Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SCANSOURCE, INC. | a2014-q2form8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - SCANSOURCE, INC. | a2014-q2exhibit991.htm |

Q2 FY 2014 FINANCIAL RESULTS CONFERENCE CALL January 30, 2014 at 5:00 pm ET Exhibit 99.2

Safe Harbor This presentation may contain certain comments, which are “forward-looking” statements that involve plans, strategies, economic performance and trends, projections, expectations, or beliefs about future events and other statements that are not descriptions of historical facts, may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking information is inherently subject to risks and uncertainties; these statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Any number of factors could cause actual results to differ materially from anticipated results. For more information concerning factors that could cause actual results to differ from anticipated results, see the “Risk Factors” included in the Company’s annual report on Form 10-K for the fiscal year ended June 30, 2013, as well as the quarterly report on Form 10-Q for the quarter ended September 30, 2013, filed with the Securities and Exchange Commission (“SEC”). Although ScanSource believes the expectations reflected in its forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. ScanSource disclaims any intentions or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law. In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles (“GAAP”), the Company also discloses certain non-GAAP measures, including return on invested capital (“ROIC”) and the percentage change in net sales excluding the impact of foreign currency exchange rates. A reconciliation of the Company's non-GAAP financial information to GAAP financial information is provided in the Company’s Form 8-K, filed with the SEC, with the quarterly earnings press release for the period indicated. 2

Highlights – Q2 FY14 3 Second quarter 2014 net sales of $741 million, at the lower end of our expected range, and EPS of $0.64, at the upper end of our expected range Both North America Communications business units (ScanSource Communications and Catalyst) had solid Y/Y sales growth and higher margins POS & Barcode sales declined Y/Y; however, Q/Q sales growth for all POS and Barcode business units Record sales quarter in Brazil for the second quarter in a row Second quarter 2014 return on invested capital of 15.9%* Strong balance sheet position for growth Signed contract with SAP for software and implementation services for new ERP * See Appendix for calculation of ROIC, a non-GAAP measure.

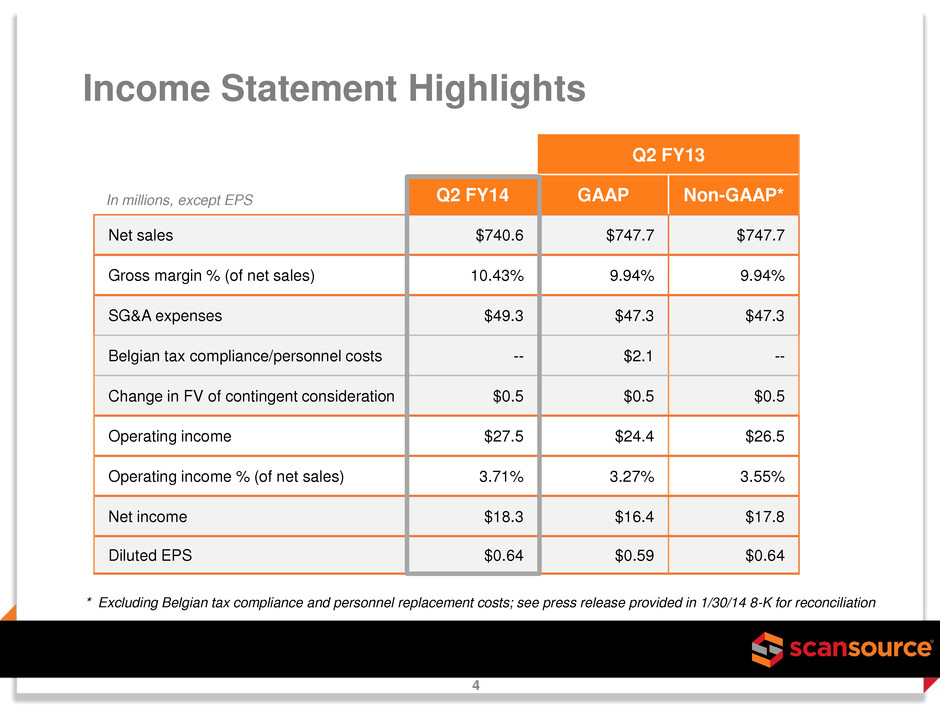

Q2 FY13 Q2 FY14 GAAP Non-GAAP* Net sales $740.6 $747.7 $747.7 Gross margin % (of net sales) 10.43% 9.94% 9.94% SG&A expenses $49.3 $47.3 $47.3 Belgian tax compliance/personnel costs -- $2.1 -- Change in FV of contingent consideration $0.5 $0.5 $0.5 Operating income $27.5 $24.4 $26.5 Operating income % (of net sales) 3.71% 3.27% 3.55% Net income $18.3 $16.4 $17.8 Diluted EPS $0.64 $0.59 $0.64 Income Statement Highlights In millions, except EPS 4 * Excluding Belgian tax compliance and personnel replacement costs; see press release provided in 1/30/14 8-K for reconciliation

