Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST POTOMAC REALTY TRUST | d681534d8k.htm |

| EX-99.1 - EX-99.1 - FIRST POTOMAC REALTY TRUST | d681534dex991.htm |

Exhibit 99.2

|

Index to Supplemental Information |

| Page | ||||

| Company Information |

3 | |||

| Geographic Footprint |

4 | |||

| Earnings Release |

5 | |||

| Consolidated Statements of Operations |

13 | |||

| Consolidated Balance Sheets |

16 | |||

| Same-Property Analysis |

17 | |||

| Highlights |

18 | |||

| Quarterly Financial Results and Measures |

19 | |||

| Annual Financial Results and Measures |

21 | |||

| Capitalization and Selected Ratios |

23 | |||

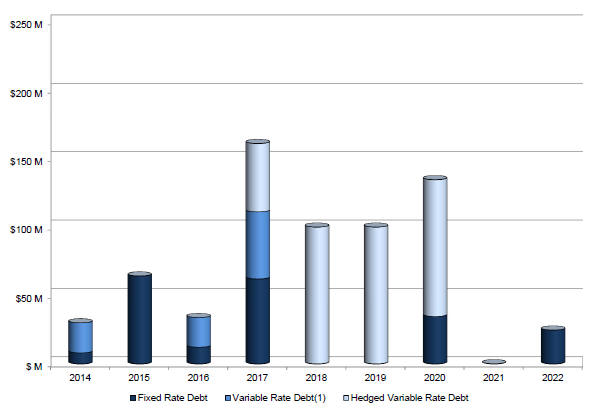

| Outstanding Debt |

24 | |||

| Debt Maturity Schedule |

25 | |||

| Selected Debt Covenants |

26 | |||

| Net Asset Value Analysis |

27 | |||

| Investment in Joint Ventures |

28 | |||

| Portfolio Summary |

29 | |||

| Leasing and Occupancy Summary |

30 | |||

| Portfolio by Size |

31 | |||

| Top Twenty-Five Tenants |

32 | |||

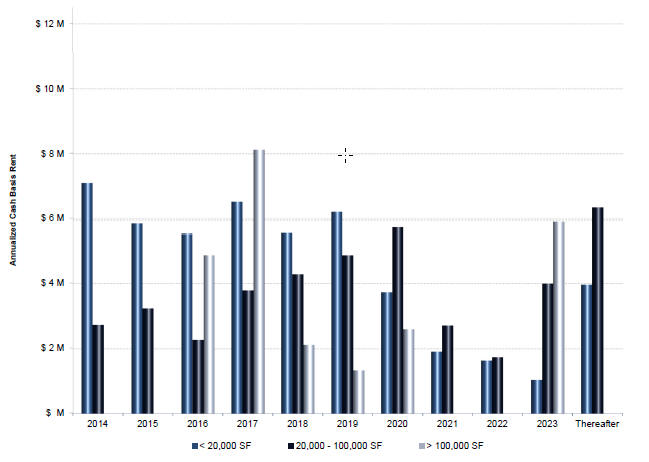

| Annual Lease Expirations |

33 | |||

| Quarterly Lease Expirations |

34 | |||

| Leasing Analysis |

35 | |||

| Retention Summary |

36 | |||

| Office Properties |

37 | |||

| Business Park / Industrial Properties |

38 | |||

| Management Statements on Non-GAAP Supplemental Measures |

39 | |||

|

Company Information |

First Potomac Realty Trust is a leader in the ownership, management, development and redevelopment of office and business park properties in the greater Washington, DC region. The Company’s focus is on acquiring properties that can benefit from its intensive property management, and repositioning properties to increase their profitability and value.

| Corporate Headquarters | 7600 Wisconsin Avenue 11th Floor Bethesda, MD 20814 | |

| New York Stock Exchange |

| |

| Website | www.first-potomac.com | |

| Investor Relations | Jaime N. Marcus Manager, Investor Relations (301) 986-9200 jmarcus@first-potomac.com | |

The forward-looking statements contained in this supplemental financial information are subject to various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements contained herein are based on reasonable assumptions, there can be no assurance that its expectations will be achieved. Certain factors that could cause actual results to differ materially from the Company’s expectations include changes in general or regional economic conditions; the Company’s ability to timely lease or re-lease space at current or anticipated rents; changes in interest rates; changes in operating costs; the Company’s ability to complete acquisitions and, if applicable, dispositions on acceptable terms; the Company’s ability to manage its current debt levels and repay or refinance its indebtedness upon maturity or other required payment dates; the Company’s ability to maintain financial covenant compliance under its debt agreements; the Company’s ability to maintain effective internal controls over financial reporting and disclosure controls and procedures; any impact of the informal inquiry initiated by the U.S. Securities and Exchange Commission (the “SEC” ); the Company’s ability to obtain debt and/or financing on attractive terms, or at all; changes in the assumptions underlying the Company’s earnings and Core FFO guidance and other risks detailed in the Company’s Annual Report on Form 10-K and described from time to time in the Company’s filings with the SEC. Many of these factors are beyond the Company’s ability to control or predict. Forward-looking statements are not guarantees of performance. For forward-looking statements herein, the Company claims the protection of the safe harbor for forward- looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

Note that certain figures are rounded to the nearest thousands or to a tenth of a percent throughout the document, which may impact footing and/or crossfooting of totals and subtotals.

3

|

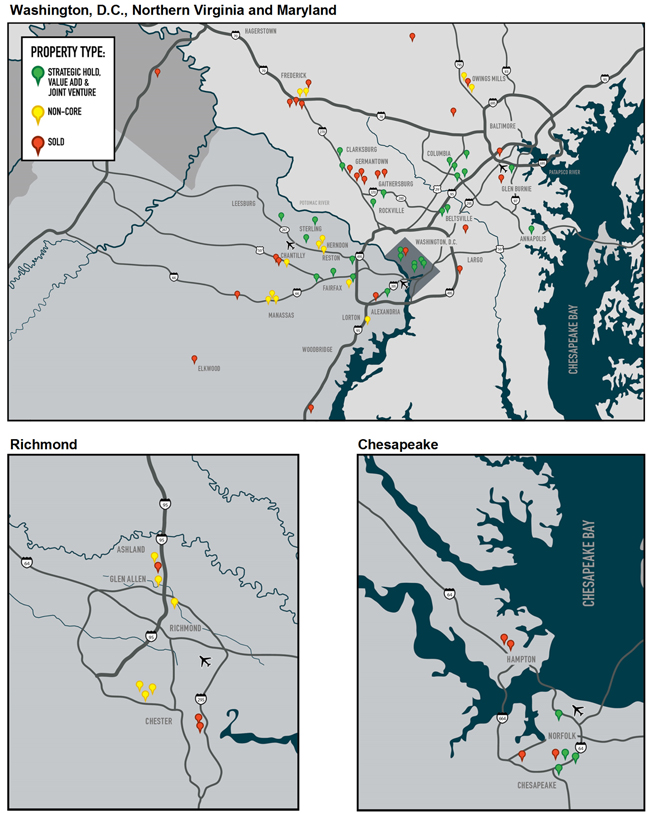

Geographic Footprint (12/31/09 through 12/31/13) |

4

|

Earnings Release |

| CONTACT: Jaime N. Marcus Manager, Investor Relations (301) 986-9200 jmarcus@first-potomac.com |

|

First Potomac Realty Trust 7600 Wisconsin Avenue 11th Floor Bethesda, MD 20814 www.first-potomac.com |

FIRST POTOMAC REALTY TRUST REPORTS

FOURTH QUARTER AND FULL-YEAR 2013 RESULTS

Operating Results Reflect Strong Execution of Strategic Plan

BETHESDA, MD. (February 20, 2014) – First Potomac Realty Trust (NYSE: FPO), a leader in the ownership, management, development, and redevelopment of office and business park properties in the greater Washington, D.C. region, reported results for the three and twelve months ended December 31, 2013.

