Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Unilife Corp | d23288d8k.htm |

July 30, 2015 Unilife Conference Call Exhibit 99.1 |

2 Cautionary Note Regarding Forward-Looking Statements This presentation dated July 30, 2015 has been prepared by Unilife Corporation ("Unilife or

Company") (NASDAQ: UNIS; ASX: UNIS). Statements and

information in this presentation are current only as at July 30, 2015 and the information in this presentation remains subject to change without notice.

While reasonable care has been taken in relation to the

preparation of this presentation, none of the Company, its subsidiaries or their respective directors, officers, employees, contractors, agents, or advisers nor any other person ("Limited

Party") guarantees or makes any representations or

warranties, express or implied, as to or takes responsibility for, the accuracy, reliability, completeness or fairness of the information, opinions, forecasts, reports, estimates and conclusions contained in this presentation. No Limited Party represents or warrants that this

presentation is complete or that it contains all information

about the Company that a prospective investor or purchaser may require in evaluating a possible investment in the Company or acquisition of shares in the Company. To the maximum extent permitted by law, each Limited Party expressly

disclaims any and all liability, including, without limitation,

any liability arising out of fault or negligence, for any loss arising from the use of or reliance on information contained in this presentation including representations or warranties or in relation to the accuracy or

completeness of the information, statements, opinions, forecasts,

reports or other matters, express or implied, contained in, arising out of or derived from, or for omissions from, this presentation including, without limitation, any financial information, any estimates or projections and any other

financial information derived therefrom. Certain statements in this presentation constitute forward looking statements and comments about future events, including the Company's

expectations about the performance of its businesses. Such

forward looking statements involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the Company and which may cause actual results,

performance or achievements to differ materially from those

expressed or implied by such statements. Forward looking statements are provided as a general guide only, and should not be relied on as an indication or guarantee of future performance. Given these

uncertainties, recipients are cautioned to not place undue

reliance on any forward looking statement. Subject to any continuing obligations under applicable law or relevant rules of the NASDAQ Stock Market or the ASX Listing Rules, the Company disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward looking statements in

this presentation to reflect any change in expectations in relation to any forward looking statements or any change in events, conditions or circumstances on which any such statement is based.

|

Agenda and Introduction

• Customer programs continue to move forward favorably • Manufacturing and selling products across multiple product platforms • From a small base, sales of prefilled syringes and wearable injectors are increasing in line with

customer ramp schedules

• Well positioned for continued success through fiscal 2016 and beyond • Executing on current long term supply agreements • Building strategic relationships with new and existing customers • Additional capital available at company’s discretion to prudently support business growth

• Introducing an entire new category of instant patch pumps for insulin • Combines the therapeutic benefits of a pump with the convenience and low cost of a pen

• Imperium: Prefilled, pre-assembled with insulin supplied ready for compact multi-day wear

• Enables insulin providers to supply a complete insulin therapy solution directly to the patient

• With prospective partners, Unilife can enter large, growing markets such as Type 2 diabetes

that are under-served due to device complexity, reimbursement constraints

and high patient costs

3 |

Unifill Shipments Increasing to Fulfill Customer Orders

• 500,000 units shipped by end of quarter • 500,000 units expected to be shipped next quarter • Expanding production capacity to support scheduled customer orders • 100MM units annual capacity this year • Continued growth over time up to 400MM units in line with multi-year ramp schedules of existing customer supply contracts 4 Assembly line for the Unifill Finesse™ at Unilife’s facility in York, PA One of Unilife’s eleven existing clean rooms at its York, PA facility |

Wearable Injectors: Shipments to Commence for Scheduled Clinical

Trials •

Continuing to be selected by customers for use

with their large-dose volume therapies

• Shipments for use in clinical trials scheduled to commence this quarter • Shipments for additional clinical trials by end of fiscal year • Integration into high-speed drug filling and packaging lines of Cook Pharmica • Confirms customers can bring to market their injectable therapies with wearable injectors ready for patient self-injection • Pre-filled. Pre-assembled. No terminal sterilization required. • Video available on Unilife website 5 Unilife’s wearable injector primary containers being filled at Cook The qualification occurred on standard high-speed drug filling lines |

