Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Intrepid Potash, Inc. | a14-24014_18k.htm |

Exhibit 99.1

|

|

Ingredients for Growth November 2014 |

|

|

This presentation contains forward-looking statements — that is, statements about future, not past, events. These forward-looking statements often relate to our future performance and management’s expectations for the future, including statements about our financial outlook. Our forward-looking statements are based on estimates and assumptions that we believe are reasonable. Actual results could be materially different from our forward-looking statements. The factors that could cause actual results to differ are discussed in our periodic filings with the Securities and Exchange Commission. Statements regarding our financial outlook speak only as of the date of our third quarter 2014 earnings release, October 29, 2014, and all other forward-looking statements speak only as of the initial release date of this presentation, November 10, 2014. We have no duty to update publicly or revise any forward-looking statements to conform the statements to actual results or to reflect new information or future events. Safe Harbor 2 |

|

|

Intrepid Overview Building on Our History of Value Creation 3 Optimizing new and upgraded assets Created opportunity to increase per ton margin and cash flow Creating a stronger Intrepid Completed multi-year modernization program Expanding low cost solar solution mining Close-to-market strategy |

|

|

Intrepid’s Unique Position Participating in industry with strong fundamentals Geographically advantaged assets Value enhancing logistics strategy Serving diverse customers and markets Leveraging solar solution mining expertise Benefitting from a prudent capital structure Highest average net realized sales price among North American competitors 4 |

|

|

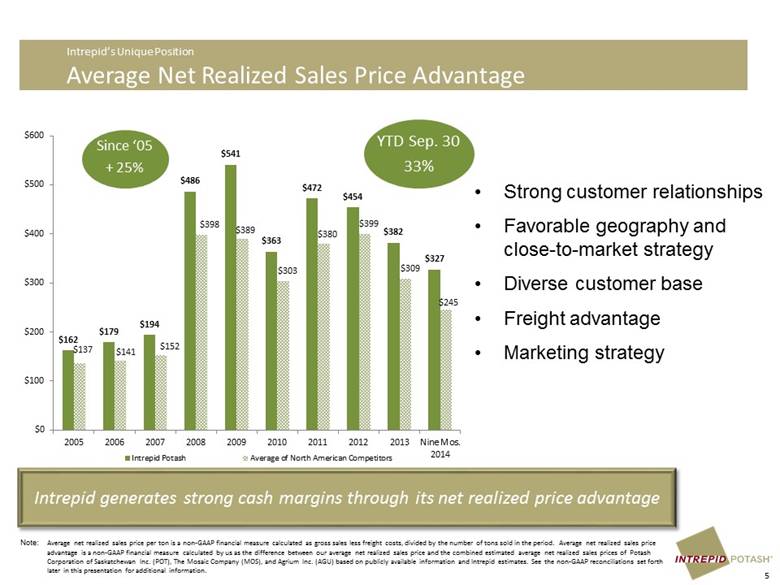

Intrepid generates strong cash margins through its net realized price advantage YTD Sep. 30 33% Note: Average net realized sales price per ton is a non-GAAP financial measure calculated as gross sales less freight costs, divided by the number of tons sold in the period. Average net realized sales price advantage is a non-GAAP financial measure calculated by us as the difference between our average net realized sales price and the combined estimated average net realized sales prices of Potash Corporation of Saskatchewan Inc. (POT), The Mosaic Company (MOS), and Agrium Inc. (AGU) based on publicly available information and Intrepid estimates. See the non-GAAP reconciliations set forth later in this presentation for additional information. Intrepid’s Unique Position Average Net Realized Sales Price Advantage 5 • Strong customer relationships • Favorable geography and close-to-market strategy • Diverse customer base • Freight advantage • Marketing strategy Since ‘05 + 25% |

|

|

• Tight granular inventory • Logistic challenges • Commodity prices • Annual U.S. potash consumption relatively consistent for decades • Balanced fertilization key to maximizing yields Industry With Strong Fundamentals Market Conditions 6 Solid potash pricing and demand in fourth quarter of 2014 |

|

|

Strategically Positioned, Serving Diverse Customers and Markets Maximizing Sales and Margin • Marketing strategy geared towards maximizing margins • Close-to-the-market • Diverse end markets and customer base • Trio® expands customer base End Market Product Size 2012 2013 YTD Sep. 30, 2014 Agricultural Granular 81% 71% 76% Industrial Standard 12% 21% 19% Animal Feed Standard 7% 8% 5% Potash Sales Mix Industrial Agricultural Animal Feed 7 Expanded customer base creates sales opportunities |

|

|

Leveraging Solar Solution Mining Expertise Intrepid is a Leader in Solar Solution Mining Inject brine into idled or created mine works Allow brine to circulate to dissolve the remaining potash Extract potash enriched brine and pump into solar evaporation pond • Low per ton cash operating cost • Creative use of idled mine works and use of mother nature’s “free” energy • Intrepid’s assets are located in geographies conducive to solar evaporation Allow solar evaporation to occur; potash recrystallizes as water evaporates Harvest the potash from the evaporation ponds Mill the product and have it ready for our customer 8 |

|

|

Leveraging Solar Solution Mining Expertise HB Drives Cash Margin Opportunity • Expected cash margin per ton from HB approximately double • Combined cash operating costs improve 9% • Potential to grow cash margin faster than production growth 9 Note: Calculation assumes cash operating cost per ton for Current Potash State of $195, which was the full year 2013 result. HB cash operating cost per ton is assumed to be $90, the midpoint of the predicted range of $80-$100 per ton based on full production rates of 150,000 to 200,000 tons annually. Per ton cash operating cost is a non-GAAP financial measure that is calculated as total of cost of goods sold divided by the number of tons of potash sold and then adjusted to exclude per-ton royalties and per-ton depreciation, depletion, and amortization. Total cost of goods sold is reported net of by-product credits and does not include warehouse and handling costs. See the non-GAAP reconciliations set forth later in this presentation for additional information. Pro Forma Potash Combined assumes 825,000 tons of production from non-HB assets and the mid-point of the 150,000 to 200,000 tons of annual forecast production from HB. Cash margin per ton is a non-GAAP financial measure that is calculated as average net realized sales price less cash operating costs, royalties, warehousing and handling. $'s per ton Current Potash State Expected HB Solar Contribution Pro Forma Potash Combined Q3 2014 Average net realized sales price 336 $ 336 $ 336 $ Cash operating costs 195 90 177 Royalties, warehousing and handling 29 29 29 Cash margin per ton 112 $ 217 $ 130 $ Cash margin per ton 33% 65% 39% |

|

|

• Cash and investments totaling $74 million • $250 unsecured credit facility in place. Availability of facility adjusts based on financial covenant results • $150 million in unsecured long-term debt outstanding, with average interest rate of less than 4% • Capital investments in 2014 of $40-$50 million, a decrease of approximately $200 million from 2013 • Generated positive free cash flow during first nine months of 2014 Balance Sheet Strength and Optimal Capital Structure As of September 30, 2014 10 |

|

|

OBJECTIVE •Respond to changing demand to pursue highest margin sales •Ability to compact 100% of potash production PROJECTS •North compaction •Trio® pellet plant OBJECTIVE •Increase production PROJECTS •HB Solar Solution mine •Moab solution mining caverns •West plant improvements GROWTH OBJECTIVE •Lower per ton cash operating costs PROJECTS •HB Solar Solution mine •North compaction •West recovery improvement MARGIN Recent Capital Investments Designed to Achieve Greatest Returns 11 |

|

|

Targeted Capital Investment Program to Achieve Greatest Returns HB Solar Solution Mine 12 Production growth at significantly lower cash operating costs • $80-$100 per ton, at full rates expected in 2016 Lowering cash operating costs • Lower by nearly 9% per ton Improves Intrepid’s overall cash operating costs • Approximately double current margin contribution per ton Creates cash margin opportunity • 150,000 – 200,000 tons at full rate expected in 2016 Grows annual production • On track, ramping up as planned Project update |

|

|

Targeted Capital Investment Program to Achieve Greatest Returns North Compaction Facility 13 • Flexibility to adjust production to pursue highest margin sales Create margin opportunity • Capacity to compact 100% of Carlsbad production Expands granulation capacity • Customer feedback that it is some of the highest quality potash in the market Improved customer satisfaction • Intended to allow for • recovery gains at West plant Increases production Pursue highest margin opportunity through production flexibility • All three lines are in service Project update |

|

|

Why Intrepid? Highest North American average net realized sales price over time and strong cash margin per ton Geographically advantaged assets and a logistics strategy to serve diversified markets and customer base Focused on growth, flexibility, and margin expansion Producing incremental low cost solar solution tons Strong capital structure Committed to lowering costs over the long term Generating positive free cash flow 14 |

|

|

Supplying a Growing America Supplying a Growing America® ® Appendix ® |

|

|

Intrepid’s Locations 16 Wendover Solar Evaporation Mine Moab Solar Solution Mine Carlsbad Assets including: West North East HB Solar Solution Mine Amax/ Horizon (potential Solar Solution development) Florida New Mexico Texas Oklahoma Kansas Nebraska South Dakota Montana Wyoming Colorado Utah Idaho Arizona Nevada Washington California Oregon Kentucky Maine New York Pennsylvania Michigan Vermont New Hampshire Virginia West Virginia Ohio Indiana Illinois North Carolina Tennessee South Carolina Alabama Mississippi Arkansas Louisiana Missouri Iowa Minnesota Wisconsin Georgia North Dakota |

|

|

HB Production Ramp Cycle 17 First production following summer 2013 evaporation season Second evaporation season with full ponds for full year Second harvest and production begin following 2014 evaporation season Third evaporation season. Brine has had longer residence time in the mineworks Hit full production rates in 2016 Full production rates expected in 2016: 150,000 to 200,000 tons at $80 - $100 per ton 2014 2015 2016 2013 |

|

|

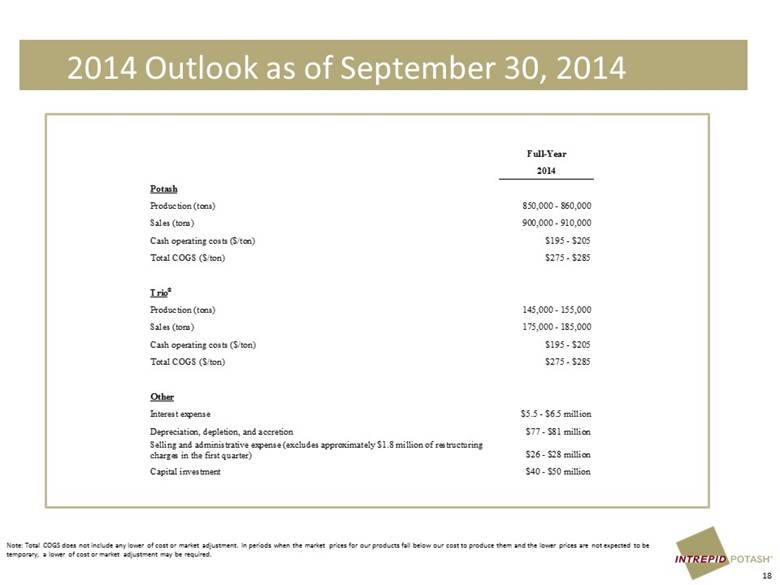

2014 Outlook as of September 30, 2014 18 Note: Total COGS does not include any lower of cost or market adjustment. In periods when the market prices for our products fall below our cost to produce them and the lower prices are not expected to be temporary, a lower of cost or market adjustment may be required. Full-Year 2014 Potash Production (tons) 850,000 - 860,000 Sales (tons) 900,000 - 910,000 Cash operating costs ($/ton) $195 - $205 Total COGS ($/ton) $275 - $285 Trio® Production (tons) 145,000 - 155,000 Sales (tons) 175,000 - 185,000 Cash operating costs ($/ton) $195 - $205 Total COGS ($/ton) $275 - $285 Other Interest expense $5.5 - $6.5 million Depreciation, depletion, and accretion $77 - $81 million Selling and administrative expense (excludes approximately $1.8 million of restructuring charges in the first quarter) $26 - $28 million Capital investment $40 - $50 million |

|

|

Financial Overview Adjusted EBITDA* (in millions) Balance Sheet as of Sep. 30, 2014 Net Income (Loss) (in millions) Diluted Earnings (Loss) Per Share Cash and Investments $ 74 million Current Assets $ 202 million Total Assets $1,167 million Debt Outstanding $ 150 million Total Liabilities $ 227 million Stockholders’ Equity $ 941 million 19 * Adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) is a non-GAAP financial measure. See the non-GAAP reconciliations set forth later in this presentation for additional information |

|

|

Non-GAAP Reconciliations To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use several non-GAAP financial measures to monitor and evaluate our performance. These non-GAAP financial measures include adjusted net income (loss), adjusted net income (loss) per diluted share, adjusted EBITDA, net sales, average net realized sales price, cash operating costs, average potash and Trio® gross margin, and free cash flow. These non-GAAP financial measures should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. In addition, because the presentation of these non-GAAP financial measures varies among companies, our non-GAAP financial measures may not be comparable to similarly titled measures used by other companies. We believe these non-GAAP financial measures provide useful information to investors for analysis of our business. We also refer to these non-GAAP financial measures in assessing our performance and when planning, forecasting and analyzing future periods. We believe these non-GAAP financial measures are widely used by professional research analysts and others in the valuation, comparison and investment recommendations of companies in the potash mining industry. Many investors use the published research reports of these professional research analysts and others in making investment decisions. On the following slides is additional information about our non-GAAP financial measures, including, if applicable, reconciliations of our non-GAAP financial measures to the most directly comparable GAAP measures: |

|

|

Non-GAAP Reconciliation Adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) is a non-GAAP financial measure that is calculated as net income adjusted for the reversal of the allowance associated with the employment-related high wage tax credits in New Mexico, restructuring expenses, interest expense, income tax expense (benefit), depreciation, depletion, and amortization, and asset retirement obligation accretion. We consider adjusted EBITDA to be useful because it reflects our operating performance before the effects of certain non-cash items and other items that we believe are not indicative of our core operations. We use adjusted EBITDA to assess operating performance and as one of the measures under our performance-based compensation programs for employees. Calculation of Adjusted EBITDA In thousands 21 |

|

|

Non-GAAP Reconciliation Net sales, average net realized sales price, and average net realized sales price advantage are non-GAAP financial measures. Net sales are calculated as sales less freight costs. Average net realized sales price is calculated as net sales, divided by the number of tons sold in the period. Average net realized sales price advantage is calculated by us as the difference between our average net realized sales price and the combined estimated average net realized sales prices of Potash Corporation of Saskatchewan Inc. (POT), The Mosaic Company (MOS), and Agrium Inc. (AGU) based on publicly available information. We consider these measures to be useful because they remove the effect of transportation and delivery costs on sales and pricing. When we arrange transportation and delivery for a customer, we include in revenue and in freight costs the costs associated with transportation and delivery. However, many of our customers arrange for and pay their own transportation and delivery costs, in which case these costs are not included in our revenue and freight costs. We use these measures as key performance indicators to analyze sales and price trends. We also use net sales as one of the measures under our performance-based compensation programs for employees. Net Sales, Average Net Realized Sales Price, and Average Net Realized Sales Price Advantage In thousands, except per ton amounts Potash: Year Ended December 31, YTD Sep. 30, 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Sales 150,381 $ 138,482 $ 188,006 $ 362,703 $ 250,887 $ 312,088 $ 392,331 $ 402,382 $ 284,831 $ 253,443 $ Freight costs 9,261 8,122 14,271 10,318 13,060 18,021 18,470 21,396 20,796 23,003 Net sales 141,120 130,360 173,735 352,385 237,827 294,067 373,861 380,986 264,035 230,440 Divided by: Tons sold (in thousands) 869 729 893 724 440 810 793 839 692 705 Average net realized sales price per ton 162 $ 179 $ 194 $ 486 $ 541 $ 363 $ 472 $ 454 $ 382 $ 327 $ Estimated average net realized sales price per ton of North American competitors (POT, MOS, AGU) 137 $ 141 $ 152 $ 398 $ 389 $ 303 $ 380 $ 399 $ 309 $ 245 $ Average net realized sales price advantage 25 $ 38 $ 42 $ 88 $ 152 $ 60 $ 92 $ 55 $ 73 $ 82 $ Average net realized sales price advantage expressed as a percentage 18% 27% 28% 22% 39% 20% 24% 14% 24% 33% |

|

|

Non-GAAP Reconciliation Cash operating costs is a non-GAAP financial measure that is calculated as total of cost of goods sold divided by the number of tons sold in the period and then adjusted to exclude per-ton depreciation, depletion, and royalties. Total cost of goods sold is reported net of by-product credits and does not include warehouse and handling costs. We consider cash operating costs to be useful because it represents our core, per-ton costs to produce potash. We use cash operating costs as an indicator of performance and operating efficiencies and as one of the measures under our performance-based compensation programs for employees. 23 Potash Cash Operating Costs Per Ton 2013 Cost of goods sold 179,207 $ Divided by sales volume (in thousands of tons) 692 Cost of goods sold per ton 260 $ Less per-ton adjustments - Depreciation and depletion 52 Royalties 13 Cash operating costs per ton 195 $ In thousands, except per ton amounts |

|

|

Historical Quarterly Production and Sales 24 Note: One short ton equals 2,000 pounds. One metrictonne, which many international competitors use, equals 1,000 kilograms or 2,204.62 pounds. Historical Quarterly Production and Sales In thousands of short tons Production Volume Potash Trio Sales Volume Potash Trc 2012 2013 2014 218 170 189 218 M 222 W 182 g3 167 g4 2C9 gl 22C 19C gl 30 33 35 34 46 50 40 =2 32 =3 3= 203 18= 2=9 203 183 184 136. 167 2=2 233 227 28 26 27 =3 39 33 22 27 36. 62 =3 Note: One short ton equals 2,000 pounds. One metric tonne, which many international competitors use, equals 1,000 kilograms or 2,204.62 pounds. |

|

|

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% - 2,000 4,000 6,000 8,000 10,000 12,000 Grains Stocks to Use Ratio KCL Tons ('000) FERTECON U.S. Potash Consumption and Grains Stocks to Use Ratio KCL Tons Average KCl Consumption Stocks to Use Ratio U.S. Potash Consumption Remains Steady and Robust Sources : Fertecon, United States Department of Agriculture (USDA), NOAA National Climatic Data Center. Potash consumption is shown in fertilizer years (July – June). Grains stocks include barley, corn, oats, sorghum and wheat. – Potash fertilizer consumption has remained relatively constant with an annual volatility of approximately 9.2 percent over the past 30 years – Corn acres planted in the U.S. in the years 2007 through 2013 were 93.5, 86.0, 86.4, 88.2, 91.9, 97.3, and 95.4 million acres. 2014 acreage is forecast at 90.9 million. 1982: Recession leads to lower consumption; payment-in-kind program reduces planted acres 1991-1997: Low grain stocks lead to increased consumption 2001- mid 2008: Global economic expansion leads to increased demand ( 2006 delayed Chinese negotiations) 2010-11: Strong recovery in US agricultural markets Major droughts/floods in Corn Belt Droughts Floods 1987 1988 2000 2012 1993 2007 2008 2011 25 |

|

|

Global Industry Susceptible to Production Interruption and Supply “Shocks” Depleted Conventional Mines Mines Currently With Less than 15 Years Reserve Life Theodore, Amelie, Marie Louis mines- France Pasquasi and San Cataldo mines - Italy Salzdetfurth, Friedrichshall, Bergmannssegen-Hugo, Siegfried- Giesen, and Niedersachen-Riedel - Germany Trona, California Horizon-Amax, Wills-Weaver, Saunders – Carlsbad, New Mexico Carlsbad, NM, United States – Mosaic*, scheduled to close Hersey, United States – Mosaic*, closed Boulby, England – ICL Soligorsk I, Belarussia - Belaruskali Taquari, Brazil – Vale Sigmundshall – K + S *On Nov. 5, 2013, M osaic stated that it is decommissioning Hersey and on July 21, 2014, stated that it is discontinuing MOP production in Carlsbad. sources: Fertecon, Intrepid Potash®, and public filings Mine Closures Due to Water Inflows PCA (Patience Lake) (0.8MM tons KCl / yr) Potacan mine (0.8MM tons KCl / yr) Mines with Water Inflows • K2 Mine Esterhazy •Produced 4 million tons KCl in 2013 •Most recent 10-K indicated more than $300 million cost to mitigate in 2013 •PCS New Brunswick Mine •Produced 0.8 million tons KCl in 2012 •Being replaced with a 2 million ton mine by 2015 • Belaruskali Mine #2 •Capacity to produce 2.5 million tons KCl per year St. Paul mine (Congo) (0.8MM tons KCl / yr) Berezniki I (1.3MM tons KCl / yr) Berezniki 3 mine (1.8MM tons KCl / yr) Mine Closures Due to Depletion Due to geology, in the 70 plus years of potash mining in the Carlsbad area, there has never been a mine lost to flooding or a water incursion 26 |

|

|

- 1 2 3 4 5 6 7 8 - 10 20 30 40 50 60 70 Global Midyear Population (in billions) million tons KCl equivalent Collapse of Soviet Union 2008 Global Financial Crisis Fundamentals of Increasing Population Continue to Drive Grain and Ultimately Potash Demand Over the Long Term Note: Grains include corn, wheat, barley, oats and sorghum. Stocks-to-use ratio is ending inventory / consumption for that crop year; data updated monthly. Sources: United Nations Food and Agriculture Organization (FAO), World Bank, US Census Bureau, USDA, Potash & Phosphate Institute (PPI,) International Fertilizer Industry Association (IFA), Fertecon (1) Futures prices based on closing price o f Chicago Board of Trade futures contracts as of 11/5/14; futures prices for November/December delivery in forecast years. Hectares of Arable Land per Person Hectares per person Crop Prices Over Time(1) World Grain Production and Stocks-to-Use Ratios Grain Production Stocks-to-Use Ratio 5 Year Average 5 Year Average Fall 2014 Futures Fall 2014 Futures Soybeans: $12.47 Soybeans: $12.47 $10.21 $10.21 Wheat: $6.54 Wheat: $6.54 $5.25 $5.25 Corn: $5.42 Corn: $5.42 $3.70 $3.70 Grain Production (Millions of Tons ) Stocks-to-Use Ratio Trend line Population Growth vs . Potash Demand 2014F 27 0.39 0.33 0.29 0.25 0.22 0.21 0.20 0.18 0.17 0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 1970 1980 1990 2000 2010 2020F 2030F 2040F 2050F Global population Global Potash Consumption 10% 20% 30% 40% 50% 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 |

|

|

For more information visit our website at www.intrepidpotash.com Investor Relations Contact: Gary Kohn Phone 303.996.3024 Email: gary.kohn@intrepidpotash.com |