Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 28, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 1-1370

_____________________________________________________________

BRIGGS & STRATTON CORPORATION

(Exact name of registrant as specified in its charter)

Wisconsin | 39-0182330 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

12301 West Wirth Street, Wauwatosa, Wisconsin 53222

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: 414-259-5333

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock (par value $0.01 per share) | New York Stock Exchange | |

Common Share Purchase Rights | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K or any amendment of this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of Common Stock held by nonaffiliates of the registrant was approximately $883.4 million based on the last reported sale price of such securities as of December 26, 2014, the last business day of the most recently completed second fiscal quarter.

Number of Shares of Common Stock Outstanding at August 14, 2015: 43,986,042.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the definitive proxy statement for the Annual Meeting to be held on October 29, 2015.

BRIGGS & STRATTON CORPORATION

FISCAL 2015 FORM 10-K

TABLE OF CONTENTS

PART I | Page | |

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Cautionary Statement on Forward-Looking Statements

This report contains certain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. The words "anticipate", “believe”, “estimate”, “expect”, “forecast”, “intend”, “plan”, “project”, and similar expressions are intended to identify forward-looking statements. The forward-looking statements are based on the Company’s current views and assumptions and involve risks and uncertainties that include, among other things, the ability to successfully forecast demand for our products; changes in interest rates and foreign exchange rates; the effects of weather on the purchasing patterns of consumers and original equipment manufacturers (OEMs); actions of engine manufacturers and OEMs with whom we compete; changes in laws and regulations; changes in customer and OEM demand; changes in prices of raw materials and parts that we purchase; changes in domestic and foreign economic conditions; the ability to bring new productive capacity on line efficiently and with good quality; outcomes of legal proceedings and claims; the ability to realize anticipated savings from restructuring actions; and other factors disclosed from time to time in our SEC filings or otherwise, including the factors discussed in Item 1A, Risk Factors, of this Annual Report on Form 10-K and in the Company's periodic reports on Form 10-Q. We undertake no obligation to update forward-looking statements made in this report to reflect events or circumstances after the date of this report.

PART I

ITEM 1. | BUSINESS |

Briggs & Stratton Corporation (the “Company”) is the world’s largest producer of air cooled gasoline engines for outdoor power equipment. Briggs & Stratton designs, manufactures, markets, sells and services these products for original equipment manufacturers (OEMs) worldwide. In addition, the Company markets and sells related service parts and accessories for its engines. Briggs & Stratton is recognized worldwide for its strong brand name and a reputation for quality, design, innovation and value.

The Company's wholly owned subsidiaries include North America’s number one marketer of pressure washers, and it is a leading designer, manufacturer and marketer of power generation, lawn and garden, turf care and job site products through its Simplicity®, Snapper®, Snapper Pro®, Ferris®, PowerBoss®, Allmand™, Billy Goat®, Murray®, Branco® and Victa® brands. Briggs & Stratton products are designed, manufactured, marketed and serviced in over 100 countries on six continents.

The Company conducts its operations in two reportable segments: Engines and Products. Further information about Briggs & Stratton’s business segments is contained in Note 9 of the Notes to Consolidated Financial Statements.

The Company’s internet address is www.basco.com. The Company makes available free of charge (other than an investor’s own internet access charges) through its internet website the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after it electronically files such material with, or furnishes such material to, the Securities and Exchange Commission. Charters of the Audit, Compensation, Finance, Nominating and Governance Committees, Corporate Governance Guidelines, Stock Ownership Guidelines and code of business conduct and ethics contained in the Briggs & Stratton Business Integrity Manual are available on the Company’s website and are available in print to any shareholder upon request to the Corporate Secretary. The information contained on and linked from the Company's website is not incorporated by reference into this Annual Report on Form 10-K.

Engines Segment

General

Briggs & Stratton manufactures four-cycle aluminum alloy gasoline engines with horsepower ranging from 5.5hp up to 37hp and torques that range from 4.50 ft-lbs gross torque to 21.00 ft-lbs gross torque. The Company’s engines are used primarily by the lawn and garden equipment industry, which accounted for 84% of the Engines segment's fiscal 2015 engine sales to OEMs. Major lawn and garden equipment applications include walk-behind lawn mowers, riding lawn mowers, garden tillers and snow throwers. The remaining 16% of engine sales to OEMs in fiscal 2015 were for use on products for industrial, construction, agricultural and other consumer applications that include portable and standby generators, pumps and pressure washers. Many retailers specify the Company's engines on the power equipment they sell and the Briggs & Stratton logo is often featured prominently on a product because of the appeal and reputation of the brand.

In fiscal 2015 approximately 33% of the Engines segment net sales were derived from sales in international markets, primarily to customers in Europe. The Company serves its key international markets through its European regional office in Switzerland, its distribution center in the Netherlands and sales and service subsidiaries in Australia, Austria, Brazil, Canada, China, the Czech Republic, England, France, Germany, India, Italy, Japan, Malaysia, Mexico, New Zealand, Russia, South Africa, Spain, Sweden and the United Arab Emirates. Briggs & Stratton is a leading supplier of gasoline engines in developed countries where there is an established lawn and garden equipment market. Briggs & Stratton also exports engines to developing nations where its engines are used in agricultural, marine, construction and other applications. More information about its foreign operations is in Note 9 of the Notes to Consolidated Financial Statements.

The Company's engines are sold primarily by its worldwide sales force through direct interaction with customers. The Company’s marketing staff and engineers provide support and technical assistance to its sales force.

1

The Engines segment also manufactures replacement engines and service parts and sells them to sales and service distributors. During fiscal 2014, the Company joined with one of its independent domestic distributors to form a venture to distribute service parts. The Company contributed non-cash assets in exchange for receiving an ownership interest in the venture. Subsequent to its formation, the venture acquired the service businesses of two additional independent domestic distributors. Subsequent to fiscal 2015, the venture added a fourth independent distributor through an acquisition. The Company's remaining domestic distributors are independently owned and operated. The Company owns its principal international distribution centers, but also uses independently owned and operated distributors.

These distributors supply service parts and replacement engines directly to independently owned, authorized service dealers throughout the world. These distributors and service dealers incorporate the Company’s commitment to reliability and service.

Customers

The Company's engine sales are primarily to OEMs. The Company's three largest external engine customers in fiscal years 2015, 2014 and 2013 were Husqvarna Outdoor Products Group (HOP), MTD Products Inc. (MTD) and Deere & Company. Engines segment sales to the top three customers combined were 48%, 51% and 48% of Engines segment sales in fiscal 2015, 2014 and 2013, respectively. Under purchasing plans available to all of its gasoline engine customers, Briggs & Stratton typically enters into annual engine supply arrangements. In certain cases, the Company has entered into longer supply arrangements of two to three years.

The Company believes that in fiscal 2015 more than 80% of all lawn and garden powered equipment sold in the United States was sold through mass merchandisers such as The Home Depot, Inc. (The Home Depot), Lowe’s Companies, Inc. (Lowe’s), Sears Holdings Corporation (Sears) and Wal-Mart Stores, Inc. (Wal-Mart). Given the buying power of the mass merchandisers, Briggs & Stratton, through its customers, has continued to experience pricing pressure; however, the Company attempts to recover increases in commodity costs through increased pricing. In addition, development of new and innovative products assists the Company and its customers in realizing higher margins.

Competition

The Company’s major competitors in engine manufacturing are Honda Motor Co., Ltd. (Honda), Kawasaki Heavy Industries, Ltd. (Kawasaki) and Kohler Co. (Kohler). Several Japanese and Chinese small engine manufacturers, of which Honda and Kawasaki are the largest, compete directly with the Company in world markets in the sale of engines to other OEMs and indirectly through their sale of end products.

The Company believes it has a significant share of the worldwide market for engines that power outdoor equipment.

