Attached files

| file | filename |

|---|---|

| 10-Q - FORM 10-Q - POTASH CORP OF SASKATCHEWAN INC | d800670d10q.htm |

| EX-31.A - EXHIBIT 31(A) - POTASH CORP OF SASKATCHEWAN INC | d800670dex31a.htm |

| EX-31.B - EXHIBIT 31(B) - POTASH CORP OF SASKATCHEWAN INC | d800670dex31b.htm |

| EX-32 - EXHIBIT 32 - POTASH CORP OF SASKATCHEWAN INC | d800670dex32.htm |

| EX-95 - EXHIBIT 95 - POTASH CORP OF SASKATCHEWAN INC | d800670dex95.htm |

| 10-Q - FORM 10-Q COURTESY PDF - POTASH CORP OF SASKATCHEWAN INC | d800670d10q1.pdf |

Exhibit 10(nn)

EXECUTIVE EMPLOYMENT AGREEMENT

THIS AGREEMENT is dated the 1st day of July, 2014.

BETWEEN:

Potash Corporation of Saskatchewan Inc. (the “Corporation”)

- and -

Jochen E. Tilk (the “Executive”)

WHEREAS the Corporation wishes to employ the Executive and the Executive wishes to be employed by the Corporation as the Chief Executive Officer of the Corporation;

AND WHEREAS the Corporation and the Executive have agreed that the employment of the Executive by the Corporation will be in accordance with the provisions of this Agreement and the Conditional Offer of Employment dated April 5, 2014 (the “Offer”) which is attached hereto as Schedule “A” and hereby incorporated into this Agreement;

NOW THEREFORE, THIS AGREEMENT WITNESSETH that in consideration of the mutual covenants herein contained and for other good and valuable consideration, the parties hereto agree as follows:

| 1. | EMPLOYMENT |

1.1 Subject to the terms and conditions set out in this Agreement, the Corporation shall employ the Executive as the Chief Executive Officer of the Corporation. The Executive shall report to the Corporation’s Board of Directors.

1.2 This Agreement and the employment of the Executive in accordance herewith shall be for an indefinite period and may be terminated by the Executive or the Corporation in accordance with the terms of this Agreement.

1.3 The Executive agrees to perform the duties and responsibilities which are normally associated with the position of Chief Executive Officer, in addition to carrying out such other duties and responsibilities which are assigned to him from time to time by the Board of Directors. The Executive shall perform his duties and responsibilities diligently and in good faith, using his energy, skill and best efforts to further the business and interests of the Corporation.

1.4 The Executive shall at all times comply with all applicable laws and regulations, and all of the Corporation’s policies and procedures, including but not limited to the Core Values and Code of Conduct, the Respect in the Workplace Policy, and the Employee Handbook for Saskatoon Corporate Employees. In the event any of the Corporation’s policies are in conflict with this Agreement, this Agreement shall govern.

1.5 The Executive agrees to relocate to and become a resident of the City of Saskatoon and make his best efforts to actively participate in the Saskatoon community during the term of his employment with the Corporation.

1.6 The Executive agrees that prior to accepting any directorship, advisory role or other similar role with another company (except an associate or affiliate of the Corporation), the Executive shall obtain the written consent of the Corporation. Any such role with outside corporations shall not conflict with or impair the performance of the Executive’s duties and responsibilities as set out in this Agreement.

1

1.7 The Executive agrees that he shall, no later than July 1, 2019, own stock of the Corporation valued at no less than five (5) times his then-current annual salary. Vested Restricted Share Units, Deferred Share Units and earned but unvested share units shall be considered stock for the purposes of this requirement as described in the Offer.

1.8 The position of Chief Executive Officer of the Corporation is considered a safety-sensitive position and accordingly the Executive shall complete a controlled substance test in accordance with the Corporation’s applicable policies.

| 2. | REMUNERATION AND BENEFITS |

2.1 In consideration for performance of his duties and responsibilities as set out herein, the Corporation shall pay the Executive the salary as described in the Offer. The Executive shall also be entitled to participate in the Corporation’s Short-Term Incentive Plan and in the Multi-Year Incentive Plan for the Executive as described in the Offer. The specific terms of the Multi-Year Incentive Plan, shall be established in accordance with the Offer.

2.2 The Executive shall also be entitled to participate in the Corporation’s PCS Inc. Pension Plan, and either a new supplemental defined contribution pension plan or the Corporation’s Supplemental Executive Retirement Income plan as set out in the Offer.

2.3 The Executive shall also be entitled to participate in all executive healthcare benefits that the Corporation provides, including an annual executive physical examination at a Canadian facility, as set out in the Offer. The Executive is entitled to reimbursement for relocation expenses in accordance with the Global Relocation Policy.

2.4 The Executive shall be entitled to five (5) weeks’ paid vacation on an annual basis, which will be pro-rated for 2014.

2.5 An assigned underground parking space is available to the Executive, the cost of which shall be shared by the Executive and the Corporation in accordance with the Corporation’s Parking Policy. The Parking Policy and the cost of the Executive’s parking space are subject to change by the Corporation and the third party vendor from which the space is leased.

2.6 The Corporation wishes to keep the Executive “whole” from a Canadian income tax perspective, and therefore agrees to indemnify the Executive against any United States federal and state income tax that may arise as a result of the Executive performing or exercising his duties and responsibilities in the United States. The parties agree that the indemnity shall apply only to the extent that the Executive’s United States federal and state income tax exceeds the amount of any Canadian federal and provincial foreign income tax credit (deduction) the Executive receives or is entitled to receive in Canada in respect of such United States federal or state income tax.

| 3. | TERMINATION |

In addition to the terms set out in the Offer, the following terms apply to the termination of the Executive’s employment with the Corporation:

| 3.1 | Termination by the Corporation for Just Cause |

3.1.1 The Corporation may terminate the Executive’s employment at any time immediately and without notice, severance or pay in lieu of notice for just cause. Just cause shall include any act or conduct which at law constitutes just cause, including but not limited to:

| (a) | Failure to perform the duties set out in this Agreement; |

2

| (b) | Breach of any of the Corporation’s policies; |

| (c) | Having a negative result on the Executive’s controlled substance test; |

| (d) | Engaging in any conduct that is materially injurious to the Corporation, financially or otherwise; |

| (e) | A breach of any provision in Article 4 of this Agreement and/or the “Non-Competition” section of the Offer; |

| (f) | The conviction of the Executive of an indictable offence; or |

| (g) | Fraud, theft, gross negligence, willful misconduct or lack of good faith by the Executive that relates to or affects the Corporation. |

3.1.2 In the event the Corporation terminates the Executive for just cause, the Corporation shall provide to the Executive a written description of the nature of the just cause.

| 3.2 | Termination by the Corporation without Just Cause |

The Corporation may terminate the Executive’s employment at any time in its absolute discretion for any reason. The terms and conditions applicable to a termination of the Executive without just cause are as set out in the Offer. The severance amounts payable to the Executive shall be paid upon receipt of an executed release from the Executive.

| 3.3 | Change in Control |

3.3.1 For the purposes of this Agreement, “Change in Control” shall include any of the following:

| (a) | Within any period of two consecutive years, individuals who at the beginning of such period constituted the Board of Directors of the Corporation and any new directors whose appointment by the Board or nominated for election by shareholders of the Corporation was approved by a vote of at least a majority of the directors then still in office who either were directors at the beginning of the period or whose appointment or nomination for election was previously so approved, cease for any reason to constitute a majority of the Board; |

| (b) | There occurs an amalgamation, merger, consolidation, wind-up, reorganization or restructuring of the Corporation with or into any other entity, or a similar event or series of such events, other than any such event or series of events which results in securities of the surviving or consolidated corporation representing 50% or more of the combined voting power of the surviving or consolidated corporation’s then outstanding securities entitled to vote in the election of directors of the surviving or consolidated corporation being beneficially owned, directly or indirectly, by the persons who were the holders of the Corporation’s outstanding securities entitled to vote in the election of directors of the Corporation prior to such event or series of events in substantially the same proportions as their ownership immediately prior to such event of the Corporation’s then outstanding securities entitled to vote in the election of the directors of the Corporation; |

| (c) | 50% or more of the fixed assets (based on book value as shown on the most recent available audited annual or unaudited quarterly consolidated financial statements) of the Corporation are sold or otherwise disposed of (by liquidation, dissolution, dividend or otherwise) in one transaction or series of transactions within any twelve month period; |

| (d) | Any party, including persons acting jointly or in concert with that party, becomes (through take-over bid or otherwise) the beneficial owner, directly or indirectly, of securities of the Corporation |

3

| representing 20% or more of the combined voting power of the Corporation’s then outstanding securities entitled to vote in the election of directors of the Corporation, unless in any particular situation the Board determines in advance of such event that such event shall not constitute a change in control; or |

| (e) | There is a public announcement of a transaction that would constitute a change in control under clause (b) (c) or (d) of this section and the Board determines that the change in control resulting from such transaction will be deemed to have occurred as of a specific date earlier than the date under (b) (c) or (d) as applicable. |

3.3.1 For the purposes of this Agreement, “Good Reason” shall include:

| (a) | A substantial diminution in the Executive’s authority, duties, responsibilities or status (including offices, title and reporting requirements) from those in effect immediately prior to the Change in Control; |

| (b) | The Corporation requiring the Executive to be based at a location in excess of eighty (80) kilometers from the location of the Executive’s principal job location or office immediately prior to the Change in Control, except for required travel on Corporation business to an extent substantially consistent with the Executive’s business obligations immediately prior to the Change in Control; |

| (c) | A reduction in the Executive’s base salary, or a substantial reduction in the Executive’s target compensation under any incentive compensation plan, as in effect as of the date of the Change in Control; |

| (d) | A failure by the Corporation to increase the Executive’s base salary in a manner consistent (both as to frequency and percentage increase) with practices in effect immediately prior to the Change in Control or with practices implemented subsequent to the Change in Control with respect to similarly positioned employees; or |

| (e) | A failure by the Corporation to continue in effect the Executive’s participation in the Corporation’s short and long-term incentive plans, stock option plans, and employee benefit and retirement plans, policies or practices at a level substantially similar or superior to and on a basis consistent with the relative levels of participation of other similarly-positioned employees, as existed immediately prior to the Change in Control. |

However, Good Reason shall not include any of the above events occurring with the consent of the Executive.

3.3.2 If a Change in Control of the Corporation occurs which results in a Good Reason, the Executive may, within two (2) years of the effective date of the Change in Control, terminate his employment with the Corporation upon providing written notice to the Corporation within thirty (30) days of the date of the occurrence of the Good Reason which resulted from the Change in Control.

3.3.3 If a Change in Control occurs and either (a) the Corporation terminates the Executive without just cause within two (2) years of the effective date of the Change in Control or (b) the Executive terminates his employment following the occurrence of a Good Reason in accordance with the terms of this Agreement, then the Corporation shall pay to the Executive, upon receipt of an executed release from the Executive, a severance in accordance with the severance provision of the Offer. In addition, if a Change in Control occurs while the Multi-Year Incentive Plan is in effect and before the Restricted Share Units (“RSU’s”) or Deferred Share Units (“DSU’s”) have been earned or vested and either (a) the Corporation terminates the Executive without just cause or (b) the Executive terminates his employment following the occurrence of a Good Reason in accordance with the terms of this Agreement, then the full amount of the units granted or earned will vest as of the date of the Change in Control.

4

| 3.4 | No Duty to Mitigate |

The amounts payable to the Executive pursuant to this section of this Agreement shall not be reduced in the event the Executive secures or does not reasonably pursue alternate employment following the termination of his employment with the Corporation.

| 4. | NON-SOLICITATION AND NON-COMPETITION |

4.1 During the Executive’s employment with the Corporation and for a period of one (1) year after the date of termination of the Executive’s employment if the Executive’s employment is terminated within six (6) months of the date of this Agreement, or for a period of two (2) years after the termination of the Executive’s employment if the Executive’s employment is terminated anytime after six (6) months of the date of this Agreement, the Executive shall not, without the prior written consent of the Corporation, directly or indirectly through any person, agent, employee or representative:

| (a) | Engage in any activity, including without limitation, as an officer, director, employee, principal, manager, agent or consultant for another entity that directly competes or is seeking to compete with the Corporation, any subsidiary or Canpotex Limited in any actual product, service or business activity (or in any product, service or business activity which was under active development while the Executive was employed by the Corporation or a subsidiary if such development is being actively pursued by the Corporation or a subsidiary during the one (1) or two (2) year periods referred to above as applicable) in any territory in which the Corporation, a subsidiary or Canpotex Limited operates, engages in any business activity or sells its products; |

| (b) | Solicit or hire, including without limitation, as an officer, director, employee, principal, manager, agent or consultant for another entity, any individual who was employed by, or provided services as a consultant or contractor to, the Corporation, a subsidiary or Canpotex Limited at any time within the six months immediately preceding such solicitation or hire; or |

| (c) | Disclose to anyone outside of the Corporation or a subsidiary, or use in other than the Corporation’s or a subsidiary’s business, any confidential, proprietary or trade secret information or material relating to the business of the Corporation or its subsidiaries, acquired by the Executive during his employment with the Corporation. For greater certainty, nothing contained herein shall limit the Executive’s ongoing obligations regarding confidentiality that may exist pursuant to any other agreement, policy of the Corporation or by operation of law. |

| 5. | GENERAL |

| 5.1 | Enurement |

This Agreement shall enure to the benefit of and be binding upon the Corporation, its successors and permitted assigns, and the Executive and his personal representatives. Neither the Executive nor the Corporation may assign its rights hereunder to another person without the consent of the other party.

| 5.2 | Entire Agreement |

This Agreement represents the entire agreement between the parties hereto with respect to the employment of the Executive by the Corporation. While the Offer forms part of this Agreement, in the event of any conflict or inconsistency between this Agreement and the Offer, this Agreement shall govern to the extent of any conflict or inconsistency.

5

| 5.3 | Notices |

Any notice required or permitted to be given under this Agreement shall be in writing and shall be properly given if delivered personally, by facsimile, by prepaid courier service or by certified or prepaid registered mail, addressed as follows (or to such other address provided by one party to the other party):

| Executive: | 122 1st Avenue South Suite 500 Saskatoon, Saskatchewan S7K 7G3 | |

| Corporation: | 122 1st Avenue South Suite 500 Saskatoon, Saskatchewan S7K 7G3 Attn: Chair of the Board of Directors | |

| 5.4 | Governing Law and Jurisdiction |

This Agreement shall be governed by and construed in accordance with the laws in force in the Province of Saskatchewan. The Executive and the Corporation each attorn to the exclusive jurisdiction of the courts of Saskatchewan except insofar as a court of another jurisdiction is required to enforce the restrictive covenants outlined in Article 4 herein.

| 5.5 | Counterparts |

This Agreement may be signed in two (2) counterparts, each of which shall be deemed an original and both of which shall together constitute the same instrument.

| 5.6 | Legal Advice |

The Executive acknowledges having had the full opportunity to seek independent legal advice in connection with the negotiation and execution of this Agreement.

IN WITNESS WHEREOF this Agreement has been executed by the parties hereto:

| POTASH CORPORATION OF SASKATCHEWAN INC. | ||

| Per: | /s/ Dallas J. Howe | |

| Chair, Board of Directors | ||

| /s/ Jochen E. Tilk | ||

| Jochen E. Tilk | ||

| /s/ Barb Kennedy | ||

| Witness to Signature of Jochen E. Tilk | ||

| Print Name: | Barb Kennedy |

6

SCHEDULE “A”

POTASH CORPORATION OF SASKATCHEWAN

April 5, 2014

Jochen E. Tilk

via E-mail: jochen.tilk@gmail.com

Dear Jochen:

Re: Conditional Offer of Employment

We are pleased to offer you the position of Chief Executive Officer of Potash Corporation of Saskatchewan Inc. (the “Company”). As discussed, this offer is conditional upon: 1) you relocating to Saskatoon and becoming an active resident and member of the Saskatoon community; 2) the execution of a subsequent executive employment agreement; and 3) the approval of this offer by the Company’s Board of Directors (the “Board”).

The following are the basic terms of your offer of employment which will be set out in a subsequent executive employment agreement:

As the CEO, you will report to the Board. Should you accept this offer, you will commence your employment on July 1, 2014 or such other date as is mutually agreed, for an indefinite period unless terminated in accordance with any executive employment agreement between you and the Company.

Compensation:

Your initial annual base salary will be $1,000,000 CDN (less applicable withholdings and deductions) which will be paid monthly. After December, 2014, you will be eligible for an increase to be effective January 1, 2015 in accordance with Company policies and procedures and based on performance and internal and external equity.

You will be entitled participate in the Company’s short-term incentive program. Your target will be 100% of your salary. Your target will be prorated in 2014 based on your start date and days worked vs. total work days in the calendar year.

You will also be entitled to participate in a Multi-year Incentive program unique to you for the period from your start date through December 31, 2015. This is offered to you in lieu of participation in the Company’s long-term compensation plans and in lieu of receiving a signing bonus or other initial payment.

Further details are set out in the attached Schedule “A”.

Retirement Plan:

You will be entitled to participate in the Company’s base pension plan which is a defined-contribution plan involving employee and Company contributions. In addition, the Company will undertake to provide a

7

new supplemental defined-contribution pension plan that will be competitive with the retirement benefits provided to executives in Canada at the median level. Your benefits under that new plan will include service retroactive to the date your employment commences and at your compensation from that date. If a new plan has not been designed by June 30, 2015, you will be included as a member in the existing defined-benefit Supplemental Executive Retirement Income (SERI) plan effective as of the date of start of employment.

Benefits and Perquisites:

You will be reimbursed (and tax gross up) for all reasonable expenses actually and properly incurred in connection with performing your duties, including reimbursement for companion travel required by the Company for Company business.

You will also be reimbursed for all reasonable moving expenses incurred in accordance with the Company policy.

You will be entitled to participate in all Company benefits provided to its executives, including one executive medical physical per year at a mutually agreed Canadian medical facility.

Stock Ownership:

As the CEO, you will be required to own Company stock valued at five (5) times your annual salary by the completion of five (5) years of employment. Vested Restricted Share Units and Deferred Share Units will be considered stock for this requirement. Earned but unvested units will also be considered for this requirement if you plan to pay the taxes on exercise from other sources.

Change in Control:

Your executive employment agreement will contain a double-trigger change of control provision which shall be mutually agreed upon.

Severance:

If, despite best efforts by all parties, the Board decides that the situation is not working, your employment may be terminated by the Board immediately without just cause and the Company shall provide the following as severance, upon receipt of an executed release:

| (a) | If terminated within six (6) months of the commencement of your employment: |

| • | payment representing (1) year of the then-current base salary plus your target short term incentive bonus; and |

| • | benefits for one (1) year. |

| (b) | If terminated anytime after six (6) months of the commencement of your employment: |

| • | payment of two (2) years’ of the then-current base salary plus your short term incentive bonus (The yearly short-term bonus amount shall be calculated by averaging the amount of short term bonuses received by you in the two years prior to your termination. However, if you are dismissed after six months of employment but before the completion of two years of employment, the yearly bonus amount shall be the target short-term bonus for the purpose of calculating the severance.; and |

| • | benefits for two (2) years. |

8

In the event of termination of your employment by the Company without just cause, you will continue to be under the Company pension and SERI plans or such other pension plan for one year from the date of your termination if you are terminated within six (6) months of the commencement of your employment with the Company; and for two (2) years from the date of your termination if you are terminated anytime after six (6) months of your employment.

To be clear, the above severance is not payable where the Company terminates your employment for just cause or if you resign or retire.

Non-competition:

You agree not to directly or indirectly or in any manner engage in any activities or business that is materially similar to or is competitive with or competes with the Company or any aspect of the business of the Company following the termination of your employment with the Company for any reason, for a period of one (1) year if terminated within six (6) months of your employment; and for a period of two (2) years if terminated anytime after six (6) months of employment.

We look forward to you joining the Company and hope that you will find this position to be both challenging and professionally rewarding.

I look forward to hearing from you

Yours truly,

Dallas Howe

Chair, Board of Directors

Potash Corporation of Saskatchewan Inc.

9

SCHEDULE “A”

Short-Term Incentive

| • | Target of 100% of salary, prorated in 2014 based on start date using days worked vs. total work days in the year. |

| • | Nominal amount of STI dollars will be determined for each year (2014 and 2015) according to the existing STIP that applies to all members of the plan (i.e. the formula and company results will be used to calculate the nominal amount available). |

The percentage of this nominal amount that will actually be paid will be based on performance on goals agreed to in the first twelve weeks after the start date. The following is an illustration of goals and the mechanics:

| Goal Performance |

Goal Rating | |||

| Exceeded above and beyond |

10 | |||

| Met all of goal |

8 | |||

| Met most of goal |

6 | |||

| Fell well short of goal |

4 | |||

| Did not perform goal |

0 | |||

| Goal |

Weighting | Rating | Product | |||||||||

| Goal 1: Residency |

10 | % | 10 | 1.00 | ||||||||

| Goal 2: Leadership Team |

15 | % | 8 | 1.20 | ||||||||

| Goal 3: PCS Knowledge |

20 | % | 8 | 1.60 | ||||||||

| Goal 4: Strategy |

25 | % | 7 | 1.75 | ||||||||

| Goal 5: Messaging |

15 | % | 6 | 0.90 | ||||||||

| Goal 6: Compensation Plans |

15 | % | 8 | 1.20 | ||||||||

| Totals |

100 | % | 7.65 | |||||||||

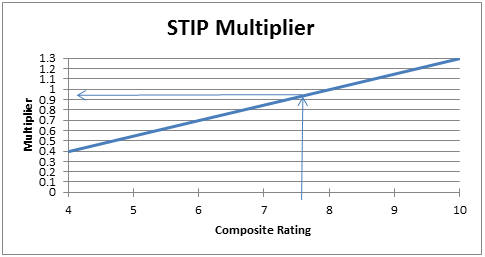

A composite STI goal performance of 7.65 would earn 94.75% of the nominal amount.

10

Multi-Year Incentive

| • | In lieu of participation in the company’s long-term compensation plans and in lieu of a signing bonus or other initial payment, the following relatively simple compensation plan will be used for the period through December 21, 2015. |

| • | This plan is based on full-value stock units (Restricted Stock Units (RSUs) or Deferred Share Units (DSUs) as selected by the CEO prior to employment). The units will vest in three years from the grant date and will be subject to a performance period from the start date to December 31, 2015 with the number of units vested being based on company performance and individual CEO performance during the performance period. |

| • | The number of RSUs granted will be the number that would equal $7.5 million using the average price of PotashCorp stock on the TSX averaged over the 20 trading days prior to the employment start date For results at the top award level (Level A), the full amount will be earned. For results at the lower award level (Level B), 70% of the units will be earned. If performance falls below the threshold, no units will be earned. In all cases, vesting will take place at the end of three full years of employment. |

| • | Company performance would represent 50% of the evaluation and individual performance would represent 50%. |

| • | Company performance will be focused on important internal metrics that can be influenced in the first 18 months with the company. No amount would be earned if the metrics are below the 2013 baseline. |

| • | The metrics to assess company performance will be established within the first twelve weeks after the start date. The following internal metrics are used for illustration of the mechanics. All comparisons are to 2013 results. (The weightings and % improvement numbers below are also just placeholders.) |

| Metric |

Weighting | Improvement | Vesting | |||||||||

| 0 | % | None | ||||||||||

| Safety, environmental performance |

10 | % | 5 | % | Level B | |||||||

| 10 | %+ | Level A | ||||||||||

| 0 | % | None | ||||||||||

| Gross Margin Improvement over 2013 – Potash |

25 | % | 5 | % | Level B | |||||||

| 10 | %+ | Level A | ||||||||||

| 0 | % | None | ||||||||||

| Gross Margin Improvement over 2013 – Nitrogen |

20 | % | 5 | % | Level B | |||||||

| 0 | %+ | Level A | ||||||||||

| 0 | % | None | ||||||||||

| Gross Margin Improvement over 2013 – Phosphate |

20 | % | 5 | % | Level B | |||||||

| 10 | %+ | Level A | ||||||||||

| 0 | % | None | ||||||||||

| Conversion of Net Income to Cash |

25 | % | 5 | % | Level B | |||||||

| 10 | %+ | Level A | ||||||||||

| • | Interpolation between vesting percentages will be done using the judgment of the Compensation Committee at the end of the performance period. |

| • | The assessment of individual performance under this plan will be based on specific performance objectives established within the first twelve weeks after the start date. The following are examples to demonstrate the mechanics: |

| • | With the senior leadership team and the Board of Directors, develop a multi-year strategy by the end of 2015 that has been approved by all. |

| • | Develop corporate compensation plans linked to the strategy for use in 2016 and beyond. |

| • | Establish and implement an effective operational excellence plan. |

11

| • | Become familiar with the key players in the industry, the governments of influence and the community of Saskatoon and become involved in significant activities in all three areas. |

| • | The individual performance will be assessed in the same way as it was under the STI plan that is by weighting the goals and assigning a numerical rating. An overall rating of 10 on the objectives would earn 100% of the eligible units (Level A) and an overall rating on the objectives of 6 would earn 70% of the eligible units (Level B). |

| • | The two components – company performance and individual performance – will be added together to result in a number of stock units granted. |

| • | If RSUs are selected for the award, they will be settled in cash. If DSUs are selected, they will be settled in cash when employment is terminated. |

12