Attached files

| file | filename |

|---|---|

| EX-32.01 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex3201.htm |

| EX-32.02 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex3202.htm |

| EX-31.01 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex3101.htm |

| EX-31.02 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex3102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended August 31, 2015

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ________ to ________

MIX 1 LIFE INC. |

(Exact name of registrant as specified in its charter) |

Nevada | 000-55422 | 68-0678499 | ||

(State or other jurisdiction | (Commission | (IRS Employer | ||

of Incorporation) | File Number) | Identification Number) |

16000 N. 80th Street, Suite E

Scottsdale, AZ 85260

(Address of principal executive offices)

(480) 344-7770

(Registrant's Telephone Number)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $0.0001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

Non-Accelerated Filer | ¨ | Smaller Reporting Company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of February 27, 2015 was $42,733,159 based upon the price ($6.21) at which the common stock was last sold as of the last business day of the most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an "affiliate" of the registrant for purposes of the federal securities laws. Our common stock is traded in the over-the-counter market and quoted on the Over-The-Counter Bulletin Board under the symbol "MIXX.QB".

As of December 14, 2015, there were 13,288,799 shares of the registrant's $0.0001 par value common stock issued and outstanding.

Documents incorporated by reference: None

Table of Contents

|

|

| Page |

| ||

PART I | ||||||

|

|

|

|

| ||

Item 1 |

| Description of Business |

|

| 4 |

|

Item 1A |

| Risk Factors |

|

| 20 |

|

Item 1B |

| Unresolved Staff Comments |

|

| 27 |

|

Item 2 |

| Description of Properties |

|

| 27 |

|

Item 3 |

| Legal Proceedings |

|

| 27 |

|

Item 4 |

| Mine Safety Disclosures |

|

| 27 |

|

|

|

|

|

|

| |

PART II | ||||||

|

|

|

|

|

| |

Item 5 |

| Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

| 28 |

|

Item 6 |

| Selected Financial Data |

|

| 30 |

|

Item 7 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

| 30 |

|

Item 7A |

| Quantitative and Qualitative Disclosures about Market Risk |

|

| 33 |

|

Item 8 |

| Financial Statements and Supplementary Data |

|

| 34 |

|

Item 9 |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

| 36 |

|

Item 9A |

| Controls and Procedures |

|

| 36 |

|

Item 9B |

| Other Information |

|

| 37 |

|

|

|

|

|

|

| |

PART III | ||||||

|

|

|

|

|

| |

Item 10 |

| Directors, Executive Officers and Corporate Governance |

|

| 38 |

|

Item 11 |

| Executive Compensation |

|

| 42 |

|

Item 12 |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

| 44 |

|

Item 13 |

| Certain Relationships and Related Transactions and Director Independence |

|

| 45 |

|

Item 14 |

| Principal Accountant Fees and Services |

|

| 46 |

|

|

|

|

|

|

| |

PART IV | ||||||

|

|

|

|

|

| |

Item 15 |

| Exhibits |

|

| 48 |

|

| 2 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as "anticipate," "expect," "intend," "plan," "believe," "foresee," "estimate" and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

· | The availability and adequacy of our cash flow to meet our requirements; |

· | Economic, competitive, demographic, business and other conditions in our local and regional markets; |

· | Changes or developments in laws, regulations or taxes in our industry; |

· | Actions taken or omitted to be taken by third parties including our competitors, as well as legislative, regulatory, judicial and other governmental authorities; |

· | Competition in our industry; |

· | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

· | Changes in our business strategy, capital improvements or development plans; |

· | The availability of additional capital to support capital improvements and development; and |

· | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

| 3 |

Use of Term

Except as otherwise indicated by the context, references in this report to "Company", "MIXX", "we", "us" and "our" are references to Mix1 Life, Inc. All references to "USD" or United States Dollars refer to the legal currency of the United States of America.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Corporate History

The Company was incorporated in the State of Nevada on June 10, 2009 under the name Antaga International Corp. We are in the business of formulation and distribution of nutritional supplements which are designed to have a positive effect on health, well-being and improve physical and mental performance.

On August 27, 2013, the Company entered into a Definitive Agreement (the "Definitive Agreement") with Mix1 LLC, an Arizona company, "Mix1." Pursuant to the Definitive Agreement, the Company acquired 100% of certain assets owned by Mix1, including, but not limited to, access to the Mix1 brand name, product formulas, packaging design specifications, vendor/supplier lists, market research reports, product sales sheets, social media assets, other work product and full rights to market and sell such assets and conduct business with the assets (the "Acquisition"). In exchange for the assets, the Company issued 3,333,333, post reverse, new shares of common stock to Mix1. On September 12, 2013, the Company changed its name to Mix1 Life, Inc. to reflect its new business. On November 1, 2013, the Company changed its trading symbol from "ANTR.OB" to "MIXX.OB". The Company is now focused on the continued development, marketing, sale and distribution of Mix1 brand.

On March 31, 2015, we entered into an Asset Purchase Agreement with Shadow Beverages and Snack, LLC, an Arizona limited liability company ("Shadow") for the purchase of the "No Fear" brand asset ("No Fear") from Shadow. Shadow's interest in the No Fear brand is in the form of an exclusive Trademark and License Agreement between Shadow and No Fear International wherein Shadow was granted exclusive licensing and distribution of the No Fear drink within the United States of America. The Company acquired One Hundred Percent (100%) of Shadow's interest in the No Fear brand only for an aggregate purchase price of Twelve Million Twenty Three Thousand Nine Hundred and Six ($12,023,906) USD.

Our Business

Mix1 products are designed for consumers looking for better options for on-the-go energy and natural products that provide the required nutrients for consumers' daily needs. We believe that our products will be able to reach the mainstream consumer market because of the broad range of occasions for consumers to drink our beverages, such as before a workout as an energy enhancer, after a workout to restore the body, as meal replacements for breakfast, lunch or dinner, as snacks or meal supplements, as energy boosts to get through the workday, or for no occasion at all.

Our business strategy over the next five years is to increase distribution of our products to national markets and expanding our distribution to international markets, to diversify and expand our current product portfolio and to increase our management and number of employees to effectively manage the growth of our business and increase our sales and marketing forces.

We commenced production of the Mix 1 products in May 2014 and began selling products in June 2014.

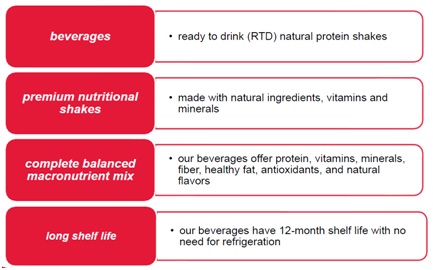

Mix1's product development was finalized and market tested in such national retailers as Whole Foods, Kroger, Ralphs and Bristol Farms. Mix1 is the premium nutritional shake made with natural ingredients and vitamins and minerals. Complete balanced macronutrient mix: protein, vitamins and minerals, fiber, healthy fat, antioxidants, no artificial sweeteners or preservatives.

| 4 |

Mix1's mission:

"Create products with high-quality ingredients that are truly functional. We believe all natural products are better than artificial ones and are the key to leading a healthy balanced life. As a company we want to improve people's lives by promoting active lifestyles and overall health. These beliefs are what lead to creating Mix1. Never again will you miss getting the necessary nutrients because you were too busy to eat. We strive to help you make healthy choices during your busy day in order to help you feel your best not only today, but every day."

