Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - PEDEVCO CORP | Financial_Report.xls |

| EX-21.1 - SUBSIDIARIES - PEDEVCO CORP | ped_exh21.htm |

| EX-4.2 - FORM OF SERIES A - PEDEVCO CORP | ped_exh42.htm |

| EX-99.1 - PEDEVCO - PEDEVCO CORP | ped_exh991.htm |

| EX-31.1 - CERTIFICATE - PEDEVCO CORP | ped_exh311.htm |

| EX-32.1 - CERTIFICATE - PEDEVCO CORP | ped_exh321.htm |

| EX-99.2 - CONDOR - PEDEVCO CORP | ped_exh992.htm |

| EX-31.2 - CERTIFICATE - PEDEVCO CORP | ped_exh312.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - PEDEVCO CORP | ped_exh231.htm |

| EX-99.3 - RED HAWK - PEDEVCO CORP | ped_exh993.htm |

| EX-23.2 - CONSENT - PEDEVCO CORP | ped_exh232.htm |

| EX-32.2 - CERTIFICATE - PEDEVCO CORP | ped_exh322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2014

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-35922

PEDEVCO Corp.

(Exact Name of Registrant as Specified in Its Charter)

|

Texas

|

22-3755993

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

4125 Blackhawk Plaza Circle, Suite 201

Danville, California 94506

(Address of Principal Executive Offices)

(855) 733 2685

(Registrant’s Telephone Number,

Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.001 par value per share NYSE MKT

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014 based upon the closing price reported on such date was approximately $41,695,000. Shares of voting stock held by each officer and director and by each person who, as of June 28, 2014, may be deemed to have beneficially owned more than 10% of the outstanding voting stock have been excluded. This determination of affiliate status is not necessarily a conclusive determination of affiliate status for any other purpose.

As of March 25, 2015, 37,817,997 shares of the registrant’s common stock, $0.001 par value per share, were outstanding

Table of Contents

|

Page

|

|||

|

PART I

|

|||

|

Item 1.

|

Business

|

5 | |

|

Item 1A.

|

Risk Factors

|

30 | |

|

Item 1B.

|

Unresolved Staff Comments

|

61 | |

|

Item 2.

|

Properties

|

61 | |

|

Item 3.

|

Legal Proceedings

|

61 | |

|

Item 4.

|

Mine Safety Disclosures

|

61 | |

|

PART II

|

|||

|

Item 5.

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

62 | |

|

Item 6.

|

Selected Financial Data

|

66 | |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

66 | |

|

Item 7A.

|

Quantitative and Qualitative Disclosure About Market Risk

|

78 | |

|

Item 8.

|

Financial Statements and Supplementary Data

|

78 | |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

78 | |

|

Item 9A.

|

Controls and Procedures

|

78 | |

|

Item 9B.

|

Other Information

|

80 | |

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

81 | |

|

Item 11.

|

Executive Compensation

|

87 | |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

97 | |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

100 | |

|

Item 14.

|

Principal Accounting Fees and Services

|

105 | |

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

106 | |

2

Forward Looking Statements

ALL STATEMENTS IN THIS DISCUSSION THAT ARE NOT HISTORICAL ARE FORWARD-LOOKING STATEMENTS. STATEMENTS PRECEDED BY, FOLLOWED BY OR THAT OTHERWISE INCLUDE THE WORDS "BELIEVES," "EXPECTS," "ANTICIPATES," "INTENDS,” "PROJECTS," "ESTIMATES,” "PLANS," "MAY INCREASE," "MAY FLUCTUATE" AND SIMILAR EXPRESSIONS OR FUTURE OR CONDITIONAL VERBS SUCH AS "SHOULD", "WOULD", "MAY" AND "COULD" ARE GENERALLY FORWARD-LOOKING IN NATURE AND NOT HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS WERE BASED ON VARIOUS FACTORS AND WERE DERIVED UTILIZING NUMEROUS IMPORTANT ASSUMPTIONS AND OTHER IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN THE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE THE INFORMATION CONCERNING OUR FUTURE FINANCIAL PERFORMANCE, BUSINESS STRATEGY, PROJECTED PLANS AND OBJECTIVES. THESE FACTORS INCLUDE, AMONG OTHERS, THE FACTORS SET FORTH BELOW UNDER THE HEADING "RISK FACTORS." ALTHOUGH WE BELIEVE THAT THE EXPECTATIONS REFLECTED IN THE FORWARD-LOOKING STATEMENTS ARE REASONABLE, WE CANNOT GUARANTEE FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS. MOST OF THESE FACTORS ARE DIFFICULT TO PREDICT ACCURATELY AND ARE GENERALLY BEYOND OUR CONTROL. WE ARE UNDER NO OBLIGATION TO PUBLICLY UPDATE ANY OF THE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER THE DATE HEREOF OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS. READERS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS. REFERENCES IN THIS FORM 10-K, UNLESS ANOTHER DATE IS STATED, ARE TO DECEMBER 31, 2014. AS USED HEREIN, THE “COMPANY,” “WE,” “US,” “OUR” AND WORDS OF SIMILAR MEANING REFER TO PEDEVCO CORP. (D/B/A PACIFIC ENERGY DEVELOPMENT), WHICH WAS KNOWN AS BLAST ENERGY SERVICES, INC. UNTIL JULY 30, 2012, AND ITS WHOLLY-OWNED AND PARTIALLY-OWNED SUBSIDIARIES, BLAST AFJ, INC. PACIFIC ENERGY DEVELOPMENT CORP., CONDOR ENERGY TECHNOLOGY LLC (UNTIL DIVESTED EFFECTIVE JANUARY 1, 2015), WHITE HAWK PETROLEUM, LLC, PACIFIC ENERGY TECHNOLOGY SERVICES, LLC, PACIFIC ENERGY & RARE EARTH LIMITED, BLACKHAWK ENERGY LIMITED, RED HAWK PETROLEUM, LLC, AND PACIFIC ENERGY DEVELOPMENT MSL LLC, UNLESS OTHERWISE STATED.

This Annual Report on Form 10-K (this “Annual Report”) may contain forward-looking statements which are subject to a number of risks and uncertainties, many of which are beyond our control. All statements, other than statements of historical fact included in this Annual Report, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs and cash flows, prospects, plans and objectives of management are forward-looking statements. When used in this Annual Report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “should,” “continue,” “predict,” “potential,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

Forward-looking statements may include statements about our:

|

●

|

business strategy;

|

|

●

|

reserves;

|

|

●

|

technology;

|

|

●

|

cash flows and liquidity;

|

|

●

|

financial strategy, budget, projections and operating results;

|

|

●

|

oil and natural gas realized prices;

|

|

●

|

timing and amount of future production of oil and natural gas;

|

|

●

|

availability of oil field labor;

|

|

●

|

the amount, nature and timing of capital expenditures, including future exploration and development costs;

|

|

●

|

availability and terms of capital;

|

|

●

|

drilling of wells;

|

|

●

|

government regulation and taxation of the oil and natural gas industry;

|

|

●

|

marketing of oil and natural gas;

|

|

●

|

exploitation projects or property acquisitions;

|

|

●

|

costs of exploiting and developing our properties and conducting other operations;

|

|

●

|

general economic conditions;

|

|

●

|

competition in the oil and natural gas industry;

|

|

●

|

effectiveness of our risk management activities;

|

|

●

|

environmental liabilities;

|

|

●

|

counterparty credit risk;

|

|

●

|

developments in oil-producing and natural gas-producing countries;

|

|

●

|

future operating results;

|

|

●

|

planned combination transaction with Dome Energy;

|

|

●

|

estimated future reserves and the present value of such reserves; and

|

|

●

|

plans, objectives, expectations and intentions contained in this Annual Report that are not historical.

|

3

All forward-looking statements speak only at the date of the filing of this Annual Report. The reader should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this Annual Report are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved. We disclose important factors that could cause our actual results to differ materially from our expectations under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. We do not undertake any obligation to update or revise publicly any forward-looking statements except as required by law, including the securities laws of the United States and the rules and regulations of the SEC.

Certain abbreviations and oil and gas industry terms used throughout this Annual Report are described and defined in greater detail under “Glossary of Oil And Natural Gas Terms” on page 27, and readers are encouraged to review that section.

Available Information

We are subject to the information and reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act, under which we file periodic reports, proxy and information statements and other information with the United States Securities and Exchange Commission, or SEC. Copies of the reports, proxy statements and other information may be examined without charge at the Public Reference Room of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549, or on the Internet at http://www.sec.gov. Copies of all or a portion of such materials can be obtained from the Public Reference Room of the SEC upon payment of prescribed fees. Please call the SEC at 1-800-SEC-0330 for further information about the Public Reference Room.

Financial and other information about PEDEVCO Corp. is available on our website (www.pacificenergydevelopment.com). Information on our website is not incorporated by reference into this report. We make available on our website, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC.

4

PART I

History

We were originally incorporated in September 2000 as Rocker & Spike Entertainment, Inc. In January 2001 we changed our name to Reconstruction Data Group, Inc., and in April 2003 we changed our name to Verdisys, Inc. and were engaged in the business of providing satellite services to agribusiness. In June 2005, we changed our name to Blast Energy Services, Inc. (“Blast”) to reflect our new focus on the energy services business, and in 2010 we changed the direction of the Company to focus on the acquisition of oil and gas producing properties.

On July 27, 2012, we acquired through a reverse acquisition, Pacific Energy Development Corp., a privately held Nevada corporation, which we refer to as Pacific Energy Development. As described below, pursuant to the acquisition, the shareholders of Pacific Energy Development gained control of approximately 95% of the voting securities of our company. Since the transaction resulted in a change of control, Pacific Energy Development was the acquirer for accounting purposes. In connection with the merger, which we refer to as the Pacific Energy Development merger, Pacific Energy Development became our wholly-owned subsidiary and we changed our name from Blast Energy Services, Inc. to PEDEVCO Corp. Following the merger, we refocused our business plan on the acquisition, exploration, development and production of oil and natural gas resources in the United States, with a primary focus on oil and natural gas shale plays and a secondary focus on conventional oil and natural gas plays.

Business Operations

Overview

We are an energy company engaged primarily in the acquisition, exploration, development and production of oil and natural gas shale plays in the Denver-Julesberg Basin (“D-J Basin”) in Colorado, which contains hydrocarbon bearing deposits in several formations, including the Niobrara, Codell, Greenhorn, Shannon, J-Sand, and D-Sand. As of December 31, 2014, we held approximately 14,985 net D-J Basin acres located in Weld and Morgan Counties, Colorado, comprised of approximately 14,013 net acres in the Wattenberg and Wattenberg Extension areas of the D-J Basin that we acquired in March 2014 from Continental Resources, Inc. (“Continental” and the “Continental Acquisition”) and previously referred to as our “Wattenberg Asset,” and approximately 972 net acres in the Wattenberg Extension area of the D-J Basin we previously referred to as our “Niobrara Asset,” which we now collectively refer to as our “D-J Basin Asset.” Our wholly-owned subsidiary, Red Hawk Petroleum, LLC (“Red Hawk”), as of December 31, 2014, holds interests in 53 gross (7.8 net) wells in our D-J Basin Asset, of which 14 gross (6.3 net) wells are operated by Red Hawk and currently producing, 17 gross (1.5 net) wells are non-operated and 22 wells have an after-payout interest. As of December 31, 2014, we also operated 5 additional wells in our D-J Basin Asset through Condor Energy Technology, LLC (“Condor”), our partially-owned subsidiary, which we divested in February 2015.

In February 2015, we continued to expand our D-J Basin position through the acquisition, of additional oil and gas working interests from Golden Globe Energy (US), LLC (“GGE” and the “D-J Basin Acquisition”), which includes approximately 12,977 additional net acres in the D-J Basin located almost entirely within Weld County, Colorado, including acreage located in the prolific Wattenberg core area, and interests in 53 gross wells with an estimated then-current net daily production of approximately 500 barrels of oil equivalent per day (“BOEPD”) as of February 7, 2015. The majority of these assets were originally conveyed to GGE’s predecessor-in-interest, RJ Resources Corp., by us in March 2014 in connection with the Continental Acquisition, and are now included in our D-J Basin Asset. See further details regarding this transaction below in “Recent Developments – D-J Basin Asset Acquisition.” Management believes the acquisition of these reserves associated with this acquisition should enhance the Company’s ability to access more traditional sources of debt financing and secure additional opportunities, including the contemplated transaction with Dome Energy, Inc. discussed in greater detail below.

In February 2015, the Company, Dome Energy AB (“Dome AB”), and Dome Energy, Inc., a wholly-owned subsidiary of Dome AB (“Dome US,” and together with DOME AB, “Dome Energy”), entered into a Heads of Agreement which contemplates the acquisition by the Company of 100% of the capital stock of Dome US in exchange for approximately 140 million shares of our common stock. Dome US produces approximately 1,250 BOEPD from a core operated portfolio of conventional oil and gas assets located in Texas and Wyoming, and from additional non-core producing assets located in Arkansas, Kentucky, Louisiana, Mississippi, and Oklahoma. See further details regarding this transaction below in “Recent Developments – Heads of Agreement with Dome Energy”

5

The contemplated acquisition of Dome US and the recently completed D-J Basin Acquisition were structured to work hand in hand with the intent of increasing the assets, proven reserves and cash flows of the Company, for the express purpose of securing lower-cost bank financing, whether by increasing Dome US’s current bank facility and/or securing new bank credit to pay down the Company’s current debt and reduce the cost of capital for the Company going forward.

Furthermore, in February 2015, the Company sold to MIE Jurassic Energy Corp. (“MIEJ”), its then 80% partner in Condor Energy Technology LLC (“Condor”), the Company's (i) 20% interest in Condor, and (ii) approximately 972 net acres and interests in three wells located in the Company’s legacy, non-core Niobrara acreage located in Weld County, Colorado, that were directly held by the Company in Condor-operated wells. The assets being sold included working interests in five Condor-operated wells that produced approximately 26 barrels of oil per day net to the Company's interest as of February 2015, as well as approximately 2,300 total net acres to the Company's interest in non-core Niobrara areas. The Company and MIEJ also agreed to aggregate and restructure all liabilities owed by the Company to MIEJ and Condor, reducing our debt outstanding with MIEJ and Condor from approximately $9.4 million to $4.925 million, revising and extending the terms of the outstanding debt due to MIEJ, and reducing our senior debt by $500,000 through MIEJ’s direct repayment of principal due to our senior lenders. See greater details regarding this transaction below in “Recent Developments – Settlement Agreement with MIEJ.”

After giving effect to the D-J Basin Acquisition and the divestiture of our legacy non-core Niobrara assets to MIEJ as discussed above, as of February 1, 2015, the Company was producing approximately 994 BOEPD from our D-J Basin Asset, we currently hold approximately 26,990 net acres in our D-J Basin Asset, and we hold interests in 53 gross (15.6 net) wells in our D-J Basin Asset, of which 14 gross (12.5 net) wells are operated by our wholly-owned subsidiary, Red Hawk and are currently producing, 17 gross (3.1 net) wells are non-operated, and 22 wells have an after-payout interest.

We have also entered into agreements to acquire a 5% interest in a Canadian publicly-traded company which is in the process of acquiring a 100% working interest in production and exploration licenses covering an approximate 380,000 acre oil and gas producing asset located in the Pre-Caspian Basin in Kazakhstan, which closing is subject to receipt of required approvals from the Kazakhstan government and satisfaction of other customary closing conditions, which are planned to be satisfied on or before July 2015. In connection with our recent D-J Basin Acquisition, we provided GGE a one-year option to acquire our interest in our Kazakhstan opportunity for $100,000, described in greater detail below in “Recent Developments – D-J Basin Asset Acquisition.”

We have listed below the total production volumes and total revenue net to the Company for the years ended December 31, 2014 and 2013 attributable to our D-J Basin Asset, including the calculated production volumes and revenue numbers for our D-J Basin Asset held indirectly through Condor that would be net to our interest if reported on a consolidated basis, and which does not include any production realized from our recent D-J Basin Acquisition.

6

|

Year Ended

December 31,

2014

|

Year Ended

December 31,

2013

|

|||||||

|

Oil volume (BBL)

|

57,753

|

16,065

|

||||||

|

Gas volume (MCF)

|

94,981

|

13,560

|

||||||

|

Volume equivalent (BOE) (1)

|

73,583

|

18,325

|

||||||

|

Revenue (000’s)

|

$

|

5,139

|

$

|

1,531

|

||||

(1) 6 Mcf of natural gas is equivalent to 1 barrel of oil.

Business Strategy

We believe that the D-J Basin shale play represents among the most promising unconventional oil and natural gas plays in the U.S. As evidenced by the recent D-J Basin Asset, we plan to continue to seek additional acreage proximate to our currently held core acreage located in the Wattenberg and Wattenberg Extension areas of Weld County, Colorado. Our strategy is to be the operator, directly or through our subsidiaries and joint ventures, in the majority of our acreage so we can dictate the pace of development in order to execute our business plan. The majority of our capital expenditure budget for the next 12 calendar months will be focused on the acquisition, development and expansion of our D-J Basin Asset, with particular emphasis placed on reducing our drilling and completion costs while increasing production results. We plan to drill and complete, and participate in the drilling and completion of, approximately 14 additional total wells (equivalent to 3.5 net wells to us) in our D-J Basin Asset through 2015 for total capital expenditures of approximately $24 million, including both operated and non-operated wells, 12 of which will be long lateral wells. We plan to utilize projected cash flow from operations, the approximately $13.5 million gross ($11.0 million net, after origination-related fees and expenses) available under our current senior debt facility, cash on hand, and proceeds from future potential debt and/or equity financings to fund our operations and business plan. In addition, the Company is currently working with Dome Energy to prepare a projected drilling and completion schedule and budget assuming the Company's acquisition of Dome US is consummated, which new 2015 program we anticipate will provide for the drilling of approximately 9 gross (4.2 net) long lateral wells at an estimated capital cost to the Company of approximately $25.8 million, and 24 gross (9 net) short lateral wells at an estimated capital cost to the Company of approximately $28.0 million, increasing our 2015 capital expenditure program with respect to drilling and completions to approximately $53.8 million, and to approximately $55.5 million total including lease renewals.

7

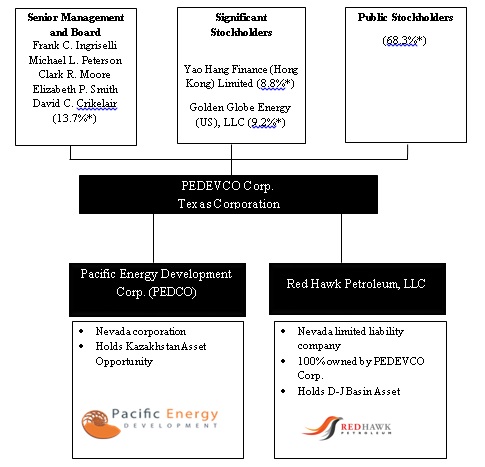

The following chart reflects our current organizational structure:

8

*Represents percentage of voting power based on 37,817,997 shares of common stock and 66,625 shares of Series A Convertible Preferred Stock outstanding as of March 25, 2015, and excludes voting power to be acquired upon exercise of outstanding options or warrants.

Competition

The oil and natural gas industry is highly competitive. We compete and will continue to compete with major and independent oil and natural gas companies for exploration opportunities, acreage and property acquisitions. We also compete for drilling rig contracts and other equipment and labor required to drill, operate and develop our properties. Most of our competitors have substantially greater financial resources, staffs, facilities and other resources than we have. In addition, larger competitors may be able to absorb the burden of any changes in federal, state and local laws and regulations more easily than we can, which would adversely affect our competitive position. These competitors may be able to pay more for drilling rigs or exploratory prospects and productive oil and natural gas properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than we can. Our competitors may also be able to afford to purchase and operate their own drilling rigs.

Our ability to drill and explore for oil and natural gas and to acquire properties will depend upon our ability to conduct operations, to evaluate and select suitable properties and to consummate transactions in this highly competitive environment. Many of our competitors have a longer history of operations than we have, and most of them have also demonstrated the ability to operate through industry cycles.

Competitive Strengths

We believe we are well positioned to successfully execute our business strategies and achieve our business objectives because of the following competitive strengths:

Management. We have assembled a management team at our Company with extensive experience in the fields of international and domestic business development, petroleum engineering, geology, petroleum field development and production, petroleum operations and finance. Several members of the team developed and ran what we believe were successful energy ventures that were commercialized at Texaco, CAMAC Energy Inc., and Rosetta Resources. We believe that our management team is highly qualified to identify, acquire and exploit energy resources in the U.S. and abroad.

Our management team is headed by our Chairman and Chief Executive Officer, Frank C. Ingriselli, an international oil and gas industry veteran with over 36 years of experience in the energy industry, including as the President of Texaco International Operations Inc., President and Chief Executive Officer of Timan Pechora Company, President of Texaco Technology Ventures, and President, Chief Executive Officer and founder of CAMAC Energy Inc. Our management team also includes President and Chief Financial Officer, Michael L. Peterson, who brings extensive experience in the energy, corporate finance and securities sectors, including as a Vice President of Goldman Sachs & Co., Chairman and Chief Executive Officer of Nevo Energy, Inc. (formerly Solargen Energy, Inc.), and a former director of Aemetis, Inc. (formerly AE Biofuels Inc.). In addition, our Executive Vice President and General Counsel, Clark R. Moore, has nearly 10 years of energy industry experience, and formerly served as acting general counsel of CAMAC Energy Inc.

Key Advisors. Our key advisors include South Texas Reservoir Alliance, LLC, which we refer to as STXRA, and other industry veterans. According to STXRA, the STXRA team has experience in drilling and completing horizontal wells, including over 100 horizontal wells with lengths exceeding 4,000 feet from 2010 to 2014, as well as experience in both slick water and hybrid multi-stage hydraulic fracturing technologies and in the operation of shale wells and fields. We believe that our relationship with STXRA, both directly and through our jointly-owned services company, Pacific Energy Technology Services, LLC, will supplement the core competencies of our management team and provide us with petroleum and reservoir engineering, petrophysical, and operational competencies that will help us to evaluate, acquire, develop, and operate petroleum resources into the future.

Significant acreage positions and drilling potential. We have accumulated interests in a total of approximately 27,000 net acres in our core D-J Basin Asset operating area, which we believe represents a significant unconventional resource play. The majority of our interests are in or near areas of considerable activity by both major and independent operators, although such activity may not be indicative of our future operations. Based on our current acreage position, we estimate there could be up to 971 potential gross drilling locations in our D-J Basin Asset acreage, and we anticipate drilling approximately 14 gross (3.5 net) wells through the end of 2015, leaving us a substantial drilling inventory for future years. In the event the Company consummates its anticipated combination with Dome Energy, we anticipate that we will expand our 2015 drilling program to drill approximately 9 gross (4.2 net) long lateral wells and 24 gross (9 net) short lateral wells in 2015.

9

Marketing

The prices we receive for our oil and natural gas production fluctuate widely. Factors that cause price fluctuation include the level of demand for oil and natural gas, weather conditions, hurricanes in the Gulf Coast region, natural gas storage levels, domestic and foreign governmental regulations, the actions of OPEC (Organization of the Petroleum Exporting Countries), price and availability of alternative fuels, political conditions in oil and natural gas producing regions, the domestic and foreign supply of oil and natural gas, the price of foreign imports and overall economic conditions. Decreases in these commodity prices adversely affect the carrying value of our proved reserves and our revenues, profitability and cash flows. Short-term disruptions of our oil and natural gas production occur from time to time due to downstream pipeline system failure, capacity issues and scheduled maintenance, as well as maintenance and repairs involving our own well operations. These situations can curtail our production capabilities and ability to maintain a steady source of revenue for our company. In addition, demand for natural gas has historically been seasonal in nature, with peak demand and typically higher prices during the colder winter months. See “Risk Factors” below.

