Attached files

| file | filename |

|---|---|

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a51226429.htm |

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a51226429ex99_1.htm |

Exhibit 99.2

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 1

MAXIMUS

Fiscal 2015 Fourth Quarter and Year-End Conference

Call

November, 12 2015

Operator: Greetings, and welcome to the MAXIMUS Fiscal 2015 Fourth Quarter and Year-End Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. If anyone should require Operator assistance during the conference, please push star, zero on your telephone keypad. As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS. Thank you. Ms. Miles, you may begin.

Lisa Miles: Good morning, and thanks for joining us. With me today is Rich Montoni, CEO; Bruce Caswell, President; and Rick Nadeau, CFO. Beginning this quarter, we are modifying the way we speak to our financial results. In the interest of brevity, we will cover the financial trends and move away from repeating all the numbers on the income statement. All of the pertinent information can be found in our press release and the detailed presentation that we provide on the Investor Relations homepage of the MAXIMUS website each quarter.

Today's financial results are shown in three segments, and today's press release also includes a supplemental table that details financial results for all four quarters of fiscal 2015 under the new segment structure.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 2

I'd like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. For a reconciliation of the non-GAAP measures presented in this document, please see the Company's most recent quarterly earnings press release.

With that, I'll hand the call over to Rick.

Rick Nadeau: Thanks, Lisa. As we get started this morning, I wanted to first address the reason for our 2016 earnings guidance revision. The revision is a result of a single program, the U.K. Health Assessment Advisory Service, which is in start-up. While we have made substantial progress in affecting positive change to the program, the ramp-up to contract volume targets has been slower than originally planned. As a result, we now expect that fiscal 2016 diluted earnings per share will range between $2.40 and $2.70.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 3

We have put forth fiscal 2016 earnings guidance that includes a wide range of possible outcomes under this program. The lower end of the range assumes that we continue to face challenges related to achieving our contract volume targets. The upper end of the range contemplates improved performance and increased volume output. The Management Team is certainly focused on delivering results that move U.S. toward the upper end of this range.

Both Rich and I will go into greater detail on the U.K. Assessment Contract throughout the call. However, as it relates to our longer-term, three- to five-year outlook, we firmly believe that the overall macro trends for our business remain intact. We continue to see opportunities for our core services across all of our segments and geographies. Governments around the world continue to seek ways to run more effectively and efficiently, while at the same time dealing with rising case loads, changing demographics and unsustainable social program spend. Through a combination of short-term and long-term opportunities, we see continued growth for years to come.

Let me start with the results for the full year. We had another solid year with double-digit, top and bottom line growth. Revenue for fiscal 2015 increased 23% over last year. Of this growth, 19% was organic, primarily from the Health and Federal Services segments, and 8% was driven by the acquisitions of Acentia and Remploy. Year-over-year top line growth was offset by $60 million, a 4% decline due to the unfavorable effects of foreign currency. On a constant currency basis, revenue would have increased 27% year-over-year.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 4

We wanted to be sure to point out that our operating margins did benefit from a reduction to the Company's 2015 Management Cash Bonus Plan, which reduced SG&A in the fourth quarter and the full year. From an accounting perspective, the cash bonus accrues throughout the year based on how the Company performs against its targets. The lower cash bonus payments were largely due to the slower ramp of the U.K. Assessment contract and our need to drive future improvements. The adjustment was proportionally allocated across the three segments, and improved the full year operating margin by 30 basis points. As a result, operating margin for fiscal 2015 was 12.4%. As expected, operating margin for the full year was tempered by new programs in start-up, and the decreasing volumes in our U.S. Federal Medicare Appeals business, which were highly accretive.

For fiscal 2015, net income attributable to MAXIMUS increased 8% and GAAP diluted earnings per share increased 11% to $2.35 compared to fiscal 2014. This included $0.04 of acquisition-related expenses. Excluding the acquisition-related expenses, adjusted diluted earnings per share for fiscal year 2015 increased 13% to $2.39.

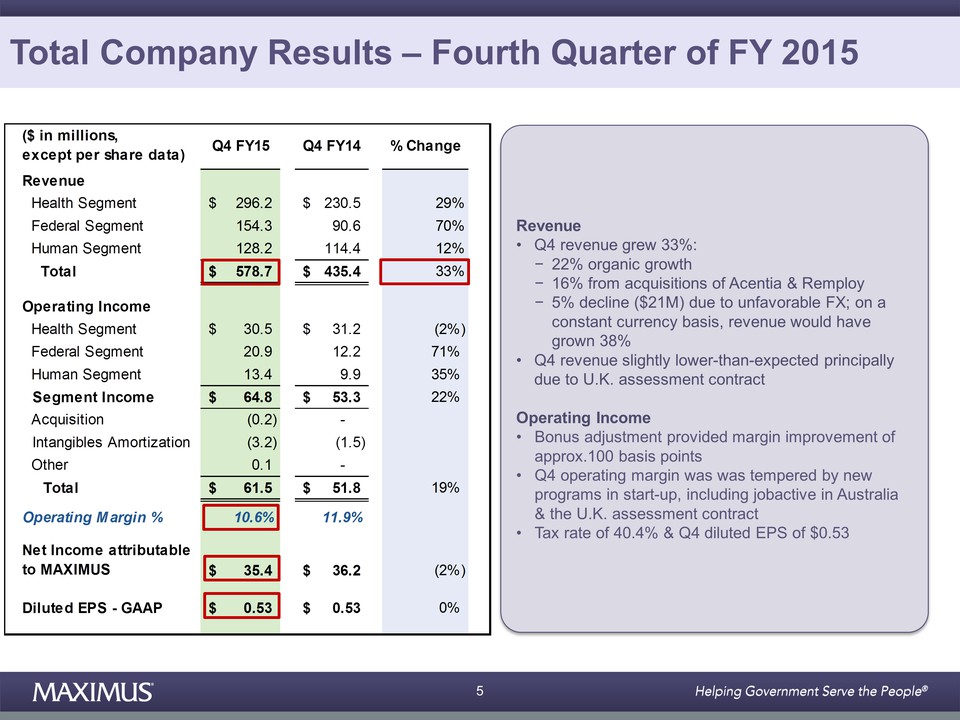

Moving on to results for the fourth quarter; revenue grew 33% compared to last year, of which 22% was attributable to organic growth and 16% was tied to the acquisitions of Acentia and Remploy. This was offset by approximately $21 million, a 5% decline due to unfavorable foreign currency exchange rates. On a constant currency basis, total revenue would have grown 38%.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 5

Revenue in the fourth quarter was lower than expected, principally due to the U.K. Assessment contract. The bonus adjustment provided operating margin improvement in the fourth quarter of approximately 100 basis points. As a result, fourth quarter operating margin was 10.6%. As expected, it was tempered by new programs in start-up, including jobactive in Australia and the Health Assessment Advisory Service in the U.K.

For the fourth quarter of fiscal year 2015, net income attributable to MAXIMUS totaled $35.4 million. The tax rate was 40.4%, which computes to diluted earnings per share of $0.53.

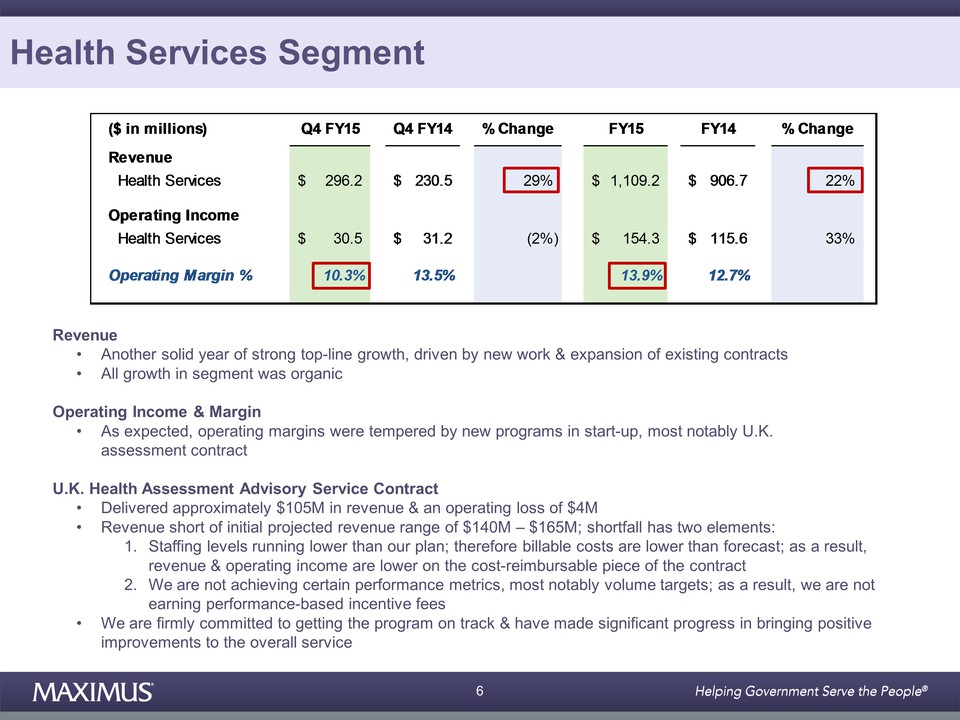

Now I will speak to segment results, starting with Health Services. The Health segment delivered another solid year of strong top line growth, driven by new work and the expansion of existing contracts. All growth in the segment was organic. Revenue grew 29% for the fourth quarter, and was up 22% for the full year, compared to the same periods in fiscal 2014. Operating margin was 10.3% for the quarter, and 13.9% for the full year. As expected, operating margins were tempered by new programs in start-up, most notably the U.K. Assessment contract.

For fiscal year 2015, the U.K. Assessment contract delivered approximately $105 million in revenue, and an operating loss of $4 million. Revenue was short of our initial projected range of $140 million to $165 million. The shortfall has two primary elements. First, our staffing levels are running lower than our plan, and therefore, billable costs are lower than forecasted. As a result, revenue and operating income are lower on the cost reimbursable piece of the contract. Second, we are not achieving certain performance metrics, most notably volume targets. As a result, we are not earning the performance-based incentive fees.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 6

We are firmly committed to getting the program on track and we have made significant progress in bringing positive improvements to the overall service. Rich will talk about this in greater detail in his prepared remarks.

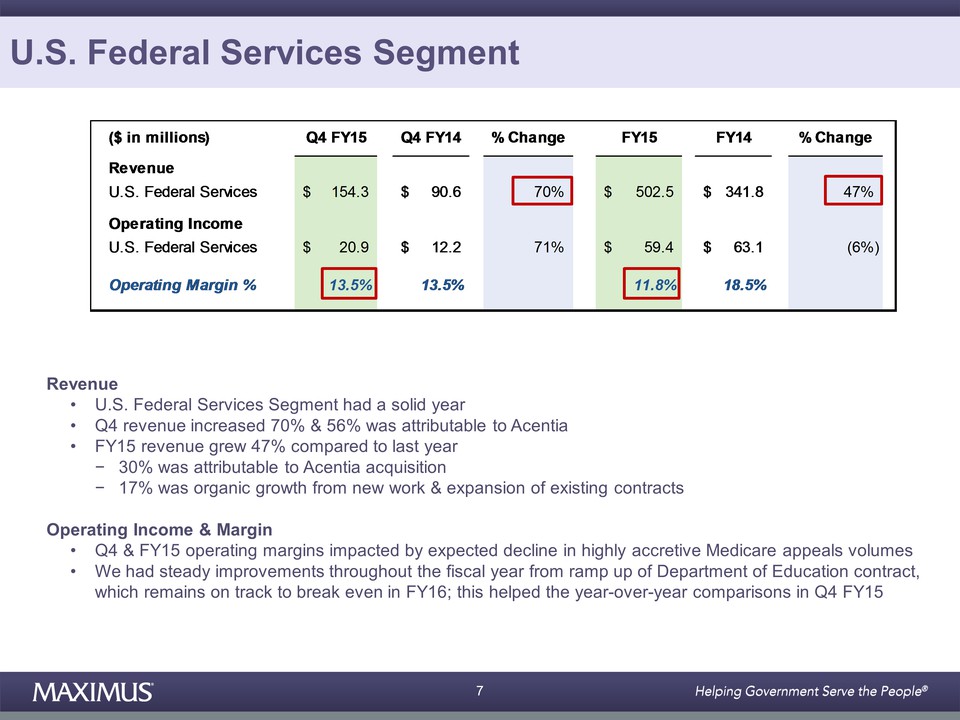

As we mentioned in our Form 8-K filing last week, we have decided to break out our U.S. Federal Services business into a third reporting segment. We believe this will be useful to investors as it provides additional visibility to our overall financial results. The U.S. Federal Services segment had a solid year. On the top line, fourth quarter revenues increased 70% over the prior-year period, of which 56% was attributable to Acentia. For fiscal year 2015, revenue grew 47% compared to last year, of which 30% was attributable to the Acentia acquisition and 17% was organic growth from new work and the expansion of existing contracts.

Operating margin for the fourth quarter was 13.5%, and for fiscal year 2015, 11.8%. Operating margins for the fourth quarter and full year were impacted by the expected decline in the Medicare Appeals volumes, which were highly accretive. We had steady improvements throughout the fiscal year from the ramp-up of the Department of Education contract, which remains on track to break even in fiscal 2016. As a result, this helped the year-over-year comparisons in the fourth quarter of 2015.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 7

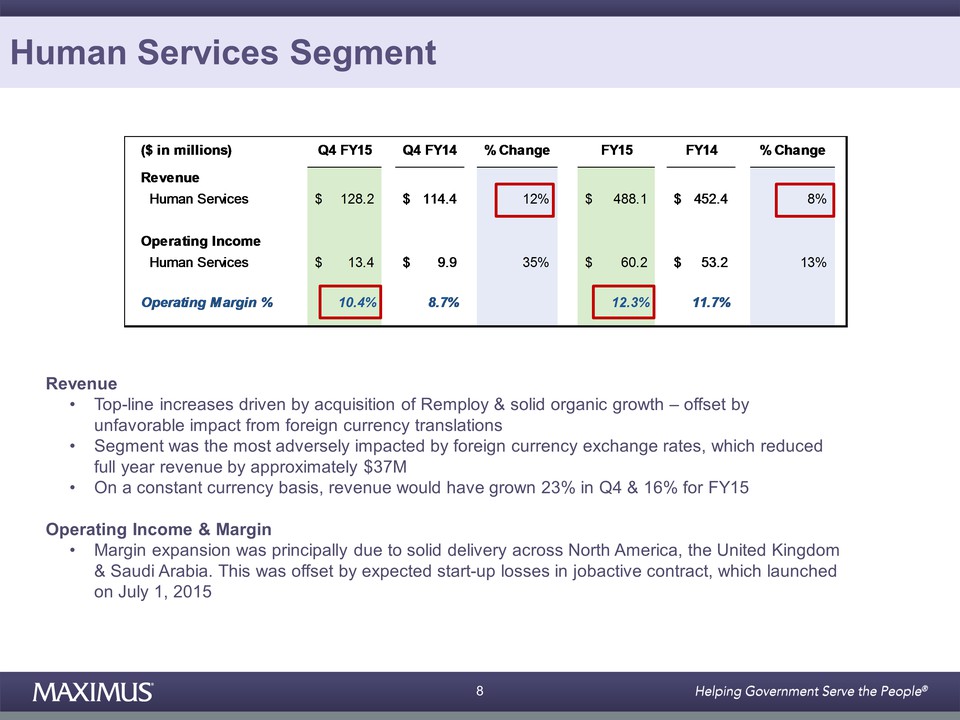

Let me turn to financial results for the Human Service segment. Revenue increased 12% in the fourth quarter and 8% for fiscal year 2015 compared to the prior-year periods. Top line increases were driven by the acquisition of Remploy and solid organic growth, which was offset by the unfavorable impact from foreign currency translations. This segment was the most adversely impacted by foreign currency exchange rates, which reduced full year revenue by approximately $37 million. On a constant currency basis, revenue would have grown 23% in the fourth quarter and 16% for the full year of fiscal 2015.

Operating margin was 10.4% for the fourth quarter, and 12.3% for the full fiscal year. Margin expansion was principally due to solid delivery across North America, the United Kingdom and Saudi Arabia. This was offset by the expected start-up losses in the jobactive contract in Australia, which launched on July 1, 2015.

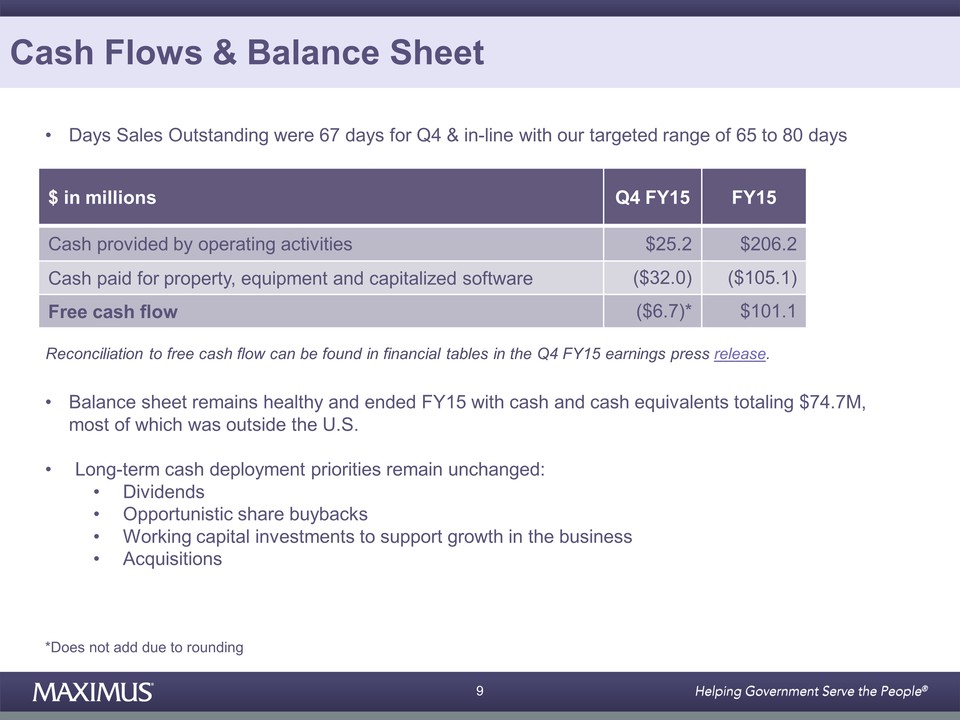

Let me move on to discuss cash flow and balance sheet items. Days sales outstanding were 67 days for the fourth quarter, which is in line with our targeted range of 65 to 80 days. For the fourth quarter of fiscal 2015, cash provided by operating activities totaled $25.2 million, with negative free cash flow of $6.7 million. For the full fiscal year, cash provided by operating activities totaled $206.2 million, with free cash flow of $101.1 million. Our balance sheet remains healthy, and we ended the fiscal year with cash and cash equivalents of $74.7 million, most of which was outside the United States.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 8

Our long-term cash deployment priorities remain unchanged and include dividends, opportunistic share buybacks, working capital investments to support the growth in the business and acquisitions.

