Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - MIX 1 LIFE, INC. | Financial_Report.xls |

| EX-32.01 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex321.htm |

| EX-31.02 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex312.htm |

| EX-32.02 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex322.htm |

| EX-31.01 - CERTIFICATION - MIX 1 LIFE, INC. | mixx_ex311.htm |

| EX-3.01 - CERTIFICATE OF AMENDMENT TO ARTICLES OF INCORPORATION - MIX 1 LIFE, INC. | mixx_ex301.htm |

| EX-14.01 - CODE OF CONDUCT AND ETHICS - MIX 1 LIFE, INC. | mixx_ex1401.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended August 31, 2014

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ________ to ________

|

MIX 1 LIFE INC. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

333-170091 |

|

68-0678499 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of Incorporation) |

|

File Number) |

Identification Number) |

|

10575 N. 114th Suite 103 Scottsdale, AZ 85259 (Address of principal executive offices) |

|

|

|

(480) 344-7770 |

|

(Registrant’s Telephone Number) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

¨ |

Accelerated Filer |

¨ |

|

Non-Accelerated Filer |

¨ |

Smaller Reporting Company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of February 28, 2014 was $24,010,598 based upon the price ($3.87) at which the common stock was last sold as of the last business day of the most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws. Our common stock is traded in the over-the-counter market and quoted on the Over-The-Counter Bulletin Board under the symbol “MIXX.OB”.

As of November 18, 2014, there were 11,639,111 shares of the registrant’s $0.0001 par value common stock issued and outstanding.

Documents incorporated by reference: None

Table of Contents

| Page | |||||

|

PART I |

|||||

|

Item 1 |

Description of Business |

4 | |||

|

Item 1A |

Risk Factors |

13 | |||

|

Item 1B |

Unresolved Staff Comments |

19 | |||

|

Item 2 |

Description of Properties |

19 | |||

|

Item 3 |

Legal Proceedings |

19 | |||

|

Item 4 |

Mine Safety Disclosures |

19 | |||

|

PART II |

|||||

|

Item 5 |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

20 | |||

|

Item 6 |

Selected Financial Data |

22 | |||

|

Item 7 |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

22 | |||

|

Item 7A |

Quantitative and Qualitative Disclosures about Market Risk |

24 | |||

|

Item 8 |

Financial Statements and Supplementary Data |

25 | |||

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

26 | |||

|

Item 9A |

Controls and Procedures |

26 | |||

|

Item 9B |

Other Information |

27 | |||

|

PART III |

|||||

|

Item 10 |

Directors, Executive Officers and Corporate Governance |

28 | |||

|

Item 11 |

Executive Compensation |

32 | |||

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

33 | |||

|

Item 13 |

Certain Relationships and Related Transactions and Director Independence |

35 | |||

|

Item 14 |

Principal Accountant Fees and Services |

36 | |||

|

PART IV |

|||||

|

Item 15 |

Exhibits |

37 | |||

|

2

|

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

|

· |

The availability and adequacy of our cash flow to meet our requirements; |

|

· |

Economic, competitive, demographic, business and other conditions in our local and regional markets; |

|

· |

Changes or developments in laws, regulations or taxes in our industry; |

|

· |

Actions taken or omitted to be taken by third parties including our competitors, as well as legislative, regulatory, judicial and other governmental authorities; |

|

· |

Competition in our industry; |

|

· |

The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

|

· |

Changes in our business strategy, capital improvements or development plans; |

|

· |

The availability of additional capital to support capital improvements and development; and |

|

· |

Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context, references in this report to “Company”, “MIXX”, “we”, “us” and “our” are references to Mix1 Life, Inc. All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

|

3

|

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Corporate History

The Company was incorporated in the State of Nevada on June 10, 2009 under the name Antaga International Corp. We are in the business of formulation and distribution of nutritional supplements which are designed to have a positive effect on health, well-being and improve physical and mental performance.

On August 27, 2013, the Company entered into a Definitive Agreement (the “Definitive Agreement”) with Mix1 LLC, an Arizona company, “Mix1.” Pursuant to the Definitive Agreement, the Company acquired 100% of certain assets owned by Mix1, including, but not limited to, access to the Mix1 brand name, product formulas, packaging design specifications, vendor/supplier lists, market research reports, product sales sheets, social media assets, other work product and full rights to market and sell such assets and conduct business with the assets (the “Acquisition”). In exchange for the assets, the Company issued 3,333,333, post reverse, new shares of common stock to Mix1. On September 12, 2013, the Company changed its name to Mix1 Life, Inc. to reflect its new business. On November 1, 2013, the Company changed its trading symbol from “ANTR.OB” to “MIXX.OB”. The Company is now focused on the continued development, marketing, sale and distribution of Mix1 protein drinks and is currently a development stage company.

Our Business

The Company’s business focuses on creating products with natural, high-quality ingredients that are truly functional. We believe all natural products are better than artificial ones and are the key to leading a healthy balanced life. As a company we want to improve people’s lives by promoting active lifestyles and overall health. These beliefs are what lead to creating Mix1. We strive to help you make healthy choices during your busy day in order to help you feel your best not only today, but every day.

Mix1 has begun to manufacture and distribute these products in 2014.

Mix1’s product development was finalized and market tested in such national retailers as Whole Foods, Kroger, Ralphs and Bristol Farms. Mix1 is the premium nutritional shake made with natural ingredients and vitamins and minerals. Complete balanced macronutrient mix: protein, vitamins and minerals, fiber, healthy fat, antioxidants, no artificial sweeteners or preservatives.

Mix1’s mission:

“Create products with natural, high-quality ingredients that are truly functional. We believe all natural products are better than artificial ones and are the key to leading a healthy balanced life. As a company we want to improve people’s lives by promoting active lifestyles and overall health. These beliefs are what lead to creating Mix1. Never again will you miss getting the necessary nutrients because you were too busy to eat. We strive to help you make healthy choices during your busy day in order to help you feel your best not only today, but every day.”

Over the last twelve months, we have reformulated and re-packaged three Mix1 shake flavors (Blueberry Vanilla, Strawberry Banana and Chocolate) in order to strengthen our mass consumer appeal. Key product and strategy changes include:

|

· |

Improving the overall taste. |

|

· |

Significantly increasing protein content. |

|

· |

Developing high impact bottle and packaging. |

|

· |

Targeting optimal product placement in grocery channel (beverage versus weight management). |

|

· |

Planning for channel diversification to include convenience, wholesale club and mass retailers. |

|

4

|

We recently partnered with a large specialty beverage manufacturer on the production of our three flavors. Our first production run of the reformulated beverages was in May 2014, and we intend to distribute to a targeted set of retailers in the western United States. We began distribution of the Mix1 products in June 2014. Our objective during 2014 is to bring the Mix1 brand back into circulation via direct store delivery (“DSD”) and natural distributors in many of the same markets and stores that previously carried Mix1 (including national retail chains). We expect significant revenue growth beginning in of 2015 as we expand distribution, sales and marketing activities.

