Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVAYA INC | a8-k_feb82016xearningsrele.htm |

| EX-99.1 - EXHIBIT 99.1 - AVAYA INC | ex991earningsrelease1q16.htm |

Avaya Q1 Fiscal Year 2016 Earnings Call February 8, 2016 Exhibit 99.2

© 2016 Avaya Inc. All rights reserved. 2 Forward Looking Statements Certain statements contained in this presentation may be forward-looking statements, including statements about our future financial and operational performance, planned and unrealized future savings, as well as statements about our future growth plans and drivers. These statements may be identified by the use of forward-looking terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "our vision," "plan," "potential," "predict," "should," "will" or "would" or the negative thereof or other variations thereof or other comparable terminology. We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors may cause our actual results, performance, or achievements to differ materially from any future results, performance, or achievements expressed or implied by these forward-looking statements. For a list and description of such risks and uncertainties, please refer to Avaya's filings with the SEC that are available at www.sec.gov and in particular, our 2015 Form 10-K filed with the SEC on November 23, 2015. Avaya disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation should be read in conjunction with our Form 8-K filed with the SEC on February 8, 2016. Within this presentation, we refer to certain non‐GAAP financial measures that involve adjustments to GAAP measures. Reconciliations between our non-GAAP financial measures and GAAP financial measures are included on the last three slides of this presentation. These slides, as well as current and historical financial data are available on our web site at www.avaya.com/investors None of the information included on the website is incorporated by reference in this presentation.