Over the last twelve months, we have reformulated and re-packaged three Mix1 shake flavors (Vanilla, Strawberry Banana and Chocolate) in order to strengthen our mass consumer appeal. Key product and strategy changes include:

· | Improving the overall taste. |

|

|

· | Significantly increasing protein content. |

|

|

· | Developing high impact bottle and packaging. |

|

|

· | Targeting optimal product placement in grocery channel (beverage versus weight management). |

|

|

· | Planning for channel diversification to include convenience, wholesale club and mass retailers. |

We recently partnered with a large specialty beverage manufacturer on the production of our three flavors. Our first production run of the reformulated beverages was in May 2014, and we intend to distribute to a targeted set of retailers in the western United States. We began distribution of the Mix1 products in June 2014. Our objective during 2014 is to bring the Mix1 brand back into circulation via direct store delivery ("DSD") and natural distributors in many of the same markets and stores that previously carried Mix1 (including national retail chains). We expect significant revenue growth beginning in of 2015 as we expand distribution, sales and marketing activities.

OUR BRANDS

Mix 1's brands exist in high growth categories and leverage the consumer demand for health, nutrition and functional ingredients. Our brands are delivering incremental volume and margin growth for our distributors while enhancing category margins for customers. That win-win formula provides Mix 1 Life Inc. with volume, revenue and industry level gross profit.

NO FEAR ENERGY |

| |

Category – Energy Drinks

Consumer Positioning – Youthful and Super Aggressive

Brand Performance Drivers – Exploding Category and Monster Fighter

· Ten-year licensing agreement with brand owner, IBML · Rights to develop other RTD categories · Trademark is expanding in mainstream apparel retailers under IBML · Previously a multi-million case brand in the Pepsi System

mix1 |

| |

| 5 |

Category – Protein Shake

Consumer positioning – Nutrition Based, All Natural

Brand Performance Drivers – Started in 2009 – High growth category

| · | 26 grams of protein |

|

|

|

| · | Lifestyle and nutrition focused |

|

|

|

| · | Natural product provides for dual placement in stores |

History of Mix 1 from Inception to Acquisition by the Company

Mix 1 was founded by Dr. James Rouse in 2005, and Dr. Rouse completed the initial product formulations. Mix1 quickly gained traction among health-oriented consumers looking for a natural protein drink alternative. Mix1 marketed and sold Mix1 products until December 2012. In December 2012, Mix1 sold its remaining inventory to wholesalers and stopped the manufacture of Mix1 products. In August 2013, we purchased all of the assets, intellectual property and market research in connection with the Mix1 products from Mix1 LLC.

Our Products and Brand

Since acquisition, we have reformulated and re-packaged three Mix1 shake flavors (Blueberry Vanilla, Strawberry Banana and Chocolate) in order to strengthen our mass consumer appeal. Additionally, we recently partnered with a large specialty beverage manufacturer on the production of our three flavors. Our first production run of the reformulated beverages was in May 2014, and we distribute to a targeted set of retailers in the western United States. We began distribution of the Mix 1 products in June 2014. Our objective during 2014 was to bring the Mix1 brand back into circulation via direct store delivery ("DSD") and natural distributors in many of the same markets and stores that previously carried Mix1 (including national retail chains). We expect significant revenue growth beginning in 2016 as we expand distribution, sales and marketing activities.

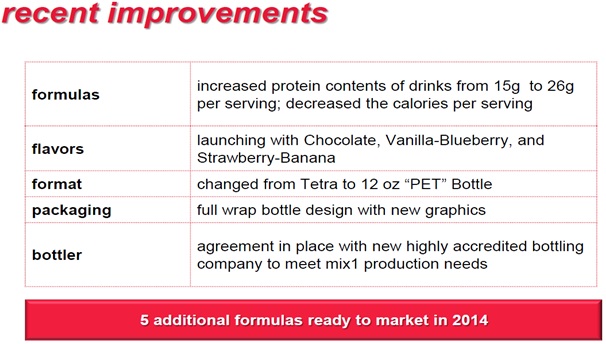

The Company has re-engineered the existing Mix1 products to improve their taste, quality, look and nutritional content. Our improvements include:

New Formulas: Using the existing Mix1 product formulas, we developed new formulas in collaboration with doctors to increase the protein content of our drinks and decrease the amount of calories, carbohydrates and sugars per serving.

New Flavors: We developed new flavors including Chocolate, Blueberry Vanilla and Strawberry Banana, which we launched in the second half of 2014. Our 99% lactose-free formulations are thick and creamy, and we have eliminated the "chalky" after-taste that typically accompanies other high-protein beverages. We developed a Mixed Berry flavor that we intend to rollout in the third quarter of 2014. We also have four additional formulas for new flavors currently under development.

New Bottle: We changed the shape of our bottle from a square Tetra Pak to a taller, more functional twelve ounce Polyethylene terephthalate "PET" bottle to make our product more appealing to consumers and to stand out among our competitors.

New Packaging: We created a new label for our bottles with better graphics and more information about the nutritional content of our drinks.

New Products: We are currently developing protein powders based on our new product formulas which we intend to launch in 2015.

| 6 |

Summary of Recent Improvements to the Mix 1 Products

The Mix1 line of natural, ready-to-drink protein shakes offers a complete and balanced nutritional blend that is intended to be consumed as a meal replacement or healthy snack. Our beverages have high protein content (on average, 26 grams per serving) and unique fruit-based flavors, with relatively low calorie count and superior taste. Our Mix1 beverages, available in a twelve-ounce PET bottle, have a twelve-month shelf life with no need for refrigeration. All of our shakes are low-fat, 99% lactose-free and made with non-GMO ingredients. A single twelve ounce serving provides 19 essential vitamins and minerals, including 70% of the recommended amount of daily calcium. The product is sweetened from only natural sugar and Stevia, and the only fat in our products is a relatively small amount of sunflower oil.

Summary of Advantages of Mix 1 Products

| 7 |

In June 2014, we commenced sales of our Mix1 products. We received our first batch of Mix1 products from our manufacturer in the second half of 2014, which we used to re-position and re-launch the brand to market all of the improvements we have made to the existing Mix1 products. Figure 1 shows our new and improved Mix1 products that we launched in 2014.

Image of our new and improved Mix1 products which launched in 2014

We plan to meaningfully expand Mix1's offerings beyond our Chocolate, Blueberry Vanilla and Strawberry Banana flavors. In 2016, we plan to introduce a multi-pack for sale in the grocery channel and will prepare product for sale in the wholesale club and mass channels. Additionally, we are currently working with one of the largest domestic whey protein suppliers on formulations for innovative natural protein powders.

