Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - MAM SOFTWARE GROUP, INC. | v389093_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - MAM SOFTWARE GROUP, INC. | v389093_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - MAM SOFTWARE GROUP, INC. | v389093_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - MAM SOFTWARE GROUP, INC. | v389093_ex32-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - MAM SOFTWARE GROUP, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JUNE 30, 2014

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ___________ TO ___________

Commission file number 000-27083

MAM Software Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 84-1108035 | |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

Maple Park, Maple Court, Tankersley, Barnsley, U.K. S75 3DP

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 011-44-122-635-2900

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| Common Stock, $0.0001 par value | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Act).

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III or this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No þ

As of December 31, 2013 14,494,437 shares of common stock were outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant, as of December 31, 2013, the last business day of the second fiscal quarter, was approximately $32,325,000, based on the average high and low price of $5.00 for the registrant’s common stock as quoted on NASDAQ Capital Market on that date. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

The registrant had 14,298,053 shares of its common stock outstanding as of September 22, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| 2 |

TABLE OF CONTENTS

| 3 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations, future cash needs, business plans and future financial results, and any other statements that are not historical facts.

From time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

For discussion of factors that we believe could cause our actual results to differ materially from expected and historical results see “Item 1A — Risk Factors” below.

| 4 |

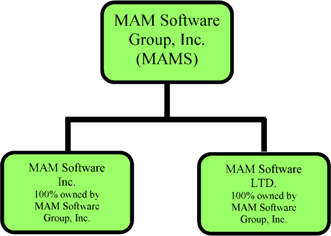

MAM Software Group, Inc. (“MAM,” the “Company,” “we,” “our,” or “us”) is a technology holding company that has one wholly owned subsidiary based in the U.S., MAM Software, Inc. (“MAM US”) which is located in Allentown, Pennsylvania, and one wholly owned subsidiary in the U.K., MAM Software Limited (“MAM Ltd.”) based in Tankersley, Barnsley, U.K. The subsidiaries operate independently from one another. We have and continue to market and develop business management software solutions that manage both the business and supply chain for small and medium-sized firms in the automotive aftermarket. The automotive aftermarket includes those businesses that supply servicing, parts, oil, tires, and performance extras to the retail market.

Our Company

MAM Software Group, Inc. is a leading provider of integrated information management solutions and services and a leading provider of cloud-based software solutions for the automotive aftermarket sector. We have a broad line of software solutions and services to address the information technology (“IT”) needs of virtually every significant sector of the automotive aftermarket sector in the United Kingdom and North America and are seeking to leverage this position into new industry verticals and new geographies around the world.

Our Markets

MAM Software Group, Inc. provides software, information and related services to businesses engaged in the automotive aftermarket in the U.S., Canada, U.K. and Ireland. The automotive aftermarket consists of businesses associated with the life cycle of a motor vehicle from when the original manufacturer’s warranty expires to when the vehicle is scrapped. Products sold by businesses engaged in this market include the parts, tires and auto services required to maintain and improve the performance or appeal of a vehicle throughout its useful life. The Company aims to meet the business needs of customers who are involved in the maintenance and repair of automobiles and light trucks in three key segments of the automotive aftermarket, namely parts, tires and auto service.

The Company’s customer base consists of wholesale parts and tire distributors, retailers, franchisees, cooperatives, auto service chains and single location auto service businesses with high customer service expectations and complex commercial relationships.

In the U.K. and Ireland, the Company also provides management solutions to businesses involved in the wholesale of construction materials. These vertical markets include plumbing, building, lumber, and electrical wholesale distribution companies.

Our Products and Services

The Company’s business management systems, information products and online services permit our customers to manage their critical day-to-day business operations through automated point-of-sale, information (content) products, inventory management, purchasing, general accounting and customer relationship management.

We provide professional IT services to our customers, including software and hardware installation, data conversion, and training and, at times, product modifications. We also provide continuing customer support services to ensure product performance and reliability, which provides us with long-term customer relationships and a significant base of recurring maintenance revenue.

| 5 |

The Company’s revenues are derived from the following:

| · | The sale of business management systems comprised of proprietary software applications, implementation and training. | |

| · | Providing subscription-based services, including software support and maintenance, and online services for a fee. | |

| · | Delivering our business management, commonly known as SaaS. | |

| · | Delivering our catalogue information as a service, commonly known as DaaS. |

Our Technologies

Our solutions are available as both 'on-premise' applications (sold via the traditional perpetual licensing model) and ‘cloud’ solutions that are delivered as a service over the Internet on a subscription basis.

Many of our business management applications are now available as SaaS, where software and associated data is centrally hosted on the cloud. Depending on the complexity of the application, MAM SaaS solutions are deployed using 'cloud hosting' or 'web application' technology:

SaaS cloud hosting - single tenants accessing fully-managed virtual servers via thin client (terminal services) connections (e.g. Autopart Online).

SaaS web application - multiple tenants accessing a dedicated website using a standard web browser (e.g. Autowork Online).

Our catalog information is also available in the cloud as DaaS. We centrally host and maintain the data, which is accessed by users via a desktop application, web application or integrated into their B2C website.

At present, most of our customers in the U.K. have our software installed in-house. However, market acceptance of cloud computing for mission critical enterprise applications has become increasingly common in recent years since software can be delivered cost-effectively, reliably, and securely to businesses over the Internet without the need for these businesses to purchase supporting software and hardware for an on-premise system or the need to keep IT people on staff to monitor and upgrade such a system.

We introduced our first subscription-based service solution over the Internet in 2005 in the U.K., and we began marketing our first cloud system to customers in North America in 2013. Since that time, we have significantly expanded our cloud-based offerings and are offering customers that maintain in-house installations significant incentives to move to our cloud-computing model. While transitioning our U.K. customers to a cloud computing model results in a decrease in our up-front revenue recognition, we believe that this is a necessary transition and is in the best interests of our customers and our own long-term business prospects as an increasing number of our customers in the U.K. are looking for solutions that are highly functional, easy to use, configurable, and fast.

Our cloud model is based on Microsoft .Net, HTML5 and SQL technologies that are both open and secure with support for user experiences on both desktop and mobile devices. Our customers that have moved away from traditional on-premise software to our cloud-based service applications benefit by substantially reducing the complexity typical of on-premise software implementations, customizations, and upgrades. Through cloud computing, we supply and manage the hardware, infrastructure, ongoing maintenance, and backup services for our customers. We install the latest version of our software for our customers, thereby reducing their need to buy and maintain their own IT resources. As a part of our cloud model, we also provide activation and training services to our customers as well as support services. In the North American market, where we have a smaller existing installed base of customers, the transition to offering cloud-based solutions will be an important part of our strategic growth in this market since we currently enjoy less market share and thus we anticipate that the near term impact will be a net-positive one as we work to increase that business in North America.

| 6 |

CORPORATE BACKGROUND

The Company’s principal executive office is located at Maple Park, Maple Court, Tankersley, Barnsley, U.K. S75 3DP and its phone number is 011-44-122-635-2900.

MAM is a former subsidiary of ADNW, a publicly traded company, the stock of which is currently traded on the pink sheets under the symbol ADNW.PK. ADNW transferred its software aftermarket services operating businesses to MAM (then known as Aftersoft Group, Inc.) and retained its database technology, Orbit.

On November 24, 2008, ADNW distributed a dividend of the 7,125,000 shares of MAM common stock that ADNW owned at such time in order to complete the spin-off of MAM’s businesses. The dividend shares were distributed in the form of a pro rata dividend to the holders of record as of November 17, 2008 (the “Record Date”) of ADNW’s common and convertible preferred stock. Each holder of record of shares of ADNW common and preferred stock as of the close of business on the Record Date was entitled to receive 0.06864782 shares of MAM’s common stock for each share of common stock of ADNW held at such time, and/or for each share of ADNW common stock that such holder would own, assuming the convertible preferred stock owned on the Record Date was converted in full. Prior to the spin-off, ADNW owned approximately 77% of MAM’s issued and outstanding common stock. Subsequent to and as a result of the spin-off, MAM is no longer a subsidiary of ADNW. The Company currently has the following wholly owned direct operating subsidiaries: MAM Software Limited in the U.K., and MAM Software, Inc. in the U.S. On April 21, 2010 shareholders approved the change of the Company’s name from Aftersoft Group, Inc. to MAM Software Group, Inc.

On March 25, 2011, (“the Effective Date”), the Company amended its Certificate of Incorporation to effectuate a one-for-one hundred reverse stock split, followed by a ten-for-one forward stock split. Pursuant to this transaction, every 100 shares of the Company's common stock were converted into one share of the Company's common stock. Immediately thereafter, a forward stock split was undertaken whereby each share of common stock was converted into 10 shares of common stock. Stockholders owning fewer than 100 shares of common stock whose interests were converted into fewer than 1 share of common stock pursuant to the reverse split, were converted into the right to receive an amount equal to the average daily closing price per share of the common stock on the OTC Bulletin Board (where the Company’s common stock was traded at the time) for the five trading days immediately before and including the Effective Date, without interest. Stockholders who held 100 or more shares as of the Effective Date received fractional shares in the reverse split and were not cashed out. Any fractional shares held after the ensuing forward split were rounded up to the nearest whole share.

| 7 |

MAM Software Group, Inc. Organization Chart

MAM Software Limited

MAM Ltd. is a provider of software to the automotive aftermarket in the U.K. and Ireland. MAM Ltd. specializes in providing reliable and competitive business management solutions to the motor factor (also known as jobber), retailing, and wholesale distribution sectors. It also develops applications for vehicle repair management and provides solutions to the retail and wholesale tire industry. All MAM Ltd. programs are based on the Microsoft Windows family of operating systems. Each program is fully compatible with the other applications in their range, enabling them to be combined to create a fully integrated package. MAM Ltd. is based in Tankersley, U.K.

MAM Software, Inc.

MAM US has two divisions, VAST and Autopart. The VAST Division develops open business management systems, and distribution channel e-commerce systems for the automotive aftermarket supply chain. These systems are used by leading aftermarket outlets, including tier one manufacturers, program groups, warehouse distributors, tire and service chains and independent installers. VAST products and services enable companies to generate new sales, operate more cost efficiently, accelerate inventory turns and maintain stronger relationships with suppliers and customers. MAM US, VAST Division and Autopart Divisions are based in Allentown, Pennsylvania.

The Autopart Division provides software solutions to the North American automotive aftermarket. It targets jobbers and warehouse distributors, supplying a localized version of the U.K.-developed software.

VAST specifically focuses on selling systems to the service and tire segment of the market, while Autopart focuses on the warehouse and jobber segment of the market.

Industry Overview

The Company serves the business needs of customers involved in the supply of parts, maintenance and repair of automobiles and light trucks in three key segments of the automotive aftermarket, namely parts, tires and auto service.

The industry is presently experiencing a level of consolidation in the lines that are being sold. The previous distinction of having parts and tires provided by two distinct suppliers is coming to an end, as our customers’ businesses need to offer their clients the widest range of products and services under one roof. As a result, what were previously parts-only stores, jobbers and warehouse, are now taking in tire inventory as well in order to satisfy their clients’ demands, and vice-versa. This in turn is causing owners of these businesses to evaluate their business systems to ensure they can compete over the short, medium and long term. An increase in the “do-it-yourself” market due to the “credit crunch” is requiring these systems, but at the same time a need to compete strongly with other parts stores is cutting margins as businesses attempt to attract new and return business. Longer warranties are still deferring the length of time until newer vehicles are entering the aftermarket, except for running spares and service parts, accident damage, and optional add-ons such as security, entertainment, performance and customization.

| 8 |

Continuing market conditions related to the overall downturn in the consumer market is also directly affecting the confidence and ability of businesses to invest in new systems. The industry’s response to this has been to introduce incentive and discount programs, but to date it is uncertain whether this approach will be successful long term.

The Company believes that growth in the automotive aftermarket will continue to be driven by the following factors:

| · | gradual growth in the aggregate number of vehicles in use; |

| · | an increase in the average age of vehicles in operation, now estimated to be 11.4 years; |

| · | growth in the total number of miles driven per vehicle per year; and |

| · | increased vehicle complexity. |

Products and Services

Meeting the needs of the automotive aftermarket requires a combination of business management systems, information products and online services that combine to deliver benefits for all parties involved in the timely repair of a vehicle. The Company provides systems and services that meet these needs and help its customers to meet their customers’ expectations. These products and services include:

| 1. | Business Management Systems comprised of the Company’s proprietary software applications, implementation and training and third-party hardware and peripherals; |

| 2. | Information Products such as an accessible catalog database related to parts, tires, labor estimates, scheduled maintenance, repair information, technical service bulletins, pricing and product features and benefits that are used by the different participants in the automotive aftermarket; |

| 3. | Online Services and products that provide online connectivity between manufacturers, warehouse distributors, retailers and automotive service providers. These products enable electronic data interchange throughout the automotive aftermarket supply chain between the different trading partners. They also enable procurement and business services to be projected over the Internet to an expanded business audience; and |

| 4. | Customer Support, Consulting and Training that provide phone and online support, implementation and training. |

Business Management Systems

MAM’s business management systems meet the needs of warehouse distributors, part stores and automotive service providers as follows:

Warehouse Distributors

Autopart. This is a U.K.-developed product that is sold and promoted both in the U.S. and in the U.K. In the U.S., it is sold by MAM Software, Inc. and in the U.K. by the MAM Software Limited. This product is designed for and targeted at warehouse distributors that seek to manage multiple locations and inventories on a single system for a regional area and are also suited to managing single location franchisees or buying group members. The product provides point of sale, inventory management, electronic purchasing capabilities, a fully integrated accounting module, a warehouse management module, and a business intelligence reporting module. It also allows the distributor to connect with their customers through our OpenWebs™ ecommerce solutions.

