Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - MAXIMUS, INC. | a2226564zex-21_1.htm |

| EX-31.2 - EX-31.2 - MAXIMUS, INC. | a2226564zex-31_2.htm |

| EX-99.1 - EX-99.1 - MAXIMUS, INC. | a2226564zex-99_1.htm |

| EX-10.6 - EX-10.6 - MAXIMUS, INC. | a2226564zex-10_6.htm |

| EX-32.2 - EX-32.2 - MAXIMUS, INC. | a2226564zex-32_2.htm |

| EX-31.1 - EX-31.1 - MAXIMUS, INC. | a2226564zex-31_1.htm |

| EX-32.1 - EX-32.1 - MAXIMUS, INC. | a2226564zex-32_1.htm |

| EX-23.1 - EX-23.1 - MAXIMUS, INC. | a2226564zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. Financial Statements and Supplementary Data.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2015

Commission file number: 1-12997

MAXIMUS, INC.

(Exact name of registrant as specified in its charter)

| Virginia (State or other jurisdiction of incorporation or organization) |

54-1000588 (I.R.S. Employer Identification No.) |

|

1891 Metro Center Drive, Reston, Virginia (Address of principal executive offices) |

20190 (Zip Code) |

Registrant's telephone number, including area code: (703) 251-8500

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, no par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of outstanding voting stock held by non-affiliates of the registrant as of March 31, 2015 was $4,308,922,065 based on the last reported sale price of the registrant's Common Stock on The New York Stock Exchange as of the close of business on that day.

There were 65,334,671 shares of the registrant's Common Stock outstanding as of November 6, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for its 2016 Annual Meeting of Shareholders to be held on March 16, 2016, which definitive Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the end of the registrant's fiscal year, are incorporated by reference into Part III of this Form 10-K.

MAXIMUS, Inc.

Form 10-K

September 30, 2015

Table of Contents

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Included in this Annual Report on Form 10-K are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, estimates, forecasts and projections about our Company, the industry in which we operate and other matters, as well as management's beliefs and assumptions and other statements that are not historical facts. Words such as "anticipate," "believe," "could," "expect," "estimate," "intend," "may," "opportunity," "plan," "potential," "project," "should," "will" and similar expressions are intended to identify forward-looking statements and convey uncertainty of future events or outcomes. These statements are not guarantees and involve risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from such forward-looking statements due to a number of factors, including without limitation:

- •

- a failure to meet performance requirements in our contracts, which might lead to contract termination and liquidated damages;

- •

- the outcome of reviews or audits, which might result in financial penalties and reduce our ability to respond to invitations for new

work;

- •

- the effects of future legislative or government budgetary and spending changes;

- •

- difficulties in integrating acquired businesses;

- •

- a failure to comply with laws governing our business, which might result in the Company being subject to fines, penalties and other

sanctions;

- •

- our failure to successfully bid for and accurately price contracts to generate our desired profit;

- •

- our ability to maintain relationships with key government entities from whom a substantial portion of our revenue is derived;

- •

- the ability of government customers to terminate contracts on short notice, with or without cause;

- •

- our ability to manage capital investments and start-up costs incurred before receiving related contract payments;

- •

- our ability to maintain technology systems and otherwise protect confidential or protected information;

- •

- the costs and outcome of litigation;

- •

- matters related to business we have disposed of or divested; and

- •

- other factors set forth in Exhibit 99.1 of this Annual Report on Form 10-K under the caption "Special Considerations and Risk Factors."

As a result of these and other factors, our past financial performance should not be relied on as an indication of future performance. Additionally, we caution investors not to place undue reliance on any forward-looking statements as these statements speak only as of the date when made. Except as otherwise required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether resulting from new information, future events or otherwise.

3

Throughout this annual report, the terms "MAXIMUS," "Company," "we," "our" and "us" refer to MAXIMUS, Inc. and its subsidiaries.

General

We provide business process services (BPS) to government health and human services agencies under our mission of Helping Government Serve the People.® We are one of the largest pure-play health and human services BPS providers to governments in the United States, the United Kingdom, Australia, Canada, Saudi Arabia and New Zealand. We use our experience, business process management expertise and advanced technological solutions to help government agencies run efficient and cost-effective programs. Our solutions improve program accountability and outcomes, while enhancing the quality of services provided to program beneficiaries.

Over the past five years, our revenue and earnings have grown primarily as a result of demographic, economic and legislative trends. These trends drive demand for services from providers, such as MAXIMUS, who can provide efficient and cost-effective solutions to problems, including:

- •

- A need for governments to manage budgets in the face of increasing demands for social services;

- •

- Aging populations that place a greater strain on health care and welfare systems;

- •

- A global demand for social services that are based upon measurable outcomes; and

- •

- Legislative initiatives, such as the Affordable Care Act (ACA) or welfare reform efforts in the U.K., which require the implementation of new services and new programs.

With our proven track record and expertise, we are in a strong position to provide these services. We believe that we bring the right combination of people, business processes and technology to deliver the best-value solution to governments. Our success has allowed us to gain market share in the areas in which we operate. As a result, we are:

- •

- The largest provider of Medicaid enrollment and the Children's Health Insurance Program (CHIP) services in the U.S.;

- •

- A leading operator of U.S. health insurance exchange customer contact centers, with services provided to six entities operating

state-based exchanges and a customer contact center for the federal marketplace;

- •

- The largest provider of government-sponsored health benefit appeals and assessments in the U.S. and the U.K.;

- •

- One of the largest providers of occupational health services in the U.K.;

- •

- One of the largest providers of disability and long-term sick support services in the U.K.; and

- •

- An established provider of welfare-to-work services throughout all of our geographies, including the U.S., the U.K., Australia, Canada, Saudi Arabia and New Zealand.

We also pursue selective acquisitions to enhance and expand our offerings or geographic presence.

- •

- In 2015, we acquired Acentia, LLC (Acentia), a provider of system modernization, software development, program management and

other information technology services to the U.S. Federal Government.

- •

- In 2015, we acquired Remploy, a leading provider of disability employment services in the U.K.

4

- •

- In 2013, we acquired Health Management Limited, a leading provider of independent medical assessments in the U.K.

- •

- In 2012, we acquired Policy Studies, Inc., a provider of health and human services operations in the U.S.

Much of our revenue is derived from long-term contractual arrangements with governments. Base contracts are typically three to five years and often have additional option periods, which provide good visibility in terms of predicting revenue. Most of our contracts are related to programs that are long-term in nature, such as Medicaid, Medicare, Social Security, the ACA and long-term employment support programs. Our client relationships are frequently decades long.

Our business segments

The Company is organized and managed based on the services we provide.

As our business changes, we revise our internal reporting and the manner in which our Chief Executive Officer operates and reviews the results of our business. This reporting forms the basis for our external reporting of our business segments. During the fourth quarter of fiscal year 2015, we revised our reporting structure to accommodate three business segments, adding a U.S. Federal Services Segment that comprises the work we perform for the U.S. Federal Government, as well as some U.S.-based appeals work. The businesses within this new segment were previously included within our Health Services Segment and include the results of the businesses acquired with Acentia in April 2015. We made these changes to our operations and internal reporting due to our acknowledgement that the U.S. Federal Government is a distinct customer with different procurement methods and regulations, the scale of our business with the U.S. Federal Government and the growth of our federal business from a primarily health-focused business to a broader business covering several federal agencies.

