Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_investorpresentationx0.htm |

February 13, 2014 NASDAQ: CAC

Safe Harbor Statement The information presented may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon current beliefs and expectations and are subject to significant risks and uncertainties some of which are beyond Camden National Corporation’s control. Actual results may differ materially from the results discussed in these forward-looking statements. Factors that could cause Camden National Corporation’s results to differ materially can be found in the risk factors set forth in Camden National Corporation’s Annual Report on Form 10-K for the year ended December 31, 2012, as updated by Camden National Corporation’s Quarterly Reports on Form 10-Q and other filings with the SEC. 1

Camden National Corporation Corporate Snapshot • Headquartered in Camden, ME; Founded 1875 • Subsidiaries: • Camden National Bank - $2.6B Assets • Acadia Trust - $696MM AUM • 481 Employees • 44 Branch Locations Financial Overview Shareholder Profile • Shares Outstanding 7.6 million • Institutional /Mutual 45% • Insiders 2% / Other 53% • Tangible Book Value per Share $23.98 • Tangible Common Equity/Tangible Assets 7.12% • Stock Price/ Tangible Book Value 148% (CAC stock closed at $35.52 on 2/6/14) Events • Sold 5 branches with $80M of deposits and $46M of loans (2013) • Acquired 14 branches from Bank of America (2012) • Named by Forbes as one of “America’s Most Trustworthy Companies” (2013 & 2012) • Named to KBW’s “Bank Honor Roll” (2012 & 2011) • Named “Financial Institution of the Year” by Finance Authority of Maine (2013, 2012, 2011 & 2009) (in 000's) 2013 2012 2011 Loans $1,580 $1,564 $1,520 Assets $2,604 $2,565 $2,303 Deposits $1,814 $1,929 $1,591 Equity $231 $234 $219 Return on Assets 0.88% 0.98% 1.13% Return on Tangible Equity 14.55% 13.19% 15.64% 2

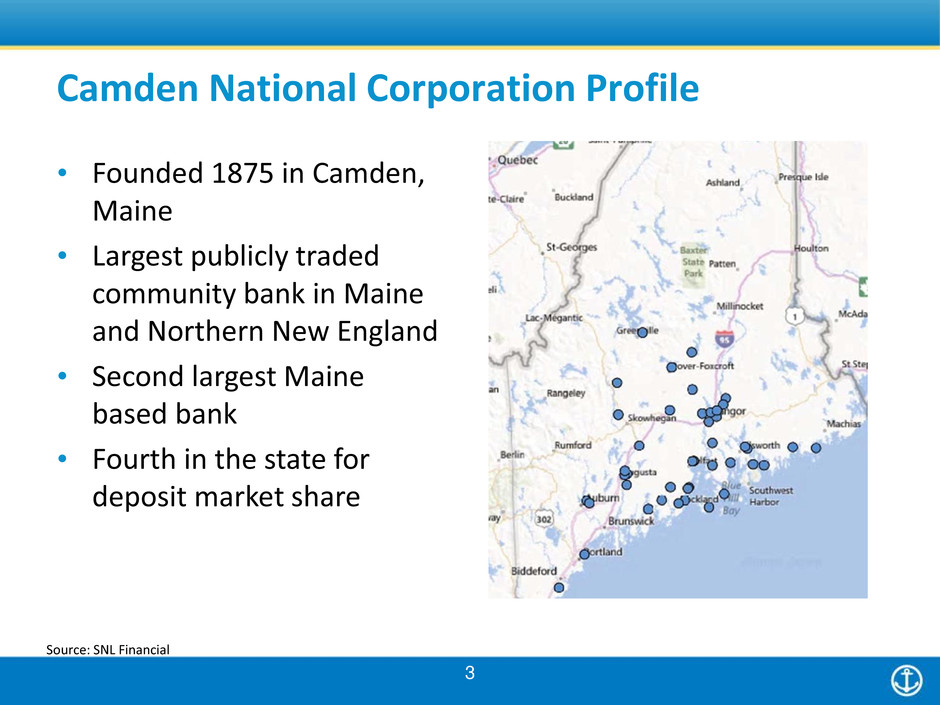

Camden National Corporation Profile 3 • Founded 1875 in Camden, Maine • Largest publicly traded community bank in Maine and Northern New England • Second largest Maine based bank • Fourth in the state for deposit market share Source: SNL Financial

