Attached files

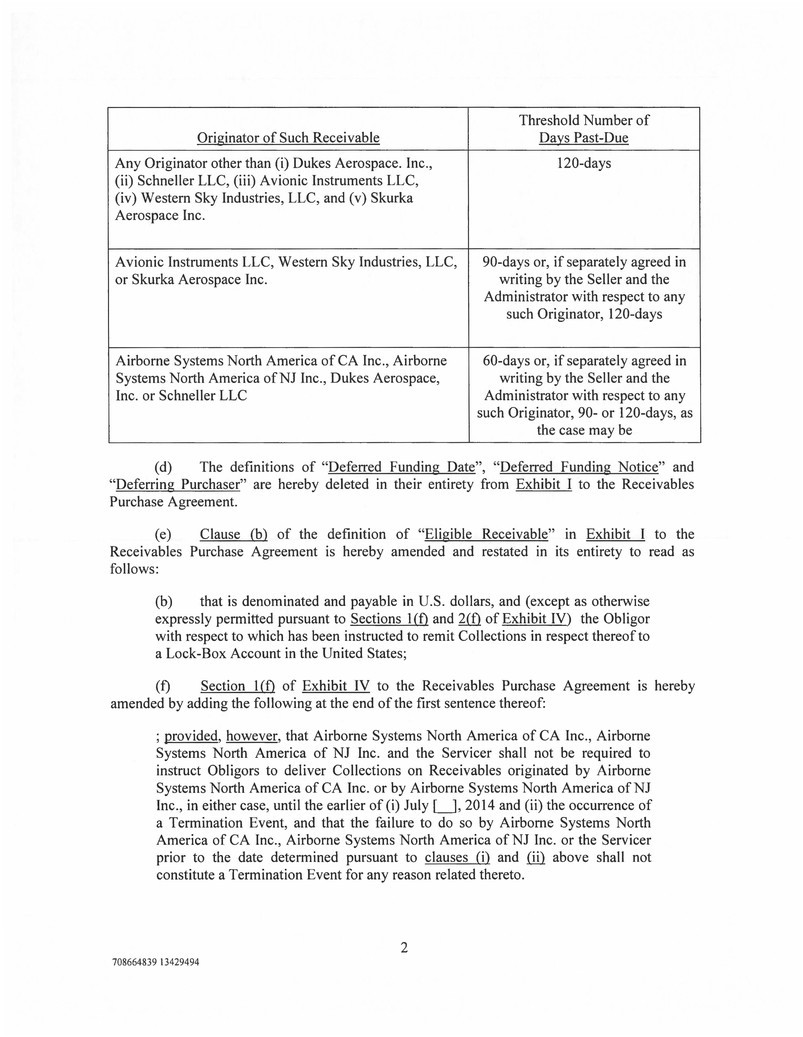

Exhibit 10.51 EXECUTION COPY FIRST AMENDMENT TO THE RECEIVABLES PURCHASE AGREEMENT This FIRST AMENDMENT TO THE RECEIVABLES PURCHASE AGREEMENT (this "Amendment"), dated as of March 25, 2014, is entered into by and among the following parties: (i) TRANSDIGM RECEIVABLES LLC, a Delaware limited liability company, as Seller; (ii) TRANSDIGM, INC., a Delaware corporation, as Servicer; and (iii) PNC BANK, NATIONAL ASSOCIATION, as a Committed Purchaser, as Purchaser Agent for its Purchaser Group and as Administrator ("PNC"). Capitalized terms used but not otherwise defined herein (including such terms used above) have the respective meanings assigned thereto in the Receivables Purchase Agreement described below. BACKGROUND A. The parties hereto have entered into a Receivables Purchase Agreement, dated as of October 21, 2013 (as amended, restated, supplemented or otherwise modified through the date hereof, the "Receivables Purchase Agreement") and desire to amend the Receivables Purchase Agreement as set forth herein. B. Concurrently herewith, Airborne Systems North America of CA Inc. and Airborne Systems North America of NJ Inc. (together, the "New Originators") and the parties hereto are entering into that certain Joinder Agreement (the "Joinder Agreement"), pursuant to which the New Originators are becoming parties to the First Tier Purchase and Sale Agreement. NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows: SECTION 1. Amendments to the Receivables Purchase Agreement. The Receivables Purchase Agreement is hereby amended as follows: (a) Section 1.2(a) of the Receivables Purchase Agreement is hereby amended by replacing "two Business Days" with "thirty-five (35) days" where it appears therein. (b) Section 1.2(b) of the Receivables Purchase Agreement is hereby amended by deleting the final two paragraphs thereof. (c) Clause (a) of the definition of "Defaulted Receivable" in Exhibit I to the Receivables Purchase Agreement is hereby amended by replacing the table set forth therein with the following: 708664839 13429494