Target Market and Industry

Since 2005, Mix1 has strived to create a strong lifestyle beverage brand with highly engaged and passionate customers. Our brand awareness is particularly strong in Colorado and California, areas where Mix1 previously had its highest sales volumes. Today, awareness and passion for Mix1 remains strong, even during our transition and re-launch period. We have an active social media fan base, and we receive frequent requests from prior customers awaiting the reintroduction of Mix1 beverages.

Mix1 products are designed for consumers looking for better options for on-the-go energy and natural products that provide the required nutrients for consumers' daily needs. We believe that our products will be able to reach the mainstream consumer market because of the broad range of occasions for consumers to drink our beverages, such as before a workout as an energy enhancer, after a workout to restore the body, as meal replacements for breakfast, lunch or dinner, as snacks or meal supplements, as energy boosts to get through the workday, or for no occasion at all.

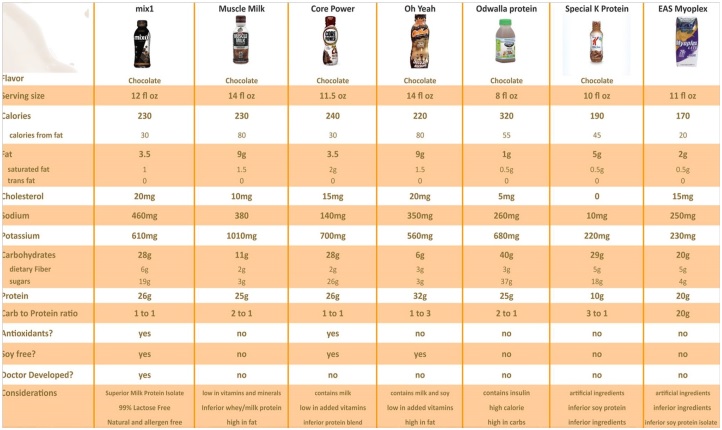

Our target customer is the rapidly growing segment of men and women ages 24 to 49 focused on living a healthy lifestyle. Many of these individuals make wellness a priority and prefer natural and organic foods. Mix1's natural ingredient list, fruit-forward flavors and brand image are key differentiating factors in the protein drink category, which separates us from our primary competitors (e.g., Muscle Milk). We believe these factors will also attract new customers to the category.

| 8 |

With our lifestyle-focused product line specially formulated to appeal to a wide range of users, Mix1 represents the next generation of functional beverages. Most ready-to-drink protein beverages have a narrow marketing focus that targets one of two niche consumer groups. Performance-focused products (i.e., Muscle Milk, Myoplex, Pure Protein) target serious gym-goers and skew heavily male. Nutrition-focused products (i.e., Boost, Ensure, Slim Fast, Special K) target weight management and skew older and heavily female. We believe that there is a large area of opportunity not currently being adequately served and that our mix1 product line addresses this market opportunity.

Smoothie and cold-pressed juice consumption has dramatically increased as consumers seek healthier "on-the-go" meal and snack options, and we believe our shakes provide the best ready-to-drink alternative to smoothies made in a blender. More so than other protein shakes, Mix1 beverages may be consumed as a meal replacement for breakfast and lunch or a mid-day snack, making our shakes a routine purchase. This repeat and balanced consumption pattern is expected to lead to long-term and loyal customers, which is expected to enable us to ultimately become a "lifestyle" beverage brand.

Projected Mix1 Consumers and Usage

We believe that our Mix1 natural, high-protein shakes will benefit from two large and sustainable trends: strong consumer demand for natural/organic foods and beverages, and increasing consumer awareness around the health benefits of protein consumption. Mintel reported in January 2013 that protein ingredients in beverages as meal supplements or replacements posted 37% growth over the past five years.[1] Also, nearly half (46%) of all consumers of these beverages state that high-protein is a primary selection attribute.[2]

Our core target market includes consumers who want a fully functional, ready to drink beverage made from all natural ingredients that provides a complete and balanced mix of nutrients for everyday occasions. This target market is large and growing. The functional beverage market was estimated to grow to $16 billion by 2015; the sports nutrition market was $19.6 billion in 2007 and is estimated to grow 51% to $29.6 billion by 2015.

According to market research performed under the direction of Mix1 prior to the Acquisition, we found that what consumers are primarily looking for in a beverage are health benefits, a reasonable price, good taste, high quality, nutritional data, low amounts of sugar, high amounts of protein, flavors offered and natural ingredients. We believe that Mix1 products will attract new consumers to the healthy beverage industry and drive incremental beverage growth by meeting the emerging demand for great tasting, high quality, health and wellness lifestyle beverages at a reasonable cost and offering multiple unique occasions for consumers to enjoy our products.

Historically, small and innovative companies have created tremendous market opportunities in the beverage industry. For example, Gatorade was an industry leader in sports drinks, Snapple was an innovator in new age beverages, Red Bull capitalized on the energy drink market, and Vitamin Water was a market mover in the enhanced water industry. Like these companies, the Company seeks to be an industry leader in the mainstream functional beverage market. We believe that one of the greatest strengths of the Mix1 brand is that our beverages fall into several different product categories including nutritional drinks, sports drinks, meal replacements, meal supplements, low calorie drinks, energy drinks, natural beverages, and more. Unlike some of our competitors, our brand is not limited by any one product category and as a result, we believe we will be able to attract a broad range of mainstream consumers.

_______________________

[1] US consumers have a healthy appetite for high protein food. The US leads the way in global launches of high protein products. (2013, January 18). Retrieved June 24, 2014, from http://www.mintel.com/press-centre/food-and-drink/us-consumers-have-a-healthy-appetite-for-high-protein-food-the-us-leads-the-way-in-global-launches-of-high-protein-products.

[2] Id.

| 9 |

Distribution

Prior to the Acquisition, Mix1 products were sold, either to distributors or directly to retailers, across the United States through multiple channels from natural health food stores, traditional grocery stores, big box stores, club stores, specialty outlets and drug stores, such as Kroger, GNC, Whole Foods Market, 7 Eleven, H-E-B, FredMeyer, QFC, King Soopers, United Supermarkets, Wild Oats Markets, Inc., Target, Henry's, Albertsons, Ralphs, Costco, Central Market, Fry's, Smith's Food and Drug Stores, and many others.

Projected Geographic Distribution Strategy

As part of the Acquisition, the Company has access to previous distribution channels established by Mix1 for the distribution of Mix1 products. The Company re-launched the Mix1 brand in the second half of 2014 through these existing distribution channels as well as new distribution channels that the Company has established since the Acquisition through its marketing efforts. The Company does not have any long-term contracts with any distributors or retailers for the sale of its products. The distributors and retailers that the Company has established will purchase Mix1 products on an order-by-order basis only if the products are immediately available for shipping.

In the future, the Company will continue to seek additional channels of distribution for its products to include convenience, wholesale club and mass retailers. The Company will first focus on distributing its products regionally, starting in Arizona, Colorado, California and other western states, and will then seek to expand its distribution channels across the U.S. and then internationally.

