Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - WHITE FOX VENTURES, INC. | ex10_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT: January 16, 2015

DNA PRECIOUS METALS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

|

Nevada

|

333-178624

|

37-1640902

|

||

|

(STATE OR OTHER

JURISDICTION OF

INCORPORATION OR

ORGANIZATION)

|

(COMMISSION FILE NO.)

|

(IRS EMPLOYEE

IDENTIFICATION NO.)

|

9921 Lani Lane, Knoxville, TN 37932

|

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

|

9125 Pascal Gagnon, Suite 204, Saint Leonard, Quebec, Canada H1P IZ4

_____________________________________________________________________________________

(FORMER ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(865)924-3210

|

REGISTRANT’S TELEPHONE NUMBER

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

1

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to the implementation of the Company’s business plan, our ability to obtain additional capital in the future to fund our planned expansion; the demand and growth of oral delivery systems for a variety of drugs and general economic factors.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On January 16, 2015 (the “Closing Date”), DNA Precious Metals, Inc. ( “DNAP”, “we”, “our” or the “Company”) entered into a Share Exchange Agreement (the “ Exchange Agreement”) with Breathe LLC, a Tennessee limited liability company organized in October 2013 and Breathe eCigs Corp., a Tenneseee corporation organized on December 31, 2014 (Breathe, LLC and Breathe eCigs Corp. shall collectively be referred to as “Breathe” ), and the members of Breathe whereby DNAP acquired all of the issued and outstanding shares of common stock of Breathe in consideration for the issuance of 150,000,000 shares of DNAP common stock.

The 150,000,000 restricted shares of DNAP common stock issued to former Breathe shareholders (members) issued at closing represent approximately 56% of the then issued and outstanding common stock of DNAP.

As a result of the transactions effected by the Exchange Agreement, at closing Breathe became a wholly owned subsidiary of DNAP. Breathe is a development stage company with limited operations to date. Breathe has received no revenues to date. Breathe plans to design, market and distribute e-cigarettes.

The Exchange Agreement also provided for, among other things, (i) the appointment and resignation certain directors and executive officers at closing, which disclosure is found below under “Item 5.01” of this current report. Further, we intend to amend the Company’s certificate of incorporation to change the Company’s name to Breathe Inc. The transaction contemplates that we will spin-off our wholly owned subsidiary, DNAP Canada to the pre-closing shareholders of Breathe. When we spin-off DNAP Canada, our sole business activity will be conducted through Breathe.

2

DESCRIPTION OF BUSINESS

Corporate History and Background

BACKGROUND:

DNA Precious Metals, Inc. (“we”, “us” “our” “DNAP” or the “Company”) is a Nevada corporation organized June 2, 2006. Our original name was Celtic Capital, Inc. On October 20, 2008, we changed our name to Entertainment Education Arts Inc. On May 12, 2010, we changed our name to DNA Precious Metals, Inc. to more accurately reflect our new business plan.

We were an exploration stage mining company whose business objective was to identify proven reserves of gold and silver, construct a mill, build out the Property’s infrastructure and place the mine into production. The Montauban Mining Project is located in the Montauban and Chavigny townships near Grondines-West in Portneauf County, Quebec, Canada (the “Property”). The Property does not contain any known ore reserves according to the definition of ore reserves under Industry Guide 7 promulgated by the Securities and Exchange Commission (“SEC”).

We have spent significant sums in exploring the property, building a mill and enhancing the overall infrastructure. To date, we have not identified any probable or proven reserves. Further exploration and extraction will be capital intensive with no assurance that further exploration will prove economically feasible. Therefore, management decided to pursue other investment opportunities where the operating capital requirements will be significantly less than for mining.

As a result of the foregoing business decision, management has acquired all of the outstanding membership interests in Breathe LLC. Breathe manufactures and distributes e-cigarettes. Sales are generated through the Internet and distribution to retailers. A more detailed description is provided below. With the acquisition of Breathe, management intends to spin-off the operations of its wholly owned subsidiary, DNAP Canada to the pre-closing DNAP shareholders, exclusive of any members of Breathe receiving shares of common stock of DNAP.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On January 16, 2015 (the “Closing Date”), DNAP, Inc. ( “DNAP”, “we”, “our” or the “Company”) entered into a Share Exchange Agreement (the “ Exchange Agreement”) with Breathe LLC, a Tennessee limited liability company, whereby DNAP acquired all of the issued and outstanding shares of common stock of Breathe in consideration for the issuance of 150,000,000 shares of DNAP common stock.

The 150,000,000 restricted shares of DNAP common stock issued to the former members of Breathe represent approximately 56% of the then issued and outstanding common stock of DNAP.

As a result of the transactions effected by the Exchange Agreement, at closing Breathe became a wholly owned subsidiary of DNAP. DNAP’s sole business activity will be focused on Breathe and its business expansion in the e-cigarette market. DNAP will no longer pursue further development of its mining properties.

The Exchange Agreement also provided for, among other things, (i) the appointment and resignation certain directors and executive officers at closing, which disclosure is found below under “Item 5.01” of this current report and a 1:25 reverse stock split. Further, we intend to amend the Company’s certificate of incorporation to change the Company’s name to Breathe, Inc. .

3

THE BUSINESS

ABOUT BREATHE SMART CIGARETTE

Breathe, LLC was formed in October 2013 and Breathe ECig Corp. was formed on December 31, 2014. On December 31, 2014, Breathe, LLC entered into a Bill of Sale to transfer 100% of the assets to Breathe ECig Corp (hereinafter Breathe, LLC and Breathe ECig Corp. shall collectively be referred to as “The Company” or “Breathe”).

Since formation, the Company has operated as a development stage company, with the intentions of designing marketing and distributing electronic cigarettes (“E-cigarettes”), vaporizers, e-liquids (i.e., liquid nicotine) and related accessories. E-cigarettes and vaporizers are replacements for traditional cigarettes allowing smokers to reproduce the smoking experience. Although they do contain nicotine, E-cigarettes and vaporizers do not burn tobacco and are not smoking cessation devices.

The Company’s initial line of products will focus on E-cigarettes. The present day E-Cigarette is a smokeless, battery-powered device that vaporizes liquid nicotine for delivery via inhalation by the user. The E-Cigarette does not contain tobacco, only nicotine derived from the tobacco plant and trace amounts of secondary chemical ingredients. The component parts of an E-Cigarette are the nicotine cartridge; the atomizer (which vaporizes the liquid nicotine); the rechargeable battery that powers it; and a light-emitting diode (LED) indicator at the end that is activated when the user draws in air (collectively referred to as the “Component Parts”). Breathe will partner with manufacturers in the United States. who will be responsible for producing the liquid nicotine filling the nicotine cartridge with liquid nicotine; thereby ensuring a safe and high standard process for producing a consumer product.