Our Products and Brand

Following the Acquisition from Mix1, the Company has re-engineered the existing Mix1 products to improve their taste, quality, look and nutritional content. Our improvements include:

|

· |

New Formulas: Using the existing Mix1 product formulas, we developed new formulas in collaboration with doctors to increase the protein content of our drinks and decrease the amount of calories, carbohydrates and sugars per serving. |

|

· |

New Flavors: We developed new flavors including Chocolate, Blueberry Vanilla and Strawberry Banana, which we intend to launch in the second half of 2014. Our 99% lactose-free formulations are thick and creamy, and we have eliminated the “chalky” after-taste that typically accompanies other high-protein beverages. We developed a Mixed Berry flavor that we intend to rollout in 2015. We also have four additional formulas for new flavors currently under development. |

|

· |

New Bottle: We changed the shape of our bottle from a square Tetra Pak to a taller, more functional twelve ounce Polyethylene terephthalate “PET” bottle to make our product more appealing to consumers and to stand out among our competitors. |

|

· |

New Packaging: We created a new label for our bottles with better graphics and more information about the nutritional content of our drinks. |

|

· |

New Products: We are currently developing protein powders based on our new product formulas which we intend to launch in 2015. |

Summary of Recent Improvements to the Mix 1 Products

The Mix1 line of natural, ready-to-drink protein shakes offers a complete and balanced nutritional blend that is intended to be consumed as a meal replacement or healthy snack. Our beverages have high protein content (on average, 26 grams per serving) and unique fruit-based flavors, with relatively low calorie count and superior taste. Our Mix1 beverages, available in a twelve-ounce PET bottle, have a twelve-month shelf life with no need for refrigeration. All of our shakes are low-fat, 99% lactose-free and made with non-GMO ingredients. A single twelve ounce serving provides 19 essential vitamins and minerals, including 70% of the recommended amount of daily calcium. The product is sweetened from only natural sugar and Stevia, and the only fat in our products is a relatively small amount of sunflower oil.

As of June 2014, we have commenced sales of our Mix1 products. Once we receive our first batch of Mix1 products from our manufacturer in the second half of 2014, we intend to re-position and re-launch the brand to market all of the improvements we have made to the existing Mix1 products. Figure 1 shows our new and improved Mix1 products that we intend to launch in 2014.

|

5

|

Image of our new and improved Mix1 products to be launched in 2014

We plan to meaningfully expand Mix1’s offerings beyond our Chocolate, Blueberry Vanilla and Strawberry Banana flavors. In 2015, we plan to introduce up to three additional ready-to-drink protein shake flavors, including Mixed Berry, which was previously our best-selling flavor. We also plan to add a multi-pack for sale in the grocery channel and will prepare product for sale in the wholesale club and mass channels. Additionally, we are currently working with one of the largest domestic whey protein suppliers on formulations for innovative natural protein powders.

Target Market and Industry

Since 2005, Mix1 has strived to create a strong lifestyle beverage brand with highly engaged and passionate customers. Our brand awareness is particularly strong in Colorado and California, areas where Mix1 previously had its highest sales volumes. Today, awareness and passion for Mix1 remains strong, even during our transition and re-launch period. We have an active social media fan base, and we receive frequent requests from prior customers awaiting the reintroduction of Mix1 beverages.

Mix1 products are designed for consumers looking for better options for on-the-go energy and natural products that provide the required nutrients for consumers’ daily needs. We believe that our products will be able to reach the mainstream consumer market because of the broad range of occasions for consumers to drink our beverages, such as before a workout as an energy enhancer, after a workout to restore the body, as meal replacements for breakfast, lunch or dinner, as snacks or meal supplements, as energy boosts to get through the workday, or for no occasion at all.

Our target customer is the rapidly growing segment of men and women ages 24 to 49 focused on living a healthy lifestyle. Many of these individuals make wellness a priority and prefer natural and organic foods. Mix1’s natural ingredient list, fruit-forward flavors and brand image are key differentiating factors in the protein drink category, which separates us from our primary competitors (e.g., Muscle Milk). We believe these factors will also attract new customers to the category.

With our lifestyle-focused product line specially formulated to appeal to a wide range of users, Mix1 represents the next generation of functional beverages. Most ready-to-drink protein beverages have a narrow marketing focus that targets one of two niche consumer groups. Performance-focused products (i.e., Muscle Milk, Myoplex, Pure Protein) target serious gym-goers and skew heavily male. Nutrition-focused products (i.e., Boost, Ensure, Slim Fast, Special K) target weight management and skew older and heavily female. We believe that there is a large area of opportunity not currently being adequately served and that our Mix1 product line addresses this market opportunity.

|

6

|

Smoothie and cold-pressed juice consumption has dramatically increased as consumers seek healthier “on-the-go” meal and snack options, and we believe our shakes provide the best ready-to-drink alternative to smoothies made in a blender. More so than other protein shakes, Mix1 beverages may be consumed as a meal replacement for breakfast and lunch or a mid-day snack, making our shakes a routine purchase. This repeat and balanced consumption pattern is expected to lead to long-term and loyal customers, which is expected to enable us to ultimately become a “lifestyle” beverage brand.

We believe that our Mix1 natural, high-protein shakes will benefit from two large and sustainable trends: strong consumer demand for natural/organic foods and beverages and increasing consumer awareness around the health benefits of protein consumption. The natural/organic market in the U.S. is currently estimated to be a $50 billion market, and it is expected to grow at over 10% per year for the next decade, per the Nutrition Business Journal. Mintel reported in January 2013 that protein ingredients in beverages as meal supplements or replacements posted 37% growth over the past five years.1 Also, nearly half (46%) of all consumers of these beverages state that high-protein is a primary selection attribute.2

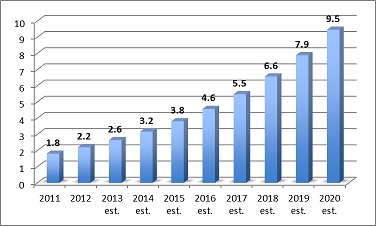

Our core target market includes consumers who want a fully functional, ready to drink beverage made from all natural ingredients that provides a complete and balanced mix of nutrients for everyday occasions. This target market is large and growing. The functional beverage market was estimated to grow to $16 billion by 2015; the sports nutrition market was $19.6 billion in 2007 and is estimated to grow 51% to $29.6 billion by 2015. The ready-to-drink protein beverage market in the U.S. is estimated to be approx. $3.2 billion and is currently growing at an estimated 20% annually per BevNet3. According to the NPD Group, Inc., one-third of adults in the U.S., almost 80 million people, indicate a strong interest in functional foods and beverages, and one in four already consumes at least one functional food or beverage per day. The ready to drink (RTD) protein beverage industry at its current growth rate is estimated to approach $10 billion in sales by 2020.4 Currently no brand has yet to define the category and consumers are becoming more accepting of protein and its benefits as opposed to wondering what ingredients they are consuming (i.e. energy drink ingredients beyond caffeine). The figure below shows the estimated yearly increase in RTD protein beverage sales in the U.S.

________________

1 US consumers have a healthy appetite for high protein food. The US leads the way in global launches of high protein products. (2013, January 18). Retrieved June 24, 2014, from http://www.mintel.com/press-centre/food-and-drink/us-consumers-have-a-healthy-appetite-for-high-protein-food-the-us-leads-the-way-in-global-launches-of-high-protein-products.

2 Id.

3 BevNet, January 31, 2013 report.

4 Id

|

7

|

The protein industries upward trend is not a fad and it is not expected to slow down any time soon according to Dr. Sloan, of Sloan Trends, Inc., who commented at the IFT 2012 Wellness Conference that “protein is hot and there is no sign the trend is going to go away in the next ten years. It’s about body composition, sports, satiety, and maintaining muscles mass as you get older.” According to the IFIC Foundation’s 2012 Food and Health Survey “nearly half of consumers try and get a certain amount or as much protein as possible.” According to Chris Schmidt, a consumer health analyst at Euromonitor, “Protein RTDs within the sports nutrition category are growing strongly. Their push into mainstream retailers and an increasing focus on lifestyle and functional nutrition branding — as opposed to hardcore sports recovery — along with the glowing praise heaped on protein by the popular media, is driving growth in both relatively mature and emerging markets.”5

According to market research performed under the direction of Mix1 prior to the Acquisition, we found that what consumers are primarily looking for in a beverage are health benefits, a reasonable price, good taste, high quality, nutritional data, low amounts of sugar, high amounts of protein, flavors offered and natural ingredients. We believe that Mix1 products will attract new consumers to the healthy beverage industry and drive incremental beverage growth by meeting the emerging demand for great tasting, high quality, health and wellness lifestyle beverages at a reasonable cost and offering multiple unique occasions for consumers to enjoy our products.

Historically, small and innovative companies, like our Company, have created tremendous market opportunities in the beverage industry. For example, Gatorade was an industry leader in sports drinks, Snapple was an innovator in new age beverages, Red Bull capitalized on the energy drink market, and Vitamin Water was a market mover in the enhanced water industry. Like these companies, the Company seeks to be an industry leader in the mainstream functional beverage market. We believe that one of the greatest strengths of the Mix1 brand is that our beverages fall into several different product categories including nutritional drinks, sports drinks, meal replacements, meal supplements, low calorie drinks, energy drinks, natural beverages, and more. Unlike some of our competitors, our brand is not limited by any one product category and as a result, we believe we will be able to attract a broad range of mainstream consumers.

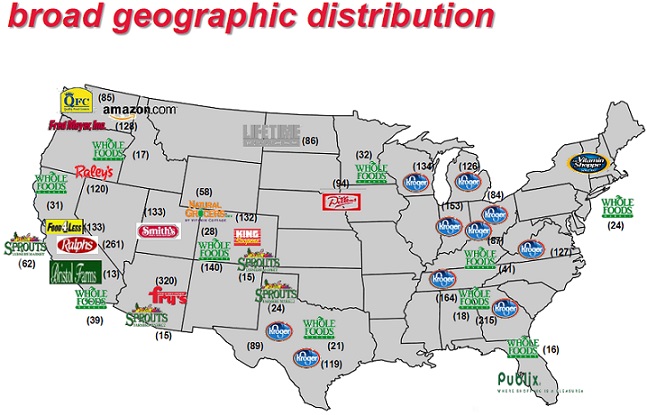

Distribution

Prior to the Acquisition, Mix1 products were sold, either to distributors or directly to retailers, across the United States through multiple channels from natural health food stores, traditional grocery stores, big box stores, club stores, specialty outlets and drug stores, such as Kroger, GNC, Whole Foods Market, 7 Eleven, H-E-B, FredMeyer, QFC, King Soopers, United Supermarkets, Wild Oats Markets, Inc., Target, Henry’s, Albertsons, Ralphs, Costco, Central Market, Fry’s, Smith’s Food and Drug Stores, and many others.

Historical Geographic Distribution

_________________

5 www.bevindustry.com state-of-the-industry-sports-and-protein-drinks

|

8

|

As part of the Acquisition, the Company has access to previous distribution channels established by Mix1 for the distribution of Mix1’s products. The Company will re-launch the Mix1 brand in the second half of 2014 through existing distribution channels as well as new distribution channels that the Company has established since the Acquisition through its marketing efforts.

In the future, the Company will continue to seek additional channels of distribution for its products to include convenience, wholesale club and mass retailers. The Company will first focus on distributing its products regionally, starting in Arizona, Colorado, California and other western states, and will then seek to expand its distribution channels across the U.S. and then internationally.

Manufacturing

We outsource the manufacturing, bottling and packaging of our products to a third party located in the U.S. on an order-by-order basis. The Company does have a long-term contract with this third party for their services. Once the products have been manufactured, bottled and packaged, they are sent directly to our distributors and retailers based on their purchase orders.

Supplies of Raw Materials

The ingredients for our products are sourced from several different suppliers located primarily in North America on an order-by-order basis. Our management researches and develops our sources of ingredients used in the manufacturing of our products. The ingredients that we source are sent to our manufacturer in the U.S. to create our products.

Marketing

We have a strong brand that evokes passion with our customers, evidenced by currently having over 20,000 Facebook fans (“likes”), 1,574 Twitter followers, 5,275 Instagram followers, and 27 subscribers to the mix1life You Tube channel. We plan to promote the Mix1 brand by engaging in traditional and digital advertising, promotions and other customer outreach. STS, a leading agency that represents a number of well-known consumer brands, is our marketing and advertising partner. We are currently working with STS on developing our brand message, marketing campaign and creative and activation concepts.

We intend to market our new and future Mix1 products using the following channels:

|

· |

Mainstream Advertising |

|

o |

Print: Advertising through print such as newspapers, magazines, mail, etc. |

|

|

|

||

| o |

Broadcast: Advertising through television or the radio. |

|

|

|

||

| o |

Out-of-home: Advertising to reach consumers while they are on-the-go in public places, in transit, retail venues, etc. |

|

|

|

||

| o |

Digital: Advertising through computers, smartphones, tablets, etc. |

|

|

|

||

| o |

Endorsements: Public endorsements of our products from celebrities, athletes, personalities, political figures, etc. that can generate mainstream awareness for Mix1. |

|

· |

Field Marketing and Consumer Promotion |

| o |

Strategic Event Sampling: Sampling increases consumer awareness of our products and provides opportunities for consumers to taste the product and learn about its nutritional benefits. |

|

|

|

||

| o |

Sponsorship: Partnering with an event, activity, key personality or organization that will give us access to a greater consumer market and generate strong community ties. |

|

9

|

|

· |

Retail Promotion |

| o |

Retailer Programs: Retailers promote our products through sales, rebates, coupons, contests, temporary price reductions (TPRs), etc. to drive consumer engagement with our product, generate word-of-mouth marketing, reinforce brand positioning and create sale opportunities. |

|

· |

In-Store Execution |

| o |

Displays of our products |

|

|

|

||

| o |

In-Store Sampling |

|

|

|

||

| o |

In-Store Coupons |

|

|

|

||

| o |

Point-of-Sale Displays: Sales promotion displayed at or near the checkout to encourage impulse buying. |

|

· |

Digital and Social Media |

| o |

Social Media Campaign: Marketing through social media sites to create content that attracts consumer attention, encourage readers to share that content via the Internet, and drive sales of our products. |

|

|

|

||

| o |

Coupons: Offer coupons online through social media sites |

|

· |

Public Relations |

| o |

Guerilla Marketing: Innovative, unconventional and low-cost marketing aimed at obtaining maximum exposure generally targeting specific consumers, such as street art, flash mobs, PR stunts, |

|

|

|

||

| o |

Public Relations including public appearances, presentations, etc. |

Business Strategy

Over the next five years, our growth strategy will focus on the following three key areas:

|

· |

Grow into a “Mega-Brand” through Increased Distribution to National Markets and Expansion into International Markets |

We will strive to become a “Mega-Brand” in the functional beverage industry by increasing the amount of product we distribute to our current customers in the U.S. and seeking additional retail markets where we can sell our products. Further, we intend to expand distribution of Mix1 products to international markets. Our primary sales focus will be convenience stores and grocery stores in the U.S. and Canada, which we plan to enter primarily through brokers and distributors. Our distribution strategy is expected to include regional direct store delivery groups (e.g., Admiral, Kalil, New Age, Swire) and national natural and organic distributors (e.g., KeHE, Lone Star, UNFI). We also plan to sell product to mass, club and drug stores, as well as gyms and hospitals, and our eCommerce strategy is planned to include selling through our own website and Amazon.com, among others.

|

· |

Diversify and Expand our Product Portfolio |

We will continue to improve our current products and introduce new flavors and ingredients while also exploring opportunities to diversify into new types of products such as protein powders to be added to water for nutritional energy enhancement. We believe that diversification engages new consumer interest and enables the brand to benefit from a proactive and developing brand image while stimulating revenue from increased buyer interest and awareness of the brand.

|

· |

Expand our Team |

Our team currently includes our officers and directors as well as five full-time employees, who together are responsible for several different segments of our business including product development, marketing, distribution, sales, public relations, finance, and more. We intend to increase the size of our management team and hire additional employees to manage the continued growth of our company and to increase our sales force and marketing efforts.

|

10

|

Intellectual Property

We own the registered trademarks for the “Mix1” brand name and logo. Generally, our trademarks remain valid and enforceable so long as we continue to use the marks in commerce and the required registration renewals are filed. We also hold the trade secrets to the formulas for all of our beverages. Additionally, we have registered the www.mix1life.com domain name.

We consider our trademarks, trade secrets and domain name to be valuable assets to the Mix1 brand and seek to protect them from infringement.

Competition

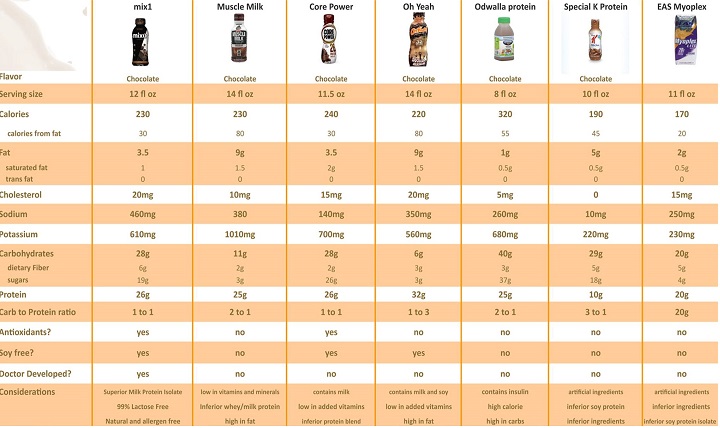

The beverage industry is highly competitive. There are a large number of widely recognized brands of ready to drink health-conscious beverages in the market, such as Muscle Milk, Core Power, Oh Yeah, Odwalla, EAS Myoplex, Ensure, Special K, Slim-Fast, Boost, Nature’s Best, and Nutrilite.

Important factors affecting our ability to compete successfully include the taste and flavor of our products, consumer promotions, rapid and effective development and marketing of new cutting edge products, attractive packaging, branded product advertising, optimal product placement in stores, and pricing. We also compete for distributors who will give our products more focus than those of our competitors, provide stable and reliable distribution and secure adequate shelf space for our products in retail stores.

Differentiation of Mix 1 from its Competitors

|

11

|

Although we operate in a highly competitive market, we believe that the use of innovative fruit-based flavors and natural ingredients set Mix1 protein shakes apart from similar products in the market. Our 99% lactose-free formulations are thick and creamy, and we believe that we have eliminated the “chalky” after-taste that typically accompanies other high-protein beverages. In the reformulation process, we also significantly increased protein content while keeping calorie count low (between 230 and 240 calories per serving). We believe that these unique product attributes will enable us to gain market share and bring a new segment of consumers into the natural protein drink category.

Government Regulation

The distribution and sale in the United States of our products is subject to the Federal Food, Drug and Cosmetic Act and various other federal, state, and local statutes and regulations applicable to the production, transportation, sale, safety, advertising, labeling, and ingredients of our products. Compliance with these regulations may involve significant costs or require us to change our business practices. Noncompliance could result in penalties being imposed on us or orders that we stop the alleged noncompliant activity. We believe that we are currently in material compliance with all such applicable laws, however, new statutes and regulations may also be instituted in the future. If a regulatory authority finds that a current or future product or production run is not in compliance with any of these regulations, we may be fined, or our product may have to be recalled and/or reformulated and/or repackaged, thus adversely affecting our financial condition and operations. We do not believe that we will require any government approval to sell or distribute our products in the U.S. In the event we expand our operations globally, we will be subject to increased regulatory issues, particularly in relation to the registration and taxation of our products in foreign markets, and may be required to obtain government approval of our foreign operations.

Recent Developments

On September 30, 2014 the Company announced that entered into a nationwide sales management agreement with a nationally recognized premier sales and marketing agency committed to building brand value for their clients and customers. This sales organization will represent all current and future flavors of the Company’s ready to drink natural protein drink in the United States for Convenience, Retail, Dollar, Mass, Specialty/Natural, and Grocery stores.

October 22, 2014 Mix1 announced that it is the Official Sports Nutrition Drink of the 2015 Waste Management Phoenix Open held January 26th-February 1st, 2015.

On November 20, 2014, the Company and the Arizona Coyotes announced today a long-term partnership agreement (the “Coyotes Agreement”). As part of the Coyotes Agreement, the Company will be designated as the Exclusive Nutritional Drink of the Arizona Coyotes. The partnership will formally go into effect immediately, with the Coyotes' exclusive suite level club being renamed "Mix1 Club". Mix1 Club will be prominently featured with new brand integration including entry and directional signage leading guests into the club and the club's interior, as well as on tickets and passes required for club admission. In addition, Mix1 will be integrated into arena signage, radio broadcasts, paw patrol sponsorship, and will sponsor Arizona Coyotes youth sports programs to build awareness of its brand through community involvement.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site, www.sec.gov.

|

12

|

ITEM 1A. RISK FACTORS

RISKS RELATED TO OUR BUSINESS

The Company has a limited operating history and virtually no revenues from operations.

The Company is a development stage company and, therefore, the Company is subject to many risks common to enterprises with limited operating histories, including potential under-capitalization, limitations with respect to personnel, financial and other resources, and limited revenue sources. The Company’s ability to successfully generate sufficient revenues from operations is dependent on a number of factors, including the availability of funds to fund its current and anticipated operations. There can be no assurance that the Company will not encounter setbacks with the on-going development and implementation of its business strategy, or that funding will be sufficient to allow it to fully execute its business plan. The inability to raise sufficient funds, either through equity or debt financing, would materially impair the Company’s ability to generate revenues. Further, as a result of the recent volatility of the global markets, a general tightening of lending standards, and a general decrease in equity financing and similar type transactions, it could be difficult for the Company to obtain funding to allow it to continue its business operations.

We have not been profitable in our operations and may never achieve profitability required to sustain our operations.

Since inception to August 31, 2014, the Company has generated virtually no revenue but has incurred $1,538,169, in operating expenses. In the foreseeable future, we expect to continue to incur significant operating losses and to not be profitable. No assurance can be given that we can ever achieve profitability. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our current cash holdings are insufficient to meet our cash requirements. Accordingly, we will need to raise additional capital to continue our business and if we are unable to do so, we will be forced to delay, reduce or cease our operations.

Our current cash and cash equivalents are insufficient to meet our anticipated cash requirements. At August 31, 2014, we had $91,794 in cash. We will need to raise additional capital immediately to continue our business operations. We cannot be certain that we will be able to raise sufficient capital or that our actual cash requirements will not be greater than anticipated. Further, financing opportunities may not be available to us, or if available, may not be available on favorable terms. The availability of financing opportunities will depend on various factors, such as market conditions and our financial condition and outlook. In addition, if we raise additional funds, the percentage ownership of our stockholders could be significantly diluted, and these newly-issued securities may have rights, preferences or privileges senior to those of existing stockholders. If we obtain additional debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we are unable to obtain financing on terms favorable to us, or at all, we will be unable to continue operations.

We have a “going concern” opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

Our independent registered public accountants have expressed substantial doubt about our ability to continue as a going concern. Since inception to August 31, 2014, the Company has incurred losses resulting in an accumulated deficit of $2,056,290. The “going concern” opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital, our ability to continue our operations will be significantly impaired. As a result we may have to liquidate our business and investors may lose their investments. Investors should consider our independent registered public accountant’s comments when deciding whether to invest in the Company.

|

13

|

The Company depends on outside suppliers, with whom the Company has no long-term contracts, to supply the ingredients for all of our products. Accordingly, we may not be able to obtain adequate supplies of ingredients for our products at favorable prices or at all, which could result in product shortages and back orders for our products, with a resulting loss of net sales and profitability.

The Company purchases all of its raw materials for the manufacture of its products from third-party suppliers, with whom the Company has no long-term agreements. Any of our suppliers could discontinue selling to the Company at any time. Although the Company believes that it could establish alternate sources for most of these ingredients, any delay in locating and establishing relationships with other sources could result in product shortages and back orders for the products, with a resulting loss of net sales and profitability. The Company is also subject to delays, disruptions or other conditions not within its control. The Company acquires some ingredients from suppliers outside of the United States. The purchase of these ingredients is subject to risks generally associated with importing raw materials from other countries, including, among other factors, delays in shipments, changes in economic and political conditions, quality assurance, tariffs, trade disputes and foreign currency fluctuations. These factors could result in a delay in or disruption of the supply of certain raw materials. Any significant delay in or disruption of the supply of raw materials could have a material adverse effect on the Company’s business.

We are heavily dependent on a single third party for the manufacturing, bottling and packaging of our products. Our business, results of operations and financial condition could be seriously harmed if there are changes to the services they provide or if they are not able to satisfy our production demands.

We outsource the manufacturing, bottling and packaging of our products to a single third party with whom we have no long-term contracts. This third party does not work exclusively for the Company and may be limited in their ability to meet our production needs on our timeline, which could cause serious delays and disruptions to our business. Further, given the highly competitive nature of the beverage industry, this third party could increase our costs without warning, limit their services to us or terminate their relationship with us altogether, at any time, which would severely disrupt our business and force us to seek alternatives. We may not be able to locate other third parties on favorable terms, or at all. If any of these events were to occur, our business, results of operations and financial condition could be seriously harmed.

Disruption in our distribution channels could have an adverse impact on our business, results of operations and financial condition.

Our ability to sell our products to distributors or directly to retailers is critical to our success. We believe that our existing distribution channels are adequate to sell our products, however, we have no long-term contracts with these distributors or retailers and they could terminate their relationships with us at any time which would disrupt our business and force us to look for new strategic relationships. We believe that there are several alternative distributors and retailers with whom we could establish strategic relationships, however, we may spend considerable amounts of time, money and resources establishing these relationships which could divert management’s attention and disrupt our business. Any disruption in our business could have an adverse impact on our results of operations and financial condition.

Demand for our products may be adversely affected by changes in consumer preferences and tastes or if we are unable to innovate or market future products effectively.

We operate in a highly competitive market and rely on demand for our products. To generate revenues and profits, we must sell products that appeal to our customers and consumers. We are highly dependent upon consumer perception of the safety and quality of our products and the ingredients they contain, as well as similar products distributed by other companies. Consumer perception of products and the ingredients they contain can be significantly influenced by scientific research or findings, national media attention and other publicity about product use. A product may be received favorably, resulting in high sales associated with that product that may not be sustainable as consumer preferences change. Future scientific research or publicity could be unfavorable to our industry or any of our particular products or the ingredients they contain and may not be consistent with earlier favorable research or publicity. A future research report or publicity that is perceived by our consumers as less favorable or that questions earlier research or publicity could have a material adverse effect on our ability to generate revenues. Any significant changes in consumer preferences or any inability on our part to anticipate or react to such changes could result in reduced demand for our products and erosion of our competitive position. Our success depends on our ability to respond to consumer trends, including concerns of consumers regarding health and wellness, obesity, product attributes and ingredients. In addition, changes in consumer demographics could result in reduced demand for our products. Consumer preferences may shift due to a variety of factors, including changes in social trends or negative publicity resulting from regulatory action or litigation against companies in the beverage industry. Any of these changes may reduce consumers’ willingness to purchase our products.

|

14

|

Our success is dependent on our product innovation, including maintaining a robust pipeline of new products, and the effectiveness of advertising campaigns and marketing programs.

While we intend to continuously improve and re-develop our products and devote significant resources to develop new products, there can be no assurance that we will successful in creating these products that will appeal to consumers, or to effectively execute advertising campaigns and marketing programs. Failure to successfully develop or launch new products or variants of our existing products could decrease consumer demand for our products by negatively affecting consumer perception of our brand.

The sale of ingested products involves product liability and other risks which could materially harm the Company’s brand name.

The Company faces an inherent risk of exposure to product liability claims if the use of its products results in illness or injury. The products that the Company sells in the U.S. are subject to laws and regulations, including those administered by the USDA and FDA that establish manufacturing practices and quality standards for food products. Product liability claims could have a material adverse effect on the Company’s business as existing insurance coverage may not be adequate. Distributors of vitamins, nutritional supplements and minerals, have been named as defendants in product liability lawsuits from time to time. The successful assertion or settlement of an uninsured claim, a significant number of insured claims or a claim exceeding the limits of the Company’s insurance coverage would harm the Company by adding costs to its business and by diverting the attention of management from the operation of its business. The Company may also be subject to claims that its products contain contaminants, are improperly labeled, include inadequate instructions as to use or inadequate warnings covering interactions with other substances. Product liability litigation, even if not meritorious, is very expensive and could also entail adverse publicity for the Company and reduce its revenue. In addition, the products the Company distributes, or certain components of those products, may be subject to product recalls or other deficiencies. Any negative publicity associated with these actions would adversely affect the Company’s brand and may result in decreased product sales and, as a result, lower revenues and profits.

In addition, third-party manufacturers produce many of the products we sell. We rely on these manufacturers to ensure the integrity of their ingredients and formulations. As a distributor of products manufactured by third parties, we may also be liable for various product liability claims for products we do not manufacture. Although our purchase agreements with our third-party vendors typically require the vendor to indemnify us to the extent of any such claims, any such indemnification is limited by its terms. Moreover, as a practical matter, any such indemnification is dependent on the creditworthiness of the indemnifying party and its insurer, and the absence of significant defenses by the insurers. We may be unable to obtain full recovery from the insurer or any indemnifying third-party in respect of any claims against us in connection with products manufactured by such third-party.

Significant additional labeling or warning requirements may inhibit sales of affected products.

Various jurisdictions may seek to adopt significant additional product labeling or warning requirements relating to the content or perceived adverse health consequences of certain products. If these types of requirements become applicable to the Company’s products under current or future environmental or health laws or regulations, they may inhibit sales of such products.

We may experience product recalls, which could reduce our sales and margin and adversely affect our results of operations.

We may be subject to product recalls, withdrawals or seizures if any of the products we formulate, manufacture or sell are believed to cause injury or illness or if we are alleged to have violated governmental regulations in the manufacturing, labeling, promotion, sale or distribution of such products. Any recall, withdrawal or seizure of any of the products we formulate, manufacture or sell would require significant management attention, would likely result in substantial and unexpected expenditures and could materially and adversely affect our business, financial condition or results of operations. Furthermore, a recall, withdrawal or seizure of any of our products could materially and adversely affect consumer confidence in our brands and decrease demand for our products and the market price of our common stock.

|

15

|

As is common in our industry, we rely on our third-party vendors to ensure that the products they manufacture and sell to us comply with all applicable regulatory and legislative requirements as well as the integrity of ingredients and proper formulation. In general, we seek representations and warranties, indemnification and/or insurance from our vendors. However, even with adequate insurance and indemnification, any claims of non-compliance could significantly damage our reputation and consumer confidence in our products, and materially and adversely affect the market price of our common stock. In addition, the failure of such products to comply with the representations and warranties regarding such products we receive from our third-party vendors, including compliance with applicable regulatory and legislative requirements, could prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operation.

Regulations or legislation governing beverage production and marketing could adversely affect our business.

The production and marketing of beverages is highly regulated by a variety of federal, state and other governmental agencies. Currently, we believe we are in compliance with such regulations. However, new or increased government regulation of the beverage industry, including but not limited to areas related to safety, chemical composition, production processes, traceability, product quality, packaging, labeling, promotions, marketing, and advertising, product recalls, records, storage and distribution could adversely impact our results of operations by increasing production costs or restricting our methods of operation and distribution.

If we are able to increase our business operations, we may not be able to effectively manage future growth, which may have a material adverse effect on our future operating results.

We anticipate that our future growth, if any, will depend upon various factors, including the strength of our brand image, the market success of our current and future products, the success of our growth strategies, competitive conditions and our ability to manage our future growth. Future growth may place a significant strain on our management and operations. Further, our operational, administrative, financial and legal procedures and controls would need to be expanded. As a result, we may need to train and manage an increasing number of employees, which could distract our management from our business. Our future success will depend substantially on the ability of our management to manage growth. If we are unable to anticipate or manage our future growth effectively, our future operating results could be adversely affected.

We operate in a highly competitive industry and may not be able to withstand competitive pressures, which may adversely impact our business.

The sale of our products is subject to significant competition in the beverage industry and is highly fragmented. Participants include specialty retailers, supermarkets, drugstores, mass merchants, multi-level marketing organizations, on-line merchants, mail-order companies and a variety of other smaller participants. We believe that the market is also highly sensitive to the introduction of new products, which may rapidly capture a significant share of the market. In the United States, we also compete for sales with heavily advertised national brands manufactured by large pharmaceutical and food companies, as well as other retailers. In addition, as some products become more mainstream, we experience increased price competition for those products as more participants enter the market. We may not be able to compete effectively and our attempts to do so may require us to reduce our prices, which may result in lower margins. Failure to effectively compete could adversely affect our market share, revenues and growth prospects. Many of our competitors are significantly larger than us, have greater resources, and enjoy greater brand recognition than we do. Significant competition increases the possibility that we could lose one or more of our major customers, lose existing product offerings at retail locations, lose market share and/or shelf space, increase expenditures or reduce selling prices, all of which could have an adverse impact on our business or results of operations.

|

16

|

We may be unsuccessful in implementing our planned international expansion, which could significantly increase our operating expenses, impair the value of our brand, harm our business and negatively affect our results of operations.

Our business strategy is dependent in part on our ability to distribute our products internationally. Expansion into international markets increases the level of regulatory issues that we must comply with, particularly in relation to the registration and taxation of our products in foreign markets. These compliance issues may prevent us from being profitable internationally. Additionally, our planned expansion may place increased demands on our operational, managerial and administrative resources and these increased demands may cause the Company to operate its business less efficiently and at greater costs, which could negatively affect our results of operations and impair the value of our brand.

The loss of our Chief Executive Officer or other key personnel would have an adverse impact on our future development and could impair our ability to succeed.

The performance of the Company is substantially dependent upon the expertise of our Chief Executive Officer, Cameron Robb, and other key personnel. In addition to his executive officer functions, Mr. Robb is responsible for several other aspects of our business operations. The death or disability of Mr. Robb, temporary or permanent loss of his services, or any negative market or industry perception with respect to him, could have a material adverse effect on our business. We do not maintain "key man" insurance with respect to Mr. Robb or any of our other key personnel, and any of them may leave us at any time, which could severely disrupt our business and future operating results.

Our Articles of Incorporation exculpates our officers and directors from certain liability to our Company or our stockholders.

Our Articles of Incorporation, and any amendments thereto, contain a provision limiting the liability of our officers and directors for damages as a result of their acts or failures to act, except for acts involving intentional misconduct, fraud or a knowing violation of law. This limitation on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our stockholders from suing our officers and directors based upon breaches of their duties to our Company.

If the Company is not able to effectively protect its intellectual property, we may experience a material, negative impact and our business may fail.

The Company believes that the Mix 1 brand is essential to its success and competitive position. We own the registered trademarks for the “Mix 1” brand name and logo, hold the trade secrets to the formulas for all of our beverages, and have registered the domain name to our website, www.mix1life.com. If the Company is unable to secure protection of its intellectual property, the Company’s business may be materially adversely affected and could fail. Further, the Company cannot be sure that its activities do not and will not infringe on the intellectual property rights of others. If the Company is compelled to prosecute infringing parties or defend against infringement claims made by third parties, we may face significant expenses and liability as well as diversion of our management’s attention from the Company’s business, any of which could negatively impact the Company’s business or financial condition.

Privacy protection is increasingly demanding, and we may be exposed to risks and costs associated with security breaches, data loss, credit card fraud and identity theft that could cause us to incur unexpected expenses and loss of revenue as well as other risks.

The protection of customer, employee, vendor, franchisee and other business data is critical to us. Federal, state, provincial and international laws and regulations govern the collection, retention, sharing and security of data that we receive from and about our employees, customers, vendors and franchisees. The regulatory environment surrounding information security and privacy has been increasingly demanding in recent years, and may see the imposition of new and additional requirements by states and the federal government as well as foreign jurisdictions in which we do business. Compliance with these requirements may result in cost increases due to necessary systems changes and the development of new processes to meet these requirements by us and our franchisees. In addition, customers and franchisees have a high expectation that we will adequately protect their personal information. If we or our service provider fail to comply with these laws and regulations or experience a significant breach of customer, employee, vendor, franchisee or other company data, our reputation could be damaged and result in an increase in service charges, suspension of service, lost sales, fines or lawsuits.

|

17

|

The use of credit payment systems makes us more susceptible to a risk of loss in connection with these issues, particularly with respect to an external security breach of customer information that we or third parties (including those with whom we have strategic alliances) under arrangements with us control. A significant portion of our sales require the collection of certain customer data, such as credit card information. In order for our sales channel to function, we and other parties involved in processing customer transactions must be able to transmit confidential information, including credit card information, securely over public networks. In the event of a security breach, theft, leakage, accidental release or other illegal activity with respect to employee, customer, vendor, franchisee third-party, with whom we have strategic alliances or other company data, we could become subject to various claims, including those arising out of thefts and fraudulent transactions, and may also result in the suspension of credit card services. This could cause consumers to lose confidence in our security measures, harm our reputation as well as divert management attention and expose us to potentially unreserved claims and litigation. Any loss in connection with these types of claims could be substantial. In addition, if our electronic payment systems are damaged or cease to function properly, we may have to make significant investments to fix or replace them, and we may suffer interruptions in our operations in the interim. In addition, we are reliant on these systems, not only to protect the security of the information stored, but also to appropriately track and record data. Any failures or inadequacies in these systems could expose us to significant unreserved losses, which could materially and adversely affect our earnings and the market price of our common stock. Our brand reputation would likely be damaged as well.

RISKS ASSOCIATED WITH OUR COMMON STOCK

The Company’s stock price may be volatile.

The market price of the Company’s common stock is likely to be highly volatile and could fluctuate widely in price in response to various potential factors, many of which will be beyond the Company’s control, including the following:

|

¨ |

competition; |

|

|

¨ |

additions or departures of key personnel; |

|

|

¨ |

the Company’s ability to execute its marketing and growth strategies; |

|

|

¨ |

operating results that fall below expectations; |

|

|

¨ |

loss of any strategic relationship; |

|

|

¨ |

industry developments; |

|

|

¨ |

economic and other external factors; and |

|

|

¨ |

period-to-period fluctuations in the Company’s financial results. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of the Company’s common stock.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. We cannot assure you of a positive return on investment or that you will not lose the entire amount of your investment in our common stock.

We may in the future issue additional shares of our common stock which would reduce investors’ ownership interests in the Company and which may dilute our share value.

Our Articles of Incorporation and amendments thereto authorize the issuance of One Hundred Million (100,000,000) shares of common stock, par value $0.001 per share. The future issuance of all or part of our remaining authorized common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

|

18

|

The Company’s common stock is currently deemed to be “penny stock”, which makes it more difficult for investors to sell their shares.

The Company’s common stock is currently subject to the “penny stock” rules adopted under section 15(g) of the Exchange Act. The penny stock rules apply to companies whose common stock is not listed on the NASDAQ Stock Market or other national securities exchange and trades at less than $5.00 per share or that have tangible net worth of less than $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If the Company remains subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for the Company’s securities. If the Company’s securities are subject to the penny stock rules, investors will find it more difficult to dispose of the Company’s securities.

Changes in formula and new flavor offerings; we cannot accurately predict the volume or timing of any future sales of our reformulated or any new products, making the timing of any revenues difficult to predict.

The past experienced by our predecessor company was based on a formula and flavor that we no longer offer or sell. Although management believes the new formula and flavors provide more attractive alternatives than the former best-selling popular berry flavor there is no assurance our consumers will agree. We may be faced with lengthy customer evaluation and approval processes associated with our reformulated and new beverage offerings. Consequently, we may incur substantial expenses and devote significant management effort and expense in developing customer acceptance, which may not result in revenue generation. As such, we cannot accurately predict the volume or timing of any future sales.

There may be limitations on the effectiveness of our internal controls, and a failure of our control systems to prevent error or fraud may materially harm our company.

Proper systems of internal controls over financial accounting and disclosure are critical to the operation of a public company. We are at the very early stages of establishing, and we may be unable to effectively establish such systems. This would leave us without the ability to reliably assimilate and compile financial information about our company and significantly impair our ability to prevent error and detect fraud, all of which would have a negative impact on our company from many perspectives. Moreover, we do not expect that disclosure controls or internal control over financial reporting, even if established, will prevent all error and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Failure of our control systems to prevent error or fraud could materially adversely impact us.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTIES

Our executive offices are located at 10575 N. 114thStreet, Suite 103, Scottsdale, AZ 85259. We currently rent this space on a month-to-month basis for approximately $250 USD a month. Our telephone number is (480) 344-7770. We believe this space is sufficient to meet our immediate needs. Additional space may be required as we expand our operations. We do not foresee any significant difficulties in obtaining any required additional facilities. We do not currently own any real estate.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

|

19

|

PART II

ITEM 5. MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is currently quoted on the OTC Bulletin Board (OTCQB) and trades under the symbol “MIXX”. Because we are quoted on the OTC Bulletin Board, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

The following table sets forth the high and low bid prices for our Common Stock per quarter as reported by the OTCBB since we began trading October 2013 based on our fiscal year end August 31. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

|

First Quarter |

|

Second Quarter |

|

Third Quarter |

Fourth Quarter |

||||||||

|

2014 – High |

4.20 |

4.95 |

3.90 |

5.73 |

|||||||||

|

2014 – Low |

3.90 |

3.45 |

2.58 |

3.27 |

|||||||||

|

2013 – High |

--- |

--- |

--- |

--- |

|||||||||

|

2013 – Low |

--- |

--- |

--- |

--- |

Record Holders

As of November 18, 2014, an aggregate of 11,369,111 shares of our common stock were issued and outstanding and were owned by approximately 99 holders of record, based on information provided by our transfer agent.

Recent Sales of Unregistered Securities

On November 29, 2013, 13,333 shares issued pursuant to a stock Purchase Agreement dated November 26, 2013 at $1.50 per share and 24,167 shares were issued for services rendered on behalf of the Company.

On December 23, 2013, 3,333,333 restricted shares of common stock held by Juan Pablo Tellez, a former executive, were cancelled and returned to treasury.

On February 12, 2014, 43,853 restricted shares of common stock were issued to several individuals for services rendered to the Company.

On February 12, 2014, 20,000 restricted shares of common stock were issued to Company’s CEO for services rendered to the Company, valued at $1.40 a share.

|

20

|

On April 1, 2014, 183,333 restricted shares of common stock were issued to four individuals pursuant to a stock Purchase Agreement, at a cost $1.50 per share.

On April 1, 2014, 20,000 restricted shares of common stock were issued to Company’s CEO for services rendered to the Company, valued at $1.40 a share.

On April 8, 2014, 18,333 restricted shares of common stock were issued to three consultants for services rendered to the Company.

On July 21, 2014, 48,333 restricted shares of common stock were issued to four investors pursuant to their Subscription and Purchase Agreements, dated February 28, 2014, at a cost basis of $1.50 per share.

On August 11, 2014, 11,667 restricted shares of common stock were issued to members of the Company’s Board of Directors, at a cost basis of $1.50 per share.

On August 11, 2014, 373,971 restricted shares of common stock were issued pursuant to a Notice of Exercise, dated August 7, 2014, exercising certain warrants owned by the holder.

Other than as previously disclosed, we did not issue any unregistered securities during the year ended August 31, 2014.

Subsequent Issuances:

On October 20, 2014, the Company issued 191,828 shares of restricted common stock. Of the 191,828 restricted shares issued, 88,168 shares were issued to four US investors at a cost basis of $1.50 per share, 11,669 shares were issued as compensation to the Company’s Board of Directors, 50,000 shares were issued to the Company’s CEO/CFO for services rendered, and the remaining 41,991 shares were issued to five consultants for services rendered to the Company.

On October 20, 2014, the Company issued 453,336 shares of restricted common stock to ten Non-US investors under Regulation S, pursuant to Subscription and Purchase Agreements dated between June and October 2014, at a cost basis of $1.50 per share.

On November 5, 2014, the Company issued 171,167 shares of restricted common stock. Of the 171,167 shares, 2,500 shares were issued as compensation for advertising services rendered to the Company, 2,000 shares were issued to a member of the Board of Directors in lieu of cash compensation, and 166,667 shares were issued to one investor pursuant to a Subscription Agreement dated October 21, 2014.

On November 13, 2014, the Company issued 30,607 restricted shares of common stock. Of the 30,607 restricted shares, 11,669 shares were issued as compensation to the Company’s Board of Directors, 834 shares were issued as interest owed on a promissory note, and the remaining 18,104 shares were issued as compensation for certain sales, advertising, legal, and general consulting services rendered to the Company.

Re-Purchase of Equity Securities

None.

Dividends

Subsequent to the year ended August 31, 2014, on September 4, 2014, the Company effectuated a reverse split (the “Reverse Split”) of its issued common shares whereby every three (3) pre-split shares of common stock were exchanged for one (1) post-split share of the Company's common stock. As a result, the total issued shares of the Company’s common stock as of the Record Date, August 22, 2014, decreased from Thirty One Million Five Hundred Sixty Five Thousand Nine Hundred Eighty (31,565,980) shares prior to the Reverse Split to Ten Million Five Hundred Twenty One Thousand Nine Hundred Ninety Four (10,521,994) shares following the Reverse Split. FINRA confirmed approval of the Reverse Split on September 10, 2014 and the Reverse Split became effective on September 11, 2014. The Reverse Split shares are payable upon surrender of certificates to the Company's transfer agent.

|

21

|

Securities Authorized for Issuance Under Equity Compensation Plans

None.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS