Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Western Refining, Inc. | form8-kxwnrearningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - Western Refining, Inc. | earningsrelease-wnrx93015.htm |

Q3 2015 Earnings Review November 3, 2015

2 Cautionary Statement on Forward-Looking Statements This presentation contains forward-looking statements which are protected by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements reflect Western’s current expectations regarding future events, results or outcomes. Words such as “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “position,” “potential,” “predict,” “project,” “strategy,” “will,” “future” and other similar terms and phrases are used to identify forward-looking statements. The forward-looking statements contained herein include, but are not limited to, statements about: Western’s share repurchases and its commitment to maintain a dividend yield in the top quartile of its peer group; and fourth quarter 2015 guidance, including total throughput, direct operating expenses, selling, general and administrative expenses (“SG&A”), depreciation and amortization, interest expense and other financing costs, fiscal year 2015 capital expenditures which include maintenance/ regulatory expenditures and discretionary expenditures. These statements are subject to the general risks inherent in Western Refining, Inc.’s business. These expectations may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Western’s business and operations involve numerous risks and uncertainties, many of which are beyond its control, which could result in Western’s expectations not being realized or otherwise materially affect Western’s financial condition, results of operations, and cash flows. Additional information relating to the uncertainties affecting Western’s business is contained in its filings with the Securities and Exchange Commission. The forward-looking statements are only as of the date made. Except as required by law, Western does not undertake any obligation to (and expressly disclaims any obligation to) update any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events.

3 Q3 2015 Highlights S Safe and reliable operations; strong throughput at El Paso and Gallup S Adjusted EBITDA of $425 million S Western Standalone: $234 million S WNRL: $28 million S NTI: $164 million S Share repurchases of $80 million; dividend of $0.34 per share S Completion of Phase One of the Bobcat Crude Oil Pipeline System in October ($ in millions, except per share data) Q3 2015 Q3 2014 Net income attributable to Western Refining, Inc. $153 $187 per Diluted Share $1.61 $1.84 Net income attributable to Western excluding special items1 $160 $175 per Diluted Share, excluding special items $1.69 $1.73 Adjusted EBITDA2 $425 $378 1 See Appendix for further detail on Net Income (loss) excluding special items. 2 Adjusted EBITDA excludes an adjustment for non-cash unrealized mark-to-market hedging gains and losses; see Appendix for reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA.

4 Refining Operating Metrics Gross Margin ($ per throughput barrel) 1 Operating margin is defined as gross margin minus direct operating expenses. Direct Operating Expenses ($ per throughput barrel) Operating Margin ($ per throughput barrel) Q3 2015 Q3 2014 El Pas o Gallu p $25 $0 $20.99 $18.51 $25 $0 $4.32 $3.64 $25 $0 $16.67 $14.87 $25 $0 $20.65 $23.08 $25 $0 $8.29 $9.10 $25 $0 $12.36 $13.98 1

5 1,200 1,000 800 600 400 200 0 $ m illi on s Beginning Cash and Restricted Cash 6/30/15 Adjusted EBITDA Payments on Debt and Capital Leases Cash Taxes and Cash Interest Paid Share Repurchases Dividends Paid CAPEX Change in Working Cap & Other NTI and WNRL Distributions Change in Restricted Cash Ending Cash and Restricted Cash 9/30/15 $612 $722 $426 $56 $2 $86 $80 $33 $76 $22 $73 Q2 2015 to Q3 2015 Consolidated Cash Flow Bridge 1 Adjusted EBITDA includes both controlling and non-controlling interests of NTI and WNRL; see Appendix for a reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA. 2 NTI and WNRL cash distributions to the non-controlling interests. 2 Western $ 405.7 $ 234.0 $ (1.6) $ (71.7) $ (80.0) $ (32.5) $ (52.3) $ 78.4 $ — $ 55.9 $ 535.9 NTI 127.9 163.8 (0.2) (2.0) — — (17.4) (89.9) (67.6) — 114.6 WNRL 78.6 27.7 — (11.9) — — (6.7) (10.5) (5.8) — 71.4 Total $ 612.2 $ 425.5 $ (1.8) $ (85.6) $ (80.0) $ (32.5) $ (76.4) $ (22.0) $ (73.4) $ 55.9 $ 721.9 1

6 Balanced Approach to Capital Allocation Growth Capital S Investment in refineries and logistics infrastructure S TexNew Mex Reversal and Extension S Bobcat Crude Oil Pipeline Dividends S Committed to maintaining a top quartile of peer group dividend yield Share Repurchase S Opportunistically repurchase WNR shares 2015E Western Standalone Capital Allocation Capital Expenditures: 40% Share Repurchase: 27% Dividends: 33% 1 Total capital allocation includes declared Q4 15 dividend of $0.38 per share, full year 2015E discretionary capital of $155.2 million, and total share repurchases through 9-30-15 of $105 million. 1Total = $389 million

7 Capital Structure 1 Western Standalone excludes NTI and WNRL. 2 Includes Restricted Cash of $12 million 3 Debt levels shown are net of premium and conversion feature. 4 See Appendix for a reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA. As of September 30, 2015 ($ millions) WNR Consolidated Western1 Standalone Total Cash and Restricted Cash 2 $ 722 $ 536 Western Revolving Credit Facility $ — $ — Term Loan, due 2020 540 540 6.25% Senior Unsecured Notes due 2021 350 350 NTI Revolving Credit Facility — 7.125% Senior Secured Notes due 2020 356 WNRL Revolving Credit Facility — 7.5% Senior Notes, due 2023 300 Total Long-term Debt 3 1,546 890 Shareholders' Equity 3,032 1,318 Total Capitalization $ 4,578 $ 2,208 LTM Adjusted EBITDA 4 $ 1,408 $ 1,058 Total Debt / LTM Adjusted EBITDA 1.1x 0.8x Total Debt / Total Capitalization 34% 40%

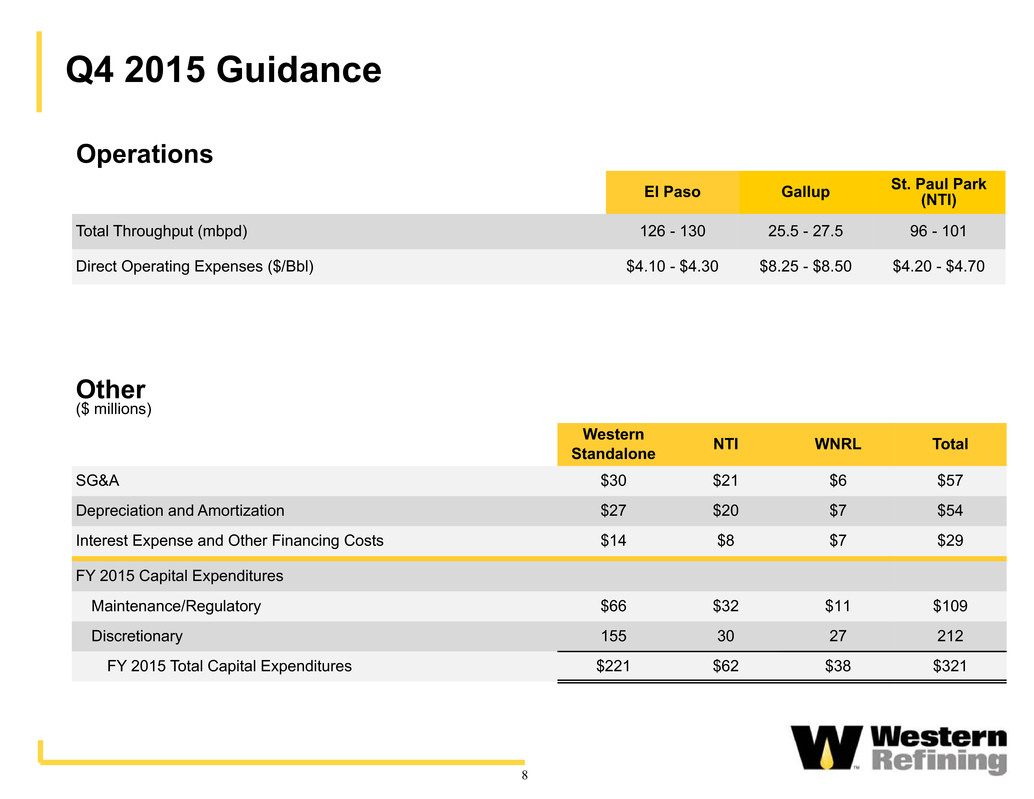

8 Operations El Paso Gallup St. Paul Park(NTI) Total Throughput (mbpd) 126 - 130 25.5 - 27.5 96 - 101 Direct Operating Expenses ($/Bbl) $4.10 - $4.30 $8.25 - $8.50 $4.20 - $4.70 Q4 2015 Guidance Other ($ millions) Western Standalone NTI WNRL Total SG&A $30 $21 $6 $57 Depreciation and Amortization $27 $20 $7 $54 Interest Expense and Other Financing Costs $14 $8 $7 $29 FY 2015 Capital Expenditures Maintenance/Regulatory $66 $32 $11 $109 Discretionary 155 30 27 212 FY 2015 Total Capital Expenditures $221 $62 $38 $321

Appendix

10 Reconciliation of Special Items 1 Income taxes recalculated after deducting special items and earnings attributable to non-controlling interest from Income before income taxes. Three Months Ended September 30, 2015 2014 (In thousands, except per share data) Reported diluted earnings per share $ 1.61 $ 1.84 Income before income taxes $ 310,215 $ 328,070 Special items: Unrealized gain on commodity hedging transactions (271) (17,020) Loss (gain) on disposal of assets, net (52) (66) Net change in lower of cost or market inventory reserve 36,795 — Earnings before income taxes excluding special items 346,687 310,984 Recomputed income taxes excluding special items 1 (96,254) (75,567) Net income excluding special items 250,433 235,417 Net income attributable to non-controlling interest 90,215 60,099 Net income attributable to Western excluding special items $ 160,218 $ 175,318 Diluted earnings per share excluding special items $ 1.69 $ 1.73

11 Consolidated Adjusted EBITDA Reconciliation 1 Adjusted EBITDA includes an adjustment for non-cash unrealized mark-to-market hedging gains and losses; see Appendix for reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA. Three Months Ended September 30, 2015 2014 (In thousands) Net income attributable to Western Refining, Inc. $ 153,303 $ 186,749 Net income attributable to non-controlling interest 64,795 60,608 Interest expense and other financing costs 26,896 18,250 Provision for income taxes 92,117 80,713 Depreciation and amortization 51,377 46,910 Maintenance turnaround expense 490 1,883 Loss (gain) on disposal of assets, net (52) (66) Net change in lower of cost or market inventory reserve 36,795 — Unrealized loss (gain) on commodity hedging transactions (271) (17,020) Adjusted EBITDA 1 $ 425,450 $ 378,027

12 Consolidated Adjusted EBITDA Reconciliations Three Month Period Ending Twelve Months Ended (In Thousands) Consolidated Western Refining, Inc. Dec 2014 Mar 2015 Jun 2015 Sep 2015 Sep 2015 Net income attributable to Western Refining, Inc. $ 130,935 $ 105,989 $ 133,919 $ 153,303 $ 524,146 Net income attributable to non-controlling interest 13,516 68,979 79,948 64,795 227,238 Interest expense and other financing costs 22,054 24,957 27,316 26,896 101,223 Provision for income taxes 69,285 59,437 78,435 92,117 299,274 Depreciation and amortization 49,398 49,926 51,143 51,377 201,844 Maintenance turnaround expense 140 105 593 490 1,328 Loss (gain) on disposal of assets, net 7,591 282 (387) (52) 7,434 Net change in lower of cost or market inventory reserve 78,554 (15,722) (38,204) 36,795 61,423 Unrealized (gain) loss on commodity hedging transactions (58,052) 20,057 22,287 (271) (15,979) Adjusted EBITDA 1 $ 313,421 $ 314,010 $ 355,050 $ 425,450 $ 1,407,931 1 Adjusted EBITDA includes an adjustment for non-cash unrealized mark-to-market hedging gains and losses; see Appendix for reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA.