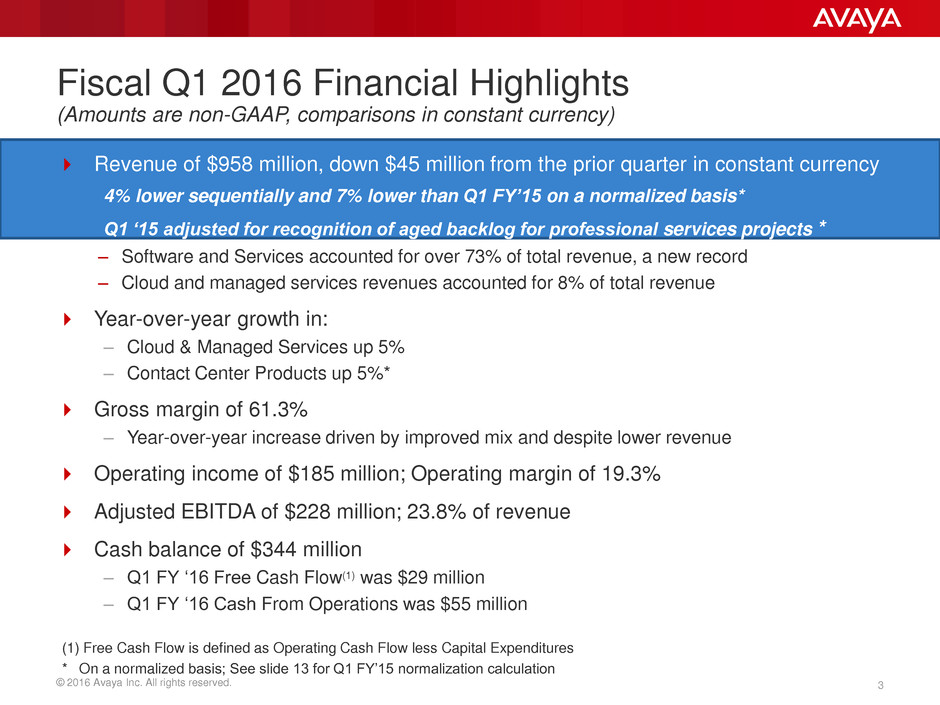

© 2016 Avaya Inc. All rights reserved. 3 Revenue of $958 million, down $45 million from the prior quarter in constant currency 4% lower sequentially and 7% lower than Q1 FY’15 on a normalized basis* Q1 ‘15 adjusted for recognition of aged backlog for professional services projects * – Software and Services accounted for over 73% of total revenue, a new record – Cloud and managed services revenues accounted for 8% of total revenue Year-over-year growth in: – Cloud & Managed Services up 5% – Contact Center Products up 5%* Gross margin of 61.3% – Year-over-year increase driven by improved mix and despite lower revenue Operating income of $185 million; Operating margin of 19.3% Adjusted EBITDA of $228 million; 23.8% of revenue Cash balance of $344 million – Q1 FY ‘16 Free Cash Flow(1) was $29 million – Q1 FY ‘16 Cash From Operations was $55 million (1) Free Cash Flow is defined as Operating Cash Flow less Capital Expenditures * On a normalized basis; See slide 13 for Q1 FY’15 normalization calculation Fiscal Q1 2016 Financial Highlights (Amounts are non-GAAP, comparisons in constant currency)

© 2016 Avaya Inc. All rights reserved. 4 Quarterly Income Statement (All amounts non-GAAP and dollars in millions) Revenue: FQ1 2016 FQ4 2015 FQ1 2015 Product $464 $499 $549 Services $494 $509 $530 Total Revenue $958 $1,008 $1,079 Gross Margin: Product 64.7% 65.3% 63.0% Services 58.1% 58.7% 57.2% Total Gross Margin 61.3% 62.0% 60.1% Operating Margin 19.3% 20.0% 17.9% Adjusted EBITDA $228 $246 $239 Adjusted EBITDA % 23.8% 24.4% 22.2% For a reconciliation of non-GAAP to GAAP financial information, please see the appendix. < ------------------ As Reported ------------------ >

© 2016 Avaya Inc. All rights reserved. 5 Quarterly Income Statement – Constant Currency Comparison (All amounts non-GAAP and dollars in millions) As Reported Revenue: FQ1 2016 FQ4 2015 FQ1 2015 Product $464 $495 $538 Services $494 $508 $513 Total Revenue $958 $1,003 $1,051 Gross Margin: Product 64.7% 65.1% 62.8% Services 58.1% 59.1% 58.0% Total Gross Margin 61.3% 62.1% 60.6% Operating Margin 19.3% 20.1% 19.2% Adjusted EBITDA $228 $246 $247 Adjusted EBITDA % 23.8% 24.5% 23.5% For a reconciliation of non-GAAP to GAAP financial information, please see the appendix. In Constant Currency

© 2016 Avaya Inc. All rights reserved. 6 Quarterly Revenue by Geographic Region (All amounts non-GAAP and dollars in millions) Revenue FQ1 2016 FQ4 2015 FQ1 2015 U.S. $528 $562 $572 EMEA $239 $243 $301 APAC $106 $113 $101 AI $85 $90 $105 Total $958 $1,008 $1,079 % of Total Revenue U.S. 55% 56% 53% EMEA 25% 24% 28% APAC 11% 11% 9% AI 9% 9% 10% Total 100% 100% 100% < ------------------ As Reported ------------------ >

