Attached files

| file | filename |

|---|---|

| EX-21 - LIST OF SUBSIDIARIES - FASTENAL CO | fast1231201510-kexhibit21.htm |

| EX-31 - CERTIFICATIONS UNDER SECTION 302 OF THE SARBANES-OXELY ACT OF 2002 - FASTENAL CO | fast1231201510-kexhibit31.htm |

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - FASTENAL CO | fast1231201510-kexhibit23.htm |

| EX-32 - CERTIFICATIONS UNDER SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 - FASTENAL CO | fast1231201510-kexhibit32.htm |

| 10-K - 10-K - FASTENAL CO | fast1231201510-k.htm |

2015 ANNUAL REPO RT 9704582 2015 Annual Report | 1.16KM | Printed in the USA ANNUAL REPORT2015

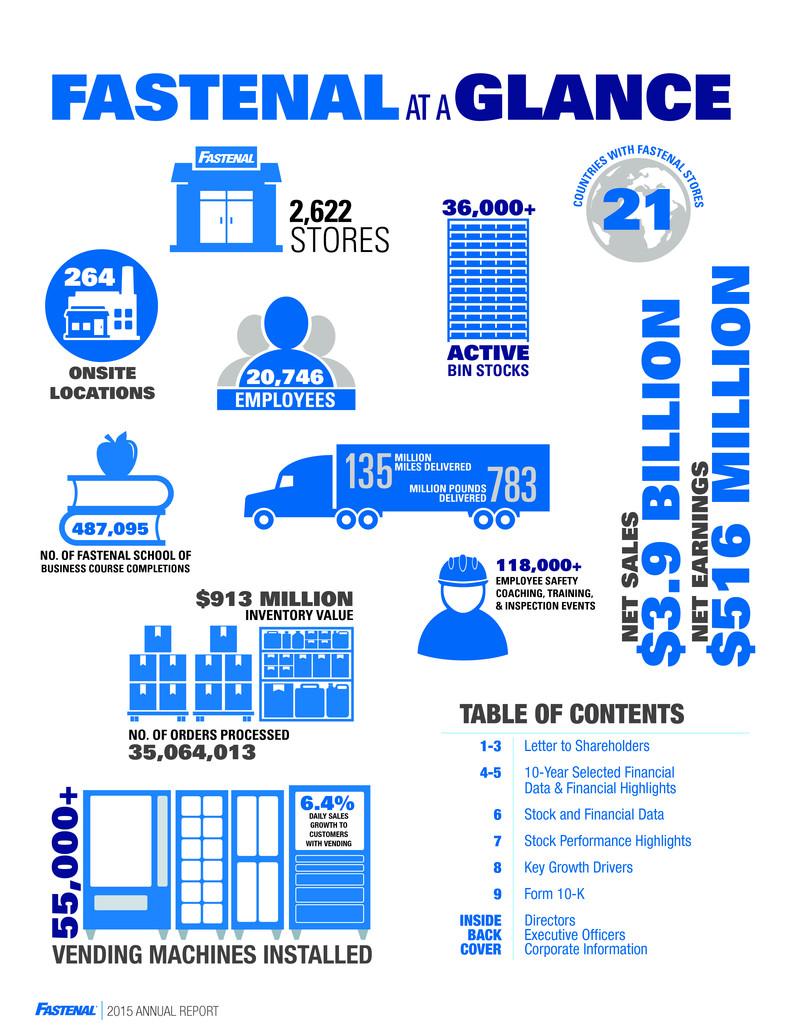

2015 ANNUAL REPORT 2015 ANNUAL REPORT MICHAEL J. DOLAN Self-Employed Business Consultant, Retired Executive Vice President and Chief Operating Officer, The Smead Manufacturing Company GARY A. POLIPNICK Executive Vice President - FAST Solutions® SCOTT A. SATTERLEE Retired President of North America Surface Transportation Division, C.H. Robinson Worldwide, Inc. (logistics and distribution company) JAMES C. JANSEN Executive Vice President - Manufacturing LELAND J. HEIN Senior Executive Vice President - Sales NICHOLAS J. LUNDQUIST Executive Vice President - Operations CHARLES S. MILLER Executive Vice President - Sales RITA J. HEISE Self-Employed Business Consultant, Retired Corporate Vice President and Chief Information Officer of Cargill, Incorporated LELAND J. HEIN SHERYL A. LISOWSKI Interim Chief Financial Officer, Controller, and Chief Accounting Officer STEPHEN L. EASTMAN President of the Parts, Garments, and Accessories Division of Polaris Industries Inc. (recreational vehicle manufacturer) DANIEL L. FLORNESS President and Chief Executive Officer DANIEL L. FLORNESS HUGH L. MILLER President and Chief Executive Officer, RTP Company (thermoplastics materials manufacturer) REYNE K. WISECUP REYNE K. WISECUP Executive Vice President - Human Resources DARREN R. JACKSON Retired Chief Executive Officer, Advance Auto Parts, Inc. (auto parts company) ASHOK SINGH Executive Vice President - Information Technology WILLARD D. OBERTON Chairman of the Board, Retired President and Chief Executive Officer, Fastenal Company MICHAEL J. ANCIUS Director of Strategic Planning, Financing, and Taxation, Kwik Trip, Inc. (retail convenience store operator) 21CO UN TR IES WIT H FASTENAL STORES DIRECTOR S EXECUTIVE OFFICER S TERRY M. OWEN Senior Executive Vice President - Sales Operations JOHN L. SODERBERG Executive Vice President - Sales Operations and Support ANNUAL MEETING FORM 10-K LEGAL COUNSEL HOME OFFICE TRANSFER AGENT INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The annual meeting of shareholders will be held at 10:00 a.m., central time, April 19, 2016, at our home office located at 2001 Theurer Boulevard, Winona, Minnesota. A copy of our 2015 Annual Report on Form 10-K to the Securities and Exchange Commission is available without charge to shareholders upon written request to internal audit at the address of our home office listed on this page. Copies of our latest press releases, unaudited supplemental company information, and monthly sales information are available at: http://investor.fastenal.com. Faegre Baker Daniels LLP Minneapolis, Minnesota Streater & Murphy, PA Winona, Minnesota Fastenal Company 2001 Theurer Boulevard Winona, Minnesota 55987-0978 Phone: (507) 454-5374 Fax: (507) 453-8049 Wells Fargo Bank, N.A. Minneapolis, Minnesota KPMG LLP Minneapolis, Minnesota CORPOR ATE INFORM ATIO N $3.9 BILLIO N $516 MILLIO N NET SALE S NET EARNING S TABLE OF CONTENTS 1-3 Letter to Shareholders 4-5 10-Year Selected Financial Data & Financial Highlights 6 Stock and Financial Data 7 Stock Performance Highlights 8 Key Growth Drivers 9 Form 10-K INSIDE BACK COVER Directors Executive Officers Corporate Information 55,000 + VENDING MACHINES INSTALLED DAILY SALES GROWTH TO CUSTOMERS WITH VENDING NO. OF FASTENAL SCHOOL OF BUSINESS COURSE COMPLETIONS 487,095 ONSITE LOCATIONS 264 STORES 2,622 INVENTORY VALUE $913 MILLION NO. OF ORDERS PROCESSED 35,064,013 20,746 EMPLOYEES 118,000+ EMPLOYEE SAFETY COACHING, TRAINING, & INSPECTION EVENTS FASTENAL AT AGLANCE 135MILLIONMILES DELIVERED 783DELIVEREDMILLION POUNDS 36,000+ BIN STOCKS ACTIVE 6.4%

