Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - AEP INDUSTRIES INC | Financial_Report.xls |

| EX-32.2 - EX-32.2 - AEP INDUSTRIES INC | d793230dex322.htm |

| EX-31.2 - EX-31.2 - AEP INDUSTRIES INC | d793230dex312.htm |

| EX-32.1 - EX-32.1 - AEP INDUSTRIES INC | d793230dex321.htm |

| EX-31.1 - EX-31.1 - AEP INDUSTRIES INC | d793230dex311.htm |

| EX-21 - EX-21 - AEP INDUSTRIES INC | d793230dex21.htm |

| 10-K - 10-K - AEP INDUSTRIES INC | d793230d10k.htm |

| EX-23 - EX-23 - AEP INDUSTRIES INC | d793230dex23.htm |

Exhibit 10.10

INDUSTRIES INC.

FISCAL YEAR 20[ ]

MANAGEMENT INCENTIVE PLAN

AEP INDUSTRIES INC.

FISCAL YEAR 20[ ] MANAGEMENT INCENTIVE PLAN

ADMINISTRATION

The Fiscal Year 20[ ] Management Incentive Plan (the “MIP” or “Plan”) will be administered by the Compensation Committee of the Board of Directors (the “Compensation Committee); provided, that, the Compensation Committee may delegate any of the foregoing powers to the Chief Executive Officer (CEO) or the Chief Financial Officer (CFO) of the Company or the Board of Directors, if (i) such delegation would not limit the deductibility of Plan awards under Section 162(m) of the Internal Revenue Code of 1986, as amended, or any successor law (“Section 162(m)”) or (ii) the Compensation Committee determines it is in the best interests of the Company not to comply with the performance-based exception specified in Section 162(m) (the Compensation Committee, together with the CEO, CFO or Board to the extent delegated such powers pursuant to this section, the “Administrator”).

The awards payable under the Plan may qualify as “performance-based compensation” within the meaning of Section 162(m), in which case the Company’s payment of awards under the Plan are tax deductible.

Subject to the terms of the Plan, applicable law and the listing standards of the Nasdaq Global Stock Market (or other national securities exchange, as applicable), the Administrator is authorized to interpret the Plan, to make, amend and rescind any rules and regulations relating to the Plan and to make all other determinations necessary or advisable for the Plan’s administration, including, without limitation in order to comply with the performance-based exception of Section 162(m). Interpretation and construction of any provision of the Plan by the Administrator will be final and conclusive.

PLAN OVERVIEW

Subject to the Administrative Guidelines set forth herein, all employees of the Company are eligible to participate in the Plan and the Administrator will determine which employees will be participants in the Plan (each employee so selected, a “Participant”).

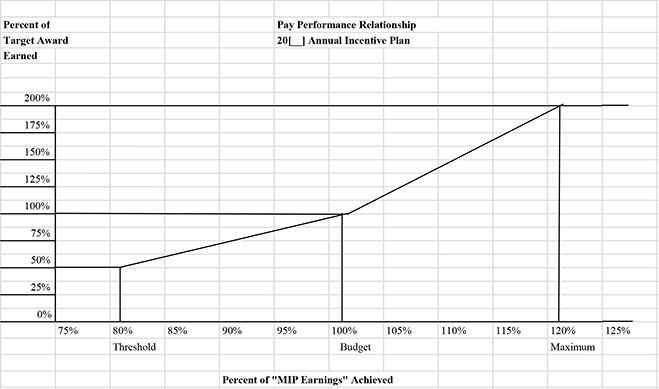

Each Participant will have a target incentive opportunity, stated as a percentage of salary (a “bonus target”). An earned bonus will be 0% to 200% of the individual’s bonus target based on MIP Adjusted EBITDA compared to the MIP Earnings Target.

The performance goal for each Participant is dependent upon job classification, with the intent to capture that portion of the Company’s business the performance of which a Participant can reasonably influence. Certain executive officers will have a performance goal related to the Company as a whole, while other Participants will have a performance goal related to various segments or divisions of the Company’s operations.

- 1 -

MIP EARNINGS TARGET AND MIP ADJUSTED EBITDA DEFINED

The MIP Earnings Target is based upon budgeted MIP Adjusted EBITDA, plus an additional dollar amount (recommended by management based on subjective factors) to further motivate MIP Participants.

MIP Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation and amortization, discontinued operations, non-core business operating income, annual change in LIFO reserve, gain or loss on disposal of property, plant and equipment, non-operating income (expense) and share-based compensation expense, all as adjusted to remove foreign exchange effect.

CALCULATION PROCEDURES FOR MIP ADJUSTED EBITDA

The following procedures will be utilized in calculating MIP Adjusted EBITDA:

| • | Extraordinary items outside the ordinary course of business, such as a gain (provision) for the sale or acquisition of assets or a business, will be excluded from MIP Adjusted EBITDA to the extent not included in the MIP Earnings Target; provided, however, extraordinary items will be included in MIP Adjusted EBITDA to the extent of cash received. In addition, professional and legal fees and severance related to completed acquisitions and dispositions will be excluded from MIP Adjusted EBITDA to the extent not contemplated by the MIP Earnings Target. |

| • | Amounts will be calculated in the business unit’s primary currency. In cases where “currency exchange rates” have an impact on business unit earnings, the exchange rate used to calculate the MIP Earnings Target will be used to calculate MIP Adjusted EBITDA in order to eliminate the effect of currency exchange rate variations. |

| • | Accounting policy changes required by the U.S. Securities and Exchange Commission or the U.S. Financial Accounting Standards Board that are approved by such parties following the approval of the MIP Earnings Target will not be utilized to calculate MIP Adjusted EBITDA. |

| • | Inter-unit management fees in effect on the date the MIP Earnings Target is approved by the Administrator will be included in MIP Adjusted EBITDA. |

| • | Inter-unit royalty fees in effect on the date the MIP Earnings Target is approved by the Administrator will be excluded from MIP Adjusted EBITDA. |

| • | Vendor pricing credits will be included in MIP Adjusted EBITDA in the fiscal year in which credits are earned, provided that the Company provides the Committee with sufficient and quantifiable support relating to such credit amounts if such credits are not included in the fiscal year-end financial statements. Any vendor pricing credits included in MIP Adjusted EBITDA for a fiscal year will be excluded from MIP Adjusted EBITDA in the following fiscal year. |

- 2 -

EARNED BONUS DETERMINATION

An earned bonus will be 0% to 200% of the individual’s bonus target based on MIP Adjusted EBITDA compared to the MIP Earnings Target, as shown below:

| • | The bonus target is earned for achieving 100% of the applicable MIP Earnings Target. |

| • | No bonus is earned for achieving less than 80% of the applicable MIP Earnings Target. |

| • | 50% of the bonus target is earned for achieving 80% of the applicable MIP Earnings Target. |

| • | The maximum of 200% of the bonus target is earned for achieving 120% or more of the applicable MIP Earnings Target. |

| • | There is a linear increase in the earned bonus from threshold to budget and from budget to maximum, each based on the above graph. |

| • | Performance will be treated on an absolute basis (i.e., if the applicable MIP Earnings Target is a loss of $100, then MIP Adjusted EBITDA of a loss of $90 would be deemed the achievement of 110% of MIP Earnings Target). |

- 3 -

The following sets forth a sample calculation if a Participant has a salary of $70,000 and a bonus target of 20%, and the MIP Adjusted EBITDA is 110% of the MIP Earnings Target:

| Salary |

$ | 70,000 | ||

| Bonus Target |

20%, or $ | 14,000 | ||

| MIP Adjusted EBITDA as a % of MIP Earnings Target |

110 | % | ||

| % of Bonus Target Earned |

150 | % | ||

| Earned Bonus in $ |

$ | 21,000 | ||

|

|

|

The maximum amount payable to any Participant with respect to an award under the Plan in any fiscal year is $4,000,000.

NO SEPARATE INCENTIVE COMPONENTS FOR PARTICIPANTS

In your prior employment or otherwise, you may have participated in an incentive program that included other subjective or critical performance measures such as:

| • Market Share |

• Sale of assets at an attractive price | |

| • Number or type of customers |

• Health and safety improvements | |

| • Quality |

• New sales/promotion tracking system | |

| • Customer satisfaction |

• New financial control system | |

| • New product introduction |

• Improved distribution system | |

AEP believes that everyone in the Company should be motivated to perform in the best interests of the Company and that additional, subjective performance measures are not necessary or appropriate for MIP purposes.

However, officers of the Company and the Administrator are authorized under the Plan to reduce the earned bonus of any individual within a business unit whose activities during the period has been counterproductive to the efforts of the business unit or who has not, for other reasons, added to the profit making goals of the Plan.

If you have any questions concerning the Plan, contact your manager or your Human Resources Manager.

- 4 -

ADMINISTRATIVE GUIDELINES

1. Base Salary for Bonus Calculations. Except as set forth in Sections 3, 4, 5, 6 and 7 below, a Participant’s annual Base Salary in effect for fiscal 20[ ], as reflected in the Company’s payroll records on October 31, 20[ ], will be used to calculate the earned bonus. For purposes of clarity, no changes in annual Base Salary for fiscal 20[ ], whether implemented on or prior to October 31, 20[ ], will be used to calculate the earned bonus.

2. Eligibility. Except as specified in Section 6(b)(ii) and 7 below, a Participant must be an active employee as of October 31, 20[ ] and on the bonus payout date to be eligible to receive payment for an earned bonus under the Plan.

3. Pro Rata Bonus Eligibility. Eligibility for a pro rata bonus is detailed in Sections 4, 5, 6, and 7 below. A pro rata bonus will apply changes in bonus targets and changes in performance goals on a pro rata basis. Further, a pro rata bonus will be earned only if the applicable performance goal is satisfied for the applicable fiscal year.

4. New Employee Added During the Plan Period. For a new employee who becomes a Participant in connection with such hire, the pro rata period will begin from the date of hire.

| 5. | Transfer or Promotion or Salary Adjustments During the Plan Period. |

(a) Transfer of Existing Employee. For an existing employee who is transferred to a new position which results in such employee becoming a Participant, the pro rata period will begin from the date of transfer.

(b) Promotion or Salary Adjustment of Existing Employee. For an existing employee who was a Participant prior to a promotion or salary adjustment and who continues to be a Participant thereafter, the earned bonus will be based on two pro rata periods: (i) from the beginning of the Plan period through the date immediately preceding such promotion or salary adjustment, and (ii) from the date of such promotion or salary adjustment until the end of the Plan period, in each case based on the base salary, bonus targets and performance goals in effect as of the end of the applicable period.

(c) Demotion of Existing Employee. For an existing employee who was a Participant and who is demoted such that the employee is no longer a Participant thereafter, the pro rata period will end on the date immediately preceding such demotion based on the bonus target and performance goal in effect as of the end of the applicable period.

6. Termination During the Plan Period.

(a) Voluntary Termination. If a Participant’s employment is terminated due to a voluntary termination, including retirement, no bonus will be earned by or paid to the Participant.

- 5 -

(b) Involuntary Termination. (i) If a Participant’s employment is terminated due to an involuntary termination (including, but not limited to, due to unsatisfactory performance or cause as determined by officers of the Company or the Administrator) other than due to job elimination or reorganization (as determined by officers of the Company or the Administrator) or due to death or disability (as set forth in Section7 below), no bonus will be earned by or paid to the Participant. For purposes of the Plan, “cause” for termination means any violation of laws or regulations or material violation of Company policies and procedures.

(ii) If a Participant’s employment is terminated due to an involuntary termination due to job elimination or reorganization (as determined by officers of the Company or the Administrator), the bonus will be earned and paid on a pro rata basis. The pro rata period will be from the beginning of the Plan period until the termination date.

7. Death or Disability During the Plan Period. If a Participant’s employment is terminated due to death, the bonus will be earned and paid (to the estate of the Participant) on a pro rata basis. The pro rata period will be from the beginning of the Plan period until the date of death.

A Participant’s disability of 30 calendar days or less will not have an impact on the Participant’s eligibility to earn a full bonus under the Plan.

If a Participant’s disability lasts more than 30 calendar days, then a bonus may be earned only for fiscal quarters in which the Participant works more than 60 calendar days and will be earned on a pro rata basis for days worked in the applicable fiscal quarter.

8. Adding Participants to the Plan. New Participants may be added to the Plan during the fiscal year as recommended by the appropriate Vice President/Group Manager and with the approval of the CEO and/or CFO (although new officers of the Company may only be added to the Plan by the Administrator). The criteria for participation will be based on both similar job classification as the list of current Participants in the Plan and a responsibility level commensurate with the Participant’s ability to influence goal outcomes. Approval will be required for both the addition of a Participant to the Plan and the proposed participant’s bonus target.

9. Timing of Payments. Financial results must be finalized as appropriate by the Company’s Vice President, Controller (or other person having similar responsibilities) and the independent auditors before bonuses can be calculated and paid. Further, no payments will be made unless and until (i) for awards generally payable under the Plan, the Administrator certifies in writing or resolves to approve payments generally in accordance with the Plan and (ii) for awards intended to qualify as performance-based compensation within the meaning of Section 162(m), the Committee certifies in writing that the applicable performance goals were met for fiscal 20[ ].

Earned bonuses will be paid in local currency as soon as possible after the end of fiscal 20[ ], but no later than January 15, 20[ ].

- 6 -

For earned bonuses under Sections 5(c), 6(b)(ii) and 7, bonus payments will be made to such Participants approximately at the same time as they are made to other Participants who continue to work for the Company through the end of the Plan period.

10. All Plan Payments Subject to Discretion. Notwithstanding the attainment of financial results, all earned bonuses under the Plan are subject to reduction or elimination by the Administrator prior to payment. For example, a reduction in any and all earned bonuses may be made if earnings are achieved in ways that are considered undesirable (such as reducing budgeted advertising expenditures to the detriment of the business); see also, “—No Separate Incentive Components for Participants.”

- 7 -