Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESSENDANT INC | esnd-8k_20151020.htm |

| EX-99.1 - EX-99.1 - ESSENDANT INC | esnd-ex991_6.htm |

Earnings Presentation Third Quarter 2015 October 21, 2015 Exhibit 99.2

Safe Harbor Statement This presentation contains forward-looking statements, including references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results or events and other statements that are not strictly historical in nature. These statements are based on management’s current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here. These risks and uncertainties include, but are not limited to the following: end-user demand for products in the office, technology, and furniture product categories may continue to decline; Essendant's reliance on key customers, and the risks inherent in continuing or increased customer concentration and consolidations; prevailing economic conditions and changes affecting the business products industry and the general economy; Essendant's ability to effectively manage its operations and to implement growth, cost-reduction and margin-enhancement initiatives; the impact of Essendant's repositioning, restructuring and rebranding activities on Essendant's customers, suppliers, and operations; Essendant's reliance on supplier allowances and promotional incentives; Essendant's reliance on independent resellers for a significant percentage of its net sales and, therefore, the importance of the continued independence, viability and success of these resellers; continuing or increasing competitive activity and pricing pressures within existing or expanded product categories, including competition from product manufacturers who sell directly to Essendant's customers; the impact of supply chain disruptions or changes in key suppliers’ distribution strategies; Essendant's ability to maintain its existing information technology systems and the systems and e-commerce services that it provides to customers, and to successfully procure, develop and implement new systems and services without business disruption or other unanticipated difficulties or costs; the creditworthiness of Essendant's customers; Essendant's ability to manage inventory in order to maximize sales and supplier allowances while minimizing excess and obsolete inventory; Essendant's success in effectively identifying, consummating and integrating acquisitions; the risks and expense associated with Essendant's obligations to maintain the security of private information provided by Essendant's customers; the costs and risks related to compliance with laws, regulations and industry standards affecting Essendant's business; the availability of financing sources to meet Essendant's business needs; Essendant's reliance on key management personnel, both in day-to-day operations and in execution of new business initiatives; and the effects of hurricanes, acts of terrorism and other natural or man-made disruptions. Shareholders, potential investors and other readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. For additional information about risks and uncertainties that could materially affect Essendant's results, please see the company’s Securities and Exchange Commission filings. The forward-looking information in this presentation is made as of this date only, and the company does not undertake to update any forward-looking statement. Investors are advised to consult any further disclosure by Essendant regarding the matters discussed in this presentation in its filings with the Securities and Exchange Commission and in other written statements it makes from time to time. It is not possible to anticipate or foresee all risks and uncertainties, and investors should not consider any list of risks and uncertainties to be exhaustive or complete.

Q3 2015 Overview Solid financial performance $1.00 Adjusted EPS(1) vs. $1.03(2) last year $183.7M operating cash flow YTD—up from $93.7M prior year Acquisitions delivering as expected Over $81M incremental sales in Q3 YOY Completed activities outlined in Q1 2015 Sold Mexican subsidiary, a non-strategic business Workforce & Facility Actions: on track to deliver $6M in savings this year Successfully transitioned two facilities to common operating platform in the qtr. Making refinements to strategy under new CEO Focus on increasing operating leverage, accelerating revenue growth and expanding earnings Recognize potential in core categories: Office Products, JanSan & Breakroom Management de-layering and organizational alignment in Q4 ’15 For a definition and reconciliation of Adjusted EPS, please see appendix. Prior year values include impact of change in accounting principle related to inventory accounting. See Reconciliation of Restated Financial Statements in the Q3 2015 Earnings Release. 3

