Attached files

| file | filename |

|---|---|

| 8-K - 8-K - W R GRACE & CO | gra8-kvaluation.htm |

W. R. Grace & Co. Valuation Considerations These notes may help investors value Grace post emergence. June 25, 2014

© 2014 W. R. Grace & Co. Disclaimer Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 This presentation contains forward-looking statements, that is, information related to future, not past, events. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues” or similar expressions. Forward-looking statements include, without limitation, expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; and markets for securities. For these statements, Grace claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Like other businesses, Grace is subject to risks and uncertainties that could cause its actual results to differ materially from its projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to materially differ from those contained in the forward-looking statements include, without limitation: risks related to foreign operations, especially in emerging regions, the cost and availability of raw materials and energy, the effectiveness of its research and development and growth investments, acquisitions and divestitures of assets and gains and losses from dispositions, developments affecting Grace's funded and unfunded pension obligations, its legal and environmental proceedings, costs of compliance with environmental regulation and those additional factors set forth in Grace's most recent Annual Report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission and are readily available on the Internet at www.sec.gov. Reported results should not be considered as an indication of future performance. Readers are cautioned not to place undue reliance on Grace's projections and forward-looking statements, which speak only as the date thereof. Grace undertakes no obligation to publicly release any revision to the projections and forward-looking statements contained in this announcement, or to update them to reflect events or circumstances occurring after the date of this announcement. Non-GAAP Financial Terms These slides contain certain “non-GAAP financial terms” which are defined in Appendix III. Reconciliations of non-GAAP terms to the closest GAAP term (i.e., net income) are provided in Appendix IV. .

© 2014 W. R. Grace & Co. Grace has a different balance sheet after emergence Debt and debt equivalents at emergence $900 million in financing for December 2013 acquisition of UNIPOL polypropylene licensing and catalyst products business and general corporate purposes $100 million in non-U.S. debt Warrant cash settlement $490 million current liability at emergence $319 million net of tax deduction when paid to trust Debt equivalent until settled in cash (up to one year after emergence) Deferred payment obligations (DPO) to asbestos trusts $603 million discounted present value as of March 31, 2014 $392 million discounted present value net of tax deductions when paid to trusts Non-cash interest will accrue annually at 9.67% rate Net debt as of March 31, 2014: ~$1.74 billion Warrant cash settlement plus DPO plus emergence financing plus non-U.S. debt less cash ~2.2X Adjusted EBITDA outlook for 2014 Net operating losses at emergence NOL generated at emergence ~$670 million Additional deduction of $490 million when warrant settled NOL, warrant deduction and other tax attributes available to offset U.S. Federal taxable income from 2014 through a portion of 2018.

© 2014 W. R. Grace & Co. Walk from Adjusted EPS to Cash EPS 2014 Adjusted EBIT (outlook of 4/23/14) $620 – 660 mm 2014 Adjusted EPS (assumes no repurchases) $4.36 – $4.69 Add backs: • $50 mm pretax non-cash DPO accretion1 • Difference between ETR and cash tax rate2 • Impact from share repurchase activity3 $0.40 $1.83 – 1.96 ~$0.10 2014 Cash EPS $6.69 – 7.15 Percent Yield (at closing price of $95.61 of 6/20/14) 7.0% – 7.5% 1. Deferred payment obligations to the personal injury trust will accrete annually at the rate of 9.67%. GAAP earnings will not be adjusted for the non-cash interest accretion. 2. ETR for 2014 estimated at 35% compared with projected cash tax rate of 10%. NOL, warrant deduction and other tax attributes available to offset U.S. Federal taxable income from 2014 through a portion of 2018. 3. $500 mm share repurchase authorization announced on 2/3/14; assumes 77 million average diluted shares outstanding on 12/31/13. Grace generates significantly more cash than earnings due to non-cash charges and cash tax accounting

© 2014 W. R. Grace & Co. Description of Warrant Settlement Agreement Agreement Terms • Warrant to be settled in cash, not shares – No dilution, no overhang • Settlement collared within a range of $375 to $490 million – $54.50 to $66.00 per share • Asbestos Trust could opt-out of settlement agreement in the event of a publicly announced change-in-control transaction within one year of emergence At Grace's recent stock price of $95.61(1), warrant valued at $490 million • Cash liability cannot increase above this amount Accounting Implications • Warrant recorded at fair value at emergence • Current liability on the balance sheet; Debt equivalent until settled in cash (1) At June 20, 2014

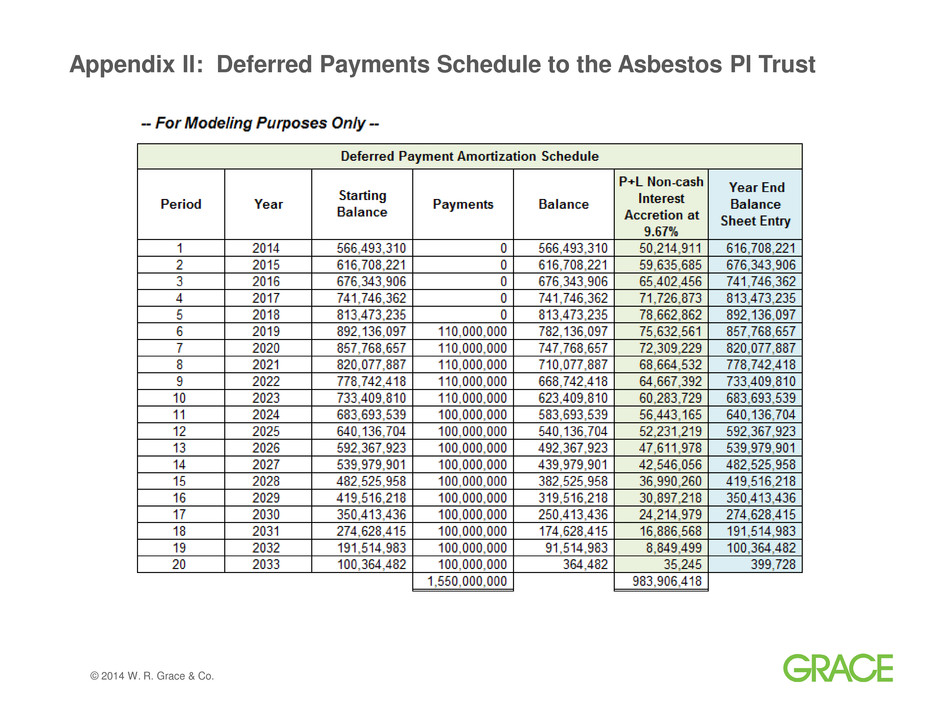

© 2014 W. R. Grace & Co. Description of Deferred Payment Obligations Grace has agreed to fund the Asbestos PI Trust in part via a series of deferred payments: • $110 million per year for 5 years beginning on January 2, 2019 and each annual anniversary thereafter until 2023 • $100 million per year for 10 years beginning on January 2, 2024 and each annual anniversary thereafter until 2033 • The deferred payments are subordinated and junior in right of payment, and in all other respects to Grace’s senior indebtedness including any refinanced senior indebtedness and are backed by 50.1% of Grace common stock in order to meet 524(g) requirements • Grace recorded the liability on a present value basis ($567 million present value as of 2/3/14 using a 9.67% discount rate) Grace has also agreed to fund the Asbestos PD Trust via a payment every six months in the amount of non-ZAI PD claims allowed during the preceding six months plus interest and, except for the first six months, the amount of PD Trust expenses for the preceding six months. Grace has recorded a liability for probable payments to the PD Trust. Grace will also pay $30 million in cash on February 3, 2017, as part of its ZAI settlement • The present value of the deferred ZAI payment is $27 million at a 3.00% discount rate • Grace is also obligated to make up to 10 contingent deferred payments of $8 million per year during the 20–year period beginning on the fifth anniversary of the effective date of the Plan if the value of ZAI assets falls below $10 million during the preceding year. These payments are not probable.

© 2014 W. R. Grace & Co. Appendix I: Year-over-year walk of Adjusted EPS to Cash EPS

© 2014 W. R. Grace & Co. Appendix II: Deferred Payments Schedule to the Asbestos PI Trust

© 2014 W. R. Grace & Co. Appendix III: Definitions of Non-GAAP Measures Non-GAAP Financial Terms Adjusted EBIT means net income adjusted for interest income and expense, income taxes, costs related to Chapter 11, asbestos-related costs, restructuring expenses and related asset impairments, pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits, certain income and expense items related to divested businesses, product lines, and certain other investments and gains and losses on sales of businesses, product lines, and certain other investments. In the 2013 first quarter, we also adjusted for the currency transaction loss incurred on our Venezuelan cash balances of $6.9 million. Adjusted EBITDA means Adjusted EBIT adjusted for depreciation and amortization. Adjusted Free Cash Flow means net cash provided by or used for operating activities minus capital expenditures plus the net cash flow from costs related to Chapter 11, cash paid to resolve contingencies subject to Chapter 11, accelerated payments under defined benefit pension arrangements, and expenditures for asbestos-related items. Grace uses Adjusted Free Cash Flow as a liquidity measure to evaluate its ability to generate cash to support its ongoing business operations, to invest in its businesses, and to provide a return of capital to shareholders. Adjusted Earnings Per Share (EPS) means Diluted EPS adjusted for costs related to Chapter 11, asbestos-related costs, restructuring expenses and related asset impairments, pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits, certain income and expense items related to divested businesses, product lines, and certain other investments and gains and losses on sales of businesses, product lines, and certain other investments, and certain discrete tax items.. Adjusted EBIT Return On Invested Capital means Adjusted EBIT (on a trailing four quarters basis) divided by the sum of net working capital, properties and equipment and certain other assets and liabilities. We use Adjusted EBIT as a performance measure in significant business decisions and in determining certain incentive compensation. We use Adjusted EBIT as a performance measure because it provides improved period-to-period comparability for decision making and compensation purposes, and because it better measures the ongoing earnings results of our strategic and operating decisions by excluding the earnings effects of our Chapter 11 proceedings, asbestos liabilities, restructuring activities, and divested businesses. Adjusted EBIT, Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted EPS, and Adjusted EBIT Return On Invested Capital do not purport to represent income measures as defined under U.S. GAAP, and should not be used as alternatives to such measures as an indicator of our performance. These measures are provided to investors and others to improve the period-to-period comparability and peer-to-peer comparability of our financial results, and to ensure that investors understand the information we use to evaluate the performance of our businesses. We have provided in the following tables a reconciliation of these non-GAAP measures to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. Adjusted EBIT has material limitations as an operating performance measure because it excludes Chapter 11- and asbestos-related costs and may exclude income and expenses from restructuring activities and divested businesses, which historically have been material components of our net income. Adjusted EBITDA also has material limitations as an operating performance measure because it excludes the impact of depreciation and amortization expense. Our business is substantially dependent on the successful deployment of capital, and depreciation and amortization expense is a necessary element of our costs. We compensate for the limitations of these measurements by using these indicators together with net income as measured under U.S. GAAP to present a complete analysis of our results of operations. Adjusted EBIT and Adjusted EBITDA should be evaluated together with net income measured under U.S. GAAP for a complete understanding of our results of operations.

© 2014 W. R. Grace & Co. Appendix IV: Reconciliation of Adjusted EBITDA to Net Income * Due to its bankruptcy, Grace had significant intercompany loans between its non-U.S. subsidiaries and its U.S. debtor subsidiaries that are not related to its operating activities. In addition Grace had accumulated significant cash balances during its bankruptcy. The intercompany loans were paid when Grace emerged from bankruptcy, and excess cash balances were used to fund a significant portion of Grace’s emergence from bankruptcy. Accordingly, income and expense items related to the intercompany loans and the cash balances are categorized as costs related to Chapter 11.

For additional information, please visit www.grace.com or contact: J. Mark Sutherland Vice President, Investor Relations +1 410.531.4590 Mark.Sutherland@grace.com David Joseph Finance Manager, Investor Relations +1 410.531.4590 David.Joseph@grace.com