Continued Investment in our Production Infrastructure in York, PA

6 Doubling cleanroom space and expanding building footprint to support customer scale-up needs

Installation of additional of cleanroom space in York, PA

Expansion of building footprint underway

Additional cleanrooms to support specific customer needs

Facility expansion to accommodate additional infrastructure

|

Mr. David Hastings

Chief Financial Officer

Financial Update |

Wearable injectors Prefilled syringes Auto Injectors Reconstitution Ocular delivery Novel delivery Market Segment CAGR Avg. Device Unit Price* Wearable Injectors 50-100% $25-$35 Prefilled Syringes 8-14% $0.50-$3 Auto Injectors 18% Disposable $5-$15 Reusable up to $500 Reconstitution Systems 9% $5-$50 Ocular Delivery 23% $40-$200 Novel Delivery 23% Typically $100+ Market Segments and Product Portfolio for Injectable Drug Delivery Auto- Injectors Wearable Injectors Ocular & Novel Delivery Systems 8 Projected growth in excess of $15B by 2025 within target market segments Size and projected growth for injectable drug delivery system segments (US$B) 2015 - 2025 These products have not yet been reviewed by the FDA 0 5,000 10,000 15,000 20,000 25,000 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Prefilled Syringes with Automatic, Integrated Safety Drug Reconstitution Delivery Systems * Roots Research. Wearable Bolus Injectors. 2014. VisionGain Medical Device Leader Series 2014-2024. Medtronic Investor Day,

2024, and Company estimates. |

Market Segment

CAGR Avg. Device Unit Price* Insulin Delivery Devices 5-12% Durable: up to $7k Patch: $20 to $50 Wearable Injectors 50-100% $25-$35 Prefilled Syringes 8-14% $0.50-$3 Auto Injectors 18% Disposable $5-$15 Reusable up to $500 Reconstitution Systems 9% $5-$50 Ocular Delivery 23% $40-$200 Novel Delivery 23% Typically $100+ Prefilled Syringes with Automatic, Integrated Safety Drug Reconstitution Delivery Systems Ocular & Novel Delivery Systems Insulin Delivery Market Segments and Product Portfolio for Injectable Drug Delivery 9 Auto- Injectors Wearable Injectors Wearable injectors Prefilled syringes Insulin Devices Projected growth in excess of $23B by 2025 * within target market segments with insulin delivery Auto Injectors Reconstitution Ocular delivery Novel delivery Size and projected growth for injectable drug delivery system segments (US$B) 2015 - 2025 $- $5,000 $10,000 $15,000 $20,000 $25,000 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 * Roots Research. Wearable Bolus Injectors. 2014. VisionGain Medical Device Leader Series 2014-2024. Medtronic Investor Day,

2024, and Company estimates. |

Diabetes is a Global Epidemic

“As many as one in three American adults will have diabetes in 2050 if

present trends continue” American Diabetes Association Fact

Sheet, June 2014 Global Diabetes Prevalence

Staggering # • 1 in 11 adults (18+ years) has diabetes • Every 7 seconds, 1 person dies from diabetes Global and U.S. Costs of Diabetes • 11.6% of total world healthcare expenditure is on diabetes – Totaling over $600 Billion # • Total U.S. cost up 48% in 5 years to $322 Billion* • Avg. burden for each American exceeds $1,000* Type 2 Diabetes Overwhelming Majority • 90–95% of patients have Type 2 Diabetes • 1 in 10 U.S. adults has Type 2 Diabetes • Technology and innovation have traditionally focused on Type 1 Population 10 # IDF Diabetes Atlas. 2014 * Dall, T. Economic Burden of Elevated Blood Glucose Levels in 2012. Diabetes Care. Vol. 37. Dec 2014. |