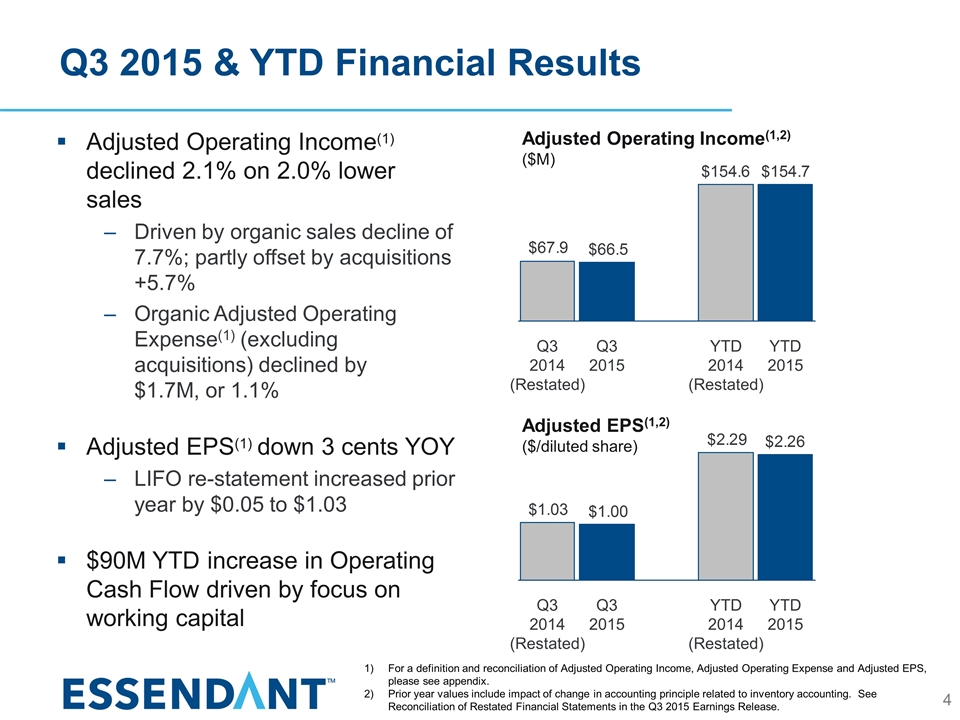

Q3 2015 & YTD Financial Results For a definition and reconciliation of Adjusted Operating Income, Adjusted Operating Expense and Adjusted EPS, please see appendix. Prior year values include impact of change in accounting principle related to inventory accounting. See Reconciliation of Restated Financial Statements in the Q3 2015 Earnings Release. Adjusted Operating Income(1,2) ($M) Adjusted EPS(1,2) ($/diluted share) Adjusted Operating Income(1) declined 2.1% on 2.0% lower sales Driven by organic sales decline of 7.7%; partly offset by acquisitions +5.7% Organic Adjusted Operating Expense(1) (excluding acquisitions) declined by $1.7M, or 1.1% Adjusted EPS(1) down 3 cents YOY LIFO re-statement increased prior year by $0.05 to $1.03 $90M YTD increase in Operating Cash Flow driven by focus on working capital 4

