Attached files

| file | filename |

|---|---|

| EX-15 - EXHIBIT 15 - W R GRACE & CO | exhibit15_20153q.htm |

| EX-32 - EXHIBIT 32 - W R GRACE & CO | exhibit32_20153q.htm |

| EX-10 - EXHIBIT 10 - W R GRACE & CO | exhibit10_20153q.htm |

| EX-31.(I).1 - EXHIBIT 31(I).1 - W R GRACE & CO | exhibit31i1_20153q.htm |

| EX-31.(I).2 - EXHIBIT 31(I).2 - W R GRACE & CO | exhibit31i2_20153q.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Quarterly Period Ended September 30, 2015 | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File Number 1-13953 | ||

W. R. GRACE & CO.

Delaware (State of Incorporation) | 65-0773649 (I.R.S. Employer Identification No.) | |

7500 Grace Drive

Columbia, Maryland 21044

(410) 531-4000

(Address and phone number of principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

Class | Outstanding at November 3, 2015 | |

Common Stock, $0.01 par value per share | 70,637,840 shares | |

TABLE OF CONTENTS

_______________________________________________________________________________

Unless the context otherwise indicates, in this Report the terms "Grace," "we," "us," "our" or "the Company" mean W. R. Grace & Co. and/or its consolidated subsidiaries and affiliates. Unless otherwise indicated, the contents of websites mentioned in this report are not incorporated by reference or otherwise made a part of this Report. GRACE®, the GRACE® logo and, except as otherwise indicated, the other trademarks, service marks or trade names used in the text of this Report are trademarks, service marks, or trade names of operating units of W. R. Grace & Co. or its affiliates and/or subsidiaries.

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Review by Independent Registered Public Accounting Firm

With respect to the interim consolidated financial statements included in this Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, PricewaterhouseCoopers LLP, the Company's independent registered public accounting firm, has applied limited procedures in accordance with professional standards for a review of such information. Their report on the interim consolidated financial statements, which follows, states that they did not audit and they do not express an opinion on the unaudited interim consolidated financial statements. Accordingly, the degree of reliance on their report on the unaudited interim consolidated financial statements should be restricted in light of the limited nature of the review procedures applied. This report is not considered a "report" within the meaning of Sections 7 and 11 of the Securities Act of 1933, and, therefore, the independent accountants' liability under Section 11 does not extend to it.

3

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of W. R. Grace & Co.:

We have reviewed the accompanying consolidated balance sheet of W. R. Grace & Co. and its subsidiaries (the “Company”) as of September 30, 2015, and the related consolidated statements of operations and comprehensive income for the three-month and nine-month periods ended September 30, 2015 and September 30, 2014 and the consolidated statements of cash flows and equity for the nine-month periods ended September 30, 2015 and September 30, 2014. These interim financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the accompanying consolidated interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

We previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet as of December 31, 2014, and the related consolidated statements of operations, comprehensive income, equity, and of cash flows for the year then ended (not presented herein), and in our report dated February 25, 2015, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying consolidated balance sheet as of December 31, 2014, is fairly stated in all material respects in relation to the consolidated balance sheet from which it has been derived.

/s/ PricewaterhouseCoopers LLP

Baltimore, Maryland

November 5, 2015

4

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Operations (unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

(In millions, except per share amounts) | 2015 | 2014 | 2015 | 2014 | |||||||||||

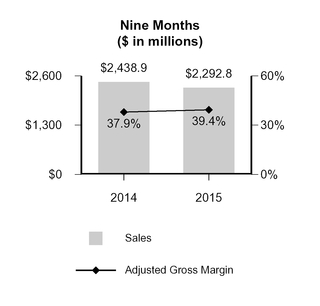

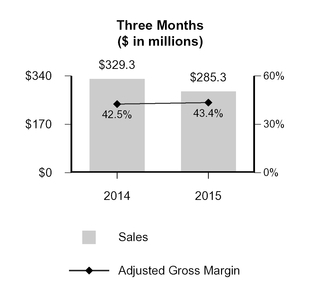

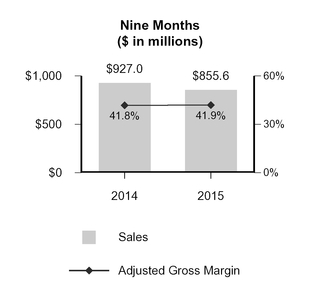

Net sales | $ | 790.1 | $ | 856.4 | $ | 2,292.8 | $ | 2,438.9 | |||||||

Cost of goods sold | 478.2 | 528.6 | 1,412.0 | 1,521.0 | |||||||||||

Gross profit | 311.9 | 327.8 | 880.8 | 917.9 | |||||||||||

Selling, general and administrative expenses | 136.3 | 147.7 | 409.4 | 428.5 | |||||||||||

Research and development expenses | 17.4 | 20.5 | 53.2 | 61.3 | |||||||||||

Interest expense and related financing costs | 25.3 | 14.7 | 74.9 | 37.0 | |||||||||||

Interest accretion on deferred payment obligations | 0.2 | 43.7 | 0.6 | 65.5 | |||||||||||

Loss in Venezuela | 60.8 | 1.0 | 60.8 | 1.0 | |||||||||||

Repositioning expenses | 14.0 | — | 34.3 | — | |||||||||||

Equity in earnings of unconsolidated affiliate | (3.6 | ) | (6.4 | ) | (12.1 | ) | (13.2 | ) | |||||||

Gain on termination and curtailment of postretirement plans | (4.5 | ) | (23.7 | ) | (4.5 | ) | (31.6 | ) | |||||||

Chapter 11 expenses, net | 1.1 | 1.7 | 4.3 | 10.8 | |||||||||||

Other expense, net | 10.7 | 9.0 | 13.1 | 29.9 | |||||||||||

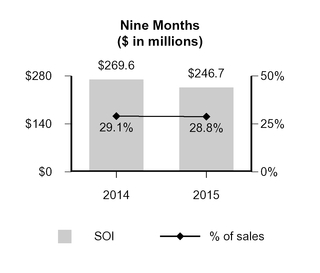

Total costs and expenses | 257.7 | 208.2 | 634.0 | 589.2 | |||||||||||

Income before income taxes | 54.2 | 119.6 | 246.8 | 328.7 | |||||||||||

Provision for income taxes | (40.1 | ) | (44.6 | ) | (122.4 | ) | (66.7 | ) | |||||||

Net income | 14.1 | 75.0 | 124.4 | 262.0 | |||||||||||

Less: Net income attributable to noncontrolling interests | (0.3 | ) | (0.5 | ) | (0.5 | ) | (1.2 | ) | |||||||

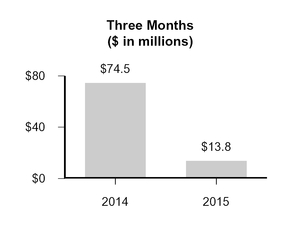

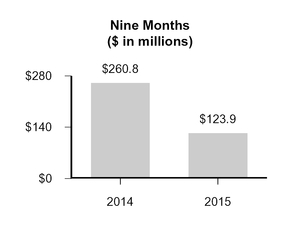

Net income attributable to W. R. Grace & Co. shareholders | $ | 13.8 | $ | 74.5 | $ | 123.9 | $ | 260.8 | |||||||

Earnings Per Share Attributable to W. R. Grace & Co. Shareholders | |||||||||||||||

Basic earnings per share: | |||||||||||||||

Net income attributable to W. R. Grace & Co. shareholders | $ | 0.19 | $ | 1.00 | $ | 1.71 | $ | 3.44 | |||||||

Weighted average number of basic shares | 72.1 | 74.7 | 72.5 | 75.9 | |||||||||||

Diluted earnings per share: | |||||||||||||||

Net income attributable to W. R. Grace & Co. shareholders | $ | 0.19 | $ | 0.99 | $ | 1.69 | $ | 3.40 | |||||||

Weighted average number of diluted shares | 72.7 | 75.6 | 73.1 | 76.8 | |||||||||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

5

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Comprehensive (Loss) Income (unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

(In millions) | 2015 | 2014 | 2015 | 2014 | |||||||||||

Net income | $ | 14.1 | $ | 75.0 | $ | 124.4 | $ | 262.0 | |||||||

Other comprehensive (loss) income: | |||||||||||||||

Defined benefit pension and other postretirement plans, net of income taxes | (2.6 | ) | (18.6 | ) | (3.8 | ) | 3.2 | ||||||||