2015 ANNUAL REPORT 1 LETTER TO SHAREHOLDERS From our perspective 2015 was a disappointing year. Our net sales grew 3.6%, our pre-tax earnings grew 4.9%, our net earnings grew 4.5%, and our net earnings per share (EPS) grew 6.0%, the latter helped by our buyback of approximately 7 million shares of outstanding stock. There is more to the story. The growth of our business (measured in net sales) weakened as we progressed through the year. In the first quarter we grew 8.8%, but our growth slid to 5.0% in the second quarter, reflecting a dramatic drop in the price of oil and a corresponding drop in our business with customers tied to the oil and gas industry. Demand continued to weaken in the latter half of the year, within and beyond the oil and gas sector. In September our daily sales growth went negative, and we finished the year with four negative months. In short, it was a tough year for our customers, and we will only succeed to the extent our customers succeed. To put this challenging environment in perspective, we analyzed the trends of our top 100 customers. Because we are a significant supplier to each of these customers, we believe this group is a good ‘proxy’ for our business activities in general. Over the last four years (2011 to 2014), the typical ratio of growth versus contraction in sales to our top-100 customers was 3:1 (75 grew and 25 contracted). This pattern continued in the first quarter of 2015; however, by the fourth quarter the ratio was at parity (49 grew and 51 contracted). A second view centers on the magnitude of contraction. In a typical quarter, sales to about half of the 25 contracting customers (or about 13%) will contract more than 10%, and approximately half of these customers (or about 6%) will contract more than 25%. Our data in the first quarter of 2015 was largely in line with this trend; however, by the fourth quarter 37% were contracting more than 10% (nearly three times the norm) and 21% were contracting more than 25% (also about three times the norm). We believe understanding this information is useful for maintaining a sense of calm and perspective during a weakening period like 2015. It’s also a reminder to everyone in our company of our mission to our customers – when they’re struggling, we need to focus our energy on providing even more ideas for savings and improvements. On the flip side, this information has no relevance to our market opportunity or the steps we need to take to grow our business long term. The market we serve is large – it’s also expanding geographically, with approximately 11% of our sales now generated outside the United States – and the competitive landscape is still very fragmented. These conditions create an opportunity for years of growth. We simply need to understand our strengths and to then invest in the right growth drivers. Our biggest strength is great people. Despite the weakening business climate in 2015, we added 2,329 people, a 12.6% increase over our employee count on December 31, 2014. Roughly 72% of this increase went into a store or an Onsite location (essentially a ‘store’ within a customer facility), while about 9% of this increase went into a non-store selling role. Said another way, about 80% of the people we added in 2015 will either directly serve or directly interface with our customers on a daily basis. This close contact creates long-term relationships and also instills a sense of urgency into our organization. The other 20% went to support our business today and to build for the future. Roughly 15% were added to our distribution teams. In 2015 we continued to expand our trucking network, with the ultimate goal of adding service capacity while also reducing our long-term costs. The lower fuel prices in 2015 allowed us to push hard toward this goal. The remaining 4% to 5% were divided across several areas of the business, with the majority taking on roles within our Information Technology group, an area where we continue to ‘play some catch up’ to expand our development capabilities. A substantial part of this technology investment was dedicated towards expanding a new software development center. Currently we have more than 75 software professionals in this center. When combined with our existing resources, this center expands our ability to develop new applications and business solutions. After people, our second strength is the economics of a great distribution business. When the economy is strong, we fund our growth with the cash generated from a profitable business. When the economy is weaker, we produce a relatively stronger operating cash flow and ultimately a stronger free cash flow. This was true in 2015 as our operating cash flow increased more than 9% and our free cash flow increased about 18%, compared to the prior year (the latter being noteworthy given our acquisition). Given the strong cash flow characteristics of the business, we chose to increase our dividend and to substantially increase our level of stock buybacks. These two items, when combined, increased the dollars returned to shareholders by about 77% (from 2014 to 2015). We believe these two strengths, funding the future by expanding our headcount today and opportunistically using our strong cash flow capabilities to your benefit, position us well as we move into 2016 and beyond. Our biggest strength is great people. Despite the weakening business climate in 2015, we added 2,329 people, a 12.6% increase over our employee count on December 31, 2014.