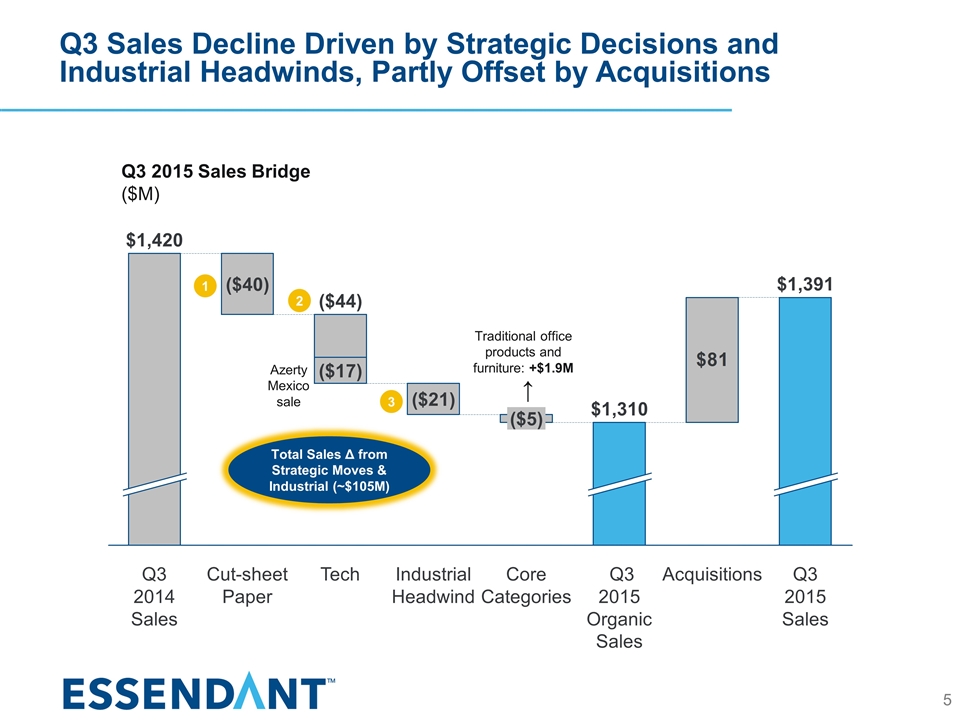

Q3 Sales Decline Driven by Strategic Decisions and Industrial Headwinds, Partly Offset by Acquisitions Q3 2015 Sales Bridge ($M) Azerty Mexico sale Traditional office products and furniture: +$1.9M ↓ 1 2 3 Total Sales Δ from Strategic Moves & Industrial (~$105M) 5

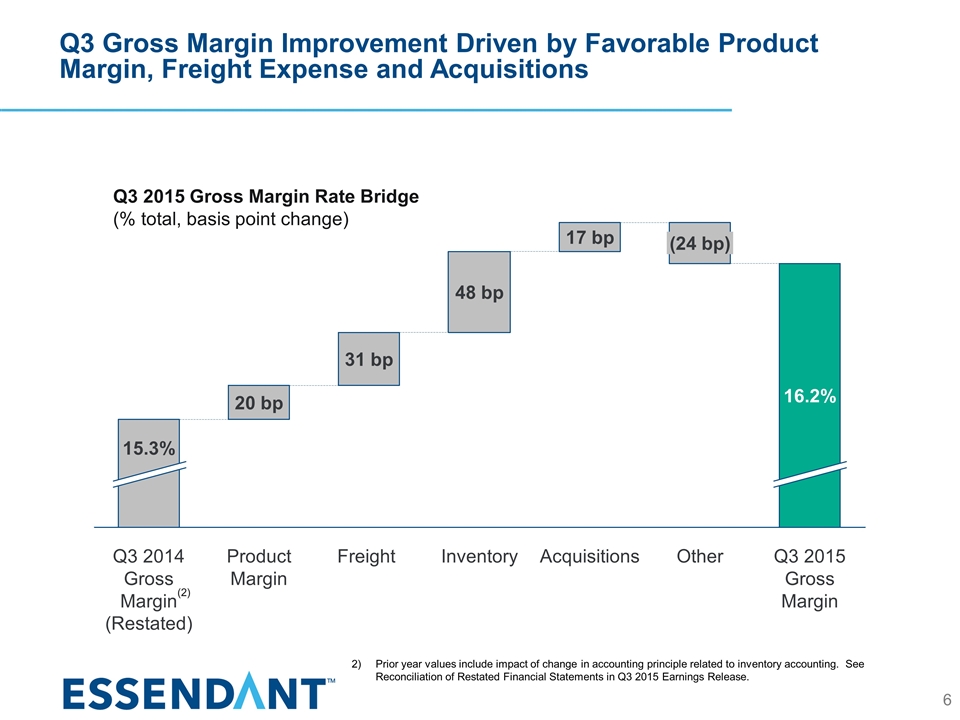

Q3 Gross Margin Improvement Driven by Favorable Product Margin, Freight Expense and Acquisitions (24 bp) 17 bp 16.2% 15.3% 48 bp 31 bp 20 bp Q3 2015 Gross Margin Rate Bridge (% total, basis point change) (2) Prior year values include impact of change in accounting principle related to inventory accounting. See Reconciliation of Restated Financial Statements in Q3 2015 Earnings Release. 6

