Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - WHITE FOX VENTURES, INC. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - WHITE FOX VENTURES, INC. | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - WHITE FOX VENTURES, INC. | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - WHITE FOX VENTURES, INC. | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - WHITE FOX VENTURES, INC. | ex32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

Form 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended June 30, 2012

|

or

| o |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from __________________ to __________________________

|

|

Commission file number: 333-178624

|

|

DNA PRECIOUS METALS, INC.

|

|

(Name of registrant as specified in its charter)

|

|

Nevada

|

37-1640902

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

9125 rue Pascal Gagnon, Suite 214

Saint Leonard, Quebec Canada

|

H1P 1Z4

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(514)852-2111

|

|

(Registrant's telephone number, including area code)

|

|

N/A

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer | o | Accelerated Filer | o |

| Non-accelerated Filer | o | Small Reporting Company | x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act Yes o No x

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Section 12, 13, or 15 (d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes _________ No___________

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of Common Stock as of the latest practicable date: 76,100,000 shares of Common Stock as of August 7, 2012.

|

PART I. - FINANCIAL INFORMATION

|

||

| 3 | ||

| 19 | ||

| 23 | ||

| 23 | ||

|

PART II - OTHER INFORMATION

|

||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this quarterly report on Form 10-Q contain or may contain forward-looking statements that are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Generally, the words “believes”, “anticipates,” “may,” “will,” “should,” “expect,” “intend,” “estimate,” “continue,” and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements which include, but are not limited to, statements concerning the Company’s expectations regarding its working capital requirements, financing requirements, business prospects, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Readers should carefully review this quarterly report in its entirety, including but not limited to our financial statements and the notes thereto. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

2

PART 1 - FINANCIAL INFORMATION

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

Consolidated Financial Statements:

|

|

| 4 | |

| 5 | |

| 6 | |

| 7 | |

| 8 |

3

|

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

|

||||||||

|

(AN EXPLORATION STAGE COMPANY)

|

||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||

|

JUNE 30, 2012 (UNAUDITED) AND DECEMBER 31, 2011

|

||||||||

|

IN US$

|

||||||||

|

ASSETS

|

||||||||

|

JUNE 30,

|

DECEMBER 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

CURRENT ASSETS

|

(UNAUDITED)

|

|||||||

|

Cash

|

$ | 101,951 | $ | 556,674 | ||||

|

Prepaid expenses

|

11,898 | 11,911 | ||||||

|

Total current assets

|

113,849 | 568,585 | ||||||

|

Fixed assets, net

|

266,881 | 198,700 | ||||||

|

Other Asset

|

||||||||

|

Mining rights

|

15,000 | 15,000 | ||||||

|

|

||||||||

|

TOTAL ASSETS

|

$ | 395,730 | $ | 782,285 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 69,797 | $ | 110,069 | ||||

|

Total current liabilities

|

69,797 | 110,069 | ||||||

|

LONG TERM LIABILITIES

|

||||||||

|

Promissory note

|

491,100 | 491,650 | ||||||

|

TOTAL LIABILITIES

|

560,897 | 601,719 | ||||||

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

Preferred stock, $0.001 par value, 10,000,000 shares authorized

|

||||||||

|

0 shares issued and outstanding

|

- | - | ||||||

|

Common stock, $0.001 par value, 100,000,000 shares authorized

|

||||||||

|

76,100,000 and 76,100,000 shares issued and outstanding, respectively

|

76,100 | 76,100 | ||||||

|

Additional paid in capital

|

1,076,900 | 1,076,900 | ||||||

|

Deficits accumulated during the development stage

|

(1,339,237 | ) | (975,921 | ) | ||||

|

Accumulated other comprehensive income (loss)

|

21,070 | 3,487 | ||||||

|

Total stockholders' equity (deficit)

|

(165,167 | ) | 180,566 | |||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

$ | 395,730 | $ | 782,285 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

4

|

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

|

||||||||||||||||||||

|

(AN EXPLORATION STAGE COMPANY)

|

||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED)

|

||||||||||||||||||||

|

FOR THE SIX AND THREE MONTHS ENDED JUNE 30, 2012 AND 2011

|

||||||||||||||||||||

|

AND FOR THE PERIOD JUNE 2, 206 (INCEPTION) THROUGH JUNE 30, 2012

|

||||||||||||||||||||

|

IN US$

|

||||||||||||||||||||

|

JUNE 2, 2006

|

||||||||||||||||||||

|

SIX MONTHS ENDED

|

THREE MONTHS ENDED

|

(INCEPTION)

|

||||||||||||||||||

|

JUNE 30,

|

JUNE 30,

|

THROUGH

|

||||||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

JUNE 30, 2012

|

||||||||||||||||

|

REVENUE

|

$ | - | $ | - | $ | - | ||||||||||||||

|

COST OF REVENUES

|

- | - | - | |||||||||||||||||

|

GROSS PROFIT

|

- | - | - | |||||||||||||||||

|

OPERATING EXPENSES

|

||||||||||||||||||||

|

Engineering costs

|

124,165 | 28,395 | (11,759 | ) | 28,395 | 491,258 | ||||||||||||||

|

Wages and related expenses

|

97,627 | - | 49,689 | - | 495,015 | |||||||||||||||

|

Professional fees

|

84,944 | 60,662 | 34,592 | 57,945 | 252,048 | |||||||||||||||

|

Rent

|

7,886 | 9,109 | 3,921 | 5,093 | 26,389 | |||||||||||||||

|

General and administrative

|

48,694 | 5,340 | 9,960 | 1,000 | 71,428 | |||||||||||||||

|

Total operating expenses

|

363,316 | 103,506 | 86,403 | 92,433 | 1,336,138 | |||||||||||||||

|

OTHER INCOME (EXPENSE)

|

||||||||||||||||||||

|

Interest expense

|

- | 3,101 | 3,101 | 3,099 | ||||||||||||||||

|

Total other income (expense)

|

- | 3,101 | - | 3,101 | 3,099 | |||||||||||||||

|

NET (LOSS)

|

$ | (363,316 | ) | $ | (106,607 | ) | $ | (86,403 | ) | $ | (95,534 | ) | $ | (1,339,237 | ) | |||||

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING

|

76,100,000 | 61,212,155 | 76,100,000 | 62,410,989 | 46,862,871 | |||||||||||||||

|

NET (LOSS) PER SHARE

|

$ | (0.00 | ) | $ | - | $ | - | $ | - | $ | (0.03 | ) | ||||||||

|

COMPREHENSIVE LOSS

|

||||||||||||||||||||

|

Net loss

|

$ | (363,316 | ) | $ | (106,607 | ) | $ | (86,403 | ) | $ | (95,534 | ) | $ | (1,339,237 | ) | |||||

|

Currency translation adjustment

|

17,583 | 2,140 | 5,906 | 1,141 | 21,070 | |||||||||||||||

|

Total comprehensive loss

|

$ | (345,733 | ) | $ | (104,467 | ) | $ | (80,497 | ) | $ | (94,393 | ) | $ | (1,318,167 | ) | |||||

The accompanying notes are an integral part of these consolidated financial statements.

5

|

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

|

||||||||||||||||||||||||||||||||

|

(AN EXPLORATION STAGE COMPANY)

|

||||||||||||||||||||||||||||||||

|

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT) (UNAUDITED)

|

||||||||||||||||||||||||||||||||

|

FOR THE PERIOD JUNE 2, 2006 (INCEPTION) THROUGH JUNE 30, 2012

|

||||||||||||||||||||||||||||||||

|

IN US $

|

||||||||||||||||||||||||||||||||

|

Accumulated

|

Accumulated

|

|||||||||||||||||||||||||||||||

|

Additional

|

During the

|

Other

|

||||||||||||||||||||||||||||||

|

Preferred Stock

|

Common Stock

|

Paid-In

|

Development

|

Comprehensive

|

||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Stage

|

Income (Loss)

|

Total

|

|||||||||||||||||||||||||

|

Balance - June 2, 2006

|

- | $ | - | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||||

|

Common shares issued to founder

|

- | - | 40,000,000 | 40,000 | - | - | - | 40,000 | ||||||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (40,000 | ) | - | (40,000 | ) | ||||||||||||||||||||||

|

Balance - December 31, 2006

|

- | - | 40,000,000 | 40,000 | - | (40,000 | ) | - | - | |||||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | - | - | - | ||||||||||||||||||||||||

|

Balance - December 31, 2007

|

- | - | 40,000,000 | 40,000 | - | (40,000 | ) | - | - | |||||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | - | - | - | ||||||||||||||||||||||||

|

Balance - December 31, 2008

|

- | - | 40,000,000 | 40,000 | - | (40,000 | ) | - | - | |||||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | - | - | - | ||||||||||||||||||||||||

|

Balance - December 31, 2009

|

- | - | 40,000,000 | 40,000 | - | (40,000 | ) | - | - | |||||||||||||||||||||||

|

Common shares issued for cash

|

- | - | 20,000,000 | 20,000 | 40,000 | - | - | 60,000 | ||||||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (17,531 | ) | 172 | (17,359 | ) | ||||||||||||||||||||||

|

Balance - December 31, 2010

|

- | - | 60,000,000 | 60,000 | 40,000 | (57,531 | ) | 172 | 42,641 | |||||||||||||||||||||||

|

Shares issued for acquisition of mining rights

|

- | - | 5,000,000 | 5,000 | 10,000 | - | - | 15,000 | ||||||||||||||||||||||||

|

Shares issued to board members

|

- | - | 5,000,000 | 5,000 | 10,000 | - | - | 15,000 | ||||||||||||||||||||||||

|

Shares issued for interest on promissory note

|

- | - | 1,000,000 | 1,000 | 2,000 | - | - | 3,000 | ||||||||||||||||||||||||

|

Shares issued in private placement

|

- | - | 3,350,000 | 3,350 | 666,650 | - | - | 670,000 | ||||||||||||||||||||||||

|

Shares issued under employment agreement

|

- | - | 1,500,000 | 1,500 | 298,500 | - | - | 300,000 | ||||||||||||||||||||||||

|

Shares issued to engineer per agreement

|

- | - | 250,000 | 250 | 49,750 | - | - | 50,000 | ||||||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (918,390 | ) | 3,315 | (915,075 | ) | ||||||||||||||||||||||

|

Balance - December 31, 2011

|

- | - | 76,100,000 | 76,100 | 1,076,900 | (975,921 | ) | 3,487 | 180,566 | |||||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (363,316 | ) | 11,677 | (351,639 | ) | ||||||||||||||||||||||

|

Balance - June 30, 2012

|

- | $ | - | 76,100,000 | $ | 76,100 | $ | 1,076,900 | $ | (1,339,237 | ) | $ | 15,164 | $ | (171,073 | ) | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

|

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

|

||||||||||||

|

(AN EXPLORATION STAGE COMPANY)

|

||||||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOW (UNAUDITED)

|

||||||||||||

|

FOR THE SIX MONTHS ENDED JUNE 30, 2012 AND 2011

|

||||||||||||

|

AND FOR THE PERIOD JUNE 2, 2006 (INCEPTION) THROUGH JUNE 30, 2012

|

||||||||||||

|

IN US $

|

||||||||||||

|

JUNE 2, 2006

|

||||||||||||

|

(INCEPTION)

|

||||||||||||

|

THROUGH

|

||||||||||||

|

2012

|

2011

|

JUNE 30, 2012

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net (loss)

|

$ | (363,316 | ) | $ | (106,607 | ) | $ | (1,339,237 | ) | |||

|

Adjustments to reconcile net (loss)

|

||||||||||||

|

to net cash (used in) operating activities:

|

||||||||||||

|

Common shares issued for services

|

- | 18,000 | 408,000 | |||||||||

|

Change in assets and liabilities

|

||||||||||||

|

Increase in prepaid expenses

|

- | - | (19,308 | ) | ||||||||

|

Increase (decrease) in accounts payable and accrued expenses

|

(40,270 | ) | (10,954 | ) | 77,117 | |||||||

|

Total adjustments

|

(40,270 | ) | 7,046 | 465,809 | ||||||||

|

Net cash (used in) operating activities

|

(403,586 | ) | (99,561 | ) | (873,428 | ) | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Acquisition of fixed assets

|

(68,209 | ) | - | (266,908 | ) | |||||||

|

Net cash (used in) investing activities

|

(68,209 | ) | - | (266,908 | ) | |||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Proceeds received from promissory note

|

- | 518,500 | 491,650 | |||||||||

|

Cash received for common stock and liability for stock to be issued

|

- | 70,000 | 730,000 | |||||||||

|

Net cash provided by financing activities

|

- | 588,500 | 1,221,650 | |||||||||

|

Effect of foreign currency

|

17,072 | 2,028 | 20,637 | |||||||||

|

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

(454,723 | ) | 490,967 | 101,951 | ||||||||

|

|

||||||||||||

|

CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD

|

556,674 | 39,070 | - | |||||||||

|

|

||||||||||||

|

CASH AND CASH EQUIVALENTS - END OF PERIOD

|

$ | 101,951 | $ | 530,037 | $ | 101,951 | ||||||

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

||||||||||||

|

Cash paid during the period for:

|

||||||||||||

|

Interest

|

$ | - | $ | - | $ | - | ||||||

|

Income taxes

|

$ | - | $ | - | $ | - | ||||||

|

SUPPLEMENTAL NONCASH ACTIVITY

|

||||||||||||

|

Common stock issued for mining rights

|

$ | - | $ | 15,000 | $ | 15,000 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

7

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 1-

|

ORGANIZATION AND BASIS OF PRESENTATION

|

On June 2, 2006, Celtic Capital, Inc. was incorporated in the State of Nevada. On October 20, 2008, Celtic Capital, Inc. changed its name to Entertainment Educational Arts Inc. On May 12, 2010, the Company changed its name to DNA Precious Metals, Inc. (the “Company”). On October 29, 2010, the Company formed DNA Precious Metals, Inc. (CD), a Canadian company and as a result, is a wholly-owned subsidiary. The Company anticipates running all of their exploration operations through this entity.

The Company is an exploration stage company that is in the business of identifying mineral claim rights in Canada and throughout the United States. The Company has conducted minimal business to date.

The Company’s primary goal is to identify and acquire premium gold (Au) and silver (Ag) properties to create an international mining company. These mineralized properties that the Company will focus on acquiring, will have easy accessibility, transportation infrastructures in place on the property and most importantly have the potential to be brought into production quickly.

Presently, the Company is evaluating a premium multi-mineralized property in the province of Quebec located in Canada and is in discussions for the possible acquisition of this highly multi-mineralized mining property.

The unaudited consolidated financial statements included herein have been prepared, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading. It is suggested that these consolidated financial statements be read in conjunction with the December 31, 2011 audited financial statements and the accompanying notes thereto. While management believes the procedures followed in preparing these consolidated financial statements are reasonable, the accuracy of the amounts are in some respects dependent upon the facts that will exist, and procedures that will be accomplished by the Company later in the year.

Going Concern

These consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated revenues since inception and has generated losses totaling $1,339,237 in their initial few years, and needs to raise additional funds to carry out their business plan. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, and the ability of the Company to obtain necessary equity financing to continue operations. The Company has had very little operating history to date.

8

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 1-

|

ORGANIZATION AND BASIS OF PRESENTATION (CONTINUED)

|

These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. These factors raise substantial doubt regarding the ability of the Company to continue as a going concern.

The Company has recently in June through December 2011, raised $670,000 of capital through the subscription of 3,350,000 shares, raised $60,000 in June 2010 through the subscription of 20,000,000 shares of stock which were issued in November 2010, and received a promissory note of $500,000 CD$ ($518,500 US$) maturing May 31, 2014. These funds will go towards furthering the Company’s business plan and acquiring property.

Effective July 1, 2009, the Company adopted the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 105-10, Generally Accepted Accounting Principles – Overall (“ASC 105-10”). ASC 105-10 establishes the FASB Accounting Standards Codification (the “Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with U.S. GAAP. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative U.S. GAAP for SEC registrants.

All guidance contained in the Codification carries an equal level of authority. The Codification superseded all existing non-SEC accounting and reporting standards. All other non-grandfathered, non-SEC accounting literature not included in the Codification is non-authoritative. The FASB will not issue new standards in the form of Statements, FASB Positions or Emerging Issue Task Force Abstracts. Instead, it will issue Accounting Standards Updates (“ASUs”). The FASB will not consider ASUs as authoritative in their own right. ASUs will serve only to update the Codification, provide background information about the guidance and provide the bases for conclusions on the change(s) in the Codification. References made to FASB guidance throughout this document have been updated for the Codification.

|

NOTE 2-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Exploration Stage Company

The Company is considered to be an exploration stage company as defined in ASC 915. The Company has devoted substantially all of its efforts to the corporate formation, the raising of capital, identifying property for acquisition and initiating mineral claims.

9

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 2-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its subsidiary. All significant intercompany accounts and transactions have been eliminated in consolidation.

Currency Translation

The Company transacts in currencies other than the U.S. dollar. The Company translates income and expense amounts at average exchange rates for the year, translates assets and liabilities at year-end exchange rates and equity at historical rates for currencies in the Canadian dollar. The Company will record these translation adjustments as accumulated other comprehensive income (loss). Gains and losses from foreign currency transactions will be included in other income (expense) in the results of operations.

Comprehensive Income (Loss)

The Company adopted ASC 220-10, “Reporting Comprehensive Income,” (formerly SFAS No. 130). ASC 220-10 requires the reporting of comprehensive income in addition to net income from operations.

Comprehensive income is a more inclusive financial reporting methodology that includes disclosure of information that historically has not been recognized in the calculation of net income.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments and other short-term investments with maturity of three months or less, when purchased, to be cash equivalents.

The Company maintains cash and cash equivalent balances at one financial institution that is insured by the Federal Deposit Insurance Corporation.

10

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 2-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

Fixed Assets

Although the Company does not have any fixed assets at this point. Any fixed assets acquired in the future will be stated at cost, less accumulated depreciation. Depreciation will be provided using the straight-line method over the estimated useful lives of the related assets. Costs of maintenance and repairs will be charged to expense as incurred.

Recoverability of Long-Lived Assets

Although the Company does not have any long-lived assets at this point, for any long-lived assets acquired in the future the Company will review their recoverability on a periodic basis whenever events and changes in circumstances have occurred which may indicate a possible impairment. The assessment for potential impairment will be based primarily on the Company’s ability to recover the carrying value of its long-lived assets from expected future cash flows from its operations on an undiscounted basis. If such assets are determined to be impaired, the impairment recognized is the amount by which the carrying value of the assets exceeds the fair value of the assets. Fixed assets to be disposed of by sale will be carried at the lower of the then current carrying value or fair value less estimated costs to sell.

Fair Value of Financial Instruments

The carrying amount reported in the consolidated balance sheets for cash and cash equivalents, accounts payable, and accrued expenses approximate fair value because of the immediate or short-term maturity of these financial instruments. The Company does not utilize derivative instruments.

Income Taxes

The Company accounts for income taxes utilizing the liability method of accounting. Under the liability method, deferred taxes are determined based on differences between financial statement and tax bases of assets and liabilities at enacted tax rates in effect in years in which differences are expected to reverse. Valuation allowances are established, when necessary, to reduce deferred tax assets to amounts that are expected to be realized.

Revenue Recognition

The Company will recognize revenue when a sale is made, the fee is fixed or determinable, collectability is probable, and no significant company obligations remain.

11

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 2-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

(Loss) Per Share of Common Stock

Basic net loss per common share is computed using the weighted average number of common shares outstanding. Diluted earnings per share (EPS) include additional dilution from common stock equivalents, such as stock issuable pursuant to the exercise of stock options and warrants. Common stock equivalents are not included in the computation of diluted earnings per share when the Company reports a loss because to do so would be anti-dilutive for periods presented. The following is a reconciliation of the computation for basic and diluted EPS:

|

June 30,

|

June 30,

|

|||||||

|

2012

|

2011

|

|||||||

|

Net loss

|

$ | (363,316 | ) | $ | (106,607 | ) | ||

|

Weighted-average common shares

|

||||||||

|

outstanding (Basic)

|

76,100,000 | 61,212,155 | ||||||

|

Weighted-average common stock

|

||||||||

|

Equivalents

|

||||||||

|

Stock options

|

- | - | ||||||

|

Warrants

|

- | - | ||||||

|

Weighted-average common shares

|

||||||||

|

outstanding (Diluted)

|

76,100,000 | 61,212,155 | ||||||

12

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 2-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

Uncertainty in Income Taxes

Under ASC 740-10-25 recognition and measurement of uncertain income tax positions is required using a “more-likely-than-not” approach. Management evaluates their tax positions on an annual basis, and has determined that as of June 30, 2012, no additional accrual for income taxes is necessary.

Recent Issued Accounting Standards

In May 2011, FASB issued Accounting Standards Update (ASU) No. 2011-04, Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. FASB ASU 2011-04 amends and clarifies the measurement and disclosure requirements of FASB ASC 820 resulting in common requirements for measuring fair value and for disclosing information about fair value measurements, clarification of how to apply existing fair value measurement and disclosure requirements, and changes to certain principles and requirements for measuring fair value and disclosing information about fair value measurements. The new requirements are effective for fiscal years beginning after December 15, 2011. The Company plans to adopt this amended guidance on October 1, 2012 and at this time does not anticipate that it will have a material impact on the Company’s results of operations, cash flows or financial position.

In June 2011, FASB issued ASU No. 2011-05, Presentation of Comprehensive Income, which amends the disclosure and presentation requirements of Comprehensive Income. Specifically, FASB ASU No. 2011-05 requires that all nonowner changes in stockholders’ equity be presented either in 1) a single continuous statement of comprehensive income or 2) two separate but consecutive statements, in which the first statement presents total net income and its components, and the second statement presents total other comprehensive income and its components. These new presentation requirements, as currently set forth, are effective for the Company beginning October 1, 2012, with early adoption permitted. The Company plans to adopt this amended guidance on October 1, 2012 and at this time does not anticipate that it will have a material impact on the Company’s results of operations, cash flows or financial position.

In September 2011, FASB issued ASU 2011-08, Testing Goodwill for Impairment, which amended goodwill impairment guidance to provide an option for entities to first assess qualitative factors to determine whether the existence of events or circumstances leads to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. After assessing the totality of events and circumstances, if an entity determines that it is not more likely than not that the fair value of a reporting unit is less than its carrying amount, performance of the two-step impairment test is no longer required. This guidance is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011, with early adoption permitted. Adoption of this guidance is not expected to have any impact on the Company’s results of operations, cash flows or financial position.

13

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 2-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

Recent Issued Accounting Standards (Continued)

There were other updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to have a material impact on the Company’s financial position, results of operations or cash flows. In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. The Company is choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, the Company’s financial statements may not be comparable to those of companies that comply with public company effective dates.

|

NOTE 3-

|

STOCKHOLDERS’ EQUITY (DEFICIT)

|

Preferred Stock

The Company was established on June 2, 2006 with 10,000,000 shares of preferred stock authorized with a par value of $0.001. The Company has never issued any preferred stock.

Common Stock

The Company was established on June 2, 2006 with 100,000,000 shares of common stock authorized with a par value of $0.001.

At incorporation, the Company issued 40,000,000 shares of common stock to the Company’s founders at par value of $40,000 for services rendered by the founder.

In November 2010, the Company issued 20,000,000 shares of common stock for $60,000 to investors ($0.003 per share – 33 investors).

In 2011, the Company issued:

|

·

|

5,000,000 shares of common stock on June 9, 2011 to acquire mining rights at a value of $15,000 which represented a per share value of $0.003 which was the price used in the November 2010 private placement. There was no change in the valuation of the Company from November 2010 to June 2011, therefore the same price was used;

|

|

·

|

5,000,000 shares of common stock on June 13, 2011 to board members for services at a value of $15,000 which represented a per share value of $0.003 which was the price used in the November 2010 private placement. There was no change in the valuation of the Company from November 2010 to June 2011, therefore the same price was used;

|

14

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 3-

|

STOCKHOLDERS’ EQUITY (DEFICIT) (CONTINUED)

|

Common Stock (Continued)

|

·

|

1,000,000 shares of common stock on June 13, 2011 for payment of interest on the promissory note of $3,000 which represented a per share value of $0.003 which was the price used in the November 2010 private placement. There was no change in the valuation of the Company from November 2010 to June 2011, therefore the same price was used;

|

|

·

|

3,350,000 shares of common stock from June 27, 2011 through October 20, 2011 for cash under a private placement. The Company issued the private placement at $0.20 per share to reflect the recent activity. There was no independent valuation report. The Company raised $670,000 for the shares of common stock.

|

|

·

|

1,500,000 shares of common stock on September 19, 2011 under employment agreements for a value of $300,000. The $0.20 value is the same value the Company used in raising funds under their private placement, and there were no changes to that value; and

|

|

·

|

250,000 shares of common stock on October 20, 2011 to a consultant who assisted on the engineering of the building for a value of $0.20 per share amounting to $50,000. The $0.20 value is the same value the Company used in raising funds under their private placement, and there were no changes to that value

|

The methodologies, approaches and assumptions that the Company used are consistent with the American Institute of Certified Public Accountants, “Practice Guide on Valuation of Privately-Held Company Equity Securities Issued as Compensation”, considering numerous objective and subjective factors to determine common stock fair market value at each issuance date, including but not limited to the following factors: (a) arm’s length private transactions; (b) shares issued for cash as a basis to determine the value for shares issued for services to non-related third parties; and (c) fair value of service provided to non-related third parties as a basis to determine value per share.

As of June 30, 2012, the Company has 76,100,000 shares of common stock issued and outstanding.

Options and Warrants

The Company has not issued any options or warrants to date.

15

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 4-

|

FIXED ASSETS

|

Fixed assets consist of the following as of June 30, 2012 (unaudited) and December 31, 2011:

|

Estimated

|

|||||||||||

|

Useful Lives

|

June 30,

|

December 31,

|

|||||||||

|

(Years)

|

2012

|

2011

|

|||||||||

|

Building

|

15 | $ | 174,117 | $ | 174,117 | ||||||

|

Equipment

|

5 | 41,744 | - | ||||||||

|

Land

|

51,020 | 24,583 | |||||||||

|

Subtotal

|

266,881 | 198,700 | |||||||||

|

Less: accumulated depreciation

|

(- | ) | (- | ) | |||||||

|

Fixed assets, net

|

$ | 266,881 | $ | 198,700 | |||||||

The building and equipment has not been placed into service as of June 30, 2012, therefore there was no depreciation recorded. The land represents a payment made to prepare a road that will lead into the building. This was completed in January 2012.

|

NOTE 5-

|

PROVISION FOR INCOME TAXES

|

Deferred income taxes are determined using the liability method for the temporary differences between the financial reporting basis and income tax basis of the Company’s assets and liabilities. Deferred income taxes are measured based on the tax rates expected to be in effect when the temporary differences are included in the Company’s tax return. Deferred tax assets and liabilities are recognized based on anticipated future tax consequences attributable to differences between financial statement carrying amounts of assets and liabilities and their respective tax bases.

As of June 30, 2012, there is no provision for income taxes, current or deferred.

|

Net operating losses

|

$ | 199,723 | ||

|

Valuation allowance

|

(199,723 | ) | ||

| $ | - |

At June 30, 2012, the Company had a net operating loss carry forward in the amount of $587,421, available to offset future taxable income through 2032. The Company established valuation allowances equal to the full amount of the deferred tax assets due to the uncertainty of the utilization of the operating losses in future periods.

A reconciliation of the Company’s effective tax rate as a percentage of income before taxes and federal statutory rate for the periods ended June 30, 2012 and 2011 is summarized below.

16

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 5-

|

PROVISION FOR INCOME TAXES (CONTINUED)

|

|

Federal statutory rate

|

(34.0)% | |||

|

State income taxes, net of federal benefits

|

0.0 | |||

|

Valuation allowance

|

34.0 | |||

| 0% | ||||

|

NOTE 6-

|

PROMISSORY NOTE

|

The Company’s Canadian subsidiary entered into a promissory note on May 13, 2011 in the amount of $500,000 CD$ with a company that matures on May 31, 2014. The note has a default interest rate of 5% per annum should repayment not occur by the maturity date and the Company be in default of the promissory note agreement. In connection with the note, the Company issued 1,000,000 shares of stock that were valued at $3,000 CD$ in June 2011 for prepaid interest.

The balance of $500,000 CD$ ($501,250 US$) remains outstanding as of June 30, 2012.

|

NOTE 7-

|

FAIR VALUE MEASUREMENTS

|

The Company adopted certain provisions of ASC Topic 820. ASC 820 defines fair value, provides a consistent framework for measuring fair value under generally accepted accounting principles and expands fair value financial statement disclosure requirements. ASC 820’s valuation techniques are based on observable and unobservable inputs. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect our market assumptions. ASC 820 classifies these inputs into the following hierarchy:

Level 1 inputs: Quoted prices for identical instruments in active markets.

Level 2 inputs: Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 inputs: Instruments with primarily unobservable value drivers.

The following table represents the fair value hierarchy for those financial assets and liabilities measured at fair value on a recurring basis as of June 30, 2012:

17

DNA PRECIOUS METALS, INC.

(FORMERLY ENTERTAINMENT EDUCATIONAL ARTS, INC.)

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JUNE 30, 2012 AND 2011

|

NOTE 7-

|

FAIR VALUE MEASUREMENTS (CONTINUED)

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Promissory note

|

- | - | 491,100 | 491,100 | ||||||||||||

|

NOTE 8-

|

MINING EXPENDITURES

|

From July 2011 to December 2011 DNA Precious Metals Inc. incurred substantial expenses related to the process of obtaining the Quebec Provincial authorization permit for the extraction of the precious metals in the tailings residue on the Montauban Mine Property. Laboratoire LTM was mandated to prepare the process mill blueprints and mining circuit extraction plans. It received a total of $187,976 CAD in three different installments including a final payment on October 7, 2011.

Groupe Alphard was mandated to prepare the geotech process and restoration of the mining residue park. It received a total of $20,987 CAD in two different installments.

SCEB Inc. was hired as the environment and engineer specialist to overlook and coordinate the entire authorization permit process. SCEB Inc. received a total of $32,784 CAD.

From January 1, 2012 to June 30, 2012 the Company incurred $232,449 related to the process of obtaining the Quebec Provincial authorization permit for the extraction of the precious metals in the tailings residue on the Montauban Mine Property. During this period Laboratoire LTM was mandated to increase the recuperation percentage of the precious metals through laboratory testing and prepare a process report based on his recommended mining circuit extraction plans. SCEB Inc. continued to work as environmental and engineer specialist overlooking and coordinating the entire authorization permit process. Groupe Alphard continued to work on the geotech process and restoration of the mining residue park. Solmatech was mandated to characterize the environment on the Montauban Mine Property and more specifically conduct soil tests on the future site of mining operations by the Company. In addition, the Company received from the provincial government $108,284 in tax credits related to the expenditures form 2011.

18

THE FOLLOWING DISCUSSION OF THE RESULTS OF OUR OPERATIONS AND FINANCIAL CONDITION SHOULD BE READ IN CONJUNCTION WITH OUR FINANCIAL STATEMENTS AND THE NOTES THERETO INCLUDED ELSEWHERE IN THIS REPORT.

Background

We were incorporated on June 2, 2006 in the state of Nevada. Our original name was Celtic Capital, Inc. On October 20, 2008, Celtic Capital, Inc. changed its name to Entertainment Educational Arts Inc. and on May 12, 2010, the Company changed its name to DNA Precious Metals, Inc.

Our Business

We are an exploration stage mining company. We are in the business of exploring for gold, silver and base metal deposits, primarily muscovite (mica). On June 9, 2011 we acquired ten (10) mining claims in the Montauban Mining Project located in the Montauban and Chavigny townships near Grondines-West in Portneauf County, Quebec, Canada (the “Property”). We acquired the Property from 9215-8062 Quebec Inc. in consideration for the issuance of 5,000,000 (5 million) shares of our common stock. We valued the shares of our common stock at $0.003 per share for total consideration of $15,000.

The Property is easily accessible and all transportation infrastructures on the Property are in place. Information from past prospectors indicates that there are zones of gold, silver and base metal mineralization on the Property.

Our primary objective is to recuperate the precious metals from the mining residues (tailings) on the Property. The recuperation of the precious metals from the tailings is less expensive than traditional mining operations primarily because the mining residues have already been crushed and grinded by prior mining companies

The Mountauban Property in Quebec, Canada is our principal asset. The entire Mountauban Property is approximately 340.36 hectares. Our development plan for the Mountauban Property involves initiating mining and production in two phases, which we believe will reduce the amount of total capital required to bring the Mountauban Property into production.

We intend to apply for permitting and begin construction of the mill. However, before we can commence processing the tailings, we must obtain a Certificate of Authorization from the Quebec Provincial government The Certificate of Authorization will give us the right to operate a mine waste treatment plant.

19

To date, we have financed our activities through the sale of equity securities and debt. We will need additional funds to fully implement our business plan.

MONTAUBAN TAILINGS

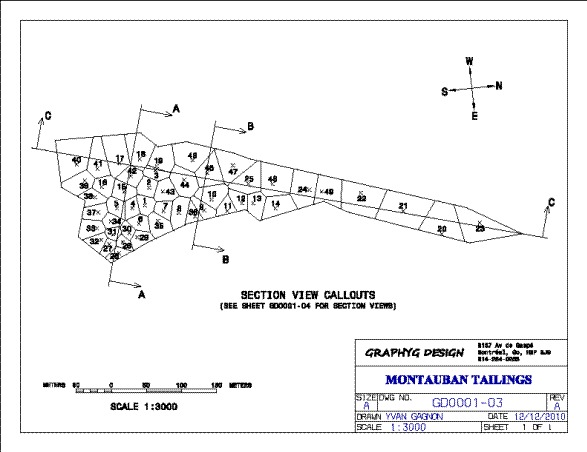

The Montauban Tailings are covering a total area of 53,093 m² and amounts to a total volume of 250,750 m³ . Since this volume is composed of tailings and that the water table is located within most of the blocks derived from each hole, the specific gravity of the material had to be evaluated to estimate the tonnage that is present on site. The estimation of the specific gravity was performed on the last drilling campaign 24 holes since no recovery evaluation is available from the first drilling campaign. Recovery of tailings in the sampling process averaged about 76% from the last percussion drilling campaign. Recoveries were ranging from 40 to 100 %, the lowest values being associated to the high water content of the deepest samples, the water table being at a depth of about 4,6 m (15 ft) within the pile of tailings. The averaged recovery was in the order of 81 % (68 samples) for the upper portion of the tailings and it dropped to below 64 % (27 samples) for the deeper portion (below the water table). The specific gravity is then estimated to be 1, 71 g/cm³.

Montauban Tailings hole location plan

The above graph shows the typical sections of the Montauban Tailings where it is clear that the drainage is towards the North (to the right on section C-C). It is also clear that the thickness is variable but not so thick compared to the value that should be reached if the whole production was to be still onsite. About 1.2 million tons were produced in the past; such a tonnage should be averaging over 13 meters in the Tailings pile. It is clear on site that an important fraction of the tailings was washed away through drainage. .

20

Figure X: Montauban Tailings view looking South

MILL CONSTRUCTION

We intend to construct a mill to process mining residues. Our focus will be to produce gold and silver concentrate in addition to a saleable mica product. By extracting mica and producing the gold and silver concentrate, we will reduce the sulphide content of the tailings thus lowering the environmental cost for the closure at the end of the operation.

Presently, there are no similar mills in the area surrounding our mining claims. The on-site mill facility is planned to be constructed initially with gravity separation equipment, consisting of spiral classifiers and Nelson concentrators in addition to other equipment. Test work to date has indicated that this configuration will effectively segregate the mica and produce a gold/silver concentrate. There is a risk that the plant as built will not effectively separate the values as designed and planned. There is also a risk that the process being used is not ideal or optimal and that a different process may enhance or increase recovery of values. We intend to continue testing to improve the recuperation and extraction process. We have incorporated flexibility into our mill building design to allow for alternative/additional precious metal extraction processes to be installed. Initial testing results indicate that recovery of mica, gold and silver is possible but economic feasibility has not been shown and there is the associated risk that the operation as planned will not be profitable either with respect to our own mining operations or refining tailings or other mining concentrates from other mining companies in close proximity to our operations.

Before gold and silver can be extracted from the tailings, the mica content must be removed. If we are able to produce a mica concentrate which corresponds to market standards, we will have an additional revenue stream with little incremental costs. There is a risk that there is no market for the mica product to be produced.

To keep expenditures as low as possible, we intend to use refurbished milling equipment when possible. Our larger expenses include the mill building, electrical distribution, pumps, pipe valves, spiral classifiers, Nelson concentrators, table separator, trommel, loader and a conveyor.

Special attention will be devoted to the potential of the surrounding area to produce more tailings, whether from the S-W extension of the actual deposit onto the adjoining property, or from the zone North of the access road (former exploitation), or again from the old tailings (on the Excel adjoining property). All these tailings will have to be neutralized in order to permanently close the site. The actual gross problematic is in the hands of the Government and it is highly probable that they would be interested in ruling it out with the least amount of expenses as possible. It should also be noted that the Government files are reporting that more than 2 million tonnes of tailings are located in numerous piles in the surroundings of the Montauban village).

21

We anticipate that the mill will be able to process 1,000 tons per day. By constructing our own mill we will be able to reduce transportation costs.

With this exception, the actual presence of tailings in Montauban, no environmental problems are reported for the Montauban Tailings (known as the recent tailings).

Comparison of Operating Results for the Six and Three Months ended June 30, 2012 and June 30, 2011 and from June 2, 2006 (“Inception”) to June 30, 2012.

We have not generated revenues from operations and do not anticipate generating any revenues from operations until all permitting is secured and our mill is built and operational. We will require additional funding to build the mill. We have filed a registration statement with the Securities and Exchange Commission and are offering 12 million shares of our common stock at $.25 per share. We have no commitment for additional funding at this time.

With the start of our exploration program expenses for the six months ended June 30, 2012 as compared to the six months ended June 30, 2011 have increased significantly. Our single largest expense is attributable to engineering costs totaling $124,165 as compared to $28,395. We anticipate that these expenses will likely increase as our construction and exploratory expenses increase and expand in scope and operations. Wages and related expenses totaled $97,627 for the six months ended June 30, 2012. During the comparable period in 2011 our officers were not paid any salary. Professional fees totaled $84,944 in 2012 as compared to $60,662 in 2011. With the commencement of operations, general and administrative expenses increased from $5,340 to $48,694

Total expenses for the six months ended June 30, 2012 and 2011 were $363,316 and $103,506. Our Net Loss for these periods was $(363,316) and $(106,607).

Our expenses for the three months ended June 30, 2012 were slightly less than our expenses for the three months ended June 30, 2011, totaling $86,403 and $92,433 respectively. Our single largest expense was attributable to professional fees totaling $34,592 as compared to $57,945. We incurred no wages and salaries in 2011 but incurred $49,689 in wages and related expenses for the three months ended June 30, 2012. We were credited $11,759 in engineering costs as compared to engineering expenses totaling $28,395 in 2011. Total expenses for the three months ended June 30, 2012 and 2011 were $86,403 and $92,433 respectively. Our Net Loss for the periods was $(86,403) and $(95,534).

Operating expenses since Inception totaled $1,336,138 consisting primarily of engineering costs totaling $491,258,wages and related expenses of $495,015 and professional fees totaling $252,048. Our Net Loss since Inception totaled $(1,339,237).

We will require additional capital to fully implement our business plan. In the past, we have used debt and equity financing. On a going forward basis, there can be no assurance that we will be able to secure additional capital or if available, on commercially acceptable terms. Until such time as we can fully implement our business plan, it is unlikely that we will be able to reverse our continuing losses in which case you may lose your entire investment.

22

Liquidity and Capital Resources

Assets and Liabilities

At June 30, 2012 we had cash totaling $101,951, prepaid expenses of $11,898 and fixed assets totaling $266,881 and mining claims totaling$15,000. Current assets totaled $113,849 and total assets were $395,730. Current liabilities totaled $69,797. We have a working capital surplus of $44,052.

At December 31. 2012 we had cash totaling $556,674, prepaid expenses totaling $1,911 and fixed assets totaling $198,700. Mining claims totaled $15,000. Current assets totaled $568,585 and total assets were $782,285. Current liabilities totaled $110,059. We had a working capital surplus of $458,516.

Current assets declined from $568,585 at December 31, 2012 to $113,849 at June 30, 2012. The reason for the significant decline in our current assets is primarily attributable to increased operating expenses related salaries, professional fees and engineering costs.

Fixed assets increased from $198,700 to $266,881. This increase is primarily attributable to an increase in equipment related to the development of the Property and preliminary mill construction.

At June 30, 2012 we had an accumulated deficit totaling $(1,339,237) as compared to $(975,921) at December 31, 2011.

Off-Balance Sheet Arrangements

We are not currently a party to, or otherwise involved with, any off-balance sheet arrangements that have or are reasonably likely to have a current or future material effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

|

Quantitative and Qualitative Disclosure About Market Risk

|

Foreign Currency Exchange Rate Risk

The Company holds cash balances in both U.S. and Canadian dollars. We transact most of our business in US and Canadian dollars. Some of our expenses, including labor and operating supplies are denominated in Canadian dollars. As a result, currency exchange fluctuations may impact our operating costs. We do not manage our foreign currency exchange rate risk through the use of financial or derivative instruments, forward contracts or hedging activities.

In general, we do not believe that any weakening or strengthening of the U.S. as compared to the Canadian dollar will have an adverse material effect on our operations.

Interest Rate Risk

The Company’s investment policy for its cash and cash equivalents is focused on the preservation of capital and supporting the liquidity requirements of the Company. We do not use interest rate derivative instruments to manage exposure to interest rate changes. We do not believe that interest rate fluctuations will have any effect on our operations.

|

Controls and Procedures

|

(a) Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and our Chief Financial Officer, evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) and determined that our disclosure controls and procedures were effective as of the end of the period covered by this Quarterly Report on Form 10-Q. The evaluation considered the procedures designed to ensure that the information required to be disclosed by us in reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and communicated to our management as appropriate to allow timely decisions regarding required disclosure.

23

(b) Changes in Internal Control over Financial Reporting

During the period covered by this Quarterly Report on Form 10-Q, there was no change in our internal control over financial reporting (as such term is defined in Rules 13a-15(d) and 13d-15(d) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

(c) Inherent Limitations of Disclosure Controls and Internal Controls over Financial Reporting

Because of its inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. Projections of any evaluation or effectiveness to future periods are subject to risks that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

PART II. OTHER INFORMATION

Item 1. Legal Proceedings.

None.

Item 1A. Risk Factors

There have been no material changes in our risk factors from those disclosed in our Registration Statement Amendment Number 8 as filed with the Securities and Exchange Commission on June 27, 2012.

Item 2. Unregistered Sales of Equity Securities.

During the six months ended June 30, 2012 we did not issue any shares of our common stock.

Item 3. Defaults upon senior securities.

None.

Item 4. Mine Safety Disclosure.

Although we have not commenced mining operations or construction of a mill to process tailings, we have begun a build out of the Property. Safety is and always will be a top priority and we are committed to providing a healthy and safe work environment for our employees, contractors and all others at our site to help meet our company-wide goal of achieving no harm to people.

There have been no injuries of any kind or nature reported on the Property.

Item 5. Other information

None.

24

|

Exhibits

|

|

Exhibit No.

|

Description

|

|

|

3.1*

|

Articles of Incorporations

|

|

|

3.2*

|

Amendment to Articles of Incorporation changing Company’s name to Entertainment

|

|

|

Education Arts Inc.

|

||

|

3.3*

|

Amendment to Articles of Incorporation changing name to DNA Precious Metals, Inc.

|

|

|

3.4*

|

Amendment to Articles of Incorporation increasing the number of authorized shares

|

|

|

3.5*

|

Bylaws

|

|

|

10.1*

|

Employment Agreement with Chandik

|

|

|

10.2*

|

Employment Agreement with Girard

|

|

|

10.3*

|

Employment Agreement with Bercovitch

|

|

|

10.4*

|

Acquisition Agreement between the Company and 9215-8062 Quebec Inc.

|

|

|

10.5*

|

Promissory Note

|

|

|

31.1

|

Section 302 Certification of the Principal Executive Officer

|

|

|

31.2

|

Section 302 Certification of the Principal Financial Officer

|

|

|

32.1

|

Section 906 Certification of Principal Executive Officer

|

|

|

32.2

|

Section 906 Certification of Principal Financial and Accounting Officer

|

* Previously filed as an exhibit to the Company’s Form S-1 Registration Statement filed December 20, 2011

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

DNA Precious Metals, Inc.

|

||

|

Date: August 7, 2012

|

||

|

|

By: /s/ James Chandik | |

| James Chandik | ||

| Chief Executive Officer |

|

Date: August 7, 2012

|

||

|

|

By:/s/Jeffrey Bercovitch

|

|

|

Jeffrey Bercovitch

|

||

|

Chief Financial Officer

|

25