Fourth Quarter 2013 and Subsequent Highlights

| • | Reported Core Funds From Operations of $14.0 million, or $0.23 per diluted share. |

| • | Executed 263,000 square feet of leases, including 165,000 square feet of new leases. |

| • | Increased leased percentage to 88.1% from 84.9% in the fourth quarter of 2012, and increased occupied percentage to 85.8% from 83.0%. |

| • | Sold Worman’s Mill Court, a 40,000 square-foot office building for net proceeds of $3.4 million in November and sold a, three-property portfolio, totaling 342,000 square feet, located in Gaithersburg, Maryland for net proceeds of $31.6 million in January 2014. |

| • | Acquired 540 Gaither Road, the third multi-story office building at Redland Corporate Center, in Rockville, Maryland, for $30.0 million, which completes the Company’s ownership of the fully leased office complex. |

| • | Amended the unsecured revolving credit facility and unsecured term loan to increase borrowing capacity, extend the maturity, and reduce LIBOR spreads for each. |

Full-Year 2013 Highlights

| • | Reported Core Funds From Operations of $59.2 million, or $1.03 per diluted share. |

| • | Executed 1.7 million square feet of leases, including 831,000 square feet of new leases. |

| • | Same property net operating income increased 1.8% on an accrual basis and 1.0% on a cash basis. |

Douglas J. Donatelli, Chairman and CEO of First Potomac Realty Trust, stated, “2013 was a very successful year for First Potomac. We made substantial progress executing on the strategic and capital plan we laid out early in the year, which included the sale of our industrial portfolio for $259 million, dramatically improving our operating metrics, and completing the acquisition of a high-quality office asset in a submarket where we have operating efficiencies. We ended the year with very strong leasing momentum and delivered our eighth consecutive quarter of positive net absorption, despite the challenges the greater Washington, D.C. region is facing. We strengthened our core portfolio performance, made positive steps executing on the disposition strategy we have outlined, and will continue to focus on opportunities in our markets that we believe will lead to long-term value creation for our shareholders.”

Funds From Operations (“FFO”) decreased for the three and twelve months ended December 31, 2013 compared with the same periods in 2012 primarily due to a reduction in net operating income as a result of the sale of the majority of the Company’s industrial properties in June 2013, the operations of which are presented in discontinued operations. The reduction in net operating income during 2013 was partially offset by a reduction in interest expense as the Company reduced its

5

|

Earnings Release - Continued |

outstanding debt by over $260 million during 2013 and decreased the weighted average interest rates on its outstanding debt. For the three months ended December 31, 2013, the Company incurred $1.0 million of additional debt extinguishment costs compared with the same period in 2012 due to the amendment and restatement of its unsecured revolving credit facility and its unsecured term loan. For the twelve months ended December 31, 2013, the Company incurred debt extinguishment charges of $6.2 million, primarily related to the repayment of debt in conjunction with property dispositions and the amendment and restatement of the unsecured revolving credit facility and unsecured term loan, compared with $13.8 million of debt extinguishment charges for the twelve months ended December 31, 2012, which were primarily related to the repayment of the Company’s senior notes.

Core FFO decreased for the three and twelve months ended December 31, 2013 compared with the same periods in 2012 primarily due to a decline in net operating income as a result of the sale of the majority of the Company’s industrial properties in June 2013, which was partially offset by a decline in interest expense.

A reconciliation between Core FFO and FFO available to common shareholders for the three and twelve months ended December 31, 2013 and 2012 is presented below (in thousands, except per share amounts):

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||||||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||||||||||||||||||

| Amount | Per diluted share(1) |

Amount | Per diluted share(1) |

Amount | Per diluted share(1) |

Amount | Per diluted share(1) |

|||||||||||||||||||||||||

| Core FFO |

$ | 13,950 | $ | 0.23 | $ | 16,805 | $ | 0.32 | $ | 59,207 | $ | 1.03 | $ | 63,605 | $ | 1.20 | ||||||||||||||||

| Loss on debt extinguishment /modification |

(1,485 | ) | (0.02 | ) | (466 | ) | (0.01 | ) | (6,224 | ) | (0.11 | ) | (13,792 | ) | (0.26 | ) | ||||||||||||||||

| Internal investigation costs |

— | — | (27 | ) | — | — | — | (3,412 | ) | (0.06 | ) | |||||||||||||||||||||

| Deferred abatement and straight-line amortization(2) |

— | — | 1,567 | 0.03 | 1,567 | 0.03 | 3,134 | 0.06 | ||||||||||||||||||||||||

| Acquisition costs |

(429 | ) | (0.01 | ) | — | — | (602 | ) | (0.01 | ) | (49 | ) | — | |||||||||||||||||||

| Development and redevelopment costs |

— | — | (397 | ) | (0.01 | ) | — | — | (397 | ) | (0.01 | ) | ||||||||||||||||||||

| Change in tax regulation(3) |

— | — | — | — | — | — | 4,327 | 0.08 | ||||||||||||||||||||||||

| Personnel separation costs |

— | — | (732 | ) | (0.02 | ) | (1,777 | ) | (0.03 | ) | (1,128 | ) | (0.03 | ) | ||||||||||||||||||

| Contingent consideration related to acquisition of property(4) |

287 | — | (39 | ) | — | 213 | — | (152 | ) | — | ||||||||||||||||||||||

| Legal costs associated with informal SEC inquiry |

— | — | (110 | ) | — | (391 | ) | (0.01 | ) | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| FFO available to common shareholders |

$ | 12,323 | $ | 0.20 | $ | 16,601 | $ | 0.31 | $ | 51,993 | $ | 0.90 | $ | 52,136 | $ | 0.98 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net (loss) income |

$ | (3,741 | ) | $ | 880 | $ | 10,981 | $ | (8,381 | ) | ||||||||||||||||||||||

| Net loss attributable to common shareholders per diluted common share(5) |

$ | (0.11 | ) | $ | (0.04 | ) | $ | (0.03 | ) | $ | (0.40 | ) | ||||||||||||||||||||

| (1) | Numbers may not foot due to rounding. |

| (2) | Represents the accelerated amortization of the straight-line balance and the deferred abatement for Engineering Solutions at I-66 Commerce Center, which terminated its lease prior to completion. The tenant vacated the property at the end of March 2013. The property was sold in May 2013. |

| (3) | Reflects the one-time non-cash impact of changed tax regulations enacted by the District of Columbia that became effective in September 2012. |

| (4) | Reflects the change in the Company’s contingent consideration liability related to its acquisitions of Ashburn Center in 2009 and 840 First Street, NE in 2011. The Company paid $1.7 million to the seller of Ashburn Center in the third quarter of 2013 to fulfill its obligation. During the fourth quarter of 2013, the Company recorded a gain as it reduced its contingent consideration obligation related to 840 First Street, NE, which was fulfilled in the first quarter of 2014. As of February 14, 2014, there were no longer any contingent consideration liabilities associated with either acquisition. |

6

|

Earnings Release - Continued |

| (5) | Reflects amounts attributable to noncontrolling interests and the impact of dividends on the Company’s preferred shares to arrive at net loss attributable to common shareholders. |

A reconciliation of net (loss) income to FFO available to common shareholders and Core FFO, as well as definitions and statements of purpose, are included below in the financial tables accompanying this press release and under “Non-GAAP Financial Measures,” respectively.

Operating Performance

At December 31, 2013, the Company’s consolidated portfolio consisted of 146 buildings totaling 9.1 million square feet. The Company’s consolidated portfolio was 88.1% leased and 85.8% occupied at December 31, 2013, compared with 87.4% leased and 85.1% occupied at September 30, 2013 and 84.9% leased and 83.0% occupied at December 31, 2012. Year over year, the Company’s consolidated portfolio experienced a 320 basis-point increase in its leased percentage and a 280 basis-point increase in its occupied percentage.

During the fourth quarter of 2013, the Company executed 263,000 square feet of leases, which consisted of 165,000 square feet of new leases and 98,000 square feet of renewal leases. The Company delivered its eighth consecutive quarter of positive net absorption, which totaled 75,000 square feet in the fourth quarter and 341,000 square feet for 2013. The 98,000 square feet of renewal leases in the quarter reflected a 59% tenant retention rate, which was driven by a number of smaller tenant move-outs in the Company’s Maryland and Northern Virginia regions. For the year ended December 31, 2013, the Company executed 1.7 million square feet of leases, which included 831,000 square feet of new leases, and delivered a tenant retention rate of 67%.

Same-Property Net Operating Income (“Same-Property NOI”) increased 0.6% on an accrual basis for the three months ended December 31, 2013 and 1.8% for the twelve months ended December 31, 2013 compared with the same periods in 2012. For the three months ended December 31, 2013, the increase in Same-Property NOI was primarily due to an increase in occupancy at Three Flint Hill, a property located in the Northern Virginia region that was placed in service in the third quarter of 2012, which was partially offset by a decrease in occupancy for the Company’s Maryland region. The increase in Same-Property NOI during the twelve months ended December 31, 2013 was primarily a result of occupancy increases at Redland Corporate Center, Atlantic Corporate Park, Van Buren Office Park, Reston Business Campus and Park Central.

A reconciliation of net (loss) income to Same-Property NOI and a definition and statement of purpose are included below in the financial tables accompanying this press release and under “Non-GAAP Financial Measures,” respectively.

