and the amount applied to monthly installments for the purchase price of the cows remain the same, the amount of sales commission income will vary depending on total monthly milk sales and the progress of repayments towards the purchase price.

20

Results of Operations

Comparison of Fiscal Years Ended June 30, 2015 and 2014

The following table sets forth certain information regarding our results of operations for the fiscal years ended June 30, 2015 and 2014.

| For the years ended June 30, | ||||||||||||||||

| Change | ||||||||||||||||

| 2015 | 2014 | Amount | % | |||||||||||||

| Revenue | $ | 66,335,166 | $ | 58,753,254 | $ | 7,581,912 | 13 | % | ||||||||

| Cost of goods sold | 20,229,296 | 21,544,372 | (1,315,076 | ) | (6 | %) | ||||||||||

| Gross profit | 46,105,870 | 37,208,882 | 8,896,988 | 24 | % | |||||||||||

| Operating expenses | 1,930,266 | 1,644,152 | 286,114 | 17 | % | |||||||||||

| Operating income/(loss) | 44,175,604 | 35,564,730 | 8,610,874 | 24 | % | |||||||||||

| Other income and (expenses) | (259,539 | ) | 687,953 | (947,492 | ) | (138 | %) | |||||||||

| Income before income taxes | 43,916,065 | 36,252,683 | 7,663,382 | 21 | % | |||||||||||

| Provision for income taxes | 10,968,816 | 9,446,671 | 1,522,145 | 16 | % | |||||||||||

| Net income before noncontrolling interests | 32,947,249 | 26,806,012 | 6,141,237 | 23 | % | |||||||||||

| Noncontrolling interests | 355,982 | 285,569 | 70,413 | 25 | % | |||||||||||

| Net income attributable to controlling interests | $ | 32,591,267 | $ | 26,520,443 | $ | 6,070,824 | 23 | % | ||||||||

Revenues

The revenue was primarily generated from sales of fresh milk and commissions on fresh milk sales by famers to whom we sold cows. We had total revenues of $66,335,166 for the fiscal year ended June 30, 2015, an increase of $7,581,912 or 13%, compared to $58,753,254 for the fiscal year ended June 30, 2014. Such increases were mainly driven by approximately $6 million commission revenue generated from the total 6,709 milk cows disposed by Yulong in November and December 2014.

The following table shows a breakdown of revenue from natural milk sales and sales commission, respectively:

| For the fiscal years ended June 30, | ||||||||||||||||

| Change | ||||||||||||||||

| 2015 | 2014 | Amount | % | |||||||||||||

| Sales of natural milk | $ | 48,441,505 | $ | 46,577,224 | $ | 1,864,281 | 4 | % | ||||||||

| Sales commissions | 17,893,661 | 12,176,030 | 5,717,631 | 47 | % | |||||||||||

| Total revenue | $ | 66,335,166 | $ | 58,753,254 | $ | 7,581,912 | 13 | % | ||||||||

For the fiscal year ended June 30, 2015, our revenue generated from natural milk sales was $48,441,505 which represented an increase of $1,864,281 or 4% compared to $46,577,224 for the fiscal year ended June 30, 2014. The increase in the natural milk sales was directly related to the increased number of milk cows compared to the same period of 2014.

The following table sets forth information regarding the number of milk cows and the revenue per cow:

| For the fiscal years ended June 30, | ||||||||||||||||

| Change | ||||||||||||||||

| 2015 | 2014 | Amount | % | |||||||||||||

| Sales of natural milk | $ | 48,441,505 | $ | 46,577,224 | $ | 1,864,281 | 4 | % | ||||||||

| Average number of milk cows | 9,831 | 9,695 | 136 | 1 | % | |||||||||||

| Revenue from per milk cow | $ | 4,927 | $ | 4,804 | $ | 123 | 3 | % | ||||||||

The revenue per milk cow increased to $4,927 for the fiscal year ended June 30, 2015 from $4,804 for the fiscal year ended June 30, 2014, an increase of $123 or 3%. Such increase was a result of the increase in number of young adult cows with high daily production comparing to the fiscal year ended June 30, 2014, but the increase is slight.

The sales commissions increased from local farmers increased by $5,717,631 or 47% to $17,893,661 for the fiscal year ended June 30, 2015 from $12,176,030 for the fiscal year ended June 30, 2014. The quantity of milk cows we now earn commission revenue increased by 52% or 5,919 to 17,341 for the fiscal year ended June 30, 2015 from 11,422 for the fiscal year ended June 30, 2014 due to an addition from the sale of cows of 6,709 by Yulong in November and December 2014 and a deduction of 790 cows which had been fully depreciated from 3 farmers. The farmers started to pay the commission to Yulong in April 2015. In addition, the daily production of the cows sold by Yulong is also higher than the cows sold by Xinhua due to their younger age.

