Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STONERIDGE INC | v386391_8k.htm |

| EX-99.1 - EX-99.1 - STONERIDGE INC | v386391_ex99-1.htm |

1 Stoneridge, Inc . Second Quarter 2014 Earnings Release Presentation August 11, 2014 Exhibit 99.2

Statements in this presentation that are not historical facts (including, but not limited to, 2014 net sales guidance) are forward - looking statements, which involve risks and uncertainties that could cause actual events or results to differ materially from those expressed or implied by the statements. Important factors that may cause actual results to differ materially from those in the forward - looking statements include, among other factors, the loss or bankruptcy of a major customer; the costs and timing of facility closures, business realignment or similar actions; a significant change in medium - and heavy - duty truck, automotive or agricultural and off - highway vehicle production; our ability to achieve cost reductions that offset or exceed customer - mandated selling price reductions; a significant change in general economic conditions in any of the various countries in which Stoneridge operates; labor disruptions at Stoneridge’s facilities or at any of Stoneridge’s significant customers or suppliers; the ability of suppliers to supply Stoneridge with parts and components at competitive prices on a timely basis; the amount of Stoneridge’s indebtedness and the restrictive covenants contained in the agreements governing its indebtedness, including its asset - based credit facility and senior secured notes; customer acceptance of new products; capital availability or costs, including changes in interest rates or market perceptions; the failure to achieve successful integration of any acquired company or business and the items described in “Risk Factors” and other uncertainties or risks discussed in Stoneridge’s periodic and current reports filed with the Securities and Exchange Commission. Important factors that could cause the performance of the commercial vehicle and automotive industry to differ materially from those in the forward - looking statements include factors such as (1) continued economic instability or poor economic conditions in the United States and global markets, (2) changes in economic conditions, housing prices, foreign currency exchange rates, commodity prices, including shortages of and increases or volatility in the price of oil, (3) changes in laws and regulations, (4) the state of the credit markets, (5) political stability, (6) international conflicts and (7) the occurrence of force majeure events . Forward Looking Statements

Forward Looking Statements (cont’d) Also, see Rounding Differences Disclosure below These factors should not be construed as exhaustive and should be considered with the other cautionary statements in Stoneridge’s filings with the Securities and Exchange Commission. Forward - looking statements are not guarantees of future performance; Stoneridge’s actual results of operations, financial condition and liquidity, and the development of the industry in which Stoneridge operates may differ materially from those described in or suggested by the forward - looking statements contained in this presentation. In addition, even if Stoneridge’s results of operations, financial condition and liquidity, and the development of the industry in which Stoneridge operates are consistent with the forward - looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. This presentation contains time - sensitive information that reflects management’s best analysis only as of the date of this presentation. Any forward - looking statements in this presentation speak only as of the date of this presentation, and Stoneridge undertakes no obligation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. Stoneridge does not undertake any obligation to publicly update or revise any forward - looking statement as a result of new information, future events or otherwise, except as otherwise required by law . Rounding Differences : There may be slight immaterial differences between figures represented in our public filings compared to what is shown in this presentation. The differences are the a result of rounding due to the representation of values in millions rather than thousands in our public filings.

Sales by Segment – 2Q14 vs 2Q13 CD ELEC PST SRI CD ELEC PST SRI Pass Car / Light Truck 59.3 0.9 0.0 60.2 56.6 0.9 0.0 57.5 Med / HD Truck 11.3 49.7 0.0 61.1 11.1 46.3 0.0 57.4 Ag 2.8 0.0 0.0 2.8 2.3 0.0 0.0 2.3 PST / Other 3.0 2.1 32.9 38.1 4.4 1.5 46.7 52.6 TOTAL 76.4 52.8 32.9 162.1 74.4 48.7 46.7 169.8 CD ELEC PST SRI CD ELEC PST SRI Pass Car / Light Truck 2.7 0.0 0.0 2.7 4.8% 0.0% 0.0% 4.7% Med / HD Truck 0.2 3.4 0.0 3.6 1.8% 7.3% 0.0% 6.4% Ag 0.5 0.0 0.0 0.5 21.7% 0.0% 0.0% 21.7% PST / Other (1.4) 0.6 (13.8) (14.5) (31.8)% 40.0% (29.5)% (27.6)% TOTAL 2.0 4.0 (13.8) (7.7) 2.7% 8.4% (29.5)% (4.6)% 2Q14 2Q13 Variance $ Variance % 2Q14 vs 2Q13 2Q14 vs 2Q13