The Company believes the major areas of competition from all engine manufacturers include product quality, brand, price, delivery and service. Other factors affecting competition are short-term market share objectives, short-term profit objectives, exchange rate fluctuations, technology, new product innovation, product support, distribution strength, and advertising. The Company believes its technology, product value, distribution, marketing, and service reputation have given it strong brand name recognition and enhanced its competitive position.

Seasonality of Demand

Sales of engines to lawn and garden OEMs are highly seasonal because of consumer buying patterns. The majority of lawn and garden equipment is sold during the spring and summer months when most lawn care and gardening activities are performed. Sales of lawn and garden equipment are also influenced by consumer sentiment, employment levels, new and existing home sales and weather conditions. Engine sales in the Company’s fiscal third quarter have historically been the highest, while sales in the first fiscal quarter have historically been the lowest.

In order to efficiently use its capital investments and meet seasonal demand for engines, the Company pursues a relatively balanced production schedule throughout the year. The schedule is adjusted to reflect changes in estimated demand, customer inventory levels and other matters outside the control of the

2

Company. Accordingly, inventory levels generally increase during the first and second fiscal quarters in anticipation of customer demand. Inventory levels begin to decrease as sales increase in the third fiscal quarter. This seasonal pattern results in high inventories and low cash flow for the Company in the first, second and the beginning of the third fiscal quarters. The pattern generally results in higher cash flow in the latter portion of the third fiscal quarter and in the fourth fiscal quarter as inventories are liquidated and receivables are collected.

Manufacturing

The Company manufactures engines and parts at the following locations: Auburn, Alabama; Statesboro, Georgia; Murray, Kentucky; Poplar Bluff, Missouri; Wauwatosa, Wisconsin; and Chongqing, China. Briggs & Stratton has a parts distribution center in Menomonee Falls, Wisconsin. The Engines segment also purchases certain products under contract manufacturing agreements.

The Company manufactures a majority of the structural components used in its engines, including aluminum die castings, carburetors and ignition systems. The Company purchases certain parts such as piston rings, spark plugs, valves, ductile and grey iron castings, plastic components, some stampings and screw machine parts and smaller quantities of other components. Raw material purchases consist primarily of aluminum and steel. The Company believes its sources of supply are adequate.

The Company has joint ventures with Daihatsu Motor Company for the manufacture of engines in Japan, and with Starting Industrial of Japan for the production of rewind starters and punch press components in the United States.

The Company has a strategic relationship with Mitsubishi Heavy Industries (MHI) for the global distribution of air cooled gasoline engines manufactured by MHI in Japan under Briggs & Stratton’s Vanguard brand.

Products Segment

General

The Products segment’s ("Products") principal product lines include portable and standby generators, pressure washers, snow throwers, lawn and garden power equipment, turf care, and job site products. Products sells its products through multiple channels of retail distribution, including consumer home centers, warehouse clubs, mass merchants and independent dealers. The Company sells its lawn and garden products and standby generators primarily through an independent dealer network and sells its pressure washers and portable generators primarily through the U.S. mass retail channel.

The Products segment product lines are marketed under its own brands such as Briggs & Stratton, Simplicity®, Snapper®, Snapper Pro®, Ferris®, Allmand™, Billy Goat®, Murray®, Branco® and Victa®, as well as other brands such as Craftsman, GE, and Troy-Bilt.

In fiscal 2013, the Company exited placement of lawn and garden products at national mass retailers. The Engines segment continues to support lawn and garden equipment OEMs who provide lawn and garden equipment to these retailers. In certain cases, the Company may license its brand name to others for use in selling lawn and garden equipment in the U.S. mass retail channel. The Products segment continues to focus on innovative, higher margin products that are sold through its independent dealer network and regional retailers. The Company also continues to sell pressure washers and portable and standby generators through the U.S. mass retail channel.

In fiscal 2015, the Company announced and began implementing restructuring actions to narrow its assortment of lower-priced Snapper consumer lawn and garden equipment and to consolidate its Products manufacturing facilities in order to further reduce costs. The Company closed its McDonough, Georgia location in the fourth quarter of fiscal 2015 and consolidated production into existing facilities. Production of pressure washers and snow throwers has been moved to the Wauwatosa, Wisconsin facility. Production of riding mowers will begin at the Wauwatosa, Wisconsin facility during the first half of fiscal 2016.

On August 29, 2014, the Company acquired all of the outstanding shares of Allmand Bros., Inc. ("Allmand") of Holdrege, Nebraska. Allmand is a leading designer and manufacturer of high quality towable light towers, industrial heaters, and solar LED arrow boards. Its products are used in a variety of industries, including construction, roadway, oil and gas, mining, and sporting and special events. Allmand's products are generally

3

powered by diesel engines, and distributed through national and regional equipment rental companies, equipment dealers and distributors. Allmand sells its products and service parts in approximately 40 countries.

On May 20, 2015, the Company acquired all of the outstanding shares of Billy Goat Industries, Inc. ("Billy Goat") of Lee's Summit, Missouri. Billy Goat is a leading manufacturer of specialty turf equipment, which includes aerators, sod cutters, overseeders, power rakes, brush cutters, walk behind blowers, lawn vacuums, and debris loaders.

Products has a network of independent dealers worldwide for the sale and service of snow throwers, standby generators and lawn and garden powered equipment. To support its international business, Products has leveraged the existing Briggs & Stratton worldwide distribution network and regional sales offices.

During fiscal 2014, the Company joined with one of its independent domestic distributors to form a venture to distribute service parts. The Company contributed non-cash assets in exchange for receiving an ownership interest in the venture. Subsequent to its formation, the venture acquired the service businesses of two additional independent domestic distributors. Subsequent to fiscal 2015, the venture added a fourth independent distributor.

Customers

Historically, Products’ major customers have included Lowe’s, Sears, The Home Depot, Wal-Mart, Tractor Supply Inc., Bunnings Warehouse, and a network of independent dealers. Sales to the top three customers combined were 27%, 27% and 28% of Products segment net sales in fiscal 2015, 2014 and 2013, respectively.

Competition

The principal competitive factors in the power products industry include price, service, product performance, brand, innovation and delivery. Products has various competitors, depending on the type of equipment. Primary competitors include: Honda (portable generators, pressure washers and lawn and garden equipment), Generac Power Systems, Inc. (portable and standby generators and job site products), Alfred Karcher GmbH & Co. (pressure washers), Techtronic Industries (pressure washers and portable generators), Deere & Company (commercial and consumer lawn mowers), MTD (commercial and consumer lawn mowers), The Toro Company (commercial and consumer lawn mowers), Scag Power Equipment, a Division of Metalcraft of Mayville, Inc. (commercial lawn mowers), and HOP (commercial and consumer lawn mowers).

Seasonality of Demand

A significant portion of Products’ sales are subject to seasonal patterns. Due to seasonal and regional weather factors, sales of pressure washers and lawn and garden powered equipment are typically higher during the third and fourth fiscal quarters than at other times of the year. Sales of portable generators and snow throwers are typically higher during the first and second fiscal quarters and can spike during weather related power outage events.

Manufacturing

Products’ manufacturing facilities are located in Munnsville, New York; Wauwatosa, Wisconsin; Holdrege, Nebraska; Lee's Summit, Missouri; and Sydney, Australia. Products also purchases certain powered equipment under contract manufacturing agreements.

Products manufactures core components for its products, where such integration improves operating profitability by providing lower costs.

Products purchases engines from its parent, Briggs & Stratton, as well as from Honda, Kawasaki and Kohler. Products has not experienced any difficulty obtaining necessary engines or other purchased components.

Products assembles products for the international markets at its U.S. and Australian locations and through contract manufacturing agreements with other OEMs and suppliers.

4

Consolidated

General Information

The Company holds patents on features incorporated in its products; however, the success of the Company’s business is not considered to be primarily dependent upon patent protection. The Company owns several trademarks which it believes significantly affect a consumer’s choice of outdoor powered equipment and job site products, and therefore create value. Licenses, franchises and concessions are not a material factor in the Company’s business.

For the fiscal years ended June 28, 2015, June 29, 2014 and June 30, 2013, the Company spent approximately $19.9 million, $19.7 million and $18.5 million, respectively, on research activities relating to the development of new products or the improvement of existing products.

In October 2012, the Board of Directors of the Company authorized an amendment to the Company's defined benefit retirement plans for U.S., non-bargaining employees. The amendment froze accruals for all non-bargaining employees effective January 1, 2014. The Company recorded a pre-tax curtailment charge of $1.9 million in the second quarter of fiscal 2013 related to the defined benefit plan change.

The average number of persons employed by the Company during fiscal 2015 and fiscal 2014 was 5,682 and 5,790, respectively. Employment in fiscal 2015 ranged from a high of 5,837 in February 2015 to a low of 5,480 in June 2015.

Export Sales

Export sales for fiscal 2015, 2014 and 2013 were $334.0 million (18% of net sales), $314.6 million (17% of net sales) and $334.9 million (18% of net sales), respectively. These sales were principally to customers in Europe, Asia, Australia, and Canada.

Refer to Note 9 of the Notes to Consolidated Financial Statements for financial information about geographic areas. Also, refer to Item 7A of this Form 10-K and Note 16 of the Notes to Consolidated Financial Statements for information about Briggs & Stratton’s foreign exchange risk management.

ITEM 1A. | RISK FACTORS |

In addition to the risks referred to elsewhere in this Annual Report on Form 10-K, the following risks, among others, may have affected, and in the future could materially affect, the Company and its subsidiaries’ business, financial condition or results of operations.

Demand for products fluctuates significantly due to seasonality. In addition, changes in the weather and consumer confidence impact demand.

Sales of our products are subject to seasonal and consumer buying patterns. Consumer demand in our markets can be reduced by unfavorable weather and weak consumer confidence. Although we manufacture throughout the year, our sales are concentrated in the second half of our fiscal year. This operating method requires us to anticipate demand of our customers many months in advance. If we overestimate or underestimate demand during a given year, we may not be able to adjust our production quickly enough to avoid excess or insufficient inventories, and that may in turn limit our ability to maximize our potential sales or maintain optimum working capital levels.

We have only a limited ability to pass through cost increases in our raw materials to our customers during the year.

We generally enter into annual purchasing plans with our largest customers, so our ability to raise our prices during a particular year to reflect increased raw materials costs is limited.

5

A significant portion of our net sales comes from major customers and the loss of any of these customers would negatively impact our financial results.

In fiscal 2015, our three largest customers accounted for 33% of our consolidated net sales. The loss of any of these customers or a significant portion of the business from one or more of our key customers would significantly impact our net sales and profitability.

Changes in environmental or other laws could require extensive changes in our operations or to our products.

Our operations and products are subject to a variety of foreign, federal, state and local laws and regulations governing, among other things, emissions to air, discharges to water, noise, the generation, handling, storage, transportation, treatment and disposal of waste and other materials and health and safety matters. We do not expect these laws and regulations to have an adverse effect on us, but we cannot be certain that these or other proposed changes in applicable laws or regulations, or their enforcement, will not adversely affect our business or financial condition in the future.

Our international operations are subject to risks and uncertainties, which could adversely affect our business or financial results.

In fiscal 2015, we derived approximately 31% of our consolidated net sales from international markets, primarily Europe. Our international operations are subject to various economic, political, and other risks and uncertainties that could adversely affect our business and operating results, including, but not limited to, regional or country specific economic downturns, fluctuations in currency exchange rates, labor practices, complications in complying with, or exposure to liability under, a variety of laws and regulations, including anti-corruption laws and regulations, political instability and significant natural disasters and other events or factors impacting local infrastructure.

Actions of our competitors could reduce our sales or profits.

Our markets are highly competitive and we have a number of significant competitors in each market. Competitors may reduce their costs, lower their prices or introduce innovative products that could adversely affect our sales or profits. In addition, our competitors may focus on reducing our market share to improve their results.

Disruptions caused by labor disputes or organized labor activities could harm our business and reputation.

Currently, approximately 10% of our workforce is represented by labor unions. In addition, we may from time to time experience union organizing activities in our non-union facilities. Disputes with the current labor union or new union organizing activities could lead to work slowdowns or stoppages and make it difficult or impossible for us to meet scheduled delivery times for product shipments to our customers, which could result in loss of business and damage to our reputation. In addition, union activity could result in higher labor costs, which could harm our financial condition, results of operations and competitive position.

Our level of debt and our ability to obtain debt financing could adversely affect our operating flexibility and put us at a competitive disadvantage.

Our level of debt and the limitations imposed on us by the indenture relating to the Senior Notes (as defined below) and our other credit agreements could have important consequences, including the following:

• | we will have to use a portion of our cash flow from operations for debt service rather than for our operations; |

• | we may not be able to obtain additional debt financing for future working capital, capital expenditures or other corporate purposes or may have to pay more for such financing; |

• | some or all of the debt under our current or future revolving credit facilities will be at a variable interest rate, making us more vulnerable to increases in interest rates; |

• | we could be less able to take advantage of significant business opportunities, such as acquisition opportunities, and to react to changes in market or industry conditions; |

• | we may be more vulnerable to general adverse economic and industry conditions; and |

• | we may be disadvantaged compared to competitors with less leverage. |

6

The terms of the indenture for the 6.875% Senior Notes due December 2020 (the "Senior Notes") do not fully prohibit us from incurring substantial additional debt in the future and our revolving credit facilities permit additional borrowings, subject to certain conditions. If incremental debt is added to our current debt levels, the related risks we now face could intensify.

We expect to obtain the money to pay our expenses and to pay the principal and interest on the outstanding Senior Notes, the credit facilities and other debt primarily from our operations or by refinancing part of our existing debt. Our ability to meet our expenses thus depends on our future performance, which will be affected by financial, business, economic and other factors. We will not be able to control many of these factors, such as economic conditions in the markets where we operate and pressure from competitors. We cannot be certain that the money we earn will be sufficient to allow us to pay principal and interest on our debt and meet our other obligations. If we do not have enough money, we may be required to refinance all or part of our existing debt, sell assets or borrow more money. We cannot guarantee that we will be able to do so on terms acceptable to us. In addition, the terms of existing or future debt agreements, including the revolving credit facilities and our indentures, may restrict us from adopting certain of these alternatives.

We are restricted by the terms of the outstanding Senior Notes and our other debt, which could adversely affect us.

The indenture relating to the Senior Notes and our multicurrency credit agreement include a number of financial and operating restrictions, which may prevent us from capitalizing on business opportunities and taking some corporate actions. These covenants could adversely affect us by limiting our ability to plan for or react to market conditions or to meet our capital needs. These covenants include, among other things, restrictions on our ability to:

• | incur more debt; |

• | pay dividends, redeem stock or make other distributions; |

• | make certain investments; |

• | create liens; |

• | transfer or sell assets; |

• | merge or consolidate; and |

• | enter into transactions with our affiliates. |

In addition, our multicurrency credit agreement contains financial covenants that, among other things, require us to maintain a minimum interest coverage ratio and impose a maximum average leverage ratio.

Our failure to comply with the restrictive covenants described above could result in an event of default, which, if not cured or waived, could result in us being required to repay these borrowings before their due date. If we are forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected by increased costs and rates.

Worldwide economic conditions may adversely affect our industry, business and results of operations.

General worldwide economic conditions have experienced volatility in recent years due to the sequential effects of the subprime lending crisis, general credit market crisis, sovereign debt crisis, collateral effects on the finance and banking industries, changes in energy costs, concerns about inflation, slower economic activity, decreased consumer confidence, reduced corporate profits and capital spending, adverse business conditions and liquidity concerns. These conditions make it difficult for our customers, our vendors and us to accurately forecast and plan future business activities, and they may cause U.S. and foreign OEMs and consumers to slow spending on our products. We cannot predict the timing or duration of any future economic slowdown or the timing or strength of a subsequent economic recovery, worldwide or in the specific end markets we serve. If the consumer and commercial lawn and garden markets significantly deteriorate due to these economic effects, our business, financial condition and results of operations will likely be adversely affected. Additionally, our stock price could decrease if investors have concerns that our business, financial condition and results of operations will be negatively impacted by a worldwide economic downturn.

7

We have goodwill and intangible assets, which were written-down in prior years. If we determine that goodwill and other intangible assets have become further impaired in the future, net income in such years would be adversely affected.

At June 28, 2015, goodwill and other intangible assets represented approximately 19.0% of our total assets. Goodwill represents the excess of cost over the fair market value of net assets acquired in business combinations. We are required to evaluate whether our goodwill and indefinite-lived intangible assets have been impaired on an annual basis, or more frequently if indicators of impairment exist. In fiscal 2015, there was no impairment of goodwill or other intangible assets. In fiscal 2014 and 2013, we recorded pre-tax non-cash goodwill and tradename impairment charges of $8.5 million and $90.1 million, respectively. The impairments were determined as part of the fair value assessments of goodwill and other intangible assets. Any additional write-down of our goodwill or intangible assets could adversely affect our results of operations.

We are subject to litigation, including product liability and warranty claims, that may adversely affect our business and results of operations.

We are a party to litigation that arises in the normal course of our business operations, including product warranty and liability (strict liability and negligence) claims, patent and trademark matters, contract disputes and environmental, asbestos, employment and other litigation matters. We face an inherent business risk of exposure to product liability and warranty claims in the event that the use of our products is alleged to have resulted in injury or other damage. In addition, we face an inherent risk that our competitors will allege that aspects of our product designs infringe their protected intellectual property. While we currently maintain general liability and product liability insurance coverage in amounts that we believe are adequate, we cannot be sure that we will be able to maintain this insurance on acceptable terms or that this insurance will provide sufficient coverage against potential liabilities that may arise. Any claims brought against us, with or without merit, may have an adverse effect on our business and results of operations as a result of potential adverse outcomes, the expenses associated with defending such claims, the diversion of our management’s resources and time and the potential adverse effect to our business reputation.

Our pension and postretirement benefit plan obligations are currently underfunded, and we may have to make significant cash payments to some or all of these plans, which would reduce the cash available for our businesses.

We have unfunded obligations under our domestic and foreign pension and postretirement benefit plans. As of June 28, 2015, our pension plans were underfunded by approximately $212 million. The funded status of our pension plans is dependent upon many factors, including returns on invested assets, the level of certain market interest rates, the mortality tables used, and the discount rate used to determine pension obligations. Unfavorable returns on the plan assets or unfavorable changes in applicable laws or regulations could materially change the timing and amount of required plan funding, which would reduce the cash available for our businesses. In addition, a decrease in the discount rate used to determine pension obligations could result in an increase in the valuation of pension obligations, which could affect the reported funding status of our pension plans and future contributions, as well as the periodic pension cost in subsequent fiscal years.

Our dependence on, and the price of, raw materials may adversely affect our profits.

The principal raw materials used to produce our products are aluminum, copper and steel. We source raw materials on a global or regional basis, and the prices of those raw materials are susceptible to significant price fluctuations due to supply/demand trends, transportation costs, government regulations and tariffs, changes in currency exchange rates, price controls, the economic climate and other unforeseen circumstances. If we are unable to pass on raw material price increases to our customers, our future profitability may be adversely affected.

8

We may be adversely affected by health and safety laws and regulations.

We are subject to various laws and regulations relating to the protection of human health and safety and have incurred and will continue to incur capital and other expenditures to comply with these regulations. Failure to comply with regulations could subject us to future liabilities, fines or penalties or the suspension of production, as well as damage our reputation.

The operations and success of our Company can be impacted by natural disasters, terrorism, acts of war, international conflict and political and governmental actions, which could harm our business.

Natural disasters, acts or threats of war or terrorism, international conflicts and the actions taken by the United States and other governments in response to such events could cause damage or disrupt our business operations, our suppliers or our customers, and could create political or economic instability, any of which could have an adverse effect on our business. Although it is not possible to predict such events or their consequences, these events could decrease demand for our products, could make it difficult or impossible for us to deliver products or could disrupt our supply chain. We may also be impacted by actions by foreign governments, including currency devaluation, tariffs and nationalization, where our facilities are located, which could disrupt manufacturing and commercial operations. In addition, our foreign operations make us subject to certain U.S. laws and regulations, including the Export Administration Regulations administered by the U.S. Department of Commerce, the trade sanctions laws and regulations administered by the U.S. Department of the Treasury’s Office of Foreign Assets Control and the Foreign Corrupt Practices Act. A violation of these laws and regulations could adversely affect our business, financial condition, and results of operations and reputation.

We are subject to tax laws and regulations in many jurisdictions, and the inability to successfully defend claims from taxing authorities could adversely affect our operating results and financial position.

We conduct business in many countries, which requires us to interpret the income tax laws and rulings in each of those taxing jurisdictions. Due to the subjectivity of tax laws between those jurisdictions as well as the subjectivity of factual interpretations, our estimates of income tax liabilities may differ from actual payments or assessments. Claims from taxing authorities related to these differences could have an adverse impact on our operating results and financial position.

If we fail to remain current with changes in gasoline engine technology or if the technology becomes less important to customers in our markets due to the impact of alternative fuels, our results would be negatively affected.

Our ability to remain current with changes in gasoline engine technology may significantly affect our business. Any advances in gasoline engine technology, including the impact of alternative fuels, may inhibit our ability to compete with other manufacturers. Our competitors may also be more effective and efficient at integrating new technologies. In addition, developing new manufacturing technologies and capabilities requires a significant investment of capital. There can be no assurance that our products will remain competitive in the future or that we will continue to be able to timely implement innovative manufacturing technologies.

Through our Products segment, we compete with certain customers of our Engines segment, thereby creating inherent channel conflict that may impact the actions of engine manufacturers and OEMs with whom we compete.

Through our Products segment, we compete with certain customers of our Engines segment. Any further forward integration of our products may strain relationships with OEMs that are significant customers of our Engines segment and have an adverse impact on operating results.

The financial stability of our suppliers and the ability of our suppliers to produce quality materials could adversely affect our ability to obtain timely and cost-effective raw materials.

The loss of certain of our suppliers or interruption of production at certain suppliers from adverse financial conditions, work stoppages, equipment failures or other unfavorable events would adversely affect our ability to obtain raw materials and other inputs used in the manufacturing process. Our cost of purchasing raw materials and other inputs used in the manufacturing process could be higher and could temporarily affect our

9

ability to produce sufficient quantities of our products, which could harm our financial condition, results of operations and competitive position.

An inability to successfully manage information systems, or to adequately maintain these systems and their security, as well as to protect data and other confidential information, could adversely affect our business and reputation.

We depend on our information systems to successfully manage our business. Any inability to successfully manage these systems, including matters related to system and data security, privacy, reliability, compliance, performance and access, as well as any inability of these systems to fulfill their intended purpose within our business, could have an adverse effect on our business.

In the ordinary course of business, we collect and store sensitive data and information, including our proprietary and regulated business information and that of our customers, suppliers and business partners, as well as personally identifiable information about our employees. Our information systems, like those of other companies, are susceptible to outages due to natural disasters, power loss, telecommunications failures, viruses, break-ins and similar events, breaches of security, or during system upgrades or new system implementations. We have taken steps to maintain adequate data security and address these risks and uncertainties by implementing security technologies, internal controls, network and data center resiliency and recovery processes. However, any operational failure or breach of security from increasingly sophisticated cyber threats could lead to the loss or disclosure of both our and our customers’ financial, product and other confidential information, result in regulatory actions and legal proceedings, and have an adverse effect on our business and reputation.

We have implemented, and Wisconsin law contains, anti-takeover provisions that may adversely affect the rights of holders of our common stock.

Our articles of incorporation contain provisions that could have the effect of discouraging or making it more difficult for someone to acquire us through a tender offer, a proxy contest or otherwise, even though such an acquisition might be economically beneficial to our shareholders. These provisions include a board of directors divided into three classes of directors serving staggered terms of three years each and the removal of directors only for cause and only with the affirmative vote of a majority of the votes entitled to be cast in an election of directors.

Each currently outstanding share of our common stock includes, and each newly issued share of our common stock through October 20, 2015 will include, a common share purchase right. The rights are attached to and trade with the shares of common stock and are exercisable only under limited circumstances. The rights will become exercisable if a person or group acquires, or announces an intention to acquire, 20% or more of our outstanding common stock, subject to certain exceptions. The rights have some anti-takeover effects and generally will cause substantial dilution to a person or group that attempts to acquire control of us without conditioning the offer on either redemption of the rights or amendment of the rights to prevent this dilution. The rights could have the effect of delaying, deferring or preventing a change of control. The rights and the related rights agreement expire by their terms on October 21, 2015.

We are subject to the Wisconsin Business Corporation Law, which contains several provisions that could have the effect of discouraging non-negotiated takeover proposals or impeding a business combination.

These provisions include:

• | requiring a supermajority vote of shareholders, in addition to any vote otherwise required, to approve business combinations not meeting adequacy of price standards; |

• | prohibiting some business combinations between an interested shareholder and us for a period of three years, unless the combination was approved by our board of directors prior to the time the shareholder became a 10% or greater beneficial owner of our shares or under some other circumstances; |

• | limiting actions that we can take while a takeover offer for us is being made or after a takeover offer has been publicly announced; and |

• | limiting the voting power of shareholders who own more than 20% of our stock. |

10

An inability to identify, complete and integrate acquisitions may adversely impact our sales, results of operations, cash flow and liquidity.

Our historical growth has included acquisitions, and our future growth strategy includes acquisition opportunities. For example, in fiscal 2015, the Company acquired Allmand, a leading designer and manufacturer of high quality towable light towers, industrial heaters and solar LED arrow boards, for approximately $59.9 million in cash. Also, in fiscal 2015, the Company acquired Billy Goat, a leading manufacturer of specialty turf equipment, which includes aerators, sod cutters, overseeders, power rakes, brush cutters, walk behind blowers, lawn vacuums, and debris loaders, for total cash consideration of $28.3 million, subject to customary post closing working capital adjustments. We may not be able to identify acquisition targets or successfully complete acquisitions in the future due to the absence of quality companies in our target markets, economic conditions, competition from other bidders, or price expectations from sellers. If we are unable to complete additional acquisitions, our growth may be limited.

Additionally, as we grow through acquisitions, we will continue to place significant demands on management, operational, and financial resources. Recent and future acquisitions will require integration of operations, sales and marketing, information technology, finance and administrative operations, which could decrease the time available to serve and attract customers. We cannot assure that we will be able to successfully integrate acquisitions, that these acquisitions will operate profitably, or that we will be able to achieve the desired financial or operational success. Our financial condition, cash flows, liquidity and results of operations could be adversely affected if we do not successfully integrate the newly acquired businesses, or if our other businesses suffer due to the increased focus on the newly acquired businesses.

An inability to successfully manage the implementation of a new global enterprise resource planning ("ERP") system could adversely affect our operations and operating results.

We are in the process of implementing a new global ERP system. This system will replace many of our existing operating and financial systems. Such an implementation is a major undertaking both financially and from a management and personnel perspective. Should the system not be implemented successfully and within budget, or if the system does not perform in a satisfactory manner, it could be disruptive and adversely affect our operations and results of operations, including our ability to report accurate and timely financial results.

We are in the process of implementing a new global ERP system. This system will replace many of our existing operating and financial systems. Such an implementation is a major undertaking both financially and from a management and personnel perspective. Should the system not be implemented successfully and within budget, or if the system does not perform in a satisfactory manner, it could be disruptive and adversely affect our operations and results of operations, including our ability to report accurate and timely financial results.

Our common stock is subject to substantial price and volume fluctuations.

The market price of shares of our common stock may be volatile. Among the factors that could affect our common stock price are those previously discussed, as well as:

• | quarterly fluctuation in our operating income and earnings per share results; |

• | decline in demand for our products; |

• | significant strategic actions by our competitors, including new product introductions or technological advances; |

• | fluctuations in interest rates or foreign currency exchange; |

• | cost increases in energy, raw materials or labor; |

• | changes in revenue or earnings estimates or publication of research reports by analysts; and |

• | domestic and international economic and political factors unrelated to our performance. |

In addition, the stock markets have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

11

ITEM 2. | PROPERTIES |

The Company maintains leased and owned manufacturing, office, warehouse, distribution and testing facilities throughout the world. The Company believes that its owned and leased facilities are adequate to perform its operations in a reasonable manner. As the Company’s business is seasonal, additional warehouse space may be leased when inventory levels are at their peak. Facilities in the United States occupy approximately 5.9 million square feet, of which 63% is owned. Facilities outside of the United States occupy approximately 0.9 million square feet, of which 29% is owned. Certain of the Company’s facilities are leased through operating lease agreements. See Note 10 to the Consolidated Financial Statements for information on the Company’s operating leases.

The following table provides information about each of the Company’s facilities (exceeding 25,000 square feet) as of June 28, 2015:

Location | Type of Property | Owned/Leased | Segment | |||

U.S. Locations: | ||||||

Auburn, Alabama | Manufacturing, office and warehouse | Owned and Leased | Engines | |||

McDonough, Georgia (1) | Manufacturing, office and warehouse | Owned and Leased | Products | |||

Statesboro, Georgia | Manufacturing, office and warehouse | Owned and Leased | Engines | |||

Murray, Kentucky | Manufacturing, office and warehouse | Owned and Leased | Engines | |||

Lee's Summit, Missouri | Manufacturing, office and warehouse | Owned | Products | |||

Poplar Bluff, Missouri | Manufacturing, office and warehouse | Owned and Leased | Engines | |||

Holdrege, Nebraska | Manufacturing, office and warehouse | Owned | Products | |||

Munnsville, New York | Manufacturing and office | Owned | Products | |||

Sherrill, New York | Warehouse | Leased | Products | |||

Menomonee Falls, Wisconsin | Distribution and office | Leased | Engines, Products | |||

Wauwatosa, Wisconsin | Manufacturing, office and warehouse | Owned | Engines, Products, Corporate | |||

Non-U.S. Locations: | ||||||

Melbourne, Australia | Office and warehouse | Leased | Engines, Products | |||

Sydney, Australia | Manufacturing and office | Leased | Products | |||

Curitiba, Brazil | Office and warehouse | Leased | Engines, Products | |||

Mississauga, Canada | Office and warehouse | Leased | Products | |||

Chongqing, China | Manufacturing, office and warehouse | Owned | Engines | |||

Shanghai, China | Office and warehouse | Leased | Engines, Products | |||

Queretaro, Mexico | Office and warehouse | Leased | Engines, Products | |||

Nijmegen, Netherlands | Distribution and office | Leased | Engines, Products | |||

(1) During fiscal 2015, the Company closed its McDonough, Georgia manufacturing facility and consolidated production into its existing facilities. At June 28, 2015, the Company had $3.8 million classified as assets held for sale, which is included in Prepaid Expenses and Other Current Assets within the Consolidated Balance Sheets, related to the McDonough, Georgia manufacturing location.

ITEM 3. | LEGAL PROCEEDINGS |

The Company is subject to various unresolved legal actions that arise in the normal course of its business. These actions typically relate to product liability (including asbestos-related liability), patent and trademark matters, and disputes with customers, suppliers, distributors and dealers, competitors and employees.

12

On May 14, 2010, the Company notified retirees and certain retirement eligible employees of various amendments to the Company-sponsored retiree medical plans intended to better align the plans offered to both hourly and salaried retirees. On August 16, 2010, a putative class of retirees who retired prior to August 1, 2006 and the United Steel Workers filed a complaint in the U.S. District Court for the Eastern District of Wisconsin (Merrill, Weber, Carpenter, et al.; United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, AFL-CIO/CLC v. Briggs & Stratton Corporation; Group Insurance Plan of Briggs & Stratton Corporation; and Does 1 through 20, Docket No. 10-C-0700), contesting the Company's right to make these changes. The complaint seeks an injunction preventing the alleged unilateral termination or reduction in insurance coverage to the class of retirees, a permanent injunction preventing defendants from ever making changes to the retirees' insurance coverage, restitution with interest (if applicable) and attorneys' fees and costs. A class has been certified, and discovery has concluded. Both parties moved for summary judgment, which was fully briefed on December 23, 2014. Summary judgment is currently pending before the court, and no hearing date or trial date has been set.

On May 12, 2010, Exmark Manufacturing Company, Inc. ("Exmark") filed suit against Briggs & Stratton Power Products Group, LLC (Case No. 8:10CV187, U.S. District Court for the District of Nebraska), alleging that certain Ferris® and Snapper Pro® mower decks infringe an Exmark mower deck patent. Exmark is seeking damages relating to sales since 2004 and attorneys’ fees. As a result of a reexamination proceeding in 2012, the United States Patent and Trademark Office (the “USPTO”) initially rejected the asserted Exmark claims as invalid. However, that decision was reversed by the USPTO on appeal. Following discovery, each of the Company and Exmark filed motions for summary judgment, which were decided by the Court on July 28, 2015. The Court concluded that one of the Company's mower deck designs infringed Exmark’s patent, leaving for trial the issues of whether another of the designs infringes, damages and willfulness of the Company's conduct. Trial is scheduled to begin on September 8, 2015. The Company believes it has strong defenses and intends to defend the lawsuit vigorously, through appeal if necessary. At this stage, the Company cannot make a reasonable estimate of the possible loss, if any, arising from this lawsuit as there are significant issues to be resolved in connection with the trial.

Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss, the Company believes the unresolved legal actions will not have a material adverse effect on its results of operations, financial position or cash flows.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

13

Executive Officers of the Registrant

Name, Age, Position | Business Experience for At Least Past Five Years | |

TODD J. TESKE, 50 Chairman, President & Chief Executive Officer (1)(2) | Mr. Teske was elected to his current position effective October 2010. He previously was President & Chief Executive Officer from January 2010 to October 2010. He served as President and Chief Operating Officer from September 2008 to January 2010; as Executive Vice President & Chief Operating Officer from September 2005 through August 2008; and as Senior Vice President and President - Briggs & Stratton Power Products Group, LLC from September 2003 to August 2005. Mr. Teske also serves as a director of Badger Meter, Inc. and Lennox International, Inc. | |

KATHRYN M. BUONO, 53 Vice President, General Counsel & Secretary | Ms. Buono was elected to her position effective April 2015. Prior to joining Briggs & Stratton, she held the position of Managing Partner of the Milwaukee, Wisconsin office of the Quarles & Brady LLP law firm from March 2014 through December 2014 and was a partner practicing in its Business Law Group. | |

RANDALL R. CARPENTER, 58 Vice President – Marketing | Mr. Carpenter was elected to his current position effective September 2009. He served as Vice President - Marketing from May 2007 through August 2009. Prior to joining Briggs & Stratton, he held the position of Vice President Marketing and Product Development for Royal Appliance Manufacturing. | |

DAVID G. DEBAETS, 52 Vice President – Global Engine Operations | Mr. DeBaets was elected to his current position in August 2015, to be effective as of September 1, 2015. He previously served as Vice President - North American Operations from September 2007 through August, 2015; as Vice President and General Manager - Large Engine Division from September 2006 through August 2007; and as Vice President & President - Home Power Products Group from May 2006 through August 2006. | |

ANDREA L. GOLVACH, 44 Vice President & Treasurer | Ms. Golvach was elected to her current position effective November 2011 after serving as Vice President of Treasury from May 2011 to November 2011. Prior to joining Briggs & Stratton, she held the position of Director of Finance & Cash Management at Harley-Davidson, Inc., a global motorcycle manufacturer, from December 2007 to May 2011 and Director of Finance & Cash Management for Harley-Davidson Financial Services from August 2005 to December 2007. | |

HAROLD L. REDMAN, 50 Senior Vice President & President – Turf & Consumer Products | Mr. Redman was elected to his current position effective September 2014. He previously served as Senior Vice President and President - Products Group from October 2010 through August 2014; as Senior Vice President and President - Home Power Products Group from September 2009 to October 2010; and as Vice President and President - Home Power Products Group from September 2006 through August 2009. Prior to joining Briggs & Stratton, he served as Senior Vice President - Sales & Marketing of Simplicity Manufacturing, Inc. | |

14

Name, Age, Position | Business Experience for At Least Past Five Years | |

WILLIAM H. REITMAN, 59 Senior Vice President & President – Global Service | Mr. Reitman was elected to his current position in August 2015, to be effective as of September 1, 2015. He previously served as Senior Vice President - Managing Director Europe & Global Service from September 2014 through August 2015; as Senior Vice President & Managing Director - Europe from September 2013 through August 2014; as Senior Vice President - Business Development & Customer Support from October 2010 through August 2013; as Senior Vice President - Sales & Customer Support from September 2007 to October 2010; as Senior Vice President - Sales & Marketing from May 2006 through August 2007; and as Vice President - Sales & Marketing from October 2004 to May 2006. | |

DAVID J. RODGERS, 44 Senior Vice President & President – Engines Group | Mr. Rodgers was elected to his current position effective August 17, 2015. He previously served as Senior Vice President & Chief Financial Officer from June 2010 through August 16, 2015 and as Vice President - Finance from February 2010 to June 2010. He served as Controller from December 2006 to February 2010 and was elected an executive officer in September 2007. Prior to joining Briggs & Stratton, he was employed by Roundy’s Supermarkets, Inc. as Vice President - Corporate Controller from September 2005 to November 2006 and Vice President - Retail Controller from May 2003 to August 2005. | |

MARK A. SCHWERTFEGER, 38 Senior Vice President & Chief Financial Officer | Mr. Schwertfeger was elected to his current position effective August 17, 2015. He previously served as Vice President & Controller (an executive officer position) from September 2014 through August 2015; as Controller from February 2010 through August 2014; and as International Controller from September 2008 to February 2010. Prior to joining Briggs & Stratton, he held the position of Director with KPMG LLP. | |

EDWARD J. WAJDA, 55 Senior Vice President & President – Standby/Job Site Products | Mr. Wajda was elected to his current position in August 2015, to be effective as of September 1, 2015. He previously served as Senior Vice President & President - Standby/Job Site Products & International from September 2014 through August 2015; as Senior Vice President & General Manager - International from September 2013 through August 2014; and as Vice President & General Manager- International from July 2008 through August 2013. Mr. Wajda was elected as an executive officer effective as of February 2011. Prior to joining Briggs & Stratton, he held the position of Senior Vice President - Global Medical Vehicle Group for Oshkosh Corporation. | |

(1) Officer is also a Director of Briggs & Stratton.

(2) Member of the Board of Directors Executive Committee.

Officers are elected annually and serve until they resign, die, are removed, or a different person is appointed to the office.

15

PART II

ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Briggs & Stratton common stock and its common share purchase rights are traded on the NYSE under the symbol “BGG”. Information required by this Item is incorporated by reference from the “Quarterly Financial Data, Dividend and Market Information” (unaudited), included in Item 8 of this report.

Changes in Securities, Use of Proceeds and Issuer Purchases of Equity Securities

The table below sets forth the information with respect to purchases made by or on behalf of the Company of its common stock during the quarterly period ended June 28, 2015.

2015 Fiscal Month | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of a Publicly Announced Program (1) | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program (1) | ||||||||||

March 30, 2015 to April 26, 2015 | 121,557 | $ | 20.07 | 121,557 | $ | 45,303,773 | ||||||||

April 27, 2015 to May 24, 2015 | 99,268 | 19.81 | 99,268 | 43,337,274 | ||||||||||

May 25, 2015 to June 28, 2015 | 162,820 | 18.91 | 162,820 | 40,258,348 | ||||||||||

Total Fourth Quarter | 383,645 | $ | 19.51 | 383,645 | $ | 40,258,348 | ||||||||

(1) On August 13, 2014, the Board of Directors authorized up to an additional $50 million in funds for use in the Company’s existing common share repurchase program with an expiration date of June 30, 2016. The common share repurchase program authorizes the purchase of shares of the Company's common stock on the open market or in private transactions from time to time, depending on market conditions and certain governing debt covenants.

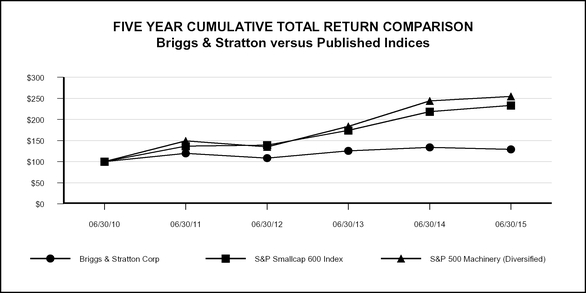

Five-year Stock Performance Graph

The graph below shows the cumulative total stockholder return of an investment of $100 (and the reinvestment of any dividends thereafter) at the close of business on June 30, 2010 in each of Briggs & Stratton common stock, the Standard & Poor’s (S&P) Smallcap 600 Index and the S&P Machinery Index.

16

ITEM 6. | SELECTED FINANCIAL DATA |

Fiscal Year | 2015(1) | 2014(2) | 2013(3) | 2012(4) | 2011(5) | |||||||||||||||

(dollars in thousands, except per share data) | ||||||||||||||||||||

SUMMARY OF OPERATIONS | ||||||||||||||||||||

NET SALES | $ | 1,894,750 | $ | 1,859,060 | $ | 1,862,498 | $ | 2,066,533 | $ | 2,109,998 | ||||||||||

GROSS PROFIT | 359,099 | 346,783 | 329,140 | 336,725 | 398,316 | |||||||||||||||

PROVISION (CREDIT) FOR INCOME TAXES | 11,271 | 8,787 | (18,484 | ) | 867 | 7,699 | ||||||||||||||

NET INCOME (LOSS) | 45,687 | 28,347 | (33,657 | ) | 29,006 | 24,355 | ||||||||||||||

EARNINGS (LOSS) PER SHARE OF COMMON STOCK: | ||||||||||||||||||||

Basic | 1.00 | 0.59 | (0.73 | ) | 0.58 | 0.49 | ||||||||||||||

Diluted | 1.00 | 0.59 | (0.73 | ) | 0.57 | 0.48 | ||||||||||||||

PER SHARE OF COMMON STOCK: | ||||||||||||||||||||

Cash Dividends | 0.50 | 0.48 | 0.48 | 0.44 | 0.44 | |||||||||||||||

Shareholders’ Investment | $ | 12.94 | $ | 14.50 | $ | 14.16 | $ | 12.91 | $ | 14.85 | ||||||||||

WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK OUTSTANDING (in 000’s) | 44,392 | 46,366 | 47,172 | 48,965 | 49,677 | |||||||||||||||

DILUTED NUMBER OF SHARES OF COMMON STOCK OUTSTANDING (in 000’s) | 44,442 | 46,436 | 47,172 | 49,909 | 50,409 | |||||||||||||||

OTHER DATA | ||||||||||||||||||||

SHAREHOLDERS’ INVESTMENT | $ | 574,250 | $ | 672,434 | $ | 667,938 | $ | 631,970 | $ | 737,943 | ||||||||||

LONG-TERM DEBT | 225,000 | 225,000 | 225,000 | 225,000 | 225,000 | |||||||||||||||

CAPITAL LEASES | — | — | — | 133 | 571 | |||||||||||||||

TOTAL ASSETS | 1,458,962 | 1,449,706 | 1,447,551 | 1,608,231 | 1,666,218 | |||||||||||||||

PLANT AND EQUIPMENT | 1,035,326 | 1,035,848 | 1,019,355 | 1,026,845 | 1,016,892 | |||||||||||||||

PLANT AND EQUIPMENT, NET OF ACCUMULATED DEPRECIATION | 314,838 | 297,007 | 287,195 | 301,249 | 329,225 | |||||||||||||||

PROVISION FOR DEPRECIATION | 48,496 | 47,190 | 52,290 | 60,297 | 59,920 | |||||||||||||||

EXPENDITURES FOR PLANT AND EQUIPMENT | 71,710 | 60,371 | 44,878 | 49,573 | 59,919 | |||||||||||||||

WORKING CAPITAL | $ | 460,127 | $ | 567,148 | $ | 584,226 | $ | 605,591 | $ | 634,356 | ||||||||||

Current Ratio | 2.4 to 1 | 2.9 to 1 | 3.1 to 1 | 3.0 to 1 | 2.8 to 1 | |||||||||||||||

NUMBER OF EMPLOYEES AT YEAR-END | 5,480 | 5,695 | 5,980 | 6,321 | 6,716 | |||||||||||||||

NUMBER OF SHAREHOLDERS AT YEAR-END | 2,681 | 2,815 | 3,153 | 3,184 | 3,289 | |||||||||||||||

QUOTED MARKET PRICE: | ||||||||||||||||||||

High | $ | 21.09 | $ | 23.02 | $ | 25.52 | $ | 20.81 | $ | 24.18 | ||||||||||

Low | $ | 17.14 | $ | 18.21 | $ | 16.20 | $ | 12.36 | $ | 16.50 | ||||||||||

(1) | In fiscal 2015, the Company had restructuring charges of $17.7 million after-tax, or $0.40 per diluted share, and acquisition-related charges of $1.4 million after-tax, or $0.03 per diluted share. |

(2) | In fiscal 2014, the Company had goodwill and tradename impairment charges of $5.5 million after-tax, or $0.12 per diluted share, and restructuring charges of $5.2 million after-tax, or $0.11 per diluted share. |

(3) | In fiscal 2013, the Company had goodwill and tradename impairment charges of $62.0 million after-tax, or $1.30 per diluted share, restructuring charges of $15.5 million after-tax, or $0.33 per diluted share, and a litigation settlement of $1.2 million after-tax, or $0.03 per diluted share. |

(4) | In fiscal 2012, the Company had restructuring charges of $28.8 million after-tax, or $0.58 per diluted share. |

(5) | In fiscal 2011, the Company had a goodwill impairment charge of $34.3 million after-tax, or $0.68 per diluted share, restructuring charges of $2.2 million after-tax, or $0.04 per diluted share, and debt redemption costs of $2.4 million after-tax, or $0.05 per diluted share. |

17

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Results of Operations

FISCAL 2015 COMPARED TO FISCAL 2014

The following table is a reconciliation of financial results by segment, as reported, to adjusted financial results by segment, excluding restructuring charges, acquisition-related charges, and goodwill and tradename impairments (in thousands, except per share data):

For the fiscal year ended June | ||||||||||||||||||||||||

2015 Reported | Adjustments(1) | 2015 Adjusted (2) | 2014 Reported | Adjustments(1) | 2014 Adjusted (2) | |||||||||||||||||||

NET SALES: | ||||||||||||||||||||||||

Engines | $ | 1,208,914 | $ | — | $ | 1,208,914 | $ | 1,219,627 | $ | — | $ | 1,219,627 | ||||||||||||

Products | 788,564 | — | 788,564 | 736,312 | — | 736,312 | ||||||||||||||||||

Inter-Segment Eliminations | (102,728 | ) | — | (102,728 | ) | (96,879 | ) | — | (96,879 | ) | ||||||||||||||

Total | $ | 1,894,750 | $ | — | $ | 1,894,750 | $ | 1,859,060 | $ | — | $ | 1,859,060 | ||||||||||||

GROSS PROFIT: | ||||||||||||||||||||||||

Engines | $ | 267,778 | $ | — | $ | 267,778 | $ | 257,441 | $ | 3,099 | $ | 260,540 | ||||||||||||

Products | 89,268 | 25,710 | 114,978 | 87,682 | 2,742 | 90,424 | ||||||||||||||||||

Inter-Segment Eliminations | 2,053 | — | 2,053 | 1,660 | — | 1,660 | ||||||||||||||||||

Total | $ | 359,099 | $ | 25,710 | $ | 384,809 | $ | 346,783 | $ | 5,841 | $ | 352,624 | ||||||||||||

ENGINEERING, SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | ||||||||||||||||||||||||

Engines | $ | 179,566 | $ | — | $ | 179,566 | $ | 184,803 | $ | — | $ | 184,803 | ||||||||||||

Products | 110,350 | 693 | 109,657 | 106,564 | — | 106,564 | ||||||||||||||||||

Total | $ | 289,916 | $ | 693 | $ | 289,223 | $ | 291,367 | $ | — | $ | 291,367 | ||||||||||||

RESTRUCTURING CHARGES AND GOODWILL AND TRADENAME IMPAIRMENT: | ||||||||||||||||||||||||

Engines | $ | — | $ | — | $ | — | $ | 425 | $ | 425 | $ | — | ||||||||||||

Products | 3,000 | 3,000 | — | 8,733 | 8,733 | — | ||||||||||||||||||

Total | $ | 3,000 | $ | 3,000 | $ | — | $ | 9,158 | $ | 9,158 | $ | — | ||||||||||||

EQUITY IN EARNINGS OF UNCONSOLIDATED AFFILIATES | ||||||||||||||||||||||||

Engines | $ | 5,668 | $ | — | $ | 5,668 | $ | 6,087 | $ | — | $ | 6,087 | ||||||||||||

Products | 1,635 | — | 1,635 | 177 | — | 177 | ||||||||||||||||||

Total | $ | 7,303 | $ | — | $ | 7,303 | $ | 6,264 | $ | — | $ | 6,264 | ||||||||||||

SEGMENT INCOME (LOSS) (3): | ||||||||||||||||||||||||

Engines | $ | 93,880 | $ | — | $ | 93,880 | $ | 78,300 | $ | 3,524 | $ | 81,824 | ||||||||||||

Products | (22,447 | ) | 29,403 | 6,956 | (27,438 | ) | 11,475 | (15,963 | ) | |||||||||||||||

Inter-Segment Eliminations | 2,053 | — | 2,053 | 1,660 | — | 1,660 | ||||||||||||||||||

Total | $ | 73,486 | $ | 29,403 | $ | 102,889 | $ | 52,522 | $ | 14,999 | $ | 67,521 | ||||||||||||

18

For the fiscal year ended June | ||||||||||||||||||||||||

2015 Reported | Adjustments(1) | 2015 Adjusted (2) | 2014 Reported | Adjustments(1) | 2014 Adjusted (2) | |||||||||||||||||||

SEGMENT INCOME (LOSS) (3): | $ | 73,486 | $ | 29,403 | $ | 102,889 | $ | 52,522 | $ | 14,999 | $ | 67,521 | ||||||||||||

Reconciliation from Segment Income (Loss) to Income Before Income Taxes: | ||||||||||||||||||||||||

Equity in Earnings of Unconsolidated Affiliates | 7,303 | — | 7,303 | 6,264 | — | 6,264 | ||||||||||||||||||

Income from Operations | $ | 66,183 | $ | 29,403 | $ | 95,586 | $ | 46,258 | $ | 14,999 | $ | 61,257 | ||||||||||||

INTEREST EXPENSE | (19,532 | ) | — | (19,532 | ) | (18,466 | ) | — | (18,466 | ) | ||||||||||||||

OTHER INCOME, Net | 10,307 | — | 10,307 | 9,342 | — | 9,342 | ||||||||||||||||||

Income Before Income Taxes | 56,958 | 29,403 | 86,361 | 37,134 | 14,999 | 52,133 | ||||||||||||||||||

PROVISION FOR INCOME TAXES | 11,271 | 10,280 | 21,551 | 8,787 | 4,307 | 13,094 | ||||||||||||||||||

Net Income | $ | 45,687 | $ | 19,123 | $ | 64,810 | $ | 28,347 | $ | 10,692 | $ | 39,039 | ||||||||||||

EARNINGS PER SHARE | ||||||||||||||||||||||||

Basic | $ | 1.00 | $ | 0.42 | $ | 1.42 | $ | 0.59 | $ | 0.23 | $ | 0.82 | ||||||||||||

Diluted | 1.00 | 0.42 | 1.42 | 0.59 | 0.23 | 0.82 | ||||||||||||||||||

(2) Adjusted financial results are non-GAAP financial measures. The Company believes this information is meaningful to investors as it isolates the impact that restructuring charges, and goodwill and tradename impairments have on reported financial results and facilitates comparisons between peer companies. The Company may utilize non-GAAP financial measures as a guide in the forecasting, budgeting, and long-term planning process. While the Company believes that adjusted financial results are useful supplemental information, such adjusted financial results are not intended to replace our GAAP financial results and should be read in conjunction with those GAAP results.

(3) The Company defines segment income (loss) as income from operations plus equity in earnings of unconsolidated affiliates.

Net Sales

Consolidated net sales for fiscal 2015 were $1.89 billion. Consolidated net sales increased $36 million or 1.9% from fiscal 2014, which includes $29 million related to unfavorable currency rates. Consolidated net sales increased $65 million or 3.5% before the impact of unfavorable currency rates. The increase in net sales is due to the results from the Allmand and Billy Goat acquisitions, a 3% increase in global engine unit shipments and higher sales of commercial lawn and garden equipment and pressure washers in North America. Partially offsetting the increase were reduced sales of generators, unfavorable engine sales mix and the planned actions to narrow the assortment of lower-priced Snapper consumer lawn and garden equipment.

Engines segment net sales for fiscal 2015 were $1.2 billion, which was $10.7 million or 0.9% lower than the prior year. This decrease is due to an unfavorable foreign exchange impact of approximately $15.3 million and an unfavorable mix of engines sold, partially offset by a 3% increase in unit shipments of global engines. Fiscal 2015 sales skewed proportionately towards small engines due to elevated levels of large engines in the channel entering this lawn and garden season.

Products segment net sales for fiscal 2015 were $788.6 million, an increase of $52.3 million or 7.1% from the prior year. The increase in net sales is due to the results of the Allmand and Billy Goat acquisitions, higher commercial lawn and garden equipment sales, higher sales in Australia on an improved lawn and garden season and higher pressure washer sales. Partially offsetting the increase is the unfavorable impact of foreign exchange of $13.6 million, reduced sales of generators due to fewer major power outages, and the planned actions to narrow the assortment of lower-priced Snapper consumer lawn and garden equipment.

19

Gross Profit Percentage

The consolidated gross profit percentage was 19.0% in fiscal 2015, an increase of 0.3% from fiscal 2014.