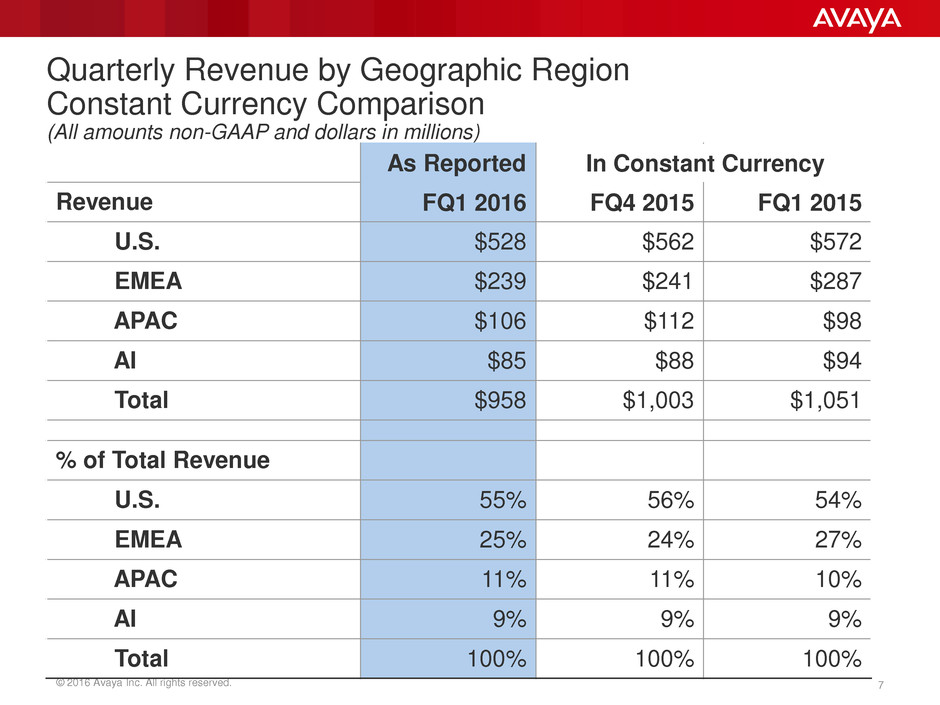

© 2016 Avaya Inc. All rights reserved. 7 Quarterly Revenue by Geographic Region Constant Currency Comparison (All amounts non-GAAP and dollars in millions) As Reported Revenue FQ1 2016 FQ4 2015 FQ1 2015 U.S. $528 $562 $572 EMEA $239 $241 $287 APAC $106 $112 $98 AI $85 $88 $94 Total $958 $1,003 $1,051 % of Total Revenue U.S. 55% 56% 54% EMEA 25% 24% 27% APAC 11% 11% 10% AI 9% 9% 9% Total 100% 100% 100% In Constant Currency