Sales, Gross Profit, & Op Income – 2Q14 vs 2Q13 EPS from Continuing Operations is $0.06 / share excluding the impact of the Goodwill write off which is $0.85 / share SRI excl PST PST PST PPA SRI SRI SRI 2Q14 2Q13 USD [millions] except per share data Actual Actual ∆ # ∆ % Net Sales 129.2 32.9 - 162.1 169.8 (7.7) (4.5%) Cost of Goods Sold 92.8 20.7 0.3 113.8 115.5 (1.7) (1.5%) Gross Profit 36.4 12.2 (0.3) 48.3 54.3 (6.0) (11.0%) Gross Profit % 28.2% 37.1% 29.8% 32.0% Goodwill Impairment - - 29.3 29.3 - 29.3 Other SG&A 27.6 13.4 1.2 42.2 42.6 (0.4) (0.9%) Total Selling, General and Administrative 27.6 13.4 30.5 71.5 42.6 28.9 67.8% SGA % 21.4% 40.7% 44.1% 25.1% Operating Income 8.8 (1.2) (30.8) (23.2) 11.8 (35.0) (296.6%) Operating Profit % 6.8% -3.6% -14.3% 6.9% Equity Earnings (0.1) - - (0.1) (0.1) - 0.0% Interest Expense (Income), Net 4.3 0.8 - 5.1 4.5 0.6 13.3% Foreign Exchange Translation - Debt (0.3) 0.6 - 0.3 0.8 (0.5) (62.5%) Other (Income) / Expense (0.8) 0.8 - - (0.7) 0.7 (100.0%) Income Before Taxes 5.7 (3.4) (30.8) (28.5) 7.2 (35.7) (495.8%) Income Before Taxes % 4.4% -10.3% -17.6% 4.2% Provision for Income Taxes 1.2 (0.6) (0.5) 0.1 0.8 (0.7) (87.5%) Income from Continuing Operations 4.5 (2.8) (30.3) (28.6) 6.4 (35.0) NM Income from Continuing Operations 3.5% -8.5% -17.6% 3.8% Discontinued Operations 0.6 - - 0.6 - 0.6 Gain/Loss on Disposal (1.1) - - (1.1) - (1.1) Income (loss) from Discontinued Operations (0.5) - - (0.5) - (0.5) Net Income (excl NC Int Exp) 4.0 (2.8) (30.3) (29.1) 6.4 (35.5) NM Non Controlling Interest - - (7.2) (7.2) 0.6 (7.8) NM Net Income Attributable to Stoneridge 4.6 (2.8) (23.1) (21.3) 5.8 (27.1) (467.2%) Net Margin % 3.6% -8.5% -13.1% 3.4% 2Q14 v 2Q13

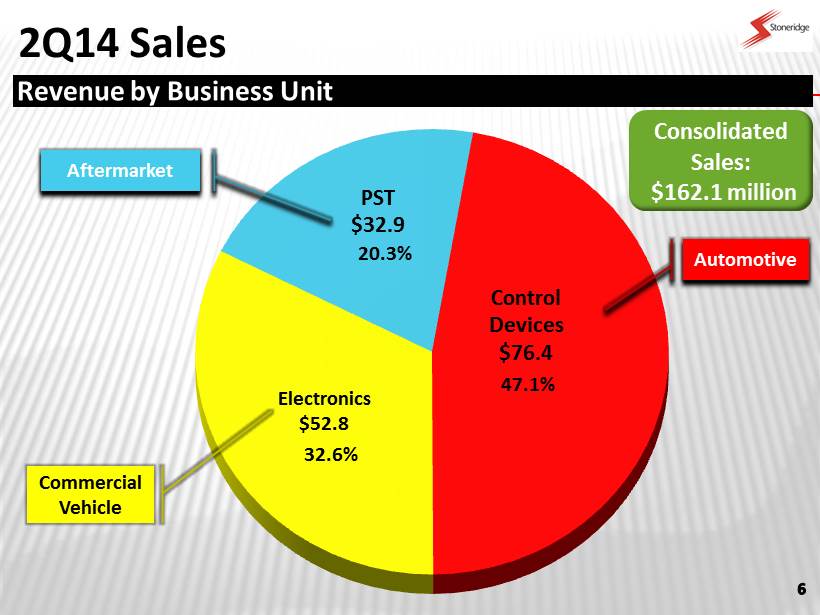

2Q14 Sales Control Devices $76.4 Electronics $52.8 PST $32.9 PST (Brazil ): Est 2012: $185 - $197 million Revenue by Business Unit Consolidated Sales : $162.1 million 2012 Guidance Core Sales (excl PST) $755 – $765 million 47.1% 20.3% 32.6% Automotive Aftermarket Commercial Vehicle