Manufacturing

We outsource the manufacturing, bottling and packaging of our products to a third party located in the U.S. on an order-by-order basis. The Company does not have any long-term contracts with this third party for their services. Further, this third party does not work exclusively for the Company and may be limited in their ability to meet our production needs. Once the products have been manufactured, bottled and packaged, they are sent directly to our distributors and retailers based on their purchase orders.

Supplies of Raw Materials

The ingredients for our products are sourced from several different suppliers located primarily in North America and Europe on an order-by-order basis. Some of the ingredients in our products are not readily available in large quantities or are available on a limited or seasonal basis only. Further, the limited availability of some of these ingredients could cause significant fluctuations in their costs. Our management researches and develops our sources of ingredients used in the manufacturing of our products. The ingredients that we source are sent to our manufacturer in the U.S. to create our products. The Company does not have any long-term contracts with our suppliers and we cannot be assured that they will be able to meet our demands.

Marketing

We have a strong brand that evokes passion with our customers, evidenced by currently having over 19,000 Facebook fans, 1,700 Twitter followers and 1,000 Instagram followers. We plan to promote the Mix1 brand by engaging in traditional and digital advertising, promotions and other customer outreach.

| 10 |

We intend to market our new and future Mix1 products using the following channels:

· | Mainstream Advertising |

· | Print: Advertising through print such as newspapers, magazines, mail, etc. | |

· | Broadcast: Advertising through television or the radio. | |

· | Out-of-home: Advertising to reach consumers while they are on-the-go in public places, in transit, retail venues, etc. | |

· | Digital: Advertising through computers, smartphones, tablets, etc. | |

· | Endorsements: Public endorsements of our products from celebrities, athletes, personalities, political figures, etc. that can generate mainstream awareness for Mix1. |

· | Field Marketing and Consumer Promotion |

· | Strategic Event Sampling: Sampling increases consumer awareness of our products and provides opportunities for consumers to taste the product and learn about its nutritional benefits. | |

· | Sponsorship: Partnering with an event, activity, key personality or organization that will give us access to a greater consumer market and generate strong community ties. |

· | Retail Promotion |

· | Retailer Programs: Retailers promote our products through sales, rebates, coupons, contests, temporary price reductions (TPRs), etc. to drive consumer engagement with our product, generate word-of-mouth marketing, reinforce brand positioning and create sale opportunities. |

· | In-Store Execution |

· | Displays of our products | |

· | In-Store Sampling | |

· | In-Store Coupons | |

· | Point-of-Sale Displays: Sales promotion displayed at or near the checkout to encourage impulse buying. |

· | Digital and Social Media |

· | Social Media Campaign: Marketing through social media sites to create content that attracts consumer attention, encourage readers to share that content via the Internet, and drive sales of our products. | |

· | Coupons: Offer coupons online through social media sites |

| 11 |

· | Public Relations |

· | Guerilla Marketing: Innovative, unconventional and low-cost marketing aimed at obtaining maximum exposure generally targeting specific consumers, such as street art, flash mobs, PR stunts, | |

· | Public Relations including public appearances, presentations, etc. |

Examples of our Consumer Marketing Strategies

Examples of our Retail Marketing Strategies

| 12 |

Business Strategy

Over the next five years, our growth strategy will focus on the following three key areas:

Grow into a "Mega-Brand" through Increased Distribution to National Markets and Expansion into International Markets

We will strive to become a "Mega-Brand" in the functional beverage industry by increasing the amount of product we distirubute to our current customers in the U.S. and seeking additional retail markets where we can sell our products. Further, we intend to expand distribution of Mix1 products to international markets. Our primary sales focus will be convenience stores and grocery stores in the U.S. and Canada, which we plan to enter primarily through brokers and distributors. Our distribution strategy is expected to include regional direct store delivery groups (e.g., Admiral, Kalil, New Age, Swire) and national natural and organic distributors (e.g., KeHE, Lone Star, UNFI). We also plan to sell product to mass, club and drug stores, as well as gyms and hospitals, and our eCommerce strategy is planned to include selling through our own website and Amazon.com, among others.

Diversify and Expand our Product Portfolio

We will continue to improve our current products and introduce new flavors and ingredients while also exploring opportunities to diversify into new types of products such as protein powders to be added to water for nutritional energy enhancement. We believe that diversification engages new consumer interest and enables the brand to benefit from a proactive and developing brand image while stimulating revenue from increased buyer interest and awareness of the brand.

No Fear Acquisition

On March 31, 2015, the Company completed the purchase of the "No Fear" beverage brand from Shadow Beverage and Snack, LLC, an Arizona limited liability company. The purchase included Shadow's interest in the No Fear brand in the form of an exclusive Trademark License Agreement dated December 5, 2011, the First and Second amendments to that agreement that bear no date, and the third amendment dated December 23, 2013 between Shadow and No Fear International wherein Shadow had exclusive licensing and distribution of the No Fear brand drink within the United States of America. The Company acquired one hundred percent (100%) of Shadow's interest in the No Fear brand for an aggregate purchase price of Twelve Million Twenty Three Thousand Nine Hundred and Six ($12,023,906) USD.

The Energy Drink Epidemic

It all started with a growing addiction to coffee. Americans drink a total of 400 million cups of coffee per day, more than one cup per person. Recently, the trend has been toward more straightforward energy drinks or shots.

Consider this comparison: Monster Beverage which, like Red Bull, is one of the leaders in the energy drink market -- has seen its revenue grow 20 times (2,000 percent) in the last 10 years. Starbucks has grown two-and-three-quarters times (274 percent) during the same period.

5-Hour Energy leads the energy-shot front, selling 1.5 billion energy shots since it was launched in 2004. The company behind the product, Living Essentials, had sales of $1 billion last year and pocketed $600 million in profit.

Right now, Red Bull, Monster, and 5-Hour Energy command the largest and most lucrative market share in the energy drink space, and that's not likely to change.

Since both Red Bull and 5-Hour Energy's parent, Living Essentials, are privately held, investors are left with Monster Beverage for exposure to energy drinks. Now they have Mix 1 Life, Inc.

Soda sales in the United States have declined for nine consecutive years and were down 3% in 2013. However, energy drink sales are growing rapidly and were up 5.5% in 2013.

According to research by IBISWorld, energy drink sales generate $6.8 billion in annual revenue in the United States. The same research predicts annual growth of 9.7% for the industry through 2019.

| 13 |

Energy-drink makers say their products are safe and haven't caused any deaths. NO Fear ounce by ounce, has roughly half the caffeine of a Starbucks coffee. In addition to caffeine, energy drinks typically include other ingredients such as taurine and ginseng that the companies market as providing additional energy kicks.

$9 billion U.S. energy-drink market in 2013, according to the data service Euromonitor. The total market $27.5 billion global energy-drinks.

Products and Brand

This philosophy is still evident With No Fear Energy Drink today as consumers are reminded that…No Fear gives you the drive to do what YOU want to do. This powerful message is delivered every time a consumer sees the name…NO FEAR.

No Fear truly is a Lifestyle brand that speaks directly to the key energy consumer demographic.