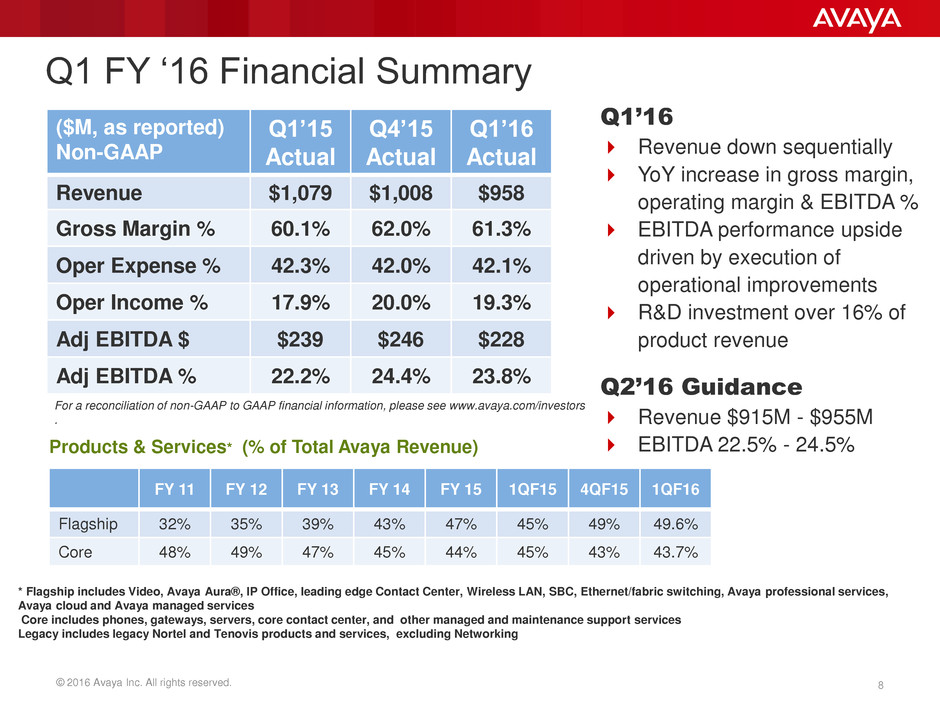

© 2016 Avaya Inc. All rights reserved. 8 Q1 FY ‘16 Financial Summary ($M, as reported) Non-GAAP Q1’15 Actual Q4’15 Actual Q1’16 Actual Revenue $1,079 $1,008 $958 Gross Margin % 60.1% 62.0% 61.3% Oper Expense % 42.3% 42.0% 42.1% Oper Income % 17.9% 20.0% 19.3% Adj EBITDA $ $239 $246 $228 Adj EBITDA % 22.2% 24.4% 23.8% Q1’16 Revenue down sequentially YoY increase in gross margin, operating margin & EBITDA % EBITDA performance upside driven by execution of operational improvements R&D investment over 16% of product revenue Q2’16 Guidance Revenue $915M - $955M EBITDA 22.5% - 24.5% FY 11 FY 12 FY 13 FY 14 FY 15 1QF15 4QF15 1QF16 Flagship 32% 35% 39% 43% 47% 45% 49% 49.6% Core 48% 49% 47% 45% 44% 45% 43% 43.7% Products & Services* (% of Total Avaya Revenue) For a reconciliation of non-GAAP to GAAP financial information, please see www.avaya.com/investors . * Flagship includes Video, Avaya Aura®, IP Office, leading edge Contact Center, Wireless LAN, SBC, Ethernet/fabric switching, Avaya professional services, Avaya cloud and Avaya managed services Core includes phones, gateways, servers, core contact center, and other managed and maintenance support services Legacy includes legacy Nortel and Tenovis products and services, excluding Networking