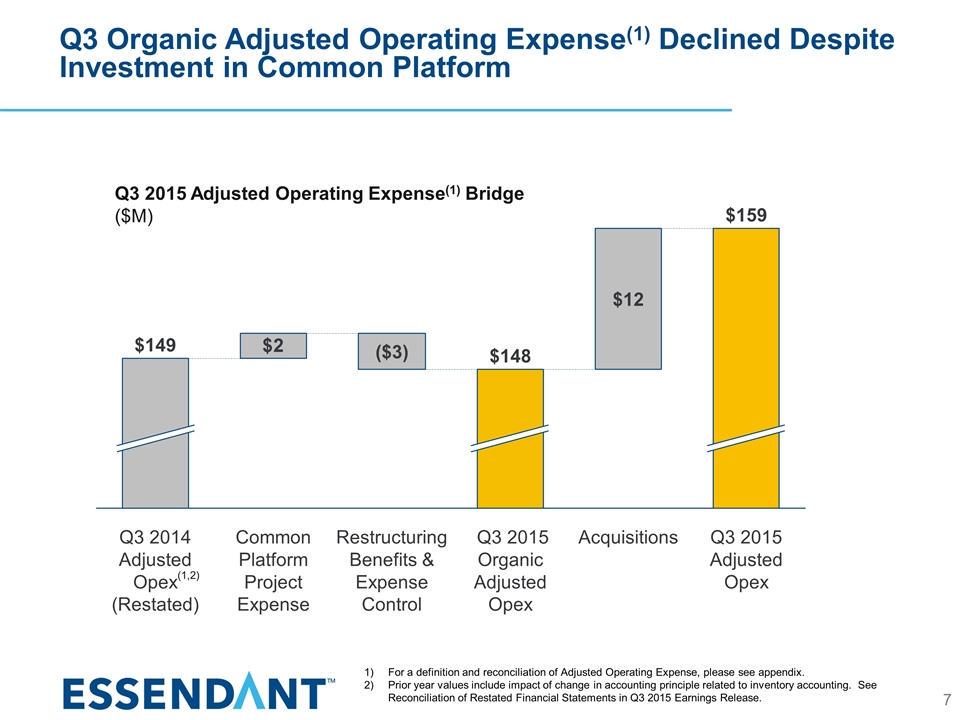

Q3 Organic Adjusted Operating Expense(1) Declined Despite Investment in Common Platform $12 Q3 2015 Adjusted Operating Expense(1) Bridge ($M) For a definition and reconciliation of Adjusted Operating Expense, please see appendix. Prior year values include impact of change in accounting principle related to inventory accounting. See Reconciliation of Restated Financial Statements in Q3 2015 Earnings Release. (1,2) 7

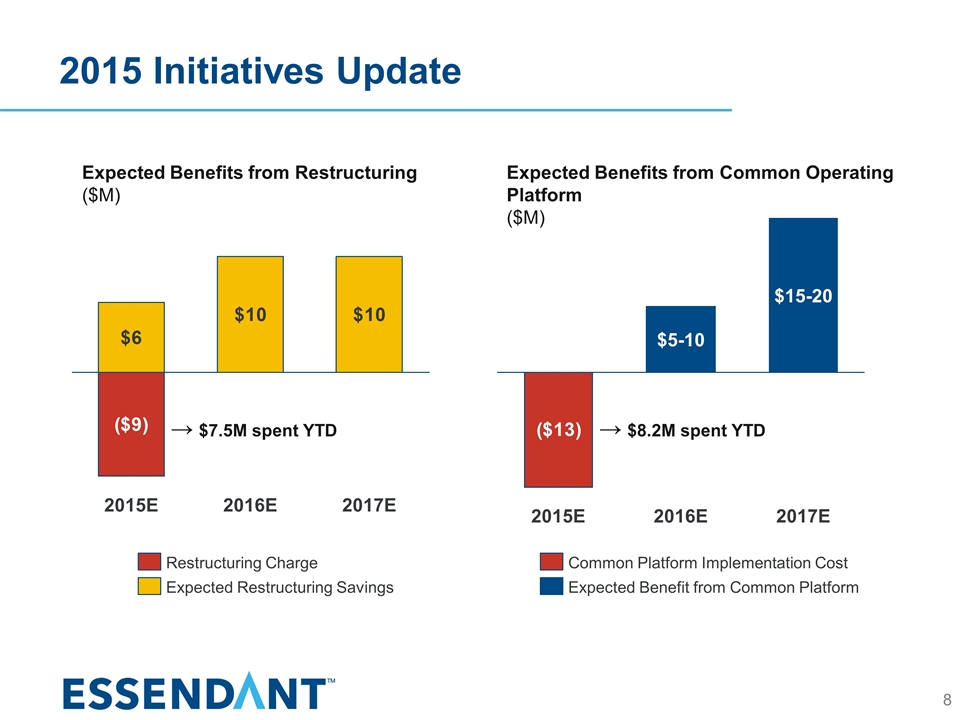

2015 Initiatives Update Expected Benefits from Restructuring ($M) $5-10 $15-20 Expected Benefits from Common Operating Platform ($M) $7.5M spent YTD ↓ $8.2M spent YTD ↓