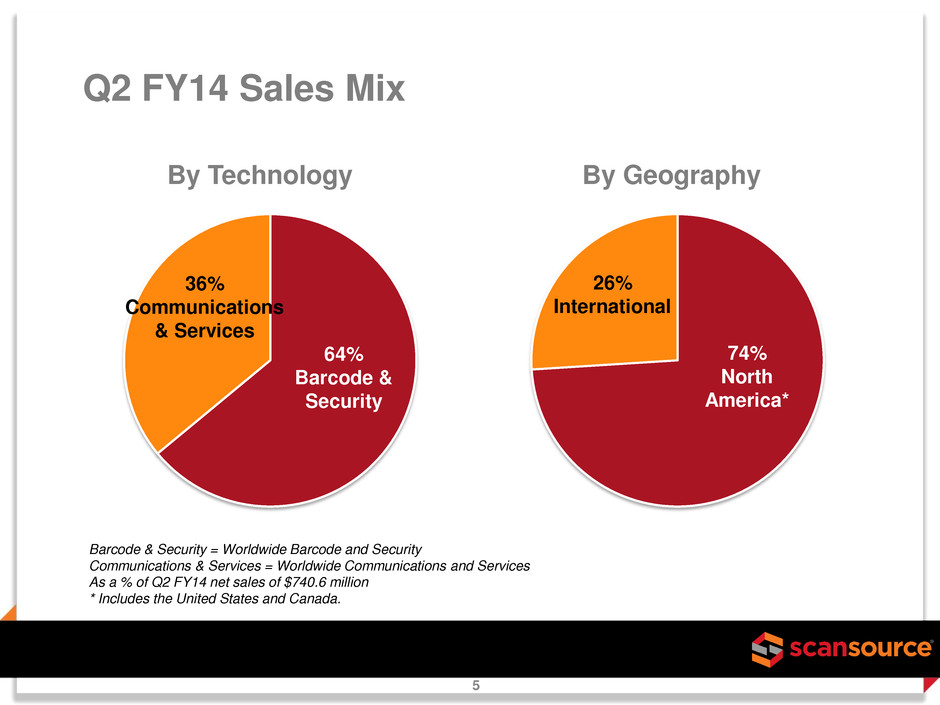

Q2 FY14 Sales Mix Barcode & Security = Worldwide Barcode and Security Communications & Services = Worldwide Communications and Services As a % of Q2 FY14 net sales of $740.6 million * Includes the United States and Canada. 64% Barcode & Security 74% North America* 36% Communications & Services 5 By Technology By Geography 26% International

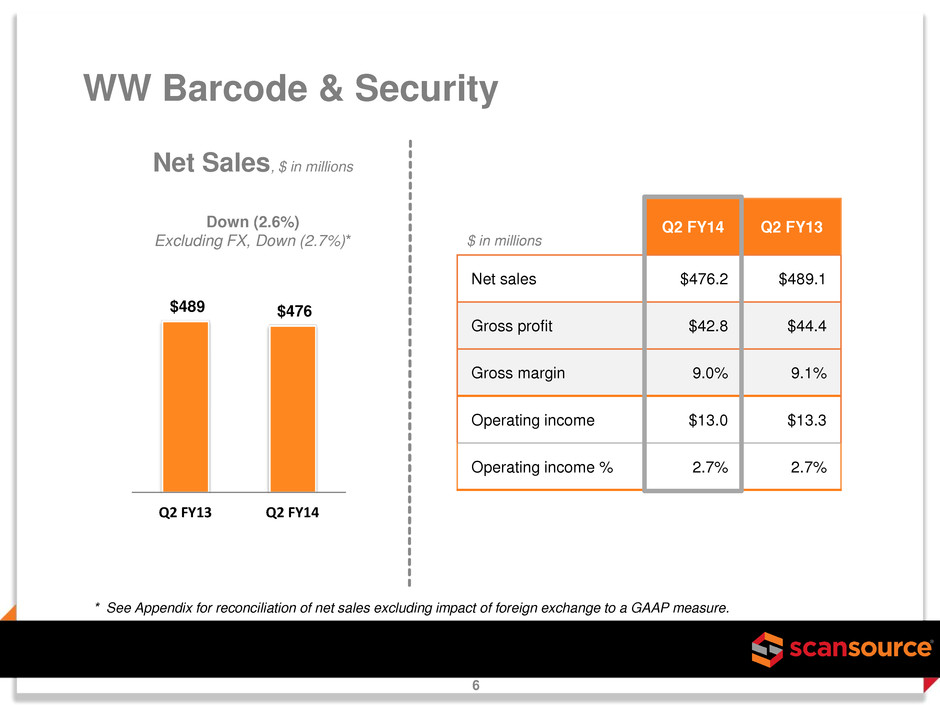

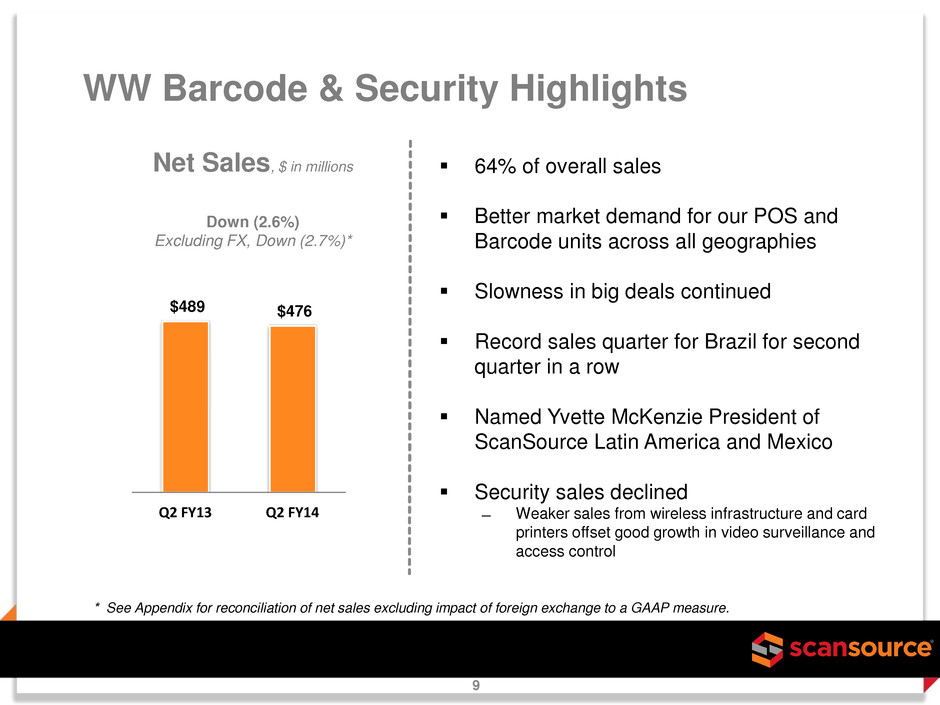

Q2 FY14 Q2 FY13 Net sales $476.2 $489.1 Gross profit $42.8 $44.4 Gross margin 9.0% 9.1% Operating income $13.0 $13.3 Operating income % 2.7% 2.7% $489 $476 Q2 FY13 Q2 FY14 WW Barcode & Security Net Sales, $ in millions Down (2.6%) Excluding FX, Down (2.7%)* $ in millions 6 * See Appendix for reconciliation of net sales excluding impact of foreign exchange to a GAAP measure.

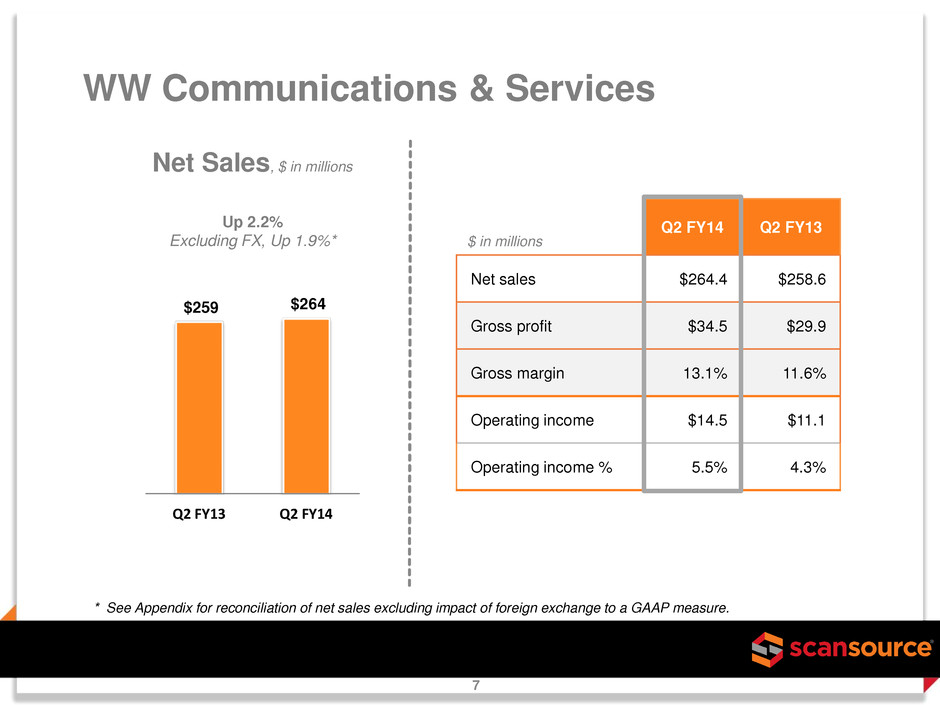

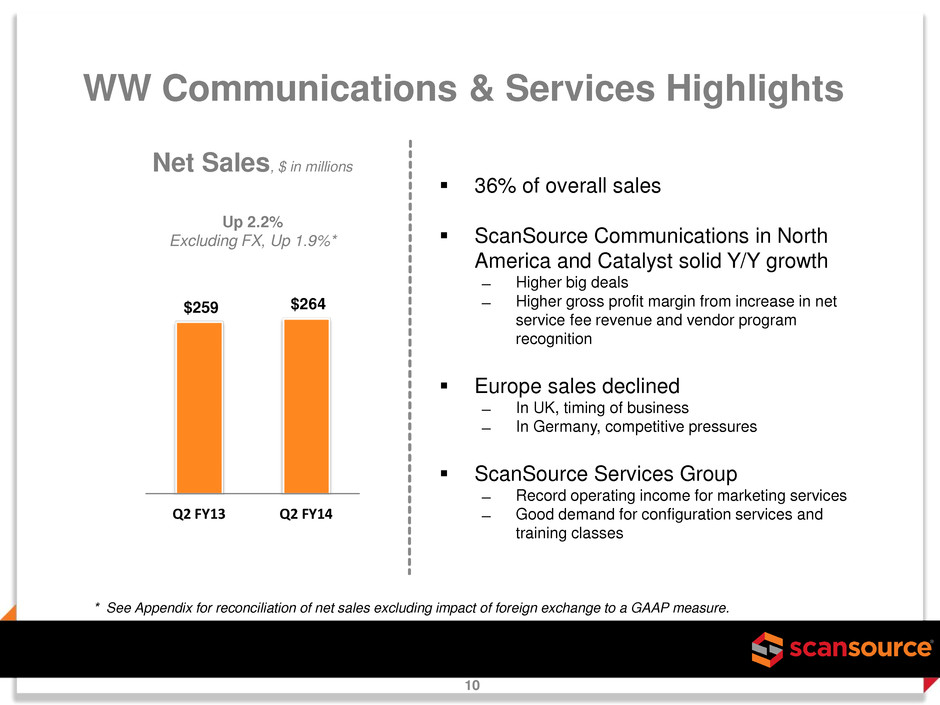

Q2 FY14 Q2 FY13 Net sales $264.4 $258.6 Gross profit $34.5 $29.9 Gross margin 13.1% 11.6% Operating income $14.5 $11.1 Operating income % 5.5% 4.3% $259 $264 Q2 FY13 Q2 FY14 WW Communications & Services $ in millions Net Sales, $ in millions Up 2.2% Excluding FX, Up 1.9%* 7 * See Appendix for reconciliation of net sales excluding impact of foreign exchange to a GAAP measure.

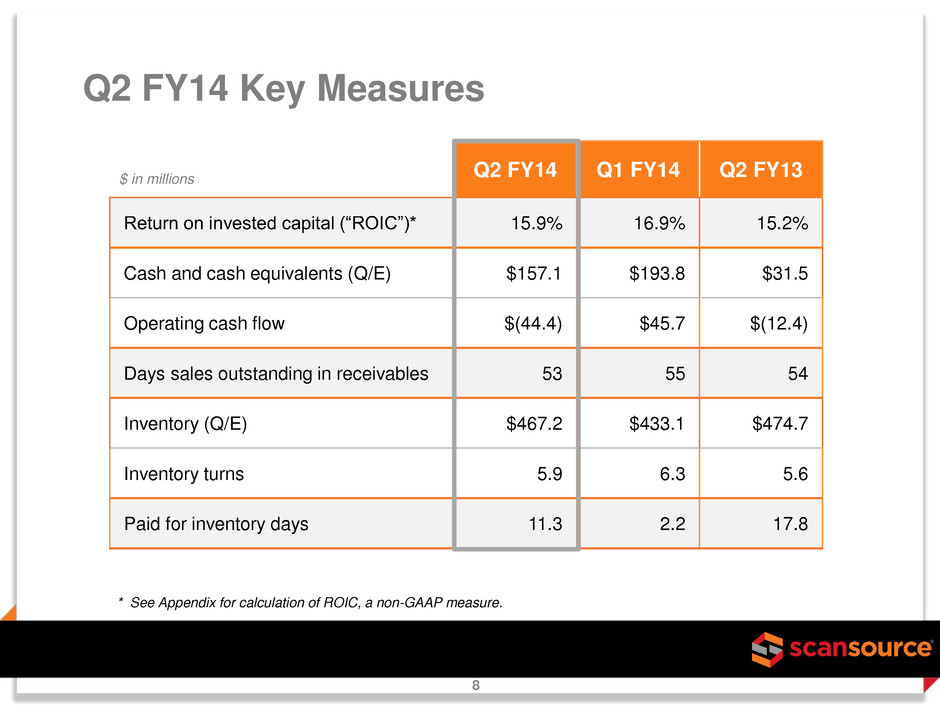

Q2 FY14 Q1 FY14 Q2 FY13 Return on invested capital (“ROIC”)* 15.9% 16.9% 15.2% Cash and cash equivalents (Q/E) $157.1 $193.8 $31.5 Operating cash flow $(44.4) $45.7 $(12.4) Days sales outstanding in receivables 53 55 54 Inventory (Q/E) $467.2 $433.1 $474.7 Inventory turns 5.9 6.3 5.6 Paid for inventory days 11.3 2.2 17.8 Q2 FY14 Key Measures * See Appendix for calculation of ROIC, a non-GAAP measure. $ in millions 8

WW Barcode & Security Highlights Net Sales, $ in millions Down (2.6%) Excluding FX, Down (2.7%)* 9 64% of overall sales Better market demand for our POS and Barcode units across all geographies Slowness in big deals continued Record sales quarter for Brazil for second quarter in a row Named Yvette McKenzie President of ScanSource Latin America and Mexico Security sales declined ̶ Weaker sales from wireless infrastructure and card printers offset good growth in video surveillance and access control * See Appendix for reconciliation of net sales excluding impact of foreign exchange to a GAAP measure. $489 $476 Q2 FY13 Q2 FY14

WW Communications & Services Highlights Net Sales, $ in millions Up 2.2% Excluding FX, Up 1.9%* 10 36% of overall sales ScanSource Communications in North America and Catalyst solid Y/Y growth ̶ Higher big deals ̶ Higher gross profit margin from increase in net service fee revenue and vendor program recognition Europe sales declined ̶ In UK, timing of business ̶ In Germany, competitive pressures ScanSource Services Group ̶ Record operating income for marketing services ̶ Good demand for configuration services and training classes * See Appendix for reconciliation of net sales excluding impact of foreign exchange to a GAAP measure. $259 $264 Q2 FY13 Q2 FY14

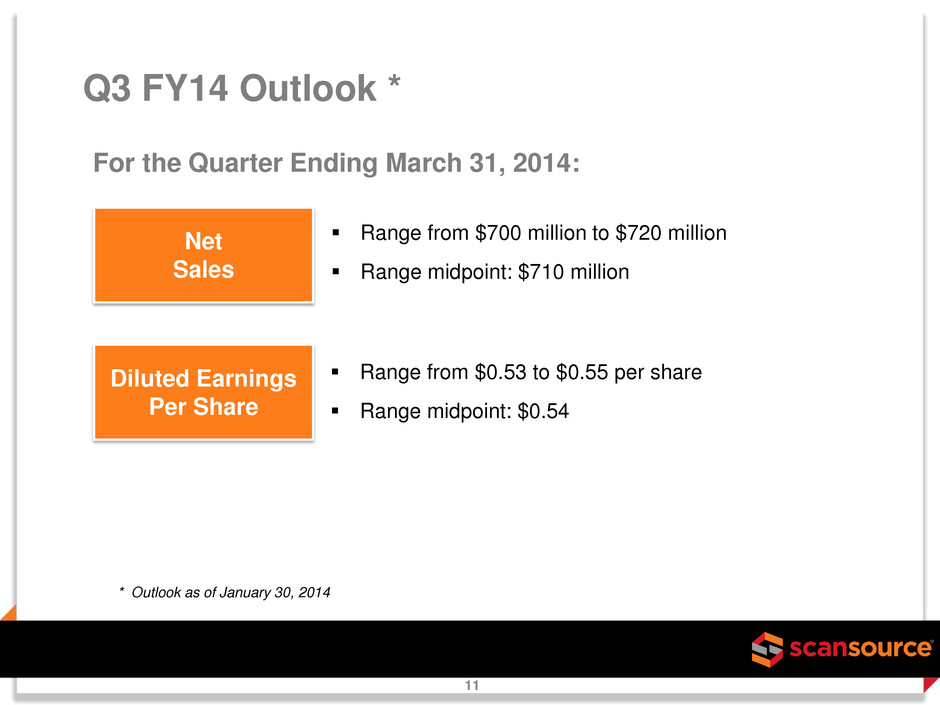

Q3 FY14 Outlook * For the Quarter Ending March 31, 2014: Net Sales Diluted Earnings Per Share Range from $700 million to $720 million Range midpoint: $710 million Range from $0.53 to $0.55 per share Range midpoint: $0.54 * Outlook as of January 30, 2014 11

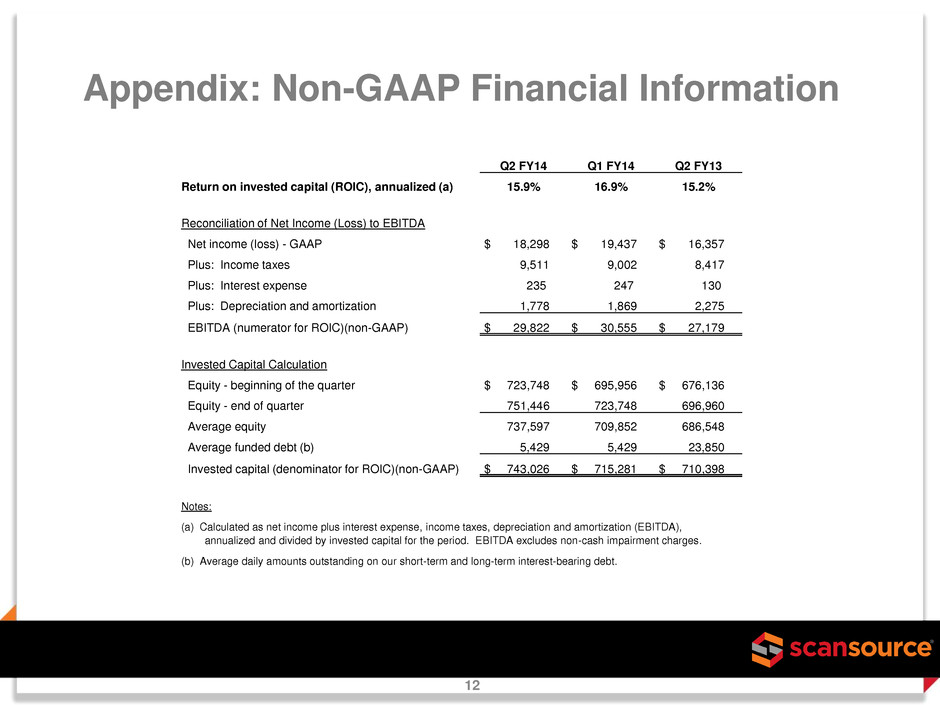

Appendix: Non-GAAP Financial Information 12 Q2 FY14 Q1 FY14 Q2 FY13 Return on invested capital (ROIC), annualized (a) 15.9% 16.9% 15.2% Reconciliation of Net Income (Loss) to EBITDA Net income (loss) - GAAP $ 18,298 $ 19,437 $ 16,357 Plus: Income taxes 9,511 9,002 8,417 Plus: Interest expense 235 247 130 Plus: Depreciation and amortization 1,778 1,869 2,275 EBITDA (numerator for ROIC)(non-GAAP) $ 29,822 $ 30,555 $ 27,179 Invested Capital Calculation Equity - beginning of the quarter $ 723,748 $ 695,956 $ 676,136 Equity - end of quarter 751,446 723,748 696,960 Average equity 737,597 709,852 686,548 Average funded debt (b) 5,429 5,429 23,850 Invested capital (denominator for ROIC)(non-GAAP) $ 743,026 $ 715,281 $ 710,398 Notes: (a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized and divided by invested capital for the period. EBITDA excludes non-cash impairment charges. (b) Average daily amounts outstanding on our short-term and long-term interest-bearing debt.

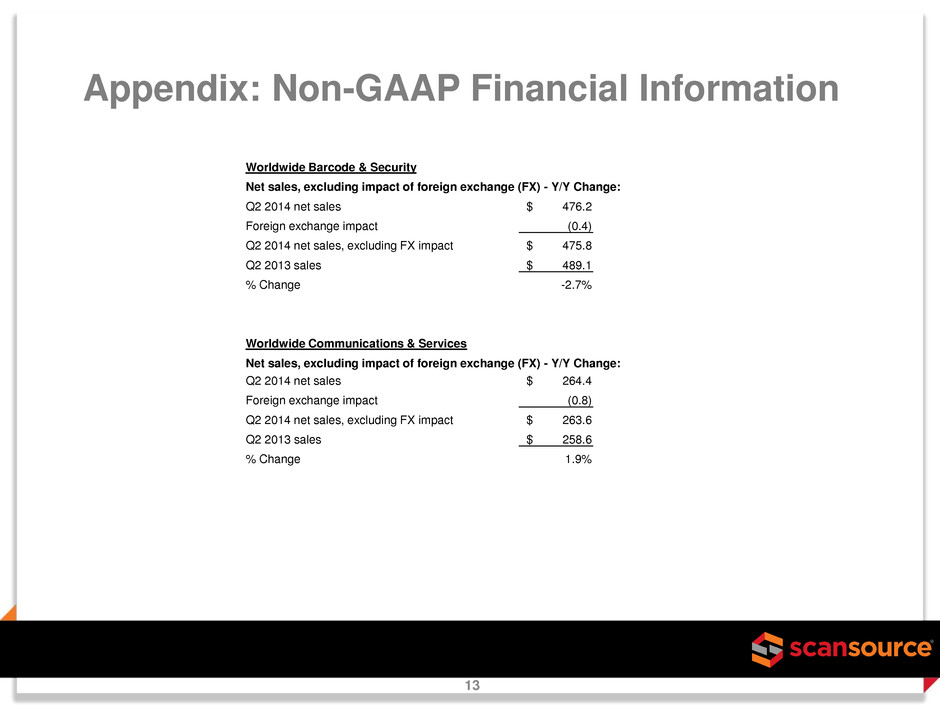

Appendix: Non-GAAP Financial Information 13 Worldwide Barcode & Security Net sales, excluding impact of foreign exchange (FX) - Y/Y Change: Q2 2014 net sales $ 476.2 Foreign exchange impact (0.4) Q2 2014 net sales, excluding FX impact $ 475.8 Q2 2013 sales $ 489.1 % Change -2.7% Worldwide Communications & Services Net sales, excluding impact of foreign exchange (FX) - Y/Y Change: Q2 2014 net sales $ 264.4 Foreign exchange impact (0.8) Q2 2014 net sales, excluding FX impact $ 263.6 Q2 2013 sales $ 258.6 % Change 1.9%