Attached files

| file | filename |

|---|---|

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a51160138.htm |

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a51160138ex99_1.htm |

Exhibit 99.2

Operator: Greetings and welcome to the MAXIMUS Fiscal 2015 Third Quarter Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS. Thank you, Ms. Miles. Please go ahead.

............................................................................................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor

Relations & Corporate Communications

Good morning. Thank you for joining us on today's conference call. I would like to point out that we've posted a presentation on our website under the Investor Relations page to assist you in following along with today's call. With me today is Chief Executive Officer, Rich Montoni; President, Bruce Caswell; and Chief Financial Officer, Rick Nadeau.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward- looking in nature. Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP measures presented in this document, please see the company's most recent quarterly earnings press release.

And with that, I'll turn the call over to Rick.

............................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief

Financial Officer & Treasurer

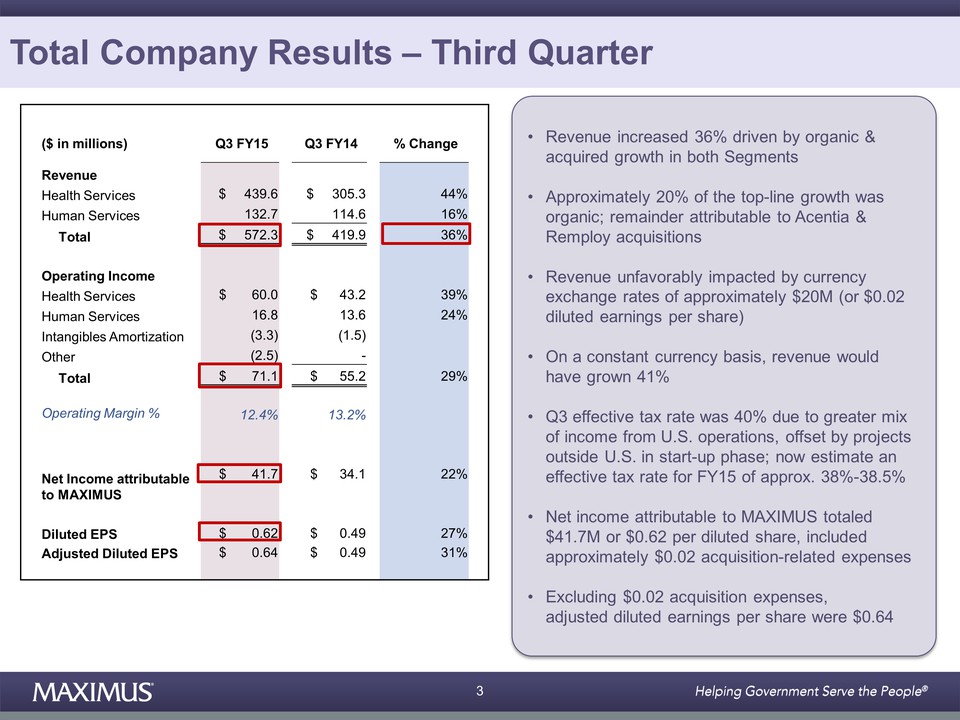

Thanks, Lisa. This morning, MAXIMUS reported third quarter revenue of $572.3 million, a 36% increase compared to the same period last year. This increase was driven by organic and acquired growth in both of our segments. Approximately 20% of the top line growth was organic growth with the remainder attributable to the acquisitions of Acentia and Remploy, both of which closed in early April.

Revenue in the period was unfavorably impacted by currency exchange rates of approximately $20 million or $0.02 of diluted earnings per share. On a constant currency basis, revenue would have grown 41%.

For the third quarter of fiscal 2015, operating income totaled $71.1 million which was an operating margin of 12.4%. This compares to operating income of $55.2 million, which was a 13.2% operating margin reported for the same period last year.

In the third quarter, our effective tax rate was 40% due to a greater mix of income from our U.S. operations. This was offset by projects outside the U.S. in start-up phase. We now estimate an effective tax rate for fiscal 2015 of approximately 38% to 38.5%.

For the third quarter, net income attributable to MAXIMUS totaled $41.7 million or $0.62 per diluted share, which included approximately $0.02 of acquisition-related expenses. Excluding the $0.02 of acquisition expenses, adjusted diluted earnings per share were $0.64.

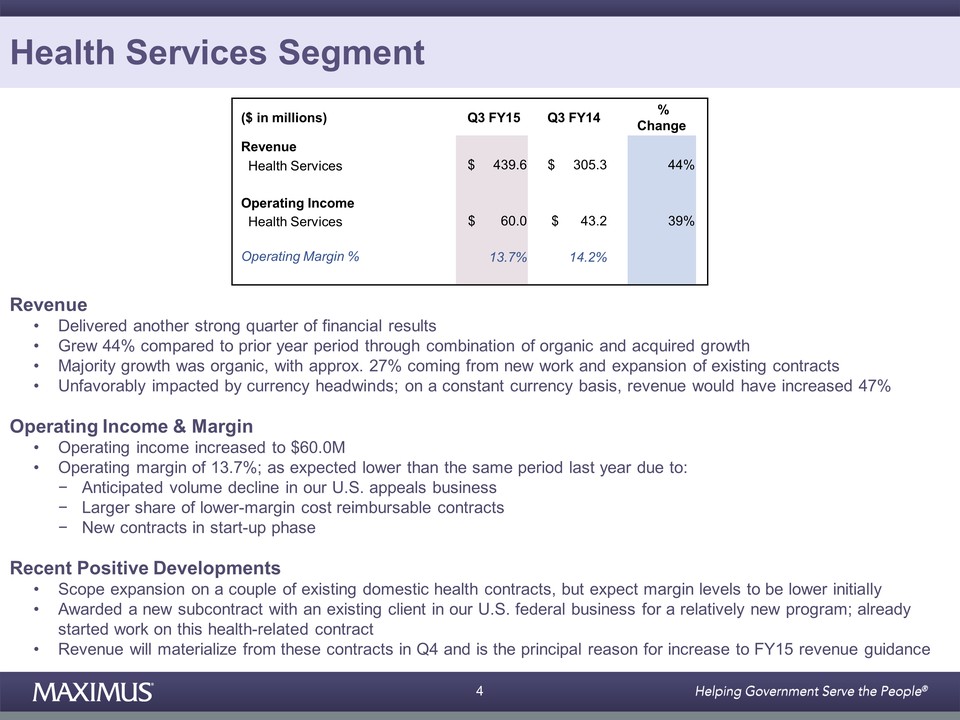

I will now speak to our results by segment starting with Health Services. For the third quarter of fiscal 2015, the Health Services Segment delivered another strong quarter of financial results. Through a combination of organic and acquired growth, Health Segment revenue grew 44% in the quarter compared to the prior year period. The majority of growth in the quarter was organic with approximately 27% coming from new work and the expansion of existing contracts. Revenue growth in this segment was unfavorably impacted by currency headwinds. On a constant currency basis, revenue would have increased 47%.

Health Services Segment operating income in the third quarter of fiscal 2015 increased to $60.0 million compared to $43.2 million for the same period last year. For the third quarter of fiscal 2015, the Health Segment delivered an operating margin of 13.7%. And, as expected, operating margin was lower than the same period last year due to the anticipated volume decline in our U.S. appeals business, a larger share of lower-margin cost reimbursable contracts and new contracts in start-up phase.

The Health Services Segment had some recent positive developments. We recently picked up some scope expansion on a couple of existing domestic health contracts but we expect margin levels to be lower initially. In addition, we were also awarded a new subcontract in our U.S. federal business for an existing client under a relatively new program. Under the contractual terms, we cannot provide any additional details, but we can tell you that we have already started work on this health-related contract.

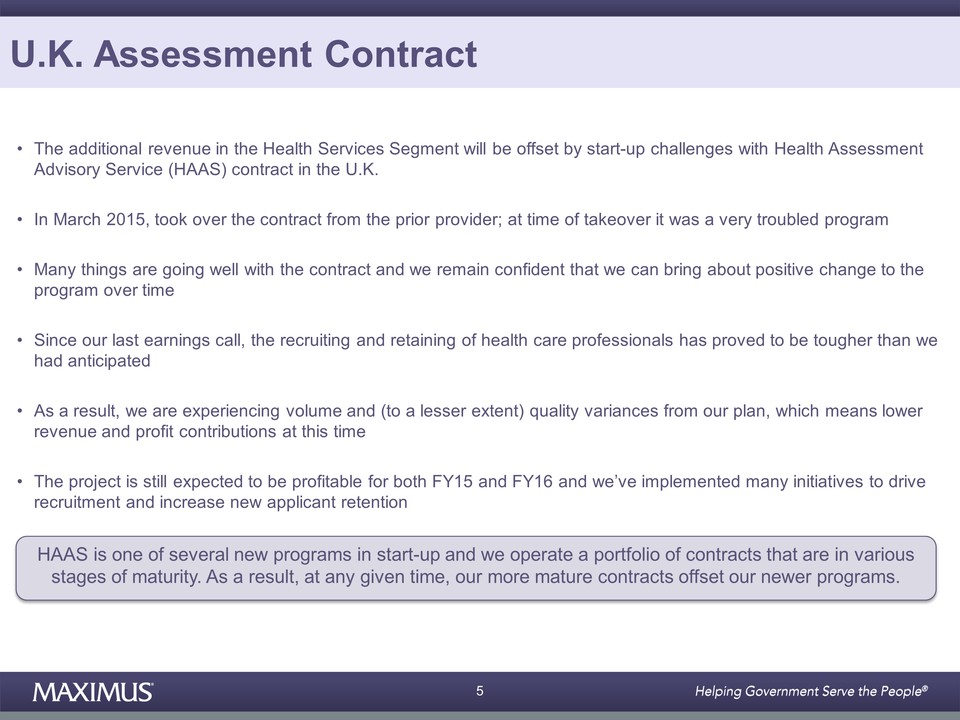

Revenue will materialize from these contracts in the fourth quarter and it is the principal reason for the increase to revenue guidance. This additional revenue will be offset by start-up challenges that we are experiencing with the Health Assessment Advisory Service contract in the UK. In March, we took over the contract from the prior provider. And at the time of takeover, it was a very troubled program. Many things are going well with the contract and we remain confident that we can bring about positive change to the program over time.

Since our last earnings call, the recruiting and retaining of healthcare professionals has proved to be tougher than we had anticipated. As a result, we are experiencing volume and, to a lesser extent, quality variances from our plan. This means lower revenue and profit contributions from the contract at this time. The project is still expected to be profitable for both fiscal 2015 and fiscal 2016.

As Rich will talk about, we have already implemented many initiatives to drive recruitment and increase new applicant retention. It is important to note that the Health Assessment Advisory Service is one of several new programs in startup. We operate a portfolio of contracts that are in various stages of maturity. As a result, at any given time, our more matured contracts offset our newer programs.

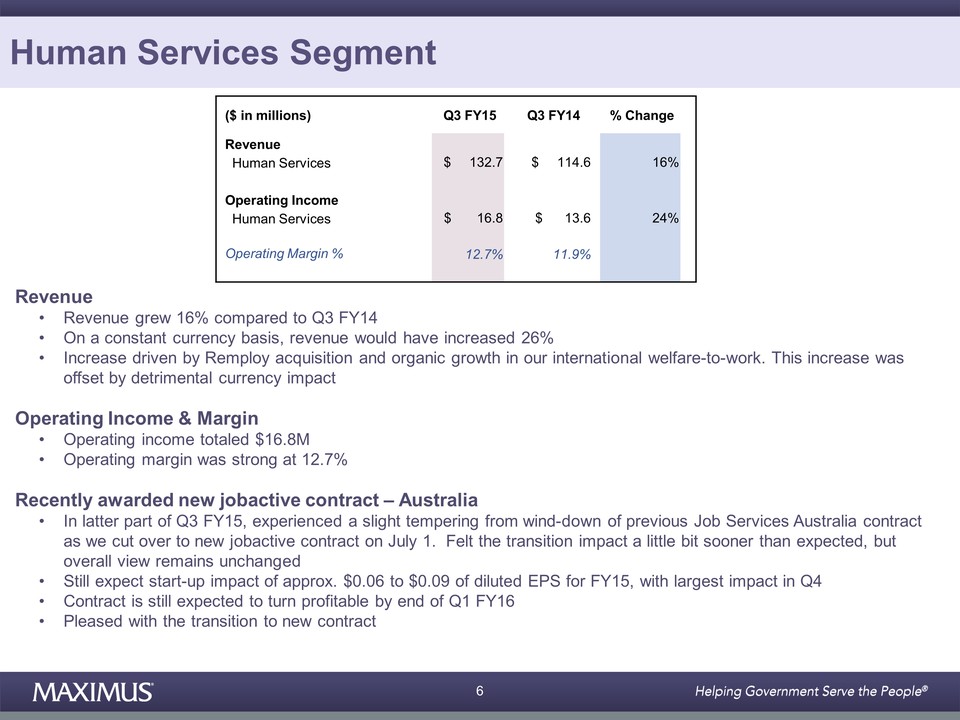

Let's turn our attention to financial results for Human Services. Once again, the Human Services Segment felt the greatest impact from adverse currency exchange rates. For the third quarter of fiscal 2015, revenue for the Human Services Segment grew 16% to $132.7 million, compared to the same period last year.

On a constant currency basis, the segment's revenue would have increased 26%. The revenue increase in the quarter was driven by the Remploy acquisition and organic growth in our international welfare-to-work operations. This was offset by the detrimental currency impact. Third quarter operating income for the Human Services Segment totaled $16.8 million and operating margin was strong at 12.7%.

As previously announced, we were recently awarded the new jobactive contract in Australia. In the latter part of the third quarter, we did experience a slight tempering from the wind-down of the old jobservices Australia contract as we cut over to the new contract on July 1. We felt the transition impact a little bit sooner than expected, but our overall view remains unchanged.

We still expect a start-up impact of approximately $0.06 to $0.09 of diluted earnings per share for fiscal 2015 with the largest impact in Q4. The contract is still expected to turn profitable by the end of the first quarter of fiscal 2016. Rich will talk about the new program launch in more detail, but we are very pleased with how the transition to the new contract is going.

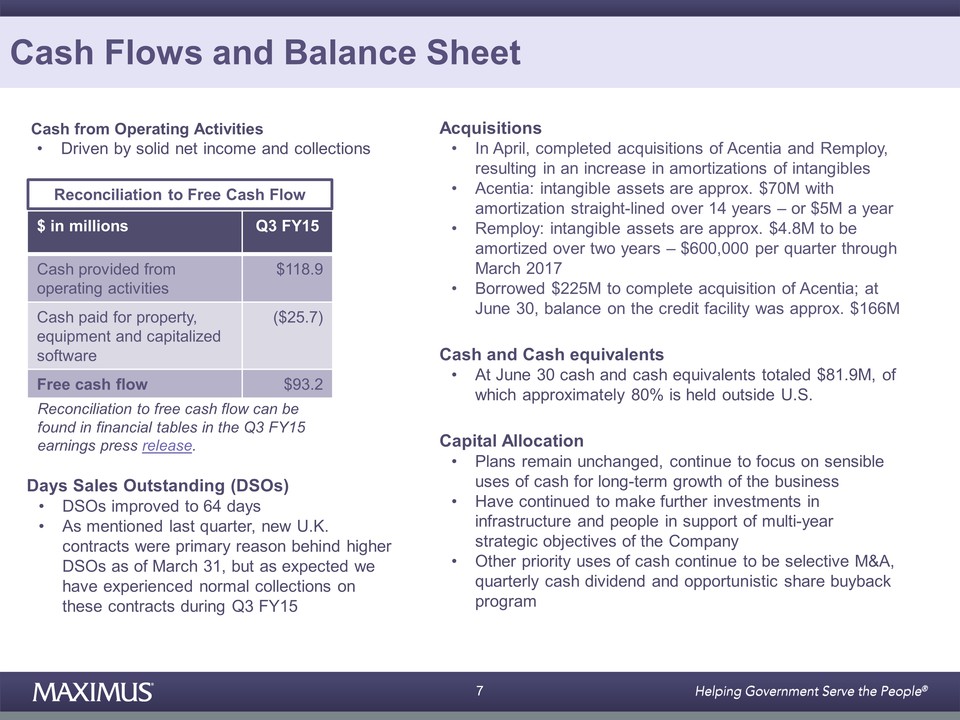

Moving on to cash flows and balance sheet items. For the third quarter of fiscal 2015, cash provided from operating activities totaled approximately $119 million, driven by solid net income and collections. As a result, free cash flow in the quarter totaled $93.2 million. A reconciliation to free cash flow can be found in the financial tables in today's press release.

As expected, DSOs improved to 64 days. As we mentioned last quarter, the new UK contracts were the primary reason behind the higher DSOs as of March 31. But as expected, we have experienced normal collections on these contracts during the third quarter. In April, we completed the acquisitions of Acentia and Remploy so you have seen an increase in the amortization of intangibles. For Acentia, the intangible assets are approximately $70 million with amortization straight lined over 14 years or $5 million a year. For Remploy, the intangible assets are approximately $4.8 million to be amortized every two years or $600,000 per quarter through March of 2017.

MAXIMUS borrowed $225 million to complete the acquisition of Acentia, and during the quarter, we paid down some of that debt so that at June 30, the balance on the credit facility was approximately $166 million. At June 30, 2015, cash and cash equivalents totaled $81.9 million, of which approximately 80% is held outside of the United States.

Our capital allocation plans remain unchanged. We continue to focus on sensible uses of cash for the long-term growth of the business. As I mentioned on our last earnings call, we have continued to make further investments in infrastructure and people in support of our multiyear strategic objectives of the company. In addition, other priority uses of cash continue to be selective M&A, our quarterly cash dividend, and our opportunistic share buyback program.

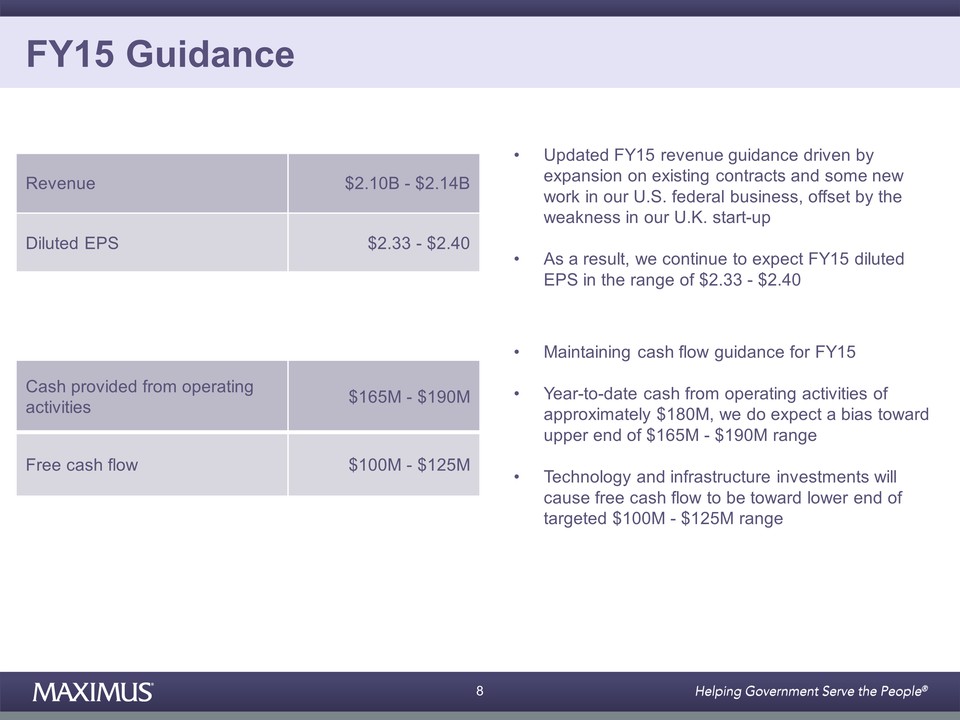

And lastly, guidance. As noted in this morning's press release, we are updating our fiscal 2015 revenue guidance, and we now expect revenue to range between $2.10 billion and $2.14 billion. This is driven by the expansion on existing contracts and some new work in our U.S. federal business which will be offset by the weakness in our UK start-up. As a result, we continue to expect fiscal 2015 diluted earnings per share in the range of $2.33 to $2.40.

We are also maintaining our cash flow guidance for fiscal 2015. We still expect cash provided from operating activities to be in the range of $165 million to $190 million. With year-to-date cash from operating activities of approximately $180 million, we do expect a bias towards the upper end of that range. In addition, the technology and infrastructure investments will cause our free cash flow to be towards the lower end of our targeted range of $100 million to $125 million for fiscal 2015.

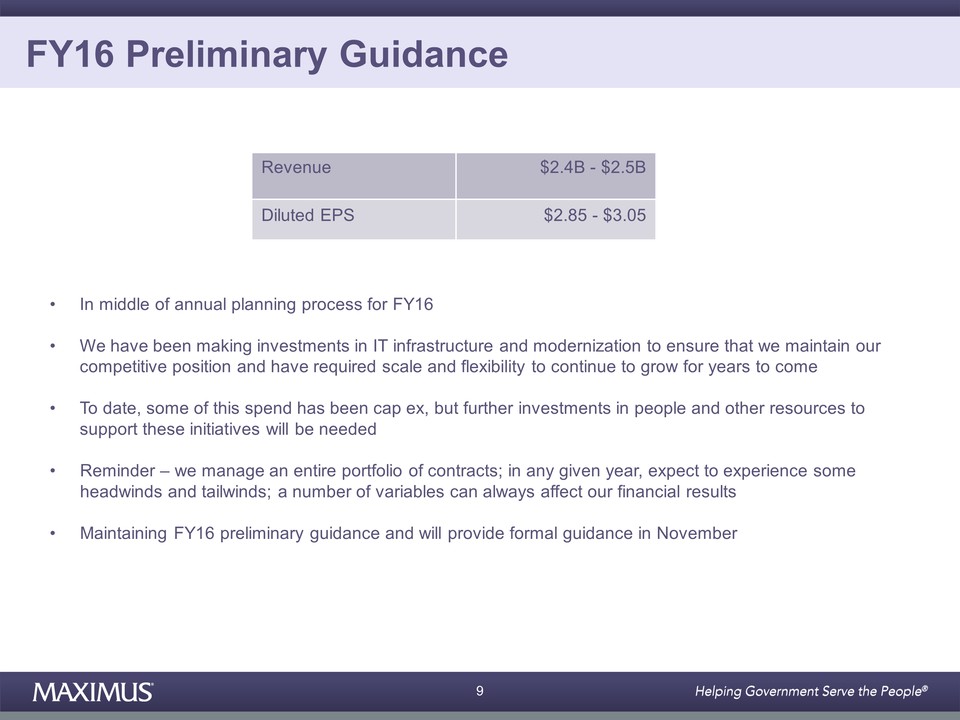

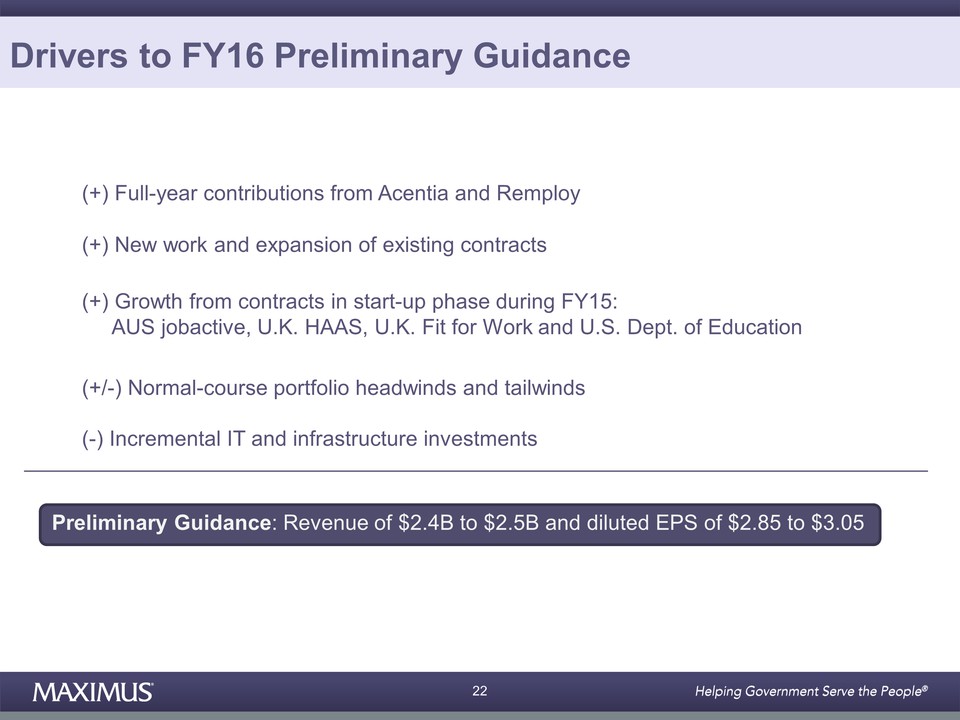

We are presently in the middle of our annual planning process for fiscal 2016. We have been making investments in IT infrastructure and modernization to ensure that we maintain our competitive position and have the required scale and flexibility to continue to grow for years to come. To-date, some of this spend has been CapEx, but further investments in people and other resources to support these initiatives will be needed.

It is important to remember that we manage an entire portfolio of contracts and in any given year, we naturally expect to experience some headwinds and some tailwinds. There are obviously a number of variables that can always affect our financial results.

To sum it all up, we are maintaining our fiscal 2016 preliminary guidance. As we stated last quarter, on a preliminary basis, we expect revenue for fiscal 2016 to range between $2.4 billion and $2.5 billion, and diluted earnings per share to range between $2.85 and $3.05.

As I stated earlier, we are currently in the middle of our annual planning process. And as always, we will provide formal guidance in November.

Thanks for joining us this morning. And now, I'll turn the call over to Rich.

..............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief

Executive Officer & Director

Thank you, Rick, and good morning everyone. With another great quarter of growth behind us, I'll take the opportunity today to provide an update on some of our longer-term objectives including new programs in start- up, our more recent acquisitions and some additional color on our internal investments.

As we've discussed in the past, we operate a portfolio of contracts, many of which are tied to operating long-term programs with clearly-defined program life cycles. Oftentimes, profitability may be lower in the early days, and then improve as the programs mature.

As part of our established risk management strategy, we place a tremendous amount of focus on closely managing our start-ups. This includes identifying and fixing issues early on because well-executed start-ups turn into mature profitable contracts.

Today, I'd like to give an update on three of these start-ups: the Health Assessment Advisory Service and the Fit for Work contracts in the United Kingdom, and the jobactive contract in Australia. As Rick mentioned, the UK Health Assessment Advisory Services contract is facing some start-up challenges. This is the contract where MAXIMUS is conducting assessments for individuals seeking certain disability benefits according to the rules set out by parliament. The program faced significant obstacles prior to MAXIMUS taking over the contract in March of this year. All along, we've recognized that it would take some time to bring meaningful improvements to the program. With five months of operations now under our belt, we have a keen understanding of the additional improvements we need to bring to bear, and we have several initiatives that are well under way.

Our performance under this program is tied to quality, timeliness and the number of assessments completed. So, as with any new program, we are focused on hitting the required performance metrics. We believe that our efforts to drive recruitment and improve retention are gaining traction and are the right course of action.

This includes, but is not limited to, an aggressive recruitment campaign that is well under way. We believe this should drive a significant uplift in qualified applicants. We are working diligently to ensure the longer-term success of this program, and we still believe that we can bring out the right changes to improve the overall service to customers.

Our second start-up in the UK is the Fit for Work contract. This is a support service to help working people who face long-term absence due to illness return to their jobs more quickly. You may recall that we launched Phase 1 of the contract last December. We recently launched Phase 2, which is the nationwide rollout of the service.

Moving on to Australia, as Rick noted, the jobactive contract successfully launched on July 1. This was a key rebid for MAXIMUS. As a reminder, we gained the net pickup in expected volumes which increased our overall market share of caseload allocations. Under the same contract, we also increased our footprint for the Work for the Dole program where we arrange activities with community-based and not-for-profit organizations.

Our Australian team has worked tirelessly under a very compressed timeframe and an early contract transition. They've done this to ensure that we are ready to go when the door is opened on July 1. We've introduced new technologies and applications to improve connectivity between job seekers and employers. Our world class operations will enable more job seekers to find and maintain meaningful employment. Congratulations to the team on a job well done.

Let me now take a moment to provide an update on our two recent acquisitions from April, that being Acentia and Remploy. We are pleased to report that integration efforts are going well. Both acquisitions are complementary to our long-term growth strategy. With Acentia, we now hold positions on several additional federal contract vehicles and have access to more federal health and civilian agencies. Already, we are seeing many new prospects that combine BPO and IT that we believe will be in a formal procurement process over the next several years. Our business development team is finalizing our integrated go-to-market plan that strengthens our sales resources, enhances our offerings, and identifies new areas of future opportunities.

With Remploy, now being part of our team, we are increasing our global presence as a leading provider of disability employment services and enhancing our business development efforts for emerging opportunities. Our mergers and acquisitions program is one component of our long-term growth strategy. We continue to look for strategic acquisitions that will complement our core, add value and are accretive. But, as you know, we're selective in our process and have a methodical approach that we've found to be successful.

We are also deep in the heart of planning for the Affordable Care Act's third open enrollment period, which starts on November 1. And while June's U.S. Supreme Court's decision essentially maintains the status quo, some states are still considering using waivers as a way to increase their autonomy over time. MAXIMUS offers states a deep understanding of the new potential policies within the context of these waivers. We also offer states the additional benefit of greater flexibility in how the exchange functions are integrated with current public health insurance programs. Over the long run, we still see opportunities for growth as states continue to shift and expand their health services programs and seek ways to operate their current programs more effectively.

As Rick mentioned, we believe there are necessary technology investments to ensure that we are best positioned for continued growth over the long run. We operate in a competitive environment, and we must keep our technology capability sharp to maintain our position as a trusted and preferred partner to governments worldwide.