Currency translation adjustments | (32.8 | ) | (12.7 | ) | (44.3 | ) | (7.5 | ) | |||||||

(Loss) gain from hedging activities, net of income taxes | (1.4 | ) | 0.7 | (1.7 | ) | (1.0 | ) | ||||||||

Other than temporary impairment of investment | — | 0.8 | — | 0.8 | |||||||||||

Gain (loss) on securities available for sale, net of income taxes | — | 0.4 | — | (0.1 | ) | ||||||||||

Total other comprehensive (loss) income attributable to noncontrolling interests | (0.6 | ) | 0.7 | 0.1 | 0.8 | ||||||||||

Total other comprehensive loss | (37.4 | ) | (28.7 | ) | (49.7 | ) | (3.8 | ) | |||||||

Comprehensive (loss) income | (23.3 | ) | 46.3 | 74.7 | 258.2 | ||||||||||

Less: comprehensive loss (income) attributable to noncontrolling interests | 0.3 | (1.2 | ) | (0.6 | ) | (2.0 | ) | ||||||||

Comprehensive (loss) income attributable to W. R. Grace & Co. shareholders | $ | (23.0 | ) | $ | 45.1 | $ | 74.1 | $ | 256.2 | ||||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

6

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Cash Flows (unaudited)

Nine Months Ended September 30, | |||||||

(In millions) | 2015 | 2014 | |||||

OPERATING ACTIVITIES | |||||||

Net income | $ | 124.4 | $ | 262.0 | |||

Reconciliation to net cash used for operating activities: | |||||||

Depreciation and amortization | 99.5 | 102.3 | |||||

Equity in earnings of unconsolidated affiliate | (12.1 | ) | (13.2 | ) | |||

Dividends received from unconsolidated affiliate | 11.8 | 11.2 | |||||

Chapter 11 expenses, net | 4.3 | 10.8 | |||||

Asbestos and bankruptcy related charges, net | (8.7 | ) | 6.8 | ||||

Cash paid for Chapter 11 and asbestos | (493.8 | ) | (1,344.6 | ) | |||

Cash paid to settle deferred payment obligation | — | (632.0 | ) | ||||

Provision for income taxes | 122.4 | 66.7 | |||||

Cash paid for income taxes, net of refunds | (34.2 | ) | (21.7 | ) | |||

Excess tax benefits from stock-based compensation | — | (0.7 | ) | ||||

Cash paid for interest on credit arrangements | (55.7 | ) | (19.8 | ) | |||

Defined benefit pension expense | 23.9 | 19.5 | |||||

Cash paid under defined benefit pension arrangements | (13.2 | ) | (94.1 | ) | |||

Currency and other losses in Venezuela | 72.5 | 1.0 | |||||

Cash paid for repositioning | (18.6 | ) | — | ||||

Cash paid for restructuring | (12.1 | ) | (4.8 | ) | |||

Cash paid for environmental remediation | (8.7 | ) | (9.7 | ) | |||

Changes in assets and liabilities, excluding effect of currency translation: | |||||||

Trade accounts receivable | (35.4 | ) | (51.4 | ) | |||

Inventories | (16.4 | ) | (49.9 | ) | |||

Accounts payable | 40.0 | 18.6 | |||||

All other items, net | 129.3 | 106.6 | |||||

Net cash used for operating activities | (80.8 | ) | (1,636.4 | ) | |||

INVESTING ACTIVITIES | |||||||

Capital expenditures | (112.4 | ) | (121.7 | ) | |||

Transfer from restricted cash and cash equivalents | — | 395.4 | |||||

Other investing activities | (1.7 | ) | 5.7 | ||||

Net cash (used for) provided by investing activities | (114.1 | ) | 279.4 | ||||

FINANCING ACTIVITIES | |||||||

Borrowings under credit arrangements | 306.3 | 1,114.4 | |||||

Repayments under credit arrangements | (85.7 | ) | (750.0 | ) | |||

Proceeds from issuance of bonds | — | 1,000.0 | |||||

Cash paid for debt financing costs | (0.4 | ) | (38.6 | ) | |||

Cash paid for repurchases of common stock | (220.1 | ) | (334.4 | ) | |||

Proceeds from exercise of stock options | 24.9 | 17.6 | |||||

Excess tax benefits from stock-based compensation | — | 0.7 | |||||

Other financing activities | — | 0.2 | |||||

Net cash provided by financing activities | 25.0 | 1,009.9 | |||||

Effect of currency exchange rate changes on cash and cash equivalents | (56.5 | ) | (9.7 | ) | |||

Decrease in cash and cash equivalents | (226.4 | ) | (356.8 | ) | |||

Cash and cash equivalents, beginning of period | 557.5 | 964.8 | |||||

Cash and cash equivalents, end of period | $ | 331.1 | $ | 608.0 | |||

The Notes to Consolidated Financial Statements are an integral part of these statements.

7

W. R. Grace & Co. and Subsidiaries

Consolidated Balance Sheets (unaudited)

(In millions, except par value and shares) | September 30, 2015 | December 31, 2014 | |||||

ASSETS | |||||||

Current Assets | |||||||

Cash and cash equivalents | $ | 331.1 | $ | 557.5 | |||

Trade accounts receivable, less allowance of $7.8 (2014—$5.8) | 455.2 | 481.1 | |||||

Inventories | 323.1 | 332.8 | |||||

Deferred income taxes | 239.6 | 235.4 | |||||

Other current assets | 77.3 | 84.1 | |||||

Total Current Assets | 1,426.3 | 1,690.9 | |||||

Properties and equipment, net of accumulated depreciation and amortization of $1,747.1 (2014—$1,818.4) | 813.9 | 833.5 | |||||

Goodwill | 439.9 | 452.9 | |||||

Technology and other intangible assets, net | 265.7 | 288.0 | |||||

Deferred income taxes | 545.6 | 612.0 | |||||

Overfunded defined benefit pension plans | 44.7 | 44.1 | |||||

Investment in unconsolidated affiliate | 112.1 | 113.1 | |||||

Other assets | 59.3 | 60.7 | |||||

Total Assets | $ | 3,707.5 | $ | 4,095.2 | |||

LIABILITIES AND EQUITY | |||||||

Current Liabilities | |||||||

Debt payable within one year | $ | 72.0 | $ | 96.8 | |||

Accounts payable | 262.3 | 255.3 | |||||

PI warrant liability | — | 490.0 | |||||

Other current liabilities | 380.8 | 340.0 | |||||

Total Current Liabilities | 715.1 | 1,182.1 | |||||

Debt payable after one year | 2,143.8 | 1,919.0 | |||||

Deferred income taxes | 17.7 | 19.3 | |||||

Income tax contingencies | 22.5 | 24.0 | |||||

Underfunded and unfunded defined benefit pension plans | 440.0 | 457.5 | |||||

Other liabilities | 111.0 | 124.3 | |||||

Total Liabilities | 3,450.1 | 3,726.2 | |||||

Commitments and Contingencies—Note 8 | |||||||

Equity | |||||||

Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 71,354,446 (2014—72,922,565) | 0.8 | 0.7 | |||||

Paid-in capital | 491.1 | 526.1 | |||||

Retained earnings | 416.0 | 292.1 | |||||

Treasury stock, at cost: shares: 6,102,179 (2014—4,524,688) | (581.3 | ) | (429.2 | ) | |||

Accumulated other comprehensive loss | (73.6 | ) | (23.8 | ) | |||

Total W. R. Grace & Co. Shareholders' Equity | 253.0 | 365.9 | |||||

Noncontrolling interests | 4.4 | 3.1 | |||||

Total Equity | 257.4 | 369.0 | |||||

Total Liabilities and Equity | $ | 3,707.5 | $ | 4,095.2 | |||

The Notes to Consolidated Financial Statements are an integral part of these statements.