21

Gross profit

Our cost of goods sold consists of feeding food, feeding expenses and other direct production overhead which includes labor costs, depreciation, lease, water & electricity, etc. Upon the shift of milk production and distribution responsibilities from us to local farmers, our direct costs have been reduced as a result of lowered feeding food costs due to lower quantity of milk cows and, we have seen a marked improvement in our margins compared with the past two years.

| For the fiscal years ended June 30, | ||||||||||||||||

| Change | ||||||||||||||||

| 2015 | 2014 | Amount | % | |||||||||||||

| Cost of goods sold | $ | 20,229,296 | $ | 21,544,372 | $ | (1,315,076 | ) | (6 | %) | |||||||

| Average number of milk cows | 9,831 | 9,695 | 136 | 1 | % | |||||||||||

| Cost per milk cow | $ | 2,058 | $ | 2,222 | $ | (164 | ) | (7 | %) | |||||||

The cost per milk cow decreased to $2,058 for the fiscal year ended June 30, 2015 which represented a decrease of $164 or 7% compared to $2,222 for the fiscal year ended June 30, 2014. The main reason for the decrease was due to the increase in the cows fed by local farmers at a lower cost. As a result, the cost per milk cow decreased accordingly.

Gross profit margin

Our gross profit margin was 69.5% for the fiscal year ended June 30, 2015 which increased by 9.7% from the fiscal year ended June 30, 2014. The main reason for such an increase was mainly due to the disposal of adult cows by Yulong for which we now earn commissions and the decreased cost per milk cow.

Operating expenses

Our operating expenses increased to $1,930,266 for the fiscal year ended June 30, 2015 from $1,644,152 for the fiscal year ended June 30, 2014, an increase of $286,114 or 17%. Our operating expenses primarily consist of human resource costs, depreciation, professional fees associated with filings required by the securities laws of the United States, consulting fees for a Chinese financial advisory company and tax surplus fund, etc. We incurred $1,002,045 and $ 679,343 in tax surplus fund for the fiscal year ended June 30, 2015 and 2014, respectively. We classified these tax surplus fund as selling expenses.

Operating income

As a result of the foregoing, we had operating income of $44,175,604 for the fiscal year ended June 30, 2015, representing an increase of $8,610,874, as compared to operating income of $35,564,730 for the fiscal year ended June 30, 2014.

Non-operating income (expenses)

For the fiscal year ended June 30, 2015, non-operating income consists primarily of interest income of $618,263 earned on the outstanding notes receivable from the farmers and other non-operating income of $226,543 which mainly consists of bank interest earned. Non-operating expenses consists of the loss on the disposal of mature biological assets of $1,101,101 and the loss on the disposal of a motor vehicle of $3,244. For the fiscal year ended June 30, 2014, non-operating income consists primarily of interest income of $537,737 earned on the outstanding notes receivable from the farmers and other non-operating income of $149,185 and $1,031 which mainly consists of bank interest earned and the gain on disposal of biological assets, respectively.

Net Income

Xinhua Cattle and Yulong Cattle are entitled to a tax exemption for the full Enterprise Income Tax in China due to a government tax preference policy for the dairy farming industry. Zhongxian Information is subject to an Enterprise Income Tax of 25% and files its own tax returns before January 16, 2015. On January 16, 2015, Zhongxian Information received a tax exemption notice from Harbin National Tax Bureau on its investment income from its subsidiaries. Jiasheng Consulting (the “WFOE”) is subject to an Enterprise Income Tax at 25% and files its own tax return. The provision for income taxes was $10,968,816 and $9,446,671 for the fiscal years ended June 30, 2015 and 2014, respectively, primarily representing the enterprise income tax on the income of Zhongxian Information. Net income before non-controlling interests was $32,947,249 and $26,806,012 for the fiscal years ended June 30, 2015 and 2014, respectively, which represented an increase in $6,141,237 or 23%. As we own 99% of Xinhua Cattle’s shares, net income attributed to the non-controlling shareholders was $355,982 and $285,569 for the fiscal years ended June 30, 2015 and 2014, respectively. Our net income attributable to the common stockholders of the Company was $32,591,267 representing $0.61 per share and $26,520,443 representing $0.50 per share for the fiscal years ended June 30, 2015 and 2014, respectively.

22

Foreign Currency Translation Adjustment

Our reporting currency is the U.S. dollar. Our local currency, Renminbi, is our functional currency. All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. Statements of income and other comprehensive income and cash flows have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of our consolidated financial statements are recorded as other comprehensive income (loss). Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. For the fiscal years ended June 30, 2015 and 2014, foreign currency translation adjustments of $560,995 and $874,250, respectively, have been reported as other comprehensive income in the consolidated statements of income and other comprehensive income, respectively.

Liquidity and Capital Resources

As of June 30, 2015 and June 30, 2014, we had no bank debt but amounts owed to shareholders of $937,524 and $656,995, respectively. The amounts due to our stockholders was principally for the professional fees incurred for being a reporting company in the United States from our stockholders’ personal bank accounts because of the restriction of official bank transfers abroad by the Bank of China. At the same time, we had $54,145,781 and $58,032,554 in cash at June 30, 2015 and 2014 as well as working capital of $64,685,249 and $65,364,104, respectively.

Operating activities