13 Last Twelve Months September 30, 2015 Western Standalone NTI WNRL WNR Consolidated (In thousands) Net income attributable to Western Refining, Inc. $ 343,869 $ 136,247 $ 44,030 $ 524,146 Net income attributable to non-controlling interest — 204,718 22,520 227,238 Interest expense and other financing costs 56,496 27,025 17,702 101,223 Provision for income taxes 298,800 — 474 299,274 Loss (gain) on disposal of assets, net 7,803 (335) (34) 7,434 Depreciation and amortization 104,567 78,341 18,936 201,844 Maintenance turnaround expense 1,328 — — 1,328 Net change in lower of cost or market inventory reserve — 61,423 — 61,423 Unrealized loss (gain) on commodity hedging transactions (19,531) 3,552 — (15,979) Adjusted EBITDA 793,332 $ 510,971 $ 103,628 $ 1,407,931 Controlling interests in NTI 1 196,213 Controlling interests in WNRL 1 68,498 Total Adjusted EBITDA $ 1,058,043 Consolidating Adjusted EBITDA Reconciliations 1 Western's controlling interests in NTI and WNRL represent 38% and 66%, respectively.

14 Adjusted EBITDA Reconciliation The tables on the previous page reconcile net income to Adjusted EBITDA for the periods presented. Adjusted EBITDA represents earnings before interest expense and other financing costs, provision for income taxes, depreciation, amortization, maintenance turnaround expense, and certain other non-cash income and expense items. However, Adjusted EBITDA is not a recognized measurement under United States generally accepted accounting principles ("GAAP"). Our management believes that the presentation of Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. In addition, our management believes that Adjusted EBITDA is useful in evaluating our operating performance compared to that of other companies in our industry because the calculation of Adjusted EBITDA generally eliminates the effects of financings, income taxes, the accounting effects of significant turnaround activities (that many of our competitors capitalize and thereby exclude from their measures of EBITDA), and certain non-cash charges that are items that may vary for different companies for reasons unrelated to overall operating performance. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • Adjusted EBITDA does not reflect our cash expenditures or future requirements for significant turnaround activities, capital expenditures, or contractual commitments; • Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt; • Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and • Adjusted EBITDA, as we calculate it, differs from the NTI and WNRL Adjusted EBITDA calculation and may differ from the Adjusted EBITDA calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally.

15 Volume Hedged (000 barrels) % of Planned Production Hedged Strike Price Mark-to-Market Price1 September 30, 2015 Offsetting Unrealized Gain Period Gasoline Distillate Gasoline Distillate Gasoline Distillate Gasoline Distillate Positions ($MM) 2 2015 Q4 750 1,772 10% 33.0% 9.70 26.38 7.36 14.68 8.9 2016 Q1 150 645 2.4% 14.0% 10.20 26.38 8.25 15.04 5.9 Q2 — 795 —% 13.2% — 26.35 — 16.04 4.7 Q3 — 1,545 —% 25.4% — 26.93 — 16.72 4.7 Q4 — 795 —% 13.1% — 26.35 — 16.02 4.7 2017 Q1 — 375 —% 8.1% — 23.49 — 16.36 — Q2 — 150 —% 2.5% — 23.60 — 17.26 — Q3 — 150 —% 2.5% — 23.60 — 18.04 — Q4 — 150 —% 2.5% — 23.60 — 17.02 — 1 Mark-to-market pricing based on data obtained from the CME Group. 2 Represents unrealized gains on short positions that were closed by the purchase of an offsetting long position as of Q3 2015, neither of which position will be realized until maturity. Western Standalone Crack Spread Hedge Positions As of September 30, 2015

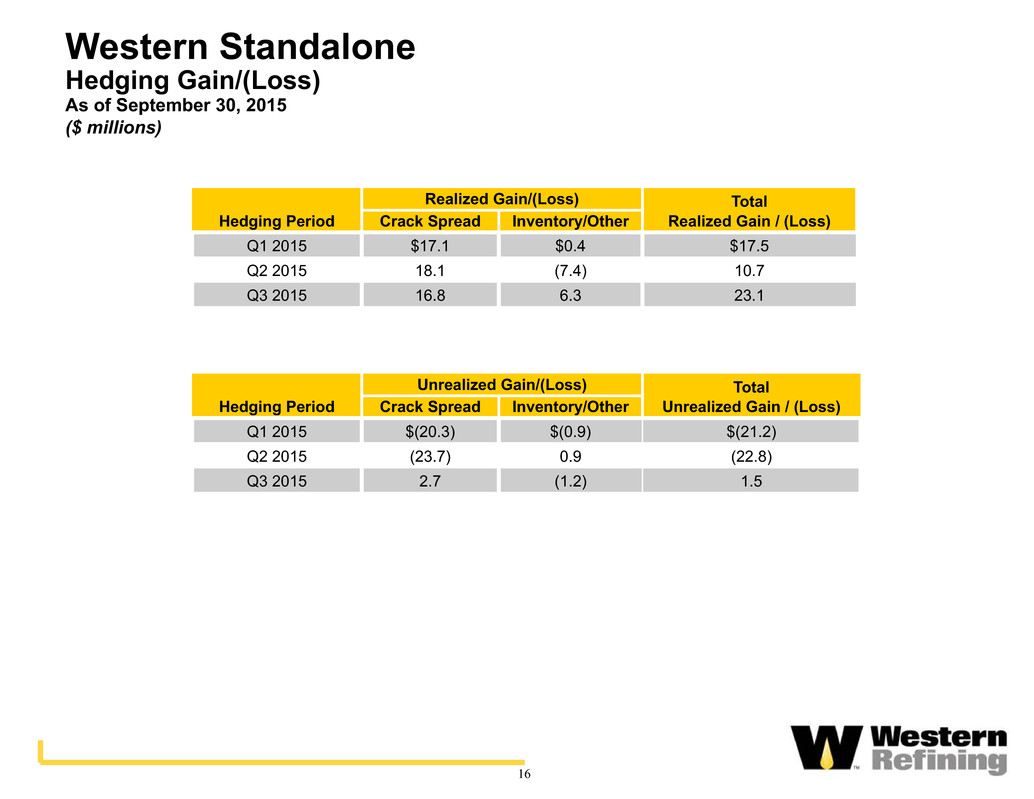

Western Standalone Hedging Gain/(Loss) As of September 30, 2015 ($ millions) Hedging Period Realized Gain/(Loss) Total Realized Gain / (Loss) Crack Spread Inventory/Other Q1 2015 $17.1 $0.4 $17.5 Q2 2015 18.1 (7.4) 10.7 Q3 2015 16.8 6.3 23.1 Hedging Period Unrealized Gain/(Loss) Total Unrealized Gain / (Loss)Crack Spread Inventory/Other Q1 2015 $(20.3) $(0.9) $(21.2) Q2 2015 (23.7) 0.9 (22.8) Q3 2015 2.7 (1.2) 1.5 16

17 Consolidated Unrealized Hedging Gains and Losses 1 ($millions) Balance Sheet Fair Value Income Statement Period Beg. Of Period End of Period Unrealized Gain (Loss) 2014 Q1 $(64.5) $9.5 $74.0 Q2 $9.5 $54.9 $45.4 Q3 $54.9 $71.9 $17.0 Q4 $71.9 $130.0 $58.1 2015 Q1 $130.0 $109.9 $(20.1) Q2 $109.9 $87.6 $(22.3) Q3 $87.6 $87.9 $0.3 1 Includes WNR crack spreads and inventory hedging positions and NTI inventory hedging positions.