Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - FOSTER L B CO | d860671dex23.htm |

| EX-21 - EXHIBIT 21 - FOSTER L B CO | d860671dex21.htm |

| EXCEL - IDEA: XBRL DOCUMENT - FOSTER L B CO | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - FOSTER L B CO | d860671dex311.htm |

| EX-32.0 - EXHIBIT 32.0 - FOSTER L B CO | d860671dex320.htm |

| EX-31.2 - EXHIBIT 31.2 - FOSTER L B CO | d860671dex312.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | Annual Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2014

Or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 0-10436

L.B. FOSTER COMPANY

(Exact name of registrant as specified in its charter)

| Pennsylvania | 25-1324733 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |

| 415 Holiday Drive, Pittsburgh, Pennsylvania | 15220 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(412) 928-3400

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered | |

| Common Stock, Par Value $0.01 | NASDAQ Global Select Market | |

| Preferred Stock Purchase Rights | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $526,238,000.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at February 25, 2015 | |

| Common Stock, Par Value $0.01 | 10,360,334 shares |

Documents Incorporated by Reference:

Portions of the Proxy Statement prepared for the 2015 Annual Meeting of Shareholders are incorporated by reference in Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K. The 2015 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Table of Contents

| PART I | ||||||

| Item 1. | 4 | |||||

| Item 1A. | 11 | |||||

| Item 1B. | 15 | |||||

| Item 2. | 16 | |||||

| Item 3. | 16 | |||||

| Item 4. | 16 | |||||

| PART II | ||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 17 | ||||

| Item 6. | 20 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 | ||||

| Item 7A. | 40 | |||||

| Item 8. | 41 | |||||

| Item 9. | Change in and Disagreements with Accountants on Accounting and Financial Disclosure |

81 | ||||

| Item 9A. | 81 | |||||

| Item 9B. | 83 | |||||

| PART III | ||||||

| Item 10. | 83 | |||||

| Item 11. | 83 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 83 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

83 | ||||

| Item 14. | 83 | |||||

| PART IV | ||||||

| Item 15. | 84 | |||||

| 86 | ||||||

2

Table of Contents

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Many of the forward-looking statements are located in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Sentences containing words such as “believe,” “intend,” “may,” “expect,” “should,” “could,” “anticipate,” “plan,” “estimate,” “predict,” “project,” or their negatives, or other similar expressions generally should be considered forward-looking statements. Forward-looking statements in this Annual Report on Form 10-K may concern, among other things, the Company’s expectations regarding our strategy, goals, projections and plans regarding our financial position, liquidity and capital resources, the outcome of litigation and product warranty claims, results of operations, decisions regarding our strategic growth strategies, market position, and product development, all of which are based on current estimates that involve inherent risks and uncertainties. The Company cautions readers that various factors could cause the actual results of the Company to differ materially from those indicated by forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Among the factors that could cause the actual results to differ materially from those indicated in the forward-looking statements are risks and uncertainties related to: general business conditions, the risk of doing business in international markets, our ability to effectuate our strategy including evaluation of potential opportunities such as strategic acquisitions, joint ventures, and other initiatives, and our ability to effectively integrate new businesses and realize anticipated benefits, a decrease in freight or passenger rail traffic, sustained declines in energy prices, a lack of state or federal funding for new infrastructure projects, the timeliness and availability of material from major suppliers, labor disputes, the impact of competition, variances in current accounting estimates and their ultimate outcomes, the seasonality of the Company’s business, the adequacy of internal and external sources of funds to meet financing needs, the Company’s ability to curb its working capital requirements, domestic and international income taxes, foreign currency fluctuations, inflation, the impact of new regulations including regarding conflict minerals, the ultimate number of concrete ties that will have to be replaced pursuant to product warranty claims, an overall resolution of the related contract claims as well as the outcome of a lawsuit filed by Union Pacific Railroad, risk inherent in litigation, and domestic and foreign governmental regulations. Should one or more of these risks or uncertainties materialize, or should the assumptions underlying the forward-looking statements prove incorrect, actual outcomes could vary materially from those indicated. The risks and uncertainties that may affect the operations, performance, and results of the Company’s business and forward-looking statements include, but are not limited to, those set forth under Item 1A, “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

The forward looking statements in this report are made as of the date of this report and we assume no obligation to update or revise any forward looking statement, whether as a result of new information, future developments, or otherwise, except as required by securities laws.

3

Table of Contents

PART I

| ITEM 1. | BUSINESS |

(Dollars in thousands, except share data unless otherwise noted)

Summary Description of Businesses

Formed in 1902, L.B. Foster Company is a Pennsylvania corporation with its principal office in Pittsburgh, PA. L.B. Foster Company is a leading manufacturer, fabricator, and distributor of products and services for the rail, construction, energy and utility markets. As used herein, “Foster”, the “Company”, “we”, “us”, and “our” or similar references refer collectively to L.B. Foster Company and its divisions and subsidiaries, unless the context otherwise requires. The Company classifies its activities into three business segments: Rail Products, Construction Products, and Tubular Products. Financial information concerning these segments is set forth in Part II, Item 8, Note 2 to the financial statements included herein, which is incorporated by reference into this Item 1.

Business Developments

On July 7, 2014, the Company acquired Carr Concrete Corporation (Carr) for $12,480. Carr is a provider of pre-stressed and precast concrete products located in Waverly, WV. The transaction was funded with cash on hand. The results of Carr’s operations from the acquisition date through December 31, 2014 are included in our Construction Products segment and were not material to the periods presented.

On October 29, 2014, the Company acquired FWO, a business of Balfour Beatty Rail GmbH for $1,103 in non-domestic cash. The German business provides track lubrication and switch roller equipment for international railway applications. The results of FWO are included within the Rail Products segment from the acquisition date through December 31, 2014 and were not material to the periods presented.

On December 30, 2014, the Company acquired Chemtec Energy Services, L.L.C. (Chemtec) for $66,719, net of cash received, which is inclusive of a $1,867 preliminary working capital adjustment. Located in Willis, TX, Chemtec is a manufacturer and turnkey provider of blending, injection, and metering equipment for the oil and gas industry. The results of operations of this acquired business are included within our Tubular Products segment from the acquisition date through December 31, 2014 and were not material to the periods presented.

Subsequent to year end, on January 13, 2015, the Company acquired the stock of Tew Holdings, LTD (Tew) for approximately $26,600, subject to the finalization of net debt and net working capital adjustments. Headquartered in Nottingham, UK, Tew provides application engineering solutions primarily to the rail market and other major industries. The transaction was funded with non-domestic cash.

More information regarding acquisitions is set forth in Part II, Item 8, Note 3 to the Consolidated Financial Statements included herein, which is incorporated by reference into this Item 1.

Rail Products

L.B. Foster Company’s Rail Products segment is comprised of several manufacturing and distribution businesses that provide a variety of products for railroads, transit authorities, industrial companies, and mining applications throughout North America and Europe. Our Rail Products segment has sales offices throughout the United States, Canada, and Europe and frequently bids on rail projects where it can offer products manufactured by the Company or sourced from numerous suppliers. These products may be provided as a package to rail lines, transit authorities, and construction contractors which reduces the customer’s procurement efforts and provides value added, just in time delivery. The segment is composed of the following business units: rail manufacturing and distribution, Rail Technologies, and pre-stressed CXT Concrete Tie products.