Autopart can be delivered as an on premise solution and sold via the traditional perpetual licensing model. Autopart Online is a hosted or ‘cloud’ based version of our Autopart solution and is delivered as a service over the Internet, commonly known as or SaaS.

DirectStep. This is our legacy product that was designed for warehouse distributors that seek to manage multiple locations and inventories on a single system. Although still actively supported, DirectStep is no longer promoted.

| 9 |

Parts Stores

Autopart. This is a U.K.-developed product that is sold in both the U.S. and U.K. In the U.S. it is sold by MAM Software, Inc. and in the U.K. by MAM Software Limited. This product is designed for and targeted at parts store chains that seek to manage multiple locations and inventories on a single system for a regional area. It is also suited to managing single location franchisees or buying group members. The product provides point of sale, inventory management, electronic purchasing capabilities a fully integrated accounting module and a business intelligence reporting module. It also allows parts stores to connect with their automotive service customers through the VAST, Autowork Online or, OpenWebs™ ecommerce solutions.

Autopart can be delivered as an on premise solution and sold via the traditional perpetual licensing model. Autopart Online is a hosted or ‘cloud’ based version of our Autopart solution and is delivered as a service over the Internet, commonly known as SaaS.

Automotive Service Providers

VAST. This product is designed for and targeted at large- to medium- sized automotive service and tire chains that seek to manage multiple locations and inventories for a regional area is also suited to managing single location stores that are part of a franchise or a buying group. VAST provides point-of-sale, inventory management, electronic purchasing and customer relationship management capabilities. It also allows the service provider to connect with parts and tires warehouse distributors and parts stores through either VAST’s online services and products or other industry connectivity solutions.

Autowork Online. This is a U.K.-developed product that is sold both in the U.S. and the U.K. In the U.S. it is sold by MAM Software, Inc. and in the U.K. by MAM Software Limited. This product is designed for and targeted at small single location automotive installers. The Autowork Online product provides estimate, job card, parts procurement and invoice capabilities. It also allows the automotive installer to connect with parts distributors to purchase components. Autowork Online is delivered as a service over the Internet, commonly known as SaaS, allowing customers to purchase the solution on a monthly basis but without the need to manage the system.

Vertical Markets

Trader. This is a U.K.-developed product that is sold by MAM Software Limited. This product is designed for and targeted at generic wholesalers and distributors. Based on the Autopart codebase, the product provides point of sale, inventory management, electronic purchasing capabilities and a fully integrated accounting module.

Information Products

The Company provides product catalog and vehicle repair information required to enable point-of-sale transactions. These proprietary database products and services generate recurring revenues through monthly or annual subscription fees.

MAM Software Limited develops and maintains proprietary information products that differentiate its products from those of the majority of its competitors in the U.K. In the U.S. and Canada, both MAM Software, Inc. and VAST develops and maintains a proprietary workflow capability that integrates information products sourced from its suppliers such as Epicor (formerly Activant), and WHI for its automotive parts and tire customers, including warehouse distributors, parts stores and automotive service providers. In April 2014, MAM Software, Inc. launched an information product developed specifically for the U.S. and Canada.

The principal information service for both MAM Software, Inc. and MAM Software Limited is Autocat+, an auto parts catalog that uses the DaaS distribution model. Autocat+ provides access to a database of automobile vehicle applications for the U.S. and U.K. markets that enables users to access information about parts quickly and accurately. The Autocat+ service is centrally hosted and data is accessed by users via MAM's business management software, a standalone desktop application, or web application. Data can also be 'consumed' via a Web Service for integration into B2C websites. Information in Autocat+ is maintained through an automatic verification and standardization process, with updates published daily.

| 10 |

In addition, information products developed or resold by VAST include Interchange Catalog, a database that provides cross references of original equipment manufacturer part numbers to aftermarket manufacturer part numbers; Price Updating, a service that provides electronic price updates following a price change by the part manufacturer; Labor Guide, a database used by automotive service providers to estimate labor hours for purposes of providing written estimates of repair costs to customers; Scheduled Service Intervals, a database of maintenance intervals; and Tire Sizing, a database that cross-references various tire products and applications.

Online Services

Both MAM Software, Inc. and MAM Software Limited offer online e-commerce services in the form of business to business and business to consumer implementations. These online services connect the automotive aftermarket from manufacturers through warehouse distributors and parts stores to automotive service providers for the purpose of purchasing parts and tires, fleet and national account transaction processing and online product price information.

OpenWebs™ e-Commerce Gateway Services

In the U.S. and Canada, VAST’s e-commerce gateway services use automotive industry standard messaging specifications to deliver online services that connect the automotive aftermarket supply chain for the purpose of purchasing parts and tires, fleet and national account transaction processing, online product and price updating for parts and tires.

OpenWebs™ e-Commerce Browser Services

In the U.S. and Canada, VAST’s e-commerce browser services enable warehouse distributors and parts stores to provide an online service to automotive service providers for the purpose of purchasing of parts and tires, accessing account information and other browser-based channel management services.

Autonet

In the U.K., MAM Ltd.’s Autonet online services connect manufacturers, warehouse distributors, parts stores and automotive service providers for the purpose of purchasing of parts and tires, fleet and national account transaction processing and product information and price distribution.

Customer Support and Consulting and Training

The Company provides support, consulting and training to its customers to ensure the successful use of its products and services. The Company believes this extra level of commitment and service builds customer relationships, enhances customer satisfaction and maximizes customer retention. These services consist of the following:

| · | Phone and online support. Customers can call dedicated support lines to speak with knowledgeable personnel who provide support and perform on-line problem solving as required. |

| · | Implementation, education and training consulting. Our consulting and training teams work together to minimize the disruption to a customer’s business during the implementation process of a new system and to maximize the customer’s benefit from the use of the system through training. |

Both MAM Software, Inc. and MAM Software Limited also provide a customer-only support portal that allows customers direct access to tutorials, on-line documentation and information related to products and services. New customers enter into support agreements, and most retain such service agreements for as long as they own the system. Monthly fees vary with the number of locations and the software modules, information products and online services subscribed to. The agreements are generally month-to-month agreements. The Company offers training at both MAM Software, Inc.’s and MAM Software Limited’s facilities, as well as the customer’s facilities and online for product updates or introduce specific new capabilities.

