Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BNC BANCORP | valleyform8-k.htm |

| EX-99.1 - PRESS RELEASE - BNC BANCORP | valleypressrelease.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - BNC BANCORP | valleymergeragreement.htm |

ACQUISITION OF

New Market, Same Disciplined Strategy

• Nine branches in attractive Roanoke, Virginia market • #1 Deposit market share among independent banks in Roanoke MSA • Respected and seasoned leadership and lending team • Estimated accretion to BNCN 2015 EPS of 5.0%+* • Estimated tangible book value dilution earned-back in under 2.5 years* • Transaction, savings and MMDA accounts represent 73% of deposits 3 * Does not include fair value accretion or revenue synergies Transaction Benefits

4 Transaction Rationale Well-planned entry into Virginia via the attractive Roanoke MSA Proven management team with similar corporate culture Branch deposit generation efficiency Additive to strong core deposit base Consistent and successful wealth management platform Strategic Rationale 5.0%+ accretive to EPS in 2015 TBV dilution earned back in under 2.5 years IRR exceeds 20% Strong capital ratios pro forma Cost savings of 30% (approximately $6.6 million) Financially Attractive Comprehensive due diligence process completed, rigorous internal and third-party loan review and OREO inspection Conservative credit mark – equal to over 100% of NPAs BNCN is an experienced acquirer (12 deals since early 2010; 2 pending) Low Risk Integration

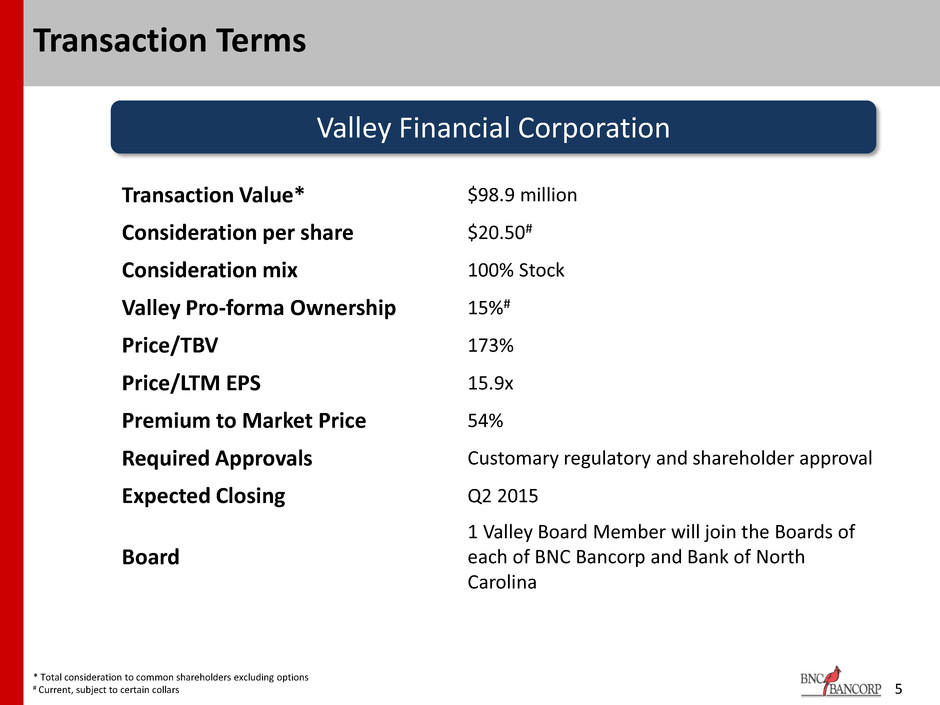

5 Transaction Terms * Total consideration to common shareholders excluding options # Current, subject to certain collars Valley Financial Corporation Transaction Value* $98.9 million Consideration per share $20.50# Consideration mix 100% Stock Valley Pro-forma Ownership 15%# Price/TBV 173% Price/LTM EPS 15.9x Premium to Market Price 54% Required Approvals Customary regulatory and shareholder approval Expected Closing Q2 2015 Board 1 Valley Board Member will join the Boards of each of BNC Bancorp and Bank of North Carolina

6 Transaction Assumptions Cost savings: 30% of VYFC LTM non-interest expense Revenue synergies: None assumed One-time costs: $8mm, pretax Core deposit intangible: $6mm Fair value mark: 3.3% aggregate mark on loans and 26% mark on OREO Capital: None required to complete the transaction Valley balance sheet restructuring: Sale of low yielding securities Retirement of high-cost wholesale funding Valley Financial Corporation

7 Credit Highlights Due Diligence Overview Estimated Fair Value Mark Rigorous due diligence process to evaluate Valley’s credit portfolios All non-performing and classified credits reviewed and select properties visited All OREO properties reviewed and select properties visited Large sample of performing credits reviewed Loan review completed by internal BNCN team, with additional independent review by highly respected regional firm Aggregate loan fair value mark 3.3% Substandard/Classified 34.4% Pass Credits 1.3% OREO fair value mark 25.7% Total $ Amount $23mm

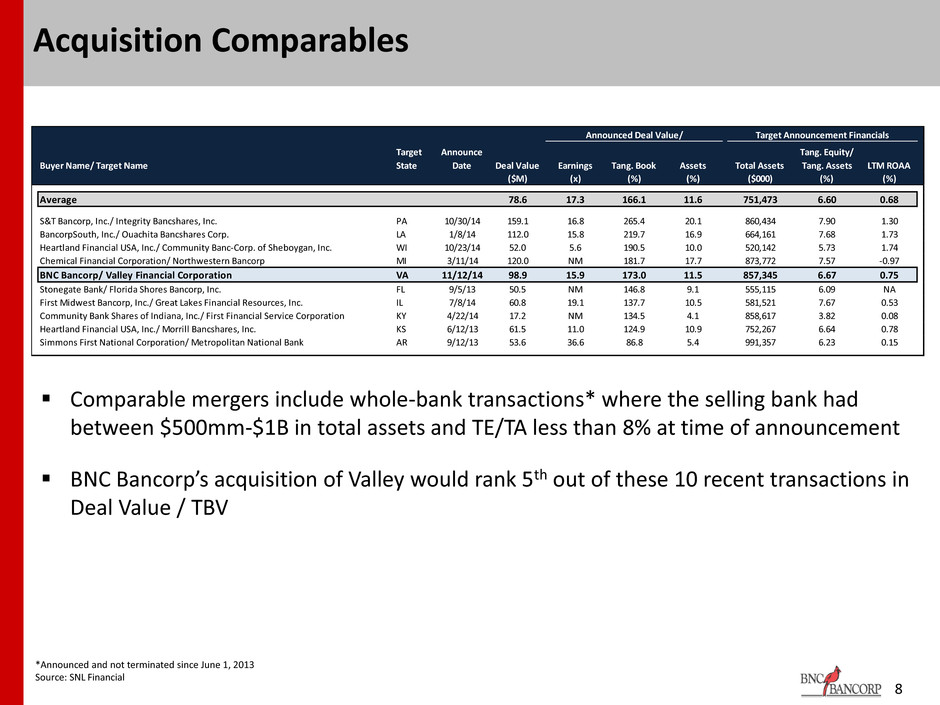

8 Acquisition Comparables Comparable mergers include whole-bank transactions* where the selling bank had between $500mm-$1B in total assets and TE/TA less than 8% at time of announcement BNC Bancorp’s acquisition of Valley would rank 5th out of these 10 recent transactions in Deal Value / TBV Buyer Name/ Target Name Target State Announce Date Deal Value Earnings Tang. Book Assets Total Assets Tang. Equity/ Tang. Assets LTM ROAA ($M) (x) (%) (%) ($000) (%) (%) Average 78.6 17.3 166.1 11.6 751,473 6.60 0.68 S&T Bancorp, Inc./ Integrity Bancshares, Inc. PA 10/30/14 159.1 16.8 265.4 20.1 860,434 7.90 1.30 BancorpSouth, Inc./ Ouachita Bancshares Corp. LA 1/8/14 112.0 15.8 219.7 16.9 664,161 7.68 1.73 Heartland Financial USA, Inc./ Community Banc-Corp. of Sheboygan, Inc. WI 10/23/14 52.0 5.6 190.5 10.0 520,142 5.73 1.74 Chemical Financial Corporation/ Northwestern Bancorp MI 3/11/14 120.0 NM 181.7 17.7 873,772 7.57 -0.97 BNC Bancorp/ Valley Financial Corporation VA 11/12/14 98.9 15.9 173.0 11.5 857,345 6.67 0.75 Stonegate Bank/ Florida Shores Bancorp, Inc. FL 9/5/13 50.5 NM 146.8 9.1 555,115 6.09 NA First Midwest Bancorp, Inc./ Great Lakes Financial Resources, Inc. IL 7/8/14 60.8 19.1 137.7 10.5 581,521 7.67 0.53 Community Bank Shares of Indiana, Inc./ First Financial Service Corporation KY 4/22/14 17.2 NM 134.5 4.1 858,617 3.82 0.08 Heartland Financial USA, Inc./ Morrill Bancshares, Inc. KS 6/12/13 61.5 11.0 124.9 10.9 752,267 6.64 0.78 Simmons First National Corporation/ Metropolitan National Bank AR 9/12/13 53.6 36.6 86.8 5.4 991,357 6.23 0.15 Announced Deal Value/ Target Announcement Financials *Announced and not terminated since June 1, 2013 Source: SNL Financial

10 Valley Transaction Meets BNC M&A Disciplines Key Attributes Valley Rationale Franchise Aspects: • High-growth metro market? Entrance into high-growth Roanoke, VA market • Complementary culture? Valley and BNC cultures very similar • Attractive core deposit base? Valley has #1 deposit share for community banks in Roanoke, #4 overall Disciplined Fundamentals: • Accretive to EPS day 1? 5.0%+ EPS accretion • TBV earn back period within 3 years? Earn back inside 2.5 years • Conservative fair value marks? 115% of NPAs • 34.4% on classified assets • 25.7% on OREO • 1.3% on performing

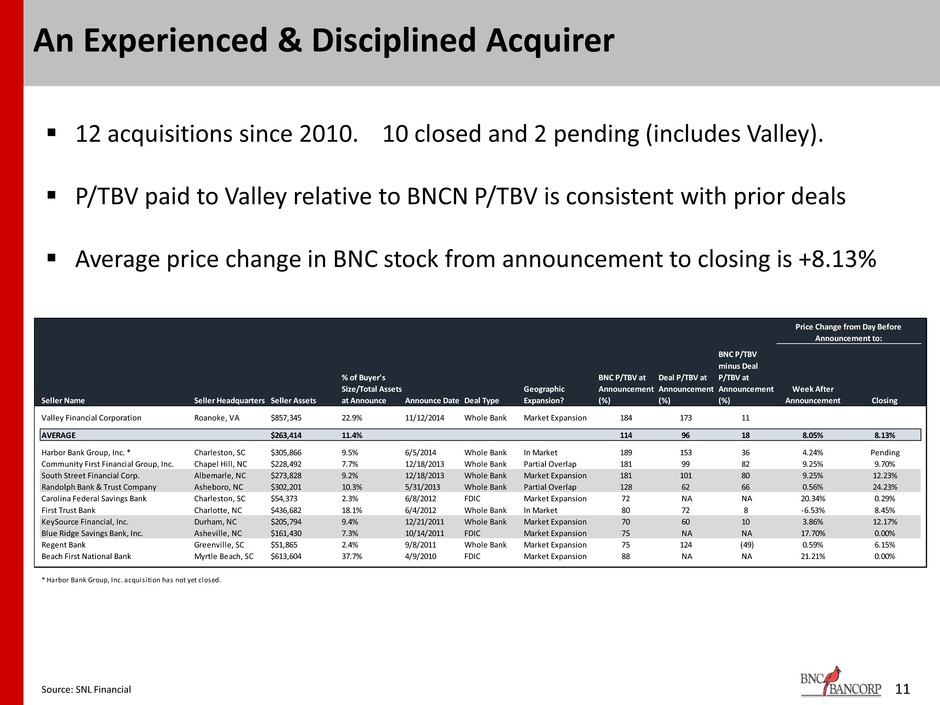

11 An Experienced & Disciplined Acquirer 12 acquisitions since 2010. 10 closed and 2 pending (includes Valley). P/TBV paid to Valley relative to BNCN P/TBV is consistent with prior deals Average price change in BNC stock from announcement to closing is +8.13% Source: SNL Financial Seller Name Seller Headquarters Seller Assets % of Buyer's Size/Total Assets at Announce Announce Date Deal Type Geographic Expansion? BNC P/TBV at Announcement (%) Deal P/TBV at Announcement (%) BNC P/TBV minus Deal P/TBV at Announcement (%) Week After Announcement Closing Valley Financial Corporation Roanoke, VA $857,345 22.9% 11/12/2014 Whole Bank Market Expansion 184 173 11 AVERAGE $263,414 11.4% 114 96 18 8.05% 8.13% Harbor Bank Group, Inc. * Charleston, SC $305,866 9.5% 6/5/2014 Whole Bank In Market 189 153 36 4.24% Pending Community First Financial Group, Inc. Chapel Hill, NC $228,492 7.7% 12/18/2013 Whole Bank Partial Overlap 181 99 82 9.25% 9.70% South Street Financial Corp. Albemarle, NC $273,828 9.2% 12/18/2013 Whole Bank Market Expansion 181 101 80 9.25% 12.23% Randolph Bank & Trust Company Asheboro, NC $302,201 10.3% 5/31/2013 Whole Bank Partial Overlap 128 62 66 0.56% 24.23% Carolina Fe eral Savings Bank Charleston, SC $54,373 2.3% 6/8/2012 FDIC Market Expansion 72 NA NA 20.34% 0.29% First Trust Bank Charlotte, NC $436,682 18.1% 6/4/2012 Whole Bank In Market 80 72 8 -6.53% 8.45% KeySource Financial, Inc. Durham, NC $205,794 9.4% 12/21/2011 Whole Bank Market Expansion 70 60 10 3.86% 12.17% Blue Ridge Savings Bank, Inc. Asheville, NC $161,430 7.3% 10/14/2011 FDIC Market Expansion 75 NA NA 17.70% 0.00% Regent Bank Greenville, SC $51,865 2.4% 9/8/2011 Whole Bank Market Expansion 75 124 (49) 0.59% 6.15% Beach First National Bank Myrtle Beach, SC $613,604 37.7% 4/9/2010 FDIC Market Expansion 88 NA NA 21.21% 0.00% * Harbor Bank Group, Inc. acquisition has not yet closed. Price Change from Day Before Announcement to:

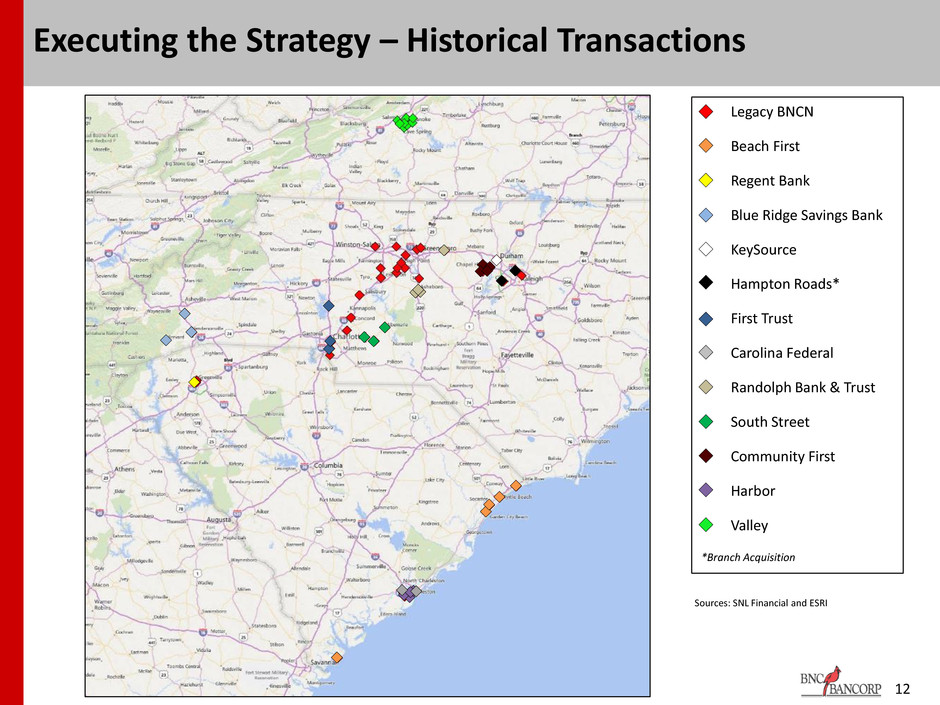

12 Executing the Strategy – Historical Transactions • Legacy BNCN • Beach First • Regent Bank • Blue Ridge Savings Bank • KeySource • Hampton Roads* • First Trust • Carolina Federal • Randolph Bank & Trust • South Street • Community First • Harbor • Valley *Branch Acquisition Sources: SNL Financial and ESRI

14 Formidable Presence in Virginia & the Carolinas Post acquisition, BNC Bancorp will be the 4th largest community bank^ headquartered in Virginia and the Carolinas as defined by total assets and market capitalization # Pro forma for Franklin Financial Corporation acquisition * Pro forma for Harbor Bank Group, Inc. and Valley Financial Corporation acquisitions ^ Community bank defined as banks with less than $20B in total assets Source: SNL Financial Rank Institution Name State Total Assets ($mm) Total Deposits ($mm) Market Cap ($mm) 1 South State Corporation SC 7,896 6,518 1,495 2 Union Bankshares Corporation VA 7,194 5,634 1,036 3 TowneBank# VA 6,083 4,534 766 4 BNC Bancorp* NC 4,919 4,033 640 5 Carter Bank & Trust VA 4,679 4,272 318 6 Yadkin Financial Corporation NC 4,179 3,185 615 7 Cardinal Financial Corporation VA 3,315 2,425 604 8 First Bancorp NC 3,196 2,679 346 9 Square 1 Financial, Inc. NC 2,988 2,668 581 10 First Community Bancshares, Inc. VA 2,550 1,932 304 11 NewBridge Bancorp NC 2,443 1,825 321 12 Park Sterling Corporation NC 2,326 1,865 341 13 HomeTrust Bancshares, Inc. NC 2,214 1,659 318 14 Southern BancShares (N.C.), Inc. NC 2,169 1,833 137 15 Hampton Roads Bankshares, Inc. VA 2,017 1,613 286

Pro Forma Franchise 15

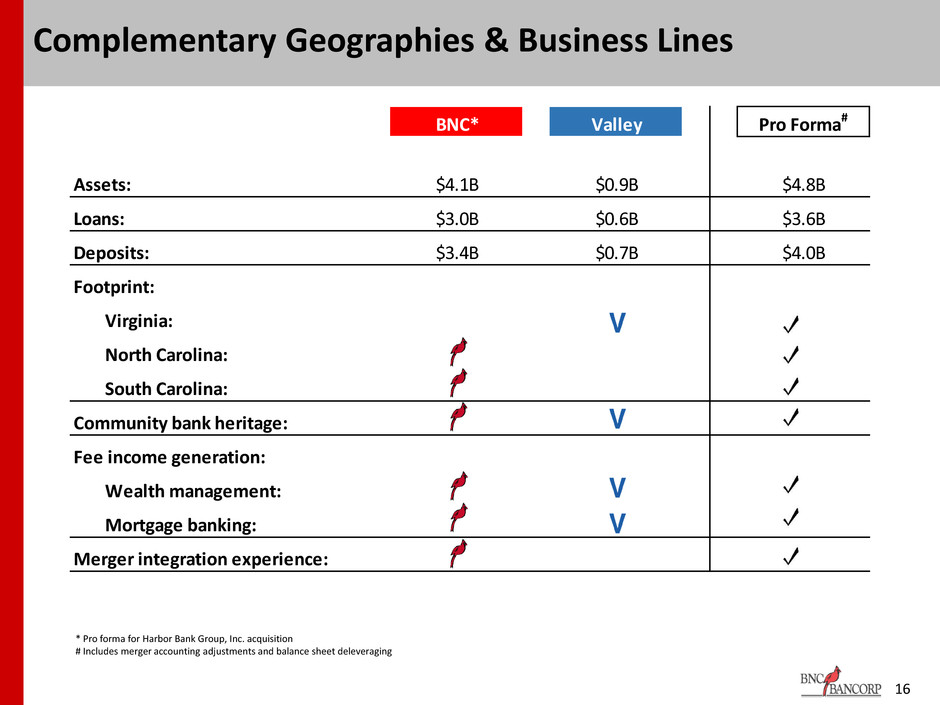

BNC* Valley Pro Forma# Assets: $4.1B $0.9B $4.8B Loans: $3.0B $0.6B $3.6B Deposits: $3.4B $0.7B $4.0B Footprint: Virginia: North Carolina: South Carolina: Community bank heritage: Fee income generation: Wealth management: Mortgage banking: Merger integration experience: 16 Complementary Geographies & Business Lines * Pro forma for Harbor Bank Group, Inc. acquisition # Includes merger accounting adjustments and balance sheet deleveraging

17 Pro Forma Balance Sheet Valley BNC* Pro Forma# Cash & Securities $199 Net Loans $602 Net Loans $3,007 Cash & Securities $615 Total Assets $857 Total Assets $4,056 Deposits $682 Deposits $3,351 Cash & Securities $660 Net Loans $3,600 Total Assets $4,800 Deposits $3,960 * Pro forma for Harbor Bank Group, Inc. acquisition # Includes merger accounting adjustments and balance sheet deleveraging $ in millions $ in millions Increases combined balance sheet to just below $5B in total assets Valley’s levered balance sheet allows combined company to continue to deliver attractive returns to shareholders Opportunity to redeploy deposits from investment securities into higher yielding loans Source: SNL Financial

18 Combined Loans Comm’l RE 47.9% Comm’l RE 52.7% Comm’l RE 51.9% 1-4 Family 22.3% 1-4 Family 19.9% 1-4 Family 20.3% C&I 15.3% C&I 6.1% C&I 7.7% Consumer 6.5% Consumer 9.7% Consumer 9.1% Construction & Development 8.1% Construction & Development 10.8% Construction & Development 10.3% Valley BNC* Combined# Other 0.8% Other 0.6% * BNC Bancorp and Harbor Bank Group, Inc. loans combined # Excludes merger accounting adjustments and balance sheet deleveraging Data as of June 30, 2014 $ in thousands Source: SNL Financial Loan Composition Amount % Loan Composition Amount % Loan Composition Amount % 1-4 Family Loans 134,169$ 22.3% 1-4 Family Loans 586,984$ 19.9% 1-4 Family Loans 721,153$ 20.3% Commercial RE 288,793 47.9% Commercial RE 1,556,138 52.7% Commercial RE 1,844,931 51.9% Construction & Development 48,585 8.1% Construction & Development 319,246 10.8% Construction & Development 367,831 10.3% Consumer 38,949 6.5% Consumer 285,833 9.7% Consumer 324,782 9.1% C&I 91,954 15.3% C&I 180,450 6.1% C&I 272,404 7.7% Other 0 0.0% Other 22,831 0.8% Other 22,831 0.6% Total Loans 602,450$ 100.0% Total Loans 2,951,481$ 100.0% Total Loans 3,553,931$ 100.0%

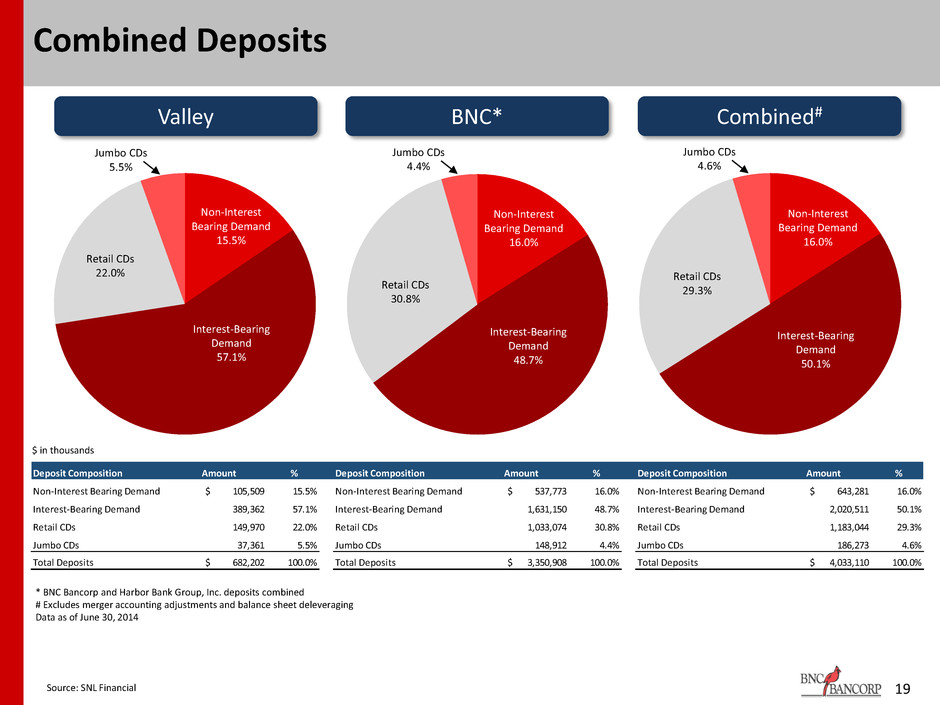

19 Combined Deposits Valley BNC* Combined# Interest-Bearing Demand 57.1% Non-Interest Bearing Demand 15.5% Retail CDs 22.0% Jumbo CDs 5.5% $ in thousands Deposit Composition Amount % Deposit Composition Amount % Deposit Composition Amount % Non-Interest Bearing Demand 105,509$ 15.5% Non-Interest Bearing Demand 537,773$ 16.0% Non-Interest Bearing Demand 643,281$ 16.0% I terest-Bearing Demand 389,362 57.1 Interest-Bearing Demand 1,631,150 48.7 Interest-Bearing Demand 2,020,511 50.1 Retail CDs 149,970 22.0% Retail CDs 1,033,074 30.8% Retail CDs 1,183,044 29.3% Jumbo CDs 37,361 5.5 Jumbo CDs 148,912 4.4 Jumbo CDs 186,273 4.6 Total Deposits 682,202$ 100.0% Total Deposits 3,350,908$ 100.0% Total Deposits 4,033,110$ 100.0% Retail CDs 30.8% Non-Interest Bearing Demand 16.0% Jumbo CDs 4.4% Interest-Bearing Demand 48.7% Retail CDs 29.3% Non-Interest Bearing Demand 16.0% Jumbo CDs 4.6% Interest-Bearing Demand 50.1% * BNC Bancorp and Harbor Bank Group, Inc. deposits combined # Excludes merger accounting adjustments and balance sheet deleveraging Data as of June 30, 2014 Source: SNL Financial

8.6% 9.9% 8.5% 8.8% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% BNCN* VYFC Pro Forma Pro Forma Q2 2015 Close^ 7.3% 6.7% 7.0% 7.3% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% BNCN* VYFC Pro Forma Pro Forma Q2 2015 Close^ 20 Pro Forma Capital Ratios Tangible Common Equity to Tangible Assets Bank Tier 1 Leverage Ratio # # Pro forma company remains well-capitalized and poised for future growth Earnings power of combined company poised to grow capital levels in coming quarters Opportunity to deploy capital across combined franchise BNC maintains a disciplined approach to capital management and focuses on capital levels when making decisions across the company * Pro forma for Harbor Bank Group, Inc. acquisition # Includes merger accounting adjustments and balance sheet deleveraging ^ Includes balance sheet growth projections Sources: SNL Financial, BNC projections

21 Transaction Summary Transaction expected to drive earnings growth and overall shareholder value for both BNC and Valley shareholders Strategic entrance into Virginia and the Roanoke market with the right leadership and platform to support disciplined growth Complements culture, geography and business lines Pro forma institution expected to be stronger, well-capitalized and remain an acquirer of choice in the Carolinas & Virginia Continues to increase liquidity in BNCN shares Increases Valley’s ability to serve larger customers

23 Valley Financial Corporation – Overview Roanoke, VA financial institution established in May 1995 Premier community bank in the Roanoke Valley area Current balance sheet built solely through organic growth Began trading on NASDAQ in 2000 Ellis Gutshall named President and Chief Executive Officer of Valley Bank in June 1996 after a brief stint as Chief Lending Officer 9 branches concentrated in the Roanoke MSA Successful wealth management platform Strong core deposit base Source: SNL Financial

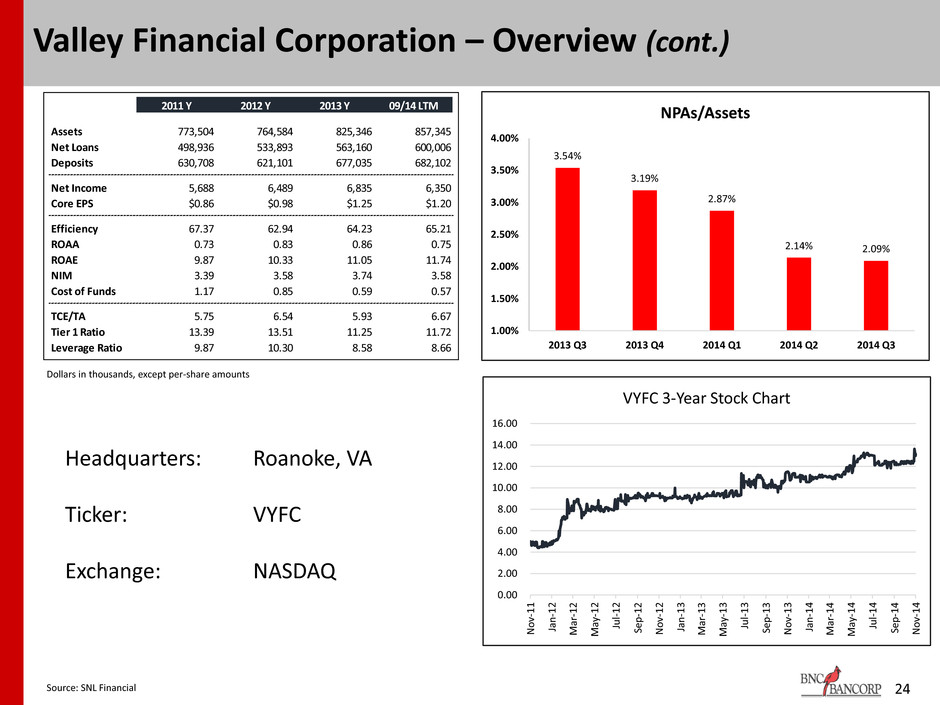

24 Valley Financial Corporation – Overview (cont.) 3.54% 3.19% 2.87% 2.14% 2.09% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 NPAs/Assets Headquarters: Roanoke, VA Ticker: VYFC Exchange: NASDAQ 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 No v-1 1 Jan-1 2 Ma r-1 2 May-1 2 Ju l-1 2 Se p-1 2 No v-1 2 Jan-1 3 Ma r-1 3 May-1 3 Ju l-1 3 Se p-1 3 No v-1 3 Jan-1 4 Ma r-1 4 M ay-1 4 Ju l-1 4 Se p-1 4 No v-1 4 VYFC 3-Year Stock Chart Source: SNL Financial 2011 Y 2012 Y 2013 Y 09/14 LTM Assets 773,504 764,584 825,346 857,345 Net Loans 498,936 533,893 563,160 600,006 Deposits 630,708 621,101 677,035 682,102 Net Income 5,688 6,489 6,835 6,350 Core EPS $0.86 $0.98 $1.25 $1.20 Efficiency 67.37 62.94 64.23 65.21 ROAA 0.73 0.83 0.86 0.75 ROAE 9.87 10.33 11.05 11.74 NIM 3.39 3.58 3.74 3.58 Cost of Funds 1.17 0.85 0.59 0.57 TCE/TA 5.75 6.54 5.93 6.67 Tier 1 Ratio 13.39 13.51 11.25 11.72 Leverage Ratio 9.87 10.30 8.58 8.66 Dollars in thousands, except per-share amounts

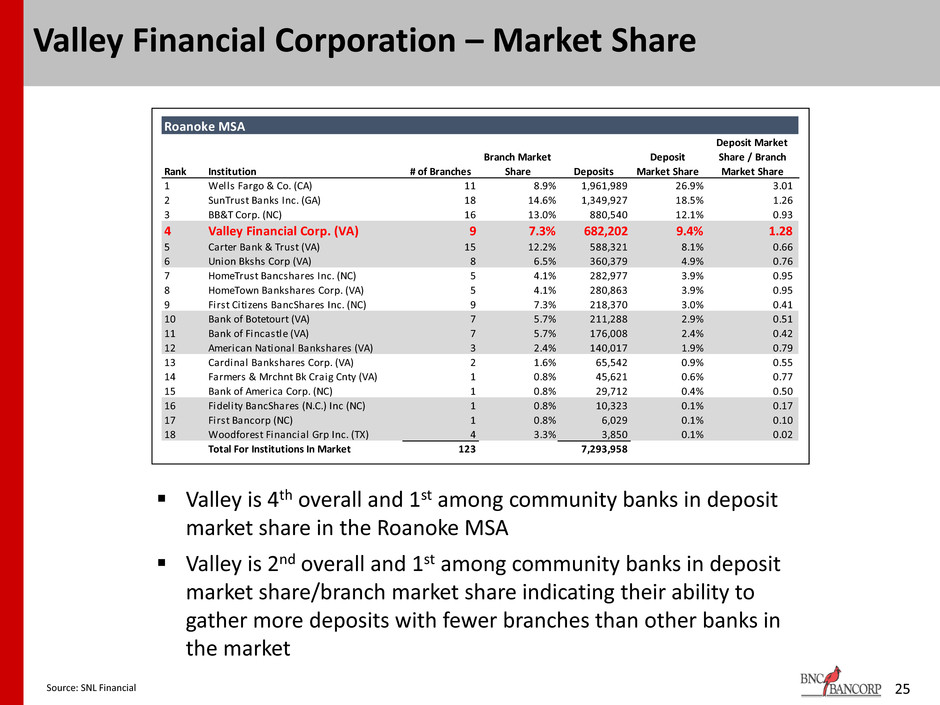

25 Valley Financial Corporation – Market Share Valley is 4th overall and 1st among community banks in deposit market share in the Roanoke MSA Valley is 2nd overall and 1st among community banks in deposit market share/branch market share indicating their ability to gather more deposits with fewer branches than other banks in the market Roanoke MSA Rank Institution # of Branches Branch Market Share Deposits Deposit Market Share Deposit Market Share / Branch Market Share 1 Wells Fargo & Co. (CA) 11 8.9% 1,961,989 26.9% 3.01 2 SunTrust Banks Inc. (GA) 18 14.6% 1,349,927 18.5% 1.26 3 BB&T Corp. (NC) 16 13.0% 880,540 12.1% 0.93 4 Valley Financial Corp. (VA) 9 7.3% 682,202 9.4% 1.28 5 Carter Bank & Trust (VA) 15 12.2% 588,321 8.1% 0.66 6 Union Bkshs Corp (VA) 8 6.5% 360,379 4.9% 0.76 7 HomeTrust Bancshares Inc. (NC) 5 4.1% 282,977 3.9% 0.95 8 HomeTown Bankshares Corp. (VA) 5 4.1% 280,863 3.9% 0.95 9 First Citizens BancShares Inc. (NC) 9 7.3% 218,370 3.0% 0.41 10 Bank of Botetourt (VA) 7 5.7% 211,288 2.9% 0.51 11 Bank of Fincastle (VA) 7 5.7% 176,008 2.4% 0.42 12 American National Bankshares (VA) 3 2.4% 140,017 1.9% 0.79 13 Cardinal Bankshares Corp. (VA) 2 1.6% 65,542 0.9% 0.55 14 Farmers & Mrchnt Bk Craig Cnty (VA) 1 0.8% 45,621 0.6% 0.77 15 Bank of America Corp. (NC) 1 0.8% 29,712 0.4% 0.50 16 Fidelity BancShares (N.C.) Inc (NC) 1 0.8% 10,323 0.1% 0.17 17 First Bancorp (NC) 1 0.8% 6,029 0.1% 0.10 18 Woodforest Financial Grp Inc. (TX) 4 3.3% 3,850 0.1% 0.02 Total For Institutions In Market 123 7,293,958 Source: SNL Financial

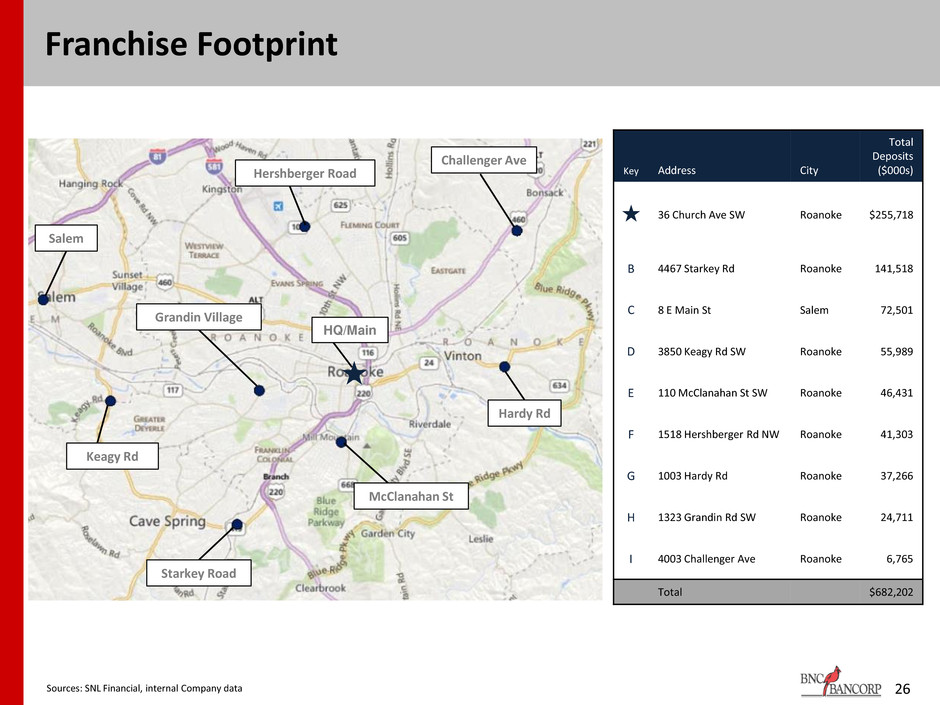

Franchise Footprint 26 HQ/Main Grandin Village Keagy Rd Salem Hardy Rd McClanahan St Starkey Road Hershberger Road Challenger Ave Sources: SNL Financial, internal Company data Key Address City Total Deposits ($000s) 36 Church Ave SW Roanoke $255,718 B 4467 Starkey Rd Roanoke 141,518 C 8 E Main St Salem 72,501 D 3850 Keagy Rd SW Roanoke 55,989 E 110 McClanahan St SW Roanoke 46,431 F 1518 Hershberger Rd NW Roanoke 41,303 G 1003 Hardy Rd Roanoke 37,266 H 1323 Grandin Rd SW Roanoke 24,711 I 4003 Challenger Ave Roanoke 6,765 Total $682,202

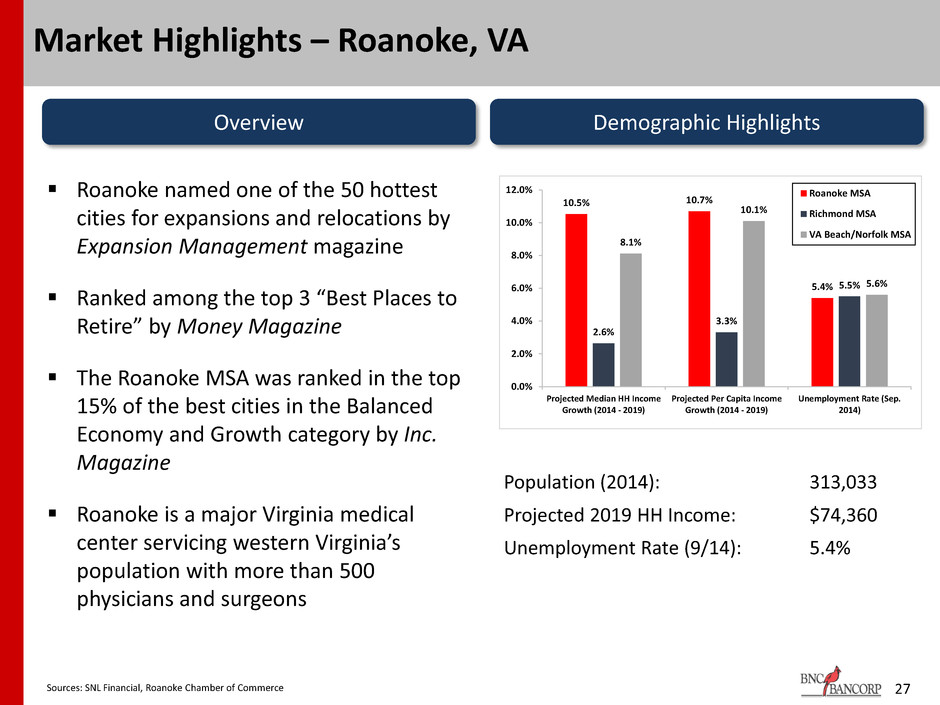

27 Market Highlights – Roanoke, VA Overview Demographic Highlights Roanoke named one of the 50 hottest cities for expansions and relocations by Expansion Management magazine Ranked among the top 3 “Best Places to Retire” by Money Magazine The Roanoke MSA was ranked in the top 15% of the best cities in the Balanced Economy and Growth category by Inc. Magazine Roanoke is a major Virginia medical center servicing western Virginia’s population with more than 500 physicians and surgeons Population (2014): 313,033 Projected 2019 HH Income: $74,360 Unemployment Rate (9/14): 5.4% 10.5% 10.7% 5.4% 2.6% 3.3% 5.5% 8.1% 10.1% 5.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Projected Median HH Income Growth (2014 - 2019) Projected Per Capita Income Growth (2014 - 2019) Unemployment Rate (Sep. 2014) Roanoke MSA Richmond MSA VA Beach/Norfolk MSA Sources: SNL Financial, Roanoke Chamber of Commerce

Building Premier Franchise in the Carolinas & Virginia 29 • Headquarters: • Branches: • Total Assets: • Total Loans: • Total Deposits: High Point, NC 48 (61) $3.7 billion ($4.8B) $2.7 billion ($3.6B) $3.1 billion ($4.0B) • Exchange: • Recent Stock Price: • Price to TBV: • Market Cap: • Annual Dividend: • Dividend Yield: NASDAQ: BNCN $16.79 184% $495 million $0.20 1.19% Pro Forma Market Capitalization exceeds all Banks headquartered in NC under $25B in size Primary Objective: Maximize Long-term Shareholder Value Sources: SNL Financial and Company filings, as of September 30, 2014 (pro forma includes Harbor Bank Group, Inc. and Valley Financial Corporation with fair value marks and balance sheet deleveraging) Market data as of November 14, 2014 (Italics = Pro forma after recent deal announcements) BNC BANCORP

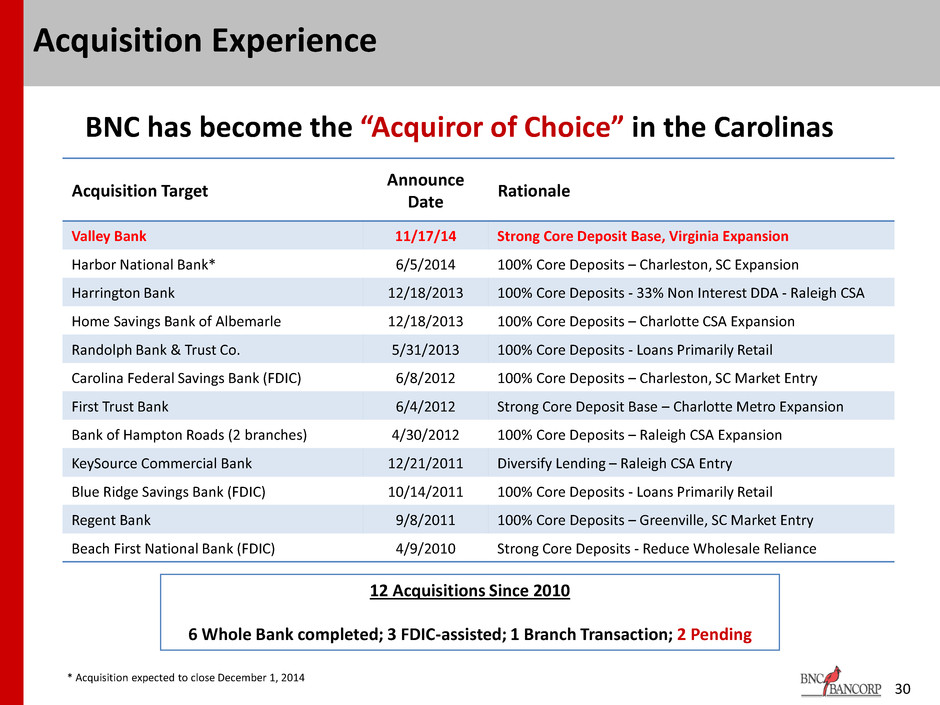

30 Acquisition Experience 12 Acquisitions Since 2010 6 Whole Bank completed; 3 FDIC-assisted; 1 Branch Transaction; 2 Pending Acquisition Target Announce Date Rationale Valley Bank 11/17/14 Strong Core Deposit Base, Virginia Expansion Harbor National Bank* 6/5/2014 100% Core Deposits – Charleston, SC Expansion Harrington Bank 12/18/2013 100% Core Deposits - 33% Non Interest DDA - Raleigh CSA Home Savings Bank of Albemarle 12/18/2013 100% Core Deposits – Charlotte CSA Expansion Randolph Bank & Trust Co. 5/31/2013 100% Core Deposits - Loans Primarily Retail Carolina Federal Savings Bank (FDIC) 6/8/2012 100% Core Deposits – Charleston, SC Market Entry First Trust Bank 6/4/2012 Strong Core Deposit Base – Charlotte Metro Expansion Bank of Hampton Roads (2 branches) 4/30/2012 100% Core Deposits – Raleigh CSA Expansion KeySource Commercial Bank 12/21/2011 Diversify Lending – Raleigh CSA Entry Blue Ridge Savings Bank (FDIC) 10/14/2011 100% Core Deposits - Loans Primarily Retail Regent Bank 9/8/2011 100% Core Deposits – Greenville, SC Market Entry Beach First National Bank (FDIC) 4/9/2010 Strong Core Deposits - Reduce Wholesale Reliance BNC has become the “Acquiror of Choice” in the Carolinas * Acquisition expected to close December 1, 2014

31 Analyst Coverage Firm Analyst Rating Price Target 2015 Estimate FIG Partners LLC Chris Marinac “Outperform” $21.00 $1.40 Raymond James William J. Wallace IV “Outperform 2” $20.00 $1.45 Sandler O’Neill + Partners Stephen Scouten “Buy” $20.00 $1.43 Keefe, Bruyette & Woods Brady Gailey “Outperform” $20.00 $1.45 Hovde Group Kevin Fitzsimmons “Outperform” $19.50 $1.44

32 Investor Contacts Richard D. Callicutt II President & Chief Executive Officer David B. Spencer Senior Executive Vice President & Chief Financial Officer BNC Bancorp 3980 Premier Drive, Suite 210 High Point, NC 27265 (366) 869-9200 www.bankofnc.com

33 Forward Looking Statements This presentation contains certain forward-looking information about BNC that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should carefully read forward-looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward-looking” information about BNC. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of BNC. Forward-looking statements speak only as of the date they are made and BNC assumes no duty to update such statements. In addition to factors previously disclosed in reports filed by BNC with the SEC, additional risks and uncertainties may include, but are not limited to: the possibility that any of the anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of operations with those of BNC will be materially delayed or will be more costly or difficult than expected; the inability to complete the merger due to the failure of shareholder approval to adopt the merger agreement; the failure to satisfy other conditions to completion of the merger, including receipt of required regulatory and other approvals; the failure of the proposed merger to close for any other reason; the effect of the announcement of the merger on customer relationships and operating results; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions and fluctuations. Additional factors affecting BNC and Valley are discussed in each company’s respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC. Please refer to the SEC’s website at www.sec.gov where you can review those documents.

34 Additional Information This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the merger, BNC will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Valley and a Prospectus of BNC, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS ARE STRONGLY URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about BNC or Valley, may be obtained after their respective filing at the SEC’s Internet site (http://www.sec.gov). In addition, (i) free copies of documents filed by BNC with the SEC may be obtained on the BNC website at www.bncbancorp.com or by requesting them in writing from Drema Michael, BNC Bancorp, 3980 Premier Drive, Suite 210, High Point, North Carolina 27265, or by telephone at (336) 869-9200; and (ii) free copies of documents filed by Valley with the SEC may be obtained on the Valley website at www.myvalleybank.com or by requesting them in writing from Kimberly Snyder, Valley Financial Corporation, 36 Church Avenue, S.W., P.O. Box 2740, Roanoke, Virginia 24011, or by telephone at (540) 342-2265. BNC and Valley and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Valley’s shareholders in connection with the proposed merger. Information about the directors and executive officers of BNC and Valley and other persons who may be deemed participants in the solicitation will be included in the Proxy Statement/Prospectus. Information about BNC’s executive officers and directors can also be found in BNC’s definitive proxy statement in connection with its 2014 Annual Meeting of Shareholders filed with the SEC on April 10, 2014. Information about Valley’s executive officers and directors can also be found in Valley’s definitive proxy statement in connection with its 2014 Annual Meeting of Shareholders filed with the SEC on March 19, 2014. Additional information regarding the interests of those persons and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. You may obtain free copies of each document as described in the preceding paragraph.