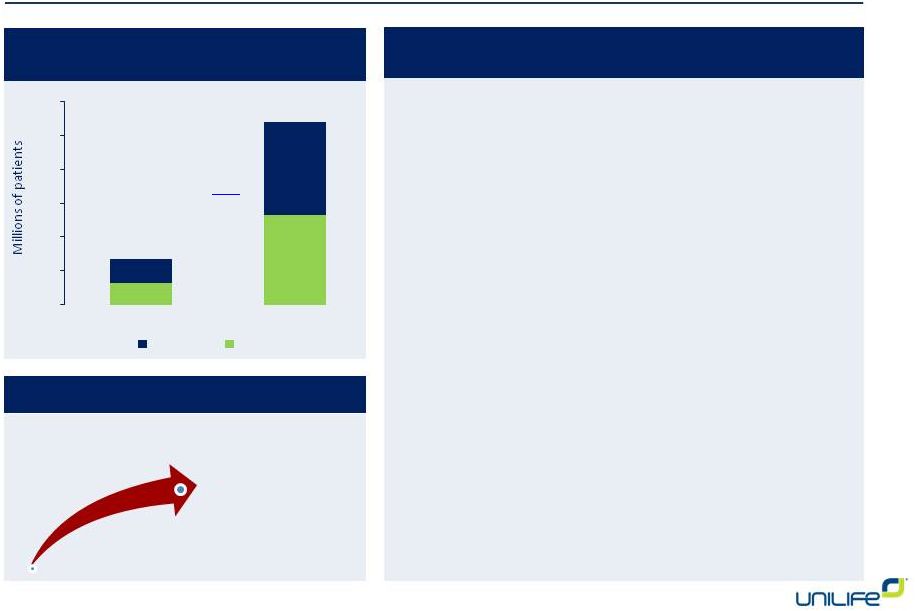

Type 2 Diabetes Population: Underserved and Ready for New Technology

Better Patient Outcomes

Possible

But Not Achieved Through Current Therapeutic

Offerings -

T2D Population Unaccepting of Traditional Pump Technology

- More than 95% of all insulin dependent T2D patients use a vial/syringe or insulin pen due to durable pump challenges: 1. Expensive with upfront costs up to $7,000 2. High ongoing costs (infusion sets / other peripherals) 3. Multiple steps to begin therapy 4. Bulky size 5. Complex (requires hand-held external controls and extensive training) - Type 2 Therapy Adherence is Low - HALF of T2D patients on insulin uncontrolled (A1C > 7%) # - 72% of physicians report patients do not take insulin as prescribed, with avg. missing injections 4-6 days per month* - Injections missed due to patients: 1. Being too busy 2. Traveling 3. Stressed by therapy 4. Fearing pain of frequent injections 5. Embarrassed to inject in public Uncontrolled Multiple Daily Injectors (MDI) Population (U.S. & E.U.) 3 million MDI diabetes patients uncontrolled (2015) 8 million projected MDI diabetes patients uncontrolled (2035) Improved Therapy Needed 6.4% CAGR 2.0% CAGR T1D T2D 20MM Insulin-Dependent Patients Worldwide Two-Thirds in the U.S. and Europe 29% of U.S. diabetes patients on insulin (CDC) 11 # Sanofi Thematic Call on Diabetes. June 16, 2014. * Peyrot, M. Diabetes Care. Insulin adherence behaviors and barriers in the multinational Global Attitudes of Patients and

Physicians in Insulin Therapy study. 2023, May. 29(5)

1.3 5.3 1.4 5.5 0 2 4 6 8 10 12 E.U. U.S. |

(IMS Health and Analyst Data)

Economic Opportunity for Primary Market Category

T2D Uncontrolled MDI

2020 2025 2030 Patients 4,078,000 5,235,000 6,565,000 Market Share Potential Revenue 5% $299 Million $383 Million $481 Million 10% $597 Million $766 Million $961 Million 15% $895 Million $1.150 Billion $1.442 Billion 20% $1.194 Billion $1.533 Billion $1.922 Billion 25% $1.493 Billion $1.916 Billion $2.403 Billion 30% $1.791 Billion $2.299 Billion $2.883 Billion 35% $2.090 Billion $2.682 Billion $3.364 Billion 40% $2.388 Billion $3.066 Billion $3.845 Billion 2.9 5.2 8.0 2.5 4.6 7.1 1.0 1.2 1.5 1.1 1.2 1.1 0 2 4 6 8 10 12 14 16 18 20 2015 2025 2035 Addressable Diabetes Populations Millions of Patients in U.S. and E.U. T1D Uncontrolled MDI CSII T2D Controlled MDI Primary Target Market Segment 12 T2D Uncontrolled MDI |

Economic Opportunity Growth with Other Segments

T1D Uncontrolled MDI and CSII

2020 2025 2030 Patients 2,274,000 2,392,000 2,516,000 Market Share Potential Revenue 5% $166 Million $175 Million $184 Million 10% $333 Million $350 Million $368 Million 15% $499 Million $525 Million $552 Million 20% $666 Million $700 Million $737 Million 25% $832 Million $875 Million $921 Million 30% $999 Million $1.050 Billion $1.105 Billion 35% $1.165 Billion $1.126 Billion $1,289 Billion 40% $1.331 Billion $1.401 Billion $1.473 Billion T2D Controlled MDI 2020 2025 2030 Patients 3,616,000 4,642,000 5,822,000 Market Share Potential Revenue 5% $265 Million $340 Million $426 Million 10% $529 Million $680 Million $852 Million 15% $794 Million $1.019 Billion $1.279 Billion 20% $1.059 Billion $1.359 Billion $1.705 Billion 25% $1.324 Billion $1.699 Billion $2.131 Billion 30% $1.588 Billion $2.039 Billion $2.557 Billion 35% $1.853 Billion $2.379 Billion $2.983 Billion 40% $2.118 Billion $2.719 Billion $3.409 Billion Tertiary Target Market Segment Secondary Target Market Segment 13 |