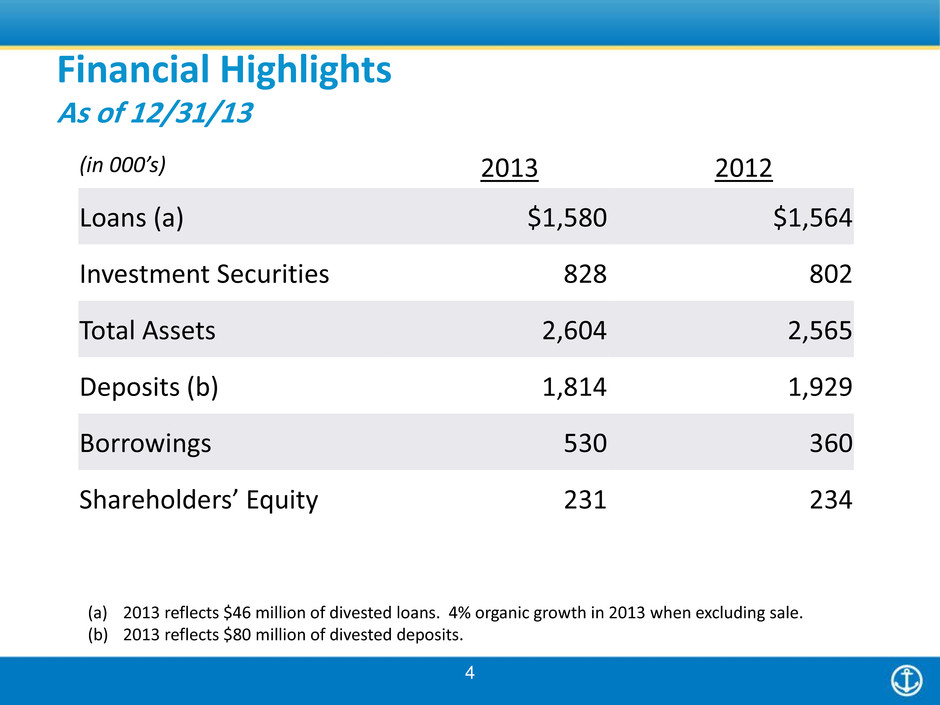

4 (in 000’s) 2013 2012 Loans (a) $1,580 $1,564 Investment Securities 828 802 Total Assets 2,604 2,565 Deposits (b) 1,814 1,929 Borrowings 530 360 Shareholders’ Equity 231 234 (a) 2013 reflects $46 million of divested loans. 4% organic growth in 2013 when excluding sale. (b) 2013 reflects $80 million of divested deposits. Financial Highlights As of 12/31/13

5 2013 2012 Net Income (in millions) (a) $22.8 $23.4 Diluted Earnings per Share $2.97 $3.05 Return on Tangible Equity 14.55% 13.19% Return on Assets 0.88% 0.98% Efficiency Ratio 62.78% 57.45% Net Interest Margin 3.20% 3.36% (a) 2013 includes after tax impact of goodwill impairment write-down of $2.8 million and gain on branch divestiture of $1.9 million Financial Highlights As of 12/31/13

Checking 30% Savings/Money Market 29% CD's 19% Borrowings 22% Funding Mix Home Equity/ Consumer 19% Commercial Real Estate 34% Residential Mortgages 36% Commercial 11% Loan Portfolio Total Loans: $1.58 billion Yield: 4.46% Funding: $2.34 billion Total Funding Cost: 0.55% Deposit Cost: 0.32% 6 Loans and Funding As of 12/31/13

Portfolio Stats Market Value $808 Million Average Yield 2.26% Duration 3.9 Years Premium $7.2 Million Premium as % of Portfolio 0.9% Investment Portfolio As of 12/31/13 7 Excludes FRB/FHLB stock of $20 million MBS $397 48% Agency CMO $387 47% Municipals $30 4% Non-Agency $7 1% Book Value - $821 Million

8 Source: FDIC Deposit Market Share data. Pro forma results excluding divested branches. Maine 2013 Rank Institution 2013 Number of Branches 2013 Total Deposits in Market ($000) 2013 Total Market Share (%) 1 Toronto-Dominion Bank 51 3,681,736 15.8 2 KeyCorp (OH) 54 2,566,856 11.0 3 Bangor Bancorp MHC (ME) 60 2,160,884 9.3 4 Camden National Corp. (ME) 44 1,829,754 7.9 5 Bank of America Corp. (NC) 19 1,409,681 6.1 6 First Bancorp Inc. (ME) 16 1,029,370 4.4 7 Machias Bancorp MHC (ME) 17 885,811 3.8 8 People's United Financial Inc. (CT) 27 868,201 3.7 9 Bar Harbor Bankshares (ME) 16 855,342 3.7 10 Norway Bancorp MHC (ME) 22 768,168 3.3 All Others in State (21) 180 7,189,721 30.9 Total For Institutions In Market 506 23,245,524 100.00 Deposit Market Share

Core Strengths • Solid track record of organic and acquired growth • Solid earnings performance • Disciplined risk management culture • Consistent shareholder returns 9