2015 ANNUAL REPORT 2 With our investment in more people and a strong balance sheet, we can aggressively pursue the following growth drivers: Industrial vending has been a wonderful complement to the Fastenal distribution business over the last five years. During this period, we deployed more than 50,000 devices, and yet we felt we could do more to build the momentum and to improve the existing business. Today, our average district manager leads a business with about 180 devices deployed. The sheer numbers make it difficult at times for our local teams to focus on servicing and improving the existing devices, growing the device count, and doing everything else needed to support their customers. This prompted us to invest in growth energy centered on vending. We closed the year with over 80% of our districts having a specialist dedicated to two things: 1) optimizing the existing devices across the district (with the right mix of products to maximize revenue for Fastenal and cost savings for our customers), and 2) working with local stores to sign more machines. This has breathed new life into our vending program, and we believe it will serve us well in 2016 and beyond. As mentioned earlier, this is where we place a ‘store’ (i.e., dedicated Fastenal personnel and inventory) within a customer’s location. We have quietly grown this business for the last 15 years, typically adding about nine Onsite locations per year. In 2015, with a bit more focus, we signed 82 new Onsite customer locations, a nine-fold increase, with about 25% of our district managers signing an Onsite location during the year. We believe the future is very bright for this initiative for a number of reasons. First, it fits our store-based distribution model (minus many of the costs involved with running a public store). Second, it brings us closer to the customer, positioning us to provide tremendous service and value. And third, our frugal culture enables us to run a profitable Onsite business where others simply cannot, eliminating the competitive field in all but the largest customer opportunities. Executing a plan is about participation across the organization, something we saw with our industrial vending initiative over the last five- plus years. This prompted us to ask a simple question: What if 65% of our district managers were signing Onsite locations each year? As a company, we have never been bashful about goals, so we’ve targeted 200 additional Onsite locations for 2016. Given the momentum we established in 2015 and what we know about the market opportunity, we believe this is achievable with some additional focus from our district managers and our National Accounts team. Late in 2014 we looked at our National Accounts group, the team responsible for signing and corporately supporting customers with multi-site contracts. We looked at their strengths and weaknesses, and we also looked at their processes and tools. We decided early on to make some personnel changes, and many of these changes involved a refocus of some very talented individuals. The results include an improvement in our pace of new signings. During 2015, we signed more new contracts (defined as new customer accounts with a multi- site contract) with national account customers than in 2014, reversing what had been a declining trend. We also decided to step away from the world of ‘spreadsheets and email’ as a way to communicate within National Accounts and other non-store selling teams, and transitioned to a CRM (customer relationship management) system. Beginning in late 2014, our technical and functional support teams worked hard to define our needs and then to implement a solution. The new CRM went live in the fall of 2015 for our National Accounts team, with other users to follow in the first half of 2016. We believe this investment will give our non-store selling teams a better view of their customers, increase efficiency, focus our resources, and ultimately improve our service. 1. INDUSTRIAL VENDING 3. NATIONAL ACCOUNTS 2. ONSITE

