Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HOME BANCORP, INC. | v413585_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - HOME BANCORP, INC. | v413585_ex2-1.htm |

| 8-K - FORM 8-K - HOME BANCORP, INC. | v413585_8k.htm |

Exhibit 99.2

June 18, 2015 Home Bancorp, Inc. To Acquire Louisiana Bancorp, Inc.

Forward Looking Statements 2 This presentation contains certain forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Forward - looking statements do not relate strictly to historical or current facts. Forward - looking statements reflect management’s current views and estimates of future economic circumstances, industry conditions, company performance and financial results. They often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Forward - looking statements, by their nature, are subject to risks and uncertainties. A number of factors - many of which are beyond our control - could cause actual conditions, events or results to differ significantly from those described in the forward - looking statements. Forward - looking statements regarding the transaction are based upon currently available information. Actual results could differ materially from those indicated in forward - looking statements. Among other factors, actual results may differ from those described in forward - looking statements due to: the possibility that the proposed transaction does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the terms of the proposed transaction may need to be modified to obtain such approvals or satisfy such conditions; the anticipated benefits from the proposed transaction are not realized in the time frame anticipated or at all as a result of changes in general economic and market conditions, interest rates, laws and regulations and their enforcement, and the degree of competition in our markets; the ability to promptly and effectively integrate the businesses of the companies; the reaction of the companies' customers to the transaction; diversion of management time on merger - related issues; changes in asset quality and credit risk; the inability to sustain revenue and earnings; and competitive conditions.

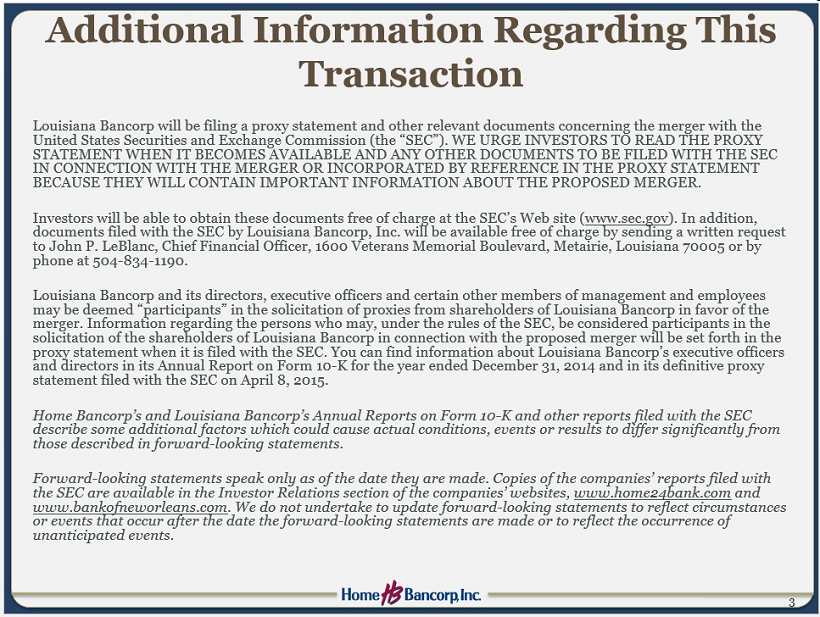

Additional Information Regarding This Transaction

Louisiana Bancorp will be filing a proxy statement and other relevant documents concerning the merger with the United States Securities and Exchange Commission (the “SEC”). WE URGE INVESTORS TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.Investors will be able to obtain these documents free of charge at the SEC’s Web site (www.sec.gov). In addition, documents filed with the SEC by Louisiana Bancorp, Inc. will be available free of charge by sending a written request to John P. LeBlanc, Chief Financial Officer, 1600 Veterans Memorial Boulevard, Metairie, Louisiana 70005 or by phone at 504-834-1190.Louisiana Bancorp and its directors, executive officers and certain other members of management and employees may be deemed “participants” in the solicitation of proxies from shareholders of Louisiana Bancorp in favor of the merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the shareholders of Louisiana Bancorp in connection with the proposed merger will be set forth in the proxy statement when it is filed with the SEC. You can find information about Louisiana Bancorp’s executive officers and directors in its Annual Report on Form 10-K for the year ended December 31, 2014 and in its definitive proxy statement filed with the SEC on April 8, 2015.Home Bancorp’s and Louisiana Bancorp’s Annual Reports on Form 10-K and other reports filed with the SEC describe some additional factors which could cause actual conditions, events or results to differ significantly from those described in forward-looking statements.Forward-looking statements speak only as of the date they are made. Copies of the companies’ reports filed with the SEC are available in the Investor Relations section of the companies’ websites, www.home24bank.com and www.bankofneworleans.com. We do not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made or to reflect the occurrence of unanticipated events.