8

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Equity (unaudited)

(In millions) | Common Stock and Paid-in Capital | Retained Earnings | Treasury Stock | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total Equity | |||||||||||||||||

Balance, December 31, 2013 | $ | 534.2 | $ | 15.8 | $ | — | $ | 10.6 | $ | 10.6 | $ | 571.2 | |||||||||||

Net income | — | 260.8 | — | — | 1.2 | 262.0 | |||||||||||||||||

Repurchase of common stock | — | — | (334.4 | ) | — | — | (334.4 | ) | |||||||||||||||

Purchase of noncontrolling interest | — | — | — | — | (0.7 | ) | (0.7 | ) | |||||||||||||||

Stock based compensation | 9.9 | — | — | — | — | 9.9 | |||||||||||||||||

Exercise of stock options | (7.2 | ) | — | 24.8 | — | — | 17.6 | ||||||||||||||||

Tax benefit related to stock plans | 0.7 | — | — | — | — | 0.7 | |||||||||||||||||

Shares issued | 1.9 | — | — | — | — | 1.9 | |||||||||||||||||

Other comprehensive income (loss) | — | — | — | (4.6 | ) | 0.8 | (3.8 | ) | |||||||||||||||

Balance, September 30, 2014 | $ | 539.5 | $ | 276.6 | $ | (309.6 | ) | $ | 6.0 | $ | 11.9 | $ | 524.4 | ||||||||||

Balance, December 31, 2014 | $ | 526.8 | $ | 292.1 | $ | (429.2 | ) | $ | (23.8 | ) | $ | 3.1 | $ | 369.0 | |||||||||

Net income | — | 123.9 | — | — | 0.5 | 124.4 | |||||||||||||||||

Repurchase of common stock | — | — | (220.1 | ) | — | — | (220.1 | ) | |||||||||||||||

Purchase of noncontrolling interest | (0.7 | ) | — | — | — | 0.7 | — | ||||||||||||||||

Stock based compensation | 7.4 | — | — | — | — | 7.4 | |||||||||||||||||

Exercise of stock options | (43.1 | ) | — | 68.0 | — | — | 24.9 | ||||||||||||||||

Tax benefit related to stock plans | 0.5 | — | — | — | — | 0.5 | |||||||||||||||||

Shares issued | 1.0 | — | — | — | — | 1.0 | |||||||||||||||||

Other comprehensive income (loss) | — | — | — | (49.8 | ) | 0.1 | (49.7 | ) | |||||||||||||||

Balance, September 30, 2015 | $ | 491.9 | $ | 416.0 | $ | (581.3 | ) | $ | (73.6 | ) | $ | 4.4 | $ | 257.4 | |||||||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

9

Notes to Consolidated Financial Statements

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

W. R. Grace & Co., through its subsidiaries, is engaged in specialty chemicals and specialty materials businesses on a global basis through three operating segments: Grace Catalysts Technologies, which includes catalysts and related products and technologies used in refining, petrochemical and other chemical manufacturing applications; Grace Materials Technologies, which includes packaging technologies and engineered materials used in consumer, industrial, coatings, and pharmaceutical applications; and Grace Construction Products, which includes specialty construction chemicals and specialty building materials used in commercial, infrastructure and residential construction.

W. R. Grace & Co. conducts all of its business through a single wholly owned subsidiary, W. R. Grace & Co.—Conn. ("Grace—Conn."). Grace—Conn. owns all of the assets, properties and rights of W. R. Grace & Co. on a consolidated basis, either directly or through subsidiaries.

As used in these notes, the term "Company" refers to W. R. Grace & Co. The term "Grace" refers to the Company and/or one or more of its subsidiaries and, in certain cases, their respective predecessors.

On February 5, 2015, the Company announced its intent to separate the business, assets and liabilities associated with the Grace Construction Products operating segment and the packaging technologies business (collectively, "GCP") into an independent publicly-traded company. Following the separation, Grace will consist of the Catalysts Technologies and Materials Technologies (excluding the packaging technologies business) operating segments. Grace intends that the separation transaction will be a tax-free spin-off to the Company's stockholders for U.S. federal income tax purposes and expects the transaction to be completed in the 2016 first quarter.

Chapter 11 Proceedings On April 2, 2001, Grace and 61 of its United States subsidiaries and affiliates filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the "Bankruptcy Court") in order to resolve outstanding asbestos personal injury and property damage claims, including class-action lawsuits alleging damages from Zonolite® Attic Insulation ("ZAI"), a former Grace attic insulation product. In 2008, Grace and other parties filed a joint plan of reorganization with the Bankruptcy Court (as subsequently amended, the "Joint Plan"). Following the confirmation of the Joint Plan in 2011 by the Bankruptcy Court and in 2012 by a U.S. District Court, and the resolution of all appeals, Grace emerged from bankruptcy on February 3, 2014.

Basis of Presentation The interim Consolidated Financial Statements presented herein are unaudited and should be read in conjunction with the Consolidated Financial Statements presented in the Company's 2014 Annual Report on Form 10-K. Such interim Consolidated Financial Statements reflect all adjustments that, in the opinion of management, are necessary for a fair statement of the results of the interim periods presented; all such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards as discussed below. All significant intercompany accounts and transactions have been eliminated.

The results of operations for the nine-month interim period ended September 30, 2015, are not necessarily indicative of the results of operations for the year ending December 31, 2015.

Use of Estimates The preparation of financial statements in conformity with U.S. generally accepted accounting principles ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements, and the reported amounts of revenues and expenses for the periods presented. Actual amounts could differ from those estimates, and the differences could be material. Changes in estimates are recorded in the period identified. Grace's accounting measurements that are most affected by management's estimates of future events are:

• | Realization values of net deferred tax assets, which depend on projections of future taxable income (see Note 5); |

• | Pension and postretirement liabilities that depend on assumptions regarding participant life spans, future inflation, discount rates and total returns on invested funds (see Note 6); and |

10

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

• | Contingent liabilities, which depend on an assessment of the probability of loss and an estimate of ultimate obligation, such as litigation (see Note 8), income taxes (see Note 5), and environmental remediation (see Note 8). |

Reclassifications Certain amounts in prior years' Consolidated Financial Statements have been reclassified to conform to the current year presentation. Such reclassifications have not materially affected previously reported amounts in the Consolidated Financial Statements.

Venezuela Until September 30, 2015, Grace accounted for its results in Venezuela at the official exchange rate of 6.3 bolivars to U.S. dollar. Based on developments in the 2015 third quarter, including changed expectations about Grace's ability to import raw materials at the official exchange rate in the future and the increase in inflation, Grace determined that it is no longer appropriate to do so. Effective September 30, 2015, Grace is accounting for its results in Venezuela at the SIMADI rate. At September 30, 2015, this rate was 199 bolivars to U.S. dollar. Grace recorded a pre-tax charge of $72.5 million in the 2015 third quarter to reflect the devaluation of monetary assets and the impairment of non-monetary assets, including $40.5 million for cash, $26.7 million for working capital and $5.3 million for properties and equipment. Of this amount, $11.7 million related to inventory was recorded in cost of goods sold, and $60.8 million related to other assets and liabilities was recorded as a separate line in the Consolidated Statement of Operations. Grace will continue to operate in Venezuela; however, the remaining assets and liabilities, as well as future sales, earnings and cash flows of Grace's Venezuelan subsidiary will be immaterial after September 30, 2015. See "Item 2. Management's Discussion and Analysis—Venezuela" for further discussion.

Effect of New Accounting Standards In April 2014, the FASB issued ASU 2014-08 "Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity." This update is intended to change the requirements for reporting discontinued operations and enhance convergence of the FASB’s and the International Accounting Standard Board’s ("IASB") reporting requirements for discontinued operations. Grace adopted this standard in the first quarter, and it did not have a material effect on the Consolidated Financial Statements.

In May 2014, the FASB issued ASU 2014-09 "Revenue from Contracts with Customers." This update is intended to remove inconsistencies and weaknesses in revenue requirements; provide a more robust framework for addressing revenue issues; improve comparability of revenue recognition practices across entities, industries, jurisdictions and capital markets; provide more useful information to users of financial statements through improved disclosure requirements; and simplify the preparation of financial statements by reducing the number of requirements to which an entity must refer. The new requirements were to be effective for fiscal years beginning after December 15, 2016, and for interim periods within those fiscal years, with early adoption not permitted. In August 2015, the FASB issued ASU 2015-14 "Revenue from Contracts with Customers—Deferral of the Effective Date," deferring the effective date by one year but permitting adoption as of the original effective date. The revised standard allows for two methods of adoption: (a) full retrospective adoption, meaning the standard is applied to all periods presented, or (b) modified retrospective adoption, meaning the cumulative effect of applying the new standard is recognized as an adjustment to the opening retained earnings balance. Grace does not intend to adopt the standard early and is in the process of determining the adoption method as well as the effects the adoption will have on the Consolidated Financial Statements.