Strategic Pillars Grow Share in Core Office Products and JanSan Businesses Win the Shift to Online Diversify into Channels and Categories that Leverage our Common Platform Strategy Overview Accelerate organic sales growth in core by using scale and distribution capability to grow share, control cost and expand earnings dollars Focus M&A on opportunities that leverage common platform---not only IT system but distribution, data infrastructure, digital expertise and functional capabilities in merchandising, sales and operations Committed to strategy, with two key refinements 1 2 9

Near-Term Objectives Move all businesses onto common platform Beginning with Office Products, JanSan and Breakroom CPO and Automotive to follow Generate profitable sales growth Aligning with customers who are taking share in each channel we serve Simplify business and continue to lower costs Gain operating leverage and reduce overhead by fully integrating recently acquired businesses Pursue merchandising excellence Optimize assortment and create additional value for business and customers 10

Appendix

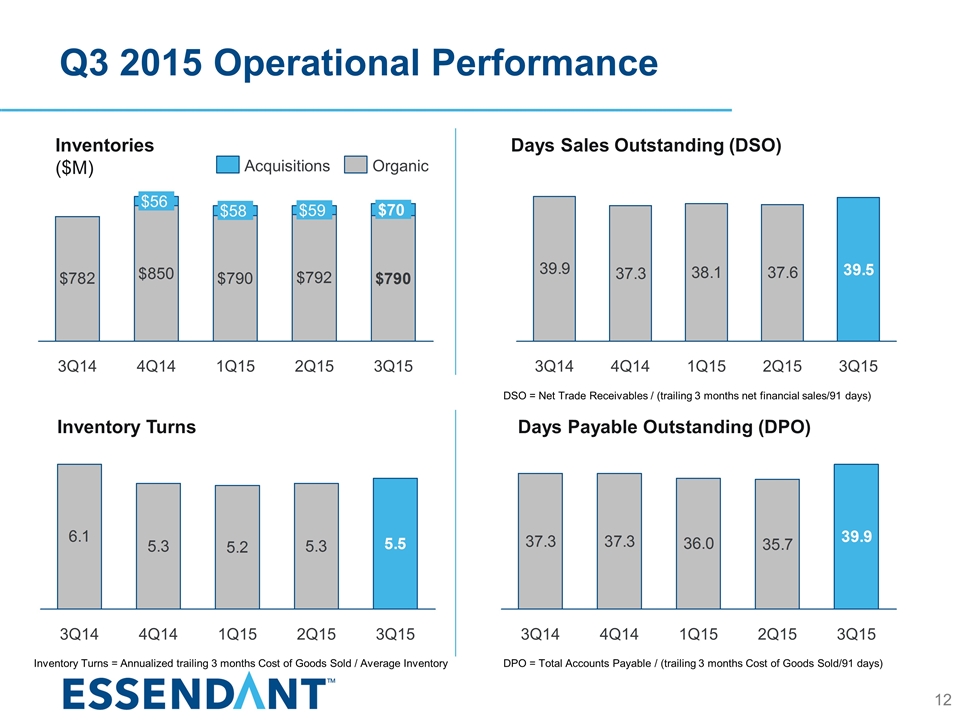

Q3 2015 Operational Performance Days Sales Outstanding (DSO) Days Payable Outstanding (DPO) Inventories ($M) Inventory Turns 12 Inventory Turns = Annualized trailing 3 months Cost of Goods Sold / Average Inventory DSO = Net Trade Receivables / (trailing 3 months net financial sales/91 days) DPO = Total Accounts Payable / (trailing 3 months Cost of Goods Sold/91 days)