IT'S AN ATTITUDE

IT'S A LIFESTYLE

IT'S A STATE OF MIND

| 14 |

Target Market and Industry

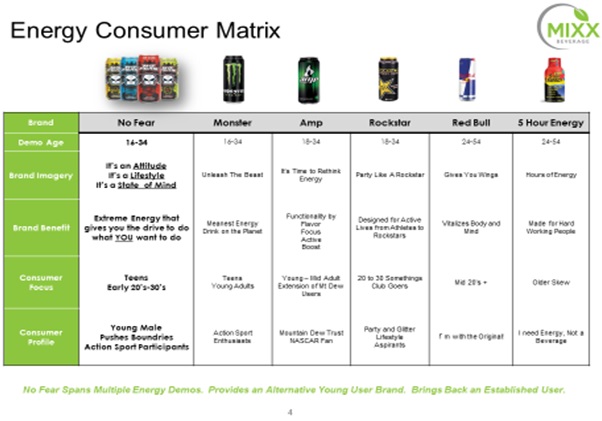

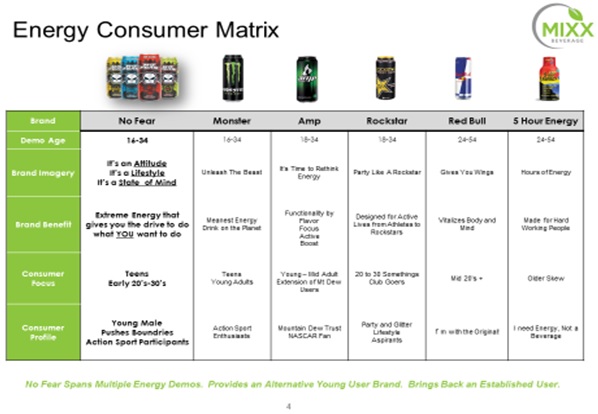

Brand |

| No Fear |

Demo Age |

| 16-34 |

Brand Imagery |

| It's an Attitude It's a Lifestyle It's a State of Mind |

Brand Benefit |

| Extreme Energy that gives you the drive to do what YOU want to do |

Consumer Focus |

| Teens Early 20's-30's |

Consumer Profile |

| Young Male Pushes Boundries Action Sport Participants |

No Fear Spans Multiple Energy Demos. Provides an Alternative Young User Brand. Brings Back an Established User.

The Energy Beverage Category is big – and getting bigger. The 2nd largest beverage category expected to double in the next 5 years. 1/3 of consumers over the age of 18 regularly consume energy drinks. Energy growth will continue in double digits. New users are entering and adopting the category, Usage occasions are increasing, and Innovation supports sustained growth.

Competition

The beverage industry is highly competitive. There are a large number of widely recognized brands, such as Monster, AMP, Rockstar, and Red Bull.

| 15 |

Distribution of No Fear

No Fear's biggest customer is Pepsi and as anyone familiar with the industry knows, this represents a tremendous opportunity for Mix1's product. No Fear currently provides products to several separate Pepsi distributors

Expand our Team

Our team currently includes our officers and directors as well as fifteen full-time employees, who together are responsible for several different segments of our business including product development, marketing, distribution, sales, public relations, finance, and more. We intend to increase the size of our management team and hire additional employees to manage the continued growth of our company and to increase our sales force and marketing efforts.

Intellectual Property

We own the registered trademarks for the "Mix1" brand name and logo. Generally, our trademarks remain valid and enforceable so long as we continue to use the marks in commerce and the required registration renewals are filed. We also hold the trade secrets to the formulas for all of our beverages. Additionally, we have registered the www.mix1life.com domain name.

On March 31, 2015, the Company completed the purchase of the "No Fear" beverage brand from Shadow Beverage and Snack, LLC, an Arizona limited liability company. The purchase included Shadow's interest in the No Fear brand in the form of an exclusive Trademark License Agreement dated December 5, 2011, the First and Second amendments to that agreement that bear no date, and the third amendment dated December 23, 2013 between Shadow and No Fear International wherein Shadow had exclusive licensing and distribution of the No Fear brand drink within the United States of America.

We consider our trademarks, trade secrets and domain name to be valuable assets to the Mix1 brand and seek to protect them from infringement.

| 16 |

Government Regulation

The distribution and sale in the United States of our products is subject to the Federal Food, Drug and Cosmetic Act and various other federal, state, and local statutes and regulations applicable to the production, transportation, sale, safety, advertising, labeling, and ingredients of our products. Compliance with these regulations may involve significant costs or require us to change our business practices. Noncompliance could result in penalties being imposed on us or orders that we stop the alleged noncompliant activity. We believe that we are currently in material compliance with all such applicable laws, however, new statutes and regulations may also be instituted in the future. If a regulatory authority finds that a current or future product or production run is not in compliance with any of these regulations, we may be fined, or our product may have to be recalled and/or reformulated and/or repackaged, thus adversely affecting our financial condition and operations. We do not believe that we will require any government approval to sell or distribute our products in the U.S. In the event we expand our operations globally, we will be subject to increased regulatory issues, particularly in relation to the registration and taxation of our products in foreign markets, and may be required to obtain government approval of our foreign operations.

Competition

The beverage industry is highly competitive. There are a large number of widely recognized brands of ready to drink health-conscious beverages in the market, such as Muscle Milk, Core Power, Oh Yeah, Odwalla, EAS Myoplex, Ensure, Special K, Slim-Fast, Boost, Nature's Best, and Nutrilite. For Energy category there are a large number of widely recognized brands, such as Monster, AMP, Rockstar, and Red Bull.

Our competitors may have substantially greater financial, marketing and distribution resources than we do and as a result, be better positioned to obtain financing, seek strategic relationships, sell their products to larger markets and more.

Important factors affecting our ability to compete successfully include the taste and flavor of our products, consumer promotions, rapid and effective development and marketing of new cutting edge products, attractive packaging, branded product advertising, optimal product placement in stores, and pricing. We also compete for distributors who will give our products more focus than those of our competitors, provide stable and reliable distribution and secure adequate shelf space for our products in retail stores. Competitive pressures in the beverage industry could prevent our products from gaining market share or cause us to experience price erosion, which could have a material adverse effect on our business and results of operations.

| 17 |

18

Differentiation of Mix 1 from its Competitors

Although we operate in a highly competitive market, we believe that the use of innovative fruit-based flavors and natural ingredients set Mix1 protein shakes apart from similar products in the market. Our 99% lactose-free formulations are thick and creamy, and we believe that we have eliminated the "chalky" after-taste that typically accompanies other high-protein beverages. In the reformulation process, we also significantly increased protein content while keeping calorie count low (between 230 and 240 calories per serving). We believe that these unique product attributes will enable us to gain market share and bring a new segment of consumers into the natural protein drink category.

Employees

As of the date of this Annual Report, we employ a total of fifteen full-time employees.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC's Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC's web site, www.sec.gov.

| 19 |

ITEM 1A. RISK FACTORS

RISKS RELATED TO OUR BUSINESS

The sale of ingested products involves product liability and other risks.