In April 2015, the FASB issued ASU 2015-03 "Simplifying the Presentation of Debt Issuance Costs." This update is part of the FASB's Simplification Initiative and is also intended to enhance convergence with the IASB's treatment of debt issuance costs. The update requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. In August 2015, the FASB issued ASU 2015-15 "Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements." The update clarifies ASU 2015-03, allowing debt issuance costs related to line of credit arrangements to be deferred and presented as an asset and subsequently amortized ratably over the term of the line-of-credit arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. The new requirements are effective for fiscal years beginning after December 15, 2015, and for interim periods within those fiscal years, with early

11

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

adoption permitted. Grace is currently evaluating the effect of these updates on the Consolidated Financial Statements and the timing of adoption. As of September 30, 2015, capitalized financing fees included in other assets in the Consolidated Balance Sheet were $33.4 million.

In July 2015, the FASB issued ASU 2015-11 "Simplifying the Measurement of Inventory." This update is part of the FASB's Simplification Initiative and is also intended to enhance convergence with the IASB's measurement of inventory. The update requires that inventory be measured at the lower of cost or net realizable value for entities using FIFO or average cost methods. The new requirements are effective for fiscal years beginning after December 15, 2016, and for interim periods within those fiscal years, with early adoption permitted. Grace is currently evaluating its effect on the Consolidated Financial Statements and the timing of adoption.

2. Inventories

Inventories are stated at the lower of cost or market, and cost is determined using FIFO. Inventories consisted of the following at September 30, 2015, and December 31, 2014:

(In millions) | September 30, 2015 | December 31, 2014 | |||||

Raw materials | $ | 82.0 | $ | 78.8 | |||

In process | 45.4 | 47.2 | |||||

Finished products | 167.5 | 177.7 | |||||

Other | 28.2 | 29.1 | |||||

$ | 323.1 | $ | 332.8 | ||||

3. Debt

Components of Debt

(In millions) | September 30, 2015 | December 31, 2014 | |||||

U.S. dollar term loan, net of unamortized discount of $1.8 at September 30, 2015, and $2.1 at December 31, 2014(1) | $ | 935.8 | $ | 692.6 | |||

5.125% senior notes due 2021 | 700.0 | 700.0 | |||||

5.625% senior notes due 2024 | 300.0 | 300.0 | |||||

Euro term loan, net of unamortized discount of $0.4 at September 30, 2015, and $0.4 at December 31, 2014(2) | 164.7 | 181.2 | |||||

Debt payable—unconsolidated affiliate | 31.5 | 31.5 | |||||

Deferred payment obligation | 28.9 | 28.2 | |||||

Other borrowings(3) | 54.9 | 82.3 | |||||

Total debt | 2,215.8 | 2,015.8 | |||||

Less debt payable within one year | 72.0 | 96.8 | |||||

Debt payable after one year | $ | 2,143.8 | $ | 1,919.0 | |||

Weighted average interest rates on total debt | 4.1 | % | 4.3 | % | |||

___________________________________________________________________________________________________________________

(1) | Interest at LIBOR +200 bps with a 75 bps LIBOR floor at September 30, 2015, and LIBOR +225 bps with a 75 bps LIBOR floor at December 31, 2014. |

(2) | Interest at EURIBOR +225 bps with a 75 bps EURIBOR floor at September 30, 2015, and EURIBOR +250 bps with a 75 bps EURIBOR floor at December 31, 2014. |

(3) | Represents borrowings under various lines of credit and other borrowings, primarily by non-U.S. subsidiaries. |

See Note 4 for a discussion of the fair value of Grace's debt.

12

The principal maturities of debt outstanding at September 30, 2015, were as follows:

(In millions) | |||

2015 | $ | 31.7 | |

2016 | 44.7 | ||

2017 | 45.3 | ||

2018 | 16.0 | ||

2019 | 15.3 | ||

Thereafter | 2,062.8 | ||

Total debt | $ | 2,215.8 | |

On January 30, 2015, Grace borrowed on its $250 million term loan facility and used the funds, together with cash on hand, to repurchase the warrant issued to the asbestos personal injury trust for $490 million. (See Note 8 for Chapter 11 information.)

Grace has reviewed the impact of the separation on the credit agreement entered into upon emergence from bankruptcy (the "Credit Agreement"). Grace anticipates that the Credit Agreement will remain with Grace but at the time of the separation will require an amendment to permit the separation. Grace intends to seek such amendment as well as repay a substantial amount of the borrowings under the Credit Agreement in connection with the separation. If an amendment is not granted, Grace will be required to repay all term loan and revolver debt and enter into a new borrowing facility.

Grace has reviewed the impact of the separation on the senior notes. The senior notes will remain obligations of Grace, and Grace does not believe that the separation will have any impact on payment or other terms.

4. Fair Value Measurements and Risk

Certain of Grace's assets and liabilities are reported at fair value on a gross basis. ASC 820 "Fair Value Measurements and Disclosures" defines fair value as the value that would be received at the measurement date in the principal or "most advantageous" market. Grace uses principal market data, whenever available, to value assets and liabilities that are required to be reported at fair value.

Grace has identified the following financial assets and liabilities that are subject to the fair value analysis required by ASC 820:

Fair Value of Debt and Other Financial Instruments

Debt payable is recorded at carrying value as discussed in Note 3. Fair value is determined based on Level 2 inputs, including expected future cash flows (discounted at market interest rates), estimated current market prices and quotes from financial institutions.

13

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

At September 30, 2015, the carrying amounts and fair values of Grace's debt were as follows:

September 30, 2015 | December 31, 2014 | ||||||||||||||

(In millions) | Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||||

U.S. dollar term loan(1) | $ | 935.8 | $ | 927.1 | $ | 692.6 | $ | 691.3 | |||||||

5.125% senior notes due 2021 | 700.0 | 691.3 | 700.0 | 720.9 | |||||||||||

5.625% senior notes due 2024 | 300.0 | 303.0 | 300.0 | 312.0 | |||||||||||

Euro term loan(1) | 164.7 | 164.0 | 181.2 | 181.4 | |||||||||||

Other borrowings | 115.3 | 115.3 | 142.0 | 142.0 | |||||||||||

Total debt | $ | 2,215.8 | $ | 2,200.7 | $ | 2,015.8 | $ | 2,047.6 | |||||||

___________________________________________________________________________________________________________________

(1) | Carrying amounts are net of unamortized discounts of $1.8 million and $0.4 million as of September 30, 2015, and $2.1 million and $0.4 million as of December 31, 2014, related to the U.S. dollar term loan and euro term loan, respectively. |

At September 30, 2015, the recorded values of other financial instruments such as cash equivalents and trade receivables and payables approximated their fair values, based on the short-term maturities and floating rate characteristics of these instruments.

Commodity Derivatives

From time to time, Grace enters into commodity derivatives such as fixed-rate swaps or options with financial institutions to mitigate the risk of volatility of prices of natural gas or other commodities. Under fixed-rate swaps, Grace locks in a fixed rate with a financial institution for future purchases, purchases its commodity from a supplier at the prevailing market rate, and then settles with the bank for any difference in the rates, thereby "swapping" a variable rate for a fixed rate.

The valuation of Grace's fixed-rate natural gas swaps was determined using a market approach, based on natural gas futures trading prices quoted on the New York Mercantile Exchange. Commodity fixed-rate swaps with maturities of not more than 12 months are used and designated as cash flow hedges of forecasted purchases of natural gas. Current open contracts hedge forecasted transactions until December 2015. The effective portion of the gain or loss on the commodity contracts is recorded in "accumulated other comprehensive loss" and reclassified into income in the same period or periods that the underlying commodity purchase affects income. At September 30, 2015, the contract volume, or notional amount, of the commodity contracts was 1.2 million MMBtu (million British thermal units) with a total contract value of $4.3 million.

The valuation of Grace's natural gas call options was determined using a market approach, based on the strike price of the options and the natural gas futures trading prices quoted on the New York Mercantile Exchange. Commodity option contracts with maturities of not more than 24 months are used and designated as cash flow hedges of forecasted purchases of natural gas. The effective portion of the gain or loss on the commodity contracts is recorded in "accumulated other comprehensive loss" and reclassified into income in the same period or periods that the underlying purchases affect income. At September 30, 2015, there are no outstanding commodity option contracts.

The valuation of Grace's fixed-rate aluminum swaps was determined using a market approach, based on aluminum futures trading prices quoted on the London Metal Exchange. Commodity fixed-rate swaps with maturities of not more than 12 months are used and designated as cash flow hedges of forecasted purchases of aluminum. Current open contracts hedge forecasted transactions until August 2016. The effective portion of the gain or loss on the commodity contracts is recorded in "accumulated other comprehensive loss" and reclassified into income in the same period or periods that the underlying commodity purchase affects income. At September 30, 2015, the contract volume, or notional amount, of the commodity contracts was 1.3 million pounds with a total contract value of $1.1 million.

14

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

Currency Derivatives

Because Grace operates in over 40 countries and does business in more than 50 currencies, results are exposed to fluctuations in currency exchange rates. Grace seeks to minimize exposure to these fluctuations by matching sales in volatile currencies with expenditures in the same currencies, but it is not always possible to do so. From time to time Grace will use financial instruments such as currency forward contracts, options, or combinations of the two to reduce the risk of certain specific transactions. However, Grace does not have a policy of hedging all exposures, because management does not believe that such a level of hedging would be cost-effective.

The valuation of Grace's currency exchange rate forward contracts is determined using both a market approach and an income approach. Inputs used to value currency exchange rate forward contracts consist of: (1) spot rates, which are quoted by various financial institutions; (2) forward points, which are primarily affected by changes in interest rates; and (3) discount rates used to present value future cash flows, which are based on the London Interbank Offered Rate (LIBOR) curve or overnight indexed swap rates.

Debt and Interest Rate Swap Agreements

Grace uses interest rate swaps designated as cash flow hedges to manage fluctuations in interest rates on variable rate debt. The effective portion of gains and losses on these interest rate cash flow hedges is recorded in "accumulated other comprehensive loss" and reclassified into "interest expense and related financing costs" during the hedged interest period.

In connection with its emergence financing, Grace entered into an interest rate swap beginning on February 3, 2015, and maturing on February 3, 2020, fixing the LIBOR component of the interest on $250 million of Grace's term debt at a rate of 2.393%. The valuation of this interest rate swap is determined using both a market approach and an income approach, using prevailing market interest rates and discount rates to present value future cash flows based on the forward LIBOR yield curves.

The following tables present the fair value hierarchy for financial assets and liabilities measured at fair value on a recurring basis as of September 30, 2015, and December 31, 2014:

Fair Value Measurements at September 30, 2015, Using | |||||||||||||||

(In millions) | Total | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||

Assets | |||||||||||||||

Currency derivatives | $ | 1.6 | $ | — | $ | 1.6 | $ | — | |||||||

Total Assets | $ | 1.6 | $ | — | $ | 1.6 | $ | — | |||||||

Liabilities | |||||||||||||||

Interest rate derivatives | $ | 10.4 | $ | — | $ | 10.4 | $ | — | |||||||

Commodity derivatives | 1.2 | — | 1.2 | — | |||||||||||

Currency derivatives | 0.9 | — | 0.9 | — | |||||||||||

Total Liabilities | $ | 12.5 | $ | — | $ | 12.5 | $ | — | |||||||

15

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

Fair Value Measurements at December 31, 2014, Using | |||||||||||||||

(In millions) | Total | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||

Assets | |||||||||||||||

Currency derivatives | $ | 3.3 | $ | — | $ | 3.3 | $ | — | |||||||

Total Assets | $ | 3.3 | $ | — | $ | 3.3 | $ | — | |||||||

Liabilities | |||||||||||||||

Interest rate derivatives | $ | 5.5 | $ | — | $ | 5.5 | $ | — | |||||||

Commodity derivatives | 2.6 | — | 2.6 | — | |||||||||||

Currency derivatives | 0.1 | — | 0.1 | — | |||||||||||

Total Liabilities | $ | 8.2 | $ | — | $ | 8.2 | $ | — | |||||||

The following tables present the location and fair values of derivative instruments included in the Consolidated Balance Sheets as of September 30, 2015, and December 31, 2014:

September 30, 2015 (In millions) | Asset Derivatives | Liability Derivatives | |||||||||

Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | ||||||||

Derivatives designated as hedging instruments under ASC 815: | |||||||||||

Commodity contracts | Other current assets | $ | — | Other current liabilities | $ | 1.2 | |||||

Currency contracts | Other current assets | 1.4 | Other current liabilities | 0.7 | |||||||

Interest rate contracts | Other current assets | — | Other current liabilities | 4.2 | |||||||

Currency contracts | Other assets | 0.2 | Other liabilities | — | |||||||

Interest rate contracts | Other assets | — | Other liabilities | 6.2 | |||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||||

Currency contracts | Other current assets | — | Other current liabilities | 0.2 | |||||||

Total derivatives | $ | 1.6 | $ | 12.5 | |||||||

December 31, 2014 (In millions) | Asset Derivatives | Liability Derivatives | |||||||||

Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | ||||||||

Derivatives designated as hedging instruments under ASC 815: | |||||||||||

Commodity contracts | Other current assets | $ | — | Other current liabilities | $ | 2.6 | |||||

Currency contracts | Other current assets | 0.8 | Other current liabilities | — | |||||||

Interest rate contracts | Other current assets | — | Other current liabilities | 2.5 | |||||||

Currency contracts | Other assets | 0.9 | Other liabilities | — | |||||||

Interest rate contracts | Other assets | — | Other liabilities | 3.0 | |||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||||

Currency contracts | Other current assets | 1.6 | Other current liabilities | 0.1 | |||||||

Total derivatives | $ | 3.3 | $ | 8.2 | |||||||

16

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The following tables present the location and amount of gains and losses on derivative instruments included in the Consolidated Statements of Operations or, when applicable, gains and losses initially recognized in other comprehensive income (loss) ("OCI") for the three and nine months ended September 30, 2015 and 2014:

Three Months Ended September 30, 2015 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives (Effective Portion) | Location of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) | Amount of Gain (Loss) Reclassified from OCI into Income (Effective Portion) | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | (4.1 | ) | Interest expense | $ | (1.1 | ) | ||

Currency contracts | (0.2 | ) | Other expense | (0.5 | ) | ||||

Currency contracts | 0.3 | Cost of goods sold | — | ||||||

Commodity contracts | (0.6 | ) | Cost of goods sold | (0.9 | ) | ||||

Total derivatives | $ | (4.6 | ) | $ | (2.5 | ) | |||

Location of Gain (Loss) Recognized in Income on Derivatives | Amount of Gain (Loss) Recognized in Income on Derivatives | ||||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||

Currency contracts | Other expense | $ | 0.5 | ||||||

Nine Months Ended September 30, 2015 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives (Effective Portion) | Location of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) | Amount of Gain (Loss) Reclassified from OCI into Income (Effective Portion) | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | (7.0 | ) | Interest expense | $ | (2.8 | ) | ||

Currency contracts | 5.6 | Other expense | 5.6 | ||||||

Currency contracts | 0.3 | Cost of goods sold | — | ||||||

Commodity contracts | (1.6 | ) | Cost of goods sold | (3.0 | ) | ||||

Total derivatives | $ | (2.7 | ) | $ | (0.2 | ) | |||

Location of Gain (Loss) Recognized in Income on Derivatives | Amount of Gain (Loss) Recognized in Income on Derivatives | ||||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||

Currency contracts | Other expense | $ | 0.4 | ||||||

17

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

Three Months Ended September 30, 2014 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives (Effective Portion) | Location of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) | Amount of Gain (Loss) Reclassified from OCI into Income (Effective Portion) | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | 1.1 | Interest expense | $ | — | ||||

Currency contracts | 0.2 | Other expense | 0.2 | ||||||

Total derivatives | $ | 1.3 | $ | 0.2 | |||||

Location of Gain (Loss) Recognized in Income on Derivatives | Amount of Gain (Loss) Recognized in Income on Derivatives | ||||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||

Currency contracts | Other expense | $ | 2.6 | ||||||

Nine Months Ended September 30, 2014 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives (Effective Portion) | Location of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) | Amount of Gain (Loss) Reclassified from OCI into Income (Effective Portion) | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | (1.8 | ) | Interest expense | $ | — | |||

Currency contracts | 0.1 | Other expense | — | ||||||

Commodity contracts | 0.4 | Cost of goods sold | 0.2 | ||||||

Total derivatives | $ | (1.3 | ) | $ | 0.2 | ||||

Location of Gain (Loss) Recognized in Income on Derivatives | Amount of Gain (Loss) Recognized in Income on Derivatives | ||||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||

Currency contracts | Other expense | $ | 7.4 | ||||||

Net Investment Hedges

Grace uses foreign currency denominated debt as nonderivative hedging instruments in certain net investment hedges. The effective portion of gains and losses attributable to these net investment hedges is recorded to "currency translation adjustments" within "accumulated other comprehensive income." Recognition in earnings of amounts previously recorded to "currency translation adjustments" is limited to circumstances such as complete or substantially complete liquidation of the net investment in the hedged foreign operation. At September 30, 2015, €147.8 million of Grace's term loan principal was designated as a hedging instrument of its net investment in European subsidiaries.