2015 ANNUAL REPORT 3 DANIEL L. FLORNESS President and Chief Executive Officer WILLARD D. OBERTON Chairman of the Board With CSP 16, we’re refreshing and expanding our store inventory model to better present our customers with same-day product solutions. 4. STORE LOCATIONS And finally, we have store locations. After several years of not opening many of them, we picked up the pace late in 2015, opening 41 stores during the year and 28 in the last three months. This compares to 24 stores opened in all of 2014. In both 2015 and 2014 we also closed or consolidated some stores – 50 and 73, respectively. Unlike many store-based businesses, we don’t fear this prospect. Because we deliver most of what we sell, we have great flexibility as to the number of locations in an individual market. The key is to stay focused on the best model to serve our customers and grow. One of the key advantages of our local store-based model is that, while our national competitors are typically restricted to 24 to 48 hour order fulfillment (at best), we’re able to meet a wide range of customer needs today. In November 2015 we set out to further hone this advantage by announcing an investment in what we’re calling ‘CSP 16.’ This is a revitalization of our ongoing Customer Service Project, which was originally launched in 2002 to improve our store merchandising and pull more inventory onto our local shelves. With CSP 16, we’re refreshing and expanding our store inventory model to better present our customers with same-day product solutions. This involves adding inventory into each store. Some of this is moving inventory from our distribution centers to our stores for more immediate and visible availability, and some is an investment in additional inventory. All of it positions our local store teams to win business by saying, “Yes, we have it today.” You may have noticed an unusual event for Fastenal in 2015. We acquired a regional fastener distributor in the Pacific Northwest of the U.S. (based in Spokane, WA). We felt this was a great business with a great cultural fit with Fastenal, and that we could make an appropriate return on our investment. We are hopeful there are other businesses with a similar fit, and that this could be an added opportunity to grow the organization. Only time will prove if this is so. A final observation about Fastenal centers on our distribution system, the flow of product from the supplier to the customer. We believe we have built what others want – a supply chain that goes the ‘last mile.’ Fastenal’s last mile has the same capability and durability of the ‘first mile’; however, it didn’t ‘break the bank’ to build, nor is it overly expensive to operate (especially compared to the value it provides). The expression ‘last mile’ originated from the building of a telephone network in the last century. The last mile (extending the network to end users’ properties) was extremely expensive relative to the corresponding call traffic, so it took decades and massive amounts of private and public dollars to build. In the race to provide faster and better customer service, this limiting factor exists in our industry today, with one exception: Fastenal’s last mile is already built. It’s represented by our local stores, our Onsite locations, and our point-of-use inventory solutions (including vending); and it’s what truly separates our company in the marketplace. This year’s letter reflects our disappointment regarding 2015 and our aspirations for 2016, and it centers on customers, people, and opportunities. We hope you find it helpful in understanding both our business and our priorities. As always, Growth Through Customer Service ® is the cornerstone of our organization. This means providing value, providing ideas, and helping everyone – Fastenal and our customers – operate more efficiently. We believe this is smart business. Thank you for your continued belief in Fastenal, and thank you for your support in the last year. Many organizations pull back in a weak environment; we move forward with investments to continue our growth for years to come.

2015 ANNUAL REPORT 4 Operating Results 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Net sales $ 3,869,187 3.6% $3,733,507 $3,326,106 $3,133,577 $2,766,859 $2,269,471 $1,930,330 $2,340,425 $2,061,819 $1,809,337 Gross profit $ 1,948,934 2.7% 1,897,402 1,719,445 1,614,524 1,434,172 1,174,836 983,435 1,236,092 1,047,574 907,675 % of net sales 50.4% 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8% 50.8% 50.2% Earnings before income taxes $ 826,020 4.9% 787,434 713,468 674,155 575,081 430,640 297,490 451,167 377,899 321,029 % of net sales 21.3% 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3% 18.3% 17.7% Net earnings $ 516,361 4.5% 494,150 448,636 420,536 357,929 265,356 184,357 279,705 232,622 199,038 % of net sales 13.3% 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0% 11.3% 11.0% Basic net earnings per share $ 1.77 6.0% 1.67 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 Basic weighted average shares outstanding 291,453 -1.7% 296,490 296,754 296,089 295,054 294,861 296,716 297,662 301,109 302,068 Diluted net earnings per share $ 1.77 6.6% 1.66 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 Diluted weighted average shares outstanding(1) 292,045 -1.8% 297,313 297,684 297,151 295,869 294,861 296,716 297,662 301,109 302,329 Dividends and Common Stock Purchase Summary 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Dividends paid $ 327,101 10.3% $296,581 $237,456 $367,306 $191,741 $182,814 $106,943 $117,474 $66,216 $ 60,548 % of net earnings 63.3% 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0% 28.5% 30.4% Dividends paid per share $ 1.12 12.0% 1.00 0.80 1.24 0.65 0.62 0.36 0.395 0.22 0.20 Purchases of common stock $ 292,951 453.3% 52,942 9,080 - - - 41,104 25,958 87,311 17,294 % of net earnings 56.7% 10.7% 2.0% - - - 22.3% 9.3% 37.5% 8.7% Common stock shares purchased 7,100 491.7% 1,200 200 - - - 2,200 1,180 4,172 948 Average price paid per share $ 41.26 -6.5% 44.12 45.40 - - - 18.69 22.00 20.93 18.25 Cash Flow Summary 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Net cash provided by operating activities $ 546,940 9.5% $499,392 $416,120 $396,292 $268,489 $240,488 $306,070 $259,898 $227,895 $97,875 % of net earnings 105.9% 101.1% 92.8% 94.2% 75.0% 90.6% 166.0% 92.9% 98.0% 49.2% Less capital expenditures, net $ (145,227) -20.9% (183,655) (201,550) (133,882) (116,489) (69,138) (47,675) (86,923) (49,830) (73,335) Acquisitions and other $ (35,400) 534.7% (5,577) (145) (133) 212 (10,329) (5,133) (72) (265) (231) Free cash flow $ 366,313 18.1% 310,160 214,425 262,277 152,212 161,021 253,262 172,903 177,800 24,309 % of net earnings 70.9% 62.8% 47.8% 62.4% 42.5% 60.7% 137.4% 61.8% 76.4% 12.2% Financial Position at Year End 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Operational working capital (accounts receivable, net and inventories) $ 1,381,638 3.8% $1,331,301 $1,198,399 $1,087,542 $984,746 $827,502 $722,574 $809,187 $740,923 $665,529 Net working capital (current assets less current liabilities) $ 1,291,610 6.9% 1,207,912 1,168,629 1,082,482 1,048,320 923,513 862,855 827,410 742,980 663,880 Fixed capital (property and equipment, net) $ 818,889 7.2% 763,889 654,850 516,427 435,601 363,419 335,004 324,182 276,627 264,030 Total assets $ 2,532,462 7.3% 2,359,102 2,075,784 1,815,832 1,684,948 1,468,283 1,327,358 1,304,149 1,163,061 1,039,016 Total debt (current portion of debt and long-term debt) $ 365,000 305.6% 90,000 - - - - - - - - Total stockholders' equity $ 1,801,289 -5.9% 1,915,217 1,772,697 1,560,360 1,458,976 1,282,512 1,190,843 1,142,259 1,010,161 992,093 All information contained in this Annual Report reflects the 2-for-1 stock split in 2011. (1) Reflects impact of stock options issued by the Company that were in-the-money and outstanding during the period. (Amounts in Thousands Except Per Share Information) 10-YEAR SELECTED FINANCIAL DA TA