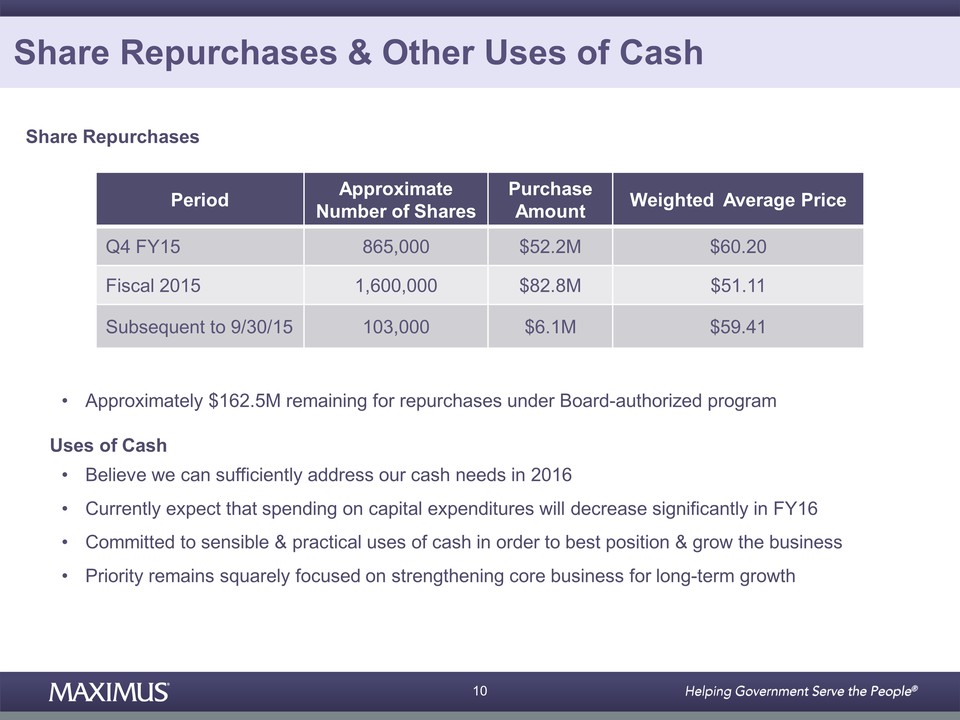

During the fourth quarter, we repurchased 865,000 shares of MAXIMUS common stock, for $52.2 million. This brings our total repurchases for fiscal 2015 to approximately 1.6 million shares, for $82.8 million. We had a weighted average price of $51.11 for all repurchases in fiscal 2015. Subsequent to quarter close, we repurchased approximately 103,000 shares for an additional $6.1 million with a weighted average price of $59.41. We presently have an estimated $162.5 million remaining under the Board-authorized program.

With the generation of free cash flow and our available line of credit, we believe we can sufficiently address our cash needs in 2016. We currently expect that spending on capital expenditures will decrease significantly in fiscal year 2016. We remain committed to sensible and practical uses of cash in order to best position and grow the business. Most importantly, our priority remains squarely focused on strengthening our core business for long-term growth.

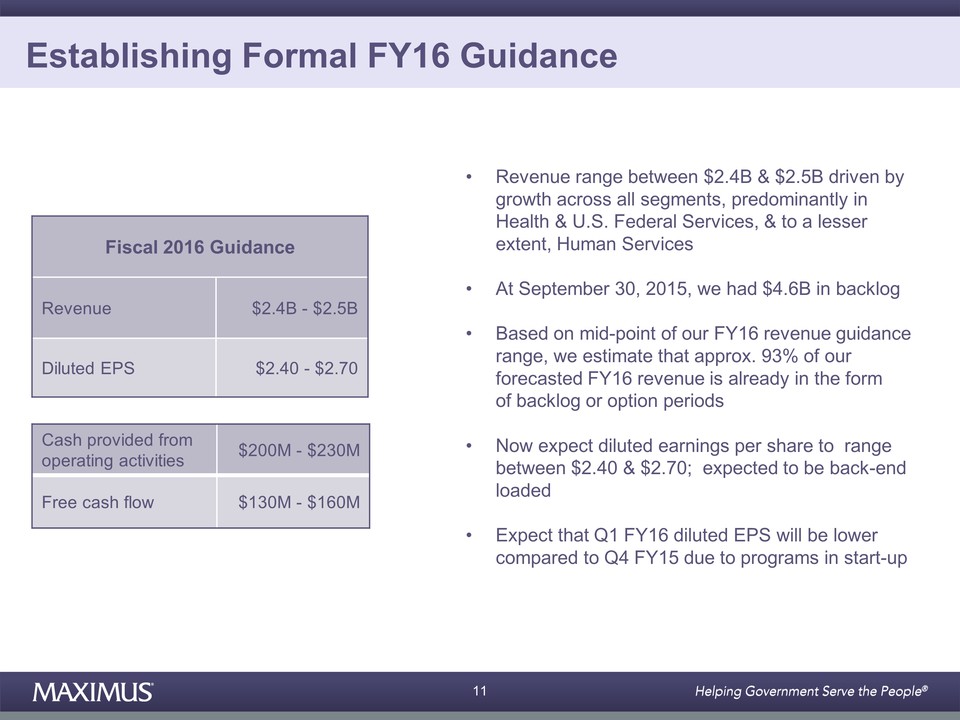

Let me complete the guidance discussion. Today we are establishing formal guidance for fiscal 2016. We continue to expect fiscal year 2016 revenue to range between $2.4 billion and $2.5 billion, driven by growth across all segments, predominantly in Health and U.S. Federal Services, and to a lesser extent the Human Services segment.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 9

At September 30, 2015, we had $4.6 billion in backlog. Based on the midpoint of our 2016 revenue guidance, we estimate that approximately 93% of our forecasted fiscal year 2016 revenue is already in the form of backlog or option periods.

On the bottom line, we now expect diluted earnings per share to range between $2.40 and $2.70. This is expected to be more back-end loaded. Right now, we anticipate that for the first quarter of fiscal year 2016, diluted earnings per share will be lower compared to the fourth quarter of fiscal year 2015, due to programs in the start-up phase.

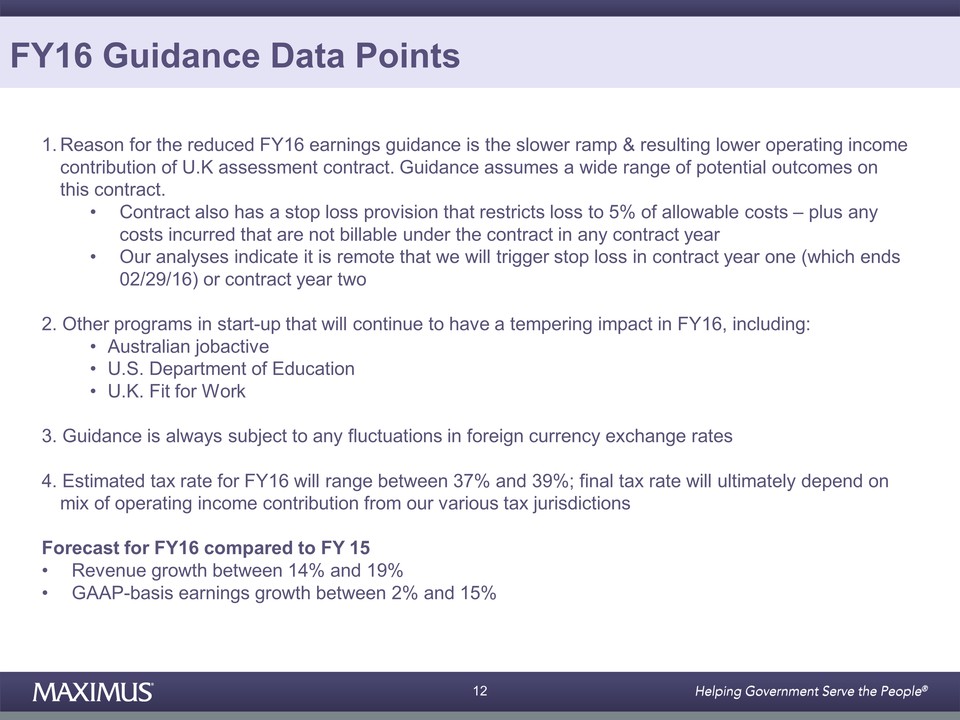

Let me share some additional data points on our formal fiscal year 2016 guidance. First, the number one reason why we reduced our fiscal year 2016 earnings guidance is the slower ramp and resulting lower income contribution of the U.K. Assessment contract. As I mentioned earlier, our guidance assumes a wide range of potential outcomes on this contract, and as a reminder, this contract does have a stop-loss provision that restricts our loss to 5% of allowable costs plus any costs incurred that are not billable under the contract in any contract year. Our analyses indicate that it is unlikely that we will trigger the stop-loss in either contract year one, which ends February 29, 2016, or contract year two.

Second, we still have other programs in start-up that will continue to have tempering impact in fiscal year 2016. This includes the Australian jobactive, the U.S. Department of Education and the U.K. Fit for Work contracts.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 10

Third, our guidance is always subject to fluctuations in foreign currency exchange rates.

Lastly, we are estimating that the tax rate for fiscal year 2016 will range between 37% and 39%. The final tax rate will ultimately depend on the mix of operating income contribution from our various tax jurisdictions.

So, when you add it all up, we are forecasting revenue growth between 14% and 19% and GAAP basis earnings growth between 2% and 15% for fiscal 2016. We expect cash provided by operating activities to be in the range of $200 million to $230 million for fiscal year 2016, and we expect free cash flow to range between $130 million and $160 million.

Thanks for your continued interest. Now I will turn the call over to Rich.

Richard Montoni: Thank you, Rick, and good morning, everyone. While the challenges we face with the U.K. Assessment contract resulted in a reduced earnings outlook for fiscal year 2016, it's important to remember that this is a single contract in our global portfolio.

Over the past 12 months, we have introduced several new growth platforms that strengthen our position for future opportunities in key markets, and the macro trends that drive demand for our services at the global level remain very favorable.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 11

In my comments this morning, I will provide some additional insights on the U.K. Assessment contract. I'll speak to the challenges we face today, what we are doing to address them and highlight some areas where we have already made solid improvements to the overall service. I will then give an update on the Acentia integration and our expectations for the third Affordable Care Act open enrollment period in the US. I will also update you on our sales awards and pipeline, and I will close by sharing with you my view on our commitment to deliver solid growth in fiscal 2016.

Let me pick up where Rick left off and start with the U.K. Assessment contract. As a reminder, this is the contract where MAXIMUS is conducting assessments for individuals seeking certain disability benefits according to the rules set down by the U.K. Parliament. The program faced significant criticism under the previous provider. When MAXIMUS took over the contract in March 2015, we acknowledged that it would take time to bring meaningful improvements to the program.

You may recall that this is a hybrid contract that is predominantly cost-reimbursable. However, it also has significant performance incentives, with the largest being tied to volumes. While we have increased volumes during the start-up phase, we are falling short of achieving the initial volume targets. Our ability to hit the volume targets is tied directly to three areas: the number of health care professionals that we recruit; the number that complete training and graduate; and the productivity of these new recruits. In order to get the program better aligned with our contractual targets, we need to have the right number of qualified health care professionals; that goal hasn't changed. What has changed is the amount of time it is taking U.S. to recruit, graduate and ramp-up the new staff, but we feel confident that, over time, we can achieve our goals. We have modified our forecast to account for the slower than expected staffing ramp. In order to meet these, we believe that we will have staffing resources in place to meet volume demand and contractual targets by the end of summer 2016.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 12

Let me now walk you through the three main areas where we are aggressively working to address the challenges. The first area is recruitment. We launched a comprehensive recruitment campaign to ensure that we have a continued flow of qualified candidates in the appropriate locations. We have expanded our network of recruitment partners and enhanced our employee referral program. We implemented an advertising and social media campaign, launched a recruitment portal website and have been exhibiting at a number of recruitment fairs across the country. Through these efforts, we have seen a sizable uptick in the number of new recruits.

The second area is improved training and support, which leads to better graduation rates. It's important to recognize that once hired, candidates must then complete rigorous training, pass a series of competency tests and graduate to become fully accredited. To increase the graduation rates, we have some key initiatives underway. We have increased our engagement and coaching efforts with new candidates during the entire training period. This is already yielding results in keeping more candidates in the process. We are also working with those recruits who struggle with the initial competency tests and are providing them with individualized training support. With this extra support, we expect that more candidates will successfully graduate to full accreditation.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 13

The third area is productivity. Once new staff begin performing assessments there is a learning curve, and it may take between six and eight months for them to achieve full productivity levels. In the meantime, we have efforts underway to increase productivity with our current workforce. We have optimized the work schedules of our staff and offered voluntary overtime incentives, including weekend shifts, to increase the number of assessments we can complete each day. This has a direct influence on our ability to reduce the significant backlog that we inherited at the time of contract takeover.

We expect that the increased recruiting efforts, supplemented by the enhanced training and optimization of our current workforce will help U.S. to increase our productivity, meet volume targets and reduce wait times over the coming months.

Over the past eight months, we've already made significant progress and realized several early accomplishments that I'd like to share. These demonstrate that, over time, we can bring about the necessary changes to put this program on the path to success. The first is addressing the current backlog. This was a top priority for the Department for Work and Pensions. At the time of contract takeover, we inherited a significant caseload of more than 550,000 outstanding assessments. Today, we have eliminated more than a third of that backlog. We are making concerted progress to continue to reduce the backlog of cases and shorten wait times.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 14

The second area of major progress is improved stakeholder engagement. We established a Customer Representative Group of more than 25 non-profits and disability advocacy groups to bring them to the table. The group continues to provide U.S. with practical feedback that we incorporate into our operations to affect positive change in such areas as clinical training, the assessment interview and our facilities and customer communications.

The third area is an improved customer experience where we really have made substantial progress to help improve the engagement levels of all customers. We've refreshed and rolled out enhanced program engagement materials to help people better understand the assessment process and prepare for their appointment. These include a user-friendly website with enriched multimedia content. We're also working hand-in-hand with DWP to update customer-facing materials to make them easier to understand. We recently completed usability testing of the draft materials and 96% of the testers reported positively on the materials. These changes go a long way to improving customer engagement.

Last month, we also launched a new help line to assist customers with completing their pre-assessment forms and provide practical support on the types of medical evidence that may be required. We are currently piloting text messaging as a means to prompt customers to complete certain tasks and to remind them of their upcoming appointments. A full nationwide rollout is planned in the coming weeks.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 15

All of these accomplishments have not gone unnoticed. During a public Work and Pensions Select Committee meeting last month, several government officials praised our recruiting plan and our efforts to work through the backlog. These public remarks are a confirmation of our effective working relationship with DWP and our belief that we are the right Company to bring about improvements to this highly visible program.

To put it all in perspective, we are making meaningful improvements and it's on an upward trajectory, but the progress remains short of initial targets, and hence original projections for operating income. This is a single contract with an operating income ramp that's now pushed to the right. As we continue to make strides forward, this is not a matter of loss mitigation but rather on bringing the start-up to a mature operation level so as to deliver normalized operating income contribution, and we've done this in many situations before. Let me explain.

Start-ups are simply the nature of our business, and new programs are the best avenue to create substantial, long-term shareholder value. Growing pains are often normal during the early days of a new program, and the pace at which start-up programs move to maturity can be difficult to predict. MAXIMUS has demonstrated results in managing challenging start-ups.

If you've followed MAXIMUS long enough, you may remember that we faced challenges on start-up programs in the past. Prime examples include our contracts in British Columbia and Texas. It took time, resources and a significant level of effort to implement the many changes needed to turn these programs around. They are now two of our flagship contracts that have delivered meaningful shareholder value over time. We still believe the U.K. Assessment contract will drive long-term significant shareholder value, it will just take longer than originally planned.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 16

Turning now to our U.S. Federal operations where we expanded our portfolio in fiscal 2015 with the acquisition of Acentia; our integration efforts are nearly complete, and as we mentioned last quarter, we are seeing new prospects that combine business process outsourcing with technology solutions. The acquisition provides U.S. with additional contract vehicles and access to new agencies. It opens up an entirely new set of opportunities for MAXIMUS.

We won a small but strategic task order on a vehicle that we gained through the acquisition. The work is for physical and behavioral health assessment reviews for individuals placed on a disabled list from their current assignments. This work is for one branch of the military. The goal of this service is to either return individuals to their current duty, assign them to a new duty or assignment, or allow them to leave the service.

This new task order plays nicely into our continuum of existing assessments and appeal services. It's also positive confirmation of the role that the acquired contract vehicles will play in our longer-term growth strategy for the federal segment. While the federal procurement process can be slow-moving, we believe, over the next few years, we will start seeing formal opportunities where we can play a meaningful role as a service provider.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 17

Shifting now to our support of the Affordable Care Act in the US, the third open enrollment period, or what we refer to as OE3, began last week and will run through January 31, 2016. While we are in the very early stages of OE3, we believe that ACA-related revenue has largely stabilized into a relatively steady state. While the number of first time enrollments are projected to be lower, we continue to support other ACA activities such as completing redeterminations, answering tax-related questions and managing certain components of consumer engagement. However, as with any large scale government program, we also expect normal course fluctuations year-in and year-out as states prioritize a wide-ranging set of initiatives under ACA.

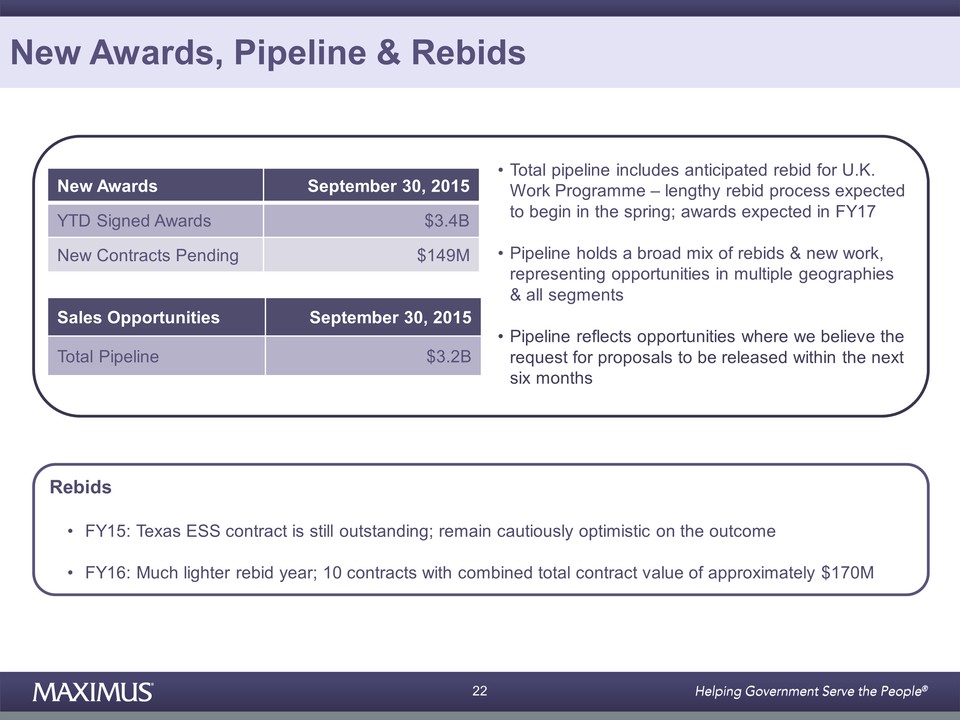

Let's move on to new awards, pipeline and rebids. Starting with new awards, we finished fiscal 2015 with record annual signed contract awards of $3.4 billion. We also had an additional $149 million in new awarded but unsigned contracts at September 30, 2015. At September 30, the sales pipeline remained healthy at $3.2 billion. As noted in the press release, this includes the anticipated rebid for the U.K. Work program. This rebid is not expected to be awarded until fiscal 2017, but the lengthy rebid process is expected to begin in the spring. Overall, both the short-term pipeline and our longer-term outlook hold a broad mix of rebids and new work, representing opportunities in multiple geographies and all segments.

Let's wrap up with rebids. While the Texas Eligibility Support Services contract is still outstanding for fiscal 2015, we remain cautiously optimistic on the outcome. As we've previously stated, fiscal 2016 will be a much lighter rebid year. We have 10 contracts with a combined total contract value of approximately $170 million up for rebid in fiscal 2016.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 18

In summary, the Management Team is keenly focused on improving our performance on the U.K. Assessment contract and delivering results towards the upper end of our guidance range. We have our arms around the issues and have corrective action plans well underway. This is but one contract in our global portfolio and, over the long-term, we fully expect that this will provide solid returns to our shareholders. Most importantly, the macro drivers remain intact and we are confident about the continued demand for our services for decades to come.

MAXIMUS recently celebrated our 40th anniversary in September, and I'd like to thank the more than 16,000 employees worldwide for their valuable contributions. Governments around the world have brought U.S. in as a trusted partner, to implement programs tied to major reform efforts, from welfare to work, to managed care and health insurance exchanges, to performance-based social reform efforts. We will continue to capitalize on opportunities that will grow the business and generate shareholder value.

With that, let's open it up for questions. Operator?

Operator: Thank you. Ladies and gentlemen, we will now be conducting a question-and-answer session. If you would like to ask a question, please push star, one on your telephone keypad now. A confirmation tone will indicate your line is in the question queue. You may push star, two if you would like to remove your question from the queue. For any participant using speaker equipment, it may be necessary to pick up your handset before pushing the star key. We do ask that you please limit your questioning to one question and one follow-up question only. If you wish to ask additional questions, you may re-enter the queue at that time. One moment while we poll for questions.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 19

Our first question comes from the line of Brian Kinstlinger from Maxim Group. Please go ahead with your question.

Brian Kinstlinger: The—hello?

Lisa Miles: Brian?

Richard Montoni: Good morning, Brian.

Brian Kinstlinger: Sorry, I don't know, a bad connection. Sorry about that. Good morning. The first question I had, as you know, guidance to the midpoint was reduced by $0.40. Can you quantify what you had expected for revenue and EPS contributions for the assessments contract in your preliminary guidance versus what your expectations are to the low and high end of today's revised guidance?

Richard Montoni: Brian, good morning, this is Rich. Just to repeat the question so everybody understands it, and the connection's just fine, Brian. Your question is, what was assumed for revenue and earnings in our original preliminary guidance, and the revised guidance which is, at the midpoint, about $0.40 less, what's behind that?

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 20

Glad to respond to it. I'm going to ask Rick Nadeau to at least initially respond to that question, Brian.

Rick Nadeau: Yes, Brian, thank you. Our guidance is based on what we know today and reflects a wide range of probable outcomes. The lower end of the range assumes that we continue to face challenges on achieving our contract volume targets. In terms of revenue, the lower end assumes approximately $230 million of revenue, and a pre-tax operating loss of about $7 million. This is due to U.S. not earning incentive fees as a result of U.S. not hitting the volume targets.

The middle of the range assumes breakeven operating income, and then the upper end of the guidance range assumes higher levels of revenue and assumes that we are earning incentive fees tied to the performance targets, most notably the volume targets. The upper end contemplates $280 million of revenue, approximately, and an operating margin of approximately 7%.

Brian, the Management Team is diligently focused to drive performance toward the upper end of the guidance range. You are correct, our preliminary guidance did assume higher revenue in margins than is presently assumed in our formal guidance. The preliminary 2016 guidance assumed operating margin that was at the upper end of our targeted range of 10% to 15% of operating income that we talked about. Those estimates were based on early trends that we were experiencing in the first few months of the contract, therefore it assumed that we would be running at higher staffing levels and earning the incentive fees on the performance-based targets.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 21

Rich, did you have anything to add to that?

Richard Montoni: Rick, I would add, from a qualitative perspective, and as you can imagine, Brian, the Management Team has spent a lot of time contemplating what the revised guidance should be. It does, as you will note, it reflects a range of probable outcomes. Our thinking when we set this formal guidance was to provide a range where the Management Team has a very high level of confidence in delivering within that range.

I'd also add that while I'm not assured, we believe that the upper end of the range is achievable, and our goal, clearly, is to exceed the lower end of the range and the Management Team is determined to drive towards the upper end of that revised range.

Next question, please?

Operator: Our next question comes from the line of Dave Styblo from Jefferies. Please go ahead with your question.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 22

Dave Styblo: Hi, good morning, thanks for the questions. I do want to (indiscernible) for a second here, just want to make sure I fully understand how to think about the move on the contract here. Certainly, it's a push out to the right. Rich, I just want to make sure that I understand, after that, are we also talking about getting to the same full run rate earnings potential that you originally thought you could make on it, or is there any press down on that over time?

Richard Montoni: Dave, that's a great question. I think it's helpful for the listeners to envision a ramp curve. That's where we are with the start-up situation; starting from basically a takeover of a prior operation from a predecessor and ramping it up in terms of its ability to deliver monthly volumes and increased quality, et cetera. So I envision this ramp curve—and it was a very aggressive ramp curve. We are climbing that ramp curve, we are making improvements, we're increasing, but not at the same rate—and really, effectively, the best vision is to envision that ramp curve pushing to the right. You hit upon a very meaningful aspect, and that is, at the end of the day will the mature level be at the same level originally anticipated? The answer is yes, definitely yes. We are not lowering the expected level of performance at the end of the day, or delivery, or volume level, revenue level of this contract when it's mature.

Dave Styblo: Okay, great. As a follow-up to that, I think you said you'd be, I think fully staffed in the summer of '16. I know, obviously you don't have '17 guidance up, but if you had, does that sort of insinuate that the '17 numbers wouldn't change, that you would be operating at that full run rate by that point, or is there—or does the push out to the right sort of impact your fiscal year '17 as well?

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 23

Richard Montoni: Well, I think what it means is that we expect that during our fiscal '16 we will reach full maturity level, and that means for all of '17 that project would be operating at that level. You touch upon a very important point in terms of, there'll be a radical difference in '17's performance versus '16's performance for this start-up contract.

Lisa Miles: Next question, please?

Operator: Our next question comes from the line of Stephen Lynch from Wells Fargo. Please go ahead with your question.

Stephen Lynch: Yes, hey guys, thanks for taking the question. I was wondering if you could talk about the slower than expected ramp of staffing for the U.K. Assessment contract. Is that being driven by a shortage of qualified health care professionals in the market or if you could just talk about what factors are causing the drag in recruiting that would be great.

Richard Montoni: Stephen, I think that's a great question. Bruce Caswell who is our President, by the way, has spent, as you would expect, along with the rest of the Executive Team, a lot of time on this project. He has been over to London several times and has some really great insights in terms of what's been done and what we will do to move this forward. So I'm going to ask Bruce to comment upon and give you some insights as it relates to that topic.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 24

Bruce Caswell: Great, and thanks, Stephen, and good morning. Fundamentally, actually, recruiting has improved quite a bit over the course of the last several months and actually is no longer as significant a constraint as it was previously. So we feel like we've made very good progress in recruiting, and we're now reaching a level of recruiting that, from a rate perspective, is an appropriate level. So the issue is really that we need to sustain that rate for the foreseeable future. We've done that through a number of methods; by increasing our supply chain partners, focusing on the quality of the recruits that we're getting, and so forth. So recruiting is less of a constraint.

The real issue that we've been facing is our ability to graduate those trainees that we bring into the system on a timely basis and ensure that we have a high level of graduation rate, and obviously, a correspondingly low attrition. It might be helpful just to give you a sense of, you know, what the training program is like that folks have to go through. It's very extensive and rigorous, it takes a long time, about three months for them to complete. They have to go through multiple competency tests in that process. These are health care professionals that, for a good portion of their career, pre-dating their joining us, have been giving very direct care to folks in a clinical environment, versus assessing very complex conditions, many of which can fluctuate from day to day. So it's a very different type of work. It's a career shift for these folks, but they are by far the most qualified people to serve as assessors.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 25

So while we can speak further about a number of the actions we've taken to address training and improve graduation rates, I did want to just clarify that recruitment we feel we've made great progress on and it no longer represents the primary constraint to our success.

Stephen Lynch: Thanks, Bruce.

Bruce Caswell: Yes.

Richard Montoni: Next question, please?

Operator: Our next question comes from the line of Charlie Strauser from CJS Securities. Please go ahead with your question.

Charlie Strauser: Hi, good morning.

Richard Montoni: Good morning, Charlie.

Charlie Strauser: If we can shift a little bit—if I can ask maybe Rick this question. The pro forma organic growth rates in both Federal and Human, if you have those numbers I'd appreciate those.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 26

Richard Montoni: So Charlie, you're asking for the pro forma organic growth rate for the Federal segment and the Human segment for the year ended September 30, 2015?

Charlie Strauser: And the quarter, please.

Richard Montoni: And the quarter. So, fiscal year, okay.

Charlie Strauser: Okay, the end of the quarter.

Richard Montoni: Sure. Rick?

Rick Nadeau: Okay. I'm sorry, which order did you want them in? Health first?

Charlie Strauser: Human and Federal, actually.

Rick Nadeau: Okay, Human and Federal, okay. So, Federal, on the top line grew 70%; 56% was attributable to—this is fourth quarter—56% was attributable to Acentia, and for fiscal 2015 revenue grew 47% and 30% was attributable to Acentia, and 17% from organic growth. That was Federal.

Charlie Strauser: Okay.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 27

Rick Nadeau: Then Human was 12% in the fourth quarter and 8% for the fiscal year, with the top line being driven by the acquisition of Remploy.

Charlie Strauser: So that's the—the 12% and 8% number is the organic number, or is that…

Rick Nadeau: I'm sorry, total revenue 12% and 8%.

Charlie Strauser: Right. Got it, and then it's all driven by Acentia and Remploy?

Rick Nadeau: Yes. On a constant currency basis revenue would have been 23% in the fourth quarter and 16% for the full fiscal year. That's in the script.