Like other distributors of products that are ingested, the Company faces an inherent risk of exposure to product liability claims if the use of its products results in illness or injury. The products that the Company sells in the U.S. are subject to laws and regulations, including those administered by the USDA and FDA that establish manufacturing practices and quality standards for food products. Product liability claims could have a material adverse effect on the Company's business as existing insurance coverage may not be adequate. Distributors of vitamins, nutritional supplements and minerals, have been named as defendants in product liability lawsuits from time to time. The successful assertion or settlement of an uninsured claim, a significant number of insured claims or a claim exceeding the limits of the Company's insurance coverage would harm the Company by adding costs to its business and by diverting the attention of senior management from the operation of its business. The Company may also be subject to claims that its products contain contaminants, are improperly labeled, include inadequate instructions as to use or inadequate warnings covering interactions with other substances. Product liability litigation, even if not meritorious, is very expensive and could also entail adverse publicity for the Company and reduce its revenue. In addition, the products the Company distributes, or certain components of those products, may be subject to product recalls or other deficiencies. Any negative publicity associated with these actions would adversely affect the Company's brand and may result in decreased product sales and, as a result, lower revenues and profits.

Significant additional labeling or warning requirements may inhibit sales of affected products.

Various jurisdictions may seek to adopt significant additional product labeling or warning requirements relating to the content or perceived adverse health consequences of the Company's product. If these types of requirements become applicable to the Company's product under current or future environmental or health laws or regulations, they may inhibit sales of such products.

As a new business enterprise, the Company likely will experience fluctuations in its operating results.

The Company's operating results may fluctuate significantly as a result of a variety of factors, many of which are outside its control. As a result of the Company's lack of operating history it is difficult for the Company to forecast its revenues or earnings accurately. The Company may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenues relative to the Company's planned expenditures would have an immediate, adverse effect on its business, results of operations and financial condition.

Criticism of the Company's product and/or the market generally could adversely affect its operating results.

Criticism of the Company's product, including criticism by healthcare professionals and other criticism for a variety of reasons, could affect consumer opinions of its product and result in decreased demand, which in turn could have an adverse effect on its results of operations and business.

Changes in the business environment for the Company's product could impact its financial results.

The business environment for the Company's product is rapidly evolving as a result of, among other things, changes in consumer preferences, including changes based on health and nutrition considerations; shifting consumer tastes and needs; changes in consumer lifestyles; and competitive product and pricing pressures. If the Company is unable to successfully adapt to this rapidly changing environment, its business could be negatively affected.

Changes in formula and new flavor offerings; we cannot accurately predict the volume or timing of any future sales of our reformulated or any new products, making the timing of any revenues difficult to predict.

The past experienced by our predecessor company was based on a formula and flavor that we no longer offer or sell. Although management believes the new formula and flavors provide more attractive alternatives than the former best-selling popular berry flavor there is no assurance our consumers will agree. We may be faced with lengthy customer evaluation and approval processes associated with our reformulated and new beverage offerings. Consequently, we may incur substantial expenses and devote significant management effort and expense in developing customer acceptance, which may not result in revenue generation. As such, we cannot accurately predict the volume or timing of any future sales.

| 20 |

If the Company is not able to effectively protect its intellectual property, its business may suffer a material, negative impact and may fail.

The Company believes that its brand is important to its success and competitive position. If the Company is unable to secure trademark protection for its intellectual property in the future or that protection is inadequate for its current products and any future products, the Company's business may be materially adversely affected. Further, the Company cannot be sure that its activities do not and will not infringe on the intellectual property rights of others. If claims are made against the Company's current product formula, the Company may not be able to effectively minimize damage claims due to its significant sales pipeline. If the Company is compelled to prosecute infringing parties, defend its intellectual property or defend itself from intellectual property claims made by others, it may face significant expenses and liability as well as the diversion of management's attention from the Company's business, any of which could negatively impact the Company's business or financial condition.

Our business could be harmed if we fail to maintain proper inventory levels.

We place orders with our manufacturers for some of our products prior to the time we receive all of our customers' orders. We do this to minimize purchasing costs, the time necessary to fill customer orders and the risk of non-delivery. We also maintain an inventory of certain products that we anticipate will be in greater demand. However, we may be unable to sell the products we have ordered in advance from manufacturers or that we have in our inventory. Inventory levels in excess of customer demand may result in inventory write-downs, and the sale of excess inventory at discounted prices could significantly impair our brand image and have a material adverse effect on our operating results and financial condition. Conversely, if we underestimate consumer demand for our products or if our manufacturers fail to supply the quality products that we require at the time we need them, we may experience inventory shortages. Inventory shortages might delay product shipments, negatively impact key relationships with our customers, and diminish brand loyalty.

We rely on contract manufacturing of our products. Our inability to secure production sources meeting our quality, cost, working conditions and other requirements, or failures by our contractors to perform, could harm our sales and reputation.

We source our products from third party manufacturers. As a result, we must locate and secure production that meets our demands. We depend on our manufacturers to maintain adequate financial resources and maintain sufficient development and manufacturing capacity. We do not have material long-term contracts with any of our manufacturers, and these manufacturers generally may unilaterally terminate their relationship with us at any time. Our dependence on contract manufacturers could subject us to a number of risks if these manufacturers do not meet our quality, cost, working conditions and other requirements or if they fail to materially perform, any of which could seriously harm our sales and reputation. Further, if we need to place greater demands on our current manufacturers due to increased customer demands, or seek additional or replacement manufacturers, we may be unable to do so on terms that are acceptable to us, if at all.

We rely on third-party suppliers who provide raw materials to our manufacturers to create our products. We have limited control over them and may not be able to obtain quality products on a timely basis or in sufficient quantity.

We do not manufacture our products or the raw materials used to create our products and instead rely on third-party suppliers to supply the materials to our manufacturers. We have no material long-term contracts with these suppliers, and we compete with other companies for raw materials and production. We may experience a significant disruption in the supply of raw materials from current sources or, in the event of a disruption, we may be unable to locate alternative materials suppliers of comparable quality at an acceptable price, or at all. In addition, if we experience significant increased demand, or if we need to replace an existing supplier, we may be unable to locate additional supplies of raw materials on terms that are acceptable to us, or at all, or we may be unable to locate any supplier with sufficient capacity to meet our requirements or to fill our orders in a timely manner. Identifying a suitable supplier is an involved process that requires us to become satisfied with their quality control, responsiveness and service, financial stability and labor and other ethical practices. Even if we are able to expand existing sources, we may encounter delays in production and added costs as a result of the time it takes to train suppliers in our methods, products and quality control standards. Delays related to supplier changes could also arise due to an increase in shipping times if new suppliers are located farther away from our markets or from other participants in our supply chain. Any delays, interruptions or increased costs in the supply of fabrics for our products could have an adverse effect on our ability to meet customer demand for our products and result in lower net revenue and income from operations both in the short and long term.

| 21 |

Our business is subject to risks associated with distribution overseas.