2015 ANNUAL REPORT 5 Operating Results 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Net sales $ 3,869,187 3.6% $3,733,507 $3,326,106 $3,133,577 $2,766,859 $2,269,471 $1,930,330 $2,340,425 $2,061,819 $1,809,337 Gross profit $ 1,948,934 2.7% 1,897,402 1,719,445 1,614,524 1,434,172 1,174,836 983,435 1,236,092 1,047,574 907,675 % of net sales 50.4% 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8% 50.8% 50.2% Earnings before income taxes $ 826,020 4.9% 787,434 713,468 674,155 575,081 430,640 297,490 451,167 377,899 321,029 % of net sales 21.3% 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3% 18.3% 17.7% Net earnings $ 516,361 4.5% 494,150 448,636 420,536 357,929 265,356 184,357 279,705 232,622 199,038 % of net sales 13.3% 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0% 11.3% 11.0% Basic net earnings per share $ 1.77 6.0% 1.67 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 Basic weighted average shares outstanding 291,453 -1.7% 296,490 296,754 296,089 295,054 294,861 296,716 297,662 301,109 302,068 Diluted net earnings per share $ 1.77 6.6% 1.66 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 Diluted weighted average shares outstanding(1) 292,045 -1.8% 297,313 297,684 297,151 295,869 294,861 296,716 297,662 301,109 302,329 Dividends and Common Stock Purchase Summary 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Dividends paid $ 327,101 10.3% $296,581 $237,456 $367,306 $191,741 $182,814 $106,943 $117,474 $66,216 $ 60,548 % of net earnings 63.3% 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0% 28.5% 30.4% Dividends paid per share $ 1.12 12.0% 1.00 0.80 1.24 0.65 0.62 0.36 0.395 0.22 0.20 Purchases of common stock $ 292,951 453.3% 52,942 9,080 - - - 41,104 25,958 87,311 17,294 % of net earnings 56.7% 10.7% 2.0% - - - 22.3% 9.3% 37.5% 8.7% Common stock shares purchased 7,100 491.7% 1,200 200 - - - 2,200 1,180 4,172 948 Average price paid per share $ 41.26 -6.5% 44.12 45.40 - - - 18.69 22.00 20.93 18.25 Cash Flow Summary 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Net cash provided by operating activities $ 546,940 9.5% $499,392 $416,120 $396,292 $268,489 $240,488 $306,070 $259,898 $227,895 $97,875 % of net earnings 105.9% 101.1% 92.8% 94.2% 75.0% 90.6% 166.0% 92.9% 98.0% 49.2% Less capital expenditures, net $ (145,227) -20.9% (183,655) (201,550) (133,882) (116,489) (69,138) (47,675) (86,923) (49,830) (73,335) Acquisitions and other $ (35,400) 534.7% (5,577) (145) (133) 212 (10,329) (5,133) (72) (265) (231) Free cash flow $ 366,313 18.1% 310,160 214,425 262,277 152,212 161,021 253,262 172,903 177,800 24,309 % of net earnings 70.9% 62.8% 47.8% 62.4% 42.5% 60.7% 137.4% 61.8% 76.4% 12.2% Financial Position at Year End 2015 Percent Change 2014 2013 2012 2011 2010 2009 2008 2007 2006 Operational working capital (accounts receivable, net and inventories) $ 1,381,638 3.8% $1,331,301 $1,198,399 $1,087,542 $984,746 $827,502 $722,574 $809,187 $740,923 $665,529 Net working capital (current assets less current liabilities) $ 1,291,610 6.9% 1,207,912 1,168,629 1,082,482 1,048,320 923,513 862,855 827,410 742,980 663,880 Fixed capital (property and equipment, net) $ 818,889 7.2% 763,889 654,850 516,427 435,601 363,419 335,004 324,182 276,627 264,030 Total assets $ 2,532,462 7.3% 2,359,102 2,075,784 1,815,832 1,684,948 1,468,283 1,327,358 1,304,149 1,163,061 1,039,016 Total debt (current portion of debt and long-term debt) $ 365,000 305.6% 90,000 - - - - - - - - Total stockholders' equity $ 1,801,289 -5.9% 1,915,217 1,772,697 1,560,360 1,458,976 1,282,512 1,190,843 1,142,259 1,010,161 992,093 All information contained in this Annual Report reflects the 2-for-1 stock split in 2011. (1) Reflects impact of stock options issued by the Company that were in-the-money and outstanding during the period. FINANCIAL HIGHLIGHTS

