Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WILLIAM LYON HOMES | d764965d8k.htm |

| EX-99.5 - EX-99.5 - WILLIAM LYON HOMES | d764965dex995.htm |

| EX-99.4 - EX-99.4 - WILLIAM LYON HOMES | d764965dex994.htm |

| EX-99.2 - EX-99.2 - WILLIAM LYON HOMES | d764965dex992.htm |

| EX-99.3 - EX-99.3 - WILLIAM LYON HOMES | d764965dex993.htm |

| EX-23.1 - EX-23.1 - WILLIAM LYON HOMES | d764965dex231.htm |

Exhibit 99.1

FORWARD-LOOKING STATEMENTS

This offering memorandum may contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Although we believe that, in making any such statements, our expectations are based on reasonable assumptions, any such statement may be influenced by factors that could cause actual outcomes and results to be materially different from those projected.

These forward-looking statements include statements relating to our anticipated financial performance, business prospects, consummation of the transactions contemplated by this offering memorandum, the use of proceeds, and/or statements preceded by, followed by or that include the words “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “could,” “plans,” “seeks” and similar expressions. These forward-looking statements speak only as of the dates stated and we do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, even if experience or future events make it clear that any expected results expressed or implied by these forward-looking statements will not be realized. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these expectations may not prove to be correct or we may not achieve the financial results, savings or other benefits anticipated in the forward-looking statements. These forward-looking statements are necessarily estimates reflecting the best judgment of our senior management and involve a number of risks and uncertainties, some of which may be beyond our control, that could cause actual results to differ materially from those suggested by the forward-looking statements. If any of those risks and uncertainties materialize, actual results could differ materially from those discussed in any such forward-looking statement. Among the factors that could cause actual results to differ materially from those discussed in forward-looking statements are those discussed under the heading “Risk Factors” in this offering memorandum, as well as in our reports filed from time to time with the SEC that are incorporated by reference herein. These factors include, but are not limited to:

| • | our ability to consummate the acquisition of Polygon Northwest Homes as described herein on time or at all, and to realize the anticipated benefits therefrom; |

| • | our ability to integrate successfully the Polygon Northwest Homes operation with our existing operations; |

| • | any adverse effect on our business operations, or those of Polygon Northwest Homes, during the pendency of the acquisition; |

| • | worsening in general economic conditions either nationally or in regions in which we operate; |

| • | worsening in markets for residential housing; |

| • | declines in real estate values, resulting in further impairment of our real estate assets; |

| • | volatility in the banking industry and credit markets; |

| • | terrorism or other hostilities involving the United States; |

| • | changes in mortgage and other interest rates; |

| • | conditions in the capital, credit and financial markets, including mortgage lending standards and the availability of mortgage financing; |

| • | changes in generally accepted accounting principles or interpretations of those principles; |

| • | changes in prices of homebuilding materials; |

| • | the availability of labor and homebuilding materials; |

i

| • | adverse weather conditions; |

| • | competition for home sales from other sellers of new and resale homes; |

| • | cancellations and our ability to realize our backlog; |

| • | the occurrence of events such as landslides, earthquakes and other geologic events that may be uninsurable or not economically insurable; |

| • | changes in governmental laws and regulations; |

| • | our ability to comply with financial and other covenants under our debt instruments; |

| • | our ability to refinance the outstanding balances of our debt obligations at their maturity; |

| • | the timing of receipt of regulatory approvals and the opening of projects; |

| • | the impact of construction defect, product liability and home warranty claims, including the adequacy of self-insurance accruals, the applicability and sufficiency of our insurance coverage; |

| • | the availability and cost of land for future development; and |

| • | other factors set forth under “Risk Factors” included herein, as well as those factors or conditions described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” in each case in our annual report on Form 10-K for the year ended December 31, 2013 and in subsequent filings with the SEC, incorporated by reference in this offering memorandum. |

ii

SUMMARY

This summary contains basic information about our business and this offering and highlights selected information contained elsewhere in this offering memorandum. This summary is not complete and does not contain all of the information that you should consider before deciding whether or not to invest in the notes. For a more complete understanding of our business and this offering, you should read this entire offering memorandum, especially the description of the terms and conditions of the notes discussed under “Description of the Notes” and the risks discussed under “Risk Factors” included in, or otherwise incorporated by reference in, this offering memorandum.

Our Company

We are one of the largest Western U.S. regional homebuilders. Headquartered in Newport Beach, California, we are primarily engaged in the design, construction, marketing and sale of single-family detached and attached homes in California, Arizona, Nevada and Colorado. Our core markets currently include Orange County, Los Angeles, San Diego, the San Francisco Bay Area, Phoenix, Las Vegas and Denver. Our acquisition of Polygon Northwest Homes will mark our expansion into the Pacific Northwest region and our entry into Washington, with a core market of Seattle, and Oregon, with a core market of Portland.

We have a distinguished legacy of more than 58 years of homebuilding operations, over which time we have sold in excess of 77,000 homes. Our markets are characterized by attractive long-term housing fundamentals. We hold leading market share positions in most of our markets and we have a significant land supply, with 14,184 lots owned or controlled as of March 31, 2014, representing an approximately ten year supply of lots based upon our home closings during the 12 months ended March 31, 2014. Through the Polygon Acquisition, we will add over 4,200 owned or controlled lots.