A list of the Company’s properties, as well as additional information regarding the Company’s results of operations can be found in the Company’s Fourth Quarter 2013 Supplemental Financial Information Report, which is posted on the Company’s website, www.first-potomac.com.

Acquisition

On October 1, 2013, the Company acquired 540 Gaither Road, the third building at Redland Corporate Center, for $30.0 million. The property is a six-story, 134,000 square foot office building located in Rockville, Maryland. Redland Corporate Center is comprised of three fully leased, multi- story Class-A office buildings totaling 483,000 square feet. The newly acquired building is 100% leased to the Department of Health and Human Services (HHS) through early 2018. The acquisition was funded with $28.2 million of proceeds from the sale of its industrial portfolio in June 2013 that was previously placed with a qualified intermediary to facilitate a tax-free exchange, as well as available cash.

7

|

Earnings Release - Continued |

The Company acquired the first two buildings at Redland Corporate Center in a joint venture with Perseus Realty, LLC (“Perseus”) in late 2010. On November 8, 2013, the Company acquired the remaining interest in the first two buildings from Perseus for $4.6 million.

Dispositions

Consistent with the Company’s previously disclosed strategy of focusing on high-quality, multi-story office properties, the Company continued to dispose of certain non-core properties. In November 2013, the Company sold Worman’s Mill Court, a 40,000 square foot single-story office building located in Frederick, Maryland, for net proceeds of approximately $3.4 million. As previously disclosed, the Company recorded an impairment charge of $0.5 million on Worman’s Mill Court in the third quarter of 2013.

On January 29, 2014, the Company sold a portfolio of properties that consisted of Girard Business Center, a seven-building, 297,000 square foot business park, and Gateway Center, a two-building, 45,000 square foot office park, both located in Gaithersburg, Maryland, for aggregate net proceeds of $31.6 million. Proceeds from the sale were used to pay down outstanding debt.

On January 10, 2014, the Company entered into a contract to sell West Park, a 29,000 square foot four-story office building located in Frederick, Maryland. Based on the anticipated sales price, the Company recorded an impairment charge of $2.2 million in the fourth quarter of 2013. The sale is expected to be completed in March 2014. However, the Company can provide no assurances regarding the timing or pricing of the sale of the West Park property, or that such sale will occur at all.

On February 11, 2014, the Company entered into a contract to sell Patrick Center, a 66,000 square foot seven-story office building located in Frederick, Maryland. The sale is expected to be completed in the second quarter of 2014. However, the Company can provide no assurances regarding the timing or pricing of the sale of the Patrick Center property, or that such sale will occur at all.

At December 31, 2013, the Company classified West Park, Girard Business Center, Gateway Center and Patrick Center as “held-for-sale” on its consolidated balance sheet. The operating results and any gains on sale of Worman’s Mill Court, West Park, Girard Business Center, Gateway Center and Patrick Center are reflected as discontinued operations in the Company’s consolidated statements of operations for each of the periods presented in this press release.

Mezzanine Loan Modification

In December 2010, the Company provided a $25.0 million mezzanine loan to the owners of 950 F Street, NW, a ten-story, 287,000 square foot, office/retail building located in Washington, D.C., which is secured by a portion of the owners’ interest in the property. The loan was pre-payable without penalty as of December 21, 2013. On January 10, 2014, the Company amended and restated the loan to increase the outstanding balance to $34.0 million, and reduced the fixed interest rate from 12.5% to 9.75%. The amended and restated mezzanine loan matures on April 1, 2017 and is repayable in full on or after December 21, 2015. The $9 million increase in the loan was provided by a draw under the Company’s unsecured revolving credit facility.

Financing Activity

As previously disclosed, on October 16, 2013, the Company amended and restated its unsecured revolving credit facility and unsecured term loan. The Company increased the size of the unsecured revolving credit facility from $255 million to $300 million and extended the maturity date of the facility to October 2017, with a one-year extension at the Company’s option. The Company divided its unsecured term loan into three $100 million tranches that mature in October 2018, 2019 and 2020, which added over two years of term from the previous maturity dates. As part of the amendments, the Company reduced its LIBOR spreads to current market rates, eliminated the prepayment lock-outs for the unsecured term loan, eliminated prepayment penalties associated with two tranches of the

8

|

Earnings Release - Continued |

unsecured term loan, decreased the capitalization rates used to calculate gross asset value in the covenant calculations, and moved to a covenant package more closely aligned with the Company’s strategic plan. The amendments to the unsecured revolving credit facility and unsecured term loan reduced the Company’s borrowing costs and, the Company believes, put it in a stronger position to deploy capital in the future. As previously disclosed, during the fourth quarter of 2013, the Company incurred $1.5 million of debt modification charges related to amending and restating the unsecured revolving credit facility and unsecured term loan.

Balance Sheet

The Company had $673.6 million of debt outstanding at December 31, 2013 compared with $933.9 million of debt outstanding at December 31, 2012. Of the Company’s outstanding debt at December 31, 2013, $230.9 million was fixed-rate debt, $350.0 million was hedged variable-rate debt, and $92.7 million was unhedged variable-rate debt. On January 15, 2014, an interest rate swap agreement that fixed LIBOR on $50.0 million of the Company’s variable-rate debt expired.

Dividends

On January 29, 2014, the Company declared a dividend of $0.15 per common share, equating to an annualized dividend of $0.60 per common share. The dividend was paid on February 18, 2014 to common shareholders of record as of February 10, 2014. The Company also declared a dividend of $0.484375 per share on its Series A Preferred Shares. The dividend was paid on February 18, 2014 to preferred shareholders of record as of February 10, 2014.

Core FFO Guidance

The Company issued its full-year 2014 Core FFO guidance of $0.92 to $1.00 per diluted share. The Core FFO guidance range is particularly wide as a result of potential capital recycling activities during 2014 (the assumptions of which are set forth in the footnotes to the table below). The following is a summary of the assumptions that the Company used in arriving at its guidance (unaudited, amounts in thousands except percentages and per share amounts):

| Expected Ranges | ||||||||||||

| Portfolio NOI |

||||||||||||

| Properties Owned 12/31/13 |

$ | 104,000 | - | $ | 107,000 | |||||||

| Properties Sold/Under Contract (1) |

(3,875) | |||||||||||

| Assumption for Additional Dispositions (2) |

(2,000) | |||||||||||

| Assumption for Acquisitions (3) |

4,875 | |||||||||||

| Total NOI |

$ | 103,000 | - | $ | 106,000 | |||||||

| Interest and Other Income |

$6,500 | |||||||||||

| FFO from Unconsolidated Joint Ventures |

$ | 4,750 | - | $ | 5,250 | |||||||

| Interest Expense (4) |

$ | 24,000 | - | $ | 26,000 | |||||||

| G&A |

$ | 20,000 | - | $ | 22,000 | |||||||

| Preferred Dividends |

$12,400 | |||||||||||

| Weighted Average Shares and Units |

60,500 | - | 61,000 | |||||||||

| Year-End Occupancy (5) |

88.0% | - | 89.5% | |||||||||

| Same Property NOI – Accrual Basis (5) |

2.5% | - | 4.0% | |||||||||

9

|

Earnings Release - Continued |

| (1) | Reflects the disposition of Girard Business Center and Gateway Center which were sold on January 29, 2014, and assumes the disposition of West Park on March 31, 2014 and Patrick Center on April 30, 2014. |

| (2) | Assumes $100 million of additional dispositions are made on September 30, 2014 at a blended 8.0% capitalization rate. This is solely an assumption for the purposes of providing guidance. No properties currently are being held or marketed for sale (other than those identified in footnote (1) above, which were held for sale at December 31, 2013). In addition, the Company can provide no assurances regarding the timing or pricing of any potential dispositions, or that such dispositions will occur at all. |

| (3) | Assumes $150 million of acquisitions are made on June 30, 2014 at a blended 6.5% capitalization rate. However, the Company can provide no assurances regarding the timing or pricing of any potential acquisitions, or that such acquisitions will occur at all. |

| (4) | Assumes proceeds from properties sold and properties under contract, as well as the assumed additional dispositions are used to repay the unsecured revolving credit facility, and capital for additional acquisitions are drawn from the unsecured revolving credit facility. |

| (5) | Assumes Gateway Center, Girard Business Center, West Park and Patrick Center are the only 2014 dispositions. |

The Company’s guidance is also based on a number of other assumptions, many of which are outside the Company’s control and all of which are subject to change. The Company may change its guidance as actual and anticipated results vary from these assumptions.

| Guidance Range for 2014 |

Low Range |

High Range |

||||||

| Net loss attributable to common shareholders per diluted share |

$ | (0.15 | ) | $ | (0.09 | ) | ||

| Real estate depreciation(1) |

1.08 | 1.09 | ||||||

| Net loss attributable to noncontrolling interests and items excluded from Core FFO per diluted share(2) |

(0.01 | ) | — | |||||

|

|

|

|

|

|||||

| Core FFO per diluted share |

$ | 0.92 | $ | 1.00 | ||||

|

|

|

|

|

|||||

| (1) | Includes the Company’s pro-rata share of depreciation from its unconsolidated joint ventures and depreciation related to the Company’s disposed properties. |

| (2) | Items excluded from Core FFO consist of the gains associated with disposed properties, the costs associated with the informal SEC inquiry, if any, impairment charges, and acquisition costs. |

Investor Conference Call and Webcast

First Potomac will host a conference call on February 21, 2014 at 9:00 AM ET to discuss fourth quarter and full-year 2013 results, and its 2014 Core FFO guidance in greater detail. The conference call can be accessed by dialing (877) 705-6003 or (201) 493-6725 for international participants. A replay of the call will be available from 12:00 Noon ET on February 21, 2014, until midnight ET on February 28, 2014. The replay can be accessed by dialing (877) 870-5176 or (858) 384-5517 for international callers, and entering pin number 13573876.

