Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NN INC | d287773dex991.htm |

| EX-32.2 - EX-32.2 - NN INC | d287773dex322.htm |

| EX-32.1 - EX-32.1 - NN INC | d287773dex321.htm |

| EX-31.2 - EX-31.2 - NN INC | d287773dex312.htm |

| EX-31.1 - EX-31.1 - NN INC | d287773dex311.htm |

| EX-23.2 - EX-23.2 - NN INC | d287773dex232.htm |

| EX-23.1 - EX-23.1 - NN INC | d287773dex231.htm |

| EX-21.1 - EX-21.1 - NN INC | d287773dex211.htm |

| EX-12.1 - EX-12.1 - NN INC | d287773dex121.htm |

| EX-10.21 - EX-10.21 - NN INC | d287773dex1021.htm |

| EX-10.20 - EX-10.20 - NN INC | d287773dex1020.htm |

| EX-10.19 - EX-10.19 - NN INC | d287773dex1019.htm |

| EX-10.18 - EX-10.18 - NN INC | d287773dex1018.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-23486

NN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 62-1096725 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 207 Mockingbird Lane Johnson City, Tennessee |

37604 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (423) 434-8300

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.01 | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2016, based on the closing price on the NASDAQ Stock Market LLC on that date was approximately $379,000,000

The number of shares of the registrant’s common stock outstanding on March 1, 2017 was 27,292,646.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement with respect to the 2017 Annual Meeting of Stockholders are incorporated by reference in Part III, Items 10 to 14 of this Annual Report on Form 10-K as indicated herein.

Table of Contents

PART I

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to us, based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of our control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector, competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues, availability of raw materials, currency and other risks associated with international trade, our dependence on certain major customers, the impact of acquisitions and divestitures, unanticipated difficulties integrating acquisitions, and realizing anticipated cost savings and operating efficiencies, risks associated with joint ventures, new laws and governmental regulations, and other risk factors and cautionary statements listed from time to time in our periodic reports filed with the Securities and Exchange Commission. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

All dollar amounts presented in tables that follow are in thousands (except for share data) unless otherwise indicated.

| Item 1. | Business Overview |

Introduction

NN, Inc. is a diversified industrial company and a leading global manufacturer of high precision bearing components, industrial plastic products and precision metal components to a variety of markets on a global basis. We have 40 manufacturing plants in North America, Western Europe, Eastern Europe, South America and China. As used in this Annual Report on Form 10-K, the terms “NN,” “the Company,” “we,” “our,” or “us” mean NN, Inc. and its subsidiaries.

Our business is aggregated into three reportable segments, the Precision Bearing Components Group, the Precision Engineered Products Group and the Autocam Precision Components Group. Our business segments and acquisition activity are described further below.

Acquisition Activity

2015

On May 29, 2015, we completed the acquisition of Caprock Manufacturing, Inc. and Caprock Enclosures, LLC (collectively referred to as “Caprock”). Caprock was a privately held plastic components supplier located in Lubbock, Texas. Caprock serves multiple end markets; including aerospace, medical and general industrial. The acquisition provided further balancing of our end markets and represented the first step in our strategic plan related to transforming our plastics business. The results of Caprock have been consolidated with NN since the date of acquisition as part of the Precision Engineered Products Group.

On October 19, 2015, we completed the acquisition (the “PEP Acquisition”) of Precision Engineered Products Holdings, Inc. (“PEP”). As a result of the PEP Acquisition, PEP became a wholly owned subsidiary of NN. PEP is a global manufacturer of highly engineered precision customized solutions serving the medical, electrical, automotive and aerospace end markets. PEP combines materials science expertise with advanced engineering and production capabilities to design and manufacture a broad range of high-precision metal and plastic components, assemblies, and finished devices. Following the PEP Acquisition and the divestiture of Delta Rubber Company (described below), we combined the operations of PEP with our Plastics and Rubber Components Group, and renamed the group as the Precision Engineered Products Group.

On November 30, 2015, we completed the divestiture of Delta Rubber Company, a wholly owned subsidiary (“Delta Rubber”). The sale of Delta Rubber was in furtherance of our strategic plan and provided further balance to our portfolio of businesses.

2014

On January 20, 2014, we acquired V-S Industries (“V-S”), a manufacturer of precision metal components with locations in Wheeling, Illinois and Juarez, Mexico. The acquisition of V-S provided us with a broader product offering, allowing for penetration into adjacent markets. V-S’s products serve a variety of industries including electric motors, HVAC, power tools, automotive and medical. V-S’s operations were integrated with the Autocam Precision Components Group.

2

Table of Contents

On June 20, 2014, we acquired RFK Industries (“RFK” or the “Konjic Plant”), a manufacturer of tapered rollers located in Konjic, Bosnia and Herzegovina. RFK’s products are complementary to our existing roller bearing products and broaden our product offerings and allows penetration into adjacent markets. RFK currently exports all of its products to customers serving the European truck, industrial vehicle and railway markets. RFK’s operations were integrated with our Precision Bearing Components Group.

On July 15, 2014, we acquired Chelsea Grinding Company (“Chelsea”), a manufacturer of cylindrical rollers used primarily in the hydraulic pump industry. Following the acquisition of Chelsea, we relocated Chelsea’s operations to our Erwin, Tennessee plant. Chelsea’s operations were integrated with the Precision Bearing Components Group.

On August 29, 2014, we acquired Autocam Corporation (“Autocam”), a manufacturer of high precision metal components serving primarily the automotive and commercial vehicle HVAC and fluid power industries. Based in Kentwood, Michigan, Autocam manufactures and assembles highly complex, system critical components for fuel systems, engines, transmission, power steering and electric motors. Autocam and its subsidiaries employ over 2,100 employees with 15 manufacturing facilities in the U.S., Europe, South America and Asia. With the acquisition of Autocam, we combined our Whirlaway and V-S businesses under the renamed Autocam Precision Components Group.

Corporate Information

We were founded in October 1980 and are incorporated in Delaware. Our principal executive offices are located at 207 Mockingbird Lane, Johnson City, Tennessee, and our telephone number is (423) 434-8300. Our website address is www.nninc.com. Information contained on our website is not part of this Annual Report on Form 10-K. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and related amendments are available via a link to www.sec.gov on our website under “Investor Relations.” Additionally, all required interactive data files pursuant to Item 405 of Regulation S-T are posted on our website.

Business Segments

Net sales, income from operations and assets for each of our business segments is presented in Management’s Discussion and Analysis of Financial Condition Results of Operations and Note 12 of the Notes to the Consolidated Financial Statements. Additional information regarding our three business segments (Precision Bearing Components Group, Precision Engineered Products Group and Autocam Precision Components Group) is presented below.

Precision Bearing Components Group

Within our Precision Bearing Components Group, we manufacture and supply high precision bearing components, consisting of balls, cylindrical rollers, tapered rollers, spherical rollers and metal retainers, for leading bearing and CV-joint manufacturers on a global basis. We are a leading independent manufacturer of precision steel bearing balls and rollers for the North American, European and Asian markets. We offer one of the industry’s most complete lines of commercially available bearing components. We emphasize application-specific engineered products that take advantage of competencies in product design and tight tolerance manufacturing processes. Our customers use our components in fully assembled ball and roller bearings and CV-joints, which serve a wide variety of end markets, including automotive, agricultural, construction, machinery, heavy truck, and rail.

Precision Engineered Products Group

Following the PEP Acquisition, we combined the operations of PEP with our Plastics and Rubber Components Segment. Within our Precision Engineered Products Group, we combine materials science expertise with advanced engineering and production capabilities to design and manufacture a broad range of high-precision metal and plastic components, assemblies, and finished devices for the medical, electrical, automotive and aerospace end markets.

Autocam Precision Components Group

Within our Autocam Precision Components Group, we manufacture highly engineered, difficult-to-manufacture precision metal components and subassemblies for the automotive, HVAC, fluid power and diesel engine end markets. Our entry into the precision metal components market began in 2006 with the acquisition of Whirlaway Corporation. We dramatically expanded the segment in 2014 with the acquisitions of Autocam and V-S. These acquisitions furthered our strategy to diversify our end markets and build upon our core manufacturing competency of high-precision metal machining.

3

Table of Contents

Products

Precision Bearing Components Group

Precision Steel Balls. At our Precision Bearing Components Group facilities (with the exception of our Veenendaal plant), we manufacture and sell high quality, precision steel balls. Our steel balls are used primarily by manufacturers of anti-friction bearings and constant velocity joints where precise spherical, tolerance and surface finish accuracies are required.

Steel Rollers. We manufacture tapered rollers at our Veenendaal, Erwin, and Konjic plants and cylindrical rollers at our Erwin plant. Rollers are an alternative rolling element used instead of balls in anti-friction bearings that typically have heavier loading or different speed requirements. Our roller products are used primarily for applications similar to those of our precision steel ball product line, plus certain non-bearing applications such as hydraulic pumps and motors. Tapered rollers are a component in tapered roller bearings that are used in a variety of applications including automotive gearbox applications, automotive wheel bearings and a wide variety of industrial applications. Most cylindrical rollers are made to specific customer requirements for diameter and length and are used in a variety of industrial applications.

Metal Retainers. We manufacture and sell precision metal retainers for roller bearings used in a wide variety of industrial applications. Retainers are used to separate and space the rolling elements within a fully assembled bearing. We manufacture metal retainers at our Veenendaal plant.

Precision Engineered Products Group

Precision Solutions. We manufacture a variety of components, assemblies and instruments, such as surgical knives, bioresorbable implants, surgical staples, orthopedic system tools, laparoscopic devices, drug delivery devices and catheter components for the medical end market, electrical contacts, connectors, contact assemblies and precision stampings for the electrical control end market, precision components, assemblies and electrical contacts for the automotive end market, and a variety of engineered materials for the aerospace and defense end market, including optical grade plastics, thermally conductive plastics, and titanium, Inconel, magnesium and gold electroplating. At our Lubbock plant, we manufacture and sell precision plastic retainers for ball and roller bearings used in a wide variety of industrial applications. We also manufacture and sell a wide range of specialized plastic products including automotive under-the-hood components, electronic instrument cases and precision electronic connectors and lenses.

Autocam Precision Components Group

Precision Components. We sell a wide range of highly engineered, extremely close tolerance, precision-machined metal components and subassemblies primarily to the consumer transportation, industrial technology, HVAC, fluid power and diesel engine end markets. We have developed an expertise in manufacturing highly complex, system critical components for fuel systems, engines and transmissions, power steering systems and electromechanical motors. This expertise has been gained through investment in technical capabilities, processes and systems, and skilled program management and product launch capabilities.

Research and Development and Product Engineering

Our research and development and product engineering efforts focus on enhancing our existing products and developing patented products, particularly in the medical industry, that can be presented to and sold by our customers. Our Precision Engineered Products Group has developed a portfolio of patented medical products that we manufacture for customers and that are sold under their brand. Our Autocam Precision Products Group engineering team focuses on lowering the cost of manufacturing existing products and developing engineered solutions to improve our customers’ products. Our Precision Bearing Components Group operates two innovation centers, one in the Netherlands for rollers and one in Italy for balls, which focuses on improving the performance of the rolling element, operating life and friction generation and reducing manufacturing costs.

Customers

Our products are supplied primarily to manufacturers for use in a broad range of industrial applications, including automotive, electrical, agricultural, construction, machinery, heavy truck, rail, medical, aerospace and defense, HVAC, fluid power and diesel engines. Our top ten customers account for approximately 48% of our revenue. Sales to each of these top ten customers are made to multiple customer locations and divisions throughout the world. Only one of these customers, AB SKF (“SKF”), had sales levels that were over 10% of total net sales. Sales to various U.S. and foreign divisions of SKF accounted for approximately 13% of net sales in 2016. In 2016, 63% of our products were sold to customers in North America, 21% to customers in Europe, 12% to customers in Asia and the remaining 4% to customers in South America.

We sell our products to most of our largest customers under either sales contracts or agreed upon commercial terms. In general, we pass through material cost fluctuations when incurred to our customers in the form of changes in selling prices. We ordinarily ship our products directly to customers within 60 days, and in many cases, during the same calendar month of the date on which a sales order is placed. Accordingly, we generally have an insignificant amount of open (backlog) orders from customers at month end.

4

Table of Contents

See Note 12 of the Notes to Consolidated Financial Statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations” for additional segment financial information.

Sales and Marketing

A primary emphasis of our marketing strategy is to expand key customer relationships by offering high quality, high-precision, application-specific customer solutions with the value of a single supply chain partner for a wide variety of products and components. Due to the technical nature of many of our products, our engineers and manufacturing management personnel also provide technical sales support functions, while internal sales employees handle customer orders and other general sales support activities. Each of our groups use a distinct direct sales force supported by senior segment management and engineering involvement. Our Precision Bearing Components Group marketing strategy focuses on our ability to provide consistent, high quality products that meet the most precise specifications of leading global brands. Our marketing strategy for the Precision Engineered Products Group and the Autocam Precision Components Group is to offer custom manufactured, high quality, precision products to markets with high value-added characteristics at competitive price levels. This strategy focuses on relationships with key customers that require the production of technically difficult parts and assemblies, enabling us to take advantage of our strengths in custom product development, equipment and tool design, component assembly and machining processes.

The following table presents a breakdown of our net sales for fiscal years 2016, 2015 and 2014:

| 2016 | 2015 | 2014 | ||||||||||

| Precision Bearing Components Group |

$ | 248,534 | $ | 261,837 | $ | 278,026 | ||||||

| Percentage of Total Sales |

30 | % | 39 | % | 57 | % | ||||||

| Precision Engineered Products Group |

258,816 | 77,183 | 33,351 | |||||||||

| Percentage of Total Sales |

31 | % | 12 | % | 7 | % | ||||||

| Autocam Precision Components Group |

326,138 | 328,260 | 177,224 | |||||||||

| Percentage of Total Sales |

39 | % | 49 | % | 36 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 833,488 | $ | 667,280 | $ | 488,601 | ||||||

|

|

|

|

|

|

|

|||||||

| Percentage of Total Sales |

100 | % | 100 | % | 100 | % | ||||||

During 2015, following the PEP Acquisition and the divestiture of Delta Rubber, we combined the operations of PEP with our Plastics and Rubber Components Group, and renamed the segment as the Precision Engineered Products Group. The Precision Engineered Products Group includes the Plastic and Rubber Components Group as presented in our previous filings. Net sales for the fiscal years 2014 solely relate to our former Plastic and Rubber Components Segment.

Employees

As of December 31, 2016, we employed a total of 4,730 full-time employees and 569 full time equivalent temporary workers. Of our total employment, 17% are management/staff/government/statutory employees and 83% are production employees. The employees at the Pinerolo, Veenendaal, Autocam France and Brainin de Mexico plants are unionized. A small group of employees at Lacey Manufacturing Company are also unionized. We believe we have a good working relationship with our employees and the unions that represent them.

5

Table of Contents

Competition

Precision Bearing Components Group

Our Precision Bearing Components Group operates in intensely competitive markets. Our domestic competitors include Hoover Precision Products, Inc., a wholly owned subsidiary of Tsubaki Nakashima Co., LTD., and Amatsuji Steel Ball Manufacturing Company, Ltd. (Japan), a wholly owned division of NSK LTD. In addition, Jiangsu General Ball and Roller Co., LTD (China) (JGBR) has announced plans to open a manufacturing facility in the United States to begin production in early 2017. Our foreign competitors include Tsubaki Nakashima Co., LTD. (Japan) and JGBR. Additionally, we compete with bearing manufacturers’ in-house (captive) production, which represents the majority of total production.

We believe that competition within the Precision Bearing Components Group is based principally on quality, price and the ability to consistently meet customer delivery requirements. Management believes that our competitive strengths are our precision manufacturing capabilities, our wide product assortment, our reputation for consistent quality and reliability, our global manufacturing footprint and the productivity of our workforce.

Precision Engineered Products Group

Our Precision Engineered Products Group also operates in intensely competitive markets. We must compete with numerous companies in each industry market segment. Many of these companies have substantially greater financial resources than we do and many currently offer competing products nationally and internationally.

Our primary competitors in the plastic bearing retainer market are Nakanishi Manufacturing Corporation and Precimold, Inc. Domestically, National Plastics and Sales, Inc., Nypro, Inc., Thermotec, Inc., GW Plastics, Inc., C&J Industries, Inc., and Nyloncraft, Inc., are amongst the largest players in the precision plastic components markets. Our primary competitors in the medical device market are Tecomet, Inc., Lake Region Medical, Inc., and Vention Medical, Inc. Our primary competitors in the electrical market are Deringer-Ney, Inc., Doduco GmbH and Metalor Technologies International. Our primary competitors in the automotive and aerospace market are Interplex Industries, Inc. and Accu-Mold, LLC.

We believe that competition within the plastic injection molding, plastic bearing retainer, precision plastic components, medical device, electrical, automotive and aerospace markets is based principally on quality, price, design capabilities and speed of responsiveness and delivery. Management believes that our competitive strengths are product development, tool design, fabrication, and tight tolerance molding processes. With these strengths, we have built our reputation in the marketplace as a quality producer of technically difficult products.

Autocam Precision Components Group

In the market in which our Autocam Precision Components Group operates, internal production of components by our customers can impact our business as the customers weigh the risk of outsourcing strategically critical components or producing in-house. Our primary outside competitors are Anton Häring KG, A. Berger Holding Gmbh & Co. KG, C&A Tool Engineering, Inc., American Turned Products, Inc., Camcraft, Inc., and A.B. Heller, Inc. We generally win new business on the basis of technical competence and our proven track record of successful product development.

Raw Materials

Precision Bearing Components Group

The primary raw material used in our core ball and roller business of the Precision Bearing Components Group is 52100 Steel, which is high quality chromium steel. Our other steel requirements include metal strip, stainless steel, and type S2 rock bit steel.

The Precision Bearing Components Group businesses purchase substantially all of their 52100 Steel requirements from suppliers in Europe and Japan, and all of their metal strip requirements from European suppliers and traders. We purchase steel on the basis of composition, quality, availability and price. For precision steel balls, the pricing arrangements with our suppliers are typically subject to adjustment every three to six months in North America and contractually adjusted on an annual basis within the European locations for the base steel price and quarterly for surcharge adjustments. If any of our current suppliers were unable to supply 52100 Steel to us, higher costs and/or production interruptions could occur as a result of obtaining 52100 Steel from alternate sources. Our operating results would be negatively affected in the event that North American or European governments impose any significant quotas, tariffs or other duties or restrictions on the import of such steel, if the U.S. dollar decreases in value relative to foreign currencies or if supplies available to us would significantly decrease.

Precision Engineered Products Group

The Precision Engineered Products Group uses a wide variety of metals in various forms, including precious metals like gold, silver, palladium and platinum. Through our diverse network of suppliers, we minimize supplier concentration risk and provide a stable supply of raw materials at competitive pricing. This group also procures resins and metal stampings from several domestic and foreign suppliers.

6

Table of Contents

For the Precision Engineered Products Group, we base purchase decisions on quality, service and price. Generally, we do not enter into written supply contracts with our suppliers or commit to maintain minimum monthly purchases of materials. However, we carefully manage raw material price volatility, particularly with respect to precious metals, through the use of consignment agreements. In effect, we lease the precious metals for our own stock and buy the raw materials on the same day customer shipments are priced, thereby eliminating speculation. In addition, our products with precious metal content are priced with a margin on the raw material cost to further protect against raw material price volatility and to provide incremental profit.

Autocam Precision Components Group

The Autocam Precision Components Group produces products from a wide variety of metals in various forms from various sources located in the North America, Europe and Japan. Basic types include hot rolled steel, cold rolled steel (both carbon and alloy), stainless, extruded aluminum, die cast aluminum, gray and ductile iron castings, hot and cold forgings and mechanical tubing. Some material is purchased directly under contracts, some is consigned by the customer, and some is purchased directly from the steel mills.

In each of our three segments, we have historically been affected by upward price pressure on steel principally due to general increases in global demand. In general, we pass through material cost fluctuations to our customers in the form of changes in selling price.

Patents, Trademarks and Licenses

Historically, we have not owned any U.S. or foreign patents, trademarks or licenses that are material to our business; however, in our Precision Engineered Products Group, we have six U.S. patents, four patent applications and trademarks for various trade names. Furthermore, we intend to develop patented products that can be presented to and sold by our customers.

Additionally, we rely on certain data and processes, including trade secrets and know-how, and the success of our business depends, to some extent, on such information remaining confidential. Each executive officer is subject to a non-competition and confidentiality agreement that seeks to protect this information. Additionally, all employees are subject to company code of ethics policies that prohibit the disclosure of information critical to the operations of our business.

Seasonal Nature of Business

General economic conditions impact our business and financial results, and certain of our businesses experience seasonal and other trends related to the industries and end markets that they serve. For example, European sales are often weaker in the summer months, medical device sales are often stronger in the fourth calendar quarter and sales to OEMs are often stronger immediately preceding and following the launch of new products. However, as a whole, we are not subject to material seasonality.

Environmental Compliance

Our operations and products are subject to extensive federal, state and local regulatory requirements both domestically and abroad relating to pollution control and protection of the environment. These laws and regulations govern, among other things, discharges to air or water, the generation, storage, handling, and use of automotive hazardous materials and the handling and disposal of hazardous waste generated at our facilities. Under such laws and regulations, we are required to obtain permits from governmental authorities for some of our operations. If we violate or fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators. Under some environmental laws and regulations, we could also be held responsible for all the costs relating to any contamination at our past or present facilities and at third-party waste disposal sites. We maintain a compliance program to assist in preventing and, if necessary, correcting environmental problems. In the Precision Bearing Components Group, the Kysucke plant, the Veenendaal plant, the Pinerolo plant and Kunshan plant are ISO 14000 or 14001 certified and all received the EPD (Environmental Product Declaration), except for the Veenendaal plant’s stamped metal parts business.

Based on information compiled to date, management believes that our current operations are in substantial compliance with applicable environmental laws and regulations, the violation of which could have a material adverse effect on our business and financial condition. We have assessed conditional asset retirement obligations and have found them to be immaterial to the consolidated financial statements. We cannot assure that currently unknown matters, new laws and regulations, or stricter interpretations of existing laws and regulations will not materially affect our business or operations in the future. More specifically, although we believe that we dispose of waste in material compliance with applicable environmental laws and regulations, we cannot be certain that we will not incur significant liabilities in the future in connection with the clean-up of waste disposal sites.

FDA Compliance

As a contract manufacturer of medical devices, certain of our subsidiaries, including PEP, are required to register as such with the U.S. Food and Drug Administration (“FDA”). Each of our facilities that manufacture finished medical devices is registered with the FDA. To maintain our registration, we deploy a robust quality management system across all of our manufacturing facilities.

7

Table of Contents

With respect to medical products that we are specifically developing to sell to our customers, before these devices can be marketed, we will seek to obtain a marketing clearance from the FDA under Section 510(k) of the United States Federal Food, Drug, and Cosmetic Act. The FDA typically grants a 510(k) clearance if the applicant can establish that the device is substantially equivalent to a predicate device. Clearance under Section 510(k) typically takes about three months from the date of submission.

Executive Officers of the Registrant

Our executive officers are:

| Name |

Age |

Position | ||

| Richard D. Holder | 54 | Chief Executive Officer and President | ||

| J. Robert Atkinson | 36 | Vice President, Corporate Treasurer and Manager of Investor Relations | ||

| Thomas C. Burwell, Jr. | 48 | Senior Vice President – Chief Financial Officer | ||

| Matthew S. Heiter | 56 | Senior Vice President and General Counsel | ||

| L. Jeffery Manzagol | 61 | Senior Vice President – General Manager of the Precision Bearing Components Group | ||

| John A. Manzi | 52 | Senior Vice President – General Manager, Precision Engineered Products Group | ||

| Warren Veltman | 55 | Senior Vice President – General Manager Autocam Precision Components Group | ||

| James R. Widders | 60 | Senior Vice President – Integration and Corporate Transformation |

Set forth below is certain additional information with respect to each of our executive officers.

Richard D. Holder joined us as President and Chief Executive Officer in June 2013. Prior to joining us, Mr. Holder served as President of Eaton Electrical Components Group of Eaton Corporation’s Electrical Sector from 2010 to 2013, Executive Vice President of the Eaton Business Systems from 2007 to 2010, Vice President and General Manager of the Power Distribution and Assemblies Division from 2004 to 2006 and Vice President Supply Chain and Operational Excellence from 2001 to 2004. Prior to joining Eaton, Mr. Holder served as Director of Aircraft & Technical Purchasing for US Airways from 1999 to 2001. Prior to this position, Mr. Holder held a variety of leadership positions at Allied Signal Corporation, an aerospace, automotive and engineering company, and Parker Hannifin Corporation, a global motion and control technology manufacturer.

J. Robert Atkinson joined us as Vice President, Corporate Treasurer and Manager of Investor Relations in 2014. Prior to joining us, Mr. Atkinson was with Regions Bank, one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, mortgage, and insurance products and services. He most recently served as vice president and commercial relationship manager in Regions Corporate Bank Group, where he was responsible for marquee corporate relationships, developing treasury management solutions and negotiating terms and conditions for new and renewal credit facilities. Prior to that position, he served as Vice President of business services. Mr. Atkinson also served as a project coordinator for the Electrical Group of Eaton Corporation. Mr. Atkinson is a member of the Association of Financial Professions and earned his certified treasury professional designation.

Thomas C. Burwell, Jr. joined us as Corporate Controller in September 2005. He was promoted to Vice President Chief Accounting Officer and Corporate Controller in 2011, and to Senior Vice President and Chief Financial Officer in November 2016. Prior to joining NN, Mr. Burwell held various positions at Coats, PLC from 1997 to 2005 ultimately becoming the Vice President of Finance for the U.S. Industrial Division. From 1992 to 1997, Mr. Burwell held various positions at the international accounting firm BDO Seidman, LLP. Mr. Burwell is a Certified Public Accountant.

Matthew S. Heiter joined us as Senior Vice President and General Counsel in July 2015. Prior to joining us, Mr. Heiter was a shareholder in the law firm of Baker, Donelson, Bearman, Caldwell and Berkowitz, PC from May 1996 to December 1999 and from July 2002 to July 2015, where he served as chairman of the firm’s Securities and Corporate Governance Practice Group. From January 2000 to July 2002, Mr. Heiter served as the Executive Vice President, General Counsel and Secretary of Internet Pictures Corporation, a publicly traded internet technology company.

L. Jeffery Manzagol joined us as Senior Vice President—General Manager of the Precision Bearing Components Group in October 2014. Manzagol stepped into his role with more than 36 years of metal bearings and high precision manufacturing experience. He most recently served as President of the Bearings Division at Kaydon Corporation. Previously, Manzagol held various leadership positions at SKF Group, including President and General Manager at the Armada, Michigan facility.

John Manzi joined us as Senior Vice President—General Manager of Precision Engineered Products Group in October 2015 in connection with the completion of the PEP Acquisition. Previously, Mr. Manzi served as the President and Chief Executive Officer of PEP. Mr. Manzi was instrumental in leading PEP’s development and, together with PEP’s management team, has successfully enhanced PEP’s end market reach, expanded its product breadth and executed on key strategic acquisitions. Mr. Manzi has 20 years of experience with PEP. Prior to joining PEP’s management team, Mr. Manzi held various positions including President of PEP’s Attleboro operations, Vice President of Operations, and Engineering Manager.

8

Table of Contents

Warren Veltman joined us as Senior Vice President and General Manager of our Autocam Precision Components Group in September 2014. Veltman served as Chief Financial Officer of Autocam Corporation from 1990 and Secretary and Treasurer since 1991. Prior to Mr. Veltman’s service at Autocam, Mr. Veltman was an Audit Manager with Deloitte & Touche LLP.

James R. Widders was appointed us as Senior Vice President of Integration and Corporate Transformation in September 2014. Prior to that appointment, Mr. Widders was Vice President and General Manager of our then-named Metal Bearing Components Group beginning in December 2010. Mr. Widders had 13 years of service at Whirlaway prior to its acquisition by NN. Prior to joining us, he served as Vice President and General Manager at Technifab, Inc. a manufacturer of molded foam components for the Aerospace industry and in various management positions with GE Superabrasives, a division of General Electric.

| Item 1A. | Risk Factors |

The following are risk factors that affect our business, prospects, financial condition, results of operations, and cash flows, some of which are beyond our control. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K. If any of the events described below were to actually occur, our business, prospects, financial condition, results of operations, or cash flows could be adversely affected and results could differ materially from expected and historical results.

Risks Related to Our Operations

A recession impacting our end markets or the geographic regions in which we or our customers operate could have a material adverse effect on our ability to finance our operations and implement our growth strategy.

During the three month period ended December 31, 2008 and the year ended December 31, 2009, we experienced a sudden and significant reduction in customer orders driven by reductions in automotive and industrial end market demand across all our businesses. Additionally, during the latter part of 2011 and all of 2012, we experienced the impacts of a European recession in our European businesses. Prior to this time, we had never been affected by a recession that had impacted both of our key geographic markets of the U.S. and Europe simultaneously. If we are impacted by a global recession in the future, this could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows and could lead to additional restructuring and/or impairment charges being incurred and our ability to implement our growth strategy.

The cyclical demand for our products and the seasonality impact on our production could adversely affect our revenues.

The end markets for fully assembled bearings and industrial and automotive components are cyclical and tend to decline in response to overall declines in industrial and automotive production. As a result, the market for the bearing components and precision metal and industrial plastic products we sell is also cyclical and impacted by overall levels of industrial and automotive production. Our sales have been, and can be in the future, negatively affected by adverse conditions in the industrial and/or automotive production sectors of the economy or by adverse global or national economic conditions generally. Similarly, any inflation in oil prices and any resulting increase in gasoline prices could have a negative impact on demand for our products as a result of consumer and corporate spending reductions.

In addition, seasonality may have a negative impact on our production. Due to the typical slower summer manufacturing season in Europe, we expect that revenues in the third fiscal quarter of each year will be lower than in the other quarters of the year.

We depend on a very limited number of sources for our primary raw material and are subject to risks of shortages and price fluctuation.

The steel that we use to manufacture our precision bearing components is of an extremely high quality and is available from only a limited number of producers on a global basis. Due to quality constraints in the U.S. steel industry, we obtain substantially all of the steel used in our U.S. operations of our Precision Bearing Components Group from non-U.S. suppliers. In addition, we obtain most of the steel used in our European operations from a single European source. If we had to obtain steel from sources other than our current suppliers, we could face higher prices and automotive costs, increased duties or taxes and shortages of steel. Problems in obtaining steel, particularly 52100 chrome steel in the quantities that we require, on commercially reasonable terms, could increase our costs and have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

9

Table of Contents

We depend heavily on a relatively limited number of customers, and the loss of any major customer would have a material adverse effect on our business.

Sales to various U.S. and foreign divisions of SKF, one of the largest bearing manufacturers in the world, accounted for approximately 13% of consolidated net sales in 2016. No other customers accounted for more than 10% of sales. During 2016, sales to various U.S. and foreign divisions of our ten largest customers accounted for approximately 48% of our consolidated net sales. The loss of all or a substantial portion of sales to these customers would cause us to lose a substantial portion of our revenue and would lower our operating profit margin and cash flows from operations.

Work stoppages or similar difficulties could significantly disrupt our operations, reduce our revenues and materially affect our earnings.

A work stoppage at one or more of our facilities could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows. Also, if one or more of our customers were to experience a work stoppage, that customer would likely halt or limit purchases of our products, which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

We operate in and sell products to customers outside the U.S. and are subject to several risks related to doing business internationally.

Because we obtain a majority of our raw materials from overseas suppliers, actively participate in overseas manufacturing operations and sell to a large number of international customers, we face risks associated with the following:

| • | changes in tariff regulations, which may make our products more costly to export or import; |

| • | changes in monetary and fiscal policies, laws and regulations, and other activities of governments, agencies and similar organizations; |

| • | Recessions or marked declines specific to a particular country or region; |

| • | the potential imposition of trade restrictions or prohibitions; |

| • | a U.S. federal tax code that discourages the repatriation of funds to the U.S.; |

| • | the potential imposition of import or other duties or taxes; |

| • | difficulties establishing and maintaining relationships with local original equipment manufacturers, distributors and dealers; |

| • | difficulty in staffing and managing geographically diverse operations; and |

| • | unstable governments or legal systems in countries in which our suppliers, manufacturing operations, and customers are located. |

These and other risks may also increase the relative price of our products compared to those manufactured in other countries, thereby reducing the demand for our products in the markets in which we operate, which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

In addition, we could be adversely affected by violations of the Foreign Corrupt Practices Act (the “FCPA”) and similar worldwide anti-bribery laws, as well as export controls and economic sanction laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Our policies mandate compliance with these laws. We operate in many parts of the world that have experienced governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. We cannot assure you that our internal controls and procedures will always protect us from the improper acts committed by our employees or agents. If we are found to be liable for FCPA, export control or sanction violations, we could suffer from criminal or civil penalties or other sanctions, including loss of export privileges or authorization needed to conduct aspects of our international business, which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

10

Table of Contents

Failure of our products could result in a product recall.

The majority of our products are components of our customers’ products that are used in the automotive industry and other critical industrial applications. A failure of our components could lead to a product recall. If a recall were to happen as a result of our components failing, we could bear a substantial part of the cost of correction. In addition to the cost of fixing the parts affected by the component, a recall could result in the loss of a portion of or all of the customer’s business. A successful product recall claim requiring that we bear a substantial part of the cost of correction or the loss of a key customer could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

Our growth strategy depends in part on companies outsourcing critical components, and if outsourcing does not continue, our business could be adversely affected.

Our growth strategy depends in part on major customers continuing to outsource components and expanding the number of components being outsourced. This requires manufacturers to depart significantly from their traditional methods of operations. If major customers do not continue to expand outsourcing efforts or determine to reduce their use of outsourcing, our ability to grow our business could be materially adversely affected.

Our markets are highly competitive, and many of our competitors have significant advantages that could adversely affect our business.

We face substantial competition in the sale of electrical, medical and aerospace and defense products. In addition, the global markets for precision bearing components and precision metal and plastic components are highly competitive, with a majority of production represented by the captive production operations of large manufacturers. Captive manufacturers make components for internal use and for sale to third parties. All of the captive manufacturers, and many of our independent competitors, are significantly larger and have greater resources than we do. Our competitors are continuously exploring and implementing improvements in technology and manufacturing processes in order to improve product quality, and our ability to remain competitive will depend, among other things, on whether we are able to keep pace with such quality improvements in a cost effective manner. Due to this competitiveness, we may not be able to increase prices for our products to cover cost increases. In many cases we face pressure from our customers to reduce prices, which could adversely affect our business, prospects, financial condition, results of operations, or cash flows. In addition, our customers may choose to purchase products from one of our competitors rather than pay the prices we seek for our products, which could adversely affect our business, prospects, financial condition, results of operations, or cash flows.

Our production capacity has been expanded geographically in recent years to operate in the same markets as our customers.

We have expanded our precision bearing components production facilities and capacity over the last several years. Historically, precision bearing component production facilities have not always operated at full capacity. Over the past several years, we have undertaken steps to address a portion of the capacity risk including closing or ceasing operations at certain plants and downsizing employment levels at others. As such, the risk exists that our customers may exit the geographic markets in which our production capacity is located and/or develop vendors in lower cost countries in which we do not have production capacity.

Any loss of key personnel and the inability to attract and retain qualified employees could have a material adverse impact on our operations.

We are dependent on the continued services of key executives and personnel. The departure of our key personnel without adequate replacement could severely disrupt our business operations. Additionally, we need qualified managers and skilled employees with technical and manufacturing industry experience to operate our businesses successfully. From time to time, there may be shortages of skilled labor, which may make it more difficult and expensive for us to attract and retain qualified employees. If we are unable to attract and retain qualified individuals or our costs to do so increase significantly, our operations would be materially adversely affected.

Risks Related to Legal and Regulatory Compliance

Environmental, health and safety laws and regulations impose substantial costs and limitations on our operations, environmental compliance may be more costly than we expect, and any adverse regulatory action may materially adversely affect our business.

We are subject to extensive federal, state, local and foreign environmental, health and safety laws and regulations concerning matters such as air emissions, wastewater discharges, solid and hazardous waste handling and disposal and the investigation and remediation of contamination. The risks of substantial costs, liabilities and limitations on our operations related to compliance with these laws and regulations are an inherent part of our business, and future conditions may develop, arise or be discovered that create substantial environmental compliance or remediation liabilities and costs.

11

Table of Contents

Compliance with environmental, health and safety legislation and regulatory requirements may prove to be more limiting and costly than we anticipate. To date, we have committed significant expenditures in our efforts to achieve and maintain compliance with these requirements at our facilities, and we expect that we will continue to make significant expenditures related to such compliance in the future. From time to time, we may be subject to legal proceedings brought by private parties or governmental authorities with respect to environmental matters, including matters involving alleged noncompliance with or liability under environmental, health and safety laws, property damage or personal injury. New laws and regulations, including those which may relate to emissions of greenhouse gases, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

Our medical devices are subject to regulation by numerous government agencies, including the FDA and comparable agencies outside the U.S. To varying degrees, each of these agencies requires us to comply with laws and regulations governing the development, testing, manufacturing, labeling, marketing and distribution of our medical devices. We cannot guarantee that we will be able to obtain marketing clearance for our new products or enhancements or modifications to existing products. If such approval is obtained, it may:

| • | take a significant amount of time; |

| • | require the expenditure of substantial resources; |

| • | involve stringent clinical and pre-clinical testing, as well as increased post-market surveillance; |

| • | involve modifications, repairs or replacements of our products; and |

| • | result in limitations on the proposed uses of our products. |

Both before and after a product is commercially released, we have ongoing responsibilities under FDA regulations. We are also subject to periodic inspections by the FDA to determine compliance with the FDA’s requirements, including primarily the quality system regulations and medical device reporting regulations. The results of these inspections can include inspectional observations on FDA’s Form-483, warning letters, or other forms of enforcement. Since 2009, the FDA has significantly increased its oversight of companies subject to its regulations, including medical device companies, by hiring new investigators and stepping up inspections of manufacturing facilities. The FDA has also significantly increased the number of warning letters issued to companies. If the FDA were to conclude that we are not in compliance with applicable laws or regulations, or that any of our medical devices are ineffective or pose an unreasonable health risk, the FDA could ban such medical devices, detain or seize adulterated or misbranded medical devices, order a recall, repair, replacement or refund of such devices, refuse to grant pending pre-market approval applications or require certificates of foreign governments for exports, and/or require us to notify health professionals and others that the devices present unreasonable risks of substantial harm to the public health. The FDA may also impose operating restrictions on a company-wide basis, enjoin and/or restrain certain conduct resulting in violations of applicable law pertaining to medical devices, and assess civil or criminal penalties against our officers, employees, or us. The FDA may also recommend prosecution to the Department of Justice. Any adverse regulatory action, depending on its magnitude, may restrict us from effectively marketing and selling our products.

Foreign governmental regulations have become increasingly stringent and more common, and we may become subject to more rigorous regulation by foreign governmental authorities in the future. Penalties for a company’s non-compliance with foreign governmental regulation could be severe, including revocation or suspension of a company’s business license and criminal sanctions. Any domestic or foreign governmental law or regulation imposed in the future may have a material adverse effect on us.

Recent developments relating to the United Kingdom’s referendum vote in favor of leaving the European Union could adversely affect us.

The United Kingdom held a referendum in June 2016 in which a majority voted for the United Kingdom’s withdrawal from the European Union. As a result of this vote, negotiations are expected to commence to determine the terms of the United Kingdom’s withdrawal from (“Brexit”) the European Union as well as its relationship with the European Union going forward, including the terms of trade between the United Kingdom and the European Union. The effects of Brexit have been and are expected to continue to be far-reaching. Brexit, and the perceptions as to its impact, may adversely affect business activity and economic conditions in Europe and globally and could continue to contribute to instability in global financial and foreign exchange markets. The full effects of Brexit are uncertain and will depend on any agreements the United Kingdom may make to retain access to European Union markets. Lastly, as a result of the Brexit, other countries in the European Union may seek to conduct referenda with respect to their continuing membership with the European Union. Given these possibilities and others we may not anticipate, as well as the lack of comparable precedent, the full extent to which our business, prospects, financial condition, results of operations, or cash flows could be adversely affected by Brexit is uncertain.

12

Table of Contents

Changes in legislation, regulation and government policy as a result of the 2016 U.S. presidential and congressional elections may have a material adverse effect on our business in the future.

The recent presidential and congressional elections in the United States could result in significant changes in, and uncertainty with respect to, legislation, regulation and government policy directly affecting our business or indirectly affecting us because of impacts on our customers and suppliers. Legislative and regulatory proposals discussed during and after the election that could have a material direct or indirect impact on us include, but are not limited to, a disallowance of the deduction for net interest expense, a tax on existing unrepatriated foreign earnings, restrictions on imports and exports, modifications to international trade policy, including withdrawal from trade agreements, environmental regulation, changes to immigration policy, changes to health insurance legislation and the imposition of tariffs and other taxes on imports. We are currently unable to predict whether such changes will occur and, if so, the ultimate impact on our business. To the extent that such changes have a negative impact on us, our suppliers or our customers, including as a result of related uncertainty, these changes may materially and adversely impact our business, prospects, financial condition, results of operations, or cash flows.

We have identified material weaknesses in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Exchange Act. As disclosed in Item 9A, management identified certain material weaknesses in our internal control over financial reporting. Because of these material weaknesses, our management concluded that we did not maintain effective internal control over financial reporting as of December 31, 2016. With the oversight of senior management and the audit committee, we have begun taking steps to remediate the underlying cause of these material weaknesses and improve the design of controls.

While we expect to take the measures necessary to address the underlying causes of these material weaknesses, we cannot at this time estimate how long it will take and our efforts may not prove to be successful in remediating these material weaknesses. While we have not incurred and do not expect to incur material expenses specifically related to the remediation of these material weaknesses, actual expenses may exceed our current estimates and overall costs of compiling the system and processing documentation necessary to assess the effectiveness of our internal control over financial reporting may be material.

If we are unable to successfully remediate these material weaknesses in our internal control over financial reporting, or identify any additional material weaknesses that may exist, the accuracy and timing of our financial reporting may be adversely affected, we may be unable to maintain compliance with securities law requirements regarding timely filing of periodic reports in addition to applicable stock exchange listing requirements, and our stock price may decline materially as a result, all of which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

Risks Related to Our Capitalization

Our indebtedness could adversely affect our business, prospects, financial condition, results of operations, or cash flows.

As of December 31, 2016, we had approximately $826 million of indebtedness outstanding, and had an additional $104.6 million available for borrowing under our debt agreements. Our high degree of leverage could have important consequences, including:

| • | increasing our vulnerability to adverse economic, industry, or competitive developments; |

| • | requiring a substantial portion of our cash flows from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flows to fund operations, capital expenditures, and future business opportunities; |

| • | exposing us to the risk of increased interest rates, which could cause our debt service obligations to increase significantly; |

| • | making it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under our debt agreements; |

| • | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; |

| • | limiting our ability to obtain additional financing for working capital, capital expenditures, product and service development, debt service requirements, acquisitions, and general corporate or other purposes; and |

| • | limiting our flexibility in planning for, or reacting to, changes in our business or market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged and who, therefore, may be able to take advantage of opportunities that our leverage may prevent us from exploiting. |

If any one of these events were to occur, our business, prospects, financial condition, results of operations, or cash flows could be materially and adversely affected. For more information regarding our indebtedness, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

Despite our high indebtedness level, we will still be able to incur substantial additional amounts of debt, which could further exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. Although our debt agreements contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions, and under certain circumstances, the amount of indebtedness that could be incurred in compliance with these restrictions could be substantial. If new debt is added to our and our subsidiaries’ debt levels, the related risks that we now face could increase.

Our debt agreements contain restrictions that will limit our flexibility in operating our business.

Our debt agreements contain various incurrence covenants that limit our ability to engage in specified types of transactions. These incurrence covenants will limit our ability to, among other things:

| • | incur additional indebtedness or issue certain preferred equity; |

| • | pay dividends on, repurchase, or make distributions in respect of our capital stock, prepay, redeem, or repurchase certain debt or make other restricted payments; |

13

Table of Contents

| • | make certain investments and acquisitions; |

| • | create certain liens; |

| • | enter into agreements restricting our subsidiaries’ ability to pay dividends to us; |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| • | alter our existing businesses; and |

| • | enter into certain transactions with our affiliates. |

In addition, the incurrence covenants in our debt agreements require us to meet specified financial ratios and satisfy other financial condition tests. Our ability to meet those financial ratios and tests will depend on our ongoing financial and operating performance, which, in turn, will be subject to economic conditions and to financial, market, and competitive factors, many of which are beyond our control. A breach of any of these covenants could result in a default under one or more of our debt agreements, and permit our lenders to cease making loans to us under our credit facilities. Furthermore, if we were unable to repay the amounts due and payable under our secured debt agreements, our secured lenders could proceed against the collateral granted to them to secure our borrowings. Such actions by the lenders could also cause cross defaults under our other debt agreements.

We may not be able to generate sufficient cash to service all of our indebtedness, and we may not be able to refinance our debt obligations as they mature.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

As our debt obligations mature or if our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital, or restructure or refinance our indebtedness. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of our existing or future debt instruments may restrict us from adopting some of these alternatives. In addition, any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations.

We have international operations that are subject to foreign economic uncertainties and foreign currency fluctuation.

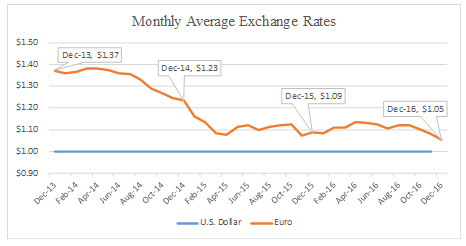

Approximately 34% of our revenues are denominated in foreign currencies, which may result in additional risk of fluctuating currency values and exchange rates and controls on currency exchange. Changes in the value of foreign currencies could increase our U.S. dollar costs for, or reduce our U.S. dollar revenues from, our foreign operations. Any increased costs or reduced revenues as a result of foreign currency fluctuations could affect our profits. In 2016, the U.S. dollar continued to strengthen compared to the euro, which adversely affected our revenue by $5.4 million. Further strengthening of the U.S. dollar may adversely affect our business, prospects, financial condition, results of operations, or cash flows.

The price of our common stock may be volatile.

The market price of our common stock could be subject to significant fluctuations and may decline. Among the factors that could affect our stock price are:

| • | macro or micro-economic factors; |

| • | our operating and financial performance and prospects; |

| • | quarterly variations in the rate of growth of our financial indicators, such as earnings per share, net income and revenues; |

| • | changes in revenue or earnings estimates or publication of research reports by analysts; |

14

Table of Contents

| • | loss of any member of our senior management team; |

| • | speculation in the press or investment community; |

| • | strategic actions by us or our competitors, such as acquisitions or restructuring; |

| • | sales of our common stock by stockholders; |

| • | general market conditions; |

| • | domestic and international economic, legal and regulatory factors unrelated to our performance; |

| • | loss of a major customer; and |

| • | the declaration and payment of a dividend. |

The stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock. In addition, due to the market capitalization of our stock, our stock tends to be more volatile than large capitalization stocks that comprise the Dow Jones Industrial Average or Standard and Poor’s 500 Index.

Provisions in our charter documents and Delaware law may inhibit a takeover, which could adversely affect the value of our common stock.

Our certificate of incorporation and bylaws, as well as Delaware corporate law, contain provisions that could delay or prevent a change of control or changes in our management that a stockholder might consider favorable and may prevent shareholders from receiving a takeover premium for their shares. These provisions include, for example, a classified board of directors and the authorization of our board of directors to issue up to five million preferred shares without a stockholder vote. In addition, our certificate of incorporation provides that stockholders may not call a special meeting.

We are a Delaware corporation subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. Generally, this statute prohibits a publicly-held Delaware corporation from engaging in a business combination with an interested stockholder for a period of three years after the date of the transaction in which such person became an interested stockholder, unless the business combination is approved in a prescribed manner. A business combination includes a merger, asset sale or other transaction resulting in a financial benefit to the stockholder. We anticipate that the provisions of Section 203 may encourage parties interested in acquiring us to negotiate in advance with our board of directors, because the stockholder approval requirement would be avoided if a majority of the directors then in office approve either the business combination or the transaction that results in the stockholder becoming an interested stockholder.

These provisions apply even if the offer may be considered beneficial by some of our stockholders. If a change of control or change in management is delayed or prevented, the market price of our common stock could decline.

Risks Related to Acquisitions and Divestitures

Acquisitions may constitute an important part of our future growth strategy.

Acquiring businesses that complement or expand our operations has been and may continue to be a key element of our business strategy. We cannot assure you that we will be successful in identifying attractive acquisition candidates or completing acquisitions on favorable terms in the future. In addition, we may borrow funds to acquire other businesses, increasing our interest expense and debt levels. Our inability to acquire businesses, or to operate them profitably once acquired, could have a material adverse effect on our business, financial position, results of operations and cash flows. Our borrowing agreements limit our ability to complete acquisitions without prior approval of our lenders.

We may not realize all of the anticipated benefits from acquired companies or any future strategic portfolio acquisition, or those benefits may take longer to realize than expected.

We may not realize all of the anticipated benefits from acquired companies or any future strategic portfolio acquisition, or those benefits may take longer to realize than expected. Achieving those benefits depends on the timely, efficient and successful execution of a number of post-acquisition events, including integrating the acquired businesses into our existing businesses. The integration process may disrupt the businesses and, if implemented ineffectively, would preclude realization of the full benefits expected. The difficulties of combining the operations of acquired companies include, among others:

15

Table of Contents

| • | the diversion of management’s attention to integration matters; |

| • | difficulties in the integration of operations and systems, including, without limitation, the complexities associated with managing the expanded operations of a significantly larger and more complex company, addressing possible differences in corporate cultures and management philosophies and the challenge of integrating complex systems, technology, networks and other assets of each of the acquired companies; |

| • | difficulties in achieving anticipated cost savings, synergies, business opportunities and growth prospects from combining the acquired businesses with our own; |

| • | the inability to implement effective internal controls, procedures and policies for acquired businesses as required by the Sarbanes-Oxley Act of 2002 within the time periods prescribed thereby; |

| • | the exposure to potential unknown liabilities and unforeseen increased expenses or delays associated with acquired businesses; |

| • | challenges in keeping existing customers and obtaining new customers; |

| • | challenges in attracting and retaining key personnel; and |

| • | the disruption of, or the loss of momentum in, ongoing operations or inconsistencies in standards, controls, procedures and policies. |

Many of these factors will be outside of our control and any one of them could result in increased costs, decreases in the amount of expected revenues and diversion of management’s time and energy, which could materially impact our business, prospects, financial condition, results of operations, or cash flows.

Additionally, we incurred a significant amount of debt in connection with our acquisitions in the past few years. Finally, in relation to such acquisitions, we have significantly higher amounts of intangible assets, including goodwill. These intangible assets will be subject to impairment testing, and we could incur a significant impact to our financial statements in the form of an impairment if assumptions and expectations related to our acquisitions are not realized.

We have and will continue to incur expenses in relation to our acquisitions and the integration of our acquired companies.