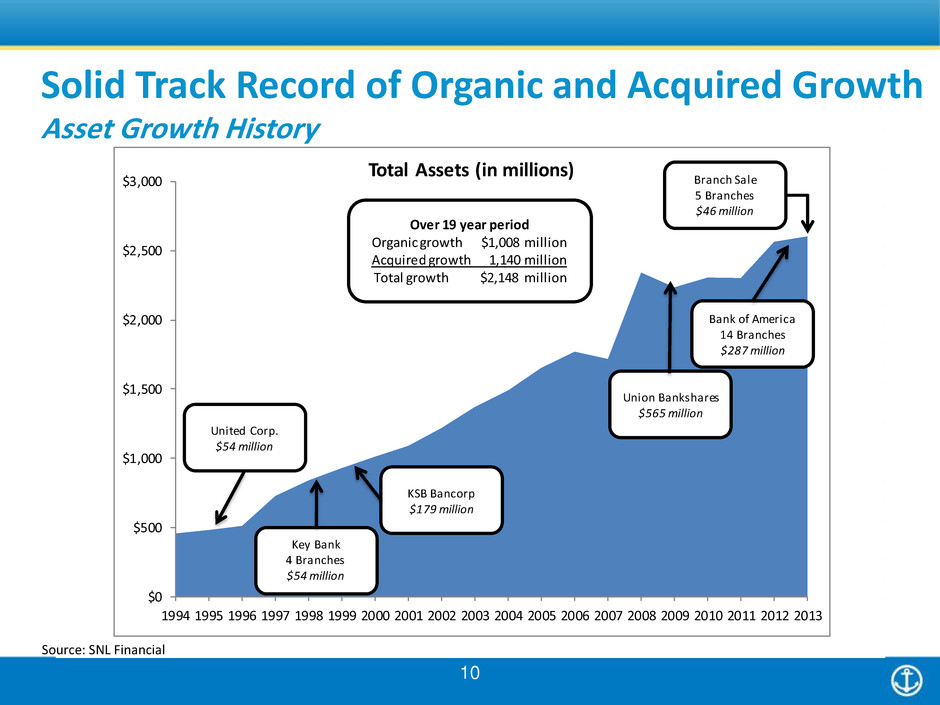

$0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Total Assets (in millions) United Corp. $54 million KSB Bancorp $179 million Union Bankshares $565 million Bank of America 14 Branches $287 million Key Bank 4 Branches $54 million Over 19 year period Organic growth $1,008 million Acquired growth 1,140 million Total growth $2,148 million Branch Sale 5 Branches $46 million 10 Solid Track Record of Organic and Acquired Growth Asset Growth History Source: SNL Financial

Solid Earnings Performance • Investment in branches, lenders, and technology impact financial performance in the short-term • Driven to create consistent returns for our shareholders • Efficient operations focused on revenue generation Proxy Peer – Average of 19 publicly traded commercial and savings banks in the Northeast (as of 12/31/13) BHCPR Peer – Average of 350 bank holding companies with consolidated assets between $1 and $3 billion (as of 9/30/13) Source: SNL Financial 11 Highlights Return on Average Assets Return on Average Equity Efficiency Ratio (FTE) 1.00% 1.09% 1.13% 0.98% 0.88% -0.50% 0.00% 0.50% 1.00% 1.50% 2009 2010 2011 2012 2013 12.81% 12.42% 12.16% 10.31% 9.74% -10.00% -5.00% 0.00% 5.00% 10.00% 15.00% 2009 2010 2011 2012 2013 54.26% 55.74% 54.68% 57.45% 62.78% 40.00% 50.00% 60.00% 70.00% 80.00% 2009 2010 2011 2012 2013

Disciplined Risk Management Culture 12 • Strong capital growth to support future loan growth • Credit quality consistent with Northeast peer group • Stable asset quality through economic downturn NPAs to Total Assets Net Charge Offs to Average Loans Total Risk Based Capital Highlights Proxy Peer – Average of 19 publicly traded commercial and savings banks in the Northeast (as of 9/30/13) BHCPR Peer – Average of 350 bank holding companies with consolidated assets between $1 and $3 billion (as of 9/30/13) Source: SNL Financial 13.49% 15.05% 15.95% 15.56% 16.45% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 2009 2010 2011 2012 2013 1.07% 1.05% 1.26% 1.11% 1.18% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2009 2010 2011 2012 2013 0.37% 0.28% 0.26% 0.24% 0.22% 0.00% 0.50% 1.00% 1.50% 2.00% 2009 2010 2011 2012 2013

13 Consistent Shareholder Returns • Earnings per share compound annual growth of 5.24% over a 15-year period • Tangible book value compound annual growth of 7.12% over a 15-year period $1.38 $1.27 $1.69 $1.89 $2.11 $2.38 $2.53 $2.80 $2.93 $3.09 $2.00 $2.98 $3.23 $3.40 $3.05 $2.97 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Earnings Per Share $8.54 $8.57 $10.34 $11.81 $13.77 $14.48 $15.65 $16.40 $15.40 $17.79 $15.62 $18.86 $20.91 $22.66 $23.68 $23.98 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Tangible Book Value

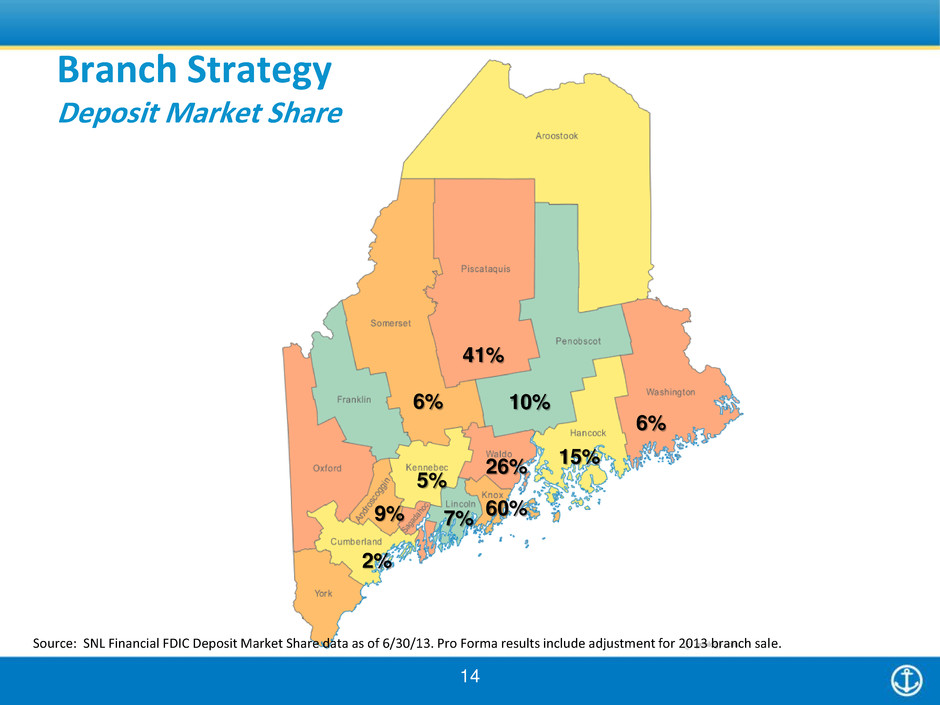

14 Branch Strategy Deposit Market Share 60% 5% 15% 10% 7% 26% 9% 2% 6% 41% 6% Source: SNL Financial FDIC Deposit Market Share data as of 6/30/13. Pro Forma results include adjustment for 2013 branch sale.

15 Source: SNL Financial Branch Strategy Focus on Growth Markets Franklin County Branch Divestiture ($80MM Deposits) I-95 Corridor BofA Branch Acquisition ($287MM Deposits) Mid-Coast Region ($854MM Deposits)

• Acquisitions • Acquisition of 14 branches from Bank of America resulted in $287 million in core deposits • Increased our market share in Maine and improved presence in growth markets • Earn back of Tangible Book Value within four years • Divestitures • Sold five branches in Franklin County in 2013 • $80 million of deposits and $46 million of loans at deposit premium of 3.5% • 2014 EPS dilution of 3% will be mitigated by stock repurchases • Consolidation • Combined Kennebunk branches during 2nd quarter 2013 16 Branch Strategy Preparing for the Future

17 “Financial Institution of the Year” by Finance Authority of Maine KBWs “Bank Honor Roll” 2011 and 2012 One of “America’s Most Trustworthy Companies” by Forbes

Proxy Peer Group Arrow Financial Corporation - NY Bar Harbor Bankshares - ME Berkshire Hills Bancorp, Inc. - MA Brookline Bancorp, Inc. - MA Century Bancorp, Inc. - MA Chemung Financial Corporation - NY Enterprise Bancorp, Inc. - MA Financial Institutions, Inc. - NY First Bancorp, Inc. – ME Independent Bank Corp. - MA Merchants Bancshares, Inc. - VT NH Thrift Bancshares, Inc. - NH Provident New York Bancorp - NY Rockville Financial, Inc. - CT Tompkins Financial Corporation - NY TrustCo Bank Corp NY - NY United Financial Bancorp, Inc. - MA Washington Trust Bancorp, Inc. - RI Westfield Financial, Inc. – MA 18