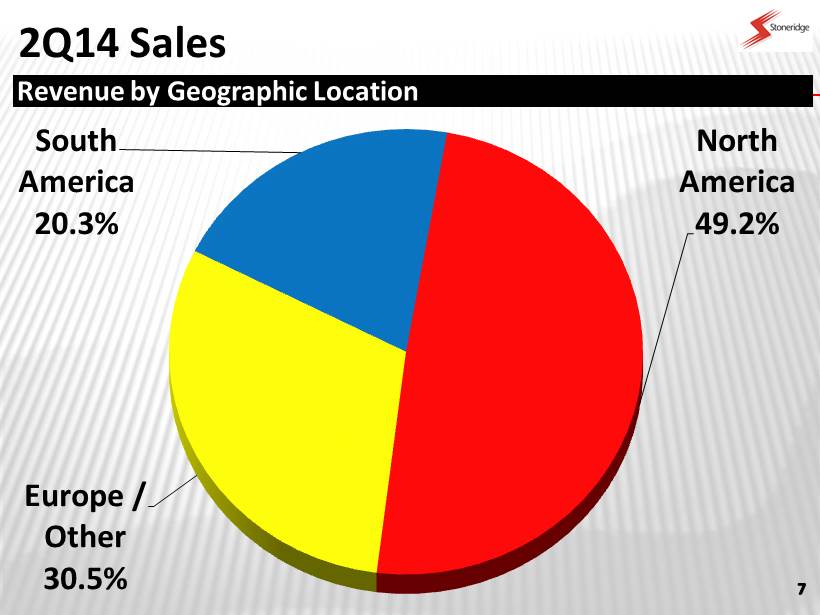

2Q14 Sales North America 49.2% Europe / Other 30.5% South America 20.3% Revenue by Geographic Location

8 PST CD, Elec , & Wiring Volume (0.13) 0.15 Mix / Direct Material (0.06) 0.00 SGA / DD (Increase) / Decrease 0.07 (0.09) Business Realignment (0.01) 0.00 CD / Elec Overhead 0.00 (0.04) PST FX (0.03) 0.00 PST Goodwill (0.85) 0.00 Interest (0.01) 0.00 TOTAL (1.02) 0.02 (0.79) (1.00) (0.01) (0.85) (0.03) (0.04) (0.01) (0.02) (0.06) 0.02 0.21 2Q14 Actual EPS TOTAL Interest PST Goodwill PST FX CD / ELEC Overhead Business Realignment SGA / DD (Increase) / Decrease Mix / Direct Material Volume 2Q13 Actual EPS Consolidated 2Q13 vs 2Q14 EPS Bridge

Sales by Segment – 2Q14 vs 1Q14 CD ELEC PST SRI CD ELEC PST SRI Pass Car / Light Truck 59.3 0.9 0.0 60.2 61.7 0.9 0.0 62.6 Med / HD Truck 11.3 49.7 0.0 61.1 7.1 47.9 0.0 55.0 Ag 2.8 0.0 0.0 2.8 4.7 0.0 0.0 4.7 PST / Other 3.0 2.1 32.9 38.1 3.8 1.3 33.9 39.0 TOTAL 76.4 52.8 32.9 162.1 77.3 50.1 33.9 161.3 CD ELEC PST SRI CD ELEC PST SRI Pass Car / Light Truck (2.4) 0.0 0.0 (2.4) (3.9)% 2.0% 0.0% (3.8)% Med / HD Truck 4.2 1.8 0.0 6.0 59.7% 3.7% 0.0% 10.9% Ag (2.0) 0.0 0.0 (2.0) (41.3)% 33.1% 0.0% (41.3)% PST / Other (0.8) 0.9 (1.0) (0.9) (21.0)% 68.7% (2.9)% (2.4)% TOTAL (0.9) 2.7 (1.0) 0.8 (1.2)% 5.3% (2.9)% 0.5% 2Q14 1Q14 Variance $ Variance % 2Q14 vs 1Q14 2Q14 vs 1Q14

10 PST CD, Elec , & Wiring Volume (0.01) 0.03 Mix / Direct Material (0.01) 0.00 SGA Decrease 0.00 0.02 PST FX 0.02 0.00 PST Goodwill (0.85) 0.00 PST Realignment (0.01) 0.00 TOTAL (0.86) 0.05 (0.79) (0.81) (0.01) (0.85) 0.02 0.02 (0.01) 0.02 0.02 2Q14 Actual EPS TOTAL PST Realignment PST Goodwill PST FX SGA Decrease Mix / Direct Material Volume 1Q14 Actual EPS Consolidated 1Q14 vs 2Q14 EPS Bridge

PST Purchase Price Accounting Expense [Non Cash] (millions) 1Q 2Q 3Q 4Q Full Year 2013 1Q14 2Q14 COGS / DM Inventory Write Up $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 COGS / Depreciation – Fixed Asset Write Up $0.3 $0.3 $0.3 $0.3 $1.2 $0.3 $0.3 SGA / Amortized Intangibles $1.6 $1.5 $1.0 $1.0 $5.1 $1.2 $1.2 TOTAL $1.9 $1.8 $1.3 $1.3 $6.3 $1.5 $1.5 1Q 2Q 3Q 4Q 2013 1Q14 2Q14 Impact on Op Margin 0.81% 0.74% 0.56% 0.55% 0.66% 0.63% 0.93% Impact on Diluted EPS $(0.04) $(0.04) $(0.02) $(0.03) $(0.13) $(0.03) $(0.60)

USD [millions] 2012 1Q13 2Q13 3Q13 4Q13 2013 1Q14 2Q14 Actual Actual Actual Actual Actual Actual Actual Actual Beginning Cash 78.7 44.6 46.7 37.0 46.1 44.6 62.8 48.4 Consolidated Net Income 3.7 4.3 6.4 5.5 0.3 16.5 0.5 (29.1) Depreciation / Amortization 35.3 9.2 8.8 8.5 8.8 35.2 8.2 7.2 Working Capital 33.2 (15.4) (11.9) (0.4) 17.4 (10.0) (23.8) 9.2 Other 3.3 1.3 0.6 5.6 (5.3) 2.1 (1.1) 32.2 Cash Flow from Operations 75.5 (0.6) 3.9 19.2 21.2 43.8 (16.2) 19.5 Capital Expenditures (26.4) (5.8) (4.9) (7.8) (6.8) (25.3) (4.6) (7.7) Free Cash Flow 49.1 (6.4) (1.0) 11.4 14.4 18.5 (20.8) 11.8 Ending Cash 44.6 46.7 37.0 46.1 62.8 62.8 48.4 45.8 Long Term Debt - Proceeds / (Repayment) (64.2) 9.5 (8.4) (3.0) 1.9 - 7.1 (2.1) Cash Flow 12 * PST borrowed 25 mm BRL in March 2013 to pay down $10 mm USD denominated debt in April 2013 * ** ** Free Cash Flow = Cash Flow from Operations – Capital Expenditures