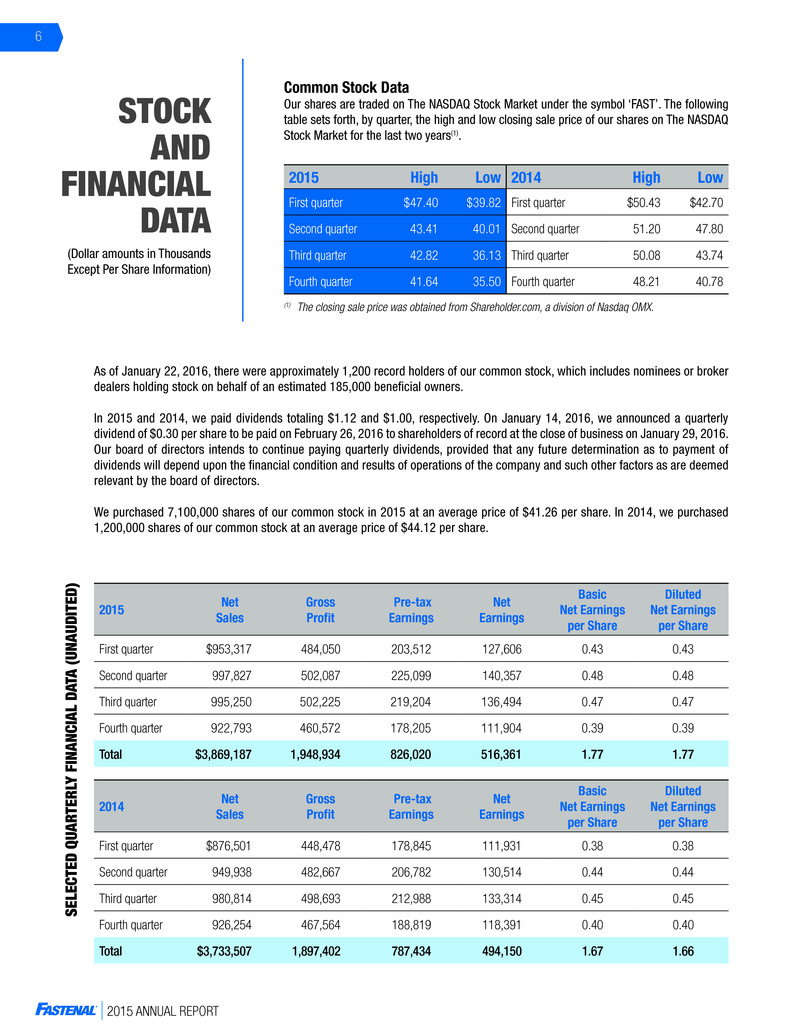

2015 ANNUAL REPORT 6 2015 High Low 2014 High Low First quarter $47.40 $39.82 First quarter $50.43 $42.70 Second quarter 43.41 40.01 Second quarter 51.20 47.80 Third quarter 42.82 36.13 Third quarter 50.08 43.74 Fourth quarter 41.64 35.50 Fourth quarter 48.21 40.78 As of January 22, 2016, there were approximately 1,200 record holders of our common stock, which includes nominees or broker dealers holding stock on behalf of an estimated 185,000 beneficial owners. In 2015 and 2014, we paid dividends totaling $1.12 and $1.00, respectively. On January 14, 2016, we announced a quarterly dividend of $0.30 per share to be paid on February 26, 2016 to shareholders of record at the close of business on January 29, 2016. Our board of directors intends to continue paying quarterly dividends, provided that any future determination as to payment of dividends will depend upon the financial condition and results of operations of the company and such other factors as are deemed relevant by the board of directors. We purchased 7,100,000 shares of our common stock in 2015 at an average price of $41.26 per share. In 2014, we purchased 1,200,000 shares of our common stock at an average price of $44.12 per share. Common Stock Data Our shares are traded on The NASDAQ Stock Market under the symbol ‘FAST’. The following table sets forth, by quarter, the high and low closing sale price of our shares on The NASDAQ Stock Market for the last two years(1). 2015 Net Sales Gross Profit Pre-tax Earnings Net Earnings Basic Net Earnings per Share Diluted Net Earnings per Share First quarter $953,317 484,050 203,512 127,606 0.43 0.43 Second quarter 997,827 502,087 225,099 140,357 0.48 0.48 Third quarter 995,250 502,225 219,204 136,494 0.47 0.47 Fourth quarter 922,793 460,572 178,205 111,904 0.39 0.39 Total $3,869,187 1,948,934 826,020 516,361 1.77 1.77 2014 Net Sales Gross Profit Pre-tax Earnings Net Earnings Basic Net Earnings per Share Diluted Net Earnings per Share First quarter $876,501 448,478 178,845 111,931 0.38 0.38 Second quarter 949,938 482,667 206,782 130,514 0.44 0.44 Third quarter 980,814 498,693 212,988 133,314 0.45 0.45 Fourth quarter 926,254 467,564 188,819 118,391 0.40 0.40 Total $3,733,507 1,897,402 787,434 494,150 1.67 1.66 (1) The closing sale price was obtained from Shareholder.com, a division of Nasdaq OMX. STOCK AND FINANCIAL DATA (Dollar amounts in Thousands Except Per Share Information) SELECTED Q UA RTER LY FINANCIAL DA TA (UN AUDITED )