A live broadcast of the conference call will also be available online at the Company’s website, www.first-potomac.com, on February 21, 2014, beginning at 9:00 AM ET. An online replay will follow shortly after the call and will continue for 90 days.

About First Potomac Realty Trust

First Potomac Realty Trust is a self-administered, self-managed real estate investment trust that focuses on owning, operating, developing and redeveloping office and business park properties in the greater Washington, D.C. region. As of December 31, 2013, the Company’s consolidated portfolio totaled 9.1 million square feet. Based on annualized cash basis rent, the Company’s portfolio consists of 51% office properties and 49% business park and industrial properties. A key element of First Potomac’s overarching strategy is its dedication to sustainability. Over one million square feet of First Potomac property is LEED Certified, with the potential for another 700,000 square feet in future development projects. Approximately half of the portfolio’s multi-story office square footage is LEED or Energy Star Certified. FPO common shares (NYSE:FPO) and preferred shares (NYSE:FPO-PA) are publicly traded on the New York Stock Exchange.

10

|

Earnings Release - Continued |

Non-GAAP Financial Measures

Funds from Operations – Funds from operations (“FFO”) represents net income (computed in accordance with U.S. generally accepted accounting principles (“GAAP”)), excluding gains (losses) on sales of real estate and impairments of real estate assets, plus real estate-related depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. The Company also excludes, from its FFO calculation, any depreciation and amortization related to third parties from its consolidated joint ventures.

The Company considers FFO a useful measure of performance for an equity REIT because it facilitates an understanding of the operating performance of its properties without giving effect to real estate depreciation and amortization, which assume that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, the Company believes that FFO provides a meaningful indication of its performance. The Company also considers FFO an appropriate performance measure given its wide use by investors and analysts. The Company computes FFO in accordance with standards established by the Board of Governors of NAREIT in its March 1995 White Paper (as amended in November 1999, April 2002 and January 2012), which may differ from the methodology for calculating FFO utilized by other equity real estate investment trusts (“REITs”) and, accordingly, may not be comparable to such other REITs. Further, FFO does not represent amounts available for management’s discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments and uncertainties, nor is it indicative of funds available to fund the Company’s cash needs, including its ability to make distributions. The Company presents FFO per diluted share calculations that are based on the outstanding dilutive common shares plus the outstanding common Operating Partnership units for the periods presented.

Core FFO – Management believes that the computation of FFO in accordance with NAREIT’s definition includes certain items that are not indicative of the results provided by the Company’s operating portfolio and affect the comparability of the Company’s period-over-period performance. These items include, but are not limited to, gains and losses on the retirement of debt, legal and accounting costs related to the Company’s prior internal investigation and the informal SEC inquiry, personnel separations costs, contingent consideration charges and acquisition costs.

The Company’s presentation of FFO in accordance with the NAREIT white paper, or presentation of Core FFO, should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of the Company’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of its liquidity. The Company’s FFO and Core FFO calculations are reconciled to net income in the Company’s Consolidated Statements of Operations included in this release.

NOI – The Company defines net operating income (“NOI”) as operating revenues (rental income, tenant reimbursements and other income) less property and related expenses (property expenses, real estate taxes and insurance). Management believes that NOI is a useful measure of the Company’s property operating performance as it provides a performance measure of the revenues and expenses directly associated with owning, operating, developing and redeveloping office and business park properties, and provides a perspective not immediately apparent from net income or FFO. Other REITs may use different methodologies for calculating NOI, and accordingly, the Company’s NOI may not be comparable to other REITs. The Company’s NOI calculations are reconciled to total revenues and total operating expenses at the end of this release.

11

|

Earnings Release - Continued |

Same-Property NOI – Same-Property Net Operating Income (“Same-Property NOI”), defined as operating revenues (rental, tenant reimbursements and other revenues) less operating expenses (property operating expenses, real estate taxes and insurance) from the properties owned by the Company for the entirety of the periods compared, is a primary performance measure the Company uses to assess the results of operations at its properties. As an indication of the Company’s operating performance, Same-Property NOI should not be considered an alternative to net income calculated in accordance with GAAP. A reconciliation of the Company’s Same-Property NOI to net income from its consolidated statements of operations is presented below. The Same-Property NOI results exclude corporate-level expenses, as well as certain transactions, such as the collection of termination fees, as these items vary significantly period-over-period thus impacting trends and comparability. Also, the Company eliminates depreciation and amortization expense, which are property level expenses, in computing Same-Property NOI as these are non-cash expenses that are based on historical cost accounting assumptions and do not offer the investor significant insight into the operations of the property. This presentation allows management and investors to distinguish whether growth or declines in net operating income are a result of increases or decreases in property operations or the acquisition of additional properties. While this presentation provides useful information to management and investors, the results below should be read in conjunction with the results from the consolidated statements of operations to provide a complete depiction of total Company performance.

Forward Looking Statements

The forward-looking statements contained in this press release, including statements regarding the Company’s 2014 Core FFO guidance and related assumptions, potential sales and the timing of such sales, and future acquisition and growth opportunities, are subject to various risks and uncertainties. Although the Company believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, there can be no assurance that its expectations will be achieved. Certain factors that could cause actual results to differ materially from the Company’s expectations include changes in general or regional economic conditions; the Company’s ability to timely lease or re-lease space at current or anticipated rents; changes in interest rates; changes in operating costs; the Company’s ability to complete acquisitions on acceptable terms; the Company’s ability to manage its current debt levels and repay or refinance its indebtedness upon maturity or other required payment dates; the Company’s ability to maintain financial covenant compliance under its debt agreements; the Company’s ability to maintain effective internal controls over financial reporting and disclosure controls and procedures; any impact of the informal inquiry initiated by the U.S. Securities and Exchange Commission (the “SEC”); the Company’s ability to obtain debt and/or financing on attractive terms, or at all; changes in the assumptions underlying the Company’s earnings and Core FFO guidance and other risks detailed in the Company’s Annual Report on Form 10-K and described from time to time in the Company’s filings with the SEC. Many of these factors are beyond the Company’s ability to control or predict. Forward-looking statements are not guarantees of performance. For forward-looking statements herein, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

12

|

Earnings Release - Continued |

Consolidated Statements of Operations

(unaudited, amounts in thousands, except per share amounts)

| Three Months Ended December 31, |

Twelve Months Ended December 31, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Revenues: |

||||||||||||||||

| Rental |

$ | 31,520 | $ | 30,575 | $ | 124,437 | $ | 119,988 | ||||||||

| Tenant reimbursements and other |

7,863 | 7,908 | 32,186 | 30,427 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

39,383 | 38,483 | 156,623 | 150,415 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Property operating |

10,675 | 9,667 | 40,850 | 36,470 | ||||||||||||

| Real estate taxes and insurance |

4,079 | 3,616 | 16,627 | 14,746 | ||||||||||||

| General and administrative |

5,380 | 5,781 | 21,979 | 23,568 | ||||||||||||

| Acquisition costs |

429 | — | 602 | 49 | ||||||||||||

| Depreciation and amortization |

15,138 | 14,532 | 57,676 | 54,468 | ||||||||||||

| Impairment of real estate assets |

— | — | — | 2,444 | ||||||||||||

| Contingent consideration related to acquisition of property |

(287 | ) | 39 | (213 | ) | 152 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

35,414 | 33,635 | 137,521 | 131,897 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