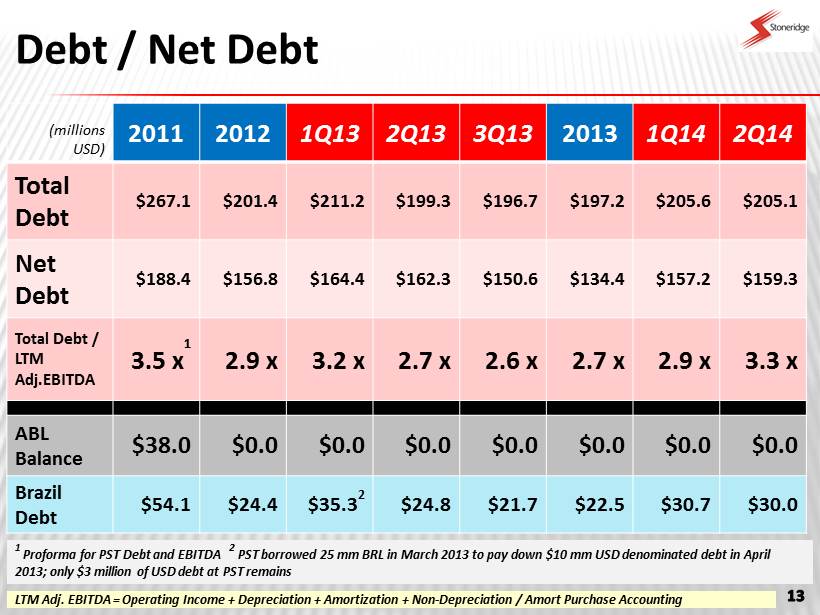

Debt / Net Debt (millions USD) 2011 2012 1Q13 2Q13 3Q13 2013 1Q14 2Q14 Total Debt $267.1 $201.4 $211.2 $199.3 $196.7 $197.2 $205.6 $205.1 Net Debt $188.4 $156.8 $164.4 $162.3 $150.6 $134.4 $157.2 $159.3 Total Debt / LTM Adj.EBITDA 3.5 x 1 2.9 x 3.2 x 2.7 x 2.6 x 2.7 x 2.9 x 3.3 x ABL Balance $38.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Brazil Debt $54.1 $24.4 $35.3 2 $24.8 $21.7 $22.5 $30.7 $30.0 LTM Adj. EBITDA = Operating Income + Depreciation + Amortization + Non - Depreciation / Amort Purchase Accounting 1 Proforma for PST Debt and EBITDA 2 PST borrowed 25 mm BRL in March 2013 to pay down $10 mm USD denominated debt in April 2013; only $3 million of USD debt at PST remains

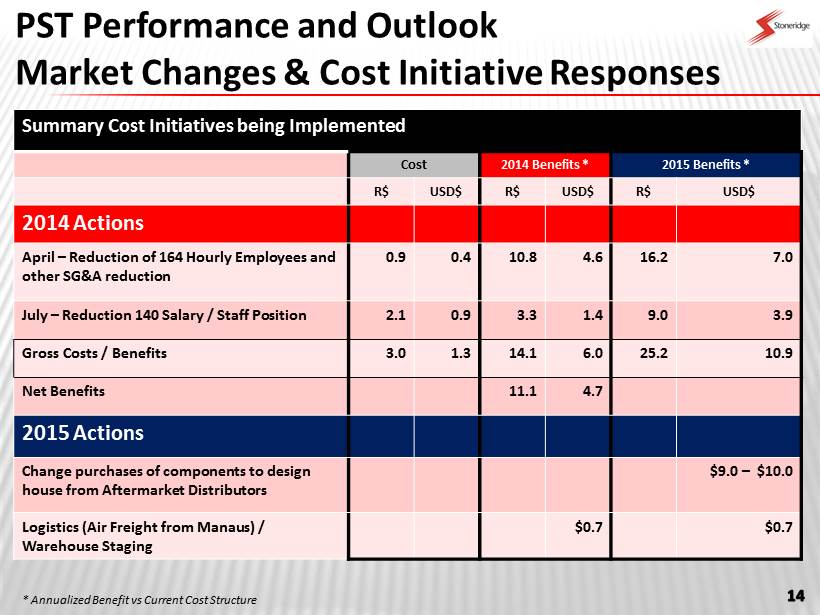

Summary Cost Initiatives being Implemented Cost 2014 Benefits * 2015 Benefits * R$ USD$ R$ USD$ R$ USD$ 2014 Actions April – Reduction of 164 Hourly Employees and other SG&A reduction 0.9 0.4 10.8 4.6 16.2 7.0 July – Reduction 140 Salary / Staff Position 2.1 0.9 3.3 1.4 9.0 3.9 Gross Costs / Benefits 3.0 1.3 14.1 6.0 25.2 10.9 Net Benefits 11.1 4.7 2015 Actions Change purchases of components to design house from Aftermarket Distributors $9.0 – $10.0 Logistics (Air Freight from Manaus ) / Warehouse Staging $0.7 $0.7 * Annualized Benefit vs Current Cost Structure PST Performance and Outlook Market Changes & Cost Initiative Responses

2014 Guidance * Includes PST $3.3 million of Non - Cash expense related to the purchase of PST Excludes any Gain or Loss associated with the Sale of the Wiring Business or any potential Refinancing Transaction Assumes USD to BRL rate of 2.40 Sales: $680 - $720 million Gross Margin: 29.0% - 31.0% Op Margin*: 5.5% - 7.0% Adjusted EPS from continuing operations: $0.55 - $0.75 Previous Guidance – May 26, 2014 Sales: $680 - $720 million Gross Margin: 29.0% - 31.0% Op Margin*: 5.5% - 7.0% EPS: $0.55 - $0.75 • Excludes results from discontinued Wiring Operations, one time costs associated with refinancing the 9.5% Senior Notes and the write - off of Goodwill in June 2014 • Assumes lower debt balances and interest rates from a refinancing transaction which is an estimated benefit of $.10 per share Revised Guidance – August 11, 2014 Assumes USD to BRL rate of 2.35