Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - VinCompass Corp. | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - VinCompass Corp. | exhibit32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - VinCompass Corp. | exhibit31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - VinCompass Corp. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - VinCompass Corp. | exhibit31-2.htm |

| EX-10.4 - EXHIBIT 10.4 - VinCompass Corp. | exhibit10-4.htm |

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended FEBRUARY 28, 2015

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from _____ to _______

Commission file number: 000-54567

TIGER JIUJIANG MINING, INC.

(Exact name of small business issuer in its charter)

| Wyoming | 80-0552115 |

| (State or jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 6F, No.81 Meishu East 6 Road, Kaohsiung, Taiwan | 804 |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: (888) 755-9766

Issuer’s email address: tigerjiujiangmining@gmail.com

Securities Registered Under Section 12(b) of the Exchange Act: None

Securities Registered Under Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer as defined by Rule 405 of the Securities Act (the “Act” or

“Securities Act”)

Yes [ ] No [X].

Indicate by check mark if the registrant is not required

to file reports pursuant to Rule 13 or Section 15(d) of the Act

Yes

[ ] No [X]

Indicate by check mark whether the issuer (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Exchange Act

during the past 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate web site, if any, every

Interactive Data File required to be submitted and posted pursuant Rule 405 of

Regulation S-T (s 220.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post such

files.

Yes [X] No [ ]

Check if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer or a smaller reporter.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes

[X] No [ ]

Issuer's revenues for its most recent fiscal year: $0.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $7,000,000 (3,500,000 common shares at $2.00); the Corporation is quoted on the OTC-BB under the symbol “TIGY”).

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

State the number of shares outstanding of each of the Issuer's classes of common stock, as of the latest practicable date: 8,500,000 common shares issued and outstanding as of the date of this report.

Transitional Small Business Disclosure Format (Check one):

Yes [ ] No [X]

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K into which the document is incorporated: (1) any annual report to shareholders; (2) any proxy or information statement and (3) any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933, as amended (the “Securities Act”):

| • | None |

2

TABLE OF CONTENTS

| Item 1 | Description of Business |

| Item 1A | Risk Factors |

| Item 1B | Unresolved Staff Comments |

| Item 2 | Properties |

| Item 3 | Legal Proceedings |

| Item 4 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| Item 5 | Selected Financial Data |

| Item 6 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| Item 6A | Quantitative and Qualitative Disclosure of Market Risk |

| Item 7 | Financial Statements and Supplementary Data |

| Item 8 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

| Item 8A(T) | Controls and Procedures |

| Item 8B | Other Information |

| Item 9. | Directors, Executive Officers and Corporate Governance |

| Item 10 | Executive Compensation |

| Item 11 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

| Item 12 | Certain Relationships and Related Transactions, and Director Independence |

| Item 13 | Principal Accountant Fees and Services |

| Part 14 | Exhibits, Financial Statements and Schedules |

Cautionary Statement Regarding Forward-Looking Statements

This annual report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. Some discussions in this report may contain forward-looking statements that involve risk and uncertainty. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made in this report. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events.

In some cases, you can also identify forward-looking statements by terminology such as “may”, “will”, “should”, “plans”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, beginning on page 4, that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. References to common shares refer to common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, and “Tiger” mean Tiger Jiujiang Mining, Inc. unless otherwise indicated.

Tiger is an exploration stage Corporation. There is no assurance that commercially viable mineral deposits exist on the claims we have under option. Further exploration and/or drilling will be required before a final evaluation as to the economic and legal feasibility of our projects is determined.

Glossary of Exploration Terms

The following terms, when used in this report, have the respective meanings specified below:

| Deposit | When mineralized material has been systematically drilled and explored to the degree that a reasonable estimate of tonnage and economic grade can be made. |

| Development | Preparation of a mineral deposit for commercial production, including installation of plant and machinery and the construction of all related facilities. The development of a mineral deposit can only be made after a commercially viable mineral deposit, a reserve, has been appropriately evaluated as economically and legally feasible. |

| Diamond drill | A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock, which is recovered in long cylindrical sections an inch or more in diameter. |

| Exploration | The prospecting, trenching, mapping, sampling, geochemistry, geophysics, diamond drilling and other work involved in searching for mineral bodies’ a mining prospect which has not yet reached either the development or production stage. |

| Mineral | A naturally occurring inorganic element or compound having an orderly internal structure and characteristic chemical composition, crystal form and physical properties. |

| Mineral Reserve | A mineral reserve is that part of a deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

| Mineralization | Rock containing an undetermined amount of minerals or metals. |

| Trenching | The digging of long, narrow excavation through soil, or rock, to expose potential mineralization for geological examination or assays. |

| Waste | Material that is too low in grade to be mined and milled at a profit. |

3

PART I

Item 1. Description of Business.

Overview

We were incorporated in the State of Wyoming on January 28, 2010, and established a fiscal year end of February 28. Our statutory registered agent's office is located at 1620 Central Avenue, Suite 202, Cheyenne, Wyoming 82001 and our business office is located at 6F, No.81 Meishu East 6 Road, Kaohsiung, Taiwan 804.

We have not had any bankruptcy, receivership or similar proceeding since incorporation. There have been no material reclassifications, mergers, consolidations or purchases or sales of any significant amount of assets not in the ordinary course of business since the date of incorporation. We are a start-up, exploration stage company engaged in the search for gold and related minerals. There is no assurance that a commercially viable mineral deposit, a reserve, exists in our claim or can be shown to exist until sufficient and appropriate exploration is done and a comprehensive evaluation of such work concludes economic and legal feasibility.