We have a significant expertise in understanding the needs of our homebuyers and designing our product offerings to meet those needs. This allows us to maximize the yield on our land investments by tailoring our home offerings to meet the buyer demands in each of our markets. We build and sell across a diverse range of product lines at a variety of price points with an emphasis on sales to entry-level, first-time move-up and second-time move-up homebuyers. We are committed to achieving the highest standards in design, quality and customer satisfaction and have received numerous industry awards and commendations throughout our operating history in recognition of our achievements.

We have experienced significant operating momentum since the beginning of 2012, during which time a variety of key housing, employment and other related economic statistics in our markets have continued to demonstrate signs of recovery and growth. In 2013, we delivered 1,360 homes, with an average selling price of approximately $383,000, and recognized home sales revenues and total revenues of $521.3 million and $572.5 million, respectively. In the three months ended March 31, 2014, we delivered 276 homes, with an average selling price of approximately $508,000, and recognized home sales revenues and total revenues of $140.3 million and $150.0 million, respectively. As of March 31, 2014, we were selling homes in 35 communities and had a consolidated backlog of 236 sold but unclosed homes, with an associated sales value of $264.8 million, representing a 55% increase in value as compared to our backlog as of March 31, 2013. The average selling price of homes in our backlog as of March 31, 2014 was approximately $538,000, which was approximately 57% higher than the average selling price of homes in our backlog as of March 31, 2013. We have experienced meaningful gross margin expansion over the past two years, achieving year-over-year growth in each of the past eight quarters. For the three months ended March 31, 2014, we achieved a 24.3% homebuilding gross margin and a 27.6% adjusted homebuilding gross margin, representing an approximately 720 basis point and 440 basis point increase, respectively, as compared to the same period in 2013. For a discussion of adjusted homebuilding gross margin and a comparison of adjusted homebuilding gross margin to homebuilding gross margin, see footnote 3 under the caption “Summary—Summary Historical and Pro Forma Financial Data” in this offering memorandum.

1

We believe that the attractive fundamentals in our markets, our leading market share positions, our long-standing relationships with land developers, our significant land supply and our focus on providing the best possible customer experience position us to capitalize on meaningful growth as the U.S. housing market continues to improve.

Recent Developments

Preliminary Results for William Lyon Homes for the Quarter Ended June 30, 2014

Our financial statements as of and for the quarter ended June 30, 2014 are not yet available, and our independent registered public accounting firm has not completed its review of our results for the second quarter. Set forth below are certain preliminary estimates of the results of operations that we expect to report for our second quarter. Our actual results may differ materially from these estimates due to the completion of our financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results for our second quarter are finalized.

The following are preliminary estimates for our quarter ended June 30, 2014:

During the three months ended June 30, 2014, we had 336 new home deliveries and an average sales price of homes delivered of $501,000, as compared to 345 new home deliveries and an average sales price of homes delivered of $350,000 during the three months ended June 30, 2013. Home sales revenue and total revenue increased 39% and 37%, respectively, to $168.2 million and $179.8 million for the three months ended June 30, 2014, from $120.6 million and $131.4 million for the three months ended June 30, 2013.

During the three months ended June 30, 2014, we had 388 net new home orders with an associated value of $195.5 million, as compared to 360 net new home orders with an associated value of $154.2 million during the three months ended June 30, 2013, representing an 8% increase in units and a 27% increase in value. We had 38 average selling communities during the three months ended June 30, 2014 and 24 average selling communities during the three months ended June 30, 2013. As of June 30, 2014, we were selling homes in 41 communities and had a consolidated backlog of 544 sold but unclosed homes, with an associated sales value of $303.3 million, representing a 6% increase in units and a 47% increase in value as compared to our backlog of 511 units with an associated sales value of $206.8 million as of June 30, 2013.

Acquisition of Polygon Northwest Homes

On June 22, 2014, California Lyon entered into a definitive purchase and sale agreement (the “Acquisition Agreement”) with PNW Home Builders, L.L.C. (“PNW Parent”), PNW Home Builders North, L.L.C., PNW Home Builders South, L.L.C. and Crescent Ventures, L.L.C. (collectively, the “Sellers”), to acquire the residential homebuilding business of PNW Parent. The residential homebuilding operations of PNW Parent and its affiliates are not conducted through a stand-alone legal entity, but rather are a combination of the residential homebuilding operations owned by Sellers through their direct and indirect ownership of certain limited liability companies that own real property (such operations being referred to herein as “Polygon Northwest Homes”) and conduct business as Polygon Northwest Company (“Polygon”). Pursuant to the Acquisition Agreement, California Lyon has agreed to purchase Polygon Northwest Homes through its acquisition of the membership interests of the underlying limited liability companies and certain service companies and other assets, for an aggregate cash purchase price of $520.0 million (the “Polygon Acquisition”). Separately, PNW Parent is also engaged in commercial building activities and rental operations, which are excluded from the Polygon Acquisition and are not being acquired by us.

The Polygon Acquisition will take place on a “zero cash, zero debt” basis, such that we will not be acquiring any cash on the balance sheet of Polygon Northwest Homes at closing and will not be assuming any of Polygon Northwest Homes’ existing debt, which will get paid off in connection with closing of the Polygon Acquisition. Sellers will retain all pre-closing liabilities pursuant to the terms of the Acquisition Agreement,

2

except for certain limited assumed liabilities including accounts payable and accrued other expenses. Pursuant to the terms of the Acquisition Agreement, we expect the Polygon Acquisition to close on or before August 15, 2014.

The $520.0 million purchase price provided for in the Acquisition Agreement is subject to working capital adjustments at, and following, closing. The following estimated balance sheet as of July 31, 2014 was used by the parties at the time of the execution of the Acquisition Agreement to arrive at the $520.0 million purchase price, and does not include line items for the assets and liabilities that are excluded pursuant to the terms of the Acquisition Agreement:

| (in thousands) | ||||

| Assets: |

||||

| Restricted Cash |

$ | 300 | ||

| Accounts Receivable |

450 | |||

| Home Building Inventories |

321,340 | |||

| Pre-Development Costs |

200 | |||

| Other Assets |

250 | |||

|

|

|

|||

| Total Assets |

$ | 322,540 | ||

| Liabilities & Members’ Equity: |

||||

| Accounts Payable |

$ | 14,174 | ||

| Accrued Other Expenses |

529 | |||

|

|

|

|||

| Total Liabilities |

$ | 14,703 | ||

| Total Equity |

307,836 | |||

|

|

|

|||

| Liabilities & Members’ Equity |

$ | 322,540 | ||

The foregoing was an estimate only and does not represent the parties’ current expectation of the financial condition of Polygon Northwest Homes at July 31, 2014.

The Acquisition Agreement contains customary representations, warranties and covenants of the parties, and the closing of the Polygon Acquisition is subject to customary closing conditions and regulatory approvals, as applicable. We cannot assure you that the Polygon Acquisition will be completed or, if completed, that it will be completed at the price, within the time period or on the terms and with the anticipated benefits contemplated by this offering memorandum. The foregoing description of the Acquisition Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Acquisition Agreement, which is included as Exhibit 2.1 to our Current Report on Form 8-K, filed with the SEC on June 23, 2014, and is incorporated by reference herein. See “Risk Factors—Risks Relating to the Polygon Acquisition” included in this offering memorandum.

Upon closing of the Polygon Acquisition, we anticipate that the acquired entities will begin operating as two new divisions of William Lyon Homes under the Polygon name, one in Washington with a core market of Seattle, and the other in Oregon with a core market of Portland. Derek Straight, the existing President of Polygon Northwest Homes’ Washington operations, and Fred Gast, the existing President of Polygon Northwest Homes’ Oregon operations, are expected to continue to run their respective divisions as newly appointed Division Presidents of William Lyon Homes, and to report directly to Matthew R. Zaist, President and Chief Operating Officer. Pursuant to the terms of the Acquisition Agreement, we expect to bring all current Polygon Northwest Homes’ employees interested in remaining with the business into our organizational structure as part of the two new divisions, which we believe will facilitate a smooth integration process and allow us to leverage the aspects of the business where detailed knowledge of local market conditions is important, while at the same time maintaining the centralized management functions of our operations.

Upon consummation of the Polygon Acquisition and the Escrow Merger, the entities acquired from Polygon Northwest Homes will become direct or indirect subsidiaries of the Company, and, promptly following

3

the Escrow Merger, in no event later than such time as the applicable entity will become a guarantor under the Revolving Credit Facility (as defined below), those entities that provide a guarantee under the Revolving Credit Facility will provide a guarantee of the notes and the 2020 notes (as defined below) and the 2019 notes (as defined below), including the additional 2019 notes (as defined below).

Business of Polygon Northwest Homes

We believe that Polygon Northwest Homes is currently the largest private homebuilder in the Pacific Northwest region, with #2 market positions in each of its core markets of Seattle and Portland according to Metrostudy, a Hanley Wood company. Polygon Northwest Homes acquires and develops residential housing for sale to the general public, which entails the purchase of land, the development of finished lots or multi-family building pads and the construction and sale of single-family homes, townhomes and condominiums. Polygon Northwest Homes has operated in the Pacific Northwest region for over 20 years, delivering approximately 16,000 homes during such time period and establishing a strong reputation for quality and customer satisfaction. During 2013, Polygon Northwest Homes delivered 791 homes, produced homebuilding revenues of approximately $290.1 million and a homebuilding gross margin of 27.1%. Average sales prices of homes delivered during 2013 were $436,000 and $254,000 in Seattle and Portland, respectively, with a focus on targeting primarily first- and second-time move-up buyers. Polygon Northwest Homes has approximately 130 employees, and is currently actively selling in 12 new home communities, with sales prices of homes in backlog currently ranging from approximately $225,000 to $578,000.

Polygon Northwest Homes is expected to own or control an aggregate of approximately 4,200 lots as of August 15, 2014 in the attractive high-demand, low-supply markets of Seattle and Portland.

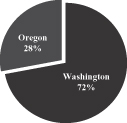

| Polygon Northwest Homes – Owned / Controlled Lots by Market |

Polygon Northwest Homes – Closings by Market |

Polygon Northwest Homes – Total Revenue by Market | ||||||

| (4,227 estimated lots as of August 15, 2014)

|

(for the twelve months ended

|

(for the twelve months ended

| ||||||

|

|

|

|

Rationale for Polygon Acquisition

We believe the Polygon Acquisition presents compelling strategic and financial rationales, including, for example:

| • | Penetration of Desirable Pacific Northwest Markets. The Polygon Acquisition marks our entry into the Pacific Northwest region of the United States through the acquisition of a highly regarded homebuilder in Seattle and Portland, two of the most attractive and land-constrained markets in the country. |

| • | Continued Growth and Diversification of Quality Land Positions. The Polygon Acquisition enhances our geographic diversification by deploying capital into high-quality assets in new West Coast markets. Giving effect to the Polygon Acquisition, we anticipate that the combined company will own or control approximately 18,000 lots across 11 core markets in six states. |

4

| • | Complementary Brands and Management Styles. Like William Lyon Homes, Polygon Northwest Homes employs a location-centric strategy offering a wide range of high-quality homes to suit the needs of its buyers in each of its submarkets and primarily targets the first- and second-time move-up buyer segments. |

| • | Strengthening Our Management Team. Polygon Northwest Homes’ senior management team has an average of 16 years of industry experience, with strong market knowledge and deep local relationships that we believe we can leverage for future growth. |

| • | Strong Cultural Fit. We believe that Polygon Northwest Homes shares the same core values as we do, focused on delivering customers both outstanding quality homes and a first-class homebuying experience, and that the team will thrive on the entrepreneurial approach that we foster at the divisional level to embrace their creativity and passion for the business. |

| • | Increase to Revenue and Cash Flow. We believe the Polygon Acquisition will drive top-line growth and generate significant cash flows in the next 24 to 36 months, as well as improve SG&A leverage through our expanded regional platform. |

Preliminary Results for Polygon Northwest Homes for the Quarter Ended June 30, 2014

Polygon Northwest Homes’ financial statements as of and for the quarter ended June 30, 2014 are not yet available, and its independent auditors have not completed their review of Polygon Northwest Homes’ results for the second quarter. Set forth below are certain preliminary estimates of the results of operations for Polygon Northwest Homes’ second quarter, though actual results may differ materially from these estimates due to the completion of Polygon Northwest Homes’ financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results for the second quarter are finalized.

The following are preliminary estimates for the quarter ended June 30, 2014:

During the three months ended June 30, 2014, Polygon Northwest Homes had 194 new home deliveries and an average sales price of homes delivered of $380,000, as compared to 213 new home deliveries and an average sales price of homes delivered of $363,000 during the three months ended June 30, 2013. Total revenue decreased to $73.8 million for the three months ended June 30, 2014, from $77.4 million for the three months ended June 30, 2013.

During the three months ended June 30, 2014, Polygon Northwest Homes had 219 net new home orders with an associated value of $84.0 million, as compared to 182 net new home orders with an associated value of $81.7 million during the three months ended June 30, 2013, representing a 20% increase in units and a 3% increase in value. Polygon Northwest Homes had 12 average sales locations during the three months ended June 30, 2014 and 17 average sales locations during the three months ended June 30, 2013. As of June 30, 2014, Polygon Northwest Homes was selling homes in 12 communities and had a consolidated backlog of 210 sold but unclosed homes, with an associated sales value of $75.3 million, representing a 46% increase in units and a 48% increase in value as compared to a backlog of 144 units with an associated sales value of $50.8 million as of June 30, 2013.

Related Transactions

Concurrent Offering of Additional 5.75% Senior Notes due 2019

Concurrently with the offering of the notes, we are offering an additional $50.0 million in aggregate principal amount of our 5.75% senior notes due 2019 (such series of notes, the “2019 notes,” and the notes being offered, the “additional 2019 notes”). The completion of this offering is not contingent on the completion of the offering of the additional 2019 notes, and the completion of the offering of the additional 2019 notes is not

5

contingent on the completion of this offering. See “Description of Other Indebtedness—5.75% Senior Notes due 2019” in this offering memorandum for an additional discussion of the 2019 notes.

Senior Unsecured Facility

In connection with the execution of the Acquisition Agreement for the Polygon Acquisition, we received definitive financing commitments from affiliates of the initial purchasers for a one-year senior unsecured loan facility of up to $520.0 million, available in a single draw (the “Senior Unsecured Facility”), less the aggregate gross proceeds from the issuance by Parent of any equity financing and the aggregate principal amount of debt financing, including the notes offered hereby and the additional 2019 notes being offered concurrently, in each case issued on or prior to the funding of the committed financing. We expect to temporarily borrow $120.0 million under the Senior Unsecured Facility. See “Description of Other Indebtedness—Senior Unsecured Facility” in this offering memorandum for an additional discussion of the terms of the Senior Unsecured Facility.

We intend to use all of the net proceeds of this offering, all of the net proceeds of the concurrent offering of the additional 2019 notes and the borrowings under the Senior Unsecured Facility, along with $119.7 million in cash on hand (including $100.0 million of cash generated from the Land Bank Arrangements (as defined below)), to finance the Polygon Acquisition and to pay related fees and expenses. See “Use of Proceeds.” In the event the concurrent offering of additional 2019 notes does not close on or prior to the date of the closing of the Polygon Acquisition, we will borrow an additional amount under the Senior Unsecured Facility.

Land Banking Arrangements

We intend to enter into several separate land banking arrangements with respect to land parcels located in California, Washington and Oregon, each of which is entitled but undeveloped, and including certain parcels proposed to be sold by the Sellers in the Polygon Acquisition (collectively, the “Land Bank Arrangements”). Land banking arrangements are a method of acquiring land in staged takedowns, typically over a time period of 24 to 36 months, that we employ from time to time in the ordinary course of business to access parcels of land with minimal cash outlay. Under the Land Bank Arrangements, the land banker will purchase the underlying land assets and fund all horizontal land development costs, and provide us with an option to purchase back the finished lots on a rolling basis for a set purchase price. In consideration for the option to repurchase, we anticipate that we will make a non-refundable deposit or option fee of 15% of the total purchase price of the parcels at issue. We anticipate that the Land Bank Arrangements will close concurrently with, or immediately prior to, the closing of the Polygon Acquisition, and we expect the aggregate proceeds to us from the Land Bank Arrangements to be approximately $100.0 million, net of deposits.

We cannot assure you that we will be successful in concluding the Land Bank Arrangements, and if we are unable to do so, we will need to obtain the necessary funding to consummate the Polygon Acquisition from either cash or other debt financing sources. See “Risk Factors—Risks Related to Our Indebtedness—We have substantial outstanding indebtedness and may incur additional debt in the future.”

Amendment to Revolving Credit Facility

On July 3, 2014, California Lyon and the lenders, including affiliates of the initial purchasers in this offering, entered into an amendment to our $100.0 million revolving credit facility (the “Revolving Credit Facility”), which amendment, among other changes, incorporated a minimum borrowing base availability of $50.0 million and increased the maximum leverage ratio from 60% to 75% for the first four quarters following the Polygon Acquisition.

Our Competitive Strengths

Leading local presence in high-growth Western U.S. markets

We believe that our market presence positions us to meaningfully capitalize on the broader national housing market recovery. We are highly disciplined in the selection of our markets, based upon underlying

6

supply and demand fundamentals, competitiveness and profitability drivers. Our land inventory is concentrated in markets that benefit from favorable housing demand drivers including high population and job growth, positive migration patterns, housing affordability and desirable lifestyle and weather characteristics.

We believe that homebuilding is a very local business and that we benefit not only from being in attractive markets, but also from having significant scale in our markets. We hold leading market share positions in most of our markets, including a #3 ranking in Los Angeles County and a #7 ranking in Orange County; a #6 ranking in Contra Costa County and a #10 ranking in Northern California; a #9 ranking in Phoenix; a #11 ranking in Las Vegas; a #7 ranking in Fort Collins / Northern Colorado and a #13 ranking in Denver, each based upon 2013 home closings as reported by Metrostudy. The Polygon Acquisition will mark our entrance into the Seattle and Portland metropolitan areas, where Polygon Northwest Homes has a #2 ranking in each market, based upon 2013 home closings as reported by Metrostudy.

Our scale and significant operating experience within our markets have allowed us to cultivate long-standing relationships with local land owners, officials, subcontractors and suppliers. We believe that maintaining significant market share enables us to achieve economies of scale, maximize our visibility to land acquisition opportunities and differentiates us from our competitors. We believe that our regional operating model, our intimate knowledge of local market conditions and our decades of operating and local market experience have enabled us to perform favorably compared to the local divisions of national homebuilders and we believe that we are well-positioned to continue to do so as the U.S. housing market continues to recover.

Significant and well-located land position

We benefit from a sizeable and well-located lot supply. As of March 31, 2014, we and our consolidated joint ventures owned 11,614 lots, all of which are entitled, and had options to purchase an additional 2,570 lots, equating to a total of approximately ten years of land supply based upon our 1,368 home closings for the 12 months ended March 31, 2014. Pro forma for the Polygon Acquisition, based on our lot supply as March 31, 2014 and Polygon Northwest Homes’ estimated lot supply of 4,227 lots as of an assumed closing date of August 15, 2014, our owned or controlled lot supply equated to 18,411 lots, positioning us well for growth in deliveries in 2015 and 2016.

Our pro forma lot supply is well-diversified across our markets and reflects our balanced approach to land investment. We have a diverse mix of finished lots available for near-term homebuilding operations and longer-term strategic land positions to support future growth. We believe that our current inventory of owned and controlled lots is sufficient to supply the vast majority of our projected future home closings for the next three years and a portion of future home closings for a multi-year period thereafter. Our meaningful supply of lots allows us to be selective in identifying new land acquisition opportunities, with a primary focus on optioning and acquiring land to drive closings, revenues and earnings growth in 2016 and beyond.

7

Total Lots Owned and Controlled and Years of Land Supply

(Actual, as of March 31, 2014, plus pro forma for the Polygon Acquisition, as of an assumed closing date of August 15, 2014)

| Division | William Lyon Homes as of March 31, 2014 |

Adjustment for |

Pro Forma Total Lots |

% of Pro Forma Total Lots |

Deliveries in Twelve Months Ended March 31, 20142 |

Years Supply3 |

||||||||||||||||||

| Arizona |

5,558 | - | 5,558 | 30% | 398 | 14.0 | ||||||||||||||||||

| Nevada |

3,116 | - | 3,116 | 17% | 272 | 11.5 | ||||||||||||||||||

| Southern California |

2,591 | - | 2,591 | 14% | 427 | 6.1 | ||||||||||||||||||

| Northern California |

1,670 | - | 1,670 | 9% | 139 | 12.0 | ||||||||||||||||||

| Colorado |

1,249 | - | 1,249 | 7% | 132 | 9.5 | ||||||||||||||||||

| Washington |

- | 2,151 | 2,151 | 12% | 447 | 4.8 | ||||||||||||||||||

| Oregon |

- | 2,076 | 2,076 | 11% | 304 | 6.8 | ||||||||||||||||||

| Total |

14,184 | 4,227 | 18,411 | 100% | 2,119 | 8.7 | ||||||||||||||||||

| 1 | Polygon Acquisition figures represent estimated lots as of an assumed closing date of August 15, 2014 |

| 2 | Represents home deliveries in twelve months ended March 31, 2014 for each of William Lyon Homes and Polygon Northwest Homes |

| 3 | Represents Pro Forma Total Lots divided by Deliveries in Twelve Months Ended March 31, 2014 |

8

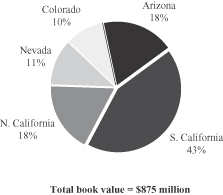

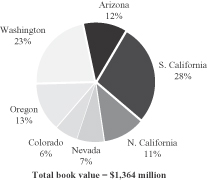

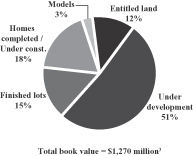

| Book Value of Owned and Controlled Inventory by Geography | Book Value of Owned Inventory by Development Status | |||

| (As of March 31, 2014 – Actual) | (As of March 31, 2014 – Actual)1 | |||

|

| |||

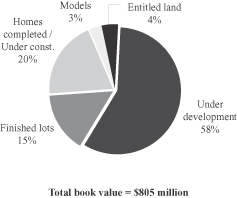

| Book Value of Owned and Controlled Inventory by Geography | Book Value of Owned Inventory by Development Status | |||

| (As of March 31, 2014 – Pro Forma for Polygon Acquisition)2 | (As of March 31, 2014 – Pro Forma for Polygon Acquisition)3 | |||

|

| |||

| 1 | Presented based on carrying value for William Lyon Homes as of March 31, 2014; excludes deposits and inventory not owned |

| 2 | Presented based on carrying value for William Lyon Homes as of March 31, 2014 and preliminary estimate of purchase price allocation for Polygon Acquisition |

| 3 | Presented based on carrying value for William Lyon Homes as of March 31, 2014 and preliminary estimate of purchase price allocation for Polygon Acquisition; excludes deposits and inventory not owned. Does not reflect the expected impact of the Land Bank Arrangements, which would otherwise have an impact on the data for “Entitled land” and “Under development,” as well as total book value. |

Land acquisition and development expertise

We believe our ability to identify, acquire and develop land in desirable locations and on favorable terms is key to our success. Unlike many of our peers, we retained our senior land acquisition and development personnel throughout the most recent housing downturn, allowing us to maintain our acquisition and development capabilities and our strong relationships with local and regional land sellers. We have purchased land and built and sold homes in highly desirable master-planned communities and developments such as The Irvine Ranch, Rancho Mission Viejo and Summerlin and we have worked with land developers such as Lewis Community Developers and FivePoint Communities throughout our and their operating histories. We believe these long-standing relationships provide us with a significant competitive advantage in our markets, where relationships are frequently just as important as, or more important than, price in the sourcing of land acquisitions.

9

We opportunistically engage in land development in certain markets. Our key senior land acquisition and development professionals have an average of 32 years of industry experience, providing our organization with the necessary expertise to successfully progress land through the entire development cycle, including the entitlement process. Some of our land holdings represent multi-phase, master-planned communities, which provide us with the opportunity to add value to our undeveloped land through re-entitlements or repositioning, particularly in those markets with highly fragmented land ownership or those lacking market participants capable of assembling and developing large land parcels. Further, engagement in land development affords us the ability to execute upon opportunistic bulk land sales when such sales translate into attractive returns comparable to or in excess of our operating projections.

Strategically diversified across buyer segments and product offerings

We offer a broad portfolio of products, including single-family detached and attached homes designed for and marketed to targeted customer segments, strategically focused to match product and price points to areas of the market with the greatest depth of demand. Our products are differentiated by size, design, livability, features and amenities in order to serve the specific needs of homebuyers, with an emphasis on sales to entry-level, first-time move-up and second-time move-up homebuyers. Despite the diversity of our product offerings, we generally standardize the number of home designs within any given product line. This standardization permits on-site mass production techniques and bulk purchasing of materials and components, which enables us to better control and reduce construction costs and cycle times. We believe that our diversified product strategy enables us to best serve multiple customer segments and to quickly adapt to market conditions and consumer preferences. Further, our ability to deliver a wide spectrum of product types to different buyer demographics allows us to pursue a broader array of land acquisition opportunities, both in terms of geographic location and land parcel size.

We continually evaluate opportunities to evolve our product mix within our communities. In communities we brought online in 2013 and 2014 year-to-date and that we expect to bring online through 2015, we have included a higher percentage of offerings targeted to what we believe to be the underserved move-up markets. For the 12 months ended March 31, 2014, approximately 69% of our home closings were to move-up buyers and 31% were to first-time buyers. This shift in product mix meaningfully contributed to the 78% increase in the average selling price of our homes delivered, from $285,000 for the three months ended March 31, 2013 to $508,000 for the three months ended March 31, 2014. Over the same period of time, the average selling price of our backlog of homes sold but not yet closed increased by 57%, from $343,000 to $538,000.

Similar to William Lyon Homes, Polygon Northwest Homes develops an extensive product offering suited to meet buyer preferences and needs in each market and market segment. Polygon Northwest Homes’ product offering ranges from single-family detached and move-up product to townhomes and condominiums. For the 12 months ended March 31, 2014, approximately 63% of Polygon Northwest Homes’ home closings were to move-up buyers and 37% were to first-time buyers. In 2013, 68% of Polygon Northwest Homes’ homebuyers had a household income in excess of $100,000.

10

| Home Closings by Average Selling Price | Buyer Segmentation by LTM Closings | |||

| (for the three months ended March 31, 2014 –

|

(for the twelve months ended March 31, 2014 –

| |||

|

|

|

We carefully study and design our products with the assistance of third-party architects, engineers, designers, consultants and homeowner focus groups. Within each of our markets, we determine the profile of buyers we hope to address and we design neighborhoods and homes taking into account the specific needs of those buyers. We believe that our customer and product diversification strategies provide us the flexibility to respond effectively to changes in consumer preferences and quickly adapt to evolving community demographics.

Long-standing reputation for delivering superior quality and customer service

We believe that our leadership positions in our markets are due in large part to our long-standing reputation as a producer of high-quality homes and our industry-leading, award-winning customer support services. Our Company and divisions have received numerous industry awards and commendations throughout our operating history, including “Professional Builder of the Year” from Professional Builder Magazine, “Builder of the Year” from Builder and Developer Magazine and, most recently in 2013 and 2014, an aggregate of 33 Eliant Homebuyer Choice Awards, the most of any homebuilder, in categories such as “Overall Purchase Experience,” “Design Selection Experience,” “Construction Experience,” “Overall First-Year Quality,” “Highest Percent of Sales from Referrals” and “Overall Home Purchase & Ownership Experience.”

We currently market and sell our homes under the William Lyon Homes brand in all of our markets except for Colorado. In Colorado, we operate under the Village Homes brand. Established in 1984 and acquired by us in 2012, Village Homes has an outstanding reputation for quality and service and has received numerous industry awards, including “America’s Best Builder” by Builder Magazine in 2002, numerous J.D. Power Awards and, most recently, the Homebuilders Association of Denver’s 2012 “Community of the Year” award. Upon consummation of the Polygon Acquisition, we will operate in Washington and Oregon under the Polygon brand. Polygon Northwest Homes has operated in the Pacific Northwest region for over 20 years and has established a strong reputation for quality and customer satisfaction. Polygon Northwest Homes’ rigorous quality assurance process, developed in 2003 by a former Boeing aerospace engineer, has served as a key source of competitive differentiation for the Polygon brand and has yielded notably high levels of customer satisfaction and referral rates.

We focus on building and selling homes that combine high-quality craftsmanship with locally influenced design characteristics that ultimately reflect the various lifestyles and aspirations of our multiple customer segments. We strive to provide the highest level of customer service during the sales process and after a home is sold. We typically engage our sales personnel on a long-term, rather than project-by-project, basis, which we believe results in a more motivated and loyal sales force with an extensive knowledge of our operating policies and products. We also employ a variety of programs and services to ensure customer satisfaction and help us improve production efficiency, reduce warranty costs and increase customer referrals. We believe that delivering

11

high-quality homes and industry-leading customer service provides for a differentiated buying experience and provides us with a competitive advantage based upon repeat customers, high referral rates and strong brand recognition, allowing us to lower customer acquisition costs and increase unit sales rates.

Deep and experienced management team with significant tenure at our Company

We benefit from a highly experienced management team, with our executive officers and regional and division presidents averaging approximately 29 years of experience in the homebuilding and development industries within California or the Southwestern United States. Our Chief Executive Officer, William H. Lyon, our President and Chief Operating Officer, Matthew R. Zaist, and our Chief Financial Officer, Colin Severn, have closely managed the operational and financial aspects of our business and each brings significant experience, operational and market knowledge and professional relationships within the industry. Our regional and division presidents have substantial industry knowledge and local market expertise, with an average of approximately 13 years at our Company and an average of approximately 30 years in the homebuilding industry. Reporting directly to our division presidents, we have a deep and long-tenured team of 24 management professionals with an average within each of our divisions of 25 or more years of experience in the homebuilding industry and ten or more years of experience at our Company. We believe this level of experience and the resulting long-standing relationships provide us with a competitive advantage, particularly as it relates to dealings with land sellers, subcontractors and material suppliers, and enable us to identify, evaluate and capitalize on market opportunities, attract and retain new customers and adjust to changing national, regional and local business conditions. We strive to ensure that we have the best team available and we believe our reputation, market presence and consistency of values and culture have enabled us to attract and retain top talent. Concurrent with the Polygon Acquisition, Derek Straight and Fred Gast will join our senior management team as presidents of our Washington and Oregon divisions, respectively. Derek and Fred bring with them a history of success and local market experience and relationships, with nine and 19 years of experience, respectively, at Polygon Northwest Homes, as well as strong leadership teams reporting to them, which team members average approximately 16 years of industry experience and 12 years of experience with Polygon Northwest Homes.

General William Lyon (USAF Ret.), our Company’s namesake and our Executive Chairman, has nearly 60 years of operating history within the homebuilding industry and his experience, knowledge of our operations and the markets in which we compete and extensive professional relationships within our industry enable him to serve as a valuable leader to our Company. General Lyon provides senior leadership to our management team and to our board of directors, ensuring that the business principles that have made our Company successful in the past are an integral part of our ongoing culture. In addition to the contributions of General Lyon, we have a strong board of directors with a diverse range of industry backgrounds and experience. We believe that our board of directors provides us with an additional point of reference on strategic operating and corporate decisions and various members bring significant real estate knowledge and relationships from which we benefit.

Our Business Strategy

Drive revenue growth and profitability by opening new communities on existing owned and controlled land supply

We intend to capitalize on our existing owned and controlled land supply, which we believe is largely sufficient to supply the vast majority of future home closings for the next three years and a portion of future home closings for a multi-year period thereafter. Upon completion of the Polygon Acquisition, we will own or have an option to purchase 100% of the lots on which we currently expect to close homes during 2014 and 2015, and substantially all of the lots on which we currently expect to close homes in 2016.

In 2013, we opened 21 new communities, increasing our total community count by approximately 39%, net of closed communities, ending with 32 and 35 net communities at December 31, 2013 and March 31, 2014, respectively. We had 41 active selling communities as of mid-year 2014, representing an approximately 28% net increase

12

from December 31, 2013, and we estimate having approximately 75 active selling communities by mid-year 2015.

We believe that the execution of our business plan through the monetization of our existing land position will allow us to increase or maintain our market share within our markets, enabling us to enhance profitability by continuing to optimize the size of our business plan in each of our markets in order to leverage operating efficiencies appropriately. We will continue to pursue growth within our markets to the extent that we believe such growth is consistent with our disciplined operating strategy, balanced land policies and overall commitment to superior product quality.

Employ disciplined land acquisition strategies to support future growth

We believe that, next to our people, our land is our most valuable asset. As a result of our strong reputation for quality and consistency and our well-established operating history of between 17 years and 58 years in our markets, we have developed long-standing relationships with local land sellers, master-planned community developers, financial institutions and other builders. We intend to leverage these relationships, along with our extensive knowledge of local market dynamics and trends, to continue to source well-positioned land parcels in our markets.

Our land acquisition strategy is dynamic, nimble and responsive to prevailing and projected future market conditions. We attempt to maximize allocation of our capital utilizing land acquisition transaction structures that minimize up-front capital requirements while maximizing long-term returns through purchase options and land banking arrangements, rolling lot takedowns, purchase contracts that provide for payment to land sellers upon closing of homes built on land purchased from them, and non-recourse or seller financing, when possible.

Maintain disciplined operating platform and low cost structure with focus on profitability and cash flow

We combine a decentralized management approach to those aspects of our business where detailed knowledge of local market conditions is important with a centralized management approach to those areas where we believe central control is required, including, in particular, land investment. Our local and regional management teams are responsible for monitoring homebuyer demand trends and managing construction, land development, sales and marketing and governmental processing activities, while our corporate staff provides back-office support for financial, treasury, human resources, information technology and legal matters. We focus on minimizing construction costs and overhead, a strategy which we believe is critical to maintaining competitive margins and profitability. We believe that we have built a scalable foundation which will support and foster revenue growth without a proportionate corresponding increase in our selling, general and administrative expenses.

Prudent focus on balance sheet optimization and investor returns

We intend to continue to employ a prudent mix of both debt and equity as part of our ongoing financing strategy. We believe we are well-positioned with a strong balance sheet and sufficient liquidity for supporting our ongoing operations and growth initiatives. We are focused on maintaining an appropriate long-term capital structure and will seek to utilize a combination of our expected meaningful cash flow generation from operations and increases in our equity base through retained earnings and potential equity issuances on an opportunistic basis to reduce net leverage. Our goal is to target total debt to book capitalization of 50% or lower by the end of 2016.

General Company Corporate Information and History

Our principal executive offices are located at 4695 MacArthur Court, 8th Floor, Newport Beach, California 92660 and our telephone number is (949) 833-3600. Our website address is www.lyonhomes.com. Information contained on our website is not a part of this offering memorandum and the inclusion of the website address in this offering memorandum is an inactive textual reference only.

13

General Escrow Issuer Corporate Information and History

The Escrow Issuer is a wholly owned subsidiary of the Issuer that was incorporated in California on July 21, 2014. The Escrow Issuer was incorporated for the sole purpose of initially issuing the notes and completing the transactions contemplated hereby. No separate information has been provided in this offering memorandum for the Escrow Issuer because (i) it does not conduct any operations, (ii) prior to the closing of the offering, it did not have any material assets and (iii) upon consummation of the Polygon Acquisition, the Escrow Issuer will be merged with and into the Issuer. The indenture governing the notes will generally restrict the Escrow Issuer from conducting any business operations prior to the consummation of the Polygon Acquisition other than those in connection with the issuance of the notes.

14