Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DAVEY TREE EXPERT CO | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - DAVEY TREE EXPERT CO | davey123114ex21.htm |

| EX-23 - EXHIBIT 23 - DAVEY TREE EXPERT CO | davey123114ex23.htm |

| EX-10.8 - EXHIBIT 10.8 - DAVEY TREE EXPERT CO | davey123114ex108.htm |

| EX-31.2 - EXHIBIT 31.2 - DAVEY TREE EXPERT CO | davey123114ex312.htm |

| EX-32.2 - EXHIBIT 32.2 - DAVEY TREE EXPERT CO | davey123114ex322.htm |

| EX-31.1 - EXHIBIT 31.1 - DAVEY TREE EXPERT CO | davey123114ex311.htm |

| EX-32.1 - EXHIBIT 32.1 - DAVEY TREE EXPERT CO | davey123114ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission file number 000-11917

THE DAVEY TREE EXPERT COMPANY

(Exact name of registrant as specified in its charter)

Ohio | 34-0176110 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1500 North Mantua Street

P.O. Box 5193

Kent, Ohio 44240

(Address of principal executive offices) (Zip code)

(330) 673-9511

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Shares, $1.00 par value

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one): Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨ Smaller Reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

There were 13,168,800 Common Shares outstanding as of February 27, 2015. The aggregate market value of the Common Shares held by nonaffiliates of the registrant as of July 1, 2014 was $330,928,487. For purposes of this calculation, it is assumed that the registrant's affiliates include the registrant's Board of Directors and its executive officers.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for the 2015 Annual Meeting of Shareholders, to be held on May 19, 2015, are incorporated by reference into Part III (to be filed within 120 calendar days of the registrant’s fiscal year end).

Page 1

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) in "Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations," "Item 7A - Quantitative and Qualitative Disclosures About Market Risk," and elsewhere. These statements relate to future events or our future financial performance. In some cases, forward-looking statements may be identified by terminology such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to differ materially from what is expressed or implied in these forward-looking statements. Some important factors that could cause actual results to differ materially from those in the forward-looking statements include:

▪ | Our business, other than tree services to utility customers, is highly seasonal and weather dependent. |

▪ | The effects of the uneven economic recovery and the continuing financial and credit uncertainties may adversely impact our customers’ spending and pricing for our services, and impede our collection of accounts receivable. |

▪ | Significant customers, particularly utilities, may experience financial difficulties, resulting in payment delays or delinquencies. |

▪ | The seasonal nature of our business and changes in general and local economic conditions, among other factors, may cause our quarterly results to fluctuate, and our prior performance is not necessarily indicative of future results. |

▪ | The uncertainties in the credit and financial markets may limit our access to capital. |

▪ | Significant increases in fuel prices for extended periods of time will increase our operating expenses. |

▪ | We have significant contracts with our utility, commercial and government customers that include liability risk exposure as part of those contracts. Consequently, we have substantial excess-umbrella liability insurance, and increases in the cost of obtaining adequate insurance, or the inadequacy of our self-insurance accruals or insurance coverages, could negatively impact our liquidity and financial condition. |

▪ | Because no public market exists for our common shares, the ability of shareholders to sell their common shares is limited. |

▪ | We are subject to intense competition. |

▪ | Our failure to comply with environmental laws could result in significant liabilities, fines and/or penalties. |

▪ | The impact of regulations initiated as a response to possible changing climate conditions could have a negative effect on our results of operations or our financial condition. |

▪ | We may encounter difficulties obtaining surety bonds or letters of credit necessary to support our operations. |

▪ | We are dependent, in part, on our reputation of quality, integrity and performance. If our reputation is damaged, we may be adversely affected. |

▪ | We may be unable to attract and retain a sufficient number of qualified employees for our field operations, and we may be unable to attract and retain qualified management personnel. |

▪ | Our facilities could be damaged or our operations could be disrupted, or our customers or vendors may be adversely affected, by events such as natural disasters, pandemics, terrorist attacks or other external events. |

▪ | We are subject to third-party and governmental regulatory claims and litigation that may have an adverse effect on us. |

▪ | We may misjudge a competitive bid and be contractually bound to an unprofitable contract. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update any of the forward-looking statements after the date of this annual report on Form 10-K to conform these statements to actual future results.

Page 2

THE DAVEY TREE EXPERT COMPANY FORM 10-K For the Year Ended December 31, 2014 TABLE OF CONTENTS | |

Page | |

PART I | |

PART II | |

PART III | |

PART IV | |

“We,” “Us,” “Our,” “Davey” and “Davey Tree,” unless the context otherwise requires, means The Davey Tree Expert Company and its subsidiaries.

Page 3

PART I

Item 1. Business.

General

The Davey Tree Expert Company, which was founded in 1880 and incorporated in Ohio in 1909, and its subsidiaries ("we" or "us") provides a wide range of arboriculture, horticulture, environmental and consulting services to our customers throughout the United States and Canada. We have two reportable operating segments organized by type or class of customer: Residential and Commercial, and Utility.

Our Residential and Commercial segment provides services to our residential and commercial customers including: the treatment, preservation, maintenance, removal, planting of trees, shrubs and other plant life; the practice of landscaping, grounds maintenance, tree surgery, tree feeding and tree spraying; the application of fertilizer, herbicides and insecticides; and, natural resource management and consulting, forestry research and development, and environmental planning.

Our Utility segment is principally engaged in providing services to our utility customers--investor-owned, municipal utilities, and rural electric cooperatives--including: the practice of line-clearing and vegetation management around power lines, rights-of-way and chemical brush control; and, natural resource management and consulting, forestry research and development and environmental planning.

We also maintain research, technical support and laboratory diagnostic facilities.

Competition and Customers

Our Residential and Commercial segment is one of the largest national tree care organizations in the United States, and competes with other national and local firms with respect to its services. On a national level, our competition is primarily landscape construction and maintenance companies as well as residential and commercial lawn care companies. At a local and regional level, our competition comes mainly from small, local companies which are engaged primarily in tree care and lawn services. Our Utility segment is the second largest organization in the industry in the United States, and competes principally with one major national competitor, as well as several smaller regional firms.

Principal methods of competition in both operating segments are customer service, marketing, image, performance and reputation. Our program to meet our competition stresses the necessity for our employees to have and project to customers a thorough knowledge of all horticultural services provided, and utilization of modern, well-maintained equipment. Pricing is not always a critical factor in a customer's decision with respect to Residential and Commercial segment; however, pricing is generally the principal method of competition for our Utility segment, although in most instances consideration is given to reputation and past production performance.

We provide a wide range of horticultural services to private companies, public utilities, local, state and federal agencies, and a variety of industrial, commercial and residential customers. During 2014, we had revenues of approximately $66 million, or approximately 8% of total revenues, from Pacific Gas & Electric Company ("PG&E"), one of our largest customers.

Regulation and Environment

Our facilities and operations, in common with those of the industry generally, are subject to governmental regulations designed to protect the environment. This is particularly important with respect to our services regarding insect and disease control, because these services involve to a considerable degree the blending and application of spray materials, which require formal licensing in most areas. Constant changes in environmental conditions, environmental awareness, technology and social attitudes make it necessary for us to maintain a high degree of awareness of the impact such changes have on the market for our services. We believe that we comply in all material respects with existing federal, state and local laws regulating the use of materials in our spraying operations as well as the other aspects of our business that are subject to any such regulation.

Marketing

We solicit business from residential customers principally through referrals, direct mail programs and to a lesser extent through the placement of advertisements in national magazines and trade journals, local newspapers and "yellow pages" telephone directories. We also employ online marketing and lead generation strategies including email marketing campaigns, search engine optimization, search engine marketing, and social media communication. Business from utility and commercial

Page 4

customers is obtained principally through negotiated contracts and competitive bidding. We carry out all of our sales and services through our employees. We generally do not use agents, and do not franchise our name or business.

Seasonality

Our business is seasonal, primarily due to fluctuations in horticultural services provided to Residential and Commercial customers and to a lesser extent by budget constraints imposed on our Utility customers. Because of this seasonality, we have historically incurred losses in the first quarter, while sales and earnings are generally highest in the second and third quarters of the calendar year. Consequently, this has created heavy demands for additional working capital at various times throughout the year. We borrow primarily against bank commitments in the form of a revolving credit facility to provide the necessary funds for our operations. You can find more information about our bank commitments in “Liquidity and Capital Resources” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” on pages 24-25 of this report.

Other Factors

Due to rapid changes in equipment technology and intensity of use, we must constantly update our equipment and processes to ensure that we provide competitive services to our customers and continue our compliance with the Occupational Safety and Health Act.

We own several trademarks including "Davey," "Davey and Design," "Arbor Green Pro," "Arbor Green," and "Davey Resource Group." Through substantial advertising and use, we believe that these trademarks have become of value in the identification and acceptance of our products and services.

Employees

We employed approximately 7,600 employees at December 31, 2014. However, employment levels fluctuate due to seasonal factors affecting our business. We consider our employee relations to be good.

Domestic and Foreign Operations

We sell our services to customers in the United States and Canada.

We do not consider the risks attendant to our business with foreign customers, other than currency exchange risks, to be materially different from those attendant to our business with domestic customers.

Financial Information About Segments and Geographic Areas

Certain financial information regarding our operations by segment and geographic area is contained in Note S to our consolidated financial statements, which are included in Part II, Item 8 of this report.

Access to Company Information

Davey Tree’s internet address is http://www.davey.com. Through our internet website, by hyperlink to the Securities and Exchange Commission (“SEC”) website (http://www.sec.gov), we make available, free of charge, our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports. Availability of the reports occurs contemporaneously with the electronic posting to the SEC’s website as the reports are electronically filed with or furnished to the SEC. The information on our website is not a part of this Annual Report on Form 10-K.

The following documents are also made available on our website and a copy will be mailed, without charge, upon request to our Corporate Secretary:

▪ | Code of Ethics |

▪ | Code of Ethics for Financial Matters |

Item 1A. Risk Factors.

The factors described below represent the principal risks we face. Except as otherwise indicated, these factors may or may not occur and we are not in a position to express a view on the likelihood of any such factor occurring. Other factors may exist that we do not consider to be significant based on information that is currently available or that we are not currently able to anticipate.

Page 5

Our business is highly seasonal and weather dependent.

Our business, other than tree services to utility customers, is highly seasonal and weather dependent, primarily due to fluctuations in horticultural services provided to Residential and Commercial customers. We have historically incurred losses in the first quarter, while revenue and operating income are generally highest in the second and third quarters of the calendar year. Inclement weather, such as uncharacteristically low or high (drought) temperatures, in the second and third quarters could dampen the demand for our horticultural services, resulting in reduced revenues that would have an adverse effect on our results of operations.

The effects of the unpredictable economic recovery and the continuing financial and credit uncertainties may adversely impact our customers’ future spending as well as pricing and payment for our services, thus negatively impacting our operations and growth.

While the economy has shown signs of improvement, sustainability of economic recovery remains uncertain. A slowing or stoppage in economic recovery may adversely impact the demand for our services and potentially result in depressed prices for our services and the delay or cancellation of projects. This makes it difficult to estimate our customers' requirements for our services and, therefore, adds uncertainty to customer demand. Increased uncertainty about the economy may cause a reduction in our customers' spending for our services and may also impact the ability of our customers to pay amounts owed, which could reduce our cash flow and adversely impact our debt or equity financing. These events could have a material adverse effect on our operations and our ability to grow at historical levels.

Financial difficulties or the bankruptcy of one or more of our major customers could adversely affect our results.

Our ability to collect our accounts receivable and future sales depends, in part, on the financial strength of our customers. We grant credit, generally without collateral, to our customers. Consequently, we are subject to credit risk related to changes in business and economic factors throughout the United States and Canada. In the event customers experience financial difficulty, and particularly if bankruptcy results, our profitability may be adversely impacted by our failure to collect our accounts receivable in excess of our estimated allowance for uncollectible accounts. Additionally, our future revenues could be reduced by the loss of a customer due to bankruptcy. Our failure to collect accounts receivable and/or the loss of one or more major customers could have an adverse effect on our net income and financial condition.

Our business is dependent upon service to our utility customers and we may be affected by developments in the utility industry.

We derive approximately 51% of our total revenues from our Utility segment. Significant adverse developments in the utility industry generally, or specifically for our major utility customers, could result in pressure to reduce costs by utility industry service providers (such as us), delays in payments of our accounts receivable, or increases in uncollectible accounts receivable, among other things. As a result, such developments could have an adverse effect on our results of operations.

Our quarterly results may fluctuate.

We have experienced and expect to continue to experience quarterly variations in revenues and operating income as a result of many factors, including:

▪ | the seasonality of our business; |

▪ | the timing and volume of customers' projects; |

▪ | budgetary spending patterns of customers; |

▪ | the commencement or termination of service agreements; |

▪ | costs incurred to support growth internally or through acquisitions; |

▪ | changes in our mix of customers, contracts and business activities; |

▪ | fluctuations in insurance expense due to changes in claims experience and actuarial assumptions; and |

▪ | general and local economic conditions. |

Accordingly, our operating results in any particular quarter may not be indicative of the results that you can expect for any other quarter or for the entire year.

Page 6

We may not have access to capital in the future due to continuing uncertainties in the financial and credit markets.

We may need new or additional financing in the future to conduct our operations, expand our business or refinance existing indebtedness. Continued weakness in the general economic conditions and/or financial markets in the United States or globally could affect adversely our ability to raise capital on favorable terms or at all. From time-to-time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity for working capital requirements, acquisitions and general corporate purposes. Our access to funds under our revolving credit facility is dependent on the ability of the financial institutions that are parties to the facility to meet their funding commitments. Those financial institutions may not be able to meet their funding commitments if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests within a short period of time. The continuation of economic disruptions and any resulting limitations on future funding, including any restrictions on access to funds under our revolving credit facility, could have a material adverse effect on us.

We are subject to the risk of changes in fuel costs.

The cost of fuel is a major operating expense of our business. Significant increases in fuel prices for extended periods of time will cause our operating expenses to fluctuate. An increase in cost with partial or no corresponding compensation from customers would lead to lower margins that would have an adverse effect on our results of operations.

We could be negatively impacted if our self-insurance accruals or our insurance coverages prove to be inadequate.

We are generally self-insured for losses and liabilities related to workers' compensation, vehicle liability and general liability claims (including any wild fire-related claims, up to certain retained coverage limits). A liability for unpaid claims and associated expenses, including incurred but not reported losses, is actuarially determined and reflected in our consolidated balance sheet as an accrued liability. The determination of such claims and expenses, and the extent of the need for accrued liabilities, are continually reviewed and updated. If we were to experience insurance claims or costs above our estimates and were unable to offset such increases with earnings, our business could be adversely affected. Also, where we self-insure, a deterioration in claims management, whether by our management or by a third-party claims administrator, could lead to delays in settling claims, thereby increasing claim costs, particularly as it relates to workers’ compensation. In addition, catastrophic uninsured claims filed against us or the inability of our insurance carriers to pay otherwise-insured claims would have an adverse effect on our financial condition.

Furthermore, many customers, particularly utilities, prefer to do business with contractors with significant financial resources, who can provide substantial insurance coverage. Should we be unable to renew our excess liability insurance and other commercial insurance policies at competitive rates, this loss would have an adverse effect on our financial condition and results of operations.

The unavailability or cancellation of third-party insurance coverage may have a material adverse effect on our financial condition and results of operations as well as disrupt our operations.

Any of our existing excess insurance coverage may not be renewed upon the expiration of the coverage period or future coverage may not be available at competitive rates for the required limits. In addition, our third-party insurers could fail, suddenly cancel our coverage or otherwise be unable to provide us with adequate insurance coverage. If any of these events occur, they may have a material adverse effect on our financial condition and results of operations as well as disrupt our operations. For example, we have operations in California, which has an environment prone to wildfires. Should our third-party insurers determine to exclude coverage for wildfires in the future, we could be exposed to significant liabilities, having a material adverse effect on our financial condition and results of operations and potentially disrupting our California operations.

Because no public market exists for our common shares, your ability to sell your common shares may be limited.

Our common shares are not traded on any national exchange, market system or over-the-counter bulletin board. Because no public market exists for our common shares, your ability to sell these shares is limited.

Page 7

We are subject to intense competition.

We believe that each aspect of our business is highly competitive. Principal methods of competition in our operating segments are customer service, marketing, image, performance and reputation. Pricing is not always a critical factor in a customer’s decision with respect to Residential and Commercial; however, pricing is generally the principal method of competition for Utility, although in most instances consideration is given to reputation and past production performance. On a national level, our competition is primarily landscape construction and maintenance companies as well as residential and commercial lawn care companies. At a local and regional level, our competition comes mainly from small, local companies which are engaged primarily in tree care and lawn services. Our Utility segment competes principally with one major national competitor, as well as several smaller regional firms. Furthermore, competitors may have lower costs because privately-owned companies operating in a limited geographic area may have significantly lower labor and overhead costs. Our competitors may develop the expertise, experience and resources to provide services that are superior in both price and quality to our services. These strong competitive pressures could inhibit our success in bidding for profitable business and may have a material adverse effect on our business, financial condition and results of operations.

Our failure to comply with environmental laws could result in significant liabilities.

Our facilities and operations are subject to governmental regulations designed to protect the environment, particularly with respect to our services regarding insect and tree, shrub and lawn disease management, because these services involve to a considerable degree the blending and application of spray materials, which require formal licensing in most areas. Continual changes in environmental laws, regulations and licensing requirements, environmental conditions, environmental awareness, technology and social attitudes make it necessary for us to maintain a high degree of awareness of the impact such changes have on our compliance programs and the market for our services. We are subject to existing federal, state and local laws, regulations and licensing requirements regulating the use of materials in our spraying operations as well as certain other aspects of our business. If we fail to comply with such laws, regulations or licensing requirements, we may become subject to significant liabilities, fines and/or penalties, which could adversely affect our financial condition and results of operations.

We cannot predict the impact that the debate on changing climate conditions, including legal, regulatory and social responses thereto, may have on our business.

Many scientists, environmentalists, international organizations, political activists, regulators and other commentators believe that global climate change has added, and will continue to add, to the unpredictability, frequency and severity of natural disasters in certain parts of the world. In response, a number of legal and regulatory measures and social initiatives have been introduced in an effort to reduce greenhouse gas and other carbon emissions that these parties believe may be contributors to global climate change. These proposals, if enacted, could result in a variety of regulatory programs, including potential new regulations, additional charges and taxes to fund energy efficiency activities, or other regulatory actions. Any of these actions could result in increased costs associated with our operations and impact the prices we charge our customers.

We cannot predict the impact, if any, that changing climate conditions will have on us or our customers. However, it is possible that the legal, regulatory and social responses to real or imagined climate change could have a negative effect on our results of operations or our financial condition.

We may be adversely affected if we are unable to obtain necessary surety bonds or letters of credit.

Surety market conditions are currently difficult as a result of significant losses incurred by many sureties in recent years, both in the construction industry as well as in certain larger corporate bankruptcies. As a result, less bonding capacity is available in the market and terms have become more expensive and restrictive. Further, under standard terms in the surety market, sureties issue or continue bonds on a project-by-project basis and can decline to issue bonds at any time or require the posting of collateral as a condition to issuing or renewing any bonds. If surety providers were to limit or eliminate our access to bonding, we would need to post other forms of collateral for project performance, such as letters of credit or cash. We may be unable to secure sufficient letters of credit on acceptable terms, or at all. Accordingly, if we were to experience an interruption or reduction in the availability of bonding capacity, our liquidity may be adversely affected.

We may be adversely affected if our reputation is damaged.

We are dependent, in part, upon our reputation of quality, integrity and performance. If our reputation were damaged in some way, it may impact our ability to grow or maintain our business.

Page 8

We may be unable to employ a sufficient workforce for our field operations.

Our industry operates in an environment that requires heavy manual labor. We may experience slower growth in the labor force for this type of work than in the past. As a result, we may experience labor shortages or the need to pay more to attract and retain qualified employees.

We may be unable to attract and retain skilled management.

Our success depends, in part, on our ability to attract and retain key managers. Competition for the best people can be intense and we may not be able to promote, hire or retain skilled managers. The loss of services of one or more of our key managers could have a material adverse impact on our business because of the loss of the manager's skills, knowledge of our industry and years of industry experience, and the difficulty of promptly finding qualified replacement personnel.

Natural disasters, pandemics, terrorist attacks and other external events could adversely affect our business.

Natural disasters, pandemics, terrorist attacks and other adverse external events could materially damage our facilities or disrupt our operations, or damage the facilities or disrupt the operations of our customers or vendors. The occurrence of any such event could adversely affect our business, financial condition and results of operations.

We are subject to third-party and governmental regulatory claims and litigation.

From time-to-time, customers, vendors, employees, governmental regulatory authorities and others may make claims and take legal action against us. Whether these claims and legal actions are founded or unfounded, if such claims and legal actions are not resolved in our favor, they may result in significant financial liability. Any such financial liability could have a material adverse effect on our financial condition and results of operations. Any such claims and legal actions may also require significant management attention and may detract from management's focus on our operations.

We may be adversely affected if we enter into a major unprofitable contract.

Our Residential and Commercial segment and our Utility segment frequently operate in a competitive bid contract environment. As a result, we may misjudge a bid and be contractually bound to an unprofitable contract, which could adversely affect our results of operations.

Item 1B. Unresolved SEC Staff Comments.

There are no unresolved comments from the Staff of the Securities and Exchange Commission.

Item 2. Properties.

Our corporate headquarters campus is located in Kent, Ohio which, along with several other properties in the surrounding area, includes The Davey Institute's research, technical support and laboratory diagnostic facilities.

We conduct administrative functions through our headquarters and our offices in Livermore, California (Utility Services). Our Canadian operations’ administrative functions are conducted through properties located in the provinces of Ontario and British Columbia. We believe our properties are well maintained, in good condition and suitable for our present operations. A summary of our properties follows:

Segment | Number of Properties | How Held | Square Footage | Number of States or Provinces | ||||

Residential and Commercial | 29 | Owned | 263,231 | 14 | ||||

Utility | 3 | Owned | 36,037 | 3 | ||||

Residential and Commercial, and Utility | 2 | Owned | 12,400 | 2 | ||||

We also rent approximately 135 properties in 29 states and three provinces.

None of our owned or rented properties used by our business segments is individually material to our operations.

Page 9

Item 3. Legal Proceedings.

We are party to a number of lawsuits, threatened lawsuits and other claims arising out of the normal course of business.

With respect to all such matters, we record an accrual for a loss contingency when it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. In addition, narrative information is provided for matters as to which management believes a material loss is reasonably possible.

Management has assessed all such matters, including the matter described below, based on current information and made a judgment concerning their potential outcome, giving due consideration to the nature of the claim, the amount and nature of damages sought and the probability of success. Management's judgment is made subject to the known uncertainty of litigation and management's judgment as to estimates made may prove materially different from actual results.

California Fire Litigation: San Diego County--Davey Tree Surgery Company, a Davey subsidiary, and Davey Resource Group, a Davey division, along with the Company have previously been sued, together with a utility services customer, San Diego Gas & Electric ("SDG&E"), and its parent company, as defendants, and as cross-defendants in cross-complaints filed by SDG&E, in the Superior Court of the State of California in and for the County of San Diego, arising out of a wildfire in San Diego County that started on October 22, 2007, referred to as the Rice Canyon fire.

Numerous lawsuits related to the Rice Canyon fire were filed against SDG&E, its parent company, Sempra Energy, and Davey. The earliest of the lawsuits naming Davey was filed on April 18, 2008. The Court ordered that the lawsuits be organized into four groups based on type of plaintiff, namely insurance subrogation claimants, individual/business claimants, governmental claimants, and plaintiffs seeking class certification. Plaintiffs' motions seeking class certification were denied and the orders denying class certification were affirmed on appeal. SDG&E filed cross-complaints against Davey for contractual indemnity, declaratory relief, and breach of contract.

During the third quarter 2012, Davey entered into a Settlement and Release Agreement (the “Agreement”) among Davey, SDG&E and Davey's insurers.

Under the Agreement (a) Davey paid SDG&E an amount previously expensed and accrued as self-insurance, (b) Davey's insurers paid SDG&E amounts under Davey's insurance policies in effect during the period of the Rice Canyon fire, and (c) SDG&E dismissed its cross-complaints against Davey and agreed to defend and hold harmless Davey from any and all claims that are currently asserted against Davey.

Item 4. Mine Safety Disclosures.

Not applicable.

Page 10

Executive Officers of the Company.

Our executive officers and their present positions and ages as of March 1, 2015 follow:

Name | Position | Age | ||

Karl J. Warnke | Chairman, President and Chief Executive Officer | 63 | ||

Patrick M. Covey | President and Chief Operating Officer, U.S. Operations | 51 | ||

Joseph R. Paul, CPA | Chief Financial Officer and Secretary | 53 | ||

Christopher J. Bast, CPA, CTP | Treasurer | 47 | ||

Marjorie L. Conner, Esquire | Assistant Secretary and Counsel | 57 | ||

James E. Doyle | Executive Vice President and General Manager, Davey Tree Expert Co. of Canada, Limited | 46 | ||

Dan A. Joy | Executive Vice President and General Manager, Commercial Landscape Services | 57 | ||

Steven A. Marshall | Executive Vice President, U.S. Utility Operations | 63 | ||

Richard A. Ramsey | Corporate Vice President, Canadian Operations | 65 | ||

Brent R. Repenning | Vice President and General Manager, Davey Resource Group | 43 | ||

Thea R. Sears, CPA | Assistant Controller | 46 | ||

James F. Stief | Executive Vice President, U.S. Residential Operations | 60 | ||

Nicholas R. Sucic, CPA | Vice President and Controller | 68 | ||

Mark J. Vaughn | Vice President and General Manager, Eastern Utility Services | 60 | ||

Mr. Warnke was elected Chairman of the Board, effective May 20, 2009, and continues to serve as President and Chief Executive Officer, having been appointed in January 2007. He was President and Chief Operating Officer from 1999 through December 31, 2006. Prior to that time, he served as Executive Vice President and General Manager - Utility Services, having been appointed in January 1993. Previously, having joined Davey Tree in 1980, Mr. Warnke performed all aspects of tree services and also held various managerial positions, including Operations Manager, Operations Support Services, Equipment and Safety functions and Operations Vice President.

Mr. Covey was elected President and Chief Operating Officer, U.S. Operations effective April 14, 2014 and served as Chief Operating Officer, U.S. Operations having been appointed in February 2012. Prior to that time, Mr. Covey served as Executive Vice President, having been appointed in January 2007, Vice President and General Manager of the Davey Resource Group, having been appointed in March 2005 and was Vice President, Southern Operations, Utility Services, having been appointed in January 2003. Previously, having joined Davey Tree in August 1991, Mr. Covey held various managerial positions, including Manager of Systems and Process Management and Administrative Manager, Utility Services.

Page 11

Mr. Paul was elected Chief Financial Officer and Secretary, effective March 23, 2013, and served as Vice President and Treasurer, having been appointed in May 2011. Mr. Paul joined Davey Tree as Treasurer in December 2005. He is a certified public accountant. Prior to joining us, Mr. Paul served as corporate controller for AccessPoint Openings, LLC, a holding company of distribution and manufacturing companies in the building products industry, having been associated with that firm since 1998. Mr. Paul served in various capacities including director of business expansion and integration at Applied Industrial Technologies, an industrial distributor, from 1993 to 1998. Prior to joining Applied Industrial Technologies, Mr. Paul was an audit manager with Deloitte LLP, having been associated with that firm since 1986.

Mr. Bast was elected Treasurer in April 2013, having joined Davey Tree in March 2013. He is a certified public accountant and a certified treasury professional. Prior to joining us, Mr. Bast served in various management positions from 1994 to 2013 at Diebold, Incorporated, a provider of self-service delivery and security systems, including senior director of North America Finance, a director of investor relations and director of treasury. Prior to joining Diebold, Mr. Bast was an auditor with Deloitte LLP, having been associated with that firm since 1991.

Ms. Conner was elected Assistant Secretary and Counsel in May 1998. Prior to that time, she served as Manager of Legal and Treasury Services.

Mr. Doyle was elected Executive Vice President and General Manager, Davey Tree Expert Co. of Canada, Limited (“Davey Tree Limited”), effective May 21, 2014 and served as Vice President and General Manager, Davey Tree Limited, having been appointed in February 2012. Prior to that time, he served as Vice President and General Manager, Operations, Davey Tree Limited, having been appointed in May 2011 and Vice President, Operations, Davey Tree Limited, having been appointed in January 2006. Previously, having joined Davey Tree in 1989, Mr. Doyle held various managerial positions, including District Manager and Operations Manager.

Mr. Joy was elected Executive Vice President and General Manager, Commercial Landscape Services, effective May 21, 2014 and served as Vice President and General Manager, Commercial Landscape Services, having been appointed in May 2013. Prior to that time, he served as Vice President, Commercial Landscape Services, having been appointed in December 2004 and Operations Manager, Commercial Landscape Services, having been appointed in January 2000. Previously, having joined Davey Tree in 1976, Mr. Joy held various managerial positions, including District Manager and Assistant District Manager.

Mr. Marshall was elected Executive Vice President, U.S. Utility Operations, effective January 1, 2007, and served as Vice President and General Manager of Eastern Utility Services, having been appointed in January 2003. Prior to that time, he served as Vice President, Southern Operations, Utility Services, having been appointed in January 1997. Previously, having joined Davey Tree in 1977, Mr. Marshall held various managerial positions, including Operations Manager, Regional Manager and District Manager.

Mr. Ramsey was elected Corporate Vice President, Canadian Operations, in May 2013 and previously served as Vice President and General Manager, Canadian Operations, since January 2000. Prior to that time, he served as Vice President and General Manager, Commercial Services.

Mr. Repenning was elected Vice President and General Manager, Davey Resource Group, effective June 6, 2010 and served as Vice President, Davey Resource Group, having been appointed in October 2009. Prior to that time, he served as Regional Manager, Davey Resource Group, having been appointed in February 2007. Previously, having joined Davey Tree in 1994, Mr. Repenning held various managerial and operational positions, including Production Manager and Supervisor.

Ms. Sears was elected Assistant Controller in May 2010, and previously served as Manager of Financial Accounting, having been appointed in April 1998. Prior to that time she served as Supervisor of Financial Accounting, having been appointed in September 1995. During her tenure with Davey Tree, Ms. Sears’ responsibilities have included a variety of roles in financial reporting, managerial reporting and operations accounting. She is a certified public accountant.

Mr. Stief was elected Executive Vice President, U.S. Residential Operations, effective February 12, 2012 and previously served as Vice President and General Manager, Residential/Commercial Services, since January 2010. Prior to that time Mr. Stief served as Vice President and General Manager, South, West and Central Residential/Commercial Operations, having been appointed in January 2007 and Vice President South, West and Central Residential/Commercial Operations, having been appointed in January 1997. Previously, having joined Davey Tree in 1978, Mr. Stief held various managerial positions, including Operations Manager and District Manager.

Page 12

Mr. Sucic was elected Vice President and Controller, effective January 1, 2007, and served as Corporate Controller and Chief Accounting Officer since having joined Davey Tree in November 2001. He is a certified public accountant. Prior to joining us, Mr. Sucic served as chief financial officer of Vesper Corporation, a manufacturer of products for industry, from 2000 to 2001; of Advanced Lighting Technologies, Inc., a designer, manufacturer and marketer of metal halide lighting products, from 1996 to 2000; and of various asset management units at The Prudential Investment Corporation, from 1989 to 1996. Prior to joining Prudential, Mr. Sucic was a partner with Ernst & Young LLP, having been associated with that firm since 1970.

Mr. Vaughn was elected Vice President and General Manager, Eastern Utility Services, effective June 6, 2010, and served as Vice President, Eastern Utility Services, having been appointed in December 2007. Prior to that time, he served as Vice President, Northern Operating Group, Utility Services, having been appointed in July 2002. Previously, having joined Davey Tree in 1972, Mr. Vaughn held various managerial positions, including Operations Manager and Regional Manager.

Our officers serve from the date of their election to the next organizational meeting of the Board of Directors and until their respective successors are elected.

Page 13

PART II

Item 5. Market for Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common shares are not listed or traded on an established public trading market and market prices are, therefore, not available. Semiannually, for purposes of the Davey 401KSOP and ESOP, the fair market value of our common shares is determined by an independent stock valuation firm, based upon our performance and financial condition, using a peer group of comparable companies selected by that firm. The peer group currently consists of: ABM Industries Incorporated; Comfort Systems USA, Inc.; Dycom Industries, Inc.; FirstService Corporation; MYR Group, Inc.; Quanta Services, Inc.; Rollins, Inc.; and, Scotts Miracle-Gro Company. The semiannual valuations are effective for a period of six months and the per-share price established by those valuations is the price at which our Board of Directors has determined our common shares will be bought and sold during that six-month period in transactions involving Davey Tree or one of its employee benefit or stock purchase plans. Since 1979, we have provided a ready market for all shareholders through our direct purchase of their common shares, although we are under no obligation to do so. These purchases are added to our treasury stock.

Record Holders and Common Shares

On February 27, 2015 we had 3,635 record holders of our common shares.

On February 27, 2015 we had 13,168,800 common shares outstanding and options exercisable to purchase 389,251 common shares, partially-paid subscriptions for 476,197 common shares and purchase rights outstanding for 195,029 common shares.

Dividends

The following table sets forth, for the periods indicated, the dividends declared per common share (in cents):

Year Ended December 31, | ||||||

Quarter | 2014 | 2013 | ||||

1 | 4.50 | 4.50 | ||||

2 | 4.50 | 4.50 | ||||

3 | 4.50 | 4.50 | ||||

4 | 5.00 | 4.50 | ||||

Total | 18.50 | 18.00 | ||||

We presently expect to pay comparable cash dividends in 2015.

Recent Sales of Unregistered Securities

None.

Page 14

Purchases of Equity Securities

The following table provides information on purchases made by the Company of our common shares during the fiscal year ended December 31, 2014:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs | |||||||

Fiscal 2014 | |||||||||||

January 1 to January 25 | 1,318 | $ | 23.90 | n/a | n/a | ||||||

January 26 to February 22 | 332 | 23.90 | n/a | n/a | |||||||

February 23 to March 29 | 87,380 | 26.40 | n/a | n/a | |||||||

Total First Quarter | 89,030 | 26.35 | |||||||||

March 30 to April 26 | 162,903 | 26.40 | n/a | n/a | |||||||

April 27 to May 24 | 97,801 | 26.40 | n/a | n/a | |||||||

May 25 to June 28 | 88,061 | 26.40 | n/a | n/a | |||||||

Total Second Quarter | 348,765 | 26.40 | |||||||||

June 29 to July 26 | 387 | 26.40 | n/a | n/a | |||||||

July 27 to August 23 | 12,142 | 27.80 | n/a | n/a | |||||||

August 24 to September 27 | 48,360 | 27.80 | n/a | n/a | |||||||

Total Third Quarter | 60,889 | 27.79 | |||||||||

September 28 to October 25 | 79,692 | 27.80 | n/a | n/a | |||||||

October 26 to November 29 | 92,991 | 27.80 | n/a | n/a | |||||||

November 30 to December 31 | 56,069 | 27.80 | n/a | n/a | |||||||

Total Fourth Quarter | 228,752 | 27.80 | |||||||||

Total Year to Date | 727,436 | $ | 26.95 | ||||||||

n/a--Not applicable. There are no publicly announced plans or programs to purchase common shares. | |||||||||||

Page 15

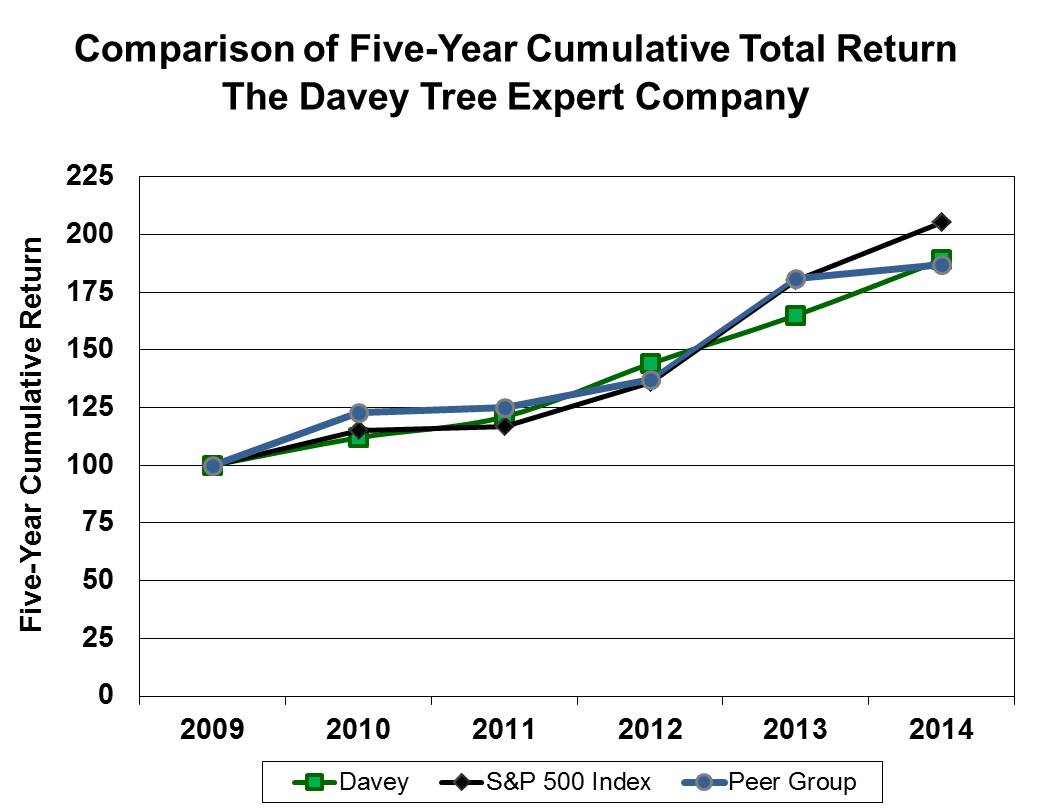

Stock Performance Graph

Comparison of five-year cumulative return among The Davey Tree Expert Company, S&P 500 Stock Index and Selected Peer Group Companies Index

The following Performance Graph compares cumulative total shareholder returns for The Davey Tree Expert Company common shares during the last five years to the Standard & Poor’s 500 Stock Index and to an index of selected peer group companies. The peer group, which is the same group used by Davey’s independent stock valuation firm, consists of: ABM Industries Incorporated; Comfort Systems USA, Inc.; Dycom Industries, Inc.; FirstService Corporation; MYR Group, Inc.; Quanta Services, Inc.; Rollins, Inc.; and Scotts Miracle-Gro Company. Each of the three measures of cumulative total return assumes reinvestment of dividends.

2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||

Davey Tree | 100 | 112 | 121 | 144 | 165 | 189 | ||||||

S&P 500 Index | 100 | 115 | 117 | 136 | 180 | 205 | ||||||

Peer Group | 100 | 123 | 125 | 137 | 181 | 187 | ||||||

The Performance Graph and related information above shall not be deemed “soliciting material” or be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

Page 16

Item 6. Selected Financial Data.

Fiscal Year Ended December 31, | |||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

(In thousands, except ratio and per share data) | |||||||||||||||||||

Operating Statement Data: | |||||||||||||||||||

Revenues | $ | 789,911 | $ | 713,848 | $ | 680,153 | $ | 646,034 | $ | 591,732 | |||||||||

Costs and expenses: | |||||||||||||||||||

Operating | 508,677 | 462,646 | 437,332 | 426,626 | 387,272 | ||||||||||||||

Selling | 140,027 | 120,842 | 111,578 | 104,871 | 97,794 | ||||||||||||||

General and administrative | 54,970 | 50,654 | 48,171 | 42,793 | 40,170 | ||||||||||||||

Depreciation | 40,970 | 38,231 | 37,365 | 37,818 | 35,530 | ||||||||||||||

Amortization of intangible assets | 2,070 | 1,980 | 1,742 | 1,908 | 1,791 | ||||||||||||||

Gain on sale of assets, net | (806 | ) | (1,294 | ) | (1,802 | ) | (783 | ) | (437 | ) | |||||||||

Income from operations | 44,003 | 40,789 | 45,767 | 32,801 | 29,612 | ||||||||||||||

Interest expense | (2,948 | ) | (2,708 | ) | (2,698 | ) | (3,794 | ) | (2,803 | ) | |||||||||

Interest income | 295 | 311 | 200 | 43 | 46 | ||||||||||||||

Litigation settlement | — | — | — | (2,900 | ) | — | |||||||||||||

Other expense | (3,050 | ) | (2,827 | ) | (2,611 | ) | (2,850 | ) | (2,521 | ) | |||||||||

Income before income taxes | 38,300 | 35,565 | 40,658 | 23,300 | 24,334 | ||||||||||||||

Income taxes | 15,131 | 12,712 | 16,063 | 9,235 | 10,281 | ||||||||||||||

Net income | $ | 23,169 | $ | 22,853 | $ | 24,595 | $ | 14,065 | $ | 14,053 | |||||||||

Earnings per share--diluted | $ | 1.63 | $ | 1.57 | $ | 1.68 | $ | .97 | $ | .93 | |||||||||

Shares used for computing per share amounts--diluted | 14,238 | 14,602 | 14,609 | 14,537 | 15,031 | ||||||||||||||

Other Financial Data: | |||||||||||||||||||

Depreciation and amortization | $ | 43,040 | $ | 40,211 | $ | 39,107 | $ | 39,726 | $ | 37,321 | |||||||||

Capital expenditures | 55,731 | 45,205 | 29,734 | 34,701 | 34,753 | ||||||||||||||

Cash flow provided by (used in): | |||||||||||||||||||

Operating activities | 49,279 | 56,310 | 43,936 | 54,422 | 49,275 | ||||||||||||||

Investing activities | (64,060 | ) | (43,205 | ) | (31,179 | ) | (34,128 | ) | (39,304 | ) | |||||||||

Financing activities | 17,335 | (16,891 | ) | (3,377 | ) | (22,044 | ) | (349 | ) | ||||||||||

Cash dividends declared per share | $ | .1850 | $ | .1800 | $ | .1775 | $ | .1700 | $ | .1700 | |||||||||

Page 17

As of December 31, | |||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

(In thousands, except ratio and per share data) | |||||||||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Working capital | $ | 58,843 | $ | 46,745 | $ | 63,208 | $ | 28,501 | $ | 25,833 | |||||||||

Current ratio | 1.54 | 1.44 | 1.64 | 1.28 | 1.29 | ||||||||||||||

Property and equipment, net | 160,883 | 136,884 | 125,716 | 130,148 | 129,627 | ||||||||||||||

Total assets | 381,004 | 333,378 | 330,932 | 303,734 | 288,307 | ||||||||||||||

Long-term debt | 81,306 | 50,034 | 54,787 | 51,136 | 61,591 | ||||||||||||||

Other long-term liabilities | 54,854 | 46,935 | 59,498 | 49,837 | 38,305 | ||||||||||||||

Shareholders' equity | 136,491 | 131,138 | 118,106 | 100,726 | 98,369 | ||||||||||||||

Common shares: | |||||||||||||||||||

Issued | 21,457 | 21,457 | 21,457 | 21,457 | 21,457 | ||||||||||||||

In treasury | 8,292 | 8,018 | 7,731 | 7,611 | 7,345 | ||||||||||||||

Net outstanding | 13,165 | 13,439 | 13,726 | 13,846 | 14,112 | ||||||||||||||

Stock options: | |||||||||||||||||||

Outstanding | 770 | 662 | 761 | 1,111 | 1,256 | ||||||||||||||

Exercisable | 389 | 342 | 640 | 942 | 945 | ||||||||||||||

ESOT valuation per share | $ | 30.10 | $ | 26.40 | $ | 23.20 | $ | 19.70 | $ | 18.40 | |||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

(Amounts in thousands, except share data)

Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”) is provided as a supplement to the accompanying consolidated financial statements and notes to help provide an understanding of our financial condition, cash flows and results of operations. MD&A is organized as follows:

▪ | Overview of 2014 Results; |

▪ | Results of Operations, including fiscal 2014 compared to fiscal 2013, fiscal 2013 compared to fiscal 2012, and liabilities for uncertain income tax positions, and other matters; |

▪ | Liquidity and Capital Resources, including cash flow summary, off-balance sheet arrangements, and capital resources; |

▪ | Recent Accounting Guidance; |

▪ | Critical Accounting Policies and Estimates; and |

▪ | Market Risk Information, including interest rate risk and foreign currency exchange rate risk. |

OVERVIEW OF 2014 RESULTS

General

We provide a wide range of horticultural services to residential, commercial, utility and institutional customers throughout the United States and Canada.

Our Business--We have two reportable operating segments organized by type or class of customer: Residential and Commercial, and Utility.

Residential and Commercial--Residential and Commercial provides services to our residential and commercial customers including: the treatment, preservation, maintenance, removal and planting of trees, shrubs and other plant life; the practice of landscaping, grounds maintenance, tree surgery, tree feeding and tree spraying; the application of fertilizer, herbicides and insecticides; and, natural resource management and consulting, forestry research and development, and environmental planning.

Page 18

Utility--Utility is principally engaged in providing services to our utility customers--investor-owned, municipal utilities, and rural electric cooperatives--including: the practice of line-clearing and vegetation management around power lines, rights-of-way and chemical brush control; and, natural resource management and consulting, forestry research and development and environmental planning.

All other operating activities, including research, technical support and laboratory diagnostic facilities, are included in “All Other.”

During the fourth quarter 2013, the Company realigned its reporting to more closely reflect the manner in which performance is assessed and decisions are made in allocating resources to the segments. Our two reportable operating segments are organized by type or class of customer: Residential and Commercial and Utility. The amounts in the table below for 2012 have been conformed to the 2014 and 2013 reporting.

Results of Operations

The following table sets forth our consolidated results of operations as a percentage of revenues and the percentage change in dollar amounts of the results of operations for the periods presented:

Year Ended December 31, | Percentage Change | |||||||||||||

2014 | 2013 | 2012 | 2014/2013 | 2013/2012 | ||||||||||

Revenues | 100.0 | % | 100.0 | % | 100.0 | % | 10.7 | % | 5.0 | % | ||||

Costs and expenses: | ||||||||||||||

Operating | 64.3 | 64.8 | 64.3 | 9.9 | 5.8 | |||||||||

Selling | 17.7 | 16.9 | 16.4 | 15.9 | 8.3 | |||||||||

General and administrative | 7.0 | 7.1 | 7.1 | 8.5 | 5.2 | |||||||||

Depreciation | 5.2 | 5.4 | 5.5 | 7.2 | 2.3 | |||||||||

Amortization of intangible assets | .3 | .3 | .3 | 4.5 | 13.7 | |||||||||

Gain on sale of assets, net | (.1 | ) | (.2 | ) | (.3 | )% | (37.7 | ) | (28.2 | ) | ||||

94.4 | 94.3 | 93.3 | 10.8 | 6.1 | ||||||||||

Income from operations | 5.6 | 5.7 | 6.7 | 7.9 | (10.9 | )% | ||||||||

Other income (expense): | ||||||||||||||

Interest expense | (.4 | ) | (.3 | ) | (.4 | )% | 8.9 | .4 | ||||||

Interest income | — | — | — | nm | nm | |||||||||

Other | (.4 | ) | (.4 | ) | (.3 | )% | nm | nm | ||||||

Income before income taxes | 4.8 | 5.0 | 6.0 | 7.7 | (12.5 | ) | ||||||||

Income taxes | 1.9 | 1.8 | 2.4 | 19.0 | (20.9 | ) | ||||||||

Net income | 2.9 | % | 3.2 | % | 3.6 | % | 1.4 | % | (7.1 | )% | ||||

nm--not meaningful | ||||||||||||||

Revenues of $789,911 were 10.7% higher than last year’s revenues of $713,848. Utility revenues increased 7.4%, and Residential and Commercial increased 15.3%.

Overall, income from operations of $44,003 increased 7.9% from the $40,789 experienced in the prior year. Income from operations was $21,382 in Utility (a 33.1% increase as compared with 2013) and $37,232 for Residential and Commercial (a 10.9% increase as compared with 2013).

Net income of $23,169 was $316 more than the $22,853 earned in 2013. The increase in net income was attributable to higher income from operations.

Operating activities in 2014 provided cash of $49,279 as compared to $56,310 provided in 2013. The $7,031 net decrease was primarily attributable to (i) an increase in net income of $316, (ii) an increase of $2,829 in depreciation and amortization expense, and (iii) $3,859 more cash used from changes in operating assets and liabilities.

Page 19

Investing activities used $64,060 in cash, or $20,855 more than that used in 2013, the result of additional expenditures for purchases of equipment and land and building necessary to support additional business growth and the purchases of businesses.

Financing activities provided $17,335 in cash in 2014, $34,226 more than the $16,891 of cash used in 2013. Our revolving credit facility provided $24,500 in cash in 2014 as compared with the $4,200 used during 2013. Purchases of common shares for treasury of $19,598 were partially offset by net cash received of $10,503 from the sale of common shares and cash received on our common share subscriptions. Dividends paid during 2014 totaled $2,674.

Fiscal 2014 Compared to Fiscal 2013

A comparison of our fiscal year 2014 results to 2013 follows:

Year Ended December 31, | ||||||||||||||

2014 | 2013 | Change | % Change | |||||||||||

Revenues | $ | 789,911 | $ | 713,848 | $ | 76,063 | 10.7 | % | ||||||

Costs and expenses: | ||||||||||||||

Operating | 508,677 | 462,646 | 46,031 | 9.9 | ||||||||||

Selling | 140,027 | 120,842 | 19,185 | 15.9 | ||||||||||

General and administrative | 54,970 | 50,654 | 4,316 | 8.5 | ||||||||||

Depreciation | 40,970 | 38,231 | 2,739 | 7.2 | ||||||||||

Amortization of intangible assets | 2,070 | 1,980 | 90 | 4.5 | ||||||||||

Gain on sale of assets, net | (806 | ) | (1,294 | ) | 488 | (37.7 | ) | |||||||

745,908 | 673,059 | 72,849 | 10.8 | |||||||||||

Income from operations | 44,003 | 40,789 | 3,214 | 7.9 | ||||||||||

Other income (expense): | ||||||||||||||

Interest expense | (2,948 | ) | (2,708 | ) | (240 | ) | 8.9 | |||||||

Interest income | 295 | 311 | (16 | ) | (5.1 | ) | ||||||||

Other | (3,050 | ) | (2,827 | ) | (223 | ) | 7.9 | |||||||

Income before income taxes | 38,300 | 35,565 | 2,735 | 7.7 | ||||||||||

Income taxes | 15,131 | 12,712 | 2,419 | 19.0 | ||||||||||

Net income | $ | 23,169 | $ | 22,853 | $ | 316 | 1.4 | % | ||||||

nm--not meaningful | ||||||||||||||

Revenues--Revenues of $789,911 increased $76,063 compared with the $713,848 reported in 2013. Utility increased $27,999, or 7.4%, from the prior year. Contract rate increases with one of our largest utility customers, new contracts and increased productivity within our U.S. and Canadian operations account for the increase. Residential and Commercial increased $51,396, or 15.3%, from 2013. Increased snow plowing revenue, added revenues from business acquisitions, additional tree pruning and tree removal revenues and increased production on our liquid service applications account for the increase. Total consolidated revenue of $789,911 includes production incentive revenue, recognized under the completed-performance method, of $4,725 during 2014 as compared with $8,120 during 2013.

Operating Expenses--Operating expenses of $508,677 increased $46,031 from the prior year, and as a percentage of revenues decreased .5% to 64.3%. Utility experienced an increase of $15,596, or 5.5%, from 2013, and as a percentage of revenues decreased 1.3% to 74.5%. Increases in employee labor and benefits expense, equipment repair and maintenance expense, travel expense, fuel expense, subcontractor expense and tool and saw expense were partially offset by decreases in material expense, damage expense and equipment transfer expense. Residential and Commercial increased $30,601, or 17.5%, compared with 2013 and as a percentage of revenue increased .9% to 53.2%. Increased employee labor and benefit expense, repair and maintenance expense, fuel expense, material expense, tool and saw expense, subcontractor expense and disposal expense, were partially offset by a reduction in equipment transfer expense and damage expense.

Page 20

Fuel costs increased in 2014 as compared with fuel costs for 2013 and impacted operating expenses within all segments. During 2014, fuel expense of $35,129 increased $2,201, or 6.7%, from the $32,928 incurred in 2013. Substantially all of the $2,201 increase relates to an increase in volume of fuel.

Selling Expenses--Selling expenses of $140,027 increased $19,185 from 2013 and as a percentage of revenues increased .8% to 17.7%. Utility increased $5,648, or 15.9%, from 2013. Increases in field management wages and incentive expense, field management travel expense, office expense, computer expense, communication expense and employee development expense were partially offset by a reduction in field management auto expense, office rent expense and utilities expense. Residential and Commercial increased $13,415, or 15.2%, from 2013 but as a percentage of revenue remained at 26.3%. Increases in field management wages and incentive expense, field management auto expense, rent expense, computer expense, communication expense, employee development expense, professional services expense and sales and marketing expense were partially offset by a reduction in field management travel expense.

General and Administrative Expenses--General and administrative expenses increased $4,316 to $54,970, a 8.5% increase, from the $50,654 experienced in 2013 and as a percentage of revenues decreased .1% to 7.0%. Pension settlement costs incurred, the result of purchasing annuities related to our defined benefit pension plans, along with increases in salary and incentive expense, office rent and utilities expense, computer expense, office expense and stock compensation expense were partially offset by decreases in management travel expense, communication expense and employee development expense.

Depreciation and Amortization Expense--Depreciation and amortization expense of $43,040 increased $2,829 from the prior year but as a percentage of revenues decreased .2% to 5.4%. The increase is attributable to higher capital expenditures for equipment and an increase in amortization expense related to our purchases of businesses.

Gain on Sale of Assets--Gain on the sale of assets of $806 decreased $488 from the $1,294 experienced in 2013. The decrease is the result of a reduction in the number of equipment units sold in 2014 as compared with 2013.

Interest Expense--Interest expense of $2,948 increased $240 from the $2,708 incurred in 2013. The increase is attributable to higher-average debt levels necessary to fund operations and capital expenditures, partially offset by lower-average interest rates, during the 2014 as compared with 2013.

Other, Net--Other, net of $3,050 increased $223 from the $2,827 experienced in 2013. Other, net, consisted of nonoperating income and expense, including foreign currency losses on the intercompany account balances of our Canadian operations.

Income Taxes--Income taxes for 2014 were $15,131, an effective tax rate of 39.5%, compared with income taxes for 2013 of $12,712, or an effective tax rate of 35.7%. The increase of 3.8% in the effective tax rate of 39.5% for 2014, as compared to 35.7% for 2013, relates primarily to changes in audit settlements and uncertain tax position adjustments.

Net Income--Net income of $23,169 was $316 higher than the $22,853 earned in 2013, the result of higher income from operations.

Page 21

Fiscal 2013 Compared to Fiscal 2012

A comparison of our fiscal year 2013 results to 2012 follows:

Year Ended December 31, | ||||||||||||||

2013 | 2012 | Change | % Change | |||||||||||

Revenues | $ | 713,848 | $ | 680,153 | $ | 33,695 | 5.0 | % | ||||||

Costs and expenses: | ||||||||||||||

Operating | 462,646 | 437,332 | 25,314 | 5.8 | ||||||||||

Selling | 120,842 | 111,578 | 9,264 | 8.3 | ||||||||||

General and administrative | 50,654 | 48,171 | 2,483 | 5.2 | ||||||||||

Depreciation | 38,231 | 37,365 | 866 | 2.3 | ||||||||||

Amortization of intangible assets | 1,980 | 1,742 | 238 | 13.7 | ||||||||||

Gain on sale of assets, net | (1,294 | ) | (1,802 | ) | 508 | (28.2 | ) | |||||||

673,059 | 634,386 | 38,673 | 6.1 | |||||||||||

Income from operations | 40,789 | 45,767 | (4,978 | ) | (10.9 | ) | ||||||||

Other income (expense): | ||||||||||||||

Interest expense | (2,708 | ) | (2,698 | ) | (10 | ) | .4 | |||||||

Interest income | 311 | 200 | 111 | 55.5 | ||||||||||

Other | (2,827 | ) | (2,611 | ) | (216 | ) | 8.3 | |||||||

Income before income taxes | 35,565 | 40,658 | (5,093 | ) | (12.5 | ) | ||||||||

Income taxes | 12,712 | 16,063 | (3,351 | ) | (20.9 | ) | ||||||||

Net income | $ | 22,853 | $ | 24,595 | $ | (1,742 | ) | (7.1 | )% | |||||

nm--not meaningful | ||||||||||||||

Revenues--Revenues of $713,848 increased $33,695 compared with the $680,153 reported in 2012. Utility increased $1,220, or .3%, from the prior year. Additional work obtained on two existing contracts as well as new contracts acquired in our U.S. operations were partially offset by a reduction in revenue on our largest utility account, the result of client-imposed production changes and losses of contracts within both our U.S. and Canadian operations. Residential and Commercial increased $31,458, or 10.4%, from 2012. Despite a slow start in the first quarter of 2013 due to poor weather conditions which delayed our ability to perform liquid service applications, the remainder of the year was strong for our Residential and Commercial operations. Continued contract work with a large customer related to tree damage purportedly caused by one of its products and the addition of a business acquired in the fourth quarter 2012 located in the midwest United States also contributed to the increase. Total consolidated revenue of $713,848 includes production incentive revenue, recognized under the completed-performance method, of $8,120 during 2013 as compared with $5,004 during 2012.

Operating Expenses--Operating expenses of $462,646 increased $25,314 from the prior year, and as a percentage of revenues increased .5% to 64.8%. Utility experienced an increase of $3,801, or 1.3%, from 2012, and as a percentage of revenues increased .7% to 75.8%. Increases in employee labor and benefits expense, equipment repair and maintenance expense, travel expense, fuel expense, tool expense and material expense were partially offset by decreases in subcontractor expense, fuel expense and disposal expense. Residential and Commercial increased $18,531, or 11.9%, compared with 2012 and as a percentage of revenue increased .7% to 52.2%. Increased employee labor and benefit expense, repair and maintenance expense, fuel expense, material expense, tool and saw expense, subcontractor expense and disposal expense, associated with the increased revenue, account for the increase.

Fuel costs increased in 2013 as compared with fuel costs for 2012 and impacted operating expenses within all segments. During 2013, fuel expense of $32,928 increased $639, or 2.0%, from the $32,289 incurred in 2012. Substantially all of the $639 increase relates to an increase in the price of fuel.

Page 22

Selling Expenses--Selling expenses of $120,842 increased $9,264 from 2012 and as a percentage of revenues increased .5% to 16.9%. Utility increased $1,637, or 4.8%, from 2012. Increases in field management wages and incentive expense, office expense and employee development expense were partially offset by a reduction in field management travel expense, computer expense, field management auto expense, professional services expense and communication expense. Residential and Commercial increased $7,024, or 8.6%, from 2012 but as a percentage of revenue decreased .5% to 26.3%. Increases in field management wages and incentive expense, field management auto expense, travel expense, rent expense, computer expense and sales and marketing expense were partially offset by a reduction in communication expense.

General and Administrative Expenses--General and administrative expenses increased $2,483 to $50,654, a 5.2% increase, from the $48,171 experienced in 2012 and as a percentage of revenues remained unchanged from the prior year at 7.1%. Increases in salary and incentive expense, professional services expense, communication expenses and computer expense were partially offset by decreases in pension expense, personal development expense and stock compensation expense.

Depreciation and Amortization Expense--Depreciation and amortization expense of $40,211 increased $1,104 from the prior year but as a percentage of revenues decreased .1% to 5.7%. The increase is attributable to an increase in depreciation expense related to higher capital expenditures for equipment and an increase in amortization expense related to our purchases of businesses.

Gain on Sale of Assets--Gain on the sale of assets of $1,294 decreased $508 from the $1,802 experienced in 2012. Fewer equipment units were sold in 2013 as compared with 2012 which accounts for the decreased gain.

Interest Expense--Interest expense of $2,708 increased $10 from the $2,698 incurred in 2012. The increase is attributable to higher average borrowing levels necessary to fund capital expenditures and operations during the 2013 as compared with 2012.

Other, Net--Other, net of $2,827 increased $216 from the $2,611 experienced in 2012. Other, net, consisted of nonoperating income and expense, including foreign currency losses on the intercompany account balances of our Canadian operations of $146 for 2013 as compared to gains of $11 for 2012.

Income Taxes--Income taxes for 2013 were $12,712, an effective tax rate of 35.7%, compared with income taxes for 2012 of $16,063, or an effective tax rate of 39.5%. The decrease of 3.8% in the effective tax rate of 35.7% for 2013, as compared to 39.5% for 2012, relates primarily to changes in audit settlements and uncertain tax position adjustments.

Net Income--Net income of $22,853 was $1,742 lower than the $24,595 earned in 2012, the result of lower income from operations.

Income Tax—Liabilities for Uncertain Tax Positions

The amount of income taxes we pay is subject to audit by U.S. federal, state and Canadian tax authorities, which may result in proposed assessments. Our estimate for the potential outcome for any uncertain tax issue is highly judgmental. Uncertain tax positions are recognized only if they are more-likely-than-not to be upheld during examination based on their technical merits. The measurement of the uncertain tax position is based on the largest benefit amount that is more-likely-than-not (determined on a cumulative probability basis) to be realized upon settlement of the matter. If payment of these amounts ultimately proves to be unnecessary, the reversal of the liabilities would result in tax benefits being recognized in the period when we determine the liabilities are no longer necessary. If the estimate of tax liabilities proves to be less than the ultimate settlement, a further charge to expense may result.

The Company is routinely under audit by U.S. federal, state, local and Canadian authorities in the area of income tax. These audits include questioning the timing and the amount of income and deductions and the allocation of income and deductions among various tax jurisdictions. During the fourth quarter 2013, the U.S. Internal Revenue Service completed its audit of the Company's U.S. income tax returns for 2010 and 2011 and, during 2010, Canada Revenue Agency completed its audit of the Company's Canadian operations for 2006, 2007 and 2008. With the exception of U.S. state jurisdictions, the Company is no longer subject to examination by tax authorities for the years through 2009. As of December 31, 2014, we believe it is reasonably possible that the total amount of unrecognized tax benefits will not significantly increase or decrease.

Page 23

Goodwill—Impairment Tests

Annually, we perform the impairment tests for goodwill during the fourth quarter. Impairment of goodwill is tested at the reporting-unit level, which for us are also our business segments. Impairment of goodwill is tested by comparing the reporting unit’s carrying value, including goodwill, to the fair value of the reporting unit. The fair values of the reporting units are estimated using discounted projected cash flows. If the carrying value of the reporting unit exceeds its fair value, goodwill is considered impaired and a second step is performed to measure the amount of impairment loss, if any. We conducted our annual impairment tests and determined that no impairment loss was required to be recognized in 2014 or for any prior periods. There were no events or circumstances from the date of our assessment through December 31, 2014 that would impact this conclusion.