Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT - VOLT INFORMATION SCIENCES, INC. | a110214ex-321.htm |

| EX-21 - EXHIBIT 21 - VOLT INFORMATION SCIENCES, INC. | a110214ex-21.htm |

| EX-31.1 - EXHIBIT - VOLT INFORMATION SCIENCES, INC. | a110214ex-311.htm |

| EX-31.2 - EXHIBIT - VOLT INFORMATION SCIENCES, INC. | a110214ex-312.htm |

| EXCEL - IDEA: XBRL DOCUMENT - VOLT INFORMATION SCIENCES, INC. | Financial_Report.xls |

| XML - IDEA: XBRL DOCUMENT - VOLT INFORMATION SCIENCES, INC. | R9999.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended November 2, 2014 | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OF 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to . | |

Commission File Number: 001-09232 |

VOLT INFORMATION SCIENCES, INC.

(Exact name of registrant as specified in its charter)

New York | 13-5658129 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1065 Avenue of Americas, New York, New York | 10018 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(212) 704-2400

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock $0.10 Par Value | NYSE MKT LLC | |

Securities Registered Pursuant to Section 12(g) of the Act:

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting company o | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No x

As of May 2, 2014, there were 20,862,795 shares of common stock outstanding. The aggregate market value of the voting and non-voting common stock held by non-affiliates as of May 2, 2014 was $91,473,000, calculated by using the closing price of the common stock on such date on the over-the-counter market of $7.94.

As of January 9, 2015 there were 20,937,796 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed for its 2015 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

VOLT INFORMATION SCIENCES, INC.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED NOVEMBER 2, 2014

TABLE OF CONTENTS

Page | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

ITEM 15. | ||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this report are “forward-looking” statements within the meaning of that term in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include statements that reflect the current views of our senior management with respect to our financial performance and future events of our business and industry in general. The terms “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature identify forward-looking statements. Forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements. We believe that these factors include, but are not limited to, the following:

• | changes in general economic conditions; |

• | our Staffing Services segment is in a very competitive industry with few significant barriers to entry; |

• | our ability to comply with restrictive covenants in our credit agreements; |

• | our project-related businesses are subject to delays, unanticipated costs and cancellations; |

• | many of our contracts either provide no minimum purchase requirements, are cancellable during the term or both; |

• | we rely extensively on our information technology systems and are vulnerable to damage and interruption; |

• | our business may be negatively affected if we are not able to keep pace with rapid changes in technology; |

• | the loss of key customers could adversely impact our business; |

• | we are dependent upon our key personnel and upon our ability to attract and retain technologically qualified personnel; |

• | the outcome of any future litigation or regulatory proceedings, including any related to the restatement of our consolidated financial statements; |

• | new and increased government regulation, employment costs or taxes could have a material adverse effect on our business, especially for our contingent staffing business; and |

• | our business could be negatively affected as a result of a potential proxy contest for the election of directors at our annual meeting. |

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this report, including under the caption Risk Factors in Item 1A of this report. There can be no assurance that we have correctly identified and appropriately assessed all factors affecting our business. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial also may adversely impact us. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Readers should not place undue reliance on any forward-looking statements contained in this report, which speak only as of the date of this report. We undertake no obligation to update any forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

3

PART I

ITEM 1. | BUSINESS |

Volt Information Sciences, Inc. (the “Company” or “Volt”) is an international provider of staffing services (traditional time and materials based as well as project based), information technology infrastructure services, telecommunication infrastructure and security services, and telephone directory publishing and printing in Uruguay. Our staffing services consist of workforce solutions that include providing contingent workers, personnel recruitment services, and managed staffing services programs supporting primarily professional administration, technical, information technology and engineering positions. Our project-based staffing assists with individual customer assignments as well as customer care call centers and gaming industry quality assurance testing services, and our managed service programs consist of managing the procurement and on-boarding of contingent workers from multiple providers. Our information technology infrastructure services provide server, storage, network and desktop IT hardware maintenance, data center and network monitoring and operations. The Company was incorporated in New York in 1957. Unless the context otherwise requires, throughout this report, the words “Volt,” “the Company,” “we,” “us” and “our” refer to Volt Information Sciences, Inc. and its consolidated subsidiaries.

This report is presented as of the time this report is being filed, rather than as of November 2, 2014, and reflects that the Company sold its Computer Systems segment in the first quarter of fiscal 2015. The results of the Computer Systems segment are presented as discontinued operations and have been excluded from continuing operations and from segment results for all periods presented.

Fiscal 2014 was a year of significant achievement and success. During the year we emerged from an expensive and distracting multi-year restatement and brought our publicly available financial information current, became and stayed current on our SEC filing requirements, remediated material weaknesses in internal control, and increased shareholder liquidity by moving from the over-the-counter stock market to the NYSE-MKT exchange.

We made significant progress on our primary goal of a more highly focused and profitable Volt. The businesses we entered the year with were very diverse with few synergies and very different business models. This challenged our organization to find collaboration opportunities, stretched our management team, and made it difficult for investors to determine the true value of our consolidated company. We therefore focused on exiting our software businesses, which had significant upfront capital investments with extended payback periods and each of which was producing significant losses, and exited our telecommunication government solutions business as reduced federal spending minimized the opportunity for growth, efficiencies and our ability to deliver profitability. Each of these businesses had significantly different risk and return profiles than our core staffing and services business that have similar profitability, risks and returns on capital. As discussed further in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, operating results from continuing operations improved in 2014 to operating income from an operating loss in 2013.

Geographic Regions and Segments:

Volt operates approximately 150 locations worldwide, with approximately 90% of our revenues generated in the United States where we have employees in all 50 states. Our principal non-U.S. markets include Canada, the United Kingdom, and Germany, with presence in most European countries and several Asian locations. Our global footprint enables us to deliver consistent quality to our enterprise customers that require an established international presence. For financial information concerning our domestic and international operations and segment reporting, see our Segment Disclosure footnote to our Consolidated Financial Statements included in this report.

We report our activities in two reportable segments: Staffing Services and Other. Our operating segments have been determined in accordance with our internal management structure, which is based on operating activities. We evaluate business performance based upon several factors, using segment operating income as the primary financial measure. We believe operating income provides management and investors a measure to analyze operating performance of each business segment against historical and competitors’ data, although historical results, including operating income, may not be indicative of future results as operating income is highly contingent on many factors including the state of the economy, competitive conditions and customer preferences.

We allocate all costs to the operating segments except for costs not directly relating to our operating activities such as corporate-wide general and administrative costs and fees related to restatement, investigations and remediation that were completed during 2014. These costs are not allocated because doing so would not enhance the understanding of segment operating performance and they are not used by management to measure segment performance.