Both MAM Software, Inc. and MAM Software Limited’s catalog information products are delivered by its Autocat teams, based in Allentown, PA and Wareham, England. The Autocat product teams source, standardize and format data collected in an electronic format from over 300 automotive parts manufacturers in both regions and the data is provided to its customers via the Internet.

| 11 |

Distribution

There are two primary vertical distribution channels for aftermarket parts and tire distribution: the traditional wholesale channel and the retail channel.

Automotive Aftermarket Distribution Channels

| · | Traditional Wholesale Channel. The wholesale channel is the predominant distribution channel in the automotive aftermarket. It is characterized by the distribution of parts from the manufacturer to a warehouse distributor, to parts stores and then to automotive service providers. Warehouse distributors sell to automotive service providers through parts stores, which are positioned geographically near the automotive service providers they serve. This distribution method provides for the rapid distribution of parts. The Company has products and services that meet the needs of the warehouse distributors, parts stores and the automotive service providers. |

| · | Retail Channel. The retail channel is comprised of large specialty retailers, small independent parts stores and regional chains that sell to “do-it-yourself” customers. Larger specialty retailers, such as Advance Auto Parts, AutoZone, Inc., and O’Reilly Automotive, Inc. carry a greater number of parts and accessories at more attractive prices than smaller retail outlets and are gaining market share. The business management systems used in this channel are either custom developed by the large specialty retailers or purchased from business systems providers by small to medium-sized businesses. The Company has products and services that support the retail channel. |

In addition to these two primary channels, some aftermarket parts and tires end up being distributed to new car dealers. The business management systems used in this channel have unique functionality specific to new car dealerships. The Company sells a small number of products into the auto service provider side of car dealerships. Aftermarket wholesalers of parts and tires provide online purchasing capabilities to some new car dealerships.

Product Development

The Company’s goal is to add value to its customers’ businesses through products and services designed to create optimal efficiency. To accomplish this goal, the Company’s product development strategy consists of the following three key components:

| · | Integrating all of the Company’s products so that its software solutions work together seamlessly, thereby eliminating the need to switch between applications; |

| · | Enhancing the Company’s current products and services to support its changing customers’ needs; and |

| · | Providing a migration path to the Company’s business management systems, reducing a fear that many customers have that changing systems will disrupt business. |

Sales and Marketing

The Company’s sales and marketing strategy is to acquire customers and retain them by cross-selling and up-selling a range of commercially compelling business management systems, information products and online services.

Within the parts, tire and auto service provider segments, each division sells and markets through a combination of field sales, inside sales, and independent representatives. The Company seeks to partner with large customers or buying groups and leverage their relationships with their customers or members. Incentive pay is a significant portion of the total compensation package for all sales representatives and sales managers. Outside sales representatives focus primarily on identifying and selling to new customers complemented by an inside sales focus on selling upgrades and new software applications to its installed customer base.

The Company’s marketing approach aims to leverage its reputation for customer satisfaction and for delivering systems, information and services that improve a customer’s commercial results. The goal of these initiatives is to maximize customer retention and recurring revenues, to enhance the productivity of the field sales team, and to create the cross-selling and up-selling opportunities for its systems, information products and online services.

| 12 |

Research and Development

The Company spent approximately $3.7 million in fiscal 2014 on research and development, with approximately $0.9 million spent by MAM US and $2.8 million by MAM Ltd. The Company spent approximately $3.4 million in fiscal 2013 on research and development, with approximately $0.9 million spent by the VAST division, $0.3 million by the Autopart division, and $2.2 million by MAM Ltd.

Patent and Trademark

We rely on a combination of intellectual property laws, as well as confidentiality procedures and contractual provisions, to protect our proprietary technology and our brand. We have not sought patent protection for any of our products. We have registered our business name, “MAM Software,” with the U.S. Patent and Trademark office. The assets consist of intellectual property relating to our specific color and font design of our business logo. In addition we have also registered our tagline, “Driving Business Performance,” with the U.S. Patent and Trademark office.

Customers

During the years ended June 30, 2014 and 2013, no customer accounted for 10% of the Company’s total revenues. The Company’s top ten customers collectively accounted for 11% of total revenues during fiscal 2014 and 18% of total revenues during fiscal 2013. Some of top customers in North America include Autopart International, AutoZone, Monro Muffler Brake, Sullivan Tire & Auto Service, and U.S. AutoForce. In the U.K. and Irish markets, MAM Ltd.’s top customers include Dingbro, Euro Car Parts, Andrew Page LTD, Maccess Limited, and Alliance Automotive U.K. LTD.

Competition

In the U.S. and Canada, MAM US competes primarily with Epicor Inc. (formerly Activant, Inc.) and WHI and several smaller software companies, including Autologue, DST and Fuse 5. VAST competes primarily with Maddenco, ASA, Tasco and RO Writer who all provide similar products and services to the U.S. automotive aftermarket. Additionally, an ongoing competitive threat to the Company comes from custom, developed, in-house systems, information products and online services. For example, AutoZone, Inc. and Genuine Parts Company’s NAPA Parts Group, each have developed their own business management systems and electronic automotive parts catalogs for their stores and members, although the Company currently has a partnership agreement with each of these companies to supply their information products through the Company’s solutions.

In the U.S. and Canada, the Company expects to compete successfully against its competitors using two separate and complimentary strategies. First, the Company will continue to focus on selling and promoting the Company’s complete supply chain solutions that provide businesses with easy integration of the Company’s business management information systems into their existing supply chain structures. Second, the Company will continue its strategy of working with those businesses that already manage their own supply chains and information products (catalogs), such as AutoZone, helping to improve and compliment their systems with the Company’s products.

VAST, in the U.S. and Canada, competes with multiple products across different market segments, so its competitors vary by segment.

Within the warehouse distribution segment, the Company will continue to support its legacy system, Direct Step, a product which the Company developed many years ago which enables large warehouses with millions of parts to locate, manage, pack and deliver the parts with ease and efficiency. DirectStep is not a Microsoft Windows-based technology. The Company’s existing and prospective customers are moving towards modern solutions which integrate easily with Internet-based transactions and interactions, and the Company believes that its Autopart product provides that solution. The Company has been selling Autopart successfully in the U.K. and Ireland since 2000, and feels that the success this product in the U.K. and the successful installation of this product within the U.S. will enable the Company to promote and benefit quickly from this product.

The tire segment is comprised of three distinct elements: retail, wholesale and commercial. Within the tire segment and the auto service segment, the Company focuses on client and market requirements, which the Company believes will enable it to offer its clients the best solution, regardless of the size of a client’s business. By continually integrating and extending the functionality of its solutions across the entire supply chain, the Company believes that it will be able to offer existing and potential clients products that suit their present and future needs. Management believes that its products will present existing and potential clients the opportunity to move away from their older existing systems, which may restrict their market opportunities, and will permit integration into additional sales channels and reduce the costly maintenance of older systems.

| 13 |

The auto parts segment within the auto service space has many competitors who have developed applications for single location auto service shops. Many of these have been developed by parts distributors like NAPA and AutoZone. While these applications do well in a small single location store, they are not widely distributed in the multi-store location segment of the auto parts business. The Company believes that its Autowork Online product is highly suited to single store locations. The strategy for generating revenue in this sector of the market will be to establish reseller agreements with distributor partners. In addition, it will focus on multi-store locations for which its product VAST is highly suited. The Company believes that this multi-store ability offers strong opportunities to beat the competition in this area and quickly increase the Company’s customer base.

The last area that the Company plans to compete in is the e-commerce space, providing new tools and solutions for this expanding Internet marketplace. The goal of the Company’s OpenWebs™ product is to connect both parts and tire partners together in a real-time environment so they can perform electronic ordering, gauge inventory levels as well as disseminate information. Within the tire segment, the Company feels that it has a competitive advantage. The Company’s observation has led it to believe that most tire distributors either do not have a business-to-business solution or have developed solutions from independent sources. While the parts segment of this market is largely tied to Epicor, Inc. (formerly Activant, Inc.) at this time, the Company believes that customers are looking for solutions that simply integrate their supply chain, completely and without further restrictions. The Company’s OpenWebs™ solution will allow its customers to achieve these goals.

In the U.K., MAM Ltd. continues to compete primarily with Epicor, Inc., (formerly Activant, Inc.) in the component sector of automotive aftermarket. In the tyre sector, MAM Ltd. competes primarily with CAM Systems, Tyreman and Team Systems. In the vertical markets now being targeted by MAM Ltd. in the U.K., the company competes with Kerridge, Chatsworth, EDP, Blue Rock, OGL and Ramtac, The Company feels that it provides a range of solutions that combine proven concepts with cutting-edge technology that are functional, effective and reliable. The Company feels that its focus towards continuing to provide solutions that enable business to find new efficiencies and increase existing efficiencies, as the Company develops its own products, will provide it an advantage over the competition. These efforts, together with strong post-sales support and ongoing in depth product and market support, will assist the Company in generating and maintaining its position within the market.

Several large enterprise resource planning and software companies, including Microsoft Corporation, Oracle Corporation and SAP AG, continue to supply Enterprise Resource Planning (“ERP”) and Supply Chain Management (“SCM”) products to medium sized original equipment manufacturers and suppliers within the automotive market, but to date have not focused strongly on the aftermarket. The solutions that they have developed are mainly focused on the efficient management of the supply chain and to date do not appear to be looking to supply systems and solutions into the jobber and service segments of the aftermarket. However there can be no assurance that those companies will not develop or acquire a competitive product or service in the future.

Employees

The Company has 210 full-time employees: 2 at MAM Software Group, Inc., 61 at MAM US and 147 at MAM Ltd. comprised of 6 in management, 21 in sales and marketing, 39 in research and development, 74 in professional services and support and 7 in general and administration. MAM Software Group, Inc.’s 2 employees include one senior executive and one accountant. MAM US has 61 employees in the U.S. comprised of two in management, 10 in sales and marketing, 6 in research and development, 38 in professional services and support and 5 in general and administration.

All of the Company’s employees have executed customary confidentiality and restrictive covenant agreements. The Company believes it has a good relationship with its employees and is currently unaware of any key management or other personnel looking to either retire or leave the employment of the Company. During 2008, the Company adopted a 2007 Long Term Stock Incentive Plan, which was approved by the Company’s Board of Directors and stockholders.

| 14 |

Our business, financial condition and operating results are subject to a number of risk factors, both those that are known to U.S. and identified below and others that may arise from time to time. These risk factors could cause our actual results to differ materially from those suggested by forward-looking statements in this report and elsewhere, and may adversely affect our business, financial condition or operating results. If any of those risk factors should occur, moreover, the trading price of our securities could decline, and investors in our securities could lose all or part of their investment in our securities. These risk factors should be carefully considered in evaluating our prospects.

We may fail to address risks we face as a developing business which could adversely affect the implementation of our business plan.

We are prone to all of the risks inherent in the establishment of any new business venture. You should consider the likelihood of our future success to be highly speculative in light of our limited operating history, as well as the limited resources, problems, expenses, risks and complications frequently encountered by entities at our current stage of development.

To address these risks, we must, among other things:

| · | implement and successfully execute our business and marketing strategy; |

| · | continue to develop new products and upgrade our existing products; |

| · | respond to industry and competitive developments; |

| · | attract, retain, and motivate qualified personnel; and |

| · | obtain equity and debt financing on satisfactory terms and in timely fashion in amounts adequate to implement our business plan and meet our obligations. |

We may not be successful in addressing these risks. If we are unable to do so, our business prospects, financial condition and results of operations would be materially adversely affected.

Global market disruptions may adversely affect our business and results of operations.

Recent disruptions in the current global credit and financial markets have included diminished liquidity and credit availability, a decline in economic growth and uncertainty about economic stability. There can be no assurance that there will not be further deterioration in credit and financial markets and confidence in economic conditions. These economic uncertainties affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. We believe that the recent global economic slowdown and the resulting slow recovery have caused certain customers to reduce or delay capital spending plans, which, if prolonged, could impact our growth expectations as potential and existing customers continue to delay decisions to purchase or upgrade their systems. We are unable to predict the likely duration and severity of the current disruptions in the credit and financial markets and adverse global economic conditions and its potential impact on our business. If the current uncertain economic conditions continue or further deteriorate, our business and results of operations could be materially and adversely affected.

Financial difficulties or the bankruptcy of one or more of our major customers could adversely affect our results.

Our ability to collect our accounts receivable and future sales depends, in part, on the financial strength of our customers. We grant credit, generally without collateral, to our customers. Consequently, we are subject to credit risk related to changes in business and economic factors throughout the United Kingdom, the United States, and Canada. In the event customers experience financial difficulty, and particularly if bankruptcy results, our profitability may be adversely impacted by our failure to collect our accounts receivable in excess of our estimated allowance for uncollectible accounts. Additionally, our future revenues could be reduced by the loss of a customer due to bankruptcy. Our failure to collect accounts receivable and/or the loss of one or more major customers could have an adverse effect on our net income and financial condition. We were recently informed that one distributor in the United Kingdom, which accounted for approximately 5.7% of our global revenues for the year ended June 30, 2014, was sold pursuant to an insolvency proceeding, which is the British equivalent of U.S. bankruptcy proceedings. Our inability to secure a new distributor for those accounts or to enter into direct agreements with the end users previously serviced by that distributor could have significant impact on our future revenues.

| 15 |

We may fail to successfully develop, market and sell our products.

To achieve profitable operations, we, along with our subsidiaries, must continue successfully to improve market and sell existing products and develop, market and sell new products. Our product development efforts may not be successful. The development of new software products is highly uncertain and subject to a number of significant risks. The development cycle-from inception to installing the software for customers - can be lengthy and uncertain. The ability to market the product is unpredictable and may cause delays. Potential products may appear promising at early stages of development, and yet may not reach the market for a number of reasons.

Additional issuances of securities will dilute your stock ownership and could affect our stock price.

As of September 22, 2014, there were 14,971,734 shares of our common stock issued and 14,298,053 shares of our common stock outstanding. Our Certificate of Incorporation authorizes the issuance of an aggregate of 18,000,000 shares of common stock and 2,000,000 shares of Preferred Stock, on such terms and at such prices as our Board of Directors may determine. These shares are intended to provide us with the necessary flexibility to undertake and complete plans to raise funds if and when needed. In addition, we may pursue acquisitions that could include issuing equity, although we have no current arrangements to do so. Any such issuances of securities would have a dilutive effect on current ownership of MAM stock. The market price of our common stock could fall in response to the sale or issuance of a large number of shares, or the perception that sales of a large number of shares could occur.

We may encounter significant financial and operating risks if we grow our business through acquisitions.

As part of our growth strategy, we may seek to acquire or invest in complementary or competitive businesses, products or technologies. The process of integrating acquired assets into our operations may result in unforeseen operating difficulties and expenditures and may absorb significant management attention that would otherwise be available for the ongoing development of our business. We may allocate a significant portion of our available working capital to finance all or a portion of the purchase price relating to possible acquisitions although we have no immediate plans to do so. Any future acquisition or investment opportunity may require U.S. to obtain additional financing to complete the transaction. The anticipated benefits of any acquisitions may not be realized. In addition, future acquisitions by U.S. could result in potentially dilutive issuances of equity securities, the incurrence of debt and contingent liabilities and amortization expenses related to intangible assets, any of which could materially adversely affect our operating results and financial position. Acquisitions also involve other risks, including entering markets in which we have no or limited prior experience.

An increase in competition from other software manufacturers could have a material adverse effect on our ability to generate revenue and cash flow.

Competition in our industry is intense. Potential competitors in the U.S. and Europe are numerous. Most competitors have substantially greater capital resources, marketing experience, research and development staffs and facilities than we have. Our competitors may be able to develop products before U.S. or develop more effective products or market them more effectively which would limit our ability to generate revenue and cash flow.

The prices we charge for our products may decrease as a result of competition and our revenues could decrease as a result.

We face potential competition from very large software companies, including Microsoft Corporation, Oracle Corporation and SAP AG which supply ERP and SCM products to our target market of small to medium-sized businesses servicing the automotive aftermarket. To date we have directly competed with one of these larger software and service companies. There can be no assurance that these companies will not develop or acquire a competitive product or service in the future. Our business would be dramatically affected by price pressure if these larger software companies attempted to gain market share through the use of highly discounted sales and extensive marketing campaigns.

| 16 |

If we fail to keep up with rapid technological change, our technologies and products could become less competitive or obsolete.

The software industry is characterized by rapid and significant technological change. We expect that the software needs associated with the automotive technology will continue to develop rapidly, and our future success will depend on our ability to develop and maintain a competitive position through technological development.

We depend on patent and proprietary rights to develop and protect our technologies and products, which rights may not offer us sufficient protection.

The software industry places considerable importance on obtaining patent and trade secret protection for new technologies, products and processes. Our success will depend on our ability to obtain and enforce protection for products that we develop under U.S. and foreign patent laws and other intellectual property laws, preserve the confidentiality of our trade secrets and operate without infringing the proprietary rights of third parties.

We also rely upon trade secret protection for our confidential and proprietary information. Others may independently develop substantially equivalent proprietary information and techniques or gain access to our trade secrets or disclose our technology. We may not be able to meaningfully protect our trade secrets which could limit our ability to exclusively produce products.

We require our employees, consultants, and parties to collaborative agreements to execute confidentiality agreements upon the commencement of employment or consulting relationships or collaboration with U.S. These agreements may not provide meaningful protection of our trade secrets or adequate remedies in the event of unauthorized use or disclosure of confidential and proprietary information.

If we become subject to adverse claims alleging infringement of third-party proprietary rights, we may incur unanticipated costs and our competitive position may suffer.

We are subject to the risk that we are infringing on the proprietary rights of third parties. Although we are not aware of any infringement by our technology on the proprietary rights of others and are not currently subject to any legal proceedings involving claimed infringements, we cannot assure you that we will not be subject to such third-party claims, litigation or indemnity demands and that these claims will not be successful. If a claim or indemnity demand were to be brought against U.S., it could result in costly litigation or product shipment delays or force U.S. to stop selling such product or providing such services or to enter into royalty or license agreements.

Our software and information services could contain design defects or errors which could affect our reputation, result in significant costs to us and impair our ability to sell our products.

Our software and information services are highly complex and sophisticated and could, from time to time, contain design defects or errors. We cannot assure you that these defects or errors will not delay the release or shipment of our products or, if the defect or error is discovered only after customers have received the products, that these defects or errors will not result in increased costs, litigation, customer attrition, reduced market acceptance of our systems and services or damage to our reputation.

If we lose key management or other personnel our business will suffer.

We are highly dependent on the principal members of our management staff. We also rely on consultants and advisors to assist us in formulating our development strategy. Our success also depends upon retaining key management and technical personnel, as well as our ability to continue to attract and retain additional highly qualified personnel. We may not be successful in retaining our current personnel or hiring and retaining qualified personnel in the future. If we lose the services of any of our management staff or key technical personnel, or if we fail to continue to attract qualified personnel, our ability to acquire, develop or sell products would be adversely affected.

| 17 |

It may be difficult for shareholders to recover against those of our directors and officers that are not residents of the U.S.

One of our directors, who is also an executive officer, is a resident of the U.K. In addition, our significant operating subsidiary, MAM Software Limited is located in the U.K. Were one or more shareholders to bring an action against us in the U.S. and succeed, either through default or on the merits, and obtain a financial award against an officer or director of the Company, that shareholder may be required to enforce and collect on his or her judgment in the U.K., unless the officer or director owned assets which were located in the U.S. Further, shareholder efforts to bring an action in the U.K. against its citizens for any alleged breach of a duty in a foreign jurisdiction may be difficult, as prosecution of a claim in a foreign jurisdiction, and in particular a foreign nation, is fraught with difficulty and may be effectively, if not financially, unfeasible.

Our management and internal systems might be inadequate to handle our potential growth.

Our success will depend in significant part on the expansion of our operations and the effective management of growth. This growth will place a significant strain on our management and information systems and resources and operational and financial systems and resources. To manage future growth, our management must continue to improve our operational and financial systems and expand, train, retain and manage our employee base. Our management may not be able to manage our growth effectively. If our systems, procedures, controls, and resources are inadequate to support our operations, our expansion would be halted and we could lose our opportunity to gain significant market share. Any inability to manage growth effectively may harm our ability to institute our business plan.

The market for our common stock is limited and you may not be able to sell your common stock.

Our common stock is currently quoted on the NASDAQ Capital Market. The market for purchases and sales of the Company’s common stock is limited and therefore the sale of a relatively small number of shares could cause the price to fall sharply. Accordingly, it may be difficult to sell shares quickly without significantly depressing the value of the stock. Unless we are successful in developing continued investor interest in our stock, sales of our stock could continue to result in major fluctuations in the price of the stock.

The price of our common stock is likely to be volatile and subject to wide fluctuations.

The market price of the securities of software companies has been especially volatile. Thus, the market price of our common stock is likely to be subject to wide fluctuations. If our revenues do not grow or grow more slowly than we anticipate, or, if operating or capital expenditures exceed our expectations and cannot be adjusted accordingly, or if some other event adversely affects U.S., the market price of our common stock could decline. If the stock market in general experiences a loss in investor confidence or otherwise fails, the market price of our common stock could fall for reasons unrelated to our business, results of operations and financial condition. The market price of our stock also might decline in reaction to events that affect other companies in our industry even if these events do not directly affect U.S.

| 18 |

We have insurance coverage for the services we offer. However, a claim for damages may be made against us regardless of our responsibility for the failure, which could expose us to liability.

We provide business management solutions that we believe are critical to the operations of our customers’ businesses and provide benefits that may be difficult to quantify. Any failure of a customer’s system installed or of the services offered by us could result in a claim for substantial damages against us, regardless of our responsibility for the failure. Although we attempt to limit our contractual liability for damages resulting from negligent acts, errors, mistakes or omissions in rendering our services, we cannot assure you that the limitations on liability we include in our agreements will be enforceable in all cases, or that those limitations on liability will otherwise protect U.S. from liability for damages. In the event that the terms and conditions of our contracts which limit our liability are not sufficient, we have insurance coverage. This coverage of approximately $5,000,000 in the aggregate in the U.K. and in the U.S. insures the business for negligent acts, error or omission, failure of the technology services to perform as intended, and breach of warranties or representations. It also insures the services that we supply including, web services, consulting, analysis, design, installation, training, support, system integration, the manufacture, sale, licensing, distribution or marketing of software, the design and development of code, software and programming and the provision of software applications as a service, rental or lease. However, there can be no assurance that our insurance coverage will be adequate or that coverage will remain available at acceptable costs. Successful claims brought against U.S. in excess of our insurance coverage could seriously harm our business, prospects, financial condition and results of operations. Even if not successful, large claims against U.S. could result in significant legal and other costs and may be a distraction to our senior management.

Because we have international operations, we will be subject to risks of conducting business in foreign countries.

International operations constitute a significant part of our business, and we are subject to the risks of conducting business in foreign countries, including:

| • | difficulty in establishing or managing distribution relationships; |

| • | different standards for the development, use, packaging and marketing of our products and technologies; |

| • | our ability to locate qualified local employees, partners, distributors and suppliers; |

| • | the potential burden of complying with a variety of foreign laws and trade standards; and |

| • | general geopolitical risks, such as political and economic instability, changes in diplomatic and trade relations, and foreign currency risks and fluctuations. |

No assurance can be given that we will be able to positively manage the risks inherent in the conduct of our international operations or that such operations will not have a negative impact on our overall financial operations.

We do not intend to declare dividends on our common stock.

We will not distribute dividends to our stockholders until and unless we can develop sufficient funds from operations to meet our ongoing needs and implement our business plan. The time frame for that is inherently unpredictable, and you should not plan on it occurring in the near future, if at all.

Item 1B. Unresolved Staff Comments.

Not applicable.

Our corporate offices are located at Maple Park, Maple Court, Tankersley, Barnsley, U.K. S75 3DP.

| 19 |

MAM US VAST Division has an office at 3435 Winchester Rd, Ste. 100, Allentown PA, 18104 and the phone number at that office is 610-336-9045. The Allentown, Pennsylvania office is approximately 7,105 square feet in size and is leased for a monthly cost of $11,600.

MAM US Autopart Division shares office space with the VAST Division and the telephone number is 610-351-2928.

MAM Ltd. has three offices. It has headquarters at Maple Park, Maple Court, Tankersley, S75 3DP, U.K. The phone number is 0-11-44-122-635-2900. It also has a regional office at 15 Duncan Close, Red House Square, Moulton Park, Northampton, NN3 6WL, U.K. The phone number is 44-160-449-4001. It has second regional office at Leanne Business Centre, Sandford Lane, Wareham, Dorset, BH20 4DY, U.K. The phone number is 44-192-955-0922. MAM Software leases approximately 15,250 square feet at its company headquarters at a monthly cost of approximately $20,400. It leases approximately 1,223 square feet at its Northampton office at a monthly cost of approximately $1,700 and approximately 717 square feet at its Wareham office at a monthly cost of approximately $930.

Although there are no pending legal proceedings against the Company, from time to time, the Company may become involved legal proceedings, lawsuits, claims and regulations in the ordinary course of its business.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded on the NASDAQ Capital Market under the symbol “MAMS.” As of June 30, 2014, there were approximately 359 shareholders of record and 15,077,830 shares of common stock issued and 14,404,149 shares outstanding. As of September 22, 2014, there were approximately 334 shareholders of record and 14,298,053 shares of common stock issued and outstanding.

On September 22, 2014, the bid and ask prices of our common stock were $5.81 and $6.00 per share, respectively, as reported by the NASDAQ Capital Market. The following table shows the range of high and low bids per share of our common stock as reported by the NASDAQ Capital Market for the fiscal year periods indicated. Such market quotations reflect inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

On March 25, 2011, (“the Effective Date”), the Company amended its Certificate of Incorporation to effectuate a one-for-one hundred reverse stock split, followed by a ten-for-one forward stock split. Pursuant to this transaction, every 100 shares of the Company's common stock were converted into one share of the Company's common stock. Immediately thereafter, a forward stock split was undertaken whereby each share of common stock was converted into 10 shares of common stock. Stockholders owning fewer than 100 shares of common stock whose interests were converted into fewer than 1 share of common stock pursuant to the reverse split, were converted into the right to receive an amount equal to the average daily closing price per share of the common stock on the OTC Bulletin Board (which was the principal market for trading our common stock at that time) for the five trading days immediately before and including the Effective Date, without interest. Stockholders who held 100 or more shares as of the Effective Date received fractional shares in the reverse split and were not cashed out. Any fractional shares held after the ensuing forward split were rounded up to the nearest whole share.

| 20 |

| 2013 | ||||||||

| High | Low | |||||||

| 1st Quarter ended September 30, 2012 | $ | 2.75 | 2.11 | |||||

| 2nd Quarter ended December 31, 2012 | $ | 3.33 | 2.55 | |||||

| 3rd Quarter ended March 31, 2013 | $ | 3.84 | 2.85 | |||||

| 4th Quarter ended June 30, 2013 | $ | 5.00 | 3.40 | |||||

| 2014 | ||||||||

| High | Low | |||||||

| 1st Quarter ended September 30, 2013 | $ | 4.81 | 3.75 | |||||

| 2nd Quarter ended December 31, 2013 | $ | 5.39 | 3.35 | |||||

| 3rd Quarter ended March 31, 2014 | $ | 6.29 | 4.98 | |||||

| 4th Quarter ended June 30, 2014 | $ | 5.94 | 4.91 | |||||

Dividends

We have never declared or paid dividends on our common stock, and our board of directors does not intend to declare or pay any dividends on the common stock in the foreseeable future. Our earnings are expected to be retained for use in expanding our business. The declaration and payment in the future of any cash or stock dividends on the common stock will be at the discretion of the board of directors and will depend upon a variety of factors, including our future earnings, capital requirements, financial condition and such other factors as our board of directors may consider to be relevant from time to time.

Securities Authorized For Issuance under Equity Compensation Plans

Equity Compensation Plan Information as of June 30, 2014

| Plan Category | Number of Securities to Be Issued upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance under the Plan (2) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders (1) | 120,484 | $ | 1.23 | 1,940,138 | ||||||||

| Equity compensation plans not approved by security holders | - | - | - | |||||||||

| Total | 120,484 | $ | 1.23 | 1,940,138 | ||||||||

| (1) | Represents the shares authorized for issuance under the Aftersoft Group, Inc. 2007 Long-Term Incentive Plan, which was approved by the Company’s shareholders at the Annual Meeting held on June 12, 2008. The maximum aggregate number of shares of Common stock that may be issued under the Plan, including Stock Options, Stock Awards, and Stock Appreciation Rights is limited to 15% of the shares of common stock outstanding on the first trading day of any fiscal year, or 2,060,622 for fiscal 2015. |

| (2) | As of July 1, 2014. |

Recent Sales of Unregistered Securities

On April 3, 2014, the Company issued 3,118 shares of common stock to a certain directors in lieu of cash compensation, which were valued at approximately $17,000 based on the closing market price of the Company’s common stock on April 1, 2014.

On April 3, 2014, the Company issued 16,759 shares of common stock valued at approximately $43,000 to the non - management members of the Board of Directors under the Company’s 2007 LTIP.

| 21 |

During the quarter ended September 30, 2014, the Company issued 8,464 shares of common stock to employees, including officers, under the ESPP in lieu of compensation, which were valued at approximately $37,000 based on the closing market price of the Company’s common stock on January 2, 2014.

On July 8, 2014, the Company issued 16,765 shares of common stock to certain directors, which were valued at approximately $43,000 based on the closing market price of the Company’s common stock on the date of the grant.

On July 8, 2014, the Company issued 3,061 shares of common stock to certain directors, in lieu of cash compensation, which were valued at approximately $17,000 based on the closing market price of the Company’s common stock on the date of the grant.

On September 23, 2014, the Company released from escrow 174,804 shares of common stock to certain executives of the Company which vested pursuant to the terms of the April 20, 2012 grant as the market price threshold of the common stock had been achieved. The shares were issued pursuant to the Company’s LTIP and the executives employment agreements. The Company withheld 66,347 shares which were used to pay taxes and those shares were retired by the Company.

On September 23, 2014, the Company released from escrow 84,676 shares of common stock to an officer of a subsidiary of the Company which vested pursuant to the terms of the March 1, 2013 grant as the market price threshold of the common stock had been achieved. The shares were issued pursuant to the Company’s LTIP and the officer’s employment agreement. The Company withheld 44,455 shares which were used to pay taxes and those shares were retired by the Company.

On September 23, 2014, the Company released from escrow 50,178 shares of common stock to a certain executive of the Company which vested pursuant to the terms of the July 1, 2013 grant as the market price threshold of the common stock had been achieved. The shares were issued pursuant to the Company’s LTIP and the executive’s employment agreement. The Company withheld 23,584 shares which were used to pay taxes and those shares were retired by the Company.

These transactions were not registered under the Securities Act in reliance on an exemption from registration set forth in Section 4(a)(2) of the Securities Act in a transaction by the Company not involving a public offering as the shares were granted as compensation for services and the recipients had access to adequate current public information concerning the Company.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations.

Some of the statements contained in this Annual Report on Form 10-K, which are not purely historical, are forward-looking statements, including, but not limited to, statements regarding the Company’s objectives, expectations, hopes, beliefs, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the use of the words “may,” “will,” “should,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of those terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, our actual results could differ materially from those disclosed in these statements due to various risk factors and uncertainties affecting our business. We caution you not to place undue reliance on these forward-looking statements. We do not assume responsibility for the accuracy and completeness of the forward-looking statements and we do not intend to update any of the forward-looking statements after the date of this report to conform them to actual results. You should read the following discussion in conjunction with our financial statements and related notes included elsewhere in this report.

| 22 |

Critical Accounting Policies

Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis of making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies, among others, affect our more significant judgments and estimates used in the preparation of our consolidated financial statements:

Fair Value of Financial Instruments

The Company’s financial instruments consist principally of cash and cash equivalents, accounts receivable, accounts payable, accrued expenses, and debt instruments.

Financial assets and liabilities that are remeasured and reported at fair value at each reporting period are classified and disclosed in one of the following three categories: