Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GATX CORP | a8-kfixedincomepresentation.htm |

GATX Corporation Presentation to Fixed Income Investors December 2014 Unless otherwise noted, GATX is the source for data provided.

Forward-Looking Statements Certain statements in this document may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor provisions of those sections and the Private Securities Litigation Reform Act of 1995. These statements refer to information that is not purely historical, such as estimates, projections and statements relating to our business plans, objectives and expected operating results, and the assumptions on which those statements are based. Some of these statements may be identified by words like “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict,” “project” or other similar words. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those described in our Annual Report on Form 10-K for the year ended December 31, 2013 and other filings with the SEC, that could cause actual results or developments to differ materially from the forward-looking statements. These risks and uncertainties include, but are not limited to: Given these risks and uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements, which reflect our analysis, judgment, belief or expectation only as of the date hereof. We have based these forward-looking statements on information currently available and disclaim any intention or obligation to update or revise these forward-looking statements to reflect subsequent events or circumstances. • changes in regulatory requirements for tank cars in crude, ethanol, and other flammable liquid commodity service • competitive factors in our primary markets, including lease pricing and asset availability • weak economic conditions, financial market volatility, and other factors that may negatively affect the rail, marine, and other industries served by us and our customers • inability to maintain satisfactory lease rates or utilization levels for our assets, or increased operating costs in our primary operating segments • changes to laws, rules, and regulations applicable to GATX and our rail, marine, and other assets, or failure to comply with those laws, rules and regulations • operational disruption and increased costs associated with compliance maintenance programs and other maintenance initiatives • financial and operational risks associated with long-term railcar purchase commitments • deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs • unfavorable conditions affecting certain assets, customers or regions where we have a large investment • risks related to our international operations and expansion into new geographic markets • inadequate allowances to cover credit losses in our portfolio or declines in the credit quality of our customer base • impaired asset charges that may result from weak economic or market conditions, changes to laws, rules, and regulations affecting our assets, events related to particular customers or asset types, or portfolio management decisions we implement • environmental remediation costs or a negative outcome in our pending or threatened litigation • our inability to obtain cost-effective insurance • operational and financial risks related to our affiliate investments, particularly where certain affiliates may contribute significantly to our consolidated operating profit • reduced opportunities to generate asset remarketing income • failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees NYSE: GMT 2

GATX Corporation’s history 3 History 1898 Founded as a railcar lessor Initiated quarterly dividends • Railcar leasing remains primary business • 95th consecutive year of uninterrupted dividends 1919 2014 With the largest railcar lease fleet in the world, GATX has been providing quality railcars and services to its customers for more than 115 years.

Solid business profile with leading market positions 4 Rail North America Largest railcar lessor in North America 2nd largest tank car lessor Extensive maintenance network Rail International 2nd largest European tank car lessor 1st to obtain a wagon leasing license in India American Steamship Company Largest US flagged vessel operator on the Great Lakes Portfolio Management RRPF(1) affiliates own one of the largest spare aircraft engine portfolios in the industry Diverse group of assets and joint venture investments Rail North America 66% ASC(2) 4% Other 2% Portfolio Management 11% Rail International 17% (1) Rolls-Royce and Partners Finance (2) American Steamship Company See the Appendix for a reconciliation of non-GAAP measures Asset Mix $7.4 billion NBV (assets on- and off- balance sheet ) as of 9/30/14

Owned* 128,000 Affiliate 4,000 Managed 1,000 Total 133,000 Owned 22,000 GATX owns, manages or has an interest in approximately 155,000 railcars* worldwide Strong global presence Rail North America & Rail International *Owned fleet data for North America reflects the acquisition of more than 18,500 boxcars announced 3/24/14 All other fleet data as of 12/31/13 5 Early stage presence in India

GATX Worldwide Railcar Fleet Rail North America & Rail International General Service Tank Cars 35% High Pressure Tank Cars 10% Specialty & Acid Tank Cars 8% Specialty Covered Hoppers 9% Gravity Covered Hoppers, 11% Open Top Cars, 9% Boxcars, 14% Other 4% Car Types 6 Approximately 150,000 wholly owned railcars* Chemicals & Plastics 25% Other, 11% Industries Served Refiners & Other Petroleum 30% Based on 2013 Rail North America & Rail International revenues of approximately $1.0 billion Railroads & Other Transports 15% Food & Agriculture 13% Mining, Minerals & Aggregates 6% *Owned fleet data for North America reflects the acquisition of more than 18,500 boxcars announced 3/24/14 All other fleet data as of 12/31/13 Offering a variety of railcar types for diverse end markets

Creating value through railcar leasing 7 •New and used •Car type, markets and customers served, timing of purchase and price are the key investment factors Buy long-lived assets •Repeatedly, maintaining high utilization • Top-tier customer base • Useful life of a railcar in excess of 30 years • Cyclically aware portfolio management Lease to customers •Provide premier customer service through maintenance, engineering, training, technology and participation in the regulatory landscape Full-service leases • Fleet optimization Scrap or sell railcars

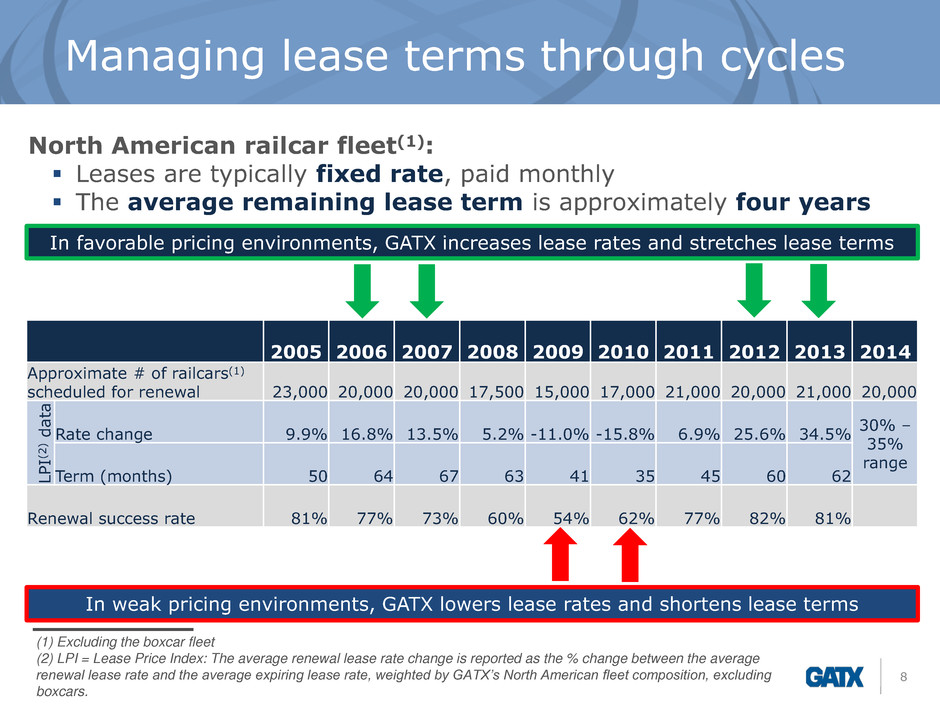

Managing lease terms through cycles 8 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Approximate # of railcars(1) scheduled for renewal 23,000 20,000 20,000 17,500 15,000 17,000 21,000 20,000 21,000 20,000 L P I( 2 ) d a ta Rate change 9.9% 16.8% 13.5% 5.2% -11.0% -15.8% 6.9% 25.6% 34.5% 30% – 35% range Term (months) 50 64 67 63 41 35 45 60 62 Renewal success rate 81% 77% 73% 60% 54% 62% 77% 82% 81% In favorable pricing environments, GATX increases lease rates and stretches lease terms In weak pricing environments, GATX lowers lease rates and shortens lease terms (1) Excluding the boxcar fleet (2) LPI = Lease Price Index: The average renewal lease rate change is reported as the % change between the average renewal lease rate and the average expiring lease rate, weighted by GATX’s North American fleet composition, excluding boxcars. North American railcar fleet(1): Leases are typically fixed rate, paid monthly The average remaining lease term is approximately four years

Maintaining our equipment to the highest standards 9 Tank cars are service-intensive assets − GATX is a full-service lessor − Customers value the consistently reliable service GATX provides Extensive maintenance network in North America − Six major service centers − Five repair centers − Six customer-dedicated sites − Twenty mobile repair units − Third party-owned shops More than 80,000 service events are performed annually in our North American maintenance network In Europe, GATX has major service centers in Germany and Poland, as well as a customer site location in Poland Safety is GATX’s top priority

Rail North America Strong demand across most car types Acquired more than 18,500 boxcars for $340 million in March 2014 − Further diversified the fleet, customer base and end markets served − Improved boxcar fleet utilization from 78.8% at acquisition to 91.3% by the end of the third quarter U.S. and Canada regulators proposed new rules for the transportation of flammable liquids by rail in July 2014 − Three options for tank car standards being considered − U.S. also addresses railroad operating procedures and classification of commodities Rail International Trend toward newer, more efficient tank cars in Europe − Economic weakness impacting utilization − Taking longer to place cars on lease Current rail market environment 10

American Steamship Company 11 Capacity of US flagged Vessel Operators Industry Total Annual Capacity* 105 Million Net Tons ASC 35% Great Lakes Fleet, Inc. 20% Van Enkevort Tug and Barge 2% Other, 2% * GATX management estimate Interlake Steamship Company 23% Grand River Navigation 11% Central Marine Logistics 7% ASC has been operating for more than 100 years − Acquired by GATX in 1973 Fleet of 17 self-unloading vessels transport dry bulk commodities including iron ore, coal and limestone aggregates

Portfolio Management 12 Marine 55% Marine Affiliate 6% Aircraft Engine Leasing Affiliates 34% Other 5% Owned Portfolio Affiliates Spare aircraft engine leasing − Partner with Rolls-Royce plc − Largest spare aircraft engine portfolio in the industry Marine − Partner with IMC Group − five ocean-going, chemical parcel tankers Marine GATX owns − more than 500 tugs and barges − six ocean-going, handy-size, chemical parcel tankers − five ocean-going, multi-gas carriers Administered Portfolio GATX manages assets for third parties $816 million NBV as of 9/30/14

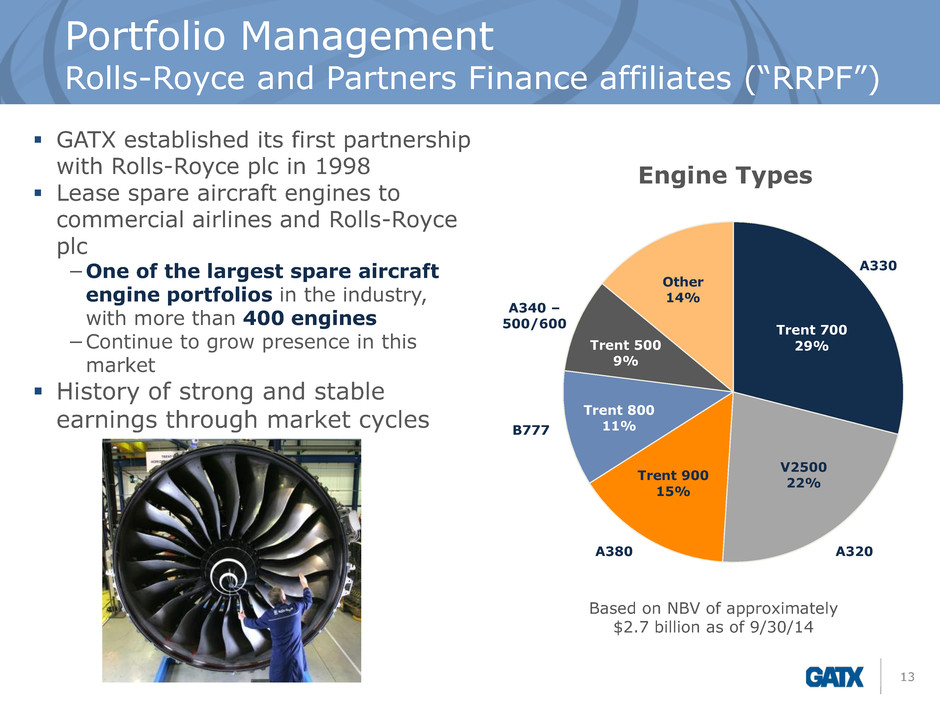

Portfolio Management Rolls-Royce and Partners Finance affiliates (“RRPF”) 13 GATX established its first partnership with Rolls-Royce plc in 1998 Lease spare aircraft engines to commercial airlines and Rolls-Royce plc −One of the largest spare aircraft engine portfolios in the industry, with more than 400 engines −Continue to grow presence in this market History of strong and stable earnings through market cycles Trent 700 29% V2500 22% Trent 900 15% Trent 800 11% Trent 500 9% Other 14% Engine Types A330 Based on NBV of approximately $2.7 billion as of 9/30/14 A320 B777 A340 – 500/600 A380

Financial Profile Overview Strong cash flow and contracted revenue – Market leadership in railcar leasing business – Credit strength of customer base Flexible capital spending Solid liquidity – $575 million committed credit facility matures in 2019 – Access to capital is well diversified Strong balance sheet – Primarily railcar assets – Limited secured debt Continued focus on improving earnings and cash flow and maintaining a strong balance sheet 14

Financial Profile 15 Strong Operating Cash Flow and Portfolio Proceeds $293 $340 $364 $267 $244 $307 $370 $401 $123 $247 $156 $68 $84 $154 $289 $385 0 50 100 150 200 250 300 350 400 450 2006 2007 2008 2009 2010 2011 2012 2013 $ i n m il li o n s Operating Cash Flow Portfolio Proceeds Continuing operations

Financial Profile Nearly $3.9 billion in committed future lease and loan receipts $1,008 $741 $572 $430 $334 $783 0 200 400 600 800 1,000 1,200 2014 2015 2016 2017 2018 Thereafter $ i n mil lion s as of 12/31/13 16

Financial Profile 17 GATX maintains relationships with high-quality customers AAA & AA, 10% A 22% BBB 36% BB or < 12% Top 50 Customer Families Data as of 12/31/13 Customer families sometimes include more than one customer account, therefore the S&P or equivalent ratings noted generally reflect the credit quality of the rated parent entity. Lease obligations of subsidiaries are not necessarily guaranteed by the rated parent entity. More than 900 Rail customers No customer exceeds 3% of GATX’s total revenues Strong credit profile Nearly 70% of the top 50 customer families are investment grade Long-standing relationships Average relationship tenure among top ten customers is 48 years Not rated/ Private 20%

Capital Spending $663 $491 $590 $676 $771 $921 $1,167 $557 0 200 400 600 800 1,000 1,200 1,400 2008 2009 2010 2011 2012 2013 2014F 2015F Total Committed 18 As of 9/30/14. Includes purchases of leased-in assets. $ i n mil lion s

Strong Balance Sheet 19 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 BBB-/Baa3 BBB/Baa2 Total Recourse Debt = On Balance Sheet Recourse Debt + Off Balance Sheet Recourse Debt + Capital Lease Obligations + Commercial Paper and Bank Credit Facilities, Net of Unrestricted Cash GATX most often issues unsecured debt, leaving its railcar assets largely unencumbered Sold aircraft leasing business & reduced leverage and secured assets

Diversified Access to Capital 20 GATX will continue to utilize its traditional sources to meet its financing needs: Unsecured commercial paper Unsecured notes Unsecured bank term loans Secured rail debt

Financings and Liquidity 21 2014 Financings – $850 million unsecured offering • $300 million 3 year notes • $250 million 5+ year notes • $300 million 30 year notes – $250 million unsecured offering of 5+ year notes – $100 million private placement of 10 year unsecured floating rate notes 2013 Financings – $500 million unsecured offering • $250 million 5 year notes • $250 million 10 year notes – $300 million unsecured offering of 5 year notes – €125 million unsecured bank term loan – $91 million railcar sale-leaseback Current Debt Outstanding (9/30/14) Recent Financings Short-Term Amount ($mm) Commercial Paper $50.0 Borrowing Under Bank Credit Facilities 9.2 Unsecured 5.70% Notes due 2015 100.0 4.75% Notes due 2015 250.0 5.80% Notes due 2016 200.0 3.50% Notes due 2016 350.0 1.25% Notes due 2017 300.0 6.00% Notes due 2018 200.0 2.375% Notes due 2018 250.0 2.5% Notes due 2019 300.0 2.5% Notes due 2019 250.0 4.85% Notes due 2021 300.0 4.75% Notes due 2022 250.0 3.90% Notes due 2023 250.0 5.20% Notes due 2044 300.0 5.75% Notes due 2015 (Canada) 85.0 Floating Rate Debt due 2017 110.0 Floating Rate Debt due 2024 100.0 Europe Floating Rate Debt due 2014 - 2020 (Europe) 375.6 Europe Fixed Rate Debt due 2014 - 2018 (Europe) 30.6 Secured Floating Rate Debt due 2020 87.8 Fixed Rate Debt due 2014 - 2016 (Nonrecourse) 18.1 Capital Lease Obligations 6.3 Total Balance Sheet 1 $4,172.6 Operating Leases Operating Leases - Recourse (Off B/S) $562.9 Operating Leases - Nonrecourse (Off B/S) 52.9 Total Operating Leases $615.8 1 Excludes adjustment for fair value hedges and debt discount, net.

Debt Maturities Annual maturities of GATX’s long-term debt obligations as of 9/30/14. Excludes $250 million 2.60% Senior Notes due 2020 issued in October 2014. $38 $551 $647 $462 $514 $1,895 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2014 2015 2016 2017 2018 Thereafter $ i n mil lion s 22 GATX’s maturity schedule is well-balanced

Financial Results 23 $2.54 $3.07 $3.49 $1.97 $1.59 $2.01 $2.81 $3.50 12.8% 14.1% 15.4% 8.5% 6.7% 8.5% 11.3% 12.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 2006 2007 2008 2009 2010 2011 2012 2013 2014F R O E $ p e r s h ar e EPS ROE $4.30 – $4.45 ~14.5% • EPS and ROE exclude Tax Adjustments and Other Items. See the Appendix for a reconciliation of these non-GAAP measures. • 2014 Forecast is based on management’s EPS guidance range of $4.30 to $4.45 per diluted share as of October 2014. • Effective January 1, 2014, GATX changed the depreciable lives of the North American railcar fleet. The impact of this change is a $0.30 increase in earnings per diluted share and an approximately 1% increase in ROE in 2014.

Summary Market leader in railcar leasing business Contracted revenue from strong and diversified customer base Operational and geographic diversification Capital spending flexibility Solid and sustained customer relationships Primarily long-lived, widely used railcar assets High market value of assets relative to book value Limited secured debt $575 million committed availability under primary credit facility Strong and efficient CP program Consistent access to capital markets through all cycles Balanced debt maturity profile Solid and predictable cash flow Strong balance sheet Excellent liquidity position 24

Opportunity 25 GATX has been a market force in the rail industry for more than 115 years GATX provides premium assets and services to a high-quality customer base GATX continues to benefit from strength in the tank car market, and is seeing broad improvement in the freight car market GATX is making disciplined investments in North America and in International rail markets

26 Appendix

Rail North America Industry Railcar Ownership 27 Railroads 23% TTX 10% Shippers 18% North American Railcar Market Railcars are owned by lessors, railroads and shippers Source: UMLER as of January 2014 Approximately 1.5 million railcars Car ownership by railroads has been declining − In 2000, 53% of railcars were owned by railroads − In 2013, 23% of railcars were owned by railroads Lessors 49%

Rail North America Industry Railcar Ownership 28 0 50 100 150 200 250 300 350 400 450 500 Intermodal Box Cars Flat Cars Tank Cars Open Top Cars Covered Hoppers Lessor owned TTX Railroad owned Shipper owned 000s of railcars Tank cars are owned by lessors such as GATX, or shippers who utilize this car type Railroads do not ordinarily own tank cars as these cars have more complex service requirements North American Fleet Composition Source: UMLER as of January 2014

Rail North America Industry Shipments 29 Coal 20% Auto 8% Metals 4% Farm products 7% Food/ Kindred products 8% Key commodity markets for North American Class I railroads include − Coal − Chemicals − Intermodal The chart at the left is based on Class I U.S. revenues − The same chart based on tons originated would show a much higher percentage for coal, reflecting the high- volume of this commodity Shipment Composition Based on 2013 Industry Revenues of approximately $72.1 billion Source: Association of American Railroads; July 2014 Chemicals 14% Intermodal 13% Other 24%

Rail North America Industry Carloading Trends 30 15,000 16,000 17,000 18,000 19,000 20,000 21,000 22,000 17,061 2004-2006 rail traffic was driven by increased demand across most major commodity types Decline in 2007-2008 carloads reflect difficulties in nearly every sector Carloadings in 2009 down 16.4% from 2008 − Chemical and petroleum products carloads decreased 12.4% and 10.2%, respectively, in 2009 Decline in carloadings from 2011 to 2013 was due to decreased shipments of coal Carloads Originated – U.S. & Canada Source: Railway Supply Institute 21,225 18,384

Rail Industry North America 31 80% 82% 84% 86% 88% 90% 92% 94% 96% 98% 100% 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 3 Q 1 4 GATX North American Fleet Utilization(2) (1) Railway Supply Institute (2) Excludes the boxcar fleet -10,000 10,000 30,000 50,000 70,000 90,000 110,000 130,000 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 U.S. Railcar Manufacturing Backlog(1)

Rail North America Car Types & Typical Commodities 32 General Service 13K-19K gallon 20K-25K gallon >25K gallon High Pressure Acid & Specialty T a nk C a rs molten sulfur clay slurry caustic soda corn syrup liquid fertilizers fuel oils asphalt food-grade oils chemicals (sodium hydroxide, styrene, etc.) ethanol & methanol food-grade oils lubricating oils light chemicals (solvents, isopentane, alkylates, etc.) light petroleum products (crude oil, fuel oils, diesel, gasoline, etc.) LPG VCM propylene carbon dioxide acids (sulfuric, hydrochloric, phosphoric, acetic, nitric, etc.) coal tar pitch dyes & inks lubricating oils Covered Hoppers Open-Top Other Gravity < 4K cf 4K – 5.5K cf Pneumatic Specialty sand cement roofing granules aggregates fly ash dry chemicals grain sugar fertilizer potash soda ash bentonite plastic pellets flour corn starch mineral powder lime clay cement gravel sand coal pet coke woodchips scrap metal steel coils flat cars intermodal box cars automotiveFr e ight C a rs

Rail International GATX Rail Europe (“GRE”) 33 LPG Wagons 12% Bulk, 6% Geographies Served Fleet Structure Based on 2013 GRE revenues Approximately 22,000 railcars as of 12/31/13 Poland 23% Austria 11% Hungary 4% Switzerland 4% Slovakia 3% Other 10% Germany 42% Czech Republic 3% Petroleum Wagons 70% Chemical Wagons 12%

Rail International GRE car types & typical commodities 34 Petroleum Wagons LPG Wagons Chemical Wagons Tank C a rs light mineral oil products - gasoline - jet fuel - diesel fuel dark mineral oil products - heavy fuel oil - tar - bitumen propane butane propylene butadiene light carbohydrate fractions chemicals petrochemicals Powder Wagons Bulk wagons lime cement lignite calcium carbide coal dust coal coke gravel sand or silica sand F re ig h t C a rs

A leader in tank car leasing North American Tank Car Leasing Market(1) GATX 22% Union Tank Car 33%Trinity 13% GE Railcar, 9% CIT, 7% ARL, 7% Other, 9% European Tank Car Leasing Market(2) GATX Rail Europe 26% VTG 36% Ermewa 19% Other 19% 35 Approximately 77,000 tank cars Approximately 270,000 tank cars (1) UMLER as of January 2014 (2) GATX management estimate

36 Reconciliation of non-GAAP measures

Reconciliation of non-GAAP measures 37 Earnings per Share 2006 2007 2008 2009 2010 2011 2012 2013 Diluted earnings per share (GAAP) 2.64$ 3.43$ 3.88$ 1.70$ 1.72$ 2.35$ 2.88$ 3.59$ Tax Adjustments (0.10) (0.36) (0.13) (0.15) (0.24) (0.19) (0.50) (0.24) Other Items: Realized/unrealized (gains)/losses on interest rate swaps at AAE 0.06 0.42 0.20 0.43 (0.15) Sale of AAE 0.30 Litigation recovery (0.09) (0.07) Gain on sale of office building (0.19) Environmental reserve reversal (0.13) Leveraged lease adjustment (0.08) EPS, excluding Tax Adjustments and Other Items 2.54$ 3.07$ 3.49$ 1.97$ 1.59$ 2.01$ 2.81$ 3.50$ On and off balance sheet assets 9/30/2014 (in millions) Consolidated on-balance-sheet assets 6,816.3$ Off-balance-sheet assets 615.8 Total on- and off-balane-sheet assets 7,432.1$