The following tables present the location and amount of gains and losses on nonderivative instruments designated as net investment hedges for the three and nine months ended September 30, 2015 and 2014. There were no reclassifications of the effective portion of net investment hedges out of OCI and into earnings for the period presented in the table below.

18

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

Three Months Ended September 30, 2015 (In millions) | Amount of Gain (Loss) Recognized in OCI in Currency Translation Adjustments (Effective Portion) | ||

Nonderivatives in ASC 815 net investment hedging relationships: | |||

Foreign currency denominated debt | $ | 0.1 | |

Total nonderivatives | $ | 0.1 | |

Nine Months Ended September 30, 2015 (In millions) | Amount of Gain (Loss) Recognized in OCI in Currency Translation Adjustments (Effective Portion) | ||

Nonderivatives in ASC 815 net investment hedging relationships: | |||

Foreign currency denominated debt | $ | 15.3 | |

Total nonderivatives | $ | 15.3 | |

Three Months Ended September 30, 2014 (In millions) | Amount of Gain (Loss) Recognized in OCI in Currency Translation Adjustments (Effective Portion) | ||

Nonderivatives in ASC 815 net investment hedging relationships: | |||

Foreign currency denominated debt | $ | 13.0 | |

Total nonderivatives | $ | 13.0 | |

Nine Months Ended September 30, 2014 (In millions) | Amount of Gain (Loss) Recognized in OCI in Currency Translation Adjustments (Effective Portion) | ||

Nonderivatives in ASC 815 net investment hedging relationships: | |||

Foreign currency denominated debt | $ | 14.8 | |

Total nonderivatives | $ | 14.8 | |

Credit Risk

Grace is exposed to credit risk in its trade accounts receivable. Customers in the petroleum refining and construction industries represent the greatest exposure. Grace's credit evaluation policies, relatively short collection terms and history of minimal credit losses mitigate credit risk exposures. Grace does not generally require collateral for its trade accounts receivable but may require a bank letter of credit in certain instances, particularly when selling to customers in cash-restricted countries.

Grace may also be exposed to credit risk in its derivatives contracts. Grace monitors counterparty credit risk and currently does not anticipate nonperformance by counterparties to its derivatives. Grace's derivative contracts are with internationally recognized commercial financial institutions.

19

The annualized effective tax rate on 2015 forecasted income is estimated to be 48.3% as of September 30, 2015, compared with 17.1% for the year ended December 31, 2014. The prior year includes a benefit of $59.6 million for the release of reserves for uncertain tax positions while 2015 includes estimated tax costs of $30.1 million to complete the separation transaction and a $24.7 million impact on the effective tax rate from the nondeductible charge related to Venezuela.

Grace generated approximately $1,800 million in U.S. federal tax deductions relating to its emergence from bankruptcy, including approximately $670 million relating to payments made upon emergence, $632 million upon payment of the PI deferred payment obligation, and $490 million upon repurchase of the warrant held by the PI Trust. These deductions generated U.S. federal and state NOLs in 2014 and 2015, which Grace will carry forward and expects to utilize in subsequent years. Under U.S. federal income tax law, a corporation is generally permitted to carry forward NOLs for a 20-year period for deduction against future taxable income. Grace also expects to generate U.S. federal tax deductions of $30 million upon payment of the ZAI PD deferred payment obligation in 2017. The present value of the expected settlement amount has already been recorded as a deferred tax asset for temporary differences. (See Note 8 for Chapter 11 information.)

The following table summarizes the balance of deferred tax assets, net of deferred tax liabilities, at September 30, 2015, of $766.6 million:

Deferred Tax Asset (Net of Liabilities)(2) | Valuation Allowance | Net Deferred Tax Asset | |||||||||

United States—Federal(1) | $ | 681.2 | $ | (2.2 | ) | $ | 679.0 | ||||

United States—States(1) | 55.4 | (4.2 | ) | 51.2 | |||||||

Germany | 36.4 | — | 36.4 | ||||||||

Other foreign | 4.3 | (4.3 | ) | — | |||||||

Total | $ | 777.3 | $ | (10.7 | ) | $ | 766.6 | ||||

___________________________________________________________________________________________________________________

(1) | The U.S. federal deductions generated relating to emergence of $670 million, settlement of the PI deferred payment obligation of $632 million, and the $490 million warrant repurchase, plus the $30 million ZAI PD deferred payment obligation, account for a significant portion of the U.S. federal and state deferred tax assets. |

(2) | Deferred tax assets are net of $5.8 million of income tax contingencies related to these deferred tax assets. |

Grace will need to generate approximately $2,000 million of U.S. federal taxable income by 2035 (or approximately $100 million per year during the carryforward period) to fully realize the U.S. federal and a majority of the U.S. state net deferred tax assets.

The following table summarizes expiration dates in jurisdictions where we have, or will have, material tax loss carryforwards:

Expiration Dates | |

United States—Federal | 2034 - 2035 |

United States—States | 2015 - 2035 |

Brazil | Unlimited Carryforward |

In evaluating Grace's ability to realize its deferred tax assets, Grace considers all reasonably available positive and negative evidence, including recent earnings experience, expectations of future taxable income and the tax character of that income, the period of time over which the temporary differences become deductible and the carryforward and/or carryback periods available to Grace for tax reporting purposes in the related jurisdiction. In estimating future taxable income, Grace relies upon assumptions and estimates about future activities, including the amount of future federal, state and international pretax operating income that Grace will generate; the reversal of temporary differences; and the implementation of feasible and prudent tax planning strategies. Grace records a valuation allowance to reduce deferred tax assets to the amount that it believes is more likely

20

than not to be realized. Grace believes it is reasonably possible that in the next 12 months the amount of the liability for unrecognized tax benefits could decrease by approximately $2 million.

As part of the separation plan, Grace is restructuring certain legal entities. The process of analyzing the tax consequences of the legal entity separation and restructuring is ongoing and includes determining the required tax liability to be reported. In the 2015 third quarter, the calculation of the annualized effective tax rate includes approximately $8 million of tax expense associated with the restructuring of foreign subsidiaries.

As of December 31, 2014, Grace had the intent and ability to indefinitely reinvest undistributed earnings of its foreign subsidiaries outside the United States. In the 2015 first quarter, Grace announced its plan to separate into two publicly traded companies and has subsequently reassessed the capital structure and financial requirements of both Grace and GCP. In the 2015 second quarter, Grace determined that it will repatriate approximately $131 million of foreign earnings in advance of the separation. Such amount was determined based on an analysis of each non-U.S. subsidiary's requirements for working capital, debt repayment and strategic initiatives. Grace also considered local country legal and regulatory restrictions. In the 2015 second quarter, Grace included tax expense of approximately $5 million in its annualized effective tax rate for repatriation attributable to current earnings and tax expense of approximately $11 million as a discrete charge for repatriation attributable to prior years' earnings. The tax effect of the repatriation is determined by several variables including the tax rate applicable to the entity making the distribution, the cumulative earnings and associated foreign taxes of the entity and the extent to which those earnings may have already been taxed in the U.S.

Grace and GCP continue to assess their capital structures, financial requirements and ability to repatriate available cash as part of the separation, which may result in additional repatriation prior to the separation. The tax consequences of additional repatriation, as well as other transactions pursuant to the separation, may require recognition of additional tax expense for actual or deemed repatriation of undistributed earnings of our foreign subsidiaries. Grace believes that the separation is a one-time, non-recurring event, and such recognition of deferred taxes of undistributed earnings would not have occurred if not for the separation. Beyond the separation, Grace expects undistributed prior-year earnings of its foreign subsidiaries to remain permanently reinvested except in certain instances where repatriation of such earnings would result in minimal or no tax. Grace bases this assertion on:

(1) | the expectation that it will satisfy its U.S. cash obligations in the foreseeable future without requiring the repatriation of prior-year foreign earnings; |

(2) | plans for significant and continued reinvestment of foreign earnings in organic and inorganic growth initiatives outside the U.S.; and |

(3) | remittance restrictions imposed by local governments. |

Grace will continually analyze and evaluate its cash needs to determine the appropriateness of its indefinite reinvestment assertion.

21

Notes to Consolidated Financial Statements (Continued)

6. Pension Plans and Other Postretirement Benefit Plans

Pension Plans The following table presents the funded status of Grace's fully-funded, underfunded, and unfunded pension plans:

(In millions) | September 30, 2015 | December 31, 2014 | |||||

Overfunded defined benefit pension plans | $ | 44.7 | $ | 44.1 | |||

Underfunded defined benefit pension plans | (81.9 | ) | (79.5 | ) | |||

Unfunded defined benefit pension plans | (358.1 | ) | (378.0 | ) | |||

Total underfunded and unfunded defined benefit pension plans | (440.0 | ) | (457.5 | ) | |||

Pension liabilities included in other current liabilities | (15.2 | ) | (15.6 | ) | |||

Net funded status | $ | (410.5 | ) | $ | (429.0 | ) | |

Fully-funded plans include several advance-funded plans where the fair value of the plan assets exceeds the projected benefit obligation ("PBO"). This group of plans was overfunded by $44.7 million as of September 30, 2015, and the overfunded status is reflected as "overfunded defined benefit pension plans" in the Consolidated Balance Sheets. Underfunded plans include a group of advance-funded plans that are underfunded on a PBO basis. Unfunded plans include several plans that are funded on a pay-as-you-go basis, and therefore, the entire PBO is unfunded. The combined balance of the underfunded and unfunded plans was $455.2 million as of September 30, 2015.

Postretirement Benefits Other Than Pensions Grace has provided postretirement health care and life insurance benefits for retired employees of certain U.S. business units and certain divested business units. The postretirement medical plan provided various levels of benefits to employees hired before 1993 who retired from Grace after age 55 with at least 10 years of service. These plans are unfunded and Grace pays a portion of the costs of benefits under these plans as they are incurred. Grace applies ASC 715 "Compensation—Retirement Benefits" to these plans, which requires that the future costs of postretirement health care and life insurance benefits be accrued over the employees' years of service. Actuarial gains and losses are recognized in the Consolidated Balance Sheets as a component of Shareholders' Equity, with amortization of the net actuarial gains and losses that exceed 10 percent of the accumulated postretirement benefit obligation recognized each quarter in the Consolidated Statements of Operations over the average future service period of active employees.

In June 2014, Grace announced that it would discontinue its postretirement medical plan for all U.S. employees effective October 31, 2014, and eliminate certain postretirement life insurance benefits. As a result of these actions, Grace recognized a gain of $41.9 million in other comprehensive income in the 2014 second quarter. Grace amortized $39.5 million from accumulated other comprehensive income into the Consolidated Statement of Operations during the five-month period from June to October 2014.

The postretirement plan was further remeasured as of September 30, 2015, due to a plan amendment to eliminate certain postretirement life insurance benefits, which resulted in a curtailment gain of $4.5 million.

22

Notes to Consolidated Financial Statements (Continued)

6. Pension Plans and Other Postretirement Benefit Plans (Continued)

Components of Net Periodic Benefit Cost (Income)

Three Months Ended September 30, | |||||||||||||||||||||||

2015 | 2014 | ||||||||||||||||||||||

Pension | Other Post Retirement | Pension | Other Post Retirement | ||||||||||||||||||||

(In millions) | U.S. | Non-U.S. | U.S. | Non-U.S. | |||||||||||||||||||

Service cost | $ | 6.4 | $ | 3.0 | $ | — | $ | 5.8 | $ | 2.7 | $ | — | |||||||||||

Interest cost | 13.7 | 4.1 | — | 15.0 | 5.7 | 0.1 | |||||||||||||||||

Expected return on plan assets | (17.6 | ) | (3.3 | ) | — | (17.4 | ) | (3.9 | ) | — | |||||||||||||

Amortization of prior service cost (credit) | 0.1 | — | (0.9 | ) | 0.1 | — | (0.9 | ) | |||||||||||||||

Amortization of net deferred actuarial loss | — | — | 0.2 | — | — | 0.2 | |||||||||||||||||

Gain on termination and curtailment of postretirement plans | — | — | (4.5 | ) | — | — | (23.7 | ) | |||||||||||||||

Net periodic benefit cost (income) | $ | 2.6 | $ | 3.8 | $ | (5.2 | ) | $ | 3.5 | $ | 4.5 | $ | (24.3 | ) | |||||||||

Nine Months Ended September 30, | |||||||||||||||||||||||

2015 | 2014 | ||||||||||||||||||||||

Pension | Other Post Retirement | Pension | Other Post Retirement | ||||||||||||||||||||

(In millions) | U.S. | Non-U.S. | U.S. | Non-U.S. | |||||||||||||||||||

Service cost | $ | 19.3 | $ | 8.9 | $ | — | $ | 17.6 | $ | 8.2 | $ | 0.1 | |||||||||||

Interest cost | 41.3 | 12.3 | 0.1 | 45.1 | 17.0 | 1.0 | |||||||||||||||||

Expected return on plan assets | (52.8 | ) | (10.0 | ) | — | (52.4 | ) | (11.7 | ) | — | |||||||||||||

Amortization of prior service cost (credit) | 0.2 | — | (2.8 | ) | 0.5 | — | (1.4 | ) | |||||||||||||||

Amortization of net deferred actuarial loss (gain) | — | — | 0.5 | — | — | (0.1 | ) | ||||||||||||||||

Mark-to-market adjustment | — | — | — | (3.1 | ) | — | — | ||||||||||||||||

Gain on termination and curtailment of postretirement plans | — | — | (4.5 | ) | — | — | (31.6 | ) | |||||||||||||||

Net periodic benefit cost (income) | $ | 8.0 | $ | 11.2 | $ | (6.7 | ) | $ | 7.7 | $ | 13.5 | $ | (32.0 | ) | |||||||||

At emergence, benefit payments of approximately $27 million were paid from a U.S. nonqualified pension plan in connection with Grace's emergence from bankruptcy. As a result, that plan was remeasured as of March 1, 2014, using a discount rate of 4.43%. The remeasurement resulted in a mark-to-market gain of $3.1 million.

Plan Contributions and Funding Grace intends to satisfy its funding obligations under the U.S. qualified pension plans and to comply with all of the requirements of the Employee Retirement Income Security Act of 1974 ("ERISA"). For ERISA purposes, funded status is calculated on a different basis than under U.S. GAAP.

Grace intends to fund non-U.S. pension plans based on applicable legal requirements and actuarial and trustee recommendations.

Defined Contribution Retirement Plan Grace sponsors a defined contribution retirement plan for its employees in the United States. This plan is qualified under section 401(k) of the U.S. tax code. Currently, Grace contributes an amount equal to 100% of employee contributions, up to 6% of an individual employee's salary or wages. Grace's costs related to this benefit plan for the three and nine months ended September 30, 2015, were $3.7 million and $11.6 million compared with $3.6 million and $10.2 million for the corresponding prior-year periods.

23

Notes to Consolidated Financial Statements (Continued)

7. Other Balance Sheet Accounts

(In millions) | September 30, 2015 | December 31, 2014 | |||||

Other Current Liabilities | |||||||

Accrued compensation | $ | 75.5 | $ | 77.0 | |||

Income tax payable | 56.6 | 34.1 | |||||

Customer volume rebates | 39.2 | 37.8 | |||||

Accrued interest | 32.2 | 21.0 | |||||

Deferred revenue | 21.4 | 19.4 | |||||

Environmental contingencies | 20.7 | 21.5 | |||||

Pension liabilities | 15.2 | 15.6 | |||||

Deferred tax liability | 0.9 | 1.5 | |||||

Other accrued liabilities | 119.1 | 112.1 | |||||

$ | 380.8 | $ | 340.0 | ||||

Accrued compensation in the table above includes salaries and wages as well as estimated current amounts due under the annual and long-term incentive programs.

8. Commitments and Contingent Liabilities

Asbestos-Related Liabilities Grace emerged from an asbestos-related Chapter 11 bankruptcy on February 3, 2014 (the "Effective Date"). Under its plan of reorganization, all pending and future asbestos-related claims are channeled for resolution to either a personal injury trust (the "PI Trust") or a property damage trust (the "PD Trust"). The trusts are the sole recourse for holders of asbestos-related claims. The channeling injunctions issued by the bankruptcy court prohibit holders of asbestos-related claims from asserting such claims directly against Grace.

Grace has satisfied all of its financial obligations to the PI Trust. Grace has fixed and contingent obligations remaining to the PD Trust. With respect to property damage claims related to Grace’s former attic insulation product installed in the U.S. ("ZAI PD Claims"), the PD Trust was funded with $34.4 million on the Effective Date. Grace is obligated to make a payment of $30 million to the PD Trust in respect of ZAI PD Claims on February 3, 2017, and has recorded a liability of $28.9 million representing the present value of this amount in "debt payable after one year" in the accompanying Consolidated Balance Sheets. Grace is also obligated to make up to 10 contingent deferred payments of $8 million per year to the PD Trust in respect of ZAI PD Claims during the 20-year period beginning on the fifth anniversary of the Effective Date, with each such payment due only if the assets of the PD Trust in respect of ZAI PD Claims fall below $10 million during the preceding year. Grace has not accrued for the 10 additional payments as Grace does not currently believe they are probable. Grace is not obligated to make additional payments to the PD Trust in respect of ZAI PD Claims beyond the payments described above. Grace has satisfied all of its financial obligations with respect to Canadian ZAI PD Claims.

With respect to other asbestos property damage claims ("Other PD Claims"), claims unresolved as of the Effective Date are to be litigated in the bankruptcy court and any future claims are to be litigated in a federal district court, in each case pursuant to procedures to be approved by the bankruptcy court. To the extent any such Other PD Claims are determined to be allowed claims, they are to be paid in cash by the PD Trust. Grace is obligated to make a payment to the PD Trust every six months in the amount of any Other PD Claims allowed during the preceding six months plus interest (if applicable) and the amount of PD Trust expenses for the preceding six months (the "PD Obligation"). The aggregate amount to be paid under the PD Obligation is not capped and Grace may be obligated to make additional payments to the PD Trust in respect of the PD Obligation. Grace has accrued for those unresolved Other PD Claims that it believes are probable and estimable. Grace has not accrued for other unresolved or unasserted Other PD Claims as it does not believe that payment is probable.

All payments to the PD Trust required after the Effective Date are secured by the Company's obligation to issue 77,372,257 shares of Company common stock to the PD Trust in the event of default, subject to customary anti-dilution provisions.

24

Notes to Consolidated Financial Statements (Continued)

8. Commitments and Contingent Liabilities (Continued)

This summary of the commitments and contingencies related to the Chapter 11 proceeding does not purport to be complete and is qualified in its entirety by reference to the plan of reorganization and the exhibits and documents related thereto, which have been filed with the SEC.

Environmental Remediation Grace is subject to loss contingencies resulting from extensive and evolving federal, state, local and foreign environmental laws and regulations relating to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. Grace accrues for anticipated costs associated with response efforts where an assessment has indicated that a probable liability has been incurred and the cost can be reasonably estimated. These accruals do not take into account any discounting for the time value of money.

Grace's environmental liabilities are reassessed whenever circumstances become better defined or response efforts and their costs can be better estimated. These liabilities are evaluated based on currently available information, including the progress of remedial investigation at each site, the current status of discussions with regulatory authorities regarding the method and extent of remediation at each site, existing technology, prior experience in contaminated site remediation and the apportionment of costs among potentially responsible parties.

Estimated Investigation and Remediation Costs

At September 30, 2015, Grace's estimated liability for environmental investigation and remediation costs totaled $54.6 million, compared with $61.7 million at December 31, 2014, and was included in "other current liabilities" and "other liabilities" in the Consolidated Balance Sheets. These amounts are based on funding and/or remediation agreements in place and Grace's estimate of costs for sites not subject to a formal remediation plan for which sufficient information is available to estimate response costs. These amounts do not include certain response costs for the Libby vermiculite mine area or certain vermiculite expansion facilities, which may be material but are not currently estimable. Due to these vermiculite-related matters, it is probable that Grace's actual response costs will exceed Grace's current estimates by material amounts. Net cash paid against previously established reserves for the nine months ended September 30, 2015 and 2014, were $8.7 million and $9.7 million, respectively.

Vermiculite-Related Matters

Grace purchased a vermiculite mine in Libby, Montana, in 1963 and operated it until 1990. Vermiculite concentrate from the Libby mine was used in the manufacture of attic insulation and other products. Some of the vermiculite ore contained naturally occurring asbestos. The U.S. Environmental Protection Agency (the "EPA") and Grace are engaged in a remedial investigation of the Libby mine and the surrounding area.

During 2010, the EPA began reinvestigating certain facilities on a list of 105 facilities where vermiculite concentrate from the Libby mine may have been used, stored or processed. Grace is cooperating with the EPA on this reinvestigation and has remediated several of these facilities. It is probable that the EPA will request additional remediation at other facilities.

Grace's total estimated liability for response costs that are currently estimable related to its former vermiculite operations in Libby and vermiculite processing sites outside of Libby at September 30, 2015, and December 31, 2014, was $15.4 million and $19.4 million, respectively. It is probable that Grace's ultimate liability for these vermiculite-related matters will exceed current estimates by material amounts. Grace's current recorded liability will be adjusted as Grace receives new information and amounts become reasonably estimable.

Non-Vermiculite-Related Matters

At September 30, 2015, and December 31, 2014, Grace's estimated liability for response costs at sites not related to its former vermiculite mining and processing activities was $39.2 million and $42.3 million, respectively. This liability relates to Grace's current and former operations, including its share of liability for off-site disposal at facilities where it has been identified as a potentially responsible party. Grace's estimated liability is based upon

25

Notes to Consolidated Financial Statements (Continued)

8. Commitments and Contingent Liabilities (Continued)

regulatory requirements and environmental conditions at each site. As Grace receives new information its estimated liability may change materially.

Purchase Commitments Grace uses purchase commitments to ensure supply and to minimize the volatility of major components of direct manufacturing costs including natural gas, certain metals, rare earths, asphalt, amines and other materials. Such commitments are for quantities that Grace fully expects to use in its normal operations.

Guarantees and Indemnification Obligations Grace is a party to many contracts containing guarantees and indemnification obligations. These contracts primarily consist of:

• | Product warranties with respect to certain products sold to customers in the ordinary course of business. These warranties typically provide that products will conform to specifications. Grace accrues a warranty liability on a transaction-specific basis depending on the individual facts and circumstances related to each sale. Both the liability and annual expense related to product warranties are immaterial to the Consolidated Financial Statements. |

• | Performance guarantees offered to customers under certain licensing arrangements. Grace has not established a liability for these arrangements based on past performance. |

• | Licenses of intellectual property by Grace to third parties in which Grace has agreed to indemnify the licensee against third party infringement claims. |

• | Contracts providing for the sale of a former business unit or product line in which Grace has agreed to indemnify the buyer against liabilities arising prior to the closing of the transaction, including environmental liabilities. |

• | Guarantees of real property lease obligations of third parties, typically arising out of (a) leases entered into by former subsidiaries of Grace, or (b) the assignment or sublease of a lease by Grace to a third party. |

Financial Assurances Financial assurances have been established for a variety of purposes, including insurance and environmental matters, trade-related commitments and other matters. At September 30, 2015, Grace had gross financial assurances issued and outstanding of $127.5 million, composed of $34.2 million of surety bonds issued by various insurance companies and $93.3 million of standby letters of credit and other financial assurances issued by various banks.

Accounting for Contingencies Although the outcome of each of the matters discussed above cannot be predicted with certainty, Grace has assessed its risk and has made accounting estimates as required under U.S. GAAP.

9. Restructuring Expenses, Asset Impairments and Repositioning Expenses

Restructuring Expenses and Asset Impairments

In the third quarter, Grace incurred costs from restructuring actions as a result of changes in the business environment and its business structure, which are included in "other expense, net" in the Consolidated Statements of Operations. Grace incurred $4.8 million ($0.5 million in Catalysts Technologies, $0.4 million in Construction Products, $0.3 million in Materials Technologies, and $3.6 million in Corporate) of restructuring expenses during the third quarter, compared with $0.8 million during the prior-year quarter. These costs are not included in segment operating income. Substantially all costs related to the restructuring programs are expected to be paid by September 30, 2016.