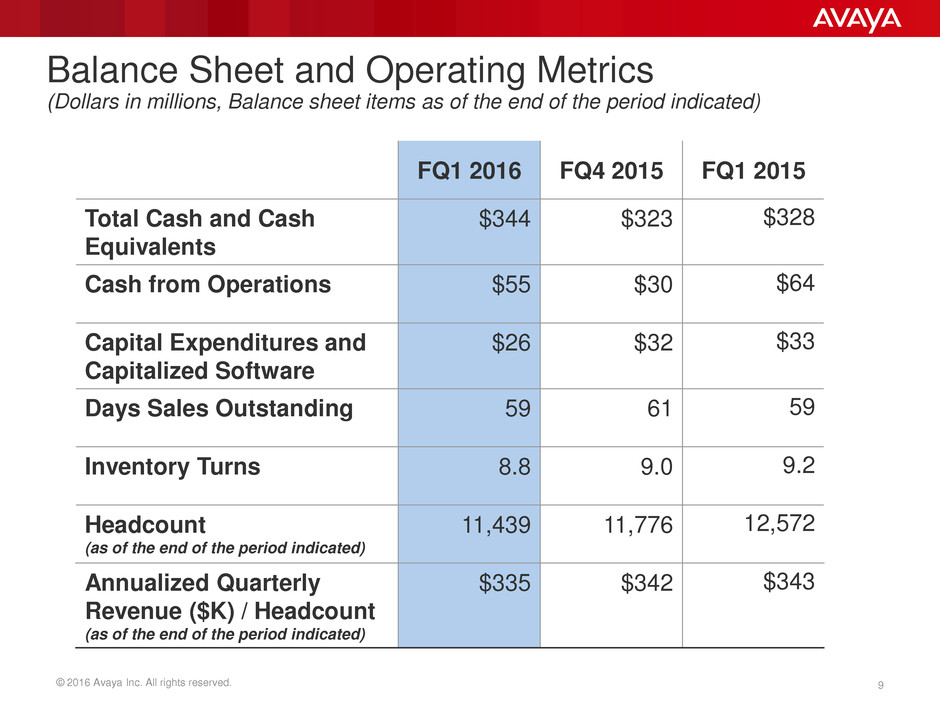

© 2016 Avaya Inc. All rights reserved. 9 Balance Sheet and Operating Metrics (Dollars in millions, Balance sheet items as of the end of the period indicated) FQ1 2016 FQ4 2015 FQ1 2015 Total Cash and Cash Equivalents $344 $323 $328 Cash from Operations $55 $30 $64 Capital Expenditures and Capitalized Software $26 $32 $33 Days Sales Outstanding 59 61 59 Inventory Turns 8.8 9.0 9.2 Headcount (as of the end of the period indicated) 11,439 11,776 12,572 Annualized Quarterly Revenue ($K) / Headcount (as of the end of the period indicated) $335 $342 $343

© 2016 Avaya Inc. All rights reserved. 10 Debt Profile ($ in Billions, by calendar year) $344M Cash Balance as of 12/31/15 Over $500M in liquidity (including cash & revolver capacity) as of 12/31/15 Q1 FY ‘16 free cash flow(1) of $29M Q1 FY ‘16 operating cash flow of $55M FY ‘16 cash requirements* expected to be approximately $870 million or less (1) Free Cash Flow is defined as Operating Cash Flow less Capital Expenditures * For Interest, Pension, Restructuring, Capital Spending, and Cash Taxes NOTE: Amounts shown exclude $6.3M quarterly term loan B-7 principal amortization to be paid prior to May 29, 2020 $0.6 $0.5 $1.3 $2.1 $1.4 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2016 2017 2018 2019 2020 2021 Overall Weighted Average Interest Rate 7.3% Today 2/8/16

