Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | d814339d8k.htm |

FOURTH QUARTER 2014

ASSOCIATED BANC-CORP

INVESTOR

PRESENTATION

Exhibit 99.1 |

FORWARD-LOOKING STATEMENTS

Important note regarding forward-looking statements:

1

Statements made in this presentation which are not purely historical are

forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This includes any statements regarding

management’s plans, objectives, or goals for future operations,

products

or

services,

and

forecasts

of

its

revenues,

earnings,

or

other measures

of performance.

Such forward-looking statements may be identified by the use of words such

as “believe”, “expect”, “anticipate”,

“plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or

similar expressions.

Forward-looking statements are based on current management

expectations and, by their nature, are subject to risks and uncertainties. Actual

results may differ materially from those contained in the

forward-looking statements. Factors which may

cause actual results to differ materially from those contained in such

forward-looking statements include those identified in the

Company’s most recent Form 10-K and subsequent SEC filings.

Such factors are incorporated herein by reference.

*

* |

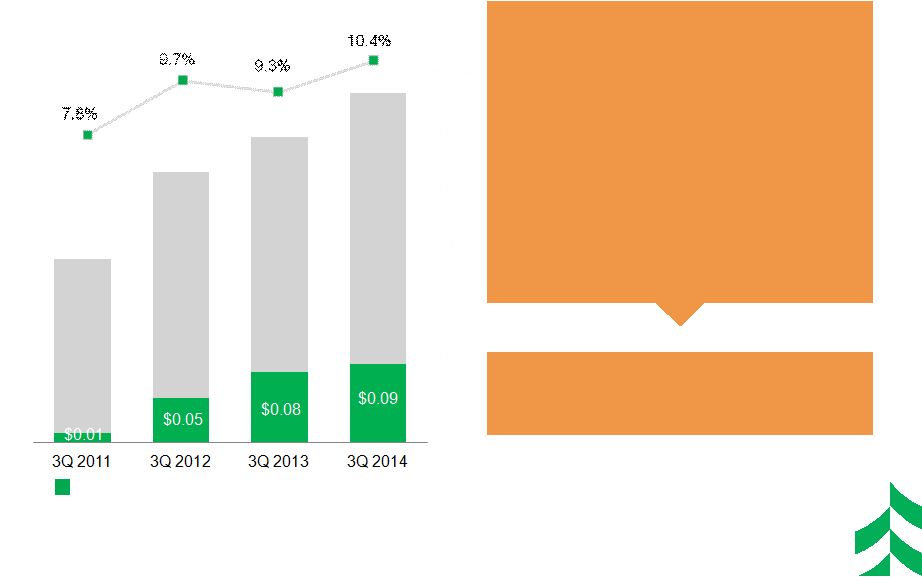

INVESTMENT HIGHLIGHTS

Midwestern financial services company built upon a strong commitment to our

colleagues and the communities we serve

$26 billion in assets (Top 50 bank holding company in the U.S.)

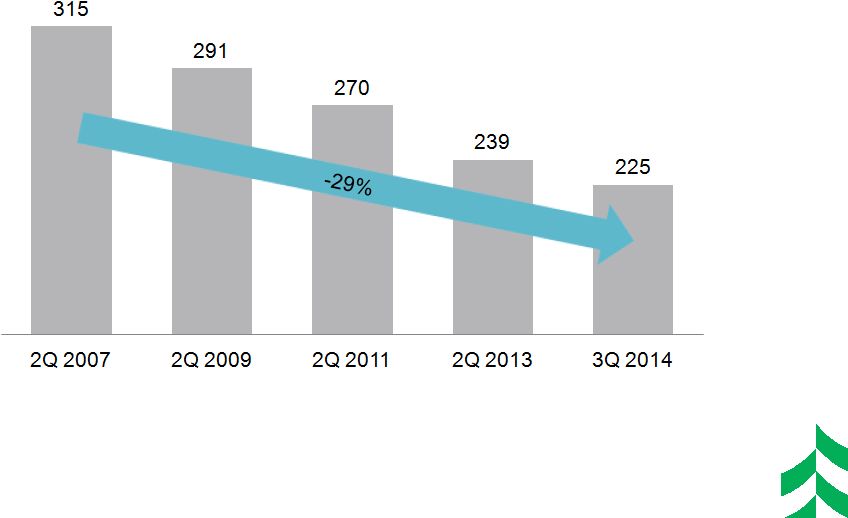

225 banking offices serving approximately one million customers

Largest bank headquartered in Wisconsin

Franchise

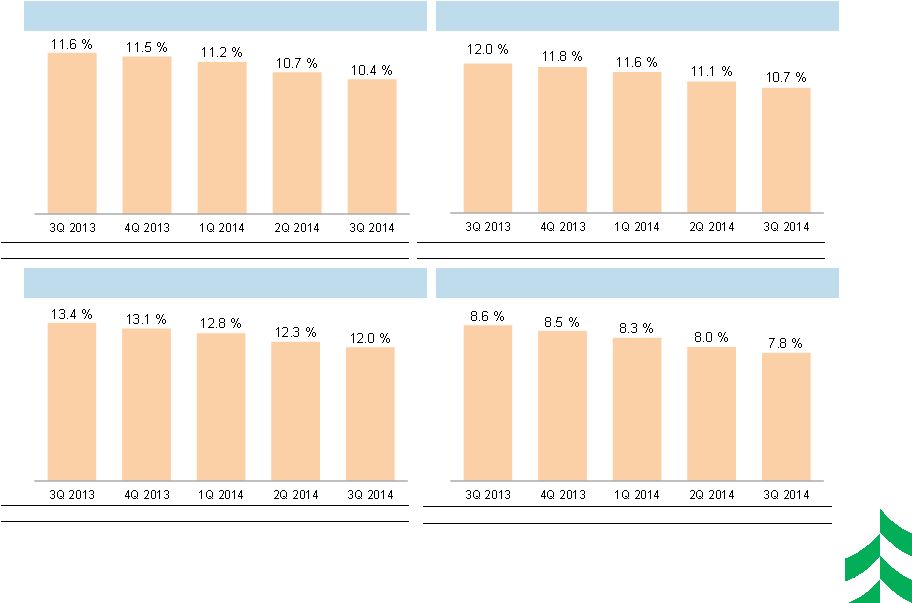

Profitability

Asset quality

Capital and

liquidity

Capital ratios remain strong and above Basel III targets

Tier 1 common: 10.39%

TCE / TA: 7.57%

Robust loan growth and disciplined expense management resulting in attractive

shareholder returns

Return on Tier 1 Common Equity of 10.4% for the third quarter

Robust organic loan growth during 2014, managing towards 8.0% average loan

growth Well controlled expenses with initiatives which should continue to

benefit results Disciplined Underwriting & Risk Management Resulting in

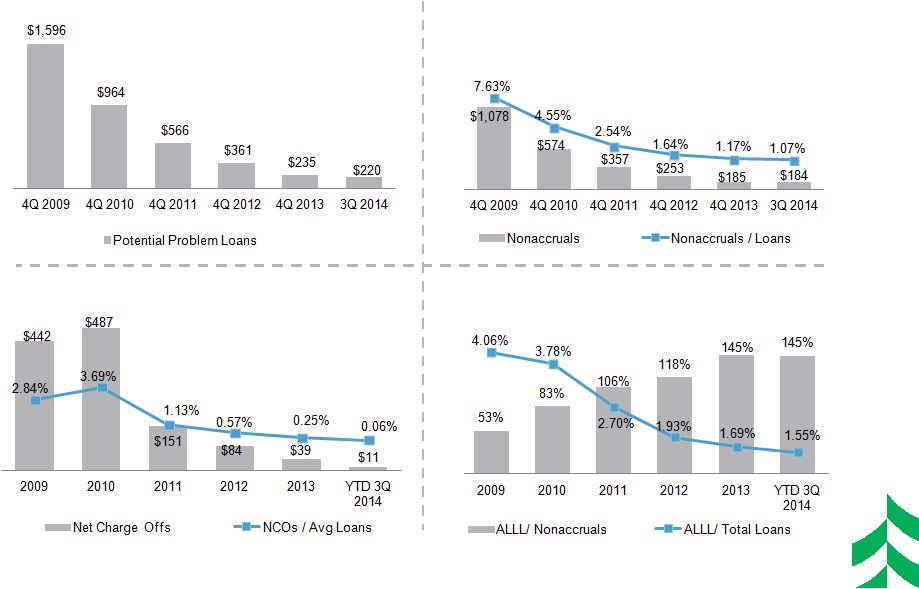

Strong Asset Quality NCOs / avg loans: 0.06% YTD 3Q 2014, down from 2.84% in

2009 Non-accruals: 1.07% nonaccruals / loans in 3Q 2014, down from 7.63%

in 4Q 2009 Reserves / loans: 1.55% in 3Q 2014 compared to 4.06% in

2009 Ratings

Franchise evolution reflected in recent years’

positive ratings trajectory (now Baa1/BBB)

2 |

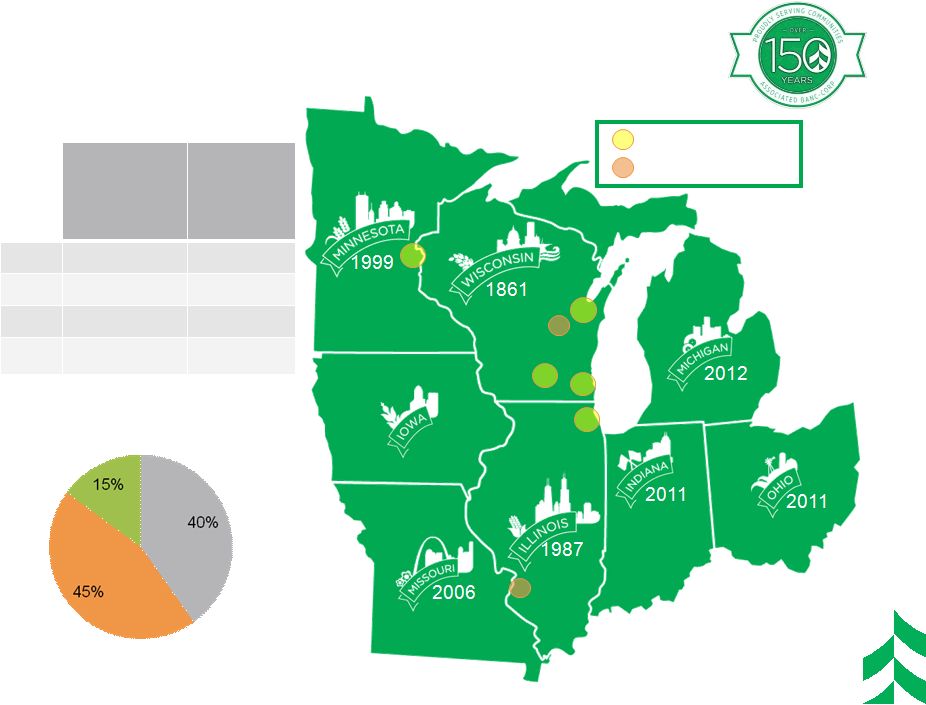

OUR

FOOTPRINT AND FRANCHISE ASBC

Deposits

($ in

billions)

ASBC

Branches

2

WI

$12.0

160

IL

$4.8

43

MN

$1.4

22

Total

$18.2

225

1

FDIC market share data 6/30/14

2

As of 9/30/14 (Period End)

>$1bn deposits

>$500mm deposits

3

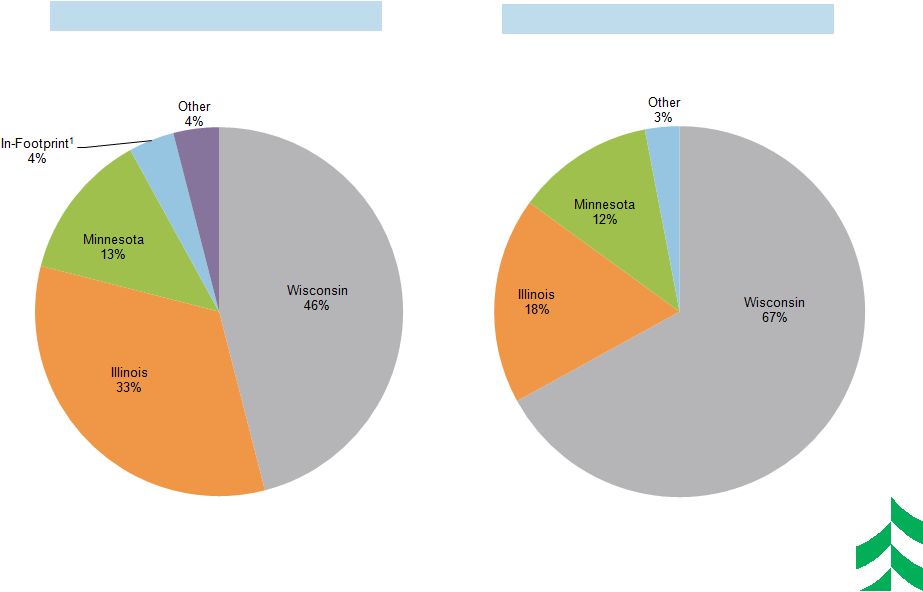

Total Loan Distribution

($17.2 billion –

Sept 2014 –

Period End)

Wisconsin

In Footprint

Other

1

1

2

*

* |

*

*

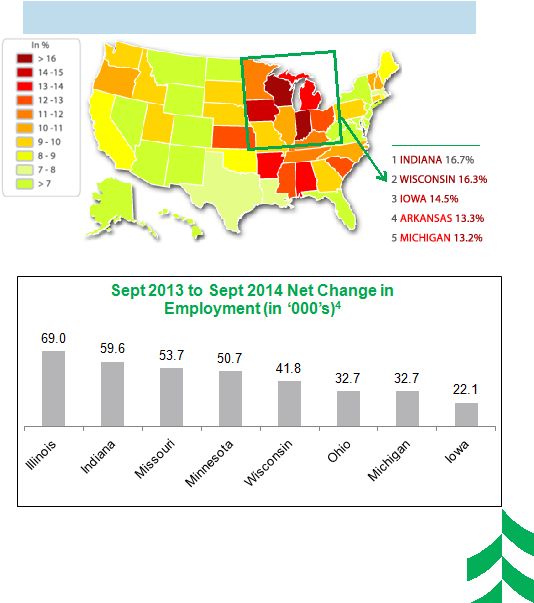

ATTRACTIVE MIDWEST MARKETS

•

Serve a Large Market Place:

(Footprint is ~ 20% of USA)

•

Manufacturing

Concentrated:

Top

3

states

(Indiana, Wisconsin, and Iowa)

for concentration of

manufacturing jobs and two

other states in the top 10

•

Favorable Employment

Dynamics:

Wisconsin,

Minnesota, Indiana, Iowa, and

Ohio all have unemployment

rates that are under 6%

•

Positive Economic Trends:

Continuing job growth across

the footprint

1

US Census Bureau 2012 ;

2

Area Development Online –

Author: Mark Crawford (Winter 2013); September 2014 US Bureau of

Labor Statistics;

4

Sept 2014 US Bureau of Labor Statistics -

“Regional and State Employment and Unemployment (Oct 21, 2014 News

Release) Manufacturing

Share

of

Non-Farm

Employment

4 of Top 5

4

2

1

3

3 |

*

*

ASSOCIATED AT ITS CORE

Community

bank values,

flexibility,

decision-

making,

attention to

relationships

and service

Big bank

products,

strength,

lending limits,

efficiency,

innovation,

depth of

expertise

5 |

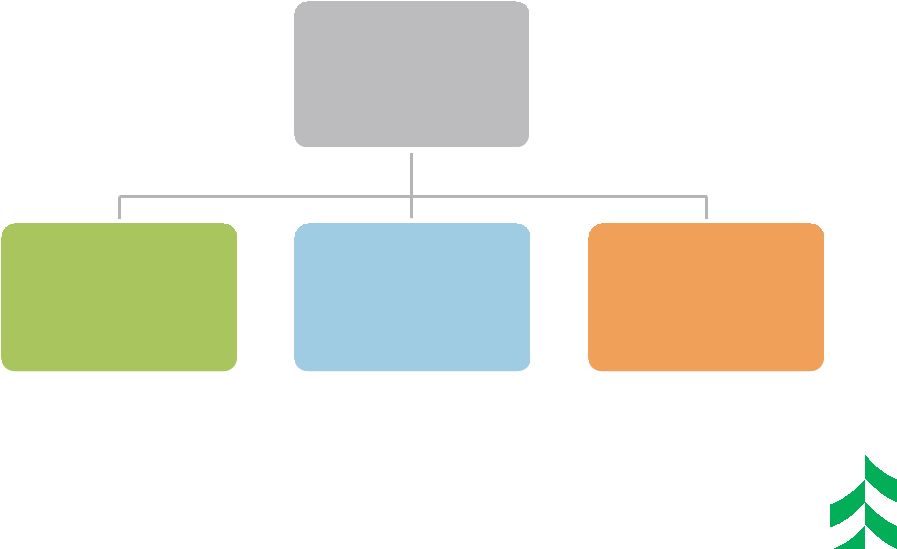

DIVERSIFIED PORTFOLIO OF VALUE-ADDED

BUSINESSES

Corporate Banking

Consumer and

Commercial

Banking

Private Client and

Institutional

Services

Commercial

Deposits and

Treasury

Management

Capital Markets

Associated

Financial Group

Specialized

Lending

Verticals

Commercial Real

Estate

Specialized

Financial Services

Group

Branch

Banking

Commercial

Banking

Residential

Lending

Payments

and Direct

Channels

AIS -

Brokerage

Private Banking

Personal Trust

Asset

Management

Retirement Plan

Services

Community

Markets

6

* |

Strong lending base in high-quality, low-volatility

diversified assets to provide foundation for

selective and prudent risk taking in higher risk

asset classes. (Meaningful allocations to

Mortgage, Multi-family and Manufacturing)

Core lending markets in Midwest with primary

emphasis placed on Wisconsin, Minnesota,

Illinois, Missouri, Iowa, Indiana, Ohio and

Michigan. (85% of Q3 2014 Loans)

•

Retail –

30-40%

•

C&I –

30-40%

•

CRE –

25-35%

DIVERSIFIED LOAN PORTFOLIO

7

Asset Mix

Geographic Mix

Industry Mix

Internal Portfolio Management Goals

•

We are building a diversified loan portfolio that we believe will perform well

through the next downturn in the credit cycle.

Current (Q3-2014)

•

Retail –

37%

•

C&I –

39%

•

CRE –

24%

* |

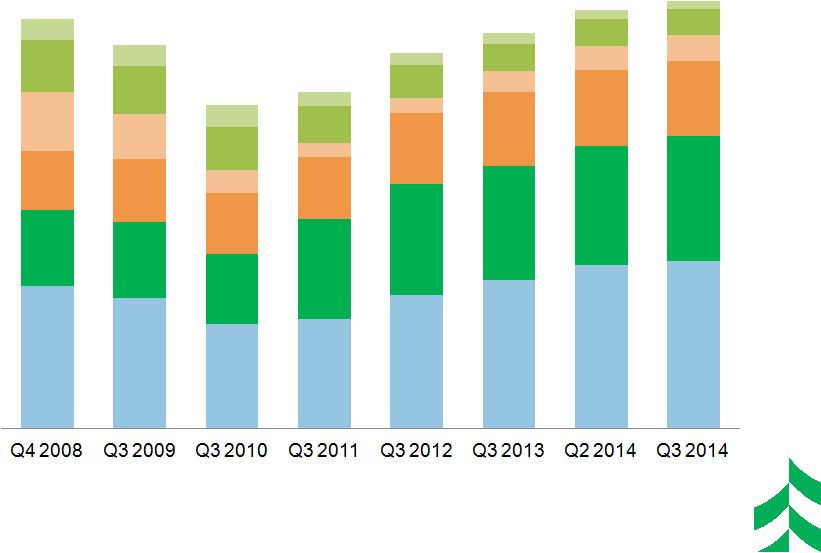

RESHAPING & REBUILDING THE LOAN

PORTFOLIO

1

Based on Average Balances, $ in Billions

Installment

HELOCs &

2 Liens

Residential

Mortgage &

HE 1

Liens

Construction

CRE

Investor

Commercial

& Business

Lending

$16.3

$15.2

$12.9

$14.9

$15.7

5%

7%

4%

11%

13%

13%

14%

14%

19%

35%

7%

17%

20%

32%

4%

18%

30%

33%

$16.6

$17.1

3%

9%

4%

19%

30%

35%

3%

7%

5%

19%

29%

37%

2%

6%

6%

18%

29%

39%

$13.4

6%

6%

18%

29%

39%

2%

34%

22%

19%

11%

13%

5%

8

nd

st

1

*

* |

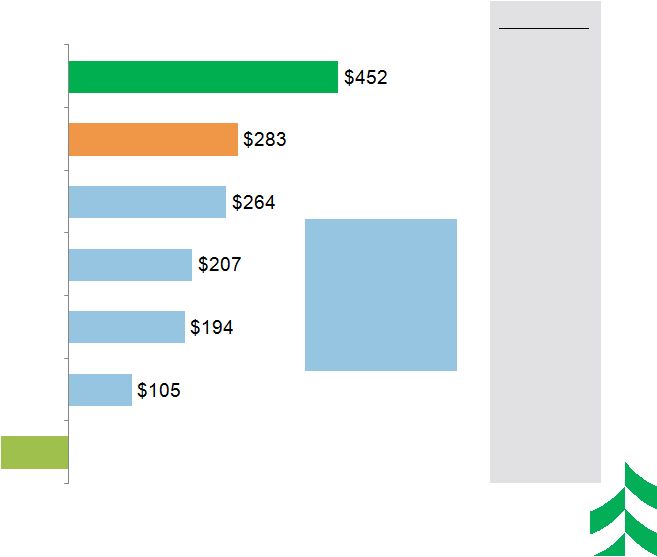

LOAN

PORTFOLIO GROWTH AVERAGE LOAN GROWTH OF $1.4 BILLION OR 9% GROWTH FROM 4Q

13 3Q 2014 vs. 4Q 2013 Change in Average Net Loan Balances by Category

($ in millions)

Home Equity & Installment

Commercial Real Estate

Residential Mortgage

Power & Utilities

Oil & Gas

Mortgage Warehouse

General Commercial Loans

Total

Commercial &

Business

Lending =

+13%

(+$770)

+12%

% Change

+101%

+8%

+6%

+47%

(5%)

+19%

9

($112)

*

* |

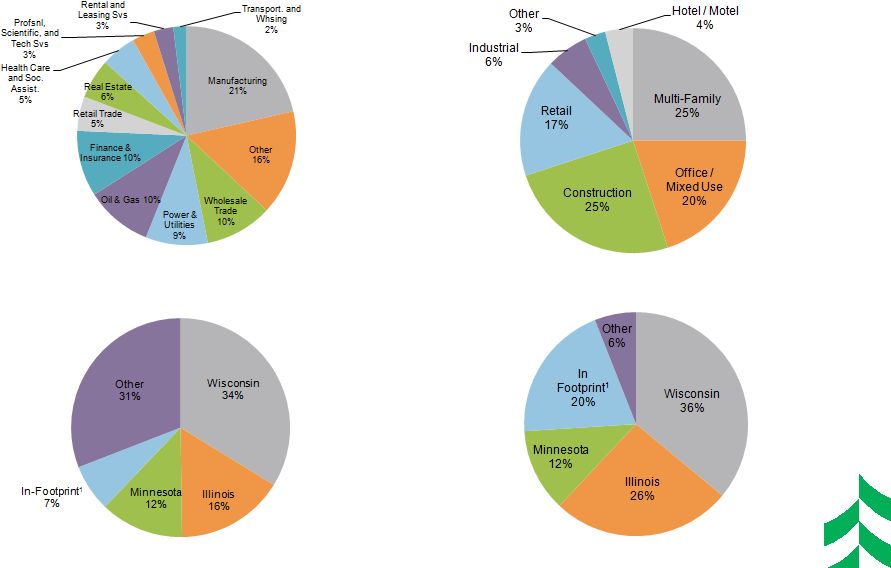

COMMERCIAL LOAN DETAIL

C&BL Loans by Industry

($6.7 billion –

Sept 2014 –

Period End)

C&BL Loans by State

1

Includes Missouri, Indiana, Ohio, Michigan, & Iowa

($6.7 billion –

Sept 2014 –

Period End)

CRE Loans by Industry

($4.0 billion –

Sept 2014 –

Period End)

CRE Loans by State

($4.0 billion –

Sept 2014 –

Period End)

10

*

* |

RETAIL LOANS BY STATE

Residential Mortgage Loans

($4.3 billion –

Sept 2014 –

Period End)

Home Equity Loans

($1.7 billion –

Sept 2014 –

Period End)

1

Includes Missouri, Indiana, Ohio, Michigan, & Iowa

2

Approximately 40% is in first lien position

11

2

*

* |

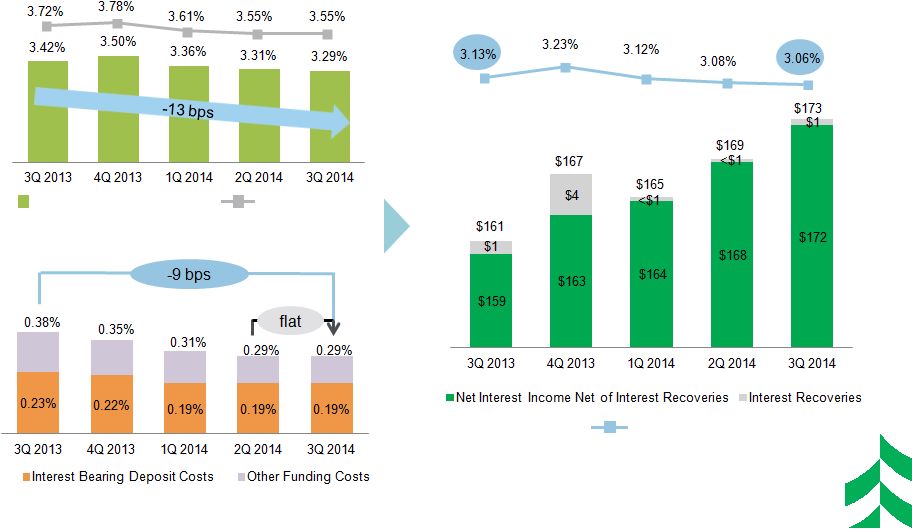

GROWING NET INTEREST INCOME WHILE

MARGIN COMPRESSES

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Net Interest Income & Net Interest Margin

($ in millions)

Net Interest Margin

Total Loan Yield

Total Interest-earning Yield

12

*

* |

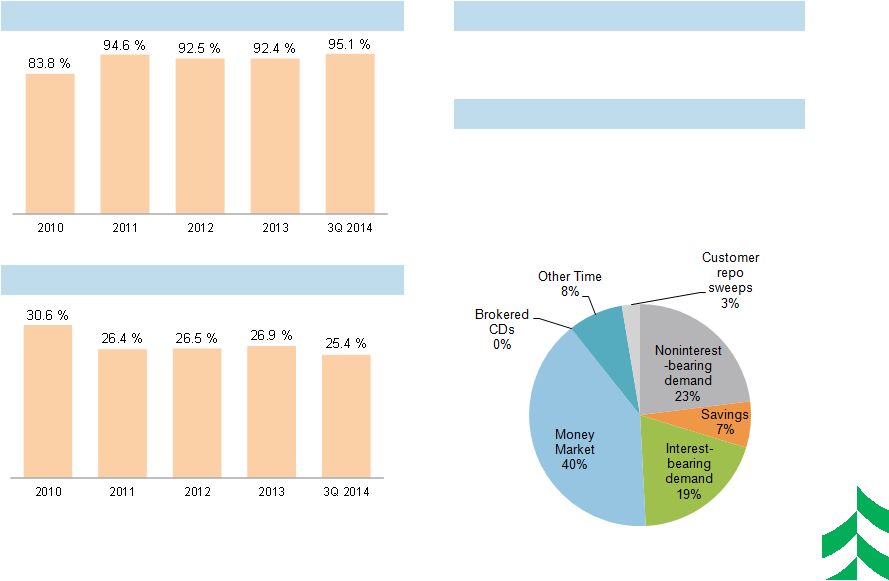

STABLE DEPOSIT AND LIQUIDITY PROFILE

Loans / Deposits

Securities / Earnings Assets

•

Bank holding company cash and liquid

investments of $117mm

Deposits and Customer Funding Mix

•

$18.7 billion at 9/30/2014

•

~990k deposit accounts with over $10 billion

of granular deposits (under $250k)

13

Strong Holding Company Liquidity

*

* |

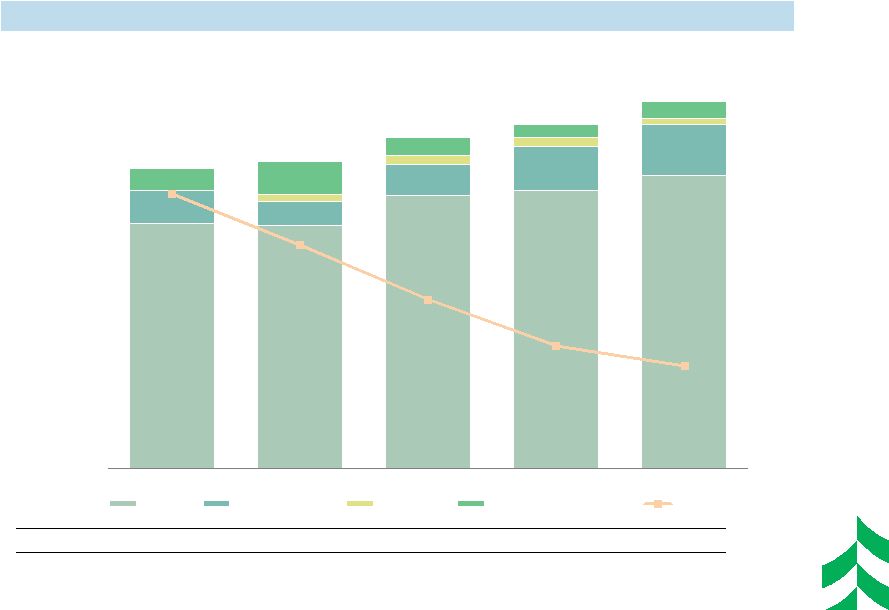

LOW-COST, CORE DEPOSIT FUNDING

Funding Composition Over Time

Cost of Deposits

0.63 %

0.46 %

0.27 %

0.18 %

0.15 %

•

Stable funding composition with 80% deposits and 20% from other low-cost

sources 14

$ 15,225

$ 15,091

$ 16,940

$ 17,267

$ 18,201

$ 2,001

$ 1,500

$ 1,925

$ 2,700

$ 3,105

$ 430

$ 585

$ 585

$ 430

$ 1,401

$ 2,037

$ 1,101

$ 783

$ 1,048

$ 18,627

$ 19,058

$ 20,551

$ 21,336

$ 22,784

0.89 %

0.70 %

0.49 %

0.31 %

0.24 %

2010

2011

2012

2013

3Q 2014

Deposits

FHLB Borrowings

Senior Debt

Other Wholesale Funding

Cost of Funds

*

* |

Amortized Cost Composition –

September 30, 2014

Investment Portfolio –

September 30, 2014

Credit Rating

($ in thousands)

Fair Value

(000’s)

% of Total

Govt & Agency

$4,722,638

83.5

AAA

105,712

1.9

AA

681,444

12.1

A

135,430

2.4

BAA1, BAA2 & BAA3

-

-

BA1 & Lower

1,889

0.0

Non-rated

6,190

0.1

TOTAL Market Value

$5,653,304

100.0%

Type

Amortized

Cost

(000’s)

Fair Value

(000’s)

TEY

(%)

Duration

(Yrs)

Govt & Agencies

$999

$996

0.67

2.36

Agency MBS

2,767,630

2,783,892

2.61

3.21

CMOs

960,063

959,630

2.36

2.96

GNMA CMBS

1,007,068

980,602

2.08

4.40

Municipals

890,196

922,318

5.07

4.88

Corporates

5,788

5,793

1.41

1.73

Other

18

73

TOTAL HTM &

AFS

$5,631,762

$5,653,304

2.86

3.64

INVESTMENT SECURITIES PORTFOLIO

Portfolio Ratings Composition –

September 30, 2014

Type

Fair Value

(000’s)

% of Total

0% RWA

$1,178,798

20.9

20% RWA

4,426,389

78.2

50% RWA

20,342

0.4

=>100% RWA

6,258

0.2

Not subject to RW

21,517

0.4

TOTAL Market Value

$5,653,304

100.0%

Risk Weighting Profile –

September 30, 2014

15

*

* |

CREDIT QUALITY TRENDS

($ IN MILLIONS)

16

*

* |

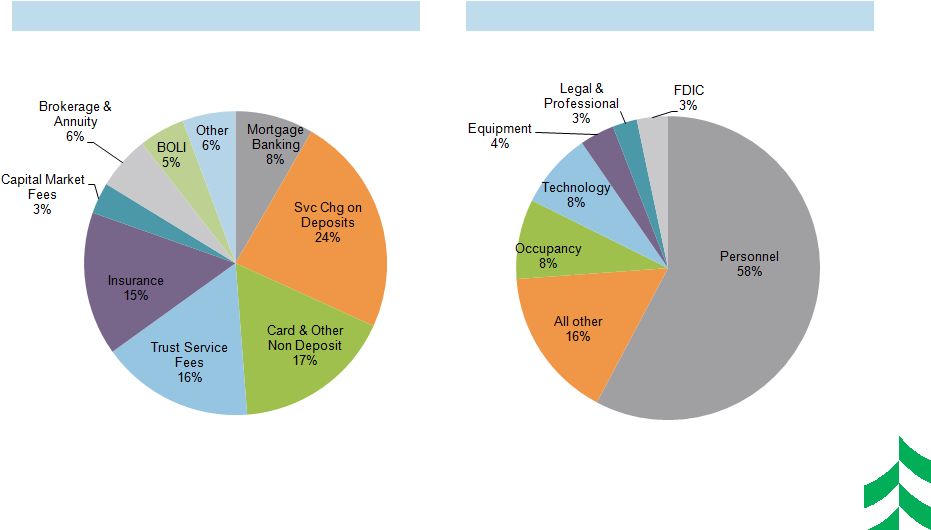

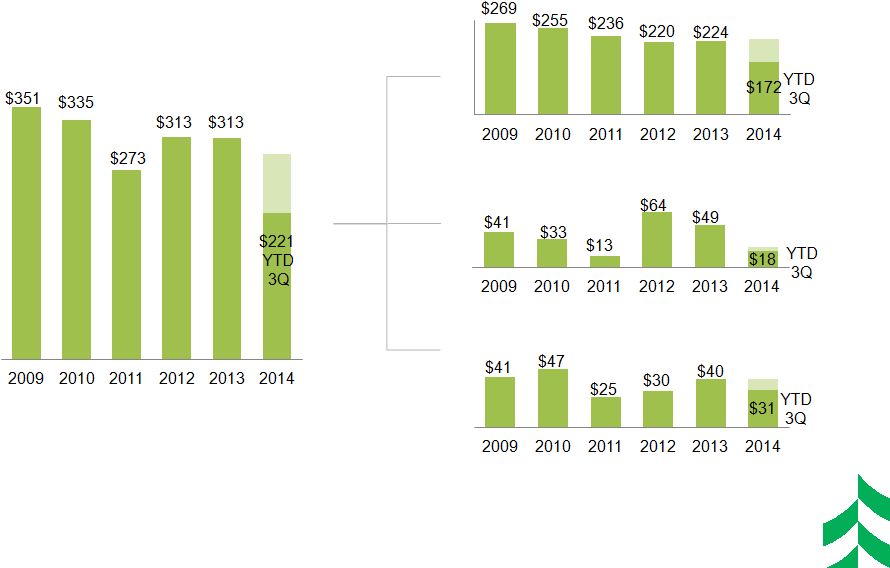

NONINTEREST INCOME AND EXPENSE

COMPOSITION

YTD SEPTEMBER 2014

Noninterest Income by Category

Noninterest Expense by Category

($221 million)

($507 million)

17

*

* |

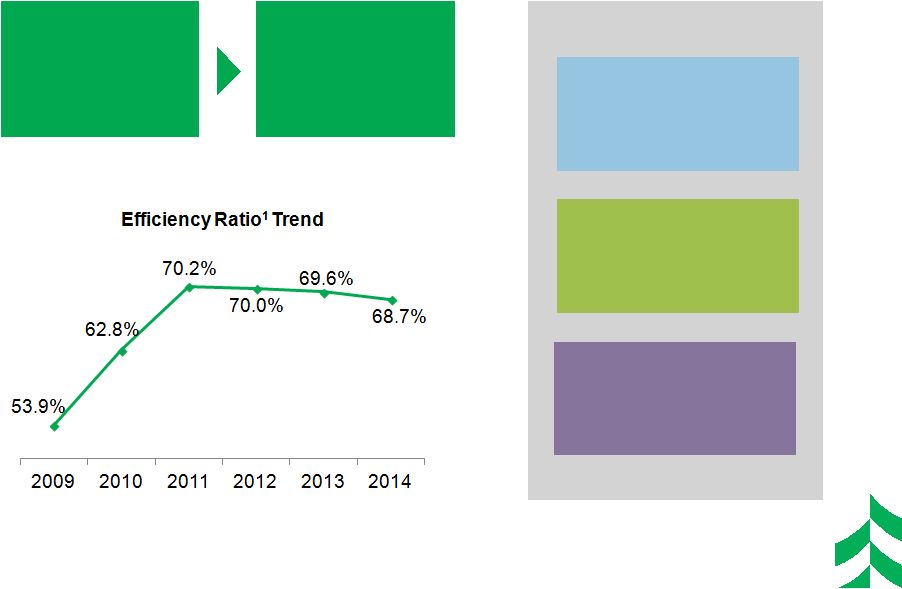

Areas of Focus

PURSUING EFFICIENCY GAINS

Efficiency Ratio¹

at 3Q 2014 =

69%

Goal =

Peer Average

or Better

1

–

Efficiency

ratio

=

Noninterest

expense,

excluding

other

intangible

amortization,

divided

by

sum

of

taxable equivalent net interest income plus noninterest income, excluding

investment securities gains/losses, net, and asset gains/losses, net.

This is a non-GAAP financial measure. Please refer to the appendix

for

a

reconciliation

of

this

measure.

Efficiency

Ratio

2014

is

YTD

Sept

2014.

Back Office Initiatives:

Implementing technology

solutions in labor intensive

processes

Real Estate Initiatives:

Actions to optimize our real

estate holdings and capacity

Distribution Initiatives:

Optimize the ways that we

interact with our customers

18

*

* |

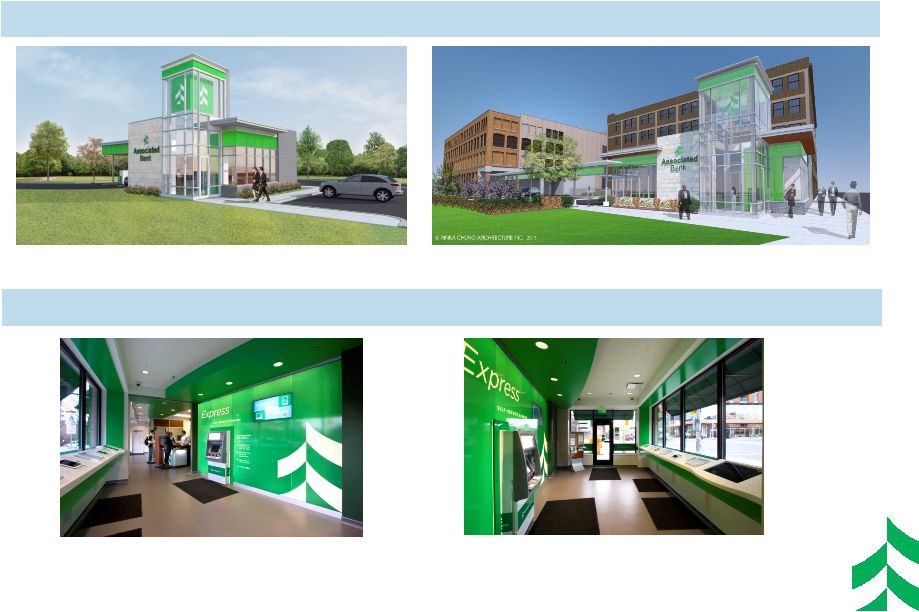

BRANCH EVOLUTION

•

Eagle River, Wisconsin

•

Milwaukee, Wisconsin

Branches coming in 2014: Lower construction costs, higher visibility profile

•

Madison, Wisconsin (UW Campus)

Express Branch: Demonstration Kiosk –

“Hands On”

& Automated Teller Machine

19

*

* |

RATIONALIZING THE FOOTPRINT

Consolidated or sold 29% of branches since 2007

1

Branch counts are as of period end.

20

1

*

* |

CAPITAL MANAGEMENT PRIORITIES

Funding

Organic Growth

Paying a

Competitive

Dividend

Non-organic

Growth

Opportunities

Share Buybacks

and

Redemptions

2012

2013

•

Fund Loan Growth and other Capital Investments

•

Repurchased $60

mm of Common

Stock

•

Redeemed $205

mm in Trust

Preferred

•

Repurchased

$120 mm of

Common Stock

•

Retired $26 mm

in Sub-Debt

•

Increased

quarterly dividend

in Q4 2012

•

Paid $0.23/

common share

•

Increased

quarterly dividend

in Q4 2013

•

Paid $0.33/

common share

•

Focused on Cost Take-out Driven Depository M&A

•

Maintaining Discipline in Pricing of any Transaction

2014

•

Repurchased $209

mm of Common Stock

through October 2014

•

Retired $155 mm in

Senior Notes in Q1

2014

•

Increased

quarterly dividend

in Q4 2014

•

Will pay $0.37/

common share

21

*

* |

STRONG CAPITAL POSITION

($ IN MILLIONS)

Tier 1 Common

Tier 1 Risk Based Capital

Total Risk Based Capital

Tier 1 Leverage

($ mm)

$ 1,904

$ 1,913

$ 1,912

$ 1,920

$ 1,873

($ mm)

$ 1,966

$ 1,975

$ 1,974

$ 1,981

$ 1,935

($ mm)

$ 2,199

$ 2,185

$ 2,187

$ 2,205

$ 2,160

($ mm)

$ 1,966

$ 1,975

$ 1,974

$ 1,981

$ 1,935

22

*

* |

RATINGS AGENGY PERSPECTIVE

Franchise turnaround reflected in improved ratings approaching pre-crisis

levels A1 / A+

Baa3 / BBB-

B2 / B

BBB+

A2

BB+

A2

BB-

Baa1

BBB

BBB

BBB

BBB

Baa1

Baa1

Baa1

Baa1

S&P

Moody’s¹

Source: S&P and Moody’s

¹

Provisional rating shown for Moody’s in 2008-2010

Associated Banc-Corp

Associated Bank NA

S&P

Moody’s

S&P

Moody’s

September 30, 2014

Senior unsecured

Subordinated debt

Outlook

BBB

BBB-

Stable

Baa1

Baa2

Stable

BBB+

NR

Stable

A3

NR

Stable

23

*

* |

EXPERIENCED MANAGEMENT TEAM

24

Phil Flynn

CEO

Joined Associated

in 2009

•

30+ Years Banking Experience

•

Union Bank of California (Vice Chairman and Chief Operating Officer)

Oliver Bueschse

Chief Strategy Officer

Joined Associated

in 2010

•

10+ Years Banking Experience

•

Union Bank of California (Head of Strategy)

Christopher Del-Moral Niles

Chief Financial Officer

Joined Associated

in 2010

•

20+ Years Financial Services Experience

•

First American Trust Corporation (Corporate Treasurer)

•

Union Bank of California( Director of Liability Management)

Patrick Derpinghaus

Chief Audit Executive

Joined Associated

in 2011

•

30+ Years Banking Experience

•

US Bank (Audit Director), The Bankers Bank of Atlanta (Chief Financial

Officer) Judith Doctor

Chief Human Resources Officer

Joined Associated

in 1982

•

30+ Years Banking Experience

•

Associated Bank (Senior Management positions in Human Resources)

Randall Erickson

General Counsel and Corporate Secretary

Joined Associated

in 2012

•

30+ Years Leadership Experience

•

M&I

(

Chief

Administrative

Officer

and

General

Counsel),

Godfrey

&

Kahn

(Partner), McDermott, Will &

Emery

Breck Hanson

Head of Commercial Real Estate

Joined Associated

in 2010

•

35+ Years Banking Experience

•

Head of Real Estate for La Salle Bank

Arthur Heise

Chief Risk Officer

Joined Associated

in 2011

•

40+ Years of Leadership Experience

•

US Bank (Director of Enterprise Risk Services and Enterprise Security

Services) Scott Hickey

Chief Credit Officer

Joined Associated

in 2008

•

35+ Years Banking experience

•

US Bank (Chief Credit Officer)

Tim Lau

Head of Community Markets

Joined Associated

in 1989

•

25+ Years Banking Experience

•

Associated Bank (Senior Management positions in Retail Banking, Commercial Banking

and Private Client and Institutional Services)

Donna Smith

Head of Corporate Banking

Joined Associated

in 2011

•

30+ Years Banking Experience

•

LaSalle Bank ( Market Executive for Midwest)

David Stein

Head of Retail Banking

Joined Associated

in 2005

•

20+ Years Banking Experience

•

JPMorgan Chase / Bank One

John Utz

Head of Specialized Industries & Commercial Financial

Services

Joined Associated

in 2010

•

20+ Years Banking Experience

•

Union Bank of California (Head of Capital Markets)

James Yee

Chief Information and Operation Officer

Joined Associated

in 2010

•

35+ Years Operations and Technology Experience

•

Union Bank of California ( Chief Information Officer)

William Bohn

Head of PCIS and President of AFG

Joined Associated

in 1997

•

20+ Years Banking Experience

•

Firstar Trust Company ( Legal/Compliance Manager)

*

* |

WHY

ASSOCIATED Reasons to Invest

1

–

Return

on

Tier

1

Common

Equity

(ROT1CE)

=

Management

uses

Tier

1

common

equity,

along

with

other

capital measures, to assess and monitor our capital position. This is a

non-GAAP financial measure. Please refer to the appendix for a

definition of this and other non-GAAP items. EPS and Dividends Paid &

ROT1CE Return on Tier 1

Common Equity

$0.20

$0.26

$0.27

$0.31

Diluted

Earnings

per

Common

Share

Dividends per Common Share

•

Leading Midwest Bank Operating in

Attractive Markets

•

Core Organic Growth Opportunity

•

Disciplined Loan and Deposit Pricing

•

Committed to Efficiency Ratio

Improvement

•

Strong Credit Quality and Capital Profile

•

Disciplined Capital Deployment

•

Improving Earnings Outlook

Management

Team

Focused

on

Creating

Long-Term Value

25

1

*

* |

OUR

VISION ASSOCIATED

will

be

the

most

admired

Midwestern financial services company,

distinguished by sound, value-added financial

solutions with personal service for our customers,

built upon a strong commitment to our colleagues

and the communities we serve, resulting in

exceptional value for our shareholders.

26

*

* |

APPENDIX

27

**************

**************

**************

**************

**************

**************

**************

**************

**************

**************

************** |

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

3Q 2013

4Q 2013

1Q 2014

2Q 2014

3Q 2014

Efficiency Ratio Reconciliation:

Efficiency ratio (1)

71.45%

73.70%

70.41%

69.70%

69.44%

Taxable equivalent adjustment

(1.50)

(1.49)

(1.35)

(1.32)

(1.36)

Asset gains, net

0.59

0.80

0.22

0.26

1.36

Other intangible amortization

(0.44)

(0.42)

(0.42)

(0.41)

(0.40)

Efficiency ratio, fully taxable equivalent (1)

70.10%

72.59%

68.86%

68.23%

69.04%

2009

2010

2011

2012

2013

YTD 3Q 2014

Efficiency Ratio Reconciliation:

Efficiency ratio (1)

56.65%

65.68%

73.33%

72.92%

71.05%

69.85%

Taxable equivalent adjustment

(1.30)

(1.60)

(1.72)

(1.60)

(1.46)

(1.34)

Asset gains (losses), net

(0.93)

(0.79)

(0.95)

(0.90)

0.40

0.61

Other intangible amortization

(0.50)

(0.50)

(0.51)

(0.43)

(0.42)

(0.41)

Efficiency ratio, fully taxable equivalent (1)

53.92%

62.79%

70.15%

69.99%

69.57%

68.71%

28

*

*

(1)

Efficiency

ratio

is

defined

by

the

Federal

Reserve

guidance

as

noninterest

expense

divided

by

the

sum

of

net

interest

income

plus

noninterest

income, excluding investment securities gains / losses, net. Efficiency

ratio, fully taxable equivalent, is noninterest expense, excluding other

intangible amortization, divided by the sum of taxable equivalent net interest

income plus noninterest income, excluding investment securities gains /

losses, net and asset gains / losses, net. This efficiency ratio is presented on a taxable equivalent basis, which adjusts net interest income

for the tax-favored status of certain loans and investment securities.

Management believes this measure to be the preferred industry measurement of

net interest income as it enhances the comparability of net interest income arising from taxable and tax-exempt sources and it

excludes certain specific revenue items (such as investment securities gains /

losses, net and asset gains / losses, net). Tier

1

common

equity,

a

non-GAAP

financial

measure,

is

used

by

banking

regulators,

investors

and

analysts

to

assess

and

compare

the quality

and composition of our capital with the capital of other financial services

companies. Management uses Tier 1 common equity, along with other capital

measures, to assess and monitor our capital position. Tier 1 common equity (period end and average) is Tier 1 capital excluding

qualifying perpetual preferred stock and qualifying trust preferred

securities. |

YTD

3Q 2014 HIGHLIGHTS AND OUTLOOK •

Loan Growth of ~ $1.4 bn YoY

•

Deposit Growth of ~ $300 mm YoY

–

Total average deposits of

$17.9 bn, up 2% YoY

•

3Q net interest income up $12 mm

or 8% YoY

•

Disciplined Expense Management

–

FTEs down 7% from 3Q13

•

Consistent Capital Deployment

–

Repurchased $159 mm of

common stock Sept YTD

2014 Highlights:

Outlook –

Growing the

Franchise & Creating Long-

Term Shareholder Value

•

Continued focus on organic

growth

•

Defending NIM compression in

low-rate environment

•

Strong focus on efficiency &

expense management

•

Disciplined focus on deploying

capital to drive long-term

shareholder value

29

Repurchased

$50

million

of common stock in

October 2014

Total

average

loans

of

$17.1

bn,

up

9%

YoY

*

* |

SEGMENT PROFITABILITY

YTD SEPTEMBER 2014

Community and

Consumer Banking

Earning Assets* = $8.0 bn

Total Revenue = $407.2 mm

Net Income = $23.0 mm

ROT1CE: 5.4%

Risk Management &

Shared Services

Earning Assets* = $5.9 bn

Total Revenue = $76.8 mm

Net Income = $49.8 mm

ROT1CE: 10.5%

Corporate and

Commercial Banking

Earning Assets* = $8.6 bn

Total Revenue = $242.9 mm

Net Income = $69.0 mm

ROT1CE: 12.5%

ASBC –

Consolidated Total

Earning Assets* = $22.5 bn

Total Revenue = $727.0 mm

Net Income = $141.8 mm

ROT1CE: 9.8%

* Average Earning Assets

30

*

* |

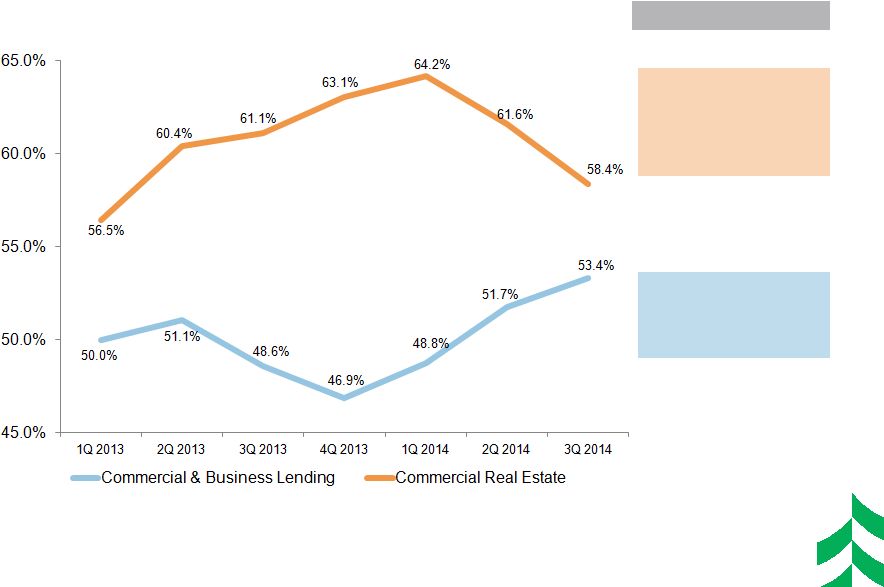

COMMERCIAL LINE UTILIZATION TRENDS

Line utilization increased in Commercial & Business Lending

Change from 2Q 14

Commercial Real

Estate (including

construction)

-

320 bps

Commercial &

Business Lending

+ 170 bps

31

*

* |

NONINTEREST INCOME TRENDS

($ IN MILLIONS)

Core Fee-based Revenue

Mortgage Banking (net) Income

Total Noninterest Income

1

–

Core

Fee-based

Revenue

=

Trust

service

fees

plus

Service

charges

on

deposit

accounts

plus

Card-based

and

other

nondeposit

fees

plus

Insurance

commissions

plus

Brokerage

and

annuity

commissions.

This

is

a

non-GAAP

measure.

Please

refer

to

the

press

release

tables

for

a

reconciliation

to

noninterest

income.

2

–

Other

Noninterest

Income

=

Total

Noninterest

Income

minus

Core

Fee-based

Revenue.

This

is

a

non-GAAP

measure.

Please

refer

to

the

press

release

tables

for

a

reconciliation

to

noninterest

income.

Other Noninterest Income

32

1

2

*

* |

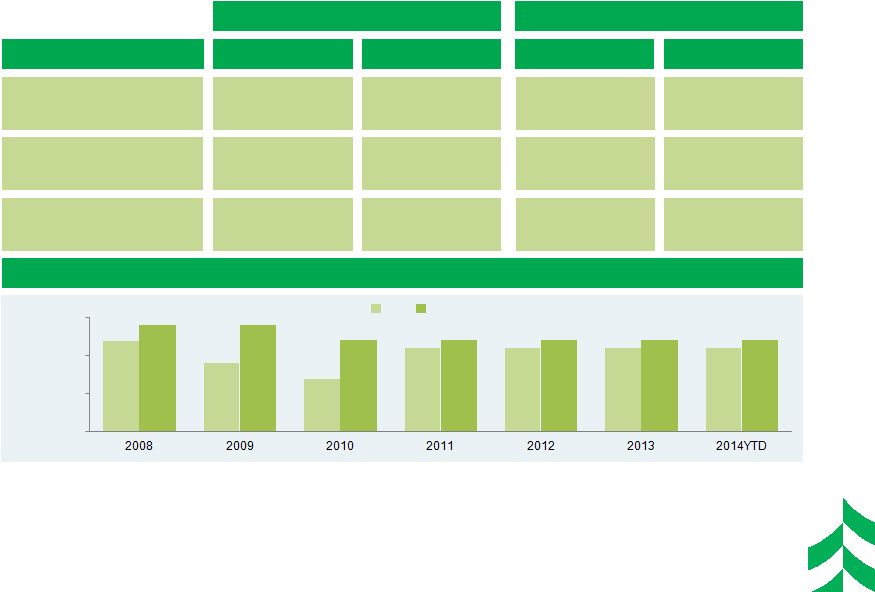

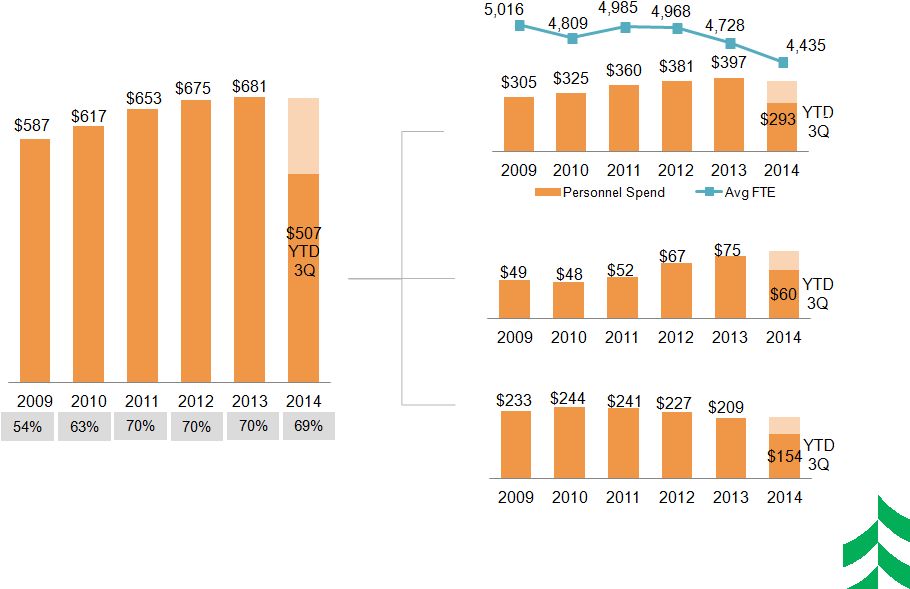

NONINTEREST EXPENSE TRENDS

($ IN MILLIONS)

Technology

Spend

Total Noninterest Expense

Other Non-Personnel Spend

Personnel Spend / FTE

Trend

1

–

Efficiency

ratio

=

Noninterest

expense,

excluding

other

intangible

amortization,

divided

by

sum

of

taxable

equivalent

net

interest

income

plus

noninterest

income,

excluding

investment

securities

gains/losses,

net,

and

asset

gains/losses,

net.

This

is

a

non-GAAP

financial

measure.

Please

refer

to

the

appendix

for

a

reconciliation

of

this

measure.

2

–

FTE

= Average Full Time Equivalent Employees

3

–

Technology

Spend

=

Technology

and

Equipment

expenses

4

–

Other

Non-Personnel

Spend

=

Total

Noninterest

Expense

less

Personnel

and

Technology

spend

Efficiency Ratio

33

1

4

3

2

*

* |

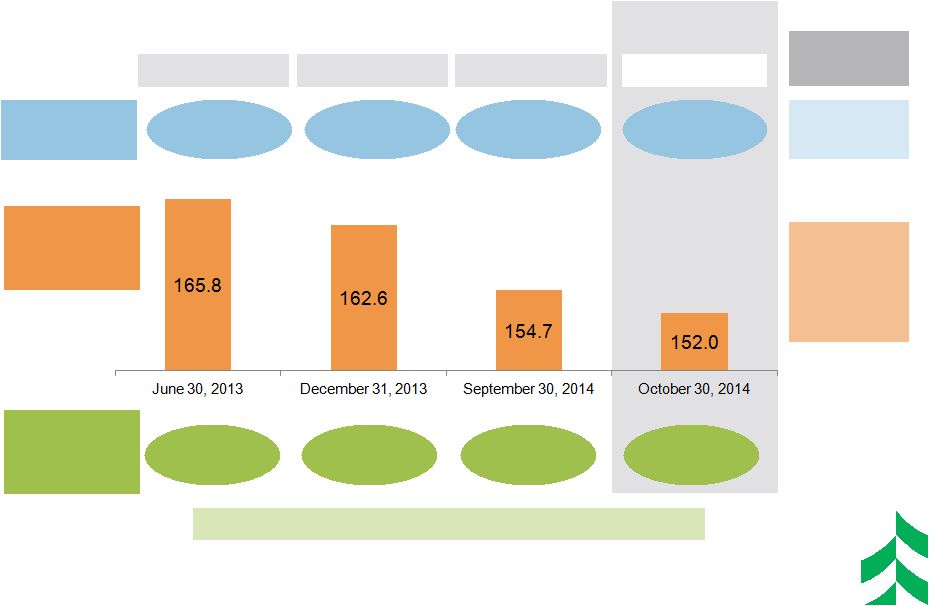

DISCIPLINED CAPITAL DEPLOYMENT

Jan –Jun 2013

Jul –Dec 2013

Jan –Sep 2014

Oct 2014

$60 mm

$60 mm

$159 mm

$50 mm

11.49%

11.46%

10.39%

9.93%

1

Estimated pro forma calculation; Basel I ratio calculation;

Shares repurchased

since end of 2012. Shares Outstanding on 12/31/2012 were 169.3 million.

•

ASBC

Basel

III

Tier

1

Common

Ratio

Goal

=

8

–

9.5%

$329 mm

Repurchased

19.4 mm

Shares

Repurchased

2013-2014

YTD Totals

$ Repurchased

Shares

Outstanding,

end of period

(in Millions)

Tier 1 Common

Ratio

34

2

3

1

2

3

Recent

Transactions

*

* |