Charlie Strauser: Got it. Great. Okay, thank you very much. I wasn't clear on that part.

Rick Nadeau: Right.

Charlie Strauser: My second question is on Texas. I know you said it's still pending, but is there any update on timing of that contract?

Richard Montoni: I think we expect to hear in this calendar year, probably in the December timeframe.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 28

Charlie Strauser: Great, thank you very much.

Richard Montoni: You're welcome, Charlie.

Lisa Miles: Next question, please?

Operator: Our next question comes from the line of Richard Close from Canaccord Genuity. Please go ahead with your question.

Richard Close: Great, thank you for taking the questions. First, I was wondering if you could comment, you mentioned the first quarter will be sequentially down from the fourth quarter. How should we think about second quarter? Will that be flat year-over-year you're thinking, or—and could you just talk about maybe the quarterly progression?

Rick Nadeau: Yes, this is Rick. We expect Q1, as we said, will be lower compared to the fourth quarter. That is because we have many programs, as you know, in the start-up. Based on what we know today we would expect a steady level of earnings growth throughout the remainder of the year. We'll grow throughout the year. However, I do want you to keep in mind that the timing of revenue and profit from things such as change orders and contract amendments can impact contract trends. So we can wind up doing work on a particular piece of work and having the charge go in one quarter and we cannot record the revenue because we have a change order that's pending and not signed. It would then wind up getting signed in the next quarter. So we can get some lumpiness that can result from that.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 29

Richard Montoni: Richard that was your first question. Do you have another one?

Richard Close: Yes. My follow-up would be on the Affordable Care Act. I think—or at least we were looking for about $300+ million contribution from that in fiscal '15. Can you let us know where you stood for fiscal '15 on health reform, and then how you're thinking about health reform contribution going forward? I think you said that you expect it to be stable, but just additional commentary in and around that, please?

Richard Montoni: I will be glad to do that, Richard. I will say that you're right, we did expect that we'd have contribution in that vicinity, actual in fiscal '15. I think fiscal '15 ended up being a very positive year from an Affordable Care Act perspective. There's just a lot of work that tends to come out of the woodworks. Bruce is going to comment in detail, but it feels like the table is set for—again, we think it's getting closer to a steady state.

The nature of the work that we do seems to be changing. The issues seem to—some issues—last year issues seem to be resolved, but new issues pop up. So Bruce, please add to that.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 30

Bruce Caswell: Rich, you're absolutely right. I guess what I'd add is, you know, we'll see normal course fluctuations with our state clients as they prioritize the wide-ranging set of initiatives that are in front of them. As we've talked about a little bit, this year's open enrollment period, for example, has a new series of tax forms that individuals will be receiving if they received qualified coverage through Medicaid or CHIP, they now get the 1095-B forms. A number of our clients will turn to us to help them with either the production or the fielding of phone calls around those types of forms.

We also—for example, in one of our larger contracts, are helping a client—you've, I'm sure, followed the status of the co-ops and there are certain co-ops that have shut down just prior to the open enrollment period. In one instance there was up to 200,000 individuals that needed to transition into new plans on a very expeditious basis. So we all turned and surged and helped to support our clients in those activities. I would call that part of kind of normal course volume fluctuations that we would see, but overall, as Rich has indicated, we feel like we've reached pretty much a steady state, stabilized operation with the Affordable Care Act.

Richard Montoni: Richard, I'm going to add one other very important point, it's more of a horizon observation. But when we first got into the Affordable Care Act and parsing how MAXIMUS might play a meaningful role, the industry pretty much focused on the universality of health care - let's get everybody we possibly can signed up into our health care program. We knew there’d be a second and a third chapter in—the second and third chapter would move away from the universality of health care, and that's still a lot of work every year to re-enroll folks, but also towards quality and cost of health care. In particular, one of the big drivers there would be long-term care for elder individuals. We're starting to see that solidify in our marketplace. I won't go into in-depth detail here, but as you follow MAXIMUS I think you should expect that that's going to further solidify and we'll see more opportunities in that direction.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 31

Next question, please?

Operator: Our next question comes from the line of Allen Klee from Sidoti. Please go ahead with your question.

Allen Klee: Yes, hi, I had two questions. One, if you could talk a little about what you said on the student loan contract and how that's going to go to breakeven potentially next year, but what the opportunity you see there is?

Then second, just going back to the U.K. contract one more time to understand, for the people you hire, what are kind of the competitive choices that you think they have that can also be an issue?

Richard Montoni: Those are good questions. Bruce, would you take the first one? Give folks a little bit of background on the student loan project, what we do, and then the breakeven concept and opportunities moving forward.

Clearly, the one thing that crosses my mind, Allen, is that this contract is important to MAXIMUS because it's with an agency that we really have not done any work with in the past, the Department of Education, and it's a sizable opportunity and as folks probably know, it was in start-up last year and is moving towards maturity. Bruce, do you want to comment on how we're doing there?

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 32

Bruce Caswell: I'll begin and then actually turn it to Rick a little bit. But as a reminder, the scope of the work that we do there is we help students who have reached a default status but for whom their cases have not been turned over to private collection agencies, and that's a large volume of students. I think the estimates nationally are—there's at least five million individuals and that will be growing toward nearly 10 million individuals by 2020 that will need that kind of assistance in that program.

We have been working with the Department to implement upgrades to the technology platform that supports the program and moving through, as Rich has noted, the normal core start-up of the program to turn it to a point where we expect it to break even in fiscal '16.

Rick, would you like to add to that?

Rick Nadeau: Yes. You have to remember, it's a 10 year contract, and Rich is right, it started and we were in start-up last year. This year we have made the progress that we expected and it should be approaching breakeven soon inside fiscal '16, and then it will turn profitable. As I said, it's a full 10 year contract.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 33

Now Bruce, did you want to talk about the…

Bruce Caswell: Health care professionals?

Rick Nadeau: The health care professionals and what other things that compete for their…

Richard Montoni: This is a good question.

Bruce Caswell: Absolutely. Yes, it is a—let me begin by just talking a little bit about the types of health care professionals that we recruit because we recruit, to a large degree, nurses, individuals with physical therapy or PT or occupational therapy, OT capabilities. Coming up in the future we'll also be adding mental health nurses to the cadre of folks that we'll be able to recruit. A large proportion of the individuals that we serve, as you can imagine, have mental health conditions that become part of that assessment process. So, having folks with that clinical capability is quite important. Doctors also comprise a significant component, but I would characterize it more in the 10% to 15% range of the folks that we're recruiting.

It's a very tight labor market in the United Kingdom, and individuals have a lot of options, whether it's to go to work for the National Health Service, whether it's to practice in a general practice mode, a GP type environment, or whether it's to do additional work on other assessment-related contracts that are out there. Furthermore, the types of characteristics that individuals need to have and the capabilities kind of really preclude you from hiring folks directly out of medical school, for example.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 34

These are individuals that need to have a level of experience and capability and really emotional intelligence and the ability to navigate through a very complex assessment process in a manner where it's a very conversational and kind of low anxiety experience for the claimant. All the while, manipulating and documenting the evidence of that assessment in a fairly sophisticated IT tool. So that does narrow the type of field of folks that can be successful in the role. We have been working very hard, however, now to profile and understand, what are the characteristics of folks that can be successful and have been successful in this role, and feed that back into the recruiting process.

Then finally, I might say, of the work that we do there are certain elements of the work, like scrutinizing complex cases that come in on paper, determining what additional, further medical evidence is needed that can only be done by individuals once they've been in the program for up to maybe a year. So it's really this time that we're seeing now as our new recruits that we've hired through the summer come in and get established to get more experienced that we'll start to see increases in productivity, but meaningfully, an increase in their capability to handle a wider range of cases.

Richard Montoni: Next question, please?

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 35

Operator: Thank you. Our next question comes from the line of Frank Sparacino from First Analysis. Please go ahead with your question.

Frank Sparacino: Hi guys. On the U.K. contract, Rick, I'm just trying to figure out from a—you know, worst case scenario perspective. You talked about stop-loss provision at 5% of allowable costs. Can you help U.S. think about that in terms of actual dollars, relative to your low end range that you talked about earlier, the $7 million?

Rick Nadeau: Sure. Stop-loss provision in the contract restricts our loss to 5% of allowable costs on the contract, plus any costs that we incur that are not billable under the contract in any contract year, meaning it's a contract-by-contract year calculation.

We—this contract has been disclosed at the approximately £595 million, which translates to a little bit more than $900 million, which puts the stop-loss then under the contract at something like $15 million per contractual year. When you factor in unbillables, we ran $5.5 million of unbillables on this contract during fiscal year '15, so that would give you a stop-loss that's around $20 million per contract year.

Now, our analysis indicates that we believe it is remote that we will trigger that stop-loss in either contract year one, which ends February 29, 2016, or contract year two.

Lisa Miles: Frank, do you have a follow-up?

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 36

Frank Sparacino: No. Thank you, guys.

Richard Montoni: You're welcome.

Lisa Miles: Thanks, Frank.

Richard Montoni: The next question, please?

Operator: Our next question comes from the line of Brian Kinstlinger from Maxim Group. Please go ahead.

Brian Kinstlinger: Great, thanks so much for taking my call. The first is, how many health care professionals do you have on that contract, the assessment contract right now, and what does the current workload require?

The follow-up—so, when I'm done with my questions, is, what was the impact to actually earnings? I know revenue, you said, and currency in the fourth quarter and how did it impact fiscal 2016 guidance and earnings, please? Thanks.

Richard Montoni: Brian, I think there are three questions there. Your first one is what's (audio interference) that we have or that we need, and then what's the current number of FTEs that we have? Then I think your third question is really the impact of currency on the consolidated results. Hold on a minute, Rick will answer the third one first and then we'll come back to Bruce on question one and two.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 37

Rick Nadeau: Yes, the currency impact on the full year was approximately $44 million of revenue and about $0.02 of earnings per share is what we calculated.