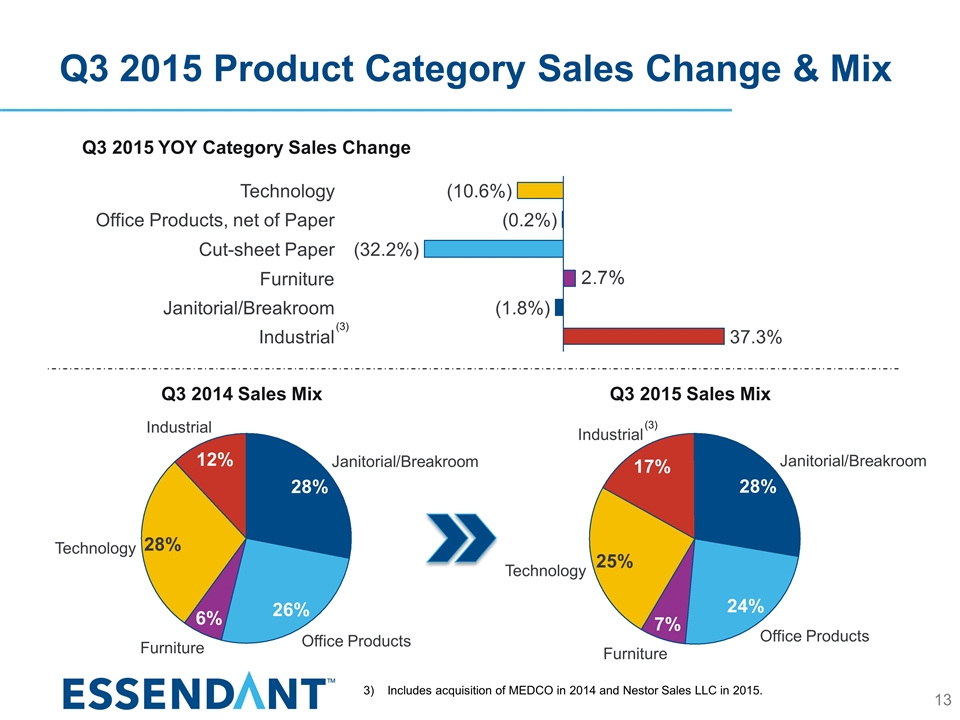

Q3 2015 Product Category Sales Change & Mix Q3 2015 Sales Mix Q3 2014 Sales Mix Q3 2015 YOY Category Sales Change (32.2%) (0.2%) (10.6%) (1.8%) Includes acquisition of MEDCO in 2014 and Nestor Sales LLC in 2015. (3) (3) 13

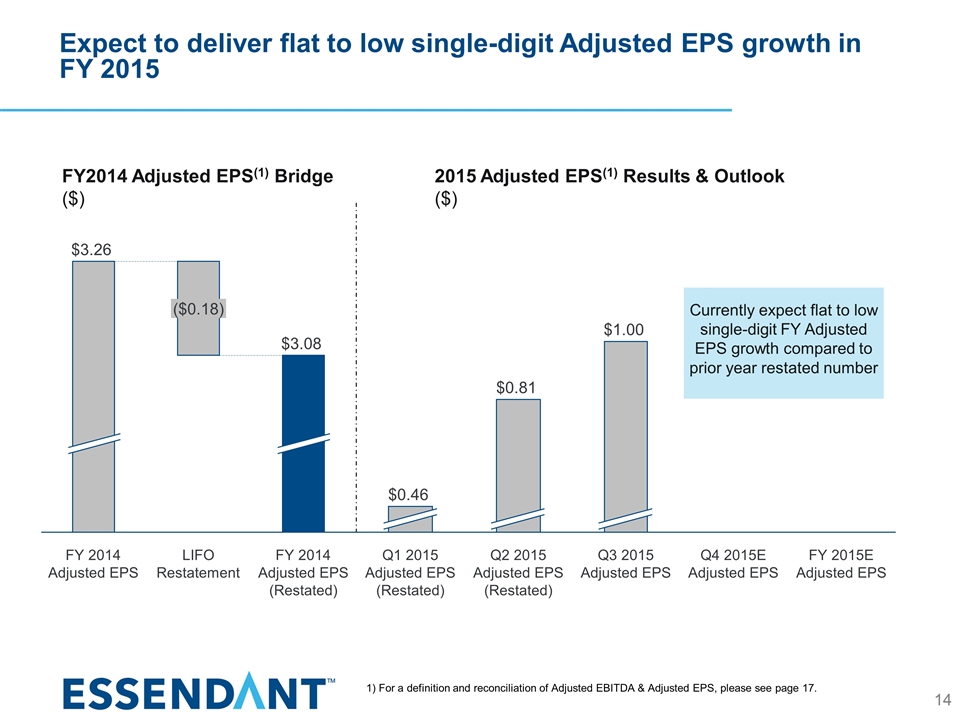

Expect to deliver flat to low single-digit Adjusted EPS growth in FY 2015 FY2014 Adjusted EPS(1) Bridge ($) 2015 Adjusted EPS(1) Results & Outlook ($) 1) For a definition and reconciliation of Adjusted EBITDA & Adjusted EPS, please see page 17. 14 Currently expect flat to low single-digit FY Adjusted EPS growth compared to prior year restated number

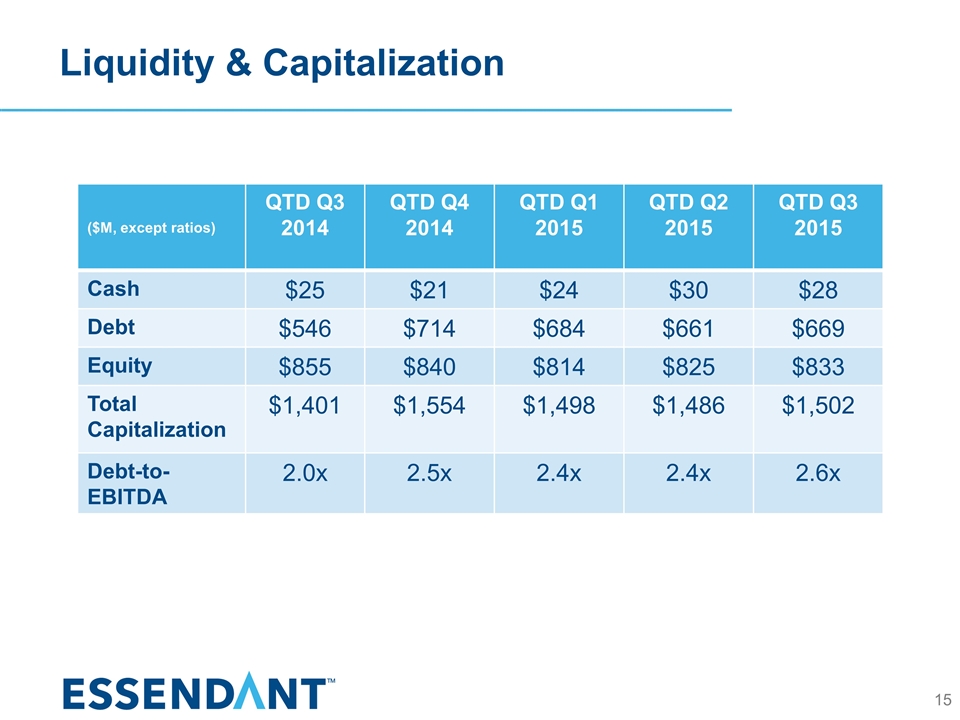

Liquidity & Capitalization ($M, except ratios) QTD Q3 2014 QTD Q4 2014 QTD Q1 2015 QTD Q2 2015 QTD Q3 2015 Cash $25 $21 $24 $30 $28 Debt $546 $714 $684 $661 $669 Equity $855 $840 $814 $825 $833 Total Capitalization $1,401 $1,554 $1,498 $1,486 $1,502 Debt-to-EBITDA 2.0x 2.5x 2.4x 2.4x 2.6x 15

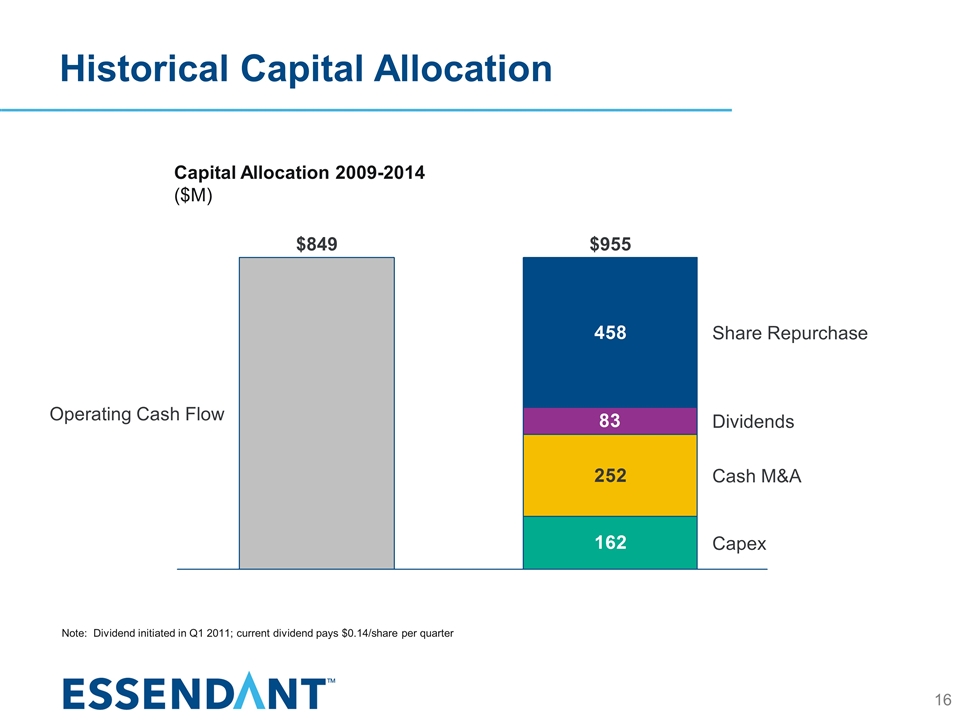

Historical Capital Allocation Capital Allocation 2009-2014 ($M) $ $ Note: Dividend initiated in Q1 2011; current dividend pays $0.14/share per quarter 16

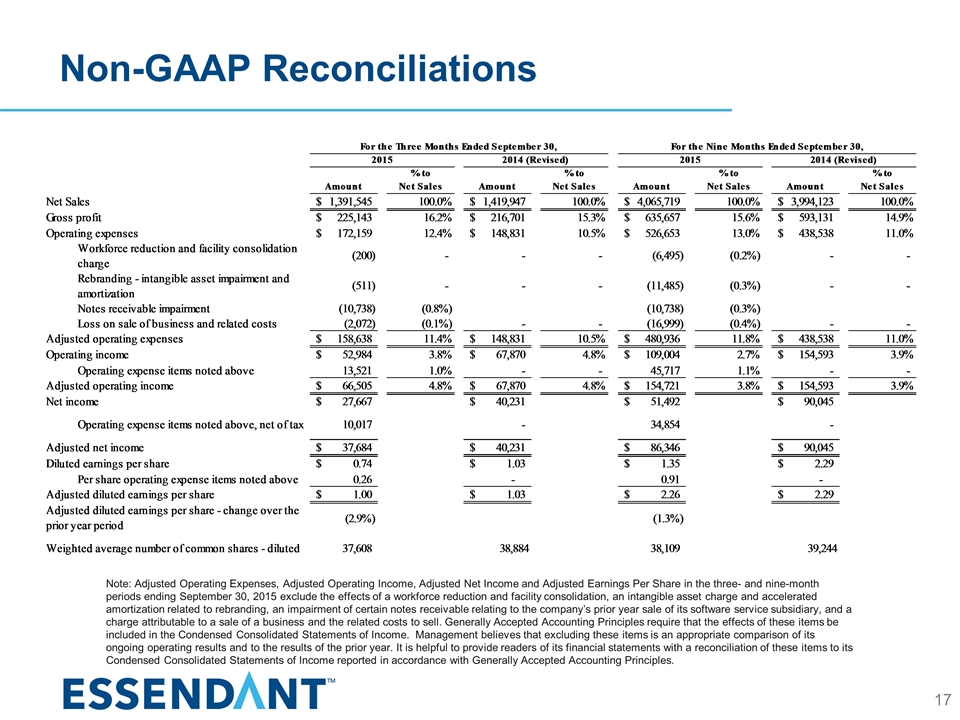

Non-GAAP Reconciliations 17 Note: Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income and Adjusted Earnings Per Share in the three- and nine-month periods ending September 30, 2015 exclude the effects of a workforce reduction and facility consolidation, an intangible asset charge and accelerated amortization related to rebranding, an impairment of certain notes receivable relating to the company’s prior year sale of its software service subsidiary, and a charge attributable to a sale of a business and the related costs to sell. Generally Accepted Accounting Principles require that the effects of these items be included in the Condensed Consolidated Statements of Income. Management believes that excluding these items is an appropriate comparison of its ongoing operating results and to the results of the prior year. It is helpful to provide readers of its financial statements with a reconciliation of these items to its Condensed Consolidated Statements of Income reported in accordance with Generally Accepted Accounting Principles.