Threshold Number of Originator of Such Receivable Days Past-Due Any Originator other than (i) Dukes Aerospace. Inc., 120-days (ii) Schneller LLC, (iii) Avionic Instruments LLC, (iv) Western Sky Industries, LLC, and (v) Skurka Aerospace Inc. Avionic Instruments LLC, Western Sky Industries, LLC, 90-days or, if separately agreed in or Skurka Aerospace Inc. writing by the Seller and the Administrator with respect to any such Originator, 120-days Airborne Systems North America ofCA Inc., Airborne 60-days or, if separately agreed in Systems North America ofNJ Inc., Dukes Aerospace, writing by the Seller and the Inc. or Schneller LLC Administrator with respect to any such Originator, 90- or 120-days, as the case may be (d) The definitions of "Deferred Funding Date", "Deferred Funding Notice" and "Deferring Purchaser" are hereby deleted in their entirety from Exhibit I to the Receivables Purchase Agreement. (e) Clause (b) of the definition of "Eligible Receivable" in Exhibit I to the Receivables Purchase Agreement is hereby amended and restated in its entirety to read as follows: (b) that is denominated and payable in U.S. dollars, and (except as otherwise expressly permitted pursuant to Sections I (f) and 2.ffi of Exhibit IV) the Obligor with respect to which has been instructed to remit Collections in respect thereof to a Lock-Box Account in the United States; (f) Section I (f) of Exhibit IV to the Receivables Purchase Agreement ts hereby amended by adding the following at the end of the first sentence thereof: ; provided, however, that Airborne Systems North America of CA Inc., Airborne Systems North America of NJ Inc. and the Servicer shall not be required to instruct Obligors to deliver Collections on Receivables originated by Airborne Systems North America of CA Inc. or by Airborne Systems North America ofNJ Inc., in either case, until the earlier of (i) July [_], 2014 and (ii) the occurrence of a Termination Event, and that the failure to do so by Airborne Systems North America of CA Inc., Airborne Systems North America of NJ Inc. or the Servicer prior to the date determined pursuant to clauses (i) and .ilil above shall not constitute a Termination Event for any reason related thereto. 2 708664839 13429494

