Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-14550

AEP INDUSTRIES INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

22-1916107 (I.R.S. Employer Identification No.) | |

| 125 Phillips Avenue, South Hackensack, New Jersey (Address of principal executive offices) |

07606-1546 (Zip code) | |

Registrant’s telephone number, including area code: (201) 641-6600

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ (Do not check if a smaller |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the common stock held by non-affiliates of the registrant as of April 30, 2010 was $106,830,400, based upon the closing price of $27.63 as reported by the Nasdaq Global Select Market on such date. Shares of common stock held by officers, directors and holders of more than 5% of the outstanding common stock have been excluded from this calculation because such persons may be deemed to be affiliates; such exclusion shall not be deemed to constitute an admission that any such person is an affiliate of the registrant.

The number of shares of the registrant’s common stock outstanding as of January 11, 2011 was 6,141,602.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the 2011 annual meeting of stockholders are incorporated by reference into Part III of this report to the extent described herein.

Table of Contents

INDEX TO FORM 10-K

2

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

Management’s Discussion and Analysis of Financial Condition and Results of Operations and other sections of this report contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent our goals, beliefs, plans and expectations about our prospects for the future and other future events, such as our ability to generate sufficient working capital, the amount of availability under our credit facility, the anticipated pricing in resin markets, our ability to continue to maintain sales and profits of our operations, and the sufficiency of our cash balances and cash generated from operating, investing, and financing activities for our future liquidity and capital resource needs. Forward-looking statements include all statements that are not historical fact and can be identified by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “anticipate,” “expect,” “believe,” “estimate,” “plan,” “project,” “predict,” “potential,” or the negative of these terms. Although these forward-looking statements reflect our good-faith belief and reasonable judgment based on current information, these statements are qualified by important factors, many of which are beyond our control, that could cause our actual results to differ materially from those in the forward-looking statements, including, but not limited to: the availability of raw materials; the ability to pass raw material price increases to customers in a timely fashion; the costs associated with the shutdown of the Fontana and Cartersville plants (acquired as part of Atlantis acquisition on October 30, 2008); the implementation of the final phase of a new operating system; the continuing impact of the U.S. recession and the global credit and financial environment and other changes in the United States or international economic or political conditions; the potential of technological changes that would adversely affect the need for our products; price fluctuations which could adversely impact our inventory; and other factors described from time to time in our reports filed or furnished with the U.S. Securities and Exchange Commission (the “SEC”), and in particular those factors set forth in Item 1A “Risk Factors” in this Annual Report on Form 10-K. Given these uncertainties, you should not place undue reliance on any such forward-looking statements. The forward-looking statements included in this report are made as of the date hereof or the date specified herein, based on information available to us as of such date. Except as required by law, we assume no obligation to update these forward-looking statements, even if new information becomes available in the future.

3

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Overview

AEP Industries Inc., founded in 1970 and incorporated in Delaware in 1985, is a leading manufacturer of plastic packaging films in North America. We manufacture and market an extensive and diverse line of polyethylene, polyvinyl chloride and polypropylene flexible packaging products, with consumer, industrial and agricultural applications. Our plastic packaging films are used in the packaging, transportation, beverage, food, automotive, pharmaceutical, chemical, electronics, construction, agriculture and textile industries.

We manufacture plastic films, principally from resins blended with other raw materials, which we either sell or further process by printing, laminating, slitting or converting. Our processing technologies enable us to create a variety of value-added products according to the specifications of our customers. Our manufacturing operations are located in the United States and Canada.

We manufacture both industrial grade products, which are manufactured to general industry specifications, and specialty products, which are manufactured under more exacting standards to assure certain required chemical and physical properties. Specialty products generally sell at higher margins than industrial grade products.

For a discussion of key operational developments occurring in fiscal 2010, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Products

As stated above, we manufacture and market an extensive and diverse line of polyethylene, polyvinyl chloride and polypropylene flexible packaging products, with consumer, industrial and agricultural applications. Flexible packaging and film products are thin, ductile bags, sacks, labels and films used for food and non-food consumer, agricultural and industrial items.

The following table summarizes our product lines:

| Product |

Material |

Examples of Uses | ||

| custom films |

polyethylene co-extruded and monolayer custom designed films | • drum, box, carton, and pail liners • furniture and mattress bags • films to cover high value products • magazine overwrap | ||

| stretch (pallet) wrap |

polyethylene | • pallet wrap | ||

|

PROformance® films |

Co-extruded and monolayer polyolefin films | • cereal box liners • fresh cut produce packaging • frozen foods • medical | ||

| polyvinyl chloride wrap |

polyvinyl chloride | • food and freezer wrap | ||

| printed and converted films |

polyethylene | • printed shrink films • printed, laminated, converted films for flexible packaging to consumer markets | ||

4

Table of Contents

| Product |

Material |

Examples of Uses | ||

| other products and specialty films |

unplasticized polyvinyl chloride polyethylene | • battery labels • credit card laminate • retail and institutional films and products • twist wrap • canliners • table covers, aprons, bibs and gloves • agricultural films |

Net sales by product line for each of the years ended October 31, 2010, 2009 and 2008 are as follows:

| 2010 | 2009 | 2008 | ||||||||||

| (in thousands) | ||||||||||||

| Custom films |

$ | 275,825 | $ | 240,182 | $ | 336,439 | ||||||

| Stretch (pallet) wrap |

245,232 | 217,999 | 184,516 | |||||||||

|

PROformance® films |

65,137 | 77,804 | 18,189 | |||||||||

| Polyvinyl chloride wrap |

79,881 | 77,870 | 88,672 | |||||||||

| Printed and converted films |

9,660 | 9,659 | 10,006 | |||||||||

| Other products and specialty films |

124,835 | 121,305 | 124,409 | |||||||||

| Total |

$ | 800,570 | $ | 744,819 | $ | 762,231 | ||||||

No single customer accounted for more than 10% of net sales in any fiscal year. No single customer accounted for more than 10% of our accounts receivable balance at October 31, 2010. See Note 13 in our consolidated financial statements for information regarding the Company’s operations by geographical area (United States and Canada).

Custom Films

We believe that the strength of our custom film operations lies in our variety of product applications, high quality control standards, well-trained and knowledgeable sales force and commitment to customer service. Most of the custom films manufactured by us, which may be as many as 35,000 separate and distinct products in any given year, are custom designed to meet the specific needs of our customers.

We manufacture a broad range of custom films, generally for industrial applications, including sheeting, tubing and bags. Bags are drum, box, carton and pail liners that are usually cut, rolled or perforated. These bags can also be used to package specialty items such as furniture and mattresses. We also manufacture films to protect items stored outdoors or in transit, such as boats and cars, and a wide array of shrink films, barrier films and overwrap films.

We also manufacture a full range of co-extruded films, and custom designed monolayer films designed specifically to service the flexible packaging market. These films are capable of being printed and laminated by third party flexible packaging converters and are used in the food, pharmaceutical, medical businesses and in a variety of other flexible packaging end users.

Stretch (Pallet) Wrap

We manufacture the most complete line of stretch film products for both hand wrap and rotary applications, using both monolayer and co-extruded constructions used to wrap pallets of industrial and commercial goods for shipping or storage. We also market a wide variety of pre stretch and high performance products designed for commodity and specialty uses.

5

Table of Contents

PROformance® Films

We offer a full range of coextruded polyolefin films, and custom designed monolayer films designed specifically to service the flexible packaging market. Capable of being printed and laminated by flexible packaging applications, our PROformance® films are used for food, pharmaceutical and medical applications and are available in up to five layers for applications requiring strength, clarity, sealability, barrier properties against oxygen or moisture transmission, and breathability for preserving freshness.

Polyvinyl Chloride Wrap

We manufacture specifically formulated in-store and pre-store films with our Resinite® line of polyvinyl chloride (“PVC”) food wrap for the supermarket and industrial markets. We offer a broad range of products with approximately 50 different formulations. Our Griffin, Georgia facility also produces dispenser (ZipSafe® cutter) boxes containing polyvinyl chloride food wrap for sale to consumers and institutions, including restaurants, schools, hospitals and penitentiaries. These institutional polyvinyl chloride food wrap products are marketed under several private labels and under our own Seal Wrap® name. By allowing oxygen to pass through, our PVC films are ideal for packaging of fresh red meats, poultry, fish, fruits, vegetables and bakery products. We also provide PVC films for windowing, blister packaging and aseptic shrink bundling film in the industrial marketplace.

Printed and Converted Films

We manufacture six, eight and ten color printing, solventless lamination, bags, and wicketed bags. Our printed and converted films provide printed rollstock to the food and beverage industries and other manufacturing and distributing companies. We also convert printed rollstock to bags and pouches for use by bakeries, fresh or frozen food processors, manufacturers or other dry goods processors.

Other Products and Specialty Films

We also manufacture other products in order to meet the full spectrum of our customers’ total packaging requirements. We manufacture unplasticized polyvinyl chloride (“UPVC”) film for use in battery labels, twist films, credit card laminates, PVC films for sale to retailers for use by consumers and a variety of film products with agricultural applications such as mulch films, fumigation films and sileage films. We also produce disposable consumer and institutional plastic products for the food service, party supply and school/collegiate markets, marketed under the Sta-Dri® brand name. Products produced include table covers and skirts, aisle runners, aprons, bibs, gloves, boots, freezer/storage bags, saddle pack bags, locker wrap and custom imprint designs.

Manufacturing

We conduct our manufacturing operations at 12 strategically located and integrated extrusion facilities in the United States and Canada. Each manufacturing facility is ISO-compliant (International Organization for Standardization) with the exception of our Mankato institutional products facility. We manufacture both industrial grade products, which are manufactured to industry specifications or for distribution from inventory, and specialty products, which are manufactured under more exacting standards to assure that their chemical and physical properties meet the particular requirements of the customer or the specialized application appropriate to its intended market. Specialty products generally sell at higher margins than industrial grade products. The size and location of our manufacturing facilities, as well as their capacity to manufacture multiple types of flexible packaging products and to re-orient equipment as market conditions warrant, enable us to achieve savings and minimize overhead and transportation costs, and to better serve our customers and remain competitive. See Item 2, “Properties” for a discussion of product lines manufactured at each facility as of October 31, 2010.

6

Table of Contents

In the film manufacturing process, resins with various properties are blended with chemicals and other additives to achieve a wide range of specified product characteristics, such as color, clarity, tensile strength, toughness, thickness, shrinkability, surface friction, transparency, sealability and permeability. The gauges of our products range from less than one mil (.001 inches) to more than 10 mils (.01 inches). Our extrusion equipment can produce printed products and film up to 40 feet wide. The blending of various kinds of resin combined with chemical and color additives is computer controlled to avoid waste and to maximize product consistency. The blended mixture is melted by a combination of applied heat and friction under pressure and is then mechanically mixed. The mixture is then forced through a die, at which point it is expanded into a flat sheet or a vertical tubular column of film and cooled. Several mixtures can be forced through separate layers of a co-extrusion die to produce a multi-layered film (co-extrusion), each layer having specific and distinct characteristics. The cooled film can then be shipped to a customer or can be further processed and then shipped. Generally, our manufacturing plants operate 24 hours a day, seven days a week.

We regularly upgrade or replace older equipment in order to keep abreast of technological advances and to maximize production efficiencies by reducing labor costs, waste and production time. During the past five fiscal years, we made significant capital improvements, including the purchase and lease of new state-of-the-art extrusion equipment and the upgrading of older equipment.

Raw Materials

We manufacture film products primarily from polyethylene, polypropylene and polyvinyl chloride resins, all of which are available from a number of domestic and foreign suppliers. We select our suppliers based on the price, quality and characteristics of the resins they produce. We currently purchase resins from major North American resin suppliers and believe any combination of purchases from such suppliers, as well as other suppliers we do not currently do business with, could satisfy our ongoing resin requirements. Our top three suppliers of resin during fiscal 2010 supplied us with 30%, 28% and 21%, respectively. Given the significant effect of resin costs on our operations and financial results, we have elected to focus our purchases with three suppliers in order to take advantage of the volume rebates which are customary among resin suppliers and critical to our success. Although the plastics industry has from time to time experienced shortages of resin supply and we have limited contractual protections in the event of such shortage, we believe we are well positioned to deal with such risks given our significant relationships and history with existing suppliers, as well as suppliers with whom we currently do not do business.

The resins used by us are produced from petroleum and natural gas. Instability in the world markets for petroleum and natural gas could adversely affect the prices of our raw materials, and this could have an adverse effect on our profitability if the increased costs cannot be passed on to customers. See Item 1A, “Risk Factors.”

Backlog

Our total backlog at October 31, 2010 was approximately $54.9 million, compared with approximately $53.4 million at October 31, 2009. We do not consider any specific month’s backlog to be a significant indicator of sales trends due to the various factors that influence backlog.

Quality Control

We believe that maintaining the highest standards of quality in all aspects of our manufacturing operations plays an important part in our ability to maintain our competitive position. We have adopted strict quality control systems and procedures designed to test the mechanical properties of our products, such as strength, puncture resistance, elasticity, abrasion characteristics and sealability, which we regularly review and modify as appropriate. As part of our commitment in providing the highest level

7

Table of Contents

of quality to our customers, we maintain an ISO 9001:2008 quality system in substantially all of manufacturing operations. ISO 9001:2008 is a quality management standard that helps organizations achieve standards of quality that are recognized and respected throughout the world.

Marketing and Sales

We believe that our ability to provide superior customer service is critical to our success. Even in those markets where our products are considered commodities and price is the single most important factor, we believe that our sales and marketing capabilities and our ability to timely deliver products is a competitive advantage. To that end, we have established good relations with our suppliers and have long-standing relationships with most of our customers, which we attribute to our ability to consistently manufacture high-quality products and provide timely delivery and superior customer service. We serve over 3,000 customers worldwide, none of which individually accounted for more than 4% of our net sales in fiscal 2010.

We believe that our research and development efforts, our high-efficiency equipment, which is automated and microprocessor-controlled, and the technical training given to our sales personnel enhance our ability to expand our sales in all of our product lines. An important component of our marketing philosophy is the ability of our sales personnel to provide technical assistance to customers. Our sales force regularly consults with customers with respect to performance of our products and the customer’s particular needs and then communicates with appropriate research and development staff regarding these matters. In conjunction with the research and development staff, sales personnel are often able to recommend a product or suggest a resin blend to produce the product with the characteristics and properties which best suit the customer’s requirements. Because we have expanded and continue to expand our product lines, sales personnel are able to offer a broad line of products to our customers.

We generally sell either directly to customers who are end-users of our products or to distributors, including nation-wide brokers, for resale to end-users. In fiscal 2010, 2009 and 2008 approximately 62%, 61%, and 62%, respectively, of our worldwide sales were directly to distributors with the balance representing sales to end-users.

Distribution

We believe that the timely delivery of our products to customers is a critical factor in our ability to maintain and grow our market position. In North America, all of our deliveries are by contracted third parties, and we monitor and control such shipments through “On Demand” Transportation Management System (TMS) software. The TMS system provides detailed reports, tracking of every shipment to customer delivery and carrier management. This enables us to better control the distribution process and ensure priority handling and direct transportation of products to our customers, thus improving the speed, reliability and efficiency of delivery.

Because of the geographic dispersion of our plants, we are able to deliver most of our products within a 500 mile radius of our plants. This enables us to reduce our use of warehouse space to store products and utilize the most efficient and economical shipping methods. We also ship products great distances when necessary and export from the United States and Canada.

Research and Development

We have a research and development department with a staff of approximately 17 persons. In addition, other members of management and supervisory personnel, from time to time, devote various amounts of time to research and development activities. The principal efforts of our research and development department are directed to assisting sales personnel in designing specialty products to meet individual customer’s needs, developing new products and reformulating existing products to

8

Table of Contents

improve quality and/or reduce production costs. During fiscal 2010, we focused a significant portion of our research and development efforts toward analyzing, merging and validating the comparable products lines of AEP’s existing products with those of Atlantis. Our research and development department has developed a number of products with unique properties, which we consider proprietary, certain of which are protected by patents. In fiscal 2010, 2009 and 2008, we spent $1.8 million, $1.8 million and $1.1 million, respectively, for research and development activities for continuing operations. Research and development expense is included in cost of sales in our consolidated statements of operations.

Intellectual Property

We own a number of patents, trademarks and licenses that relate to some of our products and manufacturing processes, and apply for new patents on significant product and process developments when appropriate. Although we believe that our patents and trademarks collectively provide us a competitive advantage, we are not dependent on any single patent or trademark. Rather, we believe our success depends on our marketing, manufacturing, and purchasing skills, as well as our ongoing research and development and unpatented proprietary know-how. We believe that the expiration or unenforceability of any of our patents, trademark registrations or licenses would not be material to our financial position or results of operations.

Competition

The business of supplying plastic packaging products is extremely competitive, and we face competition from a substantial number of companies which sell similar and substitute packaging products. Some of our competitors are subsidiaries or divisions of large, international, diversified companies with extensive production facilities, well-developed sales and marketing staffs and substantial financial resources.

We compete principally with (i) local manufacturers, who compete with us in specific geographic areas, generally within a 500 mile radius of their plants, (ii) companies which specialize in the extrusion of a limited group of products, which they market nationally, and (iii) a limited number of manufacturers of flexible packaging products who offer a broad range of products and maintain production and marketing facilities domestically and internationally.

Because many of our products are available from a number of local and national manufacturers, competition is highly price-sensitive and margins are relatively low. We believe that all of our products require efficient, low cost and high-speed production to remain cost competitive. We believe we also compete on the basis of quality, service and product differentiation.

We believe that there are few barriers to entry into many of our markets, enabling new and existing competitors to rapidly affect market conditions. As a result, we may experience increased competition resulting from the introduction of products by new manufacturers. In addition, in several of our markets, products are generally regarded as commodities. As a result, competition in such markets is based almost entirely on price and service.

Environmental Matters

We believe that there are no current environmental matters which would have a material adverse effect on our financial position, results of operations or liquidity. See discussion of environmental risk factors in Item 1A, “Risk Factors.”

Employees

At October 31, 2010, we had approximately 2,000 full and part time employees worldwide, including officers and administrative personnel. As of such date, we had three collective bargaining agreements covering 316 employees, which expire in March 2011, January 2013, and May 2013,

9

Table of Contents

respectively. While we believe that our relations with our employees are satisfactory, a dispute between our employees and us could have a material adverse effect on our business, which could affect our financial position, results of operations and liquidity.

Executive Officers of the Registrant

At January 14, 2011, our executive officers are as follows:

| Name |

Age | Position | ||||

| J. Brendan Barba |

69 | Chairman of the Board of Directors, President and Chief Executive Officer | ||||

| Paul M. Feeney |

68 | Executive Vice President, Finance and Chief Financial Officer and Director | ||||

| John J. Powers |

46 | Executive Vice President, Sales and Marketing | ||||

| David J. Cron |

56 | Executive Vice President, Manufacturing | ||||

| Paul C. Vegliante |

45 | Executive Vice President, Operations | ||||

| Lawrence R. Noll |

62 | Vice President, Tax and Administration, and Director | ||||

| James B. Rafferty |

58 | Vice President, Treasurer and Secretary | ||||

| Linda N. Guerrera |

43 | Vice President and Controller | ||||

J. Brendan Barba is one of our founders and has been our President and Chief Executive Officer and a director since our inception in January 1970. In 1985, Mr. Barba assumed the additional title of Chairman of the Board of Directors.

Paul M. Feeney has been our Executive Vice President, Finance and Chief Financial Officer and a director since December 1988. From 1980 to 1988, Mr. Feeney was Vice President and Treasurer of Witco Corporation.

John J. Powers has been our Executive Vice President, Sales and Marketing since March 1996. Prior thereto, he was Vice President-Custom Film Division since 1993 and held various sales positions with us since 1989.

David J. Cron has been our Executive Vice President, Manufacturing since July 1997. Prior thereto, he was Vice President, Manufacturing, a plant manager and held various other positions with us since 1976.

Paul C. Vegliante has been our Executive Vice President, Operations since December 1999. Prior thereto, he was our Vice President, Operations since June 1997 and held various other positions with us since 1994.

Lawrence R. Noll has been our Vice President, Tax and Administration since April 2007 and a director since February 2005. Prior thereto, he was our Vice President and Controller from 1996 to April 2007, our Vice President, Finance from 1993 to 1996, our Controller from 1980 to 1993, and our corporate Secretary from 1993 to 1998 and April 2005 to April 2007. He also served as a director from 1993 to 2004.

James B. Rafferty has been our Vice President and Treasurer since November 1996 and Secretary since April 2007. Prior thereto, he was our Assistant Treasurer from July 1996 to November 1996. From 1989 to 1995, Mr. Rafferty was Director of Treasury Operations at Borden, Inc.

Linda N. Guerrera has been our Vice President and Controller since April 2007. Prior thereto, she was our Director of Financial Reporting from September 2006 to April 2007 and our Assistant Controller—International Operations from October 1996 to September 2006. Prior to joining the Company, Ms. Guerrera was a manager at Arthur Andersen LLP in New York City.

10

Table of Contents

Certain family relationships exist between our directors and executive officers: Messrs. Powers and Vegliante are the sons-in-law of Mr. Barba; Messrs. Barba and Cron are cousins; and Ms. Guerrera is the daughter-in-law of Mr. Feeney.

Available Information

Our Internet address is www.aepinc.com. In the “Investor Relations” section of our website, we post the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, our proxy statement on Form 14A related to our annual stockholders’ meeting and any amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. All such filings are available on our Investor Relations web site free of charge. Copies of any of the above-referenced information will also be made available, free of charge, by calling (201) 641-6600 or upon written request to: Corporate Secretary, AEP Industries, Inc., 125 Phillips Avenue, South Hackensack, NJ 07606. The content on our website is not incorporated by reference into this Form 10-K unless expressly noted.

| ITEM 1A. | RISK FACTORS |

You should carefully consider each of the risks and uncertainties described below and elsewhere in this Annual Report on Form 10-K, as well as any amendments or updates reflected in subsequent filings with the SEC. We believe these risks and uncertainties, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results and could materially and adversely affect our business operations, results of operations, financial condition and liquidity. Further, additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our results and business operations.

Industry Risks

Our business is dependent on the price and availability of resin, our principal raw material, and our ability to pass on resin price increases to our customers.

The principal raw materials that we use in our products are polyethylene, polypropylene and polyvinyl chloride resins. Our ability to operate profitably is dependent, in a large part, on the markets for these resins. We use resins that are derived from petroleum and natural gas, and therefore prices of such resins fluctuate substantially as a result of changes in petroleum and natural gas prices, demand and the capacity of resin suppliers. Instability in the world markets for petroleum and natural gas could adversely affect the prices of our raw materials and their general availability. Over the past several years, we have at times experienced significant fluctuations in resin prices and availability.

Our ability to maintain profitability is heavily dependent upon our ability to pass through to our customers the full amount of any increase in raw material costs. Since resin costs fluctuate significantly, selling prices are generally determined as a “spread” over resin costs, usually expressed as cents per pound. The historical increases and decreases in resin costs have generally been reflected over a period of time in the sales prices of the products on a penny-for-penny basis. Assuming a constant volume of sales, an increase in resin costs would, therefore, result in increased sales revenues but lower gross profit as a percentage of sales or gross profit margin, while a decrease in resin costs would result in lower sales revenues with a higher gross profit margin. Further, the gap between the time at which an order is taken, resin is purchased, production occurs and shipment is made, has an impact on our financial results and our working capital needs. In a period of rising resin prices, this impact is generally negative to operating results and in periods of declining resin prices, the impact is generally positive to operating results. If there is overcapacity in the production of any specific product that we manufacture and sell, we frequently are not able to pass through the full amount of any cost increase.

11

Table of Contents

Economic conditions in the United States during fiscal 2010 were difficult with global economic and financial markets experiencing substantial disruption, which also increased the difficulty in passing through the full amount of cost increases. If resin prices increase and we are not able to fully pass on the increases to our customers, our results of operations, financial condition and liquidity will be adversely affected. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of the impact of resin costs on results of operations in fiscal 2010.

Intense competition in the flexible packaging markets may adversely affect our operating results.

The business of supplying plastic packaging products is extremely competitive. Lower volumes as a result of the current economic environment have intensified an already competitive marketplace. The competition in our market is highly price sensitive; we also compete on the basis of quality, service, timely delivery and differentiation of product properties. We face intense competition from numerous competitors, including from local manufacturers which specialize in the extrusion of a limited group of products, which they market nationally, and a limited number of manufacturers of flexible packaging products which offer a broad range of products and maintain production and marketing facilities domestically and internationally. Certain of our competitors may have extensive production facilities, well-developed sales and marketing staffs and greater financial resources than we do. We believe that there are few barriers to entry into many of our product markets. As a result, we have experienced, and may continue to experience, competition from new manufacturers. When new manufacturers enter the market for a plastic packaging product or existing manufacturers increase capacity, they frequently reduce prices to achieve increased market share. In addition, we compete with other packaging product manufacturers, many of which can offer consumers non-plastic packaging solutions. Many of these competitors have greater financial resources than we do and such competition can result in additional pricing pressures, reduced sales and lower margins. An increase in competition could result in material selling price reductions or loss of our market share, which could materially adversely affect our operations and financial condition. There can be no assurance that we will be able to compete successfully in the markets for our products or that competition will not intensify.

We are subject to various environmental and health and safety laws and regulations which govern our operations and which may result in potential liability. In addition, consumer preferences and ongoing health and safety studies on plastics and resins may adversely affect our business.

Our operations are subject to various federal, state, local and foreign environmental laws and regulations which govern:

| • | discharges into the air and water; |

| • | the storage, handling and disposal of solid and hazardous waste; |

| • | the remediation of soil and ground water contaminated by petroleum products or hazardous substances or waste; and |

| • | the health and safety of our employees. |

Compliance with these laws and regulations may require material expenditures by us. Actions by federal, state, local and foreign governments concerning environmental and health and safety matters could result in laws or regulations that could increase the cost of manufacturing our products. In addition, the nature of our current and former operations and the history of industrial uses at some of our manufacturing facilities expose us to the risk of liabilities or claims with respect to environmental and worker health and safety matters. We may also be exposed to claims for violations of environmental laws and regulations by previous owners or operators of our property. Such liability may be imposed without regard to fault, and under certain circumstances, can be joint and several, resulting

12

Table of Contents

in one party being held responsible for the entire obligation. In addition, the presence of, or failure to remediate, hazardous substances or waste may adversely affect our ability to sell or rent any property or to use it as collateral for a loan. We also may be liable for costs relating to the investigation, remediation or removal of hazardous waste and substances from a disposal or treatment facility to which we or our predecessors sent waste or materials.

Additionally, a decline in consumer preference for plastic products due to environmental considerations could have a material adverse effect on our business, financial condition and results of operations. Also, continuing studies of potential health and safety effects of various resins and plastics, including polyvinyl chlorides and other materials that we use in our products, are being conducted by industry groups, government agencies and others. The results of these studies, along with the development of any other new information, may adversely affect our ability to market and sell certain of our products or may give rise to claims for damages from persons who believe they have been injured by such products, any of which could adversely affect our operations and financial condition.

Company Risks

The existing global economic and financial market environment has had and may continue to have a negative effect on our business and operations.

The existing global economic and financial market environment has caused, among other things, lower levels of liquidity, increased borrowing rates, increased rates of default and bankruptcy, lower consumer and business spending, and lower consumer net worth, all of which has had and may continue to have a negative effect on our business, results of operations, financial condition and liquidity. Many of our customers, distributors and suppliers have been severely affected by the ongoing impacts of the economic and financial market difficulties. Current or potential customers and suppliers may no longer be in business, may be unable to fund purchases or determine to reduce purchases, all of which has and could continue to lead to reduced demand for our products, reduced gross margins, and increased customer payment delays or defaults. Further, suppliers may not be able to supply us with needed raw materials on a timely basis, may increase prices or may go out of business, which could result in our inability to meet consumer demand or affect our gross margins. We are also limited in our ability to reduce costs to offset the results of a prolonged or severe economic downturn given certain fixed costs associated with our operations, difficulties if we overstrained our resources, and our long-term business approach that necessitates we remain in position to respond when market conditions improve.

There can be no assurance that market conditions will significantly improve in the near future or that our results will not continue to be materially and adversely affected. Such conditions make it very difficult to forecast operating results, make business decisions and identify and address material business risks. The foregoing conditions may also impact the valuation of certain long-lived or intangible assets that are subject to impairment testing, potentially resulting in impairment charges which may be material to our financial condition or results of operations. See “—Financial Risks” below for a discussion of additional risks to our liquidity resulting from the current economic and financial market environment.

The loss of a key supplier could lead to increased costs and lower profit margins.

The majority of the resins purchased by the Company are purchased under supply contracts which are typically renewed annually. In fiscal 2010, the Company purchased approximately 30%, 28% and 21% of its resin requirements from its three largest suppliers. Each of these suppliers produce resins in multiple locations, and should any one, or a combination of these locations fail to meet the Company’s needs, the Company believes sufficient capacity exists among its remaining contract holders, the open market and the secondary markets to supply any shortfall that may result. Nevertheless, it is not always possible to replace a specialty resin without a disruption in our operations and replacement of significant supply is often at higher prices.

13

Table of Contents

The Company negotiates and awards its supply contracts annually. The resin contracts generally serve to establish the basic terms and conditions between the parties, but do not bind us in a materially significant way. Should any of our existing relationships fail to bid or survive the bid process, the position previously enjoyed by that contract holder typically migrates to another supplier. While this process has served the Company well in the past, there is no guarantee that the future replacement of any supplier will always result in a more effective and efficient relationship in the future.

We have limited contractual relationships with our customers and, as a result, our customers may unilaterally reduce the purchase of our products.

A substantial portion of our business is in the merchant market, in which we do not have long-term contractual relationships with our customers. As a result, our customers may unilaterally reduce the purchase of our products or, in certain cases, terminate existing orders for which we may have incurred significant production costs. The loss of several customers could, in the aggregate, materially adversely affect our operations and financial condition.

Many of our larger packaging customers are multinational companies that purchase large quantities of packaging materials. Many of these companies are purchasers with centralized procurement departments. They generally enter into supply arrangements through a tender process that solicits bids from several potential suppliers and selects the winning bid based on several attributes, including price and service. The significant negotiating leverage possessed by many of our customers and potential customers limits our ability to negotiate supply arrangements with favorable terms and creates pricing pressure, reducing margins industry wide. In addition, our customers may vary their order levels significantly from period to period, and customers may not continue to place orders with us in the future at the same levels as in prior periods. In the event we lose any of our larger customers, we may not be able to quickly replace that revenue source, which could harm our financial results.

Loss of third-party transportation providers upon whom we depend or increases in fuel prices could increase our costs or cause a disruption in our operations.

We depend upon third-party transportation providers for delivery of our products to our customers. Strikes, slowdowns, transportation disruptions or other conditions in the transportation industry, including, but not limited to, shortages of truck drivers, disruptions in rail service, decreases in ship building or increases in fuel prices, could increase our costs and disrupt our operations and our ability to service our customers on a timely basis.

We may, from time to time, experience problems in our labor relations.

Unions represent 316 employees, or 16% of our workforce, at October 31, 2010, under three collective bargaining agreements which expire in March 2011, January 2013 and May 2013, respectively. Although we believe that our present labor relations with our employees are satisfactory, our failure to renew these agreements on reasonable terms could result in labor disruptions and increased labor costs, which could adversely affect our financial performance.

We cannot assure you that our relations with the unionized portion of our workforce will remain positive or that such employees will not initiate a strike, work stoppage or slowdown in the future. In the event of such an action, our business, prospects, results of operations and financial condition could be adversely affected and we cannot assure you that we would be able to adequately meet the needs of our customers using our remaining workforce. In addition, we cannot assure you that we will not have similar actions with our non-unionized workforce or that our non-unionized workforce will not become unionized in the future.

14

Table of Contents

We are dependent on the management experience of our key personnel and our ability to attract and retain additional personnel.

Our future success depends to a large extent on the experience and continued services of our key managerial employees, including J. Brendan Barba, our Chairman, President and Chief Executive Officer, and Paul M. Feeney, our Executive Vice President, Finance, and Chief Financial Officer. We do not maintain key-person insurance for any of our officers. We may not be able to retain our executive officers and key personnel or attract additional qualified key employees in the future. Competition for qualified employees is intense, and the loss of such persons, or an inability to attract, retain and motivate additional highly skilled employees, could have a material adverse effect on our results of operations and financial condition and prospects. There can be no assurance that we will be able to retain our existing personnel or attract and retain additional qualified employees.

Our executive officers beneficially own a substantial amount of our common stock and have significant influence over our business.

At October 31, 2010, our executive officers beneficially owned 1,313,746 shares of our common stock and have the right to acquire an additional 120,239 shares of our common stock. Their ownership and voting control over approximately 21% of our common stock, together with their duties as executive officers, gives them significant influence on the outcome of corporate transactions or other matters submitted to the Board of Directors or stockholders for approval, including acquisitions, mergers, consolidations and the sale of all or substantially all of our assets.

Our business is subject to risks associated with manufacturing processes.

We internally manufacture our own products at our production facilities. While we maintain insurance covering our manufacturing and production facilities, including business interruption insurance, a catastrophic loss of the use of all or a portion of our facilities due to accident, fire, explosion, labor issues, weather conditions, other natural disaster or otherwise, whether short or long-term, could have a material adverse effect on us.

Unexpected failures of our equipment and machinery may result in production delays, revenue loss and significant repair costs, injuries to our employees, and customer claims. Any interruption in production capability may require us to make large capital expenditures to remedy the situation, which could have a negative impact on our profitability and cash flows. Our business interruption insurance may not be sufficient to offset the lost revenues or increased costs that we may experience during a disruption of our operations.

Failure to successfully implement a new core operating system may adversely affect our business operations.

We are currently and will continue to be highly dependent on automated systems to record and process Company and customer transactions and certain other components of the Company’s financial statements. As of November 1, 2009, we began implementing the initial phase of a new integrated operating system to improve our ability to address the needs of our customers, as well as to create additional efficiencies and strengthen our internal control over our financial reporting. During fiscal 2010, we supplemented the automated internal controls with additional manual and analytical procedures with a focus on revenue completeness, billing accuracy and inventory valuation. During fiscal 2011, we will begin implementing the final phase of our new system, which is centered in our manufacturing facilities, and expected to be completed during fiscal 2012. We may not be able to successfully implement the final phase of the new system in an effective or timely manner or could fail to complete all necessary data reconciliation or other conversion controls when implementing the new system. In addition, we may incur significant increases in costs and encounter extensive delays in the implementation and rollout of the final phase of the new operating system. Failure to effectively implement our new operating system may adversely affect our operations as well as customer perceptions and our internal control over financial reporting.

15

Table of Contents

Financial Risks

Capital markets have experienced a significant period of dislocation and instability, which has had and could continue to have a negative impact on the availability and cost of capital.

The recent disruptions in the U.S. capital markets have lowered the availability of capital and increased its cost. The impacts of these conditions could persist for a prolonged period of time or worsen in the future. Our ability to access the capital markets may be restricted at a time when we would like, or need, to access those markets, which could have an impact on our flexibility to react to changing economic and business conditions. Limitations on available capital, increased volatility in the financial markets and reduced business activity could materially and adversely affect our business, financial condition, results of operations and our ability to obtain and manage our liquidity. In addition, the cost of debt financing, and other important financing terms, has been and may continue to be materially adversely impacted by these market conditions.

To service our debt or redeem such debt upon a change of control, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control.

Our ability to service our debt and to fund our operations and planned capital expenditures will depend on our operating performance. This, in part, is subject to prevailing economic conditions and to financial, business and other factors beyond our control. If our cash flow from operations is insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, obtain additional equity capital or indebtedness, or refinance or restructure our debt. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In the absence of such operating results and resources, we could face substantial cash flow problems and might be required to sell material assets or operations to meet our debt service and other obligations. We cannot assure you as to the timing of such sales or the proceeds that we could realize from such sales or if additional debt or equity financing would be available on acceptable terms, if at all. As of October 31, 2010, we could have borrowed up to an additional $103.5 million under our U.S. credit facility and an additional $4.9 million under our Canadian credit facility.

A provision of our senior notes requires us, upon a change of control, to offer to purchase the outstanding senior notes. If a change of control were to occur and we could not obtain a waiver or if we do not have the funds to make the purchase, we would be in default under the senior notes, which could, in turn, cause any of our debt to which a cross-acceleration or cross-default provision applies to become immediately due and payable. If our debt were to be accelerated, we cannot assure you that we would be able to repay it.

We are subject to a number of restrictive debt covenants which may restrict our business and financing activities.

Our credit facility, the indenture relating to our senior notes and the agreements relating to the indebtedness of our subsidiaries contain restrictive debt covenants that, among other things, restrict our ability to:

| • | borrow money; |

| • | pay dividends and make distributions; |

| • | issue stock of subsidiaries; |

| • | make certain investments; |

| • | repurchase stock; |

| • | use assets as security in other transactions; |

| • | create liens; |

16

Table of Contents

| • | enter into affiliate transactions; |

| • | merge or consolidate; and |

| • | transfer and sell assets. |

In addition, our credit facility and the agreements relating to the indebtedness of our subsidiaries also require us to maintain certain financial tests. These restrictive covenants may limit our ability to expand or to pursue our business strategies. Furthermore, any indebtedness that we incur in the future may contain similar or more restrictive covenants.

Our ability to comply with the restrictions contained in our credit facility, our senior notes and the agreements relating to the indebtedness of our subsidiaries may be affected by changes in our business condition or results of operations, adverse regulatory developments or other events beyond our control. A failure to comply with these restrictions could result in a default under our credit facility, our senior notes and the agreements relating to the indebtedness of our subsidiaries, or any other subsequent financing agreement, which could, in turn, cause any of our debt to which a cross-acceleration or cross-default provision applies to become immediately due and payable. If our debt were to be accelerated, we cannot assure you that we would be able to repay it. In addition, a default could give our lenders the right to terminate any commitments that they had made to provide us with additional funds.

Risks Related to an Investment in Our Common Stock

Our common stock price may be volatile.

The market price of our common stock has fluctuated regularly in the past. The market price of our common stock will continue to be subject to significant fluctuations in response to a variety of factors, including:

| • | fluctuations in operating results, including as a result of changes in resin prices, LIFO reserve, and the other variables; |

| • | our liquidity needs and constraints; |

| • | the business environment, including the operating results and stock prices of companies in the industries we serve; |

| • | changes in general conditions in the U.S. and global economies or financial markets, including those resulting from war, incidents of terrorism and natural disasters or responses to such events; |

| • | announcements concerning our business or that of our competitors or customers; |

| • | acquisitions and divestitures; |

| • | the introduction of new products or changes in product pricing policies by us or our competitors; |

| • | change in earnings estimates or recommendations by research analysts who track our common stock or the stocks of other companies in our industry or failure of analysts to cover our common stock; |

| • | changes in accounting standards, policies, guidance, interpretations or principles; |

| • | sales of common stock by our employees, directors and executive officers; |

| • | prevailing interest rates; and |

| • | perceived dilution from stock issuances. |

17

Table of Contents

Some companies that have had volatile market prices for their securities have been subject to securities class action suits filed against them. If a suit were to be filed against us, regardless of the outcome, it could result in substantial costs and a diversion of our management’s attention and resources. This could have a material adverse effect on our business, results of operation and financial condition.

Our common stock generally has had a low trading volume historically, which could limit trading and cause further volatility in our stock.

Shares of common stock eligible for future sale, and additional equity offerings by us, may adversely affect our common stock price.

The market price of our common stock could decline as a result of sales of substantial amounts of additional shares of our common stock in the public market or in connection with future acquisitions, or the perception that such sales could occur. This could also impair our ability to raise additional capital through the sale of equity securities at a time and price favorable to us. As of October 31, 2010 under our certificate of incorporation, as amended, we are authorized to issue 30 million shares of common stock, of which approximately 6.1 million shares of common stock were outstanding and approximately 0.2 million shares of common stock were issuable related to the exercise of currently outstanding stock options and 0.2 million shares of common stock were issuable related to settlement of performance units if the performance unit holders elected settlement in stock.

We may also decide to raise additional funds through public or private equity financing to fund our operations or for other business purposes. New issuances of equity securities would reduce your percentage ownership in us and the new equity securities could have rights and preferences with priority over those of our common stock.

Our stock repurchase program could increase the volatility of the price of our common stock.

As of October 31, 2010, $4.9 million remains available under the current stock repurchase program. Repurchases may be made in the open market, in privately negotiated transactions or by other means, from time to time, subject to market conditions, applicable legal requirements and other factors, including the limitations set forth in the Company’s debt covenants. The program does not obligate the Company to acquire any particular amount of common stock and the program may be suspended at any time at the Company’s discretion.

Delaware law and our charter documents may impede or discourage a takeover, which could cause the market price of our shares to decline.

We are a Delaware corporation and the anti-takeover provisions of Delaware law imposes various impediments to the ability of a third party to acquire control of us, even if a change of control would be beneficial to our existing stockholders. For example, Section 203 of the Delaware General Corporation Law may discourage, delay or prevent a change in control by prohibiting us from engaging in a business combination with an interested stockholder for a period of three years after the person becomes an interested stockholder.

In addition, our restated certificate of incorporation and fifth amended and restated by-laws contain provisions that may discourage, delay or prevent a third party from acquiring us, even if doing so would be beneficial to our stockholders. These provisions include:

| • | requiring supermajority approval of stockholders for certain business combinations or an amendment to, or repeal of, the by-laws; |

| • | prohibiting stockholders from acting by written consent without board approval; |

| • | prohibiting stockholders from calling special meetings of stockholders; |

18

Table of Contents

| • | establishing a classified board of directors, which allows approximately one-third of our directors to be elected each year; |

| • | limitations on the removal of directors; |

| • | advance notice requirements for nominating candidates for election to our board of directors or for proposing matters that can be acted upon by stockholders at stockholder meetings; |

| • | permitting the board of directors to amend or repeal the by-laws; and |

| • | permitting the board of directors to designate one or more series of preferred stock. |

Our issuance of preferred stock could adversely affect holders of our common stock.

We are currently authorized to issue one million shares of preferred stock in accordance with our restated certificate of incorporation, none of which is issued and outstanding. Our board of directors has the power, without stockholder approval, to set the terms of any such series of preferred stock that may be issued, including voting rights, dividend rights, and preferences over our common stock with respect to dividends or if we liquidate, dissolve or wind up our business and other terms. If we issue preferred stock in the future that has preference over our common stock with respect to the payment of dividends or upon our liquidation, dissolution or winding up, or if we issue preferred stock with voting rights that dilute the voting power of our common stock, the rights of holders of our common stock or the market price of our common stock could be adversely affected.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

| ITEM 2. | PROPERTIES |

Our principal executive and administrative offices are located in a leased building in South Hackensack, New Jersey. The lease terminates in February 2015.

19

Table of Contents

The following table describes the manufacturing facilities that we own or lease and currently utilize for operations as of October 31, 2010. All of these facilities are located in the United States and Canada. Substantially all of the owned properties are pledged as collateral under our various credit facilities and the Wright Township, Pennsylvania facility is pledged under the Pennsylvania Industrial Loans. The following chart sets forth the square footage of such manufacturing facilities, including warehousing space. All of the properties are owned unless noted otherwise.

| Location |

Approximate Square Footage |

Types of Film Produced |

||||||

| Griffin, Georgia |

322,000 | PVC food wrap, UPVC | ||||||

| Wright Township, Pennsylvania |

433,000 | Custom, PROformance and stretch | ||||||

| Matthews, North Carolina |

394,000 | Custom and stretch | ||||||

| Alsip, Illinois |

182,000 | Custom | ||||||

| West Hill, Ontario, Canada |

138,000 | PVC food wrap | ||||||

| Chino, California |

259,000 | Custom and stretch | ||||||

| Waxahachie, Texas |

216,000 | Custom | ||||||

| Tulsa, Oklahoma |

126,000 | Stretch | ||||||

| Nicholasville, Kentucky |

125,000 | Stretch | ||||||

| Mankato, Minnesota |

104,000 | Custom, PROformance | ||||||

| Mankato, Minnesota |

65,000 | Institutional products | ||||||

| Bowling Green, Kentucky(A) |

165,000 | |

Printed and converted, custom, PROformance |

| ||||

| Total |

2,529,000 | |||||||

| (A) | Lease ends February 2, 2012. The lease contains an option to purchase the facility. If we elect not to purchase, we have two five-year options to extend the lease with the initial extension based on an August 31, 2011 start date. |

As of October 31, 2010, we also had manufacturing facilities located in each of Fontana, California and Cartersville, Georgia that were acquired from Atlantis on October 30, 2008. Production in the Fontana location ceased in November 2008 and such lease terminated December 15, 2010. Production in Cartersville ceased on October 31, 2009, although we remain party to the facility lease ending July 31, 2015. We have entered into a sublease for the Cartersville property aggregating approximately $0.4 million in sublease income for the period January 2011 to July 2015.

We believe that all of our properties are well maintained and in good condition, and that the current operating facilities are adequate for present and immediate future business needs.

As of October 31, 2010, our manufacturing facilities (excluding Fontana and Cartersville) had a combined average annual production capacity exceeding one billion pounds.

| ITEM 3. | LEGAL PROCEEDINGS |

We are, from time to time, party to litigation arising in the normal course of our business. We believe that there are currently no legal proceedings the outcome of which would have a material adverse effect on our financial position or our results of operations.

| ITEM 4. | REMOVED AND RESERVED |

Not applicable.

20

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is quoted on the Nasdaq Global Select Market under the symbol “AEPI.” The high and low closing prices for our common stock, as reported by the Nasdaq Global Select Market for the two fiscal years ended October 31, 2009 and 2010, respectively, are as follows:

| Price Range | ||||||||

| Fiscal Year and Period |

High | Low | ||||||

| 2009 |

||||||||

| First quarter (November-January) |

$ | 20.73 | $ | 13.16 | ||||

| Second quarter (February-April) |

20.33 | 11.08 | ||||||

| Third quarter (May-July) |

31.91 | 20.81 | ||||||

| Fourth quarter (August-October) |

41.32 | 31.50 | ||||||

| 2010 |

||||||||

| First quarter (November-January) |

$ | 41.94 | $ | 33.22 | ||||

| Second quarter (February-April) |

38.22 | 26.02 | ||||||

| Third quarter (May-July) |

28.90 | 22.76 | ||||||

| Fourth quarter (August-October) |

29.82 | 20.89 | ||||||

On January 11, 2011, the closing price for a share of our common stock, as reported by the Nasdaq Global Select Market, was $25.65.

Holders

On January 11, 2011, our common stock was held by approximately 1,500 stockholders of record. A substantially greater number of holders are beneficial owners whose shares are held of record by banks, brokers and other nominees.

Dividends

No dividends have been paid to stockholders since December 1995. The payment of future dividends is within the discretion of the board of directors and will depend upon business conditions, our earnings and financial condition and other relevant factors. The payments of future dividends, however, are restricted and subject to a number of covenants under our Loan and Security Agreement and under the Indenture pursuant to which our 7.875% Senior Notes were issued. The Company does not anticipate paying dividends in the foreseeable future.

21

Table of Contents

Purchases of Equity Securities by the Issuer

The table below sets forth the total number of shares of our common stock that we repurchased in each month of the quarter ended October 31, 2010.

| 2010 period |

Total number of shares purchased |

Average price paid per share |

Total number of shares purchased as part of publicly announced plans or programs |

Approximate dollar value of shares that may yet be purchased under the plans or programs |

||||||||||||

| August 1-August 31 |

402,776 | $ | 27.29 | — | $ | 793,022 | (a) | |||||||||

| September 1-September 30 |

119,300 | $ | 21.16 | — | $ | 5,476,072 | (b) | |||||||||

| October 1-October 31 |

24,149 | $ | 23.89 | — | $ | 4,899,129 | ||||||||||

| Total |

546,225 | $ | 25.80 | — | $ | 4,899,129 | ||||||||||

| (a) | On June 7, 2010, the Board approved a new $10.0 million stock repurchase program (the “June 2010 Repurchase Program”). On August 4, 2010, our Board authorized a $6.5 million increase to the June 2010 Repurchase Program. |

| (b) | On September 15, 2010, our Board terminated the June 2010 Repurchase Program and approved a new $8.0 million stock repurchase program (the “September 2010 Stock Repurchase Program”). Please refer to Note 10 of the Consolidated Financial Statements for further discussion of the program. |

22

Table of Contents

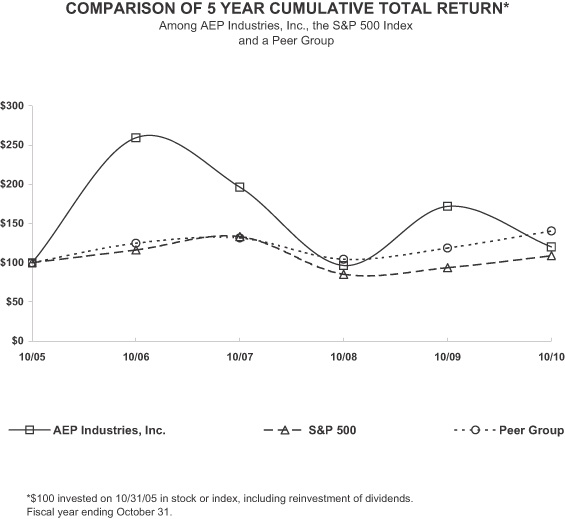

Performance Graph

The following graph compares, for the five-year period ended on October 31, 2010, the cumulative total stockholder return on our common stock against the cumulative total return of:

| • | the S&P 500 Index and |

| • | a peer group consisting of twelve publicly traded plastic manufacturing companies that we have selected. The companies in the peer group are as follows: Aptar Group, Astronics Corporation, Ball Corporation, Bemis Company, Inc., Crown Holdings, Inc., Intertape Polymer Group Inc., Pactiv Corporation, Silgan Holdings Inc., Sonoco Products Company, Spartech Corporation, Dean Foods Company and West Pharmaceutical Services, Inc. |

The graph assumes $100 was invested on October 31, 2005 in our common stock, the S&P 500 Index and the peer group consisting of twelve companies, and the reinvestment of all dividends.

23

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table presents our selected financial data. The table should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and Item 8, “Financial Statements and Supplementary Data”, of this Annual Report on Form 10-K.

| For the Year Ended October 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 800,570 | $ | 744,819 | $ | 762,231 | $ | 666,318 | $ | 697,233 | ||||||||||

| Gross profit |

110,074 | 160,436 | 96,822 | 139,152 | 151,236 | |||||||||||||||

| Operating income |

15,720 | 60,387 | 9,593 | 52,866 | 66,964 | |||||||||||||||

| Interest expense |

(15,206 | ) | (15,749 | ) | (15,731 | ) | (15,551 | ) | (15,437 | ) | ||||||||||

| Other income (expense), net |

455 | 4,785 | 916 | 779 | (7,703 | ) | ||||||||||||||

| Income (loss) from continuing operations before (provision) benefit for income taxes |

969 | 49,423 | (5,222 | ) | 38,094 | 43,824 | ||||||||||||||

| (Provision) benefit for income taxes(1) |

(1,492 | ) | (18,994 | ) | 8,534 | (15,217 | ) | (8,432 | ) | |||||||||||

| (Loss) income from continuing operations |

(523 | ) | 30,429 | 3,312 | 22,877 | 35,392 | ||||||||||||||

| (Loss) income from discontinued operations |

(43 | ) | 1,099 | 8,932 | 7,175 | 27,537 | ||||||||||||||

| Net (loss) income |

$ | (566 | ) | $ | 31,528 | $ | 12,244 | $ | 30,052 | $ | 62,929 | |||||||||

| Basic (Loss) Earnings per Common Share: |

||||||||||||||||||||

| (Loss) income from continuing operations |

$ | (0.08 | ) | $ | 4.48 | $ | 0.49 | $ | 3.05 | $ | 4.20 | |||||||||

| (Loss) income from discontinued operations |

$ | (0.01 | ) | $ | 0.16 | $ | 1.32 | $ | 0.96 | $ | 3.27 | |||||||||

| Net (loss) income per common share |

$ | (0.08 | ) | $ | 4.65 | $ | 1.80 | $ | 4.00 | $ | 7.46 | |||||||||

| Diluted (Loss) Earnings per Common Share: |

||||||||||||||||||||

| (Loss) income from continuing operations |

$ | (0.08 | ) | $ | 4.45 | $ | 0.48 | $ | 2.99 | $ | 4.14 | |||||||||

| (Loss) income from discontinued operations |

$ | (0.01 | ) | $ | 0.16 | $ | 1.31 | $ | 0.94 | $ | 3.22 | |||||||||

| Net (loss) income per common share |

$ | (0.08 | ) | $ | 4.61 | $ | 1.79 | $ | 3.93 | $ | 7.35 | |||||||||

| Cash dividends declared and paid |

— | — | — | — | — | |||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Consolidated Balance Sheet Data (at period end): |

||||||||||||||||||||

| Total assets |

$ | 350,796 | $ | 360,070 | $ | 390,840 | $ | 328,792 | $ | 336,080 | ||||||||||

| Total debt (including current portion) |

185,700 | 170,000 | 249,155 | 184,077 | 182,802 | |||||||||||||||

| Shareholders’ equity |

56,630 | 75,800 | 40,140 | 42,370 | 57,593 | |||||||||||||||

| (1) | Benefit for income taxes from continuing operations for the year ended October 31, 2008 includes $7.0 million in benefits arising from previously unrecognized tax benefits resulting from the completion in September 2008 of an IRS examination for fiscal 2005 and 2006. |

24

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is designed to provide a reader of our financial statements with a narrative explanation from the perspective of our management on our business, financial condition, results of operations, and cash flows. Our MD&A is presented in six sections:

| • | Overview |

| • | Results of Operations |

| • | Liquidity and Capital Resources |

| • | Contractual Obligations and Off-Balance-Sheet Arrangements |

| • | Critical Accounting Policies and |

| • | New Accounting Pronouncements |

Investors should review this MD&A in conjunction with the consolidated financial statements and related notes included in Item 8, “Financial Statements and Supplementary Data”, of this Annual Report on Form 10-K.

Overview

AEP Industries Inc. is a leading manufacturer of plastic packaging films. We manufacture and market an extensive and diverse line of polyethylene, polyvinyl chloride and polypropylene flexible packaging products, with consumer, industrial and agricultural applications. Our plastic packaging films are used in the packaging, transportation, beverage, food, automotive, pharmaceutical, chemical, electronics, construction, agriculture, carpeting, furniture and textile industries.

We manufacture plastic films, principally from resins blended with other raw materials, which we either sell or further process by printing, laminating, slitting or converting. Our processing technologies enable us to create a variety of value-added products according to the specifications of our customers. Our manufacturing operations are located in the United States and Canada.