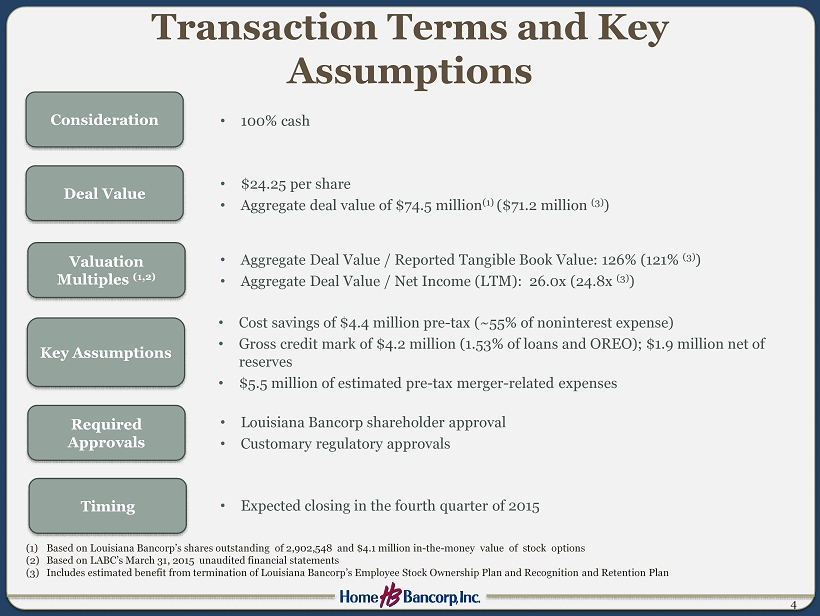

Transaction Terms and Key Assumptions • 100% cash (1) Based on Louisiana Bancorp’s shares outstanding of 2,902,548 and $4.1 million in - the - money value of stock options (2) Based on LABC’s March 31, 2015 unaudited financial statements (3) Includes estimated benefit from termination of Louisiana Bancorp’s Employee Stock Ownership Plan and Recognition and Retentio n P lan Consideration Valuation Multiples (1,2) Required Approvals Timing • $24.25 per share • Aggregate deal value of $ 74.5 million (1) ($71.2 million (3) ) Deal Value • Aggregate Deal Value / Reported Tangible Book Value: 126% (121% (3) ) • Aggregate Deal Value / Net Income (LTM): 26.0x (24.8x (3) ) • Louisiana Bancorp shareholder approval • Customary regulatory approvals • Expected closing in the fourth quarter of 2015 Key Assumptions • Cost savings of $4.4 million pre - tax (~55% of noninterest expense) • Gross credit mark of $4.2 million (1.53% of loans and OREO); $1.9 million net of reserves • $5.5 million of estimated pre - tax merger - related expenses 4

Transaction Rational • Approximately 35% accretive to 2016 estimated EPS • Immediate tangible book value dilution under 10% with estimated 3.5 year payback period • IRR > 20% Financially Attractive Low Risk Strategic Growth 5 • Expands existing footprint in the New Orleans - Metairie MSA, doubling in - market deposits and increasing market share rank to 12 th from 16 th • Significant cost savings of approximately 55% • Leverages excess capital; Pro Forma TCE ratio of approximately 9.6% at close • 106 year - old institution, providing ample opportunity to expand customer relationships • Strong cultural fit and strategic alignment • Completed due diligence, including extensive credit review • Excellent credit culture and asset quality with low expected losses • Capital position remains strong • Integration risk mitigated by Home Bancorp’s merger experience

Louisiana Bancorp Overview Company Info • Established in 1909 • Headquartered in Metairie, LA • Four branches in New Orleans - Metairie MSA • Traded on NASDAQ (Ticker: LABC) Source: SNL Financial (1) Based on LABC’s March 31, 2015 unaudited financial statements Financial Highlights (1) • Assets $331 million • Gross Loans HFI $276 million • Deposits $201 million • TCE Ratio 17.8% • NPAs / Assets 0.46% • ROAA (LTM) 0.88% 6

Expanding New Orleans Presence • Significant expansion in attractive New Orleans - Metairie MSA • Doubles deposits in New Orleans - Metairie MSA and increases market share rank to 12 th from 16 th • Nearly doubles existing loans in New Orleans - Metairie MSA Branch Locations HBCP LABC 7

Pro Forma Loan Composition Source: SNL Financial Data as of March 31, 2015 (1) Excludes purchase accounting adjustments Home Bancorp Louisiana Bancorp Pro Forma (1) Gross Loans HFI: $922 million Yield on Loans: 5.40% Gross loans HFI: $1.2 billion Gross Loans HFI: $276 million Yield on Loans: 4.21% 8

Pro Forma Deposit Composition Source: SNL Financial Data as of March 31, 2015 (1) Excludes purchase accounting adjustments Home Bancorp Louisiana Bancorp Pro Forma (1) Total Deposits: $1.0 billion Cost of Interest - Bearing Deposits: 0.37% Total Deposits: $201 million Cost of Interest - Bearing Deposits: 0.66% Total Deposits: $1.2 billion 9