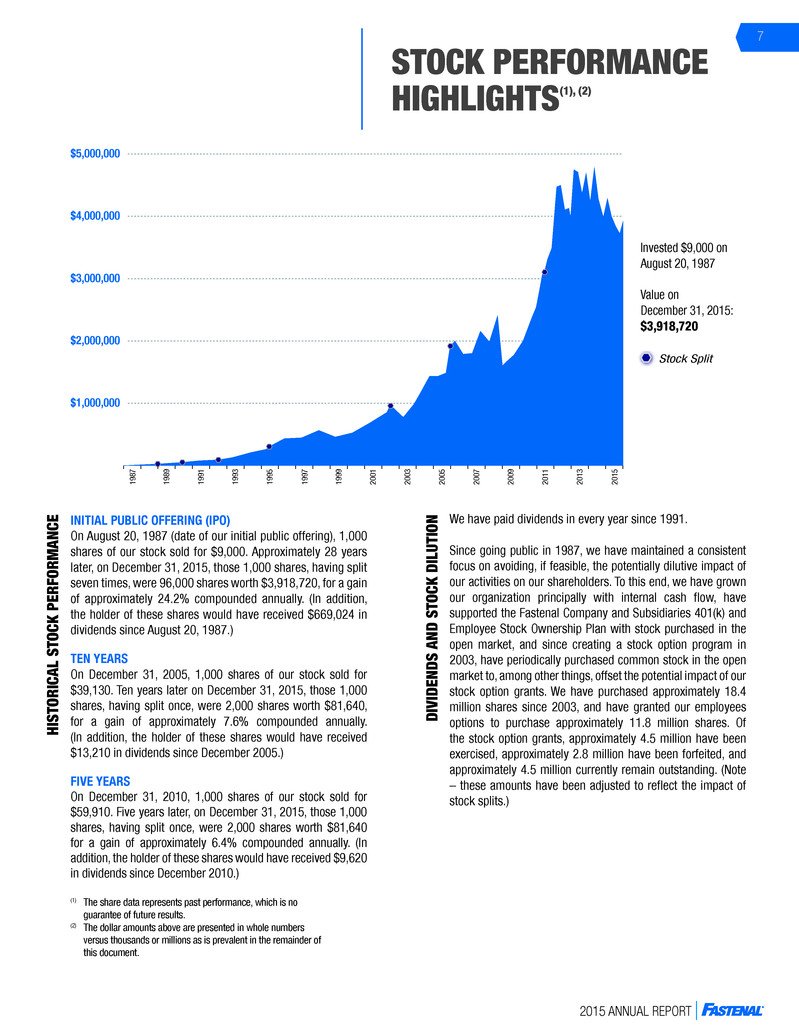

2015 ANNUAL REPORT 7 Invested $9,000 on August 20, 1987 Value on December 31, 2015: $3,918,720 Stock Split INITIAL PUBLIC OFFERING (IPO) On August 20, 1987 (date of our initial public offering), 1,000 shares of our stock sold for $9,000. Approximately 28 years later, on December 31, 2015, those 1,000 shares, having split seven times, were 96,000 shares worth $3,918,720, for a gain of approximately 24.2% compounded annually. (In addition, the holder of these shares would have received $669,024 in dividends since August 20, 1987.) TEN YEARS On December 31, 2005, 1,000 shares of our stock sold for $39,130. Ten years later on December 31, 2015, those 1,000 shares, having split once, were 2,000 shares worth $81,640, for a gain of approximately 7.6% compounded annually. (In addition, the holder of these shares would have received $13,210 in dividends since December 2005.) FIVE YEARS On December 31, 2010, 1,000 shares of our stock sold for $59,910. Five years later, on December 31, 2015, those 1,000 shares, having split once, were 2,000 shares worth $81,640 for a gain of approximately 6.4% compounded annually. (In addition, the holder of these shares would have received $9,620 in dividends since December 2010.) STOCK PERFORMANCE HIGHLIGHTS(1), (2) HISTORICAL STOCK PERFORMANC E DIVIDENDS AND STOCK DILUTIO N We have paid dividends in every year since 1991. Since going public in 1987, we have maintained a consistent focus on avoiding, if feasible, the potentially dilutive impact of our activities on our shareholders. To this end, we have grown our organization principally with internal cash flow, have supported the Fastenal Company and Subsidiaries 401(k) and Employee Stock Ownership Plan with stock purchased in the open market, and since creating a stock option program in 2003, have periodically purchased common stock in the open market to, among other things, offset the potential impact of our stock option grants. We have purchased approximately 18.4 million shares since 2003, and have granted our employees options to purchase approximately 11.8 million shares. Of the stock option grants, approximately 4.5 million have been exercised, approximately 2.8 million have been forfeited, and approximately 4.5 million currently remain outstanding. (Note – these amounts have been adjusted to reflect the impact of stock splits.) $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 198 7 198 9 199 1 199 3 199 5 199 7 199 9 200 1 200 3 200 5 200 7 200 9 201 1 201 3 201 5 (1) The share data represents past performance, which is no guarantee of future results. (2) The dollar amounts above are presented in whole numbers versus thousands or millions as is prevalent in the remainder of this document.

