Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - BNC BANCORP | harborpressrelease.htm |

| EX-2.1 - MERGER AGREEMENT - BNC BANCORP | harbormergeragreement.htm |

| 8-K - 8-K - BNC BANCORP | bnc-harborform8xk.htm |

Acquisition of

2 Forward Looking Statements This presentation contains certain forward-looking information about BNC Bancorp and subsidiaries (collectively, “BNCN”) that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should carefully read forward-looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward-looking” information about BNCN. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of BNCN. Forward-looking statements speak only as of the date they are made and BNCN assumes no duty to update such statements. In addition to factors previously disclosed in reports filed by BNCN with the Securities and Exchange Commission (“SEC”), additional risks and uncertainties may include, but are not limited to: the possibility that any of the anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of operations with those of BNCN will be materially delayed or will be more costly or difficult than expected; the inability to complete the merger due to the failure of shareholder approval to adopt the merger agreement; the failure to satisfy other conditions to completion of the merger, including receipt of required regulatory and other approvals; the failure of the proposed merger to close for any other reason; the effect of the announcement of the merger on customer relationships and operating results; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions and fluctuations. As stated previously, additional factors affecting BNCN are discussed in BNCN’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K, filed with the SEC. Please refer to the SEC’s website at www.sec.gov where you can review those documents.

3 Transaction Benefits Four branches in dynamic Charleston, South Carolina market Highly experienced leadership and lending team with local roots Local knowledge allowed Harbor National to grow and still maintain excellent asset quality throughout economic downturn Additional $250 million of core deposits in Charleston area, bringing BNC total to $300 million Transaction expected to be 4.5%+ accretive to 2015 EPS* Tangible Book Value expected earn-back inside 1.5 years* *Does not include fair value accretion or revenue synergies

4 Transaction Rationale Strategic Rationale In-market acquisition consistent with BNCN’s long-term growth strategy 100% overlap with current BNC offices in Charleston and Mount Pleasant Leverages current infrastructure in growing Charleston markets Strong core deposit franchise Creates $4.0 billion institution, well-positioned in key NC and SC markets Financially Attractive Deal meets BNCN’s acquisition performance targets Significantly accretive to EPS in 2015 Minor TBV dilution, which is earned back within 18 months Significant operating synergies Strong capital ratios pro forma Low Risk Integration Comprehensive due diligence process completed, rigorous internal and third-party loan review and OREO inspection Conservative credit mark - over 225% of NPAs Cost savings of 35% - 40% due to significant branch overlap BNCN is an experienced acquirer (11 deals since early 2010)

5 Transaction Terms Harbor National Bank Transaction Value* (as of close on June 4, 2014) $50.6 million Exchange Ratio 0.9500x+ Consideration 100% stock Price to Stated TBV 153% Required Approvals Customary regulatory and shareholder approval Expected Closing November 30, 2014 *Total consideration to common shareholders +Current, subject to certain collars

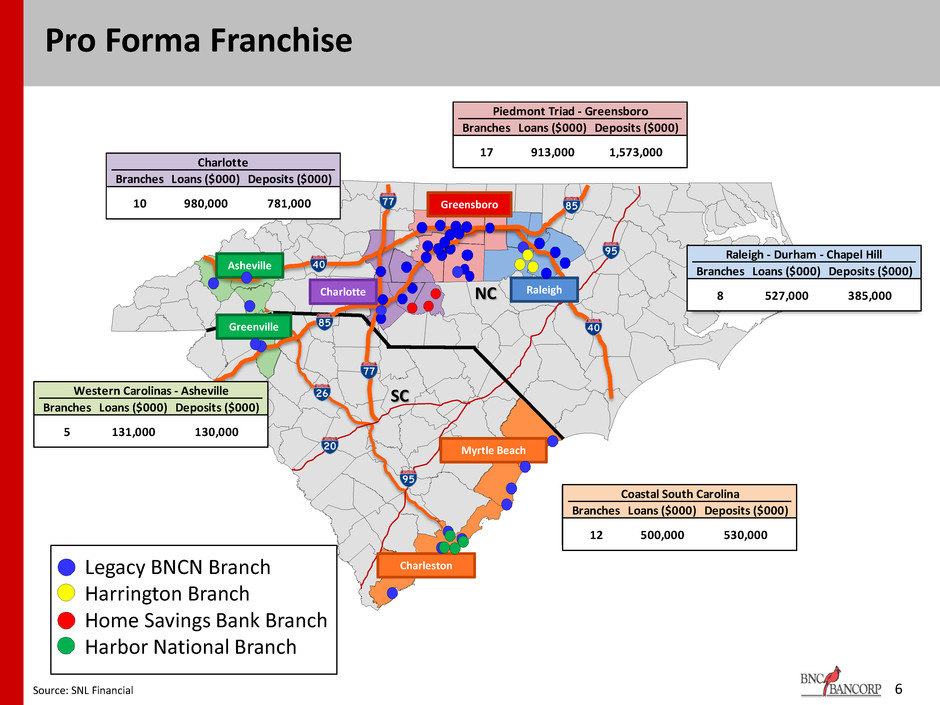

6 Pro Forma Franchise NC SC Greensboro Raleigh Myrtle Beach Charleston Greenville Asheville Legacy BNCN Branch Harrington Branch Home Savings Bank Branch Harbor National Branch Source: SNL Financial Charlotte Branches Loans ($000) Deposits ($000) 10 980,000 781,000 Piedmont Triad - Greensboro Branches Loans ($000) Deposits ($000) 17 913,000 1,573,000 Raleigh - Durham - Chapel Hill Branches Loans ($000) Deposits ($000) 8 527,000 385,000 Coastal South Carolina Branches Loans ($000) Deposits ($000) 12 500,000 530,000 Charlotte Western Carolinas - Asheville Branches Loans ($000) Deposits ($000) 5 131,000 130,000

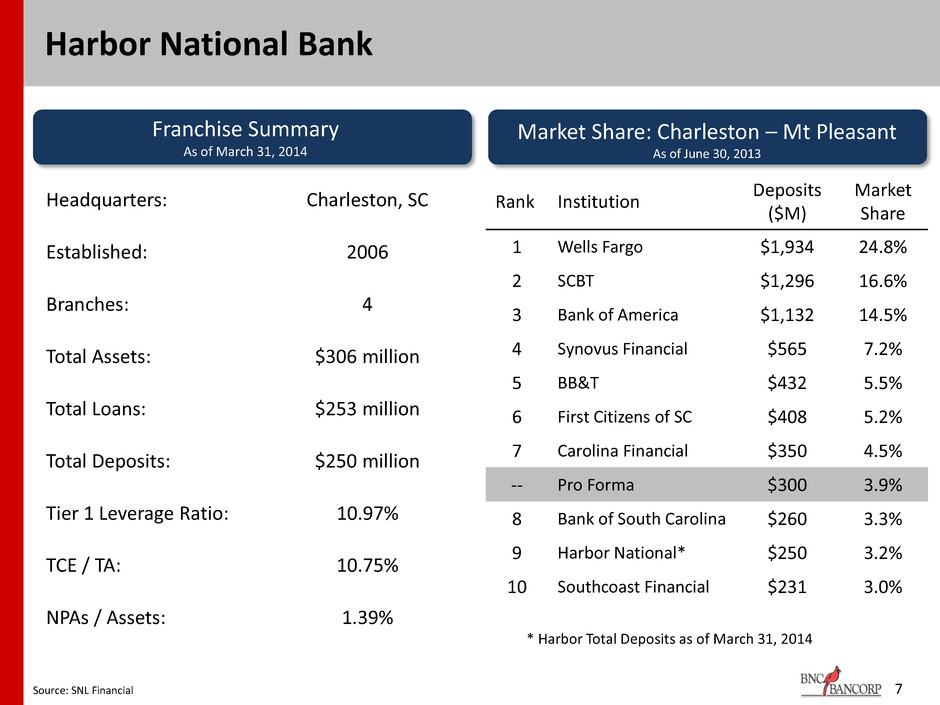

7 Harbor National Bank Headquarters: Charleston, SC Established: 2006 Branches: 4 Total Assets: $306 million Total Loans: $253 million Total Deposits: $250 million Tier 1 Leverage Ratio: 10.97% TCE / TA: 10.75% NPAs / Assets: 1.39% Rank Institution Deposits ($M) Market Share 1 Wells Fargo $1,934 24.8% 2 SCBT $1,296 16.6% 3 Bank of America $1,132 14.5% 4 Synovus Financial $565 7.2% 5 BB&T $432 5.5% 6 First Citizens of SC $408 5.2% 7 Carolina Financial $350 4.5% -- Pro Forma $300 3.9% 8 Bank of South Carolina $260 3.3% 9 Harbor National* $250 3.2% 10 Southcoast Financial $231 3.0% Source: SNL Financial Franchise Summary As of March 31, 2014 Market Share: Charleston – Mt Pleasant As of June 30, 2013 * Harbor Total Deposits as of March 31, 2014

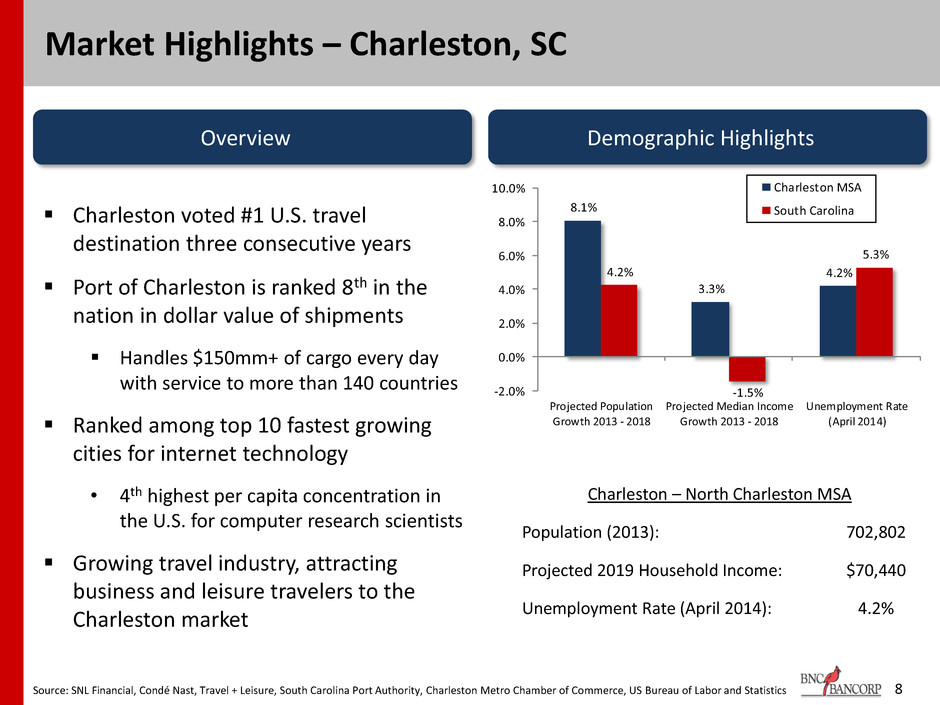

8 Market Highlights – Charleston, SC Overview Demographic Highlights Charleston voted #1 U.S. travel destination three consecutive years Port of Charleston is ranked 8th in the nation in dollar value of shipments Handles $150mm+ of cargo every day with service to more than 140 countries Ranked among top 10 fastest growing cities for internet technology • 4th highest per capita concentration in the U.S. for computer research scientists Growing travel industry, attracting business and leisure travelers to the Charleston market Source: SNL Financial, Condé Nast, Travel + Leisure, South Carolina Port Authority, Charleston Metro Chamber of Commerce, US Bureau of Labor and Statistics Charleston – North Charleston MSA Population (2013): 702,802 Projected 2019 Household Income: $70,440 Unemployment Rate (April 2014): 4.2% 8.1% 3.3% 4.2%4.2% -1.5% 5.3% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Projected Population Growth 2013 - 2018 Projected Median Income Growth 2013 - 2018 Unemployment Rate (April 2014) Charleston MSA South Carolina

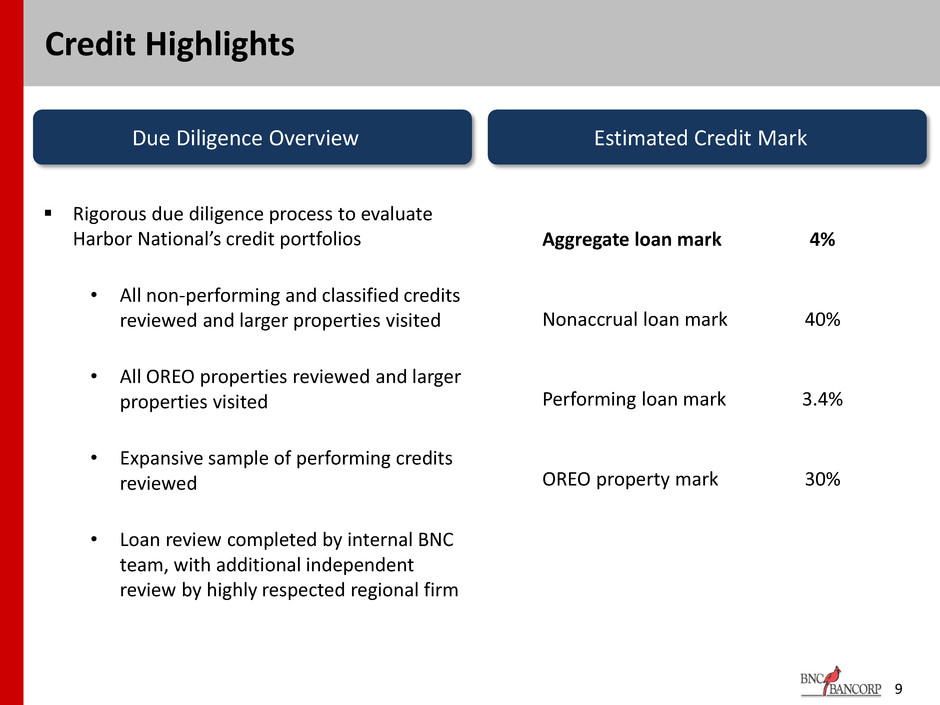

9 Credit Highlights Due Diligence Overview Estimated Credit Mark Rigorous due diligence process to evaluate Harbor National’s credit portfolios • All non-performing and classified credits reviewed and larger properties visited • All OREO properties reviewed and larger properties visited • Expansive sample of performing credits reviewed • Loan review completed by internal BNC team, with additional independent review by highly respected regional firm Aggregate loan mark 4% Nonaccrual loan mark 40% Performing loan mark 3.4% OREO property mark 30%

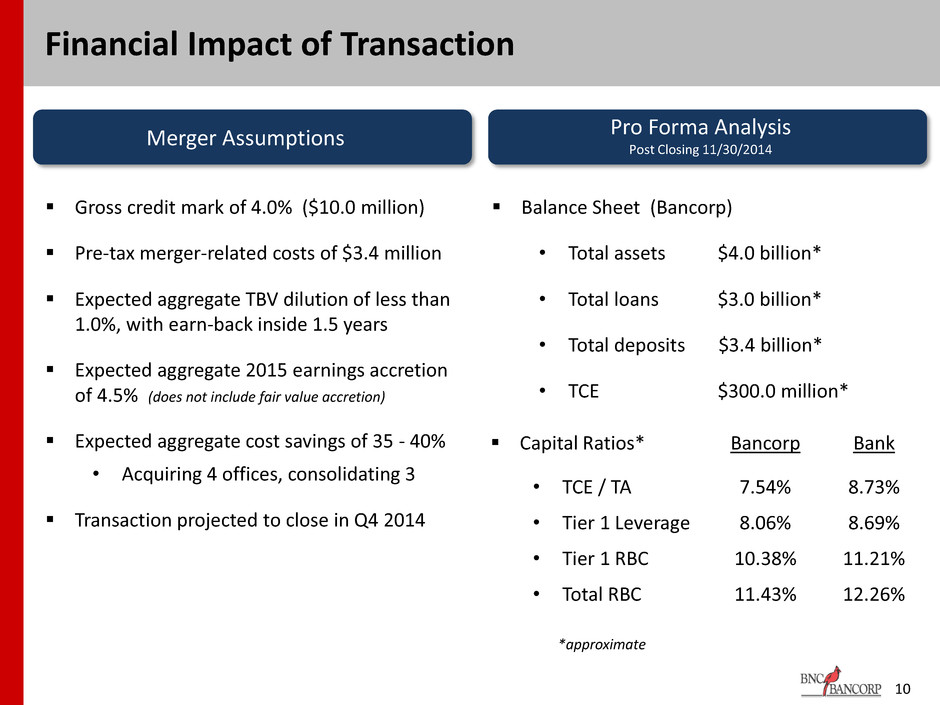

10 Financial Impact of Transaction Merger Assumptions Pro Forma Analysis Post Closing 11/30/2014 Gross credit mark of 4.0% ($10.0 million) Pre-tax merger-related costs of $3.4 million Expected aggregate TBV dilution of less than 1.0%, with earn-back inside 1.5 years Expected aggregate 2015 earnings accretion of 4.5% (does not include fair value accretion) Expected aggregate cost savings of 35 - 40% • Acquiring 4 offices, consolidating 3 Transaction projected to close in Q4 2014 Balance Sheet (Bancorp) • Total assets $4.0 billion* • Total loans $3.0 billion* • Total deposits $3.4 billion* • TCE $300.0 million* Capital Ratios* Bancorp Bank • TCE / TA 7.54% 8.73% • Tier 1 Leverage 8.06% 8.69% • Tier 1 RBC 10.38% 11.21% • Total RBC 11.43% 12.26% *approximate

Expansion through Disciplined Acquisition Strategy Source: SNL Financial and Company filings 11 Acquisitions Since 2010 6 Whole Bank completed; 3 FDIC-assisted; 1 Branch Transaction; 1 Pending Strategy: Acquire Core Deposits in High Growth Markets 11 Acquisition Target Announce Date Rationale Harbor National Bank 6/5/2014 100% Core Deposits – Charleston, SC Expansion Harrington Bank 12/18/2013 100% Core Deposits - 33% Non Interest DDA - Raleigh CSA Home Savings Bank of Albemarle 12/18/2013 100% Core Deposits – Charlotte CSA Expansion Randolph Bank & Trust Co. 5/31/2013 100% Core Deposits - Loans Primarily Retail Carolina Federal Savings Bank (FDIC) 6/8/2012 100% Core Deposits – Charleston, SC Market Entry First Trust Bank 6/4/2012 Strong Core Deposit Base – Charlotte Metro Expansion Bank of Hampton Roads (2 branches) 4/30/2012 100% Core Deposits – Raleigh CSA Expansion KeySource Commercial Bank 12/21/2011 Diversify Lending – Raleigh CSA Entry Blue Ridge Savings Bank (FDIC) 10/14/2011 100% Core Deposits - Loans Primarily Retail Regent Bank 9/8/2011 100% Core Deposits – Greenville, SC Market Entry Beach First National Bank (FDIC) 4/9/2010 Strong Core Deposits - Reduce Wholesale Reliance

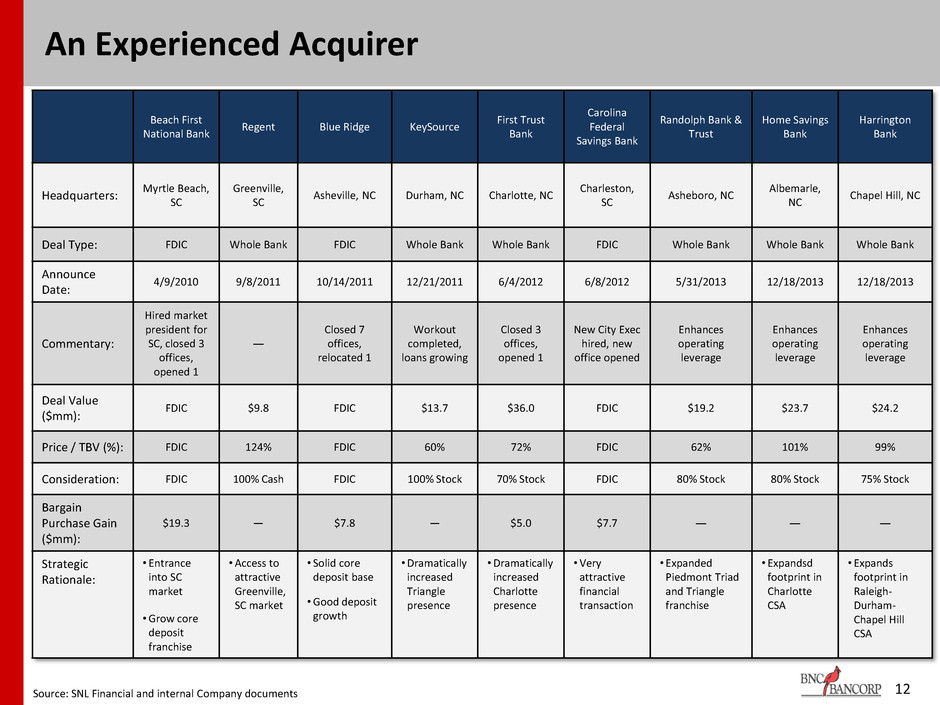

12 An Experienced Acquirer Beach First National Bank Regent Blue Ridge KeySource First Trust Bank Carolina Federal Savings Bank Randolph Bank & Trust Home Savings Bank Harrington Bank Headquarters: Myrtle Beach, SC Greenville, SC Asheville, NC Durham, NC Charlotte, NC Charleston, SC Asheboro, NC Albemarle, NC Chapel Hill, NC Deal Type: FDIC Whole Bank FDIC Whole Bank Whole Bank FDIC Whole Bank Whole Bank Whole Bank Announce Date: 4/9/2010 9/8/2011 10/14/2011 12/21/2011 6/4/2012 6/8/2012 5/31/2013 12/18/2013 12/18/2013 Commentary: Hired market president for SC, closed 3 offices, opened 1 ― Closed 7 offices, relocated 1 Workout completed, loans growing Closed 3 offices, opened 1 New City Exec hired, new office opened Enhances operating leverage Enhances operating leverage Enhances operating leverage Deal Value ($mm): FDIC $9.8 FDIC $13.7 $36.0 FDIC $19.2 $23.7 $24.2 Price / TBV (%): FDIC 124% FDIC 60% 72% FDIC 62% 101% 99% Consideration: FDIC 100% Cash FDIC 100% Stock 70% Stock FDIC 80% Stock 80% Stock 75% Stock Bargain Purchase Gain ($mm): $19.3 ― $7.8 ― $5.0 $7.7 ― ― ― Strategic Rationale: • Entrance into SC market •Grow core deposit franchise •Access to attractive Greenville, SC market • Solid core deposit base •Good deposit growth •Dramatically increased Triangle presence •Dramatically increased Charlotte presence •Very attractive financial transaction • Expanded Piedmont Triad and Triangle franchise • Expandsd footprint in Charlotte CSA • Expands footprint in Raleigh- Durham- Chapel Hill CSA Source: SNL Financial and internal Company documents

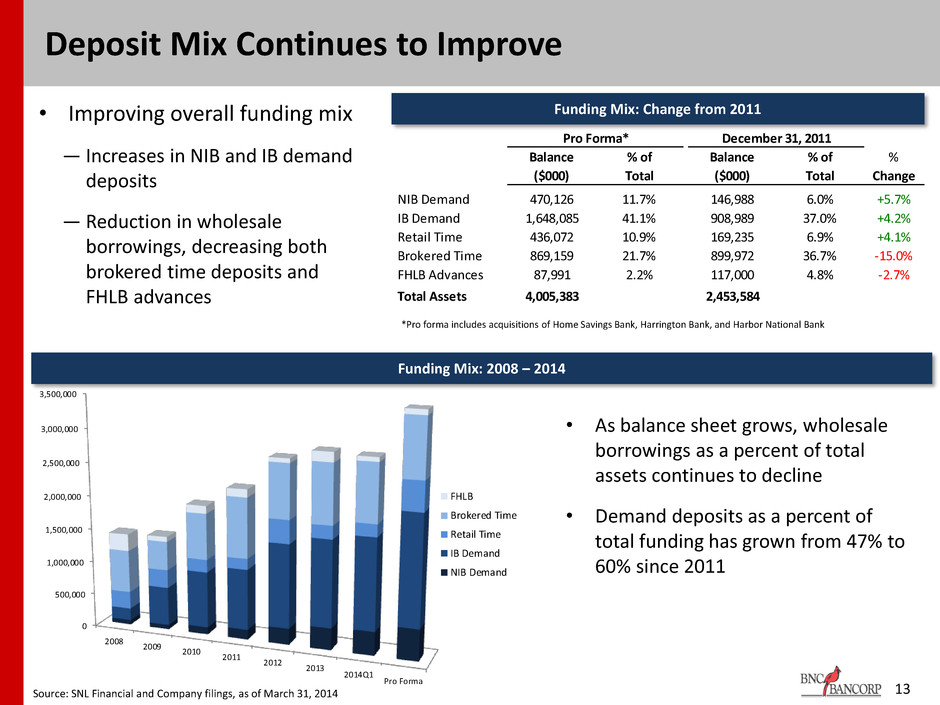

13 Deposit Mix Continues to Improve Funding Mix: 2008 – 2014 Funding Mix: Change from 2011 • Improving overall funding mix ― Increases in NIB and IB demand deposits ― Reduction in wholesale borrowings, decreasing both brokered time deposits and FHLB advances • As balance sheet grows, wholesale borrowings as a percent of total assets continues to decline • Demand deposits as a percent of total funding has grown from 47% to 60% since 2011 Source: SNL Financial and Company filings, as of March 31, 2014 *Pro forma includes acquisitions of Home Savings Bank, Harrington Bank, and Harbor National Bank Noninterest Bearing Demand Interest Bearing Demand Brokered Time Deposits Retail Time Deposits FHLB Advances 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 2008 2009 2010 2011 2012 2013 2014Q1 Pro Forma FHLB Brokered Time Retail Time IB Demand NIB Demand Pro Forma* December 31, 2011 Balance % of Balance % of % ($000) Total ($000) Total Change NIB Demand 470,126 11.7% 146,988 6.0% +5.7% IB Demand 1,648,085 41.1% 908,989 37.0% +4.2% Retail Time 436,072 10.9% 169,235 6.9% +4.1% Brokered Time 869,159 21.7% 899,972 36.7% -15.0% FHLB Advances 87,991 2.2% 117,000 4.8% -2.7% Total Assets 4,005,383 2,453,584

Transaction drives EPS growth and overall shareholder value for BNCN and Harbor shareholders Increased presence in the key strategic markets of Charleston and Mount Pleasant with the right personnel and the right platform to support growth Greatly accelerates BNCN’s execution on strategic plan to be $500 million+ in Charleston, SC and surrounding markets Pro forma institution is stronger, well-capitalized and remains one of the acquirers of choice in the Carolina markets Pro forma comparable companies trade at considerably higher multiples than stand-alone peers Continues to increase stock liquidity Increases ability to serve larger, more prominent customers with whom the management team is familiar Convenience of expanded branch network with 52 locations throughout the Carolinas 14 Transaction Summary

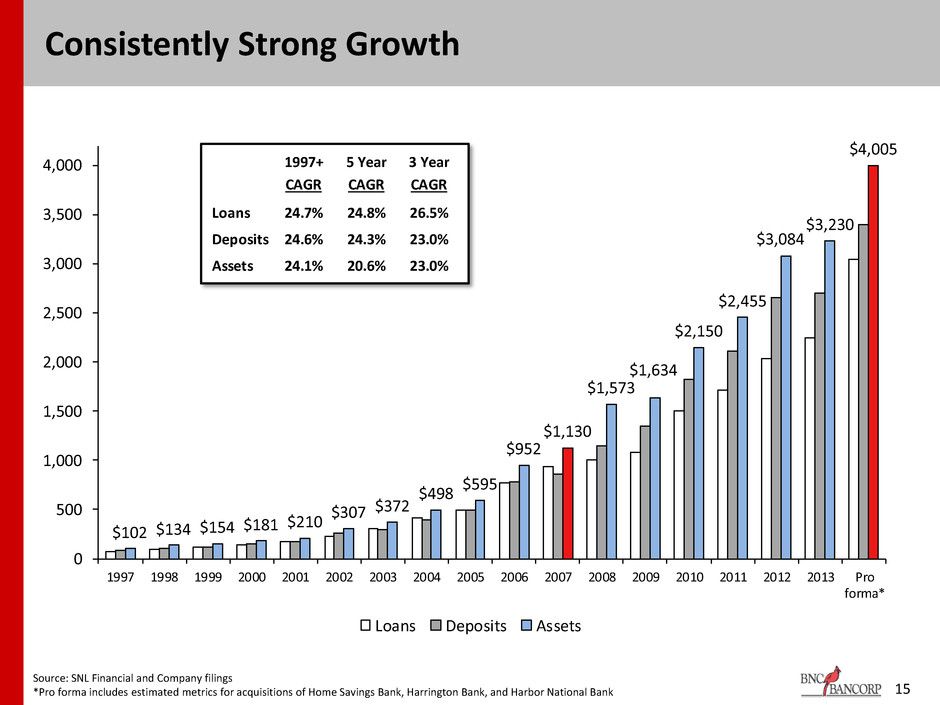

$102 $134 $154 $181 $210 $307 $372 $498 $595 $952 $1,130 $1,573 $1,634 $2,150 $2,455 $3,084 $3,230 $4,005 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Pro forma* Loans Deposits Assets Source: SNL Financial and Company filings *Pro forma includes estimated metrics for acquisitions of Home Savings Bank, Harrington Bank, and Harbor National Bank 15 Consistently Strong Growth 1997+ 5 Year 3 Year CAGR CAGR CAGR Loans 24.7% 24.8% 26.5% Deposits 24.6% 24.3% 23.0% Assets 24.1% 20.6% 23.0%

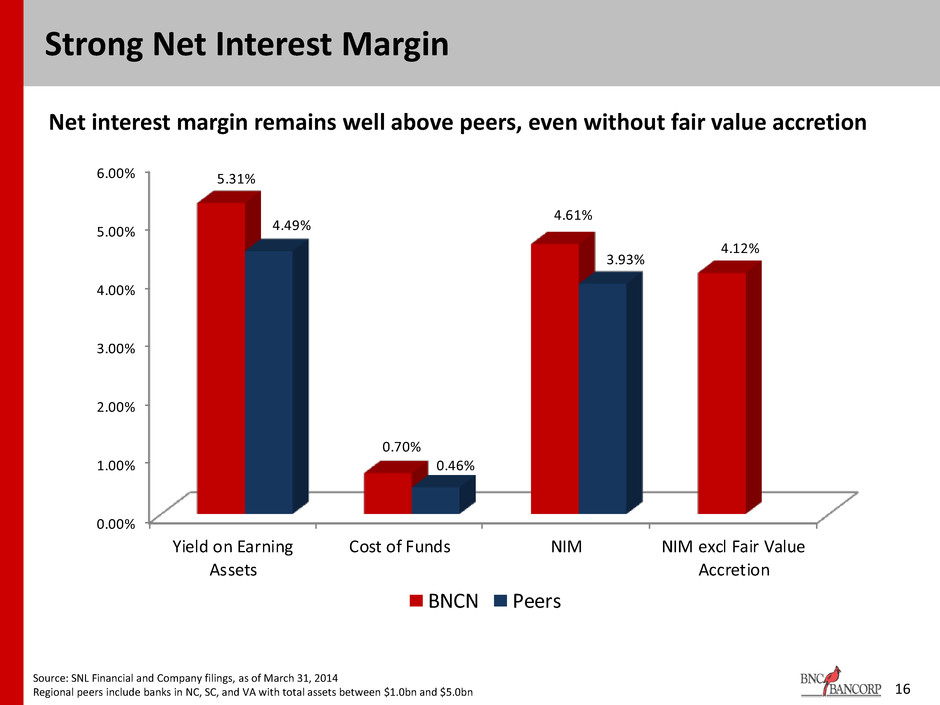

16 Strong Net Interest Margin 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Yield on Earning Assets Cost of Funds NIM NIM excl Fair Value Accretion 5.31% 0.70% 4.61% 4.12% 4.49% 0.46% 3.93% BNCN Peers Net interest margin remains well above peers, even without fair value accretion Source: SNL Financial and Company filings, as of March 31, 2014 Regional peers include banks in NC, SC, and VA with total assets between $1.0bn and $5.0bn

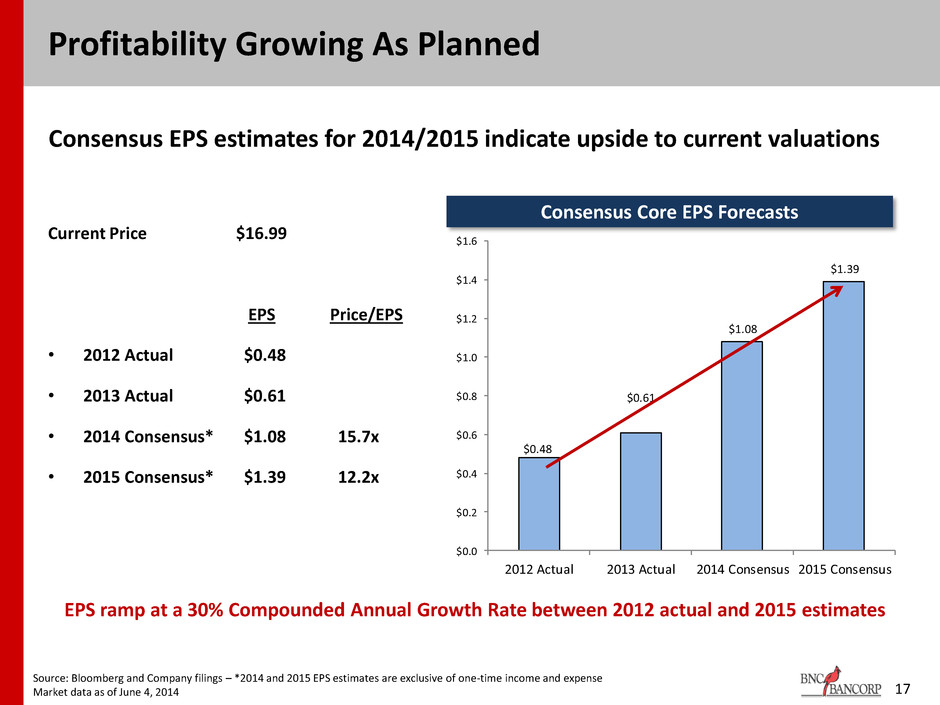

Profitability Growing As Planned Current Price $16.99 EPS Price/EPS • 2012 Actual $0.48 • 2013 Actual $0.61 • 2014 Consensus* $1.08 15.7x • 2015 Consensus* $1.39 12.2x Consensus EPS estimates for 2014/2015 indicate upside to current valuations Source: Bloomberg and Company filings – *2014 and 2015 EPS estimates are exclusive of one-time income and expense Market data as of June 4, 2014 17 EPS ramp at a 30% Compounded Annual Growth Rate between 2012 actual and 2015 estimates Consensus Core EPS Forecasts $0.48 $0.61 $1.08 $1.39 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 2012 Actual 2013 Actual 2014 Consensus 2015 Consensus

18 Investor Contacts Richard D. Callicutt II President & Chief Executive Officer David B. Spencer Senior Executive Vice President & Chief Financial Officer BNC Bancorp 3980 Premier Drive, Suite 210 High Point, NC 27265 (366) 869-9200 www.bankofnc.com

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the merger, BNC Bancorp will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of Harbor Bank Group, Inc. and a Prospectus of BNC Bancorp, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS ARE STRONGLY URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about BNC Bancorp, may be obtained after their filing at the SEC’s Internet site (http://www.sec.gov). In addition, free copies of documents filed by BNC Bancorp with the SEC may be obtained on the BNC Bancorp website at www.bncbancorp.com or by requesting them in writing from Drema Michael, BNC Bancorp, 3980 Premier Drive, Suite 210, High Point, North Carolina 27265, or by telephone at (336) 869-9200. BNC Bancorp and Harbor Bank Group, Inc. and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Harbor Bank Group, Inc.’s shareholders in connection with the proposed merger. Information about the directors and executive officers of BNC Bancorp and Harbor Bank Group, Inc. and other persons who may be deemed participants in the solicitation will be included in the Proxy Statement/Prospectus. Information about BNC Bancorp's executive officers and directors can also be found in BNC Bancorp’s definitive proxy statement in connection with its 2014 Annual Meeting of Shareholders filed with the SEC on April 10, 2014. Additional information regarding the interests of those persons and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. You may obtain free copies of each document as described in the preceding paragraph. 19 Additional Information