Our ability to export products in a timely and cost-effective manner may be affected by conditions at ports or issues that otherwise affect transportation, such as port and shipping capacity, labor disputes and work stoppages, political unrest, severe weather, or security concerns. These issues could delay exportation of products or require us to locate alternative ports to avoid disruption to our customers. These alternatives may not be available on short notice, if at all, or could result in higher transit costs, which could have an adverse impact on our business and financial condition.

Our exported products are subject to customs laws, which may impose tariffs, as well as import quota restrictions on apparel. However, we have no guarantee that regulations on exported goods will not materially change or that our business will not be adversely affected by duties, tariffs or embargoes in the future.

Violation of labor laws and practices by our manufacturers and suppliers could harm our business.

We require our manufacturers and suppliers to operate in compliance with applicable laws and regulations. While the Company promotes ethical business practices, we do not control our manufacturers or suppliers or their labor practices. The violation of labor or other laws by any of our manufacturers or suppliers, or divergence of their labor practices from those generally accepted as ethical in the local markets, could interrupt or otherwise disrupt the shipment of our products, harm the value of our trademarks, damage our reputation or expose us to potential liability for their wrongdoings.

A privacy breach could damage our reputation and our relationship with our customers, expose the Company to litigation risk and adversely affect our business.

As part of our normal course of business, we collect, process and retain sensitive and confidential customer information. Despite security measures we have in place, our facilities and systems may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information could severely damage our reputation and our relationships with our customers, expose the Company to risks of litigation and liability and adversely affect our business.

Our success depends on the continued protection of our trademarks.

Our trademarks are important to our success and competitive position, and the loss of or inability to enforce our trademarks could harm our business. We have devoted and will continue to devote substantial resources to the establishment and protection of our trademarks on a worldwide basis. Despite any precautions we may take to protect our trademarks, policing unauthorized use of them is difficult, expensive and time-consuming, and we may be unable to adequately protect our trademarks or determine the extent of any unauthorized use, particularly in those foreign countries where the laws do not protect proprietary rights as fully as in the United States. Our efforts to establish and protect our trademarks may not be adequate to prevent imitation or counterfeiting of our products by others or to prevent others from seeking to block sales of our products for violating their trademarks. Unauthorized copying of our products or unauthorized use of our trademarks may decrease sales of our products and cause significant damage to our brand name and our ability to effectively represent ourselves to our customers. Also, we cannot assure you that others will not assert rights in, or ownership of, our trademarks, that our trademarks would be upheld if challenged or that we would, in that event, not be prevented from using our trademarks, any of which could have a material adverse effect on our financial condition and results of operations. Further, we could incur substantial costs in legal actions relating to our use of our trademarks or the use of our trademarks by others. Even if we are successful in these actions, the costs we incur could have a material adverse effect on us.

| 22 |

We are an "Emerging Growth Company" and as such, intend to take advantage of certain exemptions from reporting requirements that are available to us.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012 ("JOBS Act"), and as such, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an "emerging growth company."

We will remain an emerging growth company until the earliest of: (A) the last day of the fiscal year following the fifth anniversary of our first sale of common equity securities pursuant to an effective Registration Statement, (B) the last day of the fiscal year in which we have total annual gross revenue of $1.0 billion or more, (C) the date that we are deemed to be a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (D) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

If ever we are no longer an "emerging growth company," we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not "emerging growth companies," including Section 404 of the Sarbanes-Oxley Act.

We are an "Emerging Growth Company" and we cannot be certain if the reduced disclosure requirements applicable to Emerging Growth Companies will make our Common Stock less attractive to Investors.

We are an "emerging growth company," as defined in the Jumpstart our Business Startups Act of 2012 ("JOBS Act"), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our Common Stock less attractive because we will rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

Under the JOBS Act, "emerging growth companies" can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to "opt out" of such extended transition period and, therefore, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Changes in government regulation, or failure to comply with existing regulations, could adversely affect our business, financial condition and results of operations.

Legislation has been proposed and/or adopted at the U.S. federal, state and/or municipal level and proposed and/or adopted in certain foreign jurisdictions to restrict the sale of energy drinks (including prohibiting the sale of energy drinks at certain establishments or pursuant to certain governmental programs), limit caffeine content in beverages, require certain product labeling disclosures and/or warnings, impose excise taxes, limit product size, or impose age restrictions for the sale of energy drinks. For a discussion of certain of such legislation, see "Part I, Item 1 — Business — Government Regulation." Furthermore, additional legislation may be introduced in the United States and other countries at the federal, state, local and municipal level in respect of each of the foregoing subject areas. Public health officials and health advocates are increasingly focused on the public health consequences associated with obesity, especially as the disease affects children, and are seeking legislative change to reduce the consumption of sweetened beverages. There also has been an increased focus on caffeine content in beverages. To the extent any such legislation is enacted in one or more jurisdictions where a significant amount of our products are sold individually or in the aggregate, it could result in a reduction in demand for or availability of our energy drinks and adversely affect our business, financial condition and results of operations.

| 23 |

The production, distribution and sale in the United States of many of our products are also currently subject to various federal and state regulations, including, but not limited to: the FFDC Act, including as amended by the Dietary Supplement Health and Education Act of 1994; the Occupational Safety and Health Act; various environmental statutes; and various other federal, state and local statutes and regulations applicable to the production, transportation, sale, safety, advertising, labeling and ingredients of such products. Outside the United States, the production, distribution and sale of many of our products are also subject to numerous statutes and regulations. If a regulatory authority finds that a current or future product or production run is not in compliance with any of these regulations, we may be fined, or such products may have to be recalled and/or reformulated and/or have the packaging changed, which could adversely affect our business, financial condition and results of operations.

Criticism of our energy drink products, and/or criticism or a negative perception of energy drinks generally, could adversely affect us.

An unfavorable report on the health effects of caffeine, or criticism or negative publicity regarding the caffeine content in our products or energy drinks generally, could have an adverse effect on our business, financial condition and results of operations. Articles critical of the caffeine content in energy drinks and/or indicating certain health risks of energy drinks have been published in recent years. We believe the overall growth of the energy drink market in the U.S. may have been negatively impacted by the ongoing negative publicity and comments that continue to appear in the media questioning the safety of energy drinks, and suggesting limitations on their ingredients (including caffeine) and/or the levels thereof and/or imposing minimum age restrictions for consumers. If reports, studies or articles critical of caffeine and/or energy drinks continue to be published or are published in the future, they could adversely affect the demand for our products.

Increased competition could hurt our business.

The beverage industry is highly competitive. The principal areas of competition are pricing, packaging, development of new products, flavors, product positioning as well as promotion and marketing strategies. Our products compete with a wide range of drinks produced by a relatively large number of manufacturers, some of which have substantially greater financial, marketing and distribution resources than we do.