Bruce Caswell: I'll just state that, as a matter of client confidentiality, we can't actually speak to the detailed metrics in terms of the number of health care professionals that we have on board, but I would remind you that we feel like we've made very significant progress in expanding our supply chain of qualified health care professionals. I spoke a moment ago about the breadth of that supply chain. We've added recruiting partners and others, and we really feel like we've put a very solid number of new hires into the pipeline and they're now coming through, graduating and becoming productive. It's worth noting, like we said, that it takes individuals up to six to eight months to reach full productivity after they graduate, that's why we're seeing this lag in the uptake of production. But we feel that we're at the right rate for recruiting and we feel that we just need to keep it going for the foreseeable future.

Brian Kinstlinger: Thanks.

Richard Montoni: Brian, any follow-ups?

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 38

Brian Kinstlinger: No, that's it. Thank you.

Richard Montoni: You bet. Next question, please?

Operator: Thank you. Our final question for today comes from the line of Stephen Lynch from Wells Fargo. Please go ahead.

Stephen Lynch: Hey, thanks. I just wanted to ask about backlog coverage of guidance. It sounds like you have about 93% of fiscal '16 revenue guidance in the form of backlog or option periods. It looks like that's up from 90% coverage at this time last year, going into fiscal '15. Can you maybe talk a little bit about what's driving the difference there? Are there any differences in the underlying assumptions, maybe a bigger cushion for FX impact, or is this just normal course timing of contracts? That'd be great, thanks.

Richard Montoni: Yes, I think—I'm pleased that it's 93%. I've always felt that 90% seems to be, given our business model, Stephen, 90% seems to be a very comfortable number, and frankly I think it's a great business model when you've got 90% of next year's midpoint in the form of backlog. Glad to see it's 93% but we didn't change the way we measure it. It's measured in the same fashion. I might even put the additional 3%, which is nice, in the category of statistically within the same range. So I think it's very comparable and very solid as we enter next year.

Fiscal 2015 Fourth Quarter and Year-End Conference Call

November-12-2015

Confirmation

#13623294

Page 39

Stephen Lynch: Okay, thanks.

Lisa Miles: Stephen, did you have a follow-up to that?

Stephen Lynch: Nope, that's it for me. Thank you.

Richard Montoni: Well, that's the final question.

Lisa Miles: Thank you very much for joining us on today's conference call. Management will be available following this. Thank you.

Operator: Thank you, ladies and gentlemen. This does conclude our teleconference for today. You may now disconnect your lines at this time. Thank you for your participation and have a wonderful day.

Fiscal 2015 Fourth Quarter & Full Year Earnings Richard J. Nadeau Chief Financial Officer November 12, 2015

Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from the Company’s most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. Throughout this presentation, numbers may not add due to rounding. A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Revision to Fiscal Year 2016 Earnings Guidance •Earnings guidance revision is a result of a single program in start-up: U.K. Health Assessment Advisory Service −While we have made substantial progress in effecting positive change to program, the ramp-up to contract volume targets has been slower than originally planned −As a result, we now expect FY16 diluted EPS will range between $2.40 and $2.70 •FY16 earnings guidance includes a wide range of possible outcomes under this program: −Lower end of range assumes we continue to face challenges on achieving contractual volume targets −Upper end of range contemplates improved performance −Focused on delivering results that move us back toward upper end of $2.40 to $2.70 range •Firmly believe that the overall, macro-trends remain intact for our business; continue to see opportunities for our core services across all segments & geographies •Governments around the world continue to seek ways to run more effectively and efficiently, while at the same time, dealing with rising caseloads, changing demographics & unsustainable social program spend •Through a combination of short-term & long-term opportunities, we see continued growth for years to come

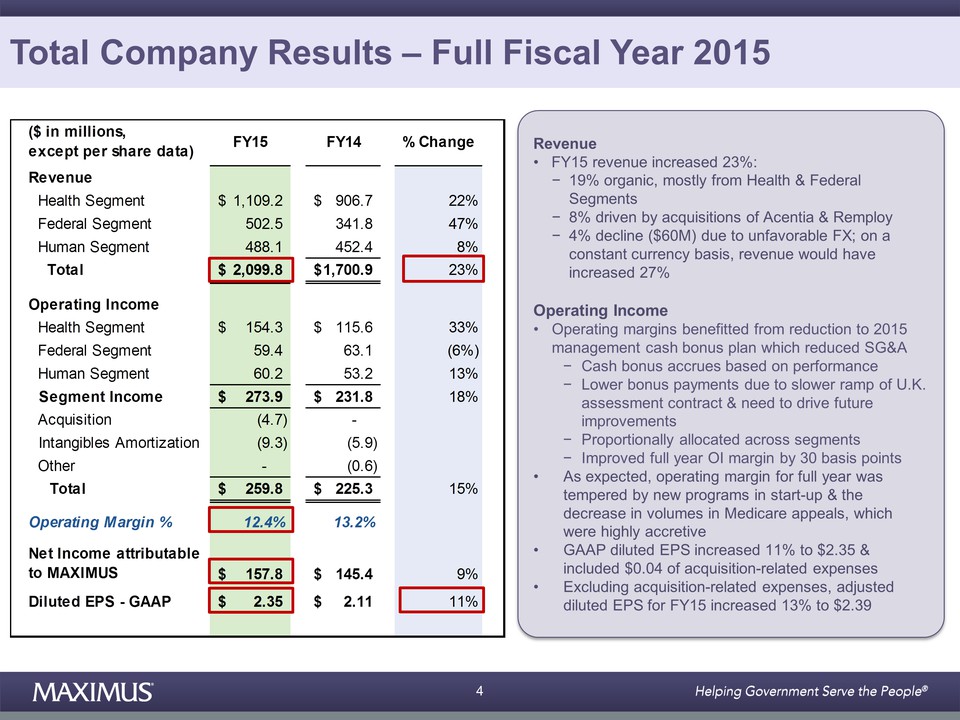

Revenue Health Segment $ 1,109.2 $ 906.7 22% Federal Segment 502.5 341.8 47% Human Segment 488.1 452.4 8% Total $ 2,099.8 $ 1,700.9 23% Operating Income Health Segment $ 154.3 $ 115.6 33% Federal Segment 59.4 63.1 (6%) Human Segment 60.2 53.2 13% Segment Income $ 273.9 $ 231.8 18% Acquisition (4.7) - Intangibles Amortization (9.3) (5.9) Other - (0.6) Total $ 259.8 $ 225.3 15% Operating Margin % 12.4% 13.2% Net Income attributable to MAXIMUS $ 157.8 $ 145.4 9% Diluted EPS - GAAP $ 2.35 $ 2.11 11% ($ in millions, except per share data) FY15 FY14 % Change Total Company Results – Full Fiscal Year 2015 Revenue • FY15 revenue increased 23%: − 19% organic, mostly from Health & Federal Segments − 8% driven by acquisitions of Acentia & Remploy − 4% decline ($60M) due to unfavorable FX; on a constant currency basis, revenue would have increased 27% Operating Income • Operating margins benefitted from reduction to 2015 management cash bonus plan which reduced SG&A − Cash bonus accrues based on performance − Lower bonus payments due to slower ramp of U.K. assessment contract & need to drive future improvements − Proportionally allocated across segments − Improved full year OI margin by 30 basis points • As expected, operating margin for full year was tempered by new programs in start-up & the decrease in volumes in Medicare appeals, which were highly accretive • GAAP diluted EPS increased 11% to $2.35 & included $0.04 of acquisition-related expenses • Excluding acquisition-related expenses, adjusted diluted EPS for FY15 increased 13% to $2.39

Revenue Health Segment $ 296.2 $ 230.5 29% Federal Segment 154.3 90.6 70% Human Segment 128.2 114.4 12% Total $ 578.7 $ 435.4 33% Operating Income Health Segment $ 30.5 $ 31.2 (2%) Federal Segment 20.9 12.2 71% Human Segment 13.4 9.9 35% Segment Income $ 64.8 $ 53.3 22% Acquisition (0.2) - Intangibles Amortization (3.2) (1.5) Other 0.1 - Total $ 61.5 $ 51.8 19% Operating Margin % 10.6% 11.9% Net Income attributable to MAXIMUS $ 35.4 $ 36.2 (2%) Diluted EPS - GAAP $ 0.53 $ 0.53 0% ($ in millions, except per share data) Q4 FY15 Q4 FY14 % Change Total Company Results – Fourth Quarter of FY 2015 Revenue • Q4 revenue grew 33%: − 22% organic growth − 16% from acquisitions of Acentia & Remploy − 5% decline ($21M) due to unfavorable FX; on a constant currency basis, revenue would have grown 38% • Q4 revenue slightly lower-than-expected principally due to U.K. assessment contract Operating Income • Bonus adjustment provided margin improvement of approx.100 basis points • Q4 operating margin was was tempered by new programs in start-up, including jobactive in Australia & the U.K. assessment contract • Tax rate of 40.4% & Q4 diluted EPS of $0.53

Revenue Health Services $ 296.2 $ 230.5 29% $ 1,109.2 $ 906.7 22% Operating Income Health Services $ 30.5 $ 31.2 (2%) $ 154.3 $ 115.6 33% Operating Margin % 10.3% 13.5% 13.9% 12.7% ($ in millions) Q4 FY15 Q4 FY14 % Change FY15 FY14 % Change Health Services Segment Revenue • Another solid year of strong top-line growth, driven by new work & expansion of existing contracts • All growth in segment was organic Operating Income & Margin • As expected, operating margins were tempered by new programs in start-up, most notably U.K. assessment contract U.K. Health Assessment Advisory Service Contract • Delivered approximately $105M in revenue & an operating loss of $4M • Revenue short of initial projected revenue range of $140M – $165M; shortfall has two elements: 1. Staffing levels running lower than our plan; therefore billable costs are lower than forecast; as a result, revenue & operating income are lower on the cost-reimbursable piece of the contract 2. We are not achieving certain performance metrics, most notably volume targets; as a result, we are not earning performance-based incentive fees • We are firmly committed to getting the program on track & have made significant progress in bringing positive improvements to the overall service