Our Market Opportunity

We operate within the rapidly growing and global e-cigarette industry, an emerging product category that is taking market share from the $783 billion global tobacco industry. The American Cancer Society estimates that there are 1.3 billion tobacco smokers in the world, consuming approximately 6 trillion cigarettes per year, or 190 thousand cigarettes per second. Tobacco use is the leading cause of preventable illness and death, causing more than 5 million annual deaths across the globe according to the CDC. We believe e-cigarettes offer an alternative for current smokers of traditional cigarettes.

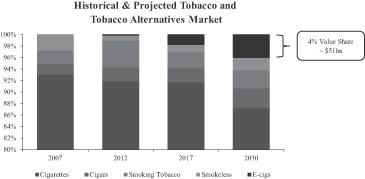

Still in the early stages of its market penetration, the e-cigarette industry is highly fragmented with approximately 250 brands worldwide according to the CDC. Primarily propelled by the cannibalization of the traditional tobacco industry, the global e-cigarette industry has recently experienced dramatic growth. According to Euromonitor, e-cigarettes accounted for approximately $3.5 billion in 2013 global retail sales, with approximately 40% of sales generated in the U.S., 30% of sales generated in Europe, and 30% of sales generated in the rest of the world. Euromonitor estimated that significant market growth was achieved from 2012 to 2013 with the U.S., Europe and the rest of the world generating growth rates of 180%, 160%, and 150%, respectively. Euromonitor also projects e-cigarette sales to represent approximately $51 billion, or 4% of the global tobacco and tobacco alternatives market by 2030. We believe that we are well positioned to benefit from, and take advantage of, these attractive market trends in the coming years.

4

|

|

|

Source: Euromonitor International 2013.

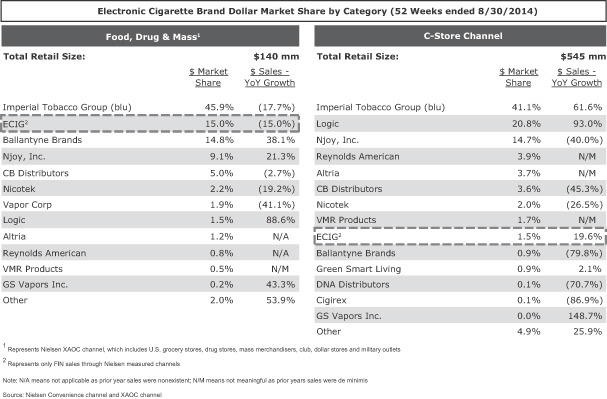

Below is a table presenting the market shares in the United States of various e-cigarette brands for the 52 weeks ended August 30, 2014:

OUR BUSINESS STRATEGY

The Company’s strategic goal is to profitably expand its operations. The business strategies employed by the Company to achieve this goal are defined succinctly through the Company’s mission statement of creating Socially Responsible Innovation in the E-Cigarette and Vaporizer industries and by fulfilling the following objectives:

|

|

·

|

Building a strong brand through a concentration of operational focus on the design, market and distribution of exceptional quality electronic cigarettes and vaporizers.

|

|

|

·

|

Specializing in the development of great tasting proprietary organic and naturally flavored e-liquids with nicotine from Tennessee-sourced Tobacco plants.

|

5

|

|

·

|

Exceptional Packaging – The Company’s high-end products will comprise high quality packaging, unique and customizable labeling for specific customers and retailers.

|

|

|

·

|

Age Verification A commitment to verifying and ensuring that all Breathe customers products are at least 21 years old, through specific product labeling and marketing efforts focused on the adult population age 21 and older.

|

|

|

·

|

Environmentally Conscious Production and Disposal Process -- A commitment to establishing an environmentally aware production and disposal process, which shall include a special recycling program for eligible retailers where (a) said retailers will be provided with a self-mailer option to ship expended lithium batteries and other recyclables to a designated facility and (b) where proceeds from these eligible recyclables will then be shared with the respective retailers.

|

|

|

·

|

Developing Our Organizational Capability – Continuing to develop our organizational capability through recruiting, retaining and rewarding highly capable people and through performance management.

|

|

|

·

|

Pursuing Growth Opportunities – Focusing on pursuing growth opportunities after launching our current product offerings and seeking brands, other products, and partnerships to complement our high-end products.

|

|

|

·

|

Maximizing our financial performance -- Continuing to drive our business activities to deliver improved financial performance.

|

|

|

·

|

Developing a global distribution platform – with the emphasis of serving customers throughout the entire world.

|

License to Intellectual Property and Brand Portfolio

Josh Kimmel has assigned to the Company the exclusive licensing rights to sell the following product lines:

|

|

·

|

Mini e-cigarette Pack – a standard e-cigarette pack designed for vending machines and convenient stores.

|

|

|

·

|

Original non CP – a standard rechargeable single unit without the child protective device.

|

|

|

·

|

Original with CP - a standard rechargeable single unit with the child protective device.

|

|

|

·

|

Smart e-cigarette PCC – Smart e-cigarette carrying case, 2 rechargeable mini-e-cigarettes with 5 cartridges and IPhone chargeable connections.

|

|

|

·

|

5 Pack mini Ref – 5 mini cartridges for the mini size e-cigarette.

|

|

|

·

|

5 pack Standard Ref – 5 refillable cartridges for the mini-size e-cigarettes.

|

Pricing, Sales Model; e-Commerce and Retail

The Company plans to offer its Products at prices, determined based on pricing strategies that are developed by the Company from time to time and which management believes to be best suited to achieve the Company’s goals at such time. These pricing strategies are expected to be developed based on a number of factors, including the needs and behaviors of customers, purchase volumes, market specific criteria, and the Company’s costs of goods.

6

The price of the brand portfolio of products are broken down as follows, with prices varying based on product type and distribution channel (e-commerce vs. retail):

|

Product

|

Mini e-Cig

Pack

|

Original non

CP

|

Original with

CP

|

Smart E-Cig

PCC

|

5 Pack mini

Ref.

|

5 pack

Standard

Ref.

|

|

E-Commerce

Price

|

19.95

|

19.95

|

19.95

|

38.00

|

19.95

|

19.95

|

|

Retail Price

|

10.00

|

10.00

|

10.50

|

25.00

|

10.50

|

10.50

|

The Company believes that the elegant design of the packaging, along with high quality products which feature excellent tasting, proprietary and handcrafted flavors justifies the costs and increases the margins.

Production and Supply for e-cigarette Lines

The launch of a new E-Cigarette line involves input from many different sources, from the manufacturer to the customer.

The stages of the development, manufacturing, production and distribution process of the E-cigarette can be summarized as follows:

|

o

|

Discussions with designers and creators (includes analysis and factory trends, target clientele and market communication);

|

|

o

|

Concept choice;

|

|

o

|

Produce mock-ups for final acceptance of unit device, packaging and flavoring;

|

|

o

|

Receive bids from component suppliers;

|

|

o

|

Choose suppliers;

|

|

o

|

Schedule production and packaging;

|

|

o

|

Issue component part purchase orders;

|

|

o

|

Follow quality control procedures for incoming components;

|

|

o

|

Follow packaging and inventory control procedures;

|

|

o

|

Engage U.S. based FDA certified e-liquid manufacturer to produce and fill nicotine cartridges after receiving Component Parts; and

|

|

o

|

Production specialists who carry out packaging or logistics for storage, order preparation and shipment.

|

7

Procurement and Distribution

In launching E-Cigarette lines, the Company must be able to coordinate procuring the Component Parts, manufacturing the product, packaging the product, storage, distribution and order processing. The Company has been in discussions with a Chinese based manufacturer who will produce the pen devices. The Company has been in discussions with a U.S. based manufacturer who will produce the e-liquids and who will also fill the cartridges with the e-liquids, which in turn will allow all of the Company’s consumerables to be U.S. oriented. Therefore, after the pen devices are manufactured overseas, the e-liquid filled cartridges will be inserted in the U.S. and ready for distribution.

The Company has been in discussions with a distribution center and warehouse located in Knoxville, TN who will procure the component goods from the manufacturers and other suppliers, package the Company’s products for distribution, manage purchase orders and the electronic data interchange.

Additionally, the distribution partner, under the supervision of the Company’s leadership, will be responsible for negotiate pricing and payment terms with suppliers, manufacture and package the products and coordinate payment to the suppliers.

Finally, the Company’s experienced leadership team will be responsible for all component costs, transportation, assembly costs and a management fee paid to the Distribution and Manufacturer.

Market Opportunity

The e-cigarette industry is booming – approximately 3.5 million Americans regularly use e-cigarettes, according to a 2013 study done by Mary Diduch. Centers for Disease Control show that e-cigarette use quadrupled in a single year from 2009 to 2010. Based on 2011 numbers alone, 21% of adult smokers in the United States have used e-cigarettes, 6% of all adults have tried e-cigarettes, and general awareness of e-cigarettes rose to 60% of all adults, up from 40% from 2010 according to a 2013 study published by the CDC. The co-founder of the Tobacco Vapor Electronic Cigarette Association stated in March 2012 that nearly 20 million e-cigarette cartridges are sold in the United States, per week.

Moreover, there is currently a favorable regulatory environment with certain federal, local and state regulation focused at advertising, age verification and use bans in public area

Marketing and Growth Strategies

In order to increase brand awareness, the Company began to focus its marketing initiatives and efforts through the development of a proprietary system that has accumulated over 20 million individuals that have the potential to see very advertisement and social media post produced by the Company. In addition to hosting a secure web portal that promotes the Company’s products and will handle order, www.breathecig.com, the Company has also been marketed on major social media platforms: LinkedIn, Facebook, Twitter, Instagram, Google and Pinterest. Because of this successful initial marketing effort:

|

|

·

|

The Company has already received hundreds of requests for more information on its products.

|

|

|

·

|

These initial efforts have been cost effective and have not involved a substantial drive to promote sales.

|

|

|

·

|

The Company’s website has received over 600,000 visitors during the last 18 months.

|

|

|

·

|

The Company has received numerous requests from customers interested in purchasing Breathe’s products, including but not limited to major retail groups, Hotel Chains, Restaurants and Club Owners.

|

8

o

Retail and Wholesale Distribution:

The Company is developing unique and distinct brands for its E-cigarette Products for purposes of marketing and selling such branded E-cigarette Products, initially in North America, China, Africa, and Europe, through retail and wholesale distribution channels, including convenience stores, retail chains, wholesale trade, pharmacies, gas stations, hotels, industrial customers, clubs, casinos and duty free stores.

In addition, the Company intends to enter into exclusive agreements with various distributors providing them with exclusivity on certain brands of Product in defined territories and markets worldwide.

E-Commerce:

The Company intends to distribute its branded Products through its website, www.breathecig.com, and other online sales platforms. Through its e-commerce sales initiatives, the Company hopes to generate recurring purchases of its exclusive brands of E-cigarettes from customers who are legally allowed to purchase cigarettes in the United States other regions. Management expects that its marketing strategy will include various forms of social media as a key element in its marketing strategies and in further establishing and growing the Company’s business. The Company’s key e-commerce platform is currently in development and scheduled to launch in the second quarter of 2014.

White Label/Private Brand Distribution:

The Company is actively pursuing opportunities and relationships to develop and offer its Products on a “white label”, private branded basis. Management of the Company believes that there is an opportunity to supply Products on a custom branded basis to a variety of customers for purposes of resale. These potential customers may include wholesale and retail customers that have or wish to develop a private customizable label.

Government Regulations

A recent United States Federal Court decision permits the United States Food and Drug Administration to regulate electronic cigarettes as “tobacco products” under the Family Smoking Prevention and Tobacco Control Act of 2009 and the United States Food and Drug Administration has indicated that it intends to do so.

Based on the December 2010 U.S. Court of Appeals for the D.C. Circuit’s decision in Sottera, Inc. v. Food & Drug Administration, 627 F.3d 891 (D.C. Cir. 2010), the United States Food and Drug Administration (the “FDA”) is permitted to regulate electronic cigarettes as “tobacco products” under the Family Smoking Prevention and Tobacco Control Act of 2009 (the “Tobacco Control Act”).

Under this Court decision, the FDA is not permitted to regulate electronic cigarettes as “drugs” or “devices” or a “combination product” under the Federal Food, Drug and Cosmetic Act unless they are marketed for therapeutic purposes.

Because we do not market our electronic cigarettes for therapeutic purposes, our electronic cigarettes are subject to being classified as “tobacco products” under the Tobacco Control Act. The Tobacco Control Act grants the FDA broad authority over the manufacture, sale, marketing and packaging of tobacco products, although the FDA is prohibited from issuing regulations banning all cigarettes or all smokeless tobacco products, or requiring the reduction of nicotine yields of a tobacco product to zero. Among other measures, the Tobacco Control Act (under various deadlines):

9

|

●

|

Increases the number of health warnings required on cigarette and smokeless tobacco products, increases the size of warnings on packaging and in advertising, requires the FDA to develop graphic warnings for cigarette packages and grants the FDA authority to require new warnings;

|

|

|

●

|

Requires practically all tobacco product advertising to eliminate color and imagery and instead consist solely of black text on white background;

|

|

|

●

|

Imposes new restrictions on the sale and distribution of tobacco products, including significant new restrictions on tobacco product advertising and promotion as well as the use of brand and trade names;

|

|

|

●

|

Bans the use of “light,” “mild,” “low” or similar descriptors on tobacco products;

|

|

|

●

|

Gives the FDA the authority to impose tobacco product standards that are appropriate for the protection of the public health (by, for example, requiring reduction or elimination of the use of particular constituents or components, requiring product testing, or addressing other aspects of tobacco product construction, constituents, properties or labeling);

|

|

|

●

|

Requires manufacturers to obtain FDA review and authorization for the marketing of certain new or modified tobacco products;

|

|

|

●

|

Requires pre-market approval by the FDA for tobacco products represented (through labels, labeling, advertising, or other means) as presenting a lower risk of harm or tobacco-related disease;

|

|

|

●

|

Requires manufacturers to report ingredients and harmful constituents and requires the FDA to disclose certain constituent information to the public;

|

|

|

●

|

Mandates that manufacturers test and report on ingredients and constituents identified by the FDA as requiring such testing to protect the public health, and allows the FDA to require the disclosure of testing results to the public;

|

|

|

●

|

Requires manufacturers to submit to the FDA certain information regarding the health, toxicological, behavioral or physiologic effects of tobacco products;

|

|

|

●

|

Prohibits use of tobacco containing a pesticide chemical residue at a level greater than allowed under federal law;

|

|

|

●

|

Requires the FDA to establish “good manufacturing practices” to be followed at tobacco manufacturing facilities;

|

|

|

●

|

Requires tobacco product manufacturers (and certain other entities) to register with the FDA; and

|

|

|

●

|

Grants the FDA the regulatory authority to impose broad additional restrictions.

|

The Tobacco Control Act also requires establishment, within the FDA’s new Center for Tobacco Products, of a Tobacco Products Scientific Advisory Committee to provide advice, information and recommendations with respect to the safety, dependence or health issues related to tobacco products. As indicated above, the Tobacco Control Act imposes significant new restrictions on the advertising and promotion of tobacco products. For example, the law requires the FDA to finalize certain portions of regulations previously adopted by the FDA in 1996 (which were struck down by the Supreme Court in 2000 as beyond the FDA’s authority). As written, these regulations would significantly limit the ability of manufacturers, distributors and retailers to advertise and promote tobacco products, by, for example, restricting the use of color, graphics and sound effects in advertising, limiting the use of outdoor advertising, restricting the sale and distribution of non-tobacco items and services, gifts, and sponsorship of events and imposing restrictions on the use for cigarette or smokeless tobacco products of trade or brand names that are used for non-tobacco products. The law also requires the FDA to issue future regulations regarding the promotion and marketing of tobacco products sold or distributed over the internet, by mail order or through other non-face-to-face transactions in order to prevent the sale of tobacco products to minors.

It is likely that the Tobacco Control Act could result in a decrease in tobacco product sales in the United States, including sales of our electronic cigarettes.

10

While the FDA has not yet mandated electronic cigarettes be regulated as tobacco products, the FDA issued proposed regulations on April 25, 2014 seeking to regulate electronic cigarettes as tobacco products. Under these proposed rules, products meeting the statutory definition of “tobacco products,” except accessories of a proposed deemed tobacco product, would be subject to the Federal Food, Drug, and Cosmetic Act (the FD&C Act), as amended by the Family Smoking Prevention and Tobacco Control Act (Tobacco Control Act). The Tobacco Control Act provides FDA authority to regulate cigarettes, cigarette tobacco, roll-your-own tobacco, smokeless tobacco, and any other tobacco products that the Agency by regulation deems to be subject to the law. Option 1 of the proposed rule would extend the Agency's “tobacco product” authorities in the FD&C Act to all other categories of products, except accessories of a proposed deemed tobacco product, that meet the statutory definition of “tobacco product” in the FD&C Act. Option 2 of the proposed rule would extend the Agency's “tobacco product” authorities to all other categories of products, except premium cigars and the accessories of a proposed deemed tobacco product, that meet the statutory definition of “tobacco product” in the FD&C Act. FDA also is proposing to prohibit the sale of “covered tobacco products” to individuals under the age of 18 and to require the display of health warnings on cigarette tobacco, roll-your own tobacco, and covered tobacco product packages and in advertisements. Further, the FDA proposed to extend its authority to cover additional products that meet the definition of a tobacco product under the proposed rule: Tobacco Products Deemed To Be Subject to the Food, Drug & Cosmetic Act (Deeming). Currently FDA regulates cigarettes, cigarette tobacco, roll-your-own tobacco and smokeless tobacco. Proposed newly “deemed” products would include: electronic cigarettes, cigars, pipe tobacco, certain dissolvables that are not “smokeless tobacco,” gels and water pipe tobacco.

If electronic cigarettes are regulated as proposed, the FDA will implement new rules to govern the labeling of electronic cigarettes, including smokeless tobacco product warning labels and “light,” “low,” “mild” or similar descriptors for tobacco products. These new laws are expected to have a significant public health impact by decreasing the number of people using tobacco products, resulting in lives saved, increased life expectancy, and lower medical costs. In addition, the FDA will also restrict the way electronic cigarette manufacturers, retailers, and distributers can advertise and promote cigarettes and smokeless tobacco products, especially marketing efforts designed to appeal to youth. Such restrictions relating to marketing, advertising, and promotion will include: prohibiting tobacco brand name sponsorship of any athletic, musical, or other social or cultural event, or any team or entry in those events, requiring that audio ads use only words with no music or sound effects, prohibiting the sale or distribution of items, such as hats and tee shirts, with cigarette and smokeless tobacco brands or logos and requiring that manufacturers receive a written order from FDA permitting the legal marketing of a new tobacco product. The FDA’s traditional “safe and effective” standard for evaluating medical products does not currently apply to tobacco. FDA evaluates new tobacco products based on a public health standard that considers the risks and benefits of the tobacco product on the population as a whole, including users and non-users. To legally market new tobacco products, a written order from FDA must be received permitting its marketing in the United States.

The application of the Tobacco Control Act to electronic cigarettes could impose, among other things, restrictions on the content of nicotine in electronic cigarettes, the advertising, marketing and sale of electronic cigarettes, the use of certain flavorings and the introduction of new products. We cannot predict the scope of such regulations or the impact they may have on our company specifically or the electronic cigarette industry generally, though if enacted, they could have a material adverse effect on our business, results of operations and financial condition.

11

In this regard, total compliance and related costs are not possible to predict and depend substantially on the future requirements imposed by the FDA under the Tobacco Control Act. Costs, however, could be substantial and could have a material adverse effect on our business, results of operations and financial condition. In addition, failure to comply with the Tobacco Control Act and with FDA regulatory requirements could result in significant financial penalties and could have a material adverse effect on our business, financial condition and results of operations and ability to market and sell our products. At present, we are not able to predict whether the Tobacco Control Act will impact us to a greater degree than competitors in the industry, thus affecting our competitive position.

Competition

Competition in the electronic cigarette industry is intense. We compete with other sellers of electronic cigarettes, most notably Lorillard, Inc., Altria Group, Inc. and Reynolds American Inc., big tobacco companies, through their electronic cigarettes business segments; the nature of our competitors is varied as the market is highly fragmented and the barriers to entry into the business are low.

We compete primarily on the basis of product quality, brand recognition, brand loyalty, service, marketing, advertising and price. We are subject to highly competitive conditions in all aspects of our business. The competitive environment and our competitive position can be significantly influenced by weak economic conditions, erosion of consumer confidence, competitors’ introduction of low-priced products or innovative products, cigarette excise taxes, higher absolute prices and larger gaps between price categories, and product regulation that diminishes the ability to differentiate tobacco products.

Our principal competitors are “big tobacco”, U.S. cigarette manufacturers of both conventional tobacco cigarettes and electronic cigarettes like Altria Group, Inc., Lorillard, Inc. and Reynolds American Inc. We compete against “big tobacco” who offers not only conventional tobacco cigarettes and electronic cigarettes but also smokeless tobacco products such as “snus” (a form of moist ground smokeless tobacco that is usually sold in sachet form that resembles small tea bags), chewing tobacco and snuff. Furthermore, we believe that “big tobacco” will devote more attention and resources to developing and offering electronic cigarettes as the market for electronic cigarettes grows. Because of their well-established sales and distribution channels, marketing expertise and significant resources, “big tobacco” is better positioned than small competitors like us to capture a larger share of the electronic cigarette market. We also compete against numerous other smaller manufacturers or importers of cigarettes. There can be no assurance that we will be able to compete successfully against any of our competitors, some of whom have far greater resources, capital, experience, market penetration, sales and distribution channels than us. If our major competitors were, for example, to significantly increase the level of price discounts offered to consumers, we could respond by offering price discounts, which could have a materially adverse effect on our business, results of operations and financial condition.

RISK FACTORS

THE RISKS AND UNCERTAINTIES DESCRIBED BELOW ARE NOT THE ONLY ONES WE FACE. ADDITIONAL RISKS AND UNCERTAINTIES NOT PRESENTLY KNOWN OR THAT WE CURRENTLY DEEM IMMATERIAL MAY ALSO IMPAIR OUR BUSINESS OPERATIONS. IF ANY OF THE FOLLOWING RISKS ACTUALLY OCCUR, OUR BUSINESS COULD BE MATERIALLY ADVERSELY AFFECTED. IN SUCH CASE, WE MAY NOT BE ABLE TO PROCEED WITH OUR PLANNED OPERATIONS AND YOUR INVESTMENT MAY BE LOST ENTIRELY.

We have a limited operating history, and may not be successful in developing profitable business operations.

12

Breathe is a development stage company focused on the e-cigarette market Breathe was organized in October 2013. Accordingly, we have a limited operating history. Our business operations must be considered in light of the risks, expenses and difficulties frequently encountered by a developmental stage company. We have generated limited revenues to date. There is nothing at this time on which to base an assumption that our business operations will be successful in the long-term. Our future operating results will depend on many factors, including:

|

|

·

|

our ability to raise adequate working capital;

|

|

|

·

|

success of in developing and marketing our e-cigarettes;

|

|

|

·

|

demand for e-cigarettes;

|

|

|

·

|

increased regulations of e-cigarettes

|

|

|

·

|

the level of our competition; and

|

|

|

·

|

our ability to attract and maintain key management and employees.

|

While our officers and directors have significant business experience, there can be no assurance that this experience will help us fully implement our business plan. Our prospects for success must be considered in the context of a new company in a highly competitive industry with few barriers to entry.

We have limited capital and will need to raise additional capital in the future.

We do not currently have sufficient capital to fund both our continuing operations and our planned growth. We will require additional capital to continue to expand our operations. We may be unable to obtain additional capital when required. Future business development activities, as well as our administrative requirements (such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) will require a substantial amount of additional capital and cash flow.

We may pursue sources of additional capital through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may not be successful in identifying suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources may not be sufficient to fund our planned operations.

Any additional capital raised through the sale of equity may dilute the ownership percentage of our stockholders. Raising any such capital could also result in a decrease in the fair market value of your equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Our ability to obtain financing, if and when necessary, may be impaired by such factors as the capital markets (both generally and in our industry in particular), our limited operating history, national unemployment rates and the departure of key employees. Further, economic downturns will likely decrease our revenues may increase our requirements for capital. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs (even to the extent that we reduce our operations), we may be required to cease our operations, divest our assets at unattractive prices or obtain financing on unattractive terms.

13

We may not be able to successfully manage our growth, which could lead to our inability to implement our business plan.

Our growth is expected to place a significant strain on our managerial, operational and financial resources, especially considering that we currently only have a small number of executive officers, employees and advisors. Further, as we enter into various contracts or other transactions, we will be required to manage multiple relationships with various consultants, businesses and other third parties.. There can be no assurance that our systems, procedures and/or controls will be adequate to support our operations or that our management will be able to achieve the rapid execution necessary to successfully implement our business plan. If we are unable to manage our growth effectively, our business, results of operations and financial condition will be adversely affected, which could lead to us being forced to abandon or curtail our business plan and operations.

Our executive officers and key employees will be crucial to our business, and we may not be able to recruit, integrate and retain the personnel we need to succeed.

Our future success is dependent, in a large part, on retaining the services of our current officers and directors. The knowledge, leadership and technical expertise of management would be difficult to replace. While no director has plans to leave or retire in the near future, the loss of any of our directors could have a material adverse effect on our operating and financial performance, including our ability to develop and execute our long The loss of the services of any key personnel, or our inability to attract, integrate and retain highly skilled technical, management, sales and marketing personnel could result in significant disruption to our operations, including our inability or limited success in developing our job verticals, completion of our initiatives, including growth plans and the results of our operations. Any failure by us to find suitable replacements for our key management may be disruptive to our operations. Competition for such personnel can be intense, and we may be unable to attract, integrate and retain such personnel successfully.

We do not have any independent directors and have not implemented various corporate governance measures, in the absence of which, stockholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

As of the date of this report, we do not have any independent directors to evaluate our decisions nor have we adopted corporate governance measures. Although not required by rules or regulations applicable to us, corporate governance measures such as the presence of independent directors, or the establishment of an audit and other independent committees of our Board of Directors, would be beneficial to our stockholders. We do not presently maintain any of these protections for our stockholders. It is possible that if our Board of Directors included independent directors and if we were to adopt corporate governance measures, stockholders would benefit from greater assurance that decisions were being made with impartiality by directors and that policies had been implemented to define conduct of our management and board members. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our officers and recommendations for director nominees may be made by existing members of the Board of Directors, who may have a direct interest in the outcome. Although we anticipate expanding the Board of Directors to include independent directors at some point in the future, when and if this will occur is uncertain.

14

Our management controls a significant percentage of our current outstanding common stock.

As of the date of this report, our officers and directors collectively and beneficially own approximately 56% of our outstanding common stock. This concentration of voting control gives management substantial influence over any matters which require a stockholder vote, including without limitation the election of directors and approval of merger and/or acquisition transactions, even if their interests may conflict with those of other stockholders. It could have the effect of delaying or preventing a change in control of, or otherwise discouraging, a potential acquirer from attempting to obtain control of the company. This could have a material adverse effect on the market price of our common stock or prevent our stockholders from realizing a premium over the then prevailing market prices for their shares of common stock.

We will be dependent on third parties to manufacture, distribute, and sell our products.

The success of our commercial operations is dependent upon the ability of these vendors to provide a high level of service and support at an economical price. If we fail to attract and retain such professions or services at a reasonable price, or if third parties do not successfully carry out their contractual obligations, meet expected deadlines or conduct our activities in accordance with applicable regulatory requirements or our stated specifications, we may not be able to, or may be delayed in our efforts to, successfully execute upon our commercial strategy.

Our business will suffer if we cannot adequately protect our patent and proprietary rights

We have a patent pending. The patent application may be challenged. In addition, there can be no assurance that the patent will provide us with meaningful protection from competition, or that we will possess the financial resources necessary to enforce any of our patents. Also, we cannot be certain that any products that we (or a licensee) develop will not infringe upon any patent or other intellectual property right of a third party. We also rely upon trade secrets, know-how, and continuing technological advances to develop and maintain our competitive position.

We are vulnerable to intellectual property infringement claims brought against us by others.

Successful intellectual property infringement claims against us could result in monetary liability or a material disruption in the conduct of our business. We cannot be certain that our products, content and brand names do not or will not infringe valid patents, trademarks, copyrights or other intellectual property rights held by third parties. We expect that infringement claims in our markets will increase in number. We may be subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. If we were found to have infringed the intellectual property rights of a third party, we could be liable to that party for license fees, royalty payments, lost profits or other damages, and the owner of the intellectual property might be able to obtain injunctive relief to prevent us from using the technology or software in the future. If the amounts of these payments were significant or we were prevented from incorporating certain technology into our products, our business could be significantly harmed. We may incur substantial expenses in defending against these third party infringement claims, regardless of their merit. As a result, due to the diversion of management time, the expense required to defend against any claim and the potential liability associated with any lawsuit, any significant litigation could significantly harm our business, financial condition and results of operations.

15

If we are unable to protect our, proprietary rights or maintain our rights to use key technologies of third parties, our business may be harmed.

We may be issued patents. Our patent applications or patents may be later challenged, invalidated or circumvented, and the rights granted under patents may not provide us with a competitive advantage. We may also face risks associated with any trademarks to which we own the rights. Policing unauthorized use of our patented, proprietary technology and other intellectual property rights could involve significant expense and could be difficult or impossible, particularly given the global nature of the Internet and the fact that the laws of certain other countries may afford us little or no effective protection of our intellectual property.

We may incur significant increased costs as a result of operating as a public company, and our management may be required to devote substantial time to new compliance initiatives.

In the future, we may incur significant legal, accounting and other expenses as a result of operating as a public company. The Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as new rules subsequently implemented by the SEC, have imposed various new requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, we expect these new rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to incur substantial costs to maintain the same or similar coverage.

In addition, the Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure controls and procedures. In particular, we are required to perform system and process evaluation and testing on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Our compliance with Section 404 will require that we incur substantial accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Risks Related to e-cigarettes:

E-cigarettes may be subject to extensive government regulations.

E-cigarettes are likely to become subject to increasing government regulation Compliance with these government regulations may result in inceased costs. If E-cigarettes become subject to taxes similar to regular cigarettes, or restriction on where individivduals can smoke eE-cigarettes, demand may decrease.

The FDA has concluded that electronic cigarettes may contain ingredients that are known to be toxic to humans and may contain other ingredients that may not be safe.

The FDA conducted a preliminary analysis on some samples of electronic cigarettes and components from two leading brands. These samples included 18 of the various flavored, nicotine, and no-nicotine cartridges offered for use with these products. These cartridges were obtained in order to test some of the ingredients contained in them and inhaled by users of electronic cigarettes. The FDA's Center for Drug Evaluation, Division of Pharmaceutical Analysis (DPA) analyzed the cartridges from these electronic cigarettes for nicotine content and for the presence of other tobacco constituents, some of which are known to be harmful to humans, including those that are potentially carcinogenic or mutagenic. The DPA's analysis of the electronic cigarette samples showed that the product contained detectable levels of known carcinogens and toxic chemicals to which users could potentially be exposed. DPA's testing also suggested that quality control processes used to manufacture these products are inconsistent or non-existent. Specifically, the DPA's analysis of the electronic cigarette cartridges from the two leading brands revealed the following:

16

|

|

·

|

Diethylene glycol was detected in one cartridge at approximately 1%. Diethylene glycol, an ingredient used in antifreeze, is toxic to humans.

|

|

·

|

Certain tobacco-specific nitrosamines which are human carcinogens were detected in half of the samples tested.

|

|

|

·

|

Tobacco-specific impurities suspected of being harmful to humans-anabasine, myosmine, and-nicotyrine-were detected in a majority of the samples tested.

|

|

|

·

|

The electronic cigarette cartridges that were labeled as containing no nicotine had low levels of nicotine present in all cartridges tested, except one.

|

|

|

·

|

Three different electronic cigarette cartridges with the same label were tested and each cartridge emitted a markedly different amount of nicotine with each puff. The nicotine levels per puff ranged from 26.8 to 43.2 mcg nicotine/100 mL puff.

|

|

|

·

|

One high-nicotine cartridge delivered twice as much nicotine to users when the vapor from that electronic cigarette brand was inhaled than was delivered by a sample of the nicotine inhalation product (used as a control) approved by FDA for use as a smoking cessation aid.

|

Because our products may contain ingredients that are known to be toxic to humans, any decreases in tobacco product sales in the United States, including sales of our electronic cigarettes, could have a material adverse effect on our business, results of operations and financial condition.

The FDA has received voluntary reports of adverse events involving e-cigarettes from consumers, health professionals and concerned members of the public.

The FDA regularly receives voluntary reports of adverse events involving e-cigarettes from consumers, health professionals and concerned members of the public. The adverse events described in these reports have included hospitalization for illnesses such as:

|

|

·

|

Pneumonia

|

|

·

|

Congestive heart failure,

|

|

|

·

|

Disorientation,

|

|

|

·

|

Seizure,

|

|

|

·

|

Hypotension, and

|

|

|

·

|

Other health problems.

|

Whether e-cigarettes caused these reported adverse events is unknown. Some of the adverse events could be related to a pre-existing medical condition or to other causes that were not reported to the FDA. Because our products may contribute to adverse events requiring hospitalization, any decreases in tobacco product sales in the United States as a result, including sales of our electronic cigarettes could have a material adverse effect on our business, results of operations and financial condition.

17

There have been publicized incidents of electronic cigarettes exploding if improperly used.

There have been several news reports publicizing incidents in which electronic cigarettes have exploded. According to such news reports, the cause of such electronic cigarettes exploding was due to improper use by users of such electronic cigarettes that charged the devices with equipment that was not intended for such devices. Although we notify users of our products with regard to how to properly use our products, we may be unable to prevent improper use that may result in explosions of our products similar to that publicized in recent news reports, which could have a material adverse effect on our business, results of operations and financial condition.

The recent development of electronic cigarettes has not allowed the medical profession to study the long-term health effects of electronic cigarette use.

Because electronic cigarettes were recently developed the medical profession has not had a sufficient period of time to study the long-term health effects of electronic cigarette use. Currently, therefore, there is no way of knowing whether or not electronic cigarettes are safe for their intended use. If the medical profession were to determine conclusively that electronic cigarette usage poses long-term health risks, electronic cigarette usage could decline, which could have a material adverse effect on our business, results of operations and financial condition.

Our business, results of operations and financial condition could be adversely affected if we are taxed like other tobacco products or if we are required to collect and remit sales tax on certain of our internet sales.

Presently the sale of electronic cigarettes is not subject to federal excise taxes, and most state and local excise taxes, like the sale of conventional cigarettes or other tobacco products, all of which have faced significant increases in the amount of taxes collected on their sales. At present, the sale of electronic cigarettes is subject to state excise taxes in only a small number of states, Minnesota and North Carolina. However, should federal, state and local governments and or other taxing authorities impose excise taxes similar to those levied by Minnesota and North Carolina, it may have a material adverse effect on the demand for our products, as consumers may be unwilling to pay the increased costs for our products.

We may be unable to establish the systems and processes needed to track and submit the excise and sales taxes we collect through Internet sales, which would limit our ability to market our products through our websites which would have a material adverse effect on our business, results of operations and financial condition. States such as New York, Hawaii, Rhode Island and North Carolina have begun collecting sales taxes on Internet sales where companies have used independent contractors in those states to solicit sales from residents of that state. The requirement to collect, track and remit sales taxes based on independent affiliate sales may require us to increase our prices, which may affect demand for our products or conversely reduce our net profit margin, either of which would have a material adverse effect on our business, results of operations and financial condition.

The market for electronic cigarettes is a niche market, subject to a great deal of uncertainty and is still evolving.

Electronic cigarettes, having recently been introduced to market, are at an early stage of development, represent a niche market and are evolving rapidly and are characterized by an increasing number of market entrants. Our future sales and any future profits are substantially dependent upon the widespread acceptance and use of electronic cigarettes. Rapid growth in the use of, and interest in, electronic cigarettes is recent, and may not continue on a lasting basis. The demand and market acceptance for these products is subject to a high level of uncertainty. Therefore, we are subject to all of the business risks associated with a new enterprise in a niche market, including risks of unforeseen capital requirements, failure of widespread market acceptance of electronic cigarettes, in general or, specifically our products, failure to establish business relationships and competitive disadvantages as against larger and more established competitors.

18

We face intense competition and our failure to compete effectively could have a material adverse effect on our business, results of operations and financial condition.

We are a developmental stage company with limited capital. We will face intense competition from larger, well established e-cigarette manufacturers including big tobacco companies which are increasingly entering into the e-cigarette market. There can be no assurance that we will be able to compete based on the superior quality of our product and niche marketing opportunities.

Sales of conventional tobacco cigarettes have been declining, which could have a material adverse effect on our business.

The overall U.S. market for conventional tobacco cigarettes has generally been declining in terms of volume of sales, as a result of restrictions on advertising and promotions, funding of smoking prevention campaigns, increases in regulation and excise taxes, a decline in the social acceptability of smoking, and other factors, and such sales are expected to continue to decline. Recently, a national drug store chain announced that it would cease selling tobacco products. If other national drug store chains also decide to cease selling tobacco products, cigarette sales could decline further. While the sales of electronic cigarettes have been increasing over the last several years, the electronic cigarette market is only developing and is a fraction of the size of the conventional tobacco cigarette market. A continual decline in cigarette sales may adversely affect the growth of the electronic cigarette market, which could have a material adverse effect on our business, results of operations and financial condition.

Electronic cigarettes face intense media attention and public pressure.

Electronic cigarettes are new to the marketplace and since their introduction certain members of the media, politicians, government regulators and advocate groups, including independent medical physicians have called for an outright ban of all electronic cigarettes, pending regulatory review and a demonstration of safety. A partial or outright ban would have a material adverse effect on our business, results of operations and financial condition.

We may experience product liability claims in our business, which could adversely affect our business.

The tobacco industry in general has historically been subject to frequent product liability claims. As a result, we may experience product liability claims from the marketing and sale of electronic cigarettes. Any product liability claim brought against us, with or without merit, could result in:

|

●

|

Liabilities that substantially exceed our product liability insurance, which we would then be required to pay from other sources, if available;

|

|

|

●

|

An increase of our product liability insurance rates or the inability to maintain insurance coverage in the future on acceptable terms, or at all;

|

|

|

●

|

Damage to our reputation and the reputation of our products, resulting in lower sales;

|

|

|

●

|

Regulatory investigations that could require costly recalls or product modifications;

|

|

|

●

|

Litigation costs; and

|

|

|

●

|

The diversion of management’s attention from managing our business.

|

Any one or more of the foregoing could have a material adverse effect on our business, results of operations and financial condition.

19

If we experience product recalls, we may incur significant and unexpected costs and our business reputation could be adversely affected.

We may be exposed to product recalls and adverse public relations if our products are alleged to cause illness or injury, or if we are alleged to have violated governmental regulations. A product recall could result in substantial and unexpected expenditures that could exceed our product recall insurance coverage limits and harm to our reputation, which could have a material adverse effect on our business, results of operations and financial condition. In addition, a product recall may require significant management time and attention and may adversely impact on the value of our brands. Product recalls may lead to greater scrutiny by federal or state regulatory agencies and increased litigation, which could have a material adverse effect on our business, results of operations and financial condition.

Product exchanges, returns and warranty claims may adversely affect our business.

If we are unable to maintain an acceptable degree of quality control of our products we will incur costs associated with the exchange and return of our products as well as servicing our customers for warranty claims. Any of the foregoing on a significant scale may have a material adverse effect on our business, results of operations and financial condition.

Adverse economic conditions may adversely affect the demand for our products.

Electronic cigarettes are new to market and may be regarded by users as a novelty item and expendable as such demand for our products may be extra sensitive to economic conditions. When economic conditions are prosperous, discretionary spending typically increases; conversely, when economic conditions are unfavorable, discretionary spending often declines. Any significant decline in economic conditions that affects consumer spending could have a material adverse effect on our business, results of operations and financial condition.

Our success is dependent upon our marketing efforts.

We intend to undertake extensive marketing activities to promote brand awareness and our portfolio of products. If we are unable to generate significant market awareness for our products and our brands at the consumer level or unable to capitalize on significant marketing, advertising or promotional campaigns we undertake, our business, financial condition and results of operations could be adversely affected.

We depend on third party manufacturers for our products.

We depend on third party manufacturers for our electronic cigarettes. Our customers associate certain characteristics of our products including the weight, feel, draw, unique flavour, packaging and other attributes of our products to the brands we market, distribute and sell. Any interruption in supply and/or consistency of our products may adversely impact our ability to deliver our products to our wholesalers, distributors and customers and otherwise harm our relationships and reputation with customers, and have a materially adverse effect on our business, results of operations and financial condition.

Although we believe that several alternative sources for the components, chemical constituents and manufacturing services necessary for the production of our products are available, any failure to obtain any of the foregoing would have a material adverse effect on our business, results of operations and financial condition.

We may be unable to promote and maintain our brands.

We believe that establishing and maintaining the brand identities of our products is a critical aspect of attracting and expanding a large customer base. Promotion and enhancement of our brands will depend largely on our success in continuing to provide high quality products. If our customers and end users do not perceive our products to be of high quality, or if we introduce new products or enter into new business ventures that are not favorably received by our customers and end users, we will risk diluting our brand identities and decreasing their attractiveness to existing and potential customers.

20

Moreover, in order to attract and retain customers and to promote and maintain our brand equity in response to competitive pressures, we may have to increase substantially our financial commitment to creating and maintaining a distinct brand loyalty among our customers. If we incur significant expenses in an attempt to promote and maintain our brands, our business, results of operations and financial condition could be adversely affected.

We expect that new products and/or brands we develop will expose us to risks that may be difficult to identify until such products and/or brands are commercially available.

We are currently developing, and in the future will continue to develop, new products and brands, the risks of which will be difficult to ascertain until these products and/or brands are commercially available. For example, we are developing new formulations, packaging and distribution channels. Any negative events or results that may arise as we develop new products or brands may adversely affect our business, financial condition and results of operations.

The market for e-cigarettes is a niche market, subject to a great deal of uncertainty, and is still evolving.

E-cigarettes, having recently been introduced to market, are at an early stage of development, represent a niche market and are evolving rapidly and are characterized by an increasing number of market entrants. Our future sales and any future profits are substantially dependent upon the widespread acceptance and use of e-cigarettes. Rapid growth in the use of, and interest in, e-cigarettes is recent, and may not continue on a lasting basis. The demand and market acceptance for these products is subject to a high level of uncertainty. Therefore, we are subject to all of the business risks associated with a new enterprise in a niche market, including risks of unforeseen capital requirements, failure of widespread market acceptance of e-cigarettes, in general or, specifically our products, failure to establish business relationships and competitive disadvantages as against larger and more established competitors.

Our business is in a relatively new consumer product segment, which is difficult to forecast.

Our industry segment is relatively new, and is constantly evolving. As a result, there is a dearth of available information with which to forecast industry trends or patterns. For instance, after several quarters of rapid growth within the segment, there was a decrease in industry growth in the second quarter of 2014 as retailers grappled with high inventory levels from 2013, coupled with changes in preferences and attitudes among users of e-cigarettes and related products. There is no assurance that sustainable industry trends or preferences will develop that will lead to predictable growth or earnings forecasts for individual companies or the industry segment as a whole. We are also unable to determine what impact future governmental regulation may have on trends and preferences or patterns within our industry segment. See “Risks Related to Government Regulation” for a discussion of the risks associated with governmental regulation.

The recent development of e-cigarettes has not allowed the medical profession to study the long-term health effects of e-cigarette use.

Because e-cigarettes were recently developed the medical profession has not had a sufficient period of time to study the long-term health effects of e-cigarette use. Currently, therefore, there is no way of knowing whether or not e-cigarettes are safe for their intended use. If the medical profession were to determine conclusively that e-cigarette usage poses long-term health risks, e-cigarette usage could decline, which could have a material adverse effect on our business, results of operations and financial condition.

The use of e-cigarettes may pose health risks as great as, or greater than, regular tobacco products.

According to the FDA, e-cigarettes may contain ingredients that are known to be toxic to humans and may contain other ingredients that may not be safe. In addition, other publicized recent studies contain assertions that additional carcinogens, including formaldehyde, may be produced through the use of tank systems. Additionally, e-cigarettes may be attractive to young people and may lead them to try other tobacco products, including conventional cigarettes that are known to cause disease. Because clinical studies about the safety and efficacy of e-cigarettes have not been submitted to the FDA, consumers currently have no way of knowing whether e-cigarettes are safe before their intended use; what types or concentrations of potentially harmful chemicals are found in these products; or how much nicotine is being inhaled.

21

Our products contain nicotine, which is considered to be a highly addictive substance.

Certain of our products contain nicotine, a chemical found in cigarettes and other tobacco products which is considered to be highly addictive. The Family Smoking Prevention and Tobacco Control Act, empowers the FDA to regulate the amount of nicotine found in tobacco products, but may not require the reduction of nicotine yields of a tobacco product to zero. Any FDA regulation may require us to reformulate, recall and or discontinue certain of the products we may sell from time to time, which may have a material adverse effect on us.

We need to maintain state of the art software and websites.

Website and Internet technologies are constantly changing. In order for us to remain competitive we must continue to develop and or utilize state of the art software. We must also continue to upgrade our websites to make visitors to our websites an educational and rewarding experience. If the software and technologies used in our websites should fall behind, we success of our business could be materially adversely affected.

If Internet search engines’ methodologies are modified or our search result page rankings decline for other reasons, our user engagement could decline.

We will depend in part on various Internet search engines, such as Google, Bing and Yahoo!, to direct a significant amount of traffic to our website. Our ability to maintain the number of visitors directed to our website is not entirely within our control. Our competitors’ search engine optimization, or “SEO,” efforts may result in their websites receiving a higher search result page ranking than ours, or Internet search engines could revise their methodologies in an attempt to improve their search results, which could adversely affect the placement of our search result page ranking. If search engine companies modify their search algorithms in ways that are detrimental to our new user growth or in ways that make it harder for our users to use our website, or if our competitors’ SEO efforts are more successful than ours, overall growth in our user base could slow, user engagement could decrease, and we could lose existing users. These modifications may be prompted by search engine companies entering the online professional networking market or aligning with competitors. Any reduction in the number of users directed to our website would harm our business and operating results.

Risks Related to Government Regulation

Changes in laws, regulations and other requirements could adversely affect our business, results of operations or financial condition.