Our Current Business – Mineral Exploration

On February 22, 2010, Tiger Jiujiang Mining, Inc. entered into an option agreement, subsequently amended on May 2, 2011, May 22, 2013, and May 31, 2014, (“Option to Purchase and Royalty Agreement”) with Kiukiang Gold Mining Company (“Kiukiang”). Under the terms of the agreement and the various amendments, Kiukiang granted Tiger the right to acquire 50% of the right, title and interest of Kiukiang in the property, subject to its receiving annual payments and a royalty, in accordance with the terms of the agreement, as follows:

| (a) | Tiger contributing exploration expenditures on the property of a minimum of $15,000 on or before May 31, 2012 ($20,000 paid to Kiukiang on May 31, 2012 and expensed as part of the Phase I exploration program); | |

| (b) | Tiger contributing exploration expenditures of a further $45,000 for aggregate minimum contributed exploration expenses of $60,000 on or before November 30, 2015; | |

| (c) | Tiger shall allot and issue 1,000,000 shares in the capital of Tiger to Kiukiang upon completion of a phase I exploration program as recommended by a competent geologist with the proviso that the report recommends further work be carried out on the Tiger property; | |

| (d) | Tiger will pay Kiukiang an annual royalty equal to three percent (3%) of Net Smelter Returns; | |

| (e) | Upon exercise of the option, Tiger will pay Kiukiang $25,000 per annum commencing on May 31, 2018, as prepayment of the NSR; and | |

| (f) | Tiger has the right to acquire an additional 25% of the right, title and interest in and to the property by the payment of $10,000 and by incurring an additional $50,000 in exploration expenditures on or before May 31, 2017. | |

| Further, the Agreement and the Option will terminate: | ||

| (a) | On November 30, 2015, at 11:59 P.M., unless on or before that date, Tiger has incurred exploration expenditures of a cumulative minimum of $60,000 on the Property; | |

| (b) | at 11:59 P.M. on May 31 of each and every year, commencing on May 31, 2018, unless Tiger has paid to Kiukiang the sum of $25,000 on or before that date. | |

4

The property is unencumbered and there are no competitive conditions which affect it. Further, there is no insurance covering the property. We believe that no insurance is necessary since it is unimproved and contains no buildings or improvements.

If the results of phase I are unfavourable, we will terminate the option agreement and will not be obligated to make any subsequent payments. Similarly, if the results of phase II are unfavourable, we will terminate the option and will not be obligated to make any subsequent payments.

To date we have completed the field work portion of the first phase work program. We received the finalized report in October, 2013 and although the report was less than encouraging we continue to seek funding to be able to carry on with the project; we have not spent any money on research and development activities. Tiger is an exploration stage corporation. There is no assurance that a commercially viable deposit exists on the mineral claims that we have under option. Further exploration will be required before an evaluation as to the economic and legal feasibility of the claims is determined.

Our Proposed Exploration Program – Plan of Operation

Our business plan is to proceed with initial exploration of the Tiger property to determine if there are commercially exploitable deposits of gold. We plan a two-phase exploration program to properly evaluate the potential of the property. We must conduct exploration to determine if gold exists and if any is found it can be economically extracted and profitably processed. We do not claim to have any ores or reserves whatsoever at this time.

Our portion of the phase I planned geological exploration program cost $20,000 (which is 50% of the total budgeted cost of $40,000 which is a reflection of costs for the specified type of work). We received the finalized report in late October, 2013 and, although the report was less than encouraging, we are currently reviewing our options and seeking funding to be able to carry on with the project. Costs for phase I consisted of wages, fees, geological and geochemical supplies, assaying, equipment, diamond drilling and operation costs. We are currently assessing the results of this program. We had $47 in cash reserves as of February 28, 2015.

We have not yet decided if Phase II will be carried out as a result of the disappointing results gathered from Phase I; in any event, it will not be considered until funds are available. Phase II would be directed towards additional trenching on selected areas and further diamond drilling; it will require up to six weeks work with total costs of approximately $100,000 (Tiger’s portion will be $50,000) comprised of wages, fees, trenching, diamond drilling, assays and related. The cost estimate is based on local costs for the specified type of efforts planned. A further three to four months may be required for analysis, evaluation of the work accomplished and the preparation of a report.

ITEM 1A RISK FACTORS

Risks Associated with Tiger Jiujiang Mining, Inc., Our Financial Condition and Our Business Model

1. Because our auditors have issued a going concern opinion and because our officer and director has not indicated a willingness to loan any additional funds to us, it is likely we will not be able to achieve our objectives and will have to cease operations.

Our financial statements for the year ended February 28, 2015, were prepared assuming that we will continue our operations as a going concern. However, our auditors have issued a going concern opinion. This means that there is doubt that we can continue as an ongoing business for the next twelve months. We were incorporated on January 28, 2010, and do not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. Junior exploration companies often fail to achieve or maintain successful operations, even in favorable market conditions.

2. We are an exploration stage corporation, lack a business history and have losses that we expect to continue into the future. If the losses continue we will have to suspend operations or cease functioning.

We were incorporated on January 28, 2010, and have not started our proposed business or realized any revenues. We have no business history upon which an evaluation of our future success or failure can be made. Our net loss since inception is $197,114. Our ability to achieve and maintain profitability and positive cash flow is dependent upon finding a profitable exploration property, generating revenues; and reducing exploration costs.

5

Based upon current plans, we expect to incur losses in future periods. This will happen because there are expenses associated with our exploration program. We may not be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

Potential investors should be aware of the difficulties normally encountered by a new enterprise and the high rate of failure of such enterprises. The potential for future success must be considered in light of the problems, expenses, difficulties complications and delays encountered in connection with the development of a business in the area in which we intend to operate and in connection with the formation and commencement of operations of a new business in general. These include, but are not limited to, competition and additional costs and expenses that may exceed current estimates. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and there can be no assurance that we will generate significant operating revenues in the future or ever achieve profitable operations.

3. We have no known mineral reserves and we may not find any gold or if we find gold it may not be in economic quantities. If we fail to find any gold or if we are unable to find gold in economic quantities, we will have to cease operations.