3,969 | 4,848 | 19,102 | 18,518 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other expenses, net: |

||||||||||||||||

| Interest expense |

6,104 | 10,090 | 33,141 | 40,998 | ||||||||||||

| Interest and other income |

(1,573 | ) | (1,521 | ) | (6,373 | ) | (6,046 | ) | ||||||||

| Equity in losses (earnings) of affiliates |

101 | (92 | ) | 47 | (40 | ) | ||||||||||

| Gain on sale of investment |

— | — | — | (2,951 | ) | |||||||||||

| Loss on debt extinguishment / modification |

1,486 | 466 | 1,810 | 13,687 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expenses, net |

6,118 | 8,943 | 28,625 | 45,648 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from continuing operations before income taxes |

(2,149 | ) | (4,095 | ) | (9,523 | ) | (27,130 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Benefit from income taxes |

— | — | — | 4,142 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from continuing operations |

(2,149 | ) | (4,095 | ) | (9,523 | ) | (22,988 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Discontinued operations: |

||||||||||||||||

| (Loss) income from operations |

(1,592 | ) | 4,975 | 5,555 | 14,446 | |||||||||||

| Loss on debt extinguishment |

— | — | (4,414 | ) | — | |||||||||||

| Gain on sale of real estate property |

— | — | 19,363 | 161 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income from discontinued operations |

(1,592 | ) | 4,975 | 20,504 | 14,607 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income |

(3,741 | ) | 880 | 10,981 | (8,381 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less: Net loss attributable to noncontrolling interests |

288 | 110 | 93 | 986 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income attributable to First Potomac Realty Trust |

(3,453 | ) | 990 | 11,074 | (7,395 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less: Dividends on preferred shares |

(3,100 | ) | (3,100 | ) | (12,400 | ) | (11,964 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to common shareholders |

$ | (6,553 | ) | $ | (2,110 | ) | $ | (1,326 | ) | $ | (19,359 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

13

|

Earnings Release - Continued |

| Three Months Ended December 31, |

Twelve Months Ended December 31, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net loss attributable to common shareholders |

$ | (6,553 | ) | $ | (2,110 | ) | $ | (1,326 | ) | $ | (19,359 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Depreciation and amortization: |

||||||||||||||||

| Real estate assets |

15,138 | 14,532 | 57,676 | 54,468 | ||||||||||||

| Discontinued operations |

547 | 2,908 | 5,828 | 11,947 | ||||||||||||

| Unconsolidated joint ventures |

1,323 | 1,428 | 5,323 | 5,883 | ||||||||||||

| Consolidated joint ventures |

(13 | ) | (49 | ) | (163 | ) | (177 | ) | ||||||||

| Impairment of real estate assets |

2,171 | — | 4,092 | 3,516 | ||||||||||||

| Gain on sale of real estate property |

— | — | (19,363 | ) | (3,091 | ) | ||||||||||

| Net loss attributable to noncontrolling interests in the Operating Partnership |

(290 | ) | (108 | ) | (74 | ) | (1,051 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Funds from operations available to common shareholders |

$ | 12,323 | $ | 16,601 | $ | 51,993 | $ | 52,136 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

14

|

Earnings Release - Continued |

Consolidated Statements of Operations

(unaudited, amounts in thousands, except per share amounts)

| Three Months Ended December 31, |

Twelve Months Ended December 31, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Funds from operations (FFO) |

$ | 15,423 | $ | 19,701 | $ | 64,393 | $ | 64,100 | ||||||||

| Less: Dividends on preferred shares |

(3,100 | ) | (3,100 | ) | (12,400 | ) | (11,964 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| FFO available to common shareholders |

12,323 | 16,601 | 51,993 | 52,136 | ||||||||||||

| Personnel separation costs |

— | 732 | 1,777 | 1,128 | ||||||||||||

| Loss on debt extinguishment / modification |

1,485 | 466 | 6,224 | 13,792 | ||||||||||||

| Internal investigation costs |

— | 27 | — | 3,412 | ||||||||||||

| Deferred abatement and straight-line amortization |

— | (1,567 | ) | (1,567 | ) | (3,134 | ) | |||||||||

| Change in tax regulation |

— | — | — | (4,327 | ) | |||||||||||

| Acquisition costs |

429 | — | 602 | 49 | ||||||||||||

| Development and redevelopment costs |

— | 397 | — | 397 | ||||||||||||

| Contingent consideration related to acquisition of property |

(287 | ) | 39 | (213 | ) | 152 | ||||||||||

| Legal costs associated with informal SEC inquiry |

— | 110 | 391 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Core FFO |

$ | 13,950 | $ | 16,805 | $ | 59,207 | $ | 63,605 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted earnings per common share: |

||||||||||||||||

| Loss from continuing operations available to common shareholders |

$ | (0.08 | ) | $ | (0.13 | ) | $ | (0.39 | ) | $ | (0.68 | ) | ||||

| (Loss) income from discontinued operations available to common shareholders |

(0.03 | ) | 0.09 | 0.36 | 0.28 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss available to common shareholders |

$ | (0.11 | ) | $ | (0.04 | ) | $ | (0.03 | ) | $ | (0.40 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding – basic and diluted |

58,061 | 50,329 | 55,034 | 50,120 | ||||||||||||

| FFO available to common shareholders per share – basic and diluted |

$ | 0.20 | $ | 0.31 | $ | 0.90 | $ | 0.98 | ||||||||

| Core FFO per share – diluted |

$ | 0.23 | $ | 0.32 | $ | 1.03 | $ | 1.20 | ||||||||

| Weighted average common shares and units outstanding: |

||||||||||||||||

| Basic |

60,657 | 52,927 | 57,630 | 52,833 | ||||||||||||

| Diluted |

60,697 | 53,026 | 57,706 | 52,921 | ||||||||||||

15

|

Earnings Release - Continued |

Consolidated Balance Sheets

(Amounts in thousands, except per share amounts)

| December 31, 2013 | December 31, 2012 | |||||||

| (unaudited) | ||||||||

| Assets: |

||||||||

| Rental property, net |

$ | 1,203,299 | $ | 1,450,679 | ||||

| Assets held-for-sale |

45,861 | — | ||||||

| Cash and cash equivalents |

8,740 | 9,374 | ||||||

| Escrows and reserves |

7,673 | 13,421 | ||||||

| Accounts and other receivables, net of allowance for doubtful accounts of $1,181 and $1,799, respectively |

12,384 | 15,271 | ||||||

| Accrued straight-line rents, net of allowance for doubtful accounts of $92 and $530, respectively |

30,332 | 28,133 | ||||||

| Notes receivable, net |

54,696 | 54,730 | ||||||

| Investment in affiliates |

49,150 | 50,596 | ||||||

| Deferred costs, net |

43,198 | 40,370 | ||||||

| Prepaid expenses and other assets |

8,279 | 8,597 | ||||||

| Intangible assets, net |

38,848 | 46,577 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,502,460 | $ | 1,717,748 | ||||

|

|

|

|

|

|||||

| Liabilities: |

||||||||

| Mortgage loans |

$ | 274,648 | $ | 418,864 | ||||

| Secured term loan |

— | 10,000 | ||||||

| Unsecured term loan |

300,000 | 300,000 | ||||||

| Unsecured revolving credit facility |

99,000 | 205,000 | ||||||

| Accounts payable and other liabilities |

41,296 | 64,920 | ||||||

| Accrued interest |

1,663 | 2,653 | ||||||

| Rents received in advance |

6,118 | 9,948 | ||||||

| Tenant security deposits |

5,666 | 5,968 | ||||||

| Deferred market rent, net |

1,557 | 3,535 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

729,948 | 1,020,888 | ||||||

|

|

|

|

|

|||||

| Noncontrolling interests in the Operating Partnership |

33,221 | 34,367 | ||||||

| Equity: |

||||||||

| Preferred Shares, $0.001 par value, 50,000 shares authorized; Series A Preferred Shares, $25 liquidation preference, 6,400 shares issued and outstanding |

$ | 160,000 | $ | 160,000 | ||||

| Common shares, $0.001 par value, 150,000 shares authorized; 58,704 and 51,047 shares issued and outstanding, respectively |

59 | 51 | ||||||

| Additional paid-in capital |

911,533 | 804,584 | ||||||

| Noncontrolling interests in consolidated partnerships |

781 | 3,728 | ||||||

| Accumulated other comprehensive loss |

(3,836 | ) | (10,917 | ) | ||||

| Dividends in excess of accumulated earnings |

(329,246 | ) | (294,953 | ) | ||||

|

|

|

|

|

|||||

| Total equity |

739,291 | 662,493 | ||||||

|

|

|

|

|

|||||

| Total liabilities, noncontrolling interests and equity |

$ | 1,502,460 | $ | 1,717,748 | ||||

|

|

|

|

|

|||||

16

|

Earnings Release - Continued |

Same-Property Analysis

(unaudited, dollars in thousands)

| Same-Property NOI(1) | Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Total base rent |

$ | 30,651 | $ | 29,707 | $ | 117,830 | $ | 115,537 | ||||||||

| Tenant reimbursements and other |

7,065 | 6,918 | 29,175 | 27,023 | ||||||||||||

| Property operating expenses |

(9,856 | ) | (9,259 | ) | (36,828 | ) | (34,903 | ) | ||||||||

| Real estate taxes and insurance |

(3,906 | ) | (3,560 | ) | (15,169 | ) | (14,369 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Same-Property NOI - accrual basis |

23,954 | 23,806 | 95,008 | 93,288 | ||||||||||||

| Straight-line revenue, net |

(571 | ) | (332 | ) | (1,780 | ) | (1,497 | ) | ||||||||

| Deferred market rental revenue, net |

36 | 208 | 132 | 599 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Same-Property NOI - cash basis |

$ | 23,419 | $ | 23,682 | $ | 93,360 | $ | 92,390 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Change in same-property NOI - accrual basis |

0.6 | % | 1.8 | % | ||||||||||||

| Change in same-property NOI - cash basis |

(1.1 | )% | 1.0 | % | ||||||||||||

| Same-property percentage of total portfolio (sf) |

95.0 | % | 92.5 | % | ||||||||||||

| Reconciliation of Consolidated NOI to Same- Property NOI | Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Total revenues |

$ | 39,383 | $ | 38,483 | $ | 156,623 | $ | 150,415 | ||||||||

| Property operating expenses |

(10,675 | ) | (9,667 | ) | (40,850 | ) | (36,470 | ) | ||||||||

| Real estate taxes and insurance |

(4,079 | ) | (3,616 | ) | (16,627 | ) | (14,746 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NOI |

24,629 | 25,200 | 99,146 | 99,199 | ||||||||||||

| Less: Non-same property NOI(2) |

(675 | ) | (1,394 | ) | (4,138 | ) | (5,911 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Same-Property NOI – accrual basis |

$ | 23,954 | $ | 23,806 | $ | 95,008 | $ | 93,288 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Change in Same-Property NOI (accrual basis) | Three Months Ended December 31, 2013 |

Percentage of Base Rent |

Twelve Months Ended December 31, 2013 |

Percentage of Base Rent |

||||||||||||

| By Region | ||||||||||||||||

| Washington, D.C. |

0.6 | % | 13 | % | 2.7 | % | 13 | % | ||||||||

| Maryland |

(6.3 | )% | 28 | % | (0.2 | )% | 29 | % | ||||||||

| Northern Virginia |

8.0 | % | 35 | % | 4.1 | % | 33 | % | ||||||||

| Southern Virginia |

(1.4 | )% | 24 | % | 0.6 | % | 25 | % | ||||||||

| By Type | ||||||||||||||||

| Business Park / Industrial |

1.5 | % | 45 | % | 1.3 | % | 46 | % | ||||||||

| Office |

(0.2 | )% | 55 | % | 2.3 | % | 54 | % | ||||||||

| (1) | Same-property comparisons are based upon those consolidated properties owned for the entirety of the periods presented. Same-property results exclude the operating results of the following non same-properties that were owned as of December 31, 2013: 440 First Street, NW, Storey Park, Girard Business Center, Gateway Center, West Park, Patrick Center and 540 Gaither Road. The twelve months ended December 31, 2013 and 2012 also exclude the operating results of Three Flint Hill and Davis Drive. |

| (2) | Non-same property NOI has been adjusted to reflect a normalized management fee percentage in lieu of an administrative overhead allocation for comparative purposes. |

17

|

Highlights (unaudited, dollars in thousands, except per share data) |

| Q4-2013 | Q3-2013 | Q2-2013 | Q1-2013 | Q4-2012 | ||||||||||||||||

| Performance Metrics |

||||||||||||||||||||

| FFO available to common shareholders(1) |

$ | 12,323 | $ | 11,451 | $ | 11,141 | $ | 17,077 | $ | 16,601 | ||||||||||

| Core FFo(1) |

$ | 13,950 | $ | 13,524 | $ | 15,886 | $ | 15,846 | $ | 16,805 | ||||||||||

| FFO available to common shareholders per diluted share |

$ | 0.20 | $ | 0.19 | $ | 0.20 | $ | 0.32 | $ | 0.31 | ||||||||||

| Core FFO per diluted share |

$ | 0.23 | $ | 0.22 | $ | 0.28 | $ | 0.30 | $ | 0.32 | ||||||||||

| Operating Metrics |

||||||||||||||||||||

| Change in Same-Property NOI |

||||||||||||||||||||

| Accrual Basis |

0.6 | % | 3.7 | % | 0.0 | % | 1.4 | % | 6.3 | % | ||||||||||

| Cash Basis |

(1.1 | )% | 2.3 | % | (0.1 | )% | 1.3 | % | 5.3 | % | ||||||||||

| Assets |

||||||||||||||||||||

| Total Assets |

$ | 1,502,460 | $ | 1,511,283 | $ | 1,557,666 | $ | 1,718,364 | $ | 1,717,748 | ||||||||||

| Debt Balances |

||||||||||||||||||||

| Unhedged Variable-Rate Debt |

$ | 92,699 | $ | 76,699 | $ | 43,657 | $ | 249,500 | $ | 165,000 | ||||||||||

| Hedged Variable-Rate Debt(2) |

350,000 | 350,000 | 350,000 | 350,000 | 350,000 | |||||||||||||||

| Fixed-Rate Debt |

230,949 | 232,275 | 294,389 | 355,387 | 418,864 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 673,648 | $ | 658,974 | $ | 688,046 | $ | 954,887 | $ | 933,864 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Leasing Metrics |

||||||||||||||||||||

| Net Absorption (Square Feet)(3) |

74,979 | 19,741 | 69,107 | (4) | 177,460 | 48,946 | ||||||||||||||

| Tenant Retention Rate |

59 | % | 30 | %(5) | 79 | %(4) | 89 | % | 58 | % | ||||||||||

| Leased% |

88.1 | % | 87.4 | % | 86.5 | % | 86.3 | % | 84.9 | % | ||||||||||

| Occupancy% |

85.8 | % | 85.1 | % | 84.0 | % | 83.9 | % | 83.0 | % | ||||||||||

| Total New Leases (Square Feet) |

165,000 | 213,000 | 234,000 | 218,000 | 291,000 | |||||||||||||||

| Total Renewal Leases (Square Feet) |

98,000 | 87,000 | 306,000 | 345,000 | 318,000 | |||||||||||||||

| (1) | See page 5 for a reconciliation of the Company’s FFO available to common shareholders and Core FFO to net (loss) income attributable to common shareholders per share. |

| (2) | As of December 31, 2013, the Company had fixed LlBOR at a weighted averaged interest rate of 1.5% on $350.0 million of its variable rate debt through twelve interest rate swap agreements. On January 15, 2014, an interest rate swap agreement that fixed LIBOR on $50.0 million of the Company’s variable rate debt expired. |

| (3) | Net absorption includes adjustments made for pre-leasing, deals signed in advance of existing lease expirations and unforeseen terminations. |

| (4) | Both the Net Absorption and Tenant Retention Rate exclude all properties that were sold in the second quarter of 2013. |

| (5) | During the third quarter of 2013, the Company had an expected tenant retention rate of 30%, primarily as a result of over 200,000 square feet of known move outs in the quarter. |

18

|

Quarterly Financial Results (unaudited, dollars in thousands) |

| Three Months Ended | ||||||||||||||||||||

| December 31, 2013 | September 30, 2013 | June 30, 2013 | March 31, 2013 | December 31, 2012 | ||||||||||||||||

| OPERATING REVENUES |

||||||||||||||||||||

| Rental |

$ | 31,520 | $ | 31,137 | $ | 31,087 | $ | 30,693 | $ | 30,575 | ||||||||||

| Tenant reimbursements and other |

7,863 | 8,112 | 7,745 | 8,465 | 7,908 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 39,383 | 39,249 | 38,832 | 39,158 | 38,483 | ||||||||||||||||

| PROPERTY EXPENSES |

||||||||||||||||||||

| Property operating |

10,675 | 10,431 | 9,432 | 10,311 | 9,667 | |||||||||||||||

| Real estate taxes and insurance |

4,079 | 4,062 | 3,975 | 4,511 | 3,616 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET OPERATING INCOME |

24,629 | 24,756 | 25,425 | 24,336 | 25,200 | |||||||||||||||

| OTHER (EXPENSES) INCOME |

||||||||||||||||||||

| Generaland administrative |

(5,380 | ) | (6,346 | ) | (4,985 | ) | (5,267 | ) | (5,781 | ) | ||||||||||

| Acquisition costs |

(429 | ) | (173 | ) | — | — | — | |||||||||||||

| Interest and other income |

1,573 | 1,696 | 1,574 | 1,530 | 1,521 | |||||||||||||||

| Equity in (losses) earnings of affiliates |

(101 | ) | 19 | 7 | 28 | 92 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBIIDA |

20,292 | 19,952 | 22,021 | 20,627 | 21,032 | |||||||||||||||

| Depreciation and amortization |

(15,138 | ) | (14,343 | ) | (14,208 | ) | (13,987 | ) | (14,532 | ) | ||||||||||

| Interest expense |

(6,104 | ) | (7,726 | ) | (9,353 | ) | (9,958 | ) | (10,090 | ) | ||||||||||

| Loss on debt extinguishment I modification |

(1,486 | ) | (123 | ) | (201 | ) | — | (466 | ) | |||||||||||

| Contingent consideration related to acquisition of property |

287 | — | (75 | ) | — | (39 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from continuing operations |

(2,149 | ) | (2,240 | ) | (1,816 | ) | (3,318 | ) | (4,095 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss) incom e from operations |

(1,592 | ) | 107 | 1,759 | 5,281 | 4,975 | ||||||||||||||

| Loss on debt extinguishment |

— | — | (4,414 | ) | — | — | ||||||||||||||

| Gain on sale of real estate property(1) |

— | 416 | 18,947 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss) income from discontinued operations |

(1,592 | ) | 523 | 16,292 | 5,281 | 4,975 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET (LOSS) INCOME |

(3,741 | ) | (1,717 | ) | 14,476 | 1,963 | 880 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less: Net loss (income) attributable to noncontrolling interests |

288 | 211 | (466 | ) | 59 | 110 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET (LOSS) INCOME ATTRIBUTABLE TO FIRST POTOMAC REALTY TRUST |

(3,453 | ) | (1,506 | ) | 14,010 | 2,022 | 990 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less: Dividends on preferred shares |

(3,100 | ) | (3,100 | ) | (3,100 | ) | (3,100 | ) | (3,100 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS |

$ | (6,553 | ) | $ | (4,606 | ) | $ | 10,910 | $ | (1,078 | ) | $ | (2,110 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Supplemental Financial Results Items:

The following items were included in the determination of net (loss) income:

| Three Months Ended | ||||||||||||||||||||

| December 31, 2013 | September 30, 2013 | June 30, 2013 | March 31, 2013 | December 31, 2012 | ||||||||||||||||

| Termination fees |

208 | $ | 61 | $ | 49 | $ | 121 | $ | 606 | |||||||||||

| Capitalized interest |

916 | 836 | 360 | 344 | 334 | |||||||||||||||

| Snow and ice removal costs (excluding reimbursements)(2) |

(304 | ) | (1 | ) | (62 | ) | (781 | ) | (57 | ) | ||||||||||

| Reserves for bad debt expense |

(239 | ) | (171 | ) | (220 | ) | (148 | ) | (180 | ) | ||||||||||

| Internal investigation costs |

— | — | — | — | (27 | ) | ||||||||||||||

| Legal costs associated with informal SEC inquiry |

— | — | (55 | ) | (336 | ) | (110 | ) | ||||||||||||

| Personnel separation costs |

— | (1,777 | ) | — | — | (732 | ) | |||||||||||||

| Discontinued Operations(3) | ||||||||||||||||||||

| Revenues |

1,766 | 1,907 | 7,875 | 12,299 | 11,658 | |||||||||||||||

| Operating expenses |

(640 | ) | (753 | ) | (2,522 | ) | (3,525 | ) | (3,204 | ) | ||||||||||

| Depreciation and amortization expense |

(547 | ) | (573 | ) | (1,786 | ) | (2,921 | ) | (2,908 | ) | ||||||||||

| Interest expense,net of interest income |

— | — | (362 | ) | (572 | ) | (571 | ) | ||||||||||||

| Impairment of real estate assets |

(2,171 | ) | (474 | ) | (1,446 | ) | — | — | ||||||||||||

| Loss on debt extinguishment |

— | — | (4,414 | ) | — | — | ||||||||||||||

| Gain on sale of real estate property(1) |

— | 416 | 18,947 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | (1,592 | ) | $ | 523 | $ | 16,292 | $ | 5,281 | $ | 4,975 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | For the three months ended September 30, 2013, the gain on sale of realestate property includes $0.4 million related to the sale of 4200 Tech Court. For the three months ended June 30, 2013, the gain on sale of real estate property includes $18.7 million related to the sale of the industrial portfolio and $0.2 m illion related to the sale of 4212 Tech Court. |

| (2) | The Company recovered approximately 65% of these costs. |

| (3) | Represents the operating results of the Company’s properties that were sold or held-for-sale for the periods presented. |

19

|

Quarterly Financial Measures (unaudited, amounts in thousands, except per share data) |

| Three Months Ended | ||||||||||||||||||||

| December 31,2013 | September 30, 2013 | June 30, 2013 | March 31,2013 | December 31, 2012 | ||||||||||||||||

| FUNDS FROM OPERATIONS (”FFO”) |

||||||||||||||||||||

| Net (loss) income attributable to common shareholders |

$ | (6,553 | ) | $ | (4,606 | ) | $ | 10,910 | $ | (1,078 | ) | $ | (2,110 | ) | ||||||

| Depreciation and amortization: |

||||||||||||||||||||

| Real estate assets |

15,138 | 14,343 | 14,208 | 13,987 | 14,532 | |||||||||||||||

| Discontinued operations |

547 | 573 | 1,786 | 2,921 | 2,908 | |||||||||||||||

| Unconsolidated joint ventures |

1,323 | 1,332 | 1,317 | 1,352 | 1,428 | |||||||||||||||

| Consolidated joint ventures |

(13 | ) | (46 | ) | (53 | ) | (51 | ) | (49 | ) | ||||||||||

| Impairment of real estate assets |

2,171 | 474 | 1,446 | — | — | |||||||||||||||

| Gain on sale of real estate property |

— | (416 | ) | (18,947 | ) | — | — | |||||||||||||

| Net (loss) income attributable to noncontrolling interests in the Operating Partnership |

(290 | ) | (203 | ) | 474 | (54 | ) | (108 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO available to common shareholders |

12,323 | 11,451 | 11,141 | 17,077 | 16,601 | |||||||||||||||

| Dividends on preferred shares |

3,100 | 3,100 | 3,100 | 3,100 | 3,100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO |

$ | 15,423 | $ | 14,551 | $ | 14,241 | $ | 20,177 | $ | 19,701 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO available to common shareholders |

12,323 | 11,451 | 11,141 | 17,077 | 16,601 | |||||||||||||||

| Personnel separation costs |

— | 1,777 | — | — | 732 | |||||||||||||||

| Loss on debt extinguishment / modification(1) |

1,485 | 123 | 4,615 | — | 466 | |||||||||||||||

| Internal investigation costs(2) |

— | — | — | — | 27 | |||||||||||||||

| Deferred abatement and straight-line amortization(3) |

— | — | — | (1,567 | ) | (1,567 | ) | |||||||||||||

| Acquisition costs |

429 | 173 | — | — | — | |||||||||||||||

| Contingent consideration related to acquisition of property |

(287 | ) | — | 75 | — | 39 | ||||||||||||||

| Development costs(4) |

— | — | — | — | 397 | |||||||||||||||

| Legal costs associated with informal SEC inquiry |

— | — | 55 | 336 | 110 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core FFO |

$ | 13,950 | $ | 13,524 | $ | 15,886 | $ | 15,846 | $ | 16,805 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ADJUSTED FUNDS FROM OPERATIONS (“AFFO”) |

||||||||||||||||||||

| Core FFO |

$ | 13,950 | $ | 13,524 | $ | 15,886 | $ | 15,846 | $ | 16,805 | ||||||||||

| Non-cash share-based compensation expense |

716 | 838 | 891 | 771 | 1,271 | |||||||||||||||

| Straight-line rent, net (5) |

(556 | ) | (446 | ) | (459 | ) | (292 | ) | (226 | ) | ||||||||||

| Deferred market rent, net |

46 | 50 | (3 | ) | (18 | ) | (74 | ) | ||||||||||||

| Non-real estate depreciation and amortization(6) |

344 | 332 | 256 | 242 | 245 | |||||||||||||||

| Debt fair value amortization |

(132 | ) | (58 | ) | (76 | ) | (8 | ) | (24 | ) | ||||||||||

| Amortization of finance costs |

426 | 672 | 816 | 756 | 777 | |||||||||||||||

| Tenant improvements(7) |

(4,448 | ) | (3,190 | ) | (6,413 | ) | (3,544 | ) | (4,898 | ) | ||||||||||

| Leasing commissions(7) |

(703 | ) | (1,690 | ) | (1,629 | ) | (1,352 | ) | (941 | ) | ||||||||||

| Capital expenditures(7) |

(2,320 | ) | (2,728 | ) | (1,627 | ) | (2,010 | ) | (4,034 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| AFFO |

$ | 7,323 | $ | 7,304 | $ | 7,642 | $ | 10,391 | $ | 8,901 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total weighted average common shares and OP units: |

||||||||||||||||||||

| Basic |

60,657 | 60,651 | 56,184 | 53,002 | 52,927 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

60,657 | 60,628 | 56,289 | 53,106 | 53,026 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO available to common shareholders and units per share: |

||||||||||||||||||||

| FFO - basic and diluted |

$ | 0.20 | $ | 0.19 | $ | 0.20 | $ | 0.32 | $ | 0.31 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core FFO - diluted |

$ | 0.23 | $ | 0.22 | $ | 0.28 | $ | 0.30 | $ | 0.32 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| AFFO per share: |

||||||||||||||||||||

| AFFO - basic and diluted |

$ | 0.12 | $ | 0.12 | $ | 0.14 | $ | 0.20 | $ | 0.17 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Reflects costs associated with amending the Company’s existing debt agreements or the charges related to prepaying I defeasing mortgage debt that encumbered properties that were subsequently sold. |

| (2) | Represents legal and accounting fees incurred in connection with the Company’s completed internal investigation. |

| (3) | Represents the accelerated amortization of the straight-line balance and the deferred abatement for Engineering Solutions at 1-66 Commerce Center, which terminated its lease prior to completion. The tenant vacated the property on March 31,2013 and 1-66 Commerce Center was sold in the second quarter of 2013. |

| (4) | During the fourth quarter of 2012. the Company expensed development costs related to a project that was deferred at Greenbrier Business Park. |

| (5) | Includes the Company’s am amortization of the following: straight-line rents and associated uncollectable amounts, rent abatements and lease incentives. |

| (6) | Most non-real estate depreciation is classified in general and administrative expense. |

| (7) | Does not include first-generation costs. which the Company defines as tenant improvements, leasing commissions and capital expenditure costs that were taken into consideration when underwriting the purchase of a property or incurred to bring the property to operating standard for its intended use. |

| First-generation costs |

||||||||||||||||||||

| Tenant improvements |

$ | 4,611 | $ | 1,420 | $ | 3,265 | $ | 2,588 | $ | 3,881 | ||||||||||

| Leasing commissions |

423 | 1,738 | 536 | 461 | 516 | |||||||||||||||

| Capital expenditures |

2,786 | 1,145 | 2,215 | 2,049 | 4,513 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total first-generation costs |

7,820 | 4,303 | 6,016 | 5,098 | 8,910 | |||||||||||||||

| Development and redevelopment |

4,332 | 1,850 | 5,692 | 4,813 | 13,849 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 12,152 | $ | 6,153 | $ | 11,708 | $ | 9,911 | $ | 13,849 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

20

|

Annual Financial Results (unaudited, amounts in thousands, except per share data) |

| Years Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| OPERATING REVENUES |

||||||||||||

| Rental |

$ | 124,437 | $ | 119,988 | $ | 106,222 | ||||||

| Tenant reimbursements and other |

32,186 | 30,427 | 25,082 | |||||||||

|

|

|

|

|

|

|

|||||||

| 156,623 | 150,415 | 131,304 | ||||||||||

| PROPERTY EXPENSES |

||||||||||||

| Property operating |

40,850 | 36,470 | 31,957 | |||||||||

| Real estate taxes and insurance |

16,627 | 14,746 | 13,082 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET OPERATING INCOME |

99,146 | 99,199 | 86,265 | |||||||||

| OTHER (EXPENSES) INCOME |

||||||||||||

| General and administrative |

(21,979 | ) | (23,568 | ) | (16,027 | ) | ||||||

| Acquisition costs |

(602 | ) | (49 | ) | (5,042 | ) | ||||||

| Interest and other income |

6,373 | 6,046 | 5,282 | |||||||||

| Equity in (losses) earnings of affiliates |

(47 | ) | 40 | 20 | ||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

82,891 | 81,668 | 70,498 | |||||||||

| Depreciation and amortization |

(57,676 | ) | (54,468 | ) | (48,248 | ) | ||||||

| Interest expense |

(33,141 | ) | (40,998 | ) | (38,652 | ) | ||||||

| Impairment of real estate assets |

— | (2,444 | ) | — | ||||||||

| Contingent consideration related to acquisition of property |

213 | (152 | ) | 1,487 | ||||||||

| Gain on sale of investment(1) |

— | 2,951 | — | |||||||||

| Loss on debt extinguishment / modification |

(1,810 | ) | (13,687 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Loss from continuing operations before income taxes |

(9,523 | ) | (27,130 | ) | (14,915 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Benefit from income taxes |

— | 4,142 | 633 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss from continuing operations |

(9,523 | ) | (22,988 | ) | (14,282 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Discontinued Operations |

||||||||||||

| Income from operations |

5,555 | 14,446 | 3,576 | |||||||||

| Loss on debt extinguishment |

(4,414 | ) | — | — | ||||||||

| Gain on sale of real estate property |

19,363 | 161 | 1,954 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income from discontinued operations |

20,504 | 14,607 | 5,530 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET INCOME (LOSS) |

10,981 | (8,381 | ) | (8,752 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Less: Net loss attributable to noncontrolling interests |

93 | 986 | 688 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO FIRST POTOMAC REALTY TRUST |

11,074 | (7,395 | ) | (8,064 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Less: Dividends on preferred shares |

(12,400 | ) | (11,964 | ) | (8,467 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS |

$ | (1,326 | ) | $ | (19,359 | ) | $ | (16,531 | ) | |||

|

|

|

|

|

|

|

|||||||

| Supplemental Financial Results Items: |

||||||||||||

| The following items were included in the determination of net income (loss): | ||||||||||||

| Years Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Termination fees |

$ | 439 | $ | 1,971 | $ | 562 | ||||||

| Capitalized interest |

2,456 | 2,146 | 1,882 | |||||||||

| Change in tax regulation(2) |

— | 4,327 | — | |||||||||

| Snow and ice removal costs (excluding reimbursements)(3) |

(1,148 | ) | (295 | ) | (872 | ) | ||||||

| Reserves for bad debt expense |

(778 | ) | (131 | ) | (535 | ) | ||||||

| Internal investigation costs |

— | (3,412 | ) | — | ||||||||

| Legal costs associated with SEC Informal Inquiry |

(391 | ) | (110 | ) | — | |||||||

| Personnel separation costs |

(1,777 | ) | (1,128 | ) | — | |||||||

| Discontinued Operations(4) |

||||||||||||

| Revenues |

$ | 23,847 | $ | 43,531 | $ | 42,762 | ||||||

| Operating expenses |

(7,441 | ) | (13,516 | ) | (14,490 | ) | ||||||

| Depreciation and amortization expense |

(5,828 | ) | (11,947 | ) | (12,897 | ) | ||||||

| Interest expense, net of interest income |

(931 | ) | (2,550 | ) | (3,073 | ) | ||||||

| Impairment of real estate assets |

(4,092 | ) | (1,072 | ) | (8,726 | ) | ||||||

| Loss on debt extinguishment |

(4,414 | ) | — | — | ||||||||

| Gain on sale of real estate property |

19,363 | 161 | 1,954 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 20,504 | $ | 14,607 | $ | 5,530 | |||||||

|

|

|

|

|

|

|

|||||||

| (1) | During the third quarter of 2012, the Company recorded a $3.0 million gain on the sale of its 95% interest in 1200 17th Street, NW, an office building in Washington, D.C. |

| (2) | Reflects the one-time non-cash impact of new tax regulations enacted by the District of Columbia that became effective in September 2012, which is included in benefit from income taxes in the above annual financial results. |

| (3) | The Company recovered approximately 65% of these costs. |

| (4) | Represents the operating results of the Company’s properties that were sold or held-for-sale for the periods presented. |

21

|

Annual Financial Measures (unaudited, amounts in thousands, except per share data) |

| Year Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||