Rail manufacturing and distribution

The rail manufacturing and distribution business sells heavy and light new rail mainly to transit authorities, industrial companies, and rail contractors for railroad sidings, plant trackage, and other carrier and material handling applications. Rail accessories include trackwork, track spikes, bolts, angle bars, and other products required

4

Table of Contents

to install or maintain rail lines. These products are sold to railroads, rail contractors, industrial customers, and transit agencies and are manufactured by the Company or purchased from other manufacturers.

The Company’s Allegheny Rail Products (ARP) division engineers and markets insulated rail joints and related accessories for the railroad and mass transit industries. Insulated joints are manufactured at the Company’s facilities in Pueblo, CO and Niles, OH.

The Company’s Transit Products division supplies power rail, direct fixation fasteners, coverboards, and special accessories primarily for mass transit systems. Most of these products are manufactured by subcontractors and are usually sold by sealed bid to transit authorities or to rail contractors worldwide.

The Company’s Trackwork division sells trackwork for industrial and export markets. The Company also has two facilities that design, test, and fabricate rail products in Atlanta, GA and Niles, OH.

Rail Technologies

L.B. Foster Rail Technologies, Corp. (Rail Technologies) engineers, manufactures, and assembles friction management products, railway wayside data collection and management systems, and related products. It also engineers and manufactures stick friction modifiers and related application systems. The Company’s friction management products control the friction at the rail/wheel interface, helping to lower fuel usage and improve train-operating efficiency, extend the life of operating assets such as rail and wheels, reduce track stresses, and lower related maintenance and operating costs for customers. Friction management products include mobile and wayside application systems that distribute lubricants and solid and liquid friction modifiers. Friction management products are designed, engineered, manufactured, and assembled in the United States and by certain wholly-owned subsidiaries located in Burnaby, British Columbia, Canada, Sheffield, United Kingdom, and Dusseldorf, Germany.

The Rail Technology business also manufactures a variety of track component products at our manufacturing facilities in St. Jean, Quebec, Canada and the United Kingdom. In Canada, these products primarily include rail anchors and rail spikes, which are products that are used to secure rails to wooden ties to restrain the movement of the rail. These products are sold primarily to Canadian railroads, with some products exported to the United States and to other international customers. In the United Kingdom, we design and manufacture a complete line of rail joints including epoxy insulated rail joints and nylon-encapsulated insulated joints, and also distribute a complete line of track fasteners to the United Kingdom railways and to other international customers.

Our 2014 acquisition of the railroad tuning unit, FWO, a business of Balfour Beatty Rail GmbH enhances our offerings to provide track lubrication and switch roller equipment for international railway applications.

Pre-stressed CXT Concrete Ties

The concrete products business, through the Company’s subsidiary, CXT Incorporated, manufactures engineered concrete railroad ties for the railroad and transit industries at its facilities in Spokane, WA and Tucson, AZ.

Construction Products

The Construction products segment is composed of the following business units: Piling Products, Fabricated Bridge Products, and precast concrete buildings and products.

Piling Products

Sheet piling products are interlocking structural steel sections that are generally used to provide lateral support at construction sites. Bearing piling products are steel H-beam sections which are driven into the ground for support of structures such as bridge piers and high-rise buildings. Piling is often used in water and land applications including cellular cofferdams and OPEN CELL® structures in inland river systems and ports.

Piling products are sourced from various manufacturers and either sold or rented to project owners and contractors. The piling division, via a sales force deployed throughout the United States, markets and sells piling

5

Table of Contents

domestically and internationally. This division offers its customers various types and dimensions of structural beam piling, sheet piling, and pipe piling. The Company is the primary distributor of domestic steel sheet piling for its primary supplier.

Fabricated Bridge Products

The fabricated products facility in Bedford, PA manufactures a number of fabricated steel and aluminum products primarily for the highway, bridge, and transit industries including concrete reinforced grid deck, open steel grid deck, aluminum bridge railing, and stay-in-place bridge forms.

Concrete Products

The CXT concrete buildings unit manufactures concrete buildings primarily for national, state, and municipal parks. This unit manufactures restrooms, concession stands, and other protective storage buildings available in multiple designs, textures, and colors. The Company is a leading high-end supplier in terms of volume, product options, and capabilities. The buildings are manufactured in Spokane, WA and Hillsboro, TX. The Company’s 2014 acquisition of Carr Concrete enhances our presence in the concrete buildings market while increasing our product portfolio to include burial vaults, bridge beams, box culverts, and other pre-stressed and precast concrete products. Carr Concrete products are distributed from the Company’s Waverly, WV facility.

Sales of the Company’s construction products are partly dependent upon the level of activity in the construction industry. Accordingly, sales of these products have traditionally been somewhat higher during the second and third quarters than during the first and fourth quarters of each year.

Tubular Products

The Tubular products segment has three discrete business units: Coated Pipe, Threaded Products, and measurement products and systems.

Coated Pipe

There are two pipeline services locations that make up our Coated Pipe business unit. Our Birmingham, AL facility coats the outside diameter and, to a lesser extent, the inside diameter of pipe primarily for oil & gas transmission pipelines. This location partners with its primary customer, a pipe manufacturer, to market fusion bonded epoxy coatings, abrasion resistant coatings, and internal linings for a wide variety of pipe diameters for pipeline projects throughout North America. The second location (Ball Winch), acquired on November 7, 2013, is located in Willis, TX. The Willis facility applies specialty outside and inside diameter coatings for oil & gas transmission, mining, and waste water pipelines. This location also provides custom coatings for specialty fittings and field service connections.

Threaded Products

The Threaded Products unit, located in Magnolia, TX, cuts, threads, and paints pipe primarily for water well applications for the agriculture industry and municipal water authorities. This location also provides threading services for the Oil Country Tubular Goods markets.

Measurement Products and Systems

Our December 30, 2014 acquisition of Chemtec enhanced the Tubular product offering into an adjacent market to include the manufacturing and provision of blending, injection, and metering equipment for the oil and gas industry.

L.B. Pipe Joint Venture

The Company is a member of a joint venture, LB Pipe & Coupling Products, LLC (LB Pipe JV), in which it maintains a 45% ownership interest. The LB Pipe JV manufactures, markets, and sells various precision couplings and other tubular products for the energy, utility, and construction markets and is scheduled to terminate on June 30, 2019. The Company has made all of its mandatory capital contributions under the JV agreement, totaling $3,000. More information concerning the JV is set forth in Part II, Item 8, Note 9 to the Consolidated Financial Statements included herein, which is incorporated by reference into this Item 1.

6

Table of Contents

Geographic and Segment Information

The following table shows, for the last three fiscal years, the net sales generated by each of the current business segments as a percentage of total net sales.

| Percentage of Net Sales |

||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Rail Products |

62 | % | 61 | % | 63 | % | ||||||

| Construction Products |

29 | 32 | 29 | |||||||||

| Tubular Products |

9 | 7 | 8 | |||||||||

|

|

|

|

|

|

|

|||||||

| 100 | % | 100 | % | 100 | % | |||||||

|

|

|

|

|

|

|

|||||||

Information concerning the Company’s liquidity and capital resources and the Company’s working capital requirements can be found in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Marketing and Competition

L.B. Foster Company generally markets its rail, construction, and tubular products directly in all major industrial areas of the United States, Canada, and Europe through a sales force of approximately 80 people. The Company also utilizes a network of agents across Europe, South America, and Asia to supplement its internal sales force to reach current customers and cultivate potential customers in these areas. For the years ended 2014, 2013, and 2012, approximately 18%, 17%, and 18%, respectively, of the Company’s total sales were outside the United States.

The major markets for the Company’s products are highly competitive. Product availability, quality, service, and price are principal factors of competition within each of these markets. No other company provides the same product mix to the various markets the Company serves. However, there are one or more companies that compete with the Company in each product line. Therefore, the Company faces significant competition from different groups of companies.

During 2014, 2013, and 2012, no single customer accounted for more than 10% of the Company’s consolidated net sales.

Raw Materials and Supplies

Most of the Company’s inventory is purchased in the form of finished or semi-finished product. The Company purchases the majority of its inventory from domestic and foreign steel producers. The Company has an agreement with a steel mill to distribute steel sheet piling in North America. Should sheet piling from its present supplier not be available for any reason, the Company risks not being able to provide product to its customers.

The Company’s purchases from foreign suppliers are subject to the usual risks associated with changes in international conditions and to United States laws which could impose import restrictions on selected classes of products and for anti-dumping duties if products are sold in the United States below certain prices.

Backlog

The dollar amount of firm, unfilled customer orders at December 31, 2014 and 2013 by business segment is as follows:

| December 31, | ||||||||

| 2014 | 2013 | |||||||

| Rail Products |

$ | 104,821 | $ | 121,853 | ||||

| Construction Products |

65,843 | 53,483 | ||||||

| Tubular Products |

13,686 | 7,775 | ||||||

|

|

|

|

|

|||||

| Total from Continuing Operations |

$ | 184,350 | $ | 183,111 | ||||

|

|

|

|

|

|||||

7

Table of Contents

Approximately 2% of the December 31, 2014 backlog is related to projects that will extend beyond 2015. Backlog from businesses acquired during 2014 represented 6% of the total.

Research and Development

Expenditures for research and development approximated $3,096, $3,154, and $2,926 in 2014, 2013, and 2012, respectively. These expenditures were predominately associated with the Company’s Rail Technologies business.

Patents and Trademarks

The Company owns a number of United States, Canadian, and European patents and trademarks. The Company has several patents on its Rail Technologies products, such as the Protector® IV application system, along with a significant number of patents related to its friction modifier product lines at Rail Technologies, which are of material importance to the business as a whole. We believe that, in the aggregate, our patents and trademarks give us a competitive advantage. We also rely on a combination of trade secrets and other intellectual property laws, non-disclosure agreements, and other protective measures to establish and protect our proprietary rights in intellectual property.

Environmental Disclosures

It is not possible to predict the outcome of actions regarding environmental matters, particularly for future remediation and other compliance efforts. The Company has recorded its estimate of the outcome of certain environmental matters. In the opinion of management, compliance with current environmental protection laws will not have a material adverse effect on the financial condition, competitive position, or capital expenditures of the Company. However, the Company’s efforts to comply with stringent environmental regulations may have an adverse effect on the Company’s future earnings.

See Item 3, Legal Proceedings included herein, for information regarding the Company’s environmental reserves which is incorporated by reference into this Item I.

Employees and Employee Relations

As of December 31, 2014, the Company had approximately 1,113 employees, 118 of whom were located in Canada, 70 of whom were located in Europe, with the remaining employees located in the United States. There were 591 hourly production workers and 522 salaried employees. Of the hourly production workers, approximately 190 are represented by unions. The Company has not suffered any major work stoppages during the past five years and considers its relations with its employees to be satisfactory. No significant collective bargaining agreements expire prior to 2017.

Substantially all of the Company’s hourly paid employees are covered by one of the Company’s noncontributory, defined benefit plans or defined contribution plans. Substantially all of the Company’s salaried employees are covered by defined contribution plans.

Financial Information about Geographic Areas

Financial information about geographic areas is set forth in Part II, Item 8, Note 2 to the Consolidated Financial Statements included herein, which is incorporated by reference into this Item 1.

Financial Information about Segments

Financial information about segments is set forth in Part II, Item 8, Note 2 to the Consolidated Financial Statements included herein, which is incorporated by reference into this Item 1.

8

Table of Contents

Executive Officers of the Registrant

Information concerning the executive officers of the Company is set forth below.

| Name |

Age |

Position | ||||

| Robert P. Bauer |

56 | President and Chief Executive Officer | ||||

| Merry L. Brumbaugh |

57 | Vice President — Tubular Products | ||||

| Samuel K. Fisher |

62 | Vice President — Rail Distribution | ||||

| Patrick J. Guinee |

45 | Vice President, General Counsel and Secretary | ||||

| John F. Kasel |

49 | Senior Vice President — Rail Products | ||||

| Brian H. Kelly |

55 | Vice President — Human Resources and Administration | ||||

| Gregory W. Lippard |

46 | Vice President — Rail Sales and Products | ||||

| Konstantinos Papazoglou |

62 | Vice President — Rail Technologies | ||||

| David J. Russo |

56 | Senior Vice President, Chief Financial Officer and Treasurer | ||||

| David R. Sauder |

44 | Vice President — Global Business Development | ||||

| Christopher T. Scanlon |

39 | Controller and Chief Accounting Officer | ||||

Mr. Bauer was elected President and Chief Executive Officer upon joining the Company in February 2012. Prior to joining the Company, Mr. Bauer previously served from June 2011 as President of the Refrigeration Division of the Climate Technologies business of Emerson Electric Company, a diversified global manufacturing and technology company. From January 2002 until May 2011, Mr. Bauer served as President of Emerson Network Power’s Liebert Division.

Ms. Brumbaugh was elected Vice President — Tubular Products in November 2004, having previously served as General Manager, Coated Products since 1996. Ms. Brumbaugh has served in various capacities with the Company since her initial employment in 1980.

Mr. Fisher’s was elected Vice President — Rail Distribution effective January 2011, as part of organizational changes within the Rail Products segment, having previously served as Senior Vice President — Rail since October 2002. From June 2000 until October 2002, Mr. Fisher served as Senior Vice President — Product Management. From October 1997 until June 2000, Mr. Fisher served as Vice President — Rail Procurement. Prior to October 1997, Mr. Fisher served in various other capacities with the Company since his employment in 1977.

Mr. Guinee was elected Vice President, General Counsel and Secretary in February 2014. Prior to joining the Company, Mr. Guinee served as Vice President — Securities & Corporate and Assistant Secretary at Education Management Corporation from July 2013 to February 2014, and was employed by H. J. Heinz Company from November 1997 to June 2013, last serving as Vice President — Corporate Governance & Securities and Assistant Secretary. He began his career as an attorney in private practice in Pittsburgh, PA in 1994.

Mr. Kasel was elected Senior Vice President — Rail Products in August 2012 having previously served as Senior Vice President — Operations and Manufacturing since May 2005 and Vice President — Operations and Manufacturing since April 2003. Mr. Kasel served as Vice President of Operations for Mammoth, Inc., a Nortek company from 2000 to 2003. His career also included General Manager of Robertshaw Controls and Operations Manager of Shizuki America prior to 2000.

Mr. Kelly was elected Vice President — Human Resources and Administration in August 2012 having previously served as Vice President, Human Resources since October 2006 after joining the organization in September 2006. Prior to joining the Company, Mr. Kelly headed Human Resources for 84 Lumber Company from June 2004. Previously, he served as a Director of Human Resources for American Greetings Corp. from June 1994 to June 2004, and he began his career with Nabisco in 1984, serving in progressively responsible generalist human resources positions in both plants and headquarters.

Mr. Lippard was elected Vice President — Rail Sales and Products in August 2012 having previously served as Vice President — Rail Product Sales since June 2000. Prior to re-joining the Company in 2000,

9

Table of Contents

Mr. Lippard served as Vice President — International Trading for Tube City, Inc. from June 1998. Mr. Lippard served in various other capacities with the Company since his initial employment in 1991.

Mr. Papazoglou was elected Vice President — Rail Technologies in August 2012 having previously served as Vice President — Friction Management since March 2011. Prior to joining the Company in December 2010, Mr. Papazoglou served as Executive Vice President and Chief Operating Officer for Portec Rail Products, Inc. from October 2006. Mr. Papazoglou served in various other capacities with Portec since his initial employment in 1978.

Mr. Russo is the Senior Vice President, Chief Financial Officer and Treasurer having resigned as Chief Accounting Officer in August 2012 upon the appointment of Mr. Scanlon as Controller and Chief Accounting Officer in August 2012. Mr. Russo was previously elected Senior Vice President, Chief Financial and Accounting Officer and Treasurer in March 2010 having served previously as Senior Vice President, Chief Financial Officer and Treasurer since December 2002. From July 2002 to December 2002, Mr. Russo served as Vice President and Chief Financial Officer. Mr. Russo was Corporate Controller of WESCO International Inc. from 1999 until joining the Company in 2002. Prior to 1999, Mr. Russo served as Corporate Controller of Life Fitness Inc.

Mr. Sauder was elected Vice President — Global Business Development upon joining the Company in November 2008. Prior to joining the Company, Mr. Sauder was Director, Global Business Development at Joy Mining Machinery where he was responsible for leading mergers and acquisitions and new business initiatives from December 2007. Prior to that, he was Manager, Business Development for Eaton Corporation from April 2006 to December 2007. He previously held various positions of increasing responsibility at Duquesne Light Company from August 1998 to April 2006 and PNC Bank from February 1993 to August 1998.

Mr. Scanlon was elected Controller and Chief Accounting Officer in August 2012 after joining the Company in July 2012. Prior to joining the Company, Mr. Scanlon served as the Online Higher Education Division Controller of Education Management Corporation from November 2009 to July 2012. Mr. Scanlon served as Manager of Central Accounting Services for Bayer Corporation, from May 2007 until November 2009. From April 2005 until May 2007, Mr. Scanlon served as a financial reporting analyst for Respironics, Inc.

Officers are elected annually at the organizational meeting of the Board of Directors following the annual meeting of stockholders.

Code of Ethics

L.B. Foster Company has a legal and ethical conduct policy applicable to all directors and employees, including its Chief Executive Officer, Chief Financial Officer and Controller. This policy is posted on the Company’s website, www.lbfoster.com. The Company intends to satisfy the disclosure requirement regarding certain amendments to, or waivers from, provisions of its policy by posting such information on the Company’s website. In addition, our ethics hotline can also be used by employees and others for the anonymous communication of concerns about financial controls, human resource concerns, and other reporting matters.

Available Information

The Company makes certain filings with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments and exhibits to those reports, available free of charge through its website, www.lbfoster.com, as soon as reasonably practicable after they are filed with the SEC. These filings are also available at the SEC’s Public Reference Room at 100 F Street N.E. Washington, D.C. 20549 or by calling 1-800-SEC-0330. These filings are also available on the internet at www.sec.gov. The Company’s press releases and recent investor presentations are also available on its website.

10

Table of Contents

| ITEM 1A. | RISK FACTORS |

Risks and Uncertainties

We operate in a changing environment that involves numerous known and unknown risks and uncertainties that could have a material adverse effect on our business, financial condition, and results of operations. The following risks highlight some of the more significant factors that have affected us and could affect us in the future. We may also be affected by unknown risks or risks that we currently believe are immaterial. If any such events actually occur, our business, financial condition, and results of operations could be materially adversely affected. You should carefully consider the following factors and other information contained in this Annual Report on Form 10-K before deciding to invest in our common stock.

We intend to pursue acquisitions, joint ventures, and strategic alliances that involve a number of inherent risks, any of which may cause us not to realize anticipated benefits.

We evaluate acquisition opportunities that have the potential to support and strengthen our business. We can give no assurances that the opportunities will be consummated or that financing will be available. In addition, acquisitions involve inherent risks that the acquired business will not perform in accordance with our expectations. We may not be able to achieve the synergies and other benefits we expect from the integration as successfully or rapidly as projected, if at all. Our failure to integrate newly-acquired operations could prevent us from realizing our expected rate of return on an acquired business and could have a material or adverse effect on our results of operations and financial condition.

Prolonged unfavorable economic and market conditions could adversely affect our business.

We could be adversely impacted by prolonged negative changes in economic conditions affecting either our suppliers or customers as well as the capital markets. Negative changes in government spending may result in delayed or permanent deferrals of existing or potential projects. No assurances can be given that we will be able to successfully mitigate various prolonged uncertainties including materials cost variability, delayed or reduced customer orders and payments, and access to available capital resources outside of operations.

In addition, current volatile market conditions and significant fluctuations in energy prices may continue for an extended period, negatively affecting our business prospects. The oil and gas markets are currently very volatile, and we cannot predict future oil and natural gas prices. Historically, oil and natural gas prices have been volatile and are subject to fluctuations in response to changes in supply and demand, market uncertainty, and a variety of additional factors that are beyond our control. Any prolonged substantial decline in the price of oil and natural gas will likely have a material adverse effect on our operations, and financial condition.

Concentration of Credit Risk

The Company has financial instruments that are exposed to concentrations of credit risk and consist primarily of cash and cash equivalents and trade accounts receivable. The Company routinely maintains cash and temporary cash investments at certain financial institutions in amounts substantially in excess of Federal Deposit Insurance Corporation (“FDIC”) and other jurisdictions insurance limits. Management believes that these financial institutions are of high quality and the risk of loss is minimal.

Our ability to maintain or improve our profitability could be adversely impacted by cost pressures as well as fluctuations in interest rates and foreign currency exchange rates.

Our profitability is dependent upon the efficient use of our resources. Rising inflation, labor costs, labor disruptions, and other increases in costs in the geographies where we operate could have a significant adverse impact on our profitability and results of operations.

The majority of our products and services are sold in the United States, Canada, and Europe. Fluctuations in the relative values of the United States dollar, Canadian dollar, British pound, and Euro will require adjustments in reported earnings and operations to reflect exchange rate translation in our Canadian and European sales and operations. If the United States dollar strengthens in value as compared to the value of the Canadian dollar,

11

Table of Contents

British pound, or Euro, our reported earnings in dollars from sales in those currencies will be unfavorable. Conversely, a favorable result will be reported if the United States dollar weakens in value as compared to the value of the Canadian dollar, British pound, or Euro.

Our business operates in highly competitive industries and a failure to react to changing market conditions could adversely impact our business.

We face strong competition in each of the markets in which we participate. A slow response to competitor pricing actions and new competitor entries into our product lines could negatively impact our overall pricing. Efforts to improve pricing could negatively impact our sales volume in all product categories. We may be required to invest more heavily to maintain and expand our product offerings. There can be no assurance that new product offerings will be widely accepted in the markets we serve. Significant negative developments in any of these areas could adversely affect our financial results and condition.

If we are unable to protect our intellectual property and prevent its improper use by third parties, our ability to compete may be harmed.

We own a number of patents and trademarks under the intellectual property laws of the United States, Canada, Europe, and other countries where product sales are possible. However, we have not perfected patent and trademark protection of our proprietary intellectual property for all products in all countries. The decision not to obtain patent and trademark protection in other countries may result in other companies copying and marketing products that are based upon our proprietary intellectual property. This could impede growth into new markets where we do not have such protections and result in a greater supply of similar products in such markets, which in turn could result in a loss of pricing power and reduced revenue.

We are subject to cybersecurity risks and may incur increasing costs in an effort to minimize those risks.

Our business employs systems and websites that allow for the storage and transmission of proprietary or confidential information regarding our customers, employees, job applicants, and other parties, including financial information, intellectual property, and personal identification information. Security breaches and other disruptions could compromise our information, expose us to liability, and harm our reputation and business. The steps we take to deter and mitigate these risks may not be successful. We may not have the resources or technical sophistication to anticipate or prevent current or rapidly evolving types of cyber-attacks. Data and security breaches can also occur as a result of non-technical issues, including intentional or inadvertent breach by our employees or by persons with whom we have commercial relationships. Any compromise or breach of our security could result in a violation of applicable privacy and other laws, legal and financial exposure, negative impacts on our customers’ willingness to transact business with us, and a loss of confidence in our security measures, which could have an adverse effect on our results of operations and our reputation.

We are dependent upon key customers.

We could be adversely affected by changes in the business or financial condition of a customer or customers. A significant decrease in capital spending by our railroad customers could negatively impact our product revenue. Our CXT concrete rail products division and ARP division are dependent on the Union Pacific Railroad (UPRR) for a significant portion of their business. No assurances can be given that a significant downturn in the business or financial condition of a customer, or customers, would not impact our results of operations and/or financial condition.

An adverse outcome in any pending or future litigation or pending or future warranty claims against the Company or its subsidiaries or our determination that a customer has a substantial product warranty claim could negatively impact our financial results and/or our financial condition.

We are party to various legal proceedings. In addition, from time to time our customers assert claims against us relating to the warranties which apply to products we sell. There is the potential that a result materially adverse to us or our subsidiaries in pending or future legal proceedings or pending or future product warranty claims could materially exceed any accruals we have established and adversely affect our financial results and/or

12

Table of Contents

financial condition. In January 2015 the UPRR filed a lawsuit against the Company asserting that we were in material breach of our 2012 amended supply agreement with the UPRR due to claimed failures to provide warranty ties to replace alleged defective concrete ties. UPRR seeks various types of relief including incidental, consequential, and other damages in amounts to be determined at trial under various legal theories. See “Executive Level Overview” for additional information regarding the UPRR’s lawsuit. We continue to work with UPRR in an attempt to reach a resolution on this matter. However, we cannot predict that such discussions will be successful, the results of litigation, or whether any settlement or judgment amounts will be within the range of our estimated accruals for loss contingencies. Consequently, while we believe the claims in the UPRR lawsuit case are without merit, and we intend to vigorously defend ourselves, an adverse outcome could result in a substantial judgment against us that could have a material adverse effect on our financial condition. No assurances can be given that our current estimate of the number of defective concrete ties that need to be replaced will not increase and result in our having to take additional charges, or that UPRR will not terminate the 2012 amended supply agreement and recover damages under its lawsuit, which events could have a material adverse effect on our financial statements, results of operations, liquidity, and capital resources.

A portion of our sales are derived from our international operations, which exposes us to certain risks inherent in doing business on an international level.

Doing business outside the United States subjects the Company to various risks, including changing economic climate and political conditions, work stoppages, exchange controls, currency fluctuations, armed conflicts, and unexpected changes in United States and foreign laws relating to tariffs, trade restrictions, transportation regulations, foreign investments, and taxation. Increasing sales to foreign countries exposes the Company to increased risk of loss from foreign currency fluctuations and exchange controls as well as longer accounts receivable payment cycles. We have little control over most of these risks and may be unable to anticipate changes in international economic and political conditions and, therefore, unable to alter its business practices in time to avoid the adverse effect of any of these possible changes.

Violations of foreign governmental regulations, including the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws could result in fines, penalties, and criminal sanctions against the Company, its officers or both and could adversely affect our business.

Our foreign operations are subject to governmental regulations in the countries in which we operate as well as U.S. laws. These include regulations relating to currency conversion, repatriation of earnings, taxation of our earnings and the earnings of our personnel, and the increasing requirement in some countries to make greater use of local employees and suppliers, including, in some jurisdictions, mandates that provide for greater local participation in the ownership and control of certain local business assets.

The U.S. Foreign Corrupt Practices Act and similar other worldwide anti-corruption laws, such as the U.K. Bribery Act, prohibit improper payments for the purpose of obtaining or retaining business. Although we have established an internal control structure, corporate policies, compliance, and training processes to reduce the risk of violation, we cannot ensure that these procedures will protect us from violations of such policies by our employees or agents. Failure to comply with applicable laws or regulations could subject us to fines and penalties and suspension or debarment from contracting. Events of non-compliance could harm our reputation, reduce our revenues and profits, and subject us to criminal and civil enforcement actions. Violations of such laws or allegations of violation could disrupt our business and result in material adverse results to our operating results or future profitability.

Certain divisions of our business depend on a small number of suppliers. The loss of any such supplier could have a material adverse effect on our business, financial condition, and result of operations.

In our rail and piling distributed products businesses, we rely on a limited number of suppliers for key products that we sell to our customers. No assurances can be given that a significant downturn in the business of one or more of these suppliers, a disruption in their manufacturing operations, an unwillingness to continue to sell to us, or a disruption in the availability of existing and new piling and rail products would not adversely impact our financial results.

13

Table of Contents

Fluctuations in the price, quality, and availability of the primary raw materials used in our business could have a material adverse effect on our operations and profitability.

Most of our businesses utilize steel as a significant product component. The steel industry is cyclical and prices and availability are subject to these cycles as well as to international market forces. We also use significant amounts of cement and aggregate in our concrete railroad tie and our precast concrete products businesses. No assurances can be given that our financial results would not be adversely affected if prices or availability of these materials were to change in a significantly unfavorable manner.

Labor disputes may have a material adverse effect on our operations and profitability.

Four of our manufacturing facilities are staffed by employees represented by labor unions. Approximately 190 employees employed at these facilities are currently working under three separate collective bargaining agreements.

In March 2014, we negotiated the renewal of the collective bargaining agreement with our Bedford, PA workforce represented by the Shopman’s Local Union Number 527. This agreement, covering approximately 50 employees, expires in March 2017.

In September 2014, we negotiated the renewal of the collective bargaining agreement with our Spokane, WA workforce represented by the United Steelworkers Local Number 338. This agreement, covering approximately 110 employees, expires in September 2017.

The bargaining unit in our St. Jean, Quebec, Canada workforce is represented by the Canadian Steel Workers Union Local Number 9443. This agreement, covering approximately 30 employees, was finalized in November 2013. A five year agreement was ratified that will expire in August 2018.

These collective bargaining agreements forbid the respective labor organizations from endorsing any work stoppage during the life of the agreements.

Our success is highly dependent on the continued service and availability of qualified personnel.

Much of our future success depends on the continued availability and service of key personnel, including our Chief Executive Officer, the executive team, and other highly skilled employees. Changes in demographics, training requirements, and the availability of qualified personnel could negatively affect our ability to compete and lead to a reduction in our profitability.

Our future performance and market value could cause write-downs of intangible assets in future periods.

We are required under U.S. generally accepted accounting principles to review intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is required to be tested for impairment at least annually. Factors that may be considered to be a change in circumstances indicating that the carrying value of our intangible assets may not be recoverable include, but are not limited to, a decline in stock price and market capitalization, a significant decrease in the market value of an asset, or a significant decrease in operating or cash flow projections. No assurances can be given that we will not be required to record a significant adverse charge to earnings during the period in which any impairment of its goodwill or intangible assets occurs.

We may not foresee or be able to control certain events that could adversely affect our business.

Unexpected events including fires or explosions at our facilities, natural disasters, armed conflicts, unplanned outages, equipment failures, failure to meet product specifications, or a disruption in certain of our operations may cause our operating costs to increase or otherwise impact our financial performance.

Shifting federal, state, local, and foreign regulatory policies impose risks to our operations.

We are subject to regulation from federal, state, local, and foreign regulatory agencies. We are required to comply with numerous laws and regulations and to obtain numerous authorizations, permits, approvals, and certificates from governmental agencies. Compliance with emerging regulatory initiatives, delays, discontinuations, or reversals of existing regulatory policies in the markets in which we operate could have an adverse effect on our business, results of operations, cash flows, and financial condition.

14

Table of Contents

A substantial portion of our operations are heavily dependent on governmental funding of infrastructure projects. Many of these projects have “Buy America” or “Buy American” provisions. Significant changes in the level of government funding of these projects could have a favorable or unfavorable impact on our operating results. Additionally, government actions concerning “Buy America” provisions, taxation, tariffs, the environment, or other matters could impact our operating results.

We may be impacted by new regulations related to conflict minerals.

The SEC, as directed in The Dodd-Frank Wall Street Reform and Consumer Protection Act, adopted new rules establishing disclosure and reporting requirements regarding the use of certain minerals referred to as “conflict minerals” in products. These new rules require us to determine, disclose, and report whether or not such conflict minerals originate from the Democratic Republic of the Congo or adjoining countries. The requirements could affect the sourcing, availability, and cost of minerals used in the manufacture of certain of the products we sell, including some that we contract to manufacture. In addition, our customers may require that our products be free of conflict minerals and our revenues may be harmed if we are unable to procure conflict-free minerals at a reasonable price. We may face reputation challenges with our customers and other stakeholders if we are unable to verify sufficiently the origins of all minerals used in our products.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

15

Table of Contents

| ITEM 2. | PROPERTIES |

The location and general description of the principal properties which are owned or leased by L.B. Foster Company, together with the segment of the Company’s business using such properties, are set forth in the following table:

| Location |

Function |

Acres |

Business |

Lease | ||||||

| Bedford, PA |

Bridge component fabricating plant. | 16 | Construction | Owned | ||||||

| Birmingham, AL |

Pipe coating facility. | 32 | Tubular | 2017 | ||||||

| Burnaby, British Columbia, Canada |

Friction management products plant. | N/A | Rail | 2021 | ||||||

| Columbia City, IN |

Rail processing facility and yard storage. | 22 | Rail | Owned | ||||||

| Hillsboro, TX |

Precast concrete facility. | 9 | Construction | Owned | ||||||

| Leicester, United Kingdom |

Material handling manufacturing plant. | N/A | Rail | 2019 | ||||||

| Magnolia, TX |

Threading facility and joint venture manufacturing facility. | 35 | Tubular | Owned | ||||||

| Niles, OH |

Rail fabrication, friction management products, and yard storage. | 35 | Rail | Owned | ||||||

| Petersburg, VA |

Piling storage facility. | 35 | Construction | Owned | ||||||

| Pueblo, CO |

Rail joint manufacturing. | 9 | Rail | Owned | ||||||

| Saint-Jean-sur-Richelieu, Quebec, Canada |

Rail anchors and track spikes manufacturing plant. | 17 | Rail | Owned | ||||||

| Sheffield, United Kingdom |

Track component and friction management products facility. | N/A | Rail | 2019 | ||||||

| Spokane, WA |

CXT concrete tie plant. | 13 | Rail | 2015* | ||||||

| Spokane, WA |

Precast concrete facility. | 5 | Construction | 2015* | ||||||

| Tucson, AZ |

CXT concrete tie plant. | 19 | Rail | 2017 | ||||||

| Waverly, WV |

Precast concrete facility. | 85 | Construction | Owned | ||||||

| Willis, TX (2) |

Pipe coating and measurement products and services facilities. | 84 | Tubular | Owned | ||||||

Included in the table above are certain facilities leased by the Company for which there is no acreage included in the lease. For these properties a “N/A” has been included in the “Acres” column.

*- Spokane lease is expected to be renewed during 2015.

Including the properties listed above, the Company has a total of 27 sales offices, including its headquarters in Pittsburgh, PA and 22 warehouses, plant, and yard facilities located throughout the United States, Canada, and Europe. The Company’s facilities are in good condition and suitable for the Company’s business as currently conducted and as currently planned to be conducted.

| ITEM 3. | LEGAL PROCEEDINGS |

Information regarding the Company’s legal proceedings and other commitments and contingencies is set forth in Part II, Item 8, Note 20 to the Consolidated Financial Statements included herein, which is incorporated by reference into this Item 3.

| ITEM 4. | MINE SAFETY DISCLOSURES |

This item is not applicable to the Company.

16

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Stock Market Information

The Company had 375 common shareholders of record on February 25, 2015. Common stock prices are quoted daily through the NASDAQ Global Select Market quotation service (Symbol: FSTR). The following table sets forth the range of high and low sales prices per share of our common stock for the periods indicated:

| 2014 | 2013 | |||||||||||||||||||||||

| Quarter |

High | Low | Dividends | High | Low | Dividends | ||||||||||||||||||

| First |

$ | 48.41 | $ | 40.09 | $ | 0.03 | $ | 45.43 | $ | 37.97 | $ | 0.03 | ||||||||||||

| Second |

54.68 | 44.82 | 0.03 | 46.45 | 39.63 | 0.03 | ||||||||||||||||||

| Third |

56.72 | 45.93 | 0.03 | 47.91 | 39.14 | 0.03 | ||||||||||||||||||

| Fourth |

54.41 | 43.81 | 0.04 | 50.00 | 42.71 | 0.03 | ||||||||||||||||||

Dividends

The Company’s September 23, 2014 credit facility permits it to pay dividends and distributions and make redemptions with respect to its stock providing no event of default or potential default (as defined in the facility agreement) has occurred prior to or after giving effect to the dividend, distribution, or redemption. Dividends, distributions, and redemptions are capped at $25,000 per year when funds are drawn on the facility. If no drawings on the facility exist, dividends, distributions, and redemptions in excess of $25,000 per year are subjected to a limitation of $75,000 in the aggregate. The $75,000 aggregate limitation also permits certain loans, strategic investments, and acquisitions.

In October 2014, the Company’s Board of Directors authorized an increase to the regular quarterly dividend to $0.04 per share.

17

Table of Contents

Performance Graph

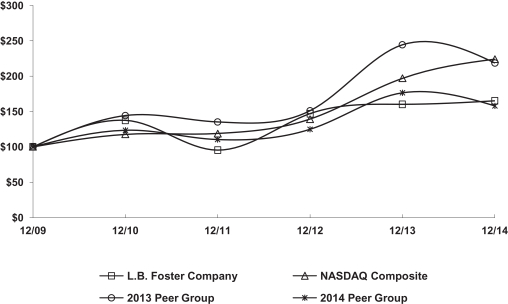

In 2014, the Company changed its peer group to align it with the Company’s comparator group as used by the Company’s compensation committee to evaluate the Company’s compensation practices. The Company’s new peer group (2014 Peer Group) consists of Accuride Corporation, Alamo Group, Inc., AM Castle & Co., American Railcar Industries, Inc., CIRCOR International, Inc., Columbus McKinnon Corporation, Furmanite Corporation, Gibraltar Industries, Inc., Houston Wire & Cable Company, Insteel Industries Inc., Lindsay Corporation, Lydall Inc., MYR Group, Inc., NN Inc., Northwest Pipe Co., Olympic Steel Inc., Orion Marine Group, Inc., Quanex Building Products Corporation, Raven Industries Inc., and Sterling Construction Co. Inc.

Prior to 2014, the Company’s old peer group (2013 Peer Group) consisted of Alamo Group, Inc., AM Castle & Co., American Railcar Industries, Inc., CIRCOR International, Inc., DXP Enterprises, Inc., Greenbrier Cos., Inc., Haynes International Inc., Houston Wire & Cable Company, Insteel Industries Inc., Lawson Products Inc., NN Inc., Olympic Steel Inc., RBC Bearings Inc., Skyline Corp., Sterling Construction Co. Inc., and Synalloy Corp.

The following tables compare total shareholder returns for the Company over the last five years to the NASDAQ Composite Index and the peer groups assuming a $100 investment made on December 31, 2009. Each of the four measures of cumulative total return assumes reinvestment of dividends. The stock performance shown on the graph below is not necessarily indicative of future price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among L.B. Foster Company, the NASDAQ Composite Index,

2013 Peer Group, and 2014 Peer Group

| * | $100 invested on 12/31/09 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. |

| 12/09 | 12/10 | 12/11 | 12/12 | 12/13 | 12/14 | |||||||||||||||||||

| L.B. Foster Company |

$100.00 | $137.34 | $95.22 | $146.67 | $160.11 | $164.88 | ||||||||||||||||||

| NASDAQ Composite |

100.00 | 117.61 | 118.70 | 139.00 | 196.83 | 223.74 | ||||||||||||||||||

| 2013 Peer Group |

100.00 | 144.08 | 135.09 | 150.81 | 244.08 | 218.48 | ||||||||||||||||||

| 2014 Peer Group |

100.00 | 123.58 | 110.11 | 124.66 | 176.21 | 157.97 | ||||||||||||||||||

18

Table of Contents

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as of December 31, 2014 with respect to compensation plans under which equity securities of the Company are authorized for issuance.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants, and rights |

Weighted-average exercise price of outstanding options, warrants, and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities to be issued upon exercise of outstanding options, warrants, or rights) |

|||||||||

| Equity compensation plans approved by shareholders |

7,500 | $ | 9.08 | 469,840 | ||||||||

| Equity compensation plans not approved by shareholders |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

7,500 | $ | 9.08 | 469,840 | ||||||||

|

|

|

|

|

|

|

|||||||

Under the 2006 Omnibus Incentive Plan, non-employee directors are automatically awarded up to 3,500 shares of the Company’s common stock as determined by the Board of Directors at each annual shareholder meeting at which such non-employee director is elected or re-elected, commencing May 24, 2006. Through December 31, 2014, there were 110,642 fully vested shares issued under the 2006 Omnibus Incentive Plan to non-employee directors. Additionally, pursuant to the 2006 Omnibus Incentive Plan, during 2014 and 2012 the Company issued approximately 14,000 and 34,000 fully-vested shares in lieu of a cash payment earned under separate three year incentive plans, respectively.

The Company grants eligible employees Restricted Stock and Performance Unit Awards under the 2006 Omnibus Plan. The forfeitable Restricted Stock Awards generally time-vest after a four year holding period, unless indicated otherwise by the underlying Restricted Stock Agreement. Performance Unit Awards are offered annually under separate three-year long-term incentive programs. Performance units are subject to forfeiture and will be converted into common stock of the Company based upon the Company’s performance relative to performance measures and conversion multiples as defined in the underlying program.

The 1998 Plan expired by its terms in 2008 and no awards may be granted under that Plan, which currently has outstanding stock option awards that expire in 2015.

The Company will withhold or employees may tender shares of restricted stock when issued to pay for withholding taxes. During 2014, 2013, and 2012, the Company withheld 21,676, 16,166, and 23,562 shares, respectively, for this purpose. The value of the shares withheld were $985, $708 and $669 in 2014, 2013, and 2012, respectively.

Issuer Purchases of Equity Securities

The Company’s purchases of equity securities for the three-month period ended December 31, 2014 were as follows:

| Total number of shares purchased(1) |

Average price paid per share |

Total number of shares purchased as part of publicly announced plans or programs(2) |

Approximate dollar value of shares that may yet be purchased under the plans or programs (in thousands) |

|||||||||||||

| October 1, 2014 — October 31, 2014 |

— | $ | — | — | $ | 15,000 | ||||||||||

| November 1, 2014 — November 30, 2014 |

— | — | — | 15,000 | ||||||||||||

| December 1, 2014 — December 31, 2014 |

1,375 | 48.40 | — | 15,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

1,375 | $ | 48.40 | — | $ | 15,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Reflects shares withheld by the Company to pay taxes upon vesting of restricted stock. |

| (2) | On December 4, 2013, the Board of Directors authorized the repurchase of up to $15,000 of the Company’s common shares until December 31, 2016. This authorization became effective January 1, 2014. |

19

Table of Contents

The Company did not purchase any common shares under the share repurchase authorization, however, the Company withheld shares for employee tax payments during the year. During the first quarter of 2014, the Company withheld 17,045 shares at an average price of $43.86. During the second quarter of 2014, the Company withheld 3,256 at an average price of $52.55. There were no share withholdings during the third quarter of 2014.

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data has been derived from our audited financial statements. The financial data presented below should be read in conjunction with the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements of the Company and the Notes thereto included elsewhere in this Annual Report on Form 10-K.

| Year Ended December 31, | ||||||||||||||||||||

| Income Statement Data |

2014(1) | 2013(2) | 2012(3) | 2011(4) | 2010(5) | |||||||||||||||

| Net sales |

$ | 607,192 | $ | 597,963 | $ | 588,541 | $ | 575,337 | $ | 467,058 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating profit |

$ | 37,082 | $ | 41,571 | $ | 22,657 | $ | 30,812 | $ | 31,217 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from continuing operations, net of tax |

$ | 25,654 | $ | 29,276 | $ | 14,764 | $ | 22,067 | $ | 20,006 | ||||||||||

| Income from discontinued operations, net of tax |

2 | 14 | 1,424 | 828 | 486 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 25,656 | $ | 29,290 | $ | 16,188 | $ | 22,895 | $ | 20,492 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings per common share: |

||||||||||||||||||||

| Continuing operations |

$ | 2.51 | $ | 2.88 | $ | 1.46 | $ | 2.16 | $ | 1.96 | ||||||||||

| Discontinued operations |

0.00 | 0.00 | 0.14 | 0.08 | 0.05 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings per common share |

$ | 2.51 | $ | 2.88 | $ | 1.60 | $ | 2.24 | $ | 2.01 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted earnings per common share: |

||||||||||||||||||||

| Continuing operations |

$ | 2.48 | $ | 2.85 | $ | 1.44 | $ | 2.14 | $ | 1.93 | ||||||||||

| Discontinued operations |

0.00 | 0.00 | 0.14 | 0.08 | 0.05 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted earnings per common share |

$ | 2.48 | $ | 2.85 | $ | 1.58 | $ | 2.22 | $ | 1.98 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends paid per common share |

$ | 0.13 | $ | 0.12 | $ | 0.10 | $ | 0.10 | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Operating profit represents the gross profit less selling and administrative expenses and amortization expense.

| (1) | 2014 includes CXT Concrete Tie warranty charges of $9,374 within the Rail Products segment. The 2014 results include the acquisitions of Carr Concrete (July 7), FWO (October 29), and Chemtec Energy Services, L.L.C. (December 30). More information about the warranty charges and acquisition activity can be found in Part II Item 8, Note 20 and Note 3, respectively, to the consolidated financial statements included herein, which is incorporated by reference into this Part II Item 6. |

| (2) | 2013 includes the results of L.B. Foster Ball Winch, Inc., which was formed for the purpose of acquiring assets of Ball Winch, LLC, beginning on November 7, 2013. |

| (3) | 2012 includes a $22,000 warranty charge and a pre-tax gain of $3,193, from the dispositions of SSD and Precise, in income from discontinued operations, net of tax. |

| (4) | 2011 includes a pre-tax gain of $577 associated with the early termination of the operating lease associated with the Company’s sale-leaseback transaction for our threaded products facility, formerly located in Houston, TX. |

| (5) | 2010 includes the results of Rail Technologies, beginning on December 15, 2010. |

| December 31, | ||||||||||||||||||||

| Balance Sheet Data |

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

| Total assets |

$ | 495,121 | $ | 413,654 | $ | 406,122 | $ | 379,894 | $ | 378,402 | ||||||||||

| Working capital |

138,908 | 171,885 | 184,423 | 155,261 | 142,303 | |||||||||||||||

| Long-term debt |

25,752 | 25 | 27 | 51 | 2,399 | |||||||||||||||

| Stockholders’ equity |

335,888 | 316,397 | 287,575 | 269,815 | 255,747 | |||||||||||||||

20

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

(Dollars in thousands, except share data unless otherwise noted)

Executive Level Overview

Recent Acquisitions by Segment

Construction Products Acquisition

On July 7, 2014, the Company acquired Carr Concrete Corporation (Carr) for $12,480. Carr is a provider of pre-stressed and precast concrete products located in Waverly, WV and the transaction was funded with cash on hand.

Rail Products Acquisitions

On October 29, 2014, the Company acquired FWO, a business of Balfour Beatty Rail GmbH for $1,103. The German business provides track lubrication and switch roller equipment for international railway applications.

Subsequent to year end, on January 13, 2015, the Company acquired the stock of Tew Holdings, LTD (Tew) for approximately $26,600, subject to the finalization of net debt and net working capital adjustments. Headquartered in Nottingham, UK, Tew provides application engineering solutions primarily to the rail market and other major industries. The transaction was funded with non-domestic cash.

Tubular Products Acquisition

On December 30, 2014, the Company acquired Chemtec Energy Services, L.L.C. (Chemtec) for $66,719, net of cash received, which is inclusive of a $1,867 preliminary working capital adjustment. Located in Willis, TX, Chemtec is a manufacturer and turnkey provider of blending, injection, and metering equipment for the oil and gas industry.

2014 Developments

In addition to the acquisitions, 2014 included many developments that will provide efficiencies and opportunities to expand our product lines. During 2014, we:

| Ÿ | Generated $66,616 in cash flows from operations to fund current year acquisitions and strategic capital investments. |

| Ÿ | Completed the centralization of our friction management operations to increase our product offerings while reducing our overhead costs. |

| Ÿ | Entered into the completion phase of our facility upgrades at our Birmingham, AL facility which will lead to increased production capacity and efficiency. |

| Ÿ | Completed a track expansion in the Columbia City, IN yard to significantly increase efficiency. |

| Ÿ | Purchased an additional facility in Bedford, PA to support growth in our corrugated bridge business. |

| Ÿ | Amended our credit agreement from a maximum credit line of $125,000 with a $50,000 accordion feature to a maximum credit line of $200,000 with a $100,000 accordion feature. |

| Ÿ | Increased the quarterly dividend 33% to $0.04 per share during the fourth quarter. |

| Ÿ | Selected an enterprise resource planning system and acquired the software to begin the implementation. |

Union Pacific Railroad (UPRR) Product Warranty Claim

On July 12, 2011, the UPRR notified (UPRR Notice) the Company and its subsidiary, CXT Incorporated (CXT), of a warranty claim under CXT’s 2005 supply contract relating to the sale of pre-stressed concrete railroad ties to the UPRR. The UPRR asserted that a significant percentage of concrete ties manufactured in 2006

21

Table of Contents

through 2011 at CXT’s Grand Island, NE facility failed to meet contract specifications, had workmanship defects and were cracking and failing prematurely. Of the 3.0 million ties manufactured between 1998 and 2011 from the Grand Island, NE facility, approximately 1.6 million ties were sold during the period the UPRR had claimed nonconformance. The 2005 contract called for each concrete tie which failed to conform to the specifications or had a material defect in workmanship to be replaced with 1.5 new concrete ties, provided, that UPRR within five years of the sale of a concrete tie, notified CXT of such failure to conform or such defect in workmanship. The UPRR Notice did not specify how many ties manufactured during this period were defective nor the exact nature of the alleged workmanship defect.

Following the UPRR Notice, the Company worked with material scientists and pre-stressed concrete experts to test a representative sample of Grand Island, NE concrete ties and assess warranty claims for certain concrete ties made in its Grand Island, NE facility between 1998 and 2011. The Company discontinued manufacturing operations in Grand Island, NE in early 2011.

2012