(g) Section 2(t) of Exhibit IV to the Receivables Purchase Agreement IS hereby amended by adding the following at the end of the first sentence thereof: ; provided, however, that Airborne Systems North America of CA Inc., Airborne Systems North America of NJ Inc. and the Servicer shall not be required to instruct Obligors to deliver Collections on Receivables originated by Airborne Systems North America of CA Inc. or by Airborne Systems North America of NJ Inc., in either case, until the earlier of (i) July 23, 2014 and (ii) the occurrence of a Termination Event, and that the failure to do so by Airborne Systems North America of CA Inc., Airborne Systems North America of NJ Inc. or the Servicer prior to the date determined pursuant to clauses (i) and .(ill above shall not constitute a Termination Event for any reason related thereto. SECTION 2. Representations and Warranties of the Seller and Servicer. Each of the Seller and the Servicer hereby represents and warrants, as to itself, to the Administrator, each Purchaser and each Purchaser Agent, as follows: (a) Representations and Warranties. Immediately after giving effect to this Amendment, the representations and warranties made by such Person in the Transaction Documents to which it is a party are true and correct as of the date hereof (unless stated to relate solely to an earlier date, in which case such representations or warranties were true and correct as of such earlier date). (b) Enforceability. This Amendment and each other Transaction Document to which it is a party, as amended hereby, constitute the legal, valid and binding obligation of such Person enforceable against such Person in accordance with its respective terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors' rights generally and by general principles of equity, regardless of whether enforceability is considered in a proceeding in equity or at law. (c) No Termination Event. No event has occurred and is continuing, or would result from the transactions contemplated hereby, that constitutes a Purchase and Sale Termination Event, an Unmatured Purchase and Sale Termination Event, a Termination Event or an Unmatured Termination Event. SECTION 3. Effect of Amendment. All provisions of the Receivables Purchase Agreement and the other Transaction Documents, as expressly amended and modified by this Amendment, shall remain in full force and effect. After this Amendment becomes effective, all references in the Receivables Purchase Agreement (or in any other Transaction Document) to "this Receivables Purchase Agreement", "this Agreement", "hereof', "herein" or words of similar effect referring to the Receivables Purchase Agreement shall be deemed to be references to the Receivables Purchase Agreement as amended by this Amendment. This Amendment shall not be deemed, either expressly or impliedly, to waive, amend or supplement any provision of the Receivables Purchase Agreement other than as set forth herein. SECTION 4. Effectiveness. This Amendment shall become effective as of the date hereof upon the satisfaction ofthe following conditions precedent: 3 708664839 13429494

(a) Execution of Amendment. The Administrator shall have received counterparts duly executed by each of the parties hereto. (b) Execution of Joinder Agreement. The Administrator shall have received counterparts of the Joinder Agreement duly executed by each of the parties thereto. (c) Execution of Joinder to Letter Agreement. The Administrator shall have received counterparts ofthe Joinder to Letter Agreement duly executed by each of the parties thereto. SECTION 5. Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute but one and the same instrument. Delivery of an executed counterpart of a signature page to this Amendment by facsimile or e-mail transmission shall be effective as delivery of a manually executed counterpart hereof. SECTION 6. GOVERNING LAW. THIS AMENDMENT SHALL BE DEEMED TO BE A CONTRACT MADE UNDER AND GOVERNED BY THE INTERNAL LAWS OF THE STATE OF NEW YORK (INCLUDING FOR SUCH PURPOSE SECTIONS 5-1401 AND 5- 1402 OF THE GENERAL OBLIGATIONS LAW OF THE STATE OF NEW YORK). SECTION 7. Section Headings. The various headings of this Amendment are included for convenience only and shall not affect the meaning or interpretation of this Amendment, the Receivables Purchase Agreement or any provision hereof or thereof. 4 708664839 13429494

IN WITNESS WHEREOF, the parties hereto have executed this Amendment by their duly authorized officers as of the date first above written. 708664839 13429494 TRANSDIGM RECEN ABLES LLC, as Seller TRANSDIGM, INC., as Initial Servicer By: ___ _,~.;c;..#-=-~""~.,..,.-------- Name: G~crfT/l.,.4~ Title: 0 . . -n . [vP, e{"o ( J'~~~ S-1 First Amendment to the Receivables Purchase Agreement (TransDigm Receivables LLC)

7086{)11839 1}129494 PNC BANK, NATIONAL ASSOCIATION, as a Committed Purchaser, as a Purchaser Agent and as Administrator By: (f!A./~ Name: Mark Falcione Title: Executive Vice President S-2 First Amendment to the Receivables Purchase Agreement (li·ansDigm Receivables LLC)