Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - ALLTEMP, INC. | f10k2014_ex31iisourcefinan.htm |

| EX-10.24 - TRIPARTITE AGREEMENT - ALLTEMP, INC. | f10k2014ex10xxviii_source.htm |

| EX-31.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - ALLTEMP, INC. | f10k2014_ex31isourcefinan.htm |

| EX-32.2 - CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - ALLTEMP, INC. | f10k2014_ex32iisourcefinan.htm |

| EXCEL - IDEA: XBRL DOCUMENT - ALLTEMP, INC. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - ALLTEMP, INC. | f10k2014_ex32isourcefinan.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2014

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number 000-55122

SOURCE FINANCIAL, INC.

(Exact name of registrant as specified in its charter).

| Delaware | 80-0142655 | |

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) | |

Level6/97 Pacific Highway North Sydney NSW 2060 Australia |

||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +61 2 8907-2500

Securities registered under Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| None | None |

Securities registered under Section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

Non-accelerated filer (Do not check if a smaller reporting company) |

☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity of the registrant held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter ended December 31, 2013 was $5,870,162.

As of October 7, 2014, the registrant had outstanding 7,671,632 shares of common stock.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions, and uncertainties that could cause actual results to differ materially from those expressed in them. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors more fully described in Item 1A of this Report under the caption “Risk Factors” and elsewhere in this Report, including the exhibits hereto.

All forward-looking statements are necessarily only estimates of future results, and actual results may differ materially from expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates, or expectations contemplated by us will be achieved. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. There are important factors that could cause our actual results, level of activity, performance, or achievements to differ materially from the results, level of activity, performance, or achievements expressed or implied by the forward-looking statements, including, but not limited to, statements regarding (i) our asset growth and sources of funding; (ii) our expansion into different consumer segments; (iii) our financing plans; (iv) the impact of regulations on us; (v) our exposure to market risks, including interest rate risk and equity price risk; (vi) our exposure to credit risks, including credit default risk and settlement risk; (vii) our competition; (viii) our projected capital expenditures; (ix) our capitalization requirements and level of reserves; (x) our liquidity; (xi) trends affecting the economy generally; and (xii) trends affecting our financial condition and our results of operations. Examples of these important factors, in addition to those discussed elsewhere in this Report, that could cause our actual results to differ substantially from those anticipated in our forward-looking statements, include, among others:

| ● | Adverse economic conditions in the United States, Australia and worldwide may negatively impact our results; | |

| ● | Our business could suffer if our access to funding is reduced | |

| ● | We face significant risks implementing our growth strategy, some of which are outside our control | |

| ● | Our financial condition, liquidity, and results of operations depend on the credit performance of our loans | |

| ● | Loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business; and | |

| ● | We operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business |

You are, therefore, cautioned not to place undue reliance on such statements which should be read in conjunction with the other cautionary statements that are included elsewhere in this Report. Any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. You are advised, however, to consult any additional disclosures we make in our reports filed with the Securities and Exchange Commission (“SEC”). This discussion is provided as permitted by the Private Securities Litigation Reform Act of 1995.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this Report only:

| ● | “AUD” or “AU Dollar” refer to the legal currency of Australia | |

| ● | “Source,” “Company,” “we,” “us,” and “our” refer to the combined businesses of Source Financial, Inc., a Delaware corporation, and its subsidiaries, Moneytech Limited, an Australian company (“Moneytech”) and its subsidiaries. For all periods prior to June 30, 2013, the date of the Moneytech Acquisition, these terms refer to Source Financial, Inc., and its predecessors and their respective consolidated subsidiaries | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended | |

| ● | “SEC” refers to the Securities and Exchange Commission | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended | |

| ● | “Series B Shares” refers to the Company’s Series B Preferred Stock; and | |

| ● | “U.S. dollars,” “dollars”, “USD” and “$” refer to the legal currency of the United States |

All share and per share information in this Report gives effect to a 1-for 100 reverse stock split of our common stock that became effective on March 21, 2013.

| ii |

Acquisition of Moneytech Limited

Share Exchange

On June 30, 2013, Source Financial, Inc. (formerly known as Wiki Group, Inc.) acquired all of the outstanding shares of Moneytech Limited, an Australian company (“Moneytech”) pursuant to a Share Exchange Agreement dated May 30, 2013 (the “Exchange Agreement”) we entered into with Moneytech, Marco Garibaldi (“Garibaldi”), Edward DeFeudis (“DeFeudis”) and Hugh Evans (“Evans”), individually as the beneficial owner of approximately 39.75% of the outstanding shares of Moneytech and on behalf of the other 49 shareholders of Moneytech (the “Moneytech Shareholders”), in exchange, for 5,300,000 shares of our common stock (the “Share Exchange”). As a result of the Share Exchange, Moneytech became a wholly-owned subsidiary of our company, with the Moneytech Shareholders owning in excess of 50% of our outstanding shares on a fully diluted basis.

Issuance of Series B Shares

In connection with our acquisition of Moneytech, we issued 5,000 shares of our Series B Preferred Stock to Hugh Evans, the Chairman and Managing Director of Moneytech. The holder of the Series B Shares has the right, until June 30, 2018, to (A) elect the majority of our Board of Directors and (B) vote on all other matters presented to the holders of common stock (the “Common Shareholders”), with each Series B Share having a number of votes equal to 1,000 shares of common stock. After June 30, 2018, the Series B Shares will have no voting rights and we will have the right to purchase the Series B Shares at a per share price equal to one tenth of a cent ($0.001). Thus, as the holder of the Series B Shares, Mr. Evans will be able to elect a majority of our Board of Directors until June 30, 2018, and as the holder of approximately 55.25% of our outstanding voting shares, Mr. Evans has effective control over our business, including matters requiring the approval of our stockholders, such as the approval of significant corporate transactions.

As a result of the consummation of the Share Exchange Agreement, the shareholders of Moneytech in combination with Hugh Evans, became our controlling stockholders. Consequently, the Share Exchange has been accounted for as a recapitalization of Moneytech effected by a share exchange in which for accounting and financial reporting purposes Moneytech is considered the acquirer. Consequently, the historical consolidated financial statements of Moneytech are now our historical financial statements, and the assets and liabilities of Source as of June 30, 2013, have been brought forward at their book value and no goodwill has been recognized.

Escrow Arrangement Concerning WikiTechnologies and Attainment of Financial Benchmarks

In connection with the Share Exchange, Garibaldi, our former Chairman and Chief Technology Officer, deposited in escrow 1,120,000 shares of our common stock (the “Garibaldi Shares”) and DeFeudis, our former President, Chief Executive Officer and Chief Financial Officer, deposited in escrow 1,120,000 shares of our common stock (the “DeFeudis Shares,” together with the Garibaldi Shares, the “GD Escrow Shares”), and we deposited in escrow all outstanding shares of the common stock of WikiTechnologies, Inc. (the “WikiTechnologies Escrow Shares,” and together with the GD Escrow Shares, the “Escrow Shares”).

During the term of the Escrow Agreement, the operations of WikiTechnologies, Inc. (“WTI”) were to be directed by Garibaldi and DeFeudis. If during the twelve-month period commencing July 1, 2013 (the “Escrow Period”), WTI achieved revenues of $4.2 million, a gross profit percentage of 25% and broke even (the “Benchmarks”), the Garibaldi Shares and DeFeudis Shares were to be returned to Garibaldi and DeFeudis and the WikiTechnologies Escrow Shares were to be returned to us.

Prior to the consummation of the Share Exchange, WTI was a technology company dedicated to making financial transactions simple, secure, social and affordable. Its principal product, WikiPay is a simple, low-cost alternative to existing mobile and online payment solutions. WikiPay is a proprietary fee-based mobile Peer-to-Peer payment system that allows mobile and online Peer-to-Peer, Business-to-Consumer, Consumer-to-Business and Business-to-Business payments through its website www.wikipay.com and mobile website m.wikipay.com. WikiPay empowers its users to perform real-time payments, scheduled payments, account inquiries for balance and transaction history, bill payment initiation, notifications and alerts, and transaction security verifications.

Immediately prior to the consummation of the Share Exchange, Source lacked the capital to aggressively market WTI’s services. The growth of WTI’s business was subject to our ability to obtain financing to implement its business plan.

| 1 |

Separation Agreement

On February 11, 2014, we entered into a Separation Agreement with Garibaldi and DeFeudis, pursuant to which (i) the WTI Escrow Shares were delivered to Garibaldi and DeFeudis, as a result of which we no longer own any equity interest in WTI, and (ii) 2,140,000 of the GD Escrow Shares were cancelled, with the remaining 100,000 shares delivered to a noteholder of WTI (the “Noteholder”).

Our Board of Directors authorized the Settlement Agreement based upon an evaluation of the operations of WTI during which it became apparent that without significant additional financing WTI would not be able to generate significant revenues and become profitable, and thus was unlikely to satisfy the financial benchmarks specified in the Share Exchange Agreement by June 30, 2014. Accordingly, our Board of Directors determined that relinquishing our equity interest in WTI on the terms and subject to the conditions set forth in the Settlement Agreement was in the best interests of our company and its stockholders.

In addition, in connection with the Settlement Agreement:

1. Evans and our company executed and delivered releases in favor of each of Garibaldi, DeFeudis and WTI, and each of Garibaldi, DeFeudis and WTI executed and delivered releases in favor of Evans and our company. In its release, WTI indemnified us against any claim that may be made by the Noteholder arising out of the actions of WTI.

2. Our designees serving on the Board of Directors of WTI delivered their resignations as directors of WTI.

3. WTI executed and delivered an agreement granting us a right to acquire its technologies in the event WTI commences a voluntary case or proceeding under any applicable bankruptcy, insolvency, reorganization or other similar law or any other case or proceeding whereby it could be adjudicated a bankrupt or insolvent, or consents to the entry of a decree or order for relief in respect of an involuntary case or proceeding under any applicable bankruptcy, insolvency, reorganization or other similar law or to the commencement of any bankruptcy or insolvency case or proceeding against it, or the filing by WTI of a petition or answer or consent seeking reorganization or relief under any such applicable law, or the consent by WTI to the filing of such petition or to the appointment of or the taking possession by a custodian, receiver, liquidator, assignee, trustee, sequestrator or other similar official of WTI or of any substantial part of its property, or the making by WTI of an assignment for the benefit of creditors, or the taking of action by WTI in furtherance of any such action.

As a result of the consummation of the Separation Agreement we no longer have an interest in WikiTechnologies and conduct no operations in the United States. Inasmuch as the assets and operations of WikiTechnologies were never transferred to us or one of our subsidiaries, we will derive no ongoing benefit from having owned WikiTechnologies, nor will we have any obligation for its past or future liabilities.

Corporate History

Source Financial, Inc., formerly known as Wiki Group, Inc., was incorporated on June 24, 1988 under the laws of the State of Delaware under the name Windsor Capital Corp.

In February 2008, we became an Internet person-to-person lending service as a result of our acquisition from Spider Investments, LLC, of all right, title and interest in and to www.swapadebt.com, a person-to-person lending website, in consideration for shares of our common stock. At the time of the acquisition, Edward DeFeudis was our Chairman, President and CEO, and was a principal in and the managing member of Spider. In connection with the acquisition, we also issued shares of our common stock to a company owned by Marco Garibaldi for services rendered and to be rendered by Mr. Garibaldi. As a result of the transaction, Mr. DeFeudis was the beneficial owner of shares representing approximately 49.8% of our then outstanding common stock, and Mr. Garibaldi was the beneficial owner of shares representing approximately 30.3% of our then outstanding common stock.

On May 4, 2011, we authorized a 10 for 1 forward split of our common stock and increased the number of our authorized shares of common stock to 750,000,000. On July 31, 2011, we authorized a 1-for-10 reverse stock split and reduced the number of our authorized shares of common stock to 150,000,000.

On February 10, 2012, pursuant to an Agreement and Plan of Merger (the “Merger Agreement”), we acquired all of the outstanding equity of WikiPay, Inc., in exchange for shares of our Series A Preferred Stock (the “Series A Preferred Shares”) convertible into sixty percent (60%) of our then outstanding shares of common stock on a fully diluted basis. At the time of the acquisition, Mr. Garibaldi, our then Chief Executive Officer, was the Chief Financial Officer and a director of WikiPay and the owner of 37% of the outstanding shares of WikiPay, and Mr. DeFeudis, our then Chairman, Chief Financial Officer and a director of our company, was the Chief Executive Officer and a director of WikiPay and the owner of approximately 35% of the then outstanding shares of WikiPay. Of the shares of Series A Preferred Stock issued pursuant to the Merger Agreement, 37% were issued to Mr. Garibaldi and approximately 35% were issued to Mr. DeFeudis.

| 2 |

On February 6, 2012, we increased the number of our authorized shares of common stock to 250,000,000.

On December 7, 2012 we increased the number of our authorized shares of common stock to 500,000,000.

On March 21, 2013, we effected a 1-for-100 reverse split of our authorized and issued common stock and changed our corporate name to Source Financial, Inc.

On October 3, 2013, we amended and restated our certificate of incorporation to decrease the number of our authorized shares of common stock and preferred stock to 50,000,000 and 1,000,000, respectively.

On June 30, 2013, we consummated the Exchange Agreement whereby Moneytech became a wholly-owned subsidiary of our company and the Moneytech Shareholders acquired in excess of 50% of our outstanding shares on a fully diluted basis.

On February 14, 2014, pursuant to the Settlement Agreement, we relinquished our ownership interest in WikiTechnologies.

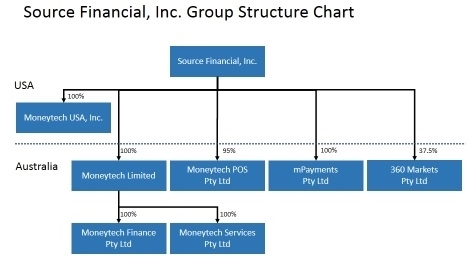

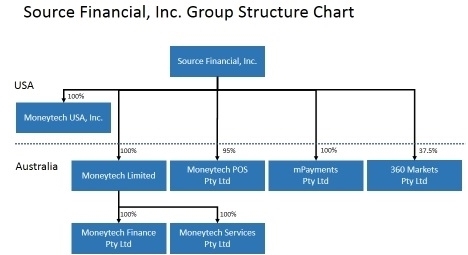

The following chart reflects our current organizational structure:

Our principal executive offices are located at Level 6/97 Pacific Highway, North Sydney NSW 2060, Australia, and our telephone number is +61 2 8907-2500. Our Internet address is www.sourcefinancial.com. Information on, or accessible through, our website is not part of this report.

Operational Overview

We provide commercial asset based lending, including accounts receivable, trade financing and other financial, services to small to medium sized businesses and individuals in Australia through Moneytech and its subsidiaries, with a focus on utilizing leading edge technology to deliver these services.

Moneytech commenced operations in 2003 as an Australian based, technology driven, commercial finance company. Moneytech has an AUD$50 million securitized wholesale debt facility (the “Wholesale Facility,” “Receivables Purchase Agreement” or “RPA”) with the structured finance division of Westpac banking Corporation (“Westpac”), one of the four leading Australian banks. Moneytech uses the Wholesale Facility to offer asset based, trade finance or accounts receivable finance and working capital solutions to small and medium enterprises (‘SME’s’) throughout Australia. Moneytech has built a portfolio of more than 5,000 high-quality business customers with its existing range of financing solutions and has experienced strong organic growth since inception.

| 3 |

To distinguish itself from traditional asset based lenders, and to manage and facilitate the advance of money to its customers, Moneytech has developed, operates and maintains its own real time core money transfer platform called The Moneytech Exchange. The Moneytech Exchange stores and tracks every invoice and payment entered into the system and automatically communicates with the major Australian transactional banks to settle thousands of transactions per day, in real time. The Moneytech Exchange is fully automated, real time and online. Human intervention only occurs to manage exceptions and provide necessary transaction approvals or authorizations. The Moneytech Exchange provides significant benefits over traditional non-technology based systems such as:

| ● | Simple, secure two factor authenticated login to initiate transactions through the web | |

| ● | Automatic processing up to pre-approved limits | |

| ● | Same day settlement for all transactions | |

| ● | Real-time reporting for all parties to each transaction, allowing for easy record keeping, reconciliation and auditing; and | |

| ● | Parameters can be assigned to each transaction to vary the cost, settlement timeframe and interest rate, depending on the industry, product, payment terms or any other criteria. |

Moneytech has invested approximately AUD$10 million developing this banking platform technology, including approximately AUD$1,376,613, AUD$1,161,340 and AUD$873,685 in the fiscal years ended June 30, 2014, 2013 and 2012, respectively, and continues to invest in research and development to expand and improve its technology and product suite to maintain and further its competitive position.

Although the Moneytech Exchange was developed in conjunction with our commercial asset based lending business, it can be used to provide a variety of money transfer services and we are in the process of allowing the public to access the Moneytech Exchange to effect money transfers. In addition, Moneytech holds an Australian Financial Services License, or AFSL and is a BPAY Authorized PIM (“Bill Pay” “Payment Institution Member”). As a BPAY PIM Moneytech is authorized by BPAY, Australia’s leading bill payment service accepted by all the major Australian banks, to manage stored value accounts for BPAY customers. As the holder of an AFSL, Moneytech is allowed to issue Non Cash Payment Products (which includes Visa cards, gift and prepaid cards, loyalty rewards program cards) for the benefit of its business partners. As an AFSL holder, Moneytech is also authorized to operate a financial services business in Australia and it currently provides advice regarding foreign exchange contracts and derivatives, deals in foreign exchange contracts and derivatives and makes a market in foreign exchange contracts and derivatives.

For the fiscal years ended June 30, 2014, 2013 and 2012 receivables financing accounted for approximately 89%, 87% and 85%, respectively, of total revenue, and payment services accounted for approximately 9%, 11% and 11%, respectively, of total revenue.

We are seeking financing to expand Moneytech’s asset based credit solutions operations in Australia through a combination of organic growth and strategic acquisitions and we are considering introducing those operations in the United States, most likely through a strategic acquisition. As of the date of this Report, we do not have any understandings, commitments or agreements with respect to any acquisitions. See “Business Strategy.”

Our Services – Provision of Capital

Credit Express

Moneytech offers two products which provide small and medium sized businesses with access to capital – Credit Express and Confirmed Capital. The underwriting criteria, fee structure and approval process for both of these products is discussed below.

Credit Express offers approved businesses, including retailers, resellers, wholesalers and manufacturers (“Buyers” or “Sellers”), commercial lines of credit and provides them access to the Moneytech Exchange. The Moneytech Exchange allows pre-approved Buyers and Sellers to automatically access financing up to pre-approved limits when a Buyer purchases inventory from a Seller. Moneytech’s client may be either the Buyer or Seller, depending upon which party requests the financing and only the party which requests the financing needs to be pre-approved.

Each transaction is conducted electronically and is based on predetermined criteria to ensure that the Moneytech receivable is acceptable to the provider of its Wholesale Facility. By utilizing Credit Express:

| ● | Buyers are able to fund the purchase of inventory with Moneytech delivering the proceeds directly to the Seller’s bank account; or | |

| ● | Sellers can fund working capital without having to wait for Buyers to pay invoices. After paying the Seller directly for the goods, Moneytech assumes the risk and collects the money from the Buyer, relieving the Seller of collection costs and cash flow challenges. |

| 4 |

Confirmed Capital

Confirmed Capital is unique because of its accounts receivable/asset based financing capability in that Moneytech funds 100% of the face amount of invoices on the day each transaction is conducted. This is more flexible than other accounts receivable financiers who typically provide a maximum of 80% of the invoice value and release funds periodically. Moneytech’s “Moneytech Exchange” stores every invoice and payment entered into the system and automatically communicates with the major Australian banks per day. This enables Moneytech to check the status of each customer’s account automatically, facilitating additional advances and enabling Moneytech to receive alerts advising it as to which customers are in default. This ease of access decreases Moneytech’s risk of loss by allowing it to automatically monitor thousands of clients and increases its efficiency.

For both Credit Express and Confirmed Capital, customers have agreed repayment terms (which may include an interest free period) for repayment of the amount advanced by Moneytech. In addition to an ownership or security interest in the goods which are the subject of a transaction or an interest in the receivable, Moneytech often secures the credit provided by having its customer grant liens on all or a portion of its assets, or by providing personal guarantees. Moneytech generates profits by charging an interest on the amounts funded above its own cost of funds and by charging service fees on transactions and account management fees. To the maximum extent possible Moneytech seeks to pass along to its customers at a mark-up, every fee incurred by it under the Wholesale Facility. Further, if the Wholesale Facility requires that Moneytech deposit funds to secure its lender, it requires its customers to fund such deposits.

Fee Structure

Moneytech has two primary ways of charging fees to clients for Credit Express and Confirmed Capital:

| (a) | Moneytech charges an interest rate on amounts outstanding in excess of the rate incurred by Moneytech’s to access its funds; and |

| (b) | Moneytech charges an initial transaction fee when a customer is accepted and seeks to charge a fee for performing each transaction, calculated as either a percentage of the transaction value or a fixed amount, or a combination of the two, but in all events in excess of the corresponding fee charged Moneytech by its lender. |

The actual fees charged to clients on an ongoing basis are usually a combination of the above, but depending on the terms of the facility may be limited to only an interest rate or only a fee for conducting the transaction.

Pre-Approval Process

Customers seeking access to either Confirmed Capital or Credit Express are required to complete an application on-line or manually downloaded from the Moneytech Exchange and furnish financial and other information concerning the applicant, all of which is input and stored on the Moneytech Exchange. The application contains terms and conditions which applicants must review and acknowledge.

Moneytech assesses the creditworthiness of each applicant using on-line verification services and in certain instances third party sources, and regularly reviews and conducts audits of customer accounts.

Where a customer displays a good credit history, Moneytech may offer an increased credit limit. In such cases, Moneytech will issue the account holder a letter of acceptance subject to acceptance by the account holder. The letter of acceptance states that in the event the offer is accepted, the account holder shall remain subject to the terms and conditions of the original Buyer Account Application form and Moneytech Buyer Terms and Conditions. This ensures that Moneytech is in a position to reduce the credit limit or put the account on hold in the event of default.

Underwriting Standards

When a new Business Account is opened, a credit limit must be established for all authorized Account members/users. This is achieved by assessing each applicant’s personal circumstances. Determination of individual credit limits are based on the assessment criteria described in Moneytech’s Statement of Credit Policy. The criteria are both qualitative and quantitative, and include but are not limited to: current and historic financial performance of the business based on assessment of its income statement and balance sheet, the net asset position of any individuals or entities providing guarantees in support of the application, the tenure of the business, the industry in which the business operates, and credit reports from reporting agencies on both the applicant and the principals or proprietors of the applicant.

| 5 |

No credit limit must be set above that which this Credit Policy allows unless the Credit and Risk Committee approve it. The Managing Director reserves the right to veto such approval. Generally speaking, unless the benefits associated with the proposed Credit Limit significantly outweigh the risks involved, no such limit increases will be approved. For credit limits not in excess of $50,000, the approval of the designated money manager and Moneytech’s national credit manager are required; for credit limits in excess of $50,000 to $150,000, the approval of the money manager and one member of Moneytech’s Credit and Risk Committee is required; and for credit limits in excess of $150,000, the approval of the money manager, two members of Moneytech’s Credit and Risk Committee and Moneytech’s insurer is required.

There is a constant review process where the credit limits of existing customers are re-assessed based on need and application by individual Accounts. The credit limit re-assessment process is critical to ensuring customer growth within the confines of our commercial risk framework. Accounts that change adversely against their original risk category must be reassessed and adjusted with reference to the account holder’s circumstances and the then current assessment criteria.

The Moneytech Exchange prevents customers from exceeding their credit limits except where the account is delinquent or when interest or fees and charges are added to the account balance.

Collateral

Moneytech routinely obtains liens on customer assets and also requires personal guarantees (other than public companies) which often are secured by liens on individuals’ assets.

Profitability

Profitability for the account of any customer is determined by measuring the difference between Moneytech’s revenue derived from the transaction fees or interest rates charged to the customer and the interest rates and fees charged by Moneytech’s senior debt provider to it. Moneytech internally targets a gross profit margin of 50% using these measures. Facilities may have a higher or lower margin, depending on the amount of risk Moneytech determines (based on its credit and collections policy) is present in the deal. Moneytech will target higher margins where it believes the risk is relatively higher, and will accept lower margins where it has determines that the risk is relatively low.

Recent and Historical Statistics as to Nonpayment

The percentage of delinquent balances in our portfolio was 1.53% and 1.65% as of June 30, 2014 and 2013, respectively. The percentage of delinquent balances in our portfolio averaged 1.77% and 1.87% in the fiscal years ended June 30, 2014 and 2013, respectively. The average collection period in our portfolio decreased from 47 days at the beginning of Fiscal 2013 to 45 days at June 30, 2013 and remained at 45 days at June 30, 2014. Bad debts as a percentage of amount funded was 0.21% and 0.40% in the fiscal years ended June 30, 2013 and 2014, respectively.

Actions Taken in the Event of Nonpayment

In the event of non-payment, a Moneytech staff member will first contact the Buyer to request prompt payment. If a payment or an acceptable payment arrangement is not forthcoming, Moneytech will utilize a collections agent to pursue the debt.

Our Services -- Money Transfers and Payment Solutions; Foreign Exchange

mPayments Pty Ltd – Payment Processing, Point of Sale and Payment Aggregation Solutions

The Moneytech Exchange was initially developed to facilitate the movement and tracking of money against debtor and trade finance facilities. The Moneytech Exchange can be used to allow members of the general public, for a fee, to conduct transactions and disburse funds to multiple beneficiaries in real time particularly where existing transactional banking facilities are not adequate or are cost prohibitive or inefficient. These activities which have yet to produce significant revenues and which will only be profitable if the fees we can charge exceed the associated costs, will be conducted by Moneytech’s subsidiary mPayments Pty Ltd (“mPay”), which Moneytech anticipates will become an additional revenue source as businesses and, potentially individual consumers, seek both efficiencies and a point of difference in making payments.

| 6 |

There are approximately 5,000 newspaper outlets in Australia which, in addition to newspapers and magazines, distribute cigarettes, snacks and similar items. We are currently working with a product and service aggregator, pursuant to an arrangement whereby at the cost of the store operator or service aggregator, the aggregator establishes kiosks in the storefronts of Australian newsagents, in which the software is installed to bring in-store, online and mobile solutions for new financial products and services to be promoted through the news agents in Australia. Moneytech has already installed the software necessary to access its system in kiosks in approximately 250 news agent and other locations. Additionally, over 150 pharmacies access Moneytech’s system electronically every day through the pharmacies’ devices. mPay software has already been installed in 700 taxicabs and riders can use the systems to pay their fares in addition to transferring funds. In excess of 5000 transactions are conducted monthly using its mPay software to pay a bill or transfer money to a third party. Moneytech will continue to seek to install software necessary to access its system in kiosks and transmission devices in other locations where the business owner seeks to provide its customers with the ability to transfer funds or utilize their credit cards. Because the kiosk or associated hardware on which Moneytech’s software is installed, is not controlled by Moneytech, in many instances the hardware is not exclusive to Moneytech and the store owner can choose to offer competing services.

Card Solutions

Moneytech is authorized to distribute Visa and Electronic Funds Transfer at Point of Sale (“eftpos”) Gift and Prepaid Cards. To do this, Moneytech has partnered with an Australian bank and Authorized Deposit taking Institution to deliver Gift and Prepaid Card solutions to the market. Moneytech profits from gift card programs primarily by charging a fee for each card issued and fees for each transaction conducted using the card.

In addition, Moneytech recently applied for and secured its own AFSL allowing it to further develop its financial services business and product suite. Moneytech now has the ability to issue Non Cash Payment Products (which includes gift and prepaid cards, loyalty and rewards programs) in its own right for the benefit of its business partners. As an example, in 2012, Moneytech was engaged by a major computer reseller to manage and distribute a Gift Card cash back rewards program. The customers were offered a Gift Card as an incentive for purchasing certain laptops. This program resulted in the issuance and distribution of over 30,000 Gift Cards in a six month period.

Moneytech’s mPay and Card Solutions businesses are not currently producing significant amount of revenues. As these are service businesses, they do not have the credit risk associated with Credit Express and Confirmed Capital. Moneytech will earn a fee on all cards issued as part of a Card Solutions Program or each transmission of funds utilizing mPay.

Moneytech will seek to expand its Card Solutions business by soliciting manufacturers, distributors and retailers interested in giving consumers gift cards as an inducement for their patronage.

360 Markets Pty Ltd: Foreign Exchange Services

As the holder of an Australian Financial Services License, or AFSL, Moneytech Limited is authorized to operate a financial services business in Australia. The license authorizes the provision of financial product advice in foreign exchange contracts and derivatives, dealing in foreign exchange contracts and derivatives and making a market in foreign exchange contracts and derivatives. Moneytech Limited is not authorized to use the term ‘Broker’ by its AFSL and is not a participant member of a licensed market that covers dealings in securities (e.g. Australian Securities Exchange) or derivatives (e.g. Sydney Futures Exchange).

To facilitate the development of a foreign exchange business, 360 Markets Pty. Limited (“360 Markets”) was founded in 2010 in conjunction with a senior foreign exchange dealer previously employed by the Commonwealth Bank of Australia, the largest Australian commercial bank. At the time 360 Markets was founded, Moneytech acquired a 37.5% interest therein. The balance of the equity in 360 Markets was acquired by the individual responsible for its activities. Further, Moneytech granted 360 Markets a sublicense to engage in foreign exchange transactions in Australia as an Authorized Representative of Moneytech and entered into an agreement with 360 Markets whereby Moneytech will receive a commission on revenues generated by 360 Markets for services it provides to parties referred by Moneytech and Moneytech will pay 360 Markets a commission for services Moneytech provides for clients referred by Moneytech. The amount of such referral fees is determined by negotiation between Moneytech and the individual who owns the balance of the equity in 360 Markets and is generally based on the gross margin anticipated to be generated. Thus, Moneytech will profit from the activities of 360 Markets through the receipt of referral fees and as the holder of an equity interest therein. Moneytech intends to offer the services of 360 Markets to those of its customers that engage in international transactions and have the need to purchase currencies other than Australian dollars.

360 Markets derives its revenue predominantly by buying and selling different currencies for its customers and charging prices in excess of those paid to the two major financial institutions from which it acquires currencies. The “spread” charged on a particular transaction is based on various factors, including, among others, the size of the transaction and the significance of the customer relationship. 360 Markets will receive orders to buy or sell currencies at market plus an agreed spread or by quotation. For orders where it quotes a price, it mitigates its foreign exchange risk by executing the transaction with its supplier as soon after the order is received as is practical and by quoting a spread that is sufficiently large to cover movements in the price during the period the quote is open. 360 Markets also offers its customers the ability to buy and sell exchange traded foreign exchange derivatives which it sources from the same suppliers it uses for its spot foreign exchange transactions. These are transacted on similar terms to the foreign exchange spot transactions and currently form a minor part of its business. 360 Markets does not take any positions in foreign exchange or foreign exchange derivatives as principal other than during the very short quotation period.

| 7 |

During the year ended June 30, 2013 and the year ended June 30, 2014, 360 Markets generated revenues of $175,275 and $381,825, respectively.

Business Strategy

In Australia, the banking environment is dominated by the “Big Four” Australian banks --- Commonwealth Bank of Australia (CBA), National Australia Bank (NAB), Australia and New Zealand Banking Group (ANZ) and Westpac. This oligopoly has resulted in a particularly risk averse and high priced lending environment, and many viable Australian business are limited in both their access to capital and their options for obtaining business loans. The SME space is especially under-serviced in this regard. This represents an opportunity for non-bank lenders, such as Moneytech, to target both high growth and established Small to Medium Enterprises with unique financial solutions, including Confirmed Capital and Credit Express.

Moneytech believes it is in a strong position to capitalize on this opportunity, as:

| 1. | Moneytech’s product offerings (particularly Confirmed Capital and Credit Express) are unique and market leading in that they can finance up to 100% of the value of an individual invoice and track the details of each transaction in real time utilizing Moneytech’s proprietary Moneytech Exchange system. | |

| 2. | Moneytech’s small size relative to the “Big Four” allows it to be more agile, responding to and developing opportunities which the Australian banks are either unwilling or unable to develop or are too slow to respond to. | |

| 3. | Moneytech has a full suite of financial products, both transactional and lending, all operated through the Moneytech Exchange, affording it a competitive advantage over similar non-bank lenders. | |

| 4. | Moneytech has an ongoing and historic entrepreneurial spirit with a customer focus, aiming to creatively and profitably satisfy customer needs and exceed customer expectations in the delivery of financial products. |

We intend to capitalize on our opportunities in the Australian market by initiating a marketing campaign to increase the number of customers served by Moneytech. As a first step in this effort, we have engaged a business development officer to develop a marketing program and establish the relationships necessary to cross sell our services. Any significant increase in the number of customers served and the volume of loans provided by us will require that we increase the credit facility we rely upon to service our customers. If we are successful in obtaining financing to finance expansion of our business in Australia, we will seek to increase our Wholesale Facility with Westpac or find another lender which will provide us with the credit necessary to expand our business at lower costs. We cannot assure you that we will be successful in increasing our Wholesale Facility, that we will be able to find another lender that will provide the necessary credit increase or that any increase will be on terms that will allow the expansion of our business to be profitable.

A number of our Australian customers regularly purchase goods from or supply goods to U.S. based counterparties or otherwise engage in dollar denominated transactions. To enable us to serve the needs of these customers without the exchange rate risk associated with AUD, we intend to seek to obtain a loan facility denominated in U.S. dollars from a U.S. institutional lender.

In addition to expanding our asset based lending business in Australia, we are actively developing a money transfer business in Australia. The Moneytech Exchange, developed to facilitate the movement and tracking of funds in connection with our debtor and trade finance facilities, provides us with a platform to conduct financial transactions and disburse funds to and from multiple parties in real time. We are currently working with HUBBED, a product and service aggregator, to establish kiosks in the storefronts of Australian news agents, bringing in-store, online and mobile solutions for new financial products and services to be promoted through the news agents in Australia. Moneytech has already installed kiosks in approximately 250 news agent and other locations. Additionally, over 150 pharmacies access the system electronically every day.

While seeking to grow our businesses organically in Australia, we will also attempt to identify and acquire one or more asset based lenders in Australia and the United States. Management believes that an acquisition in the U.S. would accelerate our efforts to enter the U.S. market and provide us with a management team with knowledge of the U.S. market. An acquisition of a traditional asset based lender in either Australia or the U.S. should allow us to upgrade the services such lender provides to its customers, although we cannot assure you that such acquisition will result in upgrading the services furnished to such lender’s customers. If we enter the U.S. market, we intend to aggressively market our asset based lending products and money transfer solutions targeted at businesses while we commence a marketing and advertising campaign for our money transfer products aimed at the consumer market in an effort to attract a large base of individual users, particularly those in the unbanked community. As of the date of this Report, we do not have any understandings, commitments or agreements with respect to any acquisitions.

| 8 |

Moneytech’s Markets

Moneytech operates in the commercial financial services market in Australia, targeting small to medium businesses (revenues between $1 million and $100 million) for their asset based lending solutions (including trade and accounts receivable finance) generally seeking loans of up to $5 million. Any business involved in the provision of products or services to other businesses which require funds to grow or that is not satisfied with its existing finance provider is a candidate for a Moneytech financial solution. Inasmuch as Moneytech’s services are generally provided to smaller businesses which are not eligible for loans from larger, established lenders, its customers are more likely to default than larger, more established borrowers. Businesses sourcing their products overseas for resale to business in Australia are a particularly good fit, as Moneytech is able to assist them with the payment of their overseas supplier, the hedging and conversion into a foreign currency, and the conversion of their receivables into cash. When doing business with such customers, although Moneytech may provide foreign exchange services, it does not assume the foreign exchange risk. If a client wishes to pay Moneytech n a currency other than the one provided by Moneytech, the client will be required to enter a currency hedge for the protection of Moneytech.

Moneytech believes that the number of potential customers for its financial services will increase as banks and other financial institutions in Australia raise the minimum size of the loans they are willing to make and the categories of eligible potential borrowers.

Sales and Marketing

To date Moneytech has grown its credit line portfolio largely by word of mouth recommendations from its customers to other businesses. Moneytech is actively seeking experienced business development officers (“BDOs”) to grow amounts funded. These BDOs will work with providers of products and services to small and medium businesses, such as traditional banks, lawyers and accountants to develop a referral network. As financing becomes available we will engage in select media advertising in key metropolitan markets and increase our internet advertising.

The Moneytech Exchange has been developed to the point where Moneytech can offer its customers funds transfer services (mPay)’s, debit and gift cards solutions and foreign exchange services. Moneytech has begun to offer these services on a limited basis and will seek to increase its marketing of these services as the necessary funds become available. In determining which product to market, we will analyze the market potential for each of these products to determine which can more readily achieve positive cash flow and allocate our marketing dollars accordingly.

Competition

The commercial finance and financial service industry in Australia has traditionally been dominated by the Big 4 Australian banks— Commonwealth Bank, Westpac Banking Corporation, Australia and New Zealand Banking Group and National Australia Bank. More recently, these banks have been decreasing the loans and other financial services provided to smaller businesses, preferring to service larger customers or act as the lender to companies such as Moneytech which then deal directly with smaller businesses. Nevertheless, the competition to provide financing to small and medium sized businesses remains intense. Competitive factors vary depending upon the financial services products offered, the nature of the customer and geographic region. Competitive forces may limit our ability to charge our customary fees and raise fees to our customers in the future. Pressure on our margins is intense and we cannot assure you that we will be able to successfully compete with our competitors. We are currently an insignificant competitor in our industry, which includes national, regional and local independent banks and finance companies and other full service financing organizations. Many of these competitors are larger than we are and have access to capital at a lower cost than we do.

Government Regulation

Australia

The Australian Securities and Investments Commission (ASIC) regulates corporations, markets and financial services in Australia and the Australian Prudential Regulatory Authority (APRA) oversees banks, credit unions, building societies, general insurance and reinsurance companies, life insurance companies, friendly societies and most members of the superannuation industry. The Reserve Bank of Australia serves as the central bank of Australia and is responsible for the payments system.

Receivables and purchase order financing in the style provided by Moneytech in Australia is not subject to regulation in Australia, as confirmed in an interpretation issued by the Australian Securities and Investment Commission concerning the exemption available to factoring arrangements under the Corporations Act 2001.

| 9 |

Moneytech’s payment services activity is considered a regulated financial activity and is conducted by virtue of having an Australian Financial Services License (AFSL) and by being a member of BPAY. Moneytech’s foreign exchange services activity is considered a regulated financial activity and is conducted by virtue of having an AFSL. An AFSL is granted by ASIC. Moneytech Limited was granted AFSL number 421414 on August 10, 2012. As the holder of an Australian Financial Services License, or AFSL, Moneytech is authorized to conduct a financial services business providing financial product advice for deposit and payment products, derivatives and foreign exchange contracts; dealing in these financial products for their own account or on behalf of another person and making a market in foreign exchange contracts and derivatives to retail and wholesale clients. The conditions of the license require compliance with various key person, financial services laws compliance measures, training, notification, financial, reporting, dispute resolution and documentation requirements.

BPAY is an electronic bill payment system in Australia which enables payments to be made through a financial institution’s on-line or telephone banking facility to merchants who are registered BPAY billers. BPAY is not subject to regulation by the Australian Payments Clearing Association or otherwise. BPAY is the registered trading name of BPAY Pty Ltd., a wholly-owned subsidiary of CreditLink Services, which is owned by Australia’s four major banks.

Moneytech Limited was accepted as a Payer Institution Member, or PIM, and was authorized to commence participating in the BPAY system commencing March 6, 2013. BPAY is offered by over 150 financial institutions and on more than 45,000 bills. The BPAY system supports its members in the provision of BPAY payments to their customers. Its members work across the banking system to provide seamless and convenient customer payments. There are three membership types: Participant Members, Associate Members and Payer Institution Members. Participant Members are Australian deposit-taking Institutions (ADIs) who directly settle their BPAY inter-institutional settlement obligations with other Participant Members. Associate Members are ADIs who don’t directly settle their BPA inter-institutional settlement obligations, instead settling through a Payment Member. Payer Institution Members (PIMs) are organizations, not necessarily ADIs, that manage stored value accounts for customers. A PIM is represented by a Participant Member and cannot be a Biller Institution.

BPAY members are required to comply with Rules and Operating Procedures established by BPAY, but are not otherwise subject to regulation by any of the Australian regulatory bodies.

United States

Non-bank asset based lenders engaged in traditional factoring and accounts receivables/asset based lending activities are not subject to federal and state regulation with respect to their finance activities. However, we cannot assure you that if we decide to enter the U.S. marketplace, alternative assets based lenders, like us, will not become subject to federal and state regulation, and impose regulatory requirements, which may limit the fees we may charge our customers and impose monetary penalties for violations of such regulatory requirements, increasing the cost of conducting their businesses. Recent legislation adopted particularly at the Federal level, such as the Dodd-Frank Act, which among other things, authorized various studies concerning the operations of financial institutions and the effects of their activities on the U.S. economy following the disastrous consequences in 2008 resulting from defaults on collateralized obligations, and the creation of the Consumer Financial Protection Bureau, which was created to regulate certain types of consumer financing transactions, and regulations adopted pursuant to such legislation, and future legislative and regulatory initiatives may impose certain regulatory requirements on non-bank financial services companies engaged in asset based lending and money transfers by individuals. If adopted, these laws also could:

| ● | Regulate credit granting activities, including establishing licensing requirements, if any, in various jurisdictions | |

| ● | Require disclosures to customers | |

| ● | Govern secured transactions | |

| ● | Set collection, foreclosure, repossession and claims handling procedures and other trade practices | |

| ● | Prohibit discrimination in the extension of credit, and | |

| ● | Regulate the use and reporting of information related to a seller’s credit experience and other data collection |

Intellectual Property

Our intellectual property, which includes software and trade secrets, trademarks, copyrights and domain names, software and trade secrets, is key to our success. We have expended significant amounts developing the software which constitutes the Moneytech Exchange. We have obtained no significant patents protecting these or our other products but rely upon trade secret laws in Australia. We routinely seek to protect our proprietary rights by entering into confidentiality and non-disclosure agreements with our employees, contractors, customers and other parties with whom we conduct business in order to protect our proprietary information.

In addition to our software we have developed and use trademarks registered in Australia, particularly relating to corporate, brand and product names. Registration of a trademark in Australia affords the owner nationwide exclusive trademark rights in the registered mark in the country of registration and the ability to prevent others from using the same or similar marks. However, to the extent a common law user has made prior use of the mark in connection with similar goods or services in a particular geographic area, the nationwide rights conferred by federal registration would be subject to that geographic area. We continue to seek to develop goodwill and brand recognition for our trademarks in Australia, and we intend to register additional trademarks in foreign countries where our products or services are or may be sold or used in the future. We cannot assure you, however, that our current trademarks or any trademarks we may use or register in the future will afford us any significant competitive advantage.

| 10 |

In recent years, many software companies have filed applications for patents covering their technologies. Many of these patents have yet to be litigated. Other competitors may develop technologies that are similar or superior to our technology and may receive and seek to enforce patents on such technology. We are not aware of any issued or pending patents that may be asserted against us.

Research and Development

To date we have invested approximately AUD$10 million developing the Moneytech Exchange, including approximately AUD$1,376,613, AUD$1,161,340 and AUD$873,685 in the fiscal years ended June 30, 2014, 2013 and 2012, respectively. The design and technical development of The Moneytech Exchange and our payment services platform are completed and both are operational. Although we will continue to upgrade and add additional functionality to The Moneytech Exchange and our payment services platform, we anticipate that our expenditures on research and development will decrease substantiality as a percentage of our revenues.

Employees

As of October 7, 2014, we had a total of 15 full time employees, 2 part time employees, 2 full-time contractors and 1 part-time contractor.

None of our employees are parties to a collective bargaining agreement. We consider our relationship with our employees to be satisfactory.

The purchase of our common stock involves a very high degree of risk.

In evaluating us and our business, you should carefully consider the risks and uncertainties described below and the other information and our consolidated financial statements and related notes included herein. The risks provided below may not be all the risks we face. If any of events described in the risks below actually occurs, our financial condition or operating results may be materially and adversely affected, the price of our common stock may decline, perhaps significantly, and you could lose all or a part of your investment.

Risks Related to Our Business

Adverse economic conditions in Australia, the United States and worldwide may negatively impact our results.

We are subject to changes in general economic conditions that are beyond our control. During periods of economic slowdown, delinquencies, defaults, and losses, generally increase while collections decrease. These periods may also be accompanied by increased unemployment rates and decreased consumer demand, which negatively impact businesses being lent to, weakening the collectability of the purchase orders we finance, increasing the risk that an event of default from one of our customers will eventuate in a loss. In addition, during an economic slowdown or recession, our servicing costs may increase without a corresponding increase in our finance charge income. Furthermore, our business is significantly affected by monetary and regulatory policies of the Reserve Bank of Australia, the Australian Federal Government and its agencies, the U.S. federal government and the US Federal Reserve. Changes in the policies of the institutions are influenced by macroeconomic conditions and other factors that are beyond our control and could have a material adverse effect on us through interest rate changes, costs of compliance with increased regulation, and other factors.

The process we use to estimate losses inherent in our credit exposure requires complex judgments, including analysis of individual industries, forecasts of economic conditions and how those economic conditions might impair the ability of our borrowers to repay their loans. The degree of uncertainty concerning economic conditions may adversely affect the accuracy of our estimates, which may, in turn, impact the reliability of the process and the quality of our assets.

| 11 |

Our business could be negatively impacted if our access to funding is reduced.

We have available an AUD$50 million Wholesale Facility with Westpac which is renewed annually on an agreed anniversary date. Our borrowing limit under the RPA is AUD$50 million, subject to interim agreed upon limits determined by various tests and covenants. As at June 30, 2014 the total amount drawn against the facility was $27,746,303. The facility has been renewed until December 31, 2014, and the interim agreed upon credit limit has been extended to AUD$40 million. We cannot guarantee that the RPA will be renewed on the current maturity date or thereafter, on reasonable terms, or at all. We require additional capital or the expansion of our borrowing capacity to substantially increase the aggregate amount of credit lines we provide. The availability of additional financing depends, in part, on factors outside of our control, and the availability of bank liquidity in general. We may also experience the occurrence of events of default or breach of financial covenants, which could reduce our access to funding. In the event of a sudden or unexpected shortage of funds in the banking system, we cannot be sure that we will be able to maintain necessary levels of funding without incurring high funding costs, a reduction in the availability of financing or the liquidation of certain assets.

Downsizing our business would have a material adverse effect on our financial position, liquidity and results of operations.

Our business could be negatively impacted if we no longer receive grants from the Australian Government.

A significant portion of the amounts paid to develop the Moneytech Exchange represents funds received from the Australian Government pursuant to a research and development grant program. Such grants represented approximately 45% of our research and development budgets in the fiscal years ended June 30, 2014 and 2013. Although the acquisition of Moneytech by us should not adversely impact Moneytech’s ability to qualify for such grants, as we grow, we may no longer be eligible for such grants. The inability to receive grants in the future commensurate with those received in the past could force us to reduce the amounts spent on research and development and could adversely affect our business and our financial results.

Our indebtedness and other obligations are significant and impose restrictions on our business.

We have a significant amount of indebtedness and are dependent upon our Wholesale Loan Facility. Our Facility imposes various constraints on the operation of our business, reduces operational flexibility and creates default risks. Our receivables purchase facility contains a cash reserve requirement which requires us to deposit money in a bank account in accordance with an agreed upon formula. We are required to hold these funds in restricted cash accounts to provide additional collateral for borrowings under the borrowing facilities. Additionally, the receivables purchase facility contains various covenants requiring in certain cases minimum financial ratios, asset quality, and portfolio performance ratios. Generally, these limits are calculated in respect of our clients as a group; however for certain obligors, delinquency, net loss and dilution are calculated with respect to the individual obligor.

Failure to meet any of these covenants could result in an event of default under the Facility. If an event of default occurs under the Facility, the lender could elect to declare all amounts outstanding to be immediately due and payable, enforce its interest against collateral pledged under the Facility or restrict our ability to obtain additional borrowings under the Facility.

If our debt service obligations increase, whether due to the increased cost of existing indebtedness or the incurrence of additional indebtedness, we may be required to dedicate a significant portion of our cash flow from operations to the payment of principal of, and interest on, our indebtedness, which would reduce the funds available for other purposes. Our indebtedness also could limit our ability to withstand competitive pressures and reduce our flexibility in responding to changing business and economic conditions.

We purchase accounts receivable primarily from and make purchase order advances primarily to small to medium companies, which present a greater risk of loss than purchasing accounts receivable from and purchase order advances to larger companies.

Our portfolio consists primarily of accounts receivable and purchase order advances from small to medium businesses with annual revenues ranging from $5 million to $50 million. Compared to larger, publicly owned firms, these companies generally have more limited access to capital and higher funding costs, may be in a weaker financial position and may need more capital to expand or compete. These financial challenges may make it difficult for our clients to continue as a going concern. Accordingly, advances made to these types of clients entail higher risks than advances made to companies who are able to access traditional credit sources. In part because of their smaller size, our clients may:

| ● | Experience significant variations in operating results | |

| ● | Have narrower product lines and market shares than their larger competitors | |

| ● | Be particularly vulnerable to changes in customer preferences and market conditions | |

| ● | Be more dependent than larger companies on one or more major customers or suppliers, the loss of which could materially impair their business, financial condition and prospects | |

| ● | Face intense competition, including from companies with greater financial, technical, managerial and marketing resources | |

| ● | Depend on the management talents and efforts of a single individual or a small group of persons for their success, the death, disability or resignation of whom could materially harm the client’s financial condition or prospects; and | |

| ● | Have less skilled or experienced management personnel than larger companies |

| 12 |

Accordingly, any of these factors could impair a client’s cash flow or result in other events, such as bankruptcy, which could limit our ability to collect on the client’s purchased accounts receivable or purchase order advances, and may lead to losses in our portfolio and a decrease in our revenues, net income and assets.

Our financial condition, liquidity, and results of operations depend on the credit performance of the credit facilities we provide to our customers.

While our underwriting guidelines were designed to establish that the obligors on the receivables we purchase represent a reasonable credit risk, the receivables we purchase nonetheless are likely to experience higher default rates than a portfolio of obligors comprised of large companies. In the event of a default, the most practical alternative may be to engage in collection action against the obligor or, if permitted under the terms of our agreement, the customer who sold the receivable to us. The realizable value of a receivable may not cover the outstanding account balance and costs of recovery, and if collection of the receivables does not yield sufficient proceeds to repay the receivables in full could result in losses on those receivables.

Our allowance for loan losses and impairments may prove to be insufficient to absorb probable losses inherent in our portfolio.

We maintain an allowance for bad or doubtful debts that we believe is appropriate to provide for probable losses inherent in our portfolio. The determination of the appropriate level of the allowance for bad or doubtful debts and impairment reserves inherently involves a high degree of subjectivity and requires us to make significant estimates of current credit risks and future trends, all of which are subject to change. Changes in economic conditions affecting clients, new information regarding our clients or their obligors, and other factors, both within and outside of our control, may require an increase in the allowance for loan losses. Furthermore, growth in our funding book generally would lead to an increase in the provision for loan losses. If the net write-offs exceed the allowance for bad and doubtful debt, we will need to make additional provisions to increase the allowance for bad and doubtful debt. There is no accurate method for predicting losses, and we cannot assure you that provision for bad and doubtful debts will be sufficient to cover actual losses. Any increases in the allowance for bad and doubtful debts will result in a decrease in net income and may have a material adverse effect on us.

Poor portfolio performance may trigger credit enhancement provisions in our Receivables Purchase Agreement.

Our RPA has delinquency, net loss ratio limits, dilution and Day Sales Outstanding limits that, if exceeded, would increase the level of credit enhancement requirements for that facility and redirect all excess cash to our lender. Generally, these limits are calculated based on the aggregate portfolio performance across all clients; however, delinquency, net loss ratios and dilutions are calculated with respect to some individual obligors.

If, at any measurement date, a trigger was hit with respect to any financing, provisions of the financing agreements would increase the level of credit enhancement requirements for that financing and redirect all excess cash to the credit provider. During this period, excess cash flow, if any, from the Facility would be used to fund the increased credit enhancement levels rather than being distributed to us. Once an impacted trust reaches the new requirement, we would return to receiving a residual distribution from the trust.

There is a risk that in the event portfolio performance was not adequate, triggering credit enhancement criteria, and that there was not sufficient cash-flow from our business to satisfy the increase in enhancement required, that our credit provider could cease its support of our business which would have a materially adverse effect on our business.

Competition may adversely impact our results, especially in Australia.

The financial services sector in which we operate is highly competitive and could become even more so, particularly in those segments which are perceived as providing higher growth prospects. Factors contributing to this include industry deregulation, mergers and acquisitions, changes in customers’ needs and preferences, entry of new participants, development of new distribution and service methods and increased diversification of products by competitors. For example, changes in the financial services sector have made it possible for non-bank financial institutions to offer products and services traditionally provided by banks, such as automatic payment systems, mortgages and credit cards.

The effect of competitive market conditions may have a material adverse effect on our financial performance and position, especially in Australia. For example, increasing competition for customers can lead to a compression in our net interest margin, or increased advertising and related expenses to attract and retain customers.

The asset backed lending market is served by a variety of entities, including, banks, credit unions, and independent finance companies. Our competitors may provide financing on terms more favorable to customers than we offer. Many of these competitors also have long-standing relationships with potential clients.

| 13 |

We anticipate that we will encounter greater competition as we expand our operations.

The market for providing loans and other financial services to small to medium size businesses is highly competitive and we expect that competition will increase. Current competitors have significantly greater financial, technical and marketing resources than we do. We expect that more companies will enter this sector of the financial services market. We may not be able to compete successfully against either current or future competitors. Increased competition could result in reduced revenue, lower margins or loss of market share, any of which could significantly harm our business.

Failure to obtain insurance on favorable terms may result in unexpected losses.

The receivables due Moneytech from its customers or their counterparties are insured pursuant to a policy issued by Euler Hermes, a Standard & Poor’s rated Trade Credit insurance provider. Pursuant to this policy, Moneytech would bear the first $500,000 of losses incurred in any calendar year, after which any bad debt losses are borne by Euler Hermes. This policy is renewed annually. No assurances can be made that we will be able to continue to insure bad debt losses or that we will be able to obtain policy coverage with premiums that are cost effective. If we are unable to renew our bad debt insurance policy or the premiums for coverage become cost prohibitive, we may face larger than expected losses from bad debts.

Changes in interest rates may adversely impact our profitability and risk profile.

Our profitability may be directly affected by interest rate levels and fluctuations in interest rates. As interest rates change, our gross interest rate spread on new facilities either increases or decreases because the rates we charge on the facilities we provide is limited by market and competitive conditions, restricting our ability to pass on increased interest costs to the consumer. Additionally, although the majority of our clients are small to medium businesses and are not highly sensitive to interest rate movement, increases in interest rates may reduce the volume of facilities we originate.

A security breach or a Cyber Attack could adversely affect our business.