Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NN INC | d894304d8k.htm |

| Exhibit 99.1

|

Investor Presentation

March 17, 2015

|

|

Forward-Looking Statement & Disclaimer

Forward Looking Statement: With the exception of the historical information contained in this presentation, the matters described herein contain forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve a number of risks and uncertainties that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector, competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues, availability of raw materials, currency and other risks associated with international trade, the Company’s dependence on certain major customers, and other risk factors and cautionary statements listed from time to time in the Company’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on 10-K for the fiscal year ended December 31, 2013.

Disclaimer: NN disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

This presentation includes certain non-GAAP measures as defined by SEC rules. A reconciliation of those measures to the most directly comparable GAAP equivalent is provided in the fourth quarter and full year 2014 press release dated March 10, 2014 on the investor relations section of our website at www.nninc.com.

|

|

Building a Diversified Industrial

|

|

Building a Diversified Industrial

Focused on a high Building a balanced

precision portfolio and Gr business that earns

outgrowing end mark oughout the cycle

Outgrowing End Str Solid

Markets Strategy

Outgrowing

ets

ansformational Flawless

ansformationalTechnology ExecutionT

Investing in

transformational

technology

Developing a fully

egrated operating

system that supports all

of our businesses

[Graphic Appears Here]

|

|

Building a Diversified Industrial

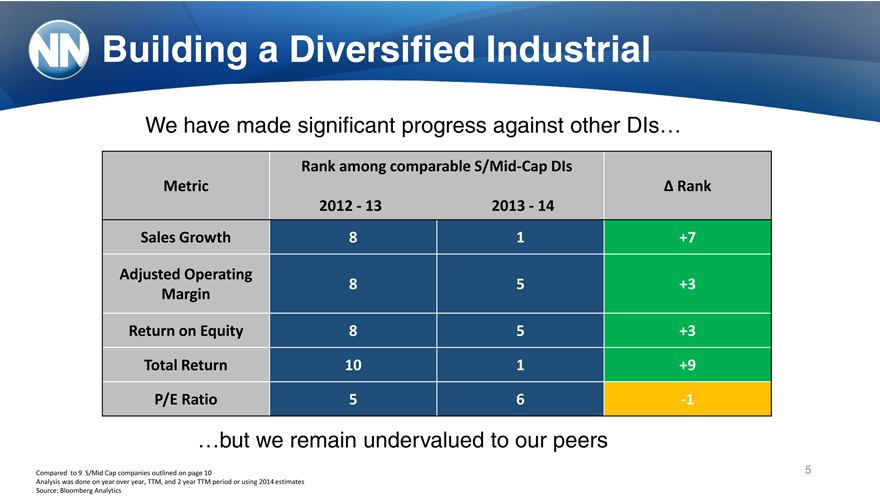

We have made significant progress against other DIs…

Rank among comparable S/Mid-Cap DIs

Metric Ä Rank

2012—13 2013—14

Sales Growth 8 1 +7

Adjusted Operating

8 5 +3

Margin

Return on Equity 8 5 +3

Total Return 10 1 +9

P/E Ratio 5 6 -1

…but we remain undervalued to our peers

Compared to 9 S/Mid Cap companies outlined on page 10 5 Analysis was done on year over year, TTM, and 2 year TTM period or using 2014 estimates Source: Bloomberg Analytics

|

|

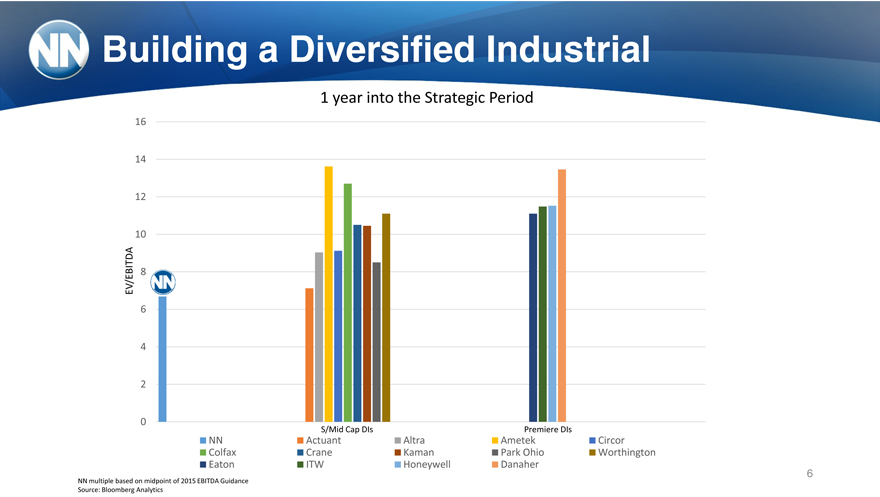

Building a Diversified Industrial

1 year into the Strategic Period

16

14

12

10

EV/EBITDA 8

6

4

2

0

S/Mid Cap DIs Premiere DIs

NN Actuant Altra Ametek Circor

Colfax Crane Kaman Park Ohio Worthington

Eaton ITW Honeywell Danaher

6

|

|

NN multiple based on midpoint of 2015 EBITDA Guidance

Source: Bloomberg Analytics

Company Overview

7

|

|

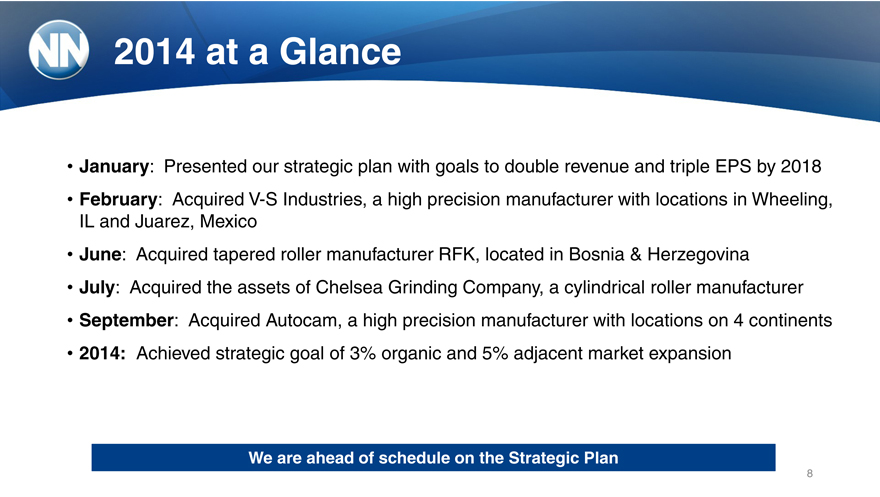

2014 at a Glance

February: Acquired V-S Industries, a high precision manufacturer with locations in Wheeling,

IL and Juarez, Mexico

June: Acquired tapered roller manufacturer RFK, located in Bosnia & Herzegovina

July: Acquired the assets of Chelsea Grinding Company, a cylindrical roller manufacturer

September: Acquired Autocam, a high precision manufacturer with locations on 4 continents

2014: Achieved strategic goal of 3% organic and 5% adjacent market expansion

We are ahead of schedule on the Strategic Plan

8

|

|

Today

2015 forecasted revenue of $690M—$710M

Global reach, local depth

Top 3 globally in both bearing components, and precision metal components

25 manufacturing facilities with operations in 10 countries

4,200 employees

Three R&D Centers around the globe

Supplying to diversified end markets in over 30 countries

[Graphic Appears Here]

1980 1999 2000 2001 2003 2005 2006 2014…

NN founded SNR Ball Whirlaway V-S RFK Chelsea

in Erwin, TN Assets Corporation Industries Grinding Autocam

Corporation Company

CGC

9

|

|

Foundation for Growth

Five new Board appointments since 2012

New President & CEO in 2013, key management retained

Developed Treasury, FP&A, Supply Chain, Shared Services and IT group infrastructure

Design of the NN Operating System

Enhanced management bandwidth with acquisitions

The fundaments of our plan have not changed. We will continue to deliver on our commitments.

10

|

|

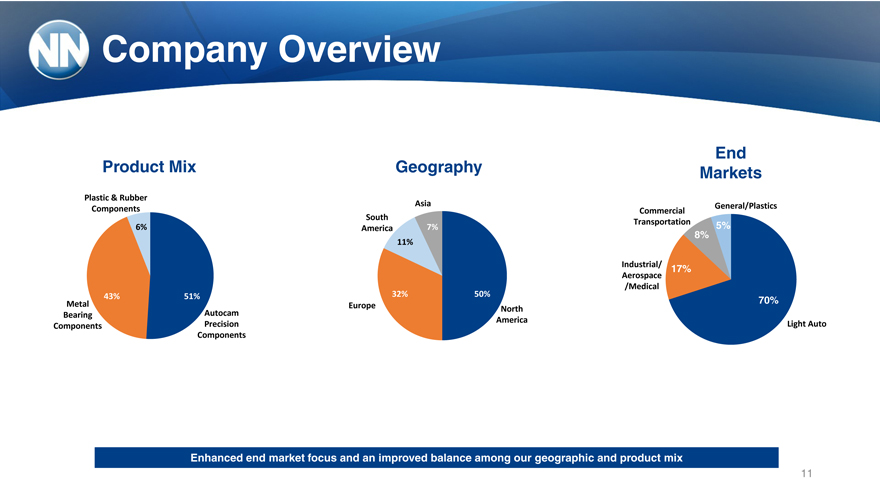

Company Overview

End

Product Mix Geography Markets

Plastic & Rubber

Asia General/Plastics

Components Commercial

South Transportation

6% America 7% 5%

8%

11%

7%

Industrial/ 17%

Aerospace

/Medical

43% 51% 32% 50%

Metal Europe North 70%

Bearing Autocam America

Components Precision Light Auto

Components 32%

Enhanced end market focus and an improved balance among our geographic and product mix

11

|

|

Customer Profile

12

|

|

Value Proposition

Ability to manufacture precision products with ultra tight tolerances in high volume

Total product life cycle

Established global footprint

Highly specialized skill and engineering in bearing components and precision machining

Significant proprietary knowledge and trade secrets

Leading manufacturer of high precision components 13

|

|

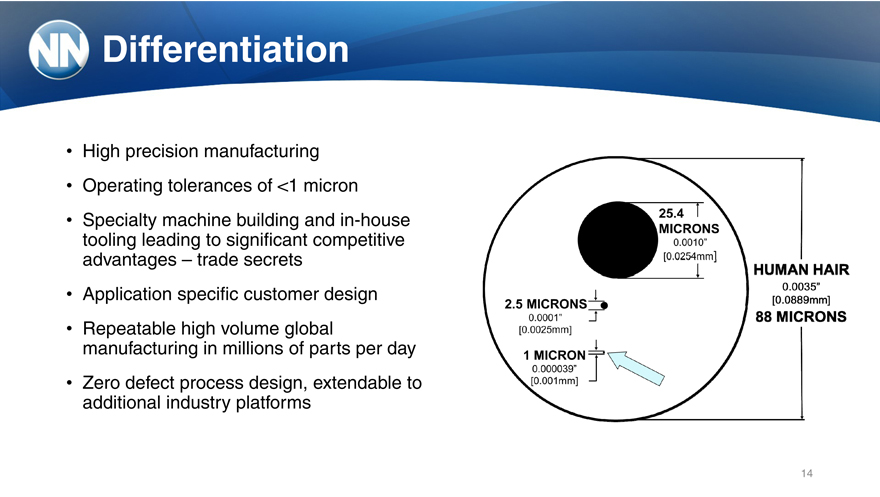

Differentiation

High precision manufacturing

Operating tolerances of <1 micron

Specialty machine building and in-house tooling leading to significant competitive advantages – trade secrets

Application specific customer design

Repeatable high volume global manufacturing in millions of parts per day

Zero defect process design, extendable to additional industry platforms

14

|

|

Global Footprint

Metal Bearing Components

Autocam Precision Components

Plastic & Rubber Components

Corporate Headquarters

25 high precision manufacturing facilities on 4 continents

15

|

|

Moving Forward 16

|

|

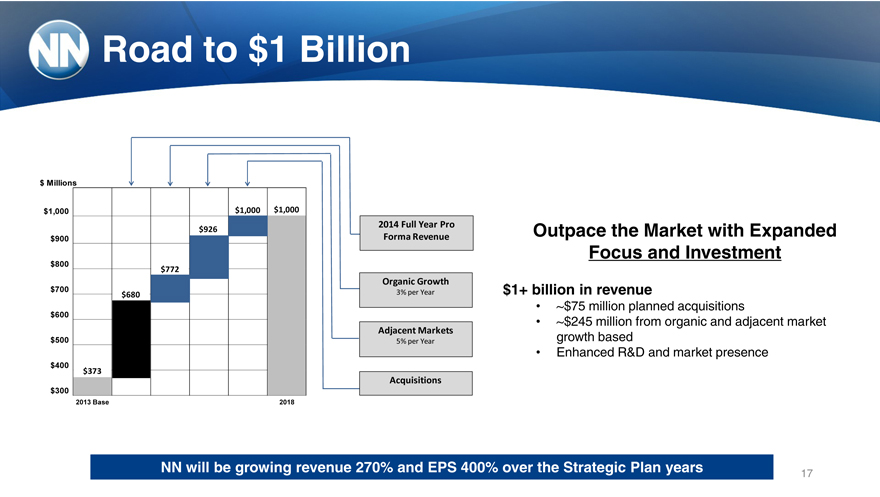

Road to $1 Billion

$ Millions

$1,000 $1,000 $1,000

$926 2014 Full Year Pro

$900 Forma Revenue

$800

$772

Organic Growth

$700 $680 3% per Year

$600

Adjacent Markets

$500 5% per Year

$400

$373

Acquisitions

$300

$200 2013 Base 2018

Outpace the Market with Expanded

Focus and Investment

$1+ billion in revenue

~$75 million planned acquisitions

~$245 million from organic and adjacent market growth based

Enhanced R&D and market presence

NN will be growing revenue 270% and EPS 400% over the Strategic Plan years

17

|

|

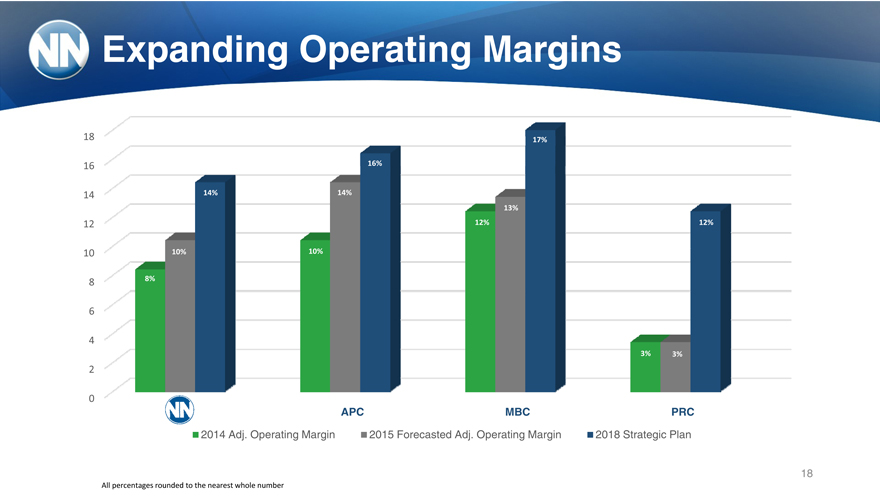

Expanding Operating Margins

18 17%

16 16%

14 14% 14%

13%

12 12% 12%

10 10% 10%

8 8%

6

4

3% 3%

2

0

APC MBC PRC

2014 Adj. Operating Margin 2015 Forecasted Adj. Operating Margin 2018 Strategic Plan

18

All percentages rounded to the nearest whole number

|

|

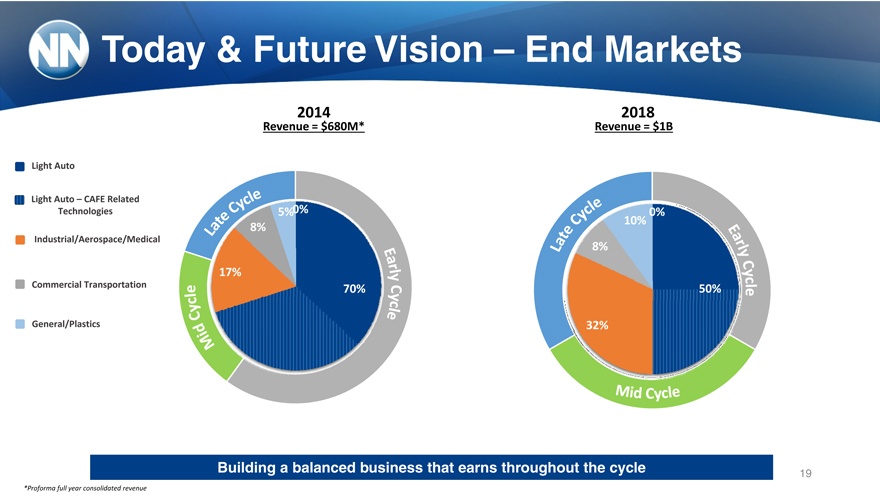

Today & Future Vision – End Markets

2014 2018

Revenue = $680M* Revenue = $1B

Light Auto

Light Auto – CAFE Related

Technologies 5% 0% 0%

8% 10%

Industrial/Aerospace/Medical

8%

17%

Commercial Transportation 70% 50%

General/Plastics 32%

Building a balanced business that earns throughout the cycle 19

*Proforma full year consolidated revenue

|

|

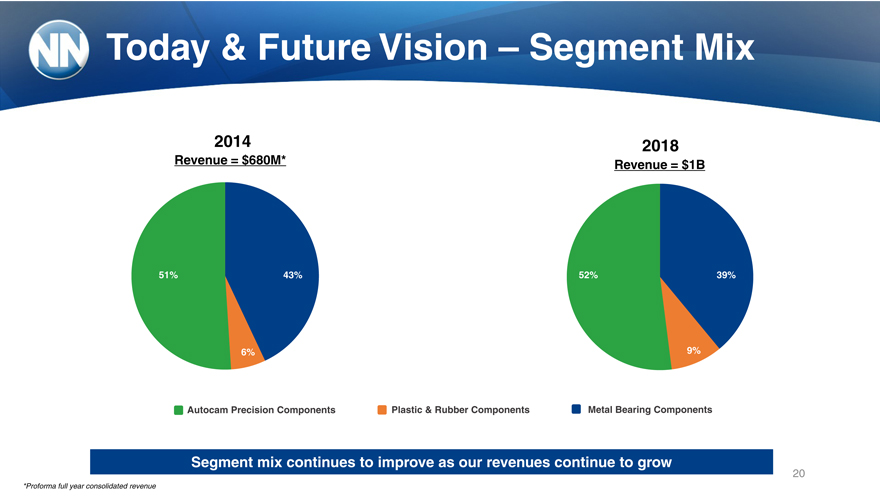

Today & Future Vision – Segment Mix

2014 2018

Revenue = $680M* Revenue = $1B

51

43%

%

51% 43% 52% 39%

43

%

6% 9%

6%

31 43% 51 50

%%%

Autocam Precision60Components Plastic & Rubber Components Metal Bearing Components

%

25

%

Segment mix continues to improve as our revenues continue to grow

20

*Proforma full year consolidated revenue

|

|

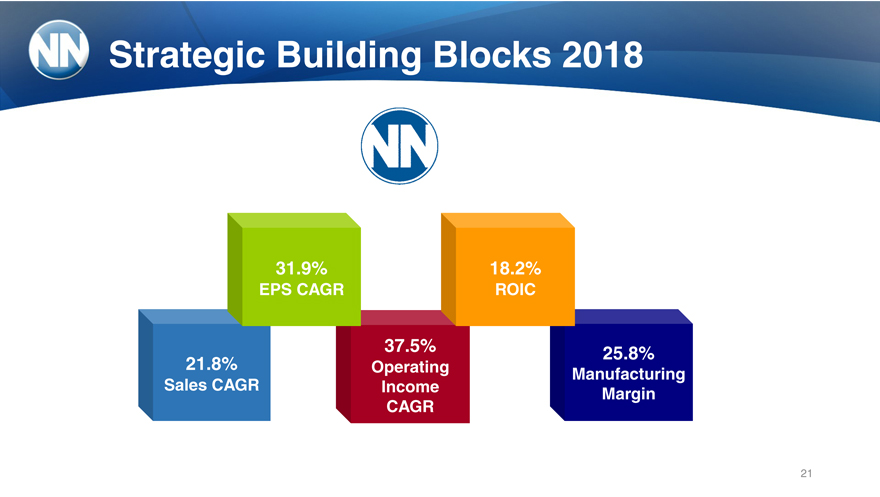

Strategic Building Blocks 2018

31.9% 18.2%

EPS CAGR ROIC

37.5% 25.8%

21.8% Operating Manufacturing

Sales CAGR Income Margin

CAGR

21

|

|

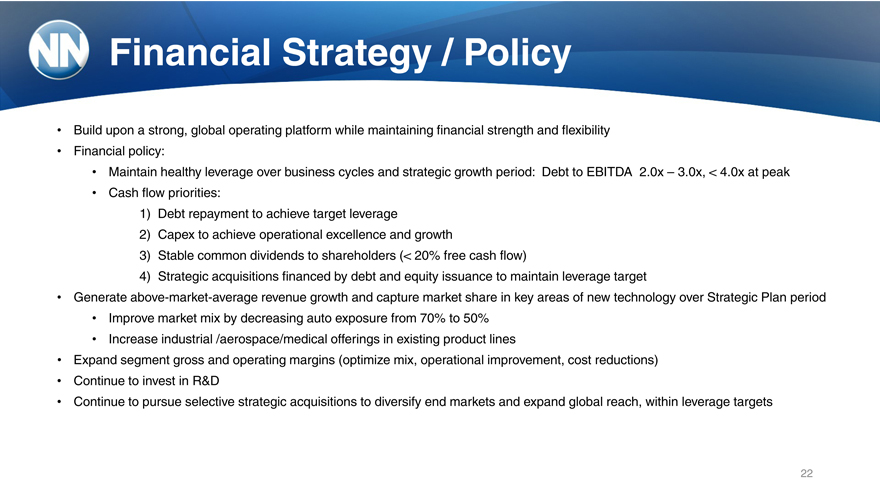

Financial Strategy / Policy

Build upon a strong, global operating platform while maintaining financial strength and flexibility

Financial policy:

Maintain healthy leverage over business cycles and strategic growth period: Debt to EBITDA 2.0x – 3.0x, < 4.0x at peak

Cash flow priorities:

1) Debt repayment to achieve target leverage

2) Capex to achieve operational excellence and growth

3) Stable common dividends to shareholders (< 20% free cash flow)

4) Strategic acquisitions financed by debt and equity issuance to maintain leverage target

Generate above-market-average revenue growth and capture market share in key areas of new technology over Strategic Plan period

Improve market mix by decreasing auto exposure from 70% to 50%

Increase industrial /aerospace/medical offerings in existing product lines

Expand segment gross and operating margins (optimize mix, operational improvement, cost reductions)

Continue to invest in R&D

Continue to pursue selective strategic acquisitions to diversify end markets and expand global reach, within leverage targets

22

|

|

Precision components group

23

|

|

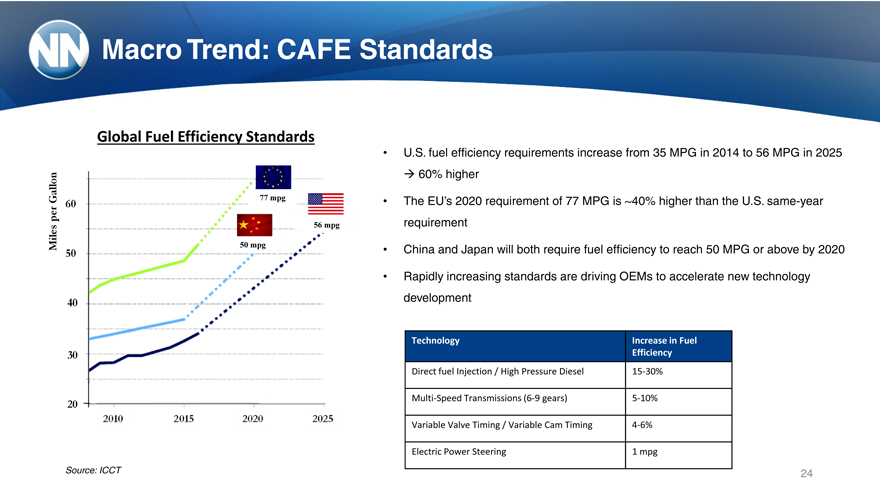

Macro Trend: CAFE Standards

Global Fuel Efficiency Standards

77 mpg

56 mpg

50 mpg

U.S. fuel efficiency requirements increase from 35 MPG in 2014 to 56 MPG in 2025 ? 60% higher

The EU’s 2020 requirement of 77 MPG is ~40% higher than the U.S. same-year requirement China and Japan will both require fuel efficiency to reach 50 MPG or above by 2020

Rapidly increasing standards are driving OEMs to accelerate new technology development

Technology Increase in Fuel

Efficiency

Direct fuel Injection / High Pressure Diesel 15-30%

Multi-Speed Transmissions (6-9 gears) 5-10%

Variable Valve Timing / Variable Cam Timing 4-6%

Electric Power Steering 1 mpg

Source: ICCT

24

|

|

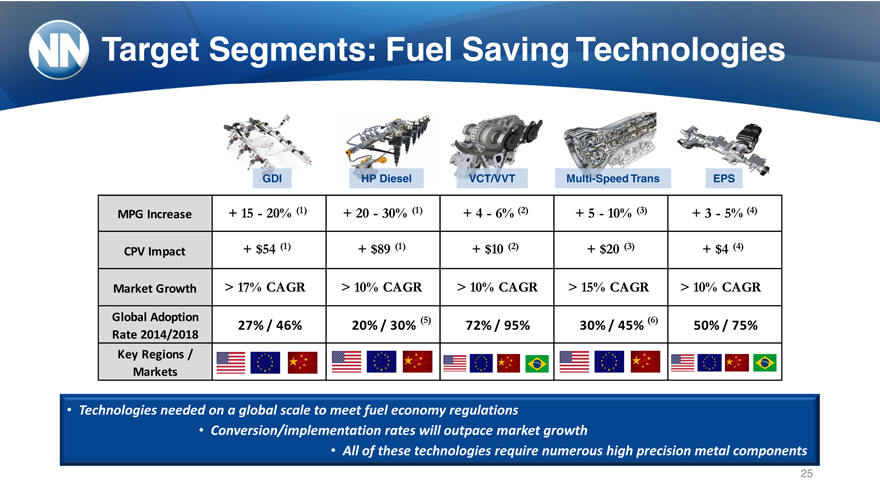

Target Segments: Fuel Saving Technologies

GDI HP Diesel VCT/VVT Multi-Speed Trans EPS

MPG Increase + 15—20% (1) + 20—30% (1) + 4—6% (2) + 5—10% (3) + 3—5% (4)

CPV Impact + $54 (1) + $89 (1) + $10 (2) + $20 (3) + $4 (4)

Market Growth > 17% CAGR > 10% CAGR > 10% CAGR > 15% CAGR > 10% CAGR

Global Adoption(5)(6)

27% / 46% 20% / 30% 72% / 95% 30% / 45% 50% / 75%

Rate 2014/2018

Key Regions /

Markets

• Technologies needed on a global scale to meet fuel economy regulations

Conversion/implementation rates will outpace market growth

All of these technologies require numerous high precision metal components

25

|

|

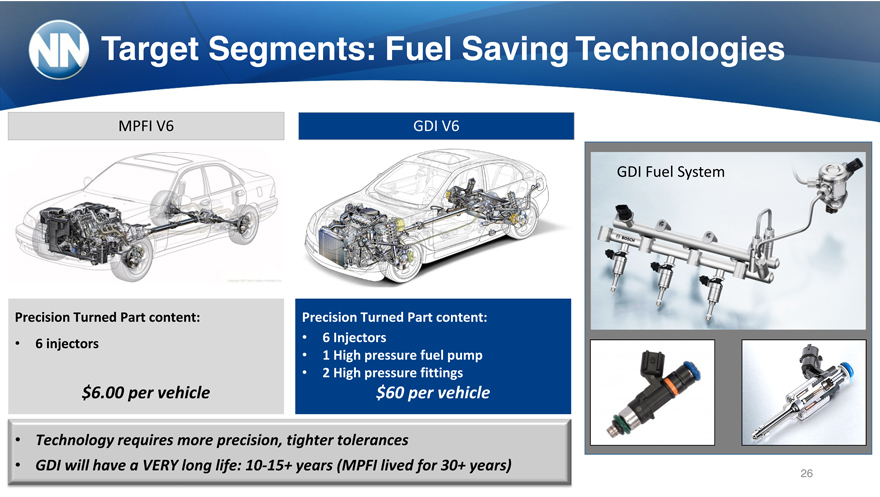

Target Segments: Fuel Saving Technologies

MPFI V6 GDI V6

GDI Fuel System

Precision Turned Part content: Precision Turned Part content:

• 6 injectors • 6 Injectors

• 1 High pressure fuel pump

• 2 High pressure fittings

$6.00 per vehicle $60 per vehicle

• Technology requires more precision, tighter tolerances

• GDI will have a VERY long life: 10-15+ years (MPFI lived for 30+ years)

26

|

|

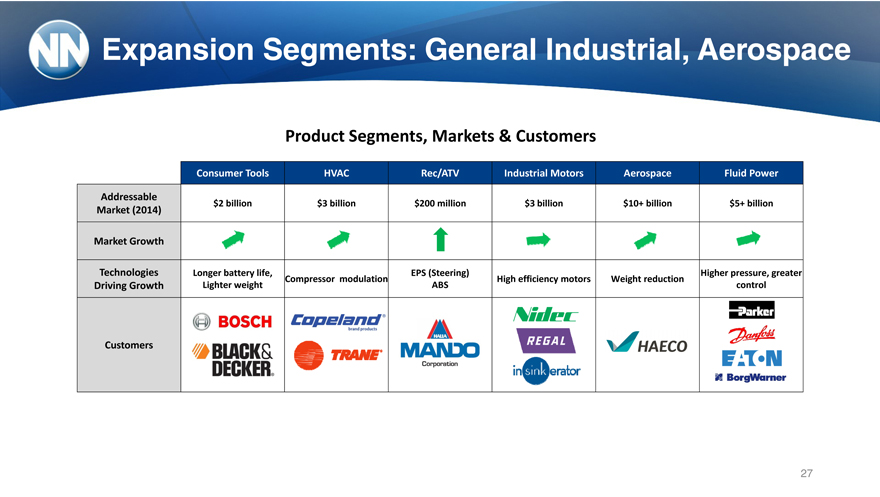

Expansion Segments: General Industrial, Aerospace

Product Segments, Markets & Customers

Consumer Tools HVAC Rec/ATV Industrial Motors Aerospace Fluid Power

Addressable

$2 billion $3 billion $200 million $3 billion $10+ billion $5+ billion

Market (2014)

Market Growth

Technologies Longer battery life, EPS (Steering) Higher pressure, greater

Compressor modulation High efficiency motors Weight reduction

Driving Growth Lighter weight ABS control

Customers

27

|

|

Bearing Components group

28

|

|

Macro Trends

Outsourcings of key components is increasing

Tier 1 and Tier 2 suppliers are concentrating on purchasing with fewer, larger suppliers

Supply chain localization continues to gain momentum

Increasing fuel economy standards are driving technology

29

|

|

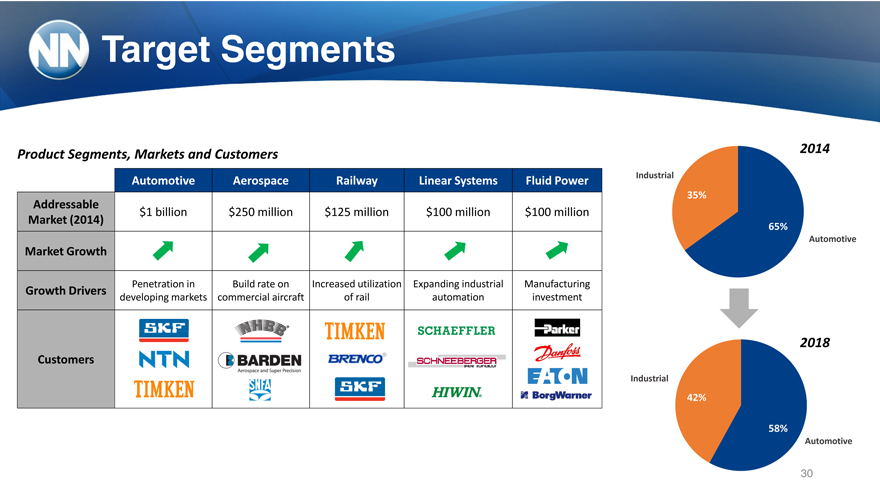

Target Segments

Product Segments, Markets and Customers 2014

Automotive Aerospace Railway Linear Systems Fluid Power Industrial

35%

Addressable

$1 billion $250 million $125 million $100 million $100 million

Market (2014) 65%

Automotive

Market Growth

Penetration in Build rate on Increased utilization Expanding industrial Manufacturing

Growth Drivers developing markets commercial aircraft of rail automation investment

2018

Customers

Industrial

42%

58%

Automotive

30

|

|

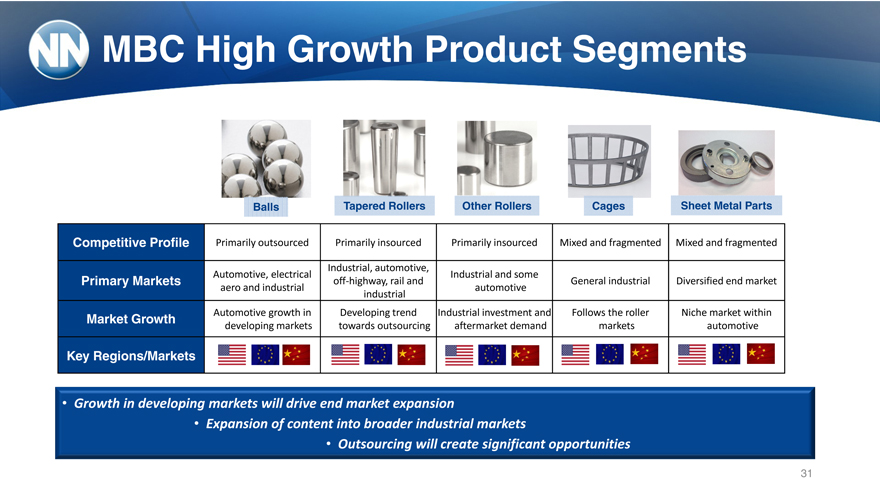

MBC High Growth Product Segments

Balls Tapered Rollers Other Rollers Cages Sheet Metal Parts

Competitive Profile Primarily outsourced Primarily insourced Primarily insourced Mixed and fragmented Mixed and fragmented

Industrial, automotive,

Automotive, electrical Industrial and some

Primary Markets off-highway, rail and General industrial Diversified end market

aero and industrial automotive

industrial

Automotive growth in Developing trend Industrial investment and Follows the roller Niche market within

Market Growth developing markets towards outsourcing aftermarket demand markets automotive

Key Regions/Markets

• Growth in developing markets will drive end market expansion

• Expansion of content into broader industrial markets

• Outsourcing will create significant opportunities

31

|

|

Investor Presentation

March 17, 2015