4

Staffing Services

The Staffing Services segment provides workforce management expertise including technology outsourcing services and solutions. Our staffing services are provided through approximately 130 locations in North America, Europe and Asia. We deliver a broad spectrum of contingent staffing, direct placement, staffing contracting and management, and other employment services. Our contingent workers are placed on assignment with our customers in a broad range of occupations including accounting, administrative, customer care, engineering, finance, human resources, information technology, life sciences, manufacturing and assembly, sales and marketing, technical communications and media, and warehousing and fulfillment. Our contingent staffing services are provided for varying periods of time to companies and other organizations (including government agencies) ranging from smaller retail accounts that may require ten or fewer contingent workers at a time to enterprise accounts that require as many as several thousand contingent workers at a time. Our enterprise accounts typically enter into longer term procurement agreements with us resulting in lower direct margins compared to our retail accounts.

Within our Staffing Services segment we refer to customers that require multi-location, coordinated account management and service delivery in multiple skillsets as enterprise customers, while our retail customers are primarily in a single location with sales and delivery handled primarily from a geographically local team and with relatively few headcount on assignment in one or two skillsets. We also distinguish between traditional staffing services for which we are paid on a time and materials basis where we provide contingent staff that work under the supervision of our customers and staffing services where we provide additional services including project based services, for which we are sometimes paid on a basis other than time and materials.

During 2014 the North American staffing management of enterprise accounts moved to a national rather than a regional account management structure with all of delivery being coordinated nationally using a blended national and local model. Under this delivery model all orders are centralized and then distributed to a team member based on a combination of skillset and customer expertise, as well as available capacity as opposed to the predominately local sales/delivery model previously utilized. The new distribution model not only allows for skillset and customer specialization, but increased efficiencies through load balancing of our delivery team that enables us to quickly respond to changes in demand on a national level. We believe that this management structure and increased efficiencies of the delivery team has improved operating margin in North America as well as helped us identify future growth opportunities in vertical, geographical and skillset markets.

Volt’s contingent staffing services enable customers to easily scale their workforce to meet changing business conditions, complete a specific project, secure the services of a specialist on an as-needed basis, substitute for regular employees during vacation or other temporary absences, staff high turnover positions, or meet seasonal peaks in workforce needs. When requested, we also provide Volt personnel at the customer’s location to coordinate and manage contingent workers. Many customers rely on Volt’s staffing services as a strategic element of their overall workforce, allowing them to more efficiently meet their fluctuating staffing requirements.

Contingent staff is recruited through proprietary internet recruiting sites, independent web-based job search companies, and social networking talent communities through which we build and maintain proprietary databases of candidates from which we can fill current and future customer needs. Contingent workers become Volt employees during the period of their assignment and we are responsible for the payment of wages, payroll taxes, workers’ compensation insurance, unemployment insurance and other benefits. Customers will sometimes hire Volt’s contingent workers as their own employees after a period of time, for which we usually receive a fee.

We also provide recruitment and direct placement services of specialists in the information technology, engineering, technical, accounting, finance and administrative support disciplines. These services are primarily provided on a contingency basis with fees earned only if our customers ultimately hire the candidates.

Our staffing services include providing master vendor services under which we administer a customer’s entire contingent workforce program. Our responsibilities for these programs usually include subcontracting procurement of contingent workers from other qualified staffing providers if we are unable to fill a position. In most cases, we are only required to pay subcontractors after we receive payment from our customer.

Our managed service programs (“MSPs”) consist of managing the procurement and on-boarding of contingent workers and a broad range of specialized solutions that includes managing suppliers and providing sourcing and recruiting support, supplier performance measurement, consolidated customer billing, supplier payment, supplier optimization and analysis, and benchmarking of spend demographics and rates. The workforce placed on assignment through our MSPs is usually provided by third-party staffing providers (“associate vendors”) or through our own staffing services. In most cases, we are only required to pay associate vendors after we receive payment from our customer. We also act as a subcontractor or associate vendor to other national providers in their managed services programs.

5

Our MSPs are administered through the use of vendor management system software (“VMS”) licensed from various VMS providers.

Our technology outsourcing services and solutions provide flexible and scalable customer care call centers, video and online gaming industry quality assurance testing services, project-based staffing, quality assurance testing, and customer care solutions including end-user and technical, sales and retention support. Project-based staffing includes project management and provides IT infrastructure outsourcing, data center management, enterprise technology implementation and integration and corporate helpdesk services.

Other Segment

Our Other reportable segment consists of our information technology and telecommunication infrastructure and security businesses, as well as our Uruguay telephone directory publishing and printing business.

Our information technology infrastructure services business provides server, storage, network and desktop IT hardware maintenance, data center and network monitoring and operations. We deliver our services across the United States and in major business centers globally, including hardware maintenance on all major brands of server, storage, network and desktop products, network and data center monitoring and operations services in large data center environments, and designing, deploying and supporting corporate technology upgrade and refresh programs including cloud strategies and Windows migration. We sell our services directly to corporate customers with data center and network product providers, and through value added resellers. Our target markets include financial services, telecommunications and aerospace.

Our telecommunication infrastructure and security services business is an integrator of enterprise, location and metropolitan security, voice and data systems for Fortune 500, critical infrastructure and telecommunications companies and government entities across the United States. We design, engineer, build, and maintain infrastructure services, Voice and Data networks, wireless systems and security systems.

Our telephone directory publishing and printing business publishes telephone directories in Uruguay under contract with the Uruguayan telephone company, including White Pages, the sale of Yellow Pages and web portal advertising. This business operates a printing facility in Uruguay, which produces the Uruguay telephone directories, directories for other publishers in other countries, and commercial books, magazines, periodicals and advertising material.

Business Strategy

We believe that building upon our established brands and reinforcing our strong customer relationships will position Volt to grow both profitability and shareholder value. Key elements of our strategy include:

Expand Margins and Reduce Operating Expenses

We are focused on increasing profitability through initiatives to expand margins, reduce operating expenses, provide superior delivery and expand profitable revenue. We are pursuing these initiatives along with promoting a culture of disciplined execution to further expand our operating income:

• | increase our market share in our key customers and target market sectors; |

• | provide superior delivery that will ultimately drive higher revenues at improved margins; |

• | focus on core business offerings and on market sectors where we are profitable or that have long-term growth potential, and reduce or eliminate non-core, non-strategic business; |

• | increase the percentage of our revenue represented by higher-margin business; |

• | exit or reduce business levels in sectors or with customers where profitability or business terms are unfavorable; and |

• | consolidate financial and other administrative and support functions, implement process standardization, and use productivity metrics to drive more cost-effective performance. |

In January 2014, we sold our Procurestaff Technologies business, and in December 2014 we announced the sale of our Computer Systems segment. Each of these transactions reflects our primary goal of increasing profitability and our strategy of aligning our portfolio of businesses around staffing and services with similar profitability, risks, and returns on capital.

Volt will continue to evaluate our individual businesses and service offerings as we seek to prioritize profitability over topline growth. These assessments are being conducted in the context of our broader portfolio and our targeted risk and return profile. Businesses or service offerings that do not meet our investment parameters will be discontinued or divested. We believe that these actions will continue to improve our results as well as the consistency of our returns across our portfolio of businesses.

6

Volt's top priority remains profitability and we believe that the actions we are taking will drive higher revenues ultimately. We expect these actions to increase margins and reduce operating expenses as a percentage of margins, thus driving increased operating income.

Align Management Incentives with Corporate-Wide Objectives

We are changing management incentive structures corporate-wide to align with short and long term strategic objectives, profitability goals and efficiency measures. Variable management compensation is being redesigned from single-factor measurements to a set of entity and business unit targets along with specific department performance measures with achievement targets that reward accomplishment thresholds rather than incremental increases.

Retain, Recruit and Develop Talent Globally

We are focused on developing a workforce that has both exceptional technical capabilities and the leadership skills that are required to support future growth of the business, which will be achieved by developing new workforce capabilities and a committed, diverse executive team with the highest level of ethics and integrity.

Customers

The Company serves multinational, national and local customers providing staffing services (traditional time and materials based as well as project based), information technology and telecommunication infrastructure and security services, and telephone directory publishing and printing in Uruguay. The Company had no single customer that accounted for more than 10% of consolidated net revenue in the fiscal years 2014, 2013 and 2012. Our top 10 customers represented approximately 30%, 34% and 34% of our fiscal 2014, 2013 and 2012 revenue, respectively. The loss of one or more of these customers, unless the business is replaced, could have an adverse effect on our results of operations or cash flows.

For the fiscal years ended 2014, 2013 and 2012, 87.1%, 89.3% and 90.7% of our revenue, respectively, were from customers in the United States.

Competition

The markets for Volt’s staffing services are highly competitive. There are few barriers to entry, so new entrants frequently appear resulting in considerable market fragmentation. There are over 100 competitors with annual revenues over $300 million, some of whom are larger and have greater resources than we do. These large competitors collectively represent less than half of all staffing services revenues, and there are many smaller companies competing in varying degrees at local levels. Our direct staffing competitors include Adecco, Allegis, CDI Corp., Hays, Kelly Services, Manpower, Randstad, Recruit, Robert Half, and Tempstaff.

Our IT infrastructure business competes with large system integration firms as well as software and hardware providers that are increasingly offering services to support their products. Many of our competitors are able to offer a wide range of global services, and some of our competitors benefit from greater brand recognition than we have.

Our telecommunication infrastructure services business has competition from a wide range of contractors, many of which have greater resources and breadth of experience. Successfully competing in this market requires us to focus on those areas where we believe our expertise and capability is greater than our competitors and where we can deliver services with a cost structure that will permit us to achieve acceptable margins at acceptable risk levels.

In addition, we compete with numerous smaller local companies in the various geographic markets in which we operate. Companies in our industries compete on price, service quality, new capabilities and technologies, customer attraction methods, and speed of completing assignments.

Intellectual Property

VOLT is the principal registered trademark for our brand in the United States. ARCTERN, A VOLT INFORMATION SCIENCES COMPANY, FNCS & DESIGN, MAINTECH, PARTNER WITH US, COMPETE WITH ANYBODY, TEAM WITH US. COMPETE WITH ANYBODY, and VOLTSOURCE are other registered trademarks in the United States. The Company also owns and uses common law trademarks and service marks.

We also own copyrights and patents and license technology from many providers. We rely on a combination of intellectual property rights in the United States and abroad to protect our brand and proprietary technology.

7

Seasonality

Our Staffing Services segment’s revenue and operating income are typically lowest in our first fiscal quarter due to the Thanksgiving, Christmas and New Year holidays, customer facility closures during the holidays in some cases for up to two weeks, and closures caused by severe winter weather conditions. The demand for our staffing services typically increases during the third and fourth quarters of the fiscal year when customers increase the use of our administrative and industrial labor during the summer vacation period. Our second fiscal quarter typically has the lowest margins as most payroll tax contributions restart each year in January. Margins typically then increase in subsequent fiscal quarters as annual payroll tax contribution maximums are met, particularly for higher salaried employees.

Employees

As of November 2, 2014, Volt employed approximately 32,000 people, including approximately 28,600 who were on contingent staffing assignments for the Staffing Services segment. Those people on contingent staffing assignments are on our payroll for the length of their assignment.

We are focused on developing a workforce that has both exceptional technical capabilities and the leadership skills that are required to support our growth. Our strategy is to be a leader in the markets we serve which will be achieved by developing new workforce capabilities and a committed, diverse executive team with the highest level of ethics and integrity.

Some of our employees outside the United States have rights under agreements with local work councils. We believe that our relations with our employees are satisfactory. While claims and legal actions related to staffing matters arise on a routine basis, we believe they are inherent in maintaining a large contingent workforce.

Regulation

Some states in the United States and certain foreign countries license and regulate contingent staffing service firms and employment agencies. Compliance with applicable present federal, state and local environmental laws and regulations has not had, and we believe that compliance with those laws and regulations in the future will not have, a material effect on our competitive position, financial condition, results of operations or cash flows.

Access to Our Information

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports with the SEC. These and other SEC reports filed by us are available to the public free of charge at the SEC’s website at www.sec.gov and in the Investors & Governance section at our website at www.volt.com, as soon as reasonably practicable after filing with the SEC.

Copies of our Code of Business Conduct and Ethics and other significant corporate documents (our Corporate Governance Guidelines, Governance Committee Charter, Audit Committee Charter, Compensation Committee Charter, Executive Committee Charter, Financial Code of Ethics, Whistleblower Policy, Foreign Corrupt Practices Act Policy, Insider Trading Policy and Electronic Communication Policy) are also available in the Investors & Governance section at our website. Copies are also available without charge upon request to Volt Information Sciences, Inc., 1065 Avenue of the Americas, New York, NY 10018, Attention: Shareholder Relations, or by calling us at (212) 704-2400.

8

ITEM 1A. | RISK FACTORS |

Risk Factors

You should carefully consider the following risks along with the other information contained in this report. The following risks could materially adversely affect our business and, as a result, our financial condition, results of operations, and the market price of our common stock. Other risks and uncertainties not known to us or that we currently do not recognize as material also could materially adversely affect our business and, as a result, our financial condition, results of operations, cash flows, and the market price of our common stock.

Risks Relating to the Economy and our Industry

Our business is adversely affected by weak economic and other business conditions.

The global economy is unsettled with low or negative growth in Europe and emerging economies. Employment rates in the United States continued a slow recovery early in the year, although the recovery then accelerated particularly in the fourth quarter. In the past our business has not performed as well during periods of elevated unemployment and weak economic conditions, and our business has similarly struggled during the recent periods.

During periods of elevated unemployment levels demand for contingent and permanent personnel decreases, which adversely impacts our Staffing Services segment. During slower economic activity, many of our customers reduce their use of contingent workers before undertaking layoffs of their own employees, resulting in decreased demand for contingent workers. Decreased demand and higher unemployment levels result in lower levels of pay rate increases and increased pressure on our markup of staffing service rates and direct margins and higher unemployment insurance costs. Since employees are also reluctant to risk changing employers, there are fewer openings available and, therefore, reduced activity in permanent placements. In recent years, many of our customers have significantly reduced their workforce, including their use of contingent labor.

In our business segments, we have experienced competition and pressure on price, margins and markups for renewals of customers’ contracts. There can be no assurance that we will be able to continue to compete in our business segments without impacting revenue or margins. Additionally, our efforts to manage costs in relation to our business volumes may not be successful, and the timing of these efforts and associated earnings charges may adversely affect our business.

Certain customers have also begun to contract for staffing services through managed service providers who assume all payment obligations on behalf of the end-customer to service suppliers such as Volt. These managed service providers may present greater credit risks than the end-customer and some of these managed service providers have in the past, and could in the future, default on their obligations to us, adversely impacting our business.

The contingent staffing industry is very competitive with few significant barriers to entry.

The markets for Volt’s staffing services are highly competitive. There are few barriers to entry, so new entrants frequently appear resulting in considerable market fragmentation. There are over 100 competitors with annual revenues over $300 million, some of whom are larger and have greater resources than we do. These competitors may be better able than we are to attract and retain qualified personnel, to offer more favorable pricing and terms, and otherwise attract and retain the business that we seek. In addition, some of the segment’s customers, generally larger companies, are mandated or otherwise motivated to utilize the services of small or minority-owned companies rather than publicly held corporations such as Volt, and have redirected substantial amounts of their staffing business to those companies. We also face the risk that certain of our current and prospective customers may decide to provide similar services internally.

There has been a significant increase in the number of customers consolidating their staffing services purchases with a single provider or a small number of providers. This trend to consolidate purchases has, in some cases, made it more difficult for us to obtain or retain customers. Additionally, pricing pressures have intensified as customers have continued to competitively bid contracts. This trend is expected to continue for the foreseeable future. As a result, we cannot assure you that we will not encounter increased competition and lower margins in the future.

Risks Related to our Capital Structure and Finances

Our ability to comply with restrictive covenants in our credit agreements.

Our existing credit facilities include restrictive covenants which limit our ability to, among other things, change our lines of business and engage in certain consolidations, mergers, liquidations, or dissolutions. These covenants could limit our ability to react to market conditions or to otherwise engage in transactions beneficial to us.

9

Risks Related to our Particular Customers and the Projects on which We Work

Our project related businesses are subject to delays, unanticipated costs and cancellations that may result in unforeseen costs, reductions in revenues or the payment of liquidated damages.

In some of our contracts we guarantee certain results of a project, such as the substantial completion of a project by a scheduled date, performance testing levels, results and other performance requirements. Failure to meet those criteria could result in additional costs or penalties, including liquidated damages, which could exceed our projected profit. Many projects involve extended time periods, sometimes over several years. We may encounter difficulties and delays, schedule changes, delays from our customers’ failure to timely obtain rights required to perform or complete a project, weather-related delays and other factors, some of which are beyond our control, that could impact our ability to complete projects in accordance with the original delivery schedules. In addition, we often contract with subcontractors to assist us with our responsibilities, and any delay or poor performance by subcontractors may result in delays in the overall progress of projects or may cause us to incur additional costs, or both. Delays and additional costs may be substantial, we may not be able to recover any or all of these costs and our revenues and operating profits could be significantly reduced. We also may be required to invest significant working capital to fund cost overruns. Delays or cancellations also may impact our reputation or relationships with customers, adversely affecting our ability to secure new contracts.

At times, project contracts may require customers or other parties to provide the specifications, design, equipment or materials to be used on a project. In some cases, the project schedule or the design, or equipment may be deficient or delivered later than required by the project schedule. In addition, our customers may change or delay various elements of a project after commencement, resulting in additional direct or indirect costs.

Under these circumstances, we generally attempt to negotiate with the customer with respect to the amount of additional time required and the compensation to be paid to us. We may be unable to obtain, through negotiation, arbitration, mediation, litigation or otherwise, adequate amounts to compensate us for additional work or expense incurred by us due to customer change orders or failure by the customer to deliver items, such as specifications or materials on time. Litigation, arbitration or mediation of claims for compensation may be lengthy and costly, and may not ultimately result in us receiving adequate compensation for these matters, which could adversely affect our results of operations or cash flows. Delays or cancellations also may impact our reputation or relationships with customers, adversely affecting our ability to secure new contracts.

Many of our contracts either provide no minimum purchase requirements, are cancellable during the term, or both.

In our Staffing Services segment most contracts are not sole source, and many of our contracts, even those with multi-year terms, provide no assurance of any minimum amount of revenue. Under many of these contracts we still must compete for each individual placement or project. In addition, many of our long-term contracts contain cancellation provisions under which the customer can cancel the contract at any time or on relatively short notice, even if we are not in default under the contract. Therefore, these contracts do not provide the assurances that typical long-term contracts often provide and are inherently uncertain with respect to the revenues and earnings we may recognize with respect to our customer contracts. Consequently, in all our business segments, if customers do not utilize our services under existing contracts or do not renew existing contracts, that could adversely affect our results of operations or cash flows.

We rely extensively on our information technology systems and are vulnerable to damage and interruption.

We rely on our information technology systems and infrastructure to process transactions, summarize results, and manage our business, including maintaining customer information. Failure to protect and maintain our data and information technology systems may cause outages or security breaches in our systems that could adversely affect our results of operations or cash flows, as well as our business reputation.

Our business may be negatively affected if we are not able to keep pace with rapid changes in technology.

We must innovate and evolve our services and products to satisfy customer requirements and to remain competitive. There can be no assurance that in the future we will be able to foresee needed changes and to identify, develop and commercialize innovative and competitive services and products in a timely and cost effective manner and to achieve customer acceptance in markets characterized by rapidly changing technology and frequent new product and service introductions.

The loss of any key customers could adversely impact our business.

Although we had no customer that represented over 10% of revenues in fiscal years 2014 or 2013, reductions, delays or cancellation of contracts with any of our key customers or the loss of one or more key customers could materially reduce our revenue and operating income. There is no assurance that our current customers will continue to do business with us or that contracts with existing customers will continue at current or historical levels.

10

We are dependent upon the quality of our personnel.

Our operations are dependent on the continued efforts of our senior management. In addition, we are dependent on the performance and productivity of our managers and field personnel. Our ability to attract and retain business is significantly affected by customer relationships and the quality of service rendered. The loss of high quality personnel and members of management with significant experience in our industry without replacement by similar quality and experience may cause a significant disruption to our business. Moreover, the loss of key managers and field personnel could jeopardize existing customer relationships with businesses that use our services based upon relationships with those managers and field personnel.

We are dependent upon our ability to attract and retain technologically qualified personnel.

Our operations are dependent upon our ability to attract and retain technologically qualified personnel, particularly for temporary assignments to customers of our Staffing Services segment, as well as in the areas of implementation and upgrading of internal systems. The availability of such personnel is dependent upon a number of economic and demographic conditions. We may in the future find it difficult or more costly to hire such personnel in the face of competition from other companies.

In addition variations in the rate of unemployment and higher wages sought by contingent workers in certain technical fields that continue to experience labor shortages could affect our ability to meet our customers’ demands in these fields and adversely affect our results of operations.

Risks Related to Legal Compliance and Litigation

We are subject to employment–related and other claims and losses that could have a material adverse effect on our business.

Our Staffing Services segment employs or engages individuals on a contingent basis and places them in a customer’s workplace. Our ability to control the customer’s workplace is limited, and we risk incurring liability to our employees for injury (which can result in increased workers’ compensation costs) or other harm that they suffer at the customer’s workplace. In addition we may face claims related to violations of wage and hour regulations, discrimination, harassment, the employment of undocumented or unlicensed personnel; misconduct, negligence or professional malpractice by our employees, and claims relating to the misclassification of independent contractors, among others.

Additionally, we risk liability to our customers for the actions or inactions of our employees, including those individuals employed on a contingent basis, that may result in harm to our customers. Such actions may be the result of negligence or misconduct on the part of our employees, damage to customer facilities due to negligence, criminal activity and other similar claims. In some cases, we must indemnify our customers for certain acts of our employees, and certain customers have negotiated increases in the scope of such indemnification agreements. We also may incur fines, penalties and losses that are not covered by insurance or negative publicity with respect to these matters. There can be no assurance that the policies and procedures we have in place will be effective or that we will not experience losses as a result of these risks.

Insurance has limits and exclusions and we retain risk.

Our insurance policies for various exposures including, but not limited to, general liability, auto liability, workers compensation and employer’s liability, directors’ and officers’ insurance, professional liability, employment practices, loss to real and personal property, business interruption, fiduciary and other management liability, are limited and the losses that we face may be not be covered, may be subject to high deductibles or may exceed the limits purchased.

Costs related to litigation could adversely impact our financial condition.

We are involved in pending and threatened legal proceedings from time to time, the outcome of which is inherently uncertain and difficult to predict. It is uncertain at what point any of these or new matters may affect us, and there can be no assurance that our financial resources are sufficient to cover these matters in their entirety or any one of these matters. Therefore, there can be no assurance that these matters will not have an adverse effect on our financial condition, results of operations or cash flows.

Improper disclosure of sensitive or confidential employee or customer data, including personal data, could result in liability and harm our reputation.

Our business involves the use, storage and transmission of information about our full-time and contingent workers, customers and other individuals. This information may contain sensitive or confidential employee and customer data, including personal data. Additionally, our employees may have access or exposure to customer data and systems, the misuse of which could result in legal liability. We and our third party service providers have established policies and procedures to help protect the security and privacy of this information. It is possible that our security controls over sensitive or confidential data and other practices we and our third party service providers follow may not prevent the improper access to or disclosure of such

11

information. Such disclosure could harm our reputation and subject us to liability under our contracts and laws that protect sensitive or personal data and confidential information, resulting in increased costs or loss of revenue. Further, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among jurisdictions and countries in which we provide services. Our failure to adhere to or successfully implement processes in response to changing regulatory requirements in this area could result in legal liability or impairment to our reputation in the marketplace.

The possession and use of personal information and data in conducting our business subjects us to legislative and regulatory burdens. We may be required to incur significant expenses to comply with mandatory privacy and security standards and protocols imposed by law, regulation, industry standards or contractual obligations.

New and increased government regulation, employment costs or taxes could have a material adverse effect on our business, especially for our contingent staffing business.

Certain of our businesses are subject to licensing and regulation in some states and most foreign jurisdictions. There can be no assurance that we will continue to be able to comply with these requirements, or that the cost of compliance will not become material. Additionally, the jurisdictions in which we do or intend to do business may:

• | create new or additional regulations that prohibit or restrict the types of services that we currently provide; |

• | impose new or additional employment costs that we may not be able to be pass on to customers or that could cause customers to reduce their use of our services, especially in our Staffing Services segment, which could adversely impact our business; |

• | require us to obtain additional licenses; or |

• | increase taxes (especially payroll and other employment-related taxes) or enact new or different taxes payable by the providers or users of services such as those offered by us, thereby increasing our costs, some of which we may not be able to pass on to customers or that could cause customers to reduce their use of our services especially in our Staffing Services segment, which could adversely impact our results of operations or cash flows. |

In some of our foreign markets, new and proposed regulatory activity is imposing additional requirements and costs, and could cause changes in customers’ attitudes regarding the use of outsourcing and contingent workers in general, which could have an adverse effect on our contingent staffing business.

Risks Related to Our Common Stock

Our stock price could be volatile and, as a result, investors may not be able to resell their shares at or above the price they paid for them.

Our stock price has in the past, and could in the future, fluctuate as a result of a variety of factors, including:

• | our failure to meet the expectations of the investment community or our estimates of our future results of operations; |

• | industry trends and the business success of our customers; |

• | loss of one or more key customers; |

• | strategic moves by our competitors, such as product or service announcements or acquisitions; |

• | regulatory developments; |

• | litigation; |

• | general economic conditions; and |

• | other domestic and international macroeconomic factors unrelated to our performance. |

The stock market has experienced, and is likely to in the future experience, volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may also adversely affect the market price of our common stock.

Our principal shareholders own a significant percentage of our common stock and will be able to exercise significant influence over Volt. Their interests may differ from those of other shareholders.

As of December 31, 2014, our principal shareholders, who are related family members, controlled approximately 40% of our outstanding common stock. Although there can be no assurance as to how these shareholders will vote, these shareholders, if they vote in the same manner, would effectively be able to control the composition of our board of directors and many other matters requiring shareholder approval and would continue to have significant influence over our affairs. The interests of our principal shareholders may not align with those of our other shareholders.

12

Furthermore, the provisions of the New York Business Corporation Law, to which we are subject, require the affirmative vote of the holders of two-thirds of all of our outstanding shares entitled to vote in order to adopt a plan of merger or consolidation between us and another entity and to approve a sale, lease, exchange or other disposition of all or substantially all of our assets not made in our usual and regular course of business. Accordingly, our principal shareholders, acting together, could prevent the approval of such transactions even if such transactions are in the best interests of our other shareholders.

Our business could be negatively affected as a result of a potential proxy contest for the election of directors at our annual meeting, and such proxy contest could cause us to incur significant expense, hinder execution of our business strategy and impact the trading value of the Company’s securities.

On December 9, 2014, Glacier Peak Capital and its affiliates submitted a notice of its intention to nominate four director candidates for election to the Board at our 2015 annual meeting of shareholders. If Glacier Peak does not withdraw its nominations and we are unable to reach an agreement with Glacier Peak relating to our 2015 annual meeting, a proxy contest is likely to occur. It is possible that Glacier-nominated directors could constitute half of the Board following our 2015 annual meeting.

A proxy contest would require us to incur significant legal fees and proxy solicitation expenses and require significant time and attention by management and the Board of Directors. In addition, if Glacier Peak’s nominees were to constitute half of the Board following our 2015 annual meeting, because any action by the Board requires the affirmative vote of not less than a majority of the directors present and voting, it is possible that the Board would deadlock on certain issues. The potential of a proxy contest could interfere with our ability to execute our strategic plan, give rise to perceived uncertainties as to our future direction, adversely affect our relationships with key business partners, result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel, any of which could materially and adversely affect our business and operating results.

The market price of our common stock could be subject to significant fluctuation or otherwise be adversely affected by the events, risks and uncertainties described above or a threat of future stockholder activism.

New York law and our Articles of Incorporation and By-laws contain provisions that could make the takeover of Volt more difficult.

Certain provisions of New York law and our articles of incorporation and by-laws could have the effect of delaying or preventing a third party from acquiring Volt, even if a change in control would be beneficial to our shareholders. These provisions of our articles of incorporation and by-laws include:

• | providing for a classified board of directors with directors having staggered, two-year terms; |

• | permitting removal of directors only for cause; |

• | providing that vacancies on the board of directors will be filled by the remaining directors then in office; and |

• | requiring advance notice for shareholder proposals and director nominees. |

In addition to the voting power of our principal shareholders discussed above, our board of directors could choose not to negotiate with a potential acquirer that it did not believe was in our strategic interests. If an acquirer is discouraged from offering to acquire Volt or prevented from successfully completing an acquisition by these or other measures, our shareholders could lose the opportunity to sell their shares at a more favorable price.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

13

ITEM 2. PROPERTIES

Our corporate headquarters is located in approximately 18,700 square feet at 1065 Avenue of the Americas, New York, New York under a lease that expires in 2015. A summary of our principal owned and leased properties (those exceeding 20,000 square feet) that are currently in use is set forth below:

United States

Location | Business Segment/Purpose | Own/Lease | Lease Expiration | Approximate Square Feet | ||||||

Orange, California | Staffing Services and General and Administrative Offices | Own (1) | — | 200,000 | ||||||

Redmond, Washington | Staffing Services | Lease | 2015 | 77,000 | ||||||

Rochester, New York | Computer Systems (2) | Lease | 2018 | 51,000 | ||||||

San Antonio, Texas | Staffing Services | Lease | 2019 | 71,000 | ||||||

Wallington, New Jersey | Other | Lease | 2015 | 32,000 | ||||||

(1) | See our Consolidated Financial Statements for information regarding a term loan secured by a deed of trust on this property. We lease approximately 39,000 square feet of these premises to an unaffiliated third party with a term through October 31, 2015, with the tenant having two additional 60-month lease renewal options and certain rights of early termination. |

(2) | See our Consolidated Financial Statements for information regarding the Company's sale of the Computer Systems segment during the first quarter of fiscal 2015. |

International

Location | Business Segment/Purpose | Own/Lease | Lease Expiration | Approximate Square Feet | ||||||

Montevideo, Uruguay | Other | Own | — | 93,000 | ||||||

Bangalore, India | Other | Lease | Between 2015 and 2017 | 30,000 | ||||||

We lease space in approximately 130 other facilities worldwide, excluding month-to-month leases, each of which consists of less than 20,000 square feet. These leases expire at various times from 2015 until 2022.

At times we lease space to others in the buildings that we own or lease if we do not require the space for our own business. We believe that our facilities are adequate for our presently anticipated uses, and we are not dependent upon any individual leased premises.

For additional information pertaining to lease commitments, see our note on Commitments and Contingencies to our Consolidated Financial Statements included in this report.

ITEM 3. | LEGAL PROCEEDINGS |

From time to time, the Company is subject to claims in legal proceedings arising in the ordinary course of its business, including those related to payroll related matters and various employment related matters. All litigation currently pending against the Company relates to matters that have arisen in the ordinary course of business and the Company believes that such matters will not have a material adverse effect on its consolidated financial condition, results of operations or cash flows.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

14

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Until August 25, 2014, our common stock was listed on the over-the-counter market under the symbol “VISI”. Since then it has traded on the NYSE MKT under the symbol “VISI”. The following table sets forth, for the periods indicated, the high and low sales prices or the high and low bid quotations for our common stock for the years ended November 2, 2014 and November 3, 2013. The over-the-counter market bid quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

Fiscal Period | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |||||||||||||

2014 | High | $ | 10.05 | $ | 10.15 | $ | 9.50 | $ | 9.50 | ||||||||

Low | $ | 8.30 | $ | 7.94 | $ | 7.45 | $ | 7.77 | |||||||||

2013 | High | $ | 7.81 | $ | 8.74 | $ | 8.10 | $ | 8.90 | ||||||||

Low | $ | 6.20 | $ | 7.79 | $ | 6.65 | $ | 6.85 | |||||||||

Cash dividends have not been paid for the five years ended November 2, 2014 and through the date of this report. One of our credit agreements contains a covenant that limits cash dividends, capital stock purchases and redemptions in any one fiscal year to the greater of $5.0 million or 50% of our prior year’s consolidated net income, as defined. As the Company reported a loss in fiscal 2014, the amount available under this covenant is $5.0 million.

On January 2, 2015 there were 269 holders of record of our common stock, exclusive of shareholders whose shares were held by brokerage firms, depositories and other institutional firms in “street name” for their customers.

Issuer Purchases of Equity Securities

On June 2, 2008, our Board of Directors authorized the repurchase of up to 1,500,000 shares of our common stock from time to time in open market or private transactions at management’s discretion, subject to market conditions and other factors. The timing and exact number of shares purchased will depend on market conditions and is subject to lender approval for purchases under the terms of our credit agreements.

Our purchases of our common stock from July 28, 2008 to November 2, 2014 were as follows:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plan or Program | Maximum Number of Shares that May Yet be Purchased Under Plan or Program | |||||||||

July 28, 2008 - August 24, 2008 | — | — | — | 1,500,000 | |||||||||

August 25, 2008 - September 21, 2008 | 255,637 | $ | 10.84 | 255,637 | 1,244,363 | ||||||||

September 22, 2008 - November 2, 2008 | 903,098 | $ | 8.75 | 903,098 | 341,265 | ||||||||

June 28, 2009 - August 2, 2009 | 32,010 | $ | 7.08 | 32,010 | 309,255 | ||||||||

Total | 1,190,745 | 1,190,745 | |||||||||||

15

Performance Information

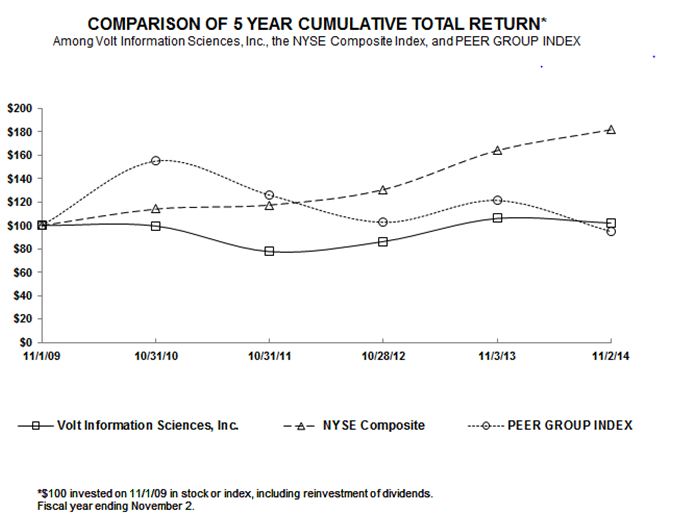

Shareholder Return Performance Graph

The Company’s Peer Group Index includes companies having market capitalizations that are within 5% of the market capitalization of the Company’s Common Stock at the end of the Company’s latest fiscal year-end (this peer group has been selected by the Company because the Company has operated in diverse business segments).

16

ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data reflects the results of operations and balance sheet data for the fiscal years ended November 2, 2014, November 3, 2013, October 28, 2012, October 30, 2011 and October 31, 2010. The data below should be read in conjunction with, and is qualified by reference to, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Company’s Consolidated Financial Statements and notes thereto. The financial information presented may not be indicative of our future performance.

Volt Information Sciences, Inc. and Subsidiaries

Selected Financial Data

For the year ended, (in thousands, except per share data) | November 2, 2014 | November 3, 2013 | October 28, 2012 | October 30, 2011 | October 31, 2010 | ||||||||||||||

52 weeks | 53 weeks | 52 weeks | 52 weeks | 52 weeks | |||||||||||||||

STATEMENT OF OPERATIONS DATA | |||||||||||||||||||

Net revenue | $ | 1,710,028 | $ | 2,017,472 | $ | 2,146,448 | $ | 2,072,760 | $ | 1,854,598 | |||||||||

Operating income (loss) | $ | 4,786 | $ | (7,252 | ) | $ | (11,018 | ) | $ | (39,872 | ) | $ | (30,718 | ) | |||||

Net loss from continuing operations, net of income taxes | $ | (3,387 | ) | $ | (12,743 | ) | $ | (16,035 | ) | $ | (28,669 | ) | $ | (36,907 | ) | ||||

Income (loss) from discontinued operations, net of income taxes | $ | (15,601 | ) | $ | (18,132 | ) | $ | 2,432 | $ | 44,298 | $ | (59,468 | ) | ||||||

Net income (loss) | $ | (18,988 | ) | $ | (30,875 | ) | $ | (13,603 | ) | $ | 15,629 | $ | (96,375 | ) | |||||

PER SHARE DATA: | |||||||||||||||||||

Basic: | |||||||||||||||||||

Loss from continuing operations | $ | (0.16 | ) | $ | (0.61 | ) | $ | (0.77 | ) | $ | (1.38 | ) | $ | (1.77 | ) | ||||

Income (loss) from discontinued operations | (0.75 | ) | (0.87 | ) | 0.12 | 2.13 | (2.86 | ) | |||||||||||

Net income (loss) | $ | (0.91 | ) | $ | (1.48 | ) | $ | (0.65 | ) | $ | 0.75 | $ | (4.63 | ) | |||||

Weighted average number of shares | 20,863 | 20,826 | 20,813 | 20,813 | 20,812 | ||||||||||||||

Diluted: | |||||||||||||||||||

Loss from continuing operations | $ | (0.16 | ) | $ | (0.61 | ) | $ | (0.77 | ) | $ | (1.37 | ) | $ | (1.77 | ) | ||||

Income (loss) from discontinued operations | (0.75 | ) | (0.87 | ) | 0.12 | 2.12 | (2.86 | ) | |||||||||||

Net income (loss) | $ | (0.91 | ) | $ | (1.48 | ) | $ | (0.65 | ) | $ | 0.75 | $ | (4.63 | ) | |||||

Weighted average number of shares | 20,863 | 20,826 | 20,813 | 20,896 | 20,812 | ||||||||||||||

For the year ended, (in thousands) | November 2, 2014 | November 3, 2013 | October 28, 2012 | October 30, 2011 | October 31, 2010 | ||||||||||||||

52 weeks | 53 weeks | 52 weeks | 52 weeks | 52 weeks | |||||||||||||||

BALANCE SHEET DATA | |||||||||||||||||||

Cash and cash equivalents | $ | 9,105 | $ | 9,846 | $ | 24,415 | $ | 36,685 | $ | 48,768 | |||||||||

Working capital | $ | 53,136 | $ | 62,146 | $ | 95,459 | $ | 110,932 | $ | 111,831 | |||||||||

Total assets | $ | 424,332 | $ | 501,340 | $ | 557,572 | $ | 579,479 | $ | 599,124 | |||||||||

Long-term debt, current portion | $ | 911 | $ | 839 | $ | 768 | $ | 708 | $ | 782 | |||||||||

Long-term debt, excluding current portion | $ | 7,216 | $ | 8,127 | $ | 9,033 | $ | 9,801 | $ | 10,509 | |||||||||

Total stockholders’ equity | $ | 91,394 | $ | 110,241 | $ | 143,117 | $ | 156,663 | $ | 140,137 | |||||||||

Note - Cash dividends were not paid during the above periods. | |||||||||||||||||||

17

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with the consolidated financial statements and notes thereto.

Unrecognized Revenue - Non-GAAP Measures

We sometimes provide services despite a customer arrangement not yet being finalized, or continue to provide services under an expired arrangement while a renewal arrangement is being finalized. Generally Accepted Accounting Principles (“GAAP”) usually requires that services revenue be deferred until arrangements are finalized or in some cases until cash is received, which causes some periods to include the expense of providing services although the related revenue is not recognized until a subsequent period (“Unrecognized Revenue”). The discussion herein refers to financial data determined both using GAAP as well as on a non-GAAP proforma basis. The non-GAAP proforma basis includes adjustments for Unrecognized Revenue so that revenue is shown in the same period as the related services are provided. This non-GAAP financial information is used by management and provided herein because it provides a more complete understanding of the Company’s business results and trends. This non-GAAP information should not be considered an alternative for, or in isolation from, the financial information prepared and presented in accordance with GAAP. In addition, this measure may not be comparable to similarly titled measures used by other companies.

Overview

Fiscal 2014 was a year of significant achievement and success. During the year we emerged from an expensive and distracting multi-year restatement and brought our publicly available financial information current, became and stayed current on our SEC filing requirements, remediated material weaknesses in internal control, and increased shareholder liquidity by moving from the over-the-counter stock market to the NYSE-MKT exchange.

We made significant progress on our primary goal of a more highly focused and profitable Volt. The businesses we entered the year with were very diverse, with few synergies and very different business models. This challenged our organization to find collaboration opportunities, stretched our management team, and made it difficult for investors to determine the true value of our consolidated Company. We therefore focused on exiting our software businesses and aligning our portfolio of businesses around staffing and services with similar profitability risks and returns on capital. We sold our software businesses which had significant upfront capital investments with extended payback periods each of which was producing significant losses. We exited our telecommunication government solutions business, as reduced federal spending minimized the opportunity for growth, efficiencies and our ability to deliver profitability. Each of these businesses had significantly different risk and return profiles than our core staffing and services business that have similar profitability, risks and returns on capital. The annual profitability and cash flow savings from the businesses we exited this year are over $20 million.

As we increased the emphasis on profitability in our core business we changed the goals driving our traditional staffing from a focus on topline growth to profitability. We changed compensation programs to reward increased operating profitability and performance as opposed to revenue increases and sales margin dollars. We now evaluate each opportunity against our top priority of achieving profitability that is consistent with or exceeds our competitors in the areas we choose to compete in. Consistent with this goal, throughout 2014 our Staffing Services segment focused on improving operating income, particularly in our North America traditional time and materials staffing services, and reducing exposure to customers where profitability or business terms are unfavorable. This resulted in revenue contraction, and may continue to do so in the near term, however we believe that focusing on profitability will drive higher shareholder value. In addition, we are focusing on superior delivery of our staffing services, which we believe will ultimately drive higher revenues at improved margins.

During the first quarter of 2014 we reorganized our Staffing Services segment separating our recruiting and delivery function from sales and moving our enterprise customers into a national service model separate from retail customers served from our local branches. We organized our enterprise teams around industry verticals and are focusing on where we have the greatest experience and expertise and therefore can offer superior customer experiences that will lead to greater profitability and long-term growth. We have organized our delivery organization into regional centers and local hubs focused on the specialized skillsets where we have the deepest knowledge of candidates and the candidate characteristics that customers look for. Enterprise customers refers to our customers that require multi-location, coordinated account management and service delivery in multiple skillsets, while our retail customers are in primarily a single location with sales and delivery handled from a geographically local team and with relatively few headcount on assignment in one or two skillsets.

In reviewing our performance we consider several key financial measures. We look at average daily revenue, direct margin, gross margin, and operating income, and gauge our operating performance based on trends in these measures. Average daily revenue excludes fees from permanent placements and conversions and subcontracted staffing. Direct margin is used in our

18

staffing businesses and represents revenue less the direct cost of contingent worker payroll and benefits, related employment taxes, and the cost of facilities used by contingent workers in fulfilling assignments and projects, including reimbursable costs. Gross margin represents revenue less direct costs (direct margin) and indirect costs, which include recruiting costs and delivery overheads such as onsite workforce management. Operating income represents gross margin less sales and marketing costs, general and administrative costs directly relating to operating activities, amortization of purchased intangible assets and restructuring costs.

In our Staffing Services segment the number of workdays, and therefore revenue, varies and is typically lowest in our first fiscal quarter due to the Thanksgiving, Christmas and New Year holidays, and demand typically increases in the third and fourth fiscal quarters when customers increase the use of our administrative and industrial labor during the summer vacation period. The number of workdays by quarter in a 52-week fiscal year is 59, 65, 63 and 64. The average revenue per workday also varies by quarter, being the lowest in our first fiscal quarter due to facility closures at some customers during the holidays in some cases for up to two weeks, and closures caused by severe winter weather conditions.

While some of our costs vary with the average daily revenue, such as recruiter and salesperson commissions, most costs vary with contingent workers on assignment (whether working on a particular day or not) or are more fixed in nature, and therefore operating income by quarter varies during the year with the first quarter being the lowest, with the lowest number of workdays and lowest daily average revenue. More significantly, employment taxes vary during the year as payroll tax contributions reset each January and annual maximums are then met in subsequent periods for various state and Federal taxes, such as Social Security Tax, particularly for higher salaried employees. For these reasons our Staffing Services segment margins and operating income is typically the lowest in the first fiscal quarter of each year and typically grows sequentially in each subsequent quarter.

Our Staffing Services segment’s customer demand is dependent on the strength of the labor market, with improving economic growth typically requiring an increase in labor resulting in greater demand for our staffing services. Conversely, during periods of weak economic growth or economic contraction the demand for our staffing services typically declines. During periods of increasing demand we typically are able to leverage our existing resources and not increase our selling, administrative and other operating costs as quickly as our revenues and direct margins, resulting in improved profitability ratios. When demand declines we typically do not decrease our selling, administrative and other operating costs as quickly as our revenues and direct margins because we seek to safeguard our long-term potential to support expansion, and this typically results in decreased profitability ratios.

Net revenue from continuing operations in 2014 decreased approximately 15% compared to 2013 and in our Staffing Services segment decreased approximately 16% as a result of lower demand primarily at our large enterprise customers and our continuing initiative to reduce exposure to customers with unfavorable business terms, and the impact of fiscal 2014 consisting of 52 weeks while fiscal 2013 consisted of 53 weeks. However, after average daily revenue decreased each quarter in 2013 and the first half of 2014 for the above reasons, a modest increase was achieved sequentially in both the third and fourth quarters of 2014. GAAP operating results from continuing operations in 2014 improved $12.1 million to income of $4.8 million from a loss of $7.3 million in 2013. Including Unrecognized Revenue, proforma operating results from continuing operations improved $15.4 million to proforma operating income of $2.1 million from a proforma loss of $13.3 million in 2013. Increased or flat direct margin percentages were achieved in each quarter of 2014 compared to the same quarter in 2013. The Staffing Services segment received a $3.0 million multi-year indirect tax recovery in 2013. Excluding the $3.0 million multi-year indirect tax recovery and approximately $1.1 million from the 53rd week in 2013, the Staffing Services segment operating income and direct margin percentage improved as a result of decreased administrative and other operating costs, the reorganization of our traditional staffing business, the divestiture of the Procurestaff business, our continuing initiative to reduce exposure to customers with unfavorable business terms and improved results in our call center, games testing and other project-based staffing services.

Net loss in fiscal 2014 of $19.0 million (proforma $21.7 million) included restatement, investigations and remediation expenses of $5.3 million, restructuring costs of $2.5 million ($0.5 million reflected in corporate general and administrative), losses from discontinued operations of $15.6 million, a $1.0 million cost in our workers compensation program related to multiple years, and a $1.4 million true-up of non-U.S. income taxes related to multiple years. Without these items net income in 2014 would have been $6.8 million and proforma net income of $4.1 million.

Net loss in fiscal 2013 of $30.9 million (proforma $37.0 million) included restatement, investigations and remediation expenses of $24.8 million, restructuring costs of $0.8 million, losses from discontinued operations of $18.1 million, the $3.0 million indirect tax recovery related to multiple years and approximately $1.1 million from the 53rd week in 2013. Without these items we would have had net income of $8.7 million and proforma net income of $2.6 million.

19

We have made substantial progress in adjusting our expense structure so that it responds to changing revenues, and are pleased that our net income and proforma net income, adjusted for the above items, is similar to last year despite the decrease in revenues. We incurred a number of general and administrative costs beyond those listed that will not recur in the future, and so while we continue to focus on streamlining costs we believe that we are well positioned to increase profitability in the future, particularly when revenues increase.