For more information on our segment presentation, including comparative revenue, gross profit, operating profit, identifiable assets and related financial information for the 2015, 2014 and 2013 fiscal years, see "Note 2. Business segments" within Item 8 of this Annual Report on Form 10-K, which we incorporate by reference herein.

Health Services Segment

Our Health Services Segment generated 53% of our total revenue in fiscal year 2015.

The Health Services Segment provides a variety of business process services, as well as related consulting services, for state, provincial and national government programs. These programs include Medicaid, CHIP and the ACA in the U.S., Health Insurance BC (British Columbia) in Canada, and the Health Assessment Advisory Service (HAAS) and Fit for Work Service in the U.K. The Segment's services help people access, navigate and use health benefit and other government programs. The Segment also helps governments engage with program recipients, while at the same time helping them to improve the efficiency, cost effectiveness, quality and accountability of their health and disability benefits programs.

Our comprehensive administrative and program operations services for government health benefits programs include:

- •

- Health insurance exchange customer contact center operations and support services;

- •

- Health insurance program eligibility and enrollment services to help beneficiaries make the best choice for their health insurance coverage and improve their access to health care;

5

- •

- Beneficiary outreach and education—including multilingual customer contact centers and multi-channel self-service options,

such as Web-based portals—for easy enrollment;

- •

- Application assistance and independent health plan enrollment counseling to beneficiaries;

- •

- Premium payment processing and administration, such as invoicing and reconciliation;

- •

- Health plan oversight; and

- •

- Comprehensive eHealth solutions with the Medigent® product suite.

Our independent health review services include:

- •

- Independent disability, long-term sick and other health assessments; and

- •

- Occupational health clinical assessments.

Our consulting services include:

- •

- Medicaid Management Information System (MMIS) planning, oversight and consulting services; and

- •

- Specialized program consulting services.

The Health Services Segment may experience seasonality due to transaction-based work, such as program open enrollment periods and activity related to contract life cycles. Most notably, the Segment may experience revenue and margin fluctuations associated with the ACA, which provides an open enrollment period that begins in our first fiscal quarter and extends into our second fiscal quarter. The exact dates may be subject to change by the U.S. Federal Government. During the first quarter of our fiscal year, reductions in working days due to holidays and vacations may also impact our sales and accounts receivable, but the effect is generally not significant.

U.S. Federal Services Segment

Our U.S. Federal Services Segment generated 24% of our total revenue in fiscal year 2015.

The U.S. Federal Services Segment provides business process services and program management for large government programs, independent health review and appeals services for both the U.S. Federal Government and similar state-based programs and technology solutions for civilian federal programs.

In this Segment, our comprehensive government program administration services include:

- •

- Centralized customer contact centers and support services;

- •

- Documents and records management; and

- •

- Case management, citizen engagement and consumer education.

Our independent health review services include:

- •

- Independent medical reviews and worker's compensation benefit appeals;

- •

- Health benefit appeals; and

- •

- Eligibility appeals.

Our technology solutions include:

- •

- Modernization of systems and IT infrastructure;

- •

- Infrastructure operations and support;

6

- •

- Software development, operations and management; and

- •

- Data analytics.

The U.S. Federal Services Segment is not expected to experience seasonality related to its programs. However, it may experience fluctuations as a result of program maturity including lower revenue and profitability related to transaction or performance based-contracts during program start-up. Some of the contracts may also be structured as cost-reimbursable, which typically carry the lowest level of risk but also carry lower levels of operating margin.

Human Services Segment

Our Human Services Segment generated 23% of our total revenue in fiscal year 2015.

The Human Services Segment provides national, state and local human services agencies with a variety of business process services and related consulting services for government programs. These programs include welfare-to-work, child support, higher education and K-12 special education. The Segment's services include:

- •

- Comprehensive welfare-to-work services to help disadvantaged individuals transition from government assistance programs to sustainable

employment and economic independence, including eligibility determination, case management, job-readiness preparation, job search and employer outreach, job retention and career advancement, and

selected educational and training services;

- •

- Full and specialized child support case management services, customer contact center operations, and program and systems consulting

services;

- •

- Management tools and professional consulting services for higher education institutions;

- •

- K-12 special education case management solutions;

- •

- Program consulting services, including independent verification and validation, cost allocation plans and other specialized consulting

offerings; and

- •

- Tax credit and employer services.

The Human Services Segment is not expected to experience seasonality related to its programs.

Geographic Information

We operate in the U.S., the U.K., Australia, Canada, Saudi Arabia and New Zealand. The distribution of revenue and assets across geographies are included in "Note 2. Business Segments" within Item 8 of this Annual Report on Form 10-K.

Market overview

We expect that demand for our core offerings will continue to increase over the next few years. This is driven principally by macro trends such as new legislation, an increasing interest by governments to implement outcomes-based programs, austerity measures and increasing caseloads, as governments strive to deliver more services with fewer resources. Health and welfare reform initiatives have created increased demand for our services, a trend we expect to continue over the next several years. In addition, we believe there is an increasing propensity by certain governments to use public-private partnerships and seek help from firms like MAXIMUS as a means to run more effective and efficient programs. We believe that we remain well-positioned to benefit from this increasing demand.

7

Demand for our services is contingent upon factors that affect governments, including:

- •

- The need for governments to deliver efficient, cost-effective services to program beneficiaries while meeting legal requirements and

achieving programmatic goals and value for funds spent on social benefits programs;

- •

- The requirement of U.S. state governments to implement federal initiatives and qualify for federal matching funds;

- •

- The impact of continued budgetary pressures, which result in governments having to operate more programs with the same level of

resources and/or implement cost-control measures;

- •

- The increased demand for social benefits programs as a result of rising caseloads and demographic trends in many developed countries;

and

- •

- The need to improve business processes, push innovations, and update technology for public programs as governments seek outside sources of support to gain needed expertise or to address trends as more public workers become eligible for retirement.

As a result, governments hire companies like MAXIMUS to help them deliver innovative, efficient and cost-effective services to beneficiaries on their behalf. We possess the knowledge and resources to operate government health and human programs efficiently and to engage with program beneficiaries, while maintaining the service levels and achieving the outcomes demanded by our clients. With the ability to balance resources with demand, we also offer the flexibility and scalability that governments do not always possess.

Health Services Market Environment

Over the past decade, health care costs have risen substantially, and this trend is expected to continue. For example, U.S. health care spending, among the highest of all industrialized countries, is increasing at a rate that outpaces inflation and national income growth. Stemming these costs, as well as improving quality and access to health care, is a major policy priority for governments. Governments seek efficient and cost-effective solutions to manage their public health programs. This includes programs meant to support individuals with disabilities and long-term medical conditions, as well as individuals with shorter-term health conditions.