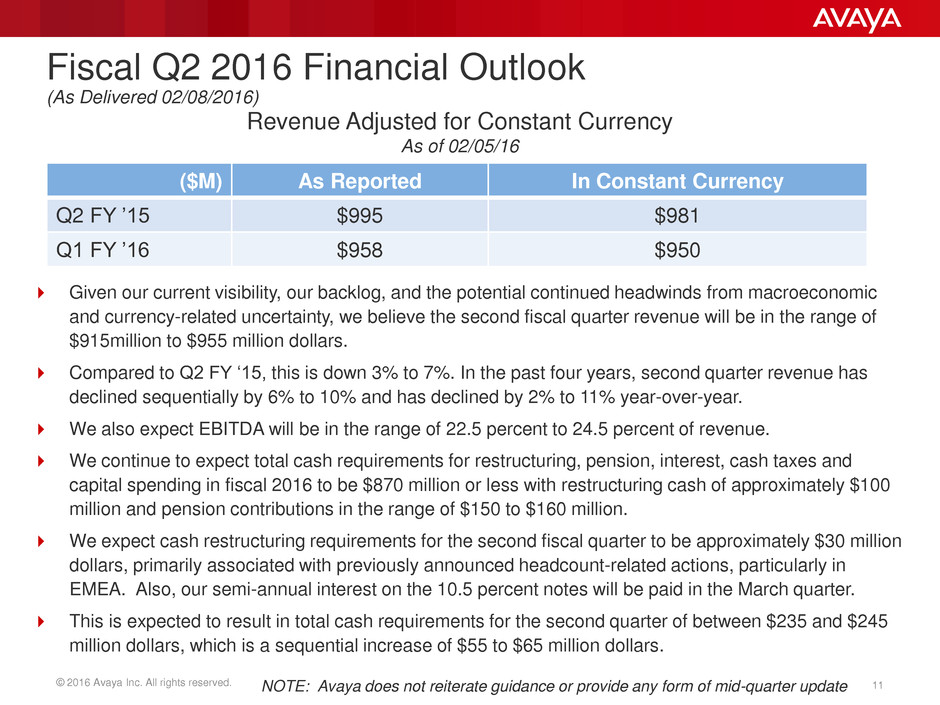

© 2016 Avaya Inc. All rights reserved. 11 Fiscal Q2 2016 Financial Outlook (As Delivered 02/08/2016) Given our current visibility, our backlog, and the potential continued headwinds from macroeconomic and currency-related uncertainty, we believe the second fiscal quarter revenue will be in the range of $915million to $955 million dollars. Compared to Q2 FY ‘15, this is down 3% to 7%. In the past four years, second quarter revenue has declined sequentially by 6% to 10% and has declined by 2% to 11% year-over-year. We also expect EBITDA will be in the range of 22.5 percent to 24.5 percent of revenue. We continue to expect total cash requirements for restructuring, pension, interest, cash taxes and capital spending in fiscal 2016 to be $870 million or less with restructuring cash of approximately $100 million and pension contributions in the range of $150 to $160 million. We expect cash restructuring requirements for the second fiscal quarter to be approximately $30 million dollars, primarily associated with previously announced headcount-related actions, particularly in EMEA. Also, our semi-annual interest on the 10.5 percent notes will be paid in the March quarter. This is expected to result in total cash requirements for the second quarter of between $235 and $245 million dollars, which is a sequential increase of $55 to $65 million dollars. NOTE: Avaya does not reiterate guidance or provide any form of mid-quarter update ($M) As Reported In Constant Currency Q2 FY ’15 $995 $981 Q1 FY ’16 $958 $950 Revenue Adjusted for Constant Currency As of 02/05/16

© 2016 Avaya Inc. All rights reserved. 12 Upcoming Events (See www.avaya.com/investors for additional details) Tuesday, March 1, 2016 – JP Morgan 2016 Global High Yield & Leveraged Finance Conference – Miami, FL – Presenter: – Dave Vellequette, CFO – Presentation Time: 10:20 AM EST – Webcast Access: http://jpmorgan.metameetings.com/confbook/highyield16/directlink?p=20802 Webcast links and details with supporting slides will be on the investor pages of our website www.avaya.com/investors

© 2016 Avaya Inc. All rights reserved. 13 Normalization for PS Aged Backlog ($M) Q4 FY ’14 Q1 FY ’15 Reported Revenue $1,126 $1,079 Currency Adjustment ($44) ($28) Revenue @Q1 FY ‘16 Currency $1,082 $1,051 Normalization for Aged Backlog ($31) ($17) Normalized Revenue $1,051 $1,034 Q1 FY ’16 Reported Revenue $958 YoY % Change (7%) H2 FY‘14: professional services management identified $48M of aged professional services projects in backlog Q4 FY‘14: $31M aged projects recognized for revenue; Q1 FY‘15: $17M aged projects recognized for revenue

© 2016 Avaya Inc. All rights reserved. 14 Pension & Other Post-Retirement Benefits Trend ($M) Cash payments are made either in compliance with applicable law and regulations where required, or to directly pay benefits where appropriate. P&L Expense is recognized as retirement benefits are earned during the participants’ years of employment. Cash Effect (1) FY’13 FY’14 Q1’15 Q2’15 Q3’15 Q4’15 FY’15 Q1’16 US Pension 108 160 15 25 26 29 95 20 Non-US Pension 25 27 4 13 4 4 25 3 OPEB 52 45 9 3 4 12 28 10 Total Cash Contributions 185 232 28 41 34 45 148 33 P&L Effect (1) FY’13 FY’14 Q1’15 Q2’15 Q3’15 Q4’15 FY’15 Q1’16(*) US Pension 104 65 15 15 15 15 60 5 Non-US Pension 31 30 7 7 6 7 27 6 OPEB (5) 4 1 1 1 - 3 (3) Total P&L Expenses 130 99 23 23 22 22 90 8 (1) Data source: Refer to “Benefit Obligations” section of Avaya’s 10-Q and 10-K for the applicable periods (*) Q1’16 reduction in US Pension expense is due principally to the change in estimate related to interest cost, while the reduction in OPEB is principally due to decreased amortization of prior service cost due to plan amendments that reduced plan benefits. NOTE: See slide 15 for amounts used in Adjusted EBITDA calculation (to reflect amortization of prior service costs and associated gains/losses)