Oil. Our crude oil is generally sold under short-term, extendable and cancellable agreements with unaffiliated purchasers. As a consequence, the prices we receive for crude oil move up and down in direct correlation with the oil market as it reacts to supply and demand factors. Transportation costs related to moving crude oil are also deducted from the price received for crude oil.

We have currently entered into a month-to-month crude oil purchase contract with a third party buyer, pursuant to which the buyer purchases the crude oil produced from our 14 operated wells in our D-J Basin Asset, periodically at a price per barrel equal to the average of the New York Mercantile Exchange’s (NYMEX) daily settle quoted price for Cushing/WTI for trade days only during a calendar month, applicable to product delivered during any such calendar month, less a per barrel differential of $10.30. The crude oil is purchased at the wellhead, and we do not bear any incremental transportation costs.

Natural Gas. Our natural gas is sold under both long-term and short-term natural gas purchase agreements. Natural gas produced by us is sold at various delivery points at or near producing wells to both unaffiliated independent marketing companies and unaffiliated mid-stream companies. We receive proceeds from prices that are based on various pipeline indices less any associated fees for processing, location or transportation differentials.

Condor entered into a Gas Purchase Contract, dated June 1, 2012, with DCP Midstream, LP, which we refer to as DCP, pursuant to which Condor agreed to sell, and DCP agreed to purchase, all gas produced from Condor’s Niobrara wells located in Weld County, Colorado, at a purchase price equal to 83% of the net weighted average value for gas attributable to Condor that is received by DCP at its facilities sold during the month, less a $0.06/gallon local fractionation fee, for a period of ten years, terminating June 1, 2022. Following the divestiture of our interest in Condor effective January 1, 2015, we no longer have an interest in, or our bound by, this agreement.

In connection with our Continental Acquisition in March 2014, we became a party to a Gas Purchase Contract, dated December 1, 2011, with DCP, pursuant to which we have agreed to sell, and DCP has agreed to purchase, all gas produced from six (6) of our D-J Basin Asset operated wells and surrounding lands located in Weld County, Colorado, at a purchase price equal to 83% of the net weighted average value for gas attributable to us that is received by DCP at its facilities sold during the month, less a $0.06/gallon local fractionation fee, for a period of ten years, terminating December 1, 2021.

In connection with our Continental Acquisition in March 2014, we also became a party to a Gas Purchase Agreement, dated April 1, 2012, as amended, with Sterling Energy Investments LLC, which we refer to as Sterling, pursuant to which we have agreed to sell, and Sterling has agreed to purchase, all gas produced from eight (8) of our D-J Basin Asset wells and surrounding lands located in Weld County, Colorado, at a purchase price equal to 85% of the revenue received by Sterling from the sale of gas after processing at Sterling’s plant that is attributable to us during the month, less a $0.50/Mcf gathering fee, subject to escalation, for a period of twenty years, terminating April 1, 2032.

We endeavor to assure that title to our properties is in accordance with standards generally accepted in the oil and natural gas industry. Some of our acreage may be obtained through farmout agreements, term assignments and other contractual arrangements with third parties, the terms of which often will require the drilling of wells or the undertaking of other exploratory or development activities in order to retain our interests in the acreage. Our title to these contractual interests will be contingent upon our satisfactory fulfillment of these obligations. Our properties are also subject to customary royalty interests, liens incident to financing arrangements, operating agreements, taxes and other burdens that we believe will not materially interfere with the use and operation of or affect the value of these properties. We intend to maintain our leasehold interests by making lease rental payments or by producing wells in paying quantities prior to expiration of various time periods to avoid lease termination.

10

Oil and Gas Properties

We believe that the Wattenberg and Niobrara Shale plays represent among the most promising unconventional oil and natural gas plays in the U.S. We plan to continue to seek additional acreage proximate to our currently held core acreage. Our strategy is to be the operator, directly or through our subsidiaries and joint ventures, in the majority of our acreage so we can dictate the pace of development in order to execute our business plan. The majority of our capital expenditure budget for the period from January 2015 to December 2015 will be focused on the acquisition, development and expansion of these formations. The Company is currently working with Dome Energy to prepare a projected drilling and completion schedule and budget assuming the Company’s acquisition of Dome US is consummated, which could impact our current 2015 drilling and completion plans.

Unless otherwise noted, the following table presents summary data for our leasehold acreage in our core areas as of December 31, 2014 and our drilling capital budget with respect to this acreage from January 1, 2015 to December 31, 2015, subject to availability of capital.

|

Drilling & Land Acquisition Capital Budget

January 1, 2015 - December 31, 2015

|

||||||||||||||||||||||||||||

|

Current Core Assets:

|

Net Acres

|

Acre Spacing

|

Potential Gross -Drilling

Locations (2)

|

Gross Wells

|

Net Wells

|

Gross Costs per Well (3)

|

Capital Cost to

the Company (3)

|

|||||||||||||||||||||

|

D-J Basin Asset (1)

|

26,990 | 80 | 971 | |||||||||||||||||||||||||

|

Long lateral

|

12 | 3.4 | $ | 6,500,000 | $ |

22,100,000

|

||||||||||||||||||||||

|

Short lateral

|

2 | 0.1 | $ | 3,300,000 | $ |

330,000

|

||||||||||||||||||||||

|

Lease renewal

|

$ | 1,700,000 | ||||||||||||||||||||||||||

|

Total Assets

|

26,990 | 971 | 14 | 3.5 | $ |

24,130,000

|

||||||||||||||||||||||

|

(1)

|

Includes the impact of our completed transactions for the D-J Basin Acquisition and the divestiture of non-core legacy Niobrara assets to MIEJ previously discussed.

|

|

(2)

|

Potential gross drilling locations are calculated using the acre spacings specified for each area in the table and adjusted assuming forced pooling in the Niobrara. Colorado, where the D-J Basin Asset is located, allows for forced pooling, which may create more potential gross drilling locations than acre spacing alone would otherwise indicate. 40 acre spacing assumed for certain acreage and 80 acre spacing is assumed for certain acreage.

|

|

(3)

|

Costs per well are gross costs while capital costs presented are net to the Company’s working interests.

|

Unless otherwise noted, the following table presents summary data for our leasehold acreage in our core areas as of December 31, 2014 and our drilling capital budget with respect to this acreage from January 1, 2015 to December 31, 2015, assuming completion of our planned combination with Dome Energy, subject to availability of capital.

|

Drilling & Land Acquisition Capital Budget

January 1, 2015 - December 31, 2015

|

||||||||||||||||||||||||||||

|

Current Core Assets:

|

Net Acres

|

Acre Spacing

|

Potential Gross -Drilling

Locations (2)

|

Gross Wells

|

Net Wells

|

Gross Costs per Well (3)

|

Capital Cost to

the Company (3)

|

|||||||||||||||||||||

|

D-J Basin Asset (1)

|

26,990 | 80 | 971 | |||||||||||||||||||||||||

|

Long lateral

|

9 | 4.2 | $ | 6,200,000 | $ |

28,000,000

|

||||||||||||||||||||||

|

Short lateral

|

24 | 9.0 | $ | 3,100,000 | $ |

25,800,000

|

||||||||||||||||||||||

|

Lease renewal

|

$ | 1,700,000 | ||||||||||||||||||||||||||

|

Total Assets

|

26,990 | 971 | 33 | 13.2 | $ |

55,500,000

|

||||||||||||||||||||||

|

(1)

|

Includes the impact of our completed transactions for the D-J Basin Acquisition and the divestiture of non-core legacy Niobrara assets to MIEJ previously discussed.

|

|

(2)

|

Potential gross drilling locations are calculated using the acre spacings specified for each area in the table and adjusted assuming forced pooling in the Niobrara. Colorado, where the D-J Basin Asset is located, allows for forced pooling, which may create more potential gross drilling locations than acre spacing alone would otherwise indicate. 40 acre spacing assumed for certain acreage and 80 acre spacing is assumed for certain acreage.

|

|

(3)

|

Costs per well are gross costs while capital costs presented are net to the Company’s working interests. We anticipate lower gross costs per well as we add more wells to our drilling program.

|

11

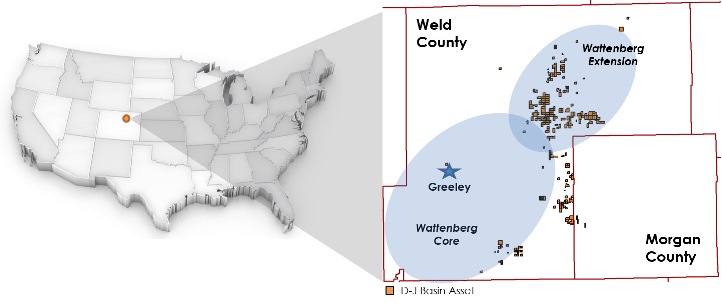

D-J Basin Asset

We directly hold all of our interests in the D-J Basin Asset through our wholly-owned subsidiary, Red Hawk. These interests are located in Weld and Morgan Counties, Colorado. Red Hawk is currently the operator of 14 gross (12.5 net) wells located in our D-J Basin Asset. Our D-J Basin Asset acreage is shown in the map below.