Outside the U.S., many governments are seeking partners to help them manage, administer or operate their social benefits programs. Countries like the U.K. are examining how public health relates to productivity, cost reduction and economic growth. The U.K. Government provides a range of social welfare benefits for people who are unable to work as a result of a disability, long-term illness or other health condition. For individuals with long-term sickness or disabilities, the government requires an independent health assessment provided by a vendor through the Health Assessment Advisory Service to determine an individual's level of benefits. For individuals with shorter-term health conditions, the Government requires an occupational health assessment and general health and work advice provided by a vendor partner through the Fit for Work Service to assist employees referred by employers and general practitioners with a wellness and return-to-work plan. We believe there is continued market demand to conduct independent assessments for participants in public benefit programs and to support employers and their employees through our commercial occupational health services.

In the U.S., as a result of Medicaid expansion and the ACA, many states have made program changes. These changes have occurred most notably through benefit changes and the expansion of managed care to new populations that have historically been served through fee-for-service Medicaid or are now eligible for coverage through the new ACA health insurance exchanges.

8

The ACA expanded access to health coverage primarily through insurance subsidies and Medicaid expansion. States are not required to expand their Medicaid programs, but the Congressional Budget Office estimates that most will expand coverage over the next several years. The Kaiser Family Foundation also estimates that 30 states and the District of Columbia have already expanded Medicaid. The ACA also extends CHIP through 2019, provides increased matching federal funds and guarantees funding through 2015. We currently serve as the administrative vendor for CHIP in six states.

In 2015, certain states and the District of Columbia operated their own exchanges. Other states participate in a partnership model or have opted to use the federal exchange. We currently operate customer contact centers for the District of Columbia and five state-based exchanges, as well as a customer contact center as a subcontractor for the federal marketplace. In 2017, states will have access to the State Innovation Waivers, also known as the 1332 Waivers, which give states the most comprehensive and flexible framework for best using federal funding for their public health insurance programs. As a result, we believe that these waivers may create a more palatable path for additional states to contemplate a shift to a state-based exchange or partnership model over the coming years.

We believe the current health market environment positions us to benefit from continued demand across all of our geographies from service areas such as operations program management and health assessments. Overall, we expect the underlying demand for our services to increase over the next several years.

U.S. Federal Services Market Environment

The U.S. federal market continues to see modest growth after several years of uncertainty due primarily to political struggles around the federal budget and the subsequent reduction of agency budgets. The overall 2016 federal budget for information technology (IT) spend is expected to grow by 1.8 percent while the projected budget for federal IT services shows 2 percent growth.

Through our acquisition of Acentia, we are now a full-service provider of business process services and technology to the U.S. Federal Government. The acquisition also provided 12 new contract vehicles that give us the opportunity to bid on task orders that we were previously unable to bid as a prime contractor. We also have access to new federal agencies, as well as the ability to expand our current portfolio of work with agencies where both companies have existing relationships. Our expanded capabilities allow us to more comprehensively address many of the challenges faced by federal agencies today.

While federal agency budgets still face fiscal pressures, we continue to see opportunities to apply our cost-effective and efficient solutions in the federal market. Federal agencies are tasked with cost-effectively managing programs at a time when changing demographics are leading to rising caseloads in many federal programs, such as Medicare where MAXIMUS provides conflict-free reviews of appeals.

Many federal agencies must also address the maintenance of legacy systems—and the pressing need for infrastructure as IT modernization continues to grow. Legacy processes and systems are fundamental to government operations, yet they are unsustainably expensive to operate in an environment that requires online agility and rapid response to new demands, requirements and global challenges. We are in a prime position to help agencies modernize and operate their mission-critical systems.

9

The implementation of the ACA also continues to impact the federal landscape. The ACA requires an independent, evidence-based external review process and the option for individuals to appeal coverage determinations or claims to insurance companies. We are presently managing the eligibility appeals process for the Federally Facilitated Marketplace and we are one of the largest providers of evidence-based health insurance appeals to Medicare and 48 state agencies. Other key factors that will likely impact the U.S. federal market include a variety of political, economic, social and technological issues:

- •

- A focus on the citizen experience and citizen services, as well as digital services;

- •

- Legacy to modernization through case management;

- •

- Agencies moving from transformation initiatives to operations and maintenance;

- •

- Agencies seeking consolidation and shared services to achieve cost efficiencies;

- •

- Changes in the acquisition and contracting environment, including consolidation of GSA schedules; and

- •

- Limited program and procurement activity ahead of the November 2016 Presidential Election.

Human Services Market Environment

The Human Services market has experienced increased demand driven by the need for governments to reduce costs and improve efficiency of certain social benefits programs. The most dynamic portion of the market is in the welfare-to-work arena where governments worldwide seek program reform as an important component of comprehensive fiscal austerity measures. Certain governments are modeling new welfare reforms after established programs in Australia, the U.K. and the U.S. Variations of these models, with which we have a substantial amount of experience, knowledge and expertise, are being emulated around the world through public-private partnerships, with MAXIMUS being a leading provider. However, the re-engineering of well-established programs like these may take years to adapt to new program models from conceptualization to implementation.

We believe we are well-positioned to compete for these global welfare-to-work opportunities because of our established presence, strong brand recognition, and ability to achieve the requisite performance requirements and outcomes outlined in the new reform measures. We offer clients demonstrated results and decades of proven experience in administering welfare-to-work programs in several states and countries.

We provide comprehensive welfare-to-work case management services throughout the U.S., the U.K., Australia, Canada, Saudi Arabia and New Zealand. In Australia, we are one of the largest and highest rated welfare-to-work providers, with more than 250 locations nationwide. We also have an established presence in the U.K.'s welfare-to-work market and presently provide employment and job training services under the Work Programme, a key component of the coalition government's austerity plan to rein in costly benefits programs and reduce mounting debt.

Through our acquisition of Remploy in the U.K., we have increased our presence in the disability employment services market where we support people with disabilities and health conditions into mainstream employment. We believe these services are transferrable to our other geographies and position us well for emerging trends in the disability services market.

In addition to welfare reform, we have seen an increase in initiatives to use private firms for children's services, such as family maintenance and child support. We currently provide services to the Family Maintenance Enforcement Program in British Columbia, as well as several jurisdictions throughout the U.S., including Shelby County, Tennessee and Baltimore, Maryland, two of the largest child support privatization efforts in the nation.

10

We believe ongoing reform initiatives and measures to reduce costs and improve efficiencies, combined with our outstanding performance, expertise and proven solutions, will continue to drive demand for our core services across multiple geographies.

Our growth strategy

Our goal is to enable future growth by remaining a leading provider of BPS and consulting services to government agencies. The key components of our business growth strategy include the following:

Pursue new business opportunities and expand our customer base. With 40 years of business expertise in the government market, we continue to be a leader in developing innovative solutions to meet the evolving needs of government agencies. We seek to grow our businesses by leveraging our existing core capabilities, consistently delivering the required outcomes for governments to achieve program goals, and pursuing opportunities with new and current clients.

