Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - NAVIGANT CONSULTING INC | d867242dex321.htm |

| EX-31.2 - EX-31.2 - NAVIGANT CONSULTING INC | d867242dex312.htm |

| EX-21.1 - EX-21.1 - NAVIGANT CONSULTING INC | d867242dex211.htm |

| EX-23.1 - EX-23.1 - NAVIGANT CONSULTING INC | d867242dex231.htm |

| EXCEL - IDEA: XBRL DOCUMENT - NAVIGANT CONSULTING INC | Financial_Report.xls |

| EX-31.1 - EX-31.1 - NAVIGANT CONSULTING INC | d867242dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 1-12173

Navigant Consulting, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 36-4094854 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

30 South Wacker Drive, Suite 3550, Chicago, Illinois 60606

(Address of principal executive offices, including zip code)

(312) 573-5600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO þ

As of February 9, 2015, 48,086,915 shares of the registrant’s common stock, par value $0.001 per share (“Common Stock”), were outstanding. The aggregate market value of shares of the Common Stock held by non-affiliates, based upon the closing sale price per share of the Common Stock on the New York Stock Exchange on June 30, 2014, was approximately $846.0 million.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information from the registrant’s definitive Proxy Statement for its Annual Meeting of Shareholders, scheduled to be held on May 14, 2015, is incorporated by reference into Part III of this report. The registrant intends to file the Proxy Statement with the Securities and Exchange Commission within 120 days of December 31, 2014.

Table of Contents

NAVIGANT CONSULTING, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

| Page | ||||||

| PART I | ||||||

| Item 1. |

4 | |||||

| Item 1A. |

9 | |||||

| Item 1B. |

17 | |||||

| Item 2. |

17 | |||||

| Item 3. |

17 | |||||

| Item 4. |

17 | |||||

| 18 | ||||||

| PART II | ||||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 19 | ||||

| Item 6. |

22 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 | ||||

| Item 7A. |

43 | |||||

| Item 8. |

44 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

44 | ||||

| Item 9A. |

44 | |||||

| Item 9B. |

44 | |||||

| PART III | ||||||

| Item 10. |

46 | |||||

| Item 11. |

46 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 46 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

46 | ||||

| Item 14. |

46 | |||||

| PART IV | ||||||

| Item 15. |

47 | |||||

| F-2 | ||||||

| F-3 | ||||||

| F-4 | ||||||

| F-5 | ||||||

| F-6 | ||||||

| F-7 | ||||||

| S-1 | ||||||

2

Table of Contents

Forward-Looking Statements

Statements included in this report which are not historical in nature are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may generally be identified by words such as “anticipate,” “believe,” “intend,” “estimate,” “expect,” “plan,” “outlook” and similar expressions. We caution readers that there may be events in the future that we are not able to accurately predict or control and the information contained in the forward-looking statements is inherently uncertain and subject to a number of risks that could cause actual results to differ materially from those contained in or implied by the forward-looking statements, including the factors described in the section entitled “Risk Factors” and Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations in this report. We cannot guarantee any future results, levels of activity, performance or achievement, and we undertake no obligation to update any of the forward-looking statements contained in this report.

3

Table of Contents

PART I

| Item 1. | Business. |

Navigant Consulting, Inc. (“we,” “us,” or “our”) is an independent specialized, global professional services firm that combines deep industry knowledge with technical expertise to enable companies to defend, protect and create value. We focus on industries and clients facing transformational change and significant regulatory and legal issues. We serve clients primarily in the healthcare, energy and financial services sectors which represent highly complex market and regulatory environments. Our professional service offerings include strategic, financial, operational, technology, risk management, compliance, investigative solutions, dispute resolution services and business process management services. We provide our services to companies, legal counsel and governmental agencies. Our business is organized in four reporting segments — Disputes, Investigations & Economics; Financial, Risk & Compliance; Healthcare; and Energy.

We are a Delaware corporation incorporated in 1996 and headquartered in Chicago, Illinois. Our executive office is located at 30 South Wacker Drive, Suite 3550, Chicago, Illinois 60606. Our telephone number is (312) 573-5600. Our common stock is traded on the New York Stock Exchange under the symbol “NCI.”

General Development of the Business

Development of the Business — Reporting Segments

Our business is organized in four reporting segments — Disputes, Investigations & Economics; Financial, Risk & Compliance; Healthcare; and Energy. Within these segments we deliver consulting services as well as offerings that include providing technology-based solutions, data hosting or processing, and business process management services (which we refer to as Technology, Data & Process services herein). In addition, we conduct business across our segments through operations in various countries outside the United States. Since our inception, we have grown through selective acquisitions of businesses (which we consider inorganic growth), recruitment of employees and investments in technology to complement our consulting skills and enhance our service offerings (which we consider organic growth). These investments have enhanced or expanded existing expertise, added new services, broadened our geographic reach, and enhanced our market share.

Our Disputes, Investigations & Economics segment provides accounting, financial and economic analysis, discovery support, and data management and analytics services across a wide range of legal and business issues and industries. We have established and maintained dispute services (including commercial litigation, financial services disputes, construction-related disputes, insurance and environmental disputes, and international arbitration) and investigative and compliance-related services (forensic investigations, information security investigations), including services specific to the healthcare and life sciences industries, and economic consulting through investments in acquisitions, recruitment of senior hires and technology. These investments have added to our suite of services and expanded those services to offices across the United States and outside the United States. In addition, we have recently expanded our global presence in the construction disputes market through a combination of acquisitions and recruitment of senior hires. Our continued senior hiring in this segment has been focused on adding broad industry expertise in our key markets, in addition to maintaining presence in key geographic markets around the globe. We have also grown our e-discovery and dispute related analytics services through a combination of senior hires, investment in technology, and acquisitions. In doing so, we have migrated the business from what was once locally managed data centers to centralized management. We have also developed technology tools that aid our client-facing employees in delivering value to our clients.

Within our Financial, Risk & Compliance segment, a substantial portion of our growth has been organic. The strategic, operational, valuation, and risk management services within this segment were largely developed over time through the recruitment of senior hires. Within this segment, we have supplemented our organic growth through acquisitions, adding anti-money laundering and anti-fraud related services. The combination of senior hiring and acquisitions has also helped establish a more formidable presence in New York. New York is home to a large portion of the financial services market in the US, which is one of our key industry focus areas, particularly for this segment. We believe building a larger presence in New York creates more opportunities to

4

Table of Contents

remain connected with clients in the industry, as well as to have capacity to serve those clients locally. Senior hiring remains a key growth driver for this segment, as we continue to add capacity to provide services, while further broadening our expertise in the continuously changing regulatory environment around the financial services industry. Services in this segment have the potential to escalate into large scale compliance oriented engagements. We have developed technology tools that complement our consulting base by helping our client-facing employees and clients more efficiently identify compliance risks, and to streamline operational activities.

Our Energy segment has grown through a combination of employee and solution development, recruiting and acquisitions. These investments have expanded our operations in markets and geographies with significant utility, government and commercial client presence in the energy sector. We have further expanded our consulting offerings to assist clients in their implementation of strategy and new business models and creating sustainable excellence in areas such as investment management, integrated resource planning, renewables, distributed energy resources, energy efficiency and demand response, and transmission and distribution operations. We believe our Energy segment has created an organization that combines market insights and business strategy knowledge with exceptional operational and technical experience to deliver financially viable and sustainable solutions for our clients on a global basis. We have grown our benchmarking and research services through acquisitions that now enable a broad array of market research capabilities (included in our Technology, Data & Process services).

We have focused significant investment resources on our Healthcare segment. We continue to recruit senior hires to build a multi-functional consulting team that spans the spectrum of the healthcare landscape including health systems, physician practice groups, health insurance providers, government agencies and life sciences companies. In addition, we’ve broadened our services to include strategic, operational, performance improvement, and revenue cycle consulting offerings. Largely through acquisitions, and including our most recent addition of Cymetrix, we have further complemented our consulting breadth and depth with business process management services (included in our Technology, Data, and Process services). The Cymetrix acquisition greatly expanded our business process management services, extending those services to hospitals, which are in addition to similar services we have been offering to physician groups. Our investment in business process management services is unique compared to most of our other investments in that the services offered establish long standing engagements through multi-year service agreements. These acquisitions and related hiring fully align with our growth strategy of combining our traditional expert-based consulting services, which are often event driven, with complementary solutions that deliver on-going value to our clients while incorporating more recurring revenue streams for us where there is a clear synergy between the two. Contracts in this business are generally multi-year engagements compared to other areas of our business where contracts typically run less than a year. These business process management services are enabled by systems and technology developed by Cymetrix, which we hope to leverage across our other Healthcare offerings. In addition to these technology investments, the Healthcare segment continues to invest in analytical tools that help our clients manage resources and processes to improve their operations, patient care, and financial performance.

Development of the Business — International Presence

Through acquisitions and senior hires in multiple locations outside of the United States, we have established a base upon which we expect to be able to attract additional senior experts to further our reach globally. Through building a multi-faceted presence in the UK that provides Disputes, Investigations & Economics, Healthcare, and Energy related services, we have developed a UK base that facilitates services we provide to clients across the globe outside of the US. We have leveraged the UK as a hub to support the establishment of operations in the Middle East and Asia to further facilitate services to clients across the globe. Within the UK, we have also invested in a technology infrastructure that supports our Technology, Data & Process services within our Disputes, Investigations & Economics segment beyond US borders.

Development of the Business — Through Technology and Employee Initiatives

As our business has matured, we have also continued to invest in technology infrastructure to support our evolving service offerings, including investment in more sophisticated operating systems to enable our

5

Table of Contents

technology-based services as they expand and change over time and to assist us in managing our broadening employee base. As part of these technology investments, we have built a private cloud environment that provides a more scalable operation, allowing us to more efficiently leverage resources within and across our data centers and across client requirements and more easily provide customizable client solutions.

We have supplemented our investments with employee-related initiatives to promote innovation and collaboration. In addition, we have focused efforts on development programs for our professionals designed to improve sales effectiveness and their ability to deliver the capabilities we have across the organization. We have also focused on other aspects of employee development, which include talent management and mentoring programs. Collectively, these innovation, collaboration, development and sales initiatives are intended to contribute to the growth of our people while enhancing our ability to grow the business organically.

While investing in recruitment, acquisitions, technology, and employee development programs, we have at the same time maintained strong cash flows which have contributed to strengthening our financial position. Over the past five years, we have reduced our bank debt balance from $207.0 million as of December 31, 2009 to $109.8 million as of December 31, 2014. In addition, in 2011 we began a stock repurchase program and through December 31, 2014 have repurchased 5.5 million shares at an average cost of $13.88 per share, effectively returning capital to our shareholders.

Human Capital Resources

At December 31, 2014, we had 3,559 employees. After adjusting total employees for part-time status and excluding project employees, we had 3,382 full-time equivalent (FTE) employees. These FTEs were comprised of the following:

| • | Client-service employees (Client-Service FTE) |

| • | 1,573 consulting employees (Consulting FTE) in businesses that deliver professional services. These individuals record time to client engagements. |

| • | 1,201 Technology, Data & Process employees (Technology, Data & Process FTE) in businesses that are comprised of technology-enabled professional services, including e-discovery services and data analytics, business process management services, technology solutions, invoice and insurance claims processing, market research and benchmarking. While some of these individuals may record time to client engagements (in professional services engagements), many do not record time to specific engagements. During the year we added 640 Technology, Data & Process FTE in connection with our acquisition of Cymetrix. |

The majority of costs related to these employees is recorded in costs of services before reimbursements.

| • | Non-billable employees (Non-Billable FTE) |

| • | 608 non-billable employees who are assigned to administrative and support functions, including office services, corporate functions, and certain practice support functions. The majority of costs related to these employees is recorded in general and administrative expense while the costs directly relating to practice support functions are recorded as costs of services before reimbursements. |

We also had 87 project employees who perform client services on a contractual basis. Project employee levels vary from period to period based on staffing and resource requirements. The majority of costs related to these employees is recorded in costs of services before reimbursements.

Our revenues are primarily generated from services performed by our client-service employees; therefore, our success depends in large part on attracting, retaining and motivating talented, creative and experienced client-service employees at all levels and across various geographies. In connection with recruiting, we employ internal recruiters, retain executive search firms, and utilize personal and business contacts. Our client-service employees are drawn from a variety of sources, including the industries we serve, accounting and other consulting organizations, and top rated colleges and universities. Our client-service employees include, but are not limited to, PhDs, MDs, MBAs, JDs, CPAs, CFEs (certified fraud examiners), ASAs (accredited senior appraisers), engineers, nurses and former government officials.

6

Table of Contents

In developing and growing our Technology, Data, & Process services, we have also added employees aligned to these businesses. We recruit, retain, and manage many of our Technology, Data & Process employees differently from our client-service employees. Particularly, in our business process management services, we add Technology, Data & Process employees through traditional recruitment, by transitioning client employees to become Navigant employees, or subcontracting services from our clients. Our demand for these resources, whether recruited, transitioned, or subcontracted from our clients, increases as we continue to expand this business. By managing these employees with our processes, centralizing their functions in our business centers, and leveraging technology to enable work streams, we are able to more efficiently and effectively deliver services. We leverage our business centers not only to help us better manage employee work forces across work streams and projects but also to create opportunities for these employees to develop professionally by exposing them to new service areas and possibilities for promotion within the management teams in these businesses.

We seek to retain our employees by offering competitive compensation packages of base and incentive compensation (and in certain instances share-based compensation and retention incentives), attractive benefits and rewarding careers. We periodically review and adjust, if needed, our employees’ total compensation (including salaries, annual cash incentive compensation, other cash and equity incentives, and benefits) to ensure that it is competitive within the industry and is consistent with our level of performance. In addition to compensation, we promote numerous charitable, philanthropic, and social awareness programs that not only support our community, but also provide experiences for our employees to promote a collaborative and rewarding environment.

We regularly evaluate employees and their productivity against future demand expectations and historical trends. From time to time, we may reduce or add resources in certain areas in an effort to align with changing demands. In connection with these changing demands, we also utilize project employees and engage independent contractors on certain engagements, which allow us to quickly adjust staffing in response to changing demand for our services.

In connection with recruiting activities and business acquisitions, our general policy is to obtain non-solicitation covenants from senior and some mid-level employees. Most of these covenants have restrictions that extend 12 months or more beyond the termination of employment. We utilize these contractual agreements and other agreements to protect our business interests, which also can reduce the risk of attrition and provide stability to our existing clients, staff and projects.

In our consulting businesses, our bill rates or fees charged to clients are tiered in accordance with the experience and position. We monitor and adjust those bill rates or fees according to then-current market conditions for our service offerings and within the various industries we serve. Similarly, pricing for our Technology, Data, & Process services is based upon the complexity of services delivered and markets served.

Industry Sectors

We provide services to clients in industries undergoing substantial regulatory or structural change. Our legal and compliance based service offerings are relevant to law firms and clients in most industries including federal and state agencies within the public sector. We also have significant industry-specific knowledge and a large client base in the energy, healthcare and financial services industries.

Competition

The market for our services is highly competitive, highly fragmented and subject to rapid change. The market includes a large number of participants with a variety of skills and industry expertise, including general management and information technology consulting firms, strategy firms, global accounting firms, and other local, regional, national and international consulting firms. Many of these companies are international in scope and have larger teams of personnel and greater financial, technical and marketing resources than we do. In particular, the Big Four accounting firms (PwC, Deloitte, EY and KPMG) are highly competitive in the consulting industry. However, we believe that our industry focus, deep industry and operational expertise, reputation, global business model and broad range of service offerings enable us to compete effectively in the marketplace. Additionally, with the acquisition of Cymetrix we have increased our ability to offer business

7

Table of Contents

process management services which, when combined with our existing consulting businesses, creates an opportunity to differentiate ourselves from other firms, as most participants in the market provide primarily business process management services without the complement of our consulting capabilities.

Developing Client Relationships

We market our services directly to corporate executives and senior management, corporate counsel, law firms, corporate boards, special committees, and governmental agencies. We use a variety of business development and marketing channels to communicate directly with current and prospective clients, including on-site presentations, industry seminars, and industry-specific articles. In addition, we have strengthened our market presence by developing our brand name and go-to-market strategy. New engagements are sought and won by our senior and mid-level employees working together across our business segments. We seek to leverage our client relationships in one business segment to cross-sell service offerings provided by other business segments. Clients frequently expand the scope of engagements during delivery to include follow-on or complementary services. Our future performance will continue to depend upon our ability to win new engagements, attract and retain employees, develop and continue client relationships and maintain our reputation.

We believe our unique mix of deep industry expertise, combined with our scale, broad geographic presence, multi-disciplinary professionals and specialized service offerings, positions us to address the majority of our clients’ critical business needs. We continue to establish programs to facilitate collaborative product development and marketing efforts, and also to develop new, innovative and repeatable solutions for our clients.

Financial Information about our Business Segments

During the year ended December 31, 2013, we disposed of a portion of our Financial, Risk & Compliance segment and the results of operations from the disposed business have been classified as discontinued operations. As such, the segment information reflects results of segment operations on a continuing basis (see Note 4 — Dispositions and Discontinued Operations to the notes to our consolidated financial statements). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 5 — Segmented Information to the notes to our Consolidated Financial Statements for discussion of total revenues, revenues before reimbursements, segment operating profit and total assets by business segment. Certain areas within our segments operate globally for information regarding our total revenues and total assets by geographic region (see Note 5 — Segment Information to the notes to our consolidated financial statements). For information regarding risks related to our international operations see “Risk Factors”.

How Our Income is Derived

Our clients’ demand for our services ultimately drives our revenues and expenses. We derive our revenues from fees on services provided. The majority of our revenues is generated on a time and materials basis, though we also have engagements where fees are a fixed amount (either in total or for a period of time) or are on a per unit or subscription basis. We may also earn incremental revenues, in addition to hourly or fixed fees, that are contingent on the attainment of certain contractual milestones or outcomes. Variations in our quarterly or yearly revenues and resulting operating profit margins may occur depending on the timing of such contractual outcomes and our ability to consider these revenues earned and realized. Regardless of the terms of our engagements, our ability to earn fees is reliant on experience and expertise of our client-service employees.

Our most significant expense is client-service employee compensation, which includes salaries, incentive compensation, and amortization of sign-on and retention incentive payments, share-based compensation and benefits. Client-service employee compensation is included in cost of services before reimbursable expenses, in addition to sales and marketing expenses and the direct costs of recruiting and training client-service employees.

Our most significant overhead expenses are administrative compensation and benefits and office-related expenses. Administrative compensation includes salaries, incentive compensation, share-based compensation and benefits for corporate management and administrative personnel that indirectly support client engagements. Office-related expenses primarily consist of rent for our offices. Other administrative costs include bad debt expense, marketing, technology, finance and human capital management.

8

Table of Contents

Concentration of Revenues

Revenues earned from our top 20 clients amounted to 27%, 30% and 31% of our total revenues for 2014, 2013 and 2012, respectively. Revenues earned from our top 10 clients amounted to 20%, 23% and 24% of our total revenues for 2014, 2013 and 2012, respectively. No single client accounted for more than 10% of our total revenues during 2014, 2013 or 2012. The mix of our largest clients typically changes from year to year. For further information on segment concentration see Item 7 — Management, Discussion and Analysis of Financial condition and Results of Operations — Segment Results below.

Non-U.S. Operations

We have offices in the United Kingdom, Canada, China, Singapore, United Arab Emirates and other countries outside the U.S. and conduct business in several other countries. The United Kingdom accounted for 7%, 5% and 6% of our total revenues for 2014, 2013, and 2012, respectively. No country, other than the United States, accounted for more than 10% of our total revenues during 2014, 2013 or 2012. Our non-U.S. subsidiaries, in the aggregate, represented approximately 8%, or $71.2 million, of our total revenues in 2014 compared to 7%, or $58.5 million, in 2013 and 8%, or $63.3 million, in 2012. These percentages are calculated based on the country of the entity the engagement does business in. For further geographic information see Note 5 — Segment Information to the notes to our financial statements.

Available Information

We maintain a corporate website at www.navigant.com. The content of our website is not incorporated by reference into this report or any other reports we file with, or furnish to, the SEC. Investors may access our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K free of charge (as soon as reasonably practicable after these materials are electronically filed with, or furnished to, the SEC) by going to the Investor Relations section of our website (www.navigant.com/investor_relations) and searching under “SEC Filings.” These materials are also available in printed form free of charge upon request. Requests should be submitted to: Navigant Consulting, Inc., 30 South Wacker Drive, Suite 3550, Chicago, Illinois 60606, Attention: Investor Relations.

| Item 1A. | Risk Factors |

In addition to other information contained in this report and in the documents incorporated by reference herein, the following factors should be considered carefully in evaluating us and our business. These factors could materially affect our business, financial condition, results of operations and/or stock price in future periods. Additional risks not currently known to us or that we currently deem to be immaterial also could materially affect our business, financial condition, results of operations or stock price in future periods.

Risks Related to the Market

Our business, results of operations and financial condition could be adversely affected by disruptions in the marketplace caused by economic and political conditions.

Economic and political conditions affect our clients’ businesses and the markets they serve. A severe and/or prolonged economic downturn or a negative or uncertain political climate could adversely affect our clients’ financial condition and the levels and types of business activity engaged in by our clients and the industries we serve. Clients could determine that discretionary projects are no longer viable or that new projects are not advisable. This may reduce demand for our services, depress pricing for our services or render certain of our services obsolete, all of which could have a material adverse effect on our business, results of operations and financial condition. Changes in economic conditions could drive changes to the regulatory or legislative landscape and consequently shift demand to services that we do not offer or for which we do not have competitive advantages, and this could negatively affect the amount of new business that we are able to obtain. If we are unable to appropriately manage costs or if we are unable to successfully anticipate changing economic and political conditions, we may be unable to effectively plan for and respond to those changes, and our business could be adversely affected. Additionally, significant economic turmoil or financial market disruptions could

9

Table of Contents

adversely impact the availability of financing to our clients and in turn may adversely impact our ability to collect amounts due from our clients or cause them to terminate their contracts with us, each of which could adversely affect our results of operations.

Our business could be adversely impacted by competition and regulatory and legislative changes.

The market for our services is highly competitive, highly fragmented, and subject to rapid change. The market includes a large number of participants with a variety of skills and industry expertise, including general management and information technology consulting firms, strategy firms, the global accounting firms and other local, regional, national, and international consulting firms. Many of these firms are international in scope and have larger teams of personnel and greater financial, technical and marketing resources than we do. Some firms may have lower overhead and other operating costs and, therefore, may be able to more effectively compete through lower cost service offerings. Many of our clients operate in highly regulated industries such as healthcare, energy, financial services and insurance. Regulatory and legislative changes in these industries could potentially render certain of our service offerings obsolete and decrease our competitive position. If we cannot compete effectively, our results of operations and financial condition could be adversely impacted.

Our inability to successfully recruit, retain and incentivize our senior-level employees will affect our ability to win new client engagements and compete effectively.

We rely heavily on a group of senior-level employees and business development professionals. We believe our future success is dependent on our ability to successfully recruit and retain their services. Competition for skilled employees is intense, and compensation and retention related issues are a continuing challenge. The consulting industry has low barriers to entry making it easy for employees to start their own businesses or work independently. In addition, it is relatively easy for employees to change employers. Although we offer various incentive compensation programs, including share-based compensation designed to retain and incentivize our senior-level employees, there can be no assurance that these programs will be effective. Further, limitations on available shares under our equity compensation plans or a sustained decline in our stock price could also affect our ability to offer adequate share-based compensation as incentives to our senior-level employees.

Our inability to successfully recruit, retain and incentivize our senior-level employees could have an adverse effect on our ability to win new client engagements or meet client needs in our current engagements, and our results of operations could be adversely affected. Further, our failure to realize the expected financial returns from our recruiting or incentive investments could adversely impact our results of operations.

Risks Related to Capital and Financing

We cannot be assured that we will have access to sufficient sources of capital to meet our cash needs.

We rely on our current cash and cash equivalents, cash flows from operations and borrowings under our credit agreement to fund our short-term and anticipated long-term operating and investing activities. Our credit agreement provides a $400.0 million revolving credit facility. At our option, subject to the terms and conditions in the credit agreement, we may elect to increase commitments under the credit facility up to an aggregate amount of $500.0 million. The credit facility becomes due and payable in full upon maturity in September 2018. At December 31, 2014, we had $109.8 million in borrowings outstanding under the credit facility and approximately $275 million available. There can be no assurance that the credit facility will continue to be sufficient to meet the future needs of our business, particularly if a decline in our financial performance occurs. If this occurs, and we are unable to otherwise increase our operating cash flows or raise additional capital or obtain other debt financing, we may be unable to meet our future cash needs, including, for example, funding our acquisitions. Furthermore, if our clients’ financial condition were to deteriorate, impairing their ability to make payments due to us, our operating cash flows would be adversely impacted which could require us to fund a greater portion of our working capital needs with borrowings under our credit facility. Lastly, certain financial institutions that are lenders under our credit facility could be adversely impacted by significant economic turmoil or financial market disruptions and therefore could become unable to meet their commitments under our credit facility, which in turn would reduce the amounts available to us under that facility.

10

Table of Contents

Our failure to comply with the covenants in our credit agreement could have a material adverse effect on our financial condition and liquidity.

Our credit agreement contains financial covenants requiring that we maintain, among other things, certain levels of fixed charge and debt coverage. Poor financial performance could cause us to be in default of these covenants. While we were in compliance with these covenants at December 31, 2014, there can be no assurance that we will remain in compliance in the future. Our borrowings under the credit facility tend to be higher during the first half of the year to fund annual incentive payments, and as a result, our consolidated leverage ratio is expected to increase from December 31, 2014 levels. If we fail to comply with the covenants in our credit agreement, this could result in our having to seek an amendment or waiver from our lenders to avoid the termination of their commitments and/or the acceleration of the maturity of outstanding amounts under the credit facility. The cost of our obtaining an amendment or waiver could be significant, and further, there can be no assurance that we would be able to obtain an amendment or waiver. If our lenders were unwilling to enter into an amendment or provide a waiver, all amounts outstanding under our credit facility would become immediately due and payable.

We have variable rate indebtedness which subjects us to interest rate risk and may cause our annual debt service obligations to increase significantly.

Borrowings under our credit facility are based on short term variable rates of interest which expose us to interest rate risk. While market interest rates have remained low for some time, these rates could increase, adversely impacting our interest expense, cash outflows and results of operations. From time to time, we use derivative instruments for non-trading purposes, primarily consisting of interest rate swap agreements, to manage our interest rate exposure by achieving a desired proportion of fixed rate versus variable rate borrowings. There can be no assurance, however, that our derivative instruments will be successful in reducing the risks inherent in exposure to interest rate fluctuations.

Risks Related to our Business Operations

Our results of operations and consequently our business may suffer if we are not able to maintain current pricing, compensation costs and productivity levels.

Our revenues and profitability are largely based on the pricing of our services, compensation costs and the number of hours our client-service employees work on client engagements. Accordingly, if we are not able to maintain adequate pricing for our services, maintain compensation costs or appropriately manage productivity levels, our results of operations may suffer. Pricing, compensation costs and productivity levels are affected by a number of factors, including:

| • | Our ability to predict future demand for our services and maintain the appropriate staffing levels without significant underutilized Consulting employees and significant lack of productivity from our Technology, Data & Process employees; |

| • | Our ability to transition client-service employees from completed client engagements to new client engagements; |

| • | Our clients’ perceptions of our ability to add value through our services; |

| • | Our competitors’ pricing of services and compensation levels; |

| • | The market demand for our services; |

| • | The market rate for employee compensation costs; |

| • | Our ability to manage our human capital resources particularly as we increase the size and diversity of our workforce and expand into new service offerings as part of our growth strategies; |

| • | The economic, political and regulatory environment as noted above; and |

| • | Our ability to accurately estimate and appropriately manage the costs of fixed-fee client engagements. |

11

Table of Contents

Some of the work we do involves greater risk than ordinary engagements which could negatively impact our business.

We do work for clients that for financial, legal, reputational or other reasons may present higher than normal risks. While we attempt to identify and mitigate our exposure with respect to higher-risk engagements and higher-risk clients, these efforts may be ineffective and an actual or alleged error or omission on our part or the part of our client or other third parties on one or more of these higher-risk engagements could have a material adverse impact on our business and financial condition. Examples of higher-risk engagements include, but are not limited to:

| • | Interim management engagements, including those for hospitals and other healthcare providers; |

| • | Engagements where we assist clients in complying with healthcare-related regulatory requirements; |

| • | Corporate restructuring engagements, both inside and outside of bankruptcy proceedings; |

| • | Engagements where we provide transactional or a valuation advisory service; |

| • | Engagements where we deliver a fairness opinion; |

| • | Engagements where we deliver project management services for large construction projects; |

| • | Engagements where we receive or process or host sensitive data, including personal consumer or private health information; |

| • | Engagements where we deliver a compliance effectiveness opinion; |

| • | Engagements involving independent consultants’ reports in support of financings; and |

| • | Engagements for governmental clients. |

Our international operations create special risks that could negatively impact our business.

We have offices in the United Kingdom, Canada, China, Singapore, United Arab Emirates and other countries outside of the U.S. and conduct business in several other countries. We expect to continue to expand globally and our international revenues may account for an increasing portion of our revenues in the future. Our international operations carry special financial, business, legal and reputational risks, including:

| • | Cultural and language difference in conducting business; |

| • | Employment laws and related factors that could result in lower utilization, higher compensation costs and cyclical fluctuations of utilization and revenues; |

| • | Currency fluctuations that could adversely affect our financial position and operating results; |

| • | Compliance with varying legal and regulatory requirements, and other barriers to conducting business; |

| • | Impact on consulting spend from international firms and global economies effected by the European sovereign debt crisis and related government and economic responses; |

| • | Risks associated with engagements performed by employees and independent contractors with governmental officials and agencies, including the risks arising from the anti-bribery and corruption regulations; |

| • | Greater difficulties in managing and staffing foreign operations, including in higher risk geographies; |

| • | Successful entry and execution in new markets; |

| • | Restrictions on the repatriation of earnings; and |

| • | Potentially adverse tax consequences, such as net operating loss carry forwards that cannot be realized or higher effective tax rates. |

If we are not able to successfully mitigate the special risks associated with our international operations, our business prospects and results of operations could be negatively impacted.

12

Table of Contents

Our inability to effectively execute on long-term growth objectives could adversely affect our results of operations and our share value.

Achievement of our long-term growth objectives may require additional investments in technology, people and acquisitions. These investments may be significantly different in size, nature and complexity in comparison to those we have made in the past, which could inherently create more risk around those investment decisions than would otherwise be the case. Specifically:

| • | Incentive compensation programs designed to motivate growth may result in innovation or investments that drive near-term growth, but that do not achieve longer-term growth and profitability objectives, or may incentivize an increase in risk compared to our current risk tolerance. |

| • | Investments in acquisitions may result in growth in businesses that may add to near-term revenues and earnings, but may negatively impact shareholder return over the long-term if they do not perform as expected, or may otherwise create higher longer-term risks, including new legal, compliance, or regulatory implications. |

| • | The businesses and services added through these investments may extend beyond the knowledge, expertise or resources of our current management team, which could result in unintended risks. |

Our inability to successfully maintain a sales pipeline and to attract business from new or existing clients could have a material adverse effect on our results of operations.

Many of our client engagement agreements are short term in nature (less than one year) or can be terminated by our clients with little or no notice and without penalty. For example, in our litigation-related engagements, if the litigation is settled, our services usually are no longer necessary and our engagement is promptly terminated. Some of our services involve multiple engagements or stages. In those engagements, there is a risk that a client may choose not to retain us for the additional stages of an engagement or that a client will cancel or delay additional planned engagements. Our client engagements are usually relatively short term in comparison to our office-related expenses and other infrastructure commitments. Therefore, we rely heavily on our senior-level employees’ ability to develop new business opportunities for our services.

In the past, we have derived significant revenues from events as inherently unpredictable as the Dodd-Frank Act, healthcare reform, the credit crisis and significant natural disasters including major hurricanes and earthquakes. Those events, in addition to being unpredictable, often have impacts that decline over time as clients adjust to and compensate for the challenges they face. These factors also limit our ability to predict future revenues and human capital resource needs especially for large engagements that may end abruptly due to factors beyond our control which in turn could adversely impact our results of operations.

Unsuccessful client engagements could result in damage to our professional reputation or legal liability which could have a material adverse effect on our business.

Our professional reputation and that of our client-service employees is critical to our ability to successfully compete for new client engagements and attract and retain employees. In addition, our client engagements subject us to the risk of legal liability. Any public assertion or litigation alleging that our services were deficient or that we breached any of our obligations to a client could expose us to significant legal liabilities, distract our management and damage our reputation. Our professional liability insurance may not cover every type of claim or liability that could potentially arise from our client engagements. In addition, the limits of our insurance coverage may not be enough to cover a particular claim or a group of claims and the costs of defense. Any factors that damage our professional reputation could have a material adverse effect on our business.

We may not be able to maintain the equity in our brand name.

We believe that the Navigant brand is an important part of our overall effort to attract and retain clients and that the importance of brand recognition will increase as competition for our services increases. We may expand our marketing activities to promote and strengthen our brand and may need to increase our marketing budget,

13

Table of Contents

hire additional marketing personnel or expend additional amounts to protect our brand and otherwise to create and maintain client brand loyalty. If we fail to effectively promote and maintain the Navigant brand, or incur excessive expenses in doing so, our business and results of operations could be adversely impacted.

We encounter professional conflicts of interest.

If we are unable to accept new client engagements for any reason, including business and legal conflicts, our client-service employees may become underutilized or discontented, which may adversely affect our future results of operations, as well as our ability to retain these consultants. In addition, although we have systems and procedures to identify potential conflicts of interest prior to accepting a new client engagement, there is no guarantee that all potential conflicts of interest will be identified, and undetected conflicts may result in damage to our professional reputation and result in legal liability which may adversely impact our business.

We may be exposed to potential risks if we are unable to achieve and maintain effective internal controls.

If we fail to achieve and maintain adequate internal control over financial reporting or fail to implement necessary new or improved controls that provide reasonable assurance of the reliability of our financial reporting and the preparation of our financial statements for external purposes, we may fail to meet our public reporting requirements on a timely basis, and may be unable to adequately or accurately report on our business and our results of operations. Even with adequate internal controls, we may not prevent or detect all misstatements or fraud. Also, internal controls that are currently adequate may in the future become inadequate because of changes in conditions or changes in regulatory standards, and the degree of compliance with our policies or procedures may deteriorate. This could have a material adverse effect on our business and our results of operations.

Acquired businesses may not achieve expected results which could adversely affect our results of operations.

We have grown our business, in part, through the acquisition of complementary businesses. The substantial majority of the purchase price we pay for acquired businesses is related to goodwill and intangible assets. We may not be able to realize the value of those assets or otherwise realize anticipated synergies unless we are able to effectively integrate the businesses we acquire. We face multiple challenges in integrating acquired businesses and their personnel, including differences in corporate cultures and management styles, retention of personnel, conflict issues with clients, and the need to divert managerial resources that would otherwise be dedicated to our current businesses. Additionally, certain senior-level consultants, as sellers of the acquired businesses, are bound by non-competition covenants that expire after a specific amount of time from the date of acquisition. When these covenants expire, our inability to retain these senior-level consultants could significantly impact the acquired businesses and their successful integration. Any failure to successfully integrate acquired businesses and retain personnel could cause the acquired businesses to fail to achieve their expected results, which would in turn adversely affect our financial performance and may require a possible impairment of the acquired assets. Additionally, the financing of acquisitions through cash, borrowings or common stock could also impair our liquidity or cause significant dilution of our shareholders.

Goodwill and other intangible assets represent a significant portion of our assets, and an impairment of these assets could have a material adverse effect on our financial condition and results of operations.

Because we have acquired a significant number of businesses, goodwill and other intangible assets represent a significant portion of our total assets. Under generally accepted accounting principles, we are required to perform an annual impairment test at the reporting unit level on our goodwill and, on a quarterly basis, we are required to assess the recoverability of both our goodwill and long-lived intangible assets. We consider our operating segments to be our reporting units. We may need to perform an impairment test more frequently if events occur or circumstances indicate that the carrying amount of these assets may not be recoverable. These events or circumstances could include a significant change in the business climate, attrition of key personnel, a prolonged decline in our stock price and market capitalization, legal factors, operating performance indicators, competition, sale or disposition of a significant portion of one of our businesses, and other factors. If the fair

14

Table of Contents

market value of one of our reporting units or other long-lived intangible assets is less than the carrying amount of the related assets, we could be required to record an impairment charge in the future. The valuation of our reporting units requires judgment in estimating future cash flows, discount rates and other factors. In making these judgments, we evaluate the financial health of our reporting units, including such factors as market performance, changes in our client base and projected growth rates. Because these factors are ever changing, due to market and general business conditions, we cannot predict whether, and to what extent, our goodwill and long-lived intangible assets may be impaired in future periods. During the second quarter 2014, in conjunction with our annual goodwill impairment test, we recorded a $122.0 million goodwill impairment related to our Disputes, Investigations, & Economics segment. At December 31, 2014, we had goodwill of $568.1 million and net intangible assets of $26.5 million. The amount of any future impairment could be significant and could have a material adverse effect on our financial results. See Note 6 — Goodwill and Intangible Assets, Net to the notes to our consolidated financial statements.

We are subject to unpredictable risks of litigation.

Although we seek to avoid litigation whenever possible, from time to time we are party to various lawsuits and claims. Disputes may arise, for example, from client engagements, employment issues, regulatory actions, business acquisitions and real estate and other commercial transactions. There can be no assurances that any lawsuits or claims will be immaterial in the future. Any material lawsuits or claims could adversely affect our business and reputation.

Our work with governmental clients has inherent risks related to the governmental contracting process.

We work for various U.S., state, local and foreign governmental entities and agencies. These engagements have special risks that include, but are not limited to, the following:

| • | Governmental agencies generally reserve the right to audit our contract costs, including allocated indirect costs, and conduct inquiries and investigations of our business practices with respect to governmental contracts. If the governmental entity finds that the costs are not reimbursable, then we will not be allowed to bill for them or the cost must be refunded to the governmental entity if it has already been paid to us. Findings from an audit also may result in our being required to prospectively adjust previously agreed rates for work which would affect our future profit margins. |

| • | If a governmental client discovers improper or illegal activities in the course of its audits or investigations, we may become subject to various civil and criminal penalties and administrative sanctions, which may include termination of contracts, forfeiture of profits, suspension of payments, fines and suspensions or debarment from doing business with other agencies of that government. |

| • | Governmental contracts, and the proceedings surrounding them, are often subject to political sensitivities and more extensive scrutiny and publicity than other commercial contracts. Negative publicity related to our governmental contracts, regardless of whether it is accurate, may damage our business by impairing our professional reputation and our ability to compete for new client engagements. |

The impact of any of the occurrences or conditions described above could affect not only our relationship with the particular governmental agency involved, but also other agencies of the same or other governmental entities as well as other non-governmental clients. Depending on the size of the engagement or the magnitude of the potential costs, penalties or negative publicity involved, any of these occurrences or conditions could have a material adverse effect on our business or results of operations.

Our revenues, operating income and cash flows are likely to fluctuate.

We experience periodic fluctuations in our revenues, operating income and cash flows and expect that this will continue to occur in the future due to timing and duration of our client engagements, utilization of our consultants, the types of engagements we are working on at different times, the geographic locations of our clients or where the services are rendered, the length of billing and collection cycles, hiring, business and asset acquisitions including the integration of those acquired businesses into our firm, and general economic factors

beyond our control. We may also experience future fluctuations in our cash flows because of increases in

15

Table of Contents

employee compensation, including changes to our incentive compensation structure and the timing of incentive payments, which we generally pay during the first quarter of each year, or hiring or retention payments or bonuses which are paid throughout the year.

The expansion and growth of our business process management services and the evolution of our service offerings into new areas subject us to different operational risks than our traditional consulting and expert businesses.

With the acquisition of Cymetrix in May 2014, a higher percentage of our net revenues is derived from our Technology, Data & Process businesses, as compared to prior periods. These businesses, in particular, our business process management services, present different operational risks when compared to our traditional consulting and expert businesses. For example, our business process management services involve managing the revenue cycle function for all or certain portions of our physician and hospital clients’ businesses, including the operation, management or oversight of billing, coding and accounts receivable departments that are critical to our clients’ financial performance. In addition, our business process management services business utilizes offshore personnel, including subcontracted personnel in India, which exposes us to additional operational risks, including special risks associated with conducting business internationally. Disruptions in service delivery, regulatory compliance concerns, data privacy and security concerns, particularly in the billing and coding areas, labor disputes, technology issues or other performance problems could damage our clients’ businesses, expose us to enhanced regulatory scrutiny and claims, and harm our reputation and our business.

As part of our long-term strategy, we plan to continue to expand our services and solutions into new areas. Expanding into new areas, and providing services to new types of clients may expose us to additional operational, regulatory or other risks specific to these new areas. We could also incur liability if we fail to comply with laws or regulations applicable to the services we provide to our clients.

If our pricing estimates do not accurately anticipate the cost, risk and complexity of performing our work, our contracts could have delivery inefficiencies or be unprofitable.

Our pricing for our fixed fee engagements, particularly in connection with our business process management services engagements that have multi-year pricing agreements, is highly dependent on our forecasts and predictions about the level of effort and cost necessary to deliver the applicable services and solutions. Our estimates are based on available data at the time the fees are set, and could turn out to be materially inaccurate. If we do not accurately estimate the effort, costs or timing for meeting our contractual commitments and/or completing projects to a client’s satisfaction, our contracts could yield lower margins than planned, or be unprofitable. In addition, we may fail to accurately assess the risks associated with potential contracts. This could result in existing contracts and contracts entered into in the future being less profitable than expected or unprofitable, which could have an adverse effect on our overall profitability.

Risks Related to Technology

We have invested in specialized technology and other intellectual property for which we may fail to fully recover our investment or which may become obsolete.

We have invested in developing specialized technology and intellectual property, including proprietary systems, processes and methodologies, that we believe provide us a competitive advantage in serving our current clients and winning new client engagements. Many of our service offerings rely on specialized technology or intellectual property that is subject to rapid change, and to the extent that this technology and intellectual property is rendered obsolete and of no further use to us or our clients, our ability to continue offering these services, and grow our revenues, could be adversely affected. There is no assurance that we will be able to develop new, innovative or improved technology or technology and intellectual property or that our technology and intellectual property will effectively compete with the intellectual property developed by our competitors. If we are unable to develop new technology and intellectual property or if our competitors develop better technology or intellectual property, our revenues and results of operations could be adversely affected.

16

Table of Contents

In addition, the scale and complexity of our business and new service offerings may require additional information systems that we may not be able to implement in a timely or cost effective manner. This may impair our ability to achieve our operating objectives and retain our competitive position, which in turn could adversely affect our results of operations.

Information system failures or service interruptions could affect our ability to provide services to our clients.

We may be subject to disruption to our operating systems, technology or ability to communicate with our workforce and clients as a result of events that are beyond our control, including but not limited to the possibility of failures at third-party data centers, worker strikes, disruptions to the internet, political instability, natural disasters, malicious attacks, or other conditions. While we have taken steps to prevent such events and have developed disaster recovery processes, there can be no assurance that these steps will be effective in every situation. Such disruptions could adversely affect our ability to fulfill client engagements and as a result may damage our reputation and adversely affect our business and results of operations.

If the integrity of our information systems is compromised or our information systems are inadequate to keep up with the needs of our business, our reputation, business and results of operations could be adversely affected.

We depend on information systems to manage and run our business. Additionally, certain services we provide require us to store, transmit or process sensitive or confidential client information, including personal consumer information and health or other personally identifiable information. If any person, including any of our employees or third-party vendors with whom we contract for data hosting services, negligently disregards or intentionally breaches the information security controls we have implemented to protect our clients’ data, or our own data or those security controls prove to be ineffective against intrusion, we could incur legal liability and may also be subject to regulatory enforcement actions, fines and/or criminal prosecution in multiple jurisdictions. Our potential liability in the event of a security breach of client data or our own data could be significant and depending on the circumstances giving rise to the breach, this liability may not be subject to a contractual limit of liability or an exclusion of consequential or indirect damages. Any unauthorized disclosure of sensitive, personal or confidential client information, whether through systems failure, employee negligence, fraud or misappropriation, could damage our reputation and cause us to lose clients. Similarly, unauthorized access to or through our information systems, including an intentional attack by any person who may develop and deploy viruses, worms or other malicious software programs, could result in negative publicity, legal liability and damage to our reputation and could have a material adverse effect on our business and results of operations.

| Item 1B. | Unresolved Staff Comments. |

None.

| Item 2. | Properties. |

Our principal executive offices are leased and are located in Chicago, Illinois. We have approximately 70 other operating leases for office facilities, principally in the United States. Our office space needs in certain geographic areas may change as our business expands or contracts in those areas. Due to the nature of consulting work, we strive to keep our office workspace flexible and promote a virtual work environment, where appropriate in order to minimize office facility costs.

| Item 3. | Legal Proceedings. |

We are not party to any material legal proceedings.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

17

Table of Contents

Executive Officers of the Registrant

The following are our executive officers at February 13, 2015:

| Name |

Title |

Age | ||||

| Julie M. Howard |

Chairman and Chief Executive Officer | 52 | ||||

| Lee A. Spirer |

Executive Vice President and Global Business Leader | 48 | ||||

| Lucinda M. Baier |

Executive Vice President and Chief Financial Officer | 50 | ||||

| Monica M. Weed |

Executive Vice President, General Counsel and Secretary | 54 | ||||

Julie M. Howard, 52, has served as our Chairman and Chief Executive Officer since May 2014 and Chief Executive Officer and a member of our board of directors since March 2012. Ms. Howard served as our President from 2006 to March 2012 and our Chief Operating Officer from 2003 to March 2012. From 2001 to 2003, Ms. Howard was our Vice President and Human Capital Officer. Prior to 2001, Ms. Howard held a variety of consulting and operational positions with several professional services firms, including the Company. Ms. Howard is currently a member of the board of directors of Kemper Corporation (formerly Unitrin, Inc.) and Innerworkings Inc. and a member of the Foundation Board for Lurie Children’s Hospital of Chicago. Ms. Howard is a founding member of the Women’s Leadership and Mentoring Alliance (WLMA). Ms. Howard is a graduate of the University of Wisconsin, with a Bachelor of Science degree in Finance. She has also completed several post-graduate courses within the Harvard Business School Executive Education program, focusing in finance and management.

Lee A. Spirer, 48, has served as our Executive Vice President and Global Business Leader since November 2012. Mr. Spirer has served in a variety of strategic and operational roles in a range of professional and business services organizations. From April 2009 to May 2012, Mr. Spirer served as Senior Vice President and Global Business Head of Kroll Risk & Compliance Solutions, and prior to that, from September 2005 to February 2008, Mr. Spirer served as Senior Vice President and Global Leader of Corporate Strategy and Development for Dun & Bradstreet Corporation. From June 2001 to September 2005, Mr. Spirer held several senior management roles at IBM Business Consulting Services, last serving as General Manager, Global Financial Markets. In addition, from March 2008 to April 2009 and again from June 2012 to October 2012, Mr. Spirer served as Managing Partner of LAS Advisory Services, advising private equity and venture capital firms on a variety of strategic and operational issues. Mr. Spirer is a graduate of The Wharton School with a Masters of Business Administration and Brandeis University with a Bachelor’s degree in Economics, with high honors and Phi Beta Kappa.

Lucinda M. Baier, 50, has served as our Executive Vice President since February 2013 and Chief Financial Officer since March 2013. Previously, Ms. Baier served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Central Parking System, Inc., a leading firm in parking management and marketing, from August 2011 to October 2012, having previously served as Senior Vice President and Chief Financial Officer since September 2010. Ms. Baier is a member of the Board of Directors and Audit Committee of The Bon-Ton Stores, Inc. Ms. Baier is a graduate of Illinois State University, with Bachelor and Master of Science degrees in Accounting and is a Certified Public Accountant.

Monica M. Weed, 54, has served as our Executive Vice President since October 2013 and General Counsel and Secretary since November 2008. Previously, Ms. Weed served as Associate General Counsel for Baxter Healthcare Corporation from March 2006 to October 2008. From March 2004 to March 2006, Ms. Weed served as Special Counsel, Rights Agent and Litigation Trustee to Information Resources, Inc. Litigation Contingent Payment Rights Trust, a publicly traded litigation trust. From 1991 through 2004, Ms. Weed served in a variety of legal roles, including Executive Vice President, General Counsel and Corporate Secretary, for Information Resources, Inc., an international market research provider to the consumer packaged goods industry. She started her legal career at the law firm of Sonnenschein Nath & Rosenthal (now Dentons). Ms. Weed received a Bachelor of Arts in Classics from Northwestern University, a law degree from the Northwestern University School of Law and a Master’s degree in Business Administration from the Kellogg Graduate School of Management, Northwestern University.

18

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

Our common stock is traded on the New York Stock Exchange under the symbol “NCI.” The following table sets forth, for the periods indicated, the high and low closing sale prices per share of our common stock.

| High | Low | |||||||

| 2014 |

||||||||

| Fourth quarter |

$ | 15.85 | $ | 12.39 | ||||

| Third quarter |

$ | 18.19 | $ | 13.87 | ||||

| Second quarter |

$ | 19.00 | $ | 16.08 | ||||

| First quarter |

$ | 19.41 | $ | 16.55 | ||||

| 2013 |

||||||||

| Fourth quarter |

$ | 19.78 | $ | 15.07 | ||||

| Third quarter |

$ | 15.91 | $ | 12.00 | ||||

| Second quarter |

$ | 14.00 | $ | 10.91 | ||||

| First quarter |

$ | 13.60 | $ | 10.84 | ||||

Holders

At February 9, 2015, there were 183 holders of record of our shares of our common stock.

Shares of our common stock that are registered in the name of a broker or other nominee are listed as a single shareholder on our record listing, even though they are held on behalf of a number of individual shareholders. As such, our actual number of shareholders is higher than the number of our shareholders of record.

Dividends

We did not declare or pay any dividends during the years ended December 31, 2014 or December 31, 2013. Dividend and other capital structure policy issues are reviewed on a periodic basis by our board of directors. In addition, the covenants in our credit agreement may limit our ability to pay dividends in the future.

19

Table of Contents

Shareholder Return Performance Graph

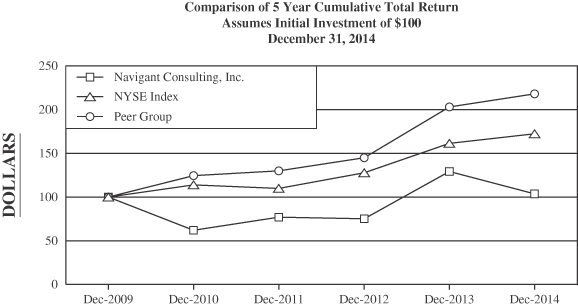

The following graph compares the yearly percentage change in the cumulative total shareholder return on our common stock against the New York Stock Exchange Market Index (the “NYSE Index”) and the peer group described below. The graph assumes that $100 was invested on December 31, 2009 in each of our common stock, the NYSE Index and the peer group. The graph also assumes that all dividends, if paid, were reinvested.

Note: The stock price performance shown below is not necessarily indicative of future price performance.

| Measurement Period | Navigant Consulting Inc. |

NYSE Index |

Peer Group(a) |

|||||||||

| FYE 12/31/09 |

$ | 100.00 | $ | 100.00 | $ | 100.00 | ||||||

| FYE 12/31/10 |

61.91 | 113.76 | 124.30 | |||||||||

| FYE 12/31/11 |

76.78 | 109.70 | 129.91 | |||||||||

| FYE 12/31/12 |

75.10 | 127.53 | 144.94 | |||||||||

| FYE 12/31/13 |

129.21 | 161.20 | 202.89 | |||||||||

| FYE 12/31/14 |

103.43 | 172.27 | 217.90 | |||||||||

| a) | The Peer Group consists of the following companies: The Advisory Board Company, CBIZ Inc., The Corporate Executive Board Company, CRA International Inc. (formerly known as Charles River Associates, Inc.), Exponent, Inc., FTI Consulting, Inc., Gartner Group, Inc., Heidrick & Struggles International Inc., Hill International, Inc., Huron Consulting Group Inc., ICF International, Inc., IHS, Inc., Korn/Ferry International, MAXIMUS, Inc., Resources Connection, Inc., Sapient Corporation, Tetra Tech, Inc., TRC Companies and VSE Corporation. The Peer Group is weighted by market capitalization. The Peer Group is the same as the current peer group used by the compensation committee of our board of directors (except for Duff & Phelps Corporation which is no longer part of the peer group as a result of delisting) to make executive compensation decisions. The peer group is reviewed and modified, if necessary, on an annual basis. |

20

Table of Contents

Issuance of Unregistered Securities

None.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table sets forth repurchases of our common stock during the fourth quarter of 2014:

| Period |

Total Number of Shares Purchased(a) |

Average Price Paid per Share |