2015 ANNUAL REPORT 8 In the industrial world, purchasing decisions are increasingly being made based not only on product price and quality, but also the supplier’s impact on productivity and various costs associated with procuring, managing, and owning inventory. This broader definition of value is often referred to as the total cost of ownership (TCO), and it’s through this lens that Fastenal truly shines. Why do companies choose Fastenal? Below are seven aspects of our service that we believe set us apart and position us to take market share faster than the competition. KEY GROWTH DRIVERS NATIONAL ACCOUNTS ONSITE PERSONNEL PRODUCT AVAILABILITY VENDING E-BUSINESS While other suppliers tout 24 to 48 hour lead times (via remote warehouses and third-party carriers), our local stores and point-of-use inventory solutions put us in a position to supply many of our customers’ needs today. Needed supplies can be quickly ‘self-served’ at the point of use, 24/7, yet every transaction is tracked and reported, increasing productivity while reducing consumption. Our Onsite model is the ultimate expression of our local service, bringing a full-time service team and immediately-available inventory within the four walls of our customers’ facilities. Our e-business solutions leverage our investment in a supply chain that goes ‘the last mile,’ pointing customers to the nearest (and thus fastest) product solutions while providing clear visibility into their business with Fastenal. Fastenal national account customers benefit from a unique value proposition – globally-leveraged pricing backed by custom local inventory and service for each of their facilities. Manufacturing and industrial services represent a small percentage of our business in terms of revenue, but they help distinguish us in the marketplace as a true solutions provider. Roughly 75% of our 20,000+ employees are located in close proximity to the customers they serve, setting the stage for superior service, strong relationships, and new opportunities. SERVICES

2015 ANNUAL REPORT 2015 ANNUAL REPORT MICHAEL J. DOLAN Self-Employed Business Consultant, Retired Executive Vice President and Chief Operating Officer, The Smead Manufacturing Company GARY A. POLIPNICK Executive Vice President - FAST Solutions® SCOTT A. SATTERLEE Retired President of North America Surface Transportation Division, C.H. Robinson Worldwide, Inc. (logistics and distribution company) JAMES C. JANSEN Executive Vice President - Manufacturing LELAND J. HEIN Senior Executive Vice President - Sales NICHOLAS J. LUNDQUIST Executive Vice President - Operations CHARLES S. MILLER Executive Vice President - Sales RITA J. HEISE Self-Employed Business Consultant, Retired Corporate Vice President and Chief Information Officer of Cargill, Incorporated LELAND J. HEIN SHERYL A. LISOWSKI Interim Chief Financial Officer, Controller, and Chief Accounting Officer STEPHEN L. EASTMAN President of the Parts, Garments, and Accessories Division of Polaris Industries Inc. (recreational vehicle manufacturer) DANIEL L. FLORNESS President and Chief Executive Officer DANIEL L. FLORNESS HUGH L. MILLER President and Chief Executive Officer, RTP Company (thermoplastics materials manufacturer) REYNE K. WISECUP REYNE K. WISECUP Executive Vice President - Human Resources DARREN R. JACKSON Retired Chief Executive Officer, Advance Auto Parts, Inc. (auto parts company) ASHOK SINGH Executive Vice President - Information Technology WILLARD D. OBERTON Chairman of the Board, Retired President and Chief Executive Officer, Fastenal Company MICHAEL J. ANCIUS Director of Strategic Planning, Financing, and Taxation, Kwik Trip, Inc. (retail convenience store operator) 21CO UN TR IES WIT H FASTENAL STORES DIRECTOR S EXECUTIVE OFFICER S TERRY M. OWEN Senior Executive Vice President - Sales Operations JOHN L. SODERBERG Executive Vice President - Sales Operations and Support ANNUAL MEETING FORM 10-K LEGAL COUNSEL HOME OFFICE TRANSFER AGENT INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The annual meeting of shareholders will be held at 10:00 a.m., central time, April 19, 2016, at our home office located at 2001 Theurer Boulevard, Winona, Minnesota. A copy of our 2015 Annual Report on Form 10-K to the Securities and Exchange Commission is available without charge to shareholders upon written request to internal audit at the address of our home office listed on this page. Copies of our latest press releases, unaudited supplemental company information, and monthly sales information are available at: http://investor.fastenal.com. Faegre Baker Daniels LLP Minneapolis, Minnesota Streater & Murphy, PA Winona, Minnesota Fastenal Company 2001 Theurer Boulevard Winona, Minnesota 55987-0978 Phone: (507) 454-5374 Fax: (507) 453-8049 Wells Fargo Bank, N.A. Minneapolis, Minnesota KPMG LLP Minneapolis, Minnesota CORPOR ATE INFORM ATIO N $3.9 BILLIO N $516 MILLIO N NET SALE S NET EARNING S TABLE OF CONTENTS 1-3 Letter to Shareholders 4-5 10-Year Selected Financial Data & Financial Highlights 6 Stock and Financial Data 7 Stock Performance Highlights 8 Key Growth Drivers 9 Form 10-K INSIDE BACK COVER Directors Executive Officers Corporate Information 55,000 + VENDING MACHINES INSTALLED DAILY SALES GROWTH TO CUSTOMERS WITH VENDING NO. OF FASTENAL SCHOOL OF BUSINESS COURSE COMPLETIONS 487,095 ONSITE LOCATIONS 264 STORES 2,622 INVENTORY VALUE $913 MILLION NO. OF ORDERS PROCESSED 35,064,013 20,746 EMPLOYEES 118,000+ EMPLOYEE SAFETY COACHING, TRAINING, & INSPECTION EVENTS FASTENAL AT AGLANCE 135MILLIONMILES DELIVERED 783DELIVEREDMILLION POUNDS 36,000+ BIN STOCKS ACTIVE 6.4%

2015 ANNUAL REPO RT 9704582 2015 Annual Report | 1.16KM | Printed in the USA ANNUAL REPORT2015