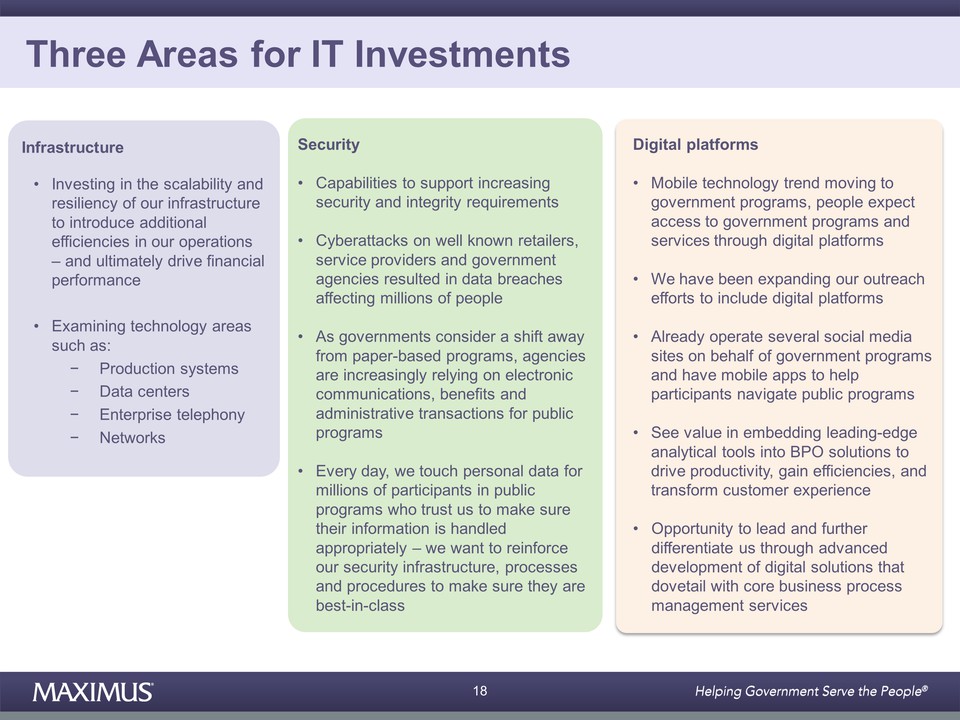

At the end of 2014, we brought in a new Chief Information Officer to execute the company's broader global technology strategy. Recently, we completed a tops-down review of our global infrastructure and we believe that now is the time to make necessary investments in three areas to best position MAXIMUS for years to come.

The first area is network infrastructure. Our plans include making investments in the scalability and resiliency of our infrastructure to introduce additional efficiencies in our operations and ultimately drive financial performance. Without wading into what we consider competitive advantages, I can share that we are examining technology areas such as production systems, data centers, enterprise telephony and networks.

The second area is security. We must have the capabilities to support the increasing security and integrity requirements of our clients. We've all read about the cyber attacks on well-known retailers, service providers and government agencies that resulted in data breaches affecting millions of people.

As governments consider a shift away from paper-based programs, agencies are increasingly relying on electronic communications, benefits and administrative transactions for the public programs. Therefore, we need to have the appropriate measures to safeguard the information of the citizens we serve. Every day, we touch the personal data for millions of participants in public programs. They are trusting us to make sure their information is handled appropriately. So, we want to reinforce our security infrastructure, processes and procedures to make sure that they are best-in-class.

And the third area is digital platforms. During this age of digital transformation, people use mobile technology for everyday activities, from conducting banking transactions to managing their health. We see this trend moving to government programs too. People are also starting to expect access to government programs and services through digital platforms.

One of our core areas of expertise is our ability to connect with participants of public programs. For several years, we've been expanding our outreach efforts to include digital platforms. We operate several social media sites on behalf of our government programs, and we've launched a number of mobile applications to help participants navigate public programs. We also see great value in further developing our analytics capabilities, where we can embed leading edge analytical tools into our BPO solutions to drive productivity and transform the customer experience. Today, we see the opportunity to lead and further differentiate ourselves through the advanced development of our digital solutions that dovetail with our core business process management services.

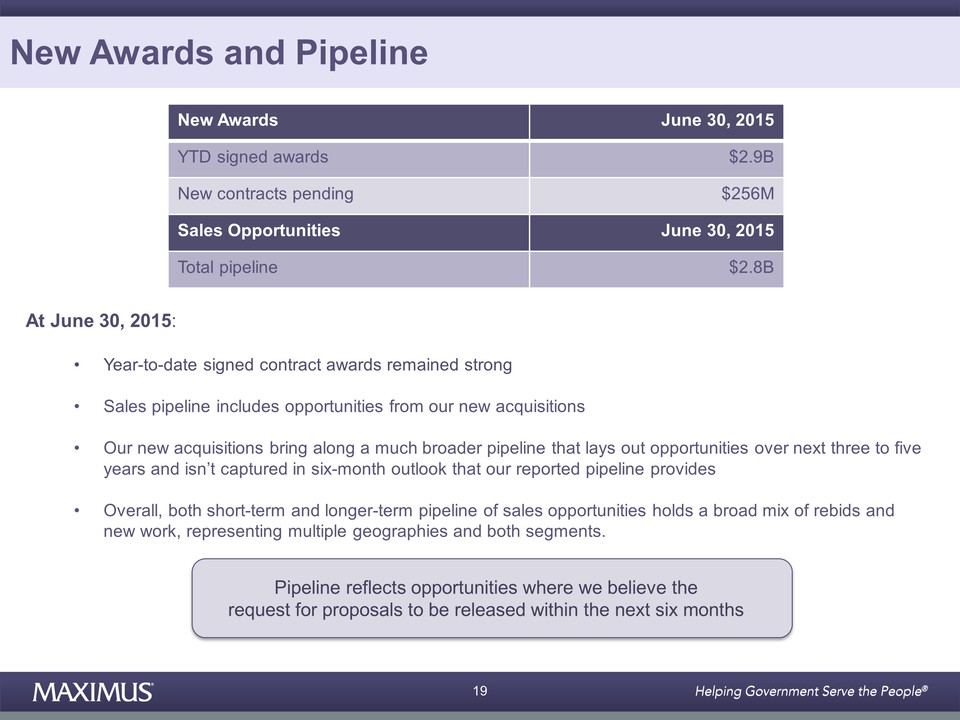

Let's move on to new awards and the pipeline. At June 30, our year-to-date signed contract awards remained strong at a record $2.9 billion. We also had an additional $256 million in new awarded unsigned contracts at June 30.

Our sales pipeline was $2.8 billion at June 30 and includes opportunities from our new acquisitions. As a reminder, our reported pipeline only reflects short-term opportunities where we believe the request for proposals will be released within the next six months. Our new acquisitions bring along a much broader pipeline that lays out opportunities over the next three to five years. This is not captured in the six-month outlook that our reported pipeline provides. Overall, both our short-term and longer-term pipeline of sales opportunities holds a broad mix of rebids and new work, representing multiple geographies in both segments.

In summary, we remain optimistic about the macro trends that should continue to fuel our future growth, and the long-term demand for our services remained strong. As we have in the past, we will provide you with our formal guidance for fiscal 2016 on our November earnings call. We continue to see growth opportunities that span multiple business areas and geographies.

The acquisition of Acentia and the addition of Remploy have strengthened our position for future opportunities in key markets. We are proud of our team's efforts for launching new contracts and advancing solutions to keep our startups on track. And we remain squarely committed to generating long-term shareholder value as we continue to grow the business.

And with that, let's open it up for questions. Operator?

Operator: Thank you. We will now be conducting a question-and-answer session. Please limit yourself to one question and one follow-up question. If you wish to ask additional questions, you may re-enter the queue. [Operator Instructions] And our first question comes from the line of Charlie Strauzer with CJS Securities. Please go ahead with your questions

..............................................................................................................................................................................................................................................................................................................................

Charles Strauzer

CJS Securities, Inc.

Hi. Good morning

............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Good morning, Charlie

............................................................................................................................................................................................................................................................................................................................

Charles Strauzer

CJS Securities, Inc.

A quick question on the guidance range for the remainder of this year, the $2.33 to $2.40. I think previously, you had said that that was going to be coming in towards the high end of that range. I didn't see that in today's release or in the comments, but just hoping you can explain a little bit more on that, and maybe just related to tax or FX or both or that kind of thing

............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

I'm glad to share our thinking with you. And Rick Nadeau, our CFO, is pleased to handle that, Charlie

..............................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

Yeah. Thanks, Charlie. Charlie, we did guide to the gap. We did show in the press release the amount of the M&A charge that is included in $0.02 this quarter and $0.04 overall. And I really think I should point you to the currency. Currency cost is about $0.02 this quarter. And if people look at what's happened in the currency exchange rates in July, they have continued to be very unfavorable toward MAXIMUS. In other words, the U.S. dollar strengthening as compared to the Australian dollar and the Canadian dollar.

You always know that start-up programs are difficult to predict, the pace at which they're going to really move to maturity. I want to make it clear. I think the upper end of the range is still our goal and it is still possible. But there are many factors that we need to consider, and some of those factors such as currency are really, frankly, out of our control

............................................................................................................................................................................................................................................................................................................................

Charles Strauzer

CJS Securities, Inc.

Is some of that also related to the higher tax rate from the higher mix from U.S. work too?

..............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Yes. Yes

...............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Any follow up, Charlie?

..............................................................................................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor Relations & Corporate Communications

Next question, please?

............................................................................................................................................................................................................................................................................................................................

Operator: Our next question comes from the line of Brian Kinstlinger with Maxim Group. Please go ahead with your questions

............................................................................................................................................................................................................................................................................................................................

Brian D. Kinstlinger

Maxim Group LLC

Great. Thanks so much. Good morning

............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Good morning, Brian

..........................................................................................................................................................................................................................................................................................................................

Brian D. Kinstlinger

Maxim Group LLC

I'm curious why you think you're having trouble recruiting on the HAAS contract? Does it have anything to do with the contract's reputation from the previous vendor? And if not, what do you think the issue is as you see it and/or the plan to fix that issue?

............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Brian, I think the challenges on recruiting health care professionals, and we recruit two types of health care professionals, one happens to be doctors and the other one's nurses and this is across the United Kingdom. So, finding the right number of those health care professionals, as we know here in the U.S., there's not a surplus of such professionals in our economy. The same condition exists in the United Kingdom.

So, we are looking for individuals, the majority of which are gainfully employed, so recruiting them is tougher than some other types of professionals. And the geographic factors also play into it. As it relates to the nature of the program and the work that we do, I think there are individuals that are actually passionate about it and care about it very, very much, and I think we've managed the program such that it is attractive to many, many individuals. So, I think it's really just a matter of supply and demand, not so much the nature of the program itself.

............................................................................................................................................................................................................................................................................................................................

Brian D. Kinstlinger

Maxim Group LLC

Okay. And then the follow up, I guess, then is if it's supply and demand, how long do you expect it might take to get this contract's revenue, profitability and head count to the path that you originally thought?

............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

That's a good question. Our original thought was that all of fiscal 2015 would be a ramp period. We took this over in the spring. In all of fiscal 2015 and throughout a good portion of 2016, our original plan this would be in ramp mode. So, our plan was that this would stabilize in fiscal 2016 and that's still our plan. So, we're a bit behind where we wanted to be. But we have actions in place such that we think we can stay on course and get this stabilized in fiscal 2016.

............................................................................................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, Brian. Next question, please?

..........................................................................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question comes from the line of Stephen Lynch with Wells Fargo. Please go ahead with your question.

...........................................................................................................................................................................................................................................................................................................................

Stephen B. Lynch

Wells Fargo Securities LLC

Hey, guys. Thanks for taking my question and congratulations on a good quarter. I guess, Human Services revenue was strong despite what sounds like was a stiff currency headwind and maybe also some earlier-than- expected interruption in the jobactive contract. Can you just talk a little bit about what drove the strength in that segment?

............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Glad to do that, Steve. Thanks for the question. Rick, can you share this?

............................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

Yes. I think, a good portion of that also is the acquisition of Remploy that we had in there, Steve. And that acquisition occurred in the early part of April, so we got a whole quarter of revenue from that. We also had good stable operations in all of our areas. Yes, Australia, you are right. We got a little more start-up impact than we expected earlier on in that contract. But the rest of the operations were good. The Work program in the UK had a good performance during that particular period.

..............................................................................................................................................................................................................................................................................................................................

Stephen B. Lynch

Wells Fargo Securities LLC

Okay. And then just as a quick follow-up to that, given the previous indication that Remploy would contribute or should contribute $30 million to $35 million of revenue in fiscal 2015, should we look at this quarter and the strength there and then expect revenue contribution to be lower in fiscal fourth quarter or maybe there's some seasonality there that we need to understand?

..............................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

No. I don't think their business is seasonal in nature. I think that what we said previously continues to be our belief I think that that's going to be an entity that should generate revenue over the first 12 months that we own it of approximately $70 million.

..............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Yeah, I think -

..............................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

Of course, currency's going to impact that as I point out.

..............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

And currency is always a factor, Steve, and I mirror what Rick says in that Remploy is strong out of the gate and we expect that momentum will continue.

..............................................................................................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, Steve. And next question, please.

..............................................................................................................................................................................................................................................................................................................................

Operator: Our next question comes from the line of Allen Klee with Sidoti. Please proceed with your question.

...............................................................................................................................................................................................................................................................................................................................

Allen Klee

Sidoti & Co. LLC

Yes. Hi. Given your comments on the tax rate being impacted by the more international business and the startup of the domestic business, is there any way to think about it that can have an impact on our fiscal 2016 assumptions?

..............................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

Yeah. Let me be clear. I guess what I intend to say is that the biggest factor driving our effective tax rate is the mix of income between international income and U.S. income. U.S. income has higher tax rates. We are the highest tax rate jurisdiction in our portfolio here in the United States.

So, when we have more income in the U.S. and less income in the United Kingdom, which has a 20% tax rate as compared to our tax rate which including state rates approaches 40%, that's what really drives our effective tax rates. So, as we stabilize and move that UK startup program to better profitability, our effective income tax rate should come back down.

...............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Which would be a factor of many in fiscal 2016 planning.

..............................................................................................................................................................................................................................................................................................................................

Allen Klee

Sidoti & Co. LLC

Okay. Thank you.

..............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

You're welcome.

..............................................................................................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor Relations & Corporate Communications

Next question, please.

..............................................................................................................................................................................................................................................................................................................................

Operator: Our next question comes from the line of Frank Sparacino with First Analysis. Please go ahead with your questions.

..............................................................................................................................................................................................................................................................................................................................

Frank Sparacino

First Analysis Securities Corp.

Hi, guys. I was hoping just to shift over on the exchange side of things, and I guess two parts of my questions. First is can you just remind me the contract with healthcare.gov in terms of when that lapses or any noteworthy dates coming up?

And then secondly, just in terms of the sales activities with some of the state-based exchanges, maybe just an update there if you're seeing any notable movement? That's it.

..............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

All right. Frank, good morning. I'd like to ask Bruce Caswell, our President in here with us this morning, to talk about those two points. One is the dating of the contract for CCO as well as the state-based dynamics.

......................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor Relations & Corporate Communications

Frank, just to clarify, as you know, we have two contracts in support of the federal marketplace. The first contract is a subcontractor where we are supporting the customer contact center. And the second is the eligibility appeals contract. Can you clarify which one you're asking about?

..............................................................................................................................................................................................................................................................................................................................

Frank Sparacino

First Analysis Securities Corp.

I guess both will be great, Lisa.

..............................................................................................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor Relations & Corporate Communications

Okay.

..............................................................................................................................................................................................................................................................................................................................

Bruce L. Caswell

President

Okay. So, Frank, let me take a moment and just give you some dynamics on the state exchanges. We're very early, still, in the planning cycle, obviously, for this open enrollment period. And I wanted to just clarify the open enrollment begins in November, November 1, 2015, and then, continues until January 31, 2016. And we think that based on what we're seeing and the conversations that we're having with our clients that the ACA-related activities have really largely stabilized into more of a steady-state run rate for us.

Of course, you're going to see normal force fluctuations in-year and out of year as states prioritize a wide range of activities in their programs. To give you a little bit more color on that, the – obviously, the GAO and others have predicted for many years that the penetration of the sales, if you will, of new Advanced Premium Tax Credit policies will kind of stabilize out into 2017 and 2018. And we've seen, as we've commented before, more states turning to us to help with some of the Medicaid-related activities on their programs, whether that's new eligibility determinations for expansion populations or renewal determinations.

And then, subsequently, there are a whole series of new tax forms. We've spoken to this a little bit before. This last open enrollment period there was the 1095-Bs and there'll be even further tax forms this next period. So, there are a lot of variables in the mix that will affect volumes. And you might see a change in mix related to the type of work that we do. But overall, like I said, I think we are seeing things stabilize into a more steady state as it relates to our ACA business.

And then coming back to the contracts, the CCO contract where we provide customer contact operations as a subcontractor for the Federally-facilitated Marketplace does continue, but as we've said, we did wind down an existing facility in Boise, Idaho, and we continue to maintain operations in Brownsville, Texas under that contract. And then the second contracted eligibility appeals that we do for the Federally-facilitated Marketplace, and that's a long-term contract. And my recollection is, is that's about an eight-year contract, but we'll confirm that. Lisa will get back to you with confirmation on the exact date. Does that help?

..............................................................................................................................................................................................................................................................................................................................

Frank Sparacino

First Analysis Securities Corp.

Yes. Thank you, Bruce.

...........................................................................................................................................................................................................................................................................................................................

Bruce L. Caswell

President

Sure.

.........................................................................................................................................................................................................................................................................................................................

Frank Sparacino

First Analysis Securities Corp.

Next question, please.

...........................................................................................................................................................................................................................................................................................................................

Operator: Thank you. [Operator Instructions] Our next question comes from the line of Charles Strauzer with CJS Securities. Please go ahead with your questions.

...........................................................................................................................................................................................................................................................................................................................

Charles Strauzer

CJS Securities, Inc.

Good morning again. As I was going to ask before, the – if you could give us a little bit granularity in the backlog or the pipeline, I should say, on remaining rebids for this year and maybe a snapshot into next year's rebid activity? Thank you.

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

All right, Charlie. Glad to take a look at the rebid situation. As it relates to fiscal 2015 rebids, overall, I think it's been a really solid year. The statistics go like this. Thus far, we've won north of 95% of our outstanding rebids, which I think is an excellent situation. Year-to-date, of the $1.2 billion that was up for rebid, we've won or extended six of those contracts, and that's been a total contract value of about $788 million. And keynote would be the fact that that includes our largest rebid coming into this fiscal year and that was jobactive in Australia and as you know, we won more than our fair share there, and we lost one very small contract.

At least three contracts opened for bid this year with a total contract value of $357 million, and the lion share of that relates to the Texas Eligibility Support contract. Currently, that one runs through calendar 2015. And we expect the decision on that rebid sometime very soon, Charlie. That amounts to – in our pipeline, that's $324 million of the $357 million.

As it relates to fiscal 2016, early peaks at fiscal 2016, is shaping up to be a much lighter rebid year compared to the $1.2 billion we had up for rebid in fiscal 2015. And as is our policy, we'll give you those exact details in our November call.

...........................................................................................................................................................................................................................................................................................................................

Charles Strauzer

CJS Securities, Inc.

That's helpful. Thank you very much.

..............................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Okay. Charlie. You're welcome.

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, Charlie. Next question, please.

...........................................................................................................................................................................................................................................................................................................................

Operator: Our next question comes from the line of Brian Kinstlinger with Maxim Group. Please go ahead with your questions.

...........................................................................................................................................................................................................................................................................................................................

Brian D. Kinstlinger

Maxim Group LLC

Great. I'm curious, we heard about three contracts in your start-up costs. What we didn't hear about is the deal we contract with the student loans. Maybe you can just highlight the progression there towards profitability and how that contract's going.

...........................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

This is Rick. That's going as expected. It's moving toward profitability on the schedule that we laid out when we bid the contract and the execution is going well.

...........................................................................................................................................................................................................................................................................................................................

Brian D. Kinstlinger

Maxim Group LLC

Great. And then you mentioned a federal contract which you couldn't give details for and I won't ask for them, but what I'm interested a little bit more in, did that come through the MAXIMUS core business and business development team or did that come through Acentia?

...........................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

That came through the existing MAXIMUS work and that was additional work for an existing client that we had which obviously has, in this particular case, a quick sales cycle.

...........................................................................................................................................................................................................................................................................................................................

Brian D. Kinstlinger

Maxim Group LLC

If I could squeeze one last one.

...........................................................................................................................................................................................................................................................................................................................

Richard J. Nadeau

Chief Financial Officer & Treasurer

Go ahead.

..............................................................................................................................................................................................................................................................................................................................

Brian D. Kinstlinger

Maxim Group LLC

Since the Supreme Court ruling, I'm curious if states are back to kind of methodical, slow transition towards state- based exchanges whereas before, there was discussion on many of them thinking about their strategy towards transitioning just in case.

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

We're going to have Bruce Caswell answer that one in detail, but I think clearly, the compelling need for clients to panic and move in a panic mode towards state-based exchanges with the overhang now passed from the Supreme Court. Clearly, that has now lifted. So, the environment has changed meaningfully. But, Bruce, would you...?

...........................................................................................................................................................................................................................................................................................................................

Bruce L. Caswell

President

I think that, Rich, you're absolutely right. And if anything right now, states are turning their attention to what things will look like in 2017 and beyond. And as we've, I think, spoken about a little bit before, the Affordable Care Act actually has a provision in it, the 2017 State Innovation Waiver provision. And from a policy perspective, it's Section 1332 of the Act. Under that provision, states can really broadly design their own state-based public health benefit programs and waive a number of key elements of the Affordable Care Act, such as the establishment of qualified health plans, the Advanced Premium Tax Credit to subsidize coverage, cost sharing reductions, and so forth. When they do that, the funding that would have otherwise gone to pay for those subsidies in the marketplace becomes available for them through pool funding and it's delivered in a periodic lump sum to them.

They can't just do this, though, without meeting some of the core provisions of the Affordable Care Act. For example, the proposed coverage that they provide has to be at least as comprehensive as would have been provided under the essential health benefits of the act and so forth. So, what we're seeing is a shift in planning and a shift in thinking for states on how they will go about potentially, if you will, creating an implementation of public health benefit programs in their own exchanges under the waiver provisions, maybe even coupled also with 1115 waivers that are available to them. But that's a longer-term thing that they're planning for, something that wouldn't happen until 2017. So presently, we'd expect this next year, at least, to be really relatively steady state from what we've seen historically.

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Next question, please.

...........................................................................................................................................................................................................................................................................................................................

Operator: Thank you. [Operator Instructions] Our next question comes from the Stephen Lynch with Wells Fargo. Please go ahead with your question.

...........................................................................................................................................................................................................................................................................................................................

Stephen B. Lynch

Wells Fargo Securities LLC

Thanks. Just one question. You guys mentioned that the recent acquisitions could open up broader opportunities over the next three to five years. I'm just curious, is that three- to five-year timeframe based on when RFPs are expected to be issued or is it primarily a function of the development and integration work that needs to be done in order to compete for these new contracts?

.........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Steve, great question. I believe the three to five years is really to get RFPs on the table as opposed to setting the table for RFPs.

...........................................................................................................................................................................................................................................................................................................................

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, Stephen. Next question, please.

...........................................................................................................................................................................................................................................................................................................................

Operator: Our next question comes from the line of Frank Sparacino with First Analysis. Please go ahead with your questions.

...........................................................................................................................................................................................................................................................................................................................

Frank Sparacino

First Analysis Securities Corp.

Hi, guys. Just one follow-up from me. And I dropped off so I apologize if this has been addressed. But when you look at the UK contract, could you be more specific in terms of the performance? I know you've outlined three key factors there, number of assessments is obviously I think pretty black and white. But in terms of how they're measuring quality and timeliness, can you just talk to that in more detail?

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Sure. Glad to do that, Frank. Well, first off, I'd reiterate that the nature of this contract, it's a hybrid contract by nature. So, fundamentally, I look at it as a cost plus contract. However, there are performance-based incentives that will create performance billing points or revenue for us. And while there are many of them, it's a complex contract, as you would expect. The number one driver is volume. The number two driver is quality.

And when you look at volume, the volume is a function of, I think, three main areas. One is recruiting of health care professionals. The second point is the retention of those health care professionals, and the last one is the productivity. So, as you can appreciate, we are organized, structured and working really hard to drive all of those. And quality as well, we have special teams that are focused on the quality aspects, and it relates to the timeliness of all of the cases that we manage. There's audit processes that audit the quality of the work that we do. So, we worked hand in glove with our quality team and the client to drive quality to the minimum expected level. Is that helpful, Frank?

...........................................................................................................................................................................................................................................................................................................................

Frank Sparacino

First Analysis Securities Corp.

It is. Thank you.

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

I'm sorry. Bruce Caswell wants to add to that.

...........................................................................................................................................................................................................................................................................................................................

Bruce L. Caswell

President

Yeah. And, Frank, just to give you a little more color on the timeliness, the timeliness really relates more to client service and whether they're being – the clients are being seen in a timely fashion in the assessment centers, and/or whether folks come and have an appointment that aren't able to be seen or sent home unseen. So, there are minor service levels related to those items but Rich is absolutely correct that the two major drivers are the assessments completed and the quality of those assessments, timeliness being a very tertiary one. Volume is the number one thing.

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Next question, please?

...........................................................................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question comes from the line of Richard Close with Canaccord Genuity. Please go ahead with your question.

...........................................................................................................................................................................................................................................................................................................................

Richard Close

Canaccord Genuity Group, Inc.

Yes. Thanks for taking the questions. Congratulations. I guess my first question would be, where do you see the most opportunity right now if you think about your pipeline and maybe stuff that's brewing that's not necessarily in your pipeline? Do you see the domestic market or the international market being more fruitful?

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

That's always a great question, Richard. I will tell you that the way we try to run the business is to always keep it a horse race between the two. And I think our teams are up for that. When I think about the growth opportunities, I really do think there are growth opportunities in all of our components. I think here, you'll see a shift in the demand on the health care side. All along, we've said that the Affordable Care Act has gone a very long way to address the universality of health care and get everybody enrolled in a health care plan. And I think we've managed to grow handsomely based upon that first chapter, whether it's providing work to health care exchanges themselves, or working with our clients those that chose to advance their Medicaid programs.

We do think, as time goes on, the two next chapters in health care in the U.S. will be the quality and the cost of health care. And you can already see specific initiatives on the table moving in that direction. We have a number of programs, more pilot in nature. I think the states are still trying to figure out what's going to work best, is it bundling of services or what's going to work with the duals, what's going to work with the elders. But we have – as you can appreciate that we have a lot of additional work ahead of us in the U.S. healthcare system. So, I think that's really – those are the tailwinds the team is dealing with.

In addition, whether it's Australia or the United Kingdom or other countries, they deal with the same issues. So, we're seeing a lot of attention on disabled populations, employment update, disabled populations helping them get off welfare and stay off welfare. And we're also still trying to advance our healthcare business in those countries such as Australia where we have a very, very meaningful book of business on the Human Services side, but I see opportunity to further advance our healthcare business.

...........................................................................................................................................................................................................................................................................................................................

Richard Close

Canaccord Genuity Group, Inc.

And so, that was going to be my next question, Australia and health expansion. Is there anything specific there or is this something that you're trying to germinate?

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

Well, I'm going to ask Bruce Caswell who just returned from Australia a short time ago to share his views on that one.

...........................................................................................................................................................................................................................................................................................................................

Bruce L. Caswell

President

Sure. I'd be happy to. I think the government of Australia is very much looking at how other governments around the world are serving various populations including those with disabilities, and they have major programs that they're outlining that could change the way they handle the assessment process for individuals with disabilities for certain public benefits. And ultimately, even the kind of self-direction, if you will, kind of the classic idea of money follows the person, the self-direction of funding for individuals with disabilities.

So, it's something we continue to take a look at as we've said a number of occasions. Our assessments business in general continues to grow, and we continue to see demand from our clients to help with what we would refer to as pre-eligibility assessment determinations in the marketplace.

...........................................................................................................................................................................................................................................................................................................................

Richard Close

Canaccord Genuity Group, Inc.

If I could slip one more in here, just a clarification on the comments with respect to three to five years, and I guess, it was with respect to the M&A, is that implying that something like Acentia is not necessarily going to contribute much to growth in the coming years or just any clarification there?

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief Executive Officer & Director

The way we think about Acentia is that we do think it's a growth opportunity. The strategic thinking on the Acentia-MAXIMUS combination was that the existing book of business of Acentia which is biased towards ITO. And, clearly, you know that it brings to the table not only a positive working relationship with many federal agencies that MAXIMUS [indiscernible] (51:12) has not had a relationship with, but also contract vehicles necessary.

So, I expect that their core business will do reasonably well. But the real strategic opportunity and really the spark for the type of growth that we are striving to deliver would be the combination of BPO and ITO and looking for opportunities that combine those two inside those agencies. So, those are not the sort of RFPs that are on the table today and we think it's going to take, as we say, two, three, maybe up to five years to germinate those up to the RFP stage.

...........................................................................................................................................................................................................................................................................................................................

Richard Close

Canaccord Genuity Group, Inc.

Okay. Thank you. Congratulations.

...........................................................................................................................................................................................................................................................................................................................

Richard A. Montoni

Chief

Executive Officer & Director

All right. Great and thank you very much. I think we're going to wrap it up. But before we do end the call, I'd like to share a couple of final thoughts with you to kind of – to pull it together, at least from my perspective, how I view our situation today.

And I would say this, that fiscal 2015, we expect will be another solid year and we expect that Q4 will be another solid quarter to bring its component piece together. I would say we're very pleased with the integration of Acentia and Remploy. They are going well and we're pleased with the longer-term opportunities they seem to be creating.

And I also say you can rest assured, we are tackling the start-up challenges on the UK assessment contracts head on and we're making progress every day in that context. But I'd also say put it in perspective, we have several other large programs that are in the start-up phase and they are going quite well.

As Bruce mentioned, the Affordable Care Act is shaping up to be a steady state opportunity for that book of business. And lastly, I would say that we are still on the planning cycle for fiscal 2016. And while we all know there are headwinds and tailwinds always to consider, the most important thing from my perspective is that the macro trends continue to drive increases in the demand for our services and we remain very excited about the long-term growth prospects here at MAXIMUS.

So, thanks for joining us today. This concludes the call. Thank you.