Non-Core Assets

We are a party to various agreements to acquire a 5% interest in a Canadian publicly-traded company which is in the process of acquiring a 100% working interest in production and exploration licenses covering an approximate 380,000 acre oil and gas producing asset located in the Pre-Caspian Basin in Kazakhstan, which we plan to close upon receipt of required approvals from the Kazakhstan government and satisfaction of other customary closing conditions, which are planned to be satisfied on or before July 2015. In connection with our recent D-J Basin Acquisition, we provided GGE a one-year option to acquire our interest in our Kazakhstan opportunity for $100,000, described in greater detail below in “Recent Developments – D-J Basin Asset Acquisition.”

Strategic Alliances

Golden Globe

On March 7, 2014, in connection with the Continental Acquisition, we entered into a $50 million 3-year term debt facility (the “Senior Notes”) with various investors including RJ Credit LLC, a subsidiary of a New York-based investment management group with more than $1.3 billion in assets under management specializing in resource investments. As part of the transaction, GGE (formerly Golden Globe Energy Corp.) (an affiliate of RJ Credit LLC) acquired an equal 13,995 net acre position in the assets we acquired from Continental (the “GGE Assets”), thereby making GGE an equal working interest partner with us in the development of these newly acquired assets, and allowing us to undertake a more aggressive drilling and development program. On February 23, 2015, we completed the acquisition of the GGE Assets from GGE pursuant to the D-J Basin Acquisition, thereby reunifying the assets we originally acquired in the Continental Acquisition, and we assumed approximately $8.35 million of junior subordinated debt from GGE that GGE incurred to develop the GGE Assets subsequent to GGE’s acquisition of them from us in March 2014 and owed to RJ Credit LLC, all as described in greater detail below in “Recent Developments – D-J Basin Asset Acquisition.” GGE also currently holds approximately 9.0% of our issued and outstanding common stock, all of our issued and outstanding Series A Convertible Preferred Stock (which, subject to shareholder approval, converts into 66.6 million shares of our common stock), and has the right to appoint two (2) designees to fill the two (2) current vacant seats on the Company’s five (5) person Board of Directors, one of which must be an independent director as defined by applicable rules, provided that no designees have been appointed by GGE to date.

MIE Holdings

Through the relationships developed by our founder and Chief Executive Officer, Frank C. Ingriselli, we formed a strategic relationship with MIE Holdings Corporation (Hong Kong Stock Exchange code: 1555.HK), one of the largest independent upstream onshore oil companies in China, which we refer to as MIE Holdings, to assist us with our plans to develop unconventional shale properties and explore acquisition opportunities in Asia. MIE Holdings an early and significant investor in our operations as discussed below, and we also jointly formed and previously operated Condor, a Nevada limited liability company that was 20% owned by us, and 80% owned by an affiliate of MIE Holdings, and which drilled, completed and operates five of our horizontal wells. In February 2015, we divested our interest in Condor to an affiliate of MIE Holdings, as described in greater detail below in “Recent Developments – Settlement Agreement with MIEJ.”

MIE Holdings has been a valuable partner, providing us necessary capital in the early stages of our development. It purchased 1,333,334 shares of our Series A preferred stock, which were automatically converted into 1,333,334 shares of our common stock in January 2013 and are still held by MIE Holdings, and originally acquired an 80% interest in Condor for total consideration of $3 million, and as of December 31, 2014, had loaned us $6.17 million through a short-term note (the “MIEJ Note”) to fund operations and development of the D-J Basin acreage operated by Condor, and $432,000 toward the acquisition of the Mississippian Asset, of which we repaid $432,000 in March 2014. On February 19, 2015, we entered into a settlement agreement with MIE Holdings’ affiliate, MIE Jurassic Energy Corporation (“MIEJ”), which aggregated all liabilities owed by the Company to MIEJ and Condor, reduced our debt outstanding with MIEJ and Condor from approximately $9.4 million to $4.925 million, revised and extended the terms of the outstanding debt due to MIEJ, and reduced our senior debt by $500,000 through MIEJ’s direct repayment of principal due to our senior lenders. See further details regarding this transaction below in “Recent Developments – Settlement Agreement with MIEJ.”

12

STXRA

On October 4, 2012, we established a technical services subsidiary, Pacific Energy Technology Services, LLC, which is 70% owned by us and 30% owned by South Texas Reservoir Alliance, LLC, which we refer to as STXRA, through which we plan to provide acquisition, engineering, and oil drilling and completion technology services in joint cooperation with STXRA in the United States. While Pacific Energy Technology Services, LLC currently has no operations, only nominal assets and liabilities and limited capitalization.

STXRA is a consulting firm specializing in the delivery of petroleum resource acquisition services and practical engineering solutions to clients engaged in the acquisition, exploration and development of petroleum resources. In April 2011, we entered into an agreement of joint cooperation with STXRA in an effort to identify suitable energy ventures for acquisition by us, with a focus on plays in shale oil and natural gas bearing regions in the United States. According to information provided by STXRA, the STXRA team has experience in their collective careers of drilling and completing horizontal wells, including over 100 horizontal wells with lengths exceeding 4,000 feet from 2010 to 2014, as well as experience in both slick water and hybrid multi-stage hydraulic fracturing technologies and in the operation of shale wells and fields. We believe that our relationship with STXRA, both directly and through our jointly-owned Pacific Energy Technology Services LLC services company, will supplement the core competencies of our management team and provide us with petroleum and reservoir engineering, petrophysical, and operational competencies that will help us to evaluate, acquire, develop and operate petroleum resources in the future.

Our Core Areas

The majority of our capital expenditure budget for the period from January 2015 to December 2015 will be focused on the acquisition and development of our core oil and natural gas properties located in the D-J Basin Asset. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources.”

D-J Basin Asset

As a result of the D-J Basin Acquisition and the divestiture of legacy non-core Niobrara assets to MIEJ, we currently hold 26,990 net acres in oil and natural gas properties related to our D-J Basin Asset. We currently own direct interests in 53 gross (15.6 net) wells in our D-J Basin Asset, of which 14 gross (12.5 net) wells are operated by Red Hawk and currently producing, 17 gross (3.1 net) wells are non-operated and 22 wells have an after-payout interest.

During the fourth quarter of 2014, we completed drilling three horizontal wells from a single pad. The Loomis 2-6H well reached a total measured depth of 11,335 feet, with a 6,298 foot total vertical depth and 4,694 foot lateral length with 25 frac stages, and tested at an initial production rate of 540 barrels of bopd and 300 mcfgd (590 boepd). The Loomis 2-3H well reached a total measured depth of 11,345 feet, with a 6,321 foot total vertical depth and 4,614 foot lateral length with 18 frac stages, and tested at an initial production rate of 540 barrels of bopd and 248 mcfgd (581 boepd). The Loomis 2-1H well reached a total measured depth of 11,365 feet, with a 6,334 foot total vertical depth and 4,851 foot lateral length with 18 frac stages, all through the Niobrara "B" Bench target zone, and tested at an initial production rate of 576 barrels of bopd and 630 mcfgd (681 boepd).

We plan to drill and complete, and participate in the drilling and completion of, approximately 14 additional total wells (equivalent to 3.5 net wells to us) in our D-J Basin Asset through 2015 for total capital expenditures (including lease renewals) of approximately $24 million, including both operated and non-operated wells, 12 of which will be long lateral wells. We will be utilizing the $13.5 million drilling facility provided by GGE, cash on hand, proceeds from future equity offerings, internally generated cash flow, and future debt financings to aggressively develop this new asset. In the event the Company consummates its anticipated combination with Dome Energy, we anticipate that we will expand our 2015 drilling program to drill approximately 9 gross (4.2 net) long lateral wells and 24 gross (9 net) short lateral wells for total capital expenditures of approximately $55.5 million (including lease renewals). We plan to utilize Dome US’s available debt facility, cash on hand, proceeds from future equity offerings, internally generated cash flow, and future debt financings to develop the D-J Basin Asset.

13

Based on publicly available information, we believe that average drilling and completion costs for wells in our core area which, for purposes of industry comparisons, have ranged between $3.0 million and $7.0 million per well with average estimated ultimate recoveries, or EURs, of 300,000 to 600,000 BOE per well and initial 30-day average production of 450 to 600 BOE per day per well. The costs incurred, EURs and initial production rates achieved by others may not be indicative of the well costs we will incur or the results we will achieve from our wells.

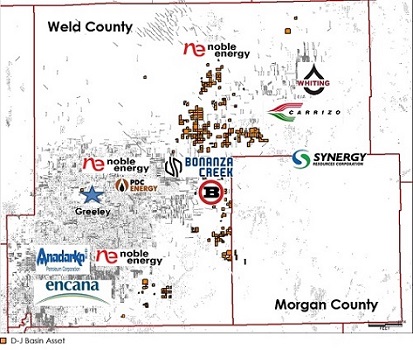

Recently, there has been significant industry activity in the Niobrara Shale play. The most active operators offsetting our acreage position include Anadarko Petroleum (NYSE: APC), Bill Barrett Corp. (NYSE: BBG), Bonanza Creek (NYSE: BCEI), Carrizo Oil and Gas, Inc. (NASDAQ: CRZO), EOG Resources (NYSE: EOG), Noble Energy (NYSE: NBL), PDC Energy (NASDAQ: PDCE), Synergy Resources (NYSE: SYRG) and Whiting Petroleum (NYSE: WLL).

Our Non-Core Areas

As described above, we have entered into agreements to acquire a 5% interest in a Canadian publicly-traded company which is in the process of acquiring a 100% working interest in production and exploration licenses covering an approximate 380,000 acre oil and gas producing asset located in the Pre-Caspian Basin in Kazakhstan. In connection with our recent D-J Basin Acquisition, we provided GGE a one-year option to acquire our interest in our Kazakhstan opportunity for $100,000, described in greater detail below in “Recent Developments – D-J Basin Asset Acquisition.”

Recent Developments

D-J Basin Asset Acquisition

On February 23, 2015 (the “Closing”), we entered into and closed the transactions contemplated by a Purchase and Sale Agreement (the “Purchase Agreement”) with GGE, pursuant to which the Company, through Red Hawk, acquired from GGE all of its rights, title and interest in approximately 12,977 net acres in the DJ Basin located almost entirely within Weld County, Colorado, including acreage located in the prolific Wattenberg core area, and interests in 53 gross (7.8 net) wells with an estimated current net daily production of approximately 500 barrels of oil equivalent per day as of February 7, 2015 (the “GGE Assets”). All of GGE’s leases and related rights, oil and gas and other wells, equipment, easements, contract rights, and production are included in the purchase, the majority of which assets were originally conveyed to GGE’s predecessor-in-interest, RJ Resources Corp., by us in March 2014 in connection with the Continental Acquisition.

As consideration for the acquisition of the GGE Assets, the Company (i) issued to GGE 3,375,000 restricted shares of common stock and 66,625 restricted shares of the Company’s newly-designated Amended and Restated Series A Convertible Preferred Stock (the “Series A Preferred” (described in greater detail below)), (ii) assumed approximately $8.35 million of junior subordinated debt from GGE (the “Junior Debt”) pursuant to an Assumption and Consent Agreement and an Amendment to Note and Security Agreement, and (iii) provided GGE with a one-year option to acquire the Company’s interest in its Kazakhstan opportunity for $100,000 pursuant to a Call Option Agreement (the “Kazakhstan Call Option Agreement”, described in greater detail below).

The Purchase Agreement contains customary representations, warranties, covenants and indemnities by the parties thereto. In addition the Company, by resolution of the Board of Directors, has formally increased the size of the Company’s Board of Directors from three (3) members to five (5) members, and provided GGE the right pursuant to the Purchase Agreement and the certificate of designation designating the Series A Preferred, upon notice to the Company, to appoint designees to fill the two (2) vacant seats, one of which must be an independent director as defined by applicable rules, provided that no designees have been appointed to date. The Board appointment rights continue until GGE no longer holds any of the Tranche One Shares (defined below). The Company has further agreed that, within ninety (90) days of the Closing, extendable by up to an additional forty-five (45) days in the event the Company is a party to a material corporate transaction that requires shareholder approval, the Company shall file all required documentation with the SEC necessary to seek shareholder approval (the “Shareholder Approval”) of the Certificate of Designation (defined below), the issuance of the Company’s common stock upon conversion of the Series A Preferred, and other related matters, and to include the Company’s Board of Directors’ recommendation to the shareholders that they approve these matters.

14

Pursuant to the Company’s Amended and Restated Certificate of Designations of PEDEVCO Corp. Establishing the Designations, Preferences, Limitations, and Relative Rights of its Series A Convertible Preferred Stock (the “Certificate of Designation”), the 66,625 shares of Series A Convertible Preferred Stock issued to GGE (which represent all of the Series A Convertible Preferred Stock designated pursuant to the terms of the Certificate of Designation) (i) have a liquidation preference senior to all of the Company’s common stock equal to $400 per share (the “Liquidation Preference”), (ii) accrue an annual dividend equal to 10% of their Liquidation Preference, payable annually from the date of issuance (the “Dividend”), (iii) vote together with the common stock on all matters, with each share having one (1) vote, and (iv) are not convertible into common stock of the Company until the Shareholder Approval is received. Upon the Company’s receipt of Shareholder Approval, (x) the Series A Convertible Preferred Stock automatically cease accruing Dividends and all accrued and unpaid Dividends are automatically forfeited and forgiven in their entirety, (y) the Liquidation Preference of the Series A Convertible Preferred Stock is reduced to $0.001 per share from $400 per share, and (z) each share of Series A Preferred is convertible into common stock on a 1,000:1 basis, subject to a lock-up that prohibits GGE from selling the shares through the public markets for less than $1 per share (on an as-converted to common stock basis) for a period that is twelve (12) months following the Closing, provided that no conversion is allowed in the event, the holder thereof, would beneficially own more than 9.99% of the Company’s outstanding common stock or voting stock.

In the event the Company repays all amounts due and outstanding under the PEDEVCO Senior Loan (defined below) within nine (9) months of the Closing, the Company is entitled, at its option, to redeem (or assign the right to redeem or purchase) the Series A Convertible Preferred Stock as follows: (i) for the first nine (9) months following the Closing, the Company may repurchase and redeem any or all of 15,000 shares of Series A Convertible Preferred Stock (the “Tranche One Shares”) at a repurchase price of $500 per share; (ii) following the first nine (9) months after the Closing until twenty-four (24) months following the Closing, the Company may repurchase and redeem any or all of the outstanding Tranche One Shares or any or all of an additional 15,000 shares of Series A Convertible Preferred Stock (the “Tranche Two Shares”) at a repurchase price of $650 per share; and (iii) following twenty-four (24) months after the Closing until thirty-six (36) months following the Closing, the Company may repurchase and redeem any or all remaining outstanding shares of Series A Convertible Preferred Stock at a repurchase price of $800 per share (collectively, the “Company Redemption Rights”). In addition, in the event the Company repays the PEDEVCO Senior Loan and redeems all the Tranche One Shares within nine (9) months of the Closing, (i) 25,000 shares of Series A Convertible Preferred Stock (the “Tranche Four Shares”) are automatically redeemed and repurchased by the Company for $0 per share, and (ii) GGE may request (but not require) that the Company redeem and repurchase (x) the Tranche Two Shares (or such portion thereof that is then outstanding) at a redemption price of $650 per share for a period of thirty (30) days following the twenty-fourth (24th) month anniversary of the Closing, and (y) the Tranche Two Shares (or such portion thereof that is then outstanding) and 11,625 shares of Series A Convertible Preferred Stock (the “Tranche Three Shares”) at a redemption price of $800 per share for a period of thirty (30) days following the thirty-sixth (36th) month anniversary of the Closing (the “Holder Redemption Requests”). In the event the Company does not redeem and repurchase (or if the Company has assigned such right, another party has redeemed or purchased) all such shares pursuant to the Holder Redemption Requests, the holders thereof have no recourse against the Company, provided that if the Company (or if applicable, the third party) does not repurchase and redeem all such requested shares, and the average closing price of the Company’s common stock over the thirty (30) day period immediately preceding the third anniversary of the Closing is below $0.80 per share, then the Company is required to issue the holders up to an additional 10,000 shares of Series A Convertible Preferred Stock, pro-rated based on the actual number of shares redeemed and repurchased by the Company.

The Assumption and Consent Agreement provides that, as of the Effective Date, the Company assumes all of GGE’s rights, obligations and liabilities under that certain Note and Security Agreement, dated April 10, 2014 (the “GGE Note”), as amended by that certain Amendment to Note and Security Agreement, dated as of the Effective Date (the GGE Note, as amended, the “Amended GGE Note”). The lender under the Amended GGE Note is RJ Credit LLC (“RJC”), and the Amended GGE Note has an aggregate principal balance of $8,353,000. The Amended GGE Note is due and payable on December 31, 2017, and bears interest at the per annum rate of twelve percent (12%) (24% upon an event of default), which interest is payable monthly in cash by the Company. The Amended GGE Note is subordinate and subject to the terms and conditions of those certain promissory notes issued by the Company in favor of BRe BCLIC Primary, BRe BCLIC Sub, BRe WINIC 2013 LTC Primary, BRe WNIC 2013 LTC Sub, and RJC, as investors (the “PEDEVCO Senior Loan Investors”), and BAM Administrative Services LLC, as agent for the investors, and any related collateral documents (collectively, the “PEDEVCO Senior Loan”), as well as any future secured indebtedness of the Company from a lender with an aggregate principal amount of at least $20,000,000 (“Future PEDEVCO Loan”). Should the Company repay the PEDEVCO Senior Loan and replace such indebtedness with a Future PEDEVCO Loan, then, upon the reasonable request of such senior lender, RJC agreed to further amend the Amended GGE Note to adjust the frequency of interest payments or to eliminate such payments and replace the same with the accrued interest to be paid at maturity.

15

The GGE Note contains customary representations, warranties, covenants and requirements for the Company to indemnify RJC and its affiliates, related parties and assigns. The GGE Note also includes various covenants (positive and negative) binding the Company, including requiring that the Company provide RJC with quarterly (unaudited) and annual (audited) financial statements, restricting the Company’s creation of liens and encumbrances, or sell or otherwise disposing, the Collateral (as defined therein). RJC is one of the lenders under the PEDEVCO Senior Loan, and is an affiliate of GGE.

The Kazakhstan Call Option Agreement provides that for a period of one (1) year following the Closing, GGE may acquire from the Company, for a purchase price of $100,000, either (i) that certain promissory note (the “A6 Promissory Note”), in the principal amount of $5 million, issued by Asia Sixth Energy Resources Limited (“Asia Sixth”) to Pacific Energy Development Corp. (“PEDCO”), a wholly-owned subsidiary of the Company, on August 1, 2014, or (ii) in the event the A6 Promissory Note is exchanged for capital stock in Caspian Energy Inc. (the “CEI Stock”) pursuant to that certain Share Purchase Agreement dated as of August 1, 2014, by and among PEDCO, Asia Sixth, and certain other parties thereto, GGE may acquire the CEI Stock from the Company.

Heads of Agreement with Dome Energy, Inc.

On February 23, 2015, the Company, Dome AB, and Dome US, entered into a Heads of Agreement (the “Heads of Agreement”) pursuant to which the parties agreed to certain terms and conditions for the acquisition by the Company of 100% of the capital stock of Dome US (the “DOME Acquisition”). Under the nonbinding Heads of Agreement, the Company agreed to acquire all of Dome AB’s oil and gas interests in the United States that are held by Dome US in exchange for approximately 140 million shares of the Company’s common stock (the “Consideration Shares”), representing approximately 64% of the Company’s total issued and outstanding shares of capital stock on an as-converted basis (assuming the Series A Preferred is converted into common stock, and excluding the 25,000 Tranche Four Series A Preferred shares issued to GGE as described above), subject to +/-4% adjustment based on further valuation due diligence by the parties.

The obligations of the parties under the Heads of Agreement are conditioned upon satisfaction or waiver by the parties of the following conditions: (i) approval by each party’s Board of Directors and shareholders in accordance with applicable law and their respective governing documents; (ii) approval of a mutually agreeable definitive acquisition agreement; (iii) approval from the NYSE MKT of the DOME Acquisition and the issuance and additional listing of the Consideration Shares; (iv) the registration with the SEC of the Consideration Shares; (v) the provision for the repayment or satisfaction of all amounts due and outstanding under the PEDEVCO Senior Loan on or immediately following the closing of the DOME Acquisition; (vi) agreement by RJC to subordinate the Amended GGE Note (as defined above) to DOME US’s senior credit facility; (vii) consummation by the Company of the acquisition of the Acquired Assets from GGE (as described above); (viii) receipt of all material necessary third party consents and approvals, including approval from each party’s senior lenders, as necessary and required; (ix) the Company’s continued listing on the NYSE MKT; and (x) completion by each party of confirmatory due diligence, to each such party’s satisfaction, including, but not limited to, with respect to the other party’s oil and gas production, leaseholds, and financial condition.

The parties intend to negotiate and enter into definitive documentation as soon as practicable, with an anticipated signing date to occur before April 30, 2015, and upon terms and conditions as mutually acceptable to the parties. Unless otherwise agreed upon by the parties, if the DOME Acquisition has not closed by September 30, 2015, either party may terminate the proposed transaction. An additional requirement of the DOME Acquisition, is that the number of the members of the Board of Directors of the Company be increased, at the closing of the transaction, by two (2) members, who shall be designated by Dome US, one of which shall be independent as defined under applicable NYSE MKT and SEC guidelines. The Company can make no guarantees or assurances that the parties will be able to mutually agree on definitive documentation, or that the DOME Acquisition will be consummated on terms and conditions acceptable to the Company, if at all.

16

Settlement Agreement with MIEJ

On February 19, 2015 (the “MIEJ Closing Date”), the Company and PEDCO entered into a Settlement Agreement (the “MIEJ Settlement Agreement”) with MIEJ. MIEJ was PEDCO’s 80% partner in Condor, and is the lender to PEDCO under that certain Amended and Restated Secured Subordinated Promissory Note, dated March 25, 2013, in the principal amount of $6,170,065, entered into by PEDCO and MIEJ (the “MIEJ-PEDCO Note”). Pursuant to the MIEJ Settlement Agreement, (i) MIEJ and PEDCO agreed to restructure the MIEJ-PEDCO Note through the entry into a new Amended and Restated Secured Subordinated Promissory Note, dated February 19, 2015 (the “New MIEJ Note”), (ii) PEDCO agreed to sell its (x) full 20% interest in Condor (the “Condor Interests”) to MIEJ pursuant to a Membership Interest Purchase Agreement entered into by and between PEDCO and MIEJ (the “Condor Purchase Agreement”), and (y) interests in approximately 945 net acres and interests in three (3) wells located in PEDCO’s legacy non-core Niobrara acreage located in Weld County, Colorado, that were directly held by PEDCO (the “PEDCO Direct Interests”) to Condor pursuant to an Assignment entered into by and between PEDCO and Condor, (the “PEDCO Direct Interests Assignment”), which Condor Interests and PEDCO Direct Interests together produce an estimated current net daily production of approximately 26 barrels of oil equivalent per day net to PEDCO as of February 7, 2015, and the parties agreed had a combined value of $4.2 million, (iii) Condor forgave approximately $1.8 million in previous working interest expenses related to the drilling and completion of certain wells operated by Condor that was due from PEDCO with respect to the PEDCO Direct Interests, and (iv) certain other related matters occurred, which, in summary, had the net effect of reducing approximately $9.4 million in aggregate liabilities due from PEDCO to MIEJ and Condor to $4.925 million, which is the new principal amount of the New MIEJ Note. In addition, pursuant to the MIEJ Settlement Agreement, (a) in consideration for the PEDEVCO Senior Loan Investors releasing their security interest on the Condor Interests and PEDCO Direct Interests, MIEJ paid $500,000 to the PEDEVCO Senior Loan Investors as a principal reduction on the PEDEVCO Senior Loan, which directly benefits PEDEVCO, (b) PEDCO paid $100,000 as a principal reduction under the MIEJ-PEDCO Note, (c) each of MIEJ, Condor and the Company fully released each other, and their respective predecessors and successors in interest, parents, subsidiaries, affiliates and assigns, and their respective officers, directors, managers, members, agents, representatives, servants, employees and attorneys, from every claim, demand or cause of action arising on or before the MIEJ Closing Date, and (d) MIEJ confirmed that the MIEJ-PEDCO Note was paid in full and that PEDCO owes no amounts to MIEJ or Condor other than the principal amount due as reflected in the New MIEJ Note.

The New MIEJ Note, bears an interest rate of 10.0% per annum with no interest due until Maturity (defined below) or except as detailed below, is secured by all of the Company’s current and after-acquired assets, and is subordinated in every way to the PEDEVCO Senior Loan as well as to New Senior Lending (defined below); however, MIEJ has no control over the cash flow of the Company, nor is MIEJ’s consent required in connection with any disposition, sale, or use of any assets of the Company or any of its subsidiaries at any time in the future, provided that the requirements of the New MIEJ Note requiring the prepayment of interest, where applicable, as described below are followed. After the MIEJ Closing Date, the Company may enter into a loan, or a series of new loans or any other new non-equity investment or assumption of indebtedness (a “New Senior Lending”) which will be senior to the New MIEJ Note, without the prior consent of MIEJ, provided that, in addition to the approximately $35 million principal balance of the PEDEVCO Senior Loan, the New Senior Lending is subject to a cap of an additional $60 million in the aggregate, such that the total lending, debt or similar investment under such cap shall not exceed $95 million in the aggregate (the “Senior Debt Cap”), with any portion of New Senior Lending in excess of the Senior Debt Cap advanced first to MIEJ until the New MIEJ Note is paid in full. The New MIEJ Note shall automatically, and without further consent from MIEJ, be subordinated in every way to any such New Senior Lending. Should the Company enter into any new financing transaction that results in raising New Senior Lending of at least $20 million in excess of the balance of the PEDEVCO Senior Loan, then MIEJ has a right to be paid all interest and fees that have accrued on the New MIEJ Note each and every time that a new financing transaction reaches or exceeds the $20 million threshold. The New MIEJ Note is due and payable on March 8, 2017, subject to automatic extensions upon the occurrence of a Long Term Financing or PEDEVCO Senior Lending Restructuring (each as defined below) (the “Maturity”).

After the MIEJ Closing Date, on a onetime basis, the PEDEVCO Senior Loan may be refinanced by a new loan (“Long-Term Financing”) by one or more third party replacement lenders (“Replacement Lenders”), and in such event the Company shall undertake commercially reasonable best efforts to cause the Replacement Lenders to simultaneously refinance both the PEDEVCO Senior Loan and the New MIEJ Note as part of such Long-Term Financing. Despite such efforts, should the Replacement Lenders be unable or unwilling to include the New MIEJ Note in such financing, then the Long-Term Financing may proceed without including the New MIEJ Note, and the New MIEJ Note shall remain in place and shall be automatically subordinated, without further consent of MIEJ, to such Long-Term Financing. Furthermore, upon the occurrence of a Long-Term Financing, the Maturity of the New MIEJ Note is automatically extended, without further consent of MIEJ, to the same maturity date of the Long-Term Financing (the “Extended Maturity Date”), provided that the Extended Maturity Date may not exceed March 8, 2020. Additionally, upon the closing of such Long-Term Financing: (a) the Long-Term Financing is required to be subject to the Senior Debt Cap, (b) the Company is required to make commercially reasonable best efforts for the Long-Term Financing to include adequate reserves or other payment provisions whereby MIEJ is paid all interest and fees accrued on the New MIEJ Note commencing as of March 8, 2017 (and annually thereafter, until such time as the New MIEJ Note is paid in full), but in any event the Replacement Lenders are required to agree to allow for quarterly interest payments (starting March 31, 2017) of not less than 5% per annum on the outstanding balance of the New MIEJ Note, plus a one-time payment of accrued interest (not to exceed $500,000) as of March 31, 2017 (the “Subordinated Interest Payments”), and the remaining 5% interest shall continue to accrue, and (c) MIEJ has the Right of Conversion (defined below) commencing as of March 8, 2017, the original maturity date of the New MIEJ Note. If the PEDEVCO Senior Loan and/or New Senior Lending is not refinanced by Replacement Lenders, but is instead refinanced, restructured or extended by the existing PEDEVCO Senior Loan Investors (a “PEDEVCO Senior Lending Restructuring”), the maturity of both the New MIEJ Note and the PEDEVCO Senior Loan may be extended to no later than March 8, 2019, without requiring the consent of MIEJ, provided that (i) any such extension of the maturity date of the New MIEJ Note past March 8, 2017 shall give MIEJ the Right of Conversion (described below) commencing on March 8, 2017, and (ii) such extension agreement shall include payment provisions whereby MIEJ shall be paid all interest and fees accrued on the New MIEJ Note as of March 8, 2018. The New MIEJ Note may be prepaid any time without penalty, and should the Company repay the New MIEJ Note on or before December 31, 2015, 20% of the principal of the New MIEJ Note amount is required to be forgiven by MIEJ, and should the Company repay the New MIEJ Note on or before December 31, 2016, 15% of the principal of the New MIEJ Note amount is required to be forgiven by MIEJ.

17

The New MIEJ Note has a conversion feature that provides, in the event that the final maturity of the New MIEJ Note is extended beyond March 8, 2017 for whatever reason, MIEJ has the right, at its discretion, to have the outstanding balance of the New MIEJ Note plus any accrued and unpaid interest thereon converted in whole or in part into common stock of the Company at a price (the “Conversion Price”) equal to 80% of the average closing price per share of common stock over the then previous 60 days from the date MIEJ exercises its conversion right (subject to adjustment for stock splits, recapitalizations and the like)(such event, a “Right of Conversion”); provided, however, that in no event shall the Conversion Price be less than $0.30 per share of common stock (the “Floor Price”). Additionally, the New MIEJ Note contains a provision preventing the conversion of the MIEJ Note to the extent that such conversion would result in more than 19.9% of the Company’s outstanding common stock or voting stock being issued in aggregate upon the conversion of such note, or otherwise require shareholder approval under the NYSE MKT rules. Notwithstanding that, the Company agreed to include a proposal in its proxy statement for its 2016 annual meeting of its shareholders (the “2016 Annual Meeting”) for the approval of the issuance of the maximum number of shares of common stock issuable in connection with conversion of the New MIEJ Note, assuming conversion at the Floor Price (the “Maximum Conversion Shares”). In the event that a vote in favor of the issuance by the Company of the Maximum Conversion Shares fails at the 2016 Annual Meeting, the Company shall thereafter take all commercially reasonable action to procure such approval no later than the 2017 annual meeting of its shareholders. The Company shall also take all reasonable actions as may be necessary to procure any associated approvals from the NYSE MKT for the issuance of the shares.