Revenue U.S. Federal Services $ 154.3 $ 90.6 70% $ 502.5 $ 341.8 47% Operating Income U.S. Federal Services $ 20.9 $ 12.2 71% $ 59.4 $ 63.1 (6%) Operating Margin % 13.5% 13.5% 11.8% 18.5% ($ in millions) Q4 FY15 Q4 FY14 % Change FY15 FY14 % Change U.S. Federal Services Segment Revenue • U.S. Federal Services Segment had a solid year • Q4 revenue increased 70% & 56% was attributable to Acentia • FY15 revenue grew 47% compared to last year − 30% was attributable to Acentia acquisition − 17% was organic growth from new work & expansion of existing contracts Operating Income & Margin • Q4 & FY15 operating margins impacted by expected decline in highly accretive Medicare appeals volumes • We had steady improvements throughout the fiscal year from ramp up of Department of Education contract, which remains on track to break even in FY16; this helped the year-over-year comparisons in Q4 FY15

Revenue Human Services $ 128.2 $ 114.4 12% $ 488.1 $ 452.4 8% Operating Income Human Services $ 13.4 $ 9.9 35% $ 60.2 $ 53.2 13% Operating Margin % 10.4% 8.7% 12.3% 11.7% ($ in millions) Q4 FY15 Q4 FY14 % Change FY15 FY14 % Change Human Services Segment Revenue • Top-line increases driven by acquisition of Remploy & solid organic growth – offset by unfavorable impact from foreign currency translations • Segment was the most adversely impacted by foreign currency exchange rates, which reduced full year revenue by approximately $37M • On a constant currency basis, revenue would have grown 23% in Q4 & 16% for FY15 Operating Income & Margin • Margin expansion was principally due to solid delivery across North America, the United Kingdom & Saudi Arabia. This was offset by expected start-up losses in jobactive contract, which launched on July 1, 2015

Cash Flows & Balance Sheet Reconciliation to free cash flow can be found in financial tables in the Q4 FY15 earnings press release. $ in millions Q4 FY15 FY15 Cash provided by operating activities $25.2 $206.2 Cash paid for property, equipment and capitalized software ($32.0) ($105.1) Free cash flow ($6.7)* $101.1 •Balance sheet remains healthy and ended FY15 with cash and cash equivalents totaling $74.7M, most of which was outside the U.S. •Long-term cash deployment priorities remain unchanged: •Dividends •Opportunistic share buybacks •Working capital investments to support growth in the business •Acquisitions •Days Sales Outstanding were 67 days for Q4 & in-line with our targeted range of 65 to 80 days *Does not add due to rounding

Share Repurchases & Other Uses of Cash •Approximately $162.5M remaining for repurchases under Board-authorized program Uses of Cash •Believe we can sufficiently address our cash needs in 2016 •Currently expect that spending on capital expenditures will decrease significantly in FY16 •Committed to sensible & practical uses of cash in order to best position & grow the business •Priority remains squarely focused on strengthening core business for long-term growth Period Approximate Number of Shares Purchase Amount Weighted Average Price Q4 FY15 865,000 $52.2M $60.20 Fiscal 2015 1,600,000 $82.8M $51.11 Subsequent to 9/30/15 103,000 $6.1M $59.41 Share Repurchases

Establishing Formal FY16 Guidance Fiscal 2016 Guidance Revenue $2.4B - $2.5B Diluted EPS $2.40 - $2.70 •Revenue range between $2.4B & $2.5B driven by growth across all segments, predominantly in Health & U.S. Federal Services, & to a lesser extent, Human Services •At September 30, 2015, we had $4.6B in backlog •Based on mid-point of our FY16 revenue guidance range, we estimate that approx. 93% of our forecasted FY16 revenue is already in the form of backlog or option periods •Now expect diluted earnings per share to range between $2.40 & $2.70; expected to be back-end loaded •Expect that Q1 FY16 diluted EPS will be lower compared to Q4 FY15 due to programs in start-up Cash provided from operating activities $200M - $230M Free cash flow $130M - $160M

Reason for the reduced FY16 earnings guidance is the slower ramp & resulting lower operating income contribution of U.K assessment contract. Guidance assumes a wide range of potential outcomes on this contract. •Contract also has a stop loss provision that restricts loss to 5% of allowable costs – plus any costs incurred that are not billable under the contract in any contract year •Our analyses indicate it is remote that we will trigger stop loss in contract year one (which ends 02/29/16) or contract year two 2. Other programs in start-up that will continue to have a tempering impact in FY16, including: •Australian jobactive •U.S. Department of Education •U.K. Fit for Work 3. Guidance is always subject to any fluctuations in foreign currency exchange rates 4. Estimated tax rate for FY16 will range between 37% and 39%; final tax rate will ultimately depend on mix of operating income contribution from our various tax jurisdictions Forecast for FY16 compared to FY 15 •Revenue growth between 14% and 19% •GAAP-basis earnings growth between 2% and 15% FY16 Guidance Data Points

Fiscal 2015 Fourth Quarter & Full Year Earnings Richard Montoni Chief Executive Officer November 12, 2015

Introduction •Challenges we face with U.K. assessment contract result in a reduced earnings outlook for FY16; this is a single contract in our global portfolio •Over past twelve months, introduced several new growth platforms that strengthened our position for future opportunities in key markets •Macro trends that drive demand for our services at global level remain very favorable Topics for today: •U.K. Health Assessment Advisory Service (HAAS) contract −Challenges today −Addressing those challenges −Improvements already made to the overall service •Updates −Acentia integration −Third ACA Open Enrollment period (OE3) −New awards, pipeline & rebids •Closing −Commitment to solid growth delivery in FY16

Three Main Challenges Today Falling short of achieving initial volume targets; ability to hit targets is tied to three areas: 1.Number of Health Care Professionals (HCPs) we recruit 2.Number of HCPs that complete training & graduate 3.Productivity of these new HCP recruits Three Main Challenges With HAAS Today Program Background Conduct assessments for individuals seeking certain disability benefits. Program faced significant criticism under previous provider. At contract takeover in March 2015, we said it would take time to meaningfully improve program. Hybrid contract – predominantly cost-reimbursable, with significant performance incentives; the largest is volumes Getting the Program Better Aligned With Contractual Targets •Need to have the right number of qualified HCPs – that goal hasn’t changed •What has changed is amount of time it is taking to recruit, graduate & ramp up new staff •Confident that we can achieve our goals over time •Modified forecasts to account for slower-than-expected staffing ramp •Believe staffing resources will be in place to meet volume demand & contractual targets by end of summer 2016

Productivity •Once new staff begin performing assessments, there is a learning curve; may take them 6-8 months to achieve full productivity levels •In the meantime, have efforts underway to increase productivity with our current workforce: −Optimized work schedules of our staff & offered voluntary overtime incentives – including weekend shifts – to increase number of assessments completed each day Efforts had direct influence on our ability to reduce the significant backlog inherited at the time of contract takeover. 2. Training & Support •Candidates must complete rigorous training, pass a series of competency tests, & graduate to become fully accredited •To increase graduation rates, we have some key initiatives underway: −Increased engagement & coaching with new candidates during entire training period. −Working with recruits who struggle with initial competency tests & providing individualized training support Yielding results by keeping more candidates in the process; with the extra support, we expect more candidates will graduate. 1. Recruitment •Launched comprehensive recruitment campaign to ensure continued flow of qualified candidates •Expanded network of recruitment partners •Enhanced employee referral program •Implemented advertising & social media campaign •New recruitment portal website •Exhibiting at recruitment fairs across the country Through these efforts, we have seen a sizable uptick in the number of new recruits. Remedies to Address Three Main HAAS Challenges Increased recruiting efforts, supplemented by enhanced training & optimization of current workforce, will help increase productivity, meet volume targets, and reduce wait times over the coming months.

Meaningful Progress on Program Improvements Enhanced Stakeholder Engagement: Customer Representative Group •Representatives from 25+ nonprofits & disability advocacy groups; group provides practical feedback that we incorporate to areas such as clinical training, assessment interview, facilities & customer communications Reduced Backlog: Top Priority for Department for Work and Pensions •At time of contract takeover, inherited significant caseload of 550,000+ outstanding assessments •Today – eliminated more than a third of backlog & making concerted progress to continue to reduce backlog of cases & shorten wait times Improved Customer Experience: Increased Engagement Levels •Refreshed & rolled out enhanced program engagement materials •User-friendly website with multi-media content •Updating customer-facing materials to make them easier to understand •Usability testing showed that 96% of testers reported positively •Launched new help-line to assist customers with pre-assessment forms & provide practical support on types of medical evidence that may be required •Piloting text messaging to prompt customers to complete certain tasks & remind them of upcoming appointments; nationwide roll-out in coming weeks

Recognition of HAAS Improvements Accomplishments Have Not Gone Unnoticed •During a public Work and Pensions Select Committee meeting, several government officials praised our recruiting plan & efforts to work through backlog •Confirmation of our effective working relationship with DWP & our belief that we are the right company to bring about improvements to this highly visible program Moving Forward •Making meaningful improvements •Progress remains short of initial targets & original projections for operating income •This is a single contract with an operating income ramp that’s now pushed to the right •Continue to make strides forward; not a matter of loss mitigation, but rather on bringing start-up to mature operation levels & delivering normalized operating income contribution

Demonstrated Results With Start-Up Challenges •Start-ups are the nature of our business •New programs are the best avenue to create substantial, long-term shareholder value •Growing pains are normal during the early days •Difficult to predict pace at which start-ups move to maturity •Past turn around successes in British Columbia & Texas: −Took time, resources & a significant level of effort to implement many changes needed to turn these programs around −Are now flagship contracts that have delivered meaningful shareholder value We believe the U.K. assessment contract will drive long-term significant shareholder value – it will just take longer than originally planned.