© 2016 Avaya Inc. All rights reserved. 15 Non-GAAP Reconciliation Adjusted EBITDA * For reconciliation of adjusted EBITDA for the fourth quarter of fiscal 2015, see our Form 8-k filed with the SEC on November 16, 2015 at www.sec.gov. . 2015 2014 Net (loss) income (27)$ 3$ Interest expense 118 112 Provision for income taxes 4 3 Depreciation and amortization 93 94 188 212 Restructuring charges, net 23 15 Sponsors’ fees 2 2 Integration-related costs - 1 Third-party sales transformation costs 2 - Non-cash share-based compensation 4 7 Change in certain tax indemnifications - (9) Gain on foreign currency transactions (6) (6) Pension/OPEB/nonretirement postemployment benefits and long- term disability costs 15 17 Adjusted EBITDA 228$ 239$ EBITDA Three months ended December 31, Avaya Inc. Supplemental Schedule of Non-GAAP Adjusted EBITDA (Unaudited; in millions)

© 2016 Avaya Inc. All rights reserved. 16 Non-GAAP Reconciliation Gross Margin and Operating Income Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, 2014 2015 2015 2015 2015 Gross Profit 638$ 592$ 584$ 616$ 579$ Gross Margin 59.1% 59.5% 58.5% 61.1% 60.4% Items excluded: Amortization of acquired technology intangible assets 9 7 10 9 8 Share-based compensation 2 - - - - Non-GAAP Gross Profit 649$ 599$ 594$ 625$ 587$ Non-GAAP Gross Margin 60.1% 60.2% 59.5% 62.0% 61.3% Reconciliation of Non-GAAP Operating Income Operating Income 104$ 83$ 84$ 100$ 91$ Percentage of Revenue 9.6% 8.3% 8.4% 9.9% 9.5% Items excluded: Amortization of acquired intangible assets 66 64 65 66 65 Restructuring charges, net 15 10 7 30 23 Integration-related costs 1 - - 2 - Third-party sales transformation costs - - - - 2 Acquisition-related costs - - 1 - - Share-based compensation 7 4 4 4 4 Other - 1 - - - Non-GAAP Operating Income 193$ 162$ 161$ 202$ 185$ Non-GAAP Operating Margin 17.9% 16.3% 16.1% 20.0% 19.3% Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliations (Unaudited; in millions) Three Months Ended

© 2016 Avaya Inc. All rights reserved. 17 Non-GAAP Reconciliation Product and Services Gross Margins Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, 2014 2015 2015 2015 2015 Revenue 549$ 487$ 494$ 499$ 464$ Costs (exclusive of amortization of technology intangible assets)ts (exclusive of amortization of acquired technology intangible assets) 203 182 186 173 164 Amortization of technology intangible assetsortiz tion of acquired technology intangible a sets 9 7 10 9 8 GAAP Gross Profit 337 298 298 317 292 GAAP Gross Margin 61.4% 61.2% 60.3% 63.5% 62.9% Items excluded: Amortization of acquired technology intangible assets 9 7 10 9 8 Non-GAAP Gross Profit 346$ 305$ 308$ 326$ 300$ Non-GAAP Gross Margin 63.0% 62.6% 62.3% 65.3% 64.7% Revenue 530$ 508$ 505$ 509$ 494$ Costs 229 214 219 210 207 GAAP Gross Profit 301 294 286 299 287 GAAP Gross Margin 56.8% 57.9% 56.6% 58.7% 58.1% Items excluded: Share-based compensation 2 - - - - Non-GAAP Gross Profit 303$ 294$ 286$ 299$ 287$ Non-GAAP Gross Margin 57.2% 57.9% 56.6% 58.7% 58.1% Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Services Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Products Three Months Ended Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliation of Gross Profit and Gross Margin by Portfolio (Unaudited; in millions)