Important factors affecting our ability to compete successfully include the taste and flavor of our products, trade and consumer promotions, rapid and effective development of new, unique cutting edge products, attractive and different packaging, branded product advertising and pricing. Our products compete with all liquid refreshments and in some cases with products of much larger and substantially better financed competitors, including the products of numerous nationally and internationally known producers such as TCCC, PepsiCo, Red Bull Gmbh, the DPS Group, Kraft Foods Inc., Suntory Holdings, Ltd., Nestle Beverage Company, Tree Top and Ocean Spray. We also compete with companies that are smaller or primarily national or local in operations. Our products also compete with private label brands such as those carried by grocery store chains, convenience store chains, and club stores.

| 24 |

There can be no assurance that we will not encounter difficulties in maintaining our current revenues or market share or position due to competition in the beverage industry. If our revenues decline, our business, financial condition and results of operations could be adversely affected.

Changes in consumer preferences may reduce demand for some of our products.

The beverage industry is subject to changing consumer preferences and shifts in consumer preferences may adversely affect us. There is increasing awareness of and concern for the health consequences of obesity. This may reduce demand for our non-diet beverages, which could reduce our revenues and adversely affect our results of operations. Recently, concerns have emerged regarding diet sodas and in particular, aspartame, which we do not use in our beverages.

Consumers are seeking greater variety in their beverages. Our future success will depend, in part, upon our continued ability to develop and introduce different and innovative beverages that appeal to consumers. In order to retain and expand our market share, we must continue to develop and introduce different and innovative beverages and be competitive in the areas of taste, quality and health, although there can be no assurance of our ability to do so. There is no assurance that consumers will continue to purchase our products in the future. Product lifecycles for some beverage brands and/or products and/or packages may be limited to a few years before consumers' preferences change. The beverages we currently market are in varying stages of their product lifecycles and there can be no assurance that such beverages will become or remain profitable for us. We may be unable to achieve volume growth through product and packaging initiatives. We may also be unable to penetrate new markets. If our revenues decline, our business, financial condition and results of operations could be adversely affected.

Increases in costs and/or shortages of raw materials and/or ingredients and/or fuel and/or costs of co-packing could harm our business.

The principal raw materials used by us are aluminum cans, PET plastic bottles, as well as flavors, juice concentrates, sugar, sucralose, milk, cream, protein, dietary ingredients and other packaging materials; the costs and availability of which are subject to fluctuations. In addition, certain of our co-pack arrangements allow such co-packers to increase their charges based on certain of their own cost increases. We are uncertain whether the prices of any of the above or any other raw materials or ingredients, certain of which have recently risen, will continue to rise or may rise in the future. We are unsure whether we will be able to pass any of such increases on to our customers. We generally do not use hedging agreements or alternative instruments to manage the risks associated with securing sufficient ingredients or raw materials although we do, from time to time, enter into purchase agreements for a significant portion of our annual anticipated requirements for certain raw materials such as aluminum cans, apple juice, sugar and sucralose.

In addition, some of these raw materials, including certain sizes of cans, are available from a limited number of suppliers.

If we do not maintain sufficient inventory levels and/or if we are unable to deliver our products to our customers in sufficient quantities, and/or if our customers' or retailers' inventory levels are too high, our operating results could be adversely affected.

| 25 |

If we do not accurately anticipate the future demand for a particular product or the time it will take to obtain new inventory, our inventory levels may be inadequate and our results of operations may be negatively impacted. If we fail to meet our shipping schedules, we could damage our relationships with distributors and/or retailers, increase our distribution costs and/or cause sales opportunities to be delayed or lost. In order to be able to deliver our products on a timely basis, we need to maintain adequate inventory levels of the desired products. If the inventory of our products held by our distributors and/or retailers is too high, they will not place orders for additional products, which could unfavorably impact our future sales and adversely affect our operating results.

The costs of packaging supplies are subject to price increases from time to time and we may be unable to pass all or some of such increased costs on to our customers.

Many of our packaging supply contracts allow our suppliers to alter the costs they charge us for packaging supplies based on changes in the costs of the underlying commodities that are used to produce those packaging supplies, such as aluminum for cans, resin for PET plastic bottles, and pulp and paper for cartons and/or trays. These changes in the prices we pay for our packaging supplies occur at certain predetermined times that vary by product and supplier. In some cases, we are able to fix the prices of certain packaging supplies and/or commodities for a reasonable period. In other cases, we bear the risk of increases in the costs of these packaging supplies, including the underlying costs of the commodities that comprise these packaging supplies. We do not use derivative instruments to manage this risk. If the costs of these packaging supplies increase, we may be unable to pass these costs along to our customers through corresponding adjustments to the prices we charge, which could have a material adverse effect on our results of operations.

If we are unable to maintain our brand image or product quality, our business may suffer.

Our success depends on our ability to build and maintain the brand image for our existing products, new products and brand extensions. There can be no assurance that our advertising, marketing and promotional programs will have the desired impact on our products' brand image and on consumer preference and demand. Product quality and/or ingredient content issues, efficacy or lack thereof, real or imagined, or allegations of product contamination, even if false or unfounded, could tarnish the image of the affected brands and may cause consumers to choose other products. Furthermore, our brand image or perceived product quality could be adversely affected by litigation, unfavorable reports in the media, internet or elsewhere, studies in general and regulatory or other governmental inquiries, in each case whether involving our products or those of our competitors, as well as proposed or new legislation affecting our industry.

If we encounter product recalls, our business may suffer and we may incur material losses.

We may be required from time to time to recall products entirely or from specific co-packers, markets or batches if such products become contaminated, damaged, mislabeled or otherwise materially not compliant with applicable regulatory requirements. Product recalls could adversely affect our profitability and our brand image. We do not maintain recall insurance.

| 26 |

RISKS ASSOCIATED WITH OUR COMMON STOCK

The Company's stock price may be volatile.

The market price of the Company's common stock is likely to be highly volatile and could fluctuate widely in price in response to various potential factors, many of which will be beyond the Company's control, including the following:

· competition; · additions or departures of key personnel; · the Company's ability to execute its business plan; · operating results that fall below expectations; · loss of any strategic relationship; · industry developments; · economic and other external factors; and · period-to-period fluctuations in the Company's financial results.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of the Company's common stock.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. We cannot assure you of a positive return on investment or that you will not lose the entire amount of your investment in our common stock.

We may in the future issue additional shares of our common stock which would reduce investors' ownership interests in the Company and which may dilute our share value.

Our Articles of Incorporation and amendments thereto authorize the issuance of 100,000,000 shares of common stock, par value $0.001 per share. The future issuance of all or part of our remaining authorized common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTIES

Our executive offices are located at 16000 N. 80th Street Suite E, Scottsdale, AZ 85260. We currently rent this space on a 3 year lease for approximately $8,000.00 USD a month. Our telephone number is (480) 344-7770. We believe this space is sufficient to meet our immediate needs. Additional space may be required as we expand our operations. We do not foresee any significant difficulties in obtaining any required additional facilities. We do not currently own any real estate.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 27 |

PART II

ITEM 5. MARKET FOR THE COMPANY'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is currently quoted on the OTC Bulletin Board (OTCQB) and trades under the symbol "MIXX". Because we are quoted on the OTC Bulletin Board, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

The following table sets forth the high and low bid prices for our Common Stock per quarter as reported by the OTCBB since we began trading October 2013 based on our fiscal year end August 31. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

| First Quarter |

|

| Second Quarter |

|

| Third Quarter |