We have no known mineral reserves. Even if we find gold it may not be of sufficient quantity so as to warrant recovery. Additionally, even if we find gold in sufficient quantity to warrant recovery it ultimately may not be recoverable. Finally, even if any gold is recoverable, we do not know that this can be done at a profit. Failure to locate gold deposits in economically recoverable quantities will ultimately cause us to cease operations.

4. Good title to the Tiger property is registered in the name of another person. Failure of Tiger to obtain good title will result in Tiger having to cease operations.

Title to the property we intend to explore is not held in our name but rather that of Kiukiang Gold Mining Company (“Kiukiang”), a corporate resident of the People’s Republic of China. In the event Kiukiang were to grant another person a deed of ownership which was subsequently registered prior to our deed, the third party would obtain good title and we would have nothing. Similarly, if it were to grant an option to another party, that party would be able to enter the property, carry out certain work commitments and earn right and title to the property and we would have little recourse as we would be harmed, will not own any property and would have to cease operations. The option agreement does not specifically reference these risks or the recourse provided. Although we would have recourse against Kiukiang under the laws of Wyoming in the situations described, there is a question as to whether that recourse would have specific value.

5. Currently Tiger has no right to the Tiger gold property. In order to exercise its rights under the option agreement we must incur certain exploration costs and make royalty payments. Failure by Tiger to incur the exploration expenditures or to make the royalty payments will result in forfeiture of Tiger’s right to acquire a 50% interest in the property.

Under the terms of the option agreement and the attendant amendments, Tiger has the right to acquire a 50% interest in the right and title to the Tiger gold property upon incurring exploration expenses of a minimum of $15,000 by May 31, 2014 (paid and completed except for the final report), incurring additional exploration expenses in the amount of $45,000 by May 31, 2015, and making annual advance on royalty payments in the amount of $25,000 commencing May 31, 2016. Failure by Tiger to make any of the payments or to incur the required exploration expenses will result in the loss of the option to acquire an interest in the property. Should we lose the option Tiger would have to cease operations. If we were to fail, after the exercise of the option, to make the required $25,000 annual payment as prepayment of the net smelter royalty we would be in default of section 5.1(c) of the option agreement and would have to remedy the default. If we failed to remedy the default this would result in the loss of the interest in the property and would force us to cease operations.

6 Our common stock is classed as a “penny stock”. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.

Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) impose sales practice and disclosure requirements on certain brokers-dealers who engage in transactions involving a “penny stock.” The SEC has adopted regulations which generally define “penny stock” to be any equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our common stock is covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules may discourage investor interest in and limit the marketability of our common stock.

6

In addition to the “penny stock” rules, the Financial Industry Regulatory Authority ( “FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

7. Upon completion of the phase I exploration program, each party to the option agreement will have the ability to decide as to whether they will carry on with phase II based on the recommendations of their own geological evaluation. Should Kiukiang decide to not proceed to phase II but we elect to, we will have to pay our share of the program as well as that of Kiukiang.

It is possible that Kiukiang may elect to not proceed to phase II. In that event, Tiger would either have to totally fund phase II (estimated at $100,000) or find a joint venture partner to pay a portion of the costs. If we are not successful in raising the required funding or finding a partner, we could be forced to abandon the project and cease operations.

Risks Associated With Doing Business in China

Various matters that are specific to doing business in China may create additional risks or increase the degree of such risks associated with our business activities. These risks are discussed below.

1. The Chinese legal system is different from the U.S. justice system. Most of the material agreements to which we or our affiliates are party or will be party in the future with respect to mining assets in the PRC are expected to be governed by Chinese law and some may be with Chinese governmental entities. The Chinese legal system embodies uncertainties that could limit the legal protection available to Tiger and its shareholders. The outcome of any litigation may be more uncertain than usual because: (i) the experience of the Chinese judiciary is relatively limited, and (ii) the interpretation of China’s laws may be subject to policy changes reflecting domestic political changes.

(a) Legal System - The Chinese use a civil law system based on written statutes. Unlike common law systems (the system in the U.S.), it is a system in which decisions in earlier legal cases do not generally have precedential value. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign, such as Tiger, invested enterprises in China. However, these laws, regulations and legal requirements remain relatively recent and are evolving rapidly; their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors such as the right of foreign invested enterprises to hold licenses and permits such as business licenses. Because our business activities are located outside the U.S., it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against us or any of these persons or entities.

(b) Limited Interpretation - The laws that do exist are relatively recent and their interpretation and enforcement involve uncertainties, which could limit the available legal protections. Even where adequate Chinese law exists it may be impossible to obtain swift and equitable enforcement of such law or to obtain enforcement of judgments by a court of another jurisdiction. The inability to enforce or obtain a remedy under such agreements would have a material adverse impact on our operations.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign, such as Tiger, investment, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial property rights or to resolve commercial disputes is unpredictable. If our new business venture is unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance or to seek an injunction, in either of these cases, may be severely limited and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

7

(c) Corporate Organization – When we commence mining operations, which means we would have successfully proven reserves in such quality and sufficient quantity to ensure for a profitable mining operation, we would form a joint venture with Kiukiang which may involve either the formation of a Sino-foreign or domestic Sino corporate entity. Continuing efforts are being made to improve civil, administrative, criminal and commercial law in China especially since its accession into the WTO. This includes the development of laws governing foreign investment in China, including a regime for Sino-foreign cooperative joint ventures and increased foreign participation in mineral resource exploration and mining. Conversely, the laws were recently changed such that there is no taxation benefit to having a wholly foreign owned enterprise which further demonstrates the ongoing evolution of the Chinese economic model and system. The interpretation and enforcement of the laws of the PRC involve uncertainties which could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses. In addition, substantially all the assets of Sino corporations are located outside the U.S; as a result, there remains much uncertainty as to the future evolution of the laws in China and, therefore, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against any of these persons or corporations.

(d) General – Until we formally enter into a joint venture with Kiukiang and have proven reserves on the Tiger Property all of our success in China will, in part, be based on the actions of Kiukiang. The risk to investors is that Kiukiang mishandles critical phases of the exploration and/or development of the property into the future resulting in losses or damages to Tiger. In addition, investors in Tiger risk that the existing laws of China will change over time as the country becomes more capitalist oriented and that some of those changes will have a deleterious effect on Tiger and its operations in China. What happens to investment in China is a question that can only be answered with time. At some point in the future Tiger may have to rethink and reorganize our investment plans and projects to minimize the tax costs. However, it must also be recognized that tax rates in China remain attractive in comparison to many competing nations.

2. Our sole officer and director, Ms. Chang Ya-Ping, is a resident and citizen of Taiwan which embodies uncertainties that could limit the legal protection available to Tiger’s shareholders.

Because Ms. Chang is a citizen and resident of Taiwan, in the event that U.S. investors sought service of process against Ms. Chang, it may be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against Ms. Chang. Further, it would be difficult to enforce judgements against her which were obtained in U.S. courts based on the civil liability provisions of U.S. federal securities laws and enforcing judgements of U.S. courts based on civil liability provisions of U.S. federal securities laws in foreign courts against Ms. Chang would likewise be difficult as would the bringing of an original action in foreign courts to enforce liabilities based on those U.S. federal securities laws.

3. There are many risks to doing business in China that may affect our future business operations that would not apply or are at variance with operating in the United States. There are regulations that apply to foreign ownership, such as Tiger, to mergers and acquisitions by foreign investors and others that would affect currency conversion and on dividends. Each may or may not impact, to some degree, our operations should we form a Chinese joint venture and continue to explore and develop our optioned mineral property. Any of these risks could cause us to be able to continue with the development of the project and may force us to suspend or cease operations.

We may find that the future rulings in regards to foreign ownership of companies involved in our business may make it more restrictive than that which we see at the present time and may force us to cease operations in China should we either form a joint venture or seek a merger with another company to continue exploration on our optioned property. We may find it difficult to form a joint venture that would be satisfactory to the Chinese government in order to be able to carry out our long tern exploration and development goals. If we were not able to arrange for a joint venture that would be acceptable to the PRC we may not be able to recoup our investment in full or may have to terminate our operations and write off whatever investment we had made to that point. That may result in our having to cease operations or go out of business.

We may not be successful in our efforts to form a joint venture as a result of non-approval by regulatory authorities and may have to suspend or cease operations because all joint ventures to be entered into must be pre-approved by both the Ministry of Commerce (“MOC”) and the State Development and Reform Commission (“SDRC”) in Beijing or their provincial bureaus. The risk that we face is that for reasons that may not be known at this time or because of changes in the regulatory regime, we may not be able to enter into a formal joint venture in which case we would either have to seek a buyer for the project or simply abandon all our previous efforts and cease operation.

In the event that we were to be successful in developing a mining property with reserves and commenced full mining operations, we may not be able to repatriate our full investment in the project which may lessen dividends available to be paid to Tiger’s shareholders. Foreign currency exchange regulation in China is primarily governed by the Foreign Currency Administration Rules (1996), as amended, (the “Exchange Rules”) and Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), (the “Administration Rules”). Under the Exchange Rules, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of the State Administration of Foreign Exchange (“SAFE”). Under the Administration Rules, companies in China with foreign investments may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. foreign

8

The State Administration of Foreign Exchange (the “SAFE”) promulgated Circular on Issues Relating to Foreign Exchange Administration of Equity Financings and Return Investments by Domestic Residents through Offshore Special Purpose Vehicles (“Circular 75” or the “Circular”) on October 21, 2005, which legalizes, and further regulates, the offshore holding company structure favored by private enterprises in their offshore fundraising activities with a view toward channeling foreign venture capital and private equity investments back into China’s private sector and took effect on November 1, 2005. The rules promulgated under this Circular may impact on our ability to form a Chinese joint venture in the future as well as our ability to invest in a Chinese project to the degree that we may require and may preclude us from the benefits of a joint venture. There appears yet to be a great deal of uncertainty as to how Circular 75 will be managed in the longer term. Since we are at least two to five years away from having to form a joint venture and having to deal with the ramifications of SAFE and Circular 75 we do not believe we are yet in a position to determine what we will do in the future; we will, however, have to be mindful of the implications of Circular 75 and monitor the changes that occur in the future.

The rules pertaining to acquisitions and mergers by foreign investors, such as Tiger, may impact our ability to operate long term in the PRC if we are successful in developing a mining project beyond the exploration stage and wish to merge with or be acquired by another entity because recently changed rules in China now require that both foreign investors and Chinese companies incorporated overseas must obtain approval for merger and acquisition activity from the Ministry of Commerce and we may not be able to obtain those approvals in the future which may jeopardize our long tern development plans.

ITEM 1B. UNRESOLVED STAFF COMMENTS

As of the date of this report, there are no unresolved comments pending from the SEC.

ITEM 2 PROPERTIES

Our business office is located at 6F, No.81 Meishu East 6 Road, Kaohsiung, Taiwan 804. Our telephone number is (888) 755-9766. Our principal office is provided by our officer and director at no cost. We believe that the condition of our principal office is satisfactory, suitable and adequate for current needs.

On February 22, 2010, Tiger Jiujiang Mining, Inc. entered into an option agreement, subsequently amended on May 2, 2011, May 22, 2013, and May 31, 2014, (“Option to Purchase and Royalty Agreement”) with Kiukiang Gold Mining Company (“Kiukiang”). Under the terms of the agreement and the various amendments, Kiukiang granted Tiger the right to acquire 50% of the right, title and interest of Kiukiang in the property, subject to its receiving annual payments and a royalty, in accordance with the terms of the agreement, as follows:

| (a) | Tiger contributing exploration expenditures on the property of a minimum of $15,000 on or before May 31, 2012 ($20,000 paid to Kiukiang on May 31, 2012 and expensed as part of the Phase I exploration program); | |

| (b) | Tiger contributing exploration expenditures of a further $45,000 for aggregate minimum contributed exploration expenses of $60,000 on or before November 30, 2015; | |

| (c) | Tiger shall allot and issue 1,000,000 shares in the capital of Tiger to Kiukiang upon completion of a phase I exploration program as recommended by a competent geologist with the proviso that the report recommends further work be carried out on the Tiger property; | |

| (d) | Tiger will pay Kiukiang an annual royalty equal to three percent (3%) of Net Smelter Returns; | |

| (e) | Upon exercise of the option, Tiger will pay Kiukiang $25,000 per annum commencing on May 31, 2018, as prepayment of the NSR; and | |

| (f) | Tiger has the right to acquire an additional 25% of the right, title and interest in and to the property by the payment of $10,000 and by incurring an additional $50,000 in exploration expenditures on or before May 31, 2017. | |

| Further, the Agreement and the Option will terminate: | ||

| (a) | On November 30, 2015, at 11:59 P.M., unless on or before that date, Tiger has incurred exploration expenditures of a cumulative minimum of $60,000 on the Property; | |

| (b) | at 11:59 P.M. on May 31 of each and every year, commencing on May 31, 2018, unless Tiger has paid to Kiukiang the sum of $25,000 on or before that date. | |

9

If the results of phase I are unfavourable, we will terminate the option agreement and will not be obligated to make any subsequent payments. Similarly, if the results of phase II are unfavourable, we will terminate the option and will not be obligated to make any subsequent payments.

Our Proposed Exploration Program – Plan of Operation

Our business plan is to proceed with the second phase in a two-phase exploration of the Tiger property to determine if there are commercially exploitable deposits of gold. We must conduct exploration to determine if gold exists and if any is found it can be economically extracted and profitably processed. We do not claim to have any ores or reserves whatsoever at this time.

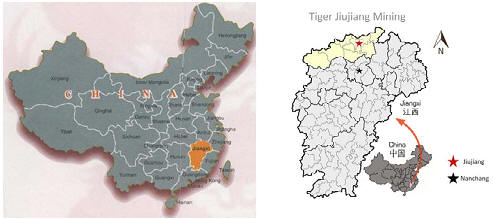

We received the finalized Phase I report in late October, 2013 and, although the report was less than encouraging, we continue to seek funding to be able to carry on with the project. We have not yet decided if Phase II will be carried out as a result of the disappointing results gathered from Phase I; in any event, it will not be considered until later in 2015. Phase II would be directed towards additional trenching on selected areas and further diamond drilling and may require up to six weeks work; total costs will be approximately $100,000, with Tiger’s portion being $50,000, comprised of wages, fees, trenching, diamond drilling, assays and related. The cost estimate is based on local costs for the specified type of efforts planned. A further three to four months may be required for analysis, evaluation of the work accomplished and the preparation of a report. The following Property Location Maps indicate approximately where the claim blocks are located west of Jiujiang City in north-western Jiangxi.

Figure 1 - Maps of location of Jiangxi Province in China

Figure 2 – Tiger Mining Property – General Location

Physiography, Location and Access

The Tiger property is located 20 km west of Ruichang City which is approximately 400 km west of Shanghai and is governed under the Ruichang Township of Jiujiang Province and is accessed by local roads.

Regional Geology

The exploration area is located at the southeast edge of the Yangtze and Jiangnan platforms in the north-western slopes of the deep fracture belts in the northwest of Jiangxi Province. The exposure of the stratums in this area is mainly in the form of metamorphic rocks which were laid down in the times of Proterozoic or Later Proterozoic Eras of the Shuangqiao Mountain Group and the Climbing Mountain Group. The geological structure is well developed and magmatic actives are frequent which has provided good formative conditions for gold ore depositions. These are all indicators of the possible presence of gold in the area. Three sites of potential interest have been located and received minor exploration work consisting of pitting, geology, sampling and a magnetic survey. These sites will become the focus of exploration during phase I.

10

In 2009, in order to further explore and define the prospect, Kiukiang engaged the Jiangxi Geological and Engineering Company, a locally based geological and engineering group to develop the property area and to expand the exploration to other sections outside the previously worked explored areas which had recently been acquired by Kiukiang.

Previous Work

No work had been performed on the property by Tiger prior to the current exploration efforts.

Our Proposed Exploration Program – Plan of Operation

Our business plan is to proceed with the initial exploration of the Tiger property to determine if there are commercially exploitable deposits of gold and silver. Poon Man Sin, Senior Engineer authored the Report in which his firm recommends a two-phase exploration program to properly evaluate the potential of the property. We must conduct exploration to determine if gold exists and if any gold which is found can be economically extracted and profitably processed.

We do not claim to have any ores or reserves whatsoever at this time on our optioned property.

We retained the services of the Jiangxi Geological and Engineering Company and Mr. Poon Man Sing prior to commencement of work to complete the first phase of the work program. We are currently assessing the results of this program. The parties to the option agreement agreed that Tiger would control the exploration work and that Kiukiang would contract for and carry out the physical work under the supervision of Tiger. They are located in the area, have access to labor & equipment and are familiar with local conditions.

We have not yet decided if Phase II will be carried out as a result of the disappointing results gathered from Phase I; in any event, it will not be considered until 2015. Phase II would be directed towards additional trenching on selected areas and further diamond drilling and may require up to six weeks work; total costs will be approximately $100,000, with Tiger’s portion being $50,000, for wages, fees, trenching, diamond drilling, assays and related. The cost estimate is based on local costs for the specified type of efforts planned. A further three to four months may be required for analysis, evaluation of the work and preparation of a report.

There is no power available on the property or within a reasonable distance. All contract work will involve bringing to the site portable power generation units.

We do not expect any changes or hiring of employees since contracts are given to consultants and sub-contractor specialists in specific fields of expertise for the exploration work. We do not expect to purchase or sell any plant or significant equipment. We intend to lease or rent any equipment, such as a backhoe, diamond drill, generators and so on, that we will need in order to carry out our exploration activities.

Environmental Laws

In the past ten years, laws and policies for environmental protection in China have moved towards stricter compliance and stronger enforcement. The basic laws in China governing environmental protection in the mineral industry sector of the economy are the Environmental Protection Law, the Environment Impact Assessment Law and the Mineral Resources Law. The State Administration of Environmental Protection and its provincial counterparts are responsible for the supervision implementation and enforcement of environment protection laws and regulations. Provincial governments also have the power to issue implementing rules and policies in relation to environmental protection in their respective jurisdictions. Applicants for exploration rights must submit environmental impact “assessments” and those projects that fail to meet environmental protection standards will not be granted licenses.

In addition, after exploration the licensee must perform water and soil maintenance and take steps towards environmental protection. After the exploration rights have expired or the concessionaire stops mining during the permit period and the mineral resources have not been fully developed, the concessionaire must perform water and soil maintenance, land recovery and environmental protection in compliance with the original development scheme, or must pay the costs of land recovery and environmental protection. After closing, the mining enterprises shall perform water and soil maintenance, land recovery and environmental protection in compliance with mine closure approval reports, or must pay the costs of land recovery and environmental protection.

Penalties for breaching the Environmental Protection Law include a warning, payment of a penalty calculated on the damage incurred, or payment of a fine. When an entity fails to adopt preventative measures or control facilities that meet the requirements of the enacted environmental protection standards, it is subject to suspension of production or operations and for payment of a fine. Material violations of environmental laws and regulations causing property damage or casualties may result in criminal liabilities.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to Tiger.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Our last annual general meeting was held on August 22, 2014, at which time stockholders approved the following actions:

| • | received and approved the financial statements of the Corporation for its financial year ended February 28, 2014, together with the report of the independent auditors thereon; |

| • | fixed the number of directors at one for the coming year; |

| • | elected Chang Ya-Ping to serve as a director until the next annual general meeting of shareholders or until her successor(s) is/are elected or appointed; |

| • | ratified the appointment of Li and Company, as independent auditors of the Corporation for the financial year ended February 28, 2015. |

11

PART II

ITEM 5. MARKET FOR REGISTRANT’S

COMMON EQUITY, RELATED STOCKHOLDER MATTERS and

ISSUER PURCHASES OF EQUITY

SECURITIES

The shares of our common stock became available for quotation on the Over-the-Counter Bulletin Board (OTC-BB) under the symbol “TIGY” on October 10, 2012. The market for our common shares is limited and can be volatile. The following table sets forth the high and low bid prices of our common stock on a quarterly basis for the periods indicated as quoted on the OTC-BB. These quotations reflect inter-dealer prices without retail mark-up, mark-down or commissions and may not reflect actual transactions.

| Quarter Ended | High Bid | Low Bid |

| May 31, 2014 | $2.00 | $2.00 |

| August 31, 2014 | $2.00 | $2.00 |

| November 30, 2014 | $2.00 | $2.00 |

| February 28, 2015 | $2.00 | $2.00 |

As of the date of this report, the shareholders’ list of our common shares showed 34 registered shareholders holding 6,000,000 shares with 2,500,000 shares being held by broker-dealers. There are 8,500,000 shares issued and outstanding.

Our common shares are issued in registered form through our stock transfer agent VStock Transfer, LLC. of 77 Spruce St., Ste 201, Cedarhurst, NY 11516. They can be contacted by telephone at 1-855-987-8625.

We have not declared any dividends since incorporation and do not anticipate that we will do so in the foreseeable future. Although there are no restrictions that limit the ability to pay dividends on our common shares, our intention is to retain future earnings for use in our operations and the expansion of our business.

ITEM 6. SELECTED FINANCIAL DATA

As a “smaller reporting company”, we are not required to provide the information required by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION and ANALYSIS OF FINANCIAL CONDITION and RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this Annual Report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this Annual Report, particularly in the section entitled “Risk Factors”.

12

We are an exploration stage company and have not generated any revenue to date. We have incurred recurring losses to date. Our financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation.

We were incorporated in the State of Wyoming on January 20, 2010, as Tiger Jiujiang Mining, Inc. and established a fiscal year end of February 28. Our statutory registered agent's office is located at 1620 Central Avenue, Suite 202, Cheyenne, Wyoming 82001 and our business office is located at 6F, No.81 Meishu East 6 Road, Kaohsiung, Taiwan 804. Our telephone number is (888) 755-9766. We are a start-up, exploration stage company engaged in the search for gold and related minerals. There is no assurance that a commercially viable mineral deposit, a reserve, exists in our claim or can be shown to exist until sufficient and appropriate exploration is done and a comprehensive evaluation of such work concludes economic and legal feasibility.

Tiger Mining Property - Physiography, Location and Access

We refer the reader to pages 14 and 15 of this report for maps as to the relative location of Tiger’s mining property. The Tiger property is located 20 km west of Ruichang City which is approximately 400 km west of Shanghai and is governed under the Ruichang Township of Jiujiang Province.

Our Proposed Exploration Program – Plan of Operation – Results of Operations

Our business plan is to proceed with the initial exploration of the Tiger property to determine if there are commercially exploitable deposits of gold and silver. Poon Man Sin, Senior Engineer, authored the Report in which his firm recommends a two-phase exploration program to properly evaluate the potential of the property. We must conduct exploration to determine if gold exists and if any gold which is found can be economically extracted and profitably processed. We do not claim to have any ores or reserves whatsoever at this time on our optioned property.

We retained the services of the Jiangxi Geological and Engineering Company and Mr. Poon Man Sing prior to commencement of work to complete the first phase of the work program. The parties to the option agreement agreed that Tiger would control the exploration work and that Kiukiang would contract for and carry out the physical work under the supervision of Tiger. They are located in the area, have ready access to labor & equipment and are familiar with local conditions.

We are assessing the results of this program now that we have a report in hand (dated October 23, 2014) and which has been translated and reviewed by a North American experienced professional engineer (June 28, 2014). We have not yet decided if Phase II will be carried out as a result of the disappointing results gathered from Phase I; in any event, it will not be considered until late 2015. Phase II would be directed towards additional trenching on selected areas and further diamond drilling and may require up to six weeks work; total costs will be approximately $100,000, with Tiger’s portion being $50,000, comprised of wages, fees, trenching, diamond drilling, assays and related. The cost estimate is based on local costs for the specified type of efforts planned. A further three to four months may be required for analysis, evaluation of the work accomplished and the preparation of a report.

There is no power available on the property or within a reasonable distance. All contract work will involve bringing to the site portable power generation units. We do not expect any changes or hiring of employees since contracts are given to consultants and sub-contractor specialists in specific fields of expertise for the exploration work. We do not expect to purchase or sell any plant or significant equipment. We intend to lease or rent any equipment, such as a backhoe, diamond drill, generators and so on, that we will need in order to carry out our exploration activities.

Results of Operations

| Year Ended | Year Ended | ||||||

| Feb. 28 | Feb. 28 | ||||||

| 2015 | 2014 | ||||||

| Revenue | $ | Nil | $ | Nil | |||

| Operating Expenses | $ | 34,489 | $ | 39,487 | |||

| Net Profit (Loss) | $ | (34,489 | ) | $ | (39,487 | ) |

COMMON SHARES: Since inception we have used common stock, an advance from a related party and a loan from an arms length party to raise money for our optioned mineral acquisition and corporate expenses. Net cash provided by financing activities in the most recent fiscal year ended February 28, 2015, was $27,917 as the result of an advance from a related party of $30,000, the issuance of a promissory note in the amount of $5,000 and the repayment of notes payable in the amount of $7,083.

13

Revenue

We have not earned any revenues since our

inception.

Expenses

Our expenses for the year ended February

28, 2015, and 2014 are outlined in the table below:

| Year ended | Year Ended | ||||||

|

|

February 28, | February 28, | |||||

|

|

2015 | 2014 | |||||

|

Mineral exploration |

$ | 0 | $ | 0 | |||

|

Professional fees |

24,713 | 30,279 | |||||

|

General & administrative expenses |

7,666 | 8,179 | |||||

|

Total Operating expenses |

32,979 | 38,458 | |||||

|

Other(income) expense - interest |

2,110 | 1,029 | |||||

|

Total expenses |

34,489 | 39,487 | |||||

|

Net loss |

$ | (34,489 | ) | $ | (39,487 | ) |

During the year ended February 28, 2015, Tiger incurred expenses of $34,489 as compared to $39,487 for the similar period last year ending on February 28, 2014. The costs incurred can be further subdivided into the following categories.

MINERAL EXPLORATION COSTS: Tiger incurred $0 (nil) in exploration costs in the current and past fiscal years ended February 28, 2015, and 2014. This expense category will vary depending on general exploration activities in the future.

PROFESSIONAL FEES: Tiger incurred $24,713 in professional fees for the fiscal year ended on February 28, 2015, as compared to $30,279 for the previous fiscal year ending on February 28, 2014. This expense category will vary depending more on corporate capital raising activities than any other activity.

GENERAL & ADMINISTRATIVE EXPENSES: $7,666 in general and administrative costs were incurred in the past year. By comparison, $8,179 was incurred for previous fiscal period ended February 28, 2014. These costs should generally remain similar from year to year.

INCOME TAX PROVISION: As a result of operating losses, there has been no provision for the payment of income taxes to date in 2014 - 2015 or from the date of inception.

Liquidity and Financial Condition

Working Capital

| At February 28, | At February 28, | ||||||

| 2015 | 2014 | ||||||

| Current Assets | $ | 47 | $ | 409 | |||

| Current Liabilities | 77,161 | 43,034 | |||||

| Working Capital | $ | (77,114 | ) | $ | (42,625 | ) |

Cash Flows

| At February 28, | At February | ||||||

|

|

2015 | 28, 2014 | |||||

|

Net Cash Used in Operating Activities |

$ | (28,279 | ) | $ | (37,118 | ) | |

|

Net Cash Provided by (Used In) Investing Activities |

Nil | Nil | |||||

|

Net Cash Provided by Financing Activities |

27,917 | 36,614 | |||||

|

Net Change During The Period |

$ | (362 | ) | $ | (504 | ) |

Use of Proceeds

Net cash provided by financing activities from inception on January 20, 2010, to February 28, 2015, was $194,753 as a result of proceeds received from the sale of our common stock ($120,000), loans and notes payable ($42,753) and a loan from a related party ($32,000). During that same period, the following table indicates how those proceeds have been spent to date:

14

|

Mineral exploration |

$ | 20,000 | ||

|

Consulting fees |

25,000 | |||

|

Professional fees |

104,417 | |||

|

General & Administrative expenses |

44,548 | |||

|

Interest expense |

3,139 | |||

|

Total Use of Proceeds to February 28, 2015 |

$ | 197,114 |

Future Operations

Presently, our revenues are not sufficient to meet operating and capital expenses. We have incurred operating losses since inception, and this is likely to continue through fiscal 2015 - 2016. Management projects that we may require $200,000 to fund our ongoing operating expenses and working capital requirements for the next twelve months, broken down as follows:

|

Operating expenses |

$ | 75,000 | ||

|

Repay loans and advances |

50,000 | |||

|

Phase II exploration program |

50,000 | |||

|

Working Capital |

75,000 | |||

|

Total |

$ | 250,000 |

As at February 28, 2015, we had a working capital deficit of $47,114. We plan to raise the additional capital required to meet the balance of our estimated funding requirements for the next twelve months primarily through the sale of equity based securities, loans from shareholders and related as well as non-related parties. We anticipate that we will not be able to satisfy any of these funding requirements internally until we significantly increase revenues.

There is substantial doubt about our ability to continue as a going concern because our business is dependent upon obtaining further financing. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

Future Financings

We will require additional financing in order to enable us to proceed with our plan of operations, as discussed above, and in order to continue operations. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will not be able to meet our other obligations as they become due. We are pursuing various alternatives to meet our immediate and long-term financial requirements.

We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations which would result in dilution to existing stockholders. There is no assurance that we will achieve any sales of equity securities or arrange for debt or other financing to fund our planned activities.

We presently do not have any arrangements for additional financing and no potential lines of credit or sources of financing are currently available for the purpose of proceeding with our plan of operations.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

We are in the development stage, have not yet achieved profitable operations and are dependent on our ability to raise capital from stockholders or other sources to meet obligations arising from normal business operations when they become due. Therefore, due to the uncertainty of our ability to meet our current operating and capital expenses, in their report on the annual financial statements for the year ended February 28, 2015, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment during the next twelve months.

15

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Use of Estimates and Assumptions and Critical Accounting Estimates and Assumptions

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reporting amounts of revenues and expenses during the reporting period.

Critical accounting estimates are estimates for which (a) the nature of the estimate is material due to the levels of subjectivity and judgment necessary to account for highly uncertain matters or the susceptibility of such matters to change and (b) the impact of the estimate on financial condition or operating performance is material. The Company’s critical accounting estimate(s) and assumption(s) affecting the financial statements were:

| (i) |

Assumption as a going concern: Management assumes that the Company will continue as a going concern, which contemplates continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business. | |

| (ii) |

Valuation allowance for deferred tax assets: Management assumes that the realization of the Company’s net deferred tax assets resulting from its net operating loss (“NOL”) carry–forwards for Federal income tax purposes that may be offset against future taxable income was not considered more likely than not and accordingly, the potential tax benefits of the net loss carry-forwards are offset by a full valuation allowance. Management made this assumption based on (a) the Company has incurred recurring losses, (b) general economic conditions, and (c) its ability to raise additional funds to support its daily operations by way of a public or private offering, among other factors. |

These significant accounting estimates or assumptions bear the risk of change due to the fact that there are uncertainties attached to these estimates or assumptions, and certain estimates or assumptions are difficult to measure or value.

Management bases its estimates on historical experience and on various assumptions that are believed to be reasonable in relation to the financial statements taken as a whole under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources.

Management regularly evaluates the key factors and assumptions used to develop the estimates utilizing currently available information, changes in facts and circumstances, historical experience and reasonable assumptions. After such evaluations, if deemed appropriate, those estimates are adjusted accordingly.

Actual results could differ from those estimates.

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions.

Pursuant to Section 850-10-20 the Related parties include a. affiliates of the Company; b. Entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c. trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d. principal owners of the Company; e. management of the Company; f. other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g. Other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

16

The financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Commitment and Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

Revenue Recognition

The Company follows paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company will recognize revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

Recently Issued Accounting Pronouncements

In August 2014, the FASB issued the FASB Accounting Standards Update No. 2014-15 “Presentation of Financial Statements—Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (“ASU 2014-15”).

In connection with preparing financial statements for each annual and interim reporting period, an entity’s management should evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the date that the financial statements are issued (or within one year after the date that the financial statements are available to be issued when applicable). Management’s evaluation should be based on relevant conditions and events that are known and reasonably knowable at the date that the financial statements are issued (or at the date that the financial statements are available to be issued when applicable). Substantial doubt about an entity’s ability to continue as a going concern exists when relevant conditions and events, considered in the aggregate, indicate that it is probable that the entity will be unable to meet its obligations as they become due within one year after the date that the financial statements are issued (or available to be issued). The term probable is used consistently with its use in Topic 450, Contingencies.

17

When management identifies conditions or events that raise substantial doubt about an entity’s ability to continue as a going concern, management should consider whether its plans that are intended to mitigate those relevant conditions or events will alleviate the substantial doubt. The mitigating effect of management’s plans should be considered only to the extent that (1) it is probable that the plans will be effectively implemented and, if so, (2) it is probable that the plans will mitigate the conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern.

If conditions or events raise substantial doubt about an entity’s ability to continue as a going concern, but the substantial doubt is alleviated as a result of consideration of management’s plans, the entity should disclose information that enables users of the financial statements to understand all of the following (or refer to similar information disclosed elsewhere in the footnotes):

| a. |

Principal conditions or events that raised substantial doubt about the entity’s ability to continue as a going concern (before consideration of management’s plans) | |

| b. |

Management’s evaluation of the significance of those conditions or events in relation to the entity’s ability to meet its obligations | |

| c. |

Management’s plans that alleviated substantial doubt about the entity’s ability to continue as a going concern. |

If conditions or events raise substantial doubt about an entity’s ability to continue as a going concern, and substantial doubt is not alleviated after consideration of management’s plans, an entity should include a statement in the footnotes indicating that there is substantial doubt about the entity’s ability to continue as a going concern within one year after the date that the financial statements are issued (or available to be issued). Additionally, the entity should disclose information that enables users of the financial statements to understand all of the following:

| a. |

Principal conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern. | |

| b. |

Management’s evaluation of the significance of those conditions or events in relation to the entity’s ability to meet its obligations. | |

| c. |

Management’s plans that are intended to mitigate the conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern. |

The amendments in this Update are effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. Early application is permitted.

Management does not believe that any recently issued, but not yet effective accounting pronouncements, when adopted, will have a material effect on the accompanying financial statements.

ITEM 7A. QUANTITATIVE and QUALITATIVE DISCLOSURES ABOUT MARKET RISKS

As a “smaller reporting company”, we are not required to provide the information required by this Item.

ITEM 8. FINANCIAL STATEMENTS and SUPPLEMENTARY DATA