• Bulky • High upfront

cost

- $4,000 to

$7,000

plus monthly costs

• Complex to operate • Preparation time to therapy – fill with insulin, change infusion sets Current Insulin Devices Fail to Meet Needs of Type 2 Patients A Product is Needed that Provides the Convenience, Simplicity, and Cost of an Insulin Pen with the Therapeutic Benefits of an Insulin Pump Cost Complexity Inconvenience • Multiple pieces of equipment • Preparation time and risk of dosing error • Low use rate

outside home • Frequent

needle

sticks • Disciplined dosing schedule required to maintain therapy adherence • Some patients require use of multiple pens per day • Low use-rate outside home • Preparation time

- fill with insulin • Risk dosing error - fill with incorrect insulin concentration • Costs not at parity with Pens • Handheld controller typicallyrequired Multiple Daily Injections (MDI) Syringe / Vial Insulin Pens

Durable Pump & Infusion Sets Continuous Subcutaneous Insulin Infusion (CSII) Patch Pumps 14 Insulin pumps Syringe / Vial Insulin Pens Patch pumps |

Key Technology Drivers in Insulin Delivery Market

• Simplify the steps to control the blood glucose level • Lower the barriers to therapy adoption and compliance Reduce Complexity • Decrease diabetes treatment burden by improving therapy delivery and minimize patient health risk • Prevent acute clinical events related to lack of glycemic control Empower Patients • Reduce bulk and cost of overheads (syringes, vials or extra pens) • Remove reimbursement constraints to continuous subcutaneous insulin infusion therapy Minimize Upfront and Add-On Cost • Leverage established channels to minimize no sales, marketing, commercial development, reimbursement, and clinical support costs Existing Sales and Distribution Channels Driving market needs for a new device category of instant patch pumps for insulin 15 |

Introducing Imperium™

16 Delivering the therapeutic advantages of a pump, with the simplicity and cost of a pen Criteria for an Instant Patch Pump for Insulin 1. Prefilled and pre-assembled with standard insulin cartridge 2. Fully functional stand-alone device (no ancillary equipment) 3. No priming required by patients 4. Single push button mechanism to immediately begin therapy 5. Fully disposable |

Imperium™ Platform –

Features and Benefits for Patients

Minimal Steps to Therapy

Supplied ready for use in a fully integrated system that is

prefilled with insulin. Just peel, stick and click.

Simple User Interface

A preset basal rate with on-demand bolus via a simple

push of the button. No handheld controller required.

Convenient, Extended Wear

Highly compact in size for comfortable, discreet multi-day

water-proof wear and convenient needle-free disposal

Smart-Enabled Connectivity

Wireless connectivity enables integration with smart-

phone apps for patient reminders and status updates.

17 |

Simple Steps of Use to Begin Therapy

Peel liner from

device Apply device to body Push button to start basal therapy Peel. Stick. Click. 18 |

19 Insulin Pens Insulin Pumps* Comparing Steps to Therapy vs. Insulin Pens and Disposable Pumps Imperium 1 Piece of equipment 2 Pieces of equipment 4+ Pieces of equipment 3 Steps to insulin therapy 12+ Steps per insulin injection 20+ Steps to insulin therapy * Including market-leading insulin patch pump |

Simple Steps of Use for Bolus Delivery

Press and Hold. Click. Press and hold button to enter bolus mode Click the button for bolus infusion Press and hold button to exit bolus mode Press and Hold. 20 |

Additional Features and Benefits for Insulin Providers

Concentrated Insulins

Prefilled, high-precision device capable of delivering

highly concentrated insulins up to U-500

Standard Fill and Materials

Uses standard materials and integrates into established

filling processes and equipment

Attractive for Reimbursement

Fits within therapy reimbursement model and priced

significantly lower than competitive pump devices

Highly Differentiated

Visually distinctive look and feel customized to

specific brand to differentiate insulin therapy from

competition U-100 U-300 U-500 21 |

Fits Seamlessly into Standard Fill Lines and Distribution Channels

Fully aligned with Unilife’s B2B Model for predictable revenue and attractive operating margins 22 Fill • Fill cartridge with insulin using standard filling equipment Finish • Finish device using industry standard processes Ship • Ship Imperium, pre- filled with insulin, via established channels Unilife • Supply sub-assemblies to customer (no terminal sterilization) Customer • Utilization of preferred component materials and standard filling and packaging processes Pharmacy • Imperium, pre-filled with insulin, available for patient pick-up Patient • Remove Imperium from package, apply onto body and activate to begin insulin therapy |

Questions 23 |