Grow long-term, recurring revenue streams. We seek to enter into long-term relationships with clients to meet their ongoing objectives. As a result, long-term contracts (three to five years with additional option years) are often the preferred method of delivery for customers and provide us with predictable recurring revenue streams. We believe an incumbent has a considerable advantage in recompetes and that customer relationships can last for decades.

Pursue strategic acquisitions. We will selectively identify and pursue strategic acquisitions. Acquisitions can provide us with a rapid and cost-effective method to enhance our services. This includes obtaining additional skill sets, increasing our access to contract vehicles, expanding our customer base, cross-selling additional services, enhancing our technical capabilities, and establishing or expanding our geographic presence.

Continue to optimize our current operations to drive innovation and quality to customers. We continue to seek efficiencies and optimize operations in order to achieve sustainable, profitable growth. We will continue to deliver quality BPS to government clients to improve the cost effectiveness, efficiency and scalability of their programs as they deal with rising demand and increasing caseloads.

Recruit and retain highly skilled professionals. We continually strive to recruit motivated individuals, including top managers from larger organizations, former government officials, consultants experienced in our service areas and recent college graduates with degrees aligned with our mission, such as degrees in government policy and administration. We believe we can continue to attract and retain experienced and educated personnel by capitalizing on our focused market approach and our reputation as a premier government services provider.

Focus on core health, U.S. federal civilian and human services business lines. We have centered our core business offerings on delivering BPS to government health and human services agencies as well as to other civilian agencies within the U.S. Federal Government. Our market focus and established presence positions us to benefit from health care and welfare reform initiatives both in the U.S. and internationally.

See Exhibit 99.1 of this Annual Report on Form 10-K under the caption "Special Considerations and Risk Factors" for information on risks and uncertainties that could affect our business growth strategy.

11

Competitive advantages

We offer a private sector alternative for the operation and management of critical government-funded health and human services programs. Our reputation and extensive experience give us a competitive advantage as governments value the level of expertise, proven delivery and brand recognition that we bring our customers. The following are the competitive advantages that allow us to capitalize on various market opportunities:

Proven track record, ability to deliver outcomes and exceptional brand recognition. We assist governments in delivering cost-effective services to beneficiaries of government programs. We run large-scale program management operations on behalf of government agencies, improving the quality of services provided to their beneficiaries and achieving the necessary outcomes to help them cost-effectively meet their program goals. This has further enhanced our brand recognition as a proven partner with government agencies.

Subject matter expertise. Our workforce includes many individuals who possess substantial subject matter expertise in areas critical to the successful design, implementation, administration and operation of government health and human services programs. Many of our employees have worked for governments in management positions and can offer insights into how we can best provide valuable, practical and effective services to our clients.

Intellectual property that supports the administration of government programs. We have proprietary solutions to address client requirements in our market that are configurable or provide a platform that can be transferred to meet contractual needs. We leverage commercial off-the-shelf platforms across multiple contracts in which we have considerable expertise to ensure we can deploy repeatable proven solutions. We also leverage software development methodology to shorten software development cycles. Extensive use of shared infrastructure and standard solutions provides considerable price and quality advantages. Management believes our extensive industry focus and expertise embedded in our systems and processes provide us with a competitive advantage.

Flexibility and scalability. We are experienced in launching large-scale operations under compressed time frames. We offer clients the flexibility and scalability to deliver the people, processes and technology to complete short- and long-term contractual assignments in the most efficient and cost-effective manner.

Financial strength. We maintain a strong balance sheet, generate consistent annual cash flow, and have access to a $400 million revolving credit facility. We possess the financial strength to ensure clients can confidently trust us to safely operate their high-profile public health and human services programs.

Focused portfolio of services. We are one of the largest publicly traded companies that provides a portfolio of BPS specifically to government customers. Our government program expertise and proven ability to deliver defined, measurable outcomes differentiate us from other firms and non-profit organizations. This includes large consulting firms that serve multiple industries and lack the focus necessary to manage the complexities of serving government agencies efficiently.

Established presence outside the United States. Governments outside the U.S. are seeking to improve government-sponsored health and human services programs, manage increasing caseloads, and contain costs. We have an established presence in the U.K., Australia, Canada, Saudi Arabia and New Zealand. Our international efforts are focused on delivering cost effective welfare-to-work and health benefits services to program participants on behalf of governments.

12

Expertise in competitive bidding. Government agencies typically award contracts through a comprehensive, complex and competitive request for proposals (RFP) and bidding process. Although the bidding criteria varies from contract to contract, we believe that typical contracts are awarded based upon a mix of technical solution and price. In some cases, governments award points for past performance tied to program outcomes. With more than 40 years of experience in responding to RFPs, we have the necessary experience and resources to navigate government procurement processes. We possess the expertise and experience to assess and allocate the appropriate resources necessary for successful project completion in accordance with contractual terms.

Our clients

Our primary customers are government agencies, with the majority at the national, provincial and state level and, to a lesser extent, some at the county and municipal level. In the U.S., even when our direct customers are state governments, a significant amount of our revenue is ultimately provided by the U.S. Federal Government in the form of cost-sharing arrangements with the states, such as is the case with Medicaid. In the year ended September 30, 2015, approximately 50% of our total revenue was derived from state government agencies, many of whose programs received significant federal funding, 22% from foreign government agencies, 20% from U.S. federal government agencies, and 8% from other sources including local municipalities and commercial customers.

We were not significantly affected by the shut-down of the U.S. Federal Government in October 2013. Many of our federally funded health and human services programs are typically deemed essential, which means that a short-term shut-down would not be expected to cause significant disruption to these operations. With the acquisition of Acentia's business, our contract portfolio contains services that may be considered discretionary. Therefore, in the event of a shut-down, a portion of our U.S. Federal Services Segment may incur costs with no certainty of recovery. In all cases, an extended delay may affect certain government programs that rely upon federal funding and may also have an effect on our cash flows from operations if payments are delayed.

For the year ended September 30, 2015, we derived approximately 20% of our consolidated revenue from contracts with the U.S. Federal Government, exclusively within our U.S. Federal Services Segment, and approximately 10% from the state of New York, exclusively within our Health Services Segment.

We typically contract with government clients under four primary pricing arrangements: performance-based, cost-plus, fixed-price and time-and-materials. For the year ended September 30, 2015, 44% of our contracts were performance-based, 29% were cost-plus, 21% were fixed-price and 6% were time-and-materials.

Generally, the relationships with our clients are long-term, multi-year contracts that are subject to option years and periodic rebids. See the "Backlog" section below for more details.

Competition

The market for providing our services to government agencies is competitive and subject to rapid change. However, given the specialized nature of our services and the programs we serve, market entry can be difficult for new or inexperienced firms. The complex nature of competitive bidding, the required investment in subject-matter expertise, repeatable processes and support infrastructure, and the need to achieve specific program outcomes creates barriers to entry for potential new competitors unfamiliar with the nature of government procurement.

13

In the U.S., our primary competitors in the Health Services Segment are Xerox, HP, Automated Health Systems and Fanuel. We consider ourselves to be a significant competitor in the markets in which we operate as we are the largest provider of Medicaid and CHIP administrative programs and operate more state-based health insurance exchanges than any other commercial provider. In the U.S. Federal Services Segment, our primary competitors in the BPS market are Serco, General Dynamics Information Technology and FCi. In the U.S. Federal Services Segment, our primary competitors in the technology sector tend to be IBM, Oracle, SRA and other federal contractors. Our primary competitors in the Human Services Segment vary according to specific business line, but are primarily specialized consulting service providers and local non-profit organizations.

Outside of the U.S., our primary competitors in the Health Services Segment include Atos, Capita, Interserve, Virgin Care and Optum. Our primary competitors in the Human Services Segment include Serco; Ingeus, a Providence Service Company; Staffline; Shaw Trust; Sarina Russon; Advanced Placement Management; and other specialized private companies and non-profit organizations, such as The Salvation Army and Goodwill Industries. Although the basis for competition varies from contract to contract, we believe that typical contracts are awarded based upon a mix of technical solution and price. In some cases, customers award points for past performance tied to program outcomes.

Legislative initiatives

We actively monitor legislative initiatives and respond to opportunities as they develop. Over the past several years, legislative initiatives created new growth opportunities and potential markets for us. Legislation passed in all the geographies in which we operate has significant public policy implications for all levels of government and presents viable business opportunities in the health and human services arena. We are well-positioned to meet the operations program management and consulting needs resulting from that legislation and subsequent regulatory and program implementation efforts.

Some legislative initiatives that have created new growth opportunities for MAXIMUS include:

The Affordable Care Act (ACA). In March 2010, the U.S. Federal Government enacted comprehensive health care reform, known as the ACA, to expand access to health coverage, protect consumer rights, control health care costs and improve the overall health care delivery system. In June 2012, the Supreme Court of the United States upheld the ACA while allowing states to opt out of the previously mandated Medicaid expansion. The law presents several opportunities for MAXIMUS. These include the operation of health insurance exchange operations; Medicaid expansion; the extension of CHIP; the integration of state eligibility processing for entitlement programs; new initiatives for long-term care that allow states more flexibility in Medicaid for home and community-based services; the expansion of independent medical appeals services and the Medicaid demonstration projects for the dual eligible population (people eligible for both Medicaid and Medicare).

Children's Health Insurance Program Reauthorization Act (CHIPRA). CHIPRA was signed into law on February 2, 2009, extending the previous SCHIP program. As part of the ACA, CHIP has been extended through 2019 and funding has been extended through 2015, which is two additional years beyond the original CHIPRA. By expanding state options to find and enroll eligible children through "express lane eligibility" and "auto enrollment," CHIPRA has presented MAXIMUS with an opportunity to expand our partnerships with states for the administration of CHIP programs. The advent of state and federal exchanges at the beginning of 2014 has increased participation of eligible children in CHIP.

Shift to Medicaid Managed Care. As Medicaid programs become larger, more complex and costly, states look to new models. Estimates from the Centers for Medicare & Medicaid Services (CMS) indicate that although the fee-for-service system covers less than half of the total Medicaid population, it accounts for more than 80% of all Medicaid spending. In response, several states have initiatives to reduce the current costs of Medicaid by moving different populations of beneficiaries from fixed-fee-for-service models to managed care, which represents new growth opportunities for MAXIMUS.

14

Work Innovation and Opportunity Act (WIOA). Signed into law in July 2014, WIOA replaces the Workforce Investment Act of 1998 and took effect on July 1, 2015. The law coordinates several core federal employment, training, education and literacy programs. It also requires states to strategically align their workforce development programs, with the option to include TANF (Temporary Assistance for Needy Families), to help job seekers access the necessary support services and to match employers with skilled workers they need to compete in the global economy. WIOA represents potential new opportunities for us to complement our existing TANF welfare-to-work operations in the U.S.

U.K. Health Assessment Advisory Service (formerly known as the Health and Disability Assessment Service). The Welfare Reform Act of 2007 replaced Incapacity Benefits with the Employment and Support Allowance and introduced the Work Capability Assessment (WCA). The WCA was designed to distinguish people who could not work due to health-related problems from people who were 'fit for work' or, with additional support, could eventually return to work. In 2010, the U.K. Government decided to reassess the 2.5 million people who had previously been determined to be eligible to receive Incapacity Benefits. The Government also decided that an independent health assessment provided by a vendor partner is the best method for the Government to determine the level of benefits for individuals with long-term sickness or disabilities. MAXIMUS has been providing assessments through the resulting HAAS on behalf of the Department for Work and Pensions (DWP) since March 2015.

U.K. Fit for Work Service (formerly known as the Health and Work Service). In 2011, the U.K. Government set up a review of the sickness absence system to help reduce the 140 million days lost to sickness absence every year. The review considered how the current sickness absence system could be changed to help people stay in work, reduce costs and contribute to economic growth. One of the outcomes of the study is the Fit for Work Service that provides occupational health assessments and general health and work advice to employees, employers and general practitioners to help people with a health condition to stay in or return to work. MAXIMUS has been operating the Fit for Work Service on behalf of DWP since August 2014.

U.K. Work Programme. The Work Programme is a government-sponsored welfare-to-work model that consolidates several existing employment programs into a single comprehensive back-to-work program in an effort to achieve higher quality, longer-term and sustainable employment outcomes for job seekers in the U.K. The Work Programme presented new opportunities for MAXIMUS and we have been delivering employment services throughout Thames Valley, Hampshire and the Isle of Wight and West London since June 2011 and North East Yorkshire and the Humber since February 2015.

Backlog

At September 30, 2015, we estimate that we had approximately $4.6 billion of revenue in backlog. Backlog represents an estimate of the remaining future revenue from existing signed base contracts and revenue from contracts that have been formally awarded, but not yet signed. Our backlog estimate includes revenue expected under the current terms of executed contracts and revenue from contracts in which the scope and duration of the services required are not definite but estimable (such as performance-based contracts). Our backlog estimate does not assume any contract renewals or option period exercises.

Increases in backlog result from the award of new contracts, the extension or renewal of existing contracts and the exercise of option periods. Reductions in backlog come from fulfilling contracts or the early termination of contracts. The backlog associated with our performance-based contracts is an estimate based upon management's experience of caseloads and similar transaction volume from which actual results may vary. The Company may modify its estimates related to performance-based contracts and as a result backlog from these contracts may increase or decrease based upon the information that management has at that time.

15

Government contracts typically contain provisions permitting government customers to terminate contracts on short notice, with or without cause.

We believe that period-to-period backlog comparisons are difficult and may not necessarily accurately reflect future revenue we may receive. The actual timing of revenue receipts, if any, on projects included in backlog could change for any of the aforementioned reasons. The dollar amount by segment of our backlog as of September 30, 2015 and 2014 was as follows:

| |

Backlog as of September 30, |

||||||

|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | |||||

| |

(In millions) |

||||||

Health Services |

$ | 2,320 | $ | 2,330 | |||

U.S. Federal Services |

832 | 570 | |||||

Human Services |

1,448 | 900 | |||||

| | | | | | | | |

Total |

$ | 4,600 | $ | 3,800 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Our BPS businesses typically involve contracts covering a number of years. Once contracts are signed, they typically take three to six months to begin generating revenue. At September 30, 2015, the average weighted life of these contracts was approximately 5 years, including option periods. Although the exercise of options is uncertain, we believe the incumbent contractor enjoys significant advantages and these options are exercised nearly 100% of the time. The longevity of these contracts assists management in predicting revenue, operating income and cash flows. We expect approximately 45% of the backlog balance to be realized as revenue in fiscal 2016 and, with the inclusion of anticipated option period renewals, to represent approximately 93% of current estimated 2016 revenue.

Employees

As of September 30, 2015, we had approximately 17,000 employees, consisting of 9,300 employees in the Health Services Segment, 3,000 employees in our U.S. Federal Services Segment, 4,300 employees in the Human Services Segment and 400 corporate administrative employees. Our success depends in large part on attracting, retaining and motivating talented, innovative, experienced and educated professionals at all levels.

As of September 30, 2015, 414 of our employees in Canada were covered under three different collective bargaining agreements, each of which has different components and requirements. There are 402 employees covered by two collective bargaining agreements with the British Columbia Government and Services Employees' Union and 12 employees covered by a collective bargaining agreement with the Professional Employees Association. These collective bargaining agreements expire beginning in 2019 through 2020.

As of September 30, 2015, 1,917 of our employees in Australia were covered under a Collective Agreement, which is similar in form to a collective bargaining agreement. The Collective Agreement is renewed annually.

As of September 30, 2015, 732 of our employees in the United Kingdom were covered under four different collective bargaining agreements, each of which has different components and requirements. There are 170 employees covered by a collective bargaining agreement with the Union Public and Commercial Services, six employees covered by a collective bargaining agreement with the Union Prospect, and a total of 556 employees covered by a collective bargaining agreement with GMB Trade Union and Unite Amicus Trade Union. These collective bargaining agreements do not have expiration dates.

16

None of our other employees are covered under any such agreement. We consider our relations with our employees to be good.

Other information

MAXIMUS, Inc. is a Virginia Corporation, founded in 1975.

Our principal executive offices are located at 1891 Metro Center Drive, Reston, Virginia, 20190. Our telephone number is 703-251-8500.

Our website address is http://www.maximus.com. We make our website available for informational purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference into this Annual Report on Form 10-K.

We make our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and the proxy statement for our annual shareholders' meeting, as well as any amendments to those reports, available free of charge through our website as soon as reasonably practical after we file that material with, or furnish it to, the SEC. Our SEC filings may be accessed through the Investor Relations page of our website. These materials, as well as similar materials for other SEC registrants, may be obtained directly from the SEC through their website at http://www.sec.gov. This information may also be read and copied at the SEC's Public Reference Room at 100 F Street NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Our operations are subject to many risks that could adversely affect our future financial condition, results of operations and cash flows and, therefore, the market value of our securities. See Exhibit 99.1 of this Annual Report on Form 10-K under the caption "Special Considerations and Risk Factors" for information on risks and uncertainties that could affect our future financial condition and performance. The information in Exhibit 99.1 is incorporated by reference into this Item 1A.

ITEM 1B. Unresolved Staff Comments.

Not applicable.

We own a 60,000 square-foot office building in Reston, Virginia. We also lease offices for operations, management and administrative functions in connection with the performance of our services. At September 30, 2015, we leased 114 offices in the United States totaling approximately 2.2 million square feet. In five countries outside the U.S., we leased 294 offices totaling approximately 1.1 million square feet. The lease terms vary from month-to-month to ten-year leases and are generally at market rates. In the event that a property is used for our services in the U.S., we typically negotiate clauses to allow termination of the lease if the service contract is terminated by our customer. Such clauses are not standard in foreign leases.

We believe that our properties are maintained in good operating condition and are suitable and adequate for our purposes.

17

We are subject to audits, investigations and reviews relating to compliance with the laws and regulations that govern our role as a contractor to agencies and departments of the United States Federal Government, state, local, and foreign governments, and otherwise in connection with performing services in countries outside of the U.S. Adverse findings could lead to criminal, civil or administrative proceedings, and we could be faced with penalties, fines, suspension or disbarment. Adverse findings could also have a material adverse effect on us because of our reliance on government contracts. We are subject to periodic audits by state, local and foreign governments for taxes. We are also involved in various claims, arbitrations, and lawsuits arising in the normal conduct of our business. These include but are not limited to, bid protests, employment matters, contractual disputes and charges before administrative agencies. Although we can give no assurance, based upon our evaluation and taking into account the advice of legal counsel, we do not believe that the outcome of any existing matter would likely have a material adverse effect on our consolidated financial position, results of operations or cash flows.

ITEM 4. Mine Safety Disclosures

Not applicable.

18

ITEM 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock trades on the New York Stock Exchange under the symbol "MMS." The following table sets forth, for the fiscal periods indicated, the range of high and low sales prices for our common stock and the cash dividends per share declared on the common stock.

| |

Price Range | |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

High | Low | Dividends | |||||||

Year Ended September 30, 2015: |

||||||||||

First Quarter |

$ | 55.97 | $ | 38.93 | $ | 0.045 | ||||

Second Quarter |

66.93 | 52.36 | 0.045 | |||||||

Third Quarter |

69.04 | 61.90 | 0.045 | |||||||

Fourth Quarter |

70.00 | 55.99 | 0.045 | |||||||

Year Ended September 30, 2014: |

||||||||||

First Quarter |

$ | 50.55 | $ | 42.71 | $ | 0.045 | ||||

Second Quarter |

50.24 | 40.61 | 0.045 | |||||||

Third Quarter |

46.48 | 40.27 | 0.045 | |||||||

Fourth Quarter |

43.40 | 37.94 | 0.045 | |||||||

As of October 30, 2015, there were 61 holders of record of our outstanding common stock. The number of holders of record is not representative of the number of beneficial owners due to the fact that many shares are held by depositories, brokers or nominees. We estimate there are approximately 28,000 beneficial owners of our common stock.

We expect to continue our policy of paying regular cash dividends, although there is no assurance as to future dividends. Future cash dividends, if any, will be paid at the discretion of our Board of Directors and will depend, among other things, upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors our Board of Directors may deem relevant.

The following table sets forth information regarding repurchases of common stock that we made during the three months ended September 30, 2015:

Period

|

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans(1) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plan (in thousands) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

July 1, 2015 - July 31, 2015 |

— | $ | — | — | $ | 104,581 | |||||||

August 1, 2015 - August 31, 2015 |

643,797 | 60.13 | 643,797 | 182,004 | |||||||||

September 1, 2015 - September 30, 2015(2) |

417,265 | 60.68 | 222,900 | 168,568 | |||||||||

| | | | | | | | | | | | | | |

Total |

1,061,062 | 60.34 | 866,697 | ||||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (1)

- Under a resolution adopted in August 2015, the Board of Directors authorized the repurchase, at management's discretion, of up to an aggregate of $200 million of our common stock. This resolution superseded similar authorizations from November 2011 and June 2014. The resolution also authorized the use of option exercise proceeds for the repurchase of our common stock.

19

- (2)

- The total number of shares purchased in September 2015 includes 194,365 restricted stock units which vested in this month but which were utilized by the recipients to net-settle personal income tax obligations. The shares were not issued and a payment for this liability was made by us in October 2015.

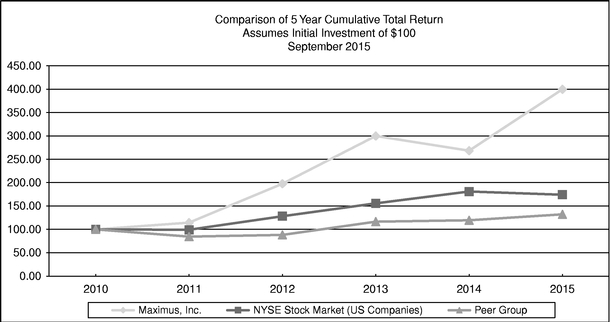

The following graph compares the cumulative total shareholder return on our common stock for the five-year period from September 30, 2010 to September 30, 2015, with the cumulative total return for the NYSE Stock Market (U.S. Companies) Index. In addition, we have compared the results of a peer group to our performance. The peer group is comprised of companies noted in our annual proxy statement as entities with whom we compete for executive talent. These companies are SAIC, Unisys, CACI International, ManTech International, CIBER and Sapient. The peer groups are weighted by market capitalization. This graph assumes the investment of $100 on September 30, 2010 in our common stock, the NYSE Stock Market (U.S. Companies) Index and our peer groups and assumes dividends are reinvested.

Notes:

- A.

- The

lines represent index levels derived from compounded daily returns that include all dividends.

- B.

- The

indexes are reweighted daily, using the market capitalization on the previous trading day.

- C.

- If

the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used.

- D.

- The index level for all series was set to $100.00 on 09/30/2010.

20

ITEM 6. Selected Financial Data.

We have derived the selected consolidated financial data presented below from our consolidated financial statements and the related notes. The revenue and operating results related to the acquisition of companies using the purchase accounting method are included from the respective acquisition dates. The selected financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" included as Item 7 of this Annual Report on Form 10-K and with the Consolidated Financial Statements and related Notes included as Item 8 of this Annual Report on Form 10-K. The historical results set forth in this Item 6 are not necessarily indicative of the results of operations to be expected in the future.

| |

Year Ended September 30, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

| |

(In thousands, except per share data) |

|||||||||||||||

Statement of operations data: |

||||||||||||||||

Revenue |

$ | 2,099,821 | $ | 1,700,912 | $ | 1,331,279 | $ | 1,050,145 | $ | 929,633 | ||||||

Operating income |

259,832 | 225,308 | 185,155 | 127,334 | 122,401 | |||||||||||

Net income attributable to MAXIMUS |

157,772 | 145,440 | 116,731 | 76,133 | 81,168 | |||||||||||

Basic earnings per share attributable to MAXIMUS |

$ | 2.37 | $ | 2.15 | $ | 1.71 | $ | 1.12 | $ | 1.18 | ||||||

Diluted earnings per share attributable to MAXIMUS |

$ | 2.35 | $ | 2.11 | $ | 1.67 | $ | 1.09 | $ | 1.14 | ||||||

Weighted average shares outstanding: |

||||||||||||||||

Basic |

66,682 | 67,680 | 68,165 | 67,734 | 68,834 | |||||||||||

Diluted |

67,275 | 69,087 | 69,893 | 69,611 | 71,062 | |||||||||||

Cash dividends per share of common stock |

$ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.15 | ||||||

| |

At September 30, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

| |

(In thousands) |

|||||||||||||||

Balance Sheet Data: |

||||||||||||||||

Cash and cash equivalents |

$ | 74,672 | $ | 158,112 | $ | 125,617 | $ | 189,312 | $ | 172,950 | ||||||

Total assets |

1,280,171 | 900,996 | 857,978 | 695,293 | 565,279 | |||||||||||

Debt |

210,974 | 1,217 | 1,489 | 1,736 | 1,696 | |||||||||||

Total MAXIMUS shareholders' equity |

612,378 | 555,962 | 529,508 | 451,106 | 374,457 | |||||||||||

21

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of financial condition and results of operations is provided to enhance the understanding of, and should be read in conjunction with, our Consolidated Financial Statements and the related Notes.

Business overview

We provide business process services (BPS) to government health and human services agencies under our mission of Helping Government Serve the People.® We are one of the largest pure-play health and human services BPS providers to governments in the United States, the United Kingdom, Australia, Canada, Saudi Arabia and New Zealand. We use our experience, business process management expertise and advanced technological solutions to help government agencies run efficient and cost-effective programs, improve program accountability and outcomes and enhance the quality of services provided to program beneficiaries.

Over the past five years, our business has grown significantly. We believe this growth has been driven by economic and demographic factors, such as aging populations and increased demand for health care, and the need for governments to operate programs effectively and efficiently. This growth has been driven by reform efforts in the United States, including the Affordable Care Act (ACA), as well as internationally with various programs in Australia and the United Kingdom.

We believe that governments will continue to seek opportunities to enhance existing processes or address new challenges through companies such as MAXIMUS. We believe that a combination of our innovative technical solutions, deep subject matter expertise, stringent adherence to our Standards of Business Conduct and Ethics, robust financial performance and global experience gives existing and future customers the confidence that MAXIMUS can reliably operate their high-profile public health and human services programs.

Significant recent acquisitions

In April 2015, we acquired 100% of Acentia, LLC (Acentia), a provider of services to the U.S. Federal Government, and 70% of Remploy, a business providing services to the United Kingdom government. We believe both acquisitions will provide us with the ability to complement our existing services in their respective markets. These acquisitions have been integrated into our U.S. Federal Services and Human Services Segments, respectively.

On July 1, 2013, we acquired Health Management Limited (HML), a leading provider of independent health assessments within the United Kingdom. We acquired HML in order to expand our independent medical assessment business and to strengthen the presence of our Health Services Segment in the United Kingdom.

Financial overview

Our results for the three years ended September 30, 2015 have been driven by the following:

- •

- The acquisitions of Acentia, HML and Remploy, which have increased revenue and profit, as well as our working capital, goodwill and

intangible asset balances;

- •

- New contracts in the United Kingdom, particularly the HAAS, which commenced in fiscal year 2015;

- •

- New contracts in the United States, particularly those related to the ACA, which resulted in growth in fiscal years 2014 and 2015;

22

- •

- Expansion to our existing work in Australia, offset by the initial costs of setting up this work and deferral of initial revenue

received;

- •

- Additional growth, driven by new work and the expansion of existing contracts;

- •

- Increased investment in our capital infrastructure, which has increased our operating costs, fixed asset balance and depreciation

charges;

- •

- Detrimental movement in foreign currencies which has resulted in reduced revenues and profits recorded by our international

businesses; and

- •

- Borrowings on our credit facilities, which have resulted in interest expense.

International businesses

We operate in international locations and, accordingly, we also transact business in currencies other than the United States Dollar, principally the British Pound, the Australian Dollar, the Canadian Dollar, the Saudi Arabian Riyal and the New Zealand Dollar. During the year ended September 30, 2015, we earned approximately 26% and 10% of revenue and operating income, respectively, from our foreign subsidiaries. At September 30, 2015, approximately 28% of our assets are held by foreign subsidiaries. International business exposes us to certain risks.

- •

- International tax rules may limit the use of cash in other parts of the business without increasing significant additional tax expense

or withholding. We mitigate this risk by maintaining sufficient capital outside the United States to support the short-term and long-term capital requirements of the businesses. We establish our legal

entities to make efficient use of tax laws and holding companies to minimize this exposure.

- •

- We are subject to exposure from foreign currency fluctuations. Our foreign subsidiaries typically incur costs in the same currency as they earn revenue, thus limiting our exposure to unexpected currency fluctuations. The operations of the U.S. business do not depend upon cash flows from foreign subsidiaries. However, declines in the relevant strength of foreign currencies against the U.S. Dollar will affect our revenue mix, profit margin and tax rate.

23

Summary of consolidated results

The following table sets forth, for the fiscal year ends indicated, selected statements of operations data:

| |

Year ended September 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | |||||||

| |

(dollars in thousands, except per share data) |

|||||||||

Revenue |

$ | 2,099,821 | $ | 1,700,912 | $ | 1,331,279 | ||||

Gross profit |

512,717 | 452,123 | 386,033 | |||||||

Gross profit margin |

24.4 | % | 26.6 | % | 29.0 | % | ||||

Selling, general and administrative expense |

238,792 | 220,925 | 193,827 | |||||||

Selling, general and administrative expense as a percentage of revenue |

11.4 | % | 13.0 | % | 14.6 | % | ||||

Amortization of intangible assets |

9,348 | 5,890 | 4,883 | |||||||

Acquisition-related expenses |

4,745 | — | 2,168 | |||||||

Operating income |

259,832 | 225,308 | 185,155 | |||||||

Operating income margin |

12.4 | % | 13.2 | % | 13.9 | % | ||||

Interest expense |

1,398 | — | — | |||||||

Other income, net |

1,385 | 2,061 | 3,867 | |||||||

Income before income taxes |

259,819 | 227,369 | 189,022 | |||||||

Provision for income taxes |

99,770 | 81,973 | 71,673 | |||||||

Effective tax rate |

38.4 | % | 36.1 | % | 37.9 | % | ||||

Net income |

160,049 | 145,396 | 117,349 | |||||||

Income/(loss) attributable to noncontrolling interests |

2,277 | (44 | ) | 618 | ||||||

Net income attributable to MAXIMUS |

$ | 157,772 | $ | 145,440 | $ | 116,731 | ||||

Basic earnings per share attributable to MAXIMUS |

$ | 2.37 | $ | 2.15 | $ | 1.71 | ||||

Diluted earnings per share attributable to MAXIMUS |

$ | 2.35 | $ | 2.11 | $ | 1.67 | ||||

To assist our presentation of the financial statements, we also include the following performance indicators. These items are considered "non-GAAP" numbers. We have also included at the end of this section details on our use of these performance indicators and reconciliations to their respective Generally Accepted Accounting Principles (GAAP) numbers.

| |

Year ended September 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | |||||||

| |

(dollars in thousands, except per share data) |

|||||||||

Adjusted diluted earnings per share attributable to MAXIMUS |

$ | 2.39 | $ | 2.11 | $ | 1.59 | ||||

Earnings Before Interest, Taxes and Amortization (EBITA) |

$ | 289,545 | $ | 248,766 | $ | 206,343 | ||||

Earnings Before Interest, Taxes Depreciation and Amortization (EBITDA) |

336,394 | 291,544 | 237,276 | |||||||

Adjusted EBITDA |

336,394 | 291,544 | 226,376 | |||||||

The following provides an overview of the significant elements of our Consolidated Statements of Operations. As our business segments have different factors driving revenue growth and profitability, the sections that follow cover these segments in greater detail. Our business sections have been updated in fiscal year 2015. Please refer to Note 2. Business segments in Item 8 of this Annual Report on Form 10-K.

24

Fiscal year 2015 compared to fiscal year 2014

Revenue increased 23% to $2,099.8 million. Much of the growth was organic, particularly in the Health Services Segment, supplemented with acquired growth from Acentia and Remploy. During fiscal year 2015, the United States Dollar gained in strength against the Australian Dollar and Canadian Dollar and, accordingly, we received lower revenues than would have been the case if currency rates had remained stable.

| |

Dollars in Thousands |

Percentage change |

|||||

|---|---|---|---|---|---|---|---|

Revenue for fiscal year 2014 |

$ | 1,700,912 | |||||

Organic revenue growth |

317,653 | 18.7 | % | ||||

Acquired revenue from Acentia and Remploy |

141,036 | 8.3 | % | ||||

Currency effect compared to fiscal year 2014 |

(59,780 | ) | (3.5 | )% | |||

| | | | | | | | |

Revenue for fiscal year 2015 |

$ | 2,099,821 | 23.5 | % | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Gross profit increased 13% to $512.7 million, representing a profit margin of 24.4% compared to 26.6% in the prior year. This decline in gross margin has been driven by several factors.

- •

- Our federal appeals business has declined year-over-year to a normal profit margin, driven by changes in related legislation.

- •

- With the acquisition of Acentia, a greater share of our customer portfolio earns income from cost-plus or time-and-materials

contracts. These contracts typically offer lower margins in return for lower risk.

- •

- The HAAS contract in the United Kingdom has received reduced performance incentives as we encounter challenges in recruiting and

retaining trained healthcare professionals.

- •

- We have several contracts in 2015 in start-up. We typically see lower margins in the early stages of a contract.

Selling, general and administrative expense (SG&A) consists of costs related to general management, marketing and administration. These costs include salaries, benefits, bid and proposal efforts, travel, recruiting, continuing education, employee training, non-chargeable labor costs, facilities costs, printing, reproduction, communications, equipment depreciation, intangible amortization, legal expenses and the costs of business combinations. Our SG&A as a percentage of revenue has declined between fiscal years 2014 to 2015, as the revenue growth of the business overall exceeded that of our administrative cost base. In addition, our management cash bonus plan was reduced in fiscal year 2015 compared to fiscal year 2014.

Acquisition-related expenses are costs directly incurred from the purchases of Acentia and Remploy in 2015 and HML in 2013, as well as any unsuccessful transactions.

Operating income increased 15% to $259.8 million, which is 12.4% of revenue. This growth was driven by organic growth and the acquisitions of Acentia and Remploy, partially offset by currency headwinds. The operating profit margin decline has been driven by the same factors as the operating profit decline, as well as increases in costs related to acquisitions and intangible asset amortization.

In fiscal year 2015, we used a combination of borrowings from our revolving credit facility and cash to fund the acquisition of Acentia as well as other strategic and working capital requirements